Abstract

The empirical literature has documented evidence concerning the relationship between financial performance and financial reporting lag. Currently, rating agencies and other stakeholders are paying considerable attention to the impact of business organizations on sustainable practices for performance assessment. However, less attention has been paid to the impact of nonfinancial performance on financial reporting lag. Therefore, the main objective of this research is to explore the influence of environmental, social and governance performance (ESG) on firms’ financial reporting lag. A total of 126 firms in the Saudi stock market from 2015 to 2023 were sampled. The data generated were analyzed using pooled OLS and fixed effects analytical techniques. It was found that Saudi firms’ financial reporting lag may decrease as their ESG performance increases, supporting stakeholder and signaling theories. The findings remain consistent when several econometric models and specifications are used. The outcomes imply that ESG performance is a crucial determinant of financial reporting quality. These findings may be beneficial for regulators, auditors and managers. Specifically, they may encourage auditors and regulators to focus on ESG reporting when discharging their oversight duties to increase accountability and raise investor confidence. Additionally, they may stimulate firms to enhance their ESG initiatives for the timely disclosure of financial statements, thus enhancing managerial efficiency.

Similar content being viewed by others

Introduction

Financial reporting lag refers to the time between a firm’s accounting year end and the date on which external auditors sign financial reports (Oradi, 2021; Sulimany, 2024). Financial reporting standards emphasize the importance of the timely disclosure of audited reports to enable users of such information to make informed decisions (Abernathy et al., 2017; Waris and Haji Din, 2023). These frameworks emphasize that if financial statements are not reported promptly, the information may lose relevance and be less valuable for decision-making. Companies should lower their financial reporting lag because timely disclosure resolves the information asymmetry between firms and the external environment (Ebaid, 2022; Lawal and Shinozawa, 2024). Addressing this asymmetry may help lower agency conflicts in companies, foster accountability, and boost investor confidence. Thus, minimizing this lag ensures the timeliness of financial reporting, which is a crucial element of financial information quality.

Environmental, social, and governance (ESG) performance concerns the nonfinancial impact of businesses on the environment, social issues, and governance (Jeyhunov et al., 2025; Zahid et al., 2022). Regulators, investors, and other stakeholders are pressuring corporations to disclose their EGS commitment because it is currently a crucial metric for rating organizational performance (Alareeni and Hamdan, 2020; Wu et al., 2024). Effective ESG management may mitigate business risks related to environmental depletion, poor governance, and social controversies. It has been reported that ESG practices may increase organizational legitimacy and improve image, assisting companies in gaining a more competitive advantage (Ali et al., 2025; Aydoğmuş et al., 2022; Zahid et al., 2024). However, some studies argue that ESG engagement may lead to higher operating costs and consume a substantial part of firms’ profit for financing investment opportunities (Lv et al., 2019; Oware et al., 2023). Managers may indulge in risky practices in the name of ESG engagement, which may result in high agency conflicts and reduce firm value (Chu et al., 2023; Cordeiro et al., 2021). Therefore, firms’ stakeholders require audited accounts promptly for investment decisions and to monitor managerial efficiency.

The literature has established a relationship between financial performance and financial reporting lag. In particular, studies have shown that profitable companies tend to reveal their financial reports early to signal their earnings quality to the public (Ebaid, 2022; Oradi, 2021; Sulimany, 2024; Waris and Haji Din, 2023). Firms regard profitability as good news; thus, profitable companies may have a shorter financial reporting lag to signal their outstanding performance. Currently, users of financial reports have attached significant weight to nonfinancial performance, such as ESG commitment, and other sustainable practices for investment decisions (Almulhim and Aljughaiman, 2023; Kong et al., 2023; Wu et al., 2024). As a major gap in the literature, less attention is paid to the influence of nonfinancial outcomes on financial reporting lag. The studies by Diab and Eissa (2024) and Özer et al. (2024) have focused on financial reporting quality and audit opinion. The research question is as follows: does ESG performance influence firms’ financial reporting lag? Addressing this issue may enable companies to prioritize ESG initiatives to increase financial reporting quality, meet stakeholders’ demands, and gain investor confidence. Therefore, this study assesses the relationship between ESG performance and the financial reporting lag of Saudi-listed companies.

