Abstract

Driven by government-led digital transformation initiatives and the rapid development of blockchain technology, low-carbon supply chain management is increasingly confronted with the dual imperative of investing in low-carbon technologies while effectively integrating blockchain systems to maximise corporate profits. This study examines low-carbon product supply chains by assessing the impact of government subsidy policies on manufacturers’ investment decisions in low-carbon technology, particularly in the context of blockchain adoption. Using a game-theoretic framework, four distinct supply chain models are developed to reflect scenarios with and without blockchain adoption and to compare the effects of technology-oriented and output-based subsidy policies. The findings suggest that larger subsidies encourage greater investment in low-carbon technologies, with higher total subsidy amounts having a stronger incentive effect. Notably, in the absence of blockchain technology, technology subsidy policies result in higher product pricing. However, when blockchain is introduced, manufacturers strategically increase wholesale prices to capture a greater share of the subsidy benefits, with the extent of the price adjustment depending on the subsidy amount. To effectively stimulate consumer purchases, policymakers should carefully consider the implications of implementing technology subsidies in markets lacking blockchain infrastructure. In addition, strengthening consumer trust in green products motivates manufacturers to intensify their efforts to reduce emissions, leading to higher wholesale and retail prices without dampening demand. These findings highlight the crucial roles of both subsidy mechanisms and blockchain technology in developing efficient low-carbon supply chain strategies. This study also introduces a unified analytical framework that defines the boundaries of low-carbon technology investments across various policy and technological scenarios, offering valuable insights for policymakers, industry stakeholders, and researchers.

Similar content being viewed by others

Introduction

Governments worldwide are actively promoting low-carbon (LC) transitions across various industries to improve global climate governance. This phenomenon encourages enterprises to invest in low-carbon technology (LCT), which can effectively reduce greenhouse gas emissions in sectors such as electricity, transportation, construction, renewable energy, clean coal utilisation, oil and gas, coalbed methane development, and carbon capture and storage. Its application not only improves energy efficiency and reduces carbon emissions but also promotes the sustainable development of the supply chain (SC). Transitioning to LC practices is critical not only for achieving global emission reduction targets but also for fostering sustainable economic growth and facilitating a green recovery. However, investing in LCT often increases overall enterprise costs, posing significant financial challenges during the adoption phase. To mitigate these challenges, government subsidy policies (SPs) are necessary to guide enterprises in LCT investments. In practice, governments generally implement two primary forms of subsidy policies: technology subsidy policies (TSPs) and output subsidy policies (OSPs). TSPs provide direct financial support for research and development (R&D) activities and the procurement of equipment, thereby easing upfront capital burdens. For instance, the Jing’an District Government in Shanghai offers a 30% subsidy for investments in independent energy-saving renovation projects (Jing’an District Government, 2024). In contrast, OSPs offer financial rewards based on the actual output of LC products or verified emission reductions, thereby incentivising performance-based results. A notable example is the policy implemented by the Fanchang District Government in Wuhu, Anhui Province, which provides a subsidy of 0.05 yuan per kilowatt-hour for self-consumed distributed photovoltaic energy exceeding 500 kilowatt-hours (Fanchang District Government, 2022). The two policies differ significantly in timing and incentive mechanisms. TSPs act as ex-ante incentives by subsidising initial input costs, thereby encouraging investment in LCT R&D, whereas OSPs function as ex-post rewards, indirectly promoting the application of LCT by providing subsidies based on the output of LC products.

Furthermore, blockchain technology (BT), an important digital technology, is gradually becoming a powerful tool for advancing low-carbon supply chains (LCSCs). For example, China Huadian Corporation has developed a digital carbon emission management system based on BT to facilitate enterprises’ green and LC transformation (ChinaHuadian Corporation, 2023). With its decentralised, transparent and tamper-proof data-sharing capabilities, blockchain enhances the traceability of carbon emissions data and reduces information asymmetry in SCs (Ji et al., 2022), thereby effectively strengthening consumer trust in green products (Babich and Hilary, 2020). Moreover, blockchain can help enterprises reduce production costs by improving production efficiency, which in turn significantly influences corporate decision-making (Niu et al., 2021; Xu et al., 2021). Although BT offers theoretical potential for enhancing LC governance, its practical application remains limited because of uncertainties about its economic viability and misalignment between policy incentives and corporate decision-making. Existing research has primarily examined blockchain’s applications in carbon footprint tracking and emissions trading. However, its influence on LCT investment decisions under different government SPs has received relatively little systematic exploration. Furthermore, many previous studies assume that government subsidies uniformly promote LC investments, often neglecting the complex relationship between subsidy effectiveness, the extent of blockchain integration, and levels of consumer trust. It is worth noting that consumer trust in enterprise product information, including carbon reduction data, is an important consideration (Li et al., 2023). If this issue is not effectively addressed, enterprises’ motivation for LC investments may be weakened. BT can also accurately reflect enterprises’ actual carbon emission data, enabling consumers to obtain carbon emission information. In summary, through structural and technological optimisation, BT has significant potential to reduce its energy consumption, improve traceability efficiency, and promote both carbon reduction and efficiency improvement. Given the potential advantages of LC governance, some governments have begun to develop public blockchain platforms to record and share real-time carbon emission data across SCs. For example, the Zhejiang Provincial Government in China has established a province-level integrated management platform based on BT, providing carbon and emission rights management services for over 1,600 enterprises, with an expected management coverage of over 200 million tonnes of carbon emissions (DOIT, 2024).

Although TSPs have been widely implemented in practice, the existing literature reveals a significant research gap regarding OSPs. This study addresses this gap by systematically comparing how these two distinct incentive mechanisms (TSPs and OSPs) influence corporate investment decisions in LCT. Simultaneously, the lack of transparency regarding crucial product information often makes it difficult for consumers to verify the genuine environmental benefits of green products during purchase, consequently undermining market valuation and purchase intentions (Xu and Duan, 2022). To address this information asymmetry, the study incorporates BT, leveraging its decentralised, transparent, and tamper-resistant features to strengthen consumer trust in green products, thereby further incentivising firms to invest in LCT. Notably, different SPs may have varying effects on multiple dimensions, including corporate blockchain adoption, LC investment strategies, product pricing, and overall SC decarbonisation performance. Given global efforts to accelerate LC transitions for greenhouse gas reduction, integrating BT with alternative SPs within a unified analytical framework not only contributes to theoretical innovation but also offers practical insights for effective policymaking and strategic corporate planning.

Based on the aforementioned research, this study focuses on the following three key questions:

-

(1)

How do government SPs influence enterprises’ LCT investment decisions within SCs?

-

(2)

Which type of SP is more effective in promoting enterprises’ LCT investments?

-

(3)

Does the level of green trust influence enterprises’ pricing decisions?

To address these questions, this study constructs a Stackelberg game model within an LC product SC consisting of a manufacturer and retailer while considering the presence of a government blockchain platform, and incorporates two policy scenarios: TSP and OSP. This analytical framework systematically reveals the manufacturer’s optimal decision-making regarding blockchain adoption and LCT investment under different SPs and further examines how these decisions affect product pricing, consumer demand, and overall SC carbon emissions. By comparing equilibrium results under different combinations of blockchain adoption and SPs, this study identifies the impact of TSP and OSP on LCT investment under blockchain-enabled information disclosure.

This study presents three key innovations and contributions. First, it develops a unified analytical model based on a Stackelberg game-theoretic framework that integrates blockchain adoption with differentiated government SPs. This novel methodological approach incorporates dynamic consumer factors, such as green trust, into strategic interactions between manufacturers and retailers, thereby advancing the understanding of the intersection between BT and LC investment decisions. The proposed framework defines the boundary conditions for LCT investments under both TSP and OSP. Theoretically, this study makes two significant contributions: (1) it reveals the distinct effects of ex-ante (TSP) and ex-post (OSP) subsidy mechanisms on corporate investment behaviour, and (2) it demonstrates how blockchain-enhanced transparency mitigates information asymmetries while highlighting the crucial role of green trust in shaping consumer demand for LC products. From a practical perspective, the findings yield actionable insights for both firms and policymakers. For businesses, the strategic implementation of blockchain can enhance the credibility of emissions data, enabling more effective pricing, production planning, and SC coordination to achieve both cost efficiency and emission reduction. For policymakers, the study recommends adopting flexible subsidy strategies (TSP/OSP) tailored to specific industry characteristics and reinforcing them with blockchain-enabled carbon tracking systems to enhance policy transparency and effectiveness. Importantly, the costs associated with blockchain implementation should be carefully managed to maximise its positive impact on LC investment incentives.

Literature review

The research on LCSC is extensive: it focuses on three aspects closely related to the objectives of this study.

LCT investment

Research on LCT investment has established a multidimensional analytical framework encompassing policy instrument design, market incentive mechanisms, and technology innovation drivers. Existing studies primarily focus on three key areas:

First, in terms of the differential impacts of carbon regulation policies, the incentive effects of carbon tax and carbon trading (CAT) mechanisms on LCT investment exhibit significant heterogeneity. Hasan et al. (2021) demonstrated—through an inventory management model—that carbon tax pricing directly influences corporate profits and emission reduction efficiency. In contrast, the CAT mechanism is more likely to achieve Pareto improvement in SCs (Wang et al., 2024). Lyu et al. (2022) further indicated that enterprises tend to prefer dynamic carbon pricing mechanisms, such as carbon taxes, over rigid carbon quota systems. These findings have been validated in the context of power SCs (Chen et al., 2021) and interregional government competition (Deng et al., 2021), suggesting that policy instruments should be tailored to industry-specific characteristics.

Second, concerning the synergy between market mechanisms and technological innovation, green credit policies (Chen et al., 2022) and carbon emission trading (Liu and Sun, 2021) facilitate LCT innovation by optimising capital allocation. Empirical evidence from China’s pilot CAT system suggests a significant increase in LC patent filings (Zhu and Lee, 2022), while green credit promotes technological upgrading through dual pathways of R&D investment and managerial efficiency (Chen et al., 2022). As an emerging driver, digital transformation enhances firms’ dynamic capabilities through data empowerment, thereby improving LCT innovation efficiency (Yang et al., 2023). Notably, the relationship between LCT investment and firm performance is nonlinear: Li et al. (2021) found that green core competencies serve as a mediating factor, with economies of scale reinforcing this mechanism.

