Abstract

We partnered with a utility in the U.S. state of Illinois to develop and pilot an approach to estimate the economic impacts of widespread, long duration (WLD) power interruptions. We surveyed their customers about hypothetical blackouts, identifying and classifying mitigating/resilience behaviors and quantifying their costs and benefits. Survey results are scaled up to the broader regional economy, and used to drive a computational general equilibrium (CGE) simulation of the effects of power interruptions and attendant customer responses (e.g., relocation, backup generation). Impacts are severe: 1-, 3-, and 14-day interruptions reduce the utility service area’s three-month GDP by $1.8 Bn (1.3%), $3.7 Bn (2.6%) and $15.2 Bn (10.4%), respectively, with losses driven overwhelmingly by disequilibrium responses to shortages as opposed to price signals (71%–88%). Doubling backup power penetration moderates GDP losses by 11%–14%, and is relatively least beneficial during the longest interruption duration. Results highlight previously unquantified economic losses that can potentially be avoided by investments in power system resilience.

Similar content being viewed by others

Introduction

Virtually all economic activities depend on electric power, making individual and collective vulnerability to service disruptions a major concern. Although most interruptions originate at the distribution system-level and cause minimal disturbance to daily life, widespread and long-duration (WLD) interruptions (affecting entire utility service territories or larger regions, and lasting days, weeks, or longer) can have large social and economic impacts1. Estimating the benefits to ratepayers and society of reducing economic losses associated with power interruptions—especially WLDs—is essential to regulatory and utility planning for power system reliability and resilience.

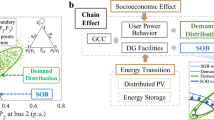

Power interruptions’ economic losses emanate from two sources. The first, market equilibrium impacts, arise from curtailment of electricity supply, and hence consumption, below the level demanded in the economy’s baseline state. Under conditions of normal market functioning, firms and households respond by substituting other inputs for electricity, which in turn stimulates price and quantity adjustments across the economy. Such responses generally increase electricity-using firms’ production costs and the prices of their commodities, reduce factor hiring and remuneration to households, and, as consumers simultaneously face rising prices and declining incomes, reduce households’ real consumption and well-being.

The second, disequilibrium impacts, arise when power disruptions trigger breakdowns in the normal functioning of markets by disrupting utility services, transportation links, and movements of goods and people. The short-run economic equilibrium consequences are that commodity demands exceed supplies (including inventories), and prices neither reflect true scarcity nor incentivize producers to increase supply to alleviate shortages. Firms and households take actions—uncoordinated by price signals—to preserve their profits and well-being, respectively (e.g., the use of backup generators). Such resilience tactics, although privately beneficial (indeed, they may be vital for survival), incur additional costs that fall directly on the customers themselves and affect prices in unanticipated ways. In such settings, the price and quantity adjustments necessary to restore the economy to its baseline state are likely to diverge from those manifesting in market equilibrium.

The present study’s motivation is that traditional survey-based elicitations of utility customer costs tend to reflect the market equilibrium impacts associated with power interruptions that are limited in time and space, and do not generalize well to WLD interruptions, whose disequilibrium consequences can lie far outside the realm of respondents’ experiences2,3. We make two contributions. First, we elaborate and quantify supply-side and demand-side responses in such disequilibrium settings—the importance of which is highlighted by recent surveys of adjustments by firms facing disasters4 and households facing blackouts5. Second, we demonstrate how such adjustments generalize to economy-wide effects that have heretofore gone unmeasured and could potentially incur large losses.

In particular, econometric and input-output analyses lack granular information on resilience actions6,7,8,9. Computational general equilibrium (CGE) simulations of disasters broadly10,11,12 and WLD power interruptions specifically13,14,15,16 have elucidated the broader economic consequences of impact-reduction measures. But these models’ representations of economic behavior reflect market equilibrium responses described above, and ignore WLD interruption-triggered actions such as idling of production, commodity shortages, customer rental of portable electricity generators, or household relocation to areas with power (e.g., the 2021 Texas blackout17,18)—and the attendant economic costs.

Building off of a methodology to integrate customer interruption surveys with CGE modeling5, this approach can be summarized in the following three steps (see Supplementary Fig. 1):

-

(1)

Advanced survey-based techniques specifically tailored to identify actions by residential, commercial, and industrial customers to reduce risk before, respond during, or adjust in the aftermath of a WLD interruption, and elicit the associated private costs and benefits.

-

(2)

Quantification of the broader economic implications of (1), by scaling up survey results and translating them into additional disequilibrium demands for commodity inputs to sectors and households, factors inputs to sectors, and shocks to sectoral productivity and household income.

-

(3)

Construction and simulation of a CGE model (see Supplementary Software 1) incorporating the direct effects of curtailment of electricity inputs to sectors and households on the benchmark equilibrium of the multi-regional economy over a three-month period, used to estimate the indirect effects of disequilibrium shocks caused by residential and non-residential resilience tactics.

Our case study application is WLD interruptions of electricity service experienced by

Commonwealth Edison (ComEd), the largest utility in the U.S. state of Illinois, which serves 3.8 million customers throughout the greater Chicago metro area and beyond (Fig. 1, panel A). We surveyed residential customers in three household income categories; non-residential customers in small and medium businesses (SMB); and large commercial and industrial (LCI) enterprises after receiving approval from the Berkeley Lab Institutional Review Board (Approval #: Pro00023221). Surveys elicited customer responses to hypothetical interruptions (split 50–50 between summer or winter events) described as a sudden and complete loss of power to all homes and businesses within a 20-mile radius followed by utility notification of a 24 h, three day, or two week delay in power restoration. For each interruption duration scenario, customers selected what action they would take from a predefined list and estimated the associated costs and/or savings (Table 1).

