Abstract

The growing influence of social media plays a pivotal role in enhancing corporate governance capabilities, thereby contributing to the quality of accounting information disclosure. Relying on a large sample comprising 19,889 A-share listed companies on the Shanghai and Shenzhen Stock Exchanges in China, spanning the period from 2012 to 2022, this research aims to empirically assess the impact of social media on accounting information disclosure of Chinese-listed companies while also investigating the moderating effect of government supervision. We found a positive relationship between increased social media usage and the heightened quality of accounting information disclosure. Specifically, a rise in negative coverage within social media is associated with a more substantial improvement in the quality of corporate accounting information disclosure. Furthermore, when social media usage attracts the moderating effect of government supervision, the positive impact on enhancing the quality of corporate accounting information disclosure becomes more evident. This research contributes theoretically by enriching existing research on the relationship between social media, government supervision, and accounting information disclosure. In practical terms, it serves as a valuable reference for fostering the healthy development of China’s capital market.

Similar content being viewed by others

Introduction

Corporate information disclosure, particularly accounting information disclosure, plays a pivotal role and holds direct relevance to the interests of corporate managers, shareholders, and creditors. This is because these stakeholders can glean crucial insights from accounting information, determining whether the company efficiently utilizes economic resources and exhibits favorable operational performance. In turn, such insights inform their behavioral decisions. Verrecchia (2001) categorizes accounting information disclosure into three types: contact-based disclosure, consideration-based disclosure, and efficiency-based disclosure. He argues that consideration-based disclosure is driven by managerial choices, focusing on the motivations behind disclosure decisions. Watts and Zimmerman (1986) suggest that although information disclosure may increase political costs, it remains a crucial means of reflecting economic incentives. This indicates that despite the potential external pressures associated with disclosure, firms still have economic incentives to disclose information. These studies provide theoretical support for understanding the motivations behind accounting information disclosure. However, they have largely overlooked the role social media may play in this process (Li et al. 2024a). In contrast to previous research that has primarily focused on traditional forms of disclosure this study introduces social media as an emerging variable that could have a profound impact on the transparency and reliability of accounting information disclosure. In China, the widespread use of social media allows the public and shareholders to directly influence corporate disclosure practices. By comparing the impact of social media, this study not only enriches the framework for accounting information disclosure but also uncovers the interaction between government regulation and social media, filling a gap in existing literature. Accounting information disclosure, as a pivotal component in corporate transparency, presents a valuable opportunity to delve into and contemplate the economic incentives driving fundamental disclosure decisions. On one hand, China mandates companies to disclose accounting information under government supervision; simultaneously, it encourages voluntary accounting information disclosure by providing guidance. When companies choose to disclose information voluntarily, they possess significant discretion in determining the method, content, and extent of such disclosures. This discretionary aspect raises concerns about the potential distortion of accounting information. In this context, social media usage emerges as a valuable tool for oversight, contributing to the assurance of the authenticity and reliability of accounting information disclosure.

Social media represents a distinct form of voluntary information disclosure, differing significantly from both mandatory disclosures and traditional voluntary methods. Unlike mandatory disclosures, which are regulated and standardized to ensure uniformity and compliance, social media disclosures are unregulated, offering companies greater flexibility in terms of content, timing, and audience engagement (Kiousis, 2001; Kaplan and Haenlein, 2010). This unstructured nature allows companies to tailor their communication strategies to specific stakeholders, fostering direct interaction and real-time feedback. Compared to other voluntary disclosure channels, such as annual reports or press releases, social media is characterized by its immediacy, accessibility, and interactive potential (Mangold and Faulds, 2009). These features enable companies to rapidly disseminate information and respond to stakeholder inquiries, enhancing transparency and trust. However, the lack of formal guidelines poses challenges, as the quality and reliability of social media disclosures may vary significantly across firms (García-Sánchez and Martínez‑Ferrero, 2017). In the context of Chinese-listed companies, social media serves as a powerful tool for accounting information disclosure, amplifying the reach and visibility of financial information. However, government supervision plays a critical role in moderating its effectiveness. While robust supervision can enhance credibility and accountability, weak oversight may allow misleading or incomplete information to proliferate, undermining investor confidence (Gipper et al. 2020; Holt and DeZoort, 2009). These dynamics underscore the need for a balanced regulatory framework to maximize the benefits of social media disclosures while mitigating potential risks. Existing literature has given limited attention to how social media affects the quality and transparency of accounting information disclosure, particularly in the context of government regulation. This study develops a novel framework by integrating social media with government regulation. The findings suggest that social media not only accelerates the dissemination of information but also improves the quality of information disclosure to some extent. Particularly, in cases where negative coverage increases, social media can enhance the transparency of corporate disclosures, thereby boosting public and shareholder trust.

Especially in recent years, the landscape of media has witnessed significant transformations with the emergence of platforms like stock bars, TikTok, Facebook, WhatsApp, Instagram, Weibo, YouTube, Twitter, Xiaohongshu, and so forth (Bin-Nashwan and Al-Daihani, 2021). This evolution, particularly in contrast to traditional media, is characterized by rapid communication, high efficiency, and cost-effectiveness (Kaplan and Haenlein, 2010; Parveen et al. 2015; Tajudeen et al. 2018; Villeda and McCamey, 2019; Qalati et al. 2021; Si et al. 2023; Bin-Nashwan et al. 2022). The combination of these traits, offering a low-cost avenue with a potentially high return, has garnered substantial interest from companies. The growing influence of social media usage and exposure plays a pivotal role in enhancing corporate governance capabilities (Ang et al. 2021; Sun et al. 2022), subsequently contributing to the enhancement of the quality of accounting information disclosure, while the exploration of the impact of social media usage on accounting information disclosure, has emerged as a focal point for accounting scholars in the field of empirical accounting. This trend has been particularly noteworthy in recent years, profoundly impacting both developed countries and emerging market economies in transition. Fueled by their distinctive institutional environments, studies on accounting information disclosure issues are proliferating, each contributing empirical results that hold significant reference value for the robust development of companies in these nations.

Recent research reveals a fragmented and evolving landscape in the intersection between social media and corporate disclosure, encompassing a broad range of themes from financial reporting to social responsibility communication. Notable studies have explored topics such as social media usage and voluntary disclosure (Hales et al. 2018; Zhang and Chen, 2020), corporate social responsibility evaluation (Haladu and Bin-Nashwan, 2024; Deegan and Islam, 2014; Ramananda and Atahau, 2020; Haladu et al. 2025a; Haladu et al. 2025b), accounting information dissemination (Cade, 2018; Lei et al. 2019; Duan et al. 2023), and the use of social media as a disclosure outlet (Grant et al. 2018; Fan et al. 2023; Booker et al. 2023). Further areas of inquiry include social media’s influence on financial reporting (Bonsón and Flores, 2011; Alexander and Gentry, 2014; Ding et al. 2020; Kogan et al. 2023), earnings management (Sun et al. 2022; Lin and Xing, 2024), and capital structure decisions (Dang et al. 2019).

Despite this growing body of work, the literature remains conceptually fragmented and lacks a unified theoretical framework to systematically explain how social media affects accounting information disclosure. Most existing studies offer descriptive insights or isolated empirical findings without examining the mechanisms or contextual conditions—such as regulatory oversight—that shape this relationship. This gap is particularly evident in emerging markets, where both corporate disclosure practices and regulatory environments differ significantly from developed economies. To address this void, our study provides an in-depth empirical analysis of how social media usage influences the quality of accounting information disclosure among Chinese-listed firms. Uniquely, we investigate the moderating role of government supervision in this relationship, providing new insights into how external governance mechanisms interact with public digital platforms to shape corporate transparency. By doing so, this study not only contributes to the literature by integrating the lens of institutional oversight but also offers practical implications for policymakers and regulators. In economies where formal institutions are still evolving, leveraging social media as an informal governance tool could enhance disclosure quality, reduce information asymmetry, and ultimately promote more efficient capital markets.

