Abstract

Background context: Foreign Direct Investment (FDI) is a crucial driver of economic growth in developing countries like India. The study explores the dynamics of FDI flow between India and developed nations, addressing the broader context of economic relationships. Specific knowledge gap: In this study, we address what influences the inward and outward flow of FDI between India and Developed countries. In addition, we aim to examine the economic phenomena that influence the variables making India attractive to other nations. Methods or approach used: The study used panel data from 2000 to 2023 from different countries, and the one-step system GMM method was used for analysis. The countries are categorized as developed or emerging countries, and the variables India seeks in these countries are examined. Key findings: Proximity, shared language, technological advancements, infrastructure, and trade agreements are key factors influencing FDI, regardless of the development status of partner nations. Emerging countries exhibit similar responses to developed nations under these conditions. Implications or applications: The findings suggest a need for future research on why developed nations fail to achieve similar FDI-driven economic growth as emerging nations. This could inform policy adjustments for leveraging FDI effectively.

Similar content being viewed by others

Introduction

Foreign Direct Investment (FDI) is a lasting (long-term) investment by the residents (s) of an economy in an enterprise that is resident in another economy (Duce and España, 2003). The economic development of a nation can be boosted with the introduction of FDI (Mwakabungu and Kauangal, 2023; Sultanuzzaman et al., 2018). By creating a competitive market, FDI can enhance the quality of production, attract investors, and improve exports, ultimately benefiting the economy (X. Liu et al., 2014). Subsequent studies have validated this theory, demonstrating how FDI impacts the economy (Alam and Shah, 2013; Bermejo Carbonell and Werner, 2018; Mehic et al., 2013). All these studies concentrated on Developed Countries (DC). This trend is changing recently towards investment in emerging nations (Goyal, 2006). Various studies revealed the importance of FDI in Emerging Countries (EC) as it is less explored and provides a potential market (Aykut and Ratha 2004; Behera and Mishra, 2022; Chang, 2010; Chen, 2012). Mehic et al. (2013) found that the FDI has moved towards emerging economies as FDI has a prominent hand in the development of the economy. In developed nations now FDI is no longer promoting economic development (Bermejo Carbonell and Werner, 2018; Chang, 2010; Wang, 2009). In these countries, FDI might have reached a maturity level, so further FDI may decline. If we look into the UNCTAD reports, we can see the increasing share of FDI from the developing nations (UNCTAD, 2023). Most of the FDI follows the pattern of the theories from developed to developing nations. In such scenarios, the IFDI (IFDI - when a country receives the investment, its inward investments or IFDI) of developed nations must be reduced, but they have a fair share of FDI with them. Developed nations are receiving the FDI even from developing nations. Such an example is India; even as a developing economy, India’s major investments are towards the developed nations. To further confirm it, we cross-checked it with the country list from IMF. IMF classifies the countries as DC, EC, Middle-income economies, and Low-income developing countries. As the problem exists between the developed and emerging economies, this research is focused on these two sections.

Faeth (2009) and Lucas (1990) say that the capital flow should be from developed to developing nations. To support this, H. Liu et al. (2020) have found that EC and low-income economies attract more FDI than DC. Behera and Mishra (2022) bring out from their research that the emerging economies are more focused on the emerging economies as they can find similarities in many domains. In the recent trend, some of the emerging nations have also taken place in the top OFDI (OFDI- when one country makes investments in another country, it is outward investments) list, and developed nations are there in the top recipients of FDI. These are against the theories. This research delves into these disparities. To analyze these, we are taking India as the prime analysis area. India shows the contrary characteristics from theory and matches the research gap. While considering the Indian scenario, we can see that as an emerging country, India is investing in Australia, UAE, and Sudan for resource exploration and Mauritius, Singapore, British Virgin Islands, and the Netherlands for tax benefits (India Brand Equity Foundation, 2022). In this Australia, Singapore, and Netherlands are DC. Regarding the theories, India’s OFDI should be towards EC or other developing countries. India is receiving FDI mainly from Singapore, the US, Mauritius, the Cayman Islands, the Netherlands, the UK, Japan, etc. Here, if you look, we can ascertain that most of the countries (Australia, Singapore, the US, the Netherlands, the UK, and Japan) that are investing in India are developed nations rather than emerging economies. The theory of EC investing in emerging nations and developed nations investing in emerging economies is not valid in this scenario.

Researchers have done studies on FDI, classifying them into various country categories. Such research can’t identify these minute patterns inside the flow of FDI. In this case, one country/variable data may normalize the results. Similarly, each country’s/entity’s motives for investments are different. So, a clustered study may not be effective. This situation creates a need for individual country analysis (Bermejo Carbonell and Werner, 2018). Even though many country-wise studies have been done, no study has properly linked the theory (OLI paradigm) with the reason for the reverse flow of FDI. Similarly, a wide range of studies have been done on the IFDI of India and not on the OFDI.

So, it becomes necessary that we need to find the variable that is affecting India’s FDI. In addition, we tried to address the economic phenomena that explain the variables for making India a favorable spot for FDI inflow. Another major problem is that India’s OFDI is towards DC, and strong justification for India’s focus on DC is also a question that needs to be addressed.

The study is structured as follows: “Literature review and hypothesis development,” Literature review on the OLI paradigm, and is further segregated into emerging and DC. The hypothesis is developed on the same. The conceptual framework is discussed later in this section. “Materials and methods” comprises Data and methodology. “Results and discussions” includes analysis and discussion, which is further classified into theoretical implications and applications for managers. Section 5 includes the conclusion, policy implications, limitations, and future directions of the study.

Literature review and hypothesis development

FDI is done to share resources and skills. The benefits of going international were first introduced in the theory of absolute advantage (Smith, 1887). FDI is crucial for developing countries as it acts as an economic development stimulator (Mehic et al., 2013; Sahu, 2021). Exploration of resources is an add-on to FDI (Sothan, 2017). After Adam Smit, Hennart’s and Dunning’s theories didn’t focus much on FDI but showed the benefits of international trade. The OLI paradigm identifies the advantages of FDI.