A Commonwealth Edison’s northern Illinois service area (shaded) and the city of Chicago (black square) (base map adapted from Illinois Commerce Commission29). B Percent of 3-month baseline residential and nonresidential electricity consumption curtailed in 1-, 3-, and 14-day outage scenarios: base case (bars) and high backup generation (circles). C Distribution of economic activity (household expenditures and sectoral production costs) and electricity intensity (electricity’s share of expenditures and production costs) by micro-region. Sectoral groupings: ACM Agriculture, Construction and Mining, EGW Electricity, Gas and Water, MFG Manufacturing, WTT Wholesale Trade and Transport, RET Retail, TCD Telecommunications, Finance and Data Processing, EDU Education, HOS Hospitals, REO Restaurants, Entertainment and Other Establishments, GOV Government.

Survey responses revealed access to backup generators as a key determinant of resilience. We tested the importance of this tactic via a high-backup generation sensitivity scenario that combined surveyed customer costs with rescaled customer weights to approximate a doubling of observed customer penetration of backup power. (See Methods.) Responses were scaled up geographically to ComEd’s service area by linking customer characteristics with regional economic accounts19, and translated into impacts to broad industry sectors and household income groups. The resulting shocks were then introduced into a CGE model of the encompassing Illinois-Indiana-Wisconsin regional economy. (See Methods and SI.) Following the standard comparative statics approach, interruption scenarios’ impacts were estimated as nominal and percentage deviations of the economy’s counterfactual, with-shock equilibria from its baseline no-shock equilibrium over the three-month period coinciding with the onset of the interruption.

Results

Survey responses

Backup generation is available to 12% of residential, 22% of SMB, and 71% of LCI respondents (Supplementary Fig. 3), with the most common fuel being diesel or gasoline (54–63% of all backup generation). For residential and SMB customers, this was followed by natural gas and propane (no LCI customers reported using propane) (Supplementary Fig. 4).

In a 1 d interruption, 54% of residential respondents would stay home and participate in activities that do not require electricity, while 33% would temporarily move in response to a 1 d interruption. In a 14 d interruption only 8% stay home, versus 83% temporarily moving. Increased evacuation imposes larger daily and total costs on the residential customer base in the form of relocation-related transportation, food, and lodging expenses. The share of respondents using backup generation declines from 13% for a 1 d interruption to 9% for a 14 d interruption, reflecting constraints on onsite fuel for powering generators as well as downsides (e.g., noise, exhaust fumes) of relying on them for long periods (Supplementary Fig. 5). Residential respondents’ resilience tactics vary with income (Supplementary Fig. 6): in a 1 d interruption low-income respondents are comparatively more likely to temporarily move, and less likely to have backup generation. We define low-, medium-, and high-income residential respondents as those that have annual household income of less than $50,000, $50,000 to $100,000, and greater than $100,000, respectively.

For non-residential respondents the most common tactic was to shut down operations, but as the interruption lengthens from 1 d to 14 d, the fraction choosing this option declines from 49% to 39% for SMB, and 54% to 31% for LCI, customers. The fraction of SMB customers using backup generation pre-positioned onsite remained constant, while the percentage of LCI respondents renting backup generation rose from 10% to 26%. The share of respondents transferring operations to a different location falls from 16% for a 3 d interruption to 11% for a 14 d interruption (Supplementary Figs. 7 and 8).

Aggregate implications of survey results

Fig 1, panels B and C, summarize the interruption scenarios’ geographic and macroeconomic characteristics. The scenarios correspond to three-month average electricity consumption being curtailed by approximately 0.1%, 0.3%, and 0.4%–1.5% for 1 d, 3 d and 14 d interruptions, respectively (see Methods). Doubling the amount of backup generation reduces electric power curtailment unevenly. Benefits to residential customers are negligible almost everywhere except for Cook, Grundy and Kankakee counties, where the survey indicated widespread household penetration of generators. Conversely, benefits to non-residential customers are large for the 3 d and 14 d interruptions across most micro-regions (individual counties or county aggregates), except for Cook and Lake counties, and rural ComEd service areas. The region’s economic activity is concentrated in Cook, DuPage and Lake counties, while potential vulnerability to losses from blackouts, indicated by the electricity intensity of activity, is concentrated in low-income households, and in the agriculture, construction and mining, manufacturing, retail, and wholesale trade and transport sectors.

Tables 2 and 3 summarize the net costs (i.e., dollar losses) of residential and non-residential resilience tactics across ComEd’s service area. (See Methods, Eqs. (1) and (2).) Aggregate residential customer costs are driven by net income losses for staying households, meals and lodging for relocating households, and costs of spoiled food, and are partially offset by savings from relocating households’ avoided expenditures on food and commuting. Total dollar losses are largest for middle income households for a 1 d interruption and high-income households for longer disruptions. A 14-fold lengthening of the interruption triples residential losses (from $2.2 Bn to $6.9 Bn), as food and housing costs rise 34-fold due to burgeoning evacuation, partially offset by sharp declines in income losses and spoiled food, and increases in avoided food and commuting costs. High backup power halves the relocation-related costs of a 1 d interruption. But such losses increase faster with lengthening interruptions as even backup generator owners eventually evacuate due to fuel shortages. Consequently, doubling generator penetration moderates household losses by only 6%–8% (Supplementary Table 14).

