Abstract

Enterprises in the context of smart manufacturing face great challenges in terms of human capital strategies as well as incentive mechanisms. Employee Stock Ownership Plans (ESOPs) is one of the key incentive mechanisms with long-term oriented function, but due to the lack of relevant explanations in the context of smart manufacturing, the mechanism of the dynamic impact of ESOPs on corporate performance has not yet been elucidated. In this study, with the idea of combining AI and accounting, we constructed a prediction model of the impact of ESOPs on enterprise performance that integrates language modeling and social sentiment mass data analysis, and introduced the prediction model to analyze the long-term, dynamic and nonlinear impact of ESOPs on enterprises; finally, we constructed an explainable AI (XAI) based on the LSTM model, and used the SHAP value method to explain the impact of ESOPs on enterprise performance. Finally, the Explainable AI (XAI) is built based on the LSTM model, and the SHAP value method is used to downsize the performance of the complex black box model LSTM, present the model “black box”, and analyze the common roles played by the elements of ESOPs, the maturity level of smart manufacturing, and the social sentiment on ESOPs in the long term and nonlinear process. Aiming at the above research problems and shortcomings, the main contributions of this paper include: analyzing the dynamic evolution path of ESOP effectiveness from the perspective of intelligent transformation of manufacturing enterprises; predicting the ESOP effectiveness of enterprises through multi-source heterogeneous data (financial data, social sentiment data, operation data) and advanced AI models (LSTM, LLM), and proposing new prediction tools and prediction theories; using XAI technology to realize ESOP effectiveness; and using XAI technology to realize ESOP effectiveness in the long term and non-linear process. Theory; the use of XAI technology to achieve ESOP incentive effect attribution analysis, for management accounting decision support to provide a new dimension of interpretation, which can be used as a research on ESOP dynamic incentive evaluation, integration of non-financial information, predictive analysis of new perspectives for the field of accounting to develop a new research direction, and for the transformation of intelligent manufacturing design and optimization of ESOP to provide empirical data basis and decision support. The study also provides empirical data basis and decision support for the design and optimization of ESOPs during the transformation of smart manufacturing.

Similar content being viewed by others

Introduction

The rapid development of the smart manufacturing industry has put forward higher requirements on the innovation ability, management level and talent quality of enterprises. Employee Stock Ownership Plans (ESOPs) can not only attract and retain key talents, but also stimulate the innovation potential of employees by closely integrating employees’ interests with the company’s goals, thus promoting the creation of corporate value and sustained growth. Therefore, an in-depth study of the impact of ESOPs on corporate performance is of great significance for companies to develop scientific and reasonable incentive strategies.

Developing countries are gradually exploring the application path of Employee Stock Ownership Plan (ESOP) in the transformation of smart manufacturing. Studies have shown that Brazil promotes ESOP practices in small and medium-sized technology enterprises through financial and tax incentives to promote innovation efficiency (Silva et al., 2018); India focuses on the integration of ESOPs and digitalization strategies in large manufacturing enterprises to strengthen the technological talent pool (Singh et al., 2020); South Africa relies on the legal framework to regulate the implementation of ESOPs in state-owned resource-based enterprises and to enhance the organizational commitment of employees ( Ndlovu et al. 2019). Compared with the single policy orientation of the above countries, China has constructed a differentiated ESOP system: state-owned enterprises have realized the linkage between equity incentives and smart manufacturing investment through mixed reform pilots, while private enterprises have formed an agile model of “dynamic equity + technology stake”. Cross-regional comparisons show that the effectiveness of China’s ESOPs stems from the synergistic resonance between the policy toolbox (fiscal and tax support, property rights reform, and digital infrastructure) and the technological endowment of enterprises (industrial Internet penetration rate and patent output density), especially in strategic industries such as high-end equipment and new energy, where ESOPs have become a double lever for leveraging smart manufacturing and green innovation.

Dasilas1 Research shows that there is a non-linear relationship between employee stock ownership plans (ESOPs) and firm performance. When initially implemented, market expectations and learning effects make corporate performance improve, but in the long run, corporate performance may decline if the plan is terminated. This suggests that the effects of ESOPs are not static, but are influenced by a variety of factors. As market competition intensifies, enterprises need to flexibly adjust incentives to ensure long-term stable development. ESOPs, as an effective incentive tool, can help enterprises improve performance in the short term, but must be continuously optimized and adjusted to avoid weakening the long-term effect2. The study points out that the nature of enterprise ownership and IT investment have a significant impact on enterprise performance. Smart manufacturing requires large IT investments, and state-owned enterprises may have more advantages in this regard due to resources and policy support3. The study shows that the government’s focus on environmental protection significantly improves the environmental, social and governance (ESG) performance of enterprises. Smart manufacturing companies need to make more efforts in environmental protection and social responsibility to meet the expectations of the government and the market4. The study found that smart logistics policies have a significant positive impact on corporate performance. Smart manufacturing and smart logistics complement each other, and enterprises should make full use of policy support to accelerate the construction of smart logistics systems. This not only helps to improve enterprise performance, but also enhances customer satisfaction5. The study shows that smart manufacturing helps enterprises realize both green production and profitability. With the enhancement of environmental awareness and the promotion of policies, intelligent manufacturing has become an important way for enterprises to realize green transformation6. The study points out that green innovation significantly improves the carbon emission performance of Chinese manufacturing enterprises, in which the internal governance mechanism plays a moderating role. Intelligent manufacturing enterprises need to make efforts on internal governance and establish a sound green innovation mechanism7. The study shows that there are differences in digital transformation strategies among enterprises with different ownership natures, which have different impacts on productivity. Under the background of smart manufacturing, enterprises should develop suitable digital transformation strategies according to their ownership nature and resource conditions. State-owned enterprises can utilize their resource advantages to make large-scale investments, while non-state-owned enterprises should take advantage of their flexibility and explore innovative paths to enhance productivity and competitiveness.

Based on the findings of the above literature, it can be seen that: Employee Stock Ownership Plans (ESOP) and intelligent manufacturing can effectively improve the operational efficiency of enterprises and promote the sustainable development of enterprises; and through the establishment of ESOPs, the interests of the employees can be closely integrated with the interests of the enterprise, so as to improve the financial performance and innovation capacity of the enterprise; at the same time, intelligent manufacturing can also bring new development opportunities to the enterprise, which can enable the optimal allocation of resources and improve the enterprise risk-resistant ability. and innovation ability, and help enterprises better cope with the external complex and changing market environment to improve the enterprise’s anti-risk ability8; at the same time, intelligent manufacturing can also bring new development opportunities to the enterprise, can make the enterprise’s resources to achieve the optimal allocation, improve the enterprise’s production efficiency and reduce the environmental pollution, so that the enterprise in the use of intelligent manufacturing can fully seize the industrial opportunities and gain a competitive advantage. To a certain extent, the findings of the above literature have good empirical reference significance and theoretical support for this paper. The traditional econometric model, because of its simplicity, is not able to deal with the non-linear effects of ESOPs, such as the long time lag and the lagging effect. Moreover, in the current stage of smart manufacturing, the performance of enterprises is also affected by the speed of technology iteration, market sentiment, human resources structure changes and other factors. After the superimposition of multiple influences, what kind of impact ESOPs will have on enterprise performance becomes more and more ambiguous.

