Abstract

The Colorado River system is among the world’s most overallocated basins, struggling to supply water to the southwestern United States and Mexico. Consequently, 90% of the basin’s native fish species are endangered, threatened or extinct. Driven by a 24-year megadrought, the United States allocated over US$4 billion for drought mitigation, including water market transactions that pay farms, cities and industries to divert less water across the US Southwest. We developed a model of how strategic water markets can restore imperilled fish habitat, integrating hydrology, ecology, economics and water rights within the river’s headwater state of Colorado. While least-cost water-use reductions improve over one-third of restorable river habitat, strategically spending 8% more nearly triples habitat improvement. Ten transactions attain 26% of that improvement for 1% of the cost. Water markets that do not legally protect conserved water are 29% less cost-effective than markets that do. Overall, strategic investing and legal reforms yield outsized ecological benefits.

Similar content being viewed by others

Main

The Colorado River basin supplies water for 40 million people and 2 million hectares of farmland in seven US states and two states in Mexico1,2 (Fig. 1). But severe historical overallocation of rights to river water and a climate change-induced 24-year megadrought are placing unprecedented stress on freshwater ecosystems and water users in the basin1,2,3,4. In fact, the basin’s rivers already run so dry that 44 of 49 native fish species are endangered, threatened or extinct,5 and flows since 2000 are near their lowest levels in the 2,000-year palaeorecord6,7.

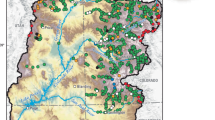

Our study area within the context of the Upper and Lower Colorado River basins contributes 24% of natural mean annual flow of the Colorado River into Lake Powell26. The area’s dominant in-basin water use is irrigation, which consumes 588 million cubic metres per year49. The area has had a longstanding rural–urban water conflict between in-basin users and 16 major transbasin diversions that export 595 million cubic metres per year to eastern Colorado50, largely for rapidly growing cities there (for example, Denver). The study area model contains 107 environmental stream reaches that have been designated as holding ecological importance (that is, instream flow water rights) by the state of Colorado27. Our model also covers the San Juan River basin within the state of Colorado (Supplementary Fig. 3) because it lacks a law that enables unprotected transactions that the Upper Colorado River sub-basin has, allowing comparative study. Map data from the Babbitt Center for Land and Water Policy51,52, Colorado’s Decision Support Systems53,54,55,56,57, the Colorado Department of Transportation58, Environmental Systems Research Institute and the National Oceanic and Atmospheric Administration. Reservoir data from the Bureau of Reclamation36.

The megadrought presents substantial challenges for water managers seeking to balance environmental and human water needs. By 2026, key operating guidelines and interstate and international agreements for managing Colorado River scarcity will expire1,8. In 2023, the US government threatened to unilaterally mandate major water cutbacks in the Lower Basin states of Arizona, California and Nevada8,9. This prospect was avoided in the short run through US$1.2 billion of incentivized temporary voluntary water transactions that paid users to reduce water consumption in those states and a wet winter in 2022–20238,10.

Just as Lower Basin states avoided water cutbacks with voluntary water transactions, to avoid the risk of cutbacks,11 Upper Basin states of Colorado, New Mexico, Utah and Wyoming have investigated starting a new water market that proactively reduces water consumption and ensures downstream deliveries to Lake Powell12. In 2019, US legislation authorized storing conserved water from such an Upper Basin water market in reservoirs such as Lake Powell (the legislation authorized the Demand Management Storage Agreement in the Upper Basin Drought Contingency Plan; this agreement requires additional steps before that market becomes active)8. In 2023, the US government allocated US$125 million to pay Upper Basin water users to refrain from exercising their full water rights (that is, the reauthorized System Conservation Pilot Program)12. Without substantial new conservation, the Upper Basin faces a risk that drier conditions will trigger mandatory water cutbacks, particularly affecting municipal water users within the state of Colorado, under the 1922 Colorado River Compact (‘Compact’)11.

These market-based conservation programmes generally do not intentionally preserve flows in environmentally sensitive river reaches. When low flows occur in environmentally sensitive river reaches, fish habitat is jeopardized. Environmental water markets, however, can provide such preservation. Here we develop an environmental water market model to evaluate how reductions in water consumption can be leveraged to strategically restore imperilled low-flow fish habitat. Instead of only reducing water consumption, strategic environmental water transactions would simultaneously reduce water consumption and preserve fish habitat at the lowest cost to the buyer. Applied to the Colorado River within the state of Colorado, the environmental water market would augment low-flow river reaches, piggybacking on reduced water consumption independently performed to deliver flow to the Lower Basin.

The Colorado River environmental water market

In the environmental water market, additional environmental flows are purchased from ‘water sellers’, mostly farmers and irrigation organizations but also cities and industrial water users. These sellers temporarily lease some or all of their right to extract water they would otherwise use for their own benefit. ‘Water buyers’ are governmental agencies and non-governmental environmental organizations who temporarily lease senior water rights to protect threatened fish habitat. Although new, junior environmental water rights may be created without buying water, because older, senior water rights receive their entire allocation before junior rights receive any water, market acquisitions of senior rights are critical for environmental protection. Environmental water markets exist across the western United States and commonly operate on a limited, ad hoc basis. However, Colorado’s instream flow programme was established in 1973 and has since voluntarily acquired about 163 water rights within about 50 projects13,14. Across Colorado River basin states, from 2014 to 2020, at least 446 environmental water transactions acquired 516 million cubic metres for US$61.4 million (2023 US$) (ref. 15).