Aggregate non-residential customer costs are driven by inventory and feedstock damage, safety and security costs, and additional labor costs necessary to recapture production. Backup generator rental and fuel, while accounting for between 4% and 14% of total losses, increase 18-fold. Total losses more than quadruple, from $2 Bn for a 1 d interruption to $9.2 Bn for a 14 d interruption. Across scenarios, losses are largest in the wholesale trade & transportation and telecommunications, finance & data processing sectors. Other major contributors to aggregate costs are the retail & restaurant and entertainment & other services sectors, but their shares of total losses decline as interruptions lengthen. Doubling backup generation reduces costs for telecommunications, finance & data processing (up to 60% for a 1 d interruption), manufacturing (up to 52% in a 14 d interruption), and retail and hospitals (13%–19% and 49%–98%, respectively, across durations). Backup power’s aggregate non-residential savings decline with interruption duration, from 15% for a 1 d interruption to 5% for a 14 d interruption (Supplementary Table 19).

Figure 2 puts these losses in the context of the regional economy, expressing them as fractions of baseline quarterly activity recorded by the economic accounts used to calibrate the CGE model19. Even for a 14 d interruption, most categories of residential losses do not exceed 2% of households’ three-month expenditures or labor income. The key exception is meals and lodging for evacuees, which can reach 10% of low-income households’ total expenditures. Across micro-regions, low-income households incur the heaviest losses, up to 15% of the total value of expenditure—double the fraction for high-income households.

In most instances categories of non-residential losses represent less than 1% of sectors’ three-month total production costs. Exceptions are costs to restore operations in the retail sector, generator rental and operation costs in the 14 d interruption scenario, and, particularly, inventory and feedstock losses in the agriculture, construction & mining and wholesale trade & transport sectors in the 3 d and 14 d scenarios, respectively. Non-residential losses exhibit more geographic heterogeneity, mirroring interregional differences in industrial composition. Notwithstanding, the four major cost-contributing sectors identified above account for the largest fractional losses at every interruption length in all micro-regions. In the 14 d scenario, these losses are dominated by retail (5%–12%) and wholesale trade & transportation (7%–15%).

CGE model simulations

Figures 3 and 4 and Tables 2 and 3; summarize the results of CGE model simulations that incorporate the direct electricity service curtailments in Fig. 1, panel B and the indirect survey-derived losses in Figs. 2 and 3 as shocks to the economy. (See Methods and Supplementary Information)

Macro- and micro-regional of electricity curtailment under normal economic conditions, electricity disruptions with disequilibrium impacts, and disruptions with disequilibrium impacts assuming high penetration of backup generation: percent change in (A) gross domestic product, (B) total real household expenditure (bars), equivalent variation (diamonds) and compensating variation (squares).

Figure 3, panel A elucidates the total (direct and indirect) household impacts. As fractions of baseline expenditure, short-duration interruptions have the largest impact on high-income households, while low-income households are most heavily impacted by a prolonged interruption. For 1 d and 3 d interruptions, low- and medium-income households’ real expenditure falls by <1%, and 2%–4%, respectively, while high-income households’ real expenditure declines by up to twice as much. A 14 d interruption triggers expenditure losses of up to 16% for low-income households—and all households in Cook county—but 8%–14% for low- and particularly middle-income households in half of the micro-regions.

Figure 3, panel B elucidates the total (direct and indirect) sectoral impacts. A 1 d interruption induces real gross output reductions of <2% in most sectors, with the exception of retail and wholesale trade & transport, whose declines are twice as large. In a 3 d interruption scenario output losses follow a similar but accentuated pattern, with additional 7%–10% real gross output reductions in agriculture, construction & mining in multiple regions, and utilities in Cook county. In a 14 d interruption, government, manufacturing, retail and particularly restaurants, entertainment & other services tend to be the most economically-resilient, with the latter increasing output by 2%–3% to satisfy households’ increased demands for food outside the home. Conversely, hospitals, education, and especially utilities and wholesale trade & transport are especially vulnerable, experiencing as much as 11%–17% real output declines.

Economy-wide effects of these changes in activity are summarized using the loss metrics of GDP, households’ aggregate expenditure on consumption, and equivalent and compensating variation—CV and EV, respectively (Fig. 4). Households’ and industries’ resilience tactics overwhelmingly drive aggregate losses. Market equilibrium impacts of electricity curtailment due to 1 d, 3 d, and 14 d interruptions are modest, associated with reductions in GDP of <0.05%, <1%, and 2%–4%, and expenditure of <0.05%, <2%, and 3%–6%, respectively. The additional effects of disequilibrium adjustments captured by the survey responses quadruples aggregate interruption costs to ~1%, ~3%, and 9%–11% of baseline GDP, and ~1%, ~3%, and 10%–14% of baseline consumption, respectively. Losses arise in the largest micro-regions that account for most of study area’s economic activity (Cook and Lake counties, and rural ComEd). These costs decline by one-ninth to one-sixth when backup generation doubles, with savings concentrated in micro-regions with the largest reductions in non-residential electricity curtailment (Kane, Grundy, Kankakee, DeKalb, and Kendall counties). Percentage CV and EV closely track expenditure losses.

In Tables 4, 1d, 3d, and 14d interruptions reduce GDP in ComEd’s service area by $0.3, $0.8, and $4.9 Bn (respectively) due to market equilibrium impacts, $2.2, $4.3, and $17.1 Bn (respectively) due to the combined effects of electricity curtailments and disequilibrium adjustments, and $1.9, $3.7, and $15.2 Bn (respectively) due to electricity curtailments and customer resilience tactics with doubled backup generation. Finally, with market equilibrium shocks, economic activity in unaffected micro-regions expands slightly, increasing GDP up to 0.08%. But disequilibrium adjustments’ additional drag on the economy is large enough to drive spillovers of losses to unaffected micro-regions to the point of shrinking their overall GDP by 0.2%.