At the same time, in the era of smart manufacturing, the performance of enterprises will be affected by the speed of technological upgrading and changes in market sentiment, in such a context with the long and short-term memory network model can better simulate the dynamic sustained effects of ESOP implementation, while taking into account the important impact of market sentiment and social opinion on enterprise value, through the large language model for the analysis of social sentiment, and quantitatively incorporate into the model, to better show the mechanism of ESOP’s effect on corporate performance. Therefore, the question that this paper wants to answer is: how does ESOP have a dynamic and non-linear lasting effect on enterprise performance by acting on employee innovative behavior, human capital and organizational adaptability in the context of smart manufacturing? What is the role of social sentiment and firm’s smart manufacturing maturity on this relationship?9.

In the process of answering these questions, this paper tries to make innovations in the following aspects: theoretically, it combines the agency theory, the resource-based view, and the human capital theory to explore what prerequisites, boundary conditions, and new contents have been changed by the smart manufacturing environment, so as to establish a more comprehensive overall analytical model to explore the strategic significance of ESOPs for labor-intensive enterprises under the smart manufacturing environment. firms’ strategic significance; methodologically, Long Short-Term Memory (LSTM) network-based intelligences, a technique suitable for capturing the long time-series dependence and nonlinear dynamic characteristics of time-series data, can better model the subsequent impacts of ESOPs and the lagged benefits of investment in smart manufacturing. In addition, since people’s value assessment of a company will be affected by the perception of the external market and public opinion, here LLM is used to do social sentiment analysis to transform the unstructured information into quantitative indicators to be added into the model10. Moreover, in order to increase the transparency of the model and improve the depth of the paper, we adopt the explainable AI (SHAP), which indicates the percentage of contribution of each factor to the model results and the specific mechanism of its action. In conclusion, it is hoped that the efforts of this paper will lead to a deeper understanding of ESOPs, and enable business managers and accounting scholars to have a new understanding of dynamic incentives, integration of non-financial information, and predictive analytics, as well as to promote the emergence of practical application tools.

Constructing the core theoretical framework

As the world moves into a new period of transformation and upgrading based on intelligence, various industries have ushered in new opportunities and challenges. Want to grasp the opportunity brought by this major change, in the new year to achieve transformation and upgrading, in this process the most important work is the various departments and units tightly cohesive, mobilize all employees to participate in the enthusiasm and creativity, in order to promote the intelligent transformation of the whole enterprise is carried out smoothly. In order to better solve this problem, this paper applies the company to adopt ESOP, which can coordinate labor-management relations and enhance the sense of identity of employees as a long-term incentive. This paper focuses on analyzing the role and effectiveness of ESOPs in the emerging industry of intelligent manufacturing, and by reviewing the results of previous research, it summarizes the new requirements of intelligent manufacturing for the production and operation of enterprises as well as human capital, and how to measure the business performance of enterprises, and builds a theoretical framework based on it and does the corresponding empirical test.

Employee stock ownership plans: theoretical origins and practical controversies

Employee stock ownership plans (ESOPs) treat the holder as a member of the enterprise, i.e., in addition to the status of a laborer, the holder has the status of a part of the enterprise’s owner under this system11. This institutional arrangement is fundamentally an understanding of the agency theory of the conflict of interests between owners and operators of enterprises due to the separation of ownership and operation, and the mode of “bundling interests” in the ESOP system may make the objectives of employees converge with those of shareholders and weaken the agency cost, thus improving the organizational efficiency of the enterprise. The resource-based view of ESOP is a unique way to enhance the enterprise’s own human capital, and it is also an effective way to attract and stabilize talents; the social exchange theory holds that ESOP is a kind of feedback system, which is equivalent to a kind of repayment behavior of the enterprise to the employees by contributing to the employees’ equity, which can easily make the employees form a kind of psychological reciprocity and a sense of belonging and commitment to the enterprise. sense of belonging and commitment to the enterprise. Even though the theoretical predictions are positive, the empirical findings of the academic community are not necessarily so as to whether ESOPs can really promote corporate performance - a considerable part of the research shows that corporate ESOPs have positive effects on corporate productivity, profitability, and market capitalization, but a part of the research also suggests that the effects of ESOPs may also have positive effects on corporate performance, but a part of the research also suggests that the effects of ESOPs may also have negative effects on corporate performance. However, some studies suggest that the effects of ESOPs may also depend on context-specific factors, such as the details of ESOPs design, the firm’s own situation, employee engagement, and the organizational culture. In this case, even if ESOPs are adopted, their effect on firm performance will be greatly reduced. This is especially the case when equity is too diluted or when employees are too cautious to limit their risk choices. From the existing literature, there are more places to focus on: First, the dynamic evolution of ESOPs affecting performance is not enough attention, the role of ESOPs incentives is not immediate, but after a period of time to play a role, and it also needs a certain amount of time to form the cumulative impact of the traditional means of analysis of cross-sectional or short-panel data is difficult to achieve such a purpose. Secondly, the role played by ESOPs in the smart manufacturing scenario and the function played by the less explored, in the context of the current smart manufacturing, the skills of the employees of the enterprise to put forward higher requirements at the same time also further increase the innovative capacity of the enterprise, changing the previous workers are more solo work, now are transformed into a collective collaborative way of working, so under this background Therefore, in this context, what kind of role ESOPs play for enterprises is very much to be explored. Thirdly, the research can be further developed under the multi-theoretical perspective. For example, how to integrate different theoretical perspectives, such as agency theory, resource-based view, social exchange theory, etc., to establish a more complete and more persuasive theoretical framework of the impact mechanism of ESOPs is one of the research issues that can be further developed in the future.

Smart manufacturing: a catalyst for corporate transformation and new challenges

As a typical representative of the deep integration of new-generation information technology and advanced manufacturing technology, Intelligent Manufacturing focuses on realizing the digitalization, networking and intelligence of the production process, and on the basis of real-time data perception, intelligent analysis and decision-making, and precise control and execution, aiming at placing the right products at the right time and place, meeting customer needs at the least cost, and forming new industries and new business models. Therefore, intelligent manufacturing reconstructs the new system of enterprise operation: expanding the productivity boundary, using the application of artificial intelligence, Internet of Things, automation and other new technologies to improve production efficiency and product quality stability, and enhance the flexibility of changes in market demand; the organizational model is transformed into a flatter and more reticulated organizational structure, with more emphasis on cross-sectoral synergy and cooperation and the enterprise’s rapid response to changes in the external environment; The upgrading of the content of human capital will change the skill requirements of employees, i.e. from traditional single repetitive work to reading data through systematic learning, optimizing the whole process and learning how to get along with machines, as well as constantly creating innovations; the driving force of value creation will shift to the speed advantage gained through technological innovation, the ability to respond quickly to customer needs, and the collaboration and integration between the various parts of the industry chain to form the enterprise. The drive for value creation moves toward the speed advantage gained through technological innovation, the ability to respond quickly to customer needs, and the ability of each part of the industry chain to collaborate and integrate with each other to form the enterprise’s own unique competitive advantage. Although smart manufacturing can draw a beautiful picture for the development of enterprises, it faces many obstacles in its actual promotion and application: large initial investment costs; complex system integration technology; possible data leakage, privacy leakage and other security issues; and large differences in the ability and knowledge structure between the existing personnel and the future production of smart products. In addition, although some researchers have discussed the technology paths related to smart manufacturing and the economic effects of smart manufacturing, there is still no clear understanding of how smart manufacturing can better realize human resource management at the enterprise level (e.g., better integrating employees into smart manufacturing through incentives, etc.), and in particular, to what extent human resource management can make smart manufacturing better. The question of how much HRM can make smart manufacturing work better is still not clearly understood.

