Abstract

Cross-border e-commerce (CBEC) has emerged as a transformative force in global trade, offering new pathways for economic growth. The influence of CBEC initiatives on alleviating firm financial constraints remains underexplored empirically, while existing literature predominantly emphasises macroeconomic and operational benefits rather than corporate financing challenges. To address this critical research gap, we examine the impact of 165 CBEC comprehensive pilot zones in China, with supportive policies including tax incentives and streamlined customs procedures, on firm financial constraints. Leveraging a longitudinal dataset of Chinese A-share-listed firms (2011–2020), this study employs a Difference-in-Differences (DiD) approach combined with Propensity Score Matching (PSM-DiD) to assess the causal effect of these pilot zones on firm financial constraints. Our findings demonstrate that the pilot zones significantly alleviate financial constraints by enhancing exports, fostering digital transformation, and promoting industrial agglomeration. Heterogeneity analyses reveal pronounced regional and sectoral variations: firms in eastern provinces, non-sub-provincial and non-municipal cities experience stronger benefits, as do non-export-oriented, high-tech, and non-polluting firms. These results underscore the efficacy of CBEC pilot zones as a policy tool for mitigating financial constraints, particularly during economic downturns, while highlighting the importance of tailored policy designs to maximise impact.

Similar content being viewed by others

Introduction

For decades, China’s financial market has exhibited a pronounced bias toward large-scale and state-owned firms, rooted in slow financial system reforms and the concentrated allocation of bank credit. This systemic imbalance has created significant barriers for highly productive firms in accessing financing (Guariglia et al. 2008). According to the Global Business Investment Climate Survey (GBIS), China ranks among the top 80 countries with the most severe financial constraints. A comparative analysis by Allen et al. (2005) benchmarking China’s financial system against Porta et al. (1998) framework reveals that approximately 75% of Chinese firms face financial constraints—a consequence of banking inefficiencies and capital market underdevelopment. Consequently, firms overwhelmingly rely on internal rather than external funding (Claessens and Tzioumis 2006).

Despite sustained government efforts to ease financing challenges, particularly for small and medium-sized enterprises (SMEs) (Firth et al. 2009), financial constraints remain a persistent obstacle to corporate growth (Hubbard 1998; Poncet et al. 2010; Stein 2001). This structural issue continues to stifle the potential of individual enterprises and broader economic dynamism. Recently, the rapid growth of cross-border e-commerce (CBEC) platforms has emerged as a transformative force in global trade and economic development (Correa et al. 2022; Lyu 2024), attracting significant scholarly attention to their potential in alleviating corporate financing constraints.

These platforms offer unique advantages in facilitating corporate financing through multiple mechanisms. First, CBEC platforms enable financial institutions to closely monitor enterprise capital flows and credit information, significantly enhancing banks’ risk assessment capabilities and expanding funding availability (Xu and Li 2020). Many platforms incorporate built-in credit guarantee systems—independently operated or managed by third parties—effectively reducing agency costs in cross-border transactions (Qi et al. 2020; Chen et al. 2021). Second, the collaborative model between e-commerce platforms and enterprises helps share financing costs and mitigate credit constraints (Wang et al. 2019).

Technological advancements further amplify these benefits. CBEC platforms leveraging IoT technologies can drive commercial banks to modernise their credit evaluation systems for e-commerce enterprises. This enhanced transparency enables investors to make more informed decisions, improving financing efficiency and diversification. Most significantly, Ma et al. (2025) highlight CBEC’s dual role in reducing transaction costs and providing comprehensive financial monitoring services, particularly in open-market environments. These platform capabilities address firms’ financing challenges and contribute to systemic improvements in global trade ecosystems.

Recognising CBEC’s pivotal role in economic development, the Chinese government has actively promoted CBEC development since 2012, recognising its strategic importance for economic growth. A centrepiece of this effort has been the establishment of CBEC comprehensive pilot zones, which Heilmann and Perry (2020) characterise as innovative “administrative experiments.” Beginning with Hangzhou in March 2015, the pilot program expanded to 132 cities across 30 provinces (excluding Tibet) by January 2022. These zones provide enterprises with advanced technological infrastructure, streamlined customs procedures, accelerated trade clearance, and preferential tax policies, creating an optimised business environment. Against this policy backdrop, our study examines how CBEC comprehensive pilot zones affect enterprise financial constraints by analysing regional and temporal variations in their implementation.

While prior studies have extensively evaluated policy impacts across domains such as economic growth (Ma et al. 2021a), firm exports (Hang and Adjouro 2021), sustainable development (Xiao and Zhang, 2022), and supply-chain resilience (Dai and Min 2024), the influence of Cross-Border E-Commerce (CBEC) initiatives on alleviating firm financial constraints remains underexplored empirically. Existing literature has predominantly emphasised the macroeconomic and operational benefits of CBEC platforms (Wu et al. 2024; Pan et al. 2023; Han et al. 2024), yet scant attention has been paid to their role in mitigating corporate financing challenges. Our study addresses this critical gap by systematically analysing the mechanisms through which CBEC comprehensive pilot zones reduce financial constraints for firms. By bridging existing knowledge gaps, our findings offer valuable insights for policymakers seeking to refine CBEC support measures and for enterprises navigating the evolving digital trade landscape.

This paper systematically reviews and collates existing literature on the comprehensive pilot zones, establishing a theoretical foundation. Then, nationally representative A-share listed firm data from 2011 to 2020 are utilised to implement DiD and PSM-DiD methodologies. In-time and in-space placebo tests have been conducted for robustness. These techniques enable causal identification of the policy’s impact on alleviating corporate financial constraints while controlling for potential confounding factors such as regional economic disparities and firm-level heterogeneity. These methodologies allow for a more accurate identification of the causal effects, controlling for potential confounding factors. We identify and validate three specific channels—export facilitation, digital transformation, and industrial agglomeration—through which CBEC comprehensive pilot zones influence financing constraints, advancing theoretical understanding of e-commerce policy spillovers. Our analysis uncovers nuanced regional and firm-level disparities (e.g., eastern vs. central/western regions, high-tech vs. non-tech sectors), offering granular insights for targeted policy design. By linking CBEC initiatives to capital market efficiency, it marginally contributes to the international community’s understanding of China’s innovative policy-making in promoting digital trade and economic transformation, potentially providing valuable references for other countries facing similar challenges.

Literature review and hypotheses

Determinants of financing constraints

The determinants of financing constraints, as established in the literature, can be broadly classified into firm-specific internal characteristics and external environmental factors. Firm-level attributes critically shape access to financing. Smaller firms, for instance, face structural disadvantages due to limited bargaining power and resource gaps (Beck and Demirguc-Kunt 2006), while ownership concentration—commonly in family-owned or state-linked enterprises—can either alleviate or exacerbate constraints depending on governance quality (Mertzanis 2017; Distinguin et al. 2016). Institutional configurations, such as internal auditing rigour or stakeholder alignment, further mediate financing outcomes (Cingano et al. 2016). Gender disparities compound these challenges: female entrepreneurs encounter systemic barriers rooted in asymmetrical access to networks and capital, perpetuating underrepresentation in formal financing channels (Asiedu et al. 2013). Conversely, multinational firms leverage cross-border diversification and export revenues to mitigate risks and enhance creditworthiness, illustrating how strategic positioning can offset inherent constraints (Freixanet 2012). Small and medium-sized enterprises (SMEs) are particularly vulnerable, as their limited collateralisable assets and opaque operational histories hinder creditworthiness assessments, often excluding them from traditional financing mechanisms (Giebel and Kraft 2019; Gezici et al. 2020; Chien et al. 2024).

The Modigliani-Miller (MM) theorem underscores the pivotal role of imperfect capital markets, where external factors like agency conflicts, information asymmetry, and transaction costs distort financing efficiency and firm value (Fazzari et al. 1988; Tian et al. 2019). Financial Development, say the degree of capital market liberalisation, significantly impacts firms’ financing and growth (Love 2003). Geographic isolation exacerbates these inefficiencies; spatial distance from financial institutions raises monitoring costs and reduces credit availability, disproportionately affecting rural or peripheral enterprises (Alessandrini et al. 2009). Recent scholarship has expanded to incorporate the transformative effects of digital technology integration and targeted policy interventions (Du and Geng 2024).

