Abstract

The increasing emphasis on climate change and environmental sustainability worldwide has brought about the convergence and increased focus on financial technologies (FinTech) and green energy initiatives. In light of this, the study’s objective is to investigate how FinTech moderates the relationship between the ecological footprint (EF) and green energy transition (GTE) in the BRICS-T nations between 1990 and 2021. This study examines how fintech moderated the GTE and EF in the BRICS-T from 1990 to 2021. We applied the Fully Modified Ordinary Least Squares (FMOLS) and used Dynamic Ordinary Least Squares (DOLS) as the main estimators for longitudinal analysis. In contrast, Driscoll-Kraay was used to verify the robustness of the results under cross-sectional dependence and heteroskedasticity. The results reveal that FinTech indirectly hinders EF by facilitating GTE. The outcomes also show that FinTech significantly constrains EF, while GDP and industrialization worsen EF. The results also confirm the important role of GTE and foreign direct investment (FDI) in reducing CO2 emissions in BRICS-T countries. Lastly, the paper offers policymakers useful recommendations for lowering EF in light of these outcomes. The study suggests establishing appropriate policies and strategies that encourage FinTech platforms to invest in green energy projects, including financial technology, promoting energy-efficient and low-carbon foreign direct investment, and encouraging GTE.

Similar content being viewed by others

Introduction

The rise in global environmental awareness is directly related to rising carbon dioxide (CO₂) emissions and heavy reliance on fossil fuels as a result of rapid industrialization1. The increasing ecological footprint (EF) associated with fossil fuel use leads to the degradation of natural ecosystems and threatens sustainable development goals. The significant decline in biodiversity, particularly since 1970, has reached a point of concern for environmental scientists. According to World Health Organization data, approximately 91% of the world’s population lives in areas with air quality considered unhealthy2. In this context, environmental sustainability, EF, and climate change are increasingly important political agenda items, especially for developing countries3,4.

As a response to these global challenges, the United Nations announced the Sustainable Development Goals (SDGs) in 2015 and recommended that all countries align with SDG 13 and SDG 7 by 2030. Of these goals, SDG 7 aims to ensure that all individuals have access to safe, accessible, environmentally friendly, and renewable energy (RENE) sources, while SDG 13 prioritizes developing urgent solutions to the impacts of climate change5. In this context, the transition to sustainable energy sources has become a fundamental pillar of both development and environmental protection6. The demand for RENE technologies to slow increasing environmental degradation and ensure sustainability is rapidly increasing globally. Resources such as solar, wind, hydro, and biomass enable the production of clean, safe, and RENE as an alternative to the negative impacts of fossil fuels7. Therefore, policymakers have implemented various incentives and regulations to accelerate the green energy transition (GTE)8.

However, environmental sustainability is closely linked not only to the transformation of energy resources but also to digitalization tools such as financial technologies (FinTech). In recent years, technological advances have led to comprehensive transformations in the financial sector, and FinTech has become the focus of numerous national and global studies9. FinTech applications, encompassing technologies such as mobile devices, big data, artificial intelligence, cloud computing, and blockchain, contribute to environmental sustainability by increasing the accessibility of financial products and encouraging environmentally friendly investments10,11,12. In this context, FinTech not only enables the digitalization of the financial system but also stands out as a transformative force supporting environmental solutions.

In light of these developments, the BRICS-T countries (Brazil, Russia, India, China, South Africa, and Turkey) are of particular importance. While these countries contribute to both national and global development through high economic growth rates, they also produce high CO₂ emissions that threaten environmental sustainability13. Indeed, the BRICS-T countries account for 41% of the world’s total carbon emissions14. This demonstrates that the group must simultaneously manage both its economic development potential and its environmental responsibilities. In line with the sustainable development goals, these countries are taking strategic steps to prevent environmental degradation15. The rich RENE resources of the BRICS-T countries—such as solar, wind, hydropower, and biomass—present a significant opportunity for clean energy production. Therefore, the green energy transition in these countries is not only a technical necessity but also a fundamental component of environmental and economic sustainability.

In this context, the aim of our study is to analyze the interaction between FinTech, GTE, FDI, and EF in BRICS-T countries during the period 1990–2021. Most studies in the literature have separately addressed the relationship between FinTech and environmental sustainability10,11,16,17,18 or the relationship between green energy transformation and the environment19,20,21,22,23. However, a holistic and empirical analysis encompassing all of these relationships has not been conducted. Our study aims to fill this important gap by examining the impact of FinTech on GTE and the implications of this relationship on the environmental footprint.

In addition, the FinTech indicator is divided into main components, such as mobile phone subscriptions (per 100 people), the Financial Development Index, and the internet usage rate. The dataset was created using the PCA method. This method allows for a more comprehensive assessment of FinTech’s impact on environmental sustainability. While previous research has mostly focused on the digital aspect of FinTech or solely on the financial development dimension24,25,26, this study makes a unique contribution by providing a holistic measurement of FinTech. Therefore, considering that the current energy and environmental policies of BRICS-T countries may not be sufficient to achieve the SDG targets, it is recommended that the policy framework should be restructured.

The remainder of the research is organized as follows: A thorough analysis of pertinent literature is given in Section "Literature review", which serves as a basis for comprehending the situation. Section "Data, model and methodology" provides detailed information about the data and methods used in this research. In Section "Empirical findings", we present the findings from the study, followed by a comprehensive discussion. In Section "Conclusion and policy implications", practical policy implications for policymaking based on the study’s results are presented.

Literature review

Green energy transition and FinTech

The increasing emphasis on climate change and environmental sustainability worldwide has caused the coming together of FinTech and green energy initiatives and a greater focus on this issue5. Providing a broad range of goods and services, ranging from blockchain networks to basic mobile payment apps27, Fintech is an invention that lowers transaction costs and boosts corporate efficiency by using science and technology to the financial sector28. Fintech is defined by the Financial Stability Board as financial innovation resulting from technical advancements through a variety of innovative financial products, business models, and technological applications. Fintech can be briefly expressed as the combination of money and innovation4.

Fintech offers new policies and frameworks to support innovation in the energy sector and green energy transformation, encouraging greater energy efficiency. The use of various digital platforms in mobilizing financial resources for green energy projects has provided significant momentum to ensure environmental sustainability. Fintech ultimately contributes to more efficient, cleaner, greener, and low-carbon energy transformation29. Furthermore, by doing away with the need for middlemen, blockchain technology in energy systems makes the RENE transition between people and companies easier. Thus, FinTech can facilitate the progress of the GTE by facilitating energy trading systems and ensuring the seamless integration of RENE sources30. In addition to facilitating energy savings, this may promote the widespread use of green energy and help establish a more sustainable energy mix.

There is a dearth of scholarly research on the actual effects of fintech on the energy transition. The pioneering study in this area was conducted by Croutzet and Dabbous9, who investigated the impact of FinTech on the use of RENE in OECD countries. This study found that FinTech positively affects the use of RENE sources. According to similar studies of Ahmad et al.5 in EU countries and Teng and Shen31, FinTech encourages the use of RENE and hence raises energy efficiency in OECD nations. Yang et al.32 analyzed the role of FinTech development in green energy transition for 112 Belt and Road Initiative (BRI) economies between 2000 and 2020. Additionally, energy poverty and energy security variables were added to the model. The findings indicate that green energy transition and energy security are important in reducing energy poverty. FinTech development was identified as a powerful regulatory financial tool among the selected variables and thus the development of fintech services in these economies is recommended. The study’s findings suggest that reducing energy poverty through the transition to green energy, rather than focusing on energy production and consumption patterns, is ideal. Qin and Tan33 used provincial-level data in China to examine the role of FinTech in the RENE transition using the entropy method. Their findings demonstrate the positive impact of FinTech in advancing the RENE transition, particularly in cities with stringent environmental policies. Nevertheless, this impact is less pronounced in relatively developed economies and cities in the central east. Hence, China’s policymakers are advised to increase public awareness of the environment, reduce capital misallocation, and foster green innovation to enhance the impact of FinTech on the RENE transition. Wu et al.34 investigated how FinTech development impacts low-carbon energy transition using data from 278 prefecture-level cities in China. The study found that FinTech positively impacts low-carbon energy transition. This impact suggests a spatial spillover effect. FinTech promotes low-carbon energy transition through green technology innovation, green finance, and industrial development. The link between low-carbon energy transition and FinTech positively influences government attention to the environment. This result suggests that policymakers should direct financially resources to low-carbon sectors.

