Abstract

The current study examines empirically the factors critical for the adoption of a Unified Payments Interface (UPI) by Indian users and the role of perceived risk as a moderator on the effect of various factors on behavioral intention outlined based on the Unified Theory of Acceptance and Use of Technology (UTAUT). The data was accumulated from users engaged in regular digital payments through different UPIs using a survey. Partial Least Square Structural Equation Modeling (PLS-SEM) in combination with multi-group analysis (MGA) was performed to investigate the proposed model and to compare the different UPIs. A positive and significant impact of performance expectancy, effort expectancy, and social influence on behavioral intention for UPI adoption was observed. However, perceived risks moderated the impact of facilitating conditions, performance expectancy, and social influence on the adoption intention. Most of the users gave similar treatment to the different UPIs used by them. This study has several practical and scientific implications for the organizations dealing in the FinTech industry along with the government who are vested in improving the scenario of digital payments in India. Based on this, the development of promotion programs can be conducted that motivate the consumers to adopt UPI usage.

Similar content being viewed by others

Introduction

With the increasing advancement in the field of the Internet, its easy access and availability, and enhanced rate of penetration of smartphone technology in the modern era, more and more consumers are getting introduced to the concept of mobile banking, cashless transactions, and digital payments (Tungare, 2019). This was intensified particularly in India when the historic move of demonetization was initiated by the Indian Government in 2016 as a part of the Digital India campaign (Chawla et al. 2019; Vally and Divya, 2018). To facilitate instantaneous digital payment in a secured manner, the National Payments Corporation of India (NPCI) launched an advanced version of Immediate Payment Service (IMPS) (Fahad, 2022) that involved a “next-generation (Gupta et al. 2022) or the third-generation (Neema and Neema, 2018) mobile-centric payment system” called the Unified Payments Interface (UPI) (Gochhwal, 2017). This can be considered as a fintech (financial technology) which enables bank payments to be done immediately free of any cost through a single click in real-time from the user’s bank account to the merchant’s using a Virtual Private Address (VPA) via an Aadhar link and a unique mobile phone number, which is controlled by the Reserve Bank of India (RBI) (Vasavada, 2022). Not only does it perform consumer-to-merchant payment transfer (Jha and Kumar, 2020; Tungare, 2019) up to a transaction limit of Rs. One Lakh (Vally and Divya, 2018), it also allows “peer to peer” easy currency exchange (Tungare, 2019). It has been considered the “game changer” (Gupta et al. 2022; Kuriakose et al. 2022) in the field of economics and can be one of the “innovative steps” for making effective digital transfer of currency (Jha and Kumar, 2020).

Some of the advantages associated with UPI over other digital payment modes such as Real-Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT), etc. include their fast, hassle-free, ease of use, convenient, ubiquitous round-the-clock service, transparency, and secured nature of the transfer of money using one-touch technology, making it the most superior mode for payment transfer among the other ways (Chawla et al. 2019; Neema and Neema, 2018; Tungare, 2019). Moreover, complaints can be raised directly and have no impact of bank holidays or any requirement to provide any debit card or bank details of the beneficiary or the payee (Vasavada, 2022). The unique nature of UPI enables consumers to directly pay utility bills and other over-the-counter payments by scanning the barcodes (Tungare, 2019). With the increased level of acceptance of UPI as a mode of payment, it has become increasingly popular among consumers (Patel and Datta, 2020). Due to its many benefits and easy-to-use nature, the use of UPI for payments has become a part of “daily life activity” for shoppers, retailers, entrepreneurs, suppliers, small traders, service providers, and many others (Gupta et al. 2023).

The commonly employed UPIs in India include Google Pay, Paytm, Bharat Interface for Money (BHIM), PhonePe, MobiKwik, Cred, etc. (Gupta et al. 2022; Tungare, 2019). Based on the reports of RBI, the number of UPI transactions has amplified from seven billion in 2016 (Chawla et al. 2019) to 22.33 billion in 2020–2021 (Kuriakose et al. 2022). Moreover, there has been a continuous change in the UPI usage pattern among the masses over the years (Jha and Kumar, 2020). The critical factors for the usage of any UPI app depend upon the market potential, rate of adoption, and timing of introduction (Gupta et al. 2023). It has been reported by EY Global Fintech Adoption Index- 2019 that India along with China has a high adoption rate over the global average (87% against 64%) (Das and Das, 2020). Studies at a global level have either tried to identify any resistance among consumers towards digital payment (Khanra, 2020; Khanra et al. 2020), especially during COVID-19 pandemic (Singh and Singh, 2022) or explored the elements embracing fintech/ mobile payment services/ mobile banking based on different adoption intention theories for new technologies such as the Technology Acceptance Model (TAM)(Nigam and Kumari, 2018), Unified theory of acceptance and use of technology model (UTAUT) (Abrahão de et al. (2016); Jha and Kumar, 2020; Kaitawarn, 2015; Wei et al. 2021; Xie et al. 2021) or during COVID-19 pandemic (Yadav et al. 2022; Yan et al. 2023), its modified models (Alkhwaldi et al. 2022; Bajunaied et al. 2023; Dayour et al. 2020; Keng-Soon et al. 2019; Khatun and Tamanna, 2021; Lee et al. 2019; Nur and Panggabean, 2021; Raj et al. 2023; Yohanes et al. 2020) including, UTAUT2 (Baptista and Oliveira, 2015; Kuriakose et al. 2022; Merhi et al. 2019), and its meta extensions (Patil et al. 2020; Upadhyay et al. 2022a), diffusion of innovation theory (Fahad, 2022) as developed by Davis (1989), Venkatesh et al. (2003), Venkatesh et al. (2012), and Rogers (1983), respectively. Along with these, some studies on the behavioral intention of mobile payment adoption demonstrated an integrated version of the UTAUT with Social network influence theory (Yi et al. 2021), UTAUT with Technology Acceptance Model (Singh et al. 2020), UTAUT with initial trust model (Chan et al. 2022; Oliveira et al. 2014), or UTAUT2 model with Innovation resistance theory (Migliore et al. 2022). Even though every model examines varied sets of antecedents of behavioral intention and its moderators, none of the research was carried out in the Indian context or compared the leading UPI apps based on the impact of adoption factors, or assessed the role of perceived risks on behavioral intention. This study aims to connect this gap by comparing the behavioral intention towards the adoption of different types of UPI commonly existing in India and to gauge the role of perceived risks as the moderator on this relationship employing multigroup analysis partial least squares structural equation modeling (PLS-SEM).

