Abstract

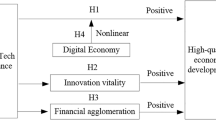

Promoting a virtuous cycle among science, technology, finance, and industry is essential for advancing a modernized industrial system. Using provincial panel data from China spanning 2010–2023, this study applies a Double Machine Learning framework to investigate the causal impact of Sci-Tech finance efficiency (STFE) on the construction of a modernized industrial system(CMIS) and to uncover its internal mechanisms. The empirical results demonstrate that higher STFE significantly promotes industrial modernization by enhancing structural upgrading and innovation capacity. Mechanism analysis further reveals that STFE accelerates the transformation of scientific and technological achievements, strengthens the integration between digital technologies and the real economy, and optimizes the allocation of key production factors—including capital, talent, and technology. These mechanisms collectively foster the coordinated upgrading of industrial systems. Moreover, the heterogeneity analysis shows that the positive impact of STFE is more pronounced in regions with stronger economic foundations, higher degrees of marketization, and lower fiscal constraints, highlighting regional disparities in policy effectiveness. Overall, this study extends the theoretical understanding of the finance–technology–industry nexus under the DML framework and provides actionable insights for promoting regional coordination and differentiated policy design in the process of industrial modernization.

Similar content being viewed by others

Data availability

Data will be made available through the corresponding author.

References

Na, H., Li, D. & Jiang, A. Sci-tech finance empowers high-tech industry quality improvement and efficiency enhancement(In Chinese). Theor. Pract. Fin. Econ., 1–8, https://link.cnki.net/urlid/43.1057.F.20250826.1855.002 (2025).

Chengming, L., Feiyan, L., Yinhe, L. & Zeyu, W. Low-carbon strategy, entrepreneurial activity, and industrial structure change: evidence from a quasi-natural experiment. J. Clean. Prod. 427, 139183. https://doi.org/10.1016/j.jclepro.2023.139183 (2023).

Fischer, B., Meissner, D., Boschma, R. & Vonortas, N. Global value chains and regional systems of innovation: towards a critical juncture? Technol. Forecast. Soc. Change. 201, 123245. https://doi.org/10.1016/j.techfore.2024.123245 (2024).

Han, Q. & Deng, C. Evaluating the development of china’s modern industrial system. Financ Res. Lett. 74, 106676. https://doi.org/10.1016/j.frl.2024.106676 (2025).

R, M. Strategic thinking, target and paths for the construction of the modern industrial system(In Chinese). China Ind. Econ. 09, 24–40. https://doi.org/10.19581/j.cnki.ciejournal.2018.09.012 (2018).

Rina, H. & Kien, S. S. Hummel’s digital transformation toward omnichannel retailing: key lessons learned. MIS Q. Exec 14, https://aisel.aisnet.org/misqe/vol14/iss2/3 (2015).

Zhiqiang, L., Yaping, Z., Caiyun, G. & Ziwei, X. Research on the impact of digital-real integration on logistics industrial transformation and upgrading under green economy. Sustainability 16, 6173. https://doi.org/10.3390/su16146173 (2024).

Mao, Q. & Pang, K. The inherent compatibility and interactive path between new quality productive forces and the modern industrial system(In Chinese). Ref 02, 62–76 (2025).

Zhang, K., Ma, W. & Sun, Q. Financial science and technology expenditure, modernized industrial system construction, and development of new-quality productive forces(In Chinese). Contemp. Fin Econ. 1–15. https://doi.org/10.13676/j.cnki.cn36-1030/f.20250623.002 (2025).

Zachary, W., A, L. S. & E, L. J. & Supply chain security: an overview and research agenda. Int. J. Logist Manag. 19, 254–281. https://doi.org/10.1108/09574090810895988 (2008).

Wu, Q., Wu, Z. & Pang, J. Integration of technology and finance with breakthroughs in enterprise digital technology. Financ Res. Lett. 74, 106712. https://doi.org/10.1016/j.frl.2024.106712 (2025).

Aghion, P. & Howitt, P. A model of growth through creative destruction. NBER https://doi.org/10.2307/2951599 (1990).

Chowdhury, R. H. & Maung, M. Financial market development and the effectiveness of R&D investment: evidence from developed and emerging countries. RIBAF 26, 258–272. https://doi.org/10.1016/j.ribaf.2011.12.003 (2012).

Johan, S. & Rob, K. Value chain innovations for technology transfer in developing and emerging economies: conceptual issues, typology, and policy implications. Food Policy. 83, 298–309. https://doi.org/10.1016/j.foodpol.2017.07.013 (2019).

Yi, S., Zhouyi, Z., Yijun, Z. & Jinhua, C. Technological innovation and supply of critical metals: A perspective of industrial chains. Resour. Policy. 79, 103144. https://doi.org/10.1016/j.resourpol.2022.103144 (2022).

Decai, T., Jiannan, L., Ziqian, Z., Valentina, B. & D, L. D. The influence of industrial structure transformation on urban resilience based on 110 prefecture-level cities in the Yangtze river. Sustain. Cities Soc. 96, 104621. https://doi.org/10.1016/j.scs.2023.104621 (2023).