Influences of CBEC, CBEC platforms and CBEC comprehensive pilot zones

Information and communication technologies (ICT)—encompassing fintech platforms, blockchain-based credit scoring, and AI-driven risk analytics—have emerged as powerful tools to mitigate information asymmetry and transaction costs, core frictions highlighted by the MM theorem (Zhou and Li 2017; Chen et al. 2023; Zhou and Wang 2023). By enabling real-time data sharing and automated risk assessments, ICT fosters more efficient borrower-lender matching, reducing reliance on physical proximity and collateral. For SMEs, ICT adoption enhances operational transparency, allowing financial institutions to evaluate creditworthiness through digital footprints (e.g., transaction histories, supply chain interactions) rather than traditional collateral (Pellegrina et al. 2017). Furthermore, firms leveraging advanced ICT signal innovativeness and managerial competence, traits that strengthen their perceived creditworthiness and access to financing (Pellegrina et al. 2017).

The rise of internet-powered e-commerce platforms has reshaped corporate financial ecosystems, particularly in fragmented credit markets like China. Fintech startups leverage these platforms to channel loanable funds, addressing localised credit shortages by connecting lenders with underserved enterprises, even those with suboptimal credit scores (Turvey and Xiong 2017; Hau et al. 2024). Empirical evidence from China’s micro-enterprise surveys (2020–2022) demonstrates that digital payment adoption significantly alleviates financing constraints by generating granular transaction records, which reduce information asymmetry and enhance credit transparency (Deng and Qian 2024; Sahi et al. 2022). This digitisation streamlines payment processing, lowers financing costs, and improves fund turnover efficiency. Moreover, strategic data sharing between banks, firms, and supply chain partners strengthens SMEs’ access to external financing by reshaping information structures (Sahi et al. 2022).

CBEC platforms further amplify these benefits through institutional innovations. Built-in credit guarantee systems—self-managed or outsourced—mitigate agency costs among cross-border collaborators, fostering trust in decentralised transactions (Qi et al. 2020; Chen et al. 2022). Integrated services such as multi-currency payment gateways decreasing sales cost (Xiao and Zhang 2022), optimised logistics lowering transport cost (Hsiao et al. 2017), and dispute resolution mechanisms (Cortés and Rosa 2013) reduce operational friction, directly lowering sales and compliance costs. Cross-Border E-Commerce (CBEC) Pilot Zones, pioneered by China since 2015, represent a policy innovation designed to integrate digital technologies with international trade frameworks. These zones are testing grounds for regulatory flexibility, digital infrastructure development, and financial incentives to boost cross-border trade efficiency. Government-backed initiatives, such as bank-entrusted loan programs, target capital-constrained enterprises (Song et al. 2024). Measures such as simplified trading procedures, expedited payment systems, tax rebates, and foreign exchange settlements are implemented to reduce transaction costs and accelerate fund turnover, enhancing operational efficiency.

The existing literature has underscored the multifaceted impacts of pilot zones on economic performance (He et al. 2024; Yang et al. 2023) and corporate development (Wen et al. 2023) in China. For instance, these zones enhance cross-border trade in goods and services by lowering transaction costs for SMEs (Chen and Yang 2021). Ma et al. (2021b) found that cities hosting Cross-Border E-Commerce (CBEC) zones experienced an increase in export volumes compared to non-pilot regions, attributing this growth to improved logistics coordination and the development of digital payment ecosystems. Similarly, Hang and Adjouro (2021) identified a “spillover effect,” whereby pilot zones stimulated ancillary industries such as warehousing and fintech, contributing to regional GDP growth. These initiatives have demonstrably improved liquidity and reduced information asymmetry (Correa et al. 2022; Ma et al. 2021b). Furthermore, CBEC Pilot Zones have redefined supply chain dynamics by integrating digital tools into cross-border operations, facilitating real-time logistics tracking, dispute resolution mechanisms, and harmonised compliance standards, collectively reducing delays and contractual conflicts. For example, pilot zones enhance supply chain resilience by diversifying sourcing networks and improving demand forecasting through big data analytics (Dai and Min 2024).

Another critical theme is the role of CBEC Pilot Zones in addressing the financing challenges SMEs face. However, few studies rigorously examine the direct causal impact of these pilot zones on corporate financing constraints, and the mechanisms linking geographic policy experimentation to firm-level financial outcomes remain underexplored. This research aims to make a marginal but significant contribution to the literature by investigating the regulatory incentives that shape financing accessibility for Chinese companies. Given that digital payment systems can substantially alleviate the financing constraints of micro-enterprises (Deng and Qian 2024), it follows that CBEC Pilot Zones, designed to integrate digital technologies with international trade frameworks, also possess similar effects.

Moreover, these zones foster a conducive financing environment through government subsidies, multi-tiered capital markets, and diverse financing methods, including equity investment, bond financing, and financial leasing. Such flexibility allows firms to select financing options tailored to their developmental stages and capital needs, enhancing overall financing efficiency. Additionally, CBEC platforms can mitigate information asymmetry between firms and banks through efficient online credit systems. These systems enhance transparency and reduce credit costs by providing real-time monitoring of firms’ operational and financial performance, thereby alleviating financing constraints (Yan et al. 2023). Integrating production and sales facilitated by CBEC platforms further reduces internal information transfer costs and administrative expenses, easing capital constraints (Ma et al. 2021b).

Based on these insights, we propose the following hypothesis:

H1: Establishing CBEC comprehensive pilot zones alleviates enterprises’ financial constraints.

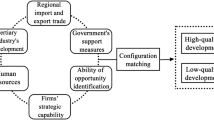

Mechanisms linking the establishment of CBEC comprehensive pilot zones to financing

Channel 1: Facilitating exports

In 2013, the General Administration of Customs of China designated the first batch of CBEC comprehensive pilot zones and standardised the basic information, standards, protocols, and management systems. The government-led e-commerce trading platforms within these zones have achieved significant institutional breakthroughs in addressing common challenges e-commerce faces, such as difficult customs clearance, complex foreign exchange settlements, high costs, and slow international logistics and distribution (Ma et al. 2025). By enhancing export declaration efficiency through methods such as “listing and releasing” and simplified declarations, CBEC comprehensive pilot zones actively promote exports (Jing et al. 2024).

This facilitation of exports allows enterprises to increase their cash flows and improve their internal and external financing capabilities. First, exports positively signal a firm’s efficiency and competitiveness (Bernard et al. 2012). This signal is particularly beneficial for securing external financing, as it is more difficult to manipulate than basic financial metrics. High sunk costs in export markets (Greenaway 2007) mean that only capable firms can export, further enhancing their credibility in lenders’ eyes. Additionally, the “export” signal helps alleviate information asymmetry in informal financing contexts, which is crucial for SMEs (Poncet et al. 2010).

Second, enterprises can effectively balance domestic and foreign market demands during different stages of the economic cycle. In a monopolistic competition framework, firms can adjust their sales strategies to optimise marginal profits. By responding to market fluctuations, they can mitigate the impact of rising marginal costs. For instance, during a domestic demand shock, firms can increase their exports; conversely, when domestic opportunities arise, they can utilise “export-to-domestic sales” strategies (Ahn and McQuoid 2012; Vannoorenberghe 2012). This flexibility results in higher profits and enhances cash flow stability, which is critical for maintaining liquidity.

Third, international sales help reduce credit-related cash-flow losses. Domestic sales often encounter delayed payments, whereas exporters can employ safer methods like letters of credit and credit insurance to safeguard their revenues (Ramaswami et al. 2019). These mechanisms provide a more reliable revenue stream, which can improve a firm’s capital structure. Export-oriented firms can also leverage schemes such as the Export Credit Scheme (ECS) to enhance their capital structure and improve firm value (Schinas 2018). Moreover, diversified sales channels create stable cash flows, reducing reliance on capital market conditions and easing financial constraints (Yu and Tong 2020).

Furthermore, integrating digital technologies within CBEC Pilot Zones facilitates real-time tracking of shipments and financial transactions, enhancing transparency and reducing the risks associated with international trade (Dai and Min 2024). This transparency can attract investors and lenders, as they are more likely to support firms that demonstrate efficient operations and lower risks.

Based on these insights, we propose the following hypothesis:

H2: Establishing CBEC comprehensive pilot zones alleviates enterprises’ financing constraints by promoting their exports.