Our environmental water market model for the Colorado River within the state of Colorado has four components (Fig. 2): water use, water rights, economics and environmental flows. First, water use is satisfied by allocating supply to satisfy farmer, industrial and municipal water needs to the degree possible under future drought conditions. Second, the model provides water for these societal needs based on available supply and water rights holders’ relative seniority. Water leased and reallocated to benefit environmental flows is tied to specific water rights. We initially consider a ‘protected market’ where water transactions protect environmental flows with the legal priority of leased water rights, meaning that water users junior to those leased rights are prohibited from taking the restored flows out of the river15,16. Third, the model’s economic component determines costs to temporarily lease water, including costs to buy water itself and costs to secure legal approval for transactions17,18. The economic component also determines which subset of water users participate in the market. Fourth, water transactions aim to support environmental flows through a complex river flow and reservoir network. Evaluating ecological benefits of water trades requires tracking restored flows throughout this network and most importantly how additional flows improve ecohydrological conditions and enhance fish survival in threatened habitats. Using the model, we then compare the ‘protected market’ to an ‘unprotected market’15,16,19,20,21. Because unprotected transactions bypass legal approval and trading rules, they incur lower legal and administrative costs at least half those for protected transactions18. Unprotected transactions involve enforceable private legal contracts between a buyer and seller, but unlike protected transactions, flows restored by unprotected transactions are not legally protected from diversion by third parties (Methods). We note that protected markets have been labelled ‘formal markets’ and unprotected markets have been labelled ‘informal markets’15,21,22,23. However, because diverse types of informal water markets exist worldwide24, we adopt the clearer terms ‘protected’ and ‘unprotected’ here.

Our environmental water market model integrates simulation of water use, water rights, economics and environmental flows. Water use for farmers, cities and industrial water users under future drought conditions is allocated based on available supply and the priority of users’ water rights. Water leased and reallocated to environmental flows is linked to specific water rights. The model’s economic component estimates costs to temporarily lease water, including costs to buy water and costs to secure legal approval for water transactions. Fish habitat benefits of water transactions are evaluated by tracking restored flows through a river flow and reservoir network and then applying flow alteration–ecological response statistical relationships. We use the model to identify water market portfolios that minimize the total cost to either (1) reduce water consumption or (2) reduce water consumption and strategically restore fish habitat. We then perform these analyses with different degrees of water-user participation, targets for reducing water consumption and types of available water transactions. We simulate both ‘protected water transactions’ that protect environmental flows against diversion by other users with the legal priority of the leased water rights and ‘unprotected water transactions’ that lack these protections. Icons adapted from the Noun Project.

Determining strategic beneficial environmental water trades must account for coupled hydrologic, ecological, legal and economic elements25. Our model integrates these elements. The goal is to determine water trades that support environmental flows by pairing sellers that supply water to a buyer aiming to augment destinations consisting of seasonally low-flow river reaches. Our trading model evaluates thousands of potential monthly trades, with any seller able to lease water in one or several monthly transactions. The choice of sellers depends on their water rights status, ability to convey water to ecologically important habitat locations and ability to reduce basinwide water consumption. We simulate transactions on a monthly basis during the irrigation season (May–October) because that is generally when fish habitat flows are diminished and environmental water transactions occur16.

Because trading decisions happen ahead of time, simulations apply season-ahead streamflow and climate forecasts based on snowpack and climate data available on 1 April. Strategic trades intentionally restore ecologically important environmental flow reaches designated by the state of Colorado’s Water Conservation Board (Fig. 1), though we evaluate fish habitat basinwide. We focus on the Upper Colorado River headwaters basin within the state of Colorado, which supplies 24% of the entire natural mean annual Colorado River flow into Lake Powell and previously hosted the most environmental water market trading volume of any Colorado River sub-basin (Fig. 1)15,26. The study area is also home to longstanding rural–urban water conflict between in-basin water users in rural western Colorado and transbasin water users who export water to eastern Colorado’s urbanizing Front Range, which includes Denver (Fig. 1)27. The model simulates water allocation among 3,279 water rights ranging from junior to senior status for 1,521 diversion points that supply users and 36 reservoirs.

The environmental water market’s goal is to restore fish habitat to intermediate ecological status or better as designated by expert input and prior ecological studies28,29. Flows below intermediate status may severely limit fish habitat, while flows at intermediate status may occasionally limit such habitat28. From an ecohydrologic perspective, the model applies flow alteration–ecological response relationships28,29,30 to maintain viable fish habitat. Alteration refers to the difference between a historical flow regime under natural conditions and a future drought year flow regime. Ecological responses are determined for rainbow and brown trout, two native warm-water fish of conservation concern and four endangered or threatened fish.

Fish habitat is evaluated for elevations and geomorphic settings with viable populations. For trout, we generate unique habitat-flow relationships for 1,137 individual river reaches. These were developed using a statistical model that links flows to more intensive, localized studies of physical habitat suitability and was validated with trout abundance field data30. For warm-water fish, we estimate potential biomass on 547 reaches using a statistical relationship between minimum summer–autumn flows and an upper bound on biomass28,29. For endangered and threatened fish, we use flow targets set using detailed fish data for a heavily impacted critical habitat reach27. We adopt flow–ecology relationships because environmental water markets improve low-flow habitat and streamflow has been called the ‘master variable’31,32 driving riverine ecosystem structure and function. We emphasize that given the influence of factors besides streamflow (for example, water quality, sediment, invasive species), these relationships do not estimate actual biomass but instead reflect an upper bound. Overall, our model addresses structural uncertainty by simulating numerous human and environmental features of the water market. However, a serious shortcoming of our model, driven by its considerable computational cost, is its limited treatment of model and data uncertainty.

