Abstract

In the modern world, exploring economic uncertainty and the unpredictability in economic conditions is crucial to determine its impact on day-to-day society. However, existing literature has examined this relationship in a generalised manner, often without focusing on the bi-directional effects among these variables. This study explores the causal and cointegrating interrelationships among economic uncertainty and suicide rates, unemployment rates, economic growth, and trade openness across 30 high uncertainty countries utilising Granger causality test and Cointegration test. Unlike existing studies, which focus on a certain country or region, the current findings disclose bi-directional causation between the measured variables, particularly in Kenya, Finland, Portugal, Latvia, Peru, Haiti, Mexico, Kazakhstan and Kyrgyz Republic. The cointegration tests show that while uncertainty reduces economic growth and trade openness in the long run, in line with contemporary literature, uncertainty also reduces suicide rates and unemployment rates in the long term. By analysing the countries with the highest economic uncertainty, this study aims to provide country-specific policies in line with Sustainable Development Goals (SDGs) developed by United Nations (UN) to navigate the bi-directional effects among economic uncertainty and the linked variables.

Similar content being viewed by others

Introduction

The economic uncertainty which is driven by global market instability and external shock, particularly pandemics and geopolitical conflicts, pose significant challenges affecting individuals and societies. The effects of uncertainty echo through socio-economic domain, especially in suicide rates, unemployment, economic growth and trade openness, which shape individual and country level prosperity. Understanding the key factors driving economic uncertainty is crucial, especially given the complexities introduced by recent global developments, especially the COVID-19 pandemic, which has had detrimental effects caused by lockdowns, supply chain disruptions with high economic policy uncertainty indexes being at an all-time high (Gopinath, 2020; Ahir et al. 2023). In context of the study’s variables, during this period global growth fell to −3% in 2020, which is considered the worst since the Great Depression of the 1930s (Gourinchas, 2024), with the global trade contracting by 8% in 2020 due to supply chain disruptions and reduced demand for goods. During the COVID-19 period the global unemployment rates peaked at 6.6% in 2020, with youth unemployment remaining significantly higher than adult rates (United Nations, 2023). There is a visible increase in suicide rates with some countries reporting higher rates due to financial hardships during the pandemic period (Er et al. 2023).

The relationship between economic uncertainty and socioeconomic variables has garnered significant scholarly attention in the recent years. When exploring economies, there is an increase in lagged economic uncertainty, as well as in unemployment and economic growth, may lead to an increased risk of suicide (Claveria, 2022a). Youth unemployment is more susceptible to Economic Policy Uncertainty (EPU) shocks than adult unemployment in France, Italy, and Spain (Dajčman et al. 2023). These imply a heavy urge among researchers to explore the interplay of economic uncertainty and its counterparts in the modern world.

When considering suicide rates, the importance of exploring it could potentially unravel the underlying societal issues like poverty, inequality, and insufficient mental health care. Furthermore, recent years have been critical in the progression of mental health care amongst individuals, which in turn could affect the prevalence of suicide rates in the world (Brådvik, 2018; Tao and Cheng, 2023). Furthermore, low-income countries often provide less priority to mental health concerns, as they typically face other socioeconomic issues for which the policymakers focus the issues prevalent in their society undermining importance of mental health care.

These economic downturns were further compounded by regional political conflicts, namely the Russian-Ukraine conflict, which disrupted the oil trade and increased essential commodity prices, leading to increasing economic instability. Typically, any country’s economy focuses on primarily the GDP to determine the standard of living of its citizens and unemployment and to determine how much of its healthy adult citizens contribute to the economy. Prominent research shows an interrelationship between unemployment and economic growth, often where studies depict a negative correlation among these factors (Claveria, 2022a). It implies that slower economic growth is typically intertwined with higher unemployment rates in a country.

In the modern world, it is crucial for any country to carry out trade activities namely, import and export, and most of the world countries engage in trade. Many countries are export heavy, where they invest the bulk of their economy into producing export of primary commodities particularly, food, electronics, and essential goods, which in turn generates revenue for them. In contrast,some countries are more import reliant for their primary commodities, however they have more refined exports namely, Integrated Circuits, Petroleum, Cars and Gold (Anwar et al. 2024). By understanding the interplay between export and import among the countries and the willingness of countries to invest their yearly budget into developing their trade infrastructure, it is possible to understand the influence of trade on the global economy. Given these challenges, an empirical examination of the interrelationship between economic uncertainty, suicide, unemployment, economic growth, and trade is timely and essential. Thereby, this study focuses on the following research and questions and objectives:

-

(1)

Question 1: How does economic uncertainty cause changes in suicide rates, unemployment rates, economic growth and trade openness in high uncertainty countries?

-

(2)

Question 2: How do the socio-economic variables affect economic uncertainty in high uncertainty countries?

-

(1)

Objective 1: To determine whether economic uncertainty cause changes in suicide rates, unemployment rates, economic growth and trade openness in high uncertainty countries.

-

(2)

Objective 2: To explore the impacts of the socio-economic variables on economic uncertainty with high uncertainty countries.

This study aims to contribute to the existing literature in the following ways. Firstly, this study identifies 30 countries with highest economic uncertainty based on the World Uncertainty Index (WUI). Where a significant gap exists in certain countries and their relationship to uncertainty is often largely unexplored. This study aims to bridge this gap by providing a comprehensive country level analysis. Secondly, it is noted that existing literature often explores how economic uncertainty affects socio-economic variables, utilising either one or two variables and often overlooking the bidirectional effects among the variables. Thirdly, this study utilises the Granger Causality and Cointegration Tests to identify the direction of relationship within the uncertainty and socio-economic relationship. While there exists studies utilising these methodologies, none have done so in unified context incorporating 5 variables. By analysing 30 countries over 23 years considering the socio-economic variables, this study applies these methodologies in a unique way providing novel findings. Fourthly, by identifying the causal and cointegrating relationships, this study provides valuable insights for policy makers. These policies are tailored to the United Nations’ Sustainable Development Goals (SDGs). The policies are aligned with SDG 3: Good Health and Well-being, SDG 4: Quality Education, SDG 8: Decent Work and Economic Growth, SDG 9: Industry, Innovation, and Infrastructure, SDG 10: Reduced Inequalities, SDG 17: Partnerships for the Goals. Finally, this study contributes significantly to visualising aspects of studies with the use of modern analytical techniques to provide an eye-catching and comprehensive visualisation.

The paper is structured as follows: it begins with a critical review of existing empirical research, followed by a detailed explanation of the data collection methods and methodologies used. The empirical results are then presented and discussed, culminating in a conclusion that outlines the study’s essential findings and policy implications.

Theoretical Framework

The relationship between economic uncertainty and socio-economic variables can be explored through various theoretical frameworks. Critical theories linking economic uncertainty and suicide rates are economic stress theory, which inspects the effects of inflation and financial instability on the mental well-being of people. Furthermore, Durkheim’s social integration theory suggests the level of interconnectedness among people has a crucial impact on suicide rates (Durkheim, 1897). However, when there is economic uncertainty, this often leads to the weakening of social ties and reducing the sense of community, which makes individuals more prone to suicide.

When considering uncertainties and unemployment rates, the job search theory suggests that during uncertainties, unemployed workers are more cautious about venturing into new jobs due to the instability of future employment (Stigler, 1962). A prevalent theory in the field of strategic management is real options theory; the primary fundamental of this theory is that when firms face uncertainty, there is a reduction of investment into capital and labour (Myers, 1977). It is preferable to make decisions after a delay with more information. However, this delay often leads to fewer jobs, thus, creating higher unemployment. Theories suggest that economic growth, economic uncertainty and unemployment are linked, as robust economic growth allows for job creation and increases labour demand. In contrast, uncertainties lead to hire freezing and layoffs.

Economic uncertainty and economic growth are deeply rooted within each other in the modern era. However, theories regarding the interrelationships among them were formulated as early as the 1930s, and such a prominent theory is the Keynesian Economic theory. This theory suggests that economic uncertainty negatively impacts consumer and business spending, leading to reduced consumer consumption and business investment; this decline leads to economic (Keynes, 1936). The prospect theory examines how people take decisions when influenced by risk & uncertainty and suggests that people evaluate potential gains and losses relative to a reference point. Kahneman and Tversky (1979) proposed that people do not always maximise utility, in situations pertaining to uncertainty influencing individual and firm decisions. Endogenous growth theory suggests that during times of uncertainty, investing in innovation, research and development is discouraged, leading to a less stable future economy (Romer, 1986). When considering these theories, a negative relationship between uncertainty and economic growth can be identified, as uncertainty can reduce investment and consumption, which in turn reduces economic growth.