Enterprise performance: multidimensional measurement and contextual adaptation

Corporate performance is a comprehensive concept that is measured in a variety of ways and is often categorized into financial and non-financial dimensions. The financial dimension mainly reflects the profitability, asset utilization efficiency and financial soundness of an enterprise at a specific point in time, and commonly used indicators include return on total assets (ROA), return on net assets (ROE), operating profit margin and Tobin’s Q. These indicators are intuitive, objective and easy to obtain. These indicators have the advantages of being intuitive, objective and easy to obtain, but because they are lagging indicators and are easily affected by the choice of corporate accounting policies, they need to be analyzed in conjunction with the data of other dimensions for a comprehensive assessment. Non-financial dimensions are mainly used to measure the development potential and sustainable competitive advantages of an enterprise, such as market share, customer satisfaction and loyalty, employee dedication and retention, technological innovations (including the number of patents, the sales ratio of new products, etc.), and brand equity. While these indicators provide a holistic view of corporate value, some are difficult to quantify accurately and lack comparability between prior and subsequent periods. In view of this, in the study of ESOPs and corporate performance, most scholars use ROA, ROE, Tobin’s Q and other financial indicators as proxy variables for performance. The author also selects the above indicators in his study and supplements them by adding other indicators to improve the robustness of the findings, but the enterprise performance generation model of smart manufacturing may emphasize more on innovation efficiency, agile response and ecological synergy, which also puts forward higher requirements on the selection of performance measurement indicators based on ESOPs.

Insights from relevant theories

In addition to the Agency Theory, Resource Base View, and Social Exchange Theory described earlier in this paper, the theoretical horizons of this research can also be borrowed: Human Capital Theory, i.e., human beings are the main body, and the knowledge and skills they acquire in the course of their own long-term education, training, and accumulation of experience are human capital, and are the fundamental guarantee for their advancement to a higher and better status, and are the key to increasing productivity of the enterprise; ESOP can be regarded as a reward incentive for employees’ investment in human capital; Stakeholder theory advocates that the production and operation decisions of enterprises should take into account the interests of all stakeholders (including employees, customers, suppliers, and the community), rather than just maximizing the interests of shareholders; ESOP is a major means for enterprises to care for their employees and to build a harmonious relationship between employers and employees. However, there are few explanatory studies that systematically organize and apply the above theories to the “dynamic impact mechanism of ESOPs on enterprise performance in the specific context of smart manufacturing”. In addition, most of the existing literature uses a single-theory explanatory framework or ignores the special contextual factors in the context of the development of such an emerging industry as smart manufacturing, and therefore fails to fully explore the boundaries of the application of specific theories and the role of inter-variable relationships, such as how smart manufacturing affects the boundaries of the role of the resource-based view of the heterogeneity of human capital and its play, and how smart manufacturing utilizes the use of informatization to change the role of information technology, and how the use of information technology in the development of new industries is affected. agency theory on the judgment standard and role of information asymmetry. In addition, traditional econometric models can hardly accurately portray the curvilinear pattern of change in corporate performance over time caused by ESOPs, and cannot well analyze the decision-making information contained in unstructured data such as social sentiment.

To summarize, many related literatures have provided this paper with a more complete content reference and empirical basis, but at the same time, it also clearly exposes more gaps. Therefore, the main innovation of this study is to construct a multi-faceted analytical framework based on previous theories and my own understanding, and use the LSTM model that can satisfy serial complexity and nonlinearity to realize the model prediction work of analyzing the impact of employee stock ownership plan on corporate performance changes in the context of intelligent manufacturing, and in the process, incorporate SHAP and other explanatory artificial intelligence (XAI) technology to analyze the decision logic of the LSTM model12. model’s decision logic. From the process point of view, it is not directly to estimate the parameters of the traditional econometric model, but through the model interpretation to find the links between the most relevant determinants of corporate performance, and how these links occur13. Therefore, enterprises can promote the improvement and upgrading of employee stock ownership plan according to the interaction between the elements in the process of carrying out the practice of employee stock ownership plan.

Theoretical analysis and hypothesis development

This paper focuses on the issue of the mechanism and boundary conditions of ESOP’s role on the final business effect (enterprise performance) of enterprises in the context of smart manufacturing transformation. To this end, based on ABT theory, RBV theory and SET theory, a hybrid model of ABT-RBV-SET is proposed at the theoretical level, which not only explores the direct mechanism of ESOPs, but also investigates the indirect mechanism of ESOPs, i.e., ESOPs promote employees’ innovation and human capital quality, and examines the role of two key situational factors, namely, the level of smart manufacturing maturity of the enterprise and the nature of enterprise ownership, in regulating ESOPs14. We also examine the role of two key contextual factors regulating ESOPs, namely, the level of smart manufacturing maturity of enterprises and the nature of enterprise ownership. Intelligent manufacturing is not only the transformation and upgrading of manufacturing production mode, organizational form and management style, but also the process of posing great challenges to the enterprise’s organizational structure, management mode and human resource strategy, and a new window for ESOPs to play the role of “empowering” and “concentrating” as an incentive mechanism. It is also a process that poses great challenges to the organizational structure, management model and human resource strategy of enterprises, and is a new window for ESOP incentive mechanism to play the role of “empowering” and “gathering hearts.

Integration and application of core theoretical foundations

Interest Synergy and Incentive Reinforcement Based on Agency Theory Perspective. Shareholders (principals) and managers (agents), managers (principals) and ordinary employees (agents) are separated, and their different goals and asymmetric information will lead to agency costs. ESOP makes employees become part owners of the company, which is helpful to circumvent the agency problem: on the one hand, after the employees hold the company’s shares, the company’s overall value creation and long-term development goals are more closely integrated with the employees’ own interests; on the other hand, it can promote the formation of benefit-sharing mechanism to stimulate employees to act beyond their own interests and reduce the tendency of opportunistic behavior, and make them contribute to the development of the enterprise more actively. At the same time to strengthen the mutual supervision mechanism, “quasi-owners” are more willing to “quasi-owner” attention to the behavior of the management, workers, to strengthen the supervision and management of their work, to a certain extent, to make up for the defects of the enterprise’s formal supervision system, reducing the total cost of supervision. Intelligent manufacturing era of higher requirements for workers, not only require employees to have a sense of independence to complete the work, but also have the enthusiasm for independent innovation, and most importantly, require the ability to quickly learn and adapt to new technologies, new technologies, new processes. Compared with the previous simple command mode, ESOP’s logic of “benefit sharing and risk sharing” can better mobilize the potential of employees, so that employees can be fully engaged in intelligent manufacturing, and when encountered with uncertainty and resistance to save the day and forge ahead, so as to better play the function of incentives.