Sustainable environment and FinTech

Fintech promotes green energy solutions10,11, enhances financial intermediation, fortifies regulatory frameworks, and supports a range of financial operations (Howarth, 2023). Moreover, Udeagha and Ngepah35 argue that fintech optimizes resource allocation and helps increase energy efficiency, playing a vital component in promoting sustainability.

With the increasing importance of FinTech in financial and economic life, recent studies have focused on the environmental impacts of FinTech and how FinTech will affect environmental sustainability. In this context, in addition to studies that identified the positive environmental impacts of FinTech11,16,35,36, some studies found the negative environmental impacts of FinTech17,37. For example, as Nenavath11 discovered, FinTech benefits environmental quality by significantly preventing environmental pollution. Similarly, Fan et al.29, and Lin et al.16 found that FinTech contributes positively to environmental sustainability in China. Udeagha and Muchapondwa10 clarified that FinTech is important in promoting ecological sustainability through emission reduction in BRICS countries. Li et al.12 discovered that FinTech development lowers the cost of financial services, hence lowering environmental damage, whereas Qin et al.36 observed that FinTech has a positive effect on the environment in China. These positive findings clarify that innovative applications of FinTech can increase resource efficiency and play an important role in promoting ecological sustainability through emission reduction. Bai et al.38 analyzed the impact of natural resource management, FinTech, environmental patents, and economic growth on the ecological footprint in the E7 economies between 2000Q1 and 2020Q4 using the Method of Moment Quantile Regression (MMQR). The findings indicate that FinTech positively impacts environmental sustainability in the E7 economies. Policymakers in the E7 economies should prioritize green financing solutions, such as establishing carbon credit trading platforms and RENE investments, for FinTech companies to improve environmental quality. Okere et al.39 investigated the impact of natural resources, globalization, and FinTech on the load capacity factor in North African economies during the period 1991–2022 using the Augmented Average Group (AMG) estimator and Hansen’s threshold estimator. The results demonstrate that FinTech enhances environmental quality and has the potential to encourage environmentally friendly investments. North African economies should consider the development of FinTech for sustainable development. In contrast, several studies show that the impact of FinTech on environmental outcomes may vary, and adverse effects have been observed. For example, Lisha et al.37 and Zhang et al.17 found that the development of FinTech hurt environmental quality in BRICS countries. In a different study on the BRICS nations, Zhang et al.17 reached similar findings. In G7 nations, Xia and Liu18 found that the advancement of financial technology in ASEAN countries led to environmental pollution. Xian et al.40 investigated the impact of environmental policy incentives, globalization, inclusive growth, and FinTech innovations on the ecological footprint of G20 economies between 1990 and 2023 using advanced econometric techniques. The environmental impact of FinTech in G20 economies depends on its impact on industries and economies, which can either deteriorate or mitigate environmental quality. Therefore, FinTech can both reduce and increase the ecological footprint. Furthermore, to mitigate environmental degradation, environmental policy incentives must be implemented sustainably, and technologies that enhance environmental quality must be adopted.

Fintech, energy transition and environmental sustainability

This part of the study is divided into three sections to improve the logical flow and make the expression more coherent: (1) General background on energy consumption and environmental degradation, (2) empirical findings from previous studies on renewable energy (RENE) and ecological footprint (EF), and (3) research gap on the moderating role of FinTech.

General background on energy consumption and environmental degradation

According to research examining the relationship between energy consumption and economic development41,42,43, it has been determined that economic development leads to ecological degradation caused by intensive energy use. The rapid economic growth experienced as a consequence of countries prioritizing economic growth44 actually shows that environmental sustainability remains secondary. Furthermore, research examining the connection between energy use and environmental quality has discovered that rising energy consumption leads to pollution, greenhouse gas emissions, and environmental deterioration45. Dependence on fossil fuels, especially oil, causes crucial ecological damage, exhibiting increased air and water pollution and greenhouse gas emissions46. Therefore, policymakers face a challenging task in achieving sustainable development and preventing environmental degradation. This pushes countries to balance combating environmental degradation and sustainable economic growth47. Thus, switching to green energy sources becomes a viable strategy to reduce the negative environmental impact caused by the use of fossil fuels for energy purposes48. RENE sources such as solar, wind, hydroelectric, and geothermal are abundant in nature49, sustainable, clean, naturally renewable, and have lower carbon footprints than fossil fuels17. As fossil fuel substitutes, these natural resources are safe for the environment and do not use up natural resources. Making the switch from these fossil fuels to renewable energy sources can be difficult and time-consuming50. The rapid increase in the use of RENE significantly contributes to reducing environmental degradation. The increase in RENE provides the energy required for industrialization and alleviates environmental degradation51. Therefore, BRICS-T countries can focus on policies that increase the use of RENE.

Empirical findings from previous studies on renewable energy (RENE) and ecological footprint (EF)

Due to its potential to address environmental concerns, the provision of green energy transformation has increased significantly. Studies on the effects of energy transformation on EF have generally found that the increase in energy transformation limits the level of EF. For example, Afshan et al.22 found that the increase in energy transformation limits the EF level in OECD countries. In other studies on OECD countries, Khan et al.52 and Sun et al.23found that RENE mitigates EF. Similar findings were found by Zhang et al17. (2024) in upper-middle-income countries. Similarly, Liu et al.19; Zheng et al.20 (2021) in BRICS nations, Hu et al.53 found that increased RENE use in 25 developing countries contributes to reducing environmental degradation. In contrast to these studies, according to Bölük and Mert54, RENE greatly improves the environment over the long run even though it temporarily raises carbon emissions.

Research gap regarding the moderating role of FinTech

Prior research has highlighted FinTech’s potential significance in minimizing EF10,11,16,18,36 and promoting the transition to green energy9,9,29,30,31. Also, existing literature has looked chiefly the relationship between green energy transformation and environmental sustainability19,20,21,22,23,52. In studies19,20,23,52 in BRICS nations, Hu et al.53, it has been found that energy transition greatly supports ecological sustainability. Fintech applications are important in contributing to the reduction of EF through green energy transition due to their potential to address environmental concerns. This important link has been overlooked in literature and therefore deserves further investigation. However, the impact of FinTech on the relationship between EF and green energy transformation cannot be well explained by the research currently in publication.

Fintech innovation contributes to a more efficient, cleaner, greener, and lower-carbon energy transition by introducing new policies to support the transition to green energy and promoting greater energy efficiency29. Furthermore, fintech supports a wide range of financial activities. The use of blockchain technology contributes to environmental sustainability by eliminating the need for intermediaries, strengthening regulatory frameworks, and promoting green energy transitions10,11,55. Similarly, fintech plays a significant role in promoting ecological sustainability by helping optimize resource allocation, increasing energy efficiency, and reducing emissions35. Because they are abundant in nature49, sustainable, clean, naturally renewable, and have lower carbon footprints compared to fossil fuels56, these green energy sources are environmentally friendly and do not deplete the natural environment50. The increase in green energy use makes a significant contribution to reducing environmental degradation. These clean resources not only provide the energy required for industrialization but also mitigate environmental degradation51. Therefore, fintech applications can encourage the widespread adoption of green energy transformation, facilitate energy conservation, and ultimately contribute to achieving a more sustainable energy mix.