In the OLI paradigm, Ownership advantages are considered as firm-specific advantages like research and development (Behera and Mishra, 2022), and technological advancement (Köymen Özer and Sayek Böke, 2017) acts as a positive variable for FDI. Location advantages like infrastructure, communication technology, and GDP have a positive impact on FDI (Asiamah et al., 2019; Rehman et al., 2020). The gravity model is a close substitute for location advantage; it has a positive impact on FDI, while variables like GDP, exchange rate, human capital, and distance show a positive relation, and language only shows a positive relation towards the manufacturing sector (Tham et al., 2018). Internalization advantages include government policies. Trade openness can also be considered with internationalization (Köymen Özer and Sayek Böke, 2017; Le et al., 2021).

FDI provides a favorable condition for economic growth in India, as we are emerging. ECs are the most fertile place for development as they provide many facilities to attract FDI. Economic growth positively affects FDI attraction (Le et al. 2021). Financial deepening can also help the FDI, especially in emerging and low-income countries (Liu et al., 2020). FDI boosts the export quality of products. Through this, the economy is growing, demonstrating an indirect impact of FDI on the economy (Liu et al., 2014). The impact of FDI depends on its size in developing nations. Therefore, these countries need to attract FDI that especially in large inflows (long-term relationship with a minimum 10% or more of voting stock) of foreign capital. Big investments happen because of natural resources and financial development (Sahu, 2020a). Multinational corporations make large investments basically for resource and human capital efficiency (Sahu and Dash, 2021). From this, we can conclude that FDI and economic growth are tied together.

The FDI is an essential part of the development of a nation. As each nation differs from others, an individual study of a nation can only bring out the true variables that affect the FDI. Spain showed that FDI doesn’t have any impact on macroeconomic variables (Bermejo Carbonell and Werner, 2018). A study in China is also similar to this, but FDI hurts Government expenditure. However, government expenditure is one of the major factors that contribute to economic growth (Wu et al., 2020). But studies conducted in Ghana, Pakistan, and Vietnam show macro variables have a positive impact on FDI (Asiamah et al., 2019; Le et al., 2021; Rehman et al., 2020). So, it is clear that as the nation changes, the variables are also contradicting. This brings a need for a nationwide study. Each of the variables for this study is selected carefully after identifying its impact on FDI (discussed in the data and variables).

Ownership advantage and FDI

How much each of these variables contributes to the FDI is the crucial part. As from many studies, we got mixed results on these variables. Through this hypothesis, we try to find the exact variables that are contributing to the Inward and OFDI of India.

H1a: Ownership advantage will be an influential factor for IFDI

H2a: Ownership advantage will be an influential factor for OFDI

Location advantage and FDI

While planning for an investment, the first and foremost criterion is the location only. One can easily identify the importance of location because a theory (the Gravity model) itself is available for this factor. If the selected location is a flourishing market with all the potential for technological advancement, then only an investment may take place. Hypothesis on location advantages will try to point out the exact variables that are affecting India in the case of Inward and OFDI.

H1 b: Location advantage will be an influential factor for IFDI

H2 b: Location advantage will be an influential factor for OFDI

Internalization advantage and FDI

Trade agreements will exist for the smooth trade and development of a nation. A good exchange rate will give a better return for their investments. To validate this, the hypothesis on Internalization is given.

H1 c: Internalization advantage will be an influential factor for IFDI

H2 c: Internalization advantage will be an influential factor for OFDI

Flow of FDI

Finding the flow of FDI is also a crucial part of this paper. We need to identify which of the variables are attracting EC as well as DC India and India towards EC as well as DC. By identifying the flow of FDI, one nation can identify the potential ground for its investments. In this case, India can also identify which areas it needs to concentrate on so that it can expand its FDI position towards the EC too. After identifying the potential factors of OFDI, it will be easy to target more countries. Data have been split into emerging and DC.

The flow of FDI between India and EC

For the analysis of EC, UAE, and Mauritius are considered as they come under EC (Nielsen, 2011). To identify the variables that initiate the flow OLI paradigm is used. Variables have been divided into Ownership, Location, and Internalization (Table 2). As the data set is panel data, the one-step system GMM method is used in the study. H3 and H4 are formulated for EC.

Most of the FDI towards EC is coming from the EC only (Aykut and Ratha, 2004). Gao (2005) claims that ECs have certain advantages that are attracting more ECs. Through this variable study, we can find out which of these variables support and contradict India.

EC is the most promising market for growth and development nowadays. Many countries’ FDI flows are also towards the EC. As an emerging nation, India needs FDI from EC too, as they are now a flourishing market. By identifying the factors that are attracting EC, India can concentrate and work on the required area so that better investments will follow. To identify it, hypothesis H3 has been formulated.

H3: OLI factors will be an influential factor in attracting EC to India

Resource-seeking nature of FDI will promote more FDI towards emerging nations (Behera and Mishra, 2022). It is found that as ECs respond positively to FDI rather than DC, investments are happening towards emerging nations (Liu et al., 2020). This analysis can help to sort out the variables that will attract India, and we can know whether these variables are supporting the literature.

India is focusing more on DC; a better potential market is being avoided. Through hypothesis H4, a clear idea of the factors that are affecting the OFDI will be sorted out. With this hypothesis, H4 India can identify the variables that are directly related to FDI and expand investments by analyzing these variables.

H4: OLI factors will be an influential factor in attracting India to the EC

The flow of FDI between India and DC

Countries such as Australia, Japan, the US, the UK, Singapore, and the Netherlands have been considered DC for the study (Nielsen, 2011). Variables have been classified into Ownership, Location, and Internalization (Table 2). As the data set is panel data, the one-step system GMM method is used for the study. H4 and H5 are formulated for the analysis of DC.