Discussion

The present study quantifies the macroeconomic costs of WLD power interruptions, elucidating the impacts of: (i) forgone household income and firm revenue/additional expenditure and production costs due to curtailment of electricity consumption, and (ii) the disequilibrium consequences of costs and savings associated with customers’ resilient/adaptive actions. The latter (backup generation, residential evacuation expenditures and commuting savings, non-residential inventory damage, safety and security expenditures and savings from avoided labor compensation) occur outside the scope of normal economic functioning, and can substantially exacerbate interruptions’ impact on the economy.

Direct comparison with prior results is complicated by differences between our and other studies’ explanatory factors (the scope of resilience tactics and their distribution across customer types), level of analysis (micro versus macro), and context (initiating extreme events and associated power system vulnerabilities). Researchers surveyed Los Angeles County, California residents on their adaptive responses to both past and hypothetical electricity and water supply interruptions, but do not record cost information20. Others surveyed the implementation costs and loss-reduction benefits of firms’ responses to hurricane shocks, without investigating the economy-wide implications4. Research has been conducted to survey the costs of power interruptions to residential, commercial, industrial, and public sector customers in a small Alaskan community, and using multipliers to scale the results to quantify regional impacts and the benefits of specific resilience-enhancing technologies21. Input-output modeling of the impacts of historic interruptions triggered by extreme weather conditions in the U.S. was conducted with estimated nationwide losses of $11.6 Bn22. Closer to the present interruption scenarios’ duration and geographic scope, one macroeconometric analysis found that a terrorist attack on New Jersey’s electricity system would cost 1.6% of the state’s annual gross product7. An earlier CGE analysis of a 14 d interruption affecting California’s five-county Bay Area region, researchers found that the hardest hit areas lose 0.17% of 6-month GDP in, while statewide losses exceed $1 Bn16. The comparatively small magnitude of these impacts reflects the omission of the disequilibrium effects of resilience tactics and the calculation of fractional losses over longer post-interruption re-equilibration periods. A CGE analysis of a Los Angeles 14 d interruption, estimated gross regional product losses over that period of 59.3% without resilience and 12.9% with a broader slate of resilience tactics than considered here15. In contrast to the present study, the effects of resilience tactics were introduced by adjusting CGE model parameters heuristically15, as opposed to using information from actual customers as we do.

We close with a discussion of caveats to our analysis. A fundamental uncertainty is the realism of the tactics captured by the survey instrument, given our scenarios’ hypothetical character. Customers’ inadequate comprehension and/or consideration of consequences to themselves and their surrounding environment could lead to an under- or over-estimate of the costs of WLD interruptions3,5. For example, over 80% of residential customers surveyed indicated that they would temporarily relocate if confronted with a 14 d interruption. However, it may not be possible for millions of customers to simultaneously evacuate from the affected area. Context thus matters, in terms of the severity of the interruption shock, attributes of affected customers and the character and magnitude of their disequilibrium responses, as well as the size of the economy and the capacity of its infrastructure through which the shock and follow-on responses propagate.

One implication is the risk of undercounting or double-counting in the present kind of bottom-up/top-down analysis, due to potential overlap between equilibrium and disequilibrium economic losses. For example, interruption-driven increases in electricity’s implicit cost induce firm and household substitution toward petroleum and natural gas, bidding up these fuels’ prices. For consistency, the associated additional fuel that would be consumed in equilibrium should be subtracted off from the disequilibrium purchases reported in the survey. Simultaneously, respondents’ expenditures should be adjusted upward by the amount of equilibrium fuel price increases, plus additional disequilibrium premia due to, e.g., price gouging. Quantifying the outcome of these opposing forces is analytically challenging, and relies on emerging methods for downscaling simulated price and quantity changes to appropriately adjust survey responses—effectively rendering disequilibrium shocks endogenous to the general equilibrium system they perturb.

A second implication is that the costs of WLD power interruptions will likely vary substantially across regional economies with different mixes of household income groups, industry sectors and intervening supply chains, associated residential and non-residential resilience tactics, and initiating conditions (e.g., disaster-related infrastructure destruction versus interruptions triggered by supply-demand imbalances or pre-emptive policies such as public safety power shutoffs). Generalizing our results to other regions and contexts will therefore require additional research. In this work, we aggregated survey responses across seasons due to limitations in temporal disaggregation of economic activity data, as well as relatively similar strategic response from customers. Further work is needed to produce credible season-specific models.

Additionally, our static analysis overlooks dynamic aspects of supply chain restoration following market disruptions. The trajectory of economic recovery is strongly influenced by infrastructure or capital stock destruction associated with the initiating event or the interruption—e.g., severe storms11, earthquakes10,23,24, or water damage from freezing pipes caused by loss of heat during a winter interruption17. Whether coordination failures or uncertainty in patterns of electricity service restoration could exert similar effects, by influencing resilience tactics, and delaying resumption of business activities or evacuee repatriation, is an important question but beyond the scope of this study. It is a priority for future research.

Note also that the estimates presented above only represent market values, and hence do not include the large amount of benefits to customers from their relocation decisions. These include, but are not limited to, avoiding adverse health and inconvenience impacts and risk to local/state/national security from WLD interruptions. In many cases, it is difficult to assign a defensible monetary number to the value of avoiding morbidity, mortality, and security impacts. Furthermore, our approach did not account for the potential capital and operations and maintenance (O&M) costs to ComEd’s electricity infrastructure from the precipitating event(s) that led to the WLD interruptions.

