Abstract

Communities and individuals are turning to courts to hold governments and high-emitting firms to account for the adverse consequences of climate change. Such litigation is part of a broader trend in which stakeholders are increasingly scrutinizing firms for their sustainability practices. For firms, rising climate litigation risk may exacerbate wider sustainability risks. Here we construct a comprehensive database of filings and decisions relating to 108 climate lawsuits against US- and European-listed firms between 2005 and 2021. We show that firms experience, on average, a 0.41% fall in stock returns following a climate-related filing or an unfavourable court decision. Cases filed against Carbon Majors, primarily the world’s largest fossil fuel producers, saw the largest stock market responses, with returns reducing by 0.57% and 1.50% following filings and unfavourable decisions, respectively. Markets respond more to ‘novel’ climate litigation involving new legal arguments or jurisdictions. Our findings suggest that climate litigation provides a way for stakeholders to challenge actual and perceived weaknesses in the sustainability practices of firms. We conclude that financial markets consider such litigation to be a relevant financial risk.

Similar content being viewed by others

Main

Climate change-related litigation has grown rapidly in recent years, in line with the increased awareness of the impacts of climate change and the urgency of taking action to contain it. Over the past two decades, annual climate litigation filings grew from less than 10 to more than 200 by 20211. Of these, around 18% are filed against firms, and the remainder against government bodies or other entities. Claims are expected to grow further following successful cases that generate yet more momentum2. At the same time, financial markets are beginning to consider sustainability risks and opportunities by incorporating them into investment decision-making processes3,4,5,6. Descriptive evidence suggests that, in addition to physical and transition risks associated with climate change, investors’ awareness of climate litigation risk is also rising7. However, causal analysis is necessary to determine whether markets are systematically taking these risks into account.

Despite the seemingly unstoppable rise in climate litigation cases and several recent successes, the evidence quantifying their impacts is still limited8,9,10. For defending companies, these lawsuits may have multiple repercussions. Direct or tangible costs include legal fees, fines or penalties, higher insurance costs, and changes to credit ratings, which could increase capital costs and decrease financial leverage11,12. Also damaging may be the adverse impacts on public reputation and staff morale11,13. While costs of firm litigation in general have increased in recent years14, many of the effects of climate-related litigation are difficult to measure because they will materialize only in the future. Nonetheless, various stakeholders, including central banks, financial regulators, firms, insurance companies, non-governmental organizations (NGOs) and investors, are seeking to assess companies’ climate-related risk more comprehensively and accurately15,16. One approach is to assess whether climate litigation systematically causes a defendant firm’s stock prices to fall and to what degree17. Such a decline in firm value, if observed, could reflect investors’ perceived estimates of the various implied costs of climate litigation.

This study attempts to quantify the financial market response to climate litigation. To understand the general effect of climate litigation, we compile a dataset that represents a near universe of corporate litigation cases against major publicly listed firms listed in North American or European stock exchanges during the period 2005–2021. The thorough coverage of our sample markedly improves on previous work that evaluated fewer cases18,19,20, and enables us to estimate an aggregate market-wide effect that can be interpreted in a general context to inform the societal impact of climate litigation on firm value, while climate lawsuits are highly heterogeneous in nature as we discuss next.

Diverse profile

Climate litigation in general has a diverse profile in terms of subject matter, covering a broad range of actions that arise from climate-related issues1,2,21. Claimants include individuals, environmental organizations, local and state governments, regulators, businesses, young people and future generations1,22, while defendants include governments, firms, financial institutions, industry groups and individuals. Objectives and legal avenues also vary considerably. The earlier corporate cases against oil, gas and electric firms in North America, much like in previous major controversies such as those regarding tobacco and asbestos, were centred around damages and adaptation costs, suing for compensation on the basis of claims that the actions of Carbon Majors exacerbated the damages suffered because of extreme weather events23. The trend in more recent years is more diverse. Increasingly, climate lawsuits are brought strategically to advance effective action on climate change worldwide, using varied legal avenues, including environmental law, tort law, human-rights and constitutional law, criminal law, securities law and international law1.

Cases are diversifying and evolving rapidly, ranging from those seeking to penalize illegal activities such as deforestation, ‘climate-washing’ claims24,25, to failure of fiduciary duties. An example of the latter is a case in 2018 whereby Enea was sued by Client Earth claiming directors are not acting in the best interest of investors because a planned new coal plant would ultimately become a stranded asset. Several cases have been brought forwards against Carbon Majors for failing to properly inform the public of the risks of climate change at a time when they were aware of them. For example, in Commonwealth v. Exxon26, the Massachusetts Attorney General accused the firm of failing to disclose climate change risks and the role their products play, as well as of climate-washing. Cases against Carbon Majors also often involve the licensing or development of new fossil fuel projects. While all these case types seek to discourage the ongoing production of fossil fuels and their energy output, the number of cases remains small, particularly resolved cases, making it difficult to gauge the impact of litigation by case type. Overall, the heterogeneous nature of climate litigation suggests that the effects of the financial market response to any individual event in isolation cannot be generalized. Thus, our focus is on the aggregate market-wide impact of climate litigation.