Finally, in terms of policy coordination and systemic transformation challenges, achieving carbon neutrality necessitates the deep coordination of policy portfolios. He et al. (2022) quantitatively analysed China’s 2060 carbon neutrality pathway and indicated that an average annual emission reduction intensity of 9.3% requires significant breakthroughs in both conventional technologies and disruptive innovations. Shang and Lv (2023) conducted a systematic assessment of urban applications of renewable energy technologies, building energy efficiency, and carbon capture technologies, emphasising the necessity of multi-stakeholder governance from a life-cycle perspective. Additionally, international comparative studies have shown that the coordinated design of carbon taxes and subsidies can alleviate corporate transition barriers (Wang et al., 2021), while industrial structural upgrading serves as a critical intermediary for the effectiveness of CAT policies (Liu and Sun, 2021).

Distinct from existing literature, this study integrates the application of BT while examining the impact of government low-carbon SPs (LCSP) on enterprises’ LCT investment decisions.

Enabling and constraining effects of BT

The application of BT in LCSC exhibits a dual characteristic of “transparency enablement” and “energy consumption constraints,” necessitating a cost-benefit tradeoff depending on the specific application context. Existing research primarily focuses on the following three areas:

First, regarding information transparency and SC restructuring, BT enhances the credibility of LC information disclosure and optimises SC decision-making through decentralised ledgers. In the battery recycling sector, BT improves traceability efficiency while reducing carbon emissions (Feng et al., 2024). In the apparel industry, it mitigates information asymmetry related to green efforts through eco-labelling mechanisms (Guo et al., 2020). Within multi-tier SCs, the integration of BT with mixed-integer nonlinear programming (MINLP) models can simultaneously reduce operational costs and carbon emissions (Manupati et al., 2020), whereas a dynamic negotiation mechanism under a Stackelberg game framework facilitates consumer-centric decarbonisation (Hua et al., 2022).

Second, there is an economic and environmental tradeoff associated with BT adoption—while BT enhances social welfare (Xu and Duan, 2022; Zhong et al., 2023; Pun et al., 2021), its high energy consumption may offset its LC benefits. Babaei et al. (2025) argued that the high energy consumption of BT will have a negative environmental impact, advocating for the adoption of wind and solar energy to power blockchain systems. A systematic review by Parmentola et al. (2022) highlighted that BT’s contribution to the Sustainable Development Goals (SDGs) is highly dependent on application design, necessitating a balance between energy efficiency and transparency.

Finally, BT and LCT exhibit dynamic complementarity in terms of digital-green synergistic innovation pathways within digital SCs. A differential game model by Kang et al. (2024) demonstrated that consumer environmental awareness (CEA) and perceived transparency (CTP) jointly drive firms’ BT adoption and green production investments, achieving optimal economic and environmental benefits via bilateral synergy. Such findings provide novel insights into addressing the “greenwashing” dilemma; however, vigilance is necessary while evaluating the potential for false prosperity among low-tech enterprises (Guo et al., 2024).

The aforementioned studies did not explicitly consider the issue of LC investment. This study integrates BT, differentiated LCSP, and LCT investment to bridge the research gap. Furthermore, our findings reinforce the positive effects of BT in mitigating information asymmetry and enhancing green trust, which aligns with the conclusions drawn in the existing literature.

Blockchain governance mechanisms

Driven by BT, SC governance mechanisms are undergoing a systematic transformation, ranging from contract enforcement to resource allocation. First, smart contract mechanisms have significantly expanded the boundaries of traditional contract management. Dolgui et al. (2020) proposed an event-driven “virtual operation” model, embedding physical operations and information processing within smart contract execution to achieve integrated planning and control. From the perspective of technology adoption, Ameyaw et al. (2023) identified key factors influencing the implementation of smart contracts in multi-party collaborative projects, highlighting their potential to enhance contract enforcement efficiency and trust among stakeholders.

Second, blockchain plays a critical role in supply chain finance (SCF) governance. Natanelov et al. (2022), through Activity-Entity-Data (AED) process mapping, developed a buyer-driven SCF model that reduces credit risk and reconfigures the logic of capital flows. Jiang et al. (2022) developed a blockchain-based trust transmission model via electronic payment vouchers for market-dominant small and medium-sized manufacturing enterprises, alleviating their financing difficulties in SCs and directly demonstrating blockchain’s positive impact on such SCF.

Finally, in terms of decentralised resource allocation and incentive mechanisms, Du et al. (2022) developed a blockchain-based edge computing market model. This model integrates a dual-layer smart contract system with a credibility-driven Proof-of-Stake (PoS) consensus mechanism, achieving efficient matching of resources and tasks. Moreover, the use of Shapley value ensures equitable distribution of returns and mitigates the wealth concentration issues inherent in traditional PoS systems. Alqarni et al. (2023) offered a macro-level review of blockchain’s contribution to SC transparency, fairness, and sustainability, with particular emphasis on its applicability and operational potential in multimodal transport scenarios.

In summary, the existing literature collectively illustrates the evolutionary path of blockchain governance mechanisms across three representative domains: automated contract enforcement, financing optimisation, and resource incentive alignment, offering theoretical foundations for future institutional design and policy development.

Precision design of SPs and collaborative innovation mechanisms

The design of SPs should shift from single-incentive mechanisms toward collaborative innovation frameworks. Existing research has primarily focused on the following three aspects.

First, in terms of the selection and dynamic adjustment of subsidy types, R&D subsidies are more effective than product subsidies in promoting the adoption of electric vehicles (Li et al., 2020), although they need to be complemented by carbon taxes to enhance emission reduction outcomes (Wang et al., 2021). Dynamic R&D subsidies improve innovation quality by increasing marginal effects (Lyu et al., 2024), whereas consumer subsidies, although stimulating demand-side growth, may weaken the overall emission reduction intensity (Bian et al., 2020).

Second, from the perspective of information asymmetry and heterogeneous corporate responses, dual subsidy mechanisms can resolve the incentive mismatch between manufacturers’ emission reduction efforts and retailers’ green promotion strategies (He et al., 2024). Firm size heterogeneity necessitates differentiated policy interventions: large enterprises can leverage digital transformation for LC transitions more effectively (Yang et al., 2023), whereas small and medium-sized enterprises (SMEs) rely on targeted support through green credit mechanisms (Bai et al., 2021).

Finally, in terms of policy coordination and the enhancement of systemic resilience, the synergy between CAT and green credit can lower entry barriers for cleaner production (Li et al., 2022). Furthermore, BT-enabled transparent subsidy distribution improves policy implementation efficiency (Dong et al., 2023). Notably, subsidies should be integrated with carbon quota allocation mechanisms (Chen et al., 2021) and industrial network embedding strategies (Zhu and Lee, 2022) to foster a risk-resilient innovation ecosystem.

The aforementioned studies, using diverse methodologies and modelling approaches, consistently concluded that SPs facilitate LCT innovation (or investment), which is consistent with the findings of this study. Additionally, by considering differentiated SPs, this study further identifies the boundary conditions under which two types of SP influence firms’ LCT investment incentives.

In summary, existing literature has conducted systematic and in-depth analyses of the impact of SPs on LC investment. However, most studies are grounded in the traditional LCSC perspective. This study introduces BT as a mechanism to address consumers’ lack of trust in firms’ LC product information. Building on this foundation, we examine the influence of SPs on firms’ LCT investment strategies within a blockchain-enabled LCSC, thereby establishing a differentiated research pathway from conventional studies.

Moreover, while prior research has predominantly focused on the factors influencing LCT investment in high-risk and highly uncertain market environments, few studies have explored how LCT investment and blockchain transparency can jointly enhance sustainability within a stable, government-led blockchain platform that provides a reliable data environment. Our study leverages this unique data advantage to propose a more refined analytical framework. Specifically, the stability of blockchain-enabled data significantly enhances consumer trust in firms’ carbon emission reduction records. This, in turn, provides a more reliable informational foundation for firms in developing LCT investment strategies and governments in implementing SPs (Table 1).

Methods

Rationale for selecting game theory

This study investigates an LCSC involving both manufacturers and retailers. As independent economic agents, manufacturers and retailers exhibit both competitive and collaborative behaviour in their pricing decisions. These interactions are also influenced by consumer preferences for LC products and government SPs. Game theory is a well-established tool for analysing strategic interactions between multiple decision-makers. First, game theory captures the strategic decision-making process between manufacturers and retailers, such as how changes in carbon emission reduction (CER) rates and wholesale prices impact retail prices. Second, concepts such as the Nash and Stackelberg Equilibrium provide optimal strategies for each party, allowing for the prediction of equilibrium outcomes under different policy and technological scenarios. Finally, game theory is well-suited for modelling dynamic systems influenced by external factors, such as government SPs and green trust, facilitating a deep analysis of how these factors affect participants’ strategies. In the context of this study, game theory is an ideal framework to explore the strategic interactions of manufacturers and retailers during the adoption and response to BT under the LCSP. These interactions and strategies form the foundation of the analysis in this paper. Therefore, game theory is selected as the methodology for this study. In addition, the research framework is structured to capture core constructs and research variables that influence firms’ decision-making within the LCSC. The primary constructs examined include manufacturers’ and retailers’ pricing strategies, investments in LCT, government SPs (specifically technology and output subsidies), and the role of BT in enhancing information transparency. The key variables analysed include wholesale price, retail price, CER rate, green trust, and subsidy amount. The game-theoretical framework enables a systematic examination of the interactions among these variables and their impact on the equilibrium outcomes, providing a structured approach to evaluating firms’ strategic behaviour under different policy settings.

