Abstract

This study investigated the effect of bureaucratic quality on tax revenue mobilization in Africa while also examining the moderating effect of democracy and corruption in this relationship. Employing the fixed effects technique and panel data for 25 African countries from 1996 to 2021, we found a significant positive association between bureaucratic quality and tax revenue. We also found that democracy significantly raises tax revenue while corruption impedes tax revenue. Furthermore, bureaucratic quality and democracy are complementary drivers of tax revenue, while corruption and bureaucratic quality are substitutes in reducing tax revenue in Africa. The study provided policy implications for African nations seeking to diversify revenue sources and improve bureaucratic quality.

Similar content being viewed by others

Introduction

Taxation is an essential component of every country’s development; hence, tax revenue mobilization is a top priority for policymakers in many countries. According to Martin et al. (2009), taxes foster one of the deepest interactions between individuals and governments. However, while some countries in other continents have experienced significant increases in their tax-to-GDP ratios over the past few decades, Africa has seen limited or no change. Thus, research on understanding the determinants of tax revenue mobilization in Africa has gained momentum recently (Moore et al. 2018; Dom et al. 2022).

Recent scholars have increasingly focused on examining how factors like the quality of governance and the effectiveness of institutions impact tax collection. Corruption, which is commonly defined as the abuse of public power for the purpose of obtaining personal advantage has been increasingly studied in the academic literature on tax revenue mobilization (Rodriguez et al. 2005; Rose-Ackerman and Palifka 2016; Phillips et al. 2025). According to Gupta and Abed (2002) and Fisman and Golden (2017), corruption poses serious challenges in developing countries, where government officials frequently misuse public funds for personal gain. Corruption within the tax administration hinders these countries’ ability to collect adequate revenue through taxes. Weak rule of law and limited accountability in governance further exacerbate corruption within tax systems. According to Ahmed and Anifowose (2024), poor governance and corruption are significant barriers to successful development. Kar and LeBlanc (2013) and Global Financial Integrity (2023) stressed that African countries face substantial revenue losses due to corruption, tax evasion, avoidance, and overall poor tax administration, with an estimated US$ 1.53 trillion in illicit outflows in 2020. Research conducted by Ahsan and Wu (2005), Imam and Jacobs (2014), Bird et al. (2008), Mukhlis et al. (2014) and Syadulah (2015) showed that implementing measures to control corruption impacts tax revenue positively. Skepticism among the public increases as corruption persists, leading to a decline in their willingness to pay taxes and low revenue generation. Therefore, effective corruption control measures are crucial for maintaining and enhancing tax revenue, as emphasized by the research conducted by Faslan (2017).

Researchers have equally argued that every effective tax administration needs a functioning state bureaucracy to prosecute its core mandate by raising tax revenue for the government (Besley and Persson 2014; Jensen 2022; Dom et al. 2022). Kornhauser (2002) stated that one significant weapon governments can deploy to deter tax evasion is excellent bureaucratic quality. Similarly, Slemrod and Yitzhaki (2002) demonstrated that an efficient bureaucracy reduces non-tax compliance. According to Aizenman and Jinjarak (2009), tax revenue generation depends heavily on the mechanism put in place by the government, so a state that has an efficient bureaucratic structure yields high tax revenue. Ehrhart (2012) research for developing countries showed that the quality of bureaucracy has a positive relationship with tax revenue, reinforcing the argument that high bureaucratic quality influences a rise in tax revenue. However, whether the system of governance influences this connection is less studied.

The system of governance plays an essential role in a country’s tax revenue. For instance, Beetham (1999) stated that “democracy is a political system where the general public significantly influences political decision-making processes and creates a high degree of political equality among citizens”. This can be argued that tax policy is too politically sensitive to be entrusted to independent bureaucracies, as representative democracy on the principle that taxation should be accompanied by political representation. Democracy serves as a crucial catalyst for promoting economic growth as it encourages firms to expand by providing incentives (Acemoglu et al. 2019).

Moreover, democracy fosters favorable conditions for the exchange of goods and services (Yu 2010). Andersson (2018) suggested that democracy leads to decreased property taxes in rural cities, increased income taxes, and reduced excise and consumption taxes in more urbanized states. This study, therefore, revisits the bureaucratic quality-tax revenue linkages while examining the moderating effect of democracy and corruption in such linkages in Africa. Specifically, we investigate the following research questions: How is bureaucratic quality associated with tax revenue collection in African countries? Can the combined force of democratic governance and bureaucratic quality, and bureaucratic quality and corruption influence tax revenue outcomes?

The study focuses on Africa for the following reasons. In Africa, government and corporate fraud contribute US$50 billion and US$80 billion annually to illicit financial flows (African Development Bank 2023). This represents approximately 3.7% of Africa’s GDP, exceeding the continent’s total annual inflows of official development assistance (OECD 2024). Countries like Nigeria, South Africa, and Angola are particularly affected, which account for over 40% of total illicit outflows from the continent between 2015 and 2021 (Olaoye et al. 2025). These illicit financial flows significantly undermine Africa’s development efforts, with recent estimates suggesting that recovering just half of these resources could fund approximately 49% of Africa’s infrastructure financing gap (Olaoye et al. 2025). Due to substantial informal economies and inadequate institutional capacities, many African countries struggle to effectively combat tax fraud, expand their limited tax bases, or increase revenue collection. Consequently, numerous low-income countries, including Somalia, Equatorial Guinea, Libya, South Sudan, Sudan, Angola, and Zimbabwe, rank among the most corrupt countries in the world (World Bank 2023; Transparency International 2023). This widespread corruption severely impedes economic progress and stifles the potential for positive development in these countries, with recent estimates suggesting that corruption reduces annual GDP growth in Africa by approximately 2–4 percentage points (African Union 2022). The enhancement of domestic tax collection holds paramount significance for numerous African nations. The ability to gather tax revenue efficiently is vital for African governments to maintain budgetary flexibility, enabling them to fund public projects and maintain essential services for their citizens. African nations must intensify their dedication to developing economic and social infrastructure to achieve the Sustainable Development Goals (African Union Commission and African Tax Administration Forum 2023; Sayed 2015). This commitment can only be fulfilled through improved tax revenue generation, which is necessary to support the required level of government spending. As noted by Drummond et al. (2012), the constrained financial resources available to African governments make it imperative to secure additional revenue, particularly to address the substantial infrastructure gaps present across many African nations.