To establish the relationship between social media usage and accounting information disclosure, we constructed a dataset of Shanghai and Shenzhen A-share listed companies in China from 2012 to 2022. Our results indicate that an increase in social media usage relates positively to enhanced accounting information disclosure. The magnitude of improvement in accounting information disclosure is anticipated to be more pronounced when confronted with a higher volume of adverse reporting in social media, in comparison to positive reporting. Upon introducing government supervision as a moderating factor, we observed an amplification of its effect.

This study significantly contributes to academic literature in three key areas. Firstly, it extends the impact of social media usage on enterprises to accounting information disclosure, establishes a comprehensive theoretical framework for the relationship between social media usage and accounting information disclosure, and enhances existing research on the effects of social media usage on corporate governance. Secondly, our research enhances understanding of the contagion effect of social media usage on capital market shareholders and supplements relevant impact mechanisms from the perspective of information communication. Thirdly, this article intersects journalism, behavioral economics, corporate management, and corporate finance. Our findings offer positive implications for expanding the literature in this field. This study offers brand-novel references for empirical research, benefiting not only China but also other market economies worldwide by addressing the practical difficulties of existing capital market development.

This research is organized as follows: The second section delves into theory and hypothesis, followed by the third section, which details the research design. The fourth section is dedicated to presenting the results and discussion, and lastly, the fifth section encapsulates the conclusions.

Theoretical background

Social media and accounting information disclosure

Technology-based platforms can play important roles in business operations, information disclosure, and performance at large (Bin-Nashwan and Li, 2025a; 2025b; Bin-Nashwan et al. 2025a). In a comprehensive survey encompassing over 300 empirical studies from the United States, Germany, Japan, and other countries, McCombs and Reynolds (2002) revealed a notable alignment between the public’s comprehension and assessment of crucial issues and the news media. Subsequently, the concept of agenda setting has been integrated into corporate studies. Research conducted by relevant scholars underscores a substantial positive correlation between media usage as a supervision and the quality of accounting information disclosure. The prominence of agenda setting becomes evident in the media’s constructive influence on enhancing the quality of corporate information disclosure, as particularly highlighted by Fombrun and Shanley (1990), Staw and Epstein (2002), and McCombs and Carroll (2003). Moreover, additional scholarly investigations underscore the pivotal role of media usage as a form of external supervision in influencing the quality of accounting information disclosure (Dyck and Zingales, 2002). In countries with extensive news media penetration, the disclosed accounting information is deemed more authentic and reliable (Dyck and Zingales, 2003; Bushman, 2003; Huang and Guo, 2014; Wang and Zhang, 2016).

In recent years, scholars have extensively studied the role of media supervision in enhancing the quality of accounting information disclosure. Dyck and Zingales (2002) argued that in countries with widespread news media, media regulation significantly improves the transparency and authenticity of disclosures. Meanwhile, Staw and Epstein (2002) emphasized the critical role of agenda-setting theory in media coverage, highlighting how media influence can enhance the quality of corporate information disclosure. Delving deeper into the content of media coverage, research validates the relationship between media supervision and the quality of corporate accounting information disclosure. It is observed that industries receiving more adverse media reporting and favorable companies within these industries garnering positive reporting exhibit enhanced accounting information quality (Aerts and Cormier, 2009; Li and Yang, 2015; Zhou and Gu, 2018; Chen et al. 2020). The advent of social media has significantly reduced the cost of accessing information, enabling the public and shareholders to more broadly monitor corporate behavior (Tajudeen et al. 2018; Villeda and McCamey, 2019). Research shows that negative coverage often draws heightened attention from the public and shareholders, which in turn pressures companies to improve financial disclosures in response to external pressure (Joe et al. 2009). Therefore, social media plays a crucial role in enhancing corporate transparency and governance structures.

As “rational economic actors,” the media adheres to the cost-benefit principle when scrutinizing accounting fraud, prioritizing the publication of articles with maximum benefits (including potential gains) and minimal costs. From a revenue standpoint, the media gives precedence to articles capable of capturing audience attention, enhancing click-through rates, or expanding circulation to boost distribution revenue. The focal points of such articles are primarily influential listed companies (Liu, 2010), a phenomenon accentuated by the surge of social media. This amplification through social media usage further underscores its impact on listed companies. The primary expenditure incurred by the media in disseminating articles on accounting fraud is the cost associated with investigation and evidence collection.

In this context, following Suchman’s (1995) legitimacy principle, legitimacy is construed as the public’s evaluation of an enterprise. Articles aimed at increasing click-through rates or broadening circulation typically target companies with significant societal impact, particularly listed companies wielding substantial social influence. Consequently, these companies become subject to heightened legitimacy scrutiny from powerful social media outlets. Faced with external pressures, particularly of a legitimate nature, a strategic response involves mitigating potential negative consequences for the sustained growth of companies. This necessitates a gradual reduction in accounting fraud, thereby enhancing the quality of accounting information (McConnell et al. 2016; Ho et al. 2023). We argue that the widespread use of social media leads to greater public visibility, which in turn encourages companies to improve their disclosure practices to maintain a positive corporate image and meet stakeholders’ expectations. Based on the preceding arguments, we formulate the next hypothesis, labeled as H1:

H1. The increase in social media usage is positively related to enhanced accounting information disclosure.

Adverse reporting in social media and accounting information disclosure

Previous research has extensively demonstrated the governance role of traditional media, including fraud exposure (Miller, 2006) and enhancing corporate board efficiency (Joe et al. 2009). The media serves as a crucial intermediary in the capital market, actively contributing to corporate governance. However, the emergence of social media has led to a gradual decline in public interest in traditional media. Social media news sources are more accessible compared to traditional media, enabling non-elites to exert influence (Knobloch-Westerwick and Johnson, 2014), and social media content and presentation formats are more diverse (Gamson and Modigliani, 1989; Miranda et al. 2016). Social media, unlike traditional media, is not bound by professional codes or prohibitions against sensationalism, potentially leading to more emotional reporting (Derks et al. 2008; Pantti, 2010). Reporting contains both positive and negative sentiments (Weinstein et al. 2021), which are strongly linked to a company’s operational performance (Kelly and Ahmad, 2018). Positive reporting in social media, while only highlighting companies’ earnings positively in the capital markets seen by investors (Jung et al, 2018), may not consistently exert significant public opinion pressure on companies. This phenomenon resulted in companies employing the tunneling behavior of major shareholders to manipulate earnings management to some extent, consequently encroaching upon the interests of small and medium-sized shareholders (Liao et al. 2023).

Negative reporting on social media tends to attract more emotional attention from the public compared to positive reporting, which can damage a company’s reputation and erode stakeholders’ trust in the company and its executives. The theoretical foundation of this study is based on media supervision theory and agenda-setting theory, emphasizing the guiding role of media coverage on corporate behavior. Specifically, negative social media coverage significantly impacts the transparency of a company’s accounting information disclosure. Social media amplifies public sentiment, exerting pressure on companies to improve the accuracy and timeliness of their financial reporting in response to negative public opinion, thus enhancing transparency. The supervisory role of social media extends beyond direct public opinion, as its influence on a company’s reputation also indirectly compels the company to improve the quality of its information disclosure. This loss of executive confidence can harm the company’s future prospects, leading to a decrease in stock price and operating performance (Joe et al. 2009; Wong and Zhang, 2022). Consequently, strong public opinion pressure compels the company to rectify improper behavior, disclose accurate accounting information, and implement appropriate strategies to enhance operational performance. Li et al. (2022) also found that negative reporting on social media exerts significant pressure on firms, subjecting them to being enforcedly supervised by shareholders. Severe negative reporting in social media can prompt intervention by external administrative supervision agencies, heighten the likelihood and severity of company sanctions, and escalate litigation risks in cases of governance issues like financial fraud, consequently exacerbating declines in the company’s stock price and operational performance.