Rationale for selecting the Stackelberg Game Model

This research presents a typical “leader-follower” hierarchy between manufacturers and retailers: manufacturers determine the wholesale price and CER rate (i.e. investment in LCT). In contrast, retailers adjust the retail price in response to consumer demand. The sequential decision-making characteristic of this process naturally aligns with the Stackelberg game framework. First, the Stackelberg model effectively captures the hierarchical and sequential nature of the decision-making process between upstream and downstream agents. Second, it allows the incorporation of external factors—such as government SPs and consumer LCP—into the decision-making process, facilitating a deeper analysis of their impact on equilibrium outcomes. Ultimately, this model enables scenario analysis to assess the impact of various subsidy schemes (such as TSP or OSP) on SC performance, carbon reduction, and profitability. Therefore, the Stackelberg model was chosen for its suitability to address the specific dynamics of this research.

The construction and solution of the game model in this study are as follows:

-

1.

In the given context, the manufacturer is the leader due to its control over resources and technology, while the retailer acts as the follower.

-

2.

The manufacturer initially determines the LCT investment and wholesale price from the retailer’s potential responses and corresponding optimal strategies.

-

3.

The retailer, following the manufacturer’s decisions, sets the retail price to maximise its profit.

-

4.

Through a series of iterative decisions and adjustments, the manufacturer and retailer reach a Stackelberg equilibrium, where neither can improve their payoff by unilaterally changing their strategy.

In this model, the manufacturer (as the leader) sets both the wholesale price and the CER rate (i.e., the level of LCT investment), while the retailer (as the follower) determines the retail price based on these decisions. This hierarchical decision structure reflects the key characteristics of the Stackelberg model and effectively captures the strategic dynamics between the manufacturer and retailer. The research framework integrates the Stackelberg game model with government SPs and BT adoption. This approach enables an analysis of how subsidy schemes and blockchain transparency affect firms’ decision-making. The primary independent variables within the framework are government subsidy amounts (TSP and OSP), BT adoption costs, and firms’ levels of green trust. The dependent variables include firms’ LCT investment levels, pricing strategies, and overall SC profitability. This structured approach ensures that the model effectively captures the essential interactions among government policies, technological adoption, and corporate strategy within the LCSC. This two-stage model allows for a phased analysis of policies and technologies: in the first stage, the manufacturer makes decisions regarding LCT investment and production based on government SPs and BT adoption costs; in the second stage, the retailer adjusts the retail price based on the manufacturer’s wholesale price, CER rate, and market demand. Through phased analysis, the model provides a clearer understanding of how policy and technological changes impact long-term decision-making. Additionally, the decentralised, transparent, and traceable nature of BT addresses consumers’ trust issues regarding LC product claims. By applying the Stackelberg game model in the context of BT, it becomes possible to analyse how increased information transparency influences the manufacturer’s investment in LCT and production strategies. Specifically, the model provides a framework for solving the subgame perfect Nash equilibrium and predicting the optimal responses of the manufacturer and retailer. Using this model, the optimal subsidy strategy for the government, the optimal LCT investment level for the manufacturer, and the optimal retail price for the retailer can be derived, allowing for an evaluation of the effects of various policies and technologies on corporate strategy.

Perfect information theory

This study assumes that both manufacturers and retailers have full and symmetric access to key information, such as carbon reduction performance, costs, and prices. This assumption is based on the theory of perfect information (Sun et al., 2022), which is a commonly used theoretical foundation in SC game models. However, in practice, LCSC often experiences information gaps, particularly regarding the actual carbon reduction performance and environmental attributes of the products. However, with the application of BT, SCs can achieve real-time, immutable sharing of carbon data, ensuring that all parties in the SC have access to the same information. This improvement in transparency helps bridge the information gap, assuming perfect information is more reasonable in a blockchain-enabled SC environment. Therefore, this assumption is supported not only by economic theory but also by the practical improvements resulting from BT.

Considerations for emerging economies

In the current global economic landscape, emerging economies have evolved as growth engines with robust development momentum. However, the convergence of high-energy-consuming industrial expansion, accelerated industrialisation, and globalisation has led to an exponential increase in carbon dioxide emissions (Rahman et al., 2022). Unlike OECD countries, which are characterised by relatively mature technological progress and a well-established environmental regulatory system, emerging economies face the “green paradox” dilemma under stringent environmental regulations. That is, the tightening of environmental policies may prompt enterprises to accelerate the exploitation of existing resources, thereby exacerbating carbon emissions and constraining sustainable economic development. Nevertheless, these economies possess enormous potential for technological innovation. Research indicates that technological progress can effectively decrease the carbon emission intensity (Wang and Wei, 2020). In particular, investment, R&D and innovation in LCT have become the core pathways for overcoming environmental constraints and achieving LC transitions (Fragkos et al., 2021).

To facilitate LC transitions, governments of emerging economies are actively exploring policy instrument innovations and constructing incentive mechanisms that combine carbon regulation with LC subsidies to guide enterprises in increasing their investment in LCT. However, the uneven development among internal regions poses challenges to the benefit assessment of applying digital technologies such as blockchain in emerging economies. The costs and benefits of technology implementation are difficult to measure accurately. When coupled with regional differences in resource endowments, the effectiveness of policy implementation varies. Nevertheless, as the largest emerging economy in the world, China has achieved significant breakthroughs in integrating the digital economy with LC development. Studies reveal that the digital economy with BT as its underlying architecture can not only directly drive high-quality LC development but also promote collaborative regional transitions through spatial spillover effects (Ma and Zhu, 2022). This practical achievement fully proves that, with scientific planning and policy guidance, BT can serve as an effective tool for emerging economies to overcome the bottlenecks of LC transitions, highlighting the strategic value of digital technologies in sustainable development.

From the micro-perspective of enterprises, influenced by financial constraints and market fluctuations, enterprises in emerging economies exhibit a significant risk-averse tendency in LCT investment, with a greater focus on short-term economic returns. This phenomenon leads to a lower basic adoption rate of LCT compared to enterprises in developed economies. This investment prudence interacts intricately with the policy instruments of emerging economies. In the absence of subsidies, enterprises often view BT as an additional cost burden, as the financial benefits generated by enhanced transparency cannot be realised immediately. However, when subsidies are provided, blockchain adoption becomes more attractive because it enhances the credibility and traceability of emissions reduction, ensuring that enterprises can effectively obtain and maximise government incentives. This dynamic makes the complementary effect between blockchain adoption and LCT investment stronger in emerging economies than in developed markets, where enterprises may already have sufficient resources to invest in LCT independently of subsidy support.

In particular, TSPs and OSPs exert differential impacts on enterprise decision-making. TSPs provide upfront financial support, encouraging enterprises to adopt blockchain as a risk mitigation tool to enhance their eligibility for subsidies. In contrast, OSPs offer rewards after enterprises achieve emissions reductions, which may further incentivise enterprises to adopt blockchain as a verification mechanism to ensure post-investment financial returns. This outcome indicates that the existence and type of subsidies largely determine blockchain’s role in enterprises’ LCT investment decisions. Under TSPs, the influence of blockchain is enhanced, whereas under OSPs, it more heavily depends on actual results.

In conclusion, the intervention of SPs significantly strengthens the correlation between blockchain adoption and LCT investment in emerging economies. The precise design of policy instruments directly affects enterprises’ strategic responses. Future research could further explore the differences in subsidy effectiveness and blockchain adoption rates across different countries, providing theoretical support for emerging economies to formulate more targeted LC transition policies.

Research design and mathematical modelling approach

Given the theoretical modelling approach used in this study, conventional sampling methods and statistical tools were not employed. However, to ensure the rigour of the theoretical framework, the following research design was implemented:

Theoretical foundation

This study is based on established theories of economics and game theory, complemented by relevant literature on SC management and environmental policy.

Construct development

Key constructs, including LCT investment, BT adoption, green trust, and government subsidies, are identified and clearly defined based on a theoretical foundation.

Mathematical modelling

A Stackelberg game framework is used to characterise the hierarchical decision-making process between manufacturers and retailers.

Equilibrium analysis

The model derives the subgame perfect Nash equilibrium using backward induction to ensure optimal decision-making strategies for all participating agents.

Comparative analysis

Different policy scenarios, such as TSPs and OSPs, are comparatively examined to evaluate how different government interventions influence corporate strategies.

Although empirical validation is beyond the scope of this study, the research design ensures that the findings are grounded in robust economic theory and dynamic SC analysis. Future studies may incorporate empirical data to further validate the model’s predictive capacity and enhance its practical relevance.

Discussion of alternative analytical methods

To enhance the credibility of the research methodology and provide a comprehensive understanding of the robustness of the results, this section explores potential alternative analytical methods that could complement the conclusions drawn from the Stackelberg game model.

Aggregate models

Aggregate models are commonly used in macroeconomic analysis and can provide a high-level perspective on LCSCs’ overall performance. For instance, by analysing total carbon emissions, total market demand, and overall profitability, aggregate models can reveal the systemic effects of SPs and blockchain adoption. However, aggregate models are limited in their ability to capture individual strategic interactions between manufacturers and retailers, thus offering limited utility for micro-level decision-making analysis.

Cost-benefit analysis (CBA)

CBA serves as a supplementary tool for evaluating the net economic impact of different SPs and BT implementation scenarios. By quantifying the costs and benefits associated with LCT investments, CBA provides a direct method for assessing the financial feasibility of policy interventions. However, this method is inherently static and does not reflect the dynamic, continuous decision-making processes typical of real-world SC interactions.

Agent-based modelling (ABM)

ABM offers a flexible approach for simulating the behaviours of individual entities (such as manufacturers, retailers, and consumers) within the LCSC. ABM can capture the heterogeneity of agents and the emergent phenomena arising from their interactions. This method can further analyse how consumer preferences, SPs, and BT adoption collectively influence SC dynamics. However, ABM typically requires substantial computational resources and assumptions, which can introduce additional complexity and uncertainty.