Some reasons motivated the choice of the Saudi corporate environment for this research. Saudi Arabia is an enormous exporter of crude oil to the world market, making the country a potential place for investors (Boshnak, 2021; Sulimany, 2023). A study of this type may offer insights for potential investors in the country’s corporate governance practices. Saudi Arabia has initiated several reforms aimed at encouraging foreign investment and diversification through Vision 2030. Vision 2030 contains several strategies that minimize trade barriers and support foreign capital inflow to boost the Saudi economy (Alshareef and Sulimany, 2024a; Sulimany, 2024). It suggests friendly initiatives such as tax exemptions and infrastructure support for industrial zones, transportation, and financial technology sectors (Ali et al., 2025; Selim and Alshareef, 2025). These incentives were designed to allow for investment in different sectors rather than just the oil sector. Furthermore, the plan prioritizes sustainable initiatives such as renewable energy investment, a carbon footprint, and green initiatives, aligning with global practices and attracting foreign investors. The development plan signals the country’s commitment to sustainable management and ESG priorities. Therefore, this research may serve as a framework that can stimulate ESG performance and improve financial reporting quality to attract more investment opportunities.

This research offers additional insights by exploring how nonfinancial performance may determine financial reporting lag. This effort provides a novel perspective on the relationship between ESG performance and financial reporting lag, contributing to the literature on financial reporting quality and corporate governance. This paper addresses an underresearched area and provides a deeper understanding of a new factor in enhancing corporate disclosure and accountability. This study also provides theoretical contributions and new perspectives. It integrates insights from stakeholder and signaling theories to observe the nexus between ESG performance and financial reporting lag, extending the application of these theories. The research outcomes have implications for policy-making, especially in the development of additional guidelines on the advantages of ESG reporting. It implies that nonfinancial performance may lower agency conflicts and improve managerial efficiency through the timely disclosure of financial reports.

The paper is organized as follows: The introduction is followed by the literature review. Section three explains the methodology, followed by a discussion of the empirical evidence and robustness analysis. The last section concludes the paper.

Literature review

Theoretical review

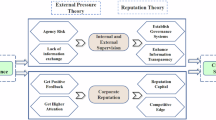

The stakeholder perspective provides the theoretical basis that supports the nexus between ESG performance and financial reporting lag. Stakeholder theory holds that creditors, the host community, and employees are also important stakeholders in corporate governance (Freeman et al., 2004; Marcon Nora et al., 2023). Firms are responsible to various interest groups, and organizations should ensure that those interests are factored into decision-making processes (Adeyemi, 2019; Kusi et al., 2018). Stakeholders are increasingly requiring organizations to prioritize ESG activities. Higher ESG performance indicates a strong commitment to the nonfinancial impact of corporations on environmental, social and governance issues (Alareeni and Hamdan, 2020; Wu et al., 2024). Participating in ESG activities may improve organizational image and increase accountability, enhancing internal governance. This improved governance may reduce audit risk and raise external auditors’ confidence in financial records. Such reliability may reduce the length of time spent on scrutinizing records, leading to a lower financial reporting lag.

Signaling theory is another framework that is relevant to this study. This theory argues that companies may disclose information of interest to firms’ stakeholders (Baek et al., 2016; Friske et al., 2023). According to this view, companies have incentives to disseminate good news to signal their governance quality. Disclosure of ESG-oriented activities is regarded as good news and indicates compliance with industry norms (Ozo and Arun, 2019). Firms with higher ESG performance have incentives to disclose their audited accounts promptly to gain more market value and bring good news to the market (Alshareef and Sulimany, 2024a; Sulimany, 2024). Disclosure enables companies to gain trust and demonstrate accountability to the external environment. This theory emphasizes that ESG disclosure reveals firms’ financial reporting quality, which enhances the reliability of financial reports and reduces audit delays.

Agency theory may provide a basis for the relationship between ESG performance and financial reporting lag. The theory argues that managers need to be closely monitored because of the separation between ownership and control (Jensen and Meckling, 1976; Sani, 2020). This theory emphasizes monitoring through diverse mechanisms to improve organizational efficiency. A strong governance structure and rewards for environmental initiatives may motivate management to pursue sound environmental policies (Dwekat et al., 2025; Sarhan et al., 2019). Hence, this theory suggests that higher ESG performance is one of the indicators of strong internal governance. Robust governance may compel managers to embrace the timely disclosure of financial reporting, which may reduce financial reporting lag.