Conceptual framework and hypotheses development

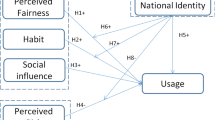

In order to achieve the objectives of this study, the theoretical framework was based on the unified theory of acceptance and use of technology model (UTAUT), which was found to be most appropriate for this study as it has a higher explanatory power compared to TAM (Lee et al. 2019). Moreover, perceived risk was identified to be one of the most common factors employed for extending the UTAUT model for evaluating mobile payment acceptance (Al-Saedi et al. 2019; Xie et al. 2021). Thus, the proposed model of this study intends to study the role of perceived risks as a moderator instead of demographics such as gender, age, and work experience as given in the existing behavioral intention framework (Venkatesh et al. 2003). Figure 1 represents the conceptual model for the study.

Behavioral intention can be portrayed as the measure of the possibility that a person will perform a specific behavior, in this case, implies the intent of purchase or utilization of a specific good, service, or technology (Nur and Panggabean, 2021). The factors inducing behavioral intention towards UPI adoption in the UTAUT model include performance expectancy, facilitating conditions, social influence, and effort expectancy, based on which each research hypothesis for this study has been derived.

Facilitating conditions and behavioral intention of UPI

Facilitating conditions as defined by Venkatesh et al. (2003) indicates “the degree to which an individual believes that an organizational and technical infrastructure exists to support the use of the system”. The use of UPI requires infrastructure that includes access to a reliable Internet network in a smartphone setup, mobile specifications, and the strength of the network (Jha and Kumar, 2020; Migliore et al. 2022). Therefore, along with high Internet speed, customer support, and assurance can be considered as the conditions that will facilitate the use of UPI (Barbu et al. 2021). Through this, the user tends to gain confidence whether to use the technology or not (Yohanes et al. 2020). It is known to directly impact the adoption of technology especially related to mobile banking (Oliveira et al. 2014), mobile payment (Abrahão de et al. (2016); Kaitawarn, 2015; Wei et al. 2021), fintech platform application (Xie et al. 2021; Yadav et al. 2022; Yohanes et al. 2020), etc. According to Statista (2023), the smartphone penetration rate in 2023 has already reached 71% and will become more than 96% by 2040, it becomes crucial to assess the impression of facilitating conditions on the behavioral intentions of the users towards UPI in the Indian context. Therefore, the first hypothesis is formulated:

Hypothesis 1: Facilitating conditions enhance consumer’s behavioral intention in adoption of UPI.

Performance expectancy and behavioral intention of UPI

Performance expectancy, “the strongest predictor of intention,” has been defined as the “degree to which an individual believes that using the system will help them to attain gains in job performance” (Venkatesh et al. 2003). This implies the increased expectations that the users have towards the capacity of technology to improve their performances (Yohanes et al. 2020). Along with this, performance expectancy also includes the gains and utilities that can be obtained from employing the “innovative channels,” leading to increased productivity of the users (Jha and Kumar, 2020). Typically, five sub-factors of performance expectancy include extrinsic motivation, perceived usefulness, relative advantages, job-fit, and finally, outcome expectation. In this study, monetary savings, economic efficiency, and completion of seamless transactions without any spatial hindrances constituted performance expectancy (Bajunaied et al. 2023; Migliore et al. 2022; Ryu, 2018b). A positive link has been predicted between performance expectancy and behavioral intention towards e-money services (Giri et al. 2019) and m-payment (Kaitawarn, 2015). More and more will likely adopt the technology when the benefits of using UPI are realized (Nur and Panggabean, 2021). This forms the basis of the second hypothesis for the study which evaluates the interaction of performance expectancy with behavioral intention. Hence, the second hypothesis is formulated:

Hypothesis 2: Performance expectancy enhances consumer’s behavioral intention in adoption of UPI.

Effort expectancy and behavioral intention of UPI

Effort expectancy can be demarcated as “the degree of ease associated with the use of the system” (Venkatesh et al. 2003). This implies the feeling that users are confident that the technology to be adopted is free of any efforts (Yohanes et al. 2020), errors, and problems (Nur and Panggabean, 2021) and will aid in achieving goals (Yan et al. 2023). Moreover, it has been linked to motivation for the continuous use of mobile (Dayour et al. 2020). This can be categorized into three major sub-factors that involve non-monetary expenses such as ease of use, complexity, and convenience (Wei et al. 2021; Xie et al. 2021; Yan et al. 2023). These predictors have also sometimes been measured separately as observed in the context of the adoption of fintech by farmers (Vandana and Mathur, 2022). Studies have proven that effort expectancy has a notable impact on the use of technologies with respect to mobile money services that act as a driving source for tourism-related industries (Dayour et al. 2020) in the time of COVID-19 pandemic (Yan et al. 2023) and even impacts the attitude of Fintech users (Upadhyay et al. 2022b). However, the limited screen size of the mobile phone, hindrances faced during operation, and the user-friendly aspects of the UPI platform decide the level of complexities and ease of use for the UPI (Xie et al. 2021). This study speculates the third research hypothesis towards understanding the impact of effort expectancy on behavioral intention as follows:

Hypothesis 3: Effort expectancy enhances behavioral intention of consumers towards adoption of UPI.

Social influence and behavioral intention of UPI

Social influence can be defined as “the degree to which an individual perceives how important others believe he or she should use the new system”. This typically implies the surrounding environment and their changing behavior (Khatun and Tamanna, 2021). In these times of social media, the validation of acceptance of technology adoption by essential others, such as family, friends, peers, leaders, etc. becomes extremely critical (Bajunaied et al. 2023;). It definitely has a positive relation with the behavioral intention to use UPI as also demonstrated by many researchers employing the UTAUT model related to digital payments in India (Jha and Kumar, 2020; Singh et al. 2020; Yadav et al. 2022). Grounded on the above, the fourth hypothesis was formulated which will examine the behavioral intention for adoption of UPI due to social influence, particularly focusing on interpersonal and external associations.