Channel 2: Digital transformation

As mentioned above, CBEC Pilot Zones are designed to integrate digital technologies with international trade frameworks. They have experienced a period of germination and growth. They have witnessed the seamless integration of cutting-edge digital technologies, including big data, cloud computing, artificial intelligence (AI), and blockchain, into every facet of the CBEC industries. Chen et al. (2024) posited that these technologies have emerged as the cornerstone driving forces behind the industry’s model innovation and efficiency transformation, thereby propelling the digital transformation of CBEC enterprises.

The digital transformation of CBEC enterprises unfolds many benefits, with one of the most significant being the expansion of financing channels. Cloud computing, big data analytics, blockchain, and AI can unlock the latent value embedded within enterprise data. This process creates alternative financial resources that transcend the traditional realm of bank credit. Traditional non-bank credit financial institutions often have high operating costs due to manual underwriting processes, complex risk assessment procedures, and physical infrastructure requirements. These elevated costs are passed on to borrowers through high interest rates for fund use, making their business logic unsustainable in the long run (Merton 1995; Allen and Santomero 2001).

When CBEC enterprises undergo digital transformation, they can leverage digital technologies to streamline operations. For example, cloud computing enables cost-effective data storage and processing, eliminating the need for expensive on-premise servers. Big data analytics can create more accurate customer and risk profiles, reducing information asymmetry and improving the efficiency of the lending process. With its immutability and transparency features, blockchain technology can enhance trust in financial transactions, enabling the development of new forms of peer-to-peer lending and supply-chain finance. At the theoretical level, the digital transformation of enterprises aligns with the transaction cost theory proposed by Coase (1993), as it reduces the costs associated with searching for information, negotiating contracts, and monitoring transactions. At the practical level, numerous case studies have shown that digital transformation can lead to significant cost savings and the creation of new business models.

A successful digital transformation can also profoundly empower supply-chain finance. As Liao et al. (2019) and Chen et al. (2023) noted, digital technologies can enhance the visibility and traceability of supply-chain activities. This enables enterprises to build more reliable supply-chain relationships and access financing based on the strength of the entire supply chain rather than just their creditworthiness. For instance, blockchain can record the movement of goods and payments in the supply chain, providing real-time information to financial institutions. This reduces the risk for lenders and allows enterprises to obtain financing at more favourable terms, thereby reducing their reliance on bank credit.

The development of digital finance, which is closely intertwined with the digital transformation of enterprises, has been shown to alleviate enterprises’ financing restrictions positively. Wang (2025) found that digital finance platforms can provide more inclusive financial services, especially to small and medium-sized enterprises (SMEs) that traditional financial institutions often underserve. These platforms use digital technologies to assess the creditworthiness of SMEs based on a wide range of data sources, including transaction data, social media data, and online behaviour data. By doing so, they can expand the pool of eligible borrowers and reduce the likelihood of enterprise exit due to a lack of access to financing. In light of the above-discussed mechanisms and evidence from existing research, we postulate:

H3: Establishing CBEC comprehensive pilot zones alleviates enterprises’ financing constraints by promoting their digital transformation.

Channel 3: Industrial agglomeration

Establishing offline industrial park platforms within CBEC comprehensive pilot zones has catalysed a robust industrial agglomeration effect, substantially reducing transaction costs and spatial frictions in inter-firm collaboration (Marshall 1920; Ellison et al. 2010). This spatial concentration creates a self-reinforcing ecosystem where enterprises gain access to shared infrastructure, specialised labor pools, and knowledge spillovers at marginal costs (Krugman 1991; Wang 2021a). Wennberg and Lindqvist (2010) demonstrate that such agglomerations lower resource-acquisition barriers through three synergistic mechanisms that alleviate financing constraints: specialisation-driven efficiency gains, supply chain relational capital, and information asymmetry mitigation.

First, industrial agglomeration enables vertical disintegration of production processes, allowing firms to specialise in niche competencies (Stigler 1951). For instance, within CBEC parks, design-focused firms coexist with logistics specialists and digital marketing agencies, mirroring Porter’s (1998) cluster theory. This division of labour reduces fixed capital requirements: a manufacturer no longer needs to invest in in-house R&D or warehousing but can outsource these functions to specialised neighbours. Such specialisation lowers per-firm capital intensity by promoting economies of scale and scope, thereby decreasing financial requirements.

Second, industrial agglomeration strengthens supply chain coordination and trade credit networks. Geographic proximity fosters relational contracts that reshape financing patterns. Fabbri and Klapper (2016) documented that clustered firms exhibit 40% higher trade credit utilisation than isolated peers. In CBEC parks, suppliers grant deferred payments (e.g., 120-day terms vs. industry-standard 60 days) due to repeated interactions and mutual monitoring. Moreover, firms can collectively negotiate bulk-purchase discounts and warehouse-sharing agreements, reducing collateral requirements. These arrangements create an endogenous credit system, substituting for traditional bank loans. Petersen and Rajan (1997) show that trade credit accounts for 20–30% of small firms’ liabilities in industrial clusters, acting as a liquidity buffer during credit crunches. Notably, Alibaba’s CBEC hubs have institutionalised this through digital supply chain platforms where transaction histories directly determine credit limits (Zhao and Wan 2024).

Third, agglomeration transforms local information ecosystems through reputation-based signalling and information spillovers. Frequent face-to-face interactions and guild-like associations (e.g., CBEC industry alliances) enable real-time reputation tracking, operationalising Diamond’s (1989) model of reputation-as-collateral. Cluster participants collectively sanction defaulters via supply chain exclusion, raising the cost of moral hazard. Also, Trade associations disseminate creditworthiness data, reducing screening costs for lenders. Boot and Thakor (2000) note that relationship banking thrives in agglomerations, with lenders offering preferential rates due to lower monitoring costs. Firms in CBEC zones exhibit lower loan rejection rates than non-clustered peers, as banks leverage localised soft information.

Based on the above analysis of the mechanisms through which industrial agglomeration alleviates enterprises’ financing constraints, we propose the following hypothesis:

H4: Establishing CBEC comprehensive pilot zones alleviates enterprises’ financing constraints by promoting enterprise agglomeration.

Data, research design and measurement

The panel data utilised in this study are primarily sourced from the CSMAR database and Wind DATABASE, and control variables at the regional level are collected from the National Bureau of Statistics. The dataset comprises A-share listed firms from 2011 to 2020, excluding firms in the financial sector (similar data is used in existing literature, such as Guo et al. 2024; Ye et al. 2025; Yu and Tian 2025). Our baseline estimation model is a high-dimensional fixed-effect multivariate linear regression, controlling for firm (i), year (t), and regional (k)fixed effects and is formulated as follows:

Dependent Variable: financial constraints (FC)

The ratio of financial assets to fixed assets measures enterprises’ financial constraints. A higher ratio suggests a firm is less financially constrained, as it possesses greater liquidity to support future investments (Almeida et al. 2004). Keynes (1936), proposed by the “precautionary reserve theory,” arguing that firms maintain cash reserves during periods of financial abundance and liquidate them during scarcity to mitigate the adverse effects of potential funding constraints on production and operational activities. This strategy helps regulate the overall level of firm funds. Financial assets exhibit higher liquidity than other assets, making their allocation a “forward-looking” approach to hedge against future uncertainties. A higher ratio of financial assets reflects lower operational risk, enhanced financing capacity, and reduced financial costs (Duchin et al. 2017; Tornell 1990).

Explanatory variable: policy identification

As discussed earlier, the establishment of CBEC comprehensive pilot zones has been gradually expanded in batches, currently encompassing 165 zones. To capture the regional variation, we construct a regional dummy variable (Zonei), which takes a value of 1 for firm i in year t if its registered office is located within a pilot zone, and 0 otherwise. Additionally, we account for time variation using a time dummy variable (Postt), which equals 1 for the year in which the pilot zone was established in a given city and all subsequent years, and 0 otherwise. The interaction term between the regional and time dummies (Zonei*Postt) is included in the model, and its coefficient captures the policy’s direct effect on financial constraints.