Value-weighted multiple-event study

To estimate the average effect of climate litigation, we compiled a comprehensive dataset recording 108 climate-related lawsuits filed against 98 major publicly listed firms on North American or European stock exchanges during the period 2005–2021. This sample of events includes both filing and important decisions on admissibility or merits, for the full range of heterogeneous causes of action described in the preceding. Cases often target more than one firm, giving 369 firm-event observations in total. We combine these data with financial data and run event study regressions widely used in financial research27 to test whether returns around litigation event days are significantly different from what would be expected absent the event (Methods). Abnormal returns for individual firm-events are reported in Supplementary Section 1. To estimate the average effect over multiple events, we use value-weighted cumulative average abnormal returns (CAARs). This ensures that the estimated average effects are economically relevant and that small stocks are not overrepresented. Unweighted results are not statistically different, but larger in magnitude, as reported in Supplementary Section 2.

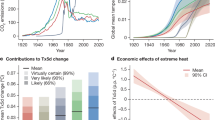

We find evidence that corporate climate litigation leads to negative market reactions. On average, case filings lead to an abnormal decrease in stock prices by 0.35% over the 3-day window from the day before, day of and day after the filing (Fig. 1). Negative court decisions had a larger effect of −0.99%, with the combined CAAR for filings and negative decisions being −0.41%. The effect is modest but statistically significant at the 95% level. Results are robust to an alternative estimation approach where cases targeting multiple firms are modelled as equal-weighted portfolios to account for cross-sectional correlation (Supplementary Table 4), where the effect for all filings and negative decisions is similar (−0.40%) and significant at the 90% level.

Red dots indicate the actual or observed cumulative average return (CAR) during a 3-day window around the filing and decision dates as a percentage, for reference. Blue dots, bars and whiskers indicate the mean, two-sided p66 (66th percentile) and two-sided p90 (90th percentile) of the CAAR, measured with the Capital Asset Pricing Model. Returns are weighted using the log of market value. Returns are winsorized at the 0.5% level; n indicates the number of firm-events. Standard errors with weighted Patell correction.

Carbon Majors

Unsurprisingly, the bulk of corporate climate litigation has been filed against the largest emitters operating in the sectors such as energy, utilities and materials—the so-called Carbon Majors—often with the intent to drive changes in their behaviour and business models17. More recently, climate litigation has targeted firms in other sectors, including industrials, consumer discretionary (including automobile) and financials (Supplementary Table 5). We observe a statistically significant effect of negative decisions and climate litigation filings on firm value for Carbon Majors (−0.57%), but not for non-Carbon Majors, where the effect is small and statistically insignificant. This result gives us confidence that markets are responding where most expected—the cases against the largest polluters where more is at stake, for example, in terms of stranded assets and reputational damage. The effect of negative decisions is particularly larger for Carbon Majors (−1.50%). Note, however, that climate litigation is a relatively new class of action. Many cases are still subject to early-stage procedural challenges, and often no final judgement has yet been delivered2. Stock market impacts may still take time to materialize.

The shifting tide

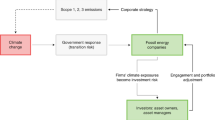

While the first corporate climate litigation case recorded dates back to 199428, it is only recently that climate litigation has been used and recognized as a tool capable of affecting ‘the outcome and ambition of climate governance’29. From the 2000s, a small set of lawsuits against oil, gas and electric companies was tested in North American courts. Examples include Comer v. Murphy Oil30, where residents and property owners from the Mississippi Gulf Coast sought damages related to Hurricane Katrina, and Kivalina v. Exxon31, where coastal Alaska residents facing the threat of rising sea levels filed a case seeking financial damages for the potential relocation. These early cases were ground-breaking and drew considerable attention to climate litigation, as measured by the Google Trend index (Fig. 2), but were ultimately unsuccessful17,23. Corporate climate litigation activity died down following the unsuccessful outcomes of these earlier high-profile cases, until momentum picked up again coinciding with several events. Litigation targeting firms became easier following the publication of an academic article by Heede in 201432 identifying 90 so-called Carbon Majors responsible for 63% of global carbon and methane emissions between 1751 and 2010. Furthermore, the Paris Agreement33 was adopted in December 2015, sending signals of strengthened international will on climate action. Around the same time, advances in attribution science were made that better equipped plaintiffs with powerful evidence that they can bring to the courts23,34,35.

The number of climate litigation cases grew rapidly, especially after 2015, as did attention to climate litigation as measured by the Google Trends index. This index is calculated as the worldwide 6-month rolling average of the term ‘climate litigation’ using Google Trends. This captures the volume of specific terms searched in the Google search engine, where the peak term value is set to 100, and all other values are set relative to that peak.

