Abstract

This study represents one of the first empirical investigations into the association between sustainability reporting (SR), as measured by the voluntary adoption of the Global Reporting Initiative (GRI) framework, and the probability of initial public offering (IPO) withdrawal on a global scale. Employing signalling theory, the impact of firms’ voluntary adoption of the GRI framework on the probability of IPO withdrawal is examined. The study examines a total of 33,536 IPOs across 22 different countries from 1995 to 2019, with each IPO influenced by distinct socioeconomic, legal and cultural environments. The findings provide persuasive evidence that the voluntary adoption of the GRI framework in IPO prospectuses can reduce global IPO withdrawals by as much as 65%. The study posits that the GRI framework serves as a means of signalling the quality of an IPO firm, its governance practices and its capacity to create long-term value. Consequently, the adoption of the GRI framework enhances investor confidence and diminishes information asymmetry in the IPO market. This research contributes to the existing body of knowledge on IPOs by emphasising the significance of SR in mitigating financial risks and fostering trust among stakeholders during the IPO process. It offers crucial insights for issuing companies, investors, lawmakers and scholars interested in understanding the impact of SR on IPO success and risk management. The implications of this study have far-reaching implications that surpass academic discourse, providing valuable insights into best practices within the industry, corporate decision-making processes and regulatory frameworks aimed at promoting responsible and sustainable growth in capital markets.

Similar content being viewed by others

Introduction

This study aims to address a research gap in the sustainability reporting (SR) and initial public offering (IPO) literature by investigating the relationship between SR frameworks, specifically the voluntary adoption of the Global Reporting Initiative (GRI) framework and the probability of withdrawal in the IPO market globally. IPO withdrawal refers to a firm’s decision to retract its initial intention to transition from a privately held corporation to a publicly traded company via an IPO (Helbing et al. 2019; Jamaani and Alidarous 2024a). This decision often occurs after the business has submitted its IPO registration paperwork to the relevant regulatory authorities but before the actual sale of its shares to public investors (Helbing 2019). The significance of the IPO market lies in its role as a major contributor to economic growth, a promoter of innovation and a facilitator of capital formation in both local and global economies (Lowry and Schwert 2002; Boulton et al. 2010; Hopp and Dreher 2013; Jamaani and Alidarous 2023). To illustrate the scale of the IPO market, Ernst and Young (EY) reported that it raised $179 billion in 2022 through more than 1600 globalFootnote 1 IPO transactions (Ernst and Young 2022). IPO research reports an ongoing problem of IPO withdrawal across capital markets that could potentially distort local and global economic growth due to the decision of IPO firms electing to retract their anticipated IPO prior to the public listing of their shares (Busaba et al. 2001; Dunbar and Foerster 2008; Jamaani and Alawadhi 2023; Jamaani and Alidarous 2024a).

Over the past three decades, IPO research has documented an average withdrawal rate of 15%–19% across global equity markets (Helbing et al. 2019; Jamaani and Alidarous 2024a). This withdrawal issue hampers capital formation, restricts business expansion and diminishes investor confidence, thereby slowing local economic development and deteriorating global market liquidity (Busaba et al. 2001; Qing 2011; Fernandez-Feijoo et al. 2014; Helbing et al. 2019; Reiff and Tykvová 2021). In addition to the detrimental economic effects, the withdrawal decision is often irrevocable for IPO firms and incurs substantial legal, underwriting and auditing fees, which are costs borne by IPO owners (Busaba et al. 2001; Boeh and Southam 2011; Jamaani 2025). IPO research indicates that inadequate information disclosure, stemming from information asymmetry between IPO owners and socially responsible investors, disrupts the information dissemination process, leading to decisions (Busaba et al. 2001; Qing 2011; Reiff and Tykvová 2021; Jamaani and Alidarous 2024a).

SR research has found that the voluntary adoption of environmental, social and governance (ESG) practices helps mitigate information asymmetry in IPO markets by providing socially responsible investors and firms with improved disclosure quality (Baker et al. 2021; Abbas et al. 2022; Wang et al. 2022; Ferri et al. 2023). SR achieves this by offering transparent and uniform non-financial disclosures regarding a business’s ESG practices, which are often overlooked in conventional financial reporting (Dhaliwal et al. 2011; Fijałkowska and Hadro 2022; Barman and Mahakud 2024; Sun et al. 2024). However, IPO-SR research remains in its infancy, having primarily focused on the impact of the ESG aspect of SR on IPO underpricing without assessing the effect of adopting SR frameworks on the withdrawal of IPO firms before going public (Chou et al. 2013; Baker et al. 2021; Economidou et al. 2023; Harasheh 2023). Research shows that IPO withdrawals are fundamentally detrimental to an IPO company than underpricingFootnote 2 (Helbing et al. 2019; Reiff and Tykvová 2021; Jamaani and Alawadhi 2023). SR research has shown that firms may voluntarily utilise many widely accepted SR frameworksFootnote 3 to organise and communicate their sustainability practices and performance, thereby mitigating the problem of information asymmetry between market participants (Goswami et al. 2023; Rowbottom 2023). Therefore, our focus on the relationship between SR frameworks, as measured by the voluntary adoption of the GRI framework, and the probability of withdrawal in the IPO market adds significant value to the IPO-SR research.

To date, IPO-SR literature has not yet investigated the influence of the voluntary adoption of the GRI framework on the IPO market, particularly concerning the ongoing phenomenon of IPO withdrawal (Busaba et al. 2001; Dunbar and Foerster 2008; Qing 2011; Helbing 2019; Helbing et al. 2019; Reiff and Tykvová 2021; Jamaani and Alawadhi 2023; Jamaani and Alidarous 2024a, 2024b). This creates a lack of understanding regarding the financial impact of using the GRI framework on IPOs and its role in mitigating withdrawal probability. This motivates us to address the following research question: How does voluntary GRI adoption impact IPO withdrawal probability?

This research examines a large dataset comprising 33,536 IPOs across 22 distinct nations with varying socioeconomic, legal and cultural contexts from 1995 to 2019. The research hypothesis is straightforward and grounded in signalling theory developed by Allen and Faulhaber (1989). This theory posits that the voluntary incorporation of the GRI framework in IPO prospectuses signals superior quality to socially responsible investors in the IPO market, demonstrating a commitment to transparency and sustainability. It also suggests that by voluntarily adopting the GRI framework, IPO firms may reduce the probability of IPO withdrawal by providing extensive and consistent SR to socially responsible IPO investors, thereby addressing information asymmetry in the IPO market. Our findings demonstrate a robust negative correlation between the voluntary adoption of the GRI framework and the probability of IPO withdrawal in the global IPO market, even after conducting a series of sensitivity tests. We discovered compelling evidence that the voluntary adoption of the GRI framework in IPO prospectuses mitigates global IPO withdrawals by up to 65%. This significant result underscores the importance of transparency, environmental sustainability and stakeholder engagement in influencing socially responsible investors’ perspectives, reducing risks and promoting the development of long-term value for IPOs. Firms that prioritise SR through the voluntary adoption of the GRI framework could enhance their standing in financial markets, appeal more to socially responsible investors who emphasise sustainability and navigate the IPO process with greater confidence.

This research makes two distinct contributions to the emerging IPO-SR literature. First, we expand the research on the tangible impacts of SR on the IPO market by emphasising the significance of adopting the GRI framework. Prior research has exclusively examined the tangible impacts of overall ESG reporting on the IPO market while neglecting the impact of the voluntary adoption of the GRI framework on IPO withdrawal probability (Garanina and Dumay 2017; Yang et al. 2021; Abbas et al. 2022; Ferri et al. 2023; Harasheh 2023; Kang and Lam 2023). This research is among the first to extend previous IPO-SR research by analysing the actual impact of the voluntary adoption of the GRI-SR framework on the probability of IPO withdrawal from a global perspective. Second, we enhance the understanding of previous literature that utilises signalling theory in SR by examining the mechanisms through which the GRI framework can function as a signalling tool to impact IPO withdrawals (Uyar et al. 2020; Yang et al. 2021; Friske et al. 2023; Luo and Tang 2023). This signalling role is achieved by mitigating the issue of information asymmetry in the IPO market through improved transparency, credibility, stakeholder interaction, risk management and the development of long-term value. The empirical evidence of this study supports signalling theory, which suggests that the voluntary adoption of the GRI framework can be employed by IPO owners as a strategy to signal quality to socially responsible investors (Abbas et al. 2022; Friske et al. 2023). Thus, the GRI framework could serve as a valuable tool for these investors to evaluate a company’s sustainability performance, objectives and the influence of sustainability on its operations (Moneva et al. 2006; Luo and Tang 2023). It offers standardised and comparable information, allowing socially responsible investors to make well-informed choices (Orazalin and Mahmood 2020; Yang et al. 2021). This promotes trust and openness, thereby reducing the asymmetry of information between IPO owners and socially responsible investors (Baker et al. 2021; Jamaani and Alidarous 2023). Ultimately, utilising the GRI framework diminishes the likelihood of socially responsible investors withdrawing their investment plans in the IPO firms, thus reducing the probability of IPO withdrawal. This, in turn, ensures sustainable capital market growth in local and global economies.