Mechanism variables

Three primary mechanisms are examined: exports, digital transformation, and industrial agglomeration. Exports are calculated by the total export revenues at the enterprise levelFootnote 1. The common way in the existing literature is to adopt a single digital transformation index to measure the level of digital transformation. In this study, we primarily follow the methodology of Wu et al. (2021). Specifically, we first extract textual content from the annual reports of A-share listed firms using the Java PDFbox library. Next, we apply Python-based web crawling techniques to identify and quantify the frequency of keywords related to digital transformation in these reports (see Supplementary Appendix Fig. A for details). These keywords include, but are not limited to, big data technology, artificial intelligence, blockchain technology, cloud computing, and digital technology applications. The frequencies of these keywords are then aggregated into a comprehensive index, which serves as a proxy for the level of a firm’s digital transformation. The degree of industrial agglomeration is measured using location entropy, calculated as follows (Nakamura 2012; Mori and Smith 2014):

where Aggit represents the number of listed enterprises in city i in year t and Si represents the administrative region i’s area.

Control variables

We first put in firm and time-fixed effects. We also follow Du and Geng (2024) to control for a series of regional economic indicators as control variables, including the natural logarithm of per capita GDP reflecting regional wealth and economic development, the rate of the annual savings and lending balance to regional GDP with higher values indicating higher levels of regional financial development in a region, the percentage of shares taken by the largest stakeholder indicating the concentration of corporate equity, the quick ratio representing liquidity of enterprise assets, Tobin’s Q representing enterprise operational performance, and the price-to-earnings ratio indicating stronger profitability of the enterprise. The descriptions of variables and statistics are presented in Tables 1 and 2.

Results and discussion

Parallel trends and exogeneity

Our identification strategy is primarily based on the DiD approach. This approach’s validity relies on two key conditions: the assumption of parallel trends and the endogeneity of treatment assignment.

The parallel trends assumption requires that, in the absence of the policy intervention, the outcome variable (financial constraints) would have followed similar trends for both the treatment group (firms located in CBEC pilot zones) and the control group firms outside these zones). The cross-border e-commerce strategies in this article were not all implemented within the same year. Instead, they were implemented in 2015, 2016, 2019, and 2020 respectively. Therefore, the DID regression in this article cannot define an absolute time point as the demarcation line for establishing cross-border e-commerce pilot zones. The sample time period in this article is from 2011 to 2020, which includes samples from the nine years before and the five years after the establishment of cross-border e-commerce, and we set the earliest year as the base period. To conduct the parallel trends test, this article sets up the following model:

p0 is the year when the policy of establishing a comprehensive cross-border e-commerce pilot zone is implemented. pr and ps are the dummy variables for r years before and s years after implementing the policies of establishing a CBEC comprehensive pilot zone. Consider the coefficient nr in the parallel trends, which reflects the difference in firms’ financing constraints within the zone between the treatment group and the control group r years before the establishment of the CBEC comprehensive pilot zone.

As shown in Fig. 1, we can observe the magnitude of nr and its corresponding 90% confidence interval. It can be seen that the coefficient trend in the nine years before the implementation of the CBEC comprehensive pilot zone policy is relatively small, and it does not pass the significance test at the 10% level. This indicates that before the comprehensive cross-border e-commerce pilot zone policy, there is no significant difference in firms’ financing constraints between the treatment group and the control group. That is, the coefficient starts to be significant in the first year after the policy takes effect, indicating that this policy has a certain lag effect. Subsequently, in the third year, the policy impact reaches maximum. However, it starts to decline in the fourth year. Although positive in the fifth year, it is no longer significant. This might be because with the rapid development of the cross-border e-commerce industry, the supporting environments such as customs, logistics, payment, and financial services nationwide are also constantly optimised and mature. The financing of firms in non-pilot zones also benefits from these overall industry advancements. Additionally, we used a dynamic DID approach with multiple pre- and post-treatment periods, which can introduce noise in the placebo test due to staggered adoption.

The exogeneity of treatment assignment requires that the policy intervention (located in a CBEC pilot zone) is not correlated with the financial constraints of enterprises or other unobserved factors that could influence these constraints. To address potential endogeneity concerns, we take several trials. First, we control for observable confounders. In addition to our baseline regressions, we further control for a comprehensive set of firm-level characteristics (e.g., size, ROA, age, etc.), regional variables (urbanisation rate, government intervention, etc.), and fixed effects (year, region, and firm). We also include region-specific time trends to account for unobserved heterogeneity. Second, in the scenario of CBEC pilot zones, one potential concern leading to endogeneity is that the region’s financial development levels affect the probability of the region being selected as the experimental zone. To mitigate selection bias, we employ Propensity Score Matching combined with DiD (PSM-DID). This approach matches treatment and control firms based on observable characteristics (e.g., financial development levels, regional economic conditions) to ensure comparability between the two groups. Third, to rule out the possibility that our results are driven by regional-specific factors rather than the policy intervention, we conduct in-time and in-space placebo tests by randomly assigning the timing and regions of the establishment of CBEC pilot zones, respectively. The insignificant coefficients from these tests suggest that our findings are not driven by artificial effects related to regional environments.

Baseline findings

The results of the baseline models are presented in Table 3. In column (1), a simplified model is estimated without control variables, incorporating only firm and time fixed effects. Additional control variables are progressively introduced from columns (2) to (6). The coefficients of interest remain consistently significant and positive across all specifications, suggesting that establishing CBEC pilot zones significantly alleviates financing constraints for firms. Hypothesis 1 is supported. The coefficient of determination, R², increases from 0.01 to 0.245, while the key estimate stabilises around 0.25, demonstrating the robustness of the findings.

Notably, our evidence also indicates that firms in more economically developed regions enjoy easier financing access and face fewer financial constraints (a significant and positive estimate of Econ). However, the relationship between financial market development and corporate financing constraints is statistically insignificant (an insignificant estimate of Fin controlling for Econ). Furthermore, when regional fixed effects are included, estimates of all regional-level variables are insignificant. This suggests that regional fixed effects effectively capture potential time-invariant confounding factors at the regional level. To further strengthen the analysis, we also controlled for time fixed effects and region-specific time trends, and the estimation results remain consistent and robust, underscoring the reliability of our conclusions.

Robustness check

We first use another method to construct the financial constraint variable. This index, SA, introduced by Hadlock and Pierce (2010), is less connected with time factors and relatively more exogenous. The equation is as follows:

Among them, Size is the firm’s total assets in a unit of ten thousand yuan in natural logarithm form, while Age is the firm’s year of establishment. The higher the value, the greater the degree of financing constraints. The absolute value of SA is put in as the dependent variable. As presented in Table 4, the coefficient of the zone remained significantly negative, and the conclusion in Table 3 is consistently found.

Moreover, the establishment of pilot zones aims to alleviate corporate financing constraints through multiple policy instruments, including government special funds, tax incentives, and financial subsidies. To empirically examine these initiatives, we conduct regression analyses focusing on three key dimensions of corporate financial capacity: (1) access to government subsidies, (2) short-term borrowing, and (3) long-term borrowing. While firm-level data on preferential lending policies and interest rates (which would directly reflect reduced credit costs) are unavailable due to data limitations, our analysis of short-term and long-term loans provides important insights into these potential financing channels. As shown in Table 4, the difference-in-differences (DiD) estimates remain consistently positive and statistically significant across all specifications. These robust findings demonstrate that the CBEC pilot zones have effectively mitigated financing constraints for enterprises in the treatment regions.

Second, we employ alternative specifications of the estimation model by introducing additional control variables at both the firm and regional levels into our baseline model. As shown in Table 5, the coefficients of interest remain consistently significant and positive, reinforcing the robustness of our findings. Consistent with the results in Table 3, when regional fixed effects are included, all regional-level variables lose their statistical significance. It is worth noting that due to missing observations in the newly introduced firm-level and regional-level variables from regressions (2) to (5), the total sample size in Table 5 is reduced; however, the effect turns out to be larger in the reduced sample. Conclusions throughout the study, by using the reduced sample, are consistent, and full results are available upon request. Overall, establishing pilot zones, which aim to reduce corporate financing costs through regional government support such as special funds, tax incentives, and financial subsidies, has effectively alleviated financial constraints for firms within these zones.

Third, in-time (see regression (1) and (2) in Table 6) and in-space (see Table 7 and Fig. 2) placebo tests have been run. The first placebo test is conducted by artificially manipulating the timeline for policy implementation, creating a fictitious policy timing scenario. As presented in Columns (1) and (2) of Table 6, the approval times for the comprehensive pilot zone policy are artificially advanced by 2 years and 1 year, respectively. Since establishing these pilot zones is fictitious, no significant effect should be observed, and the coefficients associated with the pilot zones should be statistically insignificant.