According to the Resource-Based Theory (RBV), in order to gain and maintain an enterprise’s competitive advantage in the long run, it must first possess certain valuable, scarce, inimitable, and irreplaceable core resources and competencies, and at the same time have the ability to continually create new competencies related to these resources in future market competition. As an intelligent manufacturing enterprise with technology as its core driver and involving a large amount of knowledge, it not only requires workers to be of a high level, but also must itself be a multi-knowledge structure and a rich aggregation of intellectual labor. ESOP, as a strategic human resource management tool, is of strategic significance in a technology-intensive enterprise with a rapid rate of knowledge updating. This model of realizing TT&RT (Talent Tracking & Return Technology) through option incentives has successfully attracted a large number of elite talents. This mechanism significantly increases the return rate of technicians in the field of intelligent manufacturing, effectively expands the strategic talent pool, and at the same time significantly reduces the risk of core talent loss. Shareholders will feel that they are the “masters” of the enterprise, and are more likely to bring their hidden knowledge and experience to work, and participate more actively in cross-departmental cooperation as well as organizational innovation activities, thus promoting the continuous consolidation of the important conditions of smart manufacturing: continuous improvement, rapid iteration, and solving complex problems.

Reciprocal behavior and organizational commitment driven by social exchange theory. Social exchange theory suggests that human interaction, and the connection between people’s behavior and organizations, is an exchange behavior based on the principle of reciprocity. The provision of ESOPs to employees will make employees feel that their historical efforts have been highly recognized; this is a kind of belief in the enterprise’s commitment to their own development potential; it is also the enterprise’s commitment to the long-term employment relationship with a certain time span between the two; it generates a certain degree of organizational concern and organizational care, stimulating an unconditional obligation and sense of belonging to the organization and the organizational group to which the employees should give back to the organization. A sense of belonging. Because of the importance of self-worth, feel respected and trusted, so employees produce a stronger than the organization of the psychological viscosity and emotional connection, so that the degree of work commitment and satisfaction increased, willing to serve the organization more after work, such as taking the initiative to take on more duties, enthusiastic to help others, for the benefit of the organization in the active advice, take the initiative to promote the transformation process of intelligent manufacturing enterprises to use new technologies, when encountering problems with colleagues, and to help the organization in the process of the transformation of intelligent manufacturing. Technology, when encountering the problems of colleagues are also willing to do a good job in assisting the work of intelligent manufacturing in the new era of transformation and development is more so, only employees have a positive mindset, willing to take the initiative to participate in the feelings of staying in the organization to be able to resist the internal and external forces of the pressure of change under the impact of the internal and external forces, so that the organization’s internal technological innovation and organizational culture of the synergies of the forward to reach consistency, and promote the realization of a smooth transition.

Ormulation of the research hypothesis

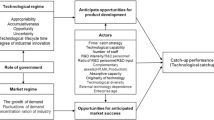

Based on the above integrated theoretical framework and the specific context of smart manufacturing, we propose the following research hypotheses, as shown in Fig. 1:

Main effects of ESOPs and firm performance

Combining the synergistic effect of agency theory, the value-added effect of human capital from the resource-based viewpoint and the reciprocal behavior-driven effect from the social exchange theory, ESOPs can realize the improvement of enterprise operational efficiency and value increase through various ways, especially in the intelligent manufacturing field, which is highly dependent on high-quality human capital, and needs to fully mobilize employees’ enthusiasm, initiative and innovation, ESOPs have a strong incentive and empowerment ability. In particular, in the field of smart manufacturing, which is highly dependent on high-quality human capital and needs to fully mobilize employees’ initiative and innovation spirit, ESOP has strong motivation and empowerment ability, and its effectiveness will be more significant. In summary:

H1

Employee shareholding system has positive effects for companies

Mediating mechanisms of ESOPs affecting firm performance

In the high-level business operation of smart manufacturing, the quality of human capital is the core driving force. This driving force essentially comes from the intelligence, skills and hard work of every employee in the organization. It is worth noting that the incentive effect of ESOP (Employee Stock Ownership Plan) is not direct, but rather promotes the growth of corporate performance through a dual transmission mechanism: on the one hand, it activates the intellectual capital of employees, on the other hand, it mobilizes the labor input of employees. It is through the positive impact on these two key dimensions that ESOPs indirectly improve overall corporate performance. Employee Incentive Capital (EIC) is an opportunity to add value to the Employee Incentive Program (EIP), which enables employees to value the EIP, in which they are willing to both put in effort and improve it. EIC helps employees to generate innovative ideas for technological innovation, process improvement, product iteration, etc., and apply them to actual work, which in turn increases the total innovation output of the enterprise. Resource-Based Theory (RBV) recognizes innovation capability as the most important source of competitive advantage for firms that is difficult to imitate. From the Social Exchange Theory (SET), it is known that the more employees perceive the recognition and support of their innovation potential through equity sharing, the higher the likelihood that they will put in more innovation efforts. ESOPs are an attractive long-term incentive tool for firms that use ESOPs to recruit and retain employees with the appropriate smart manufacturing Companies using ESOPs can recruit and retain high-caliber talent with appropriate smart manufacturing knowledge structures and smart manufacturing core competencies in a competitive environment.

ESOP will also enable existing personnel to continuously recharge and remodel themselves to meet the changing needs of the competency spectrum of smart manufacturing talent. At the same time, it can make the overall human capital stock and quality of the enterprise rise. RBV points out that enterprises can only create more value if they have high-quality human capital. Therefore, combining the above description of the human resource status of ESOP proponents and the implementation mechanism, we make the following hypothesis of mediating effect:

H2a

ESOP implementation significantly improves employee innovation.

H2b

ESOPs play an important role in firm performance, and employee innovativeness plays an intermediate role.

H3a

ESOPs will improve the quality of human capital of the firm’s managers and employees.

H3b

Human capital quality plays an important mediating role in the process of ESOP’s impact on firm performance.

Contextual moderation effect

Intelligent manufacturing maturity and the nature of enterprise ownership in different contexts ESOP effectiveness there is heterogeneity, that is, ESOP promotion of enterprise performance by the enterprise where the internal and external context of the impact of this paper focuses on the enterprise’s intelligent manufacturing maturity, the nature of the ownership of the two context variables to carry out the relevant research work, the intelligent manufacturing maturity refers to the enterprise application of intelligent technology situation, the use of data for intelligent decision-making situation, The degree of automation integration; when the smart manufacturing maturity level is high, the production and operation of the enterprise is more complex, and the enterprise has higher requirements for the professional skills of employees, cross-departmental cooperation, and emergency handling of problems; at this time, the ESOP can stimulate more sense of ownership, innovation and learning motivation among employees, which can better stimulate them to turn into productivity and improve the operation mode of the enterprise in order to improve the efficiency; on the contrary, the level of intelligentization is not as high as the level of ownership, which is the same as the level of ownership. On the contrary, the lower the intelligence level of the enterprise, ESOP may play a smaller role, may be due to the lack of effective technology platform, organizational mechanisms and other support and can not give full play to the advantages of ESOP.

H4

As the level of firms’ smart manufacturing maturity increases, the positive impact of ESOPs on firm performance is also amplified, and the role played by ESOPs on firm performance becomes stronger when the firm’s smart manufacturing maturity is higher.