Notwithstanding these limitations, we offer key principles, an operational roadmap, and basic data to facilitate improved estimates of power interruption-related losses. A fruitful next step is exploring whether our survey results can be combined with different data on population characteristics and economic structure, to extend characterization of the economic consequences of WLD electric power interruptions to a broader range of contexts. Perhaps most importantly, the information generated from these types of studies can be used to help utility planners and policymakers estimate the economic benefits—in the form of avoided losses—of proposed investments in power system resilience.

Methods

Utility customer surveys

Analysis of data collected via surveys is the conventional approach to measuring direct customer costs from short-duration, localized power interruptions. The present study extended survey techniques to analyzing longer-duration interruptions, and broadened the scope of the information gathered from customers. First, instead of being queried on willingness-to-pay to avoid interruptions2,3, residential customers are asked about specific direct costs they would incur (e.g., from food spoilage or income loss). Second, residential and non-residential customers are asked in detail about their potential adaptive, resilience-enhancing actions in the event of an interruption (e.g., the use of backup generation, temporary relocation of place-of-residence or industrial production). Representative samples of customers are asked to estimate the economic losses they would experience given various hypothetical interruption scenarios characterized by duration and time-of-year. We then statistically identify and describe the relationships between interruption attributes and customer economic losses.

Samples of respondents were drawn based on proprietary customer data provided by ComEd. Supplementary Table 1 summarizes the population and sample counts for each customer segment by geographic area. Supplementary Table 2 summarizes the population and sample size for SMB and LCI customers by industry sector. The latter were first classified by two-digit NAICS codes before being further disaggregated based on electricity intensity and importance to the regional economy.

Pre-tests of the surveys were administered to a sub-sample of customers for two weeks in March 2022; and the main surveys were administered to the remaining sample for nine weeks, from mid-April to mid-June, 2022. Further details of the survey administration are provided in the Supplementary Information. The residential customer survey effort collected 829 responses (Supplementary Table 3). The SMB customer survey collected 200 responses for the SMB customers. Supplementary Tables 4 and 5 summarize the number of responses received for the SMB survey by geographic area and industry sector, respectively. The initial LCI completion target was 80, but the response rate was low compared to previous value-of-service studies (Sullivan et al.2), with interviewers able to collect completed responses from only 61 LCI customers. Budget and time constraints prevented us from collecting more LCI responses. Supplementary Tables 6 and 7 summarize the number of responses received for the LCI survey by geographic area and industry sector, respectively.

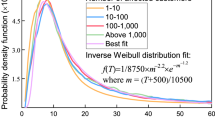

To connect the interruption scenarios to the CGE model (see below), we express blackouts of different durations as a fractional curtailment of different customers’ consumption of electric power over the three-month period of interest. For surveyed residential and non-residential customers, we used billing data for each month of the year to estimate average daily consumption, and in turn their potential unserved electricity (without mitigation actions), based on the duration of each interruption. For customers that reported backup generation, and, based on the reported characteristics of their generator, we estimated the backup electricity served, which ranges from zero to 100% of their unserved energy. Summing curtailed and backup electricity across residential and non-residential customers (firms were weighted by the number of employees), calculating the ratio, and multiplying the result by the original duration yields an interruption duration equivalent that accounts for mitigation (Fig. 1B).

The costs incurred and savings realized due to power interruptions were categorized as direct (incurred by all customers as a consequence of the interruption itself) or additional (specific to certain resilience tactics). Supplementary Table 8 summarizes these components by customer segment. Most of the cost and savings data were obtained using open-ended direct questions. The survey asks each respondent to provide estimates for each cost and saving category (e.g., “How much would you avoid on your electricity bill from this power interruption?”). In instances that a cost or savings estimate could not be directly calculated from a response, additional intermediary calculations were used to arrive at a value. Details about each cost and savings category, and cleaning/post-processing procedures necessary to extract these data from the survey responses, are given in the Supplementary Information. For residential customers, the cost and savings data were calculated at the household-level. This includes costs and savings not only incurred by a survey respondent, but for all members of the household. For each interruption scenario, non-residential respondents were asked to estimate a series of individual costs and savings resulting from the interruption, including avoided labor costs, cost of additional safety and security, damage to inventory and feedstock, lost revenue, savings on the respondent’s electric bill, and the cost of backup generation.

Interregional computable general equilibrium (CGE) model

To assess the economy-wide impacts of the curtailment of electricity as well as the responses recorded in the surveys above, we construct a static CGE simulation model of the Upper Midwest Illinois-Indiana-Wisconsin regional economy (see Supplementary Software 1). The application is over a time horizon of a single three-month period from the onset of a 1 d, 3 d, 14 d power disruption.