Indeed, we observe an increase in climate litigation risk over time. We find no significant effect for filings or decisions before January 2019, even for filings against Carbon Majors and negative decisions (Fig. 1). The tide began to shift for the climate litigation movement as it started to find incremental success. We observe a clear increase in the number of decisions in more recent years, especially substantive or procedural decisions that can be understood as negative for the firm. For example, in Lliuya v. RWE36, a German appeals court deemed as admissible a Peruvian farmer’s claim that higher water levels near his farm were caused by carbon emissions from the German utility firm RWE37. Public interest in climate litigation rose rapidly from May 2021 following a ground-breaking judgement in Milieudefensie v. Royal Dutch Shell38; the District Court of the Hague ruled that Royal Dutch Shell has to reduce its carbon emissions in 2030 by 45% because of a violation of the duty of care under Dutch law (Supplementary Section 4). We find consistently larger and statistically significant effects after 2019, of all filings (−0.34%), filings against Carbon Majors (−0.55%) and negative decisions (−1.55%) (Fig. 1), suggesting the financial markets are increasingly responding to climate litigation.

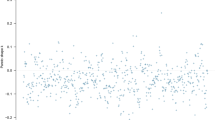

Court decisions, which may include final judgements, important interim judgements on procedural matters or settlement decisions, are of course not always negative for the firms. We classify each decision as either positive or negative for the targeted firm on the basis of the court outcome (without looking at the market reaction). Positive decisions are often decisions where the case is dismissed. Our results show that positive decisions increase abnormal returns modestly (0.29%). This effect is not statistically significant. However, the contrast with negative decisions is large, as expected (Fig. 1), with an abnormal return of 0.99%. Figure 3 shows negative decisions have had, since 2015, a larger impact in recent years.

Individual cumulative abnormal returns for positive (green) and negative (red) decisions during a 3-day window around the decision dates. Data from Supplementary Table 1.

Further heterogeneity

As climate litigation continues to expand and diversify39, financial market responses may be heterogeneous across various case characteristics. To test this, for each case, we collect information on a set of key case characteristics: whether the case was filed in a court of law rather than before an administrative or quasi-judicial body; whether the plaintiff was a government; whether the case is part of a larger group of similar cases; whether the case claimed for damages; and whether a case is ‘novel’ (using a novel form of legal argument or the first case in a given jurisdiction) (Methods).

The effects for all subgroups were lower than average and not statistically significant (Supplementary Fig. 1), except for novel cases, where the abnormal return is of a larger magnitude than average, at −0.52% for all companies and −0.66% for the subgroup of Carbon Majors (Fig. 1 and Supplementary Fig. 1). A possible explanation for this may be that cases with novelty attract more interest or have a greater element of surprise that investors have not already factored into stock prices. However, the effect of novelty is not statistically significant under the portfolio approach where the sample size is smaller (Supplementary Table 4). As climate litigation against firms continues to grow, a larger dataset will allow for further assessments on differential financial market impacts according to different elements characterizing climate litigation cases.

Total costs

Our findings suggest that small changes in valuation result from climate litigation. However, back-of-the-envelope calculations suggest that the average economic benefit of a positive decision is US$197 million, and the average economic cost of a negative decision is US$360 million (Methods). These total costs should be interpreted with caution because they are highly influenced by the largest companies and are sensitive to outliers. Nonetheless, these economic costs far exceed the average cost of defending a major litigation case (US$3 million11), suggesting that investors are pricing in expectations of lower future cash flows and risk.

The total effect of climate litigation is likely to be larger than the effect we can attribute to filings and important decisions for several reasons. First, when we expand our event window to include the week before the event, we find modest anticipation effects, which increase the average filing and negative decisions effect from −0.41% to −0.44%. Second, the concrete timelines of important cases (Supplementary Section 4) show that information is released gradually across many events, including those other than filing and decision dates, for example, subpoenas, motions or court orders. Third, drawing on previous literature findings that investors partially anticipate class-action lawsuits in general40, investors may already price in climate litigation risk for Carbon Majors, at least partially, especially because this group of firms is frequently targeted by both climate and other environmental litigation. Fourth, firms might also experience the indirect impacts of cases brought against other industry peers, governments, financiers, pension funds and university endowments, which are brought as part of a broader strategy by social movements or organizations to increase the social and financial costs experienced by major corporate emitters41.

Discussion

Financial stakeholders are increasingly evaluating climate litigation’s impacts on firms and the broader economy, recognizing its growing relevance to sustainable finance. Recent reports by the Network for Greening the Financial System highlight the urgent need to understand the risks posed by these lawsuits42 and to advance appropriate microprudential supervision of climate-related litigation risks43. They stress the urgent need for central banks and supervisory authorities to better assess and mitigate the financial sector’s exposure to such legal challenges, ensuring financial market stability in the face of sustainability challenges, including climate change.

However, existing assessments remain inadequate in fully capturing the scale and distribution of climate-related financial risks44. Organizations such as the International Sustainability Standards Board and the Network for Greening the Financial System often merge legal risks with broader ‘transition risks’, which can obscure the specific challenges posed by climate litigation. For example, the Bank of England’s 2021 climate stress test stated that insurers struggled to accurately assess their vulnerability to climate litigation risks15, highlighting a gap that must be addressed to support a sustainable transition. Recent court cases such as Aloha Petroleum’s lawsuit against its insurer for refusing to cover the defence costs of a climate lawsuit, underscore how firms’ ability to defend against climate litigation could impact the wider financial system.