System dynamics (SD)

System dynamics focuses on feedback loops and time delays within complex systems and can be used to model the long-term impacts of SPs and BT adoption on the entire SC. For example, SD can assess how changes in green trust, subsidy amounts, and LCT investment propagate throughout the SC. However, similar to aggregate models, SD is not well-suited for capturing individual strategic interactions.

In summary, while alternative methods can offer complementary perspectives, the Stackelberg game model is particularly well-suited for this study due to its ability to model hierarchical interactions, analyse strategic decision-making, and evaluate the impact of policy interventions on LCSC. Furthermore, the existing literature has extensively employed game theory to analyse SPs in LC markets, which further demonstrates its effectiveness in reflecting firms’ strategic behaviours under regulatory constraints.

This study incorporates two commonly used government SPs—TSP and OSP, both of which are widely employed to promote firms’ investments in LCT. By introducing these policy tools within a game-theoretical framework, this research effectively simulates subsidy mechanisms in real-world LC industries. Additionally, the equilibrium analysis results further validate the applicability of the model, as the research findings align with existing empirical studies on the effectiveness of subsidies and the impact of blockchain applications on SC sustainability.

Model assumptions

This study primarily investigates how different LCSPs influence enterprises’ LCT investment strategies in the context of BT. The theoretical model considers the government, manufacturers, retailers, and consumers. First, the critical role of the government was explicitly recognised in the system. The government acts as the builder of the BT application platform, providing technical support and a regulatory framework for economic activities. Second, consumers’ participation is also essential. In the model, we introduce a demand function that includes consumers’ preference for LCP, which directly affects the LC investment strategies of manufacturers and retailers. However, consumers do not directly appear as the subjects of the game; their preferences are an exogenous variable that shapes strategic interactions between manufacturers and retailers. Finally, based on the research purpose and model simplification, manufacturers and retailers are selected as the main players in the game. In SC management, the two players directly determine the investment in LCT and the production of LC products, and their decisions directly affect the adoption and marketing effect of LCT. By focusing on this pair of core players, we can reveal the specific mechanisms and effects of LCSPs more clearly in terms of incentivising LC investments. Therefore, this study examines a secondary SC comprising a manufacturer and retailer. Wang et al. (2020) demonstrated that BT ensures the traceability and transparency of SC information. In this context, we propose that the government invest in the construction of a BT platform, which will then be made available to manufacturers for a fee. Furthermore, the government monitors the information on the blockchain platform to determine whether to subsidise the manufacturer for technology or output investments. Consumers gain access to verified carbon reduction information, which enhances their level of trust in the manufacturer’s green products. The final market demand for LC products is jointly influenced by consumers’ LCP and green trust level. The data used in this study primarily originates from government-led blockchain platforms, which are constructed and funded by local governments and operate in a stable, low-risk environment. Unlike traditional studies in which data uncertainty often arises due to market fluctuations, information asymmetry, and high-risk factors, the data in this study are characterised by high authenticity, traceability, and long-term comparability. This stable data environment provides a solid foundation for constructing the theoretical framework, ensuring that the assumptions of complete information symmetry and low-risk conditions in the model are fully satisfied. The proposed LCSC structure is illustrated in Fig. 1.

The following assumptions were made:

Assumption 1: Market demand is determined by the product’s selling price, CER rate, consumers’ LCP, and consumers’ green trust degree (Li et al., 2021). Research shows that consumers tend to buy LC products (Sun et al., 2020). Green trust is defined as the level of consumer trust in product environmental claims and carbon reduction performance, and it has been extensively studied in the existing literature. Chuah et al. (2020) explored the role of green trust in shaping green brand perception and consumer behaviour. These studies indicate that green trust has a significant impact on consumers’ purchasing decisions in markets where environmental transparency is crucial. When the manufacturer does not apply BT, the green trust coefficient of consumers is 0 < λ < 1, and market demand is q1 due to the opacity of the CER information of the manufacturer’s LC products.

When a manufacturer adopts BT, SC information is relatively transparent and traceable. Then, consumers gain full access to the manufacturer’s carbon reduction information; here, the green trust factor λ = 1. The demand of consumers with LC preference increases due to increased levels of trust, marking a market demand of q2. According to the findings of the “2020 Blockchain Traceability Service Innovation and Application Report”, the implementation of the Jingdong Zhizhen Chain—a blockchain-based anti-counterfeiting and traceability service provided by Jingdong—has significantly boosted brand demand. Notably, the use of BT for the traceability of fresh products resulted in a significant sales increase of up to 77.6%. These results indicate that blockchain-enabled traceability can directly enhance consumer trust in product information, thereby driving an increase in product demand. Based on these insights, the demand expressions for the two cases are formulated as follows:

Assumption 2: Carbon emission is exclusively embodied in the production chain. The manufacturer achieves CER by investing in LCT. The LCT investment cost function \(C(r)=\frac{1}{2}k{r}^{2}\) (Liu et al., 2022), where k is the investment cost coefficient of LCT and r is the CER rate. It is assumed that the LCT investment cost coefficient k satisfies \({\beta }^{2}{\lambda }^{2} < k < {\beta }^{2}\), where β is the consumers’ LC preference coefficient.

Assumption 3: Research has shown that BT can quantify and integrate the contribution of LCT across different sectors. For instance, by employing traceability systems and intelligent optimisation processes, BT can improve material and energy use efficiency while significantly reducing production costs (Deng et al., 2024; Abdelgalil et al., 2021). Accordingly, we assume that when the manufacturer does not apply BT, the manufacturer’s cost of production is z. When manufacturers apply BT, they can integrate LCT into all stages of production through BT, thereby optimising the enterprise’s existing production process, enhancing raw material utilisation and production efficiency, saving labour costs, and collectively reducing total production costs. To reflect the impact of LCT on production efficiency, it is assumed that the production cost of the manufacturer is z − rd, where d is the efficiency coefficient of LCT to reduce costs, and r is the unit CER rate of the product (also representing the level of LCT). Further, d satisfies \(\beta < d < 3\beta\).

Assumption 4: The government’s utility is defined as total social welfare comprising four components: producer surplus, consumer surplus, government fiscal expenditures, and environmental improvements. Producer surplus is the total profit earned by manufacturers and retailers. Consumer surplus is defined as \(\frac{\left(\bar{p}-p\right)q}{2}\), where \(\bar{p}\) is the highest price consumers are willing to pay (i.e., the price when demand for the product is zero), \(\bar{p}=a+\lambda \beta r\). The cost of LC subsidies to manufacturers and the single-cycle shared cost of building the blockchain platform is \(\frac{G}{n}\). Environmental quality improvement is denoted by rq.

Assumption 5: The government has established the BT application platform. For example, the Agriculture and Rural Bureau of Weifang City, Shandong Province, China, developed a BT platform to address issues related to agricultural product traceability, quality and safety, sales links, and the insurance of local agricultural brands (Shandong Big Data Bureau, 2024). This innovation has since been extended across China (iSHANDONG, 2024). Similarly, the BT platform, built by the Georgian government in collaboration with the BitFury Group, was initially applied to land title registration and later extended to other local government departments (PR Newswire, 2017). SC enterprises seeking to use the BT platform are required to pay an application cost exclusively. The unit application cost is denoted as c. This study focuses solely on the application of BT by manufacturers, with the ongoing expenses being determined at the manufacturer’s decision-making stage. The impact coefficient is η. The unit cost of the application is assumed to satisfy \(\frac{{\left(d+\beta \right)}^{2}}{k\left(1-\theta \right)}-4 < c < \frac{4{\left(d+\beta \right)}^{2}}{{\beta }^{2}{\lambda }^{2}}-4\).

Assumption 6: Perfect market information symmetry exists between the manufacturer and retailer. The manufacturer produces LC products that exactly match the market demand, ensuring market clearance. The parameters and their definitions are summarised in Table 2.

Assumption 7: Government-led blockchain platforms ensure the stability and low-risk nature of carbon emissions and LC investment data, such that firms do not need to account for additional risk premiums in their LCT investment decisions, and the incentive effects of government SPs can be accurately quantified.

Model construction and solution

In this section, this study develops a two-stage game model for manufacturers and retailers that involves the application cost of BT, the influence of consumers’ LCP, and the degree of consumers’ green trust. In the first stage, manufacturers aim to maximise their profits by determining the wholesale price w and carbon reduction rate r of LC products. In the second stage, retailers maximise their profits by determining the retail price of LC products p. The equilibrium solutions of models A, B, C, and D are denoted as \({X}^{A* }\), \({X}^{B* }\), \({X}^{C* }\) and \({X}^{D* }\), respectively. These models were applied to the four following scenarios, outlined in Tables 3 and 4.

Model A

In model A, the government provides a subsidy for the manufacturer’s CER investment represented by a TSP factor of θ. The respective profit functions for the government, manufacturer, and retailer are as follows:

In the TSP model, the optimal values for the wholesale price \({w}^{A* }\), carbon reduction rate \({r}^{A* }\), retail price \({p}^{A* }\), demand for LC products \({q}^{A* }\), manufacturer’s profit \({\pi }_{m}^{A* }\), retailer’s profit \({\pi }_{r}^{A* }\), and total social welfare \({\pi }_{g}^{A* }\) can be obtained by solving Eqs. (A3)–(A9), respectively.

Model B

In model B, the government subsidises the output of each unit of the LC product produced by the manufacturer. The subsidy amount is denoted as μ. The respective profit functions of the government, manufacturer, and retailer are as follows:

In the OSP model, the optimal values for the wholesale price \({w}^{B* }\), carbon reduction rate \({r}^{B* }\), retail price \({p}^{B* }\), demand for LC products \({q}^{B* }\), manufacturer’s profit \({\pi }_{m}^{B* }\), retailer’s profit \({\pi }_{r}^{B* }\), and total social welfare \({\pi }_{g}^{B* }\) can be obtained from Eqs. (B3)–(B9), respectively.