Empirical review

ESG performance serves as an important metric for assessing organizational performance. Corporate stakeholders pressure business organizations to reveal their ESG commitment for their assessment and investment decisions (Alnor, 2024; Selim and Alshareef, 2025). Numerous studies have emphasized that prioritizing ESG activities demonstrates commitment to stakeholders’ engagement (Jeyhunov et al., 2025; Zahid et al., 2022). This strong commitment helps in building trust and improving corporate image. Studies have shown that ESG practices may curtail earnings management entrenchment and improve managerial efficiency (Oradi, 2021; Sulimany, 2024). Likewise, companies that engage in ESG activities are associated with more ethical principles and prioritize transparency to meet stakeholders’ needs (Ali et al., 2025; Alnor, 2024; Aydoğmuş et al., 2022; Diab and Eissa, 2024; Wu et al., 2024). However, there is growing concern about the impact of ESG performance on promoting financial reporting quality (Jeyhunov et al., 2025; Özer et al., 2024; Zahid et al., 2022). Studies have reported that firms with higher ESG scores tend to provide quality financial reports to signal their responsibility to stakeholders. This research extends prior studies by specifically assessing the effect of ESG performance on financial reporting lag. On the basis of the propositions of the stakeholder and signaling theories, this study conjectures that firms with higher ESG performance may be associated with a lower financial reporting lag. Greater ESG practices may stimulate firms to release their audited accounts to signal their environmental and social commitment to stakeholders. Therefore, the following hypothesis is proposed:

H: The financial reporting lag of Saudi listed firms may decrease as their ESG performance increases.

Method

Sampling and data

The population of the study contains 239 listed companies on the Saudi Stock Exchange. In this study, some filters were designed to generate the required data for analysis. Financial organizations were not considered because of their regulatory requirements and reporting system (Alhaji and Sani, 2018; Ebaid, 2022). Saudi firms without ESG scores according to the Bloomberg database were also removed from the sampling process. Companies with insufficient data and firms newly listed within the sample period were also removed. Consequently, the research purposively sampled 126 listed firms from 2015 to 2023. The research data include financial information and corporate governance indicators. The financial data were sourced from Eikon Datastream. The corporate governance information was gathered from the published accounts and reports of the sampled companies available on the Tadawul website.

Variables

Dependent variable

Financial reporting lag (FRL) serves as the dependent variable. The literature has emphasized the timely disclosure of audited accounts to reduce the information asymmetry between management and users of such reports (Abernathy et al., 2017; Waris and Haji Din, 2023). Consistent with prior studies, financial reporting lag was measured as the number of days between the end of a firm’s accounting year and the date of release of financial statements (Ebaid, 2022; Lawal and Shinozawa, 2024; Oradi, 2021; Sulimany, 2024). The larger the number of days is, the greater the financial reporting lag. Thus, firms are expected to have a lower financial reporting lag to enhance financial reporting quality.

Explanatory variable

ESG performance is the explanatory variable. This research adopts the Bloomberg ESG disclosure score, which is highly reliable and has been widely applied in many accounting and finance studies (Alnor, 2024; Zahid et al., 2024). The Bloomberg ESG disclosure score is a multidimensional index that covers reports of many firms worldwide. The index ranges from 0 to 100%. A higher score indicates a greater performance level and vice versa.

Control variables

This research uses additional variables to empower the specified model. These control variables are audit committee size (ACS), audit committee independence (ACI), firm size (SIZE), auditor reputation (AR), profitability (ROA), leverage (LEV), institutional ownership (IO), and COVID-19 (COVID). These variables are employed because empirical studies have reported that they can strongly influence financial reporting lag (Alfraih, 2016; Bajary et al., 2023; Chen et al., 2022; Ebaid, 2022; Oradi, 2021; Oussii and Taktak, 2018; Sulimany, 2024). The literature argues that a smaller audit committee (ACS) is more entrenched and robust because of greater cohesion among members (Alfraih, 2016; Sulimany, 2024). This improved monitoring may compel managers to embrace timely disclosure, leading to a lower financial reporting lag. Studies have revealed that audit committee independence (ACI) may shape firms’ financial reporting processes through sound advice and robust monitoring by independent directors (Bajary et al., 2023; Oradi, 2021). Their presence may strengthen firms’ internal control and reduce audit queries, lowering the financial reporting lag. Notably, larger companies (SIZE) may have timely disclosure of audited accounts due to their strong internal audit units, which can produce qualitative financial reporting (Chen et al., 2022; Ebaid, 2022; Oussii and Taktak, 2018). Regarding auditor reputation (AR), prior studies suggest that firms audited by the Big Four audit firms may be associated with timelier financial reporting (Basuony et al., 2016; Sulimany, 2023). The Big Four audit firms have a better reputation and use modern auditing techniques to carry out their assignments. This greater efficiency may enable them to complete their assignments faster, lowering the financial reporting lag.