In the context of trade openness and economic uncertainty, there are key theoretical key concepts which link them, namely the transaction cost theory suggests that uncertainty can be avoided when the firm is well established and in contrary view, uncertainty also increases the transaction costs, including transportation; this leads businesses to invest in domestic markets, which are more predictable when compared to international markets (Coase, 1937). Tinbergen (1962) explores how countries engage in trade during periods of high uncertainty and factors influencing trade. Trade Policy Uncertainty (TPU) theory this suggests that uncertainty about future trade policies creates hesitation among the firms and their willingness to invest in international trade (Handley, 2014). The gravity model of trade predicts the flows bilateral trade flows between two countries based on their economic sizes.

By understanding these prominent theories, it is possible to determine the relationships that exists among these variables and the importance of how these variables interplay with each other can be identified.

Based on the theories prevalent in the current global context, Fig. 1 depicts how the relationships among the variables are established. This provides a basic understanding of how these variables interplay with one another, aimed with this knowledge, a comprehensive analysis of existing literature is explored in the following section.

Literature review

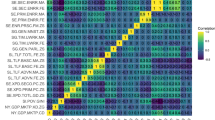

The following section examines the existing relationship between economic uncertainty, suicide rate, unemployment, economic growth, and trade for selected thirty countries with the highest economic uncertainty, providing a comprehensive context for this study. Appendix S1 shows the articles used for this study to determine the gaps in the research and for the identification of the variables. There is a significant number of articles for countries with high uncertainty particularly, Chile and South Africa, allowing us to develop our research based on existing empirical findings. Figure 2 showcases a region-wise breakdown of the countries from which articles were generated for this study’s literature. China, the United States, the United Kingdom, Brazil, and Russia contributes significantly to the literature, allowing us to examine the key players in an international stage in context of academic research on uncertainty.

Economic uncertainty stems from day-to-day transactions, however it could cause significant disruptions in economic activities in todays’ interconnected world. These uncertainties also affect businesses, where during this period they refrain from making any major investments (Bernanke, 1983; Bloom, 2009; Bachmann et al. 2013), this leads a freeze in the growth of an economy however once uncertainty is reduced there can be a temporary boom caused by the rapid investments of businesses (Bloom, 2009). Another primary factor causing uncertainty is government decisions on fiscal and monetary policies, as shown in Turkey (Kasal and Tosunoglu, 2022) and United States (Fernández-Villaverde et al. 2015), businesses struggle with this uncertainty, causing an exacerbation of economic decline. Uncertainty has grown to be a major concern in the modern scholarly community where a variety of discussions are put fourth, these reviews are taken into account when identifying the relationship between the variables in this study. By thoroughly examining these relationships, the subsequent sections are utilised to identify existing gaps in the literature.

Relationship between economic uncertainty and suicide

Economic uncertainty has transcended through geographical boundaries, impacting economies worldwide. Analyses conducted investigating this relationship in the global context (de Bruin et al. 2020; Claveria, 2022a, 2022b; Er et al. 2023; Tao and Cheng, 2023) reveals that economic downturns can have a detrimental impact on mental health, leading to the risk of suicide.

Empirical evidence highlights that economic uncertainty is a driver of suicide rates, particularly in economies with high performance (Antonakakis and Gupta, 2017; Vandoros et al. 2019; Vandoros and Kawachi, 2021; Abdou et al. 2022; Er et al. 2023; Sorić et al. 2023; Tao and Cheng, 2023; Goto et al. 2024; Lepori et al. 2024). Er et al. (2023) finds no link between low- and middle- income countries, however the West African region reveals a negative impact of uncertainty in low- and lower-middle income countries, contrasted by a positive long-term relationship in lower-middle income countries (Iheoma, 2022), another upper-middle income country: Turkey, indicates an association between uncertainty and suicide rates (Karasoy, 2024).

Uncertainty coupled with the effects of unemployment foster suicide rates in the United States (Antonakakis and Gupta, 2017). In contradiction to this Vandoros and Kawachi (2021) finds a statistically insignificant association between unemployment and suicide.

The COVID-19 pandemic stands out as major catalyst fuelling uncertainty. It exacerbates the negative effects of mental health (Lee and Nam, 2023) and induces anxiety, financial strain and suicidal thoughts (S. T. Khan et al. 2023). Additionally, the pandemic is a leading cause of suicide among youths (Bridge et al. 2023) and in the adult population (Nouhi Siahroudi et al. 2025). However, Yan et al. (2023) and A. M. Kim (2022) suggests that the overall rate of death by suicide remained basically unchanged but, suicidal ideation and suicide attempt were more prevalent. Further suggesting that the commonly shared thoughts that the pandemic’s impact would lead to an increase in suicides needs to be re-examined.

A crucial theme in contemporary literature is that the analyses on suicide rates are conducted for male and female groups separately, with a much-pronounced effect on males (Antonakakis and Gupta, 2017; Vandoros et al. 2019; Abdou et al. 2022; Goto et al. 2024; Lepori et al. 2024). Accordingly, developing gender specific policies is crucial in mitigating uncertainty effects.

Relationship between economic uncertainty and unemployment

Economic uncertainty plays a significant role in employment rates in the country, prompting researchers to examine its impact with studies generally indicating uncertainty has a positive impact on unemployment rates (Valadkhani, 2003; Caggiano et al. 2014; Payne, 2015; Caggiano et al. 2017; Schaal, 2017; Ahmed et al. 2022; Haldar and Sethi, 2022; Zaria and Tuyon, 2023). Youth employment in particular has been detrimentally affected by uncertainty (Dajčman et al. 2023). Uncertainties from one region of the world can have an impact on unemployment rates in another, as Dajčman et al. (2023) highlights, there is an effect of U.S uncertainties on unemployment rates of Germany, France, Italy and Spain. There are implications on types of uncertainty affecting unemployment in various ways, firstly, sectoral uncertainty has a stronger and lasting effect whereas, and aggregate uncertainty has a more immediate and transient effect (Choi and Loungani, 2015). Recent literature suggests COVID-19 to be a prime driver of unemployment rates (Su et al. 2021; T. Li et al. 2023), causing job losses across various sectors globally. Accordingly, while there causal flows in uncertainty and unemployment in the global context, a significant gap in exploring the bidirectional relationship between the two is noticeable.

Relationship between economic uncertainty and economic growth

Economic uncertainty shapes the economic activity with the country, influencing its inhibition and contraction. The impact of uncertainty on economic growth in a global context has been explored by many researchers (Lensink et al. 1999; Lensink, 2001; W. Kim, 2019; Cepni et al. 2020; Phan et al. 2021; Bannigidadmath et al. 2024; Gómez and Cándano, 2024; Gomado, 2025). Uncertainty acts as an inhibitor for economic growth and expansion, exerting a pessimistic impact on the growth rates in economies for high uncertainty countries (Gu et al. 2021; J. Li and Huang, 2021). In a real-world context, the countries exist in an interconnected global economy, hence the issue of spillover leading to uncertainties in more developed nations to impact the economy of less developed countries (Cepni et al. 2020; Fernández and Antonio, 2021; Ekeocha et al. 2023). Consequently, nations with robust economic growth can exert considerable influence on countries with lower economic growth.

Economic growth and its’ uncertainty relationship can be measured using various methods, as economic growth is not limited to GDP increase, it can also be measured by tourism, foreign direct investments, total factor productivity, sustainable development which are indicators that can be utilised in determining a healthy economy. The current literature provides a solid foundation for these relationships where in all cases the effect of uncertainty is negatively associated with the variables (Liu et al. 2020; Amarasekara et al. 2022; Ogbonna et al. 2022; Gupta, 2023). Moreover, the effect of economic uncertainty is both present in the short term (Adedoyin et al. 2022; Wen et al. 2022) and the long term (Adedoyin et al. 2022; Ghosh, 2022). While these studies identify a relationship between economic growth and uncertainty, a study conducted by Gomado (2025) reveals that the quality of pro-market institutions reduce the negative effects of uncertainty.

While the recent years have cause economic upheaval, with Brexit and deceleration of Chinese economy, but the COVID-19 pandemic had the most significant blow, exposing both developed and developing economies facing risks and uncertainties due to the effects of the pandemic (Njindan Iyke, 2020; Gozgor and Lau, 2021; M. Sun et al. 2024). The studies also find that the COVID-19 related deaths did not hinder GDP in advanced economies, however the lockdown restrictions had a more severe detrimental effect in emerging and developed economies (Gagnon et al. 2023). While the pandemic’s effects are detrimental if managed properly these uncertainties could also be mitigated as M. Sun et al. (2024) explains that the proactive measures adopted by China in response to the pandemic crisis played a pivotal role in effectively mitigating its detrimental effects on the GDP. However, there remains a gap in identifying the impact of economic uncertainty on economic growth in low-income countries.