Thus, over the long term, amidst the supervision of negative social media, companies are compelled to enhance the accuracy of their financial reports and ensure the authenticity of their accounting disclosures to prevent financial pitfalls and foster the sustainable growth of the company, consequently further reducing the incidence of fraudulent activities. The causal mechanism here is grounded in the idea that adverse social media coverage places additional pressure on companies to enhance transparency and disclose more accurate financial information to counter negative perceptions. Based on the preceding arguments, we formulate the next hypothesis, labeled as H2:

H2: The improvement in accounting information disclosure will be more significant when companies face a higher volume of adverse social media reporting compared to positive reporting.

The moderating effect of government supervision

While scholars have demonstrated the significant role of financial media in influencing the quality of accounting information disclosure, its impact is particularly evident in countries with high media penetration and robust corporate governance, where disclosure becomes more transparent and reliable (Dyck and Zingales, 2002, 2003). However, in emerging markets such as China, where media independence and investor protections are comparatively weaker, media supervision often needs to be supported by formal government regulation to be truly effective. In such contexts, government supervision can act as an external governance mechanism that reinforces and amplifies the influence of public scrutiny.

The pivotal “Enron Incident” in 2002 highlighted the deficiencies in corporate transparency and led to the enactment of the Sarbanes-Oxley Act (SOX), which strengthened regulatory oversight in the U.S. capital market. This event spurred scholarly interest in the moderating role of institutional supervision on the media’s impact on disclosure quality (Aerts and Cormier, 2009; Kothari et al. 2009; Li and Shen, 2010; Li and Wang, 2013; Zhang and Zhang, 2014; McConnell et al. 2016). In the digital era, the rise of social media has brought a new dimension to this discourse. Recent research, such as Chen et al. (2022), highlights how governments now play an active role in shaping the regulatory environment around online discourse, thus guiding social media’s influence on accounting transparency. Liu (2025) provides compelling empirical evidence that government oversight, as an external governance mechanism, enhances firm behavior and performance during IPOs in China, supporting the argument that formal institutions can complement informal channels like social media in corporate monitoring.

China has long recognized the importance of improving corporate disclosure. Since the 1990s, a series of reforms have been implemented to enhance transparency, culminating in the introduction of the “Measures for the Administration of Information Disclosure by Listed Companies” in 2007, and its significant revisions in 2021 by the China Securities Regulatory Commission. These were accompanied by updated accounting standards and detailed disclosure rules issued by the Shanghai and Shenzhen stock exchanges. Notably, the launch of the Investor E-Interaction platform (Yang and Zhang, 2020) enabled a structured and interactive use of social media, improving access to real-time firm-related information and contributing to higher disclosure quality—particularly when combined with sustained government oversight.

Although the media plays a supervisory role, it can also be vulnerable to information distortion and rent-seeking, especially under weak institutional constraints. In such scenarios, government supervision becomes a necessary safeguard to ensure the credibility of disclosed information (Zheng, 2007; He and Wei, 2012). The development of social media has expanded the landscape of information dissemination, increasing transparency and lowering information processing costs for investors (Chen et al. 2022). However, as social media criticism intensifies, the likelihood of regulatory attention grows, which in turn pressures firms to disclose more accurately and reduces room for manipulation.

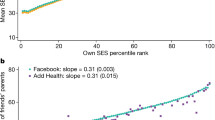

Existing studies show that social media platforms such as Twitter and Facebook reduce information asymmetry and influence firm valuations (Blankespoor et al. 2020). Negative coverage in particular shapes public opinion, increasing reputational risk and attracting regulatory scrutiny. In response, managers often improve disclosure practices to mitigate potential sanctions or reputational harm (Li and Shen, 2010; Zhang and Zhang, 2014; Blankespoor et al. 2020). As China’s capital market matures and enforcement capacity strengthens, the dual impact of social media pressure and government supervision is increasingly effective in promoting disclosure transparency. Thus, government supervision is theorized to serve as a moderating factor. It enhances the relationship between social media usage and accounting information disclosure by increasing the perceived regulatory consequences of public exposure. Accordingly, we assume that:

H3: The greater the influence of social media usage, the more pronounced the moderating effect of government supervision on accounting information disclosure.

We posit that adverse social media reporting in combination with government supervision acts as a stronger catalyst for enhanced disclosure compared to positive reporting, as firms are more compelled to comply with regulations and respond to negative external pressures.

H4: The moderating effect of government supervision is stronger when companies face adverse social media reporting than when they face positive reporting.

Building upon these premises, this paper formulates a theoretical research framework illustrating the relationships among social media usage, government supervision, and accounting information disclosure (refer to Fig. 1).

Methods

Data and sample

This study employs a sample of listed companies in China’s Shanghai and Shenzhen A-share capital markets spanning the years 2012 to 2022 to investigate the impact of social media usage on accounting information disclosure, taking into account the moderating effect influence of government supervision. The Shanghai and Shenzhen A-share markets represent the largest equity markets in China, covering a diverse range of industries and firm types (Bin-Nashwan et al. 2025b), which ensures that the study reflects varied levels of social media adoption and disclosure practices across sectors (Chen and Shi, 2017). The selection of the 2012–2022 sample period is justified for the following reasons: The years 2012–2022 mark a period of accelerated digital transformation, particularly in corporate communications and stakeholder engagement, driven by the widespread adoption of social media platforms in China. This period captures how companies are increasingly using these platforms for voluntary disclosure of accounting information (Chen et al. 2022). In the wake of the COVID-19 pandemic, reliance on digital communication, including social media, surged. Companies adopted social media as a key tool to bridge information gaps with investors and stakeholders during a time of increased economic uncertainty, making this timeframe particularly relevant for studying its impact (Gomez et al. 2024). Significant regulatory updates in corporate governance and disclosure practices occurred in China during this period. These changes, alongside heightened government supervision, provide a timely context for analyzing the moderating effects of regulatory oversight on the relationship between social media use and accounting information disclosure (Li et al. 2024a).

The sample selection criteria are as follows: (1) Exclusion of companies with unknown financial and industry data; (2) Elimination of companies with unclear property rights, missing equity structures, unknown nature of final control rights, and those with missing data; (3) Removal of companies classified as ST, PT, or those exhibiting abnormal data; (4) Exclusion of companies with incomplete financial data during the sample period; (5) Omission of IPO-listed companies for the corresponding year. To mitigate the influence of extreme values, this study applies Winsorizing to the continuous variables, comparing values beyond the 1% and 99% quantiles. After meticulous processing, a dataset comprising 19,890 listed companies was derived for the research. Financial data sources include the Flush Database, Guotai Junan Database, Wind Database, and Shenzhen Securities Exchange Website Database. The data processing was conducted using Excel 2019, Eviews 6.0, and Stata 18.0.

Definition of professional terms: “ST,” an acronym for “special treatment,” denotes stocks exhibiting abnormal financial conditions or other irregularities. The Shanghai and Shenzhen Stock Exchanges implement special treatment measures for stock transactions meeting such criteria. “PT” stands for “Particular Transfer” in English. It represents a specialized transfer service facilitating the circulation of stocks suspended from listing. Stocks undergoing this process will have “PT” prefixed to their abbreviation by the Shanghai and Shenzhen Stock Exchanges.