Then, keeping the treatment time, we randomly reassign the group of regions to be treated for DiD estimations, and this process is repeated 500 times (Follow Cao and Chen 2022). In Fig. 2, the estimates are not perfectly centred around zero, potentially because regional spillover effects might introduce noise in the in-space placebo test in our dynamic staggered DiD specification. However, the estimation results, on the whole, support our baseline findings. Table 7 presents the true policy effect (0.259) in the right tail of the placebo effect distribution as an extreme value. Assuming the true effect was 0, such an extreme estimate should not be observed in a single sampling. Specifically, the right-tail area of this distribution greater than 0.259 corresponds to the right-side p-value of 0.016 (i.e., the probability that the placebo effect is greater than the true effect). In contrast, the left-tail area less than 0.259 corresponds to the left-side p-value of 0.984 (i.e., the probability that the placebo effect is less than the true treatment effect). The probability that the absolute estimate of the placebo effect is greater than the true treatment effect is the two-sided p-value of 0.09. Therefore, the null hypothesis that “the treatment effect is 0” is rejected. However, these two evidences still further strengthen the validity of our conclusions.

Fourth, to further address potential selection bias and ensure the robustness of our findings, we employ the PSM-DID approach, and the results are presented in regression (3). By matching firms in pilot zones with comparable firms in non-pilot zones, we can more accurately isolate the causal effect of the establishment of pilot zones on corporate financing constraints. The coefficient of the interaction term Zone*Post remains positive and statistically significant (0.267, p < 0.05), consistent with our baseline results. This suggests that even after accounting for potential selection bias, the observed effects are not driven by pre-existing differences between treatment and control groups.

Fifth, parallel regional policies such as the Smart City Policy and Innovative City Policy were implemented during the same period, which might confound our results. To address this, we construct analogous difference-in-differences (DiD) interaction terms for these policies and include them as additional controls in our regression model. As shown in Column (4) of Table 6, the coefficient on Zone*Post remains positive and statistically significant (0.244, p < 0.1), demonstrating that the pilot zones’ effect on alleviating financing constraints persists even after accounting for other concurrent policies. Notably, the Innovative City Policy (Innova*Post_Inno) exhibits an independent positive effect (0.183, p < 0.05), suggesting it also contributes to reducing financing constraints. In contrast, the Smart City Policy (Smart*Post_smart) shows no statistically significant impact, implying its irrelevance to corporate financing outcomes in this setting.

Heterogeneity discussion

Heterogeneity of enterprises in different regions

In China, provinces can be split into eastern, central, and western regions. Due to differences in natural and historical endowments and locational advantages among China’s eastern, central and western regions, economic development exhibits significant disparities (Li et al. 2022). This has given rise to a huge information gap, resulting in differences in the development levels of the e-commerce industry in different regions. Therefore, we divide the sub-samples according to their respective regions and conduct regression analysis (See result in Panel A of Table 7).

The influence is considerable and pronounced in the eastern region, whereas it is relatively minor and insignificant in central and western regions (see panel A). This regional disparity can be attributed to the eastern region’s more advanced logistics systems, extensive financial networks, and a larger talent pool (Zhang 2021; Zhang et al. 2022). The Chinese government’s policy of trialling new initiatives in the eastern region first has also led to earlier and more comprehensive implementation of pilot zones in this area, amplifying the policy’s impact (Zhang 2021). Also, the eastern region has a more competitive business environment, encouraging firms to innovate and adopt new technologies. This competitive landscape amplifies the benefits of the CBEC pilot zones, as firms are more likely to leverage the policy to improve their financing conditions and expand their operations (Wang et al. 2021b). These findings align with the literature on regional economic disparities in China, highlighting the eastern region’s leading role in economic reform and innovation.

Heterogeneity of export-oriented and non-export-type firms

We also examine the differential effects of CBEC pilot zones on export-oriented and non-export-oriented firms. As shown in panel A of Table 8, the DiD estimate is significantly positive for non-export-type firms (0.527, p < 0.1), larger but less significant than export-type enterprises (0.077, p < 0.05). This suggests that the policy has generated spillover effects on domestic firms. Export-oriented firms have been operating and embedding in global markets, probably relying less on domestic financing and showing smaller marginal gains than domestically focused enterprises. Moreover, CBEC policies emphasise domestic market integration (e.g., improving logistics for CBEC), indirectly benefiting non-export firms by reducing operational costs and enhancing credit access. Additionally, while CBEC policies aim to boost cross-border trade, their broader infrastructure improvements (e.g., digital payment systems, warehousing networks) disproportionately aid non-export firms.

Heterogeneity of enterprises in cities with different administrative hierarchies

According to official classification, administrative divisions can be categorised into municipalities, sub-provincial cities, and prefecture-level cities (including county-level cities). Different city administrative hierarchies may be linked to different provision of services and political resources (Chen and Partridge 2013; Shi et al. 2020). As shown in panel B of Table 8, for enterprises located in prefecture-level cities, the estimates are notably positive, showing that setting up CBEC pilot zones positively influences alleviating the financing constraints. However, among enterprises in sub-provincial cities and municipalities, the effects are not significant. This suggests that the policy’s effectiveness is more pronounced in cities with lower administrative hierarchy. This might be that sub-provincial cities and municipalities often receive more resources and attention from the central government, reducing their reliance on CBEC pilot zones for financial support. In contrast, prefecture-level cities may face greater financing constraints and thus benefit more from the policy.

Heterogeneity of enterprises in different industries

Panel C of Table 8 examines the heterogeneous effects across different industries. The results indicate that the establishment of CBEC pilot zones has a stronger impact on alleviating financing constraints for high-tech industries (0.115, p < 0.01) and non-polluting industries (0.312, p < 0.1), compared to non-high-tech and polluting industries. This is consistent with the literature suggesting that high-tech and environmentally friendly industries are more likely to benefit from government policies promoting innovation and sustainable development (Li et al. 2022). The insignificant effects for non-high-tech and polluting industries may reflect the government’s stricter regulatory environment and reduced support for industries with high environmental costs (Ai et al. 2023). In addition, high-tech industries, particularly those involved in e-commerce, are more likely to engage in cross-border trade and thus benefit more from the CBEC pilot zones. Non-polluting industries, such as green manufacturing, also align with global trends toward sustainability, making them more competitive in international markets (Liu et al. 2022).

Mechanisms discussion

As discussed above, we explore three channels through which the pilot zone establishment can generate effects on relaxing financial constraints. The estimation results are shown in Table 9, and H2-H4 are supported. First, firms can increase cash flow and enhance their internal and external financing capabilities through export business. Theoretically, exporting serves as a “signal” that not only reflects the efficiency and competitiveness of an enterprise but also helps to strengthen relationships between the government and enterprises, as well as among enterprises (Bernard et al. 2012). Informal financing, such as commercial credit, is a vital source of financing for most firms, especially SMEs (Poncet et al. 2010). Export business works as a good signal of trade credit. It alleviates the information asymmetry in the informal financing market, enabling firms to access more channels in the informal external financing market. In addition, export enterprises can achieve higher profits and sales revenues, thus obtaining more abundant cash flow. The pilot zones facilitate firms’ exports by optimising the export declaration process and efficiency, thereby relaxing their financial constraints.

Second, effective digital transformation can empower supply chain financing, reducing firms’ reliance on bank loans (Liao et al. 2019; Chen et al. 2021). The development of digital finance has efficiently reduced the possibility of bankruptcy and alleviated firm financing constraints (Xie et al. 2024). Firm digital transformation can expand financing channels and gradually alleviate financing constraints. The digital technology of CBEC platforms promotes enterprise digital transformation in the pilot zones. As a result, it helps expand corporate financing channels.

Third, establishing offline industrial park platforms in CBEC comprehensive pilot zones facilitates cooperation and communication among enterprises, engendering agglomeration. The theory of agglomeration posits that industrial agglomeration enables firms to obtain and utilise external resources at a lower cost (Wennberg and Lindqvist 2010). One rationale is that industrial agglomeration can facilitate firm specialisation (Stigler 1951). Furthermore, the continuous subdivision of production processes reduces the demand for capital (Long and Zhang 2011). Moreover, business dealings between firms strengthen control over the supply chain, thereby increasing the utilisation of commercial credit and alleviating financing constraints. Additionally, industrial agglomeration facilitates the information dissemination, particularly the spread of delinquency information, which encourages firms to prioritise their reputation. This can promote commercial credit transactions between enterprises and decrease information asymmetry between firms and banks, thus easing sensitivity to financial costs.