The paper is organised as follows. Research background, theory and hypothesis building are covered first, followed by methodology and data selection. After the results and discussion, sensitivity testing and conclusion are provided.

Research background, theory and hypothesis building

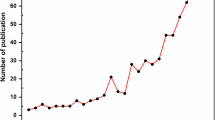

In the past decades, there has been a growing trend among socially responsible investors and firms to monitor and assess the effects of corporate operations on social and natural environments (Gray 2006; Moneva et al. 2006; Chen et al. 2015; Kwarteng et al. 2016; Oncioiu et al. 2020; Traxler et al. 2020; Khan et al. 2021; Yang et al. 2021; Pizzi et al. 2022; Ferri et al. 2023; Pizzi et al. 2024; Roszkowska-Menkes et al. 2024). Consequently, SR has emerged as a prevalent subject and established practice in the corporate sphere to illustrate the effects of companies’ activities on social and environmental contexts (Fonseca et al. 2014; Boiral et al. 2018; Friske et al. 2023; KPMG International 2023; Mougenot and Doussoulin 2024). For example, Wang et al. (2020) demonstrate that 78% of S&P 500 firms voluntarily published a sustainability report in 2018, with this implementation rate significantly higher among large businesses globally (KPMG International 2022). The SR practice involves incorporating non-financial information about ESG practices and performance alongside conventional financial reporting (Cantele and Zardini 2018; Luo and Tang 2023). According to a KPMG 2022 survey, SR has evolved into a widely adopted standard practice for companies emphasising corporate social responsibility (CSR) and has become a focal point for socially responsible investors (KPMG International 2022). This trend in SR has shown consistent growth over the last 20 years, indicating that many countries recognise the importance of including ESG information for socially responsible stakeholders (KPMG International 2022; Bag 2023). KPMG’s 2022 survey indicates that the N100 and N250Footnote 4 firms have consistently and progressively improved their rates of SR due to increasing demand from these stakeholders (KPMG International 2022). In 1999, the percentage of N250 (N100) firms reporting on sustainability was 35% (24%). However, this percentage has significantly increased to 96% (79%) in 2022. Recently, there has been a notable increase in many regions and countriesFootnote 5 in promoting and requiring companies to adopt and disclose their SR practices, driven by government and societal pressure from socially responsible investors (Pizzi et al. 2022; Kang and Lam 2023; Barman and Mahakud 2024).

Research on SR indicates that firms may voluntarily employ several established SR frameworks, including GRI, SASB and TCFDFootnote 6, to structure and communicate their sustainability practices and performance, thereby alleviating the issue of information asymmetry among market participants (Goswami et al. 2023; Rowbottom 2023). Our research focuses on the GRI-SR framework due to its widespread prevalence and acceptance among socially responsible investors and firms (Moneva et al. 2006; Fonseca et al. 2014; Chen et al. 2015; Orazalin and Mahmood 2020; Yang et al. 2021; Goswami et al. 2023). The GRI framework has maintained its position as the dominant standard for non-financial reporting since 1997, owing to its durability and strong reputation (KPMG International 2022). Furthermore, the GRI framework has gained global acceptance as one of the most common standards for managing SR, with increasing use in both the N100 and N250Footnote 7 (Brown et al. 2009b; Christofi et al. 2012; Ernst & Young Global Limited 2020; Luo and Tang 2023). In 2022, for instance, the GRI was utilised by over 68% (78%) of the N100 (N250) firms (KPMG International 2022).

The GRI is a non-profit organisation renowned for its SR framework (Luo and Tang 2023). The GRI organisation’s standards provide a comprehensive framework of principles and rules that assist firms in quantifying and disclosing their impact on the economy, society and environment (Moneva et al. 2006; Orazalin and Mahmood 2020). By adhering to the guidelines presented by the GRI, firms can systematically and transparently report their influence on sustainability matters with limited managerial discretion, enabling socially responsible investors to gain an unbiased and comprehensive understanding of firms’ operations and make well-informed investment choices (Brown et al. 2009b; Fernandez-Feijoo et al. 2014; Machado et al. 2021). Research has indicated that the implementation of the GRI framework may mitigate the problem of ‘selective reporting’ employed by some corporations for the purpose of greenwashing (Uyar et al. 2020; Khan et al. 2021; Roszkowska-Menkes et al. 2024). This refers to the practice of disclosing only a portion of confidential information to create a falsely favourable public perception (Marquis et al. 2016). Thus, the GRI framework can facilitate the process of helping firms identify pertinent sustainability issues, establish performance metrics, gather information and report on their sustainability initiatives in a standardised and comparable manner (Uyar et al. 2020; Khan et al. 2021; Roszkowska-Menkes et al. 2024). Firms can signal their commitment to environmental stewardship and good business practices by providing detailed reports on various sustainability elements to socially responsible investors (Traxler et al. 2020; Yang et al. 2021). SR scholars believe that the GRI framework may indeed mitigate information asymmetry between firms and socially responsible investors by offering a comprehensive range of indicators and reporting requirements (Martínez‐Ferrero et al. 2016; Fuhrmann et al. 2017; García‐Sánchez and Noguera‐Gámez 2017).

SR researchers contend that the GRI framework could effectively reduce information asymmetry between firms and socially responsible investors by providing a comprehensive array of indicators and reporting mandates (Martínez‐Ferrero et al. 2016; Fuhrmann et al. 2017; García‐Sánchez and Noguera‐Gámez 2017). Research suggests that the adoption of the GRI framework may somewhat alleviate the issue of ‘selective reporting’ employed by certain firms for greenwashing purposes (Uyar et al. 2020; Khan et al. 2021; Roszkowska-Menkes et al. 2024). This practice involves revealing only a segment of sensitive material to create a misleadingly positive public image (Marquis et al. 2016). However, findings regarding the implementation of the GRI framework in SR remain a subject of debate (Nikolaeva and Bicho 2011; Yang et al. 2021). Some academics argue that companies adhering to the GRI framework achieve superior success in the stock market (Willis 2003) and in terms of environmental impact (del Mar Alonso‐Almeida et al. 2014). Conversely, others express scepticism. Goel and Cragg (2005) contend that the GRI framework is overly comprehensive and includes many indicators that have not been utilised by businesses, serving primarily as a guide for reporting procedures rather than as a management tool. Research indicates that implementing the GRI framework is complicated, time-consuming and expensive due to challenges in gathering data for a multitude of metrics (Luken and Stares 2005; Lozano 2006; Lozano and Huisingh 2011). Moreover, assessing the sustainability performance of various companies using qualitative/content analysis of the GRI framework (Boiral and Henri 2017). Therefore, the specific advantages conferred by the GRI framework remain uncertain (Goel and Cragg 2005; Moneva et al. 2006; Yang et al. 2021). To our knowledge, there has been no scholarly enquiry into the financial implications of the GRI framework compared to non-GRI reporting within the context of the IPO market.