Measurements

Dependent variable

Accounting information disclosure (AID) is assessed by aligning with the comprehensive notion of accounting information transparency, indicating the extent to which a company’s accounting information authentically and effectively represents the internal earnings status and reflects all transaction information related to the company’s financial condition during a specific period (Ge, 2001). Various models are employed to measure accounting information disclosure, including the modified Jones model (Dechow et al. 1995), DD model, modified DD model, earnings radicality, and earnings smoothness. In this study, methodologies from Zhou and Wu (2013), Sun et al. (2013), and Almubarak et al. (2023) are adopted, and indicators such as earnings radicalization, earnings smoothness, and earnings timeliness are utilized to gauge the quality of accounting information disclosure.

Definition of related variables: “i” and “t” represent individual companies and the respective year to which they belong. In addition, “AIDit“signifies accounting information disclosure, “EAit” denotes earnings aggressiveness,“ESit” represents earnings smoothness,“ERCit“denotes earnings timeliness, “Deciles” indicates that the variable is processed into deciles. The variable “AIDit” is constrained within the range [1, 10]. A smaller value of “AIDit” indicates a higher level of accounting information disclosure.

Earnings aggressiveness (EA it)

Earnings aggressiveness characterizes a company’s inclination to employ a conservative strategy in recognizing losses and a more assertive approach in recognizing revenue, aiming to achieve an escalation in accruals. In alignment with methodologies outlined by Barton and Simko (2002), Das et al. (2011), and Almubarak et al. (2023), the subsequent formula is employed for the construction of earnings aggressiveness.

Definition of related variables: “i” and “t” represent individual companies and the respective year to which they belong. The variable “ACCit” signifies the accruals of company “i” in year “t”. The other variables are defined as follows: “ΔCAit” denotes the change in current assets, “ΔCLit” denotes the change in current liabilities, “ΔCashit” represents the change in monetary funds, and “ΔSTDit” represents the long-term debt due within one year. In terms of change amounts, “DEPit” represents the accumulated depreciation of fixed assets and amortization of intangible assets, “ΔTPit “represents the change in taxes payable, and “Assetit-1” represents the total assets at the end of year (t-1).

Earnings smoothness (ES it)

Earnings smoothness characterizes the correlation between reported earnings and actual earnings of listed companies, indicating the extent to which a company’s earnings fluctuations deviate from the norm. This concept is formulated based on the findings of Shaw (2003), Zhou and Wu (2013), and Zhang et al. (2021), and the earnings smoothness measure is derived from the following formula.

Definition of related variables: “i” and “t” represent individual companies and the respective year to which they belong.The variable “ESit“denotes earnings smoothness, with the standard deviation of the indicators encapsulated in “SD” brackets. Additionally, “CFOit-k” represents the net cash flow from operating activities in year (t-k) (where k = 0, 1, 2, 3), “NIit-k “represents the net profit in year (t-k), and “Assetit-k-1” represents the total assets at the end of year (t-k-1).

Earnings timeliness (ERC it)

Earnings timeliness reflects the relevance of current operating results or value information, with higher timeliness indicating greater value changes for all companies in the current period and a higher level of accounting information disclosure. This study adopts the methodologies outlined by Shaw (2003), Beekes et al. (2004), Bi (2006), and Sun et al. (2013), utilizing the estimated coefficient of the stock return rate RETit (return slope: REV_B) and the formula in the inverse regression equation of earnings and stock returns in the following formula (5) to determine the coefficient R2 (REV_R2) in model 5. The grade scores of each company’s REV_B and REV_R2 are calculated, and the sum of these two indicators, REC, is employed as a measure of earnings timeliness.

This study employs a regression model to assess data accuracy, focusing on stock returns and earnings information over a continuous five-year period commencing from the conclusion of the initial year within the chosen sample dataset. The corresponding estimation model is articulated by formula 5.

Definition of related variables: “EPSit “is the earnings per share of company i in period t, “Pit-1” is the stock closing price of company i at the end of period (t-1), and “RETit “is the 12-month period from May of year t to April of year (t + 1). The market-adjusted annual stock return of company i in period t, “DRit“is a dummy variable (if RET is negative, its value is 1, otherwise it is 0), and μit is the residual term.

Definition of related variables: “Rij” denotes monthly stock return of company i in month j, accounting for the reinvestment of cash dividends. “\({\bar{{\boldsymbol{R}}}}_{t}\)” represents average cumulative annual return of all stocks in year t.

Since annual reports of listed companies are typically disclosed within 4 months after the fiscal year-end, the model aims to avoid the inclusion of earnings information from the previous year in the current year’s stock returns. Therefore, the analysis considers the period from the beginning of the next year after the prior annual report announcement (i.e., early May of year t) until the announcement of the current year’s report. To substitute for the impact of relevant information in the current period on accounting earnings, the model utilizes the annual return rate of stocks purchased and held until the end of this period (i.e., the end of April of year t + 1). Additionally, to mitigate the influence of overall market factors, including macroeconomic and policy-related factors, the model adjusts the cumulative annual return rate of stocks based on the market average (Christie, 1987; Bi, 2006; Sun et al. 2013). To further mitigate the impact of extreme values, this study applies Winsorize processing to observed values of EPSit÷Pit-1 and RETit within a floating range of 1%.

Independent variable

The measurement indicators of social media usage (Media) encompass the number of reports on social media, including both positive and adverse reporting. In alignment with the methodologies employed by Dyck et al. (2008) and Xue et al. (2021), this study adopts the natural logarithm of “1 + the number of reporting in social media” to gauge social media usage. This measure comprises the total number of reports in social media, encompassing positive, and adverse reporting. Specifically, media signifies the overall number of reports in social media, denoted as Ln(1+Media). Media 1 represents the logarithmically transformed count of positive reporting in social media, expressed as Ln (1 + Media 1). Media 2 signifies the logarithmically transformed count of adverse reporting in social media, denoted as Ln(1+Media 2). Data for these indicators are sourced from platforms such as Tiktok, Weibo, Investor e-Interaction, Hexun.com, and Wind, providing a comprehensive reflection of the impact of social media attention.

Moderator variable

The measurement indicators for Government supervision (GOV) encompass institutional changes, internal control indices, surplus range dummy variables, auditor punishment intensity, supervision evaluation, and government transparency. This study adopts methodologies inspired by Li (2007), Song and Lai (2012), Wu et al. (2017), and Zhou et al. (2018). The metrics employed for government supervision include institutional changes, punishment intensity of listed companies, government supervision evaluation indices, and marketization indices.

Institutional changes (CHANG it)

Drawing on the studies by Zhou et al. (2018) and Li and Huang (2019), this study designates 2012 as the pivotal point for changes in the government supervision system. Supervision intensity was comparatively weak before 2012 and became stronger after that year. Hence, an institutional change variable, CHANGit, is employed as a dummy variable. It takes a value of 0 for the year 2012 and a value of 1 for the years after 2012.

Punishment intensity of listed Companies (PUNI it)

Drawing on the research by Song and Lai (2012) and Wu et al. (2017), this study obtained information on penalties imposed on listed companies from the China Securities Regulatory Commission, sourced from both the official website of the China Securities Regulatory Commission and the Guotai Junan database. The penalties consist of eight types, ranging from the mildest to the most severe: Criticism, warning, condemnation, fine, confiscation of illegal income, cancellation of business license, ban on market entry, and others. Weights are assigned to these penalties, with values of 2, 3, 4, 5, 6, 7, 8, and 1, respectively, based on their severity. The punishment intensity of listed companies (PUNIit) is calculated as the product of the type of penalty and its corresponding weight.

Government supervision evaluation indices (GREI it)

Leveraging the methodologies introduced by Li (2007) and Shen and Feng (2012), this study focuses on a research sample comprising China’s Shanghai and Shenzhen A-share listed companies spanning the period from 2009 to 2019. Specifically geared towards shareholders, the government evaluation index is procured through an extensive questionnaire survey, culminating in the comprehensive synthesis and calculation of the GREIit score.