The Colorado River under a future drought

We use our model to consider six narratives in a future drought year (Fig. 3 and Supplementary Table 1). Given the Colorado River’s long-term drying trend, the drought reflects a drier and hotter climate with further reduced flows and increased evapotranspiration. The drier and hotter climate draws from a mid-twenty-first century projection in the 2023 Colorado Water Plan33. That plan identified monthly changes between simulated historical (1970–1999) and future conditions (2035–2064) across ten notably hot and dry global climate model projections, being nearest the 75th percentile for consumptive irrigation water requirement and 25th percentile for streamflow33,34. Monthly changes were applied to a past drought year (2002).

a, Fish habitat status with no water market and improvements with mandatory cutbacks in a future drought year. Blue reaches are those with fish habitat co-benefits—improvement to intermediate ecological status in at least one month by the cutbacks. b, Fish habitat status with portfolios of water transactions that minimize the total cost to achieve reduced water consumption levels and with portfolios of environmental water transactions that minimize the total cost to achieve reduced water consumption levels and fish habitat targets of intermediate ecological status. Blue reaches are those with fish habitat co-benefits—improvement to intermediate ecological status in at least one month by the reduced water consumption-only portfolio. Green reaches illustrate how strategic portfolios substantially increase the total reach length restored to intermediate ecological status in at least one month beyond blue reaches. c, The maximum monthly improvement in trout habitat suitability from the strategic portfolio over the reduced water consumption-only portfolio. The expanded market with unprotected transactions improves the most trout habitat because 1,842 transactions are required to satisfy the reduced water consumption and fish habitat constraints, while just 118 transactions are required in the expanded market. Results for the aggressive authorized market are in Supplementary Fig. 14. Map data from Colorado’s Decision Support Systems56,57.

We first simulate what could happen without a water market, evaluating water allocation and environmental flows with no water market and no mandatory cutbacks. Second, we evaluate mandatory water-use cutbacks with no water market by halting water use by rights holders junior to the 1922 date when six states agreed to the Compact11.

Next we evaluate four water market narratives. These narratives are defined using three important exogenous conditions: water consumption reduction levels, market participation levels and legal reforms. The first water market narrative, the authorized market, adopts moderate water consumption reductions authorized in the 2019 US legislation8,35. Those reductions are equivalent to 9% of Lake Powell storage on 31 December 202235,36. The authorized market includes conditions such as those in current protected water markets with low market participation. Because the state of Colorado has not authorized protecting reallocated water all the way downstream to Lake Powell (known as ‘shepherding’), the authorized market allows only reallocated water to be protected until flow makes it to targeted downstream environmental flow reaches. The second market narrative, the aggressive authorized market, is the same as the authorized market but adopts aggressive reduced water consumption equal to 36% of Lake Powell storage on 31 December 2022, which it has been estimated is sufficient to stave off mandatory cutbacks35,36,37. The third market narrative, the expanded market, adopts aggressive reduced water consumption and high market participation. Higher participation could be prompted by policy or behavioural interventions. The third market narrative also would allow protection of reallocated water to Lake Powell (‘shepherding’). The fourth market narrative, an expanded market with unprotected transactions, is like ongoing pilot initiatives. It relies on unprotected transactions for in-basin reduced water consumption, with aggressive overall water-use reductions.

For all water market narratives, we first provide least-cost solutions for reducing water consumption. This baseline case does not intentionally improve environmental flows, but we track accompanying habitat co-benefits. Next we compare each baseline case to a least-cost solution for reducing water consumption and restoring environmental flow reaches to intermediate ecological status. Between baseline and environmental water markets, we compare five metrics: fish habitat river distance restored, reduction in water consumption, financial costs, numbers of sellers and numbers of monthly transactions.

Results

Environmental impacts with no water markets

Under the first narrative, we simulated fish habitat with no reductions in water consumption from markets or mandatory cutbacks. These simulation results show that fish habitat will become dire in the future drought year (Fig. 3a). Fish habitat status is poor for trout, warm-water fish or endangered or threatened fish for at least one month during the irrigation season (May–October) on 97% of all river miles and 95% of environmental flow reach miles. Trout habitat suitability during the irrigation season is also very low (<25%) for at least one month on 83% of river miles (Supplementary Fig. 16).

Although mandatory cutbacks are not intended to improve habitat, if they occur, there will be considerable ecological co-benefits (Fig. 3a). We find co-benefits occur on 73% of restorable river reaches (defined as the subset of reaches that can be improved to at least intermediate ecological status). Of restorable river reaches Colorado designated as ecologically important, mandatory cutbacks return 58% to at least intermediate ecological status for trout, warm-water fish or endangered and threatened fish in at least one month.

Reducing water consumption with water markets

For each water market narrative, we next identify least-cost plans to achieve moderate or aggressive water-use reductions. These plans do not intentionally preserve fish habitat. Reduced water consumption is attained through water transactions and reflects legal and hydrologic factors. These factors include legal protections, hydrologic externalities, water losses and logistical water transmission and storage issues (Methods and Supplementary Fig. 1). Overall, the model identifies complex feedbacks that reverberate throughout the water rights priority-allocation system, shifting water deliveries and environmental flows in sometimes unexpected ways.

To consider these factors, for each water market narrative, the Knitro large-scale nonlinear optimization procedure searches through thousands of simulations using our version of the state of Colorado’s StateMod flow-tracking model (Methods)27,38. We expanded that model to enable realistic simulation of water transactions (Methods and Supplementary Fig. 1). The coupled simulation–optimization model minimizes the total cost to reduce water consumption basinwide, orchestrating which diversionary water rights and reservoir water are partially or fully leased in which months and which destination river reaches receive flow savings.

Our results indicate that under future drought conditions, a least-cost solution achieves moderate reduced water consumption for US$29 million in the authorized market. Least-cost solutions achieve aggressive reduced water consumption for US$125 million in the protected aggressive authorized market but US$115 million in the protected expanded market. However, pilot water market efforts so far have largely relied on unprotected water leased from farmers (that is, ‘forbearance agreements’). This unprotected approach faces a key enforcement problem: unprotected transactions do not prevent third parties from extracting that leased water before it gets to Lake Powell15. For the least-cost reduced water consumption plan, we find achieving aggressive reduced water consumption in the expanded market with unprotected transactions costs US$129 million, which is 12% more than the protected expanded market.