This Article provides much-needed empirical evidence on financial market responses to climate litigation. Our findings that climate lawsuit filings and negative court decisions against firms lead to a fall in stock prices, although small in magnitude, indicate that climate litigation is becoming a relevant financial risk. This has implications for sustainability as it suggests the need for lenders, financial regulators and governments to incorporate these risks into their assessments to ensure resilient and sustainable financial markets. Our estimates, based on an extensive sample of all climate lawsuits filed against firms listed in the United States and Europe from 2005 to 2021, represent a general effect across the sample, with implications for how financial markets might respond to future climate litigation. By providing a methodology to track changes to financial market responses to climate litigation, our research contributes to the broader goal of aligning financial practices with sustainability objectives. While our findings are limited to climate litigation, financial actors have started to identify a transfer of tactics and trends from strategic climate litigation to other areas of sustainability such as nature risk45. Our methodology may also be utilized to understand responses in these diverse areas of sustainability-related litigation.

Furthermore, our results indicate that market responses are heterogeneous across different case types and attributes. Further analysis to understand the specific attributes of climate litigation that most affect firm value is important for developing targeted strategies that support sustainable financial practices and promote a just transition to a low-carbon economy.

Methods

Climate lawsuit sample selection and data collection

To the extent possible, we have collected all climate litigation lawsuits—involving climate as a material issue—anywhere in the world against North American and European companies between 2005 and 2021. Our main source of data is the climate litigation databases maintained by the Sabin Center for Climate Change Law with contributions from the London School of Economics and Political Sciences. Data were taken in March 2022. The Sabin Center maintains two separate databases, one for US litigation and one for ‘global’ litigation (all cases outside the United States). Together, these databases contain more than 2,600 cases before judicial and quasi-judicial bodies that involve material issues of climate change science, policy or law. Cases where climate change is only incidental to the main issues are excluded from the Sabin databases.

Using the databases as a starting point, we identified cases filed against firms by relying on (1) the Sabin Centre database classification and (2) previous classification by McCormick et al.46 of cases in the United States filed until 2016. From the McCormick dataset, we identified 76 ‘pro-climate’ cases against firms. From the Sabin Center global database, we identified 87 cases against firms. From the Sabin Center US database, we then reviewed 783 cases filed between 2016 and March 2022, of which 88 involved corporate entities as defendants. This dataset was compared with the McCormick dataset, and duplicate cases from the overlapping period of 2016 were eliminated.

From this universe of cases involving corporate actors, we identified cases involving publicly listed firms in North America and Europe. Non-traded firms are therefore excluded. Cases were also excluded due to lack of key information, such as financial data, or because relevant dates or other case information could not be identified from the databases. For example, a firm may delist from a stock exchange or be involved in a merger or acquisition. Further, as our empirical strategy describes expected stock returns as a function of their systematic risk (see Empirical approach), cases filed in countries where risk factors are unavailable were dropped. As a result, we identified 108 cases in which we can precisely define a filing date and 59 cases in which we can precisely define an important decision being handed down. We define an important decision as a merit decision or one based on admissibility. As cases are often filed against multiple firms, the 59 cases with decisions translate to 78 firm-event observations between 2005 and 2021, with 51 being a positive judgement for the corporation and 27 being negative. We review the details of each firm named in the complaint of each case. Where one or more of the firms are listed by Heede32, we classify the case as a Carbon Majors case. Supplementary Table 5 shows the sectoral distribution of Carbon Majors and non-Carbon Majors firm-events. Our final sample of filings and decisions includes 369 firm-event observations in total. This data are constructed in Microsoft Excel.

Climate lawsuit characteristics

For filings, we determined the following information for each case:

-

Did the case involve a novel form of claim and/or a claim in a novel jurisdiction? (N = 120)

-

Was the case filed before a court of law or an administrative tribunal rather than a quasi-judicial body? (N = 235)

-

Is the case part of a larger group of similar cases? (N = 135)

-

Was the plaintiff a government rather than an NGO or individuals? (N = 170)

-

Did the case involve damages rather than civil penalties? (N = 210)

To assess the novelty of claims, we investigate three factors. First, we consider whether a novel legal argument is made. We classify the legal arguments as novel in cases such as Milieudefensie v. Shell38, in which claimants relied on business and human-rights standards to argue that a firm has an obligation to reduce carbon emissions from its global operations, and in cases such as County of San Mateo v. Chevron47, one of the earliest cases in which the Carbon Majors research by Heede was used by US subnational governments to sue one or more of the Carbon Majors. Second, we consider whether a novel argument (one applied in only one or two cases globally) was applied in a new jurisdiction for the first time. Third, we consider whether a novel argument was applied against a new industry, as in the case of Deutsche Umwelthilfe (DUH) v. BMW48 and Deutsche Umwelthilfe (DUH) v. Mercedes-Benz AG49.

The assessment of whether cases were ‘similar’ was made by the authors, with reference to previous work categorizing climate litigation cases by type and theme for a range of audiences1. This category was included on the hypothesis that cases that formed part of such a group might attract greater attention from the media and, by extension, the markets.

For court decisions, we classify them simply on the basis of whether we anticipated they would have a positive or negative outcome for the targeted firm(s). Importantly, this was done without looking at the market reaction.