From the theories, it is a known factor that DC focuses more on EC. This study will be conducted in the case of India. What are the actual variables that make the focus on India come into the light?

India is now receiving more investments from developed nations. To maintain these investments, India needs to identify the variables that are affecting FDI and make improvements in the areas so that more investments will happen. Hypothesis H5 will bring out the variables that DC is looking for in India.

H5: OLI factors will be an influential factor in attracting DC to India

From the published statistical data, it is clear that India is focusing more on DC (IBEF, 2022). This shows that India stands out from the theories. This study will bring out what the variables are behind this behavior in India. As of now, we have not found a valid study showing the flow of FDI from EC to DC. The current study will contribute to filling this gap.

India’s trend of FDI is towards DC. From hypothesis H6, we can identify the factors that are affecting India’s investment pattern. Additionally, by identifying the variables, India can also look into further DC with similar variables for investment. Thus, India can take advantage of investments from developed nations.

H6: OLI factors will be an influential factor in attracting India to DC

The Eclectic paradigm of Dunning says that theories of international business don’t cover all the aspects of FDI. So, he came up with the OLI paradigm. While going for FDI, what companies choose are certain advantages; these are classified into Ownership, Location, and Internalization. Ownership shows the firm-specific advantages like patents, trademarks, technology, economies of large scale, etc. The economic, political, social, and other infrastructure facilities come under the Location advantage. In a cross-border business, the composition of the nation altogether is being analyzed. It gives an overall idea that moving out of the nation will bring you any benefits in terms of monetary or other resources, as explained in Internalization. The FDI gravity model by Head and Ries (2008) and Kleinert and Toubal (2010) says as the distance between the source and the destination country is less, the impact of FDI activity will be. Pankaj (2001) added to this literature that not only the distance but also factors like culture, economy, and administration, all elements, will also contribute if a country chooses the neighboring countries. All these factors will be similar, and they can contribute to a favorable FDI. There are other theories, like Lucas’s paradox and neo-classical trade theories, that show the direction of the flow of FDI. Both these states show that the FDI flows from DC to Less DC. These theories do not consider emerging markets. However, EC can’t be set apart because they do more FDI than DC (UNCTAD, 2021).

The eclectic paradigm holds a strong position in India as the theory can be implemented irrespective of the nation. It also covers almost all the relevant factors that are affecting the FDI. The gravity model can also be considered in the case of India, as if we look into the FDI positions (IBEF, 2022), the majority of the countries are nearby. No other theories provide such clarity on FDI in the case of India.

Due to the unexplored resources, EC is more focused on EC, which will provide them with a better opportunity to grow. We can see mainly literature showing the current trend in FDI flow, that is, between emerging nations (Aykut and Ratha, 2004; Gao, 2005; H. Liu et al., 2020). But if we consider the case of India, we know that India has less FDI with EC than with developed nations. FDI with emerging nations is mainly for tax benefits and resource exploration. As we take up the major FDI partners of India, its DC. There is not much literature done to find out what initiates the flow of FDI from an emerging country to a developed country. Here, by studying India’s OFDI flow, we can conclude this.

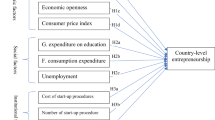

Conceptual framework

Luca’s paradox and Neoclassical theories suggest that capital flow is happening between developed nations, i.e., from capital-abundant DC to capital-scarce less developed nations. India is ranked in the top 5 FDI prospective destinations (UNCTAD, 2017). Among the DC, an EC is capturing the attention, so some hidden factors have made India attractive to other nations. We can see that the major countries engaging with India are DC (IBEF, 2022). We can conclude that capital should flow from DC to less developed nations, but in this case, Capital is flowing from a Developing country to a Developed country. There arises a need to validate these theories to know the flow of actual capital.

The OLI / Eclectic paradigm of Dunning brings out the variables that are attracting countries for investments. While considering this theory, many studies have been done to determine the variables that attract a country towards Investment (Head and Ries, 2008; Kleinert and Toubal, 2010; Pankaj, 2001). From the literature, it is clear that the factors affecting one country are different from another, so a country-specific study will only bring out the basic variables that attract FDI. By considering the OLI paradigm, we can sort out the variables and test whether these variables are helping India to attract FDI from developed nations.

In Fig. 1 below, the flow of FDI is shown. From the theories, we know the FDI flows from DC to EC (Lucas, 1990; Faeth, 2009). As an emerging country, India has FDI with EC, but a good share is with DC, which is the opposite of the theories. The drivers of FDI are represented through the OLI paradigm. Here, we will find out how the OLI paradigm is affecting India to attract FDI. H1 and H2 analyze the variables affecting the inward and OFDI of India. H3 and H4 will show the flow of FDI from and towards India with EC. H5 and H6 will show the flow of FDI from and towards India and developing countries.

Materials and methods

The study covers eight countries, which are the major contributors to Indian FDI. The countries and their classification are given in Table 1 (IBEF, 2022). Secondary data from 2000 to 2023 is used for the study. Variables and their descriptions are shown in Table 2. Variables are classified into the OLI paradigm for better understanding. The study is restricted to the availability of data, as the data on countries like the British Virgin Islands, the Cayman Islands, and Sudan were not available. To reduce the autocorrelation, logarithmic values were taken for the study. Even though the missing value up to 30% can be adjusted with the mean value of the series, we have adjusted a maximum of 13% with the mean value (Acock, 2005; Dodeen, 2003; Hawthorne et al., 2005; Ng and Yusoff, 2011).

Dependent variable

The IFDI and OFDI are considered the dependent variables for the analysis. The yearly FDI data in US$ (million) has been collected for the analysis.