Our results also show a reduced water consumption programme, which simply enhances flow to Lake Powell at the lowest cost, provides unintentional ancillary ecological co-benefits (Fig. 3b). Under the authorized market with low participation, 20% of restorable environmental flow reaches improved to intermediate ecological status (Table 1). Reflecting their aggressive reduced water consumption constraints, co-benefits occur for 45% of restorable environmental flow reaches under the aggressive authorized market and 36% of those reaches under the expanded market. The expanded market may have lower co-benefits because it focuses spending on a smaller number of cost-effective sellers and transactions than the aggressive authorized market (Table 1) despite having more participating sellers to choose from. Finally, under the expanded market with unprotected transactions, co-benefits occur on 39% of restorable environmental flow reaches.

Strategic environmental water market portfolios

The primary goal of the integrated model is to quantify the extra cost needed to strategically improve fish habitat. We implement this by identifying portfolios of water transactions that minimize the total cost to meet reduced water consumption levels plus hundreds of constraints requiring fish habitat to achieve intermediate ecological status on designated environmental flow reaches. Ecological benefits are then compared to co-benefits from least-cost water plans that lack fish habitat constraints.

Under all market types, substantially more ecological benefits are achieved when fish habitat is strategically restored versus the least-cost water plans (Fig. 3b,c and Supplementary Fig. 14). Ecological benefits are also greatest in market types with more ambitious water-use reductions and legal protections for conserved water. First, in the authorized market, strategic portfolios increase the percentage of restorable environmental flow reaches improved to intermediate ecological status from 20% to 69%. However, more habitat is restored in the three market types with an aggressive reduced water consumption target because they conserve more water, leaving more streamflows throughout the system. In the aggressive authorized market, the strategic portfolio nearly doubles intermediate habitat restored, going from 45% to 80%. Between the expanded market and expanded market with unprotected transactions, the expanded market restores more habitat. In the expanded market, strategic portfolios nearly triple intermediate habitat restored, going from 36% to 100%. In the expanded market with unprotected transactions, strategic portfolios more than double intermediate habitat restored, going from 39% to 87%. Looking beyond the environmental flow reaches, intermediate habitat increases in all restorable river reaches from 15% to 68% in the authorized market, 65% to 89% in the aggressive authorized market, 51% to 100% in the expanded market and 53% to 97% in the expanded market with unprotected transactions. Ecological improvements from strategic expanded markets and the strategic aggressive authorized market also exceed those from mandatory cutbacks (Fig. 3 and Table 1).

Importantly, strategic portfolios can achieve these add-on ecological benefits at little additional expense (Fig. 4). This result is apparent in markets with aggressive water-use reductions because they already have more water in the system. For both expanded water markets, strategic portfolios cost just 8% more than the reduced water consumption portfolio, rising from US$115 million to US$124 million in the expanded market and from US$129 million to US$139 million in the expanded market with unprotected transactions. For the aggressive authorized market, the strategic portfolio costs <1% more, raising costs from US$125 million to US$126 million. But under the authorized market, the total cost for the strategic portfolio goes up 55%, raising costs from US$29 million to US$45 million, because that market starts from a lower water-use reduction target.

Our environmental water market model combines known water prices where those are publicly advertised in our study area with a model that estimates unknown water prices (Methods). a, To show how strategic portfolios change total water volumes leased and water prices paid, bars show the change in the total volume of water leased by price interval. b, Tiered curves showing the cumulative volume leased at or before a given price interval. Gaps between the green and black curves represent shifts in volume acquired and price paid for water under strategic portfolios. Supplementary Fig. 10 provides full tiered supply curves, including transactions considered but rejected. Results for the aggressive authorized market are in Supplementary Fig. 15.

Strategic portfolios raise costs for several reasons. First, strategic portfolios generally raise costs by increasing the water volume leased. Under both expanded markets, strategic portfolios increase the volume leased by just 8% (Fig. 4). Under the aggressive authorized market, the volume leased decreases minimally (Supplementary Fig. 15). Under the authorized market, to augment its lower reduced water consumption level, the strategic portfolio requires leasing 69% more water. Second, strategic portfolios raise costs by shifting to transactions with more expensive water. In all four water market narratives, more water is leased from expensive transbasin diversions, which are located upstream in prime locations to restore headwater reaches (Fig. 4 and Supplementary Fig. 15). Indeed, water markets commonly do not adhere to the ‘law of one price’39,40, with price dispersion and commodity heterogeneity leading to disparate water prices within the same river basin (Fig. 4). Accordingly, our transaction portfolios follow a tiered supply curve, with unit prices varying over 50-fold, from US$0.02 m−3 to US$1.04 m−3 (Fig. 4b). Third, strategic portfolios increase numbers of enroled sellers and transactions, raising legal costs. The increase in transactions in the unprotected market is extremely high and signals a shortcoming: due to enforcement problems of unprotected transactions, aggressive reduced water consumption may only be achieved with transaction numbers that far outstrip today’s water markets.

Overall, strategic portfolios offer substantially more cost-effective fish habitat improvements than least-cost plans (Table 1). Compared to those plans, strategic portfolios’ cost per kilometre of habitat restored is 2.3× lower in the authorized market, 1.3× lower in the aggressive authorized market, 2.6× lower in the expanded market and 2.1× lower in the expanded market with unprotected transactions (Table 1). Least-cost plans are slightly more cost-effective for reducing water consumption (Table 1 and Fig. 4). Crucially, the expanded market with unprotected transactions is 9% less cost-effective at reducing water consumption (least-cost plans) and 29% less cost-effective at improving fish habitat (strategic portfolios) than the expanded protected market (Table 1).