Conclusion and implications

This paper investigates the influence of 165 CBEC comprehensive pilot zones on corporations’ financing constraints from 2011 to 2020. It delves into the underlying mechanisms that contribute to the efficacy of these zones. Using A-share listed companies’ panel data, the empirical model controls for firm, regional, and time fixed effects. The results indicate that establishing the pilot zones significantly alleviated the financing constraints of firms in the pilot zones, primarily through enhancing export expansion, accelerating digital transformation, and bolstering industrial clusters. The results are robust when we resort to placebo tests, PSM-DiD, et al. However, impacts vary by region, with the most significant effect observed in the eastern region, followed by the western and central areas. The policies are particularly effective for firms in relaxing financial constraints in non-sub-provincial and non-municipal cities. In addition, stronger effects are found among non-exporting, high-tech, and non-polluting firms.

Based on the results, there are some policy implications:

Expansion of pilot zones

The empirical evidence demonstrates that establishing additional CBEC comprehensive pilot zones can effectively ease firms’ financing constraints. This, in turn, can stimulate firm-level investment, innovation, and growth, thereby contributing to broader economic development. Given the remarkable achievements and positive spillover effects of the first five batches of pilot zones, characterised by enhanced foreign trade and the formation of vibrant industrial clusters, there is a strong case for further expanding the scope of these zones. Such expansion would enable more firms to benefit from the preferential policies, improved infrastructure, and enhanced market access associated with the pilot zones.

Infrastructure and export-oriented policies

Since alleviating financing constraints is closely linked to export-related activities, infrastructure development within the pilot zones should be strategically aligned with export-promotion goals. This encompasses a multi-faceted approach, including bolstering the CBEC ecosystem by improving logistics efficiency, enhancing payment security and speed, and streamlining customs clearance procedures. Active participation in formulating international CBEC standards is also essential to ensure that domestic firms can compete on a level playing field in the global market. Moreover, creating a more business-friendly environment requires a series of targeted measures. Simplifying export return and exchange policies can reduce enterprises’ operational risks and costs. Facilitating eligible e-commerce enterprises’ access to high-tech enterprise status can provide them preferential tax treatment and R&D support, enhancing their competitiveness. Optimising the tax rebate process for overseas warehouses can improve the cash-flow management of CBEC enterprises. Developing clear intellectual property protection guidelines is crucial for safeguarding the rights and interests of innovators and fostering a culture of innovation. Finally, strengthening talent-development policies, such as offering specialised training programs and attractive incentives, can attract and retain high-calibre professionals in the CBEC field.

Tailored development plans

Recognising the significant regional disparities in the impact of the pilot zones, it is imperative to develop construction plans tailored to local conditions. The central and western regions can draw valuable lessons from the successful experiences of the eastern region, such as those of Hangzhou and Ningbo. These two cities have developed unique and effective models for CBEC development, integrating their local industrial strengths, cultural characteristics, and market demands. The central and western regions can formulate customised development strategies that leverage their competitive advantages by conducting in-depth comparative analyses of their economic structures, resource endowments, and market dynamics. This may involve focusing on specific product niches, developing unique value-added services, or strengthening regional cooperation to create a more integrated and competitive CBEC ecosystem.

Regulatory compliance and standard-setting

In light of the frequent occurrence of intellectual property infringement and other regulatory challenges in the CBEC field, China should proactively formulate global and regional CBEC regulations. Although existing regulations, such as the 2010 “Regulations on the Customs Protection of Intellectual Property Rights” and the 2019 “E-commerce Law”, have laid a solid foundation, there is a pressing need for more detailed and up-to-date policies. Strengthening regulatory compliance protects the legitimate rights and interests of enterprises and enhances the international reputation of China’s CBEC industry. This, in turn, can facilitate more exports, attract more foreign investment, and ease the financing constraints of enterprises operating in the CBEC space.

Talent cultivation

The rapid growth of the CBEC industry in China has created a substantial demand for specialised talents. However, the current supply of CBEC-related professionals falls far short of this demand, resulting in a significant talent gap. To address this issue, a multi-pronged approach to talent cultivation is required. Educational institutions should optimise their curriculum offerings to include more CBEC-related courses and programs, from universities to vocational schools. These should cover various topics, including international trade law, e-commerce operations, digital marketing, and supply-chain management. At the same time, firms can collaborate with educational institutions to develop practical training programs that provide students with hands-on experience in the CBEC industry. Additionally, offering attractive incentives, such as competitive salaries, career development opportunities, and a conducive work environment, can help attract and retain top talent in the CBEC field.

In conclusion, the findings of this study provide valuable insights for policymakers, firms, and researchers in the field of CBEC. By implementing the proposed policy recommendations, China can further enhance the effectiveness of its CBEC comprehensive pilot zones, promote the healthy development of the CBEC industries, and contribute to the country’s economic growth and international competitiveness. Future research can build on these findings by exploring the long-term dynamics of the impact of pilot zones, the spillover effects on related industries, and the optimal policy mix for different regions and types of firms.

Data availability

The data are available at https://pan.quark.cn/s/f2fdd556bf30 or from the corresponding author upon request.

Notes

Refering to Guo et al. (2024), Yu and Tian (2025), and Ye et al. (2025), the main way to obtain the export data of listed companies is to first access the CSMAR database, and the specific path is: Notes to Financial Statements → Profit and Loss Items → Operating Revenue, Operating Cost → Segment Criteria → By Geographical Segment. Here, the operating revenue of enterprises can be divided into domestic and overseas revenues according to regions, and we calculate the export revenue of listed companies based on the sales revenue from overseas regions.

References

Ahn J, McQuoid AF (2012) Capacity constrained exporters: micro evidence and macro implications. Economics Research Working Paper Series 2, https://digitalcommons.fiu.edu/economics_wps/2

Ai H, Tan X, Zhou S, Zhou Y, Xing H (2023) The impact of environmental regulation on carbon emissions: evidence from China. Econ Anal Policy 80:067–1079. https://doi.org/10.1016/j.eap.2023.09.032

Alessandrini P, Presbitero AF, Zazzaro A (2009) Banks, distances and firms’ financing constraints. Rev Financ 13(2):261–307. https://doi.org/10.1093/rof/rfn010

Allen F, Qian J, Qian M (2005) Law, finance, and economic growth in China. J Financial Econ 77(1):57–116. https://doi.org/10.1016/j.jfineco.2004.06.010

Allen F, Santomero AM (2001) What do financial intermediaries do? J Bank Financ 25(2):271–294. https://doi.org/10.1016/S0378-4266(99)00129-6

Almeida H, Campello M, Weisbach MS (2004) The cash flow sensitivity of cash. J Financ 59(4):1777–1804. https://doi.org/10.1111/j.1540-6261.2004.00679.x

Asiedu E, Kalonda-Kanyama I, Ndikumana L, Nti-Addae A (2013) Access to credit by firms in Sub-Saharan Africa: how relevant is gender? Am Econ Rev 103(3):293–297

Beck T, Demirguc-Kunt A (2006) Small and medium-sized enterprises: access to finance as a growth constraint. J Bank Financ 30(11):2931–2943. https://doi.org/10.1016/j.jbankfin.2006.05.009

Bernard AB, Jensen JB, Redding SJ, Schott PK (2012) The empirics of firm heterogeneity and international trade. Annu Rev Econ 4(1):283–313. https://doi.org/10.1146/annurev-economics-080511-110928

Boot AW, Thakor AV (2000) Can relationship banking survive competition? J Financ 55(2):679–713. https://doi.org/10.1111/0022-1082.00223

Cao Y, Chen S (2022) Rebel on the canal: disrupted trade access and social conflict in China, 1650–1911. Am Econ Rev 112(5):1555–1590

Chen AP, Partridge MD (2013) When are cities engines of growth in China? Spread and backwash effects across the urban hierarchy. Regional Stud 47(8):1313–1331. https://doi.org/10.1080/00343404.2011.589831

Chen C, Zhang Y, Wang S (2023) Digital transformation and firm performance: a case study on China’s listed companies in 2009–2020. Digital Econ Sustain Dev 1(1):18. https://doi.org/10.1007/s44265-023-00018-x