Under China’s specific institutional environment, there are some differences between SOEs and private firms in terms of the dimensions of corporate governance structure (OS), business objectives, flexibility of incentive constraints, and sensitivity to market-based incentives; private firms face more intense competition, and their management and employees are more likely to show higher preference and sensitivity to incentives that are highly correlated with market performance (e.g., ESOPs) Private firms are more competitive, and their management and employees are more likely to show higher preference and sensitivity to incentives that are highly related to market performance (e.g., ESOPs), and ESOPs are more likely to be implemented in a market-oriented manner, thus making their incentive effects more direct.

Data collection and processing

Data collection

Collecting and organizing information must first figure out the source of information, so as to search for relevant information in a targeted manner, therefore, the data sources of this study are mainly the above mentioned professional databases: financial data and corporate governance data are all from Cathay Pacific database and Vantage database; Employee Stock Ownership Plan (ESOP) related data are cross-checked and collated from the data of ESOP topics in the Wind database based on the reading of listed companies’ annual reports and temporary announcements; Intelligent manufacturing related indicators (specifically, the scale of enterprises’ purchase and use of industrial robots) are collated from industry reports such as China Robotics Industry Report and the data of listed companies’ annual reports in the ESOP topics. The data related to ESOP are cross-checked against the data in the Wind database; the indicators related to intelligent manufacturing (specifically, the scale of purchase and use of industrial robots by enterprises) are compiled from industry reports such as China Robotics Industry Development Report and the annual reports of listed companies in the notes of the accounts such as “Construction in Progress” and “Fixed Assets”. Using text mining technology, the content related to “intelligent transformation”, “automated production line” and “robot procurement” in the notes of “construction in progress”, “fixed assets” and other subjects in the annual reports of listed companies. We use text mining technology to measure the degree of investment in intelligent manufacturing in chemical plants; or we directly adopt CSMAR and Wind database to provide the corresponding fields as the relevant measure of intelligent manufacturing.

Systematic acquisition and processing of social emotional data

In order for our study to capture the changing perceptions of the sample companies and ESOP plans in the market and among the public, we have established a data acquisition and analysis methodology for social sentiment.

Data source selection and strategy: financial news portals will select some mainstream financial media as the main news text data source, the articles in the media will be reviewed twice before they are published online, so there exists a considerable degree of information density and authority. As for the data source of professional investment communities, it is inclined to extract some stock investment communities with greater influence in mainland China, such as Snowball and Oriental Wealth Bar, and the voices of the large number of individual investors or some groups of professional investors here to reflect the real attitude of market participants. Based on the strong influence of microblogging, in the middle of all the 50 + industry browsing index monitoring, microblogging also from the perspective of the industry to start with the collection and summary. As for comments, anonymous professional review sites in China were used as the basis to collect staff’s attitudes and feelings towards their own company’s governance, company welfare, etc. However, due to the high sensitivity and difficulty in structuring this kind of data, it can only be used as an auxiliary validation and qualitative reference basis in general15.

Data capture and preprocessing: Each sample company can be searched by its stock code, company abbreviation, and keywords containing employee stock ownership (e.g., “employee stock ownership”, “equity incentive”, “incentive plan”), and smart manufacturing (e.g., “smart manufacturing”, “industry 4.0”, “digital transformation”), and smart manufacturing keywords (e.g. “smart manufacturing”, “industry 4.0”, “digital transformation”). The customized web crawler technology written in Python Scrapy framework and Requests library is used to crawl the relevant content, and the crawling duration is set according to the required reasonable crawling frequency and the number of times of crawling, and the crawling duration should also be set. And according to the crawling technology requirements, for the crawled website for certain protection, for crawling frequency and user agent rotation settings, to a certain extent, to reduce the pressure on the target server. Only the content that can be crawled online will be crawled, without any personal information of the user, and without logging in or going over the wall16.

Do the following steps of data cleaning for text content:

Step 1: Initial de-duplication, determine whether there are duplicates or postings of the same content based on timestamps and text content.

Step 2: Remove advertising information and other irrelevant content, using keyword matching/regular expression matching and other ways to remove all other content in the forum except those with comments;

Step 3: Regularize text, convert all text from simplified to traditional, and remove all special symbols, HTML tags, spaces, and emoticons;

Step 4: Ensure that all personally identifiable information is deleted or generalized before analyzing the data obtained from the employee evaluation platform.

Sentiment analysis model selection and process

Due to the complexity of Chinese social media texts, such as colloquialisms, Internet terms, irony, metaphors, and other lexically volatile situations, this paper compares several sentiment analysis tools and models, and finally chooses a large-scale pre-trained language model as the sentiment analysis scheme for this analysis.

Model Comparison and Selection Basis: In order to ensure the accuracy and reliability of the sentiment analysis, a dataset of 5,000 Chinese comments in the financial field (which contains three labels: positive, negative, and neutral) from Snowball and Weibo is used, which consists of 4000 items in the training set and 1000 items in the validation set, and the data are manually labeled by three postgraduate students with a background in finance and the Kappa coefficients are used to The consistency is tested and it is considered ready for model performance evaluation when Kappa> 0.75. Comparison models are based on dictionary methods, such as HowNet, Chinese sentiment vocabulary ontology library, etc.; VADER is designed for English, so it can be translated into Chinese and then tested by VADER for sentiment analysis; TextBlob is mainly used in English scenarios, and the method is similar to that of VADER, which is to call the OpenAI API to call GPT-4, and then use its powerful contextual understanding and zero sample to evaluate the performance of the model. powerful contextual understanding and zero-sample/few-sample learning ability to perform sentiment classification, and mainly take the zero-sample cue to test. From the above, it can be seen that VADER and TextBlob are more effective for English, but can not be directly used for Chinese, VADER and TextBlob have better results for processing both English and Chinese, but not as good as models optimized for Chinese or with good cross-linguistic ability in Chinese, the highest F1 value of the validation set of GPT-4 is 0.88, which is better than the other methods, and is more good at dealing with implied emotions and network phrases, GPT-4 performs emotion polarity judgment.

Sentiment score and index construction: for text segmentation and categorization: long news reports or analytical articles are segmented at the sentence level, and sentiment labels are obtained at the single-sentence or phrase level using the GPT-4 API. After obtaining the sentiment labels through the model, sentiment scores are assigned: Positive: +1, Neutral: 0, Negative: −1; the daily NSI (News Sentiment Index) is the result of aggregating the sentiment scores of all the texts about each company every day. The result is obtained by aggregating on the basis of The Social Sentiment NSI is mainly a monthly aggregation based on the daily results of the Social Sentiment NSI. The daily NSI is aggregated by monthly time frequency to obtain statistics such as the monthly mean.

Data quality control and validation: For some important time points or samples with big changes in emotions, some of them (e.g., 5%) should be extracted for manual review to check whether the emotion classification is correct (human-computer consistency evaluation), and the accuracy rate is required to reach 85% or more; try to change some cues, adjust the threshold of emotion classification, etc., to see which one does better. In addition, we can also combine the actual survey with a comprehensive consideration of aggregating the data with media attitudes and using data from microblogs and communities for cross-validation, in order to minimize the bias of a single source.