With respect to profitability (ROA), the literature has reported that profitable companies tend to have shorter financial reporting lags (Alshareef and Sulimany, 2024b; Ebaid, 2022). Profitability sends a positive signal to investors and indicates earnings quality, making profitable firms have timelier financial disclosure. Leverage (LEV) may constrain the timely disclosure of accounts because investors may regard high borrowing as bad news (Aksoy and Yilmaz, 2023). Firms with high borrowing may delay the release of audited accounts. Institutional ownership (IO) may influence financial reporting lag. Institutional investors possess management skills and financial expertise, incentivizing them to monitor managers vigorously to maximize their investment (Alshareef and Sulimany, 2024b; Ebaid, 2022). Their monitoring capacity may pressure managers to release audited accounts for their investment decisions. Family ownership (FO) and financial reporting lag may be associated. Family-owned companies tend to preserve control of their businesses to maintain social status. For them, higher accountability is a lower priority, resulting in higher managerial inefficiency. Firms with greater family ownership are likely to have audit delays (Sulimany, 2023; Waris and Haji Din, 2023). The COVID-19 pandemic has negatively affected business operations, including audit assignments. As a result, financial reporting takes a longer period of time, increasing the financial reporting lag (Lawal and Shinozawa, 2024). The measurements of these variables are reported in Table 1.

Empirical model

This research employed regression analysis to assess the effect of ESG performance on financial reporting lag. The sampled data involved multiple observations of 126 companies from 2015 to 2023. Given the data structure, it is more suitable to adopt a panel data approach to achieve the research objective. Panel data are used to analyze multiple events across several units over a period (Baltagi, 2005). This method is efficient because it offers more data points and controls for multicollinearity, leading to more robust econometric estimates (Hsiao, 1985; Kyereboah-Coleman and Biekpe, 2006). This research uses pooled OLS regression, which is the basic analytical framework for ascertaining the relationships between variables. Furthermore, the Hausman specification test is employed to choose an additional panel data technique between fixed effects and random effects. The results reveal a significant p value, indicating the appropriateness of the fixed effects model. The fixed effects model recognizes firms’ specific attributes in the estimation process (Baltagi, 2005), and it accounts for variations across firms, providing more consistent and robust regression results. However, the literature suggests that the specified model may be associated with endogeneity because the relationship between ESG performance and financial reporting may be internally determined (Özer et al., 2024; Zhang and Guo, 2024). Therefore, two-stage least squares (2SLS) and system GMM estimation are used to address this potential issue. These frameworks use instrumental variables to predict the causal effects between dependent and explanatory variables. The basic structure of the OLS and fixed effects models is as follows:

where \(y\) represents a criterion variable, \(\varnothing\) is the regression intercept, \({\delta }_{{it}}\) is the vector of the explanatory variables, and \({\mu }_{i}\) is the firm fixed effect. The stochastic error term is given as \({\varepsilon }_{{it}}\), and i and t capture the cross-sectional and time series dimensions, respectively. Equations (1) and (2) demonstrate the basic structure of the OLS estimator and the fixed effects model. Equation (2) contains \({\mu }_{i,}\) which captures firms’ specific attributes.

Results

This section presents the empirical results and is categorized into four parts. The descriptive analysis and correlation results are presented below. Additionally, this section presents the main regression results for the effect of ESG performance on financial reporting lag, followed by the robustness test results.

Descriptive analysis

The results in Table 2 present the summary statistics of the variables. Financial reporting lag (FRL) exhibits a maximum of 116 days and a minimum of 16 days. This variable shows a high standard deviation, revealing substantial variations among firms. The environmental, social, and governance index (ESG) shows an average of 29.264 and reveals a range of 3.131 to 63.010 within the study period. Audit committee size (ACS) has a maximum of seven and a minimum of three members. The committee comprises an average of 4 members. The proportion of independent directors on the audit committee (ACI) has a mean of 0.547. This value suggests that, on average, 54.7% of audit committee members are independent directors. Firm size exhibits a small amount of variation, with values ranging from 7.280 to 12.391. Auditor reputation (AR) displays an average of 0.545, suggesting that Big Four audit firms audited 54.5% of Saudi listed firms within the study period. The profitability index (ROA) shows small variations among the sampled companies and displays a mean return on assets of 7.1%. Leverage (LEV) has a higher value of 0.876%, and the recorded average is 0.271%. This evidence implies that, on average, 27.1% of a firm’s capital represents debt financing. The institutional ownership (IO) and family ownership (FO) values indicate average shareholdings of 6.8 percent and 43.1%, respectively. COVID exhibits a small amount of variation across the sampled firms.

Correlations

A correlation analysis of the study variables was carried out, and the results are presented in Table 3. According to the Pearson correlation results, the coefficients of all the explanatory variables are below 80%. This outcome demonstrates that there is no problem of multicollinearity in the model (Alshareef and Sulimany, 2024b; Pesaran, 2015a). Further evidence reveals that the variance inflation factor (VIF) values are lower than 10, indicating that the problem of multicollinearity does not affect the models.