Research on SR and IPOs is still in its infancy, having primarily focused on the impact of the ESG aspect of SR on IPO underpricing, yielding fragmented results without assessing the impact of the GRI framework on IPO firms’ withdrawal risk. Research shows that IPO withdrawals can be more detrimental to a company than underpricing (Helbing et al. 2019; Reiff and Tykvová 2021; Jamaani and Alawadhi 2023). SR research has shown that firms may voluntarily utilise many widely accepted SR frameworks to organise and communicate their sustainability practices and performance, thereby mitigating the problem of information asymmetry between market participants (Goswami et al. 2023; Rowbottom 2023). The gap between the IPO owners’ offer price and the IPO share’s first-day closing price is termed IPO underpricing. While investors benefit quickly, IPO owners suffer due to this underpricing (Jamaani and Alidarous 2019). This wealth transfer helps balance the information asymmetry between IPO owners and investors (Jamaani et al. 2022). Habib and Ljungqvist (2001) found that IPO underpricing temporarily transfers wealth from IPO owners to investors. However, Mumtaz and Smith (2021) discovered that a significant number of underpriced IPOs perform excellently in the long run, thereby recovering the financial losses incurred from initial underpricing. This may mitigate the short-term wealth loss experienced by IPO issuers. Conversely, IPO withdrawal incurs high listing costs and is rarely reversible (Busaba et al. 2001; Boeh and Southam 2011; Jamaani 2025). Retracting an IPO affects a firm’s financial sustainability, limits financing options, reduces market value, damages the company’s reputation and causes bankruptcy risk, in addition to incurring listing expenses (Busaba et al. 2001; Qing 2011). Therefore, our focus on the relationship between SR frameworks, as measured by the voluntary adoption of the GRI framework, and the probability of withdrawal in the IPO market adds significant value to the IPO-SR research.

Apart from a limited focus on the problem of IPO underpricing, IPO-ESG literature produces fragmented results. For example, Baker et al. (2021) examined the correlation between government ESG ratings or scoring and the degree of underpricing in IPOs across different capital markets. The researchers analysed 7,446 IPOs conducted in 36 different countries and found significant evidence indicating that nations with better ESG ratings tend to experience lower levels of IPO underpricing. Harasheh (2023) investigated the procedure of Italian small and medium-sized enterprises (SMEs) from 2009 to 2017, discovering that underpricing is lower for IPOs that adopt better ESG practices in the year preceding the IPO. The study concluded that the disclosure of ESG scoring reduces asymmetric information for socially responsible investors, enhances the quality of signalling for IPO owners and allows IPOs to improve the company’s image regarding SR. In contrast, Economidou et al. (2023) found that IPOs that had previously disclosed ESG information tend to experience greater initial underpricing. They attribute this contrasting outcome to a favourable market reaction, proposing a new narrative that focuses on the long-term trajectory of ESG, rather than its immediate impact on underpricing. They conclude that socially responsible investors do not perceive information on a company’s ESG activities merely as additional data and do not develop a greater emotional connection to ESG-responsible enterprises. Compared to underpricing, research indicates that IPO withdrawals have a more severe impact on a company (Helbing et al. 2019; Reiff and Tykvová 2021; Jamaani and Alawadhi 2023). Habib and Ljungqvist (2001) discovered that IPO underpricing temporarily transfers wealth from IPO proprietors to investors. Nevertheless, Mumtaz and Smith (2021) found that a substantial number of underpriced IPOs perform exceptionally well in the long term, thereby recouping the financial losses incurred due to initial underpricing. This has the potential to mitigate the short-term wealth loss of IPO issuers resulting from underpricing. Conversely, IPO withdrawal incurs substantial listing expenses and is exceedingly difficult to reverse (Busaba et al. 2001; Boeh and Southam 2011; Jamaani 2025). In addition to listing expenses, the decision to withdraw from an IPO impacts the firm’s financial sustainability, financing options, market value, image and bankruptcy risk (Busaba et al. 2001; Qing 2011).

The IPO literature has examined several factors influencing the probability of an IPO being withdrawn due to information asymmetry issues between IPO owners and investors (Busaba et al. 2001; Dunbar and Foerster 2008; Qing 2011; Helbing et al. 2019; Reiff and Tykvová 2021). The factors considered include issuer and issue characteristics, intermediaries’ participation, company governance standards and market conditions during and after the filing. These factors have been analysed as potential determinants that influence the likelihood of IPO withdrawal (Busaba et al. 2001; Dunbar and Foerster 2008; Qing 2011; Helbing et al. 2019; Reiff and Tykvová 2021). For instance, Dunbar (1998) analysed characteristics related to issuers and issues to identify reasons for IPO withdrawal, focusing on 236 cancelled and 520 completed American IPOs that occurred between 1979 and 1982. The findings reveal a positive relationship between withdrawal and the volume of filings. Boeh and Southam (2011) analysed a dataset of 1071 successful and 584 withdrawn IPOs on the American stock market from 1999 to 2004, discovering that reputable underwriters play a crucial role in preventing the withdrawal of IPO firms to maintain their reputation. This has been observed in cases where an IPO supported by banks with a negative market image was ultimately withdrawn due to a lack of reputational capital. Qing (2011) analysed data from 2284 successful and 594 failed IPOs in the American equities market from 1996 to 2005, finding no relationship between reputable underwriters and the decision to withdraw an IPO. Helbing et al. (2019) conducted an analysis of 2474 successful and 334 withdrawn IPOs in Europe from 2001 to 2015, with results aligning with those of Qing (2011). According to Boeh and Southam (2011), IPOs supported by venture capitalists (VCs) exhibit higher rates of withdrawal, as VCs may retract their support for underperforming IPOs if they discover alternative funding sources. Reiff and Tykvová (2021) utilised a dataset of 2500 completed and 938 withdrawn IPOs on the American stock market between 1997 and 2014, demonstrating that VC support and improved corporate governance can serve as indicators during periods of significant market instability, thereby reducing the probability of an IPO being withdrawn. Helbing et al. (2019) found that if a business’s chief executive officer (CEO) simultaneously serves as the president of the board, the likelihood of the firm withdrawing its IPO increases due to diminished monitoring and heightened moral hazard. Reiff and Tykvová (2021) discovered no correlation between the presence of multiple CEOs and the decision to withdraw an IPO. Recently, Jamaani and Alidarous (2024b) investigated whether withdrawals in IPOs are influenced by the participation of prominent lawyers in issuing firms. The study examined 24,312 failed and completed IPOs in the global IPO market, finding that IPO issuers can mitigate the ex-ante uncertainty of IPO investors by utilising outstanding legal expertise as quality certification signals. Additionally, Jamaani and Alidarous (2024a) investigated the effects of voluntary disclosure of various ESG proxies using a scoring method developed by Bloomberg on the probability of an IPO withdrawal. The authors found that firms engaging in ESG activities appear to view voluntary disclosure as an incentive to comply with social expectations. Thus, by mitigating information asymmetry among IPO participants, the withdrawal risk faced by these firms is reduced, which in turn diminishes scepticism regarding their legitimacy.

Prior research on IPO-SR has primarily focused on examining the influence of the voluntary disclosure of ESG performance on the IPO market, utilising ESG scoring methodologies to assess the adherence of IPOs to ESG practices and policies (Baker et al. 2021; Economidou et al. 2023; Harasheh 2023; Jamaani and Alidarous 2024a). However, this emerging literature has notable limitations, particularly concerning the significant disparities between the standardised SR measured by the GRI framework and the ESG rating or scoring approaches employed by reputable ESG providers such as Bloomberg and DataStream (Baker et al. 2021; Economidou et al. 2023; Harasheh 2023; Jamaani and Alidarous 2024a). These differences may arise from three reasons.