Given these challenges, improving bureaucratic quality is seen as essential for enhancing tax revenue collection. High-quality bureaucracies, characterized by efficient structures, meritocratic recruitment, and accountability, have been shown to boost tax compliance and reduce evasion (Kornhauser 2002; Slemrod and Yitzhaki 2002). Additionally, democracy plays a crucial role in promoting accountability and transparency, which can strengthen tax collection efforts (Ehrhart 2012). Countries with strong democratic institutions tend to have more efficient tax systems, as they foster greater public scrutiny, press freedom, and civil society engagement, all of which help reduce corruption and improve governance.

Our study, therefore, makes the following contributions to the literature on fiscal capacity and governance. First, while previous research has extensively examined tax systems in Latin America, Asia, and developed economies, there is limited empirical evidence regarding how governance and bureaucratic quality relate to tax revenue in African nations, where unique challenges of weak institutions, corruption, and large informal economies prevail. We have addressed this limitation by showing that bureaucratic quality raises tax revenue in Africa. Second, the study examines the interaction between democracy and bureaucratic quality, and corruption and bureaucratic quality and has shown that democracy complements bureaucratic quality to spur tax revenue in Africa, while corruption mitigates bureaucratic quality’s positive role on tax revenue in Africa.

The remaining sections of the paper are as follows. The literature review and hypothesis formulation are presented in Section “Literature review and development of hypotheses”. In Section “Methodology and data”, we discuss our methodology. Section “Empirical results” discusses the findings, and finally, in part “Conclusion and policy suggestions”, we present conclusions and policy implications.

Literature review and development of hypotheses

Theoretical literature

This study draws upon institutional theory, which posits that institutions are fundamental determinants of economic performance (North 1994). We argue that bureaucratic quality represents a critical institutional factor that influences state fiscal capacity through four distinct mechanisms: administrative efficiency in tax assessment and processing (Dom et al. 2022), reduction of information asymmetries through oversight mechanisms (Khan et al. 2019; Avis et al. 2018), enhancement of enforcement credibility via consistent audit strategies (Allingham and Sandmo 1972), and fostering of legitimacy that promotes quasi-voluntary compliance (Levi 1988; Enachescu et al. 2019). These mechanisms prove particularly salient in the African context, where administrative constraints frequently pose greater challenges than policy limitations. The experience of countries such as Rwanda demonstrates that targeted improvements in bureaucratic quality can yield substantial revenue gains despite challenging conditions of informality and limited institutional resources (World Bank 2019). Rwanda’s comprehensive tax administration reform—implemented through merit-based recruitment, standardized procedures, and professional management beginning in 2001, resulting in its tax-to-GDP ratio increasing from approximately 10% to over 16% by 2018. These improvements in bureaucratic quality enhanced revenue performance without substantive changes to tax rates or policy structures, illustrating how administrative efficiency can directly translate to revenue gains in developing economies. Our empirical strategy subsequently tests these theoretical relationships across a broader African context, examining whether countries with superior bureaucratic quality consistently demonstrate enhanced revenue performance while controlling for relevant economic and political factors.

Nevertheless, institutional theory suggests that institutional effectiveness is contingent upon the broader institutional environment. Democratic governance theory elucidates how political institutions may amplify bureaucratic effectiveness through three distinct channels. Democratic oversight mechanisms reinforce internal accountability systems within bureaucratic structures (Haggard and Kaufman 1995; Cheibub 1998), democratic representation enhances citizen acceptance of tax obligations through voice and participation (Profeta and Scabrosetti 2010), and democratic norms provide institutional protection for bureaucratic professionalism against arbitrary political interference (Knutsen et al. 2019). This shows that democracy and bureaucratic quality function as complementary institutions, generating virtuous cycles wherein effective service delivery reinforces democratic legitimacy.

Conversely, rent-seeking theory explicates how corruption generates institutional friction that diminishes bureaucratic performance. Rent-seeking behavior occurs when individuals exploit institutional positions to capture economic benefits rather than engage in productive activities (Tullock 2008; Krueger and Schkade 2008). Corruption systematically undermines each bureaucratic mechanism through administrative process distortion (Aidt 2016), the creation of parallel informal systems that exacerbate principal-agent problems, the elimination of enforcement credibility through bribery and collusion (Alm et al. 2016), and the erosion of legitimacy by diminishing citizen trust in tax system integrity.

Based on this theoretical foundation regarding democratic governance theory, we state our first hypothesis as:

H1: The effect of democracy on tax revenue is positive.

Empirical literature

The relationship between democratic governance and tax revenue collection has emerged as a critical area of inquiry in public finance literature, particularly given the fiscal challenges facing developing nations. Understanding how political institutions influence revenue mobilization is essential for enhancing state fiscal capacity while maintaining legitimacy.

Empirically, African countries present mixed evidence regarding the democracy-tax revenue relationship. Kipuka Kabongi and Samy (2023) examined the association between tax revenue and democracy across 51 African countries, finding a positive connection between democratic governance regimes and increased tax revenue generation. Similarly, Gnangnon (2020) identified a strong positive relationship between democracy and tax revenue across 45 African countries, while Baskaran and Bigsten (2013) found significant positive links between democracy and tax income in 29 Sub-Saharan African nations between 1990 and 2005. Rashid et al. (2021) investigated the differential impact of democracy on tax revenues across 30 developed and 29 developing countries between the years 2006–2013. It was revealed that while democracy has a positive association with tax revenues in developed countries, the association varies significantly for developing countries. On the contrary, D’Arcy (2012) discovered an inverse association between democratic governance and revenue mobilization in Africa.