Environmental degradation is pushing countries to strike a balance between combating environmental degradation and sustainable economic growth47. The necessity of achieving this balance presents fintech applications as a moderating effect, offering solutions to reduce fossil energy consumption and mitigate ecological degradation, while also offering a practical approach to minimizing the release of harmful emissions related to fossil fuel energy consumption5. The theoretical explanations and arguments above raise the question, "What is the moderating effect (FinTech × GTE) of fintech on EF through GTE in BRICS-T countries?" Given their potential to address environmental concerns, it is important that fintech applications contribute to reducing EF through the green energy transition. However, the impact of FinTech on the relationship between EF and green energy transformation cannot be well explained by the research currently in publication. As a result, not enough research has been done on how FinTech indirectly affects EF by means of the transformation of green energy. Additionally, unlike literature, our study differs from previous studies in that it combines economic and social variables such as foreign direct investment, industrialization and economic growth in the same model. Our study aims to fill these gaps in literature.

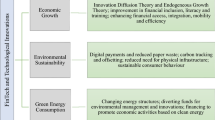

The BRICS-T countries’ variations in green energy transformation and EF are depicted in Fig. 1.

Data, model and methodology

That portion, the data and model are explained first. Second, the research model is mentioned. Third, the cross-section dependency, slope heterogeneity, Levin-Lin-Chu (LLC), Im–Pesaran–Shin (IPS), and CIPS unit root tests are performed, respectively. Then, Panel Kao, Pedroni, and Westerlund tests are given to look at the cointegration relationship. Afterwards, FMOLS and DOLS tests are discussed for robustness control. Finally, Driscoll-Kraay’s robust standard error regression test and Dumitrescu-Hurlin causality test are mentioned.

Data and model

This research attempts to evaluate the effects of FinTech, foreign direct investments, industrialization, and gross domestic product on the EF of BRICS-T countries by applying panel Pedroni57, Kao58, and Westerlund59 cointegration, FMOLS, DOLS, Driscoll-Kraay60 robust standard error and Dumitrescu-Hurlin61 causality tests. Time series data between 1990–2021 were used for BRICS-T countries. EF data as an indicator of environmental quality was accessed from the Global Footprint Network (2023). Three different indicators were used as FinTech indicators, and the data were obtained from the World Development Indicator database (WDI, 2023). Industrialization and gross domestic product data were also accessed from the WDI (2023) database.

This study’s dependent variable is EF; the main explanatory variables are FinTech and foreign direct investments. In addition, the effect of FinTech × GTE as a moderating variable is investigated. Industrialization and gross domestic product are used as control variables in the model. Table 1 lists every variable utilized in the model along with its symbols and data sources.

The economic function shown in Eq. 1 was created in the study to examine the long-term effects of FinTech foreign direct investments, industrialization, and economic growth on environmental quality in BRICS-T nations.

Here EFi,t is the ecological footprint per capita in country i at time t. FinTechi,t is the PCA index in country i at time t. FDIi,t is the foreign direct investment in country i at time t, INDi,t is the industrialization in country i at time t. GDPi,t is the economic growth in country i at time t. The model is econometrically structured as in Eq. 2.

Here, δ0 and wit represent the intercept and error term, respectively. Also, δ1 , δ2 , δ3 and δ4 represent the coefficients of the explanatory and control variables.

By looking at the combined effects of FinTech and the green GTE on the EF, Eq. 2 has been made more precise. The following changes have been made to Eq. 2.

The GTE variable in Eq. 3 represents the green transition in energy. FinTech × GTE represents the interaction term between FinTech and GTE. The indirect impact of FinTech on environmental quality through GTE is examined using this interaction term. Only the natural logarithmic transformation of GDP was carried out so as to establish a consistent base for the time series data. This situation is shown in the model with the LGDP variable. It is appropriate to emphasize that other variables in the analysis model, such as FinTech, are an index. At the same time, foreign direct investments, green transformation in energy, and industrialization are represented as percentages. Furthermore, there are no unusually high values or standard deviations in the EF value, which is determined per capita. Considering these variables’ internal scales and shapes, they do not require logarithmic transformation for the analysis. In Eq. 3, i represents the cross-sections (Brazil, Russia, India, China, South Africa, and Türkiye), and t represents the analyzed time (1990–2021).

Methodology

The methodology of this research is discussed under five subheadings: first, the cross-sectional dependence and slope heterogeneity test; second, the LLC, IPS, and CIPS stationarity test; third, the panel Kao, Pedroni, and Westerlund cointegration and FMOLS and DOLS long-term cointegration; fourth, the Driscoll-Kraay robust test; and fifth, the Dumitrescu-Hurlin causality test.

Cross-sectional dependence and slope heterogeneity test (SH)

Spatial effects or unobservable factors may cause cross-sectional dependence. Some studies have focused on testing non-stationary data by drawing attention to the importance of cross-sectional factors with first-generation tests that may cause long-term results to be misleading62. In this context, second-generation panel tests are robust to cross-sectional dependence and slope heterogeneity63. In this study, four widely preferred cross-sectional dependence tests were applied: Breusch-Pagan LM test, Pesaran-Shin-Godfrey test, Bias corrected scaled LM, and Pesaran CD (Pesaran-Shin-Godfrey corrected Durbin-Watson) test. These tests contribute to determining whether the interactions between time series change in different sectors, countries, or periods. Because these tests can be applied in heteroskedasticity and serial correlation64, heterogeneity, outliers, structural breaks, and non-symmetry on economic and financial variables can be a significant concern for empirical studies. To make more reliable and consistent estimates in long-term analyses, individual heterogeneity should also be considered4. For this purpose, the SH test developed by Pesaran and Yamagata65 was used. This test’s claim is predicated on the idea that cross-sectional units have homogeneous slopes.

The econometric equation for SH and adjusted SH is expressed below:

The symbols ΔSH and ΔASH represent delta SH and corrected delta SH in Eq. 4 and Eq. 5, respectively.

Unit root properties

To determine if the time series were stationary at the same level, panel unit root tests were employed66. When analyzing cross-sectional data, stationarity is a requirement for model acceptability and reliability. Therefore, Levin-Lin-Chu (LLC), Im-Pesaran-Shin (IPS), and CIPS tests were applied for the stationarity of the data67. However, the first-generation stationarity tests may give inconsistent results in strong cross-sectional dependence and slope heterogeneity. For this reason, the second-generation stationarity test based on cross-sectional augmented IPS, which considers cross-sectional dependence and slope heterogeneity, was performed, the CIPS panel unit root test.

This is how the CIPS test is conducted Eq. 6.

The CIPS test considers the heterogeneity of the series belonging to balanced panel data with cross-sectional dependence and the CADF statistics by making stronger estimates68.

Long-run panel cointegration tests

After applying unit root tests on time series, Kao58 and Pedroni57 techniques were used to evaluate the long-term relationship. The Kao test takes a similar approach to the Pedroni test. However, it considers cross-sectional interceptions and homogeneous coefficients in the first stage. The Westerlund59 technique, which is a powerful test against the problem of cross-sectional dependence and slope heterogeneity, was used to test the consistency of the Kao and Pedroni tests69.

Driscoll Kraay standard error

The Driscoll & Kraay60 estimation method was used in the study. This method resists consistent, heteroscedastic, temporal, and widespread cross-sectional dependence types against autocorrelation. Therefore, it is a test used in the presence of cross-sectional dependence. This methodology is a nonparametric technique that allows for extensive time dimension and flexibility. The covariance estimator is flexible enough to use balanced or unbalanced panel data by considering missing values70. In this context, the Driscoll Kraay standard error estimate for the combined DOLS analysis is shown in Eq. 7 below.