Relationship between economic uncertainty and trade openness

With trade openness considered a crucial factor in the modern world, the influence of economic uncertainty can disrupt supply chain and increase vulnerabilities in interconnected economies. Trade often tends to decline when there is a rise in uncertainty caused due to factors like geopolitical tensions, policy unpredictability and pandemics. When considering trade there are two key players China and the United States, they form a global trade network, however this also provides easier access for uncertainties to travel to unsuspecting nations (Tam, 2018; Abaidoo, 2019; Dogah, 2021). While the economic policy uncertainty affects exchanging of goods in nations showing strong negative relationship among them (Kirchner, 2019; Jory et al. 2020; Matzner et al. 2023; Younis et al. 2024). A study conducted by Handley (2014) found that TPU significantly reduces firm-level export growth which in turn creates protectionist measure, often a response to uncertainty. In addition to the effects of Chinese uncertainty on global markets, there is negative effect of overseas uncertainty on the Chinese markets affecting China’s exports (Wei, 2019; Fan et al. 2023). Moreover, TPU affects renewable energy consumption in U.S. and China (Qamruzzaman, 2024) disrupting supply chains for renewable energy technologies and deterring investments into green energy.

When considering bi-lateral trade, a one unit increase in uncertainty declines trade by 4.4, also identifying that deeper trade integration mitigates the negative impact of uncertainty on trade and in contrast, higher participation in global value chains amplifies the negative effect of uncertainty on trade (Nana et al. 2024). Moreover, Barbero et al. (2021) suggests that there is a negative impact of COVID-19 on bi-lateral trade for countries that were included in regional trade agreements, with these negative effects being more pronounced when the countries share identical income levels and the highest impact being among high-income countries.

Data and Methodology

Data

The data for this study is obtained from a publicly available global database, with the use of secondary data, primarily covering a period of 23 years for a dataset of 30 countries. With some countries being excluded due to data limitations or missing data. There was a lack of data for certain years in a number of countries, hence, Linear Regression, Polynomial Regression, or Averages were used to fill in the missing values. This study uses a quantitative approach based on the countries with highest economic uncertainty for the year 2022. The data file used for this study is presented in the Appendix S2 and it includes 690 observations for the 23 years. The following Table 1 shows the sources from which secondary data was collected.

WUI is measured by using Economist Intelligence Unit (EIU) reports that provide forecasts for various countries, therefore, the frequency of the term “uncertainty” in these reports or its variants, if any, is analysed, and the report is calculated. This count is averaged over the total number of words in the record when calculating the length of the different records. The WUI cover 143 countries, including both advanced and developing economies and provides a broader scope making it versatile for analysing diverse uncertainty factors. This index also allows for capturing the interconnected nature of the global economy where uncertainty in one country can spill over to others, as evident with the COVID-19 pandemic. A primary advantage of the WUI is that it incorporates include consistent methodology for cross-country comparisons, providing a broad coverage of the countries and giving quarterly updates, which allows to get timely data. However, the WUI has its limitations, with the EIU reports being potentially biased sources and the lack of granularity in the data, meaning the data has been grouped, particularly different uncertainties have been aggregated to provide an overall uncertainty reading.

Methodology

This study evaluates the causal and cointegrating relationships between economic uncertainty and socio-economic variables using the Granger Causality Test (Granger, 1969) and Cointegration Test respectively. The Granger Causality test has been used in similar contexts; (Jayawardhana, Anuththara, et al. 2023; Jayawardhana, Jayathilaka, et al. 2023; Kostaridou et al. 2024), and in Tourism (Rasool et al. 2021; Wijesekara et al. 2022), Healthcare (Man Sun et al. 2020; Difrancesco et al. 2023). The method is also extensively used in other disciplines, in the field of Geopolitics (Shao et al. 2024), Supply chain and Logistics (Ren et al. 2024; Wu et al. 2024), Sustainable development (Ren et al. 2023; Perera et al. 2024), and Climate change (Kumar et al. 2023) to provide better context on the causal relationships among the variables in these disciplines. While there have been modern panel causality methods, particularly Dumitrescu and Hurlin (2012); Juodis et al. (2021), however these models assume cross-sectional independence, whereas there exists significant cross-sectional dependence, as established by the Cross-Sectional Dependence test.

The Cointegration analysis has been utilised in similar research contexts (Jumbe, 2004; Ketenci, 2010; Chontanawat, 2020), including environmental sciences (Duan et al. 2008; M. K. Khan et al. 2020), education (Babatunde and Adefabi, 2005), and engineering (Turrisi et al. 2022). Using two methodologies allows for a robust analysis providing short- and long-term insights into the relationship among variables. Figure 3 shows the research pathway through the course of this study, including a detailed flowchart showcasing the actions taken to achieve the objective of this study, with an emphasis on the empirical two analytical methods.

This study is based on the Granger causality analysis, which helps predict trends by analysing possible changes between variables. If X variable causes another Y, then past data on X should provide a more accurate prediction for Y than past data on Y alone.

The formulas (1)-(8) represent the individual causality among the variables WUI & SR, WUI & UR, WUI & EG, WUI & TO, where i denotes the countries and t denotes the period in years, u and k denote the error term and several lags, these equations are used to identify bi-directional effects.

Dicky-Fuller Unit Root Test

The study also utilised the Augmented Dicky-Fuller (ADF) tests to determine the stationarity of the variables. Dickey and Fuller (1979) shows that if the calculate-ratio of the coefficient is less than critical value from Fuller table, then it is said to be stationary. The null hypothesis of the unit root is rejected at either, 1%, 5% or 10% levels.

Lag length selection criteria

At the lag selection step, the number of lags for each variable was determined to identify the causal link between WUI, SR, UR, EG and TO. There are three selection criteria used for determining the optimal lag length: Moment Akaike information criterion (MAIC), Moment selection Bayesian information criterion (MBIC), and Moment selection Hannan and Quinn information criterion (MQIC). The Vector Autoregressive (VAR) model is used for the Granger causality test. The Vector Autoregressive Selection of Order Criteria (VARSOC) command in STATA is then used to determine the optimal lag length for the VAR model. The minimum value of any of these criteria is used for the selection of the optimal lag length. The MAIC criterion is shown to provide a balanced model fit without overfitting (Ng and Perron, 2001). Therefore, to determine the optimal lag length for this study, the selection was based on the MAIC.

Granger causality test

The Granger Causality Test is conducted to determine the causal relationships among WUI and the socio-economic variables. The hypothesis considered for testing whether X Granger causes variable Y is as follows:

H0: Past values of WUI do not help predict Socio-economic Variables. This means the coefficients of the lagged values of WUI in the equation for Socio-economic Variables are zero.

H1: Past values of WUI help predict socioeconomic variables. This means the coefficients of the lagged values of WUI in the equation for Socio-economic Variables are not zero.

H2: Past values of socioeconomic variables do not help predict WUI. This means the coefficients of the lagged values of socioeconomic variables in the equation for WUI are zero.

H3: Past values of socioeconomic variables help predict WUI. This means the coefficients of the lagged values of socioeconomic variables in the equation for WUI are not zero.

The Granger Causality test is highly favoured by researchers due to its ability to explore the bidirectional causal effects between the variables. Prior to conducting the Granger causality results the logarithmic differences of the dataset for each country were generated, so that the data could be measured from a common scale. After the Granger causality test has been completed subsequently the stability of the model is tested to ensure reliability. To test for robustness of the model alternative lags were utilises with a lag added and reduced from the optimal lag specification to identify variations in empirical results.

Stability graphs

By utilising the stability graphs, it is possible to assess and visualise the stability of the model coefficients across the different samples, the primary aim is to determine whether the model’s parameters are consistent over time (Abrigo and Love, 2016). This is conducted after the Granger causality test has been completed, stability in the VAR model is verified by ensuring that all eigenvalues of the coefficient matrix remain within the unit (Lütkepohl, 2006). However, there were instances where the eigen value exceeded the circle, therefore, to make the eigenvalues lie inside the unit circle, a maximum of two differences were used ensuring stability of the results.

Cointegration tests

The cointegration test determines the relationship between two or more non-stationary variables that may individually show trends over time that might have a stable, long-run relationship with each other. The Cointegration analysis has been utilised in similar research contexts. Some key advantages of cointegration are the availability of Error Correction Models (ECM). The Westerlund test allows for the presence of structural breaks, thus accounting for external factors, namely economic crises or technological advancements. VECM rank test determines the number of cointegrating relationships that exist between a set of variables in a multivariate time series model, further giving insights into the cointegrating relationship among WUI & SR, UR, EG, TO.