Empirical approach

Supplementary Section 6 describes our financial data sources. We estimate abnormal stock returns for defendant firms following the event study methodology widely used in financial research27 by taking the difference between actual and expected (normal) stock returns. To calculate the latter, we use the Capital Asset Pricing Model market model specific to each region (North America and Europe) as is standard in event studies50. For each firm-event, we run the following ordinary least squares regression on the 3 years preceding the event:

where Rjt is the realized return for firm j at time t, Rf is the risk-free return on 1 month government bonds, αj is the intercept, MKTt is the market risk factor (return of each region’s market portfolio minus the risk-free return), and ϵjt is the error term with the expected value of zero. The model splits the observed return into an expected return and abnormal return. The former is driven by the market factor. The latter is driven by firm-specific information. The abnormal return has an expected value of zero and provides evidence of investors incorporating new market- and firm-specific information in the price of a stock. Supplementary Table 3 also shows results for a three-factor model51, but the three supplementary factors have limited explanatory power; that is, the variance of the error term is merely reduced. This is generally the case for stock prices1. Furthermore, results of an augmented three-factor model including oil price as a risk factor for carbon majors are similar. The parameters \(\hat{\alpha }\) and \(\hat{\beta }\) in equation (1) are estimated via time-series ordinary least squares regressions of excess returns on the market model over a 3-year estimation window, that is, trading days −770 to −20 relative to the filing or decision date, with a minimum of 125 days. Because the estimation window ends 20 days before the event day, our parameters \(\hat{\alpha }\) and \(\hat{\beta }\) are unlikely to be contaminated by anticipation of the event itself.

We assess abnormal returns over multiple days—known as the event window. We calculate these abnormal returns using equation (1), predicting the expected returns with our parameters \(\hat{\alpha }\) and \(\hat{\beta }\) from the estimation window. We define the cumulative average abnormal return, aggregating over the beginning (τ1) and end (τ2) of the event window as

The abnormal returns in the event window are then assessed for statistical significance relative to the distribution of abnormal returns in the estimation window.

When jointly assessing the reaction to multiple events for multiple firms of different sizes, one question is how to aggregate over CAARs. Putting equal weights on CAARs would place too much weight on small stocks, which detracts from understanding the aggregate market-wide impact of climate litigation. Instead, we weight abnormal returns by the log of each stock’s market capitalization (common shares outstanding in thousands multiplied by annual closing price, using the mean market value over the 3-year estimation window), such that the value-weighted-average CAAR is calculated as:

where \(\overline{\mathrm{CAAR}}\)(τ1,τ2) is the weighted-average cumulative abnormal return between days τ1 and τ2 for stocks, with the weight denoted by w. In terms of implementation, estimating weighted CAARs is not possible with standard event study packages within statistical software, which requires us to write our own code, which we make available.

Our main specification reports the Patell test52. This test is, in essence, a t test with unequal variances combined with an out-of-sample forecast error correction. Unequal variances means that the test considers the variance of each stock’s own returns and therefore gives lower weight to very volatile stocks. For example, returns to coal stocks such as Arch Resources have much larger volatility compared with larger firms such as Exxon Mobil. We also report a single-stage regression-based approach, where we regress equation (1) for the entire database at once as a panel, adding interaction dummies to each event to obtain firm-event-specific αi and βi and a dummy variable that is 1 during all event windows. This has the advantage that errors in the estimation of abnormal returns are included when estimating the significance of abnormal returns. The regression uses robust standard errors clustered both at the firm-event level to account for serial correlation and at the firm-day level to take into account that we have duplicated observations for firms with events with overlapping estimation periods. Further, we estimate using a portfolio approach whereby events targeting multiple companies are modelled as a single portfolio to address cross-sectional correlation (Supplementary Table 4).

Our main results report a 3-day CAAR with window (−1, 1), to capture the immediate market response to filings or decisions while minimizing potential confounding effects of other events. This is in line with our understanding that investors’ anticipation of class-action filings is generally limited (Supplementary Section 4)53. To allow for the possibility that part of the information about litigation is available on the days immediately preceding the event itself, we also investigate results for a 7-day window (−5, 1), which includes the week before the announcement, and effects for all filings remain the same at −0.35% indicating no anticipation effects. Indeed, many filings are not announced beforehand and come as a surprise. For example, most cases filed in the United States by cities, counties and states against Carbon Majors fall into this category. Even when filings are announced, there is still an element of surprise because sometimes NGOs threaten with filings but never carry them through. In addition, some filings receive very little media attention until the day of the filing.

Regarding decisions, the effect of all decisions is amplified from −0.99% in the standard case to −1.36% when we include anticipation effects from the previous week. This makes sense because dates of judicial decisions are generally not communicated in advance, and even when they are the outcome is invariably unknown. Note that by expanding the event window, we reduce the power of our test because more noise from other news is included. Therefore, only our aggregate results for all filings and negative decisions remain significant at the 95% level with a slightly increased effect from −0.41% to −0.44%. Overall, our results are indicative of limited anticipation effects. Also note that for each case, we investigate the effect of important decisions, but typically there are also some minor decisions. Our results should not be interpreted as the total effect of litigation, which would include the effects of all elements of information that gradually become available over time. To situate the impact of filings and decisions in the entire chain of events, Supplementary Section 4 provides a timeline for three important cases. We used StataMP 17 to clean our data, conduct our statistical tests and produce our figures. Our code is written using Stata’s do-file format and programming language.