Transaction prioritization

To make our results tractable in current markets with fewer transactions, we performed a transaction prioritization analysis within the strategic portfolio for the authorized market and both expanded markets (Fig. 5). Two different prioritization schemes were used. First, we prioritized ecological cost-effectiveness, and second, we prioritized reduced water consumption cost-effectiveness. Transactions were also bundled to achieve cost-effective conservation, starting with the most cost-effective transaction and building to the full portfolio. Within strategic portfolios, substantial potential exists to prioritize among transactions. For ecological cost-effectiveness, the ten best transactions in the authorized market attain 51% of the entire strategic portfolio’s total fish habitat improvement for 16% of the total cost. In the expanded market, the ten best transactions attain 26% of the total fish habitat improvement for 1% of the cost. In the expanded market with unprotected transactions, the ten best transactions attain 33% of total fish habitat improvement for 4% of the cost.

We prioritized transactions according to fish habitat (a) and reduced water consumption (b) cost-effectiveness. We performed the prioritization by first individually simulating all transactions in the strategic portfolio and ordering them from most to least cost-effective. The results in the figure come from a second set of simulations, where we cumulatively activated the transactions, starting with the most cost-effective transaction and building towards activating all transactions in the portfolio. Sometimes, overall cost-effectiveness either improved as more transactions were activated or remained comparable (that is, did not drop by >10%), in which case transactions were bundled (black bars). Such improvements in overall cost-effectiveness with more transactions are largely driven by attaining scale economies in legal costs. The fish habitat metric is the cumulative percentage improvement towards intermediate ecological status across all environmental flow reach constraints, normalized by the best portfolio (Supplementary equation (6)). The 50 most cost-effective transactions are shown.

For both fish habitat and reduced water consumption, transaction prioritization reveals clear groups of transactions with comparable cost-effectiveness, delineating transaction bundles that could be prioritized for joint investment (Fig. 5). The prioritization analysis also reveals that cost-effectiveness of top transactions varies substantially across different market types, with a predominance of particularly cost-effective transactions in the expanded market with protected transactions (Fig. 5). The most cost-effective transactions in the expanded protected market improve fish habitat by up to 5× that of the expanded market with unprotected transactions for the same unit cost.

Discussion

To address the Colorado River basin’s water security crisis, the US government allocated >US$4 billion for drought mitigation, including paying water users across the basin’s seven states to extract less water8. In Colorado, a key headwater state with access to a subset of these funds, our results show how strategically piggybacking on these investments in water-use reduction substantially benefits imperilled fish habitat and an upper bound on fish biomass. We found strategically investing <1% more funding than a least-cost plan nearly doubles fish habitat improved to intermediate status in an authorized water market with aggressive water-use reductions and greater baseline costs for those reductions. Also, we found investing 8% more than a least-cost plan, representing 0.02% of the state’s 2024–2025 budget41, nearly triples restored intermediate habitat in an expanded water market with aggressive water-use reductions, more water-user participation and more protections for restored flows. However, in an authorized water market with lower, moderate water-use reductions, a strategic portfolio involved 55% more spending but more than tripled intermediate habitat restored. Overall, our results show aggressive water-use reductions enable cost-effective strategic water trading.

Our results also illustrate how strategic investing initiatives can benefit from formal environmental water market institutions that protect restored flows to a designated place. In the Upper Colorado River basin, the US government allocated $US125 million for water conservation from unprotected transactions12. However, our results show an expanded market with unprotected transactions is 29% less cost-effective than an expanded protected market. Although unprotected markets may be well suited for localized environmental flow improvement15, our results suggest they impede effective large-scale programmes to substantially reduce water consumption. Permanent transactions are beyond this study’s scope because current Colorado River conservation programmes have relied on temporary transactions. If future programmes shift to permanent conservation, as some have suggested, strategic transaction selection might also achieve ecological benefits under a wider range of long-term, water-stressed conditions.

Rivers worldwide have been overallocated by society42,43,44. Climate adaptation that infuses new funds or support for reduced water consumption may present unique opportunities for strategic fish habitat preservation. While strategic approaches may cost marginally more, we show modest additional funding can have outsized ecological impacts. This work also illustrates how innovative systems models merging law, economics, hydrology and ecology can enable water reallocation that fosters strategic fish habitat preservation.

Methods

Simulating environmental water marketing

We expanded the state of Colorado’s river network and water allocation model, StateMod, to simulate protected and unprotected environmental water transactions16,27,45,46. StateMod accounts for physical river flow, water rights and operating rules and has been extensively calibrated to streamflow gauge data, diversions, consumption and reservoir contents.27 Our model covered two sub-basins (the Upper Colorado and San Juan/Dolores StateMod models) because the Upper Colorado has had unprotected transactions but the San Juan has not due to a legal exemption from ‘use it or lose it’ that does not apply there. Model results showed very little transaction activity in the San Juan (Supplementary Fig. 8).

Hydrology and climate change

The model simulates leases using forecasted April–October streamflows, temperature and precipitation. Because leases start in May, forecasts use snowpack and climate data available on 1 April to allow one month for government approval of leases. For 134 model locations where flows are introduced to the river network, streamflow forecasts predict total unimpaired flows summed across the months April–October for 1983–2012, the most recent 30-year period when StateMod is available. Climate forecasts predict mean monthly April–October temperature and precipitation over the same 30-year period at 12 climate stations. Different forecast locations were assigned different explanatory variables based on their hydrologic setting within the basin and an automated variable selection process. Because water buyers in current environmental water markets use forecasts from the National Water and Climate Center of the US Natural Resources Conservation Service, our forecasts employ the National Water and Climate Centerʼs preferred statistical approach, principal components regression16.

For future climate change, we selected a 2050 Hot and Dry scenario from the 2023 Colorado Water Plan33,34. It was translated to inputs for StateMod by developing monthly change factors between simulated Variable Infiltration Capacity model historical (1970–1999) and future conditions (2035–2064). We applied the change factors to a past dry year (2002). We repeated this approach for the seasonal streamflow, temperature and precipitation forecasts under 2050 climate change by calculating monthly change factors for forecasts’ explanatory variables.