Model C

In model C, the government subsidises the manufacturer’s CER investment in proportion to the technology investments, with a TSP coefficient of θ. In addition, the manufacturer must incur a cost to utilise the blockchain platform. Furthermore, applying BT can reduce the manufacturer’s periodical costs. The government must bear both the subsidy for the manufacturer’s technology investment and the cost of constructing the blockchain platform. Therefore, the respective profit functions of the government, manufacturers, and retailers are as follows:

With the application of BT in the TSP model, the optimal wholesale price \({w}^{C* }\), carbon reduction rate \({r}^{C* }\), retail price \({p}^{C* }\), demand for LC products \({q}^{C* }\), manufacturer’s profit \({\pi }_{m}^{C* }\), retailer’s profit \({\pi }_{r}^{C* }\), and total social welfare \({\pi }_{g}^{C* }\) can be determined by Eqs. (C3)–(C9), respectively.

Model D

In model D, the government subsidises the output of each unit of LC product produced by the manufacturer, with the unit subsidy amount denoted as μ. Similarly, the manufacturer pays the cost of using the blockchain platform. Applying BT can reduce the manufacturer’s periodical cost. The government bears both the subsidy for the manufacturer’s technology investment and the cost of constructing the blockchain platform. Therefore, the respective profit functions of the government, manufacturers, and retailers are as follows:

Under the OSP model with the application of BT, the optimal wholesale price \({w}^{D* }\), carbon reduction rate \({r}^{D* }\), retail price \({p}^{D* }\), demand for LC products \({q}^{D* }\), manufacturer’s profit \({\pi }_{m}^{D* }\), retailer’s profit \({\pi }_{r}^{D* }\), and total social welfare \({\pi }_{g}^{D* }\) can be obtained by solving Eqs. (D3)–(D9), respectively.

Model analysis

A unique equilibrium solution exists for the government’s implementation of either the TSP or OSP, depending on whether the manufacturer applies BT. Based on the equilibrium results, we conduct the following analysis: (1) the effects of the CER cost coefficient, LC preference coefficient, and green trust degree on the equilibrium results; (2) a comparative analysis of two SPs in the scenarios where the manufacturer applies or does not apply BT, and a comparative analysis of two SPs when the manufacturer applies BT.

We denote \(M=\left\{A,B\right\}\), and \(N=\left\{A,B,C,D\right\}\). The specific conclusions are summarised below with the proofs provided in the Appendix.

Sensitivity analysis

This section examines the impact of the LCT investment cost coefficient k, LCP coefficient β, and green trust factor λ on the key equilibrium variables, including the CER rate, demand, wholesale price, retail price, and profits of both manufacturers and retailers.

Proposition 1. As the LCT investment cost coefficient k increases, the following expressions are observed: \(\frac{\partial {r}^{N* }}{\partial k} < 0\), \(\frac{\partial {q}^{N* }}{\partial k} < 0\), \(\frac{\partial {p}^{N* }}{\partial k} < 0\), \(\frac{\partial {w}^{N* }}{\partial k} < 0\), \(\frac{\partial {\pi }_{m}^{N* }}{\partial k} < 0\), and \(\frac{\partial {\pi }_{r}^{N* }}{\partial k} < 0\).

Proposition 1 suggests that irrespective of whether the manufacturer applies BT, increases in the LCT investment cost coefficient k lead to lower CER rates, demand, wholesale price, retail price, and profits for the manufacturer and retailer under both SPs. An increase in this coefficient implies lower LCT investment efficiency, resulting in a weaker CER effect. When retailers observe a decline in the level of product emissions reductions, they are incentivised to lower retail prices to maintain demand. This reduced demand influences the SC and the consumer end, prompting manufacturers to lower wholesale prices due to concerns regarding unsold inventories. This reduced demand is the primary factor driving lower retailer profits, whereas lower demand, lower wholesale prices, and higher LCT investment costs contribute to lower manufacturer profits.

These findings suggest that reducing the cost coefficient of LCT investments or improving its efficiency is conducive to improving the LC level of products. In practice, technology accounts for 30% of the overall determinants of the enterprise’s emission reduction effect (Song et al., 2023). Thus, enterprises should be incentivised to research, develop, and improve LCT to increase efficiency and hence benefit from emission reduction. Technological advances and scale effects reduce the cost of emission reduction and increase investment in renewable energy. For example, as reported by the International Renewable Energy Agency (IRENA), due to the overall advancement of renewable energy technology, by the end of 2022, global renewable energy capacity reached 3,372 GW, representing an increase of 9.6% year-on-year, with solar power capacity increasing by 22% (191 GW) (EP, 2023).

Proposition 2. As the LC preference coefficient β increases, the following expressions are observed: \(\frac{\partial {r}^{N* }}{\partial \beta } > 0\), \(\frac{\partial {q}^{N* }}{\partial \beta } > 0\), \(\frac{\partial {p}^{N* }}{\partial \beta } > 0\), \(\frac{\partial {w}^{N* }}{\partial \beta } > 0\), \(\frac{\partial {\pi }_{m}^{N* }}{\partial \beta } > 0\), \(\frac{\partial {\pi }_{r}^{N* }}{\partial \beta } > 0\).

Proposition 2 suggests that the increasing consumer preference for LC products leads to higher CER rates, demand, wholesale prices, retail prices, and profits for manufacturers and retailers under both SPs, regardless of whether the manufacturer applies BT. An increase in the LC preference coefficient β enhances consumer sensitivity to LC products, incentivising more investment in LCT as higher market demand creates a more favourable return on investment. In turn, the increased demand stimulates enterprises’ willingness to invest in LCT, leading to the cyclical nature of LCSC. In addition, a higher consumer preference for LC products enables firms to increase product prices, as SC firms often pass on some of their LCT investment costs to consumers.

These findings demonstrate that maintaining a high preference for LC products can lead to increased investments in LCT and higher profits. Simultaneously, firms increase the pricing of preferred LC products, reflecting the commercial value of carbon reduction. In addition to advertising and other publicity measures, the government can implement a reward mechanism that cultivates consumers’ LC behaviour awareness. For example, a collaborative platform developed by Tencent and the Shenzhen Municipal Bureau of Ecological Environment, along with other institutions, has created a system that qualifies and rewards positive carbon behaviour by constructing a set of citizens’ CER mechanisms (CNR News, 2022). This mechanism, with characteristics of “recordable, measurable, profitable, and recognised”, establishes a positive feedback loop that combines commercial incentives and policy encouragement. Such incentives can help nurture a growing base of consumers with strong LC preferences, which, in turn, will contribute to the expansion of the LC product market.

Proposition 3. As the green trust factor λ increases, the following effects are observed: \(\frac{\partial {r}^{M* }}{\partial \lambda } > 0\), \(\frac{\partial {q}^{M* }}{\partial \lambda } > 0\), \(\frac{\partial {p}^{M* }}{\partial \lambda } > 0\), \(\frac{\partial {w}^{M* }}{\partial \lambda } > 0\), \(\frac{\partial {\pi }_{m}^{M* }}{\partial \lambda } > 0\), and \(\frac{\partial {\pi }_{r}^{M* }}{\partial \lambda } > 0\).

Proposition 3 reveals that an increase in the green trust λ leads to higher carbon reduction rates, demand, wholesale price, retail price, and profits for manufacturers and retailers, especially when BT is not applied, under both SPs. An increase in green trust indicates that consumers have greater confidence in the manufacturers’ LC claims, whether through blockchain disclosure or marketing efforts. This trust incentivises firms with low emission reduction levels to invest in LCT more aggressively, knowing that consumers will respond positively. The main factors influencing demand in this context are green trust levels and emission reductions. As green trust increases, more consumers with LC preferences tend to break down information barriers and buy the manufacturer’s products, driving up demand. This, in turn, prompts manufacturers to increase wholesale prices and retailers to adjust their retail prices accordingly. Ultimately, the profits of all SC members will increase.

These results suggest that fostering green trust can significantly enhance the manufacturer’s incentive to reduce emissions and invest in LCT when BT has not been applied. In the absence of BT, governments can foster consumer trust in LCT and green products through certification systems and public awareness campaigns. For instance, the “Energy Star” programme, jointly launched by the U.S. The Department of Energy (DOE) and the Environmental Protection Agency (EPA) enhance consumer confidence in energy-efficient products via their labelling system. By incentivising firms to redesign products and adopt advanced technologies to meet energy efficiency standards, the programme awards the Blue Energy Star label to the top 25% of the most energy-efficient products (GBA, 2017). This boost in green trust not only drives LCT investments but also increases firm profitability through enhanced market competitiveness. Additionally, a high level of green trust allows manufacturers to better transfer the cost of investment in LCT to consumers, thereby facilitating the development of the LC market.

Comparative analysis

In this section, propositions 4 to 7 compare the equilibrium solutions of the two SPs when BT is not applied, while propositions 8 to 11 perform the same comparison when BT is applied.