In Eq. 7, υi,t represents the independent variables (such as FinTech, FDI, IND and LGDP) and yi,t is the dependent variable (EF).

In the first stage, all variables were changed as in Eq. 8.

Here, \(\overline{Z}_{l} \; = \;Ti^{ - 1} \sum\nolimits_{t = t,i,1}^{Ti} {Z_{it} \;{\text{and}}\;\overline{\overline{{\text{Z}}}} } \; = \;\left( {\sum {Ti} } \right)^{ - 1} \sum\nolimits_{i} {\sum\nolimits_{t} {Z_{i,t} } }\)

In Eq. 9, the OLS estimator is displayed.

The modified regression model in Eq. 13 is analyzed using the combined OLS estimation technique in the second stage.

Robustness for results

For Drawing on studies in the literature71,72, FMOLS and DOLS techniques were used to examine long-term elasticity. FMOLS is a nonparametric analysis method Pedroni57 developed to evaluate cross-sectional heterogeneity, autocorrelation, and heteroskedasticity. DOLS is a parametric method that considers the endogeneity in errors while modifying OLS to correct for serial correlations73. This estimator avoids biased errors better than FMOLS by using lags and leads74. In addition, DOLS takes into account a set of leads (p) and lag (-p) that are endogenous to the first difference of the regressor75. Considering possible issues with serial correlation and endogeneity, Narayan & Smith76 stress that the DOLS technique yields trustworthy results of coefficients for explanatory factors, particularly for small sample sizes.

FMOLS models are presented in Eq. 10 and Eq. 11.

Panel FMOLS is estimated as in Eq. 12.

In Eq. 12, Ŷ* the following is the t statistic after FMi is computed for the i section.

The panel DOLS model is as follows.

In Eq. 14, Ri and –Ri are lagging and leading values. In this case, the DOLS estimator is included in Eq. 15.

The t-statistic in the DOLS estimator is as follows.

Dumitrescu-hurlin panel causality test

This test is an analysis technique developed to examine causality through panel data. This technique includes heterogeneity between units in panel data and is, therefore, very useful for evaluating causality in data sets where cross-sectional units may behave differently over time61. Dumitrescu-Hurlin panel causality is shown in Eq. 17.

Here i = 1,…, M, βi = (βi(1),…, βi(K)), φi is the constant term. Yi(k) is the autoregressive parameter. βi(k) are the regression coefficient slopes. K is the number of lags and is constant for all sections. M represents the number of sections. Using the Dumitrescu-Hurlin and Wald statistics, the null hypothesis asserts that there is no homogenous causality in any part of the panel.

Against the alternative hypothesis H1, where causality is found for at least one subgroup of the panel:

M1 = 0 indicates that causality causes W for each cross-section i. Conversely, by rejecting the null hypothesis, the regression model’s variability and the causality linkages across several cross-sections are indicated by M1 > 0. The following is the average Wald statistic.

Here Wald i,T is the individual Wald statistic for cross-section i.

Empirical findings

In model specification, the study follows Chang and Wu4 and conducts principal component analysis (PCA) to construct a composite FinTech index from three different indicators. PCA aggregates data from multiple variables and integrates them into a single weighted index. Figure 2 shows the econometric flow of the study.

The PCA findings in Table 2 show that the eigenvalue of the first principal component is greater than one, explaining 68% of the total variation. Furthermore, the positive factors for the three indicators confirm the equivalent FinTech index. Furthermore, the positive correlation between the FinTech index and the three components confirms the reliability of the FinTech index.

Table 3 presents the mean, median, Limit values, standard deviations, skewness and kurtosis values for the variables in empirical study. Each analyzed variable has 192 observations for the time series from 1990 to 2021. According to the data in Table 3, it can be said that the average value of the indicator for industrialization (IND) is the largest, and the average value for the variable representing GTE is the lowest. In addition, Table 3 shows that EF, FinTech, FDI, GTE, IND and LGDP deviate from the average values by 1.533, 9.58, 1.500, 0.269, 7.624 and 0.461, respectively. Moreover, Russia had the highest per capita EF value, used as an indicator of environmental sustainability, among the BRISC-T countries between 1990 and 2021. This value also appears high in the other countries analyzed. This negatively impacts environmental sustainability, particularly by promoting environmental pollution. Furthermore, in recent years, there has been increasing interest in green energy transformation in Brazil, India, China, and Türkiye. This could have a positive impact on environmental sustainability.

A flow process was followed to increase and verify the predictive robustness of the model. For example, the Jarque–Bera test determined that the variables did not have a normal distribution. For panel data, a modified Wald test was used for group-based heteroskedasticity. In addition, Wooldridge test was applied for autocorrelation testing. According to the test results, autocorrelation and heteroskedasticity were detected at 1% significance level. Variance increase factor (VIF) test was performed for the multicollinearity problem of time series data. The highest VIF and mean values were 1.69 and 1.38, respectively. These results indicate that there is no multicollinearity problem since they are well below the threshold value Limit of 10. Furthermore, the Hausman test fixed effects estimator was proposed to identify the optimal estimating model.

After the summary statistical information, cross-sectional dependence (CSD) analysis was performed. The results of four different test types belonging to CSD are shown in Table 4. These are Breusch-Pagan LM, Pesaran scaled LM, Bias-corrected scaled LM and Pesaran CD. According to the results of each test performed, the null hypothesis that there is no CSD at the 1% significance level was rejected. In other words, it can be concluded that a shock to occur in any of the economies of Brazil, Russia, India, China, South Africa and Türkiye may also affect other BRICS-T economies. Therefore, the variables EF, FinTech, FDI, GTE, IND and LGDP belonging to the analyzed countries are cross-sectionally interconnected and contain a CSD problem. Therefore, Pesaran & Yamagata65 slope heterogeneity was tested.

H0 = slope coefficients are heterogeneous.

According to the results in Table 5, when the probability values related to Δ and Δadj are examined at the 1% significance level, the null hypothesis that the slope coefficients are heterogeneous could not be rejected. For this reason, the existence of heterogeneous slope coefficient was found in the variables related to the analyzed BRICS-T countries.

The variables’ unit root findings are displayed in Table 6. LLC, IPS, and CIPS tests were used for stationarity. The panel variables display a unit root at the level, according to the test findings. Moreover, every variable in the first difference is statistically significant. As a result, we can declare that the variables are integrated in time, reject all zero samples, and verify that all variables are stationary in the first difference under the null hypothesis of non-stationarity.

In Table 7, three different cointegration tests were conducted to evaluate the long-term relationships of the variables. The results were at a satisfactory level, and according to all three test types, the existence of a long-term cointegration relationship between the variables was determined. Stated differently, the long-term movement of all variables was confirmed. In conclusion, the cointegration results demonstrate that the model’s variables can empirically explain the reasons behind ecological deterioration in the BRICS-T nations.

The results of FMOLS and DOLS tests used to determine the effect coefficients of the long-term relationship are presented in Table 8. In general, the directions of the coefficients related to both tests are similar. In other words, FMOLS shows that a 1% increase in the FinTech, GTE, FinTech × GTE, and FDI variables reduces EF by 1.04%, 0.98%, 7.71%, and 0.05%, respectively. According to the DOLS estimation results, the coefficients for the variables are similar. However, FMOLS and DOLS show the positive impact of industrialization and economic growth on EF. The coefficients for the IND and LGDP variables are positive for FMOLS and DOLS estimators.

Table 9 presents the results of the Driscoll-Kraay analysis for panel robust standard error estimation. Model 1 shows the coefficients of the main explanatory variables, FinTech and FDI. Model 2 shows the coefficients of both GTE, which represents the green transformation in energy and the interaction term FinTech × GTE, which considers both FinTech and green transformation in energy.