The standardized t test, weighted t test and weighted Patell test

We briefly explain our approach to adjust our test statistic for event-induced volatility. Call L the length of the event window, M the estimation window length and N the number of firm-events, indexed by i. The standardized t test with different variances per firm-event is calculated as follows:

where SARit is the standardized abnormal return, standardized by the standard deviation of each firm-event’s estimation window \({s}_{{\mathrm{A}}{{\mathrm{R}}}_{i}}=\sqrt{\frac{1}{M-4}{\sum }_{M}{\left({\mathrm{A}}{{\mathrm{R}}}_{{it}}-{\sum }_{M}{\mathrm{A}}{{\mathrm{R}}}_{{it}}\right)}^{2}}\). Firm-specific standard deviations correct for the fact that abnormal returns of volatile stocks are measured with less precision. In the case of a weighted t test, we use the weighted mean, replacing \(\frac{1}{{NL}}\) with \(\frac{{w}_{i}}{{\sum }_{N}{\sum }_{L}{w}_{i}}\). Since we use constant weights per firm-event, the standard deviation is unaffected by weights.

In the case of the Patell test, we correct the SAR by a forecast error dividing each abnormal return in the event window by a factor \(\sqrt{\frac{M-2}{M-4}}\sqrt{1+\frac{1}{M}+\frac{{\left({R}_{{m}_{t}}-\overline{{R}_{m}}\right)}^{2}}{{\sum }_{M}{\left({R}_{{m}_{t}}-\overline{{R}_{m}}\right)}^{2}}}\) where \(\overline{{R}_{m}}\) is the mean market return during the estimation window. This factor attributes lower importance to days with large swings in market prices. The total formula is therefore

Economic magnitude of financial market response

We define the economic magnitude of the financial market’s response to climate litigation as the cumulative abnormal return in the window (−1, 1) multiplied by the targeted firm’s market capitalization previously in the same year. This captures the economic value that investors attribute to the climate litigation filings and decisions when valuing the price of a share at the point of time new information becomes available. Assuming informationally efficient financial markets, prices should incorporate all forward-looking effects of climate litigation court decisions on future profits. This allows us to capture difficult indirect costs such as the probability of future litigation cases and any reputational damage that investors price into the stock that may impact future cash flow or the firm’s discount rate.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

The source data for the dataset we constructed on climate lawsuits are The Climate Litigation databases maintained by the Sabin Center for Climate Change Law (https://climatecasechart.com/) and McCormick et al.46, available from https://doi.org/10.1038/s41558-018-0240-8. The financial data from Compustat North America and Compustat Global have been obtained via S&P Global Market Intelligence Data under a license agreement with Wharton Research Data Services and cannot be made publicly accessible. Those interested in obtaining the data should contact S&P Global Market Intelligence Data. Calculations based on these data are explained in Supplementary Section 6. Exchange rate data are from I/B/E/S, and we obtain this via Refinitiv under a license agreement with Wharton Research Data Services. The daily crude oil (WTI Spot Cushing US$/BBL) price was also obtained via Refinitiv from Wharton Research Data Services. Those interested in obtaining both these data should contact Refinitiv. Fama-French risk factors are open access, and links are shared in Supplementary Table 3. The climate litigation attention index is open access and is available from Google Trends (https://tinyurl.com/yc38upa6). We use Yahoo! Finance to cross-check stock prices and liquidity for European stocks (https://finance.yahoo.com/). Excluding the variables constructed using Compustat and Refinitiv data, the dataset used in this study is made open access via GitHub at https://github.com/FVenmans/Litigation.

Code availability

The code for this analysis and open access source data can be accessed via GitHub at https://github.com/FVenmans/Litigation.

References

Setzer, J. & Higham, C. Global Trends in Climate Change Litigation: 2022 Snapshot (Grantham Research Institute on Climate Change and the Environment, 2022); https://www.lse.ac.uk/granthaminstitute/publication/global-trends-in-climate-change-litigation-2022/

Peel, J. & Osofsky, H. M. Climate change litigation. Annu. Rev. Law Soc. Sci. 16, 21–38 (2020).

Campiglio, E., Daumas, L., Monnin, P. & von Jagow, A. Climate-related risks in financial assets. J. Econ. Surv. 37, 950–992 (2022).

Krueger, P., Sautner, Z. & Starks, L. T. The importance of climate risks for institutional investors. Rev. Financ. Stud. 33, 1067–1111 (2020).

Zhang, S. Y. Are investors sensitive to climate-related transition and physical risks? Evidence from global stock markets. Res. Int. Bus. Financ. 62, 101710 (2022).

Kruse, T., Mohnen, M. & Sato, M. Do financial markets respond to green opportunities? J. Assoc. Environ. Resour. Econ. 11, 549–576 (2024).

Climate-Related Litigation: Raising Awareness About a Growing Source of Risk (Network for Greening the Financial System, 2021); https://www.ngfs.net/sites/default/files/medias/documents/climate_related_litigation.pdf

Setzer, J. & Vanhala, L. C. Climate change litigation: a review of research on courts and litigants in climate governance. Wiley Interdiscip. Rev. Clim. Change 10, e580 (2019).