The dynamics between economic uncertainty and socio-economic variables, particularly explored in Durkheim’s social integrations theory, real options theory, job search theory, Keynesian Economic theory, could be accurately tested using these methodologies to identify supporting or contrasting findings to these theories. While the study utilised these methodologies, the study also used MapChart, Jupyter Notebook and Excel for charting illustrations. The statistical analysis was conducted through STATA software. The next section carries out the empirical analysis, showing how the findings complement or contrast with existing literature whilst integrating discussion perspectives.

Results

In this section, the empirical results and a discussion of the study are presented. Figure 4 showcases the violin plots for the variables in which the countries with the highest uncertainty are used for illustration. The plots showcase significant similarity among the variables, with a notable number of countries at the bottom of the plots.

As shown in Fig. 4, it is possible to observe the WUI seems to be concentrated around the lower values, with a long tail extending towards higher uncertainty levels. Furthermore, as shown in the Appendix S3 a descriptive summary of the data is reported, where Chile has the highest economic uncertainty. Furthermore, based on the WUI plot, most countries have low to moderate levels of WUI, whereas few countries have much higher uncertainty. In addition, suicide rates show more concentrated values around the lower end, and a few countries have very high suicide rates. Moreover, this distribution is narrower than the other indicators, implying that there is less variation among the countries. When considering unemployment rates, most of the data is focused on lower unemployment percentages. However, the distribution is more comprehensive, thus implying that countries have a much better variation across countries. Furthermore, the economic growth plot shows that while most countries have minimal economic growth, however, there is an exponential difference within the spectrum. Also, when considering trade openness, there is a variance in trade reliance among the countries.

Figure 5 shows the levels of uncertainty among 135 countries. Moreover, 15 countries with highest economic uncertainty, have been highlighted, which gives a general understanding of which regions are highly affected by uncertainties.

Source: Authors’ illustrations based on data from Ahir et al. (2022) using https://www.mapchart.net/.

Granger causality results

Prior to conducting the Granger causality analysis, the prerequisites of stationarity and stability were assessed, with the ADF test applied to verify the stationarity of the variables (WUI, SR, UR, EG, TO). All variables were stationary, with the use of maximum of two difference, these results are presented in Appendix S4. Subsequently, through the lag length selection criterion MAIC, each variable-country pair utilised different lags, these results are presented in the Appendix S5.

The country-wise Granger causality results between WUI and socio-economic variables are presented in Table 2, with a detailed view of the values presented in Appendix S6. Based on the results Chile, Colombia, El Salvador, South Africa, Zimbabwe, Nepal, Mexico, Lebanon, FYR Macedonia, Sudan show a unidirectional and Peru, Kenya, Haiti, Finland, Kazakhstan show a bidirectional relationship between WUI and SR. Whereas Colombia, Switzerland, Ireland, El Salvador, South Africa, Guinea, Kenya, Nepal, Mexico, Belgium, Portugal, Tunisia, Bulgaria, FYR Macedonia, Kyrgyz Republic, Spain, Sudan show a unidirectional and Latvia show a bidirectional relationship between WUI and UR. According to the analysis WUI & EG cause each other in Kenya, Mexico and Latvia, whereas there is a unidirectional causal linkage in Chile, Peru, Brazil, Ireland, Zimbabwe, Haiti, Finland, FYR Macedonia, Kazakhstan, and Uganda. The country-wise Granger results for WUI and TO reveal that Brazil, Guinea, Nepal, China, Mexico, FYR Macedonia, Kazakhstan, Spain show a unidirectional relationship, whereas Portugal and Kyrgyz Republic show a bidirectional relationship.

Furthermore, a robustness check was conducted using an addition and a subtraction of lag lengths to validate the results, these results are present in Appendix S7. Subsequently, the Granger causality analysis was conducted using these lag lengths as presented in Appendix S8. The lag length criteria result for the reduced lag are present in Table 3 are consistent with 41 out of 56 the relationship pair being found even when a lag is reduced suggesting the presence of short-term dynamics between economic uncertainty and the socio-economic variables.

Subsequently a lag was added to test for robustness in the empirical results, which revealed key new findings as shown in Table 4, where certain relationships pairs did not exist previously have emerged, suggesting the existence of feedback loops and lagged responses as is the case in the real world, where certain events typically have a delayed effect. This emergence of new relationships, coupled with the upgrading of unidirectional relationships to bidirectional ones indicates the model’s sensitivity to lag specifications.

The tests largely confirm the existing relationships whereas also revealing that based on the model specifications the relationships weaken or strengthen. After the Granger causality analysis, the stability was tested using the Roots of the Companion Matrix diagrams, presented in Appendix S9, and confirmed that the stability condition was satisfied with all eigenvalues lying within the unit circle.

Cointegration results

When considering the Westerlund Cointegration results in Table 5, all the four tests reject the null hypothesis across the tests variable pairs, this suggests strong evidence of cointegration and long-run equilibrium relationships among the variables. With further details regarding the cointegration tests conducted presented in Appendix S10.

WUI and SR show a significant cointegration relationship with changes in WUI associated with SR over time, however this variable pair shows the weakest yet statistically significant relationship among the pairs. WUI and UR are also cointegrated, suggesting a long run equilibrium where unemployment may drive uncertainty trends or vice versa. The relationship between WUI and EG is the strongest with the largest test statistics and the high Z-values highlighting its significance. Where the increase in uncertainty is tied to economic deterioration. WUI and TO are also cointegrated, thus implying a long-run relationship, suggesting that uncertainty may affect trade or increases in trade can mitigate the effects of uncertainty.

The relationship among WUI and the socio-economic variables reveals most of the countries showing significant cointegration in countries from Latin America, Africa, Europe, and Asia suggesting the global presence of these relationships, these relationships are further explored in Table 6, which reveals unique findings, that are aligning or in direct opposition to the discussions of contemporary literature. It is also notable that Italy does not have any cointegrating or causal relationship.

The data utilised in this study may significantly influence these results, with the use of varying sample sizes and data frames there might be influences on the final Granger and Cointegration results. Additionally, assumptions to the lag lengths also might directly influence these factors. Thereby, the nature and strength of the causal and cointegrating relationships may vary according to their sensitivities.

Discussion

This section explores the empirical findings comparing it to contemporary literature and providing insights to each variable relationship.

Relationship among economic uncertainty and suicide rates

Chile, South Africa, Mexico, Lebanon, FYR Macedonia, Sudan show unidirectional causality between WUI and SR. As often discussed in contemporary literature this relationship is evident in these countries (Er et al. 2023). Compared to the existing literature Colombia, El Salvador, Zimbabwe, Nepal show a causal relationship between SR and WUI, which is not often explored, rising suicide rates can act as a visible indicator of distress in the society, signalling there is underlying economic and social instability. When considering these countries, a noticeable increase in suicides might lead to perceiving greater uncertainty about the future. Peru, Kenya, Haiti, Finland and Kazakhstan show a bidirectional relationship indicating a feedback loop where rising uncertainty may increase suicide rates and rising suicide rates may in turn contribute to greater uncertainty. While in contemporary literature a direct association might not be present, the relationship between suicide rates and uncertainty is explored using economic growth as a mediator. Additionally, when suicide rates increase, there is a reduction in economic activity, whereas an increase in economic development leads to a decrease of suicide rates (Zhang et al. 2010). This association is often not explored and suggests when economic uncertainty increases there is the formation of social support nets and increase in resilience which might in turn reduce suicide rates in the subsequent years.

When considering the cointegrating relationship among WUI and SR, most of the countries show strong cointegration among the variables. Contemporary literature suggests that economic crises typically create risk factors for mental health issues, increasing suicide rates, thereby common hypothesis is that as uncertainty increases SRs would also increase, leading to a positive cointegration. This hypothesis is supported by countries like China, Haiti, and Mexico, where a positive cointegration is present. However, the majority of the cointegrations are negative, indicating that as SR increases, WUI tends to decrease. A possible explanation for this is that having strong cultural or social support systems might mitigate the impact of uncertainty on mental health (Gopalkrishnan, 2018), it is also notable that in regions accustomed to chronic uncertainty, the effects of uncertainty might not as prominent, which lead to lower suicide rates despite uncertainty.

Relationship among economic uncertainty and unemployment rates

When considering the relationship between WUI and UR, there is a prominent unidirectional relationship in countries like Switzerland, South Africa, Guinea, Mexico, Belgium, Portugal, Tunisia, FYR Macedonia, Kyrgyz Republic, Spain where uncertainty causes unemployment rates confirming existing the existing hypothesis. However, in contrast to contemporary literature, there is also evidence of unemployment causing uncertainty in Colombia, Ireland, El Salvador, Kenya, Nepal, Sudan, and Bulgaria which shows the highest statistics. Economies with higher unemployment rates have shown decreased economic growth, particularly in studies done around the Balkans and Sub-Sharan Africa (Zivanomoyo and Mukoka, 2015; Kukaj, 2018; Agbor, 2024). In context of the bidirectional relationship between uncertainty and unemployment in Latvia, higher levels of uncertainty have been identified as a catalyst of unemployment. Subsequently, increased unemployment would in turn slow economic growth, which would exacerbate uncertainty (Saleem et al. 2018; Cieślik and Turgut, 2024). This creates a bi-directional feedback loop among uncertainty and unemployment.