First, the GRI framework and ESG scoring differ in how they handle positive and negative tones in the textual content of company reports (Cho et al. 2009), leading to substantial variations in non-financial reporting standards. ESG providers, such as Bloomberg and DataStream, employ their own methodologies and score systems to evaluate firms’ ESG performance. However, it is important to note that these assessments may not fully align with the reporting criteria of the GRI or other recognised frameworks (Cho et al. 2009). The GRI framework offers a more comprehensive set of reporting requirements focused on multiple sustainability aspects that are widely acknowledged and used globally (Yang et al. 2021). Companies adhering to the GRI framework are more likely to provide detailed and consistent sustainability information, thereby reducing managerial discretion (Brown et al. 2009b; Fernandez-Feijoo et al. 2014; Machado et al. 2021). This transparency can significantly influence a company’s business practices and operations, thereby mitigating information asymmetry for socially responsible investors (Martínez‐Ferrero et al. 2016; Machado et al. 2021). However, SR research has shown that managers may intentionally use positive language to obscure their true ESG underperformance and manipulate the perceptions of socially responsible investors (Crilly et al. 2016; Luo and Tang 2023). Such firms may have no intention of improving their fundamental ESG activities or performance; rather, their goal is to conceal unfavourable information through symbolic and biased ESG ratings (Crilly et al., 2016; Luo and Tang, 2023). Kaplan and Ramanna (2021) found that many firms selectively highlight only the non-financial performance indicators that benefit them. There is substantial evidence that corporate disclosures of ESG performance, when presented through a scoring system that emphasises positive aspects, exert a more persuasive influence on socially responsible investors (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). This, in turn, may lead these investors to form a more optimistic evaluation of the company. Recently, Sun et al. (2024) investigated the influence of ESG performance, as measured by an ESG scoring system and the adoption of the GRI framework, on the tone of ESG disclosures in 5985 Chinese listed companies. Their research establishes a direct correlation between superior ESG performance and a more favourable ESG reporting tone. They found that the GRI framework provides guidelines for companies to offer a broader array of sustainability information and indicators to socially responsible investors. The researchers argue that the GRI-SR framework is more focused on delivering transparent and comprehensive information about a wide range of sustainability challenges that extend beyond the ESG grading system and are not influenced by tone management (Sun et al. 2024).

Second, the GRI framework and ESG scoring differ in terms of stakeholder engagement, materiality and context. ESG scoring primarily focuses on providing ESG scores to socially responsible investors and may not prioritise stakeholder involvement and inclusivity in the same manner as the GRI framework (Romero et al. 2019). The GRI framework encourages the involvement of a broader range of socially responsible stakeholders in the reporting process, resulting in a more transparent and inclusive reporting approach that may contribute to reducing information asymmetry (Martínez‐Ferrero et al. 2016; Romero et al. 2019). ESG scoring often emphasises materiality from the perspective of socially responsible investors, concentrating on ESG factors that are financially relevant to the firm and its operations (Madison and Schiehll 2021). In contrast, the GRI framework encourages organisations to assess a wider range of material issues pertinent to various socially responsible stakeholders, not just socially responsible investors (Machado et al. 2021). This broader context may provide a more comprehensive view of a firm’s SR performance and mitigate information asymmetry by offering a more holistic perspective (Machado et al. 2021).

Finally, the GRI framework and ESG scoring differ in terms of long-term focus and the integration of sustainability into business strategy. ESG scoring can sometimes emphasise the short-term financial impacts of ESG factors to align with the immediate interests of socially responsible investors (Patel et al. 2021). Conversely, the GRI framework motivates firms to adopt a long-term perspective and evaluate the comprehensive effects of their operations on the environment and community (Sun et al. 2024). This long-term perspective may enable socially responsible investors to gain a deeper understanding of a firm’s overall sustainable performance, thereby minimising information asymmetry and providing further insight for long-term investment decisions (Fernandez-Feijoo et al. 2014; Dilling and Harris 2018). ESG scoring may prioritise the assessment of a firm’s current ESG performance over the integration of sustainability into its broader business operations and strategy (Veenstra and Ellemers 2020; Patil et al. 2021). In contrast, the GRI framework encourages firms to incorporate sustainability objectives into their overall strategy and decision-making processes, in addition to reporting on their sustainability performance (Hristov et al. 2022). By disclosing a firm’s long-term sustainability strategy, this integrative approach may reduce information asymmetry while providing socially responsible investors with a more comprehensive understanding of how sustainability is embedded in the company’s core business activities (García‐Sánchez and Noguera‐Gámez 2017).

Given the identified limitations of the existing IPO-SR literature and the lack of empirical research on the impact of the voluntary adoption of the GRI framework in the IPO market, socially responsible investors and firms are left without clear information regarding the function and feasibility of employing the GRI framework in the IPO market. Consequently, a research gap emerges that necessitates an examination of the impact of the GRI-SR-IPO relationship by studying the influence of the voluntary adoption of the GRI framework on the probability of IPO withdrawal. Investigating the association between a company’s SR, evaluated using the GRI-SR framework, and the likelihood of an IPO withdrawal may yield valuable insights into the relationship between the adoption of SR frameworks and the dynamics of the IPO market. Through a comprehensive exploration of this uncharted research domain, academics and practitioners can uncover significant insights into the potential influence of SR frameworks on IPO outcomes. These insights may inform firms’ strategic decision-making while contributing to the ongoing discourse on the integration of SR frameworks into mainstream financial practices (Traxler et al. 2020; Yang et al. 2021).

The theoretical connection between voluntary compliance with the GRI framework and the probability of IPO withdrawal can be elucidated through the lens of signalling theory (Ching and Gerab 2017; Orazalin and Mahmood 2020; Yang et al. 2021). Signalling theory, predominantly articulated within the context of information asymmetry, elucidates the mechanisms by which parties possessing greater information (such as IPO firms) convey signals to mitigate uncertainty for those with comparatively less information (such as IPO investors) (Spence 1978; Allen and Faulhaber 1989; Connelly et al. 2011). Empirical studies suggest that the voluntary implementation of GRI standards serves as a robust signal of a firm’s commitment to transparency, sustainability and accountable governance (Traxler et al. 2020; Yang et al. 2021). These attributes align with investor preferences, particularly as ESG factors gain increasing importance in investment decisions. Research investigating the application of GRI standards as a signal has often focused on their impact on stakeholder perceptions, investor behaviour and firm performance (Brown et al. 2009b; Fernandez-Feijoo et al. 2014; Fonseca et al. 2014; Chen et al. 2015; Giannarakis et al. 2016; Giannarakis et al. 2017; Traxler et al. 2020; Goswami et al. 2023; Luo and Tang 2023). Most of these studies utilise signalling theory, positing that companies employ signals, such as the adoption of the GRI framework, to mitigate information asymmetry, establish credibility and enhance their market reputations. IPO research has indicated that companies frequently encounter significant information asymmetry during the IPO process, which heightens the probability of withdrawal (Busaba et al. 2001; Dunbar and Foerster 2008; Helbing et al. 2019). During the IPO process, investors typically possess limited knowledge of the business’s long-term sustainability, internal operations and overall risk profile (Lee et al. 1996; Loughran and Ritter 2004; Engelen and Van Essen 2010; Colaco and Hegde 2013; Abbas et al. 2022; Jamaani and Alidarous 2024a). To mitigate this information asymmetry, firms may convey credible signals to influence investor perceptions, reduce uncertainty and ultimately decrease the probability of IPO withdrawal.

We argue that the voluntary adoption of the GRI framework can mitigate information asymmetry in the IPO market by providing credible signals to socially responsible investors, thereby reducing the probability of IPO withdrawal through four distinct mechanisms. First, the voluntary adoption of GRI standards serves as a signal of credibility and transparency. When a firm voluntarily adopts the GRI framework, it signals a significant commitment to transparency and rigorous reporting practices (Fernandez-Feijoo et al. 2014; Ching and Gerab 2017; Luo and Tang 2023). Socially responsible investors interpret this as a trustworthy indication of the company’s effective management of its ESG risks, thereby enhancing their confidence (Fernandez-Feijoo et al. 2014; Yang et al. 2021). Signalling theory posits that high-quality firms employ high-cost signals, such as extensive SR, to distinguish themselves from lower-quality companies (Connelly et al. 2011; Ching and Gerab 2017). Studies indicate that companies demonstrating greater transparency in ESG reporting generally attract increased interest from socially responsible investors during the IPO process (Baker et al. 2021; Dang 2023; Jamaani and Alidarous 2024a). Yang et al. (2021) extend signalling theory by examining the effect of adopting the GRI framework on the profitability of Chinese firms. Their study compares firms adhering to the GRI framework with those reporting sustainability without GRI compliance, utilising a sample of 122 publicly traded companies in China from 2008 to 2016. The authors indicated that the adoption of the GRI framework enhances transparency and governance, thereby fostering greater investor confidence and demand, which subsequently improves the financial performance of the firms. Traxler et al. (2020) examined the utilisation of the GRI framework by international non-governmental organisations (INGOs) for SR and assessed its impact on enhancing transparency to stakeholders. The authors found that the implementation of the GRI framework by INGOs resulted in improved transparency, offering a systematic and comprehensive structure to guide reporting on social, environmental and governance performance. They concluded that INGOs employing the GRI framework exhibited greater transparency in disclosing their activities and impacts.