Peel, J., Palmer, A. & Markey-Towler, R. Review of Literature on Impacts of Climate Litigation (Children’s Investment Fund Foundation, 2022); https://www.unimelb.edu.au/__data/assets/pdf_file/0008/4238450/Impact-lit-review-report_CIFF_Final_27052022.pdf

Voeten, E. Do domestic climate rulings make climate commitments more credible? Evidence from stock market returns. J. Polit. https://doi.org/10.1086/732952 (2024).

Solana, J. Climate change litigation as financial risk. Green. Financ. 2, 344–372 (2020).

Caldecott, B., Clark, A., Koskelo, K., Mulholland, E. & Hickey, C. Stranded assets: environmental drivers, societal challenges, and supervisory responses. Annu. Rev. Environ. Resour. 46, 417–447 (2021).

Armour, J., Mayer, C. & Polo, A. Regulatory sanctions and reputational damage in financial markets. J. Financ. Quant. Anal. 52, 1429–1448 (2017).

Arena, M. & Ferris, S. A survey of litigation in corporate finance. Manage. Financ. 43, 4–18 (2017).

Results of the 2021 Climate Biennial Exploratory Scenario (CBES). Bank of England https://www.bankofengland.co.uk/stress-testing/2022/results-of-the-2021-climate-biennial-exploratory-scenario (2022).

Scenario Analysis Working Group: Climate Litigation Risk Chapter (Climate Risk Financial Forum, 2022); https://www.fca.org.uk/publication/corporate/cfrf-guide-2022-scenario-analysis-working-group-climate-litigation-risk-chapter.pdf

Setzer, J. in Litigating the Climate Emergency: How Human Rights, Courts, and Legal Mobilization Can Bolster Climate Action (ed. Rodríguez-Garavito, C.) 206–220 (Cambridge Univ. Press, 2022); https://doi.org/10.1017/9781009106214.013

Kolaric, S. The impact of climate litigation and activism on stock prices: the case of oil and gas majors. Rev. Manage. Sci. 18, 3141–3172 (2023).

Wu, Z. & Zhong, R. The equity market response to climate change litigation. Financ. Res. Lett. 67, 105870 (2024).

Dulak, T. & Gnabo, J.-Y. Climate litigation and financial markets: a disciplinary effect? Int. Rev. Financ. Anal. 95, 103496 (2024).

Global Climate Litigation Report: 2020 Status Review (UNEP, 2020); https://www.unep.org/resources/report/global-climate-litigation-report-2020-status-review#:~:text=The%20UNEP%20Global%20Climate%20Litigation,has%20occurred%20around%20the%20world

Donger, E. Children and youth in strategic climate litigation: advancing rights through legal argument and legal mobilization. Transnatl Environ. Law 11, 263–289 (2022).

Ganguly, G., Setzer, J. & Heyvaert, V. If at first you don’t succeed: suing corporations for climate change. Oxf. J. Leg. Stud. 38, 841–868 (2018).

People of the State of New York v. Exxon Mobil Corporation (2018) 452044/2018; https://climatecasechart.com/case/people-v-exxon-mobil-corporation/

Germanwatch v. Volkswagen (2007); https://climatecasechart.com/non-us-case/germanwatch-vs-volkswagen/

Commonwealth v. Exxon (2019) 1984CV03333; https://climatecasechart.com/case/commonwealth-v-exxon-mobil-corp/

Fama, E. F., Fisher, L., Jensen, M. C. & Roll, R. The adjustment of stock prices to new information. Int. Econ. Rev. 10, 1–21 (1969).

Greenpeace Australia Ltd v. Redbank Power Company Pty Ltd (1994) 86 LEGRA 143; https://climatecasechart.com/non-us-case/greenpeace-australia-ltd-v-redbank-power-co/

Dubash, N. K. et al. in Climate Change 2022: Mitigation of Climate Change (eds Shukla, P. R. et al.) Ch. 13 (Cambridge Univ. Press, 2022).

Comer v. Murphy Oil (2005) 1:05-cv-00436; https://climatecasechart.com/case/comer-v-murphy-oil-usa-inc/

Kivalina v. Exxonmobil (2008) 4:08-cv-01138-SBA; https://climatecasechart.com/case/native-village-of-kivalina-v-exxonmobil-corp/

Heede, R. Tracing anthropogenic carbon dioxide and methane emissions to fossil fuel and cement producers 1854–2010. Climatic Change 122, 229–241 (2014).

United Nations Framework Convention on Climate Change (UNFCCC). The Paris Agreement (UNFCCC Publications, 2015).

Burger, M., Wentz, J. & Horton, R. The law and science of climate change attribution. Columbia J. Environ. Law 45, 57–88 (2020).

Stuart-Smith, R. F. et al. Filling the evidentiary gap in climate litigation. Nat. Clim. Change 11, 651–655 (2021).

Saul Luciano Lliuya v. RWE (2015) Case No. 2 O 285/15; https://climatecasechart.com/non-us-case/lliuya-v-rwe-ag/

Lloyd, E. A. & Shepherd, T. G. Climate change attribution and legal contexts: evidence and the role of storylines. Climatic Change 167, 28 (2021).