The CGE model is a stylized computational representation of the circular flow of the economy. It solves the set of commodity and factor prices and activity levels of firms’ outputs and households’ incomes that equalize supply and demand across all markets in the economy25,26,27. Our model divides the regional economy into 15 micro-regions: nine micro-regions within ComEd’s service area impacted by interruptions—Cook, DuPage, Kane, Lake, McHenry and Will counties, and three county aggregates (DeKalb and Kendall, Grundy and Kankakee, and 15 rural counties in the ComEd service area); three state-specific aggregates of counties abutting ComEd’s service area (10 in Illinois, four in Indiana and one in Wisconsin); and aggregates of the remaining counties in Indiana (88 counties), Illinois (67 counties), and Wisconsin (71 counties); as well as 38 industry sectors (Supplementary Tables 23 and 24), each of which is modeled as a representative firm characterized by a constant elasticity of substitution (CES) technology to produce a single good or service. The model groups households into nine income classes, each of which is modeled by a representative agent with CES preferences and a constant marginal propensity to save and invest out of income. The government is also represented in a simplified fashion. Its role in the circular flow of the economy is passive: collecting taxes from industries and passing some of the resulting revenue to the households as a lump-sum transfer, in addition to purchasing commodities to create a composite government good which is consumed by the households. Two factors of production are represented within the model: labor, and sector-specific capital, both of which are owned by the representative agent and rented out to the firms in exchange for factor income. The region is modeled as an open economy which engages in trade with the rest of the United States and the rest of the world using the Armington specification (imports from other states and the rest of the world are imperfect substitutes for goods produced in each state)28.

The model is specified as a square system of nonlinear equations that are numerically calibrated using social accounting matrices from IMPLAN19. These data record the flows of commodities and factors among households and sectors in all counties in Illinois, Indiana and Wisconsin in the 19 benchmark year. The model computes the prices and quantities of goods and factors that equalize supply and demand in all markets in the economy, subject to constraints on the external balance of payments. Direct impacts of a WLD electricity interruption are modeled as curtailments to the supply of electricity distribution services to industries, households and government entities. This shock increases the marginal cost of the residual electricity distribution demanded over the simulation horizon, inducing households and industry sectors to substitute other inputs for electricity, which in turn triggers a plethora of intersectoral adjustments across the study area’s micro-regions. Indirect impacts captured by the scaled-up survey responses are implemented as secular exogenous demands for commodities by households and industries, as well as secular reductions in households’ labor income and changes in sectors’ productivity. Procedures used to calculate these shocks are described in the next section. A detailed description of the model is given in the SI (§S5).

Translating survey results into shocks to the CGE model

Survey results are translated into ancillary costs or savings driven by power interruptions that are specified as disequilibrium shocks to the CGE simulations. We proceed by identifying relevant survey questions for respondents choosing different strategies, calculating the average costs (or savings) by income group for residential customers and by industry sector for non-residential customers for each interruption duration scenario, and scaling up the estimates from the sample to the population of the micro-regions to estimate aggregate direct costs/savings.

For households, for each cost category corresponding to a specific coping tactic, we use valid survey responses to calculate the average cost or saving for each interruption scenario, aggregating the survey income brackets into the income groups in Supplementary Table 10. The total numbers of households corresponding to these income groups are obtained from IMPLAN19, which allows us to compute the micro-region total cost/saving for a given cost category pertaining to a specific tactic as:

Here, \({rc}\), \(h\), \(d\) and \(r\) index residential cost categories, aggregate household income groups, interruption durations and micro-regions, \({TR}{C}_{{rc},h,r,d}\) is the total cost (saving) of each residential cost category, \({AR}{C}_{{rc},h,d}\) is the average cost (saving) of a given cost category based on survey responses, \(N{H}_{h,r}\) is the total number of households in income group \(h\) and micro-region \(r\), and \({{RF}}_{{rc},h,d}\) is the fraction of residential survey respondents in income group \(h\) that choose resilience tactic \({rc}\) for interruption duration \(d\) (Supplementary Table 11). To construct shocks to the CGE model, we make additional detailed assumptions about the residential sector (Supplementary Table 12).

The resulting costs for households in the ComEd service territory are summarized in Table 2 of the text. Loss categories refer to gross expenditures that in some cases are offset by expenditures that no longer need to be incurred. For example, household expenditures for fuel for ordinary commuting to work, shopping, family visits, etc. are no longer pertinent for those who have evacuated, and therefore must be subtracted from the fuel and transit costs, so that only the net increment is included in the CGE analysis.

For non-residential sectors, the sample level average cost and saving estimates are used to calculate the total costs and savings for the population of firms in each micro-region represented in the model. Since the costs and savings reported by the individual non-residential respondents vary depending on the size of the business/enterprise, we normalized survey responses using an indicator that can serve as a proxy of the size of the entity. For each cost category corresponding to a specific coping tactic, we use valid survey responses to calculate the average cost for each aggregate industry sector and interruption scenario. Data on total employment by industry are obtained from IMPLAN19 (Supplementary Table 16). For a given cost category pertaining to a specific tactic, the total cost for a micro-region is calculated using Eq. (2):

Here, \({nc}\) and \(j\) index non-residential cost categories and industry sectors, \({TN}{C}_{{nc},j,r,d}\) is the total non-residential cost (saving) for a given cost category, \({AN}{C}_{{nc},j,d}\) is the average normalized cost of a given cost category (calculated based on employment normalized cost) based on survey responses, \({EM}{P}_{j,r}\) is the total employment of industry \(j\) in micro-region \(r\), and \({{NF}}_{{nc},j,d}\) is the fraction of non-residential survey respondents in industry \({j}\) that choose tactic \({nc}\) for interruption duration \(d\) (Supplementary Table 17). To construct shocks to the CGE model’s sectors, we make additional detailed assumptions about the non-residential sector (Supplementary Table 18). The resulting costs for industries in the ComEd service territory are summarized in Table 3 in the text.