Nonetheless, a pivotal enquiry pertains to how the GRI framework can be operationally utilised as a signal of transparency and credibility to mitigate information asymmetry in the IPO market. Research indicates that the GRI framework enables firms to systematically and uniformly report on their sustainability performance with limited managerial discretion (Moneva et al. 2006; Traxler et al. 2020; Machado et al. 2021). This contrasts with ESG scoring systems, which evaluate and compare corporations based on their ESG practices and disclosures but are subject to managerial discretion (Cho et al. 2009). Studies indicate that ESG rating methodologies rely on data that corporations can provide themselves or obtain from third-party suppliers (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). These issues may lead to data errors, inconsistencies and discrepancies, potentially compromising the credibility and uniformity of ESG rankings (Kaplan and Ramanna 2021). Furthermore, research has shown that ESG scoring methodologies often prioritise a predetermined set of ESG elements and may overlook the whole spectrum of significant sustainability challenges relevant to a firm’s operations (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). This narrow focus may result in an inadequate evaluation of a firm’s overall sustainability performance. According to SR research, there is no universally accepted standard for ESG grading (Veenstra and Ellemers 2020; Kaplan and Ramanna 2021; Patil et al. 2021). This has led to the emergence of various techniques and rating organisations, each with its own criteria and weighting systems (Kaplan and Ramanna 2021). The lack of uniformity in this regard may pose challenges for investors in accurately comparing ESG rankings across different corporations and countries (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). Therefore, the uniformity advantage provided by the GRI reporting framework may reduce ambiguity, enhance investment trust for socially responsible investors and improve the company’s standing by promoting transparency and credibility. By voluntarily adopting the GRI framework, socially responsible investors may enhance their decision-making process when investing in IPOs, leading to reduced information asymmetry in the IPO market. Thus, the voluntary adoption of the GRI framework could signify transparency and credibility for IPOs, demonstrating a company’s commitment to comprehensive and standardised ESG disclosures. This approach reassures socially responsible investors about the reliability and accuracy of the information provided, thereby mitigating information asymmetry in the IPO market and reducing the probability of IPO withdrawal.

Second, the voluntary use of the GRI framework may signal a positive perception of a company’s long-term viability. Research on IPOs has indicated that socially responsible investors are concerned with both short-term returns and the long-term sustainability of a company (Jamaani and Alidarous 2024a). Studies also suggest that implementing the GRI framework signals a company’s commitment to long-term environmental and social impacts, as well as a forward-thinking approach (Brown et al. 2009b; Chen et al. 2015; Orazalin and Mahmood 2020; Traxler et al. 2020). This is a critical factor for socially responsible investors who incorporate ESG considerations into their investment decisions (Brown et al. 2009b; Chen et al. 2015). Bouten et al. (2011) discovered that companies complying with the GRI framework demonstrate enhanced transparency in their sustainability activities. They contend that this increased transparency fosters trust among stakeholders, particularly socially responsible investors who prioritise ESG factors. The authors emphasise that adopting the GRI framework leads to improved ESG disclosures, signalling a commitment to long-term sustainability and making companies more attractive to socially responsible investors. Michelon and Parbonetti (2012) examined the impact of GRI framework implementation on investor perceptions and corporate transparency. They found that GRI-compliant companies generally offer more comprehensive ESG performance disclosures, aiding socially responsible investors in assessing the long-term risks and opportunities associated with these companies. Their research demonstrates that the adoption of the GRI framework is associated with increased appeal to ESG-focused investors and enhanced long-term viability. Compared to non-GRI adopters, Yang et al. (2021) found that companies implementing the GRI-SR framework exhibited superior financial performance, as reflected in higher profitability, improved return on assets (ROA) and stronger stock market performance. They attribute this finding to the fact that GRI adoption signals transparency and strong governance to socially responsible investors, leading to a more favourable perception of the firm’s long-term viability. This, in turn, enhances the company’s financial performance. Therefore, we argue that the implementation of the GRI framework by IPO firms serves as a signal of long-term viability, demonstrating the company’s commitment to sustainability and alignment with global best practices. Socially responsible investors interpret this as an indication of the IPO firm’s preparedness to effectively manage future risks, thereby reducing the likelihood of IPO withdrawal among this group of investors.

Third, the voluntary adoption of the GRI framework can signal increased investor demand and an enhanced corporate reputation. Research has shown that implementing the GRI framework can bolster a company’s reputation, particularly among institutional and socially responsible investors, who are increasingly prioritising sustainability in their investment portfolios (Simmons Jr et al. 2018; Miras‐Rodríguez et al. 2020). Michelon et al. (2015) examined CSR reporting practices and found that companies adhering to the GRI framework tend to disclose more comprehensive and detailed sustainability information. The authors demonstrate that high-quality disclosure can significantly enhance a company’s reputation, particularly among socially responsible investors who value the consistency and comprehensiveness of GRI-based SR. Kaspereit and Lopatta (2016) conducted an in-depth investigation highlighting the correlation between improved financial performance and SR, including the use of the GRI framework. Their research shows that institutional investors often incorporate GRI-based reports into their evaluations of companies. The findings suggest that socially responsible investors – who prioritise long-term shareholder value and corporate sustainability – are more likely to view firms that adhere to the GRI framework favourably. Yang et al. (2021) found that the implementation of the GRI framework was associated with an enhanced corporate reputation, particularly in the areas of social and environmental responsibility. This led to improved public perception and stronger relationships with socially responsible investors. The authors attribute this outcome to the ability of Chinese companies to enhance their legitimacy and credibility on a global scale by adopting GRI frameworks aligned with internationally recognised sustainability standards (Yang et al. 2021). In a developing country like China, where transparency and sustainability practices are becoming increasingly important, the authors argue that this reputational boost was especially significant. Thus, we argue that by voluntarily complying with the GRI framework, IPO firms can enhance their public image and attract interest from socially responsible investors who prioritise sustainability and transparency in their investment decisions. This fosters both trust and transparency, thereby reducing the information asymmetry between IPO firms and sustainability-oriented investors. Consequently, the use of the GRI framework can help minimise the likelihood of socially responsible investors withdrawing their investment plans, thereby reducing the probability of IPO withdrawal.

Fourth, the voluntary use of the GRI framework can be interpreted as a signal of reduced perceived risk. Research has shown that voluntarily adopting the GRI framework reflects a company’s commitment to responsible governance and transparency, thereby signalling lower perceived risk (Dhaliwal et al. 2011; Truant et al. 2017). Hahn and Lülfs (2014) argue that firms disclosing non-financial ESG information through the GRI framework offer socially responsible investors a more comprehensive understanding of how they address sustainability-related risks. This level of transparency helps reduce information asymmetry, which often prevents socially responsible investors from fully understanding a firm’s risk-management strategies (Fijałkowska and Hadro 2022). Research has also indicated that firms demonstrate their commitment to proactively managing ESG risks by employing the GRI framework (Dhaliwal et al. 2011; Truant et al. 2017). This behaviour provides socially responsible investors with assurance regarding the firm’s long-term sustainability, ethical practices and capacity to mitigate risk exposure. As a result, perceived risk is reduced, which improves accessibility to capital sources and enhances socially responsible investors’ confidence (Fijałkowska and Hadro 2022). Baier et al. (2022) investigated the impact of the transparency of references to sustainability frameworks, such as GRI, and the depth of third-party assurance on the credibility of SRs. They discovered that the GRI framework plays a key role in reducing perceived risk in two distinct ways. First, the authors suggest that explicitly including the GRI framework in a company’s reports signals to socially responsible investors that the company is committed to adhering to globally accepted SR guidelines. This explicit inclusion ensures that the company’s sustainability initiatives are structured, thorough and aligned with international best practices, thereby reducing perceived risk. Second, the authors found that SRs with a higher level of assurance – where third-party verifiers conduct a comprehensive evaluation and validation of the data – are perceived as more trustworthy by socially responsible investors. The depth of assurance alleviates concerns that companies are using the GRI framework merely as a symbolic compliance tool, without implementing significant operational changes. Yang et al. (2021) discovered that operational hazards, particularly those related to ESG issues, were significantly reduced by companies that report using the GRI framework. Specifically, they discovered that these companies were more skilled at managing ESG risks, leading to fewer regulatory penalties and less reputational harm. The authors attribute this finding to the structured framework provided by the GRI, which helps companies identify, assess and mitigate ESG-related risks, thereby enhancing overall risk management. Thus, we argue that the voluntary adoption of GRI standards mitigates perceived risks by aligning the ESG practices of the IPO firm with established global norms, providing third-party assurance, and reducing information asymmetry between the firm and its socially responsible investors. The interplay of these factors can decrease the likelihood of IPO withdrawal by boosting socially responsible investors’ confidence and trust in the long-term prospects of the IPO company, making the firm more attractive to potential investors throughout the public offering process.