The analysis results show that FinTech is significantly negative at the 1% significance level for both models. The findings support the FMOLS and DOLS results. According to this research, FinTech can significantly contribute to making sustainable investments more accessible by strategically utilizing blockchain, big data, and artificial intelligence to support ecologically friendly change in the BRICS-T nations. This result also shows that FinTech can encourage environmental sustainability by supporting a wide range of financial activities, promoting sustainable financing solutions, and promoting clean energy solutions. Similar findings have been put forward by Udeagha & Muchapondwa10 (2023), Udeagha and Ngepah35, Lin et al.16 and Qin et al.36.

According to the results in Table 9, a 1% improvement in GTE, which represents the green transformation in energy used in the model to create the interaction term, means that EF will decrease by 0.702%. The findings show that the adoption of green energy transformation in BRICS-T countries will reduce the EF and have significant results in sustainability. As countries increasingly direct their focus to green resources such as wind, hydroelectric and solar, a significant decrease in EF is observed and the consequences of ecological hazard are mitigated. Green energy transformation not only reduces fossil fuel use but also promotes a more sustainable ecological life. This transformation has increased the importance of developing renewable power capacity because of its potential to address environmental concerns. This finding is supported by Afshan et al.22, Khan et al.67, Sun et al.23 who found it in OECD countries. Moreover, Zhang56 found a similar finding in upper-middle income countries.

In this research, within the framework of Model 2, FinTech and green energy transformation (GTE) are included in the model as an interaction term (FinTech × GTE) to examine the combined effect on EF using an alternative estimation method. Table 9 displays the findings. The coefficient of the interaction term (FinTech × GTE) is unfavorable, illustrating that FinTech and green energy transformation Hurt EF. A 1% improvement in the interaction term FinTech × GTE impedes EF by 6.410% in BRICS-T countries. Therefore, FinTech moderates the relationship between green energy transformation and EF. These outcomes indicate that advances in FinTech play an essential role in mobilizing financial resources for green energy projects and promoting sustainable practices, thus contributing to more efficient, cleaner, greener, and low-carbon energy transformation. These findings reveal a positive situation in achieving environmental sustainability by adopting green transformation in energy. In addition, the results contribute to facilitating the integration process of the financial system and achieving SDGs. Fintech underlines its importance in achieving sustainable development goals by promoting sustainable financing solutions to support innovation in the energy sector and transition. FinTech plays an important role in streamlining investment processes and financial transactions, which makes solar, wind, and other RENE projects more accessible. Financial assistance facilitates green energy adoption and reduces dependence on environmentally harmful energy sources, which helps reduce EF. Fintech improves financial intermediation, increasing the accessibility of solar, wind, and other RENE projects. Fintech strengthens environmental regulatory frameworks and sustainability by promoting clean energy solutions. This promotes the widespread adoption of green energy, reduces dependence on environmentally harmful energy sources, contributes to achieving a more sustainable energy mix, and facilitates energy saving, which helps reduce EF. These findings align with research by Teng and Shen31 in the OECD nations and Ahmad et al.5 in EU nations.

We discover a statistically significant negative correlation between FDI and EF. In BRICS-T nations, a 1% increase in FDI hinders EF by 0.0377%. The negative sign of FDI confirms the evidence of The Pollution Halo Hypothesis and thus shows that the pollution hypothesis is invalid. This result means that FDI significantly reduces EF (CO2 emissions) in BRICS-T economies. This outcome validates the argument of The Pollution Halo Hypothesis and emphasizes that FDI can work as a mechanism to help mitigate the effects of climate change. This result also means that FDI flows to developing economies carry technology and knowledge from developed economies. Improved technology will reduce environmental degradation in developing economies due to the transfer of environmentally friendly production techniques and clean energy technologies. This outcome is in line with the conclusions of a few research on BRICS-T nations that have been published in the literature77,78. The assertion that FDI flows for developing nations must be linked to investments in green technologies may be reflected in the findings demonstrating the inverse association between FDI and EF in BRICS-T nations.

Our model included LGDP variables as a proxy for economic growth. There was a statistically crucial and beneficial correlation between EF and the variable LGDP. EF benefited from economic growth. This result demonstrates that these nations’ economic development route is not environmentally sustainable. Economic growth harms the environment by increasing the EF. Our outcomes are consistent with earlier research5,79.

The variable industrialization (IND) and EF were shown to be positively and statistically significantly correlated. EF rises with industrialization (IND). These findings show that the industrialization of these countries is not ecologically friendly. Industrialization is made possible by intensive energy use. Increased energy use leads to pollution, greenhouse gas emissions, and environmental deterioration. Dependence on fossil resources to meet energy needs has led to significant environmental degradation in the global carbon footprint. Switching to renewable energy sources like solar, wind, hydropower, and geothermal is a sensible way to lessen environmental impact and the emission of toxic gases caused using fossil fuels. The rapid increase in the use of RENE significantly contributes to reducing environmental degradation. The increase in RENE use provides the energy required for industrialization and alleviates environmental degradation. Therefore, BRICS-T countries can focus on policies that increase RENE use. This finding is consistent with the studies of Zhang and Khan45,80.

Furthermore, the coefficient signs of all other variables are closely aligned with the findings of FMOLS and DOLS estimators in Table 8 and Model 1 and Model 2 in Table 9, thus verifying the precision and dependability of our findings for potential policy implications.

Figure 3 shows a summary of the analysis findings. The findings and analysis methods used in this study are consistent with the results of studies in current literature. For example, Uddin et al.24 examined G20 countries; Chang and Wu (2024) G5 countries; Yadav et al.81 BRICS countries; and Wang et al.82 E7 and G7 countries. The study results highlight the importance of FinTech in environmental sustainability.

Table 10 shows the causality connections between the factors in the model. The analysis reveals a one-way causality between FinTech and EF. This result means that EF leads to FinTech development. The same is true for GTE, which represents the green transformation in energy. A one-way causality from EF to GTE was found. The interaction term, which was introduced into the model as a moderating effect, was found to have a one-way causal relationship with EF. In other words, it was found that EF caused FinTech × GTE. Therefore, it shows that EF leads to the regulation of FinTech and green transformation in energy, but not vice versa. Existing investigations on the empirical reflections of FinTech on green transformation in energy are limited. A study conducted in this context was brought to the literature by Croutzet and Dabbous (2021). According to the empirical findings, FinTech and RENE sources are positively correlated in OECD nations. Teng and Shen31 similarly reported that FinTech is stimulating the adoption of RENE. In their study of BRICS nations, Zeng et al.83 found that FinTech development supports using low-carbon energy. The association between EF and FDI was shown to be one-way causal. Advocates of the neo-technology school of thought argue that FDI inflows will benefit national economies because clean energy production techniques require advances in knowledge and technology, which reduces the rate of ecological degradation in national economies84. While a bidirectional causality was determined between the EF and IND variables, a one-way causality from LGDP to EF was revealed.

Conclusion and policy implications

Conclusion

The study’s objective is to investigate how FinTech moderates the relationship between the ecological footprint (EF) and green energy transition (GTE) in the BRICS-T nations between 1990 and 2021. This study examines how fintech moderated the GTE and EF in the BRICS-T from 1990 to 2021. After applying unit root tests on time series, Kao58 and Pedroni57 techniques were used to evaluate the long-term relationship. We applied for the Fully Modified Ordinary Least Squares (FMOLS) and used Dynamic Ordinary Least Squares (DOLS) as the main estimators for longitudinal analysis. FMOLS and DOLS techniques were used to examine long-term elasticity. In addition, The Driscoll & Kraay60 estimation method was used to verify the robustness of the results under cross-sectional dependence and heteroskedasticity. In this study, Dumitrescu-Hurlin panel causality test technique was used. His test is an analysis technique developed to examine causality with panel data.