Recent empirical evidence continues to support the positive relationship between bureaucratic quality and tax revenue. Benitez et al. (2023) demonstrated that institutional capacity building can increase tax-to-GDP ratios through improved administrative systems. Studies by Baum et al. (2017) and Awasthi and Bayraktar (2015) showed that effective bureaucracies enhance tax administration, collection, and enforcement. Recent studies by Bah (2024) established that effective institutional quality positively leads to a boost in tax revenue generation. Similarly, Tagem and Morrissey (2023) examined institutions and tax capacity in sub-Saharan Africa, demonstrating that administrative capacity is a key determinant of fiscal performance in the region, with equity in public service provision being the most important institutional variable enhancing tax capacity. Ehrhart (2012) showed that good bureaucratic quality enhances tax revenue in their quest to investigate the correlation between domestic taxation and democracy in developing countries. Also, Rajkumar and Swaroop (2008) found that well-run bureaucracies raise tax income, which in turn helps governments meet their own budget needs. Le et al. (2012) also explore the influence of bureaucratic quality on tax performance. Their findings suggest that countries with high-quality bureaucracies exhibit enhanced tax performance. Takumah and Iyke (2017) analyzed factors that influenced tax revenue in Ghana from 1980 to 2014. The study indicated that bureaucratic quality has a positive and considerable impact on tax collection. Also, Ayenew (2016) assessed the drivers of tax revenue in Ethiopia from 1975 to 2013. The author concluded that bureaucratic quality has a positive and substantial impact on tax revenue. Another work by Besley and Persson (2014) indicated that a robust bureaucratic structure improves tax compliance and administrative efficiency, hence maximizing tax revenue. Additionally, Ajaz and Ahmad (2010) analyzed the connection between bureaucratic quality and tax revenue in 25 developing nations from 1990 to 2005. The study found that bureaucratic quality boosts tax revenue.

Since the majority of the literature supports a positive relationship between bureaucratic quality and tax revenue, we hypothesize that:

H2: The impact of bureaucratic quality on tax revenue is positive.

In emerging economies, widespread corruption significantly undermines tax collection efforts, severely limiting the government’s capacity to deliver essential services. Studies by Bird and de Jantscher (1992) indicate that corruption in tax administration results in the loss of over half of potential tax revenues, contributing to growing wealth disparities. Research by Guillamón et al. (2021) in Spain revealed a positive correlation between corruption and income levels, noting that corrupt municipalities often collect higher per capita tax revenues. Consequently, higher levels of corruption tend to have higher tax revenues per capita. They backed their findings by alluding that corrupt municipalities often have increased public expenditures, necessitating higher revenues to finance these expenditures. According to the vast majority of researchers, corruption has a significant detrimental effect on tax income. This agreement is explicit in research conducted in emerging economies, where it has shown that governments frequently lose track of more than half of all tax revenue due to corruption and evasion. Because of how difficult it is to track down these taxes, efficient revenue collection presents major obstacles. Some scholars claim that corruption can improve tax revenue collection by encouraging tax officials to work harder and discouraging tax avoidance, whereas others dispute this finding. They argue that corruption has a cumulative effect that reduces government revenue. In the study of Liu and Mikesell (2019), they revealed a positive relationship between corruption and tax revenues. They believe that countries with higher levels of corruption tend to have more complex tax systems, and the resulting tax illusion allows these states to collect higher tax revenues.

On the contrary, other researchers have shown that corruption substantially impairs government treasuries in effectively collecting taxes. The empirical evidence supporting the negative impact of corruption on tax revenues is compelling. Corruption is a deterrent to taxpaying behavior, as individuals may feel justified in evading taxes when they perceive that corruption is prevalent within the tax administration system. Consequently, this undermines the government’s ability to generate tax revenues for public expenditures. A study carried out by Tanzi and Zee (2001) highlighted the inverse relationship between corruption and tax revenue as a share of GDP. Their findings demonstrated that countries with high levels of corruption had lower tax receipts as a percentage of GDP.

Furthermore, Tanzi and Davoodi (2000) evaluated connections between corruption and individual income taxes, value-added tax (VAT), and trade tax. Their findings found a statistically significant inverse relationship between levels of corruption and individual income taxes. Arif and Rawat (2018) showed that effective governance curbs corruption and enhances tax revenue. The study of Gbewopo et al. (2009) discovered that corruption negatively influences revenue. Building on the studies that show an inverse relationship between corruption and tax revenue, we hypothesize:

H3: The impact of corruption on tax revenue is negative.

Africa’s tax systems have experienced significant upgrading over the past two decades. The rapid deployment of ICTs and the subsequent digitization of tax records have played crucial roles in this transition. The adoption of technology across Africa has shown remarkable growth, as evidenced by internet usage statistics: from a mere 9% of the population in 2009 to 38% by 2024 (International Telecommunication Union 2024). Most countries currently use computerized tax systems, and automated financial management and customs systems are commonplace (World Bank 2023). However, Mascagni et al. (2021) noted that despite the widespread implementation of ICT in tax administration and its transformative effect on tax payment processes, conclusive evidence of its impact in low-income countries remains elusive.

Empirically, Gnangnon and Brun (2018) found that ICT plays a crucial role in enhancing tax revenue across 164 nations by facilitating the electronic submission and payment of taxes. Similarly, Adams and Akobeng (2021) demonstrated that ICT integration in revenue systems not only increases tax revenue but also builds citizen confidence through improved accountability and transaction tracking. The study by Bari, Khan, and Ullah (2022) studied the impact of ICT on tax revenue mobilization in low- and middle-income countries. It was revealed that ICT has a positive relationship with tax revenue. Also, the research of Adegboye et al. (2022) investigated the impact of information communication technology on tax revenue. It was discovered that ICT enhances tax revenue. In the same vein, researchers (Gnangnon and Brun 2018; Jemiluyi and Jeke 2023) supported the claim that ICT enhances tax revenue. On the contrary, the findings of Besley and Persson (2013) portrayed that the relationship between ICT and tax revenue is inconclusive. Given the above studies, we hypothesize that:

H4: The effect of ICT on tax revenue is positive.

Studies by Sarwar and Ashraf (2016) examined the relationship between institutional quality and tax revenue in South Asian countries and found that stronger rule of law frameworks led to decreased tax collection. Recent empirical evidence on the relationship between tax revenue and the rule of law by Diabaté and Koffi (2023) argued that countries with rapidly improving rule of law indicators mostly experienced short-term revenue volatility as tax administrations learned to operate within strengthened legal frameworks.

Conversely, studies by Syadullah (2015) on governance and tax revenue relationships in ASEAN countries concluded that rule of law improvement consistently led to enhanced tax collection through improved taxpayer confidence, reduced evasion, and more effective enforcement mechanisms. Also, Tagem and Morrissey (2023) claimed that countries with robust legal institutions consistently outperform those with weaker rule of law in terms of tax collection efficiency and revenue stability. Nikiema and Zore (2025) further supported the positive relationship, showing that the rule of law increases tax revenue levels but also reduces revenue instability across sub-Saharan African countries. Based on these findings we hypothesize:

H5: Rule of law boosts tax revenue in Africa.