Regression

Tests for multicollinearity, autocorrelation, and heteroscedasticity were performed to analyze the sampled data. The variance inflation indicator (VIF), which measures multicollinearity among the variables, ranges from 1.03 to 2.70. This outcome implies that there is no multicollinearity in the model (Baltagi, 2005). The serial correlation result based on the Wooldridge LM test reveals a significant p value, suggesting that serial correlation exists in the model (Drukker, 2003). Furthermore, the sampled data were subjected to a heteroscedasticity test using the Breusch‒Pagan criteria, and the outcome appears significant. The evidence suggests that heteroscedasticity exists in the model (Baltagi, 2005; Pesaran, 2015b). Following the literature, this research uses a robust regression option to address these statistical issues (Drukker, 2003; Hoechle, 2007).

Table 4 displays the regression analysis of the relationship between ESG performance and financial reporting lag using OLS and fixed effects. The R2 of the models suggests that the explanatory variables explain 38.21% and 41.28% of the variation in financial reporting lag. Additionally, the F statistics appear significant, indicating the robustness of the stated models. The empirical findings indicate a significant negative impact of ESG performance on financial reporting lag. The outcomes from both models imply that firms may embrace the timely disclosure of audited accounts as their ESG commitment increases. The economic implication of the result is that an increase in ESG performance of 1% may lead to a reduction in the financial reporting lag of 0.150% or 0.079%, as shown by Models (1) and (2), respectively. These outcomes support signaling and stakeholder theories (Adeyemi, 2019; Alareeni and Hamdan, 2020; Kusi et al., 2018; Wu et al., 2024). These theories emphasize that ESG performance is regarded as good news capable of influencing firms to reveal financial statements to stakeholders. The results also support prior studies that reported that companies that engage in ESG activities are associated with more ethical principles and prioritize transparency to meet stakeholders’ needs (Ali et al., 2025; Alnor, 2024; Aydoğmuş et al., 2022; Diab and Eissa, 2024; Wu et al., 2024). At the same time, these findings lend credence to the growing concern that firms with higher ESG scores tend to provide quality financial reports to signal their responsibility to stakeholders (Jeyhunov et al., 2025; Özer et al., 2024; Zahid et al., 2022).

The findings above implications for regulation and policy. Regulators can utilize the outcomes of this study to improve accountability and financial reporting quality in corporate governance. Thus, companies should be required to develop more friendly ESG initiatives to reduce information asymmetry and boost investor confidence. This study may give managers more incentives to prioritize ESG practices in their decision-making processes for firm value maximization.

Some control variables incorporated into the models are significant. Audit committee size is positively and significantly related to financial reporting lag. This result supports the argument that a larger audit committee may be inefficient in carrying out monitoring because of ineffective communication and coordination challenges (Alfraih, 2016; Sulimany, 2024). Hence, firms with smaller audit committees may be associated with a lower financial reporting lag due to entrenched monitoring (Lawal and Shinozawa, 2024; Oradi, 2021). The auditor reputation variable indicates that firms audited by a Big Four audit firm may be associated with a lower financial reporting lag. These audit firms have auditing techniques that are superior to those of their counterparts, making them faster in discharging their assignments (Basuony et al., 2016; Sulimany, 2023). Hence, the findings support those of prior studies reporting a negative relationship between auditor reputation and financial reporting lag (Chen et al., 2022; Sulimany, 2024). The results of both models suggest that profitable companies are more likely than nonprofitable companies to reveal their audited accounts (Alshareef and Sulimany, 2024a; Ebaid, 2022). Profitability signals sound governance and earnings quality, which incentivizes profitable firms to convey good news to the external environment. This evidence aligns with earlier studies that suggest an inverse effect of profitability on financial reporting lag (Bajary et al., 2023; Lawal and Shinozawa, 2024). According to the results, a higher debt level may constrain the timely disclosure of financial reports because it may signal bankruptcy probability to the external environment (Aksoy and Yilmaz, 2023). This outcome confirms prior studies reporting a positive relationship between leverage and financial reporting lag (Sulimany, 2023; Waris and Haji Din, 2023). The institutional ownership coefficient shows a significant negative effect on financial reporting lag. Institutional investors closely monitor managers to ensure that accountability is promoted in investee firms. Their presence may shape firms’ internal governance and remediate internal control lapses (Alshareef and Sulimany, 2024a; Ebaid, 2022), which may lead to a lower financial reporting lag because of improvements in the financial reporting system.

Robustness checks

Endogeneity treatment

To address the possible endogeneity between ESG performance and financial reporting lag, this research employed additional analytical techniques to conduct a robustness check, as shown in Table 5. In particular, two-stage least squares and system GMM estimation were used to assess the relationship. These analytical techniques are capable of mitigating endogeneity and reverse causality using an instrumental variable approach to determine the causal effects between variables (Özer et al., 2024; Zhang and Guo, 2024). The results presented in Table 5 satisfy the basic requirements of these techniques. The results of the Sargan/Hansen tests appear nonsignificant, revealing the validity of the instruments used. The AR2 in the GMM model indicates the absence of second-order correlation in the model. The results from Models (3) and (4) demonstrate that ESG performance exerts a strong positive influence on financial reporting lag. This outcome confirms the earlier findings in Table 4, which revealed that firms with higher ESG performance may be associated with a shorter financial reporting lag.