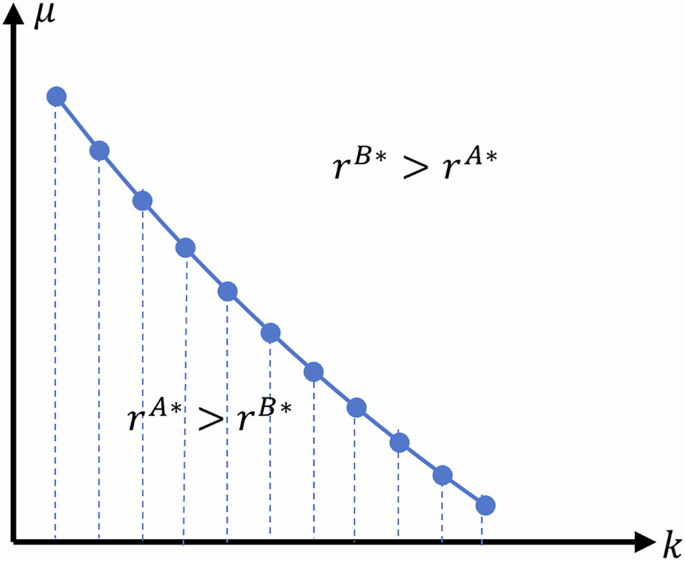

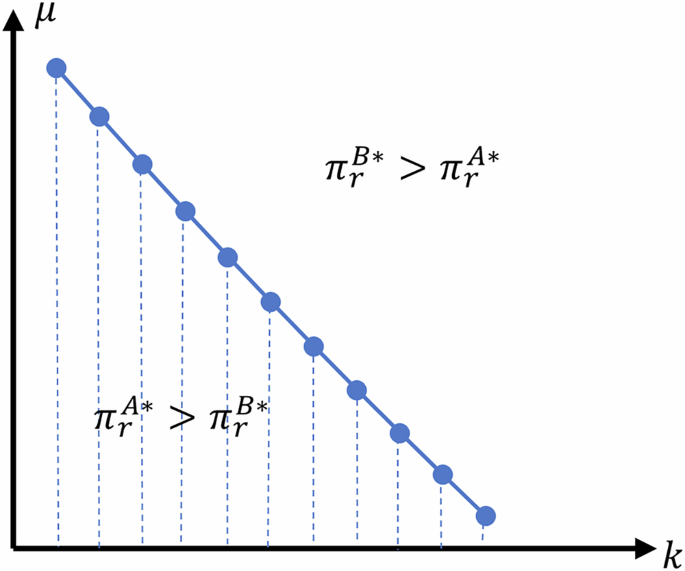

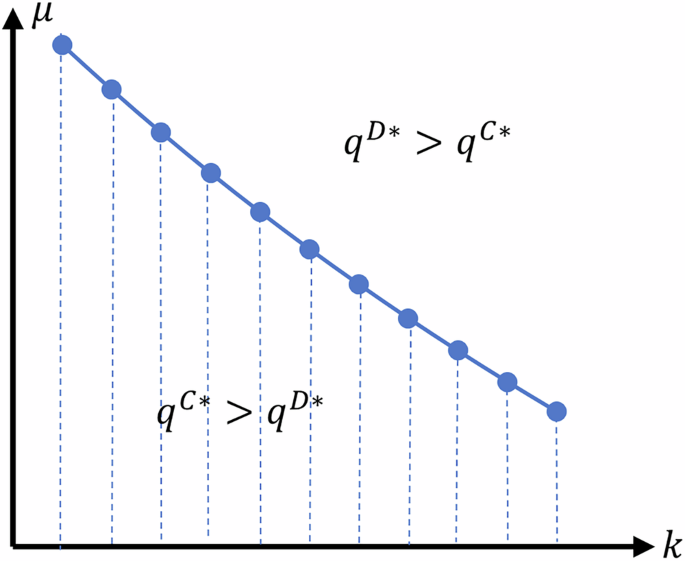

Proposition 4. When comparing the equilibrium CER rate under the TSP and OSP when the BT is not applied, the following can be observed: when \(0 < \mu < {\bar{\mu }}_{1}\), \({r}^{A* } > {r}^{B* }\); when \(\mu > {\bar{\mu }}_{1}\), \({r}^{B* } > {r}^{A* }\) (as shown in Fig. 2).

The results show that TSP is more effective for increasing the CER rate of enterprises when the unit subsidy for manufacturers is small (\(0 < \mu < {\bar{\mu }}_{1}\)). Under such conditions, OSP yields a lower total subsidy for the manufacturers, resulting in weaker incentives to invest in LCT. In contrast, when the unit subsidy amount μ is large (\(\mu > {\bar{\mu }}_{1}\)), the OSP promotes a higher CER rate. In this case, the OSP offers a larger total subsidy to manufacturers, thereby enhancing their incentives to invest in LCT.

These findings suggest that the effectiveness of TSP versus OSP in driving firms’ investment in LCT depends on the size of the unit subsidy. When the amount of subsidy per unit is low (high), manufacturers are more likely to choose to invest in a TSP (OSP).

Proposition 5. When comparing the equilibrium wholesale and retail prices under the TSP and OSP when BT is not applied, the following conclusions can be drawn: \({w}^{A* } > {w}^{B* }\), and \({p}^{A* } > {p}^{B* }\).

Proposition 5 shows that wholesale and retail prices are higher under TSP. This is because the level of total TSP is directly linked to the CER rate of manufacturers, whereas OSP is related to the total output of LC products from enterprises investing in LCT. In other words, the total amount under OSP is demand-driven; the higher the demand for LC products, the higher the production, which in turn increases the subsidy received. Therefore, manufacturers under the OSP have an incentive to lower wholesale prices, such that they can foster greater demand to increase the total subsidy. Furthermore, manufacturers under the TSP already receive subsidies when investing in LCT, which gives them an incentive to pass on costs to consumers. Consequently, manufacturers tend to set higher wholesale prices under the TSP.

These findings suggest that TSPs lead to higher wholesale and retail prices in the absence of BT. This phenomenon can be attributed to the fact that high-intensity TSP incentivises manufacturers to prioritise investments in high-value-added technologies. Such technologies often require higher product pricing to ensure cost recovery and profitability. Conversely, OSPs primarily aim to expand market scale, which intensifies price competition and constrains firms’ ability to set premium prices for their products. For example, the German government provided substantial R&D subsidies to BMW, focusing on high-value-added areas such as battery management systems, intelligent driving assistance, and vehicle connectivity (CAAM, 2024). These efforts enabled BMW to launch the i8 plug-in hybrid with a starting price significantly higher than that of comparable models, reflecting its advanced technology and premium market positioning. Excessively high product prices could discourage consumers from purchasing such products. Therefore, when BT is not applied, the government can implement an OSP to control product prices and ensure that they remain within a reasonable range.

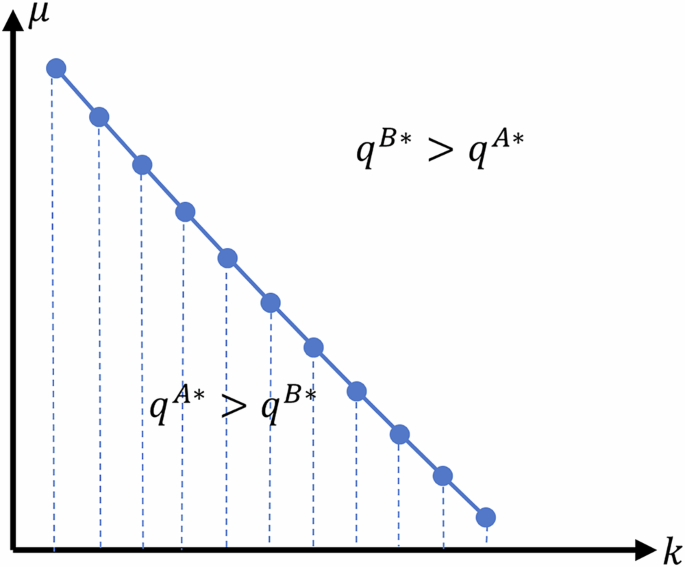

Proposition 6. By comparing the equilibrium demand under the TSP and OSP when BT is not applied, we draw the following conclusions: when \(0 < \mu < {\bar{\mu }}_{2}\), \({q}^{A* } > {q}^{B* }\); when \(\mu > {\bar{\mu }}_{2}\), \({q}^{B* } > {q}^{A* }\) (as shown in Fig. 3).

Proposition 6 demonstrates that when the unit subsidy amount μ is small (\(0 < \mu < {\bar{\mu }}_{2}\)), the TSP is more effective in increasing demand than the OSP. When the unit subsidy amount μ is large (\(\mu > {\bar{\mu }}_{2}\)), the OSP is more advantageous in terms of stimulating demand. This is because, in the absence of BT, the primary factor influencing demand is the CER rate. As noted in Proposition 4, when the unit subsidy amount is small, the TSP incentivises enterprises to invest more in LCT, leading to a higher CER rate and, consequently, higher demand. In contrast, when the unit subsidy amount is larger, the main factor affecting demand is still the carbon reduction rate. However, OSP provides greater incentives for enterprises to invest in LCT, which results in higher demand.

These findings suggest that the size of the unit subsidy not only affects manufacturers’ willingness to invest in LCT under different policies, but also the quantity demanded through the CER rate. When the investment cost coefficient for LCT is high, resulting in lower investment efficiency, the level of green trust becomes a more significant factor affecting the quantity demanded than the CER rate. In such cases, enterprises can improve the green trust level of consumers through information disclosure or marketing strategies, thereby increasing demand.