Gemmell et al. (2016) asserted that government expenditure may influence tax revenue positively depending on its spending quality and targeting. Study by Acosta-Ormaechea et al. (2019) on Latin American countries found that government expenditure increases in education and infrastructure systematically led to improved tax revenue performance. Also, Aizenman and Jinjarak (2012), who examined 44 countries across different income levels, discovered that government expenditure positively correlated with tax collection. Afonso et al. (2023) concluded that countries with government expenditure ratios above 40% of GDP faced significant constraints on tax revenue expansion due to reduced economic dynamism and increased tax avoidance behaviors. The research showed that high-spending nations experienced revenue growth rates lower than countries with more moderate government sizes. Bleaney et al. (2001) found that a 1% increase in productive government expenditure led to approximately a 0.6% increase in tax revenue in OECD countries

However, Romero-Avila and Strauch (2008), who studied 15 European Union countries, established that countries with government expenditure exceeding 45% of GDP experienced systematically lower tax revenue elasticity and greater difficulty in maintaining fiscal sustainability. Their panel cointegration analysis showed that high-spending countries faced increasing challenges in raising additional revenue as government size expanded, suggesting diminishing returns to taxation in large public sectors.

Based on the reviewed study, we hypothesize that:

H6: Efficient government consumption expenditure (government size) enhances tax revenue in Africa.

Aghion et al. (2016) and Baum et al. (2017) found that corruption reduces tax revenue by diverting tax payments, collaborating to evade taxes, and taxpayers’ unwillingness to fund corrupt governments. Nikiema and Zore (2025) asserted that institutional quality significantly reduces tax revenue instability in sub-Saharan Africa, with higher quality corruption control, government efficiency, and political stability leading to greater tax revenue stability. However, a counter-revelation expressed by Picur and Riahi‐Belkaoui (2006) argued that bureaucratic quality has a detrimental effect on tax collection with the view that a bloated bureaucracy leads to corruption and lower tax revenue. In the case of Němec et al. (2021), bureaucratic systems filled with corruption support shadow economy growth, which directly reduces formal tax collection

Considering the revelation, the study hypothesizes that.

H7: The interaction between bureaucratic quality and corruption decreases tax revenue.

Based on the strong evidence by Gnangnon (2020), Baskaran and Bigsten (2013) and Ajaz and Ahmad (2010) on the impact of democracy and bureaucratic quality on tax revenue, this study seeks to determine whether the interaction of democracy and bureaucratic quality can create a virtuous cycle that increases tax revenue. We hypothesize that:

H8: The interaction between bureaucratic quality and democracy increases tax revenue.

Methodology and data

Empirical model

In assessing the effect of governance on tax revenue in Africa, we utilized the empirical framework proposed by Bolthole et al. (2012), and the empirical model of the study is expressed as:

Where:

\({{TR}}_{{it}}\) represents tax revenue (% of GDP), \({{BUR}}_{{it}}\) represents bureaucratic quality, which captures the strength and quality of institutions, \({{RL}}_{{it}}\) represents the rule of law, \({{ICT}}_{{it}}\) refers to Information and Communication Technology (ICT). Also, \({{GS}}_{{it}}\), represents government consumption expenditure as a share of GDP, \({{Cor}}_{{it}}\), represents corruption, \({{Demo}}_{{it}}\) represents democracy. \(({{BUR}* {DEMO})}_{{it}}\) represents the interaction term between bureaucratic quality and democratic governance regime, while \(({{BUR}* {COR})}_{{it}}\) represents the interaction between bureaucratic quality and corruption, \(i=1\ldots \ldots .25\), \(t=1996\ldots 2021\), \({\varepsilon }_{{it}}\) denotes the error term.

The study used the Fixed Effects (FE) and Two-Stage Least Squares (2SLS) models to estimate the equations. The FE estimator controls for unobserved country-specific heterogeneity, while the 2SLS estimator addresses potential endogeneity and omitted variables issues (Appiah-Otoo and Chen 2023).

Data

The study extracted data from the World Bank World Development Indicators (2023), World Governance Indicators, and International Country Risk Guide (ICRG) to investigate the linkage between tax revenue and bureaucratic quality. Variables such as Tax revenue (TR) measures total tax revenue as a percentage of GDP, excluding non-tax revenues, ICT which is measured by Mobile Cellular Subscriptions (Per 100 People), and government size which refers to government consumption expenditure as a share of GDP, were obtained from the WDI database. In the case of democracy, the study used data from the Polity IV database. The Polity IV database on democracy, detailed by Marshall and Jaggers (2002), Political regime index ranging from −10 (strongly autocratic) to +10 (strongly democratic). The democracy score assesses the level of competition and openness within the electoral process. Corruption (Cor) is measured using the World Governance Indicators’ Control of Corruption index, scaling from −2.5 to +2.5 (−2.5 = higher corruption; 2.5 = absence of corruption). The corruption data was standardized by rescaling from 0–10. Bureaucratic quality (Bur) uses the ICRG index, scaling 0–10, capturing institutional strength and administrative competence. Since the scale for the institutional quality adoption in the study varies in ordinal scales, we followed (Olaniyi 2022; Olaniyi and Adedokun 2022; Olaniyi and Oladeji 2022; Aluko and Ibrahim 2021; Tang et al. 2020; Law et al. 2013, 2018; Muye and Muye 2017) to rescale the measures to 0–10. This allows uniformity, comparability, and easy interpretations of data. High values imply strong institutions, while values close to zero indicate a weak institutional framework. The score of 10 is an indication of flawless institutions.

The study covers 25 African countries (Algeria, Angola, Burkina Faso, Cameroon, Congo, Dem. Rep., Congo, Rep., Cote d’Ivoire, Gabon, Ghana, Guinea, Kenya, Liberia, Madagascar, Malawi, Mali, Namibia, Niger, Nigeria, South Africa, Tanzania, Togo, Tunisia, Uganda, Zambia and Zimbabwe) spanning 1996 to 2021. Table 1 shows variable definition, unit of measurement, and the source of the variables used.

Table 2 presents descriptive statistics for the variables employed in this analysis. Tax revenue as a percentage of GDP exhibits considerable variation across the 25 African countries, with a mean of 14.4% and a maximum of 43.98. Bureaucratic quality demonstrates an average score of 0.387 on a normalized 0–10 scale, indicating relatively modest institutional capacity throughout the sample. The average value of democracy is 3.88%, with a maximum value of 10. The average value for the rule of law (RL) is 4.599%, with a maximum value of 10 and a minimum value of 0. Also, the average values for government size, corruption, and ICT are 14.447%, 6.570%, and −0.152%, respectively, with maximum values of 27.940, 10, and 2.605.