Handling potential bias in data

In order to ensure the quality of the data and the reliability of the model, this paper takes the following measures in the data processing stage:

Bias treatment of social sentiment data: The daily index calculated based on the NSI formula removes some data from trading days with low total number of comment entries. The reason is that these data do not meet the requirements of statistics, easy to cause emotional fluctuations of the index on the day, and not typical enough, so we need to remove some of the data with very low frequency points. Sentiment scores cannot be removed because they have been normalized and there is no such thing as a “score”. When a company’s monthly sentiment is completely missing, it is not interpolated, but directly marked as missing in the model; when the missing rate is \(\le\) 30%, the variable is filled with multiple interpolation based on the company and yearly averages. The Kolmogorov-Smirnov test of the data before and after interpolation is then used to test whether the interpolation is successful after the interpolation is completed. Considering the non-random nature of social media users, their views may not represent everyone’s opinion.

Ethical Considerations and Data Compliance: Maintaining a kind crawling strategy will not unduly burden the web servers; as all collected text data is stripped of content that can be directly used to identify personal information (usernames/IDs, etc.) before being sent to the sentiment analysis session (all replaced by a uniform code), and all references to the Employee Appraisal Platform are highly profiled and anonymized, there is no risk of compromising anyone’s privacy during the entire process. and anonymized, so there is no risk of compromising anyone’s privacy during the entire process. Finally, the results of this study are for statistical summarization only, and do not involve any specific person.

Validity and reliability of data sources: news data should be selected from official media or official financial media to ensure the basic accuracy of the information; while social media data is subjective and has a small amount of “noise”, but it is still possible to utilize large-scale data aggregation to obtain large-scale time-series samples in order to reflect a certain trend sentiment on the macro level. However, it is still possible to utilize large-scale data aggregation to obtain large-scale time-series samples to reflect macro-level sentiment, and to indirectly verify the accuracy of social data in reflecting market sentiment by determining the relevance of social data sentiment to short-term fluctuations in stock prices and announcements of major events. Filtering false information and bot accounts. Although it is not possible to completely remove the fake, but we can judge whether it is a fake or robot account through some characteristics of its posting behavior, such as: unusually high posting frequency, unusually similar degree of content, too short account registration time, etc. Finally, we identify and filter out the text information sent by suspicious accounts by means of some open source toolkits, in which the Chinese language adopts the thesaurus segmentation, removes deactivated words, irrelevant symbols, and retains the business-related keywords (“equity incentive”, “intelligent manufacturing”, “artificial intelligence”, “supply chain “). Sentiment scoring rules are used to score the GPT-4 classification and construct the NSI index, and the threshold is defined within the GPT-4 classification logic.

Data Cleaning and Preprocessing: Outliers were detected and processed using box-and-line plots and Z-score methods to ensure that the data were reasonable. Data points that clearly deviated from the normal range were carefully verified and corrected. Outliers were detected using Tukey’s fences method (IQR=1.5), and data with ESOP_RATIO\(>99\%\) quantile were shrink-tailed and processed. The maximum ESOP_RATIO = 0.85 in the original data was adjusted to 0.42 (99% quantile value) after tailoring.

Table 1 shows the results of statistics comparison before and after data cleaning. Sensitivity analysis was also done: regression by enterprise ownership, state-owned/private grouping, ESOP_STATUS coefficients were in the same direction, state-owned: 0.014, p\(<0.05\); private: 0.018, p\(<0.01\). Replacing ROA with ROE as the dependent variable, the conclusion was unchanged, Adjusted R2=0.043.

Variable selection

In order to better explain the rationality of variable selection, this paper selects variables that are closely related to corporate performance based on economics and management theories. For example, financial indicators reflect the financial health of the firm, while social sentiment data (e.g., social media sentiment, news report sentiment, etc.) reflect the impact of the external environment on the firm. This paper draws on a large body of relevant literature to ensure that the selected variables are well supported in existing research. For example, Employee Stock Ownership Percentage (ESOP_RATIO) has been shown to be positively correlated with firm performance, while social sentiment data has been shown to influence market reaction and firm performance. Several derived variables, such as lagged features and interaction features, have been extracted through feature engineering to capture the complex relationships between variables. For example, lagged variables in time series features can help the model better understand the impact of historical data on firm performance.

Using LASSO regression for variable screening, first, all variables were standardized to eliminate the effect of differences in magnitude. Second, the standardized data were trained using the LASSO regression model, and the coefficients of unimportant variables were gradually compressed by adjusting the regularization parameter \(\lambda\). Finally, by analyzing the coefficients of each variable, the key variables that have a significant impact on the model prediction are identified. The final selection of variables is not only statistically significant, but also reasonable in terms of economic significance.

Feature fusion

Formulating an effective LSTM model requires a combination of financial data features such as revenue, expenses, gearing ratio, current ratio, etc., such as the following three features: social sentiment features: sentiment scores (e.g., positive and negative sentiment indices) are extracted through social media or news comments; temporal features: time stamps, seasonal features are included (e.g., 1 quarter, January); and financial features. Integrate these features into an input tensor X = [F, S, T]. Where: T is the time feature, S is the socio-emotional feature, and F is the financial feature.

Feature set construction

Financial characteristics (F) First of all, to reflect the financial health of a firm, a key financial indicator needs to be selected and extracted. Typical financial indicators include: revenue, net profit, gearing ratio, earnings per share, current ratio, return on investment, etc., and these financial indicators are put into time-series information to represent the values at each point in time, respectively.

Social emotional characterization (S)

Social sentiment data needs to be acquired through text analytics in order to extract sentiment scores from social media, news reports and user comments. Social Sentiment Feature(S) quantification process: the collected text data is normalized by segmentation, removal of stop words, punctuation and special characters. Then, the pre-processed text is judged for its emotional tendency using a pre-trained large language model to classify it as positive, negative or neutral. Sentiment scores and indices are constructed, and the number of positive, negative, and neutral comments are counted for all relevant texts of each company in each monthly period. Based on this, we constructed the social sentiment index, calculated as:

The index ranges between [−1, 1], with higher values indicating a more positive social mood. We also retained the Positive Sentiment Percentage Positive Ratio = Num_Positive / Total_Num and the Negative Sentiment Percentage Negative Ratio = Num_Negative / Total_Num as alternative or auxiliary characteristics. These sentiment metrics are organized in time series and aligned with the financial data.

Time series characteristics (T)

Characterize the time series so that the model understands what the role of time is. Consider the following: timestamps: organize the raw data by date and make sure each piece of data is associated with a specific timestamp. Time features: quarter, month, week. Lagged features, to capture time-series correlation, lagged features can be created for financial metrics and sentiment scores. For example, revenue for the previous quarter, net profit for the previous year, etc17.

Feature selection

After constructing the exclusive set, the financial indicators can be standardized or normalized to eliminate the influence of the magnitude between the features. Lasso regression feature selection method is used to identify the most important features, eliminate redundant features, and identify key financial indicators, time characteristics, and social sentiment data related to business performance.The loss function of Lasso regression is:

Where \(y_i\) is the target variable (firm performance), \(X_i\) is the feature matrix, \(\beta\) is the feature weights, and \(\lambda\) is the regularization parameter. By adjusting the value of \(\phi\), the features that have a significant impact on firm performance are selected.

LSTM model construction

The reason for choosing the LSTM architecture is mainly because of the gating mechanism, which can learn the temporal correlation of information, avoiding the problem of gradient disappearance or gradient explosion encountered by RNN networks to a large extent, and applying to the characteristics of the ESOP influence with the potential influence across time steps, which can be used to decide what kind of historical information needs to be retained at different time steps, and to forget the unneeded memories or the past information into oblivion, and constantly updating itself in the present. This facilitates the identification of more complex sequential patterns.