Valeria, S., Benedetta, F. G. & Vittorio, B. Exploring the lending business crowdfunding to support smes’ financing decisions. JIK 7, 100278. https://doi.org/10.1016/j.jik.2022.100278 (2022).

Luc, L., Ross, L. & Stelios, M. Financial innovation and endogenous growth. J. Financ Intermed.. 24, 1–24. https://doi.org/10.1016/j.jfi.2014.04.001 (2015).

Comin, D. & Nanda, R. Financial development and technology diffusion. IMF Econ. Rev. 67, 395–419. https://doi.org/10.1057/s41308-019-00078-0 (2019).

Hu, M., Zhang, J. & Chao, C. Regional financial efficiency and its non-linear effects on economic growth in China. Int. Rev. Econ. Financ.. 59, 193–206. https://doi.org/10.1016/j.iref.2018.08.019 (2019).

Yuan, S., Wu, Z. & Liu, L. The effects of financial openness and financial efficiency on Chinese macroeconomic volatilities. N Am. J. Econ. Fin. 63, 101819. https://doi.org/10.1016/j.najef.2022.101819 (2022).

Chen, L., Li, W., Yuan, K. & Zhang, X. Can informal environmental regulation promote industrial structure upgrading? Evidence from China. Appl. Econ. 54, 2161–2180. https://doi.org/10.1080/00036846.2021.1985073 (2022).

Sun, Y. & Chen, C. Digital rural construction, financial development and regional economic resilience: mechanism analysis and empirical test. Int. Rev. Econ. Financ. 104146 https://doi.org/10.1016/j.iref.2025.104146 (2025).

Huang, J., Guo, C. & Yan, S. The integration of technology and finance and corporate innovation boundary. Financ Res. Lett. 78, 107135. https://doi.org/10.1016/j.frl.2025.107135 (2025).

Anagnostopoulos, I. & Fintech Impact on regulators and banks. J. Econ. Bus. 100, 7–25. https://doi.org/10.1016/j.jeconbus.2018.07.003 (2018).

Chu, X. & Wang, J. Research on the impact of fintech policies on the rise of digital enterprises in the global value chain(In Chinese). Contemp. Econ. Res (06), 116–128, https://link.cnki.net/doi/CNKI:SUN:DDJJ.0.2024-06-012 (2024).

Li, J., Ye, S. & Zhang, Y. How digital finance promotes technological innovation: evidence from China. Financ Res. Lett. 58, 104298. https://doi.org/10.1016/j.frl.2023.104298 (2023).

Shujuan, L., Min, X. & Dongmei, L. Research on the impact of Sci-Tech finance on industrial TFP. Chin. Econ. 57, 180–192. https://doi.org/10.1080/10971475.2024.2319410 (2024).

Li, L., Tao, D. & Hao, W. Digital economy, technological innovation and green high-quality development of industry: a study case of China. Sustainability 14, 11078. https://doi.org/10.3390/su141711078 (2022).

Baldwin, R. The Globotics Upheaval: Globalization, robotics, and the Future of Work (Oxford University Press, 2019).

Hou, S. & Song, L. FinTech, sci-tech finance, and regional R&D innovation(In Chinese). Fin. Theor. Pract 41(05), 11–19, https://link.cnki.net/doi/10.16339/j.cnki.hdxbcjb (2020).

Luo, J., Wang, Y. & Xiao, F. Effect evaluation of sci–tech finance in driving enterprise digital transformation: empirical evidence from the multi-period difference-in-differences method. Appl. Econ. 1–18. https://doi.org/10.1080/00036846.2025.2536880 (2025).

James, H. & M, P. How the internet of things could transform the value chain. McKinsey & Co. Interview (2014).

Boehm, J., Dhingra, S. & Morrow, J. The comparative advantage of firms. JPE 130, 3025–3100. https://doi.org/10.1086/720630 (2022).

Li, Y., Alex, S., Pingjun, S. & Guanpeng, D. The evolution characteristics and influence mechanism of Chinese venture capital Spatial agglomeration. Int. J. Environ. Res. Public. Health. 18, 2974. https://doi.org/10.3390/ijerph18062974 (2021).

Zhang, M. W., Zhu, X. & S& Science and technology finance: from concept to theoretical system. China Soft Sci. 04, 31–42 (2018).

Yi, R., Wang, H., Lyu, B. & Xia, Q. Does venture capital help to promote open innovation practice? Evidence from China. Eur. J. Innov. Manag. 26, 1–26. https://doi.org/10.1108/EJIM-03-2021-0161 (2023).

Paul, P. K Increasing returns and economic geography. JPE 99, 483–499. https://doi.org/10.1086/261763 (1991).

Goldfarb, A., Tucker, C. & Digital economics JEL 57, 3–43, https://doi.org/10.1257/jel.20171452 (2019).