Chen L et al. (2021) The role of digital transformation to empower supply chain finance: current research status and future research directions (Guest editorial). Int J Oper Prod Manag 41(4):277–288. https://doi.org/10.1108/IJOPM-04-2021-838

Chen N, Yang Y (2021) The impact of customer experience on consumer purchase intention in cross-border E-commerce—Taking network structural embeddedness as a mediator variable. J Retail Consum Serv 59:102344. https://doi.org/10.1016/j.jretconser.2020.102344

Chen S, He Q, Xiao H (2022) A study on cross-border e-commerce partner selection in B2B mode. Electron Commer Res 22(2):1–21. https://doi.org/10.1007/s10660-020-09403-6

Chen X, Yan Y, Qiu J (2024) Can enterprise digital transformation reduce the reliance on bank credit? Evidence from China. Econ Model 132:106632. https://doi.org/10.1016/j.econmod.2023.106632

Chien F, Zhang Y, Sadiq M (2024) Impact of open innovation on globalization: a survey study on China. Technol Econ Dev Econ 30(1):196–217. https://doi.org/10.3846/tede.2024.19982

Cingano F, Manaresi F, Sette E (2016) Does credit crunch investment down? New evidence on the real effects of the bank-lending channel. Rev Financial Stud 29(10):2737–2773. https://doi.org/10.1093/rfs/hhw040

Claessens S, Tzioumis K (2006) Measuring firms’access to finance. World Bank, 1–25, https://www.academia.edu/31395114/Measuring_firms_access_to_finance

Coase RH (1993) The nature of the firm (1937). Economica 4:396–405

Correa R, Paligorova T, Sapriza H, Zlate A (2022) Cross-border bank flows and monetary policy. Rev Financial Stud 35(1):438–481. https://doi.org/10.1093/rfs/hhab019

Cortés P, De La Rosa FE (2013) Building a global redress system for low-value cross-border disputes. Int Comp Law Q 62(2):407–440. https://doi.org/10.1017/S0020589313000109

Dai B, Min S (2024) Can cross-border E-commerce reform reduce supply chain risks? Quasi-natural experiment based on cross-border E-commerce comprehensive pilot zone. J Knowl Econ 15(3):14998–15026. https://doi.org/10.1007/s13132-023-01689-9

Deng L, Qian P (2024) Mitigating effect of digital payments on the micro-enterprises’ financing constraints. Financ Res Lett 62:105209. https://doi.org/10.1016/j.frl.2024.105209

Diamond DW (1989) Reputation acquisition in debt markets. J Political Econ 97(4):828–862. https://doi.org/10.1086/261630

Distinguin I, Rugemintwari C, Tacneng R (2016) Can informal firms hurt registered SMEs’ access to credit? World Dev 84:18–40. https://doi.org/10.1016/j.worlddev.2016.04.006

Du L, Geng B (2024) Financial technology and financing constraints. Financ Res Lett 60:104841. https://doi.org/10.1016/j.frl.2023.104841

Duchin R, Gilbert T, Harford J, Hrdlicka C (2017) Precautionary savings with risky assets: when cash is not cash. J Financ 72(2):793–852. https://doi.org/10.1111/jofi.12490

Ellison, N. B., Lampe, C., & Steinfield, C. (2010). With a little help from my friends: how social network sites affect social capital processes. In A networked self, 1st ed. Routledge, England, pp. 132–153

Fabbri D, Klapper LF (2016) Bargaining power and trade credit. J Corp Financ 41:66–80. https://doi.org/10.1016/j.jcorpfin.2016.07.001

Fazzari SM, Hubbard RG, Petersen BC (1988) Financing constraints and corporate investment. Brook Pap Econ Act 1:141–195

Firth M, Lin C, Liu P, Wong SM (2009) Inside the black box: Bank credit allocation in China’s private sector. J Bank Financ 33(6):1144–1155. https://doi.org/10.1016/j.jbankfin.2008.12.008

Freixanet J (2012) Export promotion programs: their impact on companies’ internationalization performance and competitiveness. Int Bus Rev 21(6):1065–1086. https://doi.org/10.1016/j.ibusrev.2011.12.003

Gezici A, Orhangazi Ö, Yalçın C (2020) R&D activity and financing constraints: evidence from Turkey. Panoeconomicus 67(4):557–571. https://doi.org/10.2298/PAN170420011G

Giebel M, Kraft K (2019) External financing constraints and firm innovation. J Ind Econ 67(1):91–126. https://doi.org/10.1111/joie.12197

Greenaway D, Guariglia A, Kneller R (2007) Financial factors and exporting decisions. J Int Econ 73(2):377–395. https://doi.org/10.1016/j.jinteco.2007.04.002

Guariglia A (2008) Internal financial constraints, external financial constraints, and investment choice: evidence from a panel of UK firms. J Bank Financ 32(9):1795–1809. https://doi.org/10.1016/j.jbankfin.2007.12.008

Guo L, Zhong Q, Wang H (2024) Digital transformation, ESG responsibility and corporate’s export performance. Financ Res Lett 69:106106. https://doi.org/10.1016/j.frl.2024.106106

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev financial Stud 23(5):1909–1940. https://doi.org/10.1093/rfs/hhq009

Han B, Rizwanullah M, Luo Y, Atif R (2024) The role of cross-border E-commerce on the export of goods and services. Electron Commer Res 24(2):1367–1384. https://doi.org/10.1007/s10660-024-09818-5

Hang HT, Adjouro T (2021) The effects of cross-border e-commerce on international trade and economic growth: a case of China. Int J Econ Financ 13(12):82–89. https://doi.org/10.5539/ijef.v13n12p82

Hau H, Huang Y, Lin C, Shan H, Sheng Z, Wei L (2024) FinTech credit and entrepreneurial growth. J Financ 79(5):3309–3359. https://doi.org/10.1111/jofi.13384

He B, Xu D, Nan G, Zhang X, Yu X (2024) Does the cross‐border e‐commerce comprehensive pilot zones policy affect the urban–rural income gap in China? Am J Econ Sociol 83(4):773–792. https://doi.org/10.1111/ajes.12593

Heilmann S, Perry EJ (eds) (2020) Mao’s invisible hand, 17. Brill. Harvard University Asia Center, Harvard University Press, Cambridge

Hsiao YH, Chen MC, Liao WC (2017) Logistics service design for cross-border E-commerce using Kansei engineering with text-mining-based online content analysis. Telemat Inform 34(4):284–302. https://doi.org/10.1016/j.tele.2016.08.002

Hubbard RG (1998) Capital market imperfections and investment. J Econ Lit 36(1):193–225. https://doi.org/10.3386/w6652

Jing W, Zheng Y, Shen X (2024) Does the establishment of Pilot Free Trade Zones promote international expansion of enterprises? Quasi-natural experimental evidence from China. Plos one 19(8):e0308477. https://doi.org/10.1371/journal.pone.0308477

Keynes J M (1936) The general theory of interest, employment and money. Macmillan, London

Krugman P (1991) Increasing returns and economic geography. J Political Econ 99(3):483–499. https://doi.org/10.1086/261763

Li X, Shao X, Chang T, Albu LL (2022) Does digital finance promote the green innovation of China’s listed companies? Energy Econ 114:106254. https://doi.org/10.1016/j.eneco.2022.106254

Liao H, Wen Z, Liu L (2019) Integrating BWM and ARAS under hesitant linguistic environment for digital supply chain finance supplier section. Technol Econ Dev Econ 25(6):1188–1212. https://doi.org/10.3846/tede.2019.10716

Liu M, Zhang B, Liao X (2022) Can trade liberalization promote green production? Evidence from China’s manufacturing enterprises. J Asian Econ 79:101369. https://doi.org/10.1016/j.asieco.2021.101369

Long C, Zhang X (2011) Cluster-based industrialization in China: financing and performance. J Int Econ 84(1):112–123. https://doi.org/10.1016/j.jinteco.2011.03.002

Love I (2003) Financial development and financing constraints: international evidence from the structural investment model. Rev Financial Stud 16(3):765–791. https://doi.org/10.1093/rfs/hhg013

Lyu J (2024) China cross-border e-commerce comprehensive pilot zone and urban residents’ tourism consumption: empirical study based on CHFS data. Financ Res Lett 64:105396. https://doi.org/10.1016/j.frl.2024.105396

Ma M, Yu Z, Ma L, Guo W (2025) Institutional openness and city cross-border e-commerce: evidence from China’s pilot free trade zones. Econ Anal Policy 85:558–570. https://doi.org/10.1016/j.eap.2024.12.026