Simulations use a monthly time step. However, because the warm-water fish flow–ecology relationship relies on the minimum 30-day moving average flow, for that relationship we calculate that moving average with daily baseline simulation values but then add the monthly simulated change in flow with transactions to those values.

Moderate and aggressive reduced water consumption levels are those developed by the Colorado River Water Bank Work Group, a key stakeholder consortium35. Targets are evenly fulfilled over five years and proportionally allocated to sub-basins of the broader Upper Colorado River basin with past consumptive water usage35. Following ref. 35, we constrain reduced water consumption to come half from in-basin users across western Colorado and half from transmountain users. Because >99% of transmountain diversions occur in the Upper Colorado and San Juan basins within Colorado while just 50% of in-basin irrigation water use in western Colorado occurs there, this means that 67–69% of total reduced water consumption is from transmountain users in our study areas.

River ecology

We evaluate ecological outcomes for trout and warm-water fish using established flow–ecology relationships that relate deviations in specific aspects of the natural flow regime to fish habitat or potential biomass29,30. The trout flow–ecology relationship relates flow to hydraulic habitat, while the warm-water fish flow–ecology relationship relates flow to an upper bound on biomass, recognizing the influence of factors besides streamflow (for example, water quality, sediment, invasive species). Neither relationship estimates actual biomass. Those fish survival outcomes are evaluated in locations (elevation, geomorphology) where the Colorado Division of Wildlife indicated viable populations exist. Intermediate habitat status for trout is defined as habitat at 25% of mean annual flows, while for warm-water fish, intermediate status is that supplying 50% of potential biomass with naturalized flows (Supplementary Information ‘Fish Constraints’). For endangered fish, we use flow augmentation targets for one critical reach (the 15-mile Upper Colorado River endangered fish reach)27. Although we evaluate fish across all reaches with viable populations, fish constraints for strategic portfolios only exist for ecologically important environmental flow reaches designated by the Colorado Water Conservation Board. We identified which of these environmental flow reaches could be restored to intermediate habitat status under each of the narratives using a simulation with all transactions turned completely on. This gave 201 fish habitat constraints for the authorized and aggressive authorized markets (178 for trout, 19 for warm-water fish and four for endangered and threatened fish), 229 for the expanded market (202 for trout, 23 for warm-water fish and four for endangered and threatened fish) and 213 for the expanded market with unprotected transactions (190 for trout, 19 for warm-water fish and four for endangered and threatened fish).

Law

We model protected leases of diversionary water rights by explicitly simulating compliance with three major legal trading rules. First, the no-injury rule precludes any reduction in water for third-party water rights holders (that is, ‘injury’), which frequently means that the pre-transfer timing of return flows must be maintained after the lease16. We simulate a common compliance strategy for this rule: diverting water into off-channel ponds and releasing it later to maintain pre-transfer return flows. Each new instream flow water right retains the priority of the leased water rights, and diversions and consumption are reduced at the source of the lease. Second, water law limits transferable water to historical water usage16. We implemented this rule using a historical model simulation (1975–2013). Third, for the authorized market narratives only, we follow Colorado water law in limiting protected leases to only lease to existing permanent instream flow water rights, only provide sufficient flow to meet the target flow for that destination water right and not occur for more than 120 days per year15. For unprotected diversion leases, we reduce diversions and consumption at the source structure, but we do not apply the three legal rules and add no instream flow water rights. For protected leases from reservoir storage, we simulate compliance with the no-injury rule by adding compliance nodes to the model that dynamically satisfy that rule.

Economics

To represent price dispersion, for transactions with uncertain water prices, we developed hedonic regression models. The hedonic model for the Upper Colorado River study area (R2 = 0.81) evaluates 115 observed water leasing prices, finding different water rights leasing prices for different seller types, water market regions, diversion versus reservoir leases and protected versus unprotected diversion leases. For structures with known prices, we use those. For legal costs, we used a hedonic model from our own survey of 100 water market professionals17. Legal costs vary by consumptive use, water rights priority and region, with significant scale economies.

Because water-user participation has constrained water markets, we restrict structures considered for leasing in three tiers16. First, we remove certain types of structures that have little or no history of participation or may not feasibly participate. Second, we apply screening criteria used by the Colorado Water Trust. Third, we reduce the number of structures considered to a realistic number of offers—to high (61%) or low participation (20%). Participation percentages come from a 2016 survey of 266 agricultural water rights holders across Colorado that asked participants if they would participate in an agricultural water lease today; 20% answered ‘yes’ and 41% answered ‘maybe’47. We select participating water-use structures by drawing a sample weighted by a logistic regression that estimates the probability of participation in a past environmental water transaction, considering 54,050 structures in western Colorado, as a function of water-use structure characteristics (structure type (ditch or reservoir), water rights priority, total decreed water rights, previous permanent water rights transfer from structure) and local demographic characteristics (Census block group age, gender, education) (Supplementary Table 7). The logistic model’s objective is to sample a distinct set of structures representative of those that participated in past environmental transactions. While water prices could theoretically be raised to induce participation by certain sellers that are particularly helpful in meeting strategic goals (for example, using an auction), we are aware of no US environmental flow market that systematically uses such a price-incentive scheme, so our analysis uses current market prices with low and high participation.

Optimization

We used the Knitro large-scale nonlinear optimization solver’s gradient-based sequential quadratic programming algorithm38. Individual model narratives regularly used 525+ CPUs (central processing units) running for a week or more to find solutions on the Stanford University high-performance computing cluster, Sherlock. Across the narratives, numbers of monthly transactions (decision variables) range from 650 to 2,880 with 465 to 615 constraints.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

Input data for our water market price and water-user participation models are available via figshare at https://doi.org/10.6084/m9.figshare.26350912.v1 (ref. 48). Data required to run the water market model for the narratives in our manuscript are available in the same repository. Other data used in our study are from publicly available sources as cited in the Supplementary Information.