The correlation matrix (Table 3) reveals preliminary correlation relationships consistent with theoretical expectations: bureaucratic quality correlates positively with tax revenue (r = 0.439), while corruption exhibits a negative association (r = −0.393). Notably, democracy displays a weak negative correlation with tax revenue (r = −0.064), suggesting a complex relationship that warrants further multivariate investigation. We also discovered that ICT, the rule of law, and government size have a positive correlation with tax revenue. The finding indicates that a rise in ICT and efficient government expenditure (government size) will increase tax revenue. The correlation provides preliminary evidence for the links between the two variables. However, it is imperative to emphasize that a correlation does not imply causality. As a result, assuming that bureaucracy raises tax revenue purely based on this correlation is premature. The study used FE and the 2SLS techniques to evaluate the influence of bureaucracy on tax revenue while adjusting for other factors to give more robust results and conclusions that might guide policy decisions.

In ensuring that our regression model does not suffer from multicollinearity, the study conducted the Variance Inflation Factor (VIF) tests for all the explanatory variables as shown in Table 4. The VIF values for all variables are below 10, with the highest being 1.78 for bureaucratic quality (Bur). The mean VIF of 1.43 indicates that multicollinearity is not a concern in our models. Generally, VIF values greater than 10 are considered problematic (Hair et al. 2010), suggesting that our regression estimates are not affected by multicollinearity.

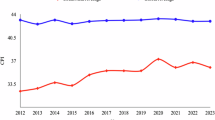

Figure 1 depicts the bivariate association between bureaucratic quality, rule of law, government size, ICT, corruption, democracy, and tax revenue. The graph illustrates a positive association between tax revenue and Bureaucratic quality, Rule of law, ICT, and government expenditure size. corruption and democracy negatively correlate with tax revenue.

Empirical results

Table 5 presents our baseline findings. The Hausman test showed that the FE model was the most appropriate compared to the Random Effects (RE) in Models 1–4. Bureaucratic quality demonstrates a positive and statistically significant relationship with tax revenue in Model 2. This suggests that countries with the highest quality bureaucratic institutions collect more tax revenue compared to countries with the weakest bureaucratic institutions when controlling for democracy, rule of law, ICT, and government size, supporting our H2. Rule of law demonstrates positive and statistically significant effects on tax revenue at the 1% significance level suggesting that countries with robust legal tax systems boost revenue affirming our H5. The revelation shows that tax evasion is discouraged by credible deterrent effects caused by predictable legal enforcement. ICT adoption exhibits consistently positive and highly significant effects with a coefficient (0.650 and 0.67, all at the 1% significance level), providing robust evidence that technological modernization substantially enhances tax collection. This confirms our H4. Similarly, government size maintains positive associations across (Models 1 and 2). The outcome of government size suggests that countries that efficiently spend large resources on tax administration enhancement generate higher tax revenues validating our H6.

Corruption exhibits a significant negative impact on tax revenue supporting our H3. The result indicates that a 1% increase in corruption will lead to a 0.35% reduction in tax revenue. This revelation affirms the theoretical expectations (principal-agent theory) that corruption undermines tax revenue generation through reduced compliance, administrative inefficiencies, and diversion of resources. Democracy showed a significant positive association with tax revenue supporting our H1. The revelation implies that countries whose governments are more democratic are more likely to collect taxes, which could be attributed to enhanced mechanisms of accountability and higher rates of citizen compliance with tax laws.

The 2SLS findings were similar to those of the FE model, except for democracy, which showed a significant detrimental effect on tax revenue. This could imply that, when endogeneity is properly addressed, democratic governance may constrain governments’ ability to maximize tax revenue, possibly reflecting electoral pressures that limit aggressive tax collection measures or create incentives for tax concessions that reduce overall revenue generation.

Building upon the direct effects examination in Tables 5 and 6 advances the empirical analysis by investigating how governance variables interact to influence tax revenue. The bureaucratic quality-corruption interaction term (BUR × COR) shows a consistent pattern of negative coefficient parameters across all models (Models 1, 3, 5). This revelation supports our H7. This outcome suggests that bureaucratic quality’s positive effect on tax revenue is systematically diminished in countries with higher levels of corruption. The phenomenon of bureaucratic capture emerges as a key mechanism, where corrupt officials co-opt well-functioning bureaucracies, leading strong bureaucratic systems to become complicit in corrupt practices that worsen tax administration. This finding aligns with studies by Aghion et al. (2016), who demonstrated how strong institutions become corrupt due to a lack of proper accountability. Contrary, the study discovered that the interaction term between bureaucratic quality and democracy (BUR × DEMO) enhances tax revenue across all models, validating our H8, thus, the interaction between bureaucratic quality and democracy increases tax revenue. This indicates that the synergistic effect of strong democratic institutions and high-quality bureaucracy will boost tax revenue collection. This supposes that democratic countries with efficient bureaucracies establish civil service protections that shield competent tax officials from arbitrary political interference, press freedom, and civil society oversight, encourage honest officials, and expose corrupt practices, will gain public trust, which will ensure higher compliance leading to higher revenue generation. This result is consistent with the findings of Acemoglu and Robinson (2019), who argued that political institutions and state capacity complementarily foster economic development, including tax capacity.

Conclusion and policy suggestions

African economies continue to experience significant constraints in domestic revenue mobilization, with tax-to-GDP ratios consistently lagging behind those observed in developed nations. Although the extant literature has identified numerous determinants of tax collection performance, the specific contribution of bureaucratic quality and its interaction with broader institutional configurations remains insufficiently examined within African institutional contexts. This study examines the impact of bureaucratic quality on tax revenue mobilization in African countries, investigating how this relationship is moderated by democratic governance and corruption. Employing panel data from 25 African countries spanning 1996–2021 and utilizing the FE and the 2SLS models, we found a significant positive association between bureaucratic quality and tax revenue. We also found that democracy significantly raises tax revenue while corruption impedes tax revenue. Furthermore, bureaucratic quality and democracy are complementary drivers of tax revenue, while corruption and bureaucratic quality are substitutes in reducing tax revenue in Africa.