Details of the data, assumptions, and modeling steps to introduce the shocks into the CGE model are provided in Supplementary Tables 20–22. Within the context of the simulated economy, many categories of residential and non-residential resilience tactics are associated with secular increases in sectors’ and household income groups’ demands for different commodities. We employed a two-step procedure to generate disequilibrium residential shocks to final demands for household consumption of commodities and non-residential shocks to intermediate demands for sectoral commodity inputs. In the first step, the scaled-up results of Eqs. (1) and (2) on induced additional household purchases were matched to overlapping groups of commodities in the IMPLAN social accounting matrix19, and induced purchases were expressed as fractions of benchmark three-month expenditures on those sets of commodities by households in different income classes (Supplementary Table 20) and firms in different sectors. The result is vectors of expenditure coefficients by additional impact category, household income group or industry sector and affected micro-region. In the second step, benchmark three-month household or sectoral expenditure on each individual commodity is multiplied by the expenditure coefficients for impact categories where the commodity belongs to the affected group of goods (Supplementary Table 21). The latter were implemented as secular shift parameters in the model’s market clearance equations, where they reflect necessary amounts of subsistence consumption that are exogenous to the general equilibrium system of market interactions.

Within the simulated economy, additional disequilibrium shocks indicated by the residential survey responses are, net impacts on households’ earnings/labor remuneration, and for non-residential survey responses, net impacts on sectors’ productivity and demands for capital and labor. We matched the results of Eqs. (1) and (2) on reduced household income to benchmark three-month household income, and increased firm factor costs and net recapture of production to sectors’ expenditures on factor hiring and gross output. The matching additional expenditures or induced increases in productivity were implemented within the model’s household income balance conditions and sectoral cost functions, respectively. The various shocks and their impacts on the model’s simulated equilibrium are summarized in Supplementary Table 25.

High-backup generation scenario

We developed an additional scenario to investigate the economic impacts (or avoided losses) of a strategy that entails substantially increasing the amount of backup generation across ComEd’s service territory. This scenario assumes that a large share of customers could rent backup generation. In our modeling approach, the services sector of the economy is the party responsible for providing access to rental backup generation. For these reasons, we did not assume that the utility was responsible for installing the backup generation and diverting labor away from actual power restoration activities. This scenario assumed a doubling of the penetration of backup generation relative to the status quo obtained via the survey responses. Our implementation was deliberately simple: we doubled the fraction of customers who selected backup generator alternatives (RA2 for residential customers; NA2 and NA3 for non-residential customers) and proportionally reduced the shares of residential customers selecting alternatives RA1 and RA3, and industrial customers selecting alternatives RA1 and RA4, before applying Eqs. (1) and (2) to recalculate scaled up ancillary costs. The results are summarized in Supplementary Tables 14 and 19.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

The economic impact model (code) developed for this project runs on third-party, proprietary input-output economic accounts purchased from IMPLAN, and was calibrated based on customer survey responses collected across the Commonwealth Edison service territory. IMPLAN’s end user license prohibits us from sharing the economic data underlying the model. The raw survey data are protected and are not available due to data privacy laws. No software was used to collect the data.

Code availability

The regional economic model was developed in GAMS/MPSGE and a copy of the code was uploaded during the manuscript submission. Please contact the corresponding author to request a copy of the code.

References

Larsen, P., Sanstad, A., LaCommare, K. & Eto, J, (eds.). Frontiers in the Economics of Widespread, Long-Duration Power Interruptions: Proceedings from an Expert Workshop. https://emp.lbl.gov/publications/frontiers-economics-widespread-long (Berkeley, CA. 2019).

Sullivan, M., Schellenberg, J. & Blundell, M. Updated Value of Service Reliability Estimates for Electric Utility Customers in the United States (Lawrence Berkeley National Laboratory Report No. LBNL-6941E, Berkeley CA USA, 2015).

Baik, S., Davis, A., Park, J., Sirinterlikci, S. & Morgan, M. Estimating what US residential customers are willing to pay for resilience to large electricity outages of long duration. Nat. Energy 5, 250–258 (2020).

Dormady, N., Rose, A., Roa-Henriquez, A. & Morin, C. The cost-effectiveness of economic resilience. Int. J. Prod. Econ. 244, 108371 (2022).

Baik, S. A., Sanstad, N., Hanus, J., Eto, P. & Larsen A hybrid approach to estimating the economic value of power system resilience. Electr. J. 34, 107013 (2021).

Rose, A., Benavides, J., Chang, S., Szczesniak, P. & Lim, D. The regional economic impact of an earthquake: direct and indirect effects of electricity lifeline disruptions. J. Reg. Sci. 37, 437–458 (1997).

Greenberg, M., Mantell, N., Lahr, M., Felder, F. & Zimmerman, R. Short and intermediate economic impacts of a terrorist-initiated loss of electric power: Case study of New Jersey. Energy Policy 35, 722–733 (1997).

Anderson, C., Santos, J. & Haimes, Y. A risk-based input–output methodology for measuring the effects of the August 2003 northeast blackout. Econ. Syst. Res. 19, 183–204 (2007).

Thomas, D. & Fung, J. Measuring downstream supply chain losses due to power disturbances. Energy Econ. 114, 106314 (2022).

Rose, A. & Liao, S. Modeling regional economic resilience to disasters: a computable general equilibrium analysis of water service disruptions. J. Reg. Sci. 45, 75–112 (2005).

Sue Wing, I., Rose, A. & Wein, A. Economic impacts of the ARkStorm scenario. Nat. Hazards Rev. 10, 1061 (2015).

Rose, A., Prager, F., Chen, Z. & Chatterjee, S. Economic Consequence Analysis of Disasters: The E-CAT Software Tool (Singapore: Springer, 2017).