In summary, we anticipate that the voluntary adoption of the GRI framework can reduce the probability of IPO withdrawal by providing quality signals to socially responsible IPO investors, thereby mitigating information asymmetry in the IPO market, as indicated by the four mechanisms discussed previously. Therefore, we propose the following hypothesis:

H1: IPO firms that voluntarily adopt the GRI framework are less likely to experience IPO withdrawal.

Data and methodology

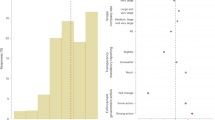

The IPO sample was drawn from a diverse range of sources, both public and private, including Bloomberg, stock exchanges, Thomson Reuters and business websites, following the methodology used in previous IPO research (Busaba et al. 2001; Dunbar and Foerster 2008; Helbing et al. 2019; Reiff and Tykvová 2021; Jamaani and Alawadhi 2023; Jamaani and Alidarous 2024b; Jamaani 2025). We adhered to the criteria established in previous IPO literature to develop the selection criteria for our dataset, as outlined in Table 1, in line with IPO research (Loughran and Ritter 2004; Butler et al. 2014; Jamaani and Alidarous 2024a). Using these selection criteria, we compiled comprehensive data on 33,536 firms that successfully filed for and withdrew IPOs between January 1995 and December 2019. The sample starts in 1995 because the GRI framework was established in 1997 (Luo and Tang 2023), allowing for a two-year period before the framework’s inception. The year 2019 was selected as the endpoint to minimise the influence of the COVID-19 pandemic and its subsequent effects (Adra et al. 2023). The dataset comprises countries from the G20, which represent the largest 20 economies. The G20 is an annual global summit aimed at strengthening international collaboration among major emerging and mature economies (Ministry of External Affairs 2024). The G20 countries were selected for their comprehensive and diverse dataset, which includes a wide range of national contexts defined by unique legal systems, cultural norms and economic institutions (Jamaani and Alidarous 2024b; The World Bank 2024). Furthermore, the substantial number of IPOs in G20 countries, which account for approximately 81% of the global IPO market (Jamaani and Alawadhi 2023; Jamaani and Alidarous 2023; Alidarous 2024a; Jamaani and Alidarous 2024a), allows for the generation of findings that are potentially more broadly generalisable.

The dependent variable, IPO withdrawal, is binary, occurring only once in the history of IPO firms. This variable takes a value of one when the firm decides to withdraw its offering, and a value of zero if the firm successfully lists publicly (Busaba et al. 2001; Dunbar and Foerster 2008; Qing 2011; Reiff and Tykvová 2021). To test our hypothesis, we use cross-sectional probit regression to analyse the relationship between the voluntary adoption of the GRI framework and the probability of IPO withdrawal. This approach accounts for the binary nature of the dependent variable and the single occurrence of the withdrawal decision across countries, in line with prior research on IPO withdrawals (Busaba et al. 2001; Dunbar and Foerster 2008; Qing 2011; Jamaani and Alawadhi 2023; Jamaani and Alidarous 2024b). We build on prior SR research by designating the primary independent variable, the GRI, as a binary variable that indicates the voluntary adoption of the GRI framework by IPO firms, as stated in their IPO prospectuses (Moneva et al. 2006; Chen et al. 2015; Yang et al. 2021). The GRI takes a value of one when the IPO firm adopts the GRI framework at the time of the offering; otherwise, it takes a value of zero if the firm does not adopt the GRI framework. Our main model is as follows:

In Eq. 1, the subscripts i and j represent an IPO firm that has withdrawn its IPO from a specific nation, while β0ij denotes the intercept of the model. We follow prior IPO research in implementing variable selection criteria, which includes a set of 27 control variables accounting for company-, market- and country-specific characteristics. This approach helps mitigate the risk of omitted variable bias (Colaco et al. 2018; Helbing et al. 2019; Reiff and Tykvová 2021; Jamaani and Alidarous 2024b). Company-specific characteristics include financial leverage (FL), return on equity (ROE), current ratio (CR), dividend per share (DPS), independent directors (ID), women on board (WOB), audit committee meetings (ACM), CEO duality (CEO), capital sold (CS), technology (T), integer offer price (IOP), proceedings (P), offer size (OP), duration (D), fees (F), price above the range (PAR), Big 4 (B), venture capitalists (VC) and reputation (R). Market-specific characteristics include volatility (V), hot (H) and volume (VOL). Country-specific characteristics include English law (EL), civil law (CL), foreign direct investment (FDI), gross domestic product (GDP) and interest rate (I). Table 2 provides a comprehensive list of definitions and measurement scales for all variables.

Results and discussion

Descriptive statistics

Table 3 presents the Pearson correlation matrix, which suggests that there is no multicollinearity problem, as the correlation coefficients for most of the variables used in this research are below 40%. Additionally, it provides several descriptive analyses of the dataset. According to the statistics, the average rate of IPO withdrawals in the sample was 15% (5030 IPOs), while 85% (28,506 IPOs) were successfully listed. The table shows that the average rate of voluntary adoption of the GRI framework is 2% globally. Out of the total 33,536 IPOs that filed, 670 have voluntarily chosen to use the GRI framework to prepare their IPO prospectuses.

Table 4 provides a more detailed examination of the descriptive statistics, with a particular emphasis on the mean values of non-GRI-adopting firms compared to those that have adopted the GRI framework. This analysis aims to identify the characteristics that differentiate the two groups. The T-test results indicate that only 4% of GRI-adopting firms withdraw from the IPO transaction, as represented by the variable IPOW. Conversely, 15% of IPOs that do not adopt the GRI framework are withdrawn globally. This result is statistically significant at the 1% level. It aligns with prior research, which indicates that the voluntary implementation of the GRI framework reduces information asymmetry among market participants, making adopting companies appear less risky and benefiting from enhanced disclosure quality (Moneva et al. 2006; Boiral and Henri 2017; Traxler et al. 2020; Yang et al. 2021). The two groups exhibit no statistically significant differences in terms of leverage, performance, liquidity and profitability, as indicated by the four accounting ratios shown in the table. Table 4 illustrates that GRI-adopting firms may signal and demonstrate superior corporate governance characteristics when preparing to go public, as they statistically outperform non-GRI-adopting IPOs in three related variables. First, IPOs that adopt the GRI framework typically hold five audit committee meetings during the years leading up to the offering, whereas non-GRI adopters have only one meeting. Second, IPOs that adopt the GRI framework ensure that, on average, their board of directors consists of four independent directors, compared to just one for non-GRI adopters. Third, when IPOs adopt the GRI framework, the number of women on the board is typically doubled upon submitting for an IPO. This outcome aligns with previous research indicating that organisations that implement the GRI framework often experience improvements in their corporate governance, which signal their quality (Levy et al. 2010; Gallén and Peraita 2017; Hamad et al. 2020). Research has shown that the GRI framework fosters enhanced accountability, transparency and stakeholder involvement – critical elements for effective corporate governance (Fernandez-Feijoo et al. 2014; Fonseca et al. 2014; Hahn and Lülfs 2014; Machado et al. 2021). Firms not only enhance the sustainability of their operations but also signal the strength of their governance structures and mitigate risks related to inadequate oversight by adhering to the GRI framework (Brown et al. 2009b; Chen et al. 2015; Boiral and Henri 2017; Orazalin and Mahmood 2020; Mougenot and Doussoulin 2024). However, GRI-adopting firms tend to exhibit weaker corporate governance due to their emphasis on unified leadership. Consequently, decision-making is faster and more aligned with leadership, as 20% of GRI-adopting IPOs have CEO duality, compared to only 5% among non-GRI adopters. When the two groups register for an IPO, they differ in three classical IPO deal characteristics: the percentage of CS, the concentration of technology-type IPOs and the IOP. GRI-adopting IPOs appear to experience reduced uncertainty, as the IPO proprietors of these firms sell a smaller amount of capital when going public, operate in less technology-intensive industries and have a smaller IOP. This indicates a greater willingness to negotiate to secure a higher offer price at the time of the offering. The findings of this study align with previous IPO research, which often associates an increase in information asymmetry, market uncertainty and withdrawal risk with a larger percentage of IPO shares sold, technology-type IPO firms and the number of IPOs (Helbing 2019; Helbing et al. 2019; Jamaani and Alawadhi 2023; Jamaani and Alidarous 2024b).