Hypothesis 4: Social influence notably enhances behavioral intention of consumers in adoption of UPI.

The moderating effect of perceived risks on behavioral intention towards UPI usage

As explained at the beginning of this section, perceived risks are one of the factors that mostly have a direct but negative impact on the intention to Fintech use as it plays the role of a barrier in the adoption of any forms of mobile payment by the consumers (Belanche et al. 2022;. Meyliana et al. 2019), even in UPI usage (Patel and Datta, 2020). It can be described as the “consumers' impression of vulnerability” and the “subjective uncertainty” surrounding the chance of winning or losing any amount of stake (Keong et al. 2020). It can be demarcated as the “individuals’ perceived potential, uncertain, adverse outcomes when adopting an Internet wealth management platform” (Xie et al. 2021). Following Jangir et al. (2023), these are those negative thoughts experienced by the consumer while buying any product. Perceived risks have been further divided into five dimensions such as cybersecurity risks, financial risks, operational risks, privacy risks, and regulatory risks (Abdul-Rahim et al. 2022; Roh et al. 2022; Ryu, 2018a) as also theorized by Jha and Sharma (2022). Financial risks apply to financial losses, while cybersecurity risks refer to the loss of control over any personal data without their permission or consent, and operational risks are linked to the possibility of product misfortune, leading to customer disappointment (Keong et al. 2020). In another study, the risk of privacy was found to induce negative attitudes and increased resistance, thereby, reducing the level of user acceptance of mobile payment services (Lee et al. 2019). None of the studies considered perceived risk on fintech as a moderator, except in one where the role of perceived usefulness, confirmation, and satisfaction on continuance intention was moderated by perceived risks (Jangir et al. 2023). Therefore, any negative moderating influence of perceived risks by the users on their intention to use UPI was validated through this final hypothesis.

Hypothesis 5: Perceived risks moderate the impact of facilitating conditions, performance expectancy, social influence, and effort expectancy, on behavioral intention of consumers towards adoption of UPI.

Research methodology

In this study, a quantitative research design using a survey as the research strategy and a positivistic research philosophy was chosen. The questionnaire was designed to conduct an extensive survey and collect data for empirical research. The period of this cross-sectional investigation was between July 2023 and February 2024.

Survey instrument

The questionnaire comprised two broad sections, one dealing with demographic details of the users such as age, gender, occupation, monthly income, etc., and their daily use habits towards Fintech payment services. Section II was designed to evaluate the various factors that were influencing or inhibiting them from using UPIs such as facilitating conditions was measured through four sub variables namely, Customer support (4 items; Miadinovic and Xiang, 2016), Speed (4 items), and Assurance (4 items) while Performance expectancy had three sub-variables such as Monetary savings (4 items; Ryu, 2018a), Economic efficiency (5 items; Bajunaied et al. 2023; Ryu, 2018a), and Seamless transaction (4 items; Chao, 2019; Ryu, 2018a). Effort expectancy had three sub-factors such as ease of use (4 items; Hu et al. 2019), convenience (5 items; Khatun and Tamanna, 2021; Ryu, 2018a), and complexity (4 items; Thompson et al. 1991) and Social influence had two sub-factors, such as Interpersonal influence (3 items) and External influence (5 items; Nur and Panggabean, 2021). Perceived risks comprised of cybersecurity risks (4 items; Ryu, 2018b), financial risks (4 items; Ryu, 2018b), operational risks (4 items), privacy risks (4 items; Roh et al. 2022), and regulatory risks (5 items; Abdul-Rahim et al. 2022; Ryu, 2018b). Behavioral intention acted as the outcome variable with 5 items (based on Sharma and Sharma, 2019). All the items followed the 5-point Likert scale, ranging from 1= “Strongly disagree” to 5 = “Strongly agree” are used to measure the construct items. After reading a brief introduction, any confusion found by the respondents in terminology was personally attended to and clarified by the researcher. A questionnaire sample is available from the authors on request. Responses without an answer were removed before data analysis for all the constructs. Two-level randomization was used to prevent order-effect bias (Perreault, 1975). The original language of the questionnaire was kept as English.

Sampling and data collection

A non-probabilistic self-chosen sampling procedure was employed to collect the primary data through a self-administered survey. A total of 416 valid responses were gathered with no unanswered questions. Table 1 describes the socio-demographic characteristics of the Indian users. It was observed that most participant users were 25 years old or younger (47.1%) with a monthly income below Rs. 25000 (51.9%). The study participants represent both genders almost equally (male 43.3%, female 56.7%) and belong to diverse professions. Therefore, the sample population in the present study represents the Indian urban population in terms of age (Silver et al. 2023), gender ratio (Rathore, 2024), or income (Statista Research Department, 2025). Two to three different UPIs were used parallelly, while the most preferred UPI was PhonePe (36.5%), followed by Google Pay and BHIM.

Common method bias and non-response bias test

The probable issues of common method bias were minimized using routine techniques like constructing variables through a thorough literature survey, preserving secrecy, allowing respondents time to reflect before responding (Lepistö et al. 2022), as well as numerical techniques where the variance inflation factor (VIF) was measured accompanied by the measurement properties of the model to minimize the effect of common bias (Qalati et al. 2021). There was also no evidence of bias resulting from non-responses when comparing the demographic and background factors of the early and late participants for differences (Armstrong and Overton, 1977).

Data analysis procedures

The variance-based partial least squares structural equation model (PLS-SEM) combined with multi-group analysis (MGA) was used to compare the collected data within the various UPIs (Henseler et al. 2009; Sarstedt et al. 2011). This technique was employed in this study as the goal of this research was the formation of theories, the sample size was limited, and a PLS-SEM required reasonable assumptions about the data distribution (Ringle et al. 2015). For hypothesis testing, SmartPLS software (version 3.3.3) was employed, and the hypotheses were accepted only when the p-value was observed to be significant at p < 0.05 at 95% confidence. Also, 5000 bootstrapped resamples were applied to obtain the standard errors and t-statistics. After the PLS-SEM model was constructed, tests were run to evaluate the model’s validity, reliability, and predictive capabilities. R2 values and structural path coefficients were used to test the model’s ability to predict outcomes. The Standardized Root Mean Square Residual (SRMR) was used to assess the model’s goodness of fit. The values for the measurement model (Fig. 2), structural model (Fig. 3), and path coefficients between the latent variables and the coefficient of determination were assessed.