Milieudefensie et al. v. Royal Dutch Shell PLC (2021) C/09/571932 / HA ZA 19-379; https://climatecasechart.com/non-us-case/milieudefensie-et-al-v-royal-dutch-shell-plc/

Peel, J., Osofsky, H. & Foerster, A. Shaping the ‘next generation’ of climate change litigation in Australia. Melb. Univ. Law Rev. 41, 793–844 (2017).

Gande, A. & Lewis, C. M. Shareholder-initiated class action lawsuits: shareholder wealth effects and industry spillovers. J. Financ. Quant. Anal. 44, 823–850 (2009).

Bouwer, K. & Setzer, J. Climate Litigation as Climate Activism: What Works (The British Academy, 2020); https://www.thebritishacademy.ac.uk/publications/knowledge-frontiers-cop26-briefings-climate-litigation-climate-activism-what-works/

Climate-Related Litigation: Recent Trends and Developments (NGFS, 2023); https://www.ngfs.net/sites/default/files/medias/documents/ngfs_report-on-climate-related-litigation-recent-trends-and-developments.pdf

Report on Micro-prudential Supervision of Climate-Related Litigation Risks (NGFS, 2023); https://www.ngfs.net/sites/default/files/medias/documents/ngfs_report-on-microprudential-supervision-of-climate-related-litigation-risks.pdf

Wetzer, T., Stuart-Smith, R. & Dibley, A. Climate risk assessments must engage with the law. Science 383, 152–154 (2024).

Nature-Related Litigation: Emerging Trends and Lessons Learned from Climate-Related Litigation (NGFS, 2024); https://www.ngfs.net/sites/default/files/medias/documents/report-nature-related-litigation-emerging-trends-lessons-climate.pdf

McCormick, S. et al. Strategies in and outcomes of climate change litigation in the United States. Nat. Clim. Change 8, 829–833 (2018).

County of San Mateo v. Chevron Corp. (2017) 17CIV03222; https://climatecasechart.com/case/county-san-mateo-v-chevron-corp/

Deutsche Umwelthilfe (DUH) v. Bayerische Motoren Werke AG (BMW) (2021) Case No. 3 O 12581/212021; http://climatecasechart.com/non-us-case/deutsche-umwelthilfe-duh-v-bmw/

Deutsche Umwelthilfe (DUH) v. Mercedes-Benz AG; http://climatecasechart.com/non-us-case/deutsche-umwelthilfe-duh-v-mercedes-benz-ag/ (2021).

Campbell, J.Y, Lo, A.W. & MacKinlay, A.C. The Econometrics of Financial Markets (Princeton Univ. Press, 2012).

Fama, E. F. & French, K. R. Common risk factors in the returns on stocks and bonds. J. Financ. Econ. 33, 3–56 (1993).

Patell, J. M. Corporate forecasts of earnings per share and stock price behaviour: empirical test. J. Account. Res. 14, 246–276 (1976).

Klock, M. Do class action filings affect stock prices? The stock market reaction to securities class actions post PSLRA. J. Bus. Securities Law 15, 109–154 (2015).

Acknowledgements

M.S., C.H., J.S. and F.V. acknowledge financial support from the Grantham Research Institute on Climate Change and the Environment, at the London School of Economics and the ESRC Centre for Climate Change Economics and Policy (CCCEP) (ref. ES/R009708/1). G.G. acknowledges financial support from the Economic and Social Research Council (ESRC) (ref. DTP/192540) and the Swiss National Science Foundation (SNSF) (grant agreement no. 207800). M.S. acknowledges support from the ESRC funded project PRINZ (ref. ES/W010356/1). C.H. and F.V. acknowledge support from Gallagher Re. We are grateful to E. Voeten and T. Kruse for comments and suggestions. We acknowledge valuable feedback from participants at the Grantham workshop (London), EAERE conference (Limassol), LSE Department of Geography and Environment PhD Seminar Series (London), the Global Research Alliance for Sustainable Finance and Investment conference (New Haven) and Panthéon–Assas University Paris Law, Economics and Regulation conference. We thank S. Elmhirst, J. Tan, H. Cornwall, R. Byrnes and H. Kerry for research assistance. Any remaining errors are our own.

Author information

Authors and Affiliations

Contributions

M.S. and J.S. acquired funding and coordinated the project. M.S., F.V. and J.S. conceptualized the idea. All authors contributed equally to the investigation and interpretation of results. C.H. and J.S. collected the legal data. G.G. collected the financial data. G.G., M.S. and J.S. conducted the literature review. G.G., M.S. and F.V. conducted the statistical analysis. All authors contributed to writing the article

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Sustainability thanks David Ramos and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Fig. 1, Tables 1–6 and Sections 1–6.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sato, M., Gostlow, G., Higham, C. et al. Impacts of climate litigation on firm value. Nat Sustain 7, 1461–1468 (2024). https://doi.org/10.1038/s41893-024-01455-y

Received:

Accepted:

Published:

Version of record:

Issue date:

DOI: https://doi.org/10.1038/s41893-024-01455-y