Alternative measure of financial reporting lag

An additional measure of financial reporting lag was employed to conduct another robustness check, and the results are reported in Table 6. In this research, the financial reporting lag data were log transformed, which is consistent with prior studies (Baatwah et al., 2015; Waris and Haji Din, 2023). This measurement may mitigate the possible influence of extreme values in the sampled data. The model was re-estimated using pooled OLS and two-stage least squares, as shown in Table 6. According to the results, ESG performance has a negative effect on financial reporting lag, supporting the earlier findings presented in Tables 4 and 5. Hence, the outcome remains consistent when several econometric models and alternative measures of financial reporting are used.

Conclusion

The literature has revealed the impact of financial performance on financial reporting lag. It has been shown that profitable companies have incentives to reveal audited accounts promptly to signal their performance. Currently, rating agencies and other stakeholders are paying considerable attention to the impact of business organizations on sustainable practices for performance assessment. The empirical literature seems to have paid less attention to the effect of nonfinancial performance on corporate disclosure. Hence, this study explores the influence of ESG performance on financial reporting lag. It focuses on 126 Saudi-listed companies from 2015 to 2023 and applies several econometric models. The major finding is that Saudi firms’ financial reporting lag may decrease as their ESG performance increases. This outcome implies that ESG commitment signals good governance capable of motivating firms to embrace the timely disclosure of financial records and boost investor confidence.

The findings of this study have theoretical and practical relevance. The findings support stakeholder, signaling, and agency theories, which advocate for stakeholder engagement, ESG commitment, and strong governance mechanisms as important determinants of financial reporting lag. Additionally, they imply that the propositions of these theories are applicable in the Saudi context. This study will encourage managers to prioritize ESG activities to lower the financial reporting lag and promote greater accountability in firms’ governance, earning stakeholder trust. The findings could encourage regulators to develop or update standards, shaping future sustainability initiatives. The results can enhance auditors’ understanding of the importance of nonfinancial outcomes in promoting financial reporting quality, which will enable auditors to focus more on ESG reports when carrying out monitoring for greater accountability.

This study provides valuable contributions to the literature on sustainability and financial reporting. However, some limitations must be acknowledged to guide future studies. There is a need for future studies to use other proxies to measure financial reporting timeliness for comparison with the reported outcome. Furthermore, this analysis was based on Saudi-listed companies, which may limit the generalizability of our findings to other emerging economies because of differences in regulations. Therefore, future studies may focus on other developing countries to obtain further evidence. Future studies can also expand the analysis by incorporating variables not covered by this research for more insights into the determinants of financial reporting lag.

Data availability

The dataset generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Abernathy JL, Barnes M, Stefaniak C, Weisbarth A (2017) An international perspective on audit report lag: a synthesis of the literature and opportunities for future research. Int J Audit 21(1):100–127. https://doi.org/10.1111/ijau.12083

Adeyemi A (2019) Balancing the objectives of corporate governance: social welfare V profitability. J Law Policy Glob 83(1932):31–42

Aksoy M, Yilmaz MK (2023) Does board diversity affect the cost of debt financing? Empirical evidence from Turkey. Gend Manag 38(4):504–524

Alareeni BA, Hamdan A (2020) ESG impact on performance of US SandP 500-listed firms. Corp Gov 20(7):1409–1428. https://doi.org/10.1108/CG-06-2020-0258

Alfraih MM (2016) Corporate governance mechanisms and audit delay in a joint audit regulation. J Financ Regul Compliance 24(3):292–316

Alhaji SS, Sani G (2018) Managerial ownership and financial performance of listed manufacturing firms in Nigeria. Int J Acad Res Bus Soc Sci 8(9):1227–1243

Ali NBM, Hussin HAAA, Mohammed HMF, Mohmmed KAAH, Almutiri AAS, Ali MA (2025) The effect of environmental, social, and governance (ESG) disclosure on the profitability of Saudi-listed firms: insights from Saudi Vision 2030. Sustainability 2977(17). https://doi.org/10.3390/su17072977

Almulhim AA, Aljughaiman AA (2023) Corporate sustainability and financial performance: the moderating effect of CEO characteristics. Sustainability 15(16). https://doi.org/10.3390/su151612664