Ran, Z. & Zheng, J. Innovation and development under technological paradigms: research on the economic growth effects of technological diversity and specialization(In Chinese). J. Manag. World. 40 (09), 1–20. https://doi.org/10.19744/j.cnki.11-1235/f.2024.0103https://link.cnki.net/doi/ (2024).

Chernozhukov, V. et al. Double/debiased machine learning for treatment and structural parameters. Oxford University Press Oxford, UK, https://doi.org/10.1111/ectj.12097 (2018).

Wang, X. The measurement and spatial-temporal evolution characteristics of the level of modern industrial system(In Chinese). Mod. Econ. Res. 10, 1–13. https://doi.org/10.13891/j.cnki.mer.2023.10.001 (2023).

Wang, R. & Li, Z. Structural heterogeneity and Spatial distribution characteristics of china’s technology finance efficiency: based on two-dimensional output perspective(In Chinese). Manag. Rev. 34 (09), 35–46. https://doi.org/10.14120/j.cnki.cn11-5057/f.2022.09.002 (2022).

Feng, S. & Zhou, Y. Will synergy of science-technology policy goals promote the transformation of scientific and technological achievements? Based on the text big data of science-technology policies(In Chinese). J. Finance Econ. 50 (8), 19–33. https://doi.org/10.16538/j.cnki.jfe.20240714.102 (2024). https://link.cnki.net/doi/

Zhou, M., Wang, L. & Guo, J. Measurement and temporal-spatial comparison of integration of the digital economy and the real economy in the context of new quality productivity: based on patent co-classification method(In Chinese). J. Quant. Technol. Econ. 41 (07), 5–27. https://doi.org/10.13653/j.cnki.jqte.20240516.001 (2024). https://link.cnki.net/doi/

Xiong, L., Huang, L. & Yang, L. Construction of a unified national market and urban entrepreneurial vitality—Evidence from the reform of the approval system for engineering construction projects(In Chinese). China.Ind.Econ. (05), 81–99, doi:https://link.cnki.net/doi/https://doi.org/10.19581/j.cnki.ciejournal.2025.05.004 (2025).

Du, Q. & Yu, H. Chinese urban labor skill complementarity, income level, and population urbanization from 2003 to 2015(In Chinese). Geogr. Sci. 39 (04), 525–532. https://doi.org/10.13249/j.cnki.sgs.2019.04.001 (2019).

Bai, J., Zhang, Y. & Bian, Y. Does innovation-driven policy increase entrepreneurial activity in cities—Evidence from the National innovative City pilot policy(In Chinese). China Ind. Econ. 06, 61–78. https://doi.org/10.19581/j.cnki.ciejournal.2022.06.016 (2022).

Kaoru, T. & Miki, T. An epsilon-based measure of efficiency in DEA–a third pole of technical efficiency. Eur. J. Oper. Res. 207, 1554–1563. https://doi.org/10.1016/j.ejor.2010.07.014 (2010).

Xu, J. & Xia, J. Accelerate the construction of a modern industrial system supported by the real economy(In Chinese). Ref (08), 14–25, https://link.cnki.net/urlid/50.1012.F.20230829.1553 (2023).

Zhou, S., Ye, N. & Zhan, W. Research on the impact of pilot policies on combining technology and finance on regional innovation—Based on the perspective of fintech(In Chinese). Econ 08, 95–106. https://doi.org/10.16158/j.cnki.51-1312/f.2023.08.010 (2023).

Han, L. & Ting, L. Financial development and environmental pollution control-an analysis of intermediary effect based on technological innovation. Ecol. Chem. Eng. 30, 251–258. https://doi.org/10.2478/eces-2023-0026 (2023).

Funding

This work was supported by the 2025 Special Project for Research in Philosophy and Social Science in Shaanxi Province (Grant No. 2025YB0295), the Xi’an Social Science Planning Fund Project (Grant No. 25JX147), and the Xi’an International Studies University Research Project (Grant No. 25XWC05).

Author information

Authors and Affiliations

Contributions

Conceptualization, R.H.; writing—original draft preparation and writing—review and editing, R.H., X.L.; writing—review and editing, X.L.; methodology, R.H., J.T.; data curation, S.W., C.L., Q.Z.; All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval and consent to participate

This study uses aggregated, publicly available province-level panel data (2010–2023) compiled from official statistical yearbooks and research databases. It does not involve human participants, human biological materials, or the collection, processing, or analysis of any personally identifiable information. Therefore, ethics approval and informed consent are not required. This determination is consistent with the Measures for the Ethical Review of Life Science and Medical Research Involving Humans (National Health Commission of the People’s Republic of China, 2023), which govern ethical review requirements for research involving human participants. In addition, the academic ethics review body of the School of Economics and Finance, Xi’an International Studies University, has confirmed that this study falls outside the scope of human-subject research and issued a formal waiver of ethics approval.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Huang, R., Liu, X., Tian, J. et al. Sci-Tech finance efficiency promotes the construction of a modernized industrial system evidence from double machine learning. Sci Rep (2026). https://doi.org/10.1038/s41598-026-35019-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-026-35019-1