Results

Measurement model

Convergent and discriminant validity, internal consistency reliability, and validity of all of the reflective latent constructs were tested to judge the measurement model (Roldán and Sánchez-Franco, 2012). The construct validity and reliability have been elaborated in Table 2. The reliability of this model was measured through Cronbach’s alpha values and the composite reliability measures. The Cronbach alpha values for all the constructions were found to be within the acceptable range of 0.6 to 0.7, representing that all of the constructs showed good internal consistency (Hair et al. 2017).

The first-order model’s dimensionality was examined by means of confirmatory factor analysis (CFA) applying PLS path modeling (Wetzels et al. 2009). Additionally, the convergent as well as discriminant validity were established. According to Hair et al. (2017), item loadings that were significant at p < 0.01 and more than 0.7 were taken into consideration. The average variance extracted (AVE) and composite reliability (CR) were considered to determine the scale’s validity reliability. According to the results, AVE and CR of all the sub-variables exceeded their respective cutoff values of 0.50 and 0.80, suggesting convergent validity (Hair et al. 2017). This shows that high level of validity among the factors used to measure the constructs. In order to test for collinearity, the VIF (variance inflation factor) values were utilized. These values were found to be less than 5, which suggests that there is no collinearity between the research variables (Hair et al. 2017). Additionally, the fact that the VIF values for reflective indicators were even lower than 3.30 confirms that the bias due to the common technique has been eliminated. The VIF values in this study varied from 1.211 to 2.002.

The Fornell and Larcker criterion along with the Heterotrait-Monotrait (HTMT) Ratio, were primarily used to test the discriminant validity (Supplementary Table S1 and Supplementary Table S2). According to Fornell and Larcker (1981), the results demonstrated that the square root of each latent construct’s AVE value was greater than the correlations between latent factors. Furthermore, the HTMT ratio was also found to be lower than 0.85, supporting the uniqueness of each design. Furthermore, the standardized root mean square residual (SRMR) was utilized to comprehend the quality of fit. The fit indices such as SRMR = 0.062, squared Euclidean distance (d_ULS) = 2.35, geodesic distance (d_G) = 2.55, chi-square (χ2) = 3452.59 and Normed Fit Index (NFI) = 0.905 were found to be within the stipulated values representing that the proposed measurement model (Fig. 2) possessed a good fit.

Stone-Geisser’s Q2 value was assessed to understand the predictive relevance of the model (Fig. 4) (Geisser, 2012; Stone, 1974) (Supplementary Table S3). The Q2 values of behavioral intention (0.450) were acceptable, implying a high degree of predictive relevance (Fig. 4) (Richter et al. 2016). It was observed through R-square values that 34.4% of the variation in behavioral intention was explained by its sub-constructs, while 98.1% to 99.6% of the variation in social influence and perceived risks was explained by their sub-constructs, respectively (Supplementary Table S4). This result indicates that the proposed model predicts the reliability of the model well.

The effect size (f2) reveals the extent of the impact of independent constructs on the dependent constructs, as recommended by Hair et al. (2017) (Supplementary Table S5). The effect size of the relationships varied from small to large estimated based on Cohen (1992).

Hypothesis testing through structural model

The PLS bootstrapping approach, which approximates the normality of the data with the use of path weightings at a 95% level of confidence (Rahi et al. 2018), was used to derive the path coefficients and significance levels of the proposed model. Table 3 demonstrates the results of the proposed hypotheses with their corresponding path coefficients along with t-values. Keeping in consideration of the critical t-value’s criterion of more or equal to 1.96 for two-tailed test (p < 0.05), the testing of the model showed that only facilitating conditions did not significantly impact behavioral intention directly (t = 1.121, p > 0.05), while rest of the variables such as performance expectancy (t = 5.610), effort expectancy (t = 2.805), social influence (t = 3.618), and perceived risks (t = 5.007) were found to positively and significantly influence behavioral intention towards UPI adoption. This implies that Hypothesis 1: Facilitating conditions enhance consumer’s behavioral intention in adoption of UPI, stands rejected while Hypothesis 2: Performance expectancy enhances consumer’s behavioral intention in adoption of UPI, Hypothesis 3: Effort expectancy enhances behavioral intention of consumers towards adoption of UPI, and Hypothesis 4: Social influence notably enhances behavioral intention of consumers in adoption of UPI, stands accepted.

Coming to the results of the perceived risk’s moderation effects on the relationship between factors influencing behavioral intention to use UPI, it was found that perceived risk positively and significantly moderated the effect of facilitating conditions on behavioral intention, while negatively moderated the influence of performance expectancy and social influence on behavioral influence. However, effort expectancy was found to be insignificant. Thus, it can be concluded that Hypothesis 5: Perceived risks moderate the impact of facilitating conditions, performance expectancy, social influence, and effort expectancy, on behavioral intention of consumers towards adoption of UPI, was partially accepted.

Differences within the studied UPI platforms

Table 4 depicts the comparison of the three most common UPIs obtained from employing multi-group analysis (MGA) in PLS-SEM to understand the differences in the relationships between all the study variables (Sarstedt et al. 2011). It was observed that there were significant differences between BHIM and PhonePe when the facilitating conditions, performance expectancy, and effort expectancy impacted behavioral intention toward UPI adoption. The p-value of the variations in path coefficients higher than 0.95 or lower than 0.05 in Henseler’s MGA signifies a substantial variation between the individual path coefficients of both categories (Henseler et al. 2009). Moreover, no important variation in the relationship between the adoption of BHIM and Google Pay or Google Pay and PhonePe, implying great similarities in the perception of the users.