Ownership

Ownership advantages are internal to the home country’s enterprise but can be used with other resources of the home country or elsewhere (Dunning, 1977). GFCF, Patent, Information and Communication Technology (ICT), and R&D together form the ownership advantage of OLI. These variables show the unique characteristics of the home country. Economic condition through GDP Per Capita is collected in US$ (Dang and Nguyen, 2021; Dunning, 1977). Gross Fixed Capital Formation is the Percentage of GDP that is used to evaluate the availability of capital in the nation (Dunning, 1977; Özkan-Günay, 2011). The number of patent applications is considered (Dunning, 1977). The percentage of ICT goods exported is considered. R&D expenditure as a percentage of GDP is taken (Dunning, 1977).

Location

The tangible and intangible assets that are capable of generating income streams have originated from the home country but are available to all enterprises of the nation (Dunning, 1977). OLI, as well as the gravity model, points out the importance of Location. GDP, Infrastructure, Trade, natural resources, human capital, inflation, language, and distance are taken to represent the location. Trade, natural resources, and human capital are the prominent locational factors. Market potential is evaluated through GDP is collected in US$ (Dang and Nguyen, 2021; Dunning, 1977). For infrastructure, Mobile cellular subscriptions (per 100 people) are considered (Alam and Shah, 2013). The Trade percentage of GDP is considered to identify the trade volume of the nation (Dunning, 1977). The resource-seeking nature of the FDI is quite famous. For natural resource valuation, we have considered adjusted savings (Total natural resources rents (% of GDP)) (Dunning, 1977). Labor force participation rate, total (% of total population ages 15–64), is taken to evaluate the human capital (Soumaré, 2015). To measure the performance of the nation, inflation is taken (Dang and Nguyen, 2021). In case the countries share a common language, it acts as a positive element towards FDI (Head and Ries, 2008; Kleinert and Toubal, 2010). We are providing a value of 1 in case the countries share a common language. If there is a proximity between distances, it boosts FDI. So, the distance between the source and destination of FDI is considered.

Internalization

Internalization comes from the procession of some specific advantages that are available only to them (Dunning, 1977). Exchange rate and FTA are considered for the internalization advantage (Antonakakis and Tondl, 2015). As the exchange rate is inversely related to FDI in developed countries, we check the same for the emerging nations. For this official exchange rate (Local Currency Unit per US$, period average) is considered (Dunning, 1977; Tham et al., 2018). Trade openness is the major factor that attracts FDI. When there are fewer trade restrictions, more trade opportunities arise. Regional Trade Agreements and Free Trade Agreements will boost the economy (Behera and Mishra, 2022). If there exists a relation between the countries, then 1 is taken; else 0 for the computation.

The factors affecting both OFDI and IFDI may not be the same in all cases. This study will consider all the factors and try to bring out the true variables behind the FDI of a nation.

Methodology

Panel data is a multidimensional dataset. The panel data set will help to study the country-specific variables as well as the variables over a time period. For the current study, we have used panel data from 2000 to 2023 from different countries.

Generalized Method of Moments (GMM)

The study uses the system Generalized Method of Moments (GMM), which is the most suitable model for panel data analysis (Tham et al. 2018). GMM is a combination of Ordinary Least Squares and 2-stage Least Squares. If the data has endogenous variables, one-step system GMM is advised as it can handle the weak. VIF values (attached in Annexure) further suggest for GMM model (Nomani et al. 2025; Ofir and Khuri, 1986). In our dataset, variables such as distance, language, and FTA are endogenous. The problem of simultaneity bias that happens due to endogeneity issues can be addressed by GMM (Nomani et al. 2025; Roodman, 2009). The one-step system GMM was chosen according to the data points. As the dataset is finite in size, one-step system GMM will be more suitable than the two-step system GMM. The study consists of a small panel (only 9 countries, 207 observations), and two-step GMM might not perform well and may even mislead (Roodman, 2009). Similarly, we have time-invariant variables like distance, language, and dummy variable-FTA, which cannot be addressed in two-step GMM (Baum et al., 2003; Hayakawa, 2007; Roodman, 2009). The analyzes undertaken include autoregressive models of order one (AR(1)) and order two (AR(2)) to assess the first and second order correlations within the data. Additionally, the Hansen test is employed to evaluate the robustness of the proposed model. The foundational equation governing the GMM is presented in Eq. 1 (Tham et al. 2018). Furthermore, Eq. 2 delineates the inward flow of FDI, while Eq. 3 articulates the outward flow of FDI.

Results and discussions

The study was conducted to identify the major factors that are affecting FDI in the case of India. For this, FDI is segregated into IFDI and OFDI. From the data set, variables have been selected and evaluated. Secondly, to analyze the flow of FDI, the countries are being divided into DC and EC, and further analysis is being done to identify which variables are attracting FDI from DC as well as EC, and the variables that India is looking for in DC and EC. A total of 16 variables have been categorized according to the OLI paradigm.

Tables 3 and 4 will show the inward and OFDI position of India and the variables that influence the same under the OLI paradigm. For the Inward and OFDI positions, the one-step system GMM method is used.

IFDI positions

Table 3 shows the IFDI position of India. Regarding ownership and location advantage, patents and GDP exhibit a strong relationship with IFDI (Sothan, 2017; Tham et al., 2018). Unlikely, while evaluating the whole countries in the world, the internalization advantage doesn’t have any influence on the IFDI of India. This also put forth a suggestion that the categorization of the countries is required for the study.

OFDI positions

Table 4 shows the OFDI position of India. GDPPC, R&D, and Patents are highly significant variables towards the OFDI of India, from the ownership advantage. GDP, Language, and distance are highly significant, and trade and infrastructure also have a significant effect (p < 0.10) is significant on location (Abor and Harvey, 2008). Internalization advantages support Exchange rate and FTA (Mehic et al. 2013).