The study’s focus is to investigate how FinTech moderates the relationship (FinTech × GTE) between the ecological footprint (EF) and green energy transition (GTE) in the BRICS-T nations. However, the impact of FinTech on the relationship between EF and green energy transformation cannot be well explained by the research currently in publication. As a result, enough research has not been done on how FinTech indirectly affects EF by means of the transformation of green energy. This gap in literature is filled by our study. The second contribution of this study to literature is its use of a different fintech variable. Unlike the existing literature24,25,26, this study used a comprehensive indicator of fintech by taking a PCA of mobile cellular (subscriptions per 100 people), the Financial Development Index, and internet usage (% population). In model specification, the study conducts principal component analysis (PCA) to construct a composite FinTech index from three different indicators. PCA aggregates data from multiple variables and integrates them into a single weighted index. In this sense, the fintech indicator is important in explaining environmental sustainability. Based on this background, it can be concluded that current energy and environmental policies in BRICS-T countries may not be sufficient to achieve the SDGs. Therefore, restructuring the policy framework for BRICS-T countries is important.

The findings indicate that the coefficient of the interaction term (FinTech × GTE) is negative, illustrating that FinTech and green energy transformation reduce EF. The results reveal that FinTech indirectly hinders EF by facilitating GTE. Therefore, FinTech moderates the relationship between green energy transformation and EF. These outcomes indicate that advances in FinTech play an essential role in mobilizing financial resources for green energy projects and promoting sustainable practices, thus contributing to more efficient, cleaner, greener, and low-carbon energy transformation. These findings reveal a positive situation in achieving environmental sustainability by adopting green transformation in energy. In addition, the contribution of the results to Fintech underlines its importance in achieving sustainable development goals by promoting sustainable financing solutions to support innovation in the energy sector and transition. FinTech plays an important role in streamlining investment processes and financial transactions, which makes solar, wind, and other RENE projects more accessible.

The results show that FinTech applications increase the accessibility of solar, wind, and other renewable energy (RENE) projects by improving financial intermediation, reduce dependence on environmentally harmful energy sources by facilitating green energy transitions, and strengthen environmental regulatory frameworks and sustainability by promoting clean energy solutions. These, in turn, help reduce EF. The results also show that FinTech facilitates green energy adoption and reduces dependence on environmentally harmful energy sources, which helps reduce EF. Fintech improves financial intermediation, increasing the accessibility of solar, wind, and other RENE projects. Fintech strengthens environmental regulatory frameworks and sustainability by promoting clean energy solutions. This result promotes the widespread adoption of green energy, reduces dependence on environmentally harmful energy sources, contributes to achieving a more sustainable energy mix, and facilitates energy saving, which helps reduce EF. These findings align with research by Teng and Shen31 in the OECD nations and Ahmad et al.5 in EU nations. This result is important for providing policymakers with recommendations for reducing the ecological footprint. Identifying how FinTech impacts the link between green energy transformation and environmental sustainability can guide policymakers in using FinTech applications alongside green energy transformation to improve environmental outcomes.

Fintech applications can encourage widespread adoption of green energy transitions, facilitate energy savings, and ultimately contribute to a more sustainable energy mix. This can reduce EF. Because of their potential to address environmental concerns, it is important that fintech applications contribute to reducing EF through green energy transitions. However, the impact of FinTech on the relationship between EF and green energy transformation cannot be well explained by the research currently in publication. This important link has been overlooked in literature. Prior research has highlighted FinTech’s potential significance in minimizing EF10,11,16 and promoting the transition to green energy9,30. Furthermore, in BRICS countries, the existing literature has generally investigated the relationship between green energy transition and environmental sustainability20,26,52,85.The literature has overlooked the impact of the interaction term between Fintech and GTE (Fintech x GTE) on EF. The main contribution of this study is to reveal this link.

The empirical results also show that FinTech in BRICS-T countries contributes to ecological sustainability by reducing EF. Furthermore, it has been shown that FinTech lessens environmental degradation through green energy transformation, and the combined effect of FinTech and green energy transformation has a negative influence on EF. The results also confirm the important role of GTE and FDI in reducing EF, while economic growth and industrialization worsen EF in BRICS-T countries.

Policy implications

We suggest a number of policy initiatives to address environmental degradation in the BRICS-T nations in light of the study’s findings.

First, establishing appropriate policies and strategies to encourage FinTech platforms to invest in green energy projects

The results indicate that the coefficient of the interaction term (FinTech × GTE) is negative, illustrating that FinTech and green energy transformation reduce EF. The results reveal that FinTech indirectly hinders EF by facilitating GTE. FinTech contributes significantly to the reduction of EF through the transformation of green energy. These findings suggest that advances in FinTech contribute positively to environmental sustainability through the adoption of green energy. Based on this finding, policymakers are advised to mobilize financial resources to increase the accessibility of solar, wind, and other renewable energy projects. This will contribute to a more efficient, cleaner, greener, and lower-carbon energy transition. Advances in FinTech will positively contribute to achieving environmental sustainability through the adoption of green energy. Based on this finding, policymakers are advised to facilitate the integration of the financial system with technology and promote sustainable financing solutions to support innovation in the energy sector, thereby advancing the achievement of sustainable development goals. Providing financial assistance facilitates the advancement of green energy adoption and reduces dependence on environmentally harmful energy sources, which helps reduce the energy efficiency. Policymakers are recommended to give the deployment of different incentive mechanisms top priority in order to attract different FinTech platforms to be engaged in green energy projects in order to take advantage of this combined effect. Appropriate policies and strategies should be implemented to achieve this, including tax incentives or various financial rewards to support financial initiatives that prioritize environmental issues.

Second, investing in financial technology and expanding green fintech applications

The study found that FinTech significantly reduces the EF in BRICS-T countries. Based on this finding, policymakers are advised to invest more in fintech in BRICS-T countries for the strategic use of artificial intelligence, big data, and blockchain technologies. Providing tax incentives, increased funding of research and development initiatives, and expanding digital literacy are vital to promote sustainability and efficiency in digital transactions, which can ultimately foster innovation in FinTech in line with sustainable development goals, increase environmental awareness, and thus make a valuable contribution to environmental protection efforts. Consequently, increased support for financial technology can play a significant role in promoting a more sustainable environment by contributing to a reduction in ecological footprints through emissions reductions. Furthermore, technologies such as digital wallets and paperless payment systems reduce the environmental impact of financial services and contribute to the elimination of paper and plastic waste. Green bonds are one of the most widely used methods for financing environmentally friendly projects. Carbon credit trading is another effective tool used to fund projects aimed at reducing carbon emissions. The integration of financial technologies in areas such as green bonds, low-carbon projects, and renewable energy investments plays a significant role in the development of globally sustainable financial products. These green fintech mechanisms make it easier for environmentally beneficial initiatives to achieve their sustainability goals. The widespread adoption of green fintech applications is recommended for policymakers.

Third, promoting energy-efficient and low-carbon foreign direct investment

In BRICS-T countries, FDI inflows and EF are cointegrated and move together in the long run. The results supporting the negative relationship between FDI and EF may reflect the argument that FDI flows in BRICS-T countries should be associated with more green technology investments. Improved technology can reduce environmental degradation in BRICS-T economies as a result of the transfer of environmentally friendly production techniques and clean energy technologies. These countries should attract more FDI into RENE projects through tax incentives. Therefore, ensuring the inflow of quality FDI for green development and ecological sustainability is important. The developments in the financial system should accompany the attraction of FDI inflows during the transition to green technologies. Our findings suggest that energy-efficient and low-carbon quality FDI should be encouraged, emphasizing cleaner technology and environmental awareness.