Table 4 also illustrates that the average size of IPO firms that implement the GRI framework is significantly larger, with an average IPO size of $963 million, compared to $93 million for non-GRI adopters. This suggests that GRI-adopting IPOs are well-established organisations with a wide range of resources, which enables them to absorb the costs of implementing the GRI framework and ensure high-quality disclosures. This is consistent with previous IPO research, which argues that large IPO firms possess sufficient internal and external resources to adhere to corporate governance standards and provide superior disclosure quality, thereby reducing the likelihood of IPO withdrawal risk (Busaba et al. 2001; Dunbar and Foerster 2008; Qing 2011; Reiff and Tykvová 2021). The table shows that market-timing practices are evident, as 47% of GRI-adopting IPOs are released during periods of high market activity, compared to 38% of non-GRI adopters. On average, GRI-adopting IPOs are listed during periods of increased market volatility and higher average annual IPO listings. In contrast to non-GRI adopters, GRI-adopting IPOs are listed during years when the average local foreign direct investment inflow is stronger, GDP growth is higher, and interest rates are lower. This finding is consistent with prior research, which suggests that ESG-focused firms can time their IPOs to align with favourable market sentiment through sustainability and responsible investments (Mumtaz and Yoshino 2021; Wang et al. 2022). The table also shows that GRI-adopting IPOs aim to reduce information asymmetry by sending credible signals to investors when they go public. They accomplish this by engaging reputable intermediaries to prepare their IPO prospectus. Specifically, the table reveals that, on average, 30% of GRI-adopting IPOs (compared to 19% of non-GRI adopters) employ one of the ‘Big Four’ auditing firms, and 72% of GRI-adopting IPOs (compared to 46% of non-GRI adopters) employ reputable underwriters. These findings align with previous research, which has shown that high-quality IPO firms that prioritise transparency tend to employ reputable underwriters and auditors to signal their quality and reduce the information gap between the firm and potential investors (Jamaani and Alidarous 2023; Alidarous 2024a).

Regression results and discussion

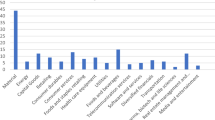

Table 5 presents Model 1, which utilises probit regression analysis to examine the impact of the voluntary adoption of the GRI reporting framework on the likelihood of IPO withdrawal. The model includes fixed factors related to year, industry and country. Solid evidence is found indicating that the voluntary adoption of the GRI framework in IPO prospectuses reduces worldwide IPO withdrawals by 65%. Our results demonstrate that firms engaged in more extensive SR through voluntary adoption of the GRI framework are less likely to withdraw their IPOs. These findings confirm the H1 that the voluntary adoption of the GRI framework signals quality and helps reduce information asymmetry between firms and investors in the IPO market. Firms can enhance transparency, build investor trust and reduce uncertainty regarding their sustainability practices by providing comprehensive sustainability information. This, in turn, may restore the confidence of socially responsible investors. IPO companies that voluntarily adopt the GRI framework may be perceived as more reliable and strategically positioned for sustained success. These findings align with signalling theory, which posits that the GRI framework serves as a signal of quality, aligns stakeholder interests and enhances a firm’s credibility. By voluntarily disclosing sustainability information through the GRI framework, companies demonstrate their commitment to openness, responsibility and the creation of long-term value. Signalling can improve a firm’s reputation and reduce information asymmetry between the company and potential investors (Ching and Gerab 2017; Friske et al. 2023). As a result, companies that participate voluntarily in GRI reporting while preparing their IPO prospectus may be seen as more dependable and credible, reducing the perceived risk associated with withdrawing from an IPO.

Model 2 in Table 5 incorporates a wide range of controlling and relevant factors, accounting for company-, market- and country-specific characteristics in the analysis to mitigate the risk of omitted variable bias. Although the GRI coefficient remains statistically significant and negative, indicating that the voluntary adoption of the GRI framework reduces the probability of IPO withdrawal by 40%, the economic effect of the GRI coefficient decreased from 65% in Model 1 to 40% in Model 2. This change is attributed to the inclusion of controls for company-, market- and country-specific characteristics.

The results related to company-specific characteristics reported in Model 2 in Table 5 indicate that only four out of the 18 controlling factors are significant: FL, ROE, ACM and the presence of women on the board. This suggests that these factors do not play a decisive role in determining the probability of IPO withdrawal. The remaining 12 company-specific factors have statistically significant influences on the probability of IPO withdrawal, with varying degrees of economic relevance. Notably, the CR shows a statistically significant positive correlation with IPO withdrawal, indicating that a one-unit increase in liquidity corresponds to a 0.0071% rise in the probability of IPO withdrawal. Although this result has a marginal economic effect, it suggests that firms with surplus cash, such as major retailers or technology corporations with substantial working capital, may be more hesitant to seek external funding in a challenging market and may prefer to cancel their IPO (Jamaani and Alawadhi 2023). Conversely, DPS reduce the probability of withdrawal, with each dollar increase in DPS corresponding to a 0.17% decrease in the likelihood of withdrawal. This suggests that consistent dividend payments signify financial robustness and increase investor appeal (Jamaani and Alawadhi 2023). Similarly, an increase in the number of IDs has a positive effect, as adding one ID reduces the withdrawal event rate by 0.75%. This supports the claim that strong governance boosts investor confidence and regulatory endorsement (Nipper 2021). Furthermore, CEO duality significantly reduces the probability of withdrawal, indicating that firms with a CEO who concurrently serves as board chair are 52% less likely to withdraw (Helbing et al. 2019). This is because cross-functionally aligned leadership enhances strategic decision-making, particularly in organisations led by influential dual-role leaders like Elon Musk (Tesla). The proportion of CS by the firm is also significant; for every 10% of equity sold, the probability of withdrawal from the IPO decreases by 1.1% (a trend that is more pronounced for IPOs with greater ownership commitment). This aligns with examples of exceptionally successful IPOs, such as Alibaba’s 2014 IPO (Helbing et al. 2019). Conversely, technology companies have a 33% lower probability of withdrawal, indicating heightened investor demand and growth expectations, particularly within the expanding software industry, as demonstrated by companies like Nvidia and Snowflake. On the other hand, companies that price their IPO shares at integer values have a 31% higher probability of withdrawal, suggesting uncertainty regarding valuation – a characteristic previously identified in unsuccessful IPOs (Bradley et al. 2004). An increase in the IPO offer price slightly reduces the probability of withdrawal, with a $10 rise in the offer price leading to a 0.01% decrease in withdrawal probability. While minimal, this reduction is significant in terms of pricing strategy. If a firm files for an IPO (having completed the prospectus submission) and intends to be listed for more than 100 days, the probability of its withdrawal increases by 21% for each additional 100 days of listing. An increase of $1 million in IPO underwriting fees raises the probability of withdrawal by 3%, which may lead smaller enterprises to reconsider pursuing their IPOs (Ursel and Zhong 2018). The results also show that firms using B auditors are 31% less likely to withdraw, indicating that enhanced scrutiny of financial statements by audit firms such as Deloitte, PwC, EY and KPMG strengthens trust among regulators and investors (Alidarous 2024a). IPOs backed by venture capital are 27% more likely to be withdrawn, likely because venture capitalists may advocate for postponements or cancellations if market conditions are unfavourable for achieving high valuations (Reiff and Tykvová 2021). This is exemplified by Airbnb, whose IPO was postponed in 2020 due to market volatility and ultimately did not proceed until a later date.