Alnor NHA (2024) Corporate governance characteristics and environmental sustainability affect the business performance among listed Saudi companies. Sustainability 8436(16). https://doi.org/10.3390/su16198436

Alshareef MN, Sulimany HGH (2024a) Board financial expertise and financial sustainability: evidence from Saudi-listed firms. Sustainability 16(7100). https://doi.org/10.3390/su16167100

Alshareef MN, Sulimany HGH (2024b) Effects of board gender and foreign directorship on the financial sustainability of Saudi listed firms: Does family ownership matter? Heliyon 10(20). https://doi.org/10.1016/j.heliyon.2024.e39359

Aydoğmuş M, Gülay G, Ergun K (2022) Impact of ESG performance on firm value and profitability. In Borsa Istanbul Review (Vol. 22, pp.119–S127). Borsa Istanbul Anonim Sirketi. https://doi.org/10.1016/j.bir.2022.11.006

Baatwah SR, Salleh Z, Ahmad N (2015) CEO characteristics and audit report timeliness: do CEO tenure and financial expertise matter? Manag Audit J 30(8–9):998–1022

Baek HY, Cho DD, Fazio PL (2016) Family ownership, control, and corporate capital structure. J Fam Bus Manag 6(2):169–185

Bajary AR, Shafie R, Ali A (2023) COVID-19 pandemic, internal audit function, and audit report lag: evidence from an emerging economy. Cogent Bus Manag 10(1):2178360. https://doi.org/10.1080/23311975.2023.2178360

Baltagi BH (2005) Econometric Analysis of Panel Data 3rd edn. John Wiley and Sons Ltd

Basuony MAK, Mohamed EKA, Hussain MM, Marie OK (2016) Board characteristics, ownership structure, and audit report lag in the Middle East. Int J Corp Gov 7(2):180. https://doi.org/10.1504/ijcg.2016.078388

Boshnak HA (2021) The impact of board composition and ownership structure on dividend payout policy: evidence from Saudi Arabia. Int J Emerg Mark 18(9):3178–3200

Chen C, Jia H, Xu Y, Ziebart D (2022) The effect of audit firm attributes on audit delay in the presence of financial reporting complexity. Manag Audit J 37(2):283–302

Chu H-L, Liu N-Y, Chiu S-C (2023) CEO power and CSR: the moderating role of CEO characteristics. China Account Financ Rev 25(1):101–121

Cordeiro JJ, Galeazzo A, Shaw TS (2021) The CSR–CFP relationship in the presence of institutional voids and the moderating role of family ownership. Asian Business Manag https://doi.org/10.1057/s41291-021-00157-z

Diab A, Eissa AM (2024) ESG performance, auditor choice, and audit opinion: evidence from an emerging market. Sustainability 16(12). https://doi.org/10.3390/su16010124

Drukker DM (2003) Testing for serial correlation in linear panel-data models. Stata J 3(2):168–177

Dwekat A, Taweel A, Salameh A (2025) Boardroom diversity and financial performance in Palestinian banks and insurers. Discover Sustain 40(6). https://doi.org/10.1007/s43621-025-00836-3

Ebaid IE-S (2022) Nexus between corporate characteristics and financial reporting timelines: evidence from the Saudi stock exchange. J Money Bus 2(1):43–56

Freeman RE, Wicks AC, Parmar B (2004) Stakeholder theory and “the corporate objective revisited. Organ Sci 15(3):364–369

Friske W, Hoelscher SA, Nikolov AN (2023) The impact of voluntary sustainability reporting on firm value: Insights from signalling theory. J Acad Mark Sci 51(2):372–392. https://doi.org/10.1007/s11747-022-00879-2

Hoechle D (2007) Robust standard errors for panel regressions with cross-sectional dependence. Stata J 7(3):281–312

Hsiao C (1985) Benefits and limitations of panel data. Econ Rev 4(1):121–174. https://doi.org/10.1080/07474938508800078

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3(4):305–360

Jeyhunov A, Kim JD, Bae SM (2025) The effects of board diversity on Korean companies’ ESG performance. Sustainability 17(17). https://doi.org/10.3390/su17020787

Kong Y, Donkor M, Musah M, Nkyi JA, Ampong GOA (2023) Capital structure and corporate financial sustainability: evidence from listed non-financial entities in Ghana. Sustainability 15(5). https://doi.org/10.3390/su15054211

Kusi BA, Gyeke-dako A, Agbloyor EK, Darku AB (2018) Does corporate governance structures promote shareholders or stakeholders value maximization? Evidence from African banks. Corp Gov 18(2):270–288

Kyereboah-Coleman A, Biekpe N (2006) Corporate governance and financing choices of firms: a panel data analysis. South Afr J Econ 74(4):670–681