Fourth, establishing green energy transformation policies that will reduce fossil energy consumption

The study results indicate that industrialization and GDP worsen EF, while green energy transition improves EF. Dependence on fossil fuels, especially on oil, puts more pressure on environmental sustainability. In addition, a joint effort should be made to reduce dependence on fossil fuels. Therefore, the negative consequences of industrialization and economic growth on EF emphasize the necessity of implementing sustainable solutions and policies to reduce fossil energy consumption in BRICS-T countries to mitigate environmental degradation. Focusing on green energy sources appears as pragmatic technique to reducing ecological damage. The rapid increase in the use of RENE significantly contributes to reducing environmental degradation. Increased use of RENE provides the energy required for industrialization and alleviates environmental degradation. As BRICS-T countries increasingly shift their focus to green resources such as wind, hydropower, and solar, a significant decrease in EF is observed, mitigating the consequences of ecological hazards. Shifting to green energy sources such as solar, wind, hydropower, and geothermal energy presents a practical approach to reducing ecological damage and minimizing harmful emissions related to fossil fuel energy consumption. Therefore, policymakers in BRICS-T countries are encouraged to implement an energy transition, and BRICS-T countries can focus on policies that increase the use of RENE.

Implementing policies that include these efforts, incentives, measures, and supports can maximize the positive aspects of environmental factors while mitigating the negative consequences. By implementing these policies, policymakers can create a favorable environment for FinTech to encourage green energy transformation while significantly contributing to environmental sustainability.

Limitations and future research directions

In a collection of BRICS-T nations, this study examined the connections between Fintech, foreign direct investment, green energy revolution, and the environment. This study’s primary weakness is that it only evaluated the effects of particular components on the environment. A multifaceted perspective to the issue might be offered by a research that takes into account the environmental, social, political, economic, and other financial components of sustainable development. Furthermore, this issue can be examined in different groups of countries, for instance, African economies that are rich in natural resources but relatively low in terms of access to energy.

Data availability

The datasets used in this study are available from the corresponding author upon reasonable request.

References

Viglioni, M. T. D., Calegario, C. L. L., Viglioni, A. C. D., & Bruhn, N. C. P. Foreign direct investment and environmental degradation: Can intellectual property rights help G20 countries achieve carbon neutrality? Technol. Soc. 77, 102501 (2024).

Huo, Y. et al. Carbon footprint of farming practices in farmland ecosystems on the North and Northeast China plains. J. Environ. Manag. 354, 120378 (2024).

Murshed, M. An empirical analysis of the non-linear impacts of ICT-trade openness on renewable energy transition, energy efficiency, clean cooking fuel access and environmental sustainability in South Asia. Environ. Sci. Pollut. Res. 27, 36254–36281 (2020).

Chang, Y. & Wu, P. Influence of fiscal decentralization, fintech, and mineral resources on green productivity of G5 countries. Resour. Polic. 89, 104509 (2024).

Ahmad, M., Pata, U. K., Ahmed, Z. & Zhao, R. Fintech, natural resources management, green energy transition, and ecological footprint: Empirical insights from EU countries. Resour. Polic. 92, 104972 (2024).

Yang, X. & Khan, I. Dynamics among economic growth, urbanization, and environmental sustainability in IEA countries: The role of industry value-added. Environ. Sci. Pollut. Res. 29, 4116–4127 (2022).

Qin, L. et al. The salience of carbon leakage for climate action planning: Evidence from the next eleven countries. Sustain. Product. Consum. 27, 1064–1076 (2021).

Wang, L., Su, C.-W., Ali, S. & Chang, H.-L. How China is fostering sustainable growth: The interplay of green investment and production-based emission. Environ. Sci. Pollut. Res. 27, 39607–39618 (2020).

Croutzet, A. & Dabbous, A. Do FinTech trigger renewable energy use? Evidence from OECD countries. Renew. Energy 179, 1608–1617 (2021).

Udeagha, M. C. & Muchapondwa, E. Green finance, fintech, and environmental sustainability: Fresh policy insights from the BRICS nations. Int. J. Sust. Dev. World 30, 633–649 (2023).

Nenavath, S. Impact of Fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID). Renew. Energy 193, 913–919 (2022).

Li, A., Li, S., Chen, S. & Sun, X. The role of Fintech, natural resources, and renewable energy consumption in Shaping environmental sustainability in China: A NARDL perspective. Resour. Polic. 88, 104464 (2024).

Zhang, Y.-J. & Wang, W. Do renewable energy consumption and service industry development contribute to CO2 emissions reduction in BRICS countries?. Environ. Sci. Pollut. Res. 26, 31632–31643 (2019).

Wu, L., Liu, S., Liu, D., Fang, Z. & Xu, H. Modelling and forecasting CO2 emissions in the BRICS (Brazil, Russia, India, China, and South Africa) countries using a novel multi-variable grey model. Energy 79, 489–495 (2015).

Barut, A., Kaya, E., Bekun, F. V. & Cengiz, S. Environmental sustainability amidst financial inclusion in five fragile economies: Evidence from lens of environmental Kuznets curve. Energy 269, 126802 (2023).

Lin, H.-H., Hsu, C.-C., Wu, P.-H., Shen, C.-C. & Chen, G.-H. Demystifying the interconnections among natural resources, Fintech, green technologies, and sustainable environment in E-7 nations. Resour. Polic. 90, 104698 (2024).

Zhang, Y., Zheng, K., Xia, F. & Cheng, Z. Fintech, natural resource rents, renewable energy consumption and environmental quality: A perspective of green economic recovery from BRICS economies. Resour. Polic. 89, 104604 (2024).

Xia, A. & Liu, Q. Modelling the asymmetric impact of fintech, natural resources, and environmental regulations on ecological footprint in G7 countries. Resour. Polic. 89, 104552 (2024).

Liu, Q., Zhao, Z., Liu, Y. & He, Y. Natural resources commodity prices volatility, economic performance and environment: Evaluating the role of oil rents. Resour. Polic. 76, 102548 (2022).

Zheng, F., Zhou, X., Rahat, B. & Rubbaniy, G. Carbon neutrality target for leading exporting countries: On the role of economic complexity index and renewable energy electricity. J. Environ. Manage. 299, 113558 (2021).

Zhang, Y., Li, L., Sadiq, M. & Chien, F. The impact of non-renewable energy production and energy usage on carbon emissions: Evidence from China. Energy Environ. https://doi.org/10.1177/0958305X221150432 (2023).

Afshan, S., Ozturk, I. & Yaqoob, T. Facilitating renewable energy transition, ecological innovations and stringent environmental policies to improve ecological sustainability: Evidence from MM-QR method. Renew. Energy 196, 151–160 (2022).

Sun, Y., Guan, W., Razzaq, A., Shahzad, M. & An, N. B. Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renew. Energy 190, 385–395 (2022).

Uddin, M., Siddik, A. B., Yuhuan, Z. & Naeem, M. A. Fintech and environmental efficiency: The dual role of foreign direct investment in G20 nations. J. Environ. Manage. 360, 121211 (2024).

Li, J., Wu, Y. & Xiao, J. J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 86, 317–326 (2020).

Liu, Y., Luan, L., Wu, W., Zhang, Z. & Hsu, Y. Can digital financial inclusion promote China’s economic growth?. Int. Rev. Financ. Anal. 78, 101889 (2021).

Huo, S., Ni, L., Basheer, M. F., Al-Aiban, K. M. & Hassan, S. G. The role of fintech, mineral resource abundance, green energy and financial inclusion on ecological footprint in E7 countries: New insight from panel nonlinear ARDL cointegration approach. Resour. Polic. 94, 105083 (2024).

Raza, S. A. & Shah, N. Testing environmental Kuznets curve hypothesis in G7 countries: The role of renewable energy consumption and trade. Environ. Sci. Pollut. Res. 25, 26965–26977 (2018).

Fan, M., Lu, Z., Zhou, Y. & Wang, J. Threshold and spillovers effects of fintech on China’s energy dependence on fossil fuel. Resour. Polic. 91, 104890 (2024).