Typically, higher uncertainty is associated with economic downturns, which increase unemployment rates. For instance, the 2008 financial crisis, an uncertain period led to higher level of unemployment (Kalleberg and TM, 2017). This is supported by results in countries like Chile, Zimbabwe, FYR Macedonia, Latvia, and Uganda where a positive cointegration is present, suggesting higher levels of uncertainty cause higher unemployment. However, the results also suggest a counterintuitive narrative, where many of the countries show a negative cointegration, where higher uncertainty leads to lower levels of unemployment. This negative association is present in regions of Latin America and Africa, where there is a much higher emphasis on informal economies. The cointegrating relationships reveals uncertainty decreases unemployment rates in the long run, suggesting that uncertainty prompts adaptive economic responses, particularly increased hiring or greater willingness among workers to accept jobs during uncertain times.

Relationship among economic uncertainty and economic growth

A country’s economic growth signifies its living standards, employment opportunities and the nation’s income. However, these nations are subject to uncertainties which break down consumer-business confidence, hindering investments, and deteriorating economic activity, this is the case in Peru, Finland, Kazakhstan and Uganda (Gu et al. 2021; J. Li and Huang, 2021). In the contrary, the results for Chile, Brazil, Ireland, Zimbabwe, Haiti, FYR Macedonia show that economic growth can affect uncertainty in these countries. As the growth of a nation is stable, the businesses and consumers feel more confident in the future, leading to more investment and spending, reducing any domestic uncertainties. The bi-directional relationship is more pronounced in Kenya, Mexico and Libya, where economic uncertainty is seen as a hindrance for growth, while economic growth in nations is a catalyst that serves in reducing uncertainties. Nations with high uncertainty could implement policies that ease doing business, reduction in the tax rate, stabilisation of exchange rate and political environments, which are key components for economic growth (Mmeri et al. 2023). The observed causal relationship from uncertainty to economic growth aligns with the previous research, which has established uncertainty to be a driver of economic stagnation.

The relationship among WUI and EG reveals that a majority show negative cointegration, particularly in Chile, Colombia, Tunisia, Kyrgyzstan, and Uganda. This suggests that as WUI increases, EG tends to decrease, aligning with the expectation that uncertainty interferes with economic growth. However, in contrast to this, several countries show positive cointegration, including Switzerland, Kenya, Nepal, Mali, China, Haiti, Mexico, Spain, and Sudan. This indicates that higher WUI correlates with higher EG, which is unusual even based on a general theoretical standpoint. A possible explanation for this could be that high uncertainty might spur innovation or structural reforms that boost growth if uncertainty persists for a longer period.

Relationship among economic uncertainty and trade openness

Trade interconnects the globe allowing nations to exchange good and services and allows for accessibility and efficiency. However, trade also allows for uncertainty to seep through it, and make it spread much faster due to global connectivity, which creates an uncertain environment (Yayi, 2024). The results show that countries like China, Mexico and Spain reflect this sentiment. Contradicting this Brazil, Guinea, Nepal, Macedonia and Kazakhstan show an effect of trade on uncertainty, suggesting that expanding trade and increasing globalisation could in turn, reduce uncertainty. The two-way directional effects of WUI and TO discovered in Portugal and Kyrgyz Republic would allow prediction that that in events of uncertainty trade contracts and vice versa. However, among the variable pairs examined, the least association is present in the WUI-TO pair, suggesting that while uncertainty and trade could predict each other, their effects might be prominent on a global scale.

The relationship between WUI and TO is a negative one with countries including Switzerland, Ireland, South Africa, Zimbabwe, Mali, China, Haiti, Lebanon, Finland, Portugal, Tunisia, Kyrgyzstan, and Spain showing this negative cointegration. This suggests implying that higher uncertainty reduces trade openness in these countries. The presence of a negative cointegration relationship aligns with economic theory explored in the theoretical framework with uncertainty disrupting trade due to its interconnectedness in the global economy. However, there is a dilemma concerning Peru, Uganda, and Sudan, which is the existence of a positive relationship among uncertainty and trade, which is not often seen in contemporary literature. An explanation for this would be that Uganda and Sudan might be actively seeking out trade opportunities thus increasing their resilience and Peru’s resilience on commodity exports, where uncertainty drives trade stabilizing revenues.

Conclusion

In a rapidly advancing global landscape, uncertainties surrounding nations highlight the need to understand key factors that might influence these economies. This study provides fascinating insights into the causal and cointegrating, bidirectional relationships that exist between economic uncertainty and socioeconomic variables. The Granger Causality test and Cointegrations tests were utilised with data from the World Bank and World Uncertainty Index.

This study identifies that economic uncertainty, and the socio-economic variables indeed have a relationship in line with previous literature, however the study adds to existing literature by providing bidirectional causal relationships, particularly in Kenya, Finland, Portugal, Latvia, Peru, Haiti, Mexico, Kazakhstan and Kyrgyz Republic. The cointegration results also show provide unique findings, firstly, in a majority of countries when economic uncertainty rises suicide rates and unemployment rates decrease in the long run. Also confirming existing findings where uncertainty reduces economic growth and trade openness in the long run.

Nations could benefit from incorporating mental health awareness campaigns and suicide prevention initiatives, enhancing the social resilience within the nation. Additionally, nation in Europe, Sub-Saharan Africa and Latin America needs to promote youth employment by providing education and vocational skills at an early age. Diversification of the economy into more sustainable sectors is needed in developing and least developed nations, particularly by conducting a though analysis of the adverse effects of uncertainties on other sectors. Nations should emphasise on trade openness during uncertainties, by identifying the opportunities for growth, entering into free trade agreements and enacting beneficial trade policies.

In conclusion, a significant causal or cointegrating relationship can be identifies among all countries in this study, except Italy. Thereby, targeted policy interventions could enhance sustainable growth. The policy implications tailored to patterns and trends identified in the analysis is presented in the subsequent sections.

Policy implications

This study explores the causal relationships between economic uncertainty and socioeconomic variables. With the causal and cointegrating findings, this study provides critical country-specific policy implications that are designed in alignment with the UN SDGs.

In Latin-American countries should invest more into to create accessible counselling, and increasing awareness given the prominent relationship between uncertainty and suicide. This contributes to achieving SDG 3: Good Health and Well-being, by reducing premature mortality from non-communicable diseases. In large countries with rural backdrops, access to mental health services can be inconsistent, thus policymakers should ensure that the people have access to proper mental health care. Findings suggest, suicide rates overall are impacted by uncertainty, but an underlying societal issue needs to be addressed. Male suicide rates are often higher compared to female suicide rates, thus targeted policy interventions are needed. For instance, developed countries like the UK and Australia introduced suicide prevention initiatives for men, other nations could take inspiration to come up with initiatives focusing on sub-groups to ensure suicide prevention. The governments should also work towards destigmatising mental health by launching proper campaigns and avoiding sensationalising suicide reports as per the World Health Organisation Guidelines (WHO). This ensures that even during uncertainties, the population would have strong resilience and confidence in the systems in place.

Developed countries, particularly in Europe, and developing countries in African and Latin American regions should invest in promoting education and training programs aimed at increasing the available labour force given that they have a high association of uncertainty on unemployment. There should be efforts focusing on increasing human capital while also providing suitable vocational training ensuring social integration to reduce uncertainty in line with SDG 4: Quality Education and SDG 10: Reduced Inequalities. Our study explores how in contemporary literature, the youth unemployment is high in the countries examined, hence it recommended to implement policies that encourage hiring young workers and marginalized groups, particularly women. Aligning with Target 8.6: Reducing Youth Unemployment.

In terms of sustainable economic growth, the countries in the Latin American and Sub Sharan African countries should promote sustainable production to ensure continued economic growth and diversification into varying economies to mitigate effects of uncertainty. Additionally, these countries can allocate part of their yearly budget to Research and Development of new technologies, allowing for sustainable growth. Such initiatives contribute to achieving aligning with SDG 8: Decent Work and Economic Growth and SDG 9: Industry, Innovation, and Infrastructure. Moreover, expanding access to quality education to build a skilled workforce that is inclusive in nature allows to achieve SDG 4: Quality Education and SDG 10: Reduced Inequalities.

For Guinea, FYR Macedonia, Brazil, Nepal, Kazakhstan, enhancing trade openness can mitigate uncertainty as indicated by their unidirectional relationships found in the empirical results. Least Developed Countries (LDCs) particularly, Guinea and Nepal can benefit from Aid for trade support agreements that help create jobs and increase exports, however these nations must first invest in trade infrastructure involve significant initial costs but would bring substantial long term economic benefits. Policies aimed at increasing exports from these developing nations and promoting free trade agreements will help mitigate uncertainty and boost economic activity aligning with UN SDG 17: Partnerships for the Goals.

Limitations of the study and prospects for future research

The study’s scope was limited to a scope of 23 years due to data availability constraints. While the World Uncertainty Index remain a useful tool for identifying global uncertainty, there are certain limitation, its use of the word ‘uncertainty’ and its variants might not incorporate varied expressions of uncertainty. Furthermore, the use of uncertainty as an exogenous variable, might not fully capture the dynamics between economic uncertainty and the socio-economic variables, also affecting the feedback loops and lagged effects when utilising alternative lag lengths.

The Granger causality test utilised in this study also has its limitations, as it cannot be applied to non-stationary data, and it identifies temporal relationships and does not account for all possible underlying variables. Furthermore, the causality tests reveal only a causal effect, however that might not be the case in real world scenarios. Thereby, factors not included in the model could also affect the findings. The Cointegration tests also contain certain limitations, for instance cointegration might be present due to common trends or other factors, even when no meaningful relationship exists.

A potential extension of this research could be utilising economic uncertainty as an exogenous variable in causality frameworks (VECM with exogenous terms). Additionally, including additional socio-economic variables like poverty rates and inflation rates could expand the base of the literature. Additionally, in a cross-country setting Granger causality assumes linearity, which may not fully capture the non-linear dynamics among the variables.

Data availability

All data generated or analysed during this study are included in this published article and its supplementary information files.

References

Abaidoo R (2019) Policy uncertainty and dynamics of international trade. J Financ Econ Policy 11(1):101–120. https://doi.org/10.1108/JFEP-02-2018-0034

Abdou R, Cassells D, Berrill J, Hanly J (2022) Revisiting the relationship between economic uncertainty and suicide: An alternative approach. Soc Sci Med 306(1):1–9. https://doi.org/10.1016/j.socscimed.2022.115095

Abrigo MRM, Love I (2016) Estimation of Panel Vector Autoregression in Stata. Stata J 16(3):778–804. https://doi.org/10.1177/1536867x1601600314

Adedoyin FF, Afolabi JO, Yalçiner K, Bekun FV (2022) The export-led growth in Malaysia: Does economic policy uncertainty and geopolitical risks matter? J Public Aff 22(1):1–12. https://doi.org/10.1002/pa.2361

Agbor EB (2024) The impact of unemployment on economic growth in Sub-Saharan Africa. 83, 1-11. https://doi.org/10.7176/JAAS/83-04

Ahir H, Bloom N, Furcer D (2022) The World Uncertainty Index. Retrieved from https://worlduncertaintyindex.com/data/

Ahir H, Bloom N, Furceri D (2023) Global Economic Uncertainty Remains Elevated, Weighing on Growth. Retrieved from https://www.imf.org/en/Blogs/Articles/2023/01/26/global-economic-uncertainty-remains-elevated-weighing-on-growth

Ahmed A, Granberg M, Troster V, Uddin GS (2022) Asymmetric dynamics between uncertainty and unemployment flows in the United States. Stud Nonlinear Dyn Econ 26(1):155–172. https://doi.org/10.1515/snde-2019-0058

Amarasekara C, Iyke BN, Narayan PK (2022) The role of R&D and economic policy uncertainty in Sri Lanka’s economic growth. Financial Innov 8(1):1–16. https://doi.org/10.1186/s40854-021-00322-5

Antonakakis N, Gupta R (2017) Is Economic Policy Uncertainty Related to Suicide Rates? Evidence from the United States. Soc Indic Res 133:1–25. https://doi.org/10.1007/s11205-016-1384-4

Anwar A, Mifrahi MN, Ahmad Kusairee MABZ (2024) International trade and economic growth in ASEAN. J Kebijak Ekon dan Keuang 3(1):109–115. https://doi.org/10.20885/JKEK.vol3.iss1.art14

Babatunde MA, Adefabi RA (2005) Long Run Relationship between Education and Economic Growth in Nigeria: Evidence from the Johansen’s Cointegration Approach. Paper presented at the Regional Conference on Education in West Africa: Constraints and Opportunities, Dakar, Senegal

Bachmann R, Elstner S, Sims ER (2013) Uncertainty and Economic Activity: Evidence from Business Survey Data. Am Econ J: Macroecon 5(2):217–249. https://doi.org/10.1257/mac.5.2.217

Bannigidadmath D, Ridhwan MHA, Indawan F (2024) Global Uncertainty and Economic Growth – Evidence from Pandemic Periods. Emerg Mark Financ Trade 60(2):345–357. https://doi.org/10.1080/1540496X.2023.2213377

Barbero J, de Lucio JJ, Rodríguez-Crespo E (2021) Effects of COVID-19 on trade flows: Measuring their impact through government policy responses. PLoS ONE 16(10):1–20. https://doi.org/10.1371/journal.pone.0258356

Bernanke BS (1983) Irreversibility, Uncertainty, and Cyclical Investment. Q J Econ 98(1):85–106. https://doi.org/10.2307/1885568

Bloom N (2009) The Impact of Uncertainty Shocks. Econometrica 77(3):623–685. https://doi.org/10.3982/ECTA6248

Brådvik L (2018) Suicide Risk and Mental Disorders. Int J Environ Res Public Health, 15(9). https://doi.org/10.3390/ijerph15092028

Bridge JA, Ruch DA, Sheftall AH, Hahm HC, O’Keefe VM, Fontanella CA,… Horowitz LM (2023) Youth Suicide Rates Increased During the COVID-19 Pandemic. Pediatrics, 151(3). https://doi.org/10.1542/peds.2022-058375

Caggiano G, Castelnuovo E, Figueres JM (2017) Economic policy uncertainty and unemployment in the United States: A nonlinear approach. Econ Lett 151:31–34. https://doi.org/10.1016/j.econlet.2016.12.002

Caggiano G, Castelnuovo E, Groshenny N (2014) Uncertainty shocks and unemployment dynamics in U.S. recessions. J Monet Econ 67:78–92. https://doi.org/10.1016/j.jmoneco.2014.07.006

Cepni O, Guney IE, Swanson NR (2020) Forecasting and nowcasting emerging market GDP growth rates: The role of latent global economic policy uncertainty and macroeconomic data surprise factors. J Forecast 39(1):18–36. https://doi.org/10.1002/for.2602

Choi S, Loungani P (2015) Uncertainty and unemployment: The effects of aggregate and sectoral channels. J Macroecon 46:344–358. https://doi.org/10.1016/j.jmacro.2015.10.007

Chontanawat J (2020) Relationship between energy consumption, CO2 emission and economic growth in ASEAN: Cointegration and causality model. Energy Rep. 6(1):660–665. https://doi.org/10.1016/j.egyr.2019.09.046

Cieślik A, Turgut MB (2024) Uncertainty and long-run economy: the role of R &D and business dynamism. Empir Econ 66(4):1403–1441. https://doi.org/10.1007/s00181-023-02501-y

Claveria O (2022a) Global economic uncertainty and suicide: Worldwide evidence. Soc Sci Med 305:1–9. https://doi.org/10.1016/j.socscimed.2022.115041

Claveria O (2022b) Modelling The Dynamic Interaction Between Economic Uncertainty, Growth, Unemployment And Suicide. 1-24 https://doi.org/10.2139/ssrn.4148762

Coase RH (1937) The Nature of the Firm. Economica 4(16):386–405. https://doi.org/10.2307/2626876

Dajčman S, Kavkler A, Levenko N, Romih D (2023) Spillover effects of economic policy uncertainty on adult and youth unemployment. Rev Economic Perspect 23:47–70. https://doi.org/10.2478/revecp-2023-0001

de Bruin A, Agyemang A, Chowdhury MIH (2020) New insights on suicide: uncertainty and political conditions. Appl Econ Lett 27(17):1424–1429. https://doi.org/10.1080/13504851.2019.1686453

Dickey DA, Fuller WA (1979) Distribution of the Estimators for Autoregressive Time Series With a Unit Root. J Am Stat Assoc 74(366):427–431. https://doi.org/10.2307/2286348

Difrancesco S, van Baardewijk JU, Cornelissen AS, Varon C, Hendriks RC, Brouwer AM (2023) Exploring the use of Granger causality for the identification of chemical exposure based on physiological data. Front Netw Physiol 3:1106650. https://doi.org/10.3389/fnetp.2023.1106650

Dogah KE (2021) Effect of trade and economic policy uncertainties on regional systemic risk: Evidence from ASEAN. Econ Model 104:1–12. https://doi.org/10.1016/j.econmod.2021.105625

Duan J, Yan Y, Bofu Z, Zhao J (2008) Analysis of the relationship between urbanisation and energy consumption in China. Int J Sustain Dev World Ecol 15(4):309–317. https://doi.org/10.3843/SusDev.15.4:4a

Dumitrescu E-I, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Durkheim E (1897) Suicide: A Study in Sociology. 1-482. https://gallica.bnf.fr/ark:/12148/bpt6k6128145d/f14.item

Ekeocha DO, Ogbuabor JE, Ogbonna OE, Orji A (2023) Economic policy uncertainty, governance institutions and economic performance in Africa: are there regional differences? Econ Change Restruct 56(3):1367–1431. https://doi.org/10.1007/s10644-022-09472-7

Er ST, Demir E, Sari E (2023) Suicide and economic uncertainty: New findings in a global setting. SSM - Popul Health 22:1–7. https://doi.org/10.1016/j.ssmph.2023.101387

Fan H, Nie G, Xu Z (2023) Market uncertainty and international trade. Rev Econ Dyn 51:450–478. https://doi.org/10.1016/j.red.2023.05.001

Fernández-Villaverde J, Guerrón-Quintana P, Kuester K, Rubio-Ramírez J (2015) Fiscal Volatility Shocks and Economic Activity. Am Econ Rev 105(11):3352–3384. https://doi.org/10.1257/aer.20121236

Fernández L, Antonio R (2021) Spillovers of US Uncertainty Shocks to Nicaragua. 01-38. https://doi.org/10.7764/tesisUC/ECO/61946

Gagnon JE, Kamin SB, Kearns J (2023) The impact of the COVID-19 pandemic on global GDP growth. J Jpn Int Econ 68:1–12. https://doi.org/10.1016/j.jjie.2023.101258

Ghosh S (2022) Geopolitical risk, economic growth, economic uncertainty and international inbound tourism: an Indian Illustration. Rev Econ Political Sci 7(1):2–21. https://doi.org/10.1108/REPS-07-2020-0081

Gomado KM (2025) Impact of uncertainty on economic growth: The role of pro-market institutions in developing countries. Kyklos 78(1):3–44. https://doi.org/10.1111/kykl.12408

Gómez M, Cándano L (2024) Economic growth, tourism, and economic policy uncertainty in the main tourist destinations (1998–2018). EconoQuantum, 21. https://doi.org/10.18381/eq.v21i1.7315

Gopalkrishnan N (2018) Cultural diversity and mental health: considerations for policy and practice. Front Public Health 6:1–7. https://doi.org/10.3389/fpubh.2018.00179

Gopinath G (2020) The Great Lockdown: Worst Economic Downturn Since the Great Depression. Retrieved from https://www.imf.org/en/Blogs/Articles/2020/04/14/blog-weo-the-great-lockdown-worst-economic-downturn-since-the-great-depression

Goto H, Kawachi I, Vandoros S (2024) The association between economic uncertainty and suicide in Japan by age, sex, employment status, and population density: an observational study. Lancet Reg Health – West Pac 46:1–10. https://doi.org/10.1016/j.lanwpc.2024.101069

Gourincha P-O (2024) Global Economy Remains Resilient Despite Uneven Growth, Challenges Ahead. Retrieved from https://www.imf.org/en/Blogs/Articles/2024/04/16/global-economy-remains-resilient-despite-uneven-growth-challenges-ahead

Gozgor G, Lau CK (2021) Editorial: Economic Effects of COVID-19 Related Uncertainty Shocks. Front Public Health 9:1–2. https://doi.org/10.3389/fpubh.2021.760619

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424–438. https://doi.org/10.2307/1912791

Gu X, Cheng X, Zhu Z, Deng X (2021) Economic policy uncertainty and China’s growth-at-risk. Econ Anal Policy 70:452–467. https://doi.org/10.1016/j.eap.2021.03.006

Gupta P (2023) A Review of correlation among the Economic Growth, Economic Unceratinty and Sustainable Development in India. Int J Adv Res 11:1068–1072. https://doi.org/10.21474/IJAR01/16535

Haldar A, Sethi N (2022) The Economic effects of COVID-19 Mitigation Policies on Unemployment and Economic Policy Uncertainty. Buletin Ekonomi Moneter dan Perbankan, 15 th BMEB Call for Papers Special Issue, 61-84. https://doi.org/10.21098/bemp.v25i0.1833

Handley K (2014) Exporting under trade policy uncertainty: Theory and evidence. J Int Econ 94(1):50–66. https://doi.org/10.1016/j.jinteco.2014.05.005

Iheoma CG (2022) Effect of economic uncertainty on public health expenditure in Economic Community of West African States: Implications for sustainable healthcare financing. Health Sci Rep. 5(4):e678. https://doi.org/10.1002/hsr2.678

Jayawardhana T, Anuththara S, Nimnadi T, Karadanaarachchi R, Jayathilaka R, Galappaththi K (2023) Asian ageing: The relationship between the elderly population and economic growth in the Asian context. PLoS ONE 18(4):e0284895. https://doi.org/10.1371/journal.pone.0284895

Jayawardhana T, Jayathilaka R, Nimnadi T, Anuththara S, Karadanaarachchi R, Galappaththi K, Dharmasena T (2023) The cost of aging: Economic growth perspectives for Europe. PLoS ONE 18(6):e0287207. https://doi.org/10.1371/journal.pone.0287207

Jory SR, Khieu HD, Ngo TN, Phan HV (2020) The influence of economic policy uncertainty on corporate trade credit and firm value. J Corp Financ 64:1–55. https://doi.org/10.1016/j.jcorpfin.2020.101671

Jumbe CBL (2004) Cointegration and causality between electricity consumption and GDP: empirical evidence from Malawi. Energy Econ 26(1):61–68. https://doi.org/10.1016/S0140-9883(03)00058-6

Juodis A, Karavias Y, Sarafidis V (2021) A homogeneous approach to testing for Granger non-causality in heterogeneous panels. 60, 93-112. https://doi.org/10.1007/s00181-020-01970-9

Kahneman D, Tversky A (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica 47(2):263–291. https://doi.org/10.2307/1914185

Kalleberg AL, TM VONW (2017) The U.S. Labor Market During and After the Great Recession: Continuities and Transformations. Rsf 3(3):1–19. https://doi.org/10.7758/rsf.2017.3.3.01

Karasoy A (2024) The Drivers of Suicides in Turkey: An Econometric Approach. OMEGA - J Death Dying, 1-19. https://doi.org/10.1177/00302228241232731

Kasal S, Tosunoglu SJPEP (2022) Effects of Fiscal Policy Uncertainty on Turkish Economy. Prague Econ 31(6):538–566. https://doi.org/10.18267/j.pep.811

Ketenci N (2010) Cointegration analysis of tourism demand for Turkey. 10(1), 1-25. https://www.usc.es/economet/journals1/aeid/aeid1016.pdf

Keynes JM (1936) The General Theory of Employment, Interest and Money. In (pp. 1-190). Retrieved from https://www.files.ethz.ch/isn/125515/1366_KeynesTheoryofEmployment.pdf

Khan MK, Khan MI, Rehan M (2020) The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ Innov 6(1):1. https://doi.org/10.1186/s40854-019-0162-0

Khan ST, Bhat MA, Saeed W (2023) Financial Strain, Covid-19 Anxiety and Suicidal Ideation Among Wage Workers During the Pandemic Crisis 2019. Vikalpa 48(4):269–282. https://doi.org/10.1177/02560909231208545

Kim AM (2022) The impact of the COVID-19 pandemic on suicides: A population study. Psychiatry Res 314:114663. https://doi.org/10.1016/j.psychres.2022.114663

Kim W (2019) Government spending policy uncertainty and economic activity: US time series evidence. J Macroecon 61:103124. https://doi.org/10.1016/j.jmacro.2019.103124

Kirchner S (2019) State of Confusion: Economic Policy Uncertainty and International Trade and Investment. Aust Econ Rev 52(2):178–199. https://doi.org/10.1111/1467-8462.12319

Kostaridou E, Siatis N, Zafeiriou E (2024) Resource Price Interconnections and the Impact of Geopolitical Shocks Using Granger Causality: A Case Study of Ukraine–Russia Unrest. J Risk Financ Manag 17(6):240. https://doi.org/10.3390/jrfm17060240

Kukaj D (2018) Impact of Unemployment on Economic Growth: Evidence from Western Balkans. Eur J Mark Econ 1(1):1–9. https://doi.org/10.26417/ejme.v1i1.p10-18