Conclusions

With digitalization transforming money transactions between buyers and sellers, the use of UPI has rapidly escalated among consumers becoming the preferred choice for making payments with ease. In this context, the current research provides a holistic understanding of customers’ behavioral intention to use different UPI payment methods in India. Four factors derived from the UTAUT model, including, “facilitating conditions”, “performance expectancy”, “effort expectancy”, and “social influence”, along with “perceived risks” as a fifth factor were considered to determine the behavioral intentions of customers towards UPI using SEM studies. The measurement model showed satisfactory good results in terms of construct reliability and validity. The obtained SRMR value of 0.062 and NFI of 0.905 further confirmed a good fit of the proposed model, and a Q2 value greater than zero implied good predictive relevance of the same. The SEM results showed that except “facilitating conditions” all the other three factors of the UTAUT model positively influenced the behavioral intentions towards UPI adoption. Prior studies, in corroboration with this study, suggested that “performance expectancy” (Lin et al. 2020; Saini and Khasa, 2023), “effort expectancy” (Bajunaied et al. 2023; Dayour et al. 2020), and “social influence” (Patil et al. 2020) significantly influence the behavioral intention towards mobile payment systems. In line with the present study, there are few studies which showed no significant influence of “facilitating condition” on the behavioral intention towards mobile payment services (Masa’deh et al. 2024; Win et al. 2021). Furthermore, a study on Indian users showed that a lack of facilitating conditions was found as a major barrier to mobile payment service usage (Pal et al. 2020). On the other hand, “perceived risks” were found to have a moderating influence on behavioral intentions, demonstrated by the significant positive effects on “facilitating conditions”, and significant negative effects on “performance expectancy” and “social influence”; while the effect on “effort expectancy” was insignificant. Although prior studies demonstrated a significant effect of perceived risk on behavioral intention integrated with the UTAUT model (Lee et al. 2019; Wei et al. 2021), studies are limited in understanding the moderating role of perceived risk on developing intention toward UPI (Jangir et al. 2023). Further, the results of MGA showed no significant variations in the adoption of BHIM-Google Pay or Google Pay-PhonePe, implying similar user perceptions on the UPI platforms. In contrast, significant differences in BHIM-PhonePe adoptive perceptions revealed the influence of “facilitating conditions”, “performance expectancy”, and “effort expectancy” on the behavioral intentions of UPI customers.

Overall, the findings of the study suggest that UPI usage can be encouraged by regulating “perceived risks” and advancing the “facilitating conditions” of the platforms. However, it is important to realize that the present study suffers from a few limitations, which may provide directions for future research. Essentially, the cross-sectional quantitative research design used may restrict the understanding of time-dependent causal inferences in the trend of UPI usage, and besides, the small population size makes it difficult to generalize the results. To address these, future investigations may consider replicating the study across different populations and combining the obtained cross-sectional data with a longitudinal study to observe the changes and interactions of variables over time. Additionally, prospective future studies can include: (i) an extension of the current adoption models to other existing models; (ii) considering other UPIs in use; (iii) comparing the usage statistics of publicly and privately owned UPIs; and (iv) comparing the levels of behavioral intentions pre- and post-pandemic.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Change history

14 August 2025

In this article, the citation metadata for the author Padma Kiran K. was listed as “K, P.K.”, this has been updated to reflect the correct name as “Padma Kiran, K.” to ensure accurate indexing and citation. The original article has been corrected.

References

Abdul-Rahim R, Bohari SA, Aman A, Awang Z (2022) Benefit-risk perceptions of FinTech adoption for sustainability from bank consumers’ perspective: the moderating role of fear of COVID-19. Sustainability 14:1–24. https://doi.org/10.3390/su14148357

Abrahão de RS, Moriguchi SN, Andrade DF (2016) Intention of adoption of mobile payment: an analysis in the light of the Unified Theory of Acceptance and Use of Technology (UTAUT). RAI Rev de Adm ção e Inovação 13(3):221–230. https://doi.org/10.1016/j.rai.2016.06.003

Alkhwaldi AF, Alharasis EE, Shehadeh M, Abu-AlSondos IA, Oudat MS, Bani Atta AA (2022) Towards an understanding of fintech users’ adoption: intention and e-loyalty post-COVID-19 from a developing country perspective. Sustainability 14(19):1–23. https://doi.org/10.3390/su141912616

Al-Saedi K, Al-Emran M, Abusham E, El-Rahman SA (2019) Mobile payment adoption: a systematic review of the UTAUT model. Int Conf Fourth Ind Revolut 2019:4–8. https://doi.org/10.1109/ICFIR.2019.8894794

Armstrong JS, Overton T (1977) Munich personal RePEc archive estimating nonresponse bias in mail surveys estimating nonresponse bias in mail surveys. J Mark Res 14(3):396–402

Bajunaied, K, Hussin, N, & Kamarudin, S (2023). Behavioral intention to adopt FinTech services: an extension of unified theory of acceptance and use of technology. J Open Innov Technol Market Complex 9(100010). https://doi.org/10.1016/j.joitmc.2023.100010

Baptista G, Oliveira T (2015) Understanding mobile banking: the unified theory of acceptance and use of technology combined with cultural moderators. Comput Hum Behav 50:418–430. https://doi.org/10.1016/j.chb.2015.04.024

Barbu CM, Florea DL, Dabija DC, Barbu MCR (2021) Customer experience in fintech. J Theor Appl Electron Commer Res 16(5):1415–1433. https://doi.org/10.3390/jtaer16050080

Belanche D, Guinalíu M, Albá, P (2022) Customer adoption of p2p mobile payment systems: The role of perceived risk. Telematics Inform 72(101851). https://doi.org/10.1016/j.tele.2022.101851

Chan R, Troshani I, Rao Hill S, Hoffmann A (2022) Towards an understanding of consumers’ FinTech adoption: the case of Open Banking. Int J Bank Mark 40(4):886–917. https://doi.org/10.1108/IJBM-08-2021-0397/FULL/XML

Chao CM (2019) Factors determining the behavioral intention to use mobile learning: an application and extension of the UTAUT model. Front Psychol 10(JULY):1–14. https://doi.org/10.3389/fpsyg.2019.01652

Chawla P, Singhal A, Bajaj P (2019) A study on awareness and adoption of unified payments interface (UPI) for digital payments. A J Compos Theory XII(XI):1396–1404

Cohen J (1992) Statistical power analysis for the behavioral sciences (2nd Ed.). Lawrence ELbaum Associates