Data preparation

Convert the feature matrix X into a time series format adapted to the LSTM input requirements. Assume that data from the past T time steps are used to predict performance at the next time step. Construct the input sequence \((X_t, X_{t-1}, \dots , X_{t-T})\) and the output sequence \(y_t\), where \(y_t\) is the firm’s performance metric corresponding to time t. The output sequence \(y_t\) is the firm’s performance metric corresponding to time t. The output sequence \(y_t\) is the firm’s performance metric corresponding to time t.

Mediating variables: mainly include employees’ innovation ability, which will be measured by a combination of indicators in this study. The main indicators include the intensity of annual R&D investment, the number of new patent applications in the same year. In addition, text analysis can be considered in the robustness test to extract the frequency or semantic intensity of words used by enterprises in “innovation”, “R&D”, “new product”, “new technology”, etc. from the MD&A section of the annual report of the enterprises to measure the innovation capability of the employees. The quality of human capital can be measured by the following indicators related to per capita compensation, i.e. (total cash paid to and for employees) / (total executive compensation) / (total cash paid to and for employees) / (total executive compensation) / (total executive compensation). -total executive compensation)/(total number of employees - number of executives), which more directly reflects the degree of compensation incentives for employees in general. The ratio of the company’s personnel with master’s degree or above or personnel with bachelor’s degree or above to all personnel, data from annual reports of listed companies and databases such as CSMAR and Wind.

Moderating variable: it involves the maturity of enterprise intelligent manufacturing. Due to the lack of a unified and recognized enterprise smart manufacturing direct evaluation index system, this paper uses comprehensive proxy indicators as a reference. According to the annual reports of enterprises on “intelligent manufacturing”, “industrial internet”, “digital transformation”, “artificial intelligence application”, “robot automation”, “big data analysis”, “intelligent manufacturing”, “industrial internet”, “digital transformation”, “artificial intelligence application”, “robot automation”, “big data analysis”, and so on. ”, “robot automation”, “big data analysis” and other related terms in the annual report of the fixed asset investment ratio as a proxy variable for the maturity of the enterprise’s intelligent manufacturing, the future can be combined with specific industry characteristics and enterprise research data to establish a more accurate maturity index. In the future, a more accurate maturity index can be established by combining specific industry characteristics and enterprise research data. Nature of enterprise ownership: the type of enterprise ultimate controller to distinguish between state-owned enterprises and non-state-owned enterprises is mainly represented by a dummy variable.

Modeling and testing strategies

The process of updating the cell state and hidden state can be broken down into the following steps in the LSTM model:

Forget Gate, which determines which information will be discarded under the cell state.

Input gate, which determines what new information will be stored in the cell state.

Candidate Cell state (Candidate Cell state), generates new candidate values that will be added to the cell state.

Update cell state (cell state update), which updates the cell state by combining forgotten gates and input gates.

The Output Gate (OG), determines the output of the next hidden state.

Hidden State Update (HSU), the final hidden state will be used for the next time step calculation and prediction of the output layer.

The LSTM model used in this paper exploits the complex temporal relationships in the time-series data rather than simply inferring certain predetermined parameterized models. The theoretical hypotheses (H1 to H5) proposed in this paper are based on the analytical perspective of SHAP interpretability and are explored analytically in terms of the direct, mediating, and moderating effects of ESOPs in the predictive framework of the LSTM model.The LSTM model is used as a predictive engine to build a behavioral process model based on the predictive performance of the LSTM model, with inputs of ESOP-related variables ( ESOPS_TATUS, ESOPS_RATIO), mediating variables (employee innovation ability index, human capital quality index), moderating variables (smart manufacturing maturity SMM_it, enterprise ownership OS_it) and other control variables, and the output is the predicted value of enterprise performance Performance_it. To minimize the predicted performance value and calculate the difference with the actual performance, the difference is used to evaluate the performance of the LSTM model.

Next, the theoretical hypotheses are explored: in this study, H1 describes the total effect of ESOP variables (ESOP_STATUS_it, ESOP_RATIO_it) on the predicted value of Performance_it; H2 and H3 describe the indirect effect of ESOP on the predicted value of Performance_it through the mediating variables (employees’ innovation ability and human capital quality). Part of the mediating effect of the predicted value of Performance_it, i.e., it analyzes the process of how ESOP affects the predicted value of Performance_it through the mediating variables, and here the conclusion can be drawn by analyzing the predicted value of ESOP on the mediating variables and the predicted value of the mediating variables on Performance_it.H4 investigates the total effect of the maturity of smart manufacturing ( SMM_it) how it moderates the mechanism of the ESOP variable’s effect on the predicted value of Performance_it; H5 is the process of illustrating the effect of ownership nature on business performance by analyzing how OS_it moderates the mechanism of the ESOP variable’s effect on the predicted value of Performance_it, and it is not done by testing the \(\alpha\)1, \(\beta\)1, \(\gamma\)2, \(\delta\)3, \(\phi\)3, and other coefficients’ statistical significance to prove whether they have an effective impact. The above conclusions are mainly based on the method of SHAP decomposition analysis, which is used to essentially quantify the degree and direction of the influence of each input factor individually or interactively on the final output results of the LSTM model.

LSTM models make predictions based on input features, and we test this theoretical assumption using the SHAP method, which is derived from the Shapley value in cooperative game theory, and distributes the model’s contribution to the prediction outcome equally across the input features to obtain the contribution of each feature. Each prediction sample is given the SHAP value corresponding to each feature. If the SHAP value of a feature is positive, it means that the feature will push the prediction in a higher direction; if it is negative, it means that it will push in a lower direction. The mathematical expression is given below: \(g(z') = \phi _0 + \sum _{i=1}^{M} \phi _i z'_i\), where g is the explanatory model, \(z'\) simplifies the input features (\(z'_i=1\) means this feature exists, \(z'_i=0\) means this feature does not exist), M represents the number of input features, \(\phi _0\) is the model base value (i.e., the output of the model in the absence of all input features, which in practice represents the mean value of the target variable of the whole training set), and \(\phi _i\) is the SHAP value of feature i. The model base value of feature i is the SHAP value of the entire training set. output, which in practice represents the mean value of the target variable of the whole training set, \(\phi _i\) is the SHAP value of feature i. From SHAP, we can see how ESOP-related variables, mediating variables and moderating variables interact in the LSTM model to affect the prediction of enterprise performance, which can provide a basis for the theoretical hypotheses in this paper instead of using only statistical means to verify them as traditionally done. In smart manufacturing, the incentive effect of ESOP and the return on investment of smart technology have a certain time lag and cumulative effect, and because the value of the enterprise is affected by the market sentiment of a certain time lag and volatility, so LSTM based on the mining of time-series information is more suitable for this kind of long time-series and strong correlation relationship than the traditional econometric model to predict the value of the enterprise.

Model training

Since the dependent variable of this study, firm performance, is a continuous variable, we define the prediction task of the model as a regression problem. We use mean square error as a loss function to minimize the squared difference between the predicted and actual values of the model. The MSE loss function is defined as follows:

Where:

N is the sample size.

yi is the true firm performance value for the ith sample.