The results indicate that all market-specific characteristics significantly influence the probability of IPO withdrawal, suggesting that overall market conditions play a crucial role in the decision to list. High market volatility prior to the listing period indicates that for every 1-point increase in market volatility, the probability of IPO withdrawal rises by 10%. This suggests that firms are more likely to postpone or cancel IPOs during periods of uncertainty, such as economic recessions and financial crises (Reiff and Tykvová 2021). The finding that setting the IPO offer price above the average range reduces the probability of withdrawal by 1.6% implies that firms opting for a higher-than-expected price demonstrate greater investor confidence in the offering (Busaba et al. 2001). The positive coefficient on H suggests that firms are 19% more likely to withdraw their IPOs during peak market conditions. This implies that firms may choose to withdraw their IPOs when they perceive the market as overly favourable for achieving optimal valuations. This trend aligns with the behaviour of companies delaying their IPOs during periods of significant price increases in technology and social media stocks (Busaba 2006). The volume of IPO listings indicates that for every 100 additional IPOs in the pipeline, the probability of withdrawal decreases by 0.16%. This suggests that high IPO activity reflects investor confidence and market stability, a pattern often observed in strong IPO years (Helbing et al. 2019).

The results indicate that all country-specific characteristics significantly influence the probability of IPO withdrawals, highlighting the roles of legal environments, economic conditions and capital flows in shaping IPO characteristics. EL shows positive and significant correlations, suggesting that IPOs in countries with common law systems (e.g., the UK, the US) are 35% more likely to withdraw. This implies that higher levels of investor protection laws, more complex regulatory systems and longer legal processes in these countries may lead companies to withdraw their IPOs if they believe they cannot meet compliance requirements (Jamaani and Alidarous 2024b). Additionally, FDI inflows reveal a positive correlation between foreign direct investment and the likelihood of IPO withdrawals. This suggests that a 1% increase in FDI inflow may lead to a 4.5% increase in the probability of IPO withdrawal. This result implies that a significant influx of foreign capital could reduce companies’ reliance on IPOs for funding, providing firms with greater opportunities to pursue private equity or cross-border merger transactions (Alidarous 2024b). GDP growth of −0.030 indicates that a 1% increase in GDP growth corresponds to a 3% reduction in the probability of IPO withdrawal. Enhanced economic growth fosters a more stable financial environment, boosts investment confidence and improves the success rate of IPOs (Jamaani and Alawadhi 2023). This is linked to an economic boom, which leads to accelerated IPO activity during periods of prosperity (Thanh 2020). Interest rates suggest that a 1% increase in interest rates results in a 1.3% decrease in the probability of an IPO withdrawal. This indicates that higher borrowing costs make public markets more appealing for firms seeking to raise capital, thereby reducing withdrawal rates. This trend aligns with observations during periods of rising interest rates, where firms prefer public markets due to the reduced attractiveness of private financing (Dunbar and Foerster 2008).

Our main results demonstrate that the adoption of the GRI-SR framework mitigates the persistent issue of information asymmetry in the IPO market, reducing the risk of IPO withdrawal through four explainable channels. First, the findings suggest that voluntary compliance with the GRI framework serves as a signal of transparency and credibility. The probability of an IPO withdrawal is significantly reduced when a company voluntarily adopts the GRI framework, which highlights its commitment to transparency and meticulous reporting practices (Fernandez-Feijoo et al. 2014; Ching and Gerab 2017; Luo and Tang 2023). The voluntary implementation of the GRI framework reduces information asymmetry by providing socially responsible investors and stakeholders with a standardised framework to evaluate a firm’s ESG performance, particularly in relation to an IPO’s prospectus (Fernandez-Feijoo et al. 2014; Luo and Tang 2023). Unlike ESG scoring systems, which assess and rank companies based on their ESG practices and disclosures, the GRI framework offers a standard methodology that enables businesses to report their sustainability performance in a systematic and consistent manner (Cho et al. 2009). Prior research suggests that ESG grading methods rely on data that companies may provide or acquire from third-party vendors, but these approaches have limitations (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). These limitations include data inaccuracies, inconsistencies and anomalies that can undermine the trustworthiness and consistency of ESG rankings (Kaplan and Ramanna 2021). These limitations are supported by earlier research, which suggests that ESG scoring techniques often prioritise a pre-established set of ESG factors, potentially overlooking a full range of important sustainability issues relevant to a company’s operations (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). SR research has highlighted this issue, arguing that there is no widely recognised benchmark for ESG grading (Veenstra and Ellemers 2020; Kaplan and Ramanna 2021; Patil et al. 2021). Consequently, various methodologies and rating agencies have emerged, each using distinct standards and methods to assign importance (Kaplan and Ramanna 2021). The lack of consistency in this regard may pose challenges for investors in accurately comparing ESG ratings across different firms (Muslu et al. 2019; Ignatov 2023; Kimbrough et al. 2024). Thus, the findings of this study validate that the GRI reporting framework’s uniformity advantage can effectively reduce uncertainty, bolster investor confidence and enhance a company’s reputation by signalling transparency and accountability. By voluntarily adopting the GRI-SR framework, information asymmetry between IPO owners and socially responsible investors is likely to decrease, empowering investors to improve their decision-making process when investing in IPOs, ultimately lowering the probability of IPO withdrawal.

Second, the findings suggest that the voluntary implementation of the GRI framework may be seen as an indication of a positive perception regarding long-term sustainability. Research on IPOs shows that investors prioritise both short-term returns and an organisation’s long-term sustainability (Jamaani and Alidarous 2024a). Additionally, the adoption of the GRI framework by organisations signals their commitment to long-term environmental and social efforts, as well as a forward-thinking approach (Brown et al. 2009b; Chen et al. 2015; Orazalin and Mahmood 2020; Traxler et al. 2020). This is a critical factor for investors who integrate ESG considerations into their investment decisions (Brown et al. 2009b; Chen et al. 2015). The findings of this research align with those of Cantele and Zardini (2018), who discovered that GRI reporting enhances the long-term sustainability of firms by providing them with a competitive advantage and establishing them as leaders in sustainable and ethical business practices. Competitive firms often prioritise the development of positive relationships with their stakeholders, including socially responsible investors, clients, vendors and legislators (Kwarteng et al. 2016). Thus, the findings of this study align with previous research, which shows that competitive firms can reduce uncertainties and asymmetries in the flow of information by actively addressing issues, providing essential information and engaging in meaningful dialogue through effective communication strategies (Chen et al. 2015; Cantele and Zardini 2018). The present findings confirm that the voluntary adoption of the GRI-SR framework can be perceived as a quality signal that reduces information asymmetry, fostering confidence and trust among stakeholders. This, in turn, leads to more accurate evaluations of a company’s value and prospects, ultimately decreasing the likelihood of IPO withdrawal.

Third, the findings suggest that the voluntary adoption of the GRI-SR framework can be interpreted as a sign of enhanced investor demand and an improved reputation. Research has shown that implementing the GRI framework can enhance a company’s image, particularly among institutional investors and socially responsible investors who prioritise sustainability in their portfolios (Simmons Jr et al. 2018; Miras‐Rodríguez et al. 2020). The results of the present study align with previous research on sustainable responsibility, which indicates that sustainable organisations may use the GRI framework to communicate their commitment to sustainable practices and long-term performance, ultimately influencing investor demand and market reputation (Sun et al. 2024). Research has shown that the GRI framework encourages organisations to adopt a long-term perspective and assess the broader impact of their operations on society and the environment (Fernandez-Feijoo et al. 2014). The current findings align with previous research, which suggests that socially responsible investors can gain a more comprehensive understanding of a firm’s overall sustainable performance by adopting a long-term approach (Yang et al. 2021; Goswami et al. 2023). This reduces information asymmetry and provides additional insights for making long-term investment decisions (Dilling and Harris 2018). The present findings suggest that this approach can mitigate information asymmetry, providing socially responsible investors with a more comprehensive understanding of how sustainability is integrated into a company’s core business operations. By disclosing its long-term sustainability plan, the company can boost investor demand and enhance its market reputation (García‐Sánchez and Noguera‐Gámez 2017; Yang et al. 2021). Consequently, sustainable IPO firms may increase investor demand and market reputation by utilising the GRI framework to signal their commitment to long-term success. This approach helps to attract socially responsible investors by demonstrating sustainable practices and reduces the likelihood of these investors withdrawing from the IPO.