Our findings contribute to the literature on taxation and institutional development in several ways. First, we demonstrate that bureaucratic quality significantly enhances tax revenue collection, confirming theoretical predictions regarding the importance of administrative capacity for state fiscal performance. Second, the positive interaction between bureaucratic quality and democratic governance indicates that democratic institutions amplify bureaucratic effectiveness through accountability, legitimacy, and institutional protection mechanisms, thereby enhancing tax revenue collection in Africa. Conversely, the negative interaction between bureaucratic quality and corruption suggests that corrupt environments systematically undermine administrative capacity, creating institutional friction that constrains bureaucratic effectiveness. These findings support the institutional configuration approach, which posits that tax revenue mobilization depends on the joint effects of multiple institutional factors rather than individual components operating independently. Our evidence contributes to the state capacity literature by demonstrating how different institutional dimensions interact to shape fiscal outcomes, extending beyond the traditional focus on bureaucratic quality to encompass democratic governance, corruption control, and technological adoption.

The study recommends that African governments seeking to enhance tax revenue mobilization should pursue integrated institutional reforms rather than combined approaches. Effective tax administration requires coordinated investments in bureaucratic professionalization, democratic accountability mechanisms, anti-corruption strategies, and ICT infrastructure. The conditional nature of these relationships indicates that reform sequencing is critical, with foundational institutional changes potentially necessary before technological solutions achieve optimal effectiveness. Development partners should recognize these interdependencies when designing technical assistance programs, adopting comprehensive approaches that address institutional environments rather than focusing on isolated capacity-building interventions.

Data availability

The datasets generated during the current study are available from the corresponding author on reasonable request.

References

Acemoglu D, Robinson JA (2019) The narrow corridor: states, societies, and the fate of liberty: winners of the 2024 Nobel Prize in Economics. Penguin, UK

Acemoglu D, Naidu S, Restrepo P, Robinson JA (2019) Democracy does cause growth. J Political Econ 127(1):47–100

Acosta-Ormaechea S, Sola S, Yoo J (2019) Tax composition and growth: a broad cross-country perspective. Ger Econ Rev 20(4):e70–e106

Adams S, Akobeng E (2021) ICT, governance and inequality in Africa. Telecommun Policy 45(10):102198

Adams S, Klobodu EKM (2017) Capital flows and the distribution of income in sub-Saharan Africa. Econ Anal Policy 55:169–178

Adegboye A, Ojeka SA, Tolase O, Omoremi O, Jude-Okeke Y (2022) Technology penetration and human development nexus in middle-income countries: the synergy effect of inclusive resources distribution. Inf Technol Dev 28(4):860–874

Afonso A, Schuknecht L, Tanzi V (2023) The size of government. In Afonso A, Jalles J T, Venâncio A. (Eds) Handbookon Public Sector Efficiency. Northampton, MA: Edward Elgar Publishing (pp. 6–31)

African Development Bank (2023) Domestic resource mobilization: fighting against corruption and illicit financial flows. AfDB, Abidjan. https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/domestic-resource-mobilization

African Union Commission, & African Tax Administration Forum (2023) Revenue statistics in Africa 2023. OECD Publishing

African Union (2022) African anti-corruption outlook report 2022. African Union Advisory Board on Corruption, Arusha. https://anticorruption.au.int/en/reports

Aghion P, Akcigit U, Cagé J, Kerr WR (2016) Taxation, corruption, and growth. Eur Econ Rev 86:24–51

Ahmed A, Anifowose M (2024) Corruption, corporate governance, and sustainable development goals in Africa. Corp Gov Int J Bus Soc 24(1):119–138

Ahsan SM, Wu S (2005) Tax structure and reform in China, 1979-2002. Mimeo, Department of Economics. Concordia University, Canada

Aidt TS (2016) Rent seeking and the economics of corruption. Const Political Econ 27:142–157

Aizenman J, Jinjarak Y (2012) Income inequality, tax base and sovereign spreads (No. w18176). National Bureau of Economic Research

Aizenman J, Jinjarak Y (2009) Globalization and developing countries—a shrinking tax base? J Dev Stud 45(5):653–671

Ajaz T, Ahmad E (2010) The effect of corruption and governance on tax revenues. Pak Dev Rev 49(4):405–417

Allingham MG, Sandmo A (1972) Income tax evasion: a theoretical analysis. J Public Econ 1(3-4):323–338

Aluko OA, Ibrahim M (2021) Institutions and financial development in ECOWAS. J Sustain Financ Invest 11(2):187–198

Andersson PF (2018) Democracy, urbanization, and tax revenue. Stud Comp Int Dev 53:111–150

Appiah-Otoo I, Chen X (2023) Is crowdfunding the solution? Appraising the environmental contributions of crowdfunding. Environ Dev Sustain 27(1):831–855

Arif I, Rawat AS (2018) Corruption, governance, and tax revenue: evidence from EAGLE countries. J Transnatl Manag 23(2-3):119–133

Avis E, Ferraz C, Finan F (2018) Do government audits reduce corruption? Estimating the impacts of exposing corrupt politicians. J Political Econ 126(5):1912–1964

Awasthi R, Bayraktar N (2015) Can tax simplification help lower tax corruption? Eurasia Econ Rev 5:297–330

Ayenew W (2016) Determinants of tax revenue in Ethiopia (Johansen co-integration approach). Int J Bus Econ Manag 3(6):69–84

Bah M (2024) Tax revenue mobilization and institutional quality in sub-Saharan Africa: An empirical investigation. Afr Develop Rev 36:201–221

Bari E, Khan TI, Ullah MS (2022) The value-added tax (VAT) improvement program: raising the operational efficacy of the VAT administration in Bangladesh (Joint agency research report). Oxfam & SUPRO

Baskaran T, Bigsten A (2013) Fiscal capacity and the quality of government in sub-Saharan Africa. World Dev 45:92–107

Baum MA, Gupta MS, Kimani E, Tapsoba MSJ (2017) Corruption, taxes and compliance. International Monetary Fund

Beetham D (1999) Democracy and human rights, vol 249. Polity Press, Cambridge

Benitez JC, Mansour M, Pecho M, Vellutini C (2023) Building tax capacity in developing countries. International Monetary Fund

Besley T, Persson T (2013) Taxation and development. In Auerbach AJ, Chetty R, Feldstein MS, Saez E. (Eds) Handbookof Public Economics Vol 5. Amsterdam; New York: North-Holland (Elsevier), pp 51–110