Zhu, S., Song, M., Lim, M. K., Wang, J. & Zhao, J. The development of energy blockchain and its implications for China’s energy sector. Resour. Polic. 66, 101595 (2020).

Teng, M. & Shen, M. Fintech and energy efficiency: Evidence from OECD countries. Resour. Polic. 82, 103550 (2023).

Yang, W., Aslam, N. & Saeed, R. Exploring the role of fintech development in bridging the gap between green energy transition, energy security, and energy poverty: Empirical investigation for BRI countries. Energy Environ. https://doi.org/10.1177/0958305X241310200 (2025).

Qin, Q. & Tan, L. Lighting a green future: The role of FinTech in the renewable energy transition. Sci. Prog. 108, 00368504251323566 (2025).

Wu, X., Zhang, Y. & Lee, C.-C. Driving low-carbon energy transition with FinTech: The role of government environmental attention. Energy https://doi.org/10.1016/j.energy.2025.136993 (2025).

Udeagha, M. C. & Ngepah, N. The drivers of environmental sustainability in BRICS economies: Do green finance and fintech matter?. World Dev. Sustain. 3, 100096 (2023).

Qin, L., Aziz, G., Hussan, M. W., Qadeer, A. & Sarwar, S. Empirical evidence of fintech and green environment: Using the green finance as a mediating variable. Int. Rev. Econ. Financ. 89, 33–49 (2024).

Lisha, L. et al. Natural resources, green innovation, Fintech, and sustainability: A fresh insight from BRICS. Resour. Polic. 80, 103119 (2023).

Bai, Y., Eweade, B. S., Aghazadeh, S., Bamidele, R. O. & Xu, Y. Pathways to environmental sustainability: Do fintech, natural resources, and environmental patents matter in E-7 nations?. Renew. Energy 247, 122987 (2025).

Okere, K. I., Dimnwobi, S. K. & Fasanya, I. O. Pathways to environmental sustainability: Exploring the role of FinTech, natural resources and globalization in North Africa. Int. J. Sust. Dev. World 32, 446–464 (2025).

Xian, M. Impact of inclusive growth, environmental policy incentives, fintech and globalization on environmental sustainability in G20 countries. Sustainability 17, 50 (2025).

Pala, F. & Barut, A. Finansal gelişme, ekonomik büyüme ve enerji tüketiminin çevresel kalite üzerindeki etkisi: E-7 ülkeleri örneği. Anadolu Üniv. Sos. Bilimler Derg/ 21, 347–366 (2021).

Ahmed, Z., Adebayo, T. S., Udemba, E. N., Murshed, M. & Kirikkaleli, D. Effects of economic complexity, economic growth, and renewable energy technology budgets on ecological footprint: The role of democratic accountability. Environ. Sci. Pollut. Res. 29, 24925–24940 (2022).

Sharif, A., Baris-Tuzemen, O., Uzuner, G., Ozturk, I. & Sinha, A. Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: Evidence from Quantile ARDL approach. Sustain. Cities Soc. 57, 102138 (2020).

Hao, Y. & Chen, P. Do renewable energy consumption and green innovation help to curb CO2 emissions? Evidence from E7 countries. Environ. Sci. Pollut. Res. 30, 21115–21131 (2023).

Zhang, J. & Khan, I. Energy use, energy access, and oil price fluctuations as new determinants of environmental quality in APEC countries. Gondwana Res. 132, 309–322 (2024).

Shen, M., Ma, N. & Chen, Q. Has green finance policy promoted ecologically sustainable development under the constraints of government environmental attention?. J. Clean. Prod. 450, 141854 (2024).

Zhang, D., Mohsin, M., Rasheed, A. K., Chang, Y. & Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Polic. 153, 112256 (2021).

Aydin, M., Degirmenci, T., Erdem, A., Sogut, Y. & Demirtas, N. From public policy towards the green energy transition: Do economic freedom, economic globalization, environmental policy stringency, and material productivity matter?. Energy 311, 133404 (2024).

Bai, R. & Liu, Y. Natural resources as a source of financing energy poverty reduction? resources extraction perspective. Resour. Polic. 82, 1–27 (2023).

Hassan, S. T., Wang, P., Khan, I. & Zhu, B. The impact of economic complexity, technology advancements, and nuclear energy consumption on the ecological footprint of the USA: Towards circular economy initiatives. Gondwana Res. 113, 237–246 (2022).

Cheng, C., Ren, X., Wang, Z. & Yan, C. Heterogeneous impacts of renewable energy and environmental patents on CO2 emission—evidence from the BRIICS. Sci. Total Environ. 668, 1328–1338 (2019).

Khan, H., Weili, L., Bibi, R., Sumaira, & Khan, I. Innovations, energy consumption and carbon dioxide emissions in the global world countries: An empirical investigation. J. Environ. Sci. Econom. 1, 12–25 (2022).

Hu, H., Xie, N., Fang, D. & Zhang, X. The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: Evidence from 25 developing countries. Appl. Energy 211, 1229–1244 (2018).

Bolük, G. & Mert, M. The renewable energy, growth and environmental Kuznets curve in Turkey: An ARDL approach. Renew. Sustain. Energy Rev. 52, 587–595 (2015).

Li, B. et al. Do green innovation, ICT, and economic complexity matter for sustainable development of BRI economies: Moderating role of higher education. Environ. Sci. Pollut. Res. 30, 57833–57849 (2023).

Zhang, J. Energy access challenge and the role of fossil fuels in meeting electricity demand: Promoting renewable energy capacity for sustainable development. Geosci. Front. 15, 101873 (2024).

Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet. Theor. 20, 597–625 (2004).

Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 90, 1–44 (1999).

Westerlund, J. New simple tests for panel cointegration. Economet. Rev. 24, 297–316 (2005).

Driscoll, J. & Kraay, A. Consistent covariance matrix estimation with spatially dependent data. Rev. Econ. Stat. 80, 549–560 (1998).

Dumitrescu, E.-I. & Hurlin, C. Testing for granger non-causality in heterogeneous panels. Econ. Model. 29, 1450–1460 (2012).

Xuan, D., Jiang, X. & Fang, Y. Can globalization and the green economy hedge natural resources? Functions of population growth and financial development in BRICS countries. Resour. Polic. 82, 103414 (2023).

De Hoyos, R. E. & Sarafidis, V. The testing for cross-sectional dependence in panel data model. Stand. Genom. Sci. 6, 482–496 (2006).

Pesaran, M. General diagnostic tests for cross section dependence in panels. Cambridge Working Papers in Economics (2004).

Pesaran, M. H., Ullah, A. & Yamagata, T. A bias-adjusted lm test of error cross-section independence. Economet. J. 11, 105–127 (2008).

Essandoh, O. K., Islam, M. & Kakinaka, M. Linking international trade and foreign direct investment to CO2 emissions: Any differences between developed and developing countries?. Sci. Total Environ. 712, 136437 (2020).

Khan, M. Effect of natural resources on economic growth in Pakistan: A time series analysis. Asian J. Econ. Model. 9, 29–47 (2021).

Pesaran, M. H. A simple panel unit root test in the presence of cross-section dependence. J Appl. Econom. 22, 265–312 (2007).

Chishti, M. Z. & Sinha, A. Do the shocks in technological and financial innovation influence the environmental quality? Evidence from BRICS economies. Technol. Soc. 68, 101828 (2022).

Hoechle, D. Robust standard errors for panel regressions with cross-sectional dependence. Stand. Genom. Sci. 7, 281–312 (2007).

Rahman, M. M. & Alam, K. The roles of globalization, renewable energy and technological innovation in improving air quality: Evidence from the world’s 60 most open countries. Energy Rep. 8, 9889–9898 (2022).

Muhammad, S., Long, X., Salman, M. & Dauda, L. Effect of urