Abstract

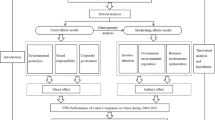

This study applies machine learning methods to develop a comprehensive index of corporate digitalization and investigates its influence on environmental, social, and governance (ESG) outcomes. The results indicate that firms with higher levels of corporate digitalization generally achieve better ESG performance. An in-depth analysis of five core dimensions—artificial intelligence, blockchain, cloud computing, big data, and digital technology application—reveals that four of these factors significantly bolster ESG performance, whereas blockchain does not exhibit a notable effect. Further examination shows that CEO duality dilutes the positive impact of corporate digitalization on ESG outcomes, while government linked corporations strengthen this relationship. Subsample analyses suggest that the negative moderating effect of CEO duality is more pronounced in high-polluting industries, whereas the positive effect of government-linked ownership is mainly driven by minority state-owned enterprises. These findings underscore digitalization as a key enabler of ESG improvement, contingent on internal governance design and external institutional context. The study contributes to emerging research on digital sustainability and offers practical insights for investors and policymakers seeking to align digital and ESG agendas.

Similar content being viewed by others

Introduction

The global economic landscape is undergoing profound changes, driven by increasing demands for sustainable development and advancements in digital technologies (Maqsood et al., 2025; Zada et al., 2025). As traditional growth models—characterized by resource-intensive practices and scale-driven expansion—prove unsustainable, firms face growing pressure to integrate ESG principles into their operations (Annesi et al., 2024; Li et al., 2024; Long et al., 2024). ESG represents a comprehensive framework for sustainable development, emphasizing environmental responsibility, social contributions, and governance effectiveness (Gidage & Bhide, 2024). Unlike conventional corporate social responsibility (CSR), ESG incorporates measurable and strategic dimensions that align corporate objectives with societal and environmental priorities (Khamisu et al., 2024). Globally, ESG has become a critical factor in shaping corporate strategies, driven by growing stakeholder expectations and institutional pressures (Elamer & Boulhaga, 2024; Khaw et al., 2024).

In emerging markets like China, the institutionalization of ESG practices has accelerated, particularly following the 2018 revision of the Code of Corporate Governance for Listed Companies by the China Securities Regulatory Commission, which mandated comprehensive ESG disclosures (Chen et al., 2022). Similar momentum is evident worldwide: the European Union’s Corporate Sustainability Reporting Directive requires standardized ESG disclosures (Hummel & Jobst, 2024); the U.S. Securities and Exchange Commission has proposed climate risk reporting rules (Securities and Exchange Commission, 2022); and Japan’s Stewardship Code promotes ESG-conscious investment (Financial Services Agency of Japan, 2020). These developments underscore that the digitalization–ESG nexus is not only a domestic concern but also a global imperative, making it highly relevant for firms, investors, and policymakers across regions. Despite this momentum, achieving high ESG performance remains challenging, especially in dynamic business environments where external demands intersect with internal organizational constraints.

Corporate digitalization offers transformative tools for addressing sustainability challenges. By integrating technologies such as big data, artificial intelligence, blockchain, and cloud computing into business operations, firms can enhance efficiency, governance transparency, and stakeholder engagement (Cheng et al., 2023; Guo et al., 2023; Pu & Zulkafli, 2024). Blockchain, for instance, improves supply chain traceability, while artificial intelligence facilitates environmental monitoring and predictive analysis (Bibri et al., 2023; Khanchel et al., 2024; Vrana & Singh, 2022). However, the adoption of digitalization is not without barriers. It often requires substantial financial investment (Broccardo et al., 2022), specialized managerial capabilities (Matt et al., 2022), and organizational restructuring (Barker et al., 2022), making it less accessible to resource-constrained firms (Lin & Deng, 2024). Moreover, emerging risks—such as data privacy breaches, algorithmic bias in ESG-related AI models, and the misuse of digital platforms for greenwashing—may further undermine the credibility and effectiveness of digital ESG initiatives (Adebayo & Ackers, 2024; Elamer & Boulhaga, 2024). These concerns underscore the need for strong governance mechanisms and institutional safeguards to ensure that digitalization genuinely supports sustainability objectives rather than serving as a tool for symbolic compliance.

Corporate governance significantly shapes the effectiveness of corporate digitalization, particularly in its ability to drive ESG performance (e.g., Huang et al., 2023; Liu et al., 2024). Among the critical governance factors, CEO duality, where the CEO also serves as the board chairperson, is a subject of ongoing debate in corporate governance literature. While the centralization of authority under CEO duality can streamline decision-making, it often undermines board independence and weakens oversight mechanisms (Bhaskar et al., 2024; Eisenhardt, 1989). This lack of effective checks and balances may result in managerial priorities shifting toward short-term financial gains rather than long-term sustainability objectives, such as ESG initiatives (Rath et al., 2024). Digitalization, which inherently demands strategic foresight and resource reallocation, may fail to deliver its potential ESG benefits in such governance settings. Conversely, firms with a clear separation between the CEO and board chairperson are more likely to exhibit robust governance practices, ensuring that digitalization efforts align with broader sustainability goals (Oliveira et al., 2021). These contrasting dynamics raise important questions about the extent to which CEO duality moderates the relationship between corporate digitalization and ESG performance, especially in firms operating under varying governance structures.

In addition to governance factors, institutional ownership and affiliations, particularly in the form of government linked corporations (GLCs), play a crucial role in determining the success of corporate digitalization in achieving ESG goals (Lu et al., 2023). GLCs, characterized by significant government ownership or influence, operate at the intersection of public policy and private enterprise. They often face heightened expectations to align their strategies with national sustainability objectives, given their role in fulfilling governmental agendas (Bruton et al., 2014; Ogbeibu et al., 2023). This alignment grants GLCs unique access to governmental resources, such as subsidies, regulatory support, and preferential policies, which can lower the barriers to adopting advanced digital technologies for ESG purposes (Yang & Han, 2023). Moreover, GLCs are subject to greater scrutiny from both the public and regulatory bodies, incentivizing them to prioritize transparency, accountability, and CSR in their operations (Caputo et al., 2021). As a result, GLCs are expected to be better positioned than non-GLCs to leverage corporate digitalization as a tool for enhancing ESG performance. However, the mechanisms through which these institutional affiliations amplify the benefits of digitalization remain underexplored.

Despite growing attention to both ESG and digitalization, significant gaps remain in understanding their intersection. First, ESG performance is often measured inconsistently across studies—varying by disclosure scope, third-party ratings, or industry-specific standards—which limits comparability and generalizability (e.g., Cheng et al., 2023; Gidage & Bhide, 2024; Elamer & Boulhaga, 2024). Second, most prior studies treat digitalization as a static construct, relying on narrow proxies such as IT investment or keyword frequency, without capturing its evolving, multidimensional nature. Third, although corporate governance is widely recognized as a key driver of ESG performance, few studies have examined how specific structures, such as CEO duality and institutional affiliations like GLCs, influence the relationship between digitalization and ESG outcomes. This gap may stem from the fact that much of the existing literature focuses on developed markets, where GLCs are relatively uncommon and board structures tend to be more standardized. By contrast, such governance configurations are more prominent in emerging economies, yet remain largely underexplored.

To address these gaps, this study proposes a novel approach by developing a dynamic corporate digitalization index using machine learning techniques to capture firm-level digitalization from multi-source data. This comprehensive metric reflects the evolving nature of digitalization over time and enables us to empirically examine its impact on ESG performance, providing new insights into how firms can leverage digitalization to achieve sustainability objectives. Our findings demonstrate that corporate digitalization significantly enhances ESG performance, though its effectiveness is contingent upon governance and institutional conditions. CEO duality weakens this relationship, highlighting the need for stronger board oversight, whereas GLCs strengthen it by leveraging state-backed resources and digital infrastructure to promote sustainability. Dimension-specific analysis shows that artificial intelligence, cloud computing, big data, and digital technology application all exert significant positive effects on ESG outcomes, while blockchain yields no measurable impact—underscoring which aspects of digitalization are most relevant for sustainability. Moreover, our subsample analysis reveals that CEO duality has a more adverse moderating effect in high-pollution industries, where robust governance mechanisms are especially critical. In contrast, minority state-owned enterprises are better positioned to translate digitalization into ESG improvements, likely due to greater operational autonomy and reduced bureaucratic constraints relative to majority-owned counterparts.

This study offers the following key contributions: First, we introduce a novel machine learning-based methodology to construct a dynamic corporate digitalization index, providing a more accurate and comprehensive measurement of corporate digitalization. Unlike previous studies that relied on static or narrowly defined proxies derived from textual analysis, our index leverages multi-source data and context-specific machine learning models to capture firm-level digitalization, reflecting its evolving nature over time. This methodological innovation not only enhances the precision of digitalization research but also establishes a robust foundation for future studies to explore the dynamic effects of digitalization on various corporate outcomes.

Second, by identifying multiple sub-dimensions of corporate digitalization, this study advances the theoretical understanding of its impact on ESG performance. Drawing on principal–agent theory, resource-based theory, and dynamic capabilities theory, we examine how corporate digitalization fosters ESG performance through mechanisms such as digital innovation and governance enhancements. This integrative approach not only clarifies the pathways through which digitalization drives sustainability but also enriches the theoretical discourse by linking digital strategies to long-term ESG objectives. Furthermore, the study offers actionable insights for aligning digitalization with sustainable development goals, bridging theoretical contributions with practical implications.

Third, although corporate governance is widely acknowledged as a key driver of ESG outcomes, limited research has explored how governance structures—such as CEO duality—or institutional affiliations like GLCs moderate the digitalization–ESG relationship. To the best of our knowledge, existing studies have not directly examined these moderating mechanisms within the digitalization–ESG nexus, especially in the context of emerging economies. This gap may partly stem from the fact that much of the existing literature focuses on developed markets, where government-linked firms are less prevalent and board structures are more uniform. In contrast, these governance configurations are more salient in emerging economies, yet remain underexamined.

Fourth, we elucidate the institutional dynamics of digitalization by investigating the moderating role of GLCs. GLCs, with their privileged access to government resources and heightened accountability to public stakeholders, serve as intermediaries between policy priorities and corporate strategies. This study reveals how institutional affiliations enhance the effectiveness of corporate digitalization in achieving ESG goals, providing new insights into how firms with strong institutional ties can leverage these advantages to improve sustainability outcomes.

The remainder of this paper is organized as follows. Section “Theoretical background and hypothesis” reviews the relevant theoretical perspectives and develops the research hypotheses. Section “Research design” describes the research design, including data sources, variables, and the empirical modeling approach. Section “Result analysis” reports the main empirical findings and presents robustness tests. Section “Moderation effect analysis” explores the moderating effects, and Section “Further analysis” delves into each dimension of corporate digitalization. Finally, Section “Discussion” summarizes the key findings and discusses their broader implications, while Section “Conclusions and Recommendation” provides the overall conclusions and practical suggestions.

Theoretical background and hypothesis

Corporate digitalization and ESG performance

Digitalization—the strategic application of technologies such as artificial intelligence, blockchain, big data, and cloud computing—has emerged as a transformative force in how firms manage operations and engage with stakeholders (Hussain et al., 2024). Its growing influence on sustainability performance is widely acknowledged, particularly in emerging markets, where digitalization can compensate for institutional voids and governance weaknesses (Maqsood et al., 2025; Soluk et al., 2021). The relationship between corporate digitalization and ESG performance can be theoretically interpreted through three major perspectives: agency theory, the resource-based view, and dynamic capabilities.

First, digitalization is expected to agency problems and align managerial actions with long-term ESG goals. According to agency theory, conflicts arise when managerial incentives favor short-term financial returns at the expense of long-term investments, such as those required for ESG performance (Raimo et al., 2020; Chen et al., 2022). By enhancing information transparency and real-time disclosure, digital technologies such as automated reporting systems and integrated ESG dashboards reduce information asymmetry and discourage opportunistic behavior (Li et al., 2024; Maqsood et al., 2024). For example, blockchain-based auditing and IoT-enabled environmental monitoring tools make ESG-related decisions more observable and accountable to stakeholders, thus curbing short-termism (Yang et al., 2024). This increased visibility encourages firms to prioritize ESG-aligned strategies, even when returns are deferred.

Second, from the resource-based view (RBV), digitalization constitutes a strategic resource that enables firms to embed ESG into their value chains. RBV posits that unique, non-substitutable resources—such as proprietary digital platforms or ESG analytics capabilities—form the basis of competitive advantage (Khanra et al., 2021). In emerging markets, where resource inefficiencies and compliance gaps are more pronounced, digital infrastructure plays a critical role in enhancing ESG efficiency and scalability (Hou et al., 2024). For instance, digital supply chain platforms promote environmental optimization and stakeholder integration by reducing redundancies and enabling ESG-compliant procurement (L. Cheng et al., 2023; Nayal et al., 2021). These capabilities enable firms to achieve dual goals: financial efficiency and sustainability legitimacy.

Third, digitalization strengthens dynamic capabilities by allowing firms to sense, seize, and reconfigure resources in response to ESG-related challenges. Teece’s (2007) framework suggests that rapidly changing stakeholder expectations and policy landscapes require agile organizational responses. In this context, digital tools facilitate early identification of regulatory risks, stakeholder sentiment, and social license dynamics (Quttainah & Ayadi, 2024; Singh et al., 2024). For example, ESG sentiment analysis using natural language processing (NLP) enables firms to track reputational concerns in real time, thereby fine-tuning their sustainability responses. In volatile regulatory environments—typical of emerging economies—these dynamic capabilities are indispensable for sustaining ESG competitiveness (Maqsood et al., 2023; S. Yang et al., 2024). Based on this multi-theoretical foundation and recent empirical advancements, we propose the following hypothesis:

H1: Corporate digitalization positively impacts ESG performance.

The moderating role of CEO duality

The concentration of power in the hands of a single individual, as seen in CEO duality, is widely debated in corporate governance literature. This structure is expected to negatively moderate the positive impact of digitalization on ESG performance for several reasons, as outlined below.

To begin with, CEO duality is expected to weaken the governance oversight necessary for effective ESG decision-making, thereby diluting the positive impact of digitalization on ESG performance. According to agency theory, an independent board serves as a critical mechanism to monitor managerial decisions and prevent short-termism (Fama, 1980; Shu et al., 2024). Digitalization often requires significant investments and long-term commitments to drive ESG improvements, which can conflict with short-term financial goals. However, in firms with CEO duality, the lack of board independence reduces the effectiveness of such oversight, allowing CEOs to prioritize short-term financial performance over ESG objectives (Bhaskar et al., 2024). Recent research further suggests that digital investments aimed at improving ESG outcomes are more likely to be strategically neglected in firms with excessive CEO power concentration due to limited checks and balances in the boardroom (Chen et al., 2024; Hou et al., 2024; Maqsood et al., 2025). From the perspective of digital governance, CEO duality may also weaken algorithmic accountability and oversight mechanisms related to ESG technologies, such as automated disclosures or stakeholder analytics platforms (Pu, 2025). When digital ESG tools operate without transparent governance structures, their effectiveness in improving sustainability outcomes may be compromised. This suggests that digitalization’s potential to drive ESG performance is likely to be constrained in firms where CEO duality exists, as strategic decisions become less scrutinized and more aligned with immediate managerial priorities.

Moreover, CEO duality is anticipated to misalign corporate priorities with stakeholder expectations, thereby limiting the ability of digitalization to enhance ESG performance. The stakeholder theory posits that firms should balance the interests of various stakeholders, including employees, customers, and society, to achieve long-term success (Stoelhorst & Vishwanathan, 2022). Digitalization enhances stakeholder engagement and transparency, which are crucial for ESG initiatives. However, when power is concentrated in a single individual, decision-making may deviate from the broader interests of stakeholders toward self-serving managerial objectives (Lin et al., 2023). In such cases, digital platforms designed for stakeholder dialog may be underutilized or selectively disclosed, weakening the participatory governance potential of ESG digital tools (Yang et al., 2024). As a result, digitalization’s ability to integrate stakeholder-centric ESG practices may be undermined in firms with CEO duality, as stakeholder engagement becomes secondary to managerial control and influence.

In addition, the concentration of power under CEO duality is likely to stifle the collaborative and innovative potential of digitalization, thereby weakening its impact on ESG performance. Digitalization and ESG initiatives both require cross-functional collaboration and diverse perspectives to be effectively integrated into corporate strategy (Luo, 2024). However, CEO duality has been shown to reduce the diversity of viewpoints in decision-making processes, as the CEO-chairperson may dominate strategic discussions and marginalize dissenting opinions (Feix & Wernicke, 2023). This “single voice dominance” effect weakens the capacity of digital tools—such as ESG data dashboards and integrated analytics platforms—to generate organizational learning and drive innovation in sustainability strategies (Zada et al., 2025). This lack of debate and critical evaluation can result in suboptimal utilization of digital technologies, limiting their capacity to drive innovation and resource allocation toward ESG objectives. Consequently, firms with CEO duality are less likely to realize the full potential of digitalization in fostering ESG performance.

Finally, CEO duality is likely to reduce the transparency and accountability that digitalization fosters, thereby negatively moderating its influence on ESG performance. One of the key benefits of digitalization is its ability to improve information transparency, enabling better ESG reporting and performance tracking (Asif et al., 2023). However, CEOs holding dual roles may strategically limit such transparency to protect their interests or avoid scrutiny, undermining the governance benefits of digitalization (Martínez-Ferrero et al., 2024). Research in emerging markets further highlights that digital ESG systems are particularly vulnerable to strategic underreporting or greenwashing when the CEO dominates board governance structures (Chen et al., 2024; Li et al., 2024; Maqsood et al., 2024). This tendency to withhold critical ESG-related data or resist external reporting standards weakens the trust and accountability that digitalization aims to build, further diminishing its positive impact on ESG outcomes. Based on the above perspectives, the following hypothesis is proposed:

H2: CEO duality acts as a negative moderator in the relationship between corporate digitalization and ESG performance.

While the preceding discussion suggests that CEO duality generally weakens the positive effect of digitalization on ESG performance, it is reasonable to expect that this negative moderating effect may not be uniform across all types of firms. Specifically, firms operating in high-polluting industries may face heightened challenges due to more stringent environmental regulations and public scrutiny (Zhao & Chen, 2024; Yang et al., 2024). These industries, including energy, mining, chemicals, and heavy manufacturing, are subject to intense institutional and regulatory pressures, which demand robust and transparent ESG practices. In such contexts, effective governance is critical, and CEO duality may undermine the capacity to meet these demands. The lack of board independence under CEO duality restricts the decision-making process and leads to a strategic misalignment between immediate financial goals and long-term ESG objectives, exacerbating the negative effects on digitalization’s ability to improve ESG performance.

Compounding these difficulties, high-polluting firms are typically required to invest heavily in digital technologies such as emissions tracking systems, real-time pollution monitoring, and sustainable resource management tools, to comply with stringent regulations. CEO duality may prioritize short-term cost containment over these necessary long-term investments, further hindering digitalization’s potential to enhance ESG outcomes. In contrast, firms in less-regulated industries face fewer external pressures and greater flexibility, reducing the negative moderating effect of CEO duality. Therefore, we propose the following hypothesis:

H3: The negative moderating effect of CEO duality on the relationship between corporate digitalization and ESG performance is more pronounced in high-polluting industries than in non-high-polluting industries.

The moderating role of government linked corporations

GLCs operate at the nexus of public and private interests, uniquely positioned to influence the integration of digitalization and ESG performance. With their strong ties to governmental institutions and mandates for accountability and sustainability, GLCs are expected to positively moderate the relationship between corporate digitalization and ESG performance.

First, GLCs are uniquely positioned to respond to heightened regulatory and normative pressures, which are likely to amplify the positive effects of digitalization on ESG performance. Institutional theory posits that organizations embedded in institutional environments adapt their behaviors to comply with regulatory frameworks and societal expectations (Risi et al., 2022; Scott, 1987). GLCs, characterized by partial government ownership or substantial government influence, operate under increased pressure to adhere to national sustainability agendas and comply with international ESG benchmarks (De Pilla et al., 2024). Recent studies argue that GLCs are more sensitive to institutional logics in emerging markets, where governments actively promote ESG and digitalization as dual policy objectives (Maqsood et al., 2025; Yang et al., 2024). Digitalization equips GLCs with advanced tools, such as automated ESG reporting and carbon footprint tracking, enabling compliance with strict regulations and enhancing ESG transparency (Škare et al., 2023). Moreover, GLCs are often early adopters of government-endorsed digital governance platforms, which facilitate standardized ESG disclosures across sectors (Hou et al., 2024). This institutional alignment is further strengthened by governmental support in the form of policies and subsidies that incentivize the adoption of ESG-driven digital practices (Liu et al., 2023). Thus, GLCs are better positioned than non-GLCs to leverage digitalization in improving ESG outcomes.

Second, GLCs’ dual responsibility to governmental and societal stakeholders makes them more likely to use digitalization as a tool to enhance ESG performance. Stakeholder theory advocates for balancing the interests of diverse stakeholders, including governments, communities, and shareholders, to achieve long-term value creation (Stoelhorst & Vishwanathan, 2022). For GLCs, the government serves as a critical stakeholder, demanding enhanced ESG performance to fulfill public welfare objectives. Digitalization enables GLCs to meet these demands by improving stakeholder communication, enhancing ESG transparency, and fostering socially responsible practices (Wan & Ding, 2024). For instance, many GLCs use AI-based stakeholder feedback systems and blockchain-enabled reporting platforms to demonstrate their environmental and social initiatives to the public and regulators (Fan et al., 2024; Maqsood et al., 2024). Digital platforms allow GLCs to engage with communities on environmental initiatives or disclose ESG metrics in real time, building trust and legitimacy. This stakeholder-driven focus magnifies the impact of digitalization on ESG outcomes within GLCs.

Third, GLCs’ privileged access to governmental resources provides a distinct advantage in utilizing digitalization to strengthen ESG performance. Resource dependence theory asserts that organizations depend on external resources, such as funding, legitimacy, and expertise, to achieve strategic goals (Hillman et al., 2009). GLCs often benefit from government-provided resources, including financial support, tax incentives, and policy guidance, which reduce the barriers to implementing costly digitalization initiatives (Huang et al., 2023). These resources also enable GLCs to pursue ESG initiatives that may otherwise be financially prohibitive for non-GLCs, such as large-scale renewable energy projects or advanced waste management systems powered by digital technologies (Martsinchyk et al., 2024). Furthermore, GLCs often receive preferential access to digital infrastructure, including government-sponsored artificial intelligence research platforms, sector-wide ESG data hubs, and blockchain-based environmental tracking systems developed through public-private collaborations (Maqsood et al., 2024; Wan & Ding, 2024). These resources form part of China’s broader digital governance architecture and give GLCs a distinct advantage in ESG implementation. Therefore, the above reasoning leads to the following hypothesis:

H4: GLCs act as a positive moderator in the relationship between corporate digitalization and ESG performance.

Although GLCs generally exhibit a stronger alignment with national ESG and digitalization agendas due to their institutional embeddedness, the magnitude of this positive moderating effect may vary with the degree of government ownership. Specifically, GLCs with minority state ownership may be better positioned to leverage digitalization for ESG enhancement than those with majority state ownership.

From the perspective of resource dependence theory, minority state-owned firms enjoy a hybrid advantage: they retain access to governmental support—such as funding, legitimacy, and regulatory backing—while maintaining greater managerial autonomy and operational flexibility (Jiachun et al., 2024). This structural configuration allows these firms to adopt and integrate digital tools in a more agile and innovation-driven manner, aligning ESG practices with both market expectations and policy incentives. In contrast, majority-owned GLCs often face greater bureaucratic control and political oversight, which can reduce responsiveness to digital innovation and limit the strategic use of ESG technologies (Adebayo & Ackers, 2024; Maqsood et al., 2024). Decision-making in these firms may be shaped more by administrative compliance than by performance optimization, thus attenuating the benefits that digitalization can bring to ESG outcomes.

Moreover, empirical research suggests that minority-owned GLCs tend to be more market-oriented and responsive to stakeholder demands, while majority-owned GLCs often pursue non-commercial objectives, such as employment stability or policy execution, which can dilute their ESG innovation strategies (Lin et al., 2021). As such, the interplay between digitalization and ESG performance is likely to be more effectively realized in minority-owned GLCs, where institutional legitimacy and market incentives jointly reinforce sustainability practices. Based on these considerations, we propose the following hypothesis:

H5: The positive moderating effect of GLCs on the relationship between corporate digitalization and ESG performance is stronger in firms with minority state ownership than in those with majority state ownership.

Research design

Data and sample

Our study focuses on A-share listed companies in China over the period from 2009 to 2021. ESG performance data were obtained from the Huazheng ESG rating database, which is specifically designed for the Chinese market. This database offers a thorough and standardized methodology for assessing corporate ESG practices, making it a widely trusted source for evaluating the sustainability initiatives of Chinese firms. Additionally, we gathered firm-level governance and financial information, including various corporate characteristics and operational metrics, from the CSMAR database. Renowned for its precision and extensive data coverage, the CSMAR database serves as a leading financial research platform in China.

To ensure the robustness and accuracy of our analysis, we undertook several data refinement steps. First, we excluded financial institutions such as banks and insurance companies because their unique financial structures and regulatory frameworks differ markedly from those of non-financial firms. Second, we removed companies classified under the ST and *ST categories by the China Securities Regulatory Commission during the sample period. These classifications indicate that firms have experienced financial or operational irregularities for two consecutive years, which could potentially bias our results. Third, we omitted any observations with missing data for key variables to maintain the completeness and consistency of our dataset. Lastly, we applied winsorization to continuous financial variables at the 1% and 99% percentiles to reduce the impact of outliers.

Variable measurements

-

(I)

Dependent Variable. In this study, ESG performance—the dependent variable—is measured using the Huazheng ESG rating system, a respected framework tailored for the Chinese market (e.g., Zhang et al., 2024; Zhang et al., 2023; Zhao & Chen, 2024). This system provides a comprehensive and standardized assessment of firms’ environmental (E), social (S), and governance (G) practices by integrating both quantitative metrics and qualitative evaluations. Consistent with prior research methodologies, the Huazheng ESG ratings are converted into a numerical scale ranging from 1 to 9, corresponding to nine distinct levels—C, CC, CCC, B, BB, BBB, A, AA, and AAA—where higher values indicate superior ESG performance. These ESG scores, derived from the Huazheng database, are utilized as continuous variables in our analysis, with higher scores reflecting stronger commitments to sustainability and greater alignment with societal and environmental objectives.

-

(II)

Independent Variable. The independent variable in our study, corporate digitalization (CD), captures the degree to which firms adopt and implement advanced digital technologies as part of their strategic orientation. To quantify CD, we developed an advanced natural language processing (NLP) framework tailored to the linguistic nuances of the Chinese language. Annual reports, especially the Management Discussion and Analysis (MD&A) sections, provide critical insights into corporate strategies and digital transformation initiatives (Kindermann et al., 2020). However, traditional keyword frequency-based approaches often fail to account for the semantic complexity of the Chinese language, where a single concept can be expressed through various synonyms or context-dependent terms. To address this limitation, we employed Python’s Jieba library for precise text segmentation, followed by advanced word embedding techniques using Gensim’s Word2Vec models. This multi-step methodology ensured a more accurate and context-sensitive identification of digitalization-related terms, setting a higher standard for text-based variable construction in non-English contexts.

The core of our approach lies in the application of Continuous Bag-of-Words (CBOW) and Skip-Gram models within the Word2Vec framework, two neural network architectures known for their ability to learn semantic relationships from unstructured text. CBOW predicts target words based on their surrounding context, making it effective for capturing frequent terms, while Skip-Gram predicts context words given a target word, excelling at identifying relationships for less common terms. This dual modeling approach allowed us to generate dense vector representations (embeddings) for words, capturing both local and global semantic patterns within the corpus. To optimize computational efficiency and improve the accuracy of our word embeddings, we employed negative sampling, a widely recognized technique that approximates the softmax function to reduce the complexity of neural network training. These steps not only enhanced the precision of term identification but also expanded the vocabulary of digitalization concepts beyond the initial seed keywords, including terms such as “artificial intelligence,” “cloud computing,” “big data,” “blockchain” and “digital technology application.” To ensure semantic validity, we manually verified representative word pairs (e.g., synonyms or related terms) for contextual similarity based on domain knowledge and examined vector clustering of key concepts. Finally, the semantically enriched vocabulary was used to construct a comprehensive seed dictionary, allowing us to calculate the frequency of digitalization-related terms in each firm’s MD&A section. To mitigate the effects of skewness in raw frequency data, we applied a logarithmic transformation (LN (keyword frequency + 1)), ensuring a normalized and comparable measure of digitalization across firms.

To address potential concerns regarding disclosure-driven bias in text-based digitalization proxies, we draw on the approach of Chen and Srinivasan (2023) and construct an alternative measure based on digital innovation output. Specifically, we introduce CD_P, defined as the natural logarithm of one plus the number of digital-related patent applications filed by a firm. This patent-based proxy captures the substantive technological engagement of firms and complements the disclosure-based measure derived from annual reports.

-

(III)

Moderating Variables. This study explores the moderating roles of CEO duality (Dual) and government-linked corporations (GLCs) in the relationship between corporate digitalization and ESG performance. CEO duality is operationalized as a binary variable, where a value of 1 indicates that the CEO also serves as the board chairperson, and 0 denotes otherwise. This binary classification captures the extent of decision-making authority concentration, which may potentially diminish governance oversight and influence strategic initiatives, including those related to ESG efforts. Similarly, GLCs are defined as firms that are either partially owned by the government or significantly influenced by governmental entities. GLC status is also measured as a binary variable, with a value of 1 assigned to government-linked firms and 0 to non-government-linked firms.

-

(IV)

Control Variables. Building upon the foundational research on ESG performance (e.g., Liu et al., 2023; Lu et al., 2023; Martínez-Ferrero et al., 2024; Zhao & Chen, 2024), this study incorporates a comprehensive array of control variables designed to capture a wide range of firm-specific factors that could potentially impact ESG performance. Firm age (FirmAge) is calculated as the natural logarithm of the number of years since the firm’s establishment, thereby reflecting the influence of organizational maturity and longevity on sustainability outcomes. Financial leverage (Lev) is defined as the ratio of total debt to total assets, serving as a proxy for a firm’s financial risk exposure and the dynamics of its capital structure. Profitability (ROA), determined by dividing net income by total assets, gauges the firm’s operational efficiency and its capacity to generate returns from its asset base. Sales growth (Growth) is measured by the year-over-year percentage change in operating revenue, indicating the firm’s growth trajectory and opportunities for market expansion. The variable Loss is operationalized as a binary indicator, where a value of 1 signifies that the firm has reported a net loss in a given year, and 0 otherwise, thus signaling periods of financial distress or instability. Board size (Board) is quantified by taking the natural logarithm of the total number of directors on the board, providing insights into the scale and breadth of the firm’s governance structure. Conversely, board independence (Indep) is measured as the proportion of independent directors relative to the total number of board members, capturing the quality and effectiveness of governance practices within the firm. Ownership concentration (TOP1) is defined as the percentage of shares held by the largest shareholder, highlighting the degree of control and influence exerted by major stakeholders over corporate decisions. Additionally, managerial ownership (Mshare) represents the proportion of shares owned by the firm’s managers, reflecting the alignment of managerial interests with those of other shareholders and the potential for influence over strategic corporate decisions.

Regression models

To investigate the effect of corporate digitalization on ESG performance and to explore how CEO duality (Dual) and government-linked corporations (GLCs) may influence this relationship, the following fixed effects regression models are developed:

Baseline model

The baseline regression model is designed to assess the direct impact of corporate digitalization on ESG performance:

where ESGi,t represents the ESG performance of firm i in year t, measured using the Huazheng ESG rating system. CDi,t denotes corporate digitalization, quantified based on the frequency of digitalization related terms in annual reports. Controlsi,t is a vector of control variables, including firm age (FirmAge), financial leverage (Lev), return on assets (ROA), sales growth (Growth), loss (Loss), board size (Board), board independence (Indep), ownership concentration (TOP1), and managerial ownership (Mshare). Industry fixed effects (\({\eta }_{i}\)) and year fixed effects (\({\mu }_{t}\)) are included to account for unobservable heterogeneity across industries and years, and εi,t is the error term.

Moderation model

To analyze the moderating effects of CEO duality and government linked corporations on the relationship between corporate digitalization and ESG performance, the following model is constructed:

For CEO duality: \({\rm{Moderator}}_{i,t}\) is a binary variable equal to 1 if the CEO also serves as the board chairperson and 0 otherwise. The interaction term \({{\rm{CD}}_{i,t}* {\rm{Dual}}}_{i,t}\) tests whether CEO duality weakens or enhances the relationship between corporate digitalization and ESG performance.

For GLCs: \({\rm{Moderator}}_{i,t}\) is a binary variable equal to 1 if the firm is government linked and 0 otherwise. The interaction term \({{\rm{CD}}_{i,t}* {\rm{GLCs}}}_{i,t}\) examines whether GLCs strengthen the relationship between corporate digitalization and ESG performance.

Result analysis

Descriptive statistics

Table 1 provides descriptive statistics for the main variables used in this study, including the dependent variables (ESG_HZ and ESG_PB), corporate digitalization (CD) as the key independent variable, and the moderating variables (Dual and GLCs). The focus is on understanding the distribution and variability of these variables across the sample.

For dependent variable: ESG performance is measured using two complementary sources. The first measure, ESG_HZ, is sourced from the Huazheng ESG database, which provides a standardized rating for ESG practices of Chinese listed firms. ESG_HZ has a mean of 6.452 and a standard deviation of 1.132, with values ranging from 1 to 9, indicating substantial variability in ESG performance across firms. This suggests that while some firms achieve high ESG scores, reflecting strong sustainability practices, others perform poorly in these areas. The second measure, ESG_PB, sourced from the Bloomberg database, reports ESG scores with greater numerical range and granularity. ESG_PB has a mean of 28.518 and a standard deviation of 9.163, with a minimum value of 6.198 and a maximum value of 68.917, highlighting broader dispersion in ESG performance compared to ESG_HZ. The inclusion of two distinct ESG measures ensures robustness and cross-validation of results.

In terms of the independent variable: Corporate digitalization (CD), the primary independent variable, captures the intensity of digitalization within firms. CD is measured through the frequency of digitalization-related terms in annual reports, log-transformed for normalization. The mean value of CD is 1.275 with a standard deviation of 1.384, indicating moderate levels of digitalization across the sample. The values range from 0 to 6.301, reflecting significant heterogeneity, with some firms demonstrating advanced digitalization while others exhibit little to no engagement in digitalization. As a robustness check, we also employ CD_P—as an alternative proxy for corporate digitalization. CD_P has a mean of 0.802 and ranges from 0 to 8.447, similarly capturing substantial variation in firms’ digital innovation activities.

Regarding the moderating variables: Two key moderating variables are included in the analysis. The mean value of CEO duality (Dual) is 0.284, indicating that 28.4% of the firms have a CEO duality structure, reflecting a relatively balanced distribution between firms with concentrated decision-making authority and those with separate governance roles. Similarly, the mean value of government-linked corporations (GLCs) is 0.360, showing that 36% of the firms in the sample have some level of government ownership or influence, underscoring the significant presence of GLCs in China’s corporate landscape.

With respect to moderating variables: A comprehensive set of control variables is included to account for firm-specific characteristics that may influence ESG performance. FirmAge has a mean of 2.858, indicating that the sample predominantly consists of mature firms. Lev averages 0.418, reflecting moderate reliance on debt financing, while ROA, a measure of profitability, has a mean of 0.041, with some firms exhibiting losses (mean = 0.098). Growth, capturing revenue expansion, shows high variability, with a mean of 0.181 and values ranging from −0.658 to 4.024. Governance-related variables, such as Board and Indep, exhibit typical distributions, with board size averaging 2.127 (log-transformed) and independent directors accounting for 37.5% of board composition on average. TOP1 has a mean of 34.594, while Mshare averages 14.175%, with wide variability reflecting differing ownership structures across firms. The values of these control variables are consistent with patterns reported in prior studies, supporting the robustness of the dataset and its suitability for examining the proposed research questions (e.g., Liu et al., 2023; Shu et al., 2024).

Correlation analysis and variance inflation factor test

The Pearson correlation matrix of the main variables is presented in Table 2. Generally, the correlation coefficients between the independent variable, moderating variables, and controls are below 0.50, indicating no severe correlation issues among these variables. To ensure robustness, a multicollinearity diagnostic test was conducted for continuous variables. The results show that all variables have variance inflation factors (VIF) below 2.5, with the highest VIF being 2.02 for ROA, well within the acceptable threshold. This suggests no significant multicollinearity concerns in the model.

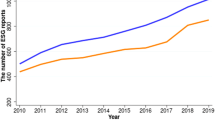

Scatter diagram analysis

Scatter diagram analysis is a powerful tool for visualizing relationships between variables, detecting trends, and identifying outliers, as highlighted in Cleveland (1985) and Tukey (1977). To explore the relationship between CD and ESG, we conducted scatter diagram analysis. Due to the large number of observations in the sample, ESG scores were divided into 3000 equally sized groups for analysis in Fig.1. The resulting positive slope provides preliminary evidence of a positive correlation between CD and ESG.

Benchmark regression analysis

Table 3 delineates the results of the benchmark regression analysis, which explores the relationship between CD and ESG performance (ESG_HZ). Across all model specifications, the coefficient for CD consistently remains positive and statistically significant at the 1% level, providing robust evidence of a favorable association between CD and ESG performance. In Column (1), which does not incorporate any fixed effects or control variables, the CD coefficient is estimated at 0.040 (p < 0.01), establishing a baseline positive relationship. Upon introducing year and industry fixed effects in Column (2), the CD coefficient increases to 0.053 (p < 0.01). This enhancement suggests that the positive relationship persists and even strengthens when accounting for unobserved heterogeneity across different time periods and industry sectors, thereby mitigating potential omitted variable bias.

Subsequent models, Columns (3) and (4), incorporate a comprehensive set of control variables designed to account for various firm-specific characteristics that may influence ESG performance. These controls include FirmAge, Lev, ROA, Growth, Loss, Board, Indep, TOP1, and Mshare. The inclusion of these control variables significantly enhances the model’s explanatory power, as evidenced by the rise in adjusted R2 from 0.086 in Column (3) to 0.154 in Column (4). Even after controlling for these factors, the coefficient of CD remains significant, recording values of 0.063 (p < 0.01) in Column (3) and 0.046 (p < 0.01) in Column (4). These consistent findings across all models robustly support the conclusion that CD positively contributes to ESG performance.

The control variables exhibit patterns that are largely in line with theoretical expectations and existing literature (e.g., Asif et al., 2023; Liu et al., 2023; Lu et al., 2023; Martínez-Ferrero et al., 2024; Shu et al., 2024). Specifically, variables such as FirmAge, Lev, ROA, Board, Indep, and TOP1 are positively associated with ESG performance, indicating that older firms, those with higher financial leverage, greater profitability, larger and more independent boards, and higher ownership concentration tend to perform better on ESG metrics. Conversely, Growth, Loss, and Mshare exhibit negative relationships with ESG performance, suggesting that firms experiencing rapid sales growth, financial distress, or higher managerial ownership may face challenges in maintaining high ESG standards. Notably, ROA has the largest coefficient (2.837 in Column (4), p < 0.01), underscoring that profitability is a significant driver of ESG outcomes within our model.

Overall, the findings substantiate that CD significantly enhances ESG performance, aligning with the perspective that digitalization is a crucial facilitator of corporate sustainability initiatives (e.g., Fan et al., 2024; Lu et al., 2023; Quttainah & Ayadi, 2024). This study extends prior research by offering robust empirical evidence within the Chinese context, thereby highlighting the broader implications of digitalization beyond mere financial and operational performance. Unlike earlier studies that predominantly focused on isolated aspects of ESG, our results emphasize the comprehensive role of CD in fostering transparency, enhancing stakeholder engagement, and optimizing resource utilization—key elements in promoting sustainable corporate practices. These findings are consistent with the resource-based view (Hillman et al., 2009; Khanra et al., 2021), which posits that digital technologies act as unique and valuable resources for securing a sustainable competitive advantage, as well as the dynamic capabilities framework (Teece, 2007), which underscores the agility that digitalization provides in adapting to evolving ESG expectations. Additionally, our analysis resonates with agency theory, suggesting that digital tools can mitigate information asymmetry and reduce managerial opportunism. By enhancing transparency and improving monitoring mechanisms, digitalization has the potential to strengthen governance structures and better align corporate objectives with the long-term interests of stakeholders (Singh et al., 2024; Stoelhorst & Vishwanathan, 2022).

Robustness checks

To validate the stability and reliability of the observed relationship between CD and ESG performance, a series of robustness tests were conducted. These tests employed alternative independent variable, alternative data sources, varied model specifications, and different estimation techniques to ensure that the primary findings are not contingent on specific methodological choices. The outcomes of these robustness checks are detailed in Table 4, with each column corresponding to a distinct robustness test.

-

(1)

Replacement of the independent variable. In Column (1), we replace the original independent variable (CD) with CD_P. This alternative proxy captures the intensity of firms’ digital innovation activities and provides a complementary perspective to the text-based digitalization index used in the baseline model. The regression results show a significantly positive association between CD_P and ESG performance (β = 0.144, p < 0.01), indicating that firms with more extensive digital innovation tend to achieve better ESG outcomes.

-

(2)

Alternative ESG data source. In Column (2), we replaced the dependent variable with ESG performance data from the Bloomberg database (ESG_PB), a globally recognized and widely utilized source for assessing corporate sustainability. This substitution aims to confirm that the positive association between CD and ESG is consistent across different measurement frameworks. The results demonstrate a positive and significant relationship between CD and ESG_PB (β = 0.549, p < 0.01), aligning with the findings from the Huazheng ESG database and thereby reinforcing the robustness of our primary conclusion.

-

(3)

Individual fixed effects model. Column (3) applies a firm fixed effects model to account for time-invariant unobserved heterogeneity, such as differences in corporate culture or governance structures. The results show that CD remains positively and significantly associated with ESG performance (β = 0.023, p < 0.01), confirming that the observed relationship is robust even when controlling for firm-specific factors.

-

(4)

Interaction fixed effects model. In Column (4), we include year-by-industry interaction fixed effects to control for unobserved heterogeneity at the intersection of time and industry, capturing industry-specific trends over time. The coefficient for CD remains positive and significant (β = 0.063, p < 0.01), demonstrating that the relationship between CD and ESG performance holds under more granular controls.

-

(5)

Subsample test. To address potential biases introduced by the COVID-19 pandemic, we excluded data from 2020 and 2021 and re-estimated the model using a subsample in Column (5). The results show that CD continues to positively and significantly impact ESG performance (β = 0.040, p < 0.01), indicating that the findings are not driven by pandemic-related anomalies.

-

(6)

Generalized method of moments estimation. To address potential endogeneity concerns—such as reverse causality, measurement error, and omitted variable bias—we employ the two-step system Generalized Method of Moments (GMM) estimator in Column (6). This dynamic panel data approach is particularly suitable given the persistence of ESG behavior and the potential simultaneity between digitalization and ESG outcomes.

Following recent empirical practices (e.g., Pu, 2025), we use lagged values of the endogenous variables—specifically, the lagged levels and first differences of CD and ESG—as internal instruments within the system GMM framework. The inclusion of the lagged dependent variable (L.ESG_HZ) further helps control for serial correlation and dynamic feedback effects. This instrumenting strategy is grounded in the assumption that past values of corporate ESG performance and digitalization are correlated with current outcomes but uncorrelated with contemporaneous structural errors, thereby satisfying the exclusion restriction condition. This approach has been widely adopted in the corporate digitalization and sustainability literature, particularly when valid external instruments are unavailable or difficult to justify.

The results reveal that CD continues to have a positive and statistically significant effect on ESG performance (β = 0.057, p < 0.05), supporting our main hypothesis. Moreover, diagnostic tests validate the reliability of the GMM specification: the Hansen J test (p = 0.229) fails to reject the null hypothesis of instrument validity, and the Arellano–Bond test for second-order autocorrelation (AR(2) = 0.487) indicates no residual serial correlation. Together, these results reinforce the credibility of our identification strategy and suggest that our findings are not driven by the endogeneity concerns addressed in the analysis.

-

(7)

Driscoll–Kraay fixed effects model. To account for potential heteroskedasticity, serial correlation, and cross-sectional dependence in the error terms, Column (7) utilizes the Driscoll–Kraay fixed effects estimator. This robust estimation technique is essential for ensuring that our standard errors remain consistent and reliable under complex error structures, which are often present in large panel datasets. The application of the Driscoll–Kraay estimator reveals that CD maintains a strong and highly significant positive relationship with ESG performance (β = 0.076, p < 0.01). This finding corroborates the robustness of our primary results, confirming that the positive association between corporate digitalization and ESG performance is not sensitive to alternative assumptions regarding the error structure.

Moderation effect analysis

Baseline moderating effect of CEO duality

Table 5 delineates the moderating impact of CEO duality on the relationship between CD and ESG performance. Through a stepwise regression approach spanning Columns (1) to (3), the interaction term CD*Dual consistently exhibits a negative and statistically significant coefficient. Specifically, in Column (1), devoid of any control variables, the significant negative interaction coefficient (γ = −0.021, p < 0.05) underscores that CEO duality attenuates the positive influence of CD on ESG performance at the baseline level. Upon the introduction of three pivotal control variables—FirmAge, Lev, and ROA—in Column (2), the interaction term remains significant albeit with a marginally reduced magnitude (γ = −0.018, p < 0.05). This persistence indicates that the moderating effect of CEO duality endures even after accounting for firm-specific characteristics. Column (3), which incorporates the full suite of control variables, further corroborates the stability of the interaction effect (γ = −0.018, p < 0.05), affirming the robustness of CEO duality as a moderator across diverse model specifications. Figure 2 graphically represents the marginal effects of CEO duality, revealing that firms with CEO duality exhibit diminished marginal effects of CD on ESG_HZ compared to those without such duality. Additionally, Fig. 3 illustrates a linear trend in the marginal effects, highlighting that the positive impact of corporate digitalization on ESG performance is substantially more pronounced in firms lacking CEO duality. These findings suggest that concentrated decision-making authority inherent in dual CEO structures may impede a firm’s ability to effectively harness digitalization for enhancing ESG outcomes.

(Note: this figure illustrates the estimated marginal effects of CD on ESG performance stratified by the presence of CEO duality. The analysis controls for FirmAge, Lev, ROA, Growth, Loss, Board, Indep, Top1, and Mshare. Data sources from Huazheng ESG Database. Error bars represent 95% confidence intervals. The interaction effect (CD * Dual) is statistically significant at the 5% level, indicating that CEO duality negatively moderates the relationship between CD and ESG performance).

(Note: this figure presents the linear trends of the marginal effects of CD on ESG performance across varying levels of CEO duality. The analysis incorporates all control variables as specified in the regression models. The positive slope for firms without CEO duality (solid line) is significantly steeper compared to firms with CEO duality (dashed line), underscoring the mitigating effect of CEO duality on the efficacy of digitalization initiatives in enhancing ESG outcomes. Data visualization was performed using Stata 17).

The observed moderating effect aligns with and extends the extant literature on corporate governance and digitalization. Prior studies have established that digitalization fosters transparency, accountability, and operational efficiency, thereby promoting robust ESG initiatives (Lu et al., 2023). However, governance configurations such as CEO duality have been identified as critical impediments to effective decision-making and oversight, often facilitating managerial opportunism and resulting in suboptimal organizational outcomes (Lin et al., 2023; Martínez-Ferrero et al., 2024). One plausible explanation for our findings is that CEO duality constrains the diversity of perspectives and critical discourse necessary for integrating ESG principles into digitalization strategies (Bhaskar et al., 2024). Moreover, the amalgamation of CEO and Chairman roles may lead to a concentration of authority, whereby ESG-oriented investments are deprioritized in favor of initiatives that yield immediate financial returns. This tendency is likely exacerbated in firms where external stakeholders, such as regulators or institutional investors, exert limited pressure on ESG compliance (Kräussl et al., 2023). Consequently, the interplay between CEO duality and digitalization may reflect a misalignment between managerial priorities and ESG objectives, potentially undermining the effective utilization of digital tools for sustainability endeavors.

Cross-Industry variation in the moderating effect of CEO duality

To further investigate whether the moderating effect of CEO duality varies across industries, we conducted a subsample analysis based on industry pollution levels. Following the classification criteria established by the Ministry of Ecology and Environment of China and widely adopted in prior literature (e.g., Wei et al., 2025), we categorize firms into heavy-polluting and non-heavy-polluting industries. Figure 4 displays the estimated coefficients and 95% confidence intervals of the interaction term CD * Dual for each subsample.

(Note: this figure presents the estimated coefficients and 95% confidence intervals for the interaction term CD * Dual in two subsamples: heavy-polluting industries and non-heavy-polluting industries. The negative and statistically significant coefficient observed in heavy-polluting industries supports the view that CEO duality has a more detrimental moderating effect in sectors with greater ESG exposure).

As shown in Fig. 4, the interaction term CD * Dual is significantly negative in heavy-polluting industries (γ = −0.032, p < 0.01), whereas it is statistically insignificant in non-heavy-polluting industries. This result suggests that the negative moderating effect of CEO duality on the relationship between digitalization and ESG performance is more pronounced in industries facing higher environmental and regulatory pressures, thereby providing empirical support for Hypothesis H3.

These findings align with theoretical expectations derived from institutional and stakeholder theories. In high-pollution sectors, firms face stricter ESG scrutiny from regulators and stakeholders, requiring them to effectively integrate digital tools for environmental compliance and sustainability communication (e.g., De Pilla et al., 2024; Risi et al., 2022; Zhao & Chen, 2024). However, when decision-making authority is concentrated in a single individual, as is the case with CEO duality, such firms may fall short of aligning digital strategies with ESG imperatives. In contrast, firms in less-regulated sectors experience more flexibility in ESG engagement, where the governance risks of CEO duality appear to be less detrimental.

Baseline moderating effect of government linked corporations

In this section, we explore the distinctive role of GLCs in enhancing the relationship between CD and ESG performance. GLCs, characterized by significant government ownership or influence, operate within a framework of intensified regulatory and institutional mandates aimed at fulfilling national sustainability objectives and upholding public accountability standards (Liu et al., 2023; Martsinchyk et al., 2024). These unique governance structures impose additional layers of responsibility on GLCs, compelling them to adhere to higher standards of transparency and social responsibility. Consequently, GLCs are predisposed to leverage digitalization more effectively to achieve superior ESG outcomes compared to their non-government-linked counterparts.

Table 6 presents empirical evidence supporting the hypothesis that GLCs significantly moderate the positive impact of CD on ESG_HZ. Across the sequential regression models (Columns 1 to 3), the interaction terms (GLCs * CD) consistently display positive and highly statistically significant coefficients at the 1% level (γ = 0.089, p < 0.01; γ = 0.076, p < 0.01; γ = 0.064, p < 0.01). This robust significance indicates that the presence of GLCs amplifies the beneficial effects of CD on ESG performance. Furthermore, the marginal effect analysis depicted in Fig. 5 demonstrates that the marginal effect of CD on ESG_HZ for GLCs is approximately 0.089, compared to a marginal effect of 0.064 for non-GLCs. Figure 6 reinforces this finding by illustrating a steeper positive slope for GLCs, signifying a more substantial incremental improvement in ESG performance per unit increase in digitalization. These graphical representations corroborate the quantitative results, underscoring the pivotal role of GLCs in maximizing the ESG-related benefits of digitalization.

(Note: this figure depicts the estimated marginal effects of CD on ESG performance for firms with and without Government-Linked. The analysis controls for FirmAge, Lev, ROA, Growth, Loss, Board, Indep, Top1, and Mshare. Error bars represent 95% confidence intervals. The interaction term (CD * GLCs) is statistically significant at the 1% level, indicating that the presence of GLCs enhances the impact of CD on ESG performance).

(Note: the figure illustrates the linear trends in the marginal effects of CD on ESG across varying levels of Government-Linked Corporation presence. The steeper positive slope for GLCs (solid line) compared to non-GLCs (dashed line) signifies a more substantial incremental improvement in ESG performance per unit increase in CD for GLCs. Data visualization was performed using Stata 17).

These findings are consistent with existing literature and further enrich the understanding of the pivotal role that GLCs play in advancing sustainable development goals. Prior research has demonstrated that GLCs, benefiting from privileged access to government resources and heightened sensitivity to regulatory pressures, are more inclined to adopt ESG practices that align with national policy directives (Adebayo & Ackers, 2024; Liu et al., 2023). Additionally, GLCs are subject to increased public and stakeholder scrutiny regarding social responsibility and transparency, which incentivizes them to harness digital tools more effectively to enhance sustainability initiatives (Kong & Liu, 2023; Xiao et al., 2024). Our study extends these insights by empirically demonstrating that, within the digitalization framework, GLCs significantly magnify the positive effect of corporate digitalization on ESG performance. This amplification underscores the critical role of GLCs in leveraging their institutional advantages and resource dependencies to comply with and proactively advance ESG objectives, thereby contributing to more robust and sustainable corporate practices.