Besley T, Persson T (2014) Why do developing countries tax so little? J Econ Perspect 28(4):99–120

Bird RM, de Jantscher MC (eds) (1992) Improving tax administration in developing countries, vol 19. International Monetary Fund, Washington, DC

Bird RM, Martinez-Vazquez J, Torgler B (2008) Tax effort in developing countries and high-income countries: the impact of corruption, voice, and accountability. Econ Anal Policy 38(1):55–71

Bleaney M, Gemmell N, Kneller R (2001) Testing the endogenous growth model: public expenditure, taxation, and growth over the long run. Can J Econ/Revue canadienne d'économique 34(1):36–57

Bolthole T, Asafu‐Adjaye J, Carmignani F (2012) Natural resource abundance, institutions and tax revenue mobilisation in Sub‐Sahara Africa. South Afr J Econ 80(2):135–156

Castañeda Rodríguez VM (2018) Tax determinants revisited. An unbalanced data panel analysis. J Appl Econ 21(1):1–24

Cheibub JA (1998) Political regimes and the extractive capacity of governments: taxation in democracies and dictatorships. World Politics 50(3):349–376

D’Arcy M (2012) Taxation, democracy and state-building: how does sequencing matter? (Quality of Government Working PaperNo. 2012:04). QoG Institute, Department of Political Science, University of Gothenburg. ISSN 1653‑8919

Diabaté N, Koffi MV (2023) Analysis of tax effort in WAEMU: how important are institutional/administrative reforms? Afr Dev Rev 35(1):1–10

Dom R, Custers A, Davenport S, Prichard W (2022) Innovations in tax compliance: building trust, navigating politics, and tailoring reform. World Bank Publications

Drummond MP, Daal MW, Srivastava MN, Oliveira MLE (2012) Mobilizing revenue in Sub-Saharan Africa: empirical norms and key determinants. International Monetary Fund, Washington, DC

Ehrhart H (2012) Assessing the relationship between democracy and domestic taxes in developing countries. Economics Bulletin, 32(1):551–566

Enachescu J, Olsen J, Kogler C, Zeelenberg M, Breugelmans SM, Kirchler E (2019) The role of emotions in tax compliance behavior: a mixed-methods approach. J Econ Psychol 74:102194

Faslan S (2017) Analisis Pengaruh Tata Kelola Peerintahan yang Baik Terhadap Tingkat Ketaatan Membayar Pajak (Doctoral dissertation, Thesis. Thesis Unila)

Fisman R, Golden MA (2017) Corruption: what everyone Needs to Know®. Oxford University Press

Gbewopo A, Chambas G, Combes JL (2009) Corruption and mobilization of tax revenue: an econometric analysis. Louvain Econ Res 752:229–268

Gemmell N, Kneller R, Sanz I (2016) Does the composition of government expenditure matter for long‐run GDP levels? Oxf Bull Econ Stat 78(4):522–547

Global Financial Integrity (2023) Illicit financial flows and development indices: 2009-2020. Global Financial Integrity, Washington, DC. https://gfintegrity.org/issue/illicit-financial-flows/

Gnangnon SK (2020) Effect of development aid on tax reform in recipient-countries: does trade openness matter? J Int Commer, Econ Policy 11(01):2050001

Gnangnon SK, Brun JF (2018) Impact of bridging the Internet gap on public revenue mobilization. Inf Econ Policy 43:23–33

Guillamón MD, Cifuentes J, Faura U, Benito B (2021) Effect of political corruption on municipal tax revenues: efecto de la corrupción política en los ingresos impositivos municipales. Rev de Contabilidad Span Account Rev 24(2):231–240

Gupta MS, Abed MGT (2002) Governance, corruption, and economic performance. International Monetary Fund

Haggard S, Kaufman RR (1995) The Political Economy of Democratic Transitions (7th Edition). Princeton, NJ: PrincetonUniversity Press

Hair JF, Anderson RE, Babin BJ, Black WC (2010) Multivariate data analysis: a global perspective, (7th ed.). Pearson Education

Imam PA, Jacobs D (2014) Effect of corruption on tax revenues in the Middle East. Rev Middle East Econ Financ 10(1):1–24

International Telecommunication Union (2024) Facts and figures 2024. ITU. https://www.itu.int/itu-d/reports/statistics/facts-figures-2024/

Jemiluyi OO, Jeke L (2023) Tax revenue mobilization effort in Southern African Development Community (SADC) bloc: does ICT matter? Cogent Econ Financ 11(1):2172810

Jensen A (2022) Employment structure and the rise of the modern tax system. Am Econ Rev 112(1):213–234

Kar D, LeBlanc B (2013) Illicit financial flows from developing countries: 2002-2011. Global Financial Integrity, Washington, DC

Khan AQ, Khwaja AI, Olken BA (2019) Making moves matter: experimental evidence on incentivizing bureaucrats through performance-based postings. Am Econ Rev 109(1):237–270

Kimbro MB (2002) A cross-country empirical investigation of corruption and its relationship to economic, cultural, and monitoring institutions: an examination of the role of accounting and financial statements quality. J Account Audit Financ 17(4):325–350

Kipuka Kabongi D, Samy Y (2023) Democracy and taxation: evidence from African countries. J Afr Dev 24(1):43–64

Knutsen CH, Gerring J, Skaaning SE, Teorell J, Maguire M, Coppedge M, Lindberg SI (2019) Economic development and democracy: an electoral connection. Eur J Political Res 58(1):292–314

Kornhauser ME (2002) Legitimacy and the right of revolution: the role of tax protests and anti-tax rhetoric in America. Buff L Rev 50:819

Krueger AB, Schkade DA (2008) The reliability of subjective well-being measures. J Public Econ 92(8-9):1833–1845

Law SH, Azman-Saini WNW, Ibrahim MH (2013) Institutional quality thresholds and the finance–growth nexus. J Bank Financ 37(12):5373–5381

Law SH, Kutan AM, Naseem NAM (2018) The role of institutions in finance curse: evidence from international data. J Comp Econ 46(1):174–191

Le TM, Moreno-Dodson B, Bayraktar N (2012) Tax capacity and tax effort: extended cross-country analysis from 1994 to 2009. World Bank Policy Research Working Paper, 6252. Washington, DC: World Bank

Lessmann C, Markwardt G (2010) One size fits all? Decentralization, corruption, and the monitoring of bureaucrats. World Dev 38(4):631–646