Marketization indices (GTRANS it)

Considering that the level of marketization may impact the effectiveness of government supervision, this study adopts the methodology put forth by Song et al. (2019). It incorporates the five dimensions outlined in the “China Provincial Marketization Index Report” (2020 Edition) by Fan and Wang, utilizing the weighted total score data. The extent of marketization is denoted by GTRANSit, serving as a metric to gauge the quality of government supervision.

Control variables

This study incorporates ten control variables, namely company size (SIZE), profitability (ROA), financial leverage (LEV), nature of property rights (STATE), growth ability (GROWTH), own cash flow ratio (CF), executive compensation (SALARY), audit opinions (AUDIT), industry nature (INDUST), and annual variables (YEAR). The precise definitions for each variable can be found in Table 1.

Model design

A multiple regression model (model 8) was formulated, with accounting information disclosure (AID) serving as the dependent variable. The definitions of independent and control variables from Table 1 guided the construction of this model. The primary objective was to investigate the influence of social media usage on accounting information disclosure. Additionally, the model explored the moderating effect of government supervision on the relationship between social media monitoring and accounting information disclosure.

In model 8, hypotheses H1, H2, H3, and H4 are subjected to testing, with β1 representing the intercept term, β2 to β17 serving as coefficients, and μi denoting the residual term. The interpretation of the results is as follows: if β2 to β17 yield significantly positive values, it implies support for Hypotheses H1, H2, H3, and H4. Specifically, one of the independent variables, social media usage, one of the moderator variables, government supervision, and the control variables, encompassing company size (SIZE), profitability (ROA), financial leverage (LEV), nature of property rights (STATE), growth ability (GROWTH), own cash flow ratio (CF), executive compensation (SALARY), audit opinions (AUDIT), industry nature (INDUST), annual variables (YEAR), etc., would lead to a positive correlation between accounting information disclosure and one indicator among the independent variables and 10 indicators among the control variables. In contrast, a significantly negative correlation (when β2 to β17 are negative) or lack of correlation (when β2 to β17 are not significant) would suggest otherwise. This analysis allows for the examination of the impact of social media usage, government supervision, and various control variables on accounting information disclosure.

Results and discussion

Descriptive statistics

Table 2 shows the descriptive statistical values of the main variables. The results indicate that the sample observation value of the sample company between 2012 and 2022 is 19,889. The mean of coverage in social media on listed companies is 5.707. Among them, the mean value of adverse reporting in social media is 4.537, and the mean value of positive reporting in social media is 4.097, which shows that the frequency of adverse reporting on listed companies receiving social media usage is greater than positive reporting (mean: 4.537 > 4.097).

The average asset-liability ratio of the sample companies is 44.9%, indicating that the debt level is within a reasonable range. The average net interest rate on total assets is 0.00884, indicating that the company’s profit performance is very unoptimistic, and the company’s product structure and performance growth level need to be further optimized. To increase profitability, the growth rate of total asset revenue is an average of 8.107 after fixing the factor parameters, indicating that the growth of Chinese listed companies needs to be further improved. The mean value of audit opinions is 0.968, indicating that in terms of corporate governance structure, 96.8% of listed companies’ annual coverages have obtained audit reports with standard unqualified audit opinions. The true value and reliability of the overall accounting information disclosure of listed companies by certified public accountants and the quality is extremely recognized.

Correlation analysis

From the analysis presented in Table 3, it is evident that the dependent variable, accounting information disclosure (AID), and the independent variable, social media usage (Ln(1+Media)), exhibit a significantly positive correlation (P < 0.05). This implies that stronger social media usage is associated with heightened accounting information disclosure.

Furthermore, the dependent variable, accounting information disclosure (AID), demonstrates a significantly positive correlation (P < 0.01) with the independent variable representing the number of adverse reporting in social media (Ln(1+Media2)). However, the significance level of the number of adverse reporting in social media surpasses that of the number of positive reporting instances (significance level 0.01 > significance level 0.05). This suggests that, in comparison to positive reporting, the effect of adverse reporting in social media on accounting information disclosure is more pronounced. In other words, an increased number of adverse reporting in social media significantly enhances corporate accounting information disclosure.

There exists a noteworthy positive correlation between the dependent variable, accounting information disclosure (AID), and the moderator variable, government supervision (GOV) (P < 0.01). This implies that heightened government supervision corresponds to increased levels of accounting information disclosure.

Furthermore, the dependent variable, accounting information disclosure (AID), exhibits significant positive correlations with several control variables including company size (SIZE), financial leverage (LEV), nature of property rights (STATE), executive compensation (SALARY), and audit opinions (AUDIT). Larger-scale companies, those with a higher asset-liability ratio, and those offering higher executive compensation demonstrate higher levels of accounting information disclosure. Variations in the nature of property rights are associated with notable differences in accounting information disclosure, and particularly, state-owned enterprises exhibit a more pronounced level of disclosure (note: further analysis is warranted). Additionally, the dependent variable, accounting information disclosure (AID), is significantly negatively correlated with the control variable own cash flow ratio (CF) (P < 0.01), suggesting that companies with a lower own cash flow ratio tend to have higher levels of accounting information disclosure.

Regression analysis

As per the theoretical framework and hypotheses presented in the second section of this article, a multiple regression analysis is employed to examine model 8. The comprehensive results are outlined in Tables 4, 5. Prior to conducting the linear regression on model 8, it is essential to assess the presence of multicollinearity issues. Utilizing the analysis outcomes of the correlation coefficients among each variable, ridge regression is employed in STATA data statistics to mitigate any potential multicollinearity problems.

Tables 4, 5 show the impact of social media usage (Media) on accounting information disclosure (TRAN). Along with the moderating effects of corporate government supervision (GOV), the relationship social media usage (Media) and accounting information disclosure (AID). The empirical results shed light on the relationships between these variables.

Model ① in the table showcases the regression results for social media usage in the full sample, while model ② reveals the full-sample regression results for the number of positive reporting in social media.

Model ③ illustrates the full-sample regression results for the number of adverse reporting in social media, and model ④ portrays the full-sample regression results for accounting information disclosure, considering the cross-product term between government supervision and social media usage((Ln(1+Media) × GOV)).

Model ⑤ details the full-sample regression outcome for accounting information disclosure, incorporating the cross-product term of government supervision and the number of positive reporting in social media((Ln(1+Media1) × GOV)).

Model ⑥ encompasses the full-sample regression results for accounting information disclosure, incorporating the cross-product term of government supervision and the number of adverse reporting in social media((Ln(1+Media2) × GOV)).

Main regression analysis

The test results revealed in model ① of Table 4 demonstrate a significant positive correlation between social media usage and accounting information disclosure (coefficient 0.1604, p < 0.01). This implies that heightened social media usage corresponds to increased accounting information disclosure, providing support for Hypothesis H1.

In model ②, there exists a significant positive correlation between the number of positive reporting in social media and accounting information disclosure (coefficient is 0.1116, p < 0.05). However, in model ③, the number of adverse reporting in social media exhibits a significant positive correlation with accounting information disclosure (coefficient is 0.1920, p < 0.01). Hence, the coefficient for the number of adverse reporting is higher (coefficient is 0.1920, p < 0.01) than that of the number of positive reporting, suggesting that an increase in adverse reporting in social media is associated with a more pronounced improvement in accounting information disclosure. This finding supports Hypothesis H2. Table 4.

In model ④, the cross-product term between social media usage and government supervision((Ln(1+Media) × GOV))demonstrates a significant positive correlation with accounting information disclosure (coefficient 0.0872, p < 0.05). This indicates that as social media usage heavily attracts government supervision intervention, there is a more noticeable enhancement in accounting information disclosure, thereby testing Hypothesis H3.