Das A, Das D (2020) Perception, adoption, and pattern of usage of fintech services by bank customers: evidences from Hojai District of Assam. Emerg Econ Stud 6(1):7–22. https://doi.org/10.1108/MF-08-2022-0379

Davis FD (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q 13(3):319–340

Dayour F, Adongo CA, Agyeiwaah E (2020) Continuous intention to use mobile money (MM) services: driving factors among small and medium-sized tourism and hospitality enterprises (SMTHEs). Afr J Manag 6(2):85–114. https://doi.org/10.1080/23322373.2020.1753495

Fahad MS (2022) Exploring the determinants of adoption of unified payment interface (UPI) in India: a study based on diffusion of innovation theory. Digit Business, 2(100040). https://doi.org/10.1016/j.digbus.2022.100040

Fornell C, Larcker DF(1981) Evaluating structural equation models with unobservable variables and measurement error J Mark Res 18:39–50. https://doi.org/10.20546/ijcrar.2016.409.006

Geisser S (2012) The predictive sample reuse method with applications. J Am Stat Assoc 70(350):320–328

Giri RRW, Apriliani D, Sofia A (2019) Behavioral intention analysis on e-money services in Indonesia: using the modified UTAUT model. Adv Econ, Bus Manag Res 65(ICEBEF2018):73–76. https://doi.org/10.2991/icebef-18.2019.17

Gochhwal R (2017) Unified payment interface—an advancement in payment systems. Am J Ind Bus Manag 07(10):1174–1191. https://doi.org/10.4236/ajibm.2017.710084

Gupta M, Taneja S, Sharma V, Singh A, Rupeika-Apoga R, Jangir K (2023) Does previous experience with the unified payments interface (UPI) affect the usage of Central Bank Digital Currency (CBDC)? J Risk Financ Manag 16(6):286. https://doi.org/10.3390/jrfm16060286

Gupta P, Kapoor K, Bharadwaj S, Singh R (2022) Behavioural intention and user contentment towards digital payment—a study on UPI amongst Indian Masses. Cent Eur Manag J 30:1921–1933. https://doi.org/10.57030/23364890.cemj.30.4.195

Gupta S, Dhingra S, Tanwar S, Aggarwal R (2022) What explains the adoption of mobile wallets? A study from merchants’ perspectives. Int J Human Comput Interact 1–13. https://doi.org/10.1080/10447318.2022.2104408

Hair J, Hollingsworth CL, Randolph AB, Chong AYL (2017) An updated and expanded assessment of PLS-SEM in information systems research. Ind Manag Data Syst 117(3):442–458. https://doi.org/10.1108/IMDS-04-2016-0130/FULL/XML

Henseler J, Ringle CM, Sinkovics RR (2009) The use of partial least squares path modeling in international marketing. Adv Int Mark 20:277–319

Hu Z, Ding S, Li S, Chen L, Yang S (2019) Adoption intention of fintech services for bank users: an empirical examination with an extended technology acceptance model. Symmetry 11(3). https://doi.org/10.3390/sym11030340

Jangir K, Sharma V, Taneja S, Rupeika-Apoga R (2023) The moderating effect of perceived risk on users’ continuance intention for fintech services. J Risk and Financ Manag 16(1). https://doi.org/10.3390/jrfm16010021

Jha R, Kumar R (2020) UPI—an innovative step for making digital payment effective and consumer perception on unified payment interface. Int J Anal Exp Modal Anal 8(7):f698–f705

Jha A, Sharma R (2022) Unified payment interface (UPI)- India’s next transformation. In Developments and Trends in the Banking and Finance Sector (pp 49–57) Empyreal Publishing House

Kaitawarn C (2015) Factor influencing the acceptance and use of m-payment in Thailand: a case study of AIS mPAY rabbit. Rev Integr Bus Econ Res 4(3):222

Keng-Soon C, Choo Yen-San W, Pui-Yee Y, Hong-Leong C, Teh Shwu-Shing J (2019) An adoption of fintech service in Malaysia. South East Asia J Contemp Bus, Econ Law 18(5):134–147

Keong OC, Leong TK, Bio CJ (2020) Perceived risk factors affect intention to use FinTech. J Account Financ Emerg Econ 6(2):453–463

Khanra S (2020) Barriers towards the adoption of digital learning platforms. Acad Mark Stud J 24(4):1–7. www.coursera.org

Khanra S, Joseph RP, Dhir A, Kaur P (2020) Antecedents of the barriers toward the adoption of unified payment interface. IFIP Adv Inf Commun Technol 618:608–625. https://doi.org/10.1007/978-3-030-64861-9_53

Khatun N, Tamanna M (2021) Factors affecting the adoption of fintech: a study based on the financial institutions in Bangladesh. Copernican J Financ Account 9(4):51–75. https://doi.org/10.12775/cjfa.2020.021

Kuriakose A, Sajoy PB, George E (2022) Modelling the consumer adoption intention towards unified payment interface (UPI): an extended UTAUT2 model with relative advantage, add-on services and promotional benefits. 2022 International Conference on Interdisciplinary Research in Technology and Management, IRTM 2022 - Proceedings, 1–7. https://doi.org/10.1109/IRTM54583.2022.9791524

Lee J-M, Lee B, Rha JY (2019) Determinants of mobile payment usage and the moderating effect of gender: extending the UTAUT model with privacy risk. Int J Electron Commer Stud 10(1):43–64. https://doi.org/10.7903/ijecs.1644

Lepistö K, Saunila M, Ukko J (2022) Enhancing customer satisfaction, personnel satisfaction and company reputation with total quality management: combining traditional and new views. Benchmarking, ahead of print. https://doi.org/10.1108/BIJ-12-2021-0749/FULL/PDF

Lin WR, Lin CY, Ding YH (2020) Factors affecting the behavioral intention to adopt mobile payment: an empirical study in Taiwan. Mathematics 8(10):1–19. https://doi.org/10.3390/math8101851

Masa’deh R, Salman A, Al-Dmour A, Jodeh A, Alobeed S, Khrisat A (2024) Evaluating enablers and outcomes of clients’ behavioral intention to use electronic mobile payment services during Covid-19 pandemic: an empirical study on Jordanian Insurance Companies. Jordan J Bus Adm 20(4):485–513. https://doi.org/10.35516/jjba.v20i4.169