Levi M (1988) Of rule and revenue. University of California Press

Liu C, Mikesell JL (2019) Corruption and tax structure in American states. Am Rev Public Adm 49(5):585–600

Marshall MG, Gurr, TR, Davenport C, Jaggers K (2002) Polity iv, 1800-1999: Comments on munck and verkuilen.Comparative Political Studies, 35(1), 40–45

Martin IW, Mehrotra AK, Prasad M (eds) (2009) The new fiscal sociology: taxation in comparative and historical perspective. Cambridge University Press

Mascagni G, Mengistu AT, Woldeyes FB (2021) Can ICTs increase tax compliance? Evidence on taxpayer responses to technological innovation in Ethiopia. J Econ Behav Organ 189:172–193

Moore M, Prichard W, Fjeldstad OH (2018) Taxing Africa: coercion, reform and development. Bloomsbury Academic, p 288

Mukhlis I, Utomo SH, Soesetyo Y (2014) Increasing tax compliance through strengthening capacity of education sector for export-oriented SMEs handicraft field in East Java, Indonesia. Eur Sci J 10(7):272–287

Muye IM, Muye IY (2017) Testing for causality among globalization, institution and financial development: further evidence from three economic blocs. Borsa Istanb Rev 17(2):117–132

Němec D, Kotlánová E, Kotlán I, Machová Z (2021) Corruption, taxation and the impact on the shadow economy. Economies 9(1):18

Nikiema R, Zore M (2025) Tax revenue instability in Sub‐Saharan Africa: does institutional quality matter? Am J Econ Sociol 84(1):153–177

North DC (1994) Economic performance through time. Am Econ Rev 84(3):359–368

OECD (2024) Illicit financial flows in West and Central Africa: key trends and policy responses. OECD Publishing, Paris

Olaniyi CO (2022) On the transmission mechanisms in the finance–growth nexus in Southern African countries: Does institution matter?. Economic Change and Restructuring, 55(1):153–191

Olaniyi CO, Adedokun A (2022) Finance-institution-growth trilogy: time-series insights from South Africa. Int J Emerg Mark 17(1):120–144

Olaniyi CO, Oladeji SI (2022) Interplay between financial sector and institutional framework in the economic growth process of Kenya. J Public Aff 22(3):e2562

Olaoye OO, Tabash MI, Abdulaziz Saleh Al-Faryan M, Ray S (2025) Analysing the effects of illicit financial flows on sustainable development: an insight from Sub-Saharan Africa. Int J Public Adm 1–14. https://doi.org/10.1080/01900692.2024.2449058

Phillips RD, Dávid-Barrett E, Barrington R (2025) Defining corruption in context. Perspect Politics 1–15

Picur RD, Riahi‐Belkaoui A (2006) The impact of bureaucracy, corruption and tax compliance. Rev Account Financ 5(2):174–180

Profeta P, Scabrosetti S (2010) The political economy of taxation: lessons from developing countries. Edward Elgar Publishing

Rajkumar AS, Swaroop V (2008) Public spending and outcomes: does governance matter? J Dev Econ 86(1):96–111

Rashid H, Warsame H, Khan S (2021) The differential impact of democracy on tax revenues in developing and developed countries. Int J Public Adm 44(8):623–635

Rodriguez P, Uhlenbruck K, Eden L (2005) Government corruption and the entry strategies of multinationals. Acad Manag Rev 30(2):383–396

Romero-Avila D, Strauch R (2008) Public finances and long-term growth in Europe: evidence from a panel data analysis. Eur J Political Econ 24(1):172–191

Rose-Ackerman S, Palifka BJ (2016) Corruption and government: causes, consequences, and reform. Cambridge University Press

Sarwar, Ashraf (2016) Institutional determinants of tax buoyancy in developing nations. J Emerg Econ Islamic Res 4(1):62–73

Sayed Z (2015) Transforming our world: The 2030 agenda for sustainable development. Ethics Critical Thinking J 2015(3):112

Slemrod J, Yitzhaki S (2002) Tax avoidance, evasion, and administration. Handb Public Econ 3:1423–1470

Syadullah M (2015) Governance and tax revenue in Asean countries. J Soc Dev Sci 6(2):76–88

Tagem AME, Morrissey O (2023) Institutions and tax capacity in sub-Saharan Africa. J Institut Econ 19(3):332–347

Takumah W, Iyke BN (2017) The links between economic growth and tax revenue in Ghana: an empirical investigation. Int J Sustain Econ 9(1):34–55

Tang CF, Salman A, Abosedra S (2020) Dynamic interaction of tourism, finance, and institutions in explaining growth in Asia’s little dragon economies. Int J Tour Res 22(1):15–25

Tanzi MV, Davoodi MHR (2000) Corruption, growth, and public finances (Epub) (No. 0-182). International Monetary Fund

Tanzi MV, Zee MHH (2001) Tax policy for developing countries. International Monetary Fund

Transparency International (2023) Corruption perceptions index 2023. Transparency International, Berlin. https://www.transparency.org/en/cpi/2023

Tullock G (2008) Public goods, redistribution and rent seeking. Edward Elgar Publishing

World Bank (2019) Rwanda economic update: lighting Rwanda. World Bank Group, Washington, DC. https://openknowledge.worldbank.org/handle/10986/32247

World Bank (2023) Worldwide governance indicators 2023 update. World Bank, Washington, DC. https://info.worldbank.org/governance/wgi/

World Bank (2023) Digital government projects: improving service delivery through digitalization. World Bank, Washington, DC. https://www.worldbank.org/en/topic/digitaldevelopment/brief/digital-government-projects

World Development Indicators (2023) The World Bank, Washington, DC. https://datatopics.worldbank.org/world-development-indicators/

Yu M (2010) Trade, democracy, and the gravity equation. J Dev Econ 91(2):289–300

Author information

Authors and Affiliations

Contributions

EA: conceptualization, writing. EA, NS, and IA-O: editing, formal analysis, validation. EA and IA-O: software. EA, BNKA, KD, TM, and YMAK: review, data curation. NS: supervision.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Not applicable.

Informed consent

Not applicable.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Appiah, E., Song, N., Appiah-Otoo, I. et al. The impact of bureaucratic quality on tax revenue collection in democratic settings. Humanit Soc Sci Commun 12, 1290 (2025). https://doi.org/10.1057/s41599-025-05620-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-05620-2