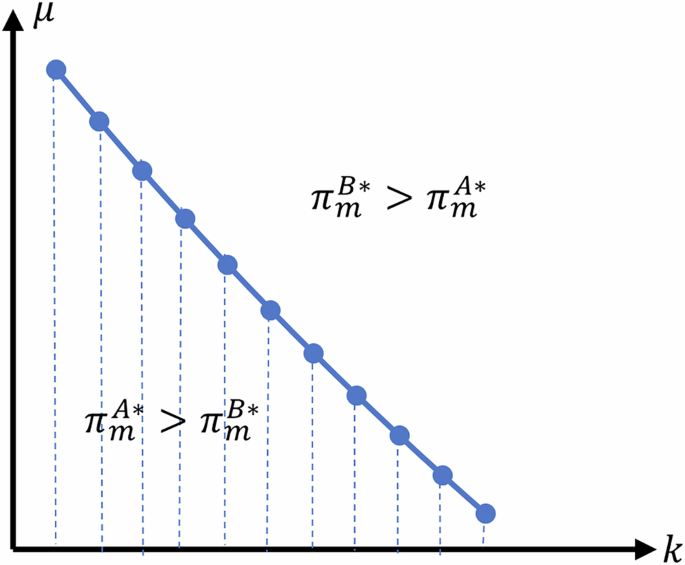

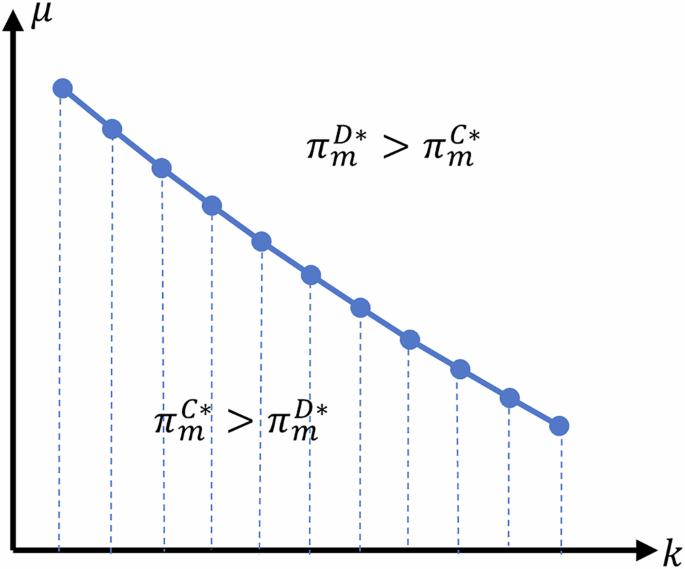

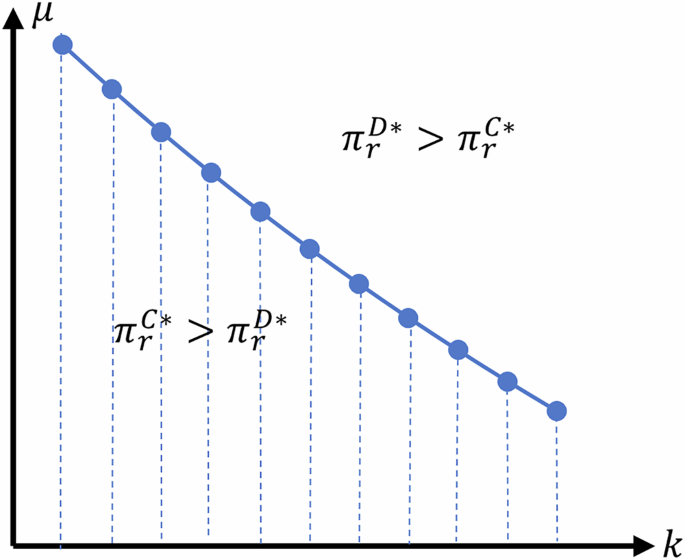

Proposition 7. By comparing the equilibrium manufacturer’s and retailer’s profit under the TSP and OSP when BT is not applied, the following conclusions can be drawn: when \(0 < \mu < {\bar{\mu }}_{3}\), \({\pi }_{m}^{A* } > {\pi }_{m}^{B* }\); when \(\mu > {\bar{\mu }}_{3}\), \({\pi }_{m}^{B* } > {\pi }_{m}^{A* }\) (as shown in Fig. 4). Further, when \(0 < \mu < {\bar{\mu }}_{4}\), \({\pi }_{r}^{A* } > {\pi }_{r}^{B* }\); when \(\mu > {\bar{\mu }}_{4}\), \({\pi }_{r}^{B* } > {\pi }_{r}^{A* }\) (as shown in Fig. 5).

Proposition 7 demonstrates that when the unit subsidy amount μ is small (\(0 < \mu < {\bar{\mu }}_{3}\) or \(0 < \mu < {\bar{\mu }}_{4}\)), both manufacturers and retailers gain higher profits under the TSP. However, when the unit subsidy amount μ is large (\(\mu > {\bar{\mu }}_{3}\) or \(\mu > {\bar{\mu }}_{4}\)), the OSP is more favourable for manufacturers and retailers. According to Proposition 6, when the unit subsidy is small (large), the demand under the TSP (OSP) is higher, which in turn, helps increase the profits of SC firms.

These findings indicate that manufacturers’ and retailers’ profits are directly related to unit subsidy size. Specifically, when the unit subsidy is small (large), SC firms are more likely to choose to invest and produce under the TSP (OSP).

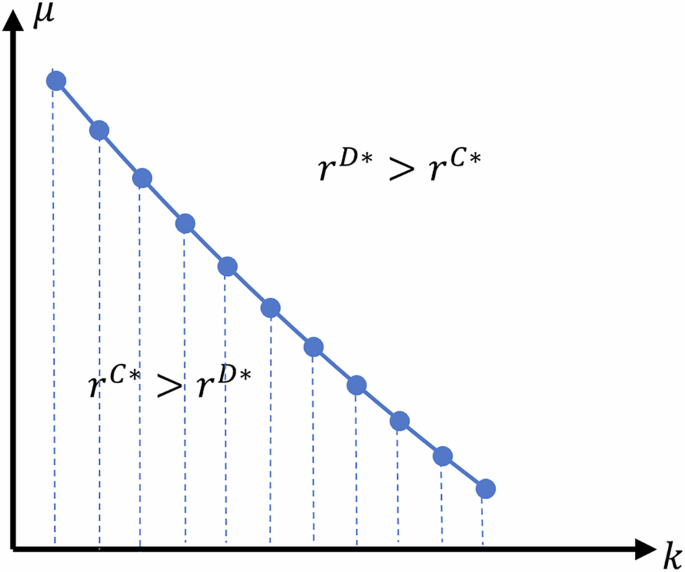

Proposition 8. By comparing the equilibrium CER rate under the TSP and OSP when the BT is applied, we draw the following conclusions: when \(0 < \mu < {\bar{\mu }}_{5}\), \({r}^{C* } > {r}^{D* }\); when \(\mu > {\bar{\mu }}_{5}\), \({r}^{D* } > {r}^{C* }\) (as shown in Fig. 6).

The results show that the TSP is more effective at increasing the CER rate of enterprises under a small government subsidy for manufacturers to produce a single LC product μ (\(0 < \mu < {\bar{\mu }}_{5}\)). In contrast, when the unit subsidy amount μ is large (\(\mu > {\bar{\mu }}_{5}\)), the OSP facilitates higher CER rates. This result mirrors the situation when BT is not applied: when the subsidy per unit is small, the TSP provides more incentives to invest in LCT, leading to a higher rate of CER. However, when the subsidy amount is larger, the OSP offers a greater incentive for manufacturers to improve their willingness to invest in LCT under the OSP, resulting in higher CER rates.

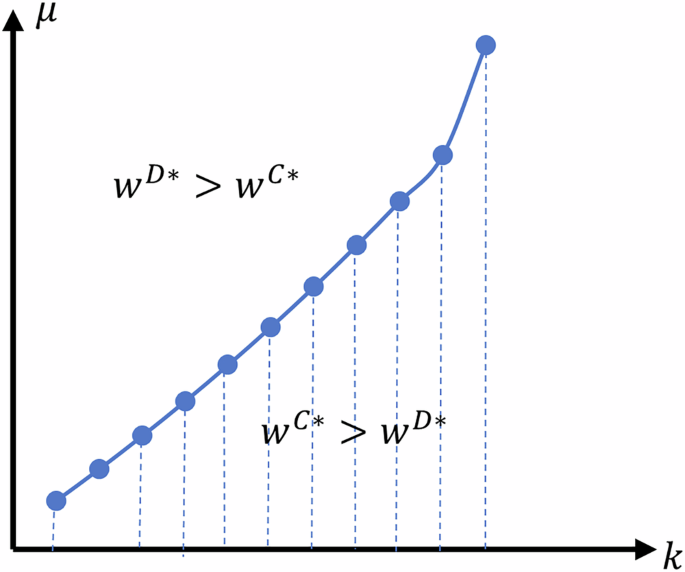

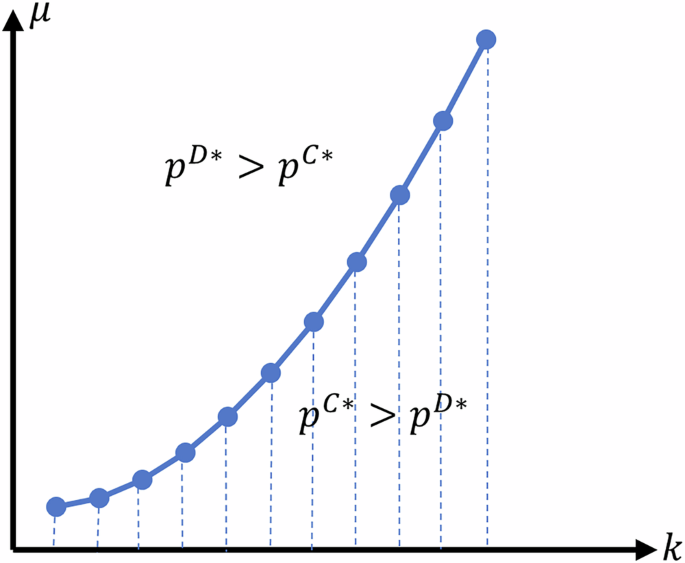

Proposition 9. By comparing the equilibrium wholesale price and the retail price under TSP and OSP when BT is applied, the following conclusions can be drawn: when \(0 < \mu < {\bar{\mu }}_{6}\), \({w}^{C* } > {w}^{D* }\); when \(\mu > {\bar{\mu }}_{6}\), \({w}^{D* } > {w}^{C* }\) (as in Fig. 7); Further, when \(0 < \mu < {\bar{\mu }}_{7}\), \({p}^{C* } > {p}^{D* }\); when \(\mu > {\bar{\mu }}_{7}\), \({p}^{D* } > {p}^{C* }\) (as in Fig. 8).

Proposition 9 demonstrates that when the unit subsidy μ is small (\(0 < \mu < {\bar{\mu }}_{6}\) or \(0 < \mu < {\bar{\mu }}_{7}\)), both wholesale and retail prices are higher under the TSP. In contrast, when the unit subsidy μ is large (\(\mu > {\bar{\mu }}_{6}\) or \(\mu > {\bar{\mu }}_{7}\)), both wholesale and retail prices are higher under the OSP. As discussed in Proposition 5, when BT is not applied, the wholesale and retail prices under the TSP are higher than those under the OSP. However, when BT is applied, the level of consumer green trust in the enterprise is maximised. Consumers can directly observe an increase in the CER rate. Consequently, the cost of LCT investment increases, prompting enterprises to pass the cost on to consumers by setting higher wholesale prices.