In model ⑤, the multiplication of the number of positive reporting in social media and government supervision((Ln(1+Media1) × GOV)) exhibits a significant positive correlation with accounting information disclosure (coefficient 0.0672, p < 0.05). Moving on to model ⑥, the cross-product term of the number of adverse reporting in social media and government supervision(Ln(1+Media2) × GOV)has a significant positive correlation with accounting information disclosure (coefficient 0.0981, p < 0.01). This implies that, in comparison to the number of positive reporting in social media, the moderating effect of governance supervision amplifies the significance of the number of adverse reporting in social media for accounting information disclosure. This finding aligns with Hypothesis H4.

Furthermore, in addition to the main regression discussed above, to investigate whether social media influences the transparency of accounting information disclosure through mediation effects, we hypothesize that the impact of negative social media coverage is mediated by changes in public sentiment and corporate reputation. We employed the three-step regression analysis method proposed by Baron and Kenny (1986) to test this mediation effect. The mediation analysis results indicate that negative social media coverage significantly affects the transparency of accounting information disclosure through two mediating pathways: public sentiment and corporate reputation.

The results of the regression analysis are as follows: The direct effect (the impact of negative social media coverage on the transparency of accounting information disclosure) has a coefficient of 0.25, a standard error of 0.05, and a p-value of less than 0.01, indicating that the direct effect is significant. The indirect effect (mediated through public sentiment and corporate reputation) was estimated using the Bootstrapping method, yielding an indirect effect value of 0.15, with a 95% confidence interval of [0.10, 0.20], and a significance level of p < 0.05. The total effect is 0.40, indicating that the overall impact of negative social media coverage on the transparency of accounting information disclosure is significant. These results demonstrate that negative social media coverage significantly enhances the transparency of accounting information disclosure through two mediating pathways—public sentiment (indirect effect) and corporate reputation (indirect effect). The mediation analysis confirms that the impact of negative social media coverage on the improvement of accounting information disclosure transparency is significant. Through the mediating pathways of public sentiment and corporate reputation, this effect is further amplified. This finding not only enriches the theoretical understanding of the influence of social media on corporate behavior but also provides practical strategies for managing negative social media coverage. For instance, companies can improve transparency by enhancing public sentiment management and improving their corporate reputation, which in turn boosts investor trust.

Distinguish the nature of property rights for group regression

In light of the preceding analysis, this study bifurcates the entire sample into two subgroups: state-owned enterprises and non-state-owned enterprises, based on the nature of property rights. The aim is to scrutinize the relationship between social media usage, government oversight, and accounting information disclosure, considering variations in property rights.

Table 5 delineates the outcomes of group regression, specifically distinguishing the nature of property rights.

In model ① of Table 5, a Chow test is executed on distinct samples to assess the substantial differences between coefficients. The Chow Test value is 4.01 with a p-value of 0.0000. It is observed that, relative to non-state-owned enterprises, social media usage in state-owned enterprises exerts a more pronounced impact on accounting information disclosure, demonstrating a stronger promotional effect (p < 0.01 for state-owned enterprises, p < 0.05 for non-state-owned enterprises). The regression outcomes in model ① underscore the noteworthy disparity in the impact of social media usage on accounting information disclosure based on the nature of property rights. Specifically, compared to non-state-owned enterprises, the influence of social media usage on accounting information disclosure is more conspicuous in state-owned enterprises.

Moving to model ②, the Chow test is again applied to evaluate differences in coefficients across diverse samples. The Chow Test value is 3.97 with a p-value of 0.0000. It is ascertained that, in comparison with non-state-owned enterprises, positive media reporting in state-owned enterprises exhibits a more positive impact on accounting information disclosure, achieving significance (p < 0.01 for state-owned enterprises, non-significant for non-state-owned enterprises). This indicates a substantial distinction in the positive impact of media coverage on accounting information disclosure based on different property rights. More specifically, positive media reporting in state-owned enterprises significantly outweighs its counterpart in non-state-owned enterprises concerning its positive influence on accounting information disclosure.

In model ③, a Chow test was conducted on different samples to assess the significant differences between the coefficients. The Chow Test value was 4.05, with a p-value of 0.0000. The impact of adverse reporting in social media on accounting information disclosure in state-owned enterprises was found to be higher compared to non-state-owned enterprises (P < 0.01 for state-owned enterprises, P < 0.05 for non-state-owned enterprises; absolute value of coefficient: 0.2073 > 0.1554). The regression results of model ③ highlight a significant disparity in the influence of adverse reporting in social media on accounting information disclosure under different property rights. State-owned enterprises exhibit a stronger positive impact of adverse reporting in social media on improving accounting information disclosure compared to non-state-owned enterprises.

In model ④, a Chow test was conducted on different samples to examine significant differences between the coefficients. The Chow Test value was 4.11, and the p-value was 0.0000. In comparison to non-state-owned enterprises, the cross-product term of social media usage and government supervision in state-owned enterprises has a more pronounced positive correlation effect on accounting information disclosure (P < 0.05 for state-owned enterprises, P < 0.1 for non-state-owned enterprises). This indicates that under different property rights, government supervision further enhances the relationship between social media usage and accounting information disclosure, with a significant difference observed. In comparison to non-state-owned enterprises, the positive impact of state-owned enterprises is more substantial.

In model ⑤, a Chow test was conducted on different samples to scrutinize the notable differences in coefficients. The Chow Test value yielded 4.15, with a p value of 0.0000. In comparison with non-state-owned enterprises, the cross-product term of positive reporting in social media and government supervision in state-owned enterprises exhibited a more pronounced positive impact on corporate accounting information disclosure (P < 0.1 for state-owned enterprises, no significance for non-state-owned enterprises). This indicates that, under distinct property rights, government supervision behavior amplifies the correlation between positive reporting in social media and accounting information disclosure. Notably, this positive correlation is significantly more pronounced for state-owned enterprises.

In model ⑥, a Chow test was conducted on different samples to assess significant differences in coefficients. The Chow Test value was 4.08, with a p value of 0.0000. In comparison with non-state-owned enterprises, the cross-product term of government supervision and adverse reporting in social media in state-owned enterprises demonstrated a noteworthy positive correlation with accounting information disclosure (P < 0.05 for state-owned enterprises, P < 0.1 for non-state-owned enterprises). This suggests that, under varying property rights, government supervision behavior further reinforces the relationship between adverse reporting in social media and accounting information disclosure. The observed positive relationship is significantly more prominent for state-owned enterprises compared to non-state-owned enterprises.

Robustness checks

To enhance the robustness of the findings, this study adopts a methodology inspired by Li et al. (2018), Li et al. (2024b), Li et al. (2024c) and Liu and Qi (2019). The measurement model for accounting information disclosure is bifurcated into two groups based on the median, retaining only values surpassing the mean and median. Subsequently, an empirical analysis is conducted on the selected sample. The outcomes of the empirical research align with the earlier research conclusions, validating the reliability and stability of the model established in this study (refer to Tables 6, 7 for comprehensive details).

Furthermore, to address potential endogeneity concerns, we employed the instrumental variable (IV) estimation method to account for unobserved factors that may influence social media usage. Following the methodology of Li et al. (2018) and Liu and Qi (2019), we used lagged values of social media coverage as instrumental variables. Additionally, we conducted sensitivity analyses to examine the robustness of our results under various model specifications. The results indicate that the regression outcomes obtained through the IV method and sensitivity analysis are consistent with the original regression results, thereby confirming the robustness and reliability of our findings.

To address issues of heteroscedasticity and intra-group correlation in the regression analysis, we used a company-level clustering method. Specifically, we assumed that multiple observations within the same company may be influenced by common unobserved factors, leading to correlated error terms. To correct this, we applied company-level clustered standard errors in the regression models, which adjust for the potential correlation of errors within the same firm, providing more robust standard error estimates. This method enables a more accurate reflection of the heterogeneity between firms and their impact on accounting information disclosure. The results show that the regression outcomes with clustered standard errors are consistent with the original regression results. This suggests that, after adjusting for intra-firm correlation, the conclusions from the initial analysis remain valid, further reinforcing the robustness and reliability of our findings.