Emerging country’s FDI positions

Tables 5 and 6 will show the inward and OFDI position of India with EC and the variables that influence the same under the OLI paradigm. For the Inward and OFDI positions, the one-step system GMM method is used. Due to the singularity matrix, FTA is being eliminated from the study for EC.

IFDI positions

Table 5 shows the IFDI position of India with EC. While considering the ownership advantage, Patent, and GDPPC have a highly significant, and R&D is significant at p < 0.10 relation towards IFDI (Le et al., 2021; Sahu, 2021). Location advantage is the prominent one in the case of IFDI (Behera and Mishra, 2022). Variables like GDP, trade, and distance are highly significant (Sahu, 2020b). Exchange rates are significant with IFDI from Internalization advantage (Asiamah et al., 2019; Tham et al., 2018).

OFDI positions

Table 6 shows India’s OFDI position with EC. The GFCF, GDPPC, ICT, and R&D are significant variables towards the OFDI of India, in Ownership advantage (Baharumshah and Almasaied, 2009). Distance, trade, human capital, and inflation (Kinda, 2018) are the significant variables of Location advantage. Internalization advantage shows the exchange rate as a significant variable in the OFDI position.

DC FDI positions

Tables 7 and 8 will show the inward and OFDI position of India with DC and the variables that influence the same under the OLI paradigm. For the Inward and OFDI positions, the one-step system GMM method is used.

IFDI positions

Table 7 shows the IFDI position of India with DC. While considering the ownership advantage, ICT, and R&D have a highly significant relation to IFDI (Bermejo Carbonell and Werner, 2018). Trade is highly significant from Location advantage, GDP (1%), Inflation (5%), language, and Distance are significant at p < 0.10. None of the internalization advantages significantly impacts IFDI.

OFDI positions

Table 8 shows the OFDI position of India with DC. The GDPPC, patent, ICT, and R&D are the significant variables towards the OFDI of India (Alam and Shah, 2013). Language is the variable that is highly significant, and Infrastructure is significant at 10% for Location advantage (Özkan-Günay, 2011). Distance, trade, natural resources, and GDP are the next level of significant variables. The exchange rate is a significant variable (p < 0.05) of Internalization.

Discussion

FDI plays a crucial role in the economy, making it essential to understand the dynamics of OFDI and IFDI. Key variables influencing IFDI include GDPPC, patents, ICT, and R&D related to Ownership, as well as factors like GDP, trade, inflation, language, and distance from Location and exchange rates related to Internalization. Conversely, for OFDI, all the variables from Ownership, Location, exchange rates, and FTAs related to Internalization.

IFDI and OLI paradigm

Ownership and location advantage are the prominent ones in the case of IFDI. Variables like patents and GDP are highly significant. The liberal patent policies will help the domestic companies to innovate and grow, thereby increasing the competition for foreign firms (Chang et al., 2013). From these research findings, we can conclude that other countries are generally looking for only the Ownership advantage in India. No other advantage holds a significant relation with the FDI. This also opens a gap for the researchers to categorize the countries according to homogeneity. Such categorization is done further in this study.

OFDI and OLI paradigm

Location and ownership advantages are equally important, and internalization is lacking in the case of OFDI. Patent, R&D, and GDPPC are significant variables for the OFDI of India from ownership advantage and GDP, language, and distance from location advantages. Better infrastructure will increase the cost of operations, which mostly discourages the emerging nations (Owusu-Manu et al., 2019). Exchange rate and FTA are the significant variables of internationalization. Likewise, the trade agreements come with restrictions that tie the firm from exploring the options (Jang, 2011).

IFDI and EC

Ownership and Location advantages have more or less equal importance, but Internalization doesn’t have such an advantage in IFDI positions. Patent, and GDPPC from ownership, and GDP, distance, and trade from location advantage. From Internalization exchange rate is significant.

OFDI and EC

The patent, R&D, and GDPPC are the significant variables towards the OFDI of India. Location advantages do not show any strong variables, but infrastructure and distance can be considered. Internalization advantages may be influenced by a singular variable, specifically the exchange rate. This highlights the significance of currency fluctuations in the context of international business operations and strategic decision-making.

IFDI and DC

When it comes to DC, Ownership has a higher hand than Location and Internalization advantages. While ICT and R&D are from Ownership advantage, GDP, trade, inflation, language, and distance are from Location. Here, internalization doesn’t pose any significance; it shows that the DC doesn’t need any trade agreements are anything to boost their investments in EC, but they only need strong ownership and location advantages.

OFDI and DC

Patent, R&D, and GDPPC from Ownership and language from Location are important for FDI, but those areas need further exploration. Exchange rate in Internalization can boost OFDI, but only to an extent.

Table 9 and Fig. 2 represent the consolidated results in tabular and pictorial forms, respectively. ✓ Statistical significance. Each hypothesis and its significant variables have been presented for clarity. Inverse and direct relations are indicated with ↓ and ↑ respectively. Hypotheses H2, H3, H5, and H6 are accepted, while H1 and H4 are partially accepted. The internalization advantage was not accepted in H1 and H5, which is why those sections have been left blank. Figure 2 presents the consolidated findings of the study, illustrating the formulated hypotheses alongside the significant variables identified. The arrows indicate the direction of FDI flow. It is noteworthy that the internalization advantage is unaddressed in all nations and developed nations, as the analysis did not support hypotheses H1 and H5. It is noteworthy that the internalization advantage becomes nullified in the context of developed nations. The findings related to hypotheses H1 and H5, which propose that internalization advantages drive inward flows of FDI, were not supported by the results.

Theoretical implications

This analysis has found the key variables responsible for this unique flow, hence providing new insights to EC to drive more FDI.