This analysis demonstrates that BT influences enterprise pricing strategies under different SPs. Specifically, without blockchain implementation, firms operating under TSP tend to adopt higher product pricing. Conversely, with BT adoption, firms receiving smaller total subsidies are more likely to reduce prices, reflecting a lower willingness to invest in LCT. Such firms seek to enhance profitability by leveraging price reductions, underscoring the interplay between subsidy intensity and LC investment incentives.

Proposition 10. By comparing the equilibrium demand under the TSP and OSP when BT is applied, the following conclusions can be drawn: when \(0 < \mu < {\bar{\mu }}_{8}\), \({q}^{C* } > {q}^{D* }\); when \(\mu > {\bar{\mu }}_{8}\), \({q}^{D* } > {q}^{C* }\) (as shown in Fig. 9).

Proposition 10 shows that when the unit subsidy amount μ is small (\(0 < \mu < {\bar{\mu }}_{8}\)), the TSP is more effective in increasing demand than the OSP. However, when the unit subsidy amount μ is large (\(\mu > {\bar{\mu }}_{8}\)), the OSP is superior for increasing demand. This result can be attributed to the fact that when enterprises apply BT, product information becomes fully transparent, and the primary factor affecting demand is the CER rate. As previously stated in Proposition 7, when the amount of unit subsidy is small (large), the CER rate under the TSP (OSP) is higher, leading to increased demand.

These findings suggest that the level of consumer green trust in enterprises is maximised when enterprises apply BT compared to when they do not. In addition, the CER rate is the primary factor influencing demand. Therefore, the government must control the application cost for BT, thereby encouraging more enterprises to adopt the technology by implementing appropriate SPs tailored to market conditions to incentivise enterprises to invest more in LCT; this can, in turn, boost demand.

Proposition 11. A comparison of the equilibrium manufacturer’s and retailer’s profits under the TSP and OSP when BT is applied leads to the following conclusion: when \(0 < \mu < {\bar{\mu }}_{9}\), \({\pi }_{m}^{C* } > {\pi }_{m}^{D* }\); when \(\mu > {\bar{\mu }}_{9}\), \({\pi }_{m}^{D* } > {\pi }_{m}^{C* }\) (as shown in Fig. 10); Further, when \(0 < \mu < {\bar{\mu }}_{10}\), \({\pi }_{r}^{C* } > {\pi }_{r}^{D* }\); when \(\mu > {\bar{\mu }}_{10}\), \({\pi }_{r}^{D* } > {\pi }_{r}^{C* }\) (as shown in Fig. 11).

Proposition 11 indicates that when the unit subsidy amount μ is small (\(0 < \mu < {\bar{\mu }}_{9}\) or \(0 < \mu < {\bar{\mu }}_{10}\)), the TSP enables SC firms to earn higher profits. Furthermore, when the unit subsidy amount μ is large (\(\mu > {\bar{\mu }}_{9}\) or \(\mu > {\bar{\mu }}_{10}\)), the OSP is more optimal for SC firms. According to Proposition 10, when the amount of subsidy per unit is small, the demand under the TSP is higher. Moreover, because investment in LCT is greater under the TSP, the benefits of improved production efficiency and reduced production costs are more pronounced. This leads to higher profits for SC firms. Similarly, when the unit subsidies are large, the OSP leads to higher demand and, due to increased investments in LCT, greater improvements in production efficiency and cost reductions. These factors ultimately lead to higher profits.

These findings suggest that, for SC enterprises that adopt BT, investing in LCT increases product demand, reduces production costs, and enhances production efficiency, thereby driving higher profits.

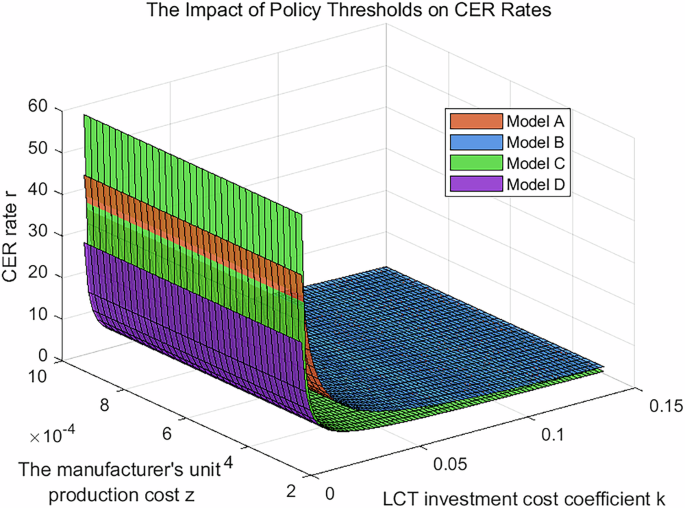

Corollary 1. The influencing factors of the policy threshold \({\bar{\mu }}_{t}\) (where \({t}=\,1,\,2,...,\,10\)) are analysed as follows:

-

(1)

\(\frac{\partial {\bar{\mu }}_{t}}{\partial z} < 0\);

-

(2)

when \(c < \bar{c}\), \(\frac{\partial {\bar{\mu }}_{6}}{\partial k} < 0\); when \(c > \bar{c}\), \(\frac{\partial {\bar{\mu }}_{6}}{\partial k} > 0\). When \(c < \widetilde{c}\), \(\frac{\partial {\bar{\mu }}_{7}}{\partial k} < 0\); when \(c > \widetilde{c}\), \(\frac{\partial {\bar{\mu }}_{7}}{\partial k} > \!\!0\);

-

(3)

\(\frac{\partial {\bar{\mu }}_{x}}{\partial k} < 0\) (where \({x}=\,1,\,2,\,3,\,4,\,5,\,8,\,9,\,10\)).

Corollary 1 (1) shows that the threshold \({\bar{\mu }}_{t}\) is negatively correlated with the initial unit production cost z. As factors such as equipment ageing reduce production efficiency, the threshold declines, thereby enhancing the effectiveness of OSP in promoting LCT adoption, consumer demand and SC performance. In contrast, for firms applying BT and making substantial LC R&D investments, improved efficiency raises \({\bar{\mu }}_{t}\), making OSP effective only under high per-unit subsidy levels—thus favouring TSP.

Corollary 1 (2) reveals that the influence of the investment cost coefficient k on thresholds \({\bar{\mu }}_{6}\) and \({\bar{\mu }}_{7}\) depends on blockchain unit cost. When blockchain cost is low (\(c < \bar{c}\) or \(c < \widetilde{c}\)), the thresholds decrease with increasing k. When the cost is high (\(c > \bar{c}\) or \(c > \widetilde{c}\)), the thresholds increase with k.

Corollary 1 (3) indicates that thresholds \({\bar{\mu }}_{x}\) are negatively related to k. This suggests that lower investment efficiency (or higher costs) reduces the threshold, making OSP a more suitable option. In high-tech firms or regions, further improvements require greater investment, lowering thresholds and enhancing the effectiveness of OSP. Conversely, higher thresholds favour TSP in low-tech settings with lower marginal investment costs.

Figure 12 further illustrates the threshold’s role in determining the effectiveness of policy. Without blockchain, a crossover point exists between TSP (Model A) and OSP (Model B). Before this point, TSP yields better outcomes. However, as k increases and \({\bar{\mu }}_{1}\) falls, OSP becomes increasingly effective at the same subsidy rate. These results suggest that policy thresholds can be adjusted through the investment cost coefficient or production cost. From an environmental standpoint, increases in either parameter lower the threshold, narrowing the scope for TSP and enhancing the relative advantage of OSP.

Key findings

The sensitivity and comparative analyses yielded several key findings.

TSP and green trust: a delicate balance between pricing and profitability

Under TSP, manufacturers’ optimal CER rate and profitability show a positive correlation with the level of green trust. In the absence of BT, product prices are higher than those under OSP. However, the adoption of BT incentivises manufacturers to increase wholesale prices, a decision directly influenced by the subsidy amount. These findings suggest that TSP trigger distinct different incentive mechanisms for manufacturers’ behaviour depending on the technological context.

Total subsidies as drivers of LC investment willingness

The study reveals that an increase in the total subsidy amount, whether provided through TSP or OSP, significantly enhances manufacturers’ willingness to invest in LCT. This finding underscores that subsidy amounts have a broad impact, influencing not only manufacturers’ specific emission reduction strategies but also acting as a vital catalyst for the overall LC transition of the SC. Therefore, the careful design of subsidy schemes is essential to ensure optimal policy outcomes.

Dual driving effect of BT and green trust

BT ensures complete transparency of LC information, thereby maximising consumer green trust. Under these circumstances, manufacturers are significantly motivated to intensify their emissions reduction efforts. Although the resulting increase in both green trust and CER rates leads to higher retail prices, the market demand for LC products continues to grow, reflecting a preference for environmentally responsible offerings. Conversely, in the absence of BT, the incomplete transparency of LC information limits green trust levels. Consequently, without active promotion and marketing of the products by governments or corporations, manufacturers must depend on further increases in CER rates and adjustments to pricing strategies to adapt to evolving consumer preferences.

Dynamic relationships between transparency and consumer demand

The study reveals that in the absence of BT, an increase in green trust effectively motivates manufacturers to intensify their emission reduction efforts. These efforts not only lead to higher wholesale and retail prices but also stimulate demand growth by strengthening consumer preferences for LC products. This finding reveals that even when information transparency is incomplete, the synergistic relationship between green trust and consumer preferences can still promote the expansion of the LC product market.

Strategic trade-offs of dual SPs

Both TSP and OSP have distinct advantages and disadvantages in terms of incentivising LC transformation. Their impacts vary significantly depending on the implementation of BT. This highlights the importance for policymakers to consider the relationship between subsidy intensity, technological transparency, and market demand when designing policies and exploring multidimensional synergies to better promote the research and application of LCT.

Numerical analysis