Lawal T, Shinozawa Y (2024) Financial reporting lag during COVID-19: evidence from flash reporting in Japan. Asia Pac J Account Econ 31(3):320–338. https://doi.org/10.1080/16081625.2022.2147967

Lv W, Wei Y, Li X, Lin L (2019) What dimension of CSR matters to organizational resilience? Evidence from China. Sustainability 11(6). https://doi.org/10.3390/su11061561

Marcon Nora GA, Alberton A, Ayala DHF (2023) Stakeholder theory and actor-network theory: the stakeholder engagement in energy transitions. Bus Strategy Environ 32(1):673–685

Oradi J (2021) CEO succession origin, audit report lag, and audit fees: evidence from Iran. J Int Account Audit Tax 45:100414. https://doi.org/10.1016/j.intaccaudtax.2021.100414

Oussii AA, Taktak NB (2018) Audit committee effectiveness and financial reporting timeliness: the case of Tunisian listed companies. Afr J Econ Manag Stud 9(1):34–55

Oware KM, Appiah K, Adomah Worae T (2023) CSR disclosure and debt financing in India: does CEO tenure matter? J Appl Account Res 24(3):442–463. https://doi.org/10.1108/JAAR-08-2021-0204

Özer G, Aktaş N, Çam İ (2024) Corporate environmental, social, and governance activities and financial reporting quality: an international investigation. Borsa Istanb Rev 24(3):549–560. https://doi.org/10.1016/j.bir.2024.03.001

Ozo FK, Arun TG (2019) Stock market reaction to cash dividends: evidence from the Nigerian stock market. Manag Financ 45(3):366–380

Pesaran MH (2015a) Time series and panel data econometrics (First Edit). Oxford University Press

Pesaran MH (2015b) Time series and panel data econometrics (First Edit). Oxford University Press

Sani A (2020) Managerial ownership and financial performance of the Nigerian listed firms: the moderating role of board independence. Int J Acad Res Account Financ Manag Sci 10(3):64–73

Sarhan AA, Ntim CG, Al-Najjar B (2019) Board diversity, corporate governance, corporate performance, and executive pay. Int J Financ Econ 24(2):1–26

Selim MM, Alshareef N (2025) Trends and opportunities in renewable energy investment in Saudi Arabia: Insights for achieving Vision 2030 and enhancing environmental sustainability. Alex Eng J 112:224–234. https://doi.org/10.1016/j.aej.2024.10.107

Sulimany HGH (2023) Ownership structure and audit report lag of Saudi listed firms: a dynamic panel analysis. Cogent Business Manag 10(2). https://doi.org/10.1080/23311975.2023.2229105

Sulimany HGH (2024) Does institutional ownership moderate the relationship between audit committee composition and audit report lag: evidence from Saudi Arabia? SAGE Open 14(2). https://doi.org/10.1177/21582440241241171

Waris M, Haji Din B (2023) Impact of corporate governance and ownership concentrations on timelines of financial reporting in Pakistan. Cogent Business Manag 10(1). https://doi.org/10.1080/23311975.2023.2164995

Wu Z, Gao J, Luo C, Xu H, Shi G (2024) How does boardroom diversity influence the relationship between ESG and firm financial performance? Int Rev Econ Financ 89:713–730. https://doi.org/10.1016/j.iref.2023.10.045

Zahid RMA, Khan MK, Anwar W, Maqsood US (2022) The role of audit quality in the ESG-corporate financial performance nexus: empirical evidence from Western European companies. Borsa Istanb Rev 22:200–212. https://doi.org/10.1016/j.bir.2022.08.011

Zahid RMA, Saleem A, Maqsood US, Sági J (2024) Moderating role of audit quality in ESG performance and capital financing dynamics: insights in China. Environ Dev Sustain 26(5):12031–12060. https://doi.org/10.1007/s10668-023-03636-9

Zhang L, Guo C (2024) Can corporate ESG performance improve audit efficiency?: empirical evidence based on audit latency perspective. PLoS ONE 3(19). https://doi.org/10.1371/journal.pone.0299184

Acknowledgements

The author thanks Taif University, Saudi Arabia, for supporting this work through project number (TU- DSPP-2024-303). This research was funded by Taif University, Saudi Arabia, Project No. (TU-DSPP-2024-303).

Author information

Authors and Affiliations

Contributions

The H.G.S. confirms the sole responsibility for the conception of the study, presented results, and manuscript preparation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

AI usage disclosure

AI tools were not used in writing this manuscript.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Sulimany, H.G.H. Effect of environmental, social and governance performance on the financial reporting lag of Saudi listed companies. Humanit Soc Sci Commun 12, 1335 (2025). https://doi.org/10.1057/s41599-025-05709-8

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05709-8