Ma S, Guo X, Zhang H (2021b) New driving force for China’s import growth: assessing the role of cross‐border e‐commerce. World Econ 44(12):3674–3706. https://doi.org/10.1111/twec.13168

Ma S, Lin Y, Pan G (2021a) Does cross-border e-commerce contribute to the growth convergence? An analysis based on Chinese provincial panel data. J Glob Inf Manag 29(5):86–111. 10.0.15.178/JGIM.20210901.oa6

Marshall A (1920) Industrial organization, continued. The concentration of specialized industries in particular localities. In Principles of economics. Palgrave Macmillan, London

Merton R C (1995) A functional perspective of financial intermediation. Financial Manag, 23–41, https://doi.org/10.2307/3665532

Mertzanis C (2017) Ownership structure and access to finance in developing countries. Appl Econ 49(32):3195–3213. https://doi.org/10.1080/00036846.2016.1257106

Mori T, Smith TE (2014) A probabilistic modeling approach to the detection of industrial agglomerations. J Econ Geogr 14(3):547–588. https://doi.org/10.1093/jeg/lbs062

Nakamura R (2012) Contributions of local agglomeration to productivity: stochastic frontier estimations from Japanese manufacturing firm data. Pap Regional Sci 91(3):569–597. https://doi.org/10.1111/j.1435-5957.2012.00452.x

Pan L, Fu X, Li Y (2023) SME participation in cross - border e - commerce as an entry mode to foreign markets: a driver of innovation or not? Electron Commer Res 23(4):2327–2356. https://doi.org/10.1007/s10660-022-09539-7

Pellegrina LD, Frazzoni S, Rotondi Z, Vezzulli A (2017) Does ICT adoption improve access to credit for small enterprises? Small Bus Econ 48:657–679. https://doi.org/10.1007/s11187-016-9794-x

Petersen MA, Rajan RG (1997) Trade credit: theories and evidence. Rev Financial Stud 10(3):661–691. https://doi.org/10.1093/rfs/10.3.661

Poncet S, Steingress W, Vandenbussche H (2010) Financial constraints in China: firm-level evidence. China Econ Rev 21(3):411–422. https://doi.org/10.1016/j.chieco.2010.03.001

Porta RL et al. (1998) Law and finance. J Political Econ 106(6):1113–1155. https://doi.org/10.1086/250042

Porter ME (1998) Clusters and the new economics of competition, 76, No. 6. Harvard Business Review, Boston, pp. 77-90

Qi X, Chan JH, Hu J et al. (2020) Motivations for selecting cross-border e-commerce as a foreign market entry mode. Ind Mark Manag 89:50–60

Qi X, Chan JH, Hu J, Li Y (2020) Motivations for selecting cross-border e-commerce as a foreign market entry mode. Ind Mark Manag 89:50–60. https://doi.org/10.1016/j.indmarman.2020.01.009

Ramasamy B, Yeung MCH (2019) China’s one belt one road initiative: the impact of trade facilitation versus physical infrastructure on exports. World Econ 42(6):1673–1694. https://doi.org/10.1111/twec.12808

Sahi AM et al. (2022) Financial reporting quality of financial institutions: Literature review. Cogent Bus Manag 9(1):2135210

Schinas O (2018) Financing ships of innovative technology. In Finance and risk management for international logistics and the supply Chain. Elsevier, Amsterdam, pp. 167–192

Shi L, Wurm M, Huang X, Zhong T, Taubenböck H (2020) Measuring the spatial hierarchical urban system in China in reference to the Central Place Theory. Habitat Int 105:102264. https://doi.org/10.1016/j.habitatint.2020.102264

Song S, Wang F, Liu X (2024) Impact of the regional financial reform on corporate financialization: evidence from China. Int Rev Financial Anal 96:103641. https://doi.org/10.1016/j.irfa.2024.103641

Stein JC (2001) Agency, information, and corporate investment. In: Handbook of the economics of finance, 1st ed, Elsevier B.V., Amsterdam, p 111–165

Stigler GJ (1951) The division of labor is limited by the extent of the market. J political Econ 59(3):185–193. https://doi.org/10.1086/257075

Tian M, Xu G, Zhang L (2019) Does environmental inspection led by central government undermine Chinese heavy-polluting firms’ stock value? The buffer role of political connection. J Clean Prod 236:117695. https://doi.org/10.1016/j.jclepro.2019.117695

Tornell A (1990) Real vs. financial investment can Tobin taxes eliminate the irreversibility distortion? J Dev Econ 32(2):419–444. https://doi.org/10.1016/0304-3878(90)90045-D

Turvey CG, Xiong X (2017) Financial inclusion, financial education, and e-commerce in rural China. Agribusiness 33(2):279–285. https://doi.org/10.1002/agr.21503

Vannoorenberghe G (2012) Firm-level volatility and exports. J Int Econ 86(1):57–67. https://doi.org/10.1016/j.jinteco.2011.08.013

Wang J et al. (2021b) Does tax deduction relax financing constraints? Evidence from China’s value-added tax reform. China Econ Rev 67:101619. https://doi.org/10.1016/j.chieco.2021.101619

Wang W (2021) The heterogeneity of agglomeration effect: evidence from Chinese cities. Growth Change 52(1):392–424. https://doi.org/10.1111/grow.12430

Wang W (2025) Digital finance and firm green innovation: the role of media and executives. Financ Res Lett 74:106794. https://doi.org/10.1016/j.frl.2025.106794

Wang Y, Yu Z, Jin M (2019) E-commerce supply chains under capital constraints. Electron Commer Res Appl 35:100851. https://doi.org/10.1016/j.elerap.2019.100851

Wen H, Liu Y, Zhou F (2023) Promoting the international competitiveness of small and medium-sized enterprises through cross-border e-commerce development. Sage Open 13(4):21582440231210119. https://doi.org/10.1177/21582440231210

Wennberg K, Lindqvist G (2010) The effect of clusters on the survival and performance of new firms. Small Bus Econ 34:221–241. https://doi.org/10.1007/s11187-008-9123-0

Wu F, Hu HZ, Lin HY, Ren XY (2021) Enterprise digital transformation and capital market performance: empirical evidence from stock liquidity. Manag World 37(7):130–144+10. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0097

Wu H, Qiao Y, Luo C (2024) Cross-border e-commerce, trade digitisation and enterprise export resilience. Financ Res Lett 65:105513. https://doi.org/10.1016/j.frl.2024.105513

Xiao L, Zhang Y (2022) An analysis on the policy evolution of cross-border ecommerce industry in China from the perspective of sustainability. Electron Commer Res 22(3):875–899. https://doi.org/10.1007/s10660-020-09427-y

Xie K, Qin F, Dong M, Lu X (2024) The impact of digital finance on the survival and growth of SMEs: evidence from China. Emerg Mark Financ Trade 60(13):2980–2993. https://doi.org/10.1080/1540496X.2024.2332392

Xu X, Li J (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574. https://doi.org/10.1016/j.jclepro.2020.121574

Yan Z, Lu X, Chen Y, Wang K (2023) Institutional distance, internationalization speed and cross-border e-commerce platform utilization. Manag Decis 61(1):176–200. https://doi.org/10.1108/MD-09-2021-1172

Yang L, Liu J, Yang W (2023) Impacts of the sustainable development of cross-border e-commerce pilot zones on regional economic growth. Sustainability 15(18):13876. https://doi.org/10.3390/su151813876

Ye D, Tu Y, Xia S (2025) Environmental regulation and corporate exports: quasi-experimental evidence from China’s environmental protection tax law. J Environ Manag 373:123818. https://doi.org/10.1016/j.jenvman.2024.123818

Yu H, Tian S (2025) Impact of corporate financialization constraints on export activities: analysis of the moderating effect of economic policy uncertainty. Financ Res Lett 79:107278. https://doi.org/10.1016/j.frl.2025.107278

Yu Z, Tong J (2020) Financing benefit from exporting: an indirect identification approach. J Multinatl Financial Manag 57:100657. https://doi.org/10.1016/j.mulfin.2020.100657

Zhang Y (2021) The regional disparity of influencing factors of technological innovation in China: evidence from high-tech industry. Technol Econ Dev Econ 27(4):811–832. https://doi.org/10.3846/tede.2021.14828