Code availability

The water market model and code that support the findings of this study are available via figshare at https://doi.org/10.6084/m9.figshare.26350912.v1 (ref. 48).

References

Wheeler, K. G. et al. What will it take to stabilize the Colorado River? Science 377, 373–375 (2022).

Richter, B. D. et al. New water accounting reveals why the Colorado River no longer reaches the sea. Commun. Earth Environ. 5, 134 (2024).

Overpeck, J. & Udall, B. Climate change and the aridification of North America. Proc. Natl Acad. Sci. USA 117, 11856–11858 (2020).

Udall, B. & Overpeck, J. The twenty-first century Colorado River hot drought and implications for the future. Water Resour. Res. 53, 2404–2418 (2017).

Blinn, D. & Poff, N. L. in Rivers of North America (eds Benke, A. & Cushing, C.) 483–522 (Elsevier Academic Press, 2011).

Colorado River Basin Natural Flow and Salt Data (Bureau of Reclamation, 2023).

Gangopadhyay, S., Woodhouse, C. A., McCabe, G. J., Routson, C. C. & Meko, D. M. Tree rings reveal unmatched 2nd century drought in the Colorado River Basin. Geophys. Res. Lett. 49, e2022GL098781 (2022).

Stern, C. V, Sheikh, P. A & Hite, K. Management of the Colorado River: Water Allocations, Drought, and the Federal Role (Congressional Research Service, 2025).

Near-Term Colorado River Operations Draft Supplemental Environmental Impact Statement (Bureau of Reclamation, 2023).

Flavelle, C. A breakthrough deal to keep the Colorado River from going dry, for now. New York Times (22 May 2023).

Castle, A. & Fleck, J. The risk of curtailment under the Colorado River Compact. Preprint at SSRN https://doi.org/10.2139/ssrn.3483654 (2019).

Upper Colorado River Commission Upper Colorado River Officials Release Details of Water Savings Program (UCRC, 2022).

Smith, S. M. Instream flow rights within prior appropriation: insights from Colorado. Nat. Resour. J. 59, 181–213 (2019).

Bassi, L. J., Schneider, S. J. & White, K. M. ISF law—stories about the origin and evolution of Colorado’s instream flow law in this prior appropriation state. U. Denver Water L. Rev. 22, 389–436 (2018).

Womble, P., Townsend, A. & Szeptycki, L. Decoupling environmental water markets from water law. Environ. Res. Lett. 17, 065007 (2022).

Womble, P. Water Rights Markets in the 21st Century: Transaction Costs and Optimal Environmental Water Portfolios in Colorado, USA. PhD dissertation, Stanford University (2020).

Womble, P. & Hanemann, W. M. Water markets, water courts, and transaction costs in Colorado. Water Resour. Res. 56, e2019WR025507 (2020).

Womble, P. & Hanemann, W. M. Legal change and water market transaction costs in Colorado. Water Resour. Res. 56, e2019WR025508 (2020).

Garrick, D. & Aylward, B. Transaction costs and institutional performance in market-based environmental water allocation. Land Econ. 88, 536–560 (2012).

Garrick, D. E. in Water Allocation in Rivers Under Pressure: Water Trading, Transaction Costs and Transboundary Governance in the Western U.S. and Australia 121–173 (Edward Elgar Publishing, 2015).

Zeff, H. B., Hadjimichael, A., Reed, P. M. & Characklis, G. W. Using financial contracts to facilitate informal leases within a western United States water market based on prior appropriation. Earth’s Future 12, e2023EF003739 (2024).

Carey, J., Sunding, D. L. & Zilberman, D. Transaction costs and trading behavior in an immature water market. Environ. Dev. Econ. 7, 733–750 (2002).

Bjornlund, H. Formal and informal water markets: drivers of sustainable rural communities? Water Resour. Res. 40, W09S07 (2004).

Garrick, D. E. et al. Informal Water Markets in an Urbanising World: Some Unanswered Questions (World Bank, 2019).

Garrick, D. E. et al. A systems perspective on water markets: barriers, bright spots, and building blocks for the next generation. Environ. Res. Lett. 18, 031001 (2023).

Gold, D. F., Gupta, R. S. & Reed, P. M. Exploring the spatially compounding multi-sectoral drought vulnerabilities in Colorado’s West Slope river basins. Earth’s Future 12, e2024EF004841 (2024).

Upper Colorado River Basin Water Resources Planning Model User’s Manual (Colorado Water Conservation Board, 2016).

Sanderson, J. S. et al. Colorado Basin Roundtable Watershed Flow Evaluation Tool Study (Northwest Colorado Council of Governments, 2012).

Sanderson, J. S. et al. Getting to scale with environmental flow assessment: the Watershed Flow Evaluation Tool. River Res. Appl. 28, 1369–1377 (2012).

Wilding, T. K., Bledsoe, B., Poff, N. L. & Sanderson, J. Predicting habitat response to flow using generalized habitat models for trout in Rocky Mountain streams. River Res. Appl. 30, 805–824 (2014).

Power, M. E. et al. Hydraulic food-chain models. BioScience 45, 159–167 (1995).

Poff, N. L. et al. The ecological limits of hydrologic alteration (ELOHA): a new framework for developing regional environmental flow standards. Freshw. Biol. 55, 147–170 (2010).

Colorado Water Plan (Colorado Water Conservation Board, 2023).

Harding, B. CRWAS Phase II Climate, Task 5, CRWAS-II Climate Hydrology Approach and Results (Colorado Water Conservation Board, 2015).