Cross-ownership variation in the moderating effect of GLCs

In this section, we examine the moderating effect of GLCs ownership structure on the relationship between CD and ESG performance, as proposed in Hypothesis 5 (H5). We differentiate between minority state-owned and majority state-owned enterprises. In Chinese corporations, majority state-owned enterprises are those where the government holds over 50% of the shares, granting it control over decisions and often leading to bureaucratic constraints and limited autonomy. In contrast, minority state-owned enterprises, with less than 50% government ownership, enjoy greater flexibility and independence while still benefiting from government resources. Based on our prediction from resource dependence theory, minority state-owned GLCs are expected to exhibit stronger positive moderating effects than majority state-owned GLCs, due to their greater autonomy in decision-making.

Figure 7 displays the coefficients from the subsample tests of CD × GLCs for majority and minority state-owned enterprises. The results suggest that the moderating effect of GLCs is significantly stronger in minority state-owned enterprises (γ = 0.088, p < 0.01) compared to majority state-owned enterprises (γ = 0.057, p > 0.1). The coefficient for majority state-owned enterprises is statistically insignificant, indicating that the positive moderating effect of GLC status is considerably weaker in firms with greater government ownership.

(Note: this figure shows the estimated coefficients and 95% confidence intervals for the interaction term CD * GLCs across two subsamples: majority state-owned enterprises and minority state-owned enterprises. The stronger positive moderating effect observed in minority state-owned enterprises suggests that these firms benefit more from digitalization in enhancing ESG performance).

These findings provide empirical support for H5, suggesting that minority state-owned enterprises are better positioned to leverage digitalization to enhance ESG performance as they have more operational flexibility and greater strategic independence. On the other hand, majority state-owned enterprises, which are more likely to be subject to bureaucratic control and political interference, exhibit weaker effects of digitalization on ESG outcomes. One possible explanation is that the higher level of government involvement in majority state-owned enterprises limits their ability to implement innovative digital strategies quickly, as decisions are often influenced by political objectives rather than purely business-driven considerations. This reduces their capacity to fully capitalize on the potential of digital tools to improve ESG performance.

Further analysis

Our preceding empirical results establish that CD significantly enhances ESG performance. However, a critical and underexplored question remains: which specific dimensions of CD are most instrumental in optimizing ESG outcomes? As outlined in the hypothesis development, extensive research has underscored the transformative potential of advanced digital technologies—namely artificial intelligence (AI), blockchain (BC), cloud computing (CC), big data (BD), and digital technology application (DTA)—in revolutionizing organizational operations and fostering digital innovation (Fan et al., 2024; Kindermann et al., 2020; Luo, 2024; Quttainah & Ayadi, 2024; Singh et al., 2024). These technologies collectively offer unparalleled opportunities for firms to streamline innovation processes, enhance R&D decision-making, promote environmental sustainability, and mitigate agency problems. Nevertheless, the extant literature has yet to delineate which specific dimension of corporate digitalization most effectively navigates complex technological landscapes to maximize ESG performance.

To address this gap, we disaggregated the overall CD index into five distinct dimensions based on corporate digitalization keywords: AI, BC, CC, BD, and DTA. Utilizing data visualization techniques as employed by Tao et al. (2024), Figs. 8 through 12 present the regression results for each digitalization dimension. The empirical analysis reveals that four out of the five dimensions—AI, CC, BD, and DTA—exhibit a statistically significant positive impact on ESG performance, whereas BC does not demonstrate a measurable effect.

AI emerges as a robust enhancer of ESG performance, likely due to its capacity to optimize decision-making processes and improve predictive analytics related to sustainability metrics. CC contributes significantly by enabling scalable and flexible data management systems that support comprehensive ESG reporting and real-time monitoring. BD facilitates the aggregation and analysis of vast datasets, thereby enhancing transparency and accountability in ESG practices. DTA, encompassing a broad range of tools and platforms, supports the implementation of targeted sustainability initiatives and efficient resource management.

In contrast, BC, despite offering decentralized transparency, traceability, and immutability, fails to show a significant impact on ESG performance in our analysis. This lack of effect can be attributed to several factors. First, the practical implementation of BC in ESG domains remains nascent, hindered by technological and financial barriers associated with integrating blockchain into existing ESG frameworks (Asif et al., 2023; Shahzad et al., 2023). Firms often lack the requisite technical expertise and infrastructure to effectively deploy blockchain for ESG-specific applications, such as carbon tracking or ethical supply chain management (Camel et al., 2024; Kouhizadeh et al., 2020). Additionally, the high initial costs and complexity of blockchain technology may deter widespread adoption, limiting its potential to drive substantial ESG outcomes. Moreover, in many cases, blockchain is adopted more for symbolic compliance or marketing appeal rather than deep functional ESG integration. Consequently, the underutilization of BC in ESG initiatives underscores the need for further refinement and targeted exploration of blockchain applications to fully harness its sustainability potential.

Discussion

Digitalization has long played a critical role in improving corporate sustainability, even before the advent of advanced AI and machine learning. Earlier technologies such as enterprise resource planning, computerized compliance systems, and online stakeholder portals laid the groundwork for more efficient ESG reporting, resource management, and regulatory adherence (Kolk & Pinkse, 2005; Schaltegger et al., 2012). Building upon these foundations, our findings show that modern digitalization—particularly when supported by sound governance and institutional support—can substantially improve ESG outcomes.

We find that digitalization significantly improves ESG performance, particularly in firms with decentralized leadership structures and those benefitting from state affiliation. These results align with prior research emphasizing the role of digital tools in enhancing transparency, operational efficiency, and stakeholder responsiveness (Anjaria, 2024; Shahzad et al., 2023). Moreover, our analysis reveals that not all digital dimensions contribute equally—artificial intelligence, cloud computing, big data, and digital technology application are most effective, while blockchain has limited influence under current implementation constraints. Such limited impact may stem from fragmented implementation, low interoperability, and the absence of unified reporting standards (e.g., Jnr, 2024). To enhance blockchain’s ESG relevance, industry-wide frameworks, platform interoperability, and regulatory recognition will likely be necessary. This observation underscores the need for more enabling institutional and technical conditions to unlock blockchain’s potential for ESG integration. Complementary studies have also shown that digitalization does not always translate into ESG improvements. Some studies highlight risks such as symbolic adoption, digital greenwashing, or the lack of capacity to operationalize digital tools effectively (Adebayo & Ackers, 2024; Broccardo et al., 2022). These insights underscore the significance of governance and institutional quality in shaping the actual impact of digitalization on sustainability outcomes.

From a theoretical standpoint, this study integrates and extends several perspectives. Agency theory helps explain why CEO duality impairs ESG progress under digitalization: centralized authority weakens oversight, increasing the risk of managerial short-termism (Fama & Jensen, 1983; Krause et al., 2013). Conversely, stakeholder theory suggests that GLCs are better equipped to translate digital strategies into ESG gains due to their dual accountability to both the state and the public (Freeman et al., 2021; Li et al., 2024). The resource-based view further supports the idea that GLCs possess unique assets—such as regulatory support and reputational legitimacy—that enhance their capacity to deploy digital technologies for sustainability (Barney, 1991; Bruton et al., 2014). This advantage may stem not only from greater operational autonomy but also from alignment with political expectations—such as demonstrating digital innovation outcomes in line with national development goals. In this sense, minority SOEs may benefit from both institutional flexibility and symbolic incentives for ESG visibility.

Additionally, these insights carry significant implications for both corporate strategy and public policy. Firms with concentrated leadership structures may fail to fully exploit the ESG potential of digital investments unless governance reforms—such as board independence or role separation—are instituted. GLCs and similar hybrid entities should strategically integrate high-impact digital technologies like AI and big data into ESG processes, leveraging their institutional advantages. Policymakers can also play a catalytic role by combining digitalization incentives with ESG disclosure mandates, as exemplified by the EU’s Corporate Sustainability Reporting Directive and the U.S. Securities and Exchange Commission’s proposed climate-related disclosure rules (Hummel & Jobst, 2024; Securities and Exchange Commission, 2022).