Merhi M, Hone K, Tarhini A (2019) A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: extending UTAUT2 with security, privacy and trust. Technol Soc 59(January):101151. https://doi.org/10.1016/j.techsoc.2019.101151

Meyliana, Fernando E, Surjandy (2019) The influence of perceived risk and trust in adoption of fintech services in Indonesia. CommIT (Commun Inf Technol) J 13(1):31–37

Miadinovic J, Xiang H (2016) A study on factors affecting the behavioral intention to use mobile shopping fashion apps in Sweden. http://www.diva-portal.org/smash/get/diva2:933382/FULLTEXT01.pdf

Migliore G, Wagner R, Cechella FS, Liébana-Cabanillas F (2022) Antecedents to the adoption of mobile payment in China and Italy: an integration of UTAUT2 and innovation resistance theory. Inf Syst Front 24(6):2099–2122. https://doi.org/10.1007/s10796-021-10237-2

Neema K, Neema A (2018) UPI (unified payment interface)-a new technique of digital payment: an explorative study. Int J Curr Res Multidiscip 3(10):1–10. https://www.india-briefing.com/news/growth-of-digital-payments-systems-in-india

Nigam A, Kumari S (2018) Adoption of united payment interface application: an empirical investigation using TAM framework. CPJ Glob Rev 10(2):29–36. https://www.cpj.edu.in/wp-content/uploads/2022/11/CPJ-Global-Review-July-2018-dt.-29-08-2018-Final-min.pdf#page=11

Nur T, Panggabean RR (2021) Factors influencing the adoption of mobile payment method among generation Z: the extended UTAUT approach. J Account Res, Organ Econ 4(1):14–28. https://doi.org/10.24815/jaroe.v4i1.19644

Oliveira T, Faria M, Thomas MA, Popovič A (2014) Extending the understanding of mobile banking adoption: when UTAUT meets TTF and ITM. Int J Inf Manag 34(5):689–703. https://doi.org/10.1016/j.ijinfomgt.2014.06.004

Pal A, Herath T, De’ R, Rao HR (2020) Contextual facilitators and barriers influencing the continued use of mobile payment services in a developing country: insights from adopters in India. Inf Technol Dev 26(2):394–420. https://doi.org/10.1080/02681102.2019.1701969

Patel NL, Datta JS (2020) Factors influencing the usage of UPI among customers. Int J Creat Res Thoughts 8(9):1589–1596

Patil P, Tamilmani K, Rana NP, Raghavan V (2020) Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. Int J Inf Manag 54(February):102144. https://doi.org/10.1016/j.ijinfomgt.2020.102144

Perreault WD (1975) Controlling order-effect bias. Public Opin Q 39(4):544–551

Qalati SA, Yuan LW, Khan MAS, Anwar F (2021) A mediated model on the adoption of social media and SMEs’ performance in developing countries. Technol Soc 64(July 2020):101513. https://doi.org/10.1016/j.techsoc.2020.101513

Rahi S, Abd Ghani M, Alnaser FMI, Ngah AH(2018) Investigating the role of unified theory of acceptance and use of technology (UTAUT) in internet banking adoption context. Manag Sci Letters 8(3):173–186. https://doi.org/10.5267/j.msl.2018.1.001

Raj LV, Amilan S, Aparna K, Swaminathan K (2023) Factors influencing the adoption of cashless transactions during COVID-19: an extension of enhanced UTAUT with pandemic precautionary measures. J Financ Serv Market. https://doi.org/10.1057/s41264-023-00218-8

Rathore M (2024) Gender ratio in urban India between 2018 and 2020, by state. Statista 1370082

Richter NF, Sinkovics RR, Ringle CM, Schlägel C (2016) A critical look at the use of SEM in international business research. Int Mark Rev 33(3):376–404. https://doi.org/10.1108/IMR-04-2014-0148

Ringle CM, Wende S, Becker JM (2015) SmartPLS 3. Boenningstedt: SmartPLS GmbH

Rogers EM (1983) Diffusion of innovations. Free Press New York

Roh T, Yang YS, Xiao S, Park BIL (2022) What makes consumers trust and adopt fintech? An empirical investigation in China. Electron Commerce Res https://doi.org/10.1007/s10660-021-09527-3

Roldán JL, Sánchez-Franco MJ (2012) Variance-based structural equation modeling: guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; (pp. 193–221). IGO Global. https://doi.org/10.4018/978-1-4666-0179-6.ch010

Ryu HS (2018b) What makes users willing or hesitant to use Fintech?: the moderating effect of user type. Ind Manag Data Syst 118(3):541–569. https://doi.org/10.1108/IMDS-07-2017-0325

Ryu HS (2018a) Understanding benefit and risk framework of Fintech adoption: Comparison of early adopters and late adopters. Proceedings of the Annual Hawaii International Conference on System Sciences, 2018-Janua, 3864–3873. https://doi.org/10.24251/hicss.2018.486

Saini L, Khasa S (2023) Behavioural intention to use mobile payments in the light of the UTAUT2 Model. Eduzone, 12(1), 219–230. www.allcommercejournal.com

Sarstedt M, Henseler J, Ringle CM (2011) Multigroup analysis in partial least squares (PLS) path modeling: alternative methods and empirical results. Adv Int Mark 22:195–218. https://doi.org/10.1108/S1474-7979(2011)0000022012

Sharma SK, Sharma M (2019) Examining the role of trust and quality dimensions in the actual usage of mobile banking services: an empirical investigation. Int J Inf Manag 44:65–75. https://doi.org/10.1016/j.ijinfomgt.2018.09.013

Silver L, Huang C, Clancy L (2023) Key facts as India surpasses China as the world’s most populous country. Pew Research Center. https://www.pewresearch.org/short-reads/2023/02/09/key-facts-as-india-surpasses-china-as-the-worlds-most-populouscountry/

Singh NK, Singh P (2022) Identifying consumer resistance of mobile payment during Covid-19: an interpretive structural modeling (ISM) approach. Bus Manag Econ Eng 20(2):258–285. https://doi.org/10.3846/bmee.2022.16905