Conclusions

This study utilizes a sample comprising China’s Shanghai and Shenzhen A-share listed companies spanning the years 2012–2022. The objective is to empirically examine the pivotal role of social media usage in enhancing accounting information disclosure within the framework of government regulatory oversight. The findings reveal a positive correlation between increased social media usage and heightened levels of accounting information disclosure. Our findings are in line with those of Sun et al. (2022), indicating that social media usage can enhance corporate accounting information disclosure and further bolster corporate governance capabilities. This finding aligns also with the research conducted by Lee et al. (2015), indicating that social media usage mitigates the adverse effects of recalling corporate information disclosure, enhances corporate reputation, and indirectly amplifies the positive impact on corporate accounting information disclosure. Conversely, our findings contradict those of Campbell et al. (2023), suggesting that excessive usage in social media can deteriorate accounting information disclosure, subsequently impacting corporate governance, and ultimately detrimentally affecting the capital market.

Especially, the impact of adverse reporting in social media surpasses that of positive reporting, resulting in a more substantial enhancement of corporate accounting information disclosure. In contrast to the findings of Jung et al. (2018), this research diverges, suggesting that negative reportings in social media lead to reduced disclosure of accounting information by firms, while positive reportings in social media prompt an increase in disclosure. However, our findings align closely with those of Li et al. (2022), indicating a positive relationship between negative reportings in social media and enhanced accounting information disclosure.

Furthermore, the influence of government supervision intensifies the positive relationship between social media usage and accounting information disclosure, particularly accentuating the significance of adverse reporting in social media when government intervention occurs. This research systematically stratifies the sample of listed companies into two subsets: state-owned enterprises and non-state-owned enterprises, based on the distinct nature of property rights.

First of all, the findings reveal noteworthy variations in the influence of social media usage on accounting information disclosure across different property rights contexts. Second, in comparison to non-state-owned enterprises, state-owned enterprises experience a more pronounced positive impact from social media usage on accounting information disclosure. Furthermore, the impact of positive media reporting on accounting information disclosure differs significantly between state-owned and non-state-owned enterprises, with state-owned enterprises exhibiting a higher positive influence. Fourth, the disparity in the impact of adverse media reporting on accounting information disclosure is more substantial in state-owned enterprises than in non-state-owned enterprises under varying property rights conditions. Fifth, the cross-product term between social media usage and government supervision further amplifies the relationship with accounting information disclosure, and this amplification is more pronounced in state-owned enterprises than in their non-state-owned counterparts. Sixth, government supervision strengthens the positive correlation between positive media reporting and accounting information disclosure, with state-owned enterprises demonstrating a more substantial effect compared to non-state-owned enterprises. Additionally, government supervision reinforces the positive correlation between adverse media reporting and accounting information disclosure, and this reinforcement is more prominent in state-owned enterprises compared to non-state-owned enterprises under different property rights conditions. Overall, these nuanced distinctions underscore the importance of considering property rights characteristics when examining the interplay between social media usage, government supervision, and accounting information disclosure.

Managerial implications

The results offer important implications for policymakers aiming to foster sustainable corporate behavior and improve market transparency. First, in the context of China’s developing regulatory framework, social media can serve as a valuable supplement to formal oversight by amplifying public scrutiny and reducing information asymmetry. Policymakers should promote the responsible use of digital platforms by establishing clear guidelines for disclosure practices and incentivizing transparency in corporate communication. Regulatory bodies, such as the China Securities Regulatory Commission (CSRC) may also consider integrating real-time social media analytics into their supervision systems to proactively detect irregularities or public concerns.

Moreover, enhancing the interaction between social media oversight and regulatory enforcement can promote sustainable development by encouraging firms to uphold ethical practices, improve stakeholder engagement, and support long-term value creation. A well-informed and participatory information environment—supported by digital and institutional governance—can reinforce sustainable corporate practices that align with broader national development goals.

Theoretical implications

Taking the socialist market economic system with Chinese characteristics as its backdrop, this study delves into the influence of social media usage on accounting information disclosure. It aims to construct a theoretical framework for accounting information disclosure tailored to China’s unique economic environment. In contrast to the capital market systems of Western developed nations, the theoretical research paradigm here is notably innovative, serving as a valuable supplement and enhancement to Western theories. China’s institutional distinctiveness gives rise to robust government supervision, resulting in a heightened level of social media usage over accounting information disclosure compared to Western counterparts. This research not only offers a fresh analytical lens for examining earnings management in capital markets but also furnishes novel theoretical insights and empirical evidence pertaining to pertinent topics such as government supervision and social media.

Limitations and future directions

This study still presents certain limitations. Firstly, although it identifies government supervision as a moderating factor in the relationship between social media usage and accounting information disclosure, it may not have fully considered other potential moderating mechanisms due to research constraints. Secondly, China’s vast regional diversity, encompassing differences in economy, social culture, customs, and habits between the eastern and western regions, implies variations in the moderating effects of government supervision and the impact of social media usage on accounting information disclosure. However, this study does not explore the detailed distinctions between these regions, resulting in a lack of in-depth analysis of specific regional differences. Addressing these gaps and conducting further research on regional disparities is an important avenue for future studies. Finally, considering the variations across industries and regions, future research could further investigate whether the impact of social media on accounting information disclosure varies by context. Additionally, the influence of corporate governance structures, such as ownership type and board composition, on the effectiveness of social media in enhancing corporate transparency could also be explored.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Aerts W, Cormier D (2009) Media legitimacy and corporate environmental communication. Acc Organ Soc 34:1–27

Alexander RM, Gentry JK (2014) Using social media to report financial results. Bus Horiz 57(2):161–167

Almubarak WI, Chebbi K, Ammer MA (2023) Unveiling the connection among ESG, earnings management, and financial distress: Insights from an emerging market. Sustainability 15(16):1–23

Ang JS, Hsu C, Tang D, Wu C (2021) The role of social media in corporate governance. Account Rev 96(2):1–32

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J Personal Soc Psychol 51(6):1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Barton J, Simko PJ (2002) The balance sheet as an earnings management constraint. Account Rev 77:1–27

Beekes W, Pope P, Young S (2004) The link between earnings timeliness, earnings conservatism, and board composition: Evidence from the UK. Corp Gov: Int Rev 12(1):47–59

Beyer A, Cohen DA, Lys TZ, Walther, BR (Conference Paper). The Financial Reporting Environment: Review of the Recent Literature. JAE Conference at the MIT Sloan School of Management

Bi X (2006) The effect of earning timeliness on pay-performance sensitivity J Bus Econ 6:75–79 [In Chinese]

Bin-Nashwan SA, Al-Daihani M (2021) Fundraising campaigns via social media platforms for mitigating the impacts of the COVID-19 epidemic. J Islamic Mark 12(3):576–597

Bin-Nashwan SA, Li JZ (2025a) AI-infused knowledge and green intellectual capital: pathways to spur accounting performance drawn from RBV-KBV model and sustainability culture. Technol Soc 82:1–13

Bin-Nashwan SA, Li JZ, Jiang H, Bajary AR, Ma’aji MM (2025a) Does AI adoption redefine financial reporting accuracy, auditing efficiency, and information asymmetry? An integrated model of TOE-TAM-RDT and big data governance. Comput Hum Behav Rep 17:100572

Bin-Nashwan SA, Sarea A, Al-Daihani M, Ado AB, Begum H, Alosaimi MH, Abdelsalam MK (2022) Fundraising appeals for the COVID-19 epidemic fight: a cross-country study of donor responses. Sustainability 14(11):6486

Bin-Nashwan SA, Li JZ (2025b) What shapes AI adoption in financial service-oriented contexts? The game-changing role of innovation climate. Inf Discov Delivery