Guha, G. Simulation of the economic impact of regionwide electricity outages from a natural hazard using a CGE model. Southeast. Econ. Rev. 32, 101–124 (2005).

Rose, A., Oladosu, G. & Salvino, D. (2005). Economic impacts of electricity outages in los angeles: the importance of resilience and general equilibrium effects. In Obtaining the Best from Regulation and Competition (eds. Crew, M. & Spiegel, M.) 47, 179–210 (Springer, 2005).

Rose, A., Oladosu, G. & Liao, S. Business interruption impacts of a terrorist attack on the electric power system of Los Angeles: customer resilience to a total blackout. Risk Anal. 27, 513–531 (2007).

Sue Wing, I. & Rose, A. Economic consequence analysis of electric power infrastructure disruptions: General equilibrium approaches. Energy Econ. 89, 104756 (2020).

Busby, J. et al. Cascading risks: understanding the 2021 winter blackout in Texas. Energy Res. Soc. Sci. 77, 102106 (2021).

Macmillan, M. et al. Shedding light on the economic costs of long-duration power outages: a review of resilience assessment methods and strategies. Energy Res. Soc. Sci. 99, 103055 (2023).

IMPLAN. Data for Illinois (Indiana and Wisconsin Counties, IMPLAN Group LLC, 2020).

Abbou, A. et al. Household adaptations to infrastructure system service interruptions. J. Infrastruct. Syst. 28, 04022036 (2022).

Baik, S., Carvallo, J. P., Vargas, V., Smith, B. & Larsen, P. Valuation of RDS projects – RADIANCE project. In Valuation Analysis of Resilient Distribution System Projects – Final report. PNNL-28570. (eds. Michael Kintner-Meyer and Bruce Hamilton) 5-28–5-34 (US Department of Energy Grid Modernization Lab Consortium (GMLC), 2023).

Bhattacharyya, A., Yoon, S. & Hastak, M. Economic impact assessment of severe weather-induced power outages in the U.S. J. Infrastruct. Syst. 27, 04021038 (2021).

Casari, M. & Wilkie, S. Sequencing lifeline repairs after an earthquake: an economic approach. J. Regulatory Econ. 27, 47–65 (2005).

Sue Wing, I., Wei, D., Rose, A. & Wein, A. Economic consequences of the haywired scenario—digital and utility network linkages and resilience, In The HayWired Earthquake Scenario—Societal Consequences, (eds. Detweiler, S. and Wein, A.), 381–462 (USGS Scientific Investigations Report No. 2017–5013–R–W, U.S. Dept. of the Interior, 2021).

Dixon, P. & Jorgenson, D. (eds) Handbook of Computable General Equilibrium Modeling (Elsevier, North Holland, 2013).

Sue Wing, I. Computable general equilibrium models for the analysis of economy-environment interactions, In Research Tools in Natural Resource and Environmental Economics, (eds. Batabyal, A. & Nijkamp, P.) 255–305 (World Scientific, Hackensack, 2011).

Sue Wing, I. & Balistreri, E. J. Computable general equilibrium models for economic policy evaluation and economic consequence analysis, In Oxford University Press Handbook on Computational Economics and Finance (eds. Chen, S.-H., Kaboudan, M. & Du, Y. R.) 139–203 (Oxford University Press, 2018).

Armington, P. A theory of demand for products distinguished by place of production. Int. Monetary Fund. Staff Pap. 16, 159–178 (1969).

Illinois Commerce Commission. Map of Commonwealth Edison (ComEd) Service Territory. https://icc.illinois.gov/docket/P2023-0610/documents/341537/files/596634.pdf (2023).

Acknowledgements

This research was supported by the Commonwealth Edison Company under Lawrence Berkeley National Laboratory Contract Award No. AWD00004769 (P.L.). The authors would like to first and foremost thank Susanna Aguilar from Commonwealth Edison. Susanna provided substantial assistance throughout the project including facilitating critical interactions between Berkeley Lab, Resource Innovations, and Commonwealth Edison. We would also like to thank Kristina LaCommare (Berkeley Lab) for her assistance with the ongoing management of this challenging project. Joe Eto, also from Berkeley Lab, provided constructive feedback throughout the project and served as an internal, expert reviewer. Michael Sullivan, from Resource Innovations, provided advice throughout the project. We would also like to thank the staff at MDC Research who conducted in-depth interviews with non-residential customers. The views and opinions expressed herein do not necessarily state or reflect those of the United States Government or any agency thereof, The Regents of the University of California, the Commonwealth Edison Company, or the institutions with which the authors are affiliated.

Author information

Authors and Affiliations

Contributions

P.L. served as principal investigator and developed the overall workflow of the study. I.S.W. designed, developed and assisted with the calibration of the regional economic model. D.W. and A.R. assisted with the calibration of the regional economic model. S.B., J.P.C., A.S. and P.L. reviewed the initial model output and suggested revisions to improve accuracy of the model calculations. P.L., A.R., S.B., D.W., J.S., C.R. and R.P. developed the survey instruments. J.S., C.R. and R.P. assisted with the administration of the surveys and processed the survey results. I.S.W., P.L., J.P.C., A.S., D.W., A.R., S.B., J.S., C.R. and R.P. wrote the manuscript and contributed to the revisions.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Communications thanks the anonymous reviewers for their contribution to the peer review of this work. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wing, I.S., Larsen, P.H., Carvallo, J.P. et al. A Method to estimate the economy-wide consequences of widespread, long duration electric power interruptions. Nat Commun 16, 3335 (2025). https://doi.org/10.1038/s41467-025-58537-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41467-025-58537-4