ŷi is the firm performance value predicted by the model for the ith sample.

MSE is chosen as the loss function because it gives higher weight to larger prediction errors, which helps the model learn and reduces extreme biases.

For the optimizer, we still choose the Adam optimizer. The main advantage of the Adam optimizer is its ability to adaptively adjust the learning rate of each parameter and combines the advantages of first-order moment estimation (Momentum) and second-order moment estimation (RMSProp), which usually performs robustly and efficiently in a variety of deep learning tasks. Adam’s updating rule is to compute the gradient, update the first-order moments (mean) and second-order moments (variance) estimates, and using these estimates to adjust the learning rate for each parameter. Specific steps include:

The gradient g is computed from the derivative of the current small batch loss function with respect to the parameter \(\theta\). Initialize the first-order moment estimate \(m_0 = 0\) and the second-order moment estimate \(v_0 = 0\).

At the tth iteration, the first order moments are updated:\(m_t=\beta _1*m_{t-1}+(1-\beta _1)*g_t\)

Updating the second order moments:\(v_t=\beta _2*v_{t-1}+(1-\beta _2 )*g_t^2\)

Calculate the bias-corrected first-order moment estimates:\({\hat{m}}_t=m_t/(1-\beta _1^t)\)

Calculate the bias-corrected second-order moment estimates:\({\hat{v}}_t=v_t/(1-\beta _2^t)\)

Update parameters:\(\theta _t=\theta _{t-1}-\alpha *{\hat{m}}_t/({\hat{v}}_t+\epsilon )\)

Where \(\alpha\) is the learning rate, \(\beta _1\) and \(\beta _2\) are exponential decay rates (usually close to 1), and \(\epsilon\) is a very small smoothing term (e.g., \(10^{-8}\)) to prevent division by zero.

Model performance comparison and benchmarking

To further demonstrate that the LSTM model used in this study outperforms other models commonly used in predicting the impact of ESOPs on firm performance, some common benchmark models other than the LSTM were selected as controls. Multiple linear regression: Applies traditional econometrics to these fundamentals, such as introducing lagged terms to represent the static component. ARIMA model: A classic single time series forecasting model, suitable for forecasting a single metric; however, does not have the ability to integrate for multidimensional attributes. Random Forest Regression: can solve the problem of nonlinearity well, but the long-term dependence on the series itself cannot be captured. In this paper, we will use evaluation indexes such as mean square error (MSE), mean absolute error (MAE) and coefficient of determination (R2), and select the same training set and test set (the range of features used in each model should be the same) for comparative analysis.

Interpretable AI (XAI) methods: SHAP analysis

Despite the strong predictive power of the LSTM model, the internal decision-making mechanism cannot be explained because it is a “black-box” model, and to solve this problem, we use SHAP value analysis to achieve this. SHAP is derived from game theory, and is used to sum the marginal contribution of each feature to a single prediction output and obtain a global feature importance ranking, which makes it interpretable and robust. The SHAP approach is derived from game theory, using which it is possible to sum the marginal contributions of individual features to the output of a single prediction and obtain a global ranking of feature importance, which gives it the advantages of interpretability and robustness. Meanwhile, it is a model-independent method to measure feature importance based on real data, which is to some extent different from the traditional Random Forest applied to judge the overall importance of the model or the input xgboost model that evaluates the interpretability of the model with a single value, and it can better explain the training of LSTM models in the actual project operation. The mean absolute value of SHAP value is calculated in SHAP for all the features in all the samples. In SHAP, the average absolute SHAP values of all features of all samples are calculated to know the order of their importance to the overall model predictions; SHAP summary plots depict the influence (positive/negative and magnitude) of each feature on the model outputs, the magnitude of the various feature values, and the relationship between the two; and SHAP dependency plots show how the individual features affect the model predictions and the interactions among the features, etc., which allow one to understand the key drivers affecting business performance predictions. key drivers affecting business performance prediction and the way they affect business performance prediction, and study the interactions between different features, such as the different effects of ESOPs in different smart manufacturing maturity levels or socio-emotional environments.

Empirical analysis

Sample selection and data sources

In order to verify the impact of employee stock ownership plan (ESOP) on corporate performance, LSTM prediction model is constructed and its validity is examined using actual data. Manufacturing enterprises in A-share listed companies in Shanghai and Shenzhen during 2014-2020 are selected as samples, focusing on enterprises that have carried out employee stock ownership programs. The data sources are: employee stock ownership program and corresponding financial data from Wind Information Database, enterprise performance data from databases such as Cathay Pacific Information Database and China Research Information Service Platform; industrial background, market environment and other aspects refer to industry research reports and relevant public information. Considering the data quality and other issues, the following standards are adhered to in data processing: excluding listed companies with abnormal financial data or large deviations; standardizing the key performance indicators, trying to ensure that the data has continuity to ensure the accuracy of the results; and eliminating the interference of the extremes, finally arriving at the performance data about a total of 7,536 companies.

Model construction

Model inputs include ESOP_STATUS indicates whether the firm has implemented an employee stock ownership plan (1 is implemented, 0 is not implemented). ESOP_RATIO indicates the ratio of employee stock ownership to total equity. Control variables include firm size, capital structure, return on assets, market position and social sentiment (positive, negative, neutral). The model output is the performance indicators of the firm, such as return on total assets, return on net assets or earnings per share18.

The LSTM model consists of the following layers: the input layer receives the processed variable data. the LSTM layer captures the long term dependencies in the time series data. The fully connected layer converts the output of the LSTM layer into the final forecast. The output layer then outputs the predicted value of the firm’s performance. Table 2 shows the key input variables of the model (e.g., ESOP_STATUS and ESOP_RATIO) and their statistical characteristics, and briefly describes the statistical characteristics of each variable.

Model validation

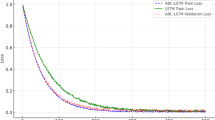

In order to ensure the validity and reliability of the LSTM model, two methods, K-cross validation and independent test set validation, are used, and a detailed validation process is carried out with the graphs and data in this paper. The following are the specific model validation methods and steps, as well as the detailed model performance index values19:

The method of K-cross validation is to divide the dataset into multiple subsets and evaluate the generalization ability of the model by K-fold cross validation, taking \(K = 5\). In each iteration, \(K - 1\) subsets are used for training and the remaining one is used for validation. The final model performance is based on the average result of multiple iterations. For the independent test set validation method, the data is first divided, and a portion of the data not involved in training is set aside as an independent test set to ensure the temporal order and independence of the test set. Then the model is evaluated by using the trained model to predict the independent test set and calculate the performance metrics19.

Three metrics are introduced to give a more complete picture of the model’s performance: Mean Square Error (MSE), which measures the difference between predicted and actual values; the coefficient of determination (\(R^2\)), which assesses the model’s ability to account for data variability; and Mean Absolute Error (MAE), which measures the average absolute difference between predicted and actual values. These metrics allow for a more comprehensive assessment of the predictive accuracy and stability of the model.

Figure 2 shows the change in performance metrics for each iteration of the K-fold cross-validation process, verifying the stability and consistency of the model.

Figure 3 illustrates the comparison between predicted and actual values in the independent test set, which visualizes the prediction accuracy of the model.