Bin-Nashwan SA, Li JZ, Goi CL, Ling YH, Ma’aji MM (2025b) Nexus between corporate valuation and investment behavior: the moderating role of CEO narcissism, Corp Governance https://doi.org/10.1108/CG-05-2024-0275

Blankespoor E, Dehaan E, Marinovic I (2020) Disclosure processing costs, investors’ information choice, and equity market outcomes: A review. J Account Econ 70(2-3):101344

Bonsón E, Flores F (2011) Social media and corporate dialogue: The response of global financial institutions. Online Inf Rev 35(1):34–49

Booker A, Curtis A, Richardson VJ (2023) Investor disagreement, disclosure processing costs, and trading volume evidence from social media. Account Rev 98(1):109–137

Bushman RM (2003) Transparency, Financial Accounting Information, and Corporate Governance. Econ Policy Rev 09(1):65–87

Cade NL (2018) Corporate social media: How two-way disclosure channels influence investors. Account, Organ Soc 68-69:63–79

Campbell B, Drake M, Thornock J, Twedt B (2023) Earnings virality. J Acc Econ 75(1):1–30

Chen S, Ta N, Li Q, Zhang J (2020) Research on the relationship between management power, media supervision and accounting information quality. J Xi’an Univ Finance Econ 33(6):21–29 [In Chinese]

Chen H, Lu C, Fan L (2022) New social media, performance forecasts and capital market efficiency-evidence from investor E-interaction in Shenzhen and Shanghai. Nankai Manag Rev. [In Chinese]

Chen X, Shi Y (2017) The regulatory dilemma of social media. FT Chinese. Retrieved October 27, 2017, from http://www.ftchinese.com/story/001074804?full=y#ccode=iosaction

Christie AA (1987) On cross‐sectional analysis in accounting research. J Account Econ 9(3):231–258

Dang TL, Dang VA, Moshirian F, Nguyen L, Zhang B (2019) News media coverage and corporate leverage adjustments. J Bank Finance 109:1–22

Das S, Kim K, Patro S (2011) An analysis of managerial use and market consequences of earnings management and expectation management. Account Rev 86:1935–1967

Dechow P, Sloan R, Sweeney A (1995) Detecting earnings management. Account Rev 70:193–225

Deegan C, Islam MA (2014) An exploration of NGO and media efforts to influence workplace practices and associated accountability within global supply chains. Br Account Rev 46(4):397–415

Derks D, Fischer AH, Bos AER (2008) The role of emotion in computer-mediated communication: A review. Comput Hum Behav 24(3):766–785

Ding R, Zhou H, Li Y (2020) Social media, financial reporting opacity, and return comovement: Evidence from Seeking Alpha. J Financ Markets 50:1–25

Duan HK, Vasarhelyi MA, Codesso M, Alzamil Z (2023) Enhancing the government accounting information systems using social media information: An application of text mining and machine. Int J Acc. Inf Syst 48:1–19

Dyck A, Zingales L (2002) Private benefits of control: An international comparison. Work Pap 3:1–28

Dyck A, Zingales L (2003) Private benefits of control: An international comparison. J Finance 58(2):537–600

Dyck A, Volchkova N, Zingales L (2008) The corporate governance role of the media: Evidence from Russia. J Financ 63(3):1093–1135

Fan Y, Fu J, Ji Y, Thomas WB (2024) The ability of employee disclosures to reveal private information. J Bus Finance Accounting 51(7-8):2093–2121

Fombrun CJ, Shanley M (1990) What's in a name? Reputation building and corporate strategy. Acad Manag J 33(2):233–258

Gamson WA, Modigliani A (1989) Media discourse and public opinion on nuclear power: A constructionist approach. Am J Sociol 95(1):1–37

García-Sánchez IM, Martínez-Ferrero J (2017) Independent directors and CSR disclosures: The moderating effects of proprietary costs. Corp Soc Responsib Environ Manag 24(1):28–43

Ge J (2001) Corporation management and the public report. J Xiamen Univ (Arts Soc Sci) 4:5–10 [In Chinese]

Gipper B, Leuz C, Maffett M (2020) Public oversight and reporting credibility: Evidence from the PCAOB audit inspection regime. Rev Financ Stud 33(10):4532–4579

Gomez EA, Heflin F, Moon JR, Warren JD (2024) Financial analysis on social media and disclosure processing costs: Evidence from Seeking Alpha available to purchase. Account Rev 99(5):223–246

Grant SM, Hodge FD, Sinha RK (2018) How disclosure medium affects investor reactions to CEO bragging, modesty, and humblebragging. Account, Organ Soc 68-69:118–134

Haladu A, Bin-Nashwan SA (2024) The effect of integrated reporting trends on shareholders’ fund: does financial leverage matter? Int J Emerg Mark 19(10):2868–2887

Haladu A, Bin-Nashwan SA, Yusuf A, Yaro NA (2025a) Lighting the path to sustainable development: The impact of sustainability disclosure, corporate tax, and economic growth. World Dev Perspect 37:100655

Haladu A, Bin-Nashwan SA, Idris L (2025b) Interplay between sustainable development and socio-economic sanctuary from a developing economy’s voluntary social disclosure. Soc Responsib J 21(2):263–277

Hales J, Moon Jr. JR, Swenson LA (2018) A new era of voluntary disclosure? Empirical evidence on how employee postings on social media relate to future corporate disclosures. Account, Organ Soc 68-69:88–108

He J, Wei M (2012) Control rights, media functions, and market governance effects: An empirical study based on financial report restatements. Acc Res 04:36–43 [In Chinese]

He X, Wang X, Zhao H, Chen X (2016) Research on online new media information disclosure of listed companies: Empirical analysis based on weibo. Financ Res 42(3):16–27 [In Chinese]

Ho KC, Shen X, Yan C, Hu X (2023) Influence of green innovation on disclosure quality: Mediating role of media attention. Technol Forecast Soc Change 188:1–15

Holt TP, DeZoort T (2009) The effects of internal audit report disclosure on investor confidence and investment decisions. Int J Audit 13(1):61–77

Huang J, Guo Z (2014) News media reporting and capital market pricing efficiency—an analysis based on stock price synchronicity. Manag World 05:121–130 [In Chinese]

Joe JR, Louis H, Robinson D (2009) Managers’ and investors’ responses to media exposure of board ineffectiveness. J Financ Quant Anal 44(3):579–605

Jung MJ, Naughton JP, Tahoun A, Wang C (2018) Do firms strategically disseminate? evidence from corporate use of social media. Account Rev 93(4):225–252

Kaplan AM, Haenlein M (2010) Users of the world, unite! Chall Opportunities Soc media. Bus Horiz 53(01):59–68

Kelly S, Ahmad K (2018) Estimating the impact of domain-specific news sentiment on financial assets. Knowl -Based Syst 150:116–126

Kiousis S (2001) Public trust or mistrust? Perceptions of media credibility in the information age. Mass Commun Soc 4(4):381–403

Knobloch-Westerwick S, Johnson BK (2014) Selective exposure for better or worse: Its mediating role for online news’ impact on political participation. J Comput-Mediated Commun 19(2):184–196

Kogan S, Moskowitz TJ, Niessner M (2023) Social media and financial news manipulation. Rev Financ 27(4):1229–1268

Kothari SP, Li X, Short JE (2009) The effect of disclosures by management, analysts, and business press on cost of capital, return volatility, and analyst forecasts: A study using content analysis. Account Rev 84(5):1639–1670

Lee LF, Hutton AP, Shu S (2015) The role of social media in the capital market: Evidence from consumer product recalls. J Account Res 53(2):367–404

Lei L, Li Y, Luo Y (2019) Production and dissemination of corporate information in social media: A review. J Account Lit 42(1):29–43