Colorado River Water Bank Work Group. Upper Basin Demand Management Economic Study in Western Colorado (Water Bank Work Group, 2020).

Data for ‘Lake Powell Storage’ and ‘Lake Mead Storage’ (Bureau of Reclamation, 2024); https://www.usbr.gov/uc/water/hydrodata/reservoir_data/site_map.html

Colorado River Risk Study: Phase III Final Report (Hydros Consulting, 2019).

Byrd, R. H., Nocedal, J. & Waltz, R. A. in Large-Scale Nonlinear Optimization (eds Pillo, G. & Roda, M.) 35–59 (Springer US, 2006).

Edwards, E. & Libecap, G. D. in Handbook on the Economics of Natural Resources (eds Halvorsen, R. & Layton, D. F.) 442–473 (Edward Elgar Publishing, 2015).

Colby, B. G., Crandall, K. & Bush, D. B. Water right transactions: market values and price dispersion. Water Resour. Res. 29, 1565–1572 (1993).

Colorado House Bill 1430 (Colorado House of Representatives, 2024).

Richter, B. D. et al. Water scarcity and fish imperilment driven by beef production. Nat. Sustain 3, 319–328 (2020).

Gleick, P. H. & Palaniappan, M. Peak water limits to freshwater withdrawal and use. Proc. Natl Acad. Sci. USA 107, 11155–11162 (2010).

Postel, S. L., Daily, G. C. & Ehrlich, P. R. Human appropriation of renewable freshwater. Science 271, 785–788 (1996).

Hadjimichael, A., Quinn, J. & Reed, P. Advancing diagnostic model evaluation to better understand water shortage mechanisms in institutionally complex river basins. Water Resour. Res. 56, e2020WR028079 (2020).

Hadjimichael, A. et al. Defining robustness, vulnerabilities, and consequential scenarios for diverse stakeholder interests in institutionally complex river basins. Earth’s Future 8, e2020EF001503 (2020).

Ag Water Rights Holder Survey Results (Colorado Cattlemen’s Association, 2016).

Womble, P. et al. Data and code supporting ‘A strategic environmental water rights market for Colorado River reallocation,’ submitted to Nature Sustainability. figshare https://doi.org/10.6084/m9.figshare.26350912.v1 (2025).

Historic Crop Consumptive Use Analysis: Colorado River Basin (Colorado Water Conservation Board, 2015).

Citizen’s Guide to Colorado’s Transbasin Diversions (Water Education Colorado, 2014).

Upper and Lower Colorado River Basin Boundaries (Babbitt Center for Land and Water Policy, accessed 27 May 2025); https://services5.arcgis.com/9b85MAhVnAUWydgW/arcgis/rest/services/New_General_Map_4_29_WFL1/FeatureServer

Colorado River Basin Rivers (Babbitt Center for Land and Water Policy, accessed 27 May 2025); https://services5.arcgis.com/9b85MAhVnAUWydgW/arcgis/rest/services/Colorado_River_Basin_Rivers_ArcHub/FeatureServer

Diversion 5 Irrigated Lands (Colorado’s Decision Support Systems, accessed 27 May 2025); https://cdss.colorado.gov/gis-dataision-5-colorado

Structures – With Water Rights (Colorado’s Decision Support Systems, accessed 27 May 2025); https://dnrftp.state.co.us/?u=anonymous&p=anonymous&path=/CDSS/GIS/Structure.zip

Instream Flow Reaches – Decreed and Pending Reaches (Colorado’s Decision Support Systems, accessed 27 May 2025); https://dnrftp.state.co.us/?u=anonymous&p=anonymous&path=/CDSS/GIS/ISF_Reach.zip

Source Water Route Framework (Colorado’s Decision Support Systems, accessed 27 May 2025); https://dnrftp.state.co.us/?u=anonymous&p=anonymous&path=/CDSS/GIS/Source_Water_Route_Framework.zip

Division Boundaries (Colorado’s Decision Support Systems, accessed 27 May 2025); https://dnrftp.state.co.us/?u=anonymous&p=anonymous&path=/CDSS/GIS3CO.zip

Colorado Cities – polygon (Colorado Department of Transportation, accessed 2008); https://koordinates.com/layer/1040-colorado-cities-polygon-2008/

Acknowledgements

This work was supported by the Stanford University Woods Institute for the Environment Realizing Environmental Innovation Program (S.M.G., B.H.T., P.W., J.S.H.-S.), Walton Family Foundation (P.W., J.S.H.-S., S.M.G.), Stanford Emmett Interdisciplinary Program in Environment and Resources (P.W.), Stanford Interdisciplinary Graduate Fellowship (P.W.), Ishiyama Family Foundation (P.W.), Babbitt Center for Land and Water Policy (P.W.), Robert and Patricia Switzer Foundation (P.W.), a Landreth Family Grant (P.W.) and a McGee/Levorsen grant from the Stanford School of Earth, Energy and Environmental Sciences (P.W.). Model runs relied on the Stanford Research Computer Center’s Sherlock high-performance computing cluster, and additional computing resources were provided by the Microsoft AI for Earth programme. We thank J. Brannon for help with StateMod and S. Bhandari for research assistance.

Author information

Authors and Affiliations

Contributions

P.W., S.M.G., B.H.T. and J.S.H.-S. designed and performed research. P.W., S.M.G. and J.S.H.-S. analysed data. P.W. and S.M.G. wrote the paper.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Sustainability thanks Dustin Garrick, Elizabeth Koebele and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary methods, Figs. 1–18, Tables 1–8 and references.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Womble, P., Gorelick, S.M., Thompson, B.H. et al. A strategic environmental water rights market for Colorado River reallocation. Nat Sustain 8, 925–935 (2025). https://doi.org/10.1038/s41893-025-01585-x

Received:

Accepted:

Published:

Issue date:

DOI: https://doi.org/10.1038/s41893-025-01585-x