Through this study, we have found that if the nations are nearby and have no language barriers, technological advancement (R&D and ICT), and infrastructure, along with trade agreements, then the emerging nations don’t matter whether it is developed nations or not. These are the strong variables that can pull emerging nations into developed nations. In this scenario, the gravity model has good significance. For instance, the developed nations have better technology compared to the emerging nations; capturing these and replicating them in the home country can be the major motive of emerging nations, through which their economy can grow. Various trade agreements will have many advantages, such as cost reduction, ease of trade, market expansion, and so on. This is also an attractive factor for emerging nations. The gravity theory predominantly emphasizes geographical location variables as determinants of FDI flows (Dorakh, 2020; Kahouli and Maktouf, 2015; Tham et al., 2018; Younsi and Bechtini, 2019). In contrast, the OLI framework encompasses a broader array of factors that provide a more comprehensive understanding of the variables influencing FDI. This holistic approach allows for a nuanced identification of the determinants that affect investment decisions across different contexts.

Variables like Patents, distance, language, infrastructure, and trade agreements can attract even an emerging country to invest with DC. These variables also exist in even IFDI positions. These variables can make inward as well as OFDI. All the theories ignore the fact that even developing countries go to the DC for these benefits. Through this analysis, we discovered that a bidirectional movement exists between the developed and developing countries, which was ignored by the theories.

The internalization advantage is not significant in the context of inward FDI from developed nations. This insight offers a fresh perspective on the issue. It appears that developed countries largely overlook the internalization advantage. In ECs, the regulatory framework tends to favor joint ventures or other collaborative arrangements over fully owned subsidiaries, thereby promoting growth and development in these regions. Such frameworks serve to deter investment in fully owned subsidiaries by multinational corporations. The advantages associated with ownership and location are particularly aligned with the strategic objectives of developed nations, particularly in terms of cost reduction and labor force optimization.

Managerial application

The company’s main aim will be to increase the profit from these investments. Technological advancement (patent and R&D) is the major area they are focusing on, regardless of the country’s development status. Countries nearby have the advantage of language and distance these will also boost the investment potential. Government and other institutional initiatives (FTA) will reduce the hassle in the process of investment and the operating cost. Along with these variables, if human capital is there, then a country can attract investment from emerging nations, too. While looking into the OLI framework, the companies need to look for all three 3 advantages. In a simpler form, the managers need to look into the countries that provide technological advancement, a good institutional and legal framework, and geographical proximity.

Conclusion and policy implications

Since all the country’s resources and structures are different from one another, country-wise analysis must bring out the FDI flow pattern. This study reveals that variables influencing one country do not necessarily affect another in the same manner. The relevance of a variable might change due to the unique situation of the country. So, it is always recommended to make a country-wise analysis to get the FDI picture clear.

In the case of India, we can say that patent, distance, language, GDP, infrastructure, GDPPC, and trade agreements are the most common and significant variables that affect FDI decisions.

Policy implications

Good economic conditions (GDP, GCF, GDPPC, and exchange rate), better utilization of natural resources, and upgraded trade agreements (FTA) will bring some of the best investments. A nation should possess better infrastructure, economic conditions, and natural resources to attract emerging nations’ FDI. DC also considers these variables but requires FTAs and better trade conditions for investment. But the EC considers that the trade agreements will act as a shortcut to enter the developing markets.

Limitations and future directions

Firstly, the analysis of this study is applicable in the case of India. Due to data availability issues, many countries as well as variables were excluded due to data availability constraints. New methodologies like machine learning can also bring out much better results. Secondly, China was also showing a similar trend to India till 2000. Later on, China shifted its investment strategy, and they are now concentrating on EC too. What made China change the trend will bring out some insights for other countries, especially India, as India can make a comparative analysis to find out the variables that changed the course of action and can try to implement it if it is much more profitable. Thirdly, from the literature, it was pointed out that in the case of DC, FDI is not responding to economic growth (Bermejo Carbonell and Werner, 2018; Chang, 2010; Wang, 2009). This provides a scope for a new study on why economic growth is not happening due to FDI in DC, unlike emerging nations.

Data availability

The datasets analyzes during the current study are available in the UNCTAD, WDI, CEPII, and WTO repository, https://unctadstat.unctad.org/datacentre/, https://databank.worldbank.org/reports.aspx?source=World-Development-Indicators, https://cepii.fr/CEPII/en/bdd_modele/bdd_modele_item.asp?id=6, and https://globaltradedata.wto.org/resource-library, respectively.

References

Abor J, Harvey SK (2008) Foreign direct investment and employment: host country experience. Macroecon Financ Emerg Mark Econ 1(2):213–225. https://doi.org/10.1080/17520840802323224

Acock AC (2005) Working With Missing Values. J Marriage Fam 67(4):1012–1028. https://doi.org/10.1111/j.1741-3737.2005.00191.x

Alam A, Shah SZA (2013) Determinants of foreign direct investment in OECD member countries. J Econ Stud 40(4):515–527. https://doi.org/10.1108/JES-10-2011-0132

Antonakakis N, Tondl G (2015) Robust determinants of OECD FDI in developing countries: insights from Bayesian model averaging. Cogent Econ Financ 3(1). https://doi.org/10.1080/23322039.2015.1095851

Asiamah M, Ofori D, Afful J (2019) Analysis of the determinants of foreign direct investment in Ghana. J Asian Bus Econ Stud 26(1):56–75. https://doi.org/10.1108/jabes-08-2018-0057

Aykut D, Ratha D (2004) Research Note - South-south FDI flows: How big are they. In United Nations Conf Trade Dev Div Investig Technol Enterp Dev 13(1):149

Baharumshah AZ, Almasaied SW (2009) Foreign direct investment and economic growth in Malaysia: interactions with human capital and financial deepening. Emerg Mark Financ Trade 45(1):90–102. https://doi.org/10.2753/REE1540-496X450106

Baum CF, Schaffer ME, Stillman S (2003) Instrumental variables and GMM: estimation and testing. Stata J 3(1):1–31

Behera P, Mishra BR (2022) Determinants of bilateral FDI positions: empirical Insights from ECs using model averaging techniques. Emerg Mark Financ Trade 58(3):710–726. https://doi.org/10.1080/1540496X.2020.1837107

Bermejo Carbonell J, Werner RA (2018) Does foreign direct investment generate economic growth? A new empirical approach applied to Spain. Econ Geogr 94(4):425–456. https://doi.org/10.1080/00130095.2017.1393312

Chang CL, Chen SP, McAleer M (2013) Globalization and knowledge spillover: International direct investment, exports and patents. Econ Innov N Technol 22(4):329–352. https://doi.org/10.1080/10438599.2012.707412

Chang SC (2010) Estimating relationships among FDI inflow, domestic capital, and economic growth using the threshold error correction approach. Emerg Mark Financ Trade 46(1):6–15. https://doi.org/10.2753/REE1540-496X460101

Chen MY (2012) Entry mode choice and performance: evidence from Taiwanese FDI in China. Emerg Mark Financ Trade 48(3):31–51. https://doi.org/10.2753/REE1540-496X480302

Dang VC, Nguyen QK (2021) Determinants of FDI attractiveness: Evidence from ASEAN-7 countries. Cogent Social Sci 7(1). https://doi.org/10.1080/23311886.2021.2004676

Dodeen HM (2003) Effectiveness of Valid Mean Substitution in Treating Missing Data in Attitude Assessment. Ass Eval Higher Educ 28(5):505–513. https://doi.org/10.1080/02602930301674

Dorakh A(2020) A Gravity Model Analysis of FDI across EU Member States. J Eco Integration 35(3):426–456. https://doi.org/10.11130/jei.2020.35.3.426

Duce M, España BD (2003) Definitions of Foreign Direct Investment (FDI): a methodological note. Banco de Esp 6(2):43–49

Dunning JH (1977) Trade, location of economic activity and the MNE: a search for an eclectic approach. In: The international allocation of economic activity: proceedings of a Nobel Symposium held at Stockholm. London, Palgrave Macmillan UK, pp 395–418

Faeth I (2009) Determinants of foreign direct investment - a tale of nine theoretical models. J Econ Surv 23(1):165–196. https://doi.org/10.1111/j.14676419.2008.00560.x

Gao T (2005) Foreign direct investment from developing Asia: some distinctive features. Econ Lett 86(1):29–35. https://doi.org/10.1016/j.econlet.2004.04.025

Goyal A (2006) Corporate social responsibility as a signalling device for foreign direct investment. Int J Econ Bus 13(1):145–163. https://doi.org/10.1080/13571510500520077

Hawthorne G, Elliott P (2005) Imputing Cross-Sectional Missing Data: Comparison of Common Techniques. Aust New Zealand J Psych 39(7):583–590. https://doi.org/10.1080/j.1440-1614.2005.01630.x

Hayakawa K (2007) Small sample bias properties of the system GMM estimator in dynamic panel data models. Econ Lett 95(1):32–38

Head K, Ries J (2008) FDI as an outcome of the market for corporate control: theory and evidence. J Int Econ 74(1):2–20

IBEF (2022) FDI in India: Foreign Direct Investment Opportunities. https://www.ibef.org/economy/foreign-direct-investment

India Brand Equity Foundation (2022) FDI in India: Foreign Direct Investment Opportunities. Aug 2022. https://www.ibef.org/economy/foreign-direct-investment

Jang YJ (2011) The impact of bilateral free trade agreements on bilateral foreign direct investment among developed countries. World Econ 34:1628–1651. https://doi.org/10.1111/j.1467-9701.2011.01356.x

Kahouli B, Maktouf S (2015) The determinants of FDI and the impact of the economic crisis on the implementation of RTAs: A static and dynamic gravity model. Int Bus Rev 24(3):518–529. https://doi.org/10.1016/j.ibusrev.2014.10.009

Kinda T (2018) The quest for non-resource-based FDI: do taxes matter? Macroecon Financ Emerg Mark Econ 11(1):1–18. https://doi.org/10.1080/17520843.2016.1244095

Kleinert J, Toubal F (2010) Distance and the margins of multinational firms’ activities. Beiträge zur Jahrestagung des Vereins für Socialpolitik 2010: Ökonomie der Familie-Session: trade, gravity and distance, No. A4-V2. https://hdl.handle.net/10419/37165

Köymen Özer S, Sayek Böke S (2017) The characteristics of domestic firms: materializing productivity spillovers from FDI. Emerg Mark Financ Trade 53(11):2562–2584. https://doi.org/10.1080/1540496X.2016.1219943

Le B, Ngo TTT, Nguyen NT, Nguyen DT (2021) The relationship between foreign direct investment and local economic growth: a case study of Binh Dinh province, Vietnam. J Asian Financ Econ Bus 8(4):33–42. https://doi.org/10.13106/jafeb.2021.vol8.no4.0033

Liu H, Islam MA, Khan MA, Hossain MI, Pervaiz K (2020) Does financial deepening attract foreign direct investment? Fresh evidence from panel threshold analysis. Res Int Business Financ 53. https://doi.org/10.1016/j.ribaf.2020.101198

Liu X, Luo Y, Qiu Z, Zhang R (2014) FDI and economic development: evidence from China’s regional growth. Emerg Mark Financ Trade 50:87–106. https://doi.org/10.1080/1540496X.2014.1013852

Lucas RE (1990) Why doesn’t capital flow from rich to poor countries? Am Econ Rev 80(2):92–96

Mehic E, Silajdzic S, Babic-Hodovic V (2013) The impact of FDI on economic growth: some evidence from Southeast Europe. Emerg Mark Financ Trade 49(1):5–20. https://doi.org/10.2753/REE1540-496X4901S101

Mwakabungu BHP, Kauangal J (2023) An empirical analysis of the relationship between FDI and economic growth in Tanzania. Cogent Econ Finance 11(1). https://doi.org/10.1080/23322039.2023.2204606

Ng CG, Yusoff MSB (2011) Missing Values in Data Analysis: Ignore or Impute? Educ Med J 3(1). https://doi.org/10.5959/eimj.3.1.2011.or1

Nielsen L (2011) Classifications of countries based on their level of development: how it is done and how it could be done. Int Monetary Fund 11(31):1

Nomani A, Rithi SR, Negi R (2025) Mapping the Foreign Investments (OFDI) from emerging economies toward developed nations: a consequential convergence of investment outflows and the oli paradigm. Thunderbird Int Business Rev https://doi.org/10.1002/tie.22435

Ofir C, Khuri A (1986) Multicollinearity in marketing models: diagnostics and remedial measures. Int J Res Mark 3(3):181–205

Owusu-Manu DG, Edwards DJ, Mohammed A, Thwala WD, Birch T (2019) Short run causal relationship between foreign direct investment (FDI) and infrastructure development. J Eng Des Technol 17(6):1202–1221. https://doi.org/10.1108/JEDT-04-2019-0100

Özkan-Günay E (2011) Determinants of FDI inflows and policy implications: a comparative study for the enlarged EU and Candidate countries. Emerg Mark Financ Trade 47(4):71–85. https://doi.org/10.2753/REE1540-496X4705S405

Pankaj G (2001) Distance still matters: the hard reality of global expansion. Harv Bus Rev 79(8):137–147

Rehman FU, Khan MA, Khan MA, Pervaiz K, Liaqat I (2020) The causal, linear, and nonlinear nexus between sectoral FDI and infrastructure in Pakistan: using a new global infrastructure index. Res Int Business Financ 52. https://doi.org/10.1016/j.ribaf.2019.101129

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in Stata. In Stata J 9(1)

Sahu JP (2020a) Do large foreign direct investment inflows behave differently from smaller inflows? Evidence from developing countries. Margin J Appl Econ Res 14(1):86–106. https://doi.org/10.1177/0973801019886488

Sahu JP (2020b) Do surges in foreign direct investment inflows lead to surges in economic growth? Evidence from developing countries. Stud Econ Financ 38(2):317–338. https://doi.org/10.1108/SEF-10-2019-0418

Sahu JP (2021) Does inflow of foreign direct investment stimulate economic growth? Evidence from developing countries. Transnatl Corporat Rev 13(4):376–393. https://doi.org/10.1080/19186444.2020.1833603

Sahu JP, Dash SK (2021) What explains FDI inflows to ASEAN countries? Evidence from quantile regressions. J Asian Econ Integr 3(1):25–37. https://doi.org/10.1177/2631684620982775

Smith A (1887) An Inquiry into the Nature and Causes of the Wealth of Nations. T. Nelson and Sons

Sothan S (2017) Causality between foreign direct investment and economic growth for Cambodia. Cogent Econ Financ 5(1). https://doi.org/10.1080/23322039.2016.1277860

Soumaré I (2015) Does FDI improve economic development in North African countries? Appl Econ 47(51):5510–5533. https://doi.org/10.1080/00036846.2015.1051655

Sultanuzzaman MR, Fan H, Akash M, Wang B, Shakij USM (2018) The role of FDI inflows and export on economic growth in Sri Lanka: an ARDL approach. Cogent Econ Financ 6(1):1–17. https://doi.org/10.1080/23322039.2018.1518116

Tham SY, Khoon Goh S, Wong KN, Fadhli A (2018) Bilateral export trade, outward and inward FDI: a dynamic gravity model approach using sectoral data from Malaysia. Emerg Mark Financ Trade 54(12):2718–2735. https://doi.org/10.1080/1540496X.2017.1402176

UNCTAD (2017) World Investment Report 2023: Investment and the Digital Economy. New York: UN. https://unctad.org/system/files/official-document/wir2017_en.pdf

UNCTAD (2021) World Investment Report 2021: investing in sustainable recovery. UN. https://hbs.unctad.org/foreign-direct-investment

UNCTAD (2023) World Investment Report 2023: Investing in Sustainable Energy for All. New York: UN. https://unctad.org/publication/world-investment-report-2023

Younsi M, Bechtini M (2019) Does good governance matter for FDI? New evidence from emerging countries using a static and dynamic panel gravity model approach. Eco Transit Inst Change 27(3):841–860. https://doi.org/10.1111/ecot.12224

Wang M (2009) Foreign direct investment and domestic investment in the host country: evidence from panel study. Appl Econ 41(16):3711–3721. https://doi.org/10.1080/00036840802314580

Wu W, Yuan L, Wang X, Cao X, Zhou S (2020) Does FDI drive economic growth? Evidence from city data in China. Emerg Mark Financ Trade 56(11):2594–2607. https://doi.org/10.1080/1540496X.2019.1644621

Acknowledgements

The authors reported that no funding was received by any author for this research work.

Funding

Open access funding provided by Vellore Institute of Technology.

Author information

Authors and Affiliations

Contributions

Rithi S R: Contributed to the conception, data collection, and drafting of the manuscript. Also involved in revising the manuscript. Abuzar Nomani: Led the design of the study, data collection, analysis, and interpretation of the data, provided critical feedback on the methodology, and contributed to revising the manuscript. Mohsin Khan: Guided the study design and contributed to drafting and revising the manuscript. Manoharan M: Offered critical insights into the study framework, reviewed the data interpretation, and contributed to the final review and approval of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Human participants or their data

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

S. R, R., Nomani, A., Khan, M. et al. Determinants influencing the flow of FDI in India: an empirical insight using panel data. Humanit Soc Sci Commun 12, 1497 (2025). https://doi.org/10.1057/s41599-025-05726-7

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05726-7