Kumar V, Bharti B, Singh HP, Topno AR (2023) Assessing the interrelation between NDVI and climate dependent variables by using granger causality test and vector auto-regressive neural network model. Phys Chem Earth, Parts A/B/C 131:103428. https://doi.org/10.1016/j.pce.2023.103428

Lee E-w, Nam JY (2023) Is a change in economic status associated with anxiety, depression and suicide ideation during the COVID-19 pandemic in South Korean adults? J Public Health 45(4):870–877. https://doi.org/10.1093/pubmed/fdad142

Lensink R (2001) Financial Development, Uncertainty and Economic Growth. De Econ 149(3):299–312. https://doi.org/10.1023/A:1011903008017

Lensink R, Bo H, Sterken E (1999) Does uncertainty affect economic growth? An empirical analysis. Weltwirtschaftliches Arch 135(3):379–396. https://doi.org/10.1007/BF02707331

Lepori GM, Morgan S, Assarian BA, Mishra T (2024) Economic activity and suicides: Causal evidence from macroeconomic shocks in England and Wales. Soc Sci Med 342:1–9. https://doi.org/10.1016/j.socscimed.2023.116538

Li J, Huang S (2021) The dynamic relationship between economic policy uncertainty and substantial economic growth in China. Mar Econ Manag 4(2):113–134. https://doi.org/10.1108/MAEM-04-2021-0003

Li T, Barwick PJ, Deng Y, Huang X, Li S (2023) The COVID-19 pandemic and unemployment: Evidence from mobile phone data from China. J Urban Econ 135:103543. https://doi.org/10.1016/j.jue.2023.103543

Liu H, Liu Y, Wang Y (2020) Exploring the influence of economic policy uncertainty on the relationship between tourism and economic growth with an MF-VAR model. Tour Econ 27(5):1081–1100. https://doi.org/10.1177/1354816620921298

Lütkepohl H (2006) Structural vector autoregressive analysis for cointegrated variables. Allgemeines Statistisches Arch 90(1):75–88. https://doi.org/10.1007/s10182-006-0222-4

Matzner A, Meyer B, Oberhofer H (2023) Trade in times of uncertainty. World Econ 46(9):2564–2597. https://doi.org/10.1111/twec.13463

Mmeri A, Ongeri B, Ndolo D (2023) Effects of Uncertainity on Domestic Private Investments in Kenya. Eur Sci J ESJ 2:248–274. https://doi.org/10.19044/esipreprint.2.2023.p248

Myers SC (1977) Determinants of corporate borrowing. J Financ Econ 5(2):147–175. https://doi.org/10.1016/0304-405X(77)90015-0

Nana I, Tapsoba MSJ, Ouedraogo R (2024) The heterogeneous effects of uncertainty on trade. In Vol. 139. (pp. 1-45). Retrieved from https://scholar.google.com/scholar?q=the+heterogeneous+effects+of+uncertainty+on+trade&hl=en&as_sdt=0&as_vis=1&oi=scholart

Ng S, Perron P (2001) Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 69(6):1519–1554. https://doi.org/10.1111/1468-0262.00256

Njindan Iyke B (2020) Economic Policy Uncertainty in Times of COVID-19 Pandemic. Asian Econ Lett 1(2):1–5. https://doi.org/10.46557/001c.17665

Nouhi Siahroudi A, Hashemi Nazari SS, Namdari M, Panahi MH, Mahdavi SA, Khademi A (2025) The effect of COVID-19 on completed suicide rate in Iran: an Interrupted Time Series study (ITS). Volume 13. https://doi.org/10.3389/fpubh.2025.1387213

Ogbonna OE, Ogbuabor JE, Manasseh CO, Ekeocha DO (2022) Global uncertainty, economic governance institutions and foreign direct investment inflow in Africa. Econ Change Restruct 55(4):2111–2136. https://doi.org/10.1007/s10644-021-09378-w

Payne JE (2015) The role of economic policy uncertainty in the US entrepreneurship-unemployment nexus. J Entrepren Public Policy 4(3):352–366. https://doi.org/10.1108/JEPP-01-2015-0004

Perera N, Dissanayake H, Samson D, Abeykoon S, Jayathilaka R, Jayasinghe M, Yapa S (2024) The interconnectedness of energy consumption with economic growth: A granger causality analysis. Heliyon 10(17):e36709. https://doi.org/10.1016/j.heliyon.2024.e36709

Phan DHB, Iyke BN, Sharma SS, Affandi Y (2021) Economic policy uncertainty and financial stability–Is there a relation? Econ Model 94:1018–1029. https://doi.org/10.1016/j.econmod.2020.02.042

Qamruzzaman M (2024) Clarifying the nexus between Trade Policy Uncertainty, Economic Policy Uncertainty, FDI and Renewable Energy Demand. Int J Energy Econ Policy 14(2):367–382. https://doi.org/10.32479/ijeep.15470

Rasool H, Maqbool S, Tarique M (2021) The relationship between tourism and economic growth among BRICS countries: a panel cointegration analysis. Future Business Journal, 7. https://doi.org/10.1186/s43093-020-00048-3

Ren X, Fu C, Jin C, Li Y (2024) Dynamic causality between global supply chain pressures and China’s resource industries: A time-varying Granger analysis. Int Rev Financ Anal 95:103377. https://doi.org/10.1016/j.irfa.2024.103377

Ren X, Li J, He F, Lucey B (2023) Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew Sustain Energy Rev 173:113058. https://doi.org/10.1016/j.rser.2022.113058

Romer PM (1986) Increasing Returns and Long-Run Growth. J Political Econ 94(5):1002–1037. https://doi.org/10.1086/261420

Saleem H, Wen J, Khan MB (2018) The impact of economic policy uncertainty on the innovation in China: Empirical evidence from autoregressive distributed lag bounds tests. Cogent Econ Financ 6(1):1–15. https://doi.org/10.1080/23322039.2018.1514929

Schaal E (2017) Uncertainty and Unemployment. Econometrica 85(6):1675–1721. https://doi.org/10.3982/ECTA10557

Shao L, Cao S, Zhang H (2024) The impact of geopolitical risk on strategic emerging minerals prices: Evidence from MODWT-based Granger causality test. Resour Policy 88:104388. https://doi.org/10.1016/j.resourpol.2023.104388

Sorić M, Sorić P, Clavería ÓG (2023) Economic uncertainty and suicide mortality in post-pandemic England. 51. https://doi.org/10.13039/501100011033

Stigler GJ (1962) Information in the Labor Market. J Polit Econ 70(5):94–105. https://doi.org/10.1086/258727

Su C-W, Dai K, Ullah S, Andlibd Z (2021) COVID-19 pandemic and unemployment dynamics in European economies. Econ Res -Ekon Istraživanja 35(1):1753–1764. https://doi.org/10.1080/1331677X.2021.1912627

Sun M, Xie H, Tang Y (2020) Directed Network Defects in Alzheimer’s Disease Using Granger Causality and Graph Theory. Curr Alzheimer Res, 17. https://doi.org/10.2174/1567205017666201215140625

Sun M, Yan S, Cao T, Zhang J (2024) The impact of COVID-19 pandemic on the world’s major economies: based on a multi-country and multi-sector CGE model. Front Public Health 12:1–20. https://doi.org/10.3389/fpubh.2024.1338677

Tam PS (2018) Global trade flows and economic policy uncertainty. Appl Econ 50(34-35):3718–3734. https://doi.org/10.1080/00036846.2018.1436151

Tao H-L, Cheng H-P (2023) Economic policy uncertainty and subjective health: A gender perspective. Soc Sci Med 334:116200. https://doi.org/10.1016/j.socscimed.2023.116200

The World Bank (2022) World Bank Open Data. Retrieved from https://data.worldbank.org/

Tinbergen J (1962) Shaping the World Economy: Suggestions for an International Economic Policy. In (pp. 1-330). Retrieved from https://www.jstor.org/stable/2550637?origin=crossref

Turrisi S, Zappa E, Cigada A (2022) Combined Use of Cointegration Analysis and Robust Outlier Statistics to Improve Damage Detection in Real-World Structures. Sensors 22(6):1–20. https://doi.org/10.3390/s22062177

United Nations (2023) Decent Work and Economic Growth. Retrieved from https://www.un.org/sustainabledevelopment/economic-growth/

Valadkhani A (2003) The causes of unemployment in Iran: an empirical investigation. Retrieved from https://www.semanticscholar.org/paper/The-causes-of-unemployment-in-Iran%3A-an-empirical-Valadkhani/d08061f27cfa12195181ad70c9e6b8314f9a64f3

Vandoros S, Avendano M, Kawachi I (2019) The association between economic uncertainty and suicide in the short-run. Soc Sci Med 220:403–410. https://doi.org/10.1016/j.socscimed.2018.11.035