Singh S, Sahni MM, Kovid RK (2020) What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag Decis 58(8):1675–1697. https://doi.org/10.1108/MD-09-2019-1318

Statista (2023) Smartphone penetration rate in India from 2009 to 2023, with estimates until 2040. https://www.statista.com/statistics/1229799/india-smartphone-penetration-rate/#:~:text=In

Statista Research Department (2025) Average monthly salary of salaried class in India 2022, by gender. https://www.statista.com/statistics/1452812/india-average-monthly-salary-of-salaried-class-by-gender/

Stone M (1974) Cross-validatory choice and assessment of statistical predictions. J R Stat Soc: Ser B 36(2):111–147. https://doi.org/10.1111/j.2517-6161.1976.tb01573.x

Thompson RL, Higgins CA, Howell JM (1991) Personal computing: toward a conceptual model of utilization. MIS Q 15(1):125–143

Tungare V (2019) A study on customer insight towards UPI (unified payment interface)—an advancement of mobile payment system. Int J Sci Res 8(4):1408–1412

Upadhyay N, Upadhyay S, Abed SS, Dwivedi YK (2022b) Consumer adoption of mobile payment services during COVID-19: extending meta-UTAUT with perceived severity and self-efficacy. Int J Bank Mark 40(5):960–991. https://doi.org/10.1108/IJBM-06-2021-0262/FULL/XML

Upadhyay N, Upadhyay S, Abed SS, Dwivedi YK (2022a) Consumer adoption of mobile payment services during COVID-19: extending meta-UTAUT with perceived severity and self-efficacy. Int J Bank Market https://doi.org/10.1108/IJBM-06-2021-0262

Vally KS, Divya KH (2018) A study on digital payments in india with perspective of consumer's adoption. Int J Pure Appl Math 119(15):1259–1267

Vandana, Mathur HP (2022) Conceptual development of factors driving fintech adoption by farmers. Purushartha 15(1):39–50. https://doi.org/10.21844/16202115103

Vasavada SS (2022) Unified Payment Interface (UPI)- India’s next transformation. In Y Negi (Ed.), Developments and Trends in the Banking and Finance Sector (pp 49–57) Empyreal Publishing House

Venkatesh V, Thong J, Xu X (2012) Consumer acceptance and user of information technology: extending the unified theory of acceptance and use of technology. MIS Q 36(1):157–178

Venkatesh V, Morris MG, Davis GB, Davis FD (2003) User acceptance of information technology: toward a unified view. MIS Q 27(3):425–478

Wei MF, Luh YH, Huang YH, Chang YC (2021) Young generation’s mobile payment adoption behavior: analysis based on an extended UTAUT model. J Theor Appl Electron Commer Res 16(4):1–20. https://doi.org/10.3390/jtaer16040037

Wetzels M, Odekerken-Schröder G, Van Oppen C (2009) Using PLS Path Modeling for Assessing Hierarchical Construct Models: Guidelines and Empirical Illustration Service Design for Innovation View project. MIS Q 33(1):177–195

Win NN, Aung PP, Phyo MT (2021) Factors Influencing Behavioral Intention to Use and Use Behavior of Mobile Banking in Myanmar Using a Model Based on Unified Acceptance Theory. Human Behav Dev Soc 22(1)

Xie J, Ye L, Huang W, Ye M (2021) Understanding fintech platform adoption: Impacts of perceived value and perceived risk. J Theor Appl Electron Commer Res 16(5):1893–1911. https://doi.org/10.3390/jtaer16050106

Yadav US, Tripathi R, Tripathi MA (2022) Effect of digital and financial awareness of household womens on the use of fin-tech in India: observing the relation with (Utaut) model. J Sustain Bus Econ 5(3):18–26. https://doi.org/10.30564/jsbe.v5i3.14

Yan C, Siddik AB, Akter N, Dong Q (2023) Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: the role of FinTech. Environ Sci Pollut Res 30(22):61271–61289. https://doi.org/10.1007/s11356-021-17437-y

Yi G, Zainuddin NMM, Bt Abu Bakar NA (2021) Conceptual model on internet banking acceptance in China with social network influence. Int J Inform Vis 5(2):177–186. https://doi.org/10.30630/joiv.5.2.403

Yohanes K, Junius K, Saputra Y, Sari R, Lisanti Y, Luhukay D (2020) Unified Theory of Acceptance and Use of Technology (UTAUT) model perspective to enhance user acceptance of fintech application. Proceedings of 2020 International Conference on Information Management and Technology, ICIMTech 2020, August, 643–648. https://doi.org/10.1109/ICIMTech50083.2020.9211250

Author information

Authors and Affiliations

Contributions

Conceptualization: PKK; literature review: PKK and VNS; methodology: PKK; data collection: PKK and VNS; analysis: PKK; writing—original draft: PKK; writing—review and editing: PKK and VNS; supervision: VNS—both authors have read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This study is a non-interventional, survey-based research project involving adult human participants. It complies with institutional ethical standards and internationally recognized ethical guidelines, including the Declaration of Helsinki. The study was approved by the Research Progress and Assessment Committee (R-PAC) of KLEF Deemed to be university on 8 August 2023 (Approval Code: RPAC/PhD/2023/1028) where Padma Kiran K is pursuing a PhD. Additionally, as part of the author’s PhD research, the study received ethical approval from the university.

Informed consent

This study involved adult human participants who completed a questionnaire as part of the research. Informed consent was obtained from all individual participants between 22 August 2023 and 20 February 2024 who were involved in the study. Participants were informed about the purpose of the study and were assured that their personal details would be kept confidential. They were informed that their participation was voluntary and that they could withdraw at any time without any consequences. The questionnaire included questions designed to assess participants’ opinions on various risks and benefits associated with FinTech adoption. This allowed the researchers to gather insights into participants’ perspectives on these matters.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Padma Kiran, K., Vedala, N.S. Exploring behavioral intentions of consumers towards different digital payment services through the interplay of perceived risks and adoption factors. Humanit Soc Sci Commun 12, 1141 (2025). https://doi.org/10.1057/s41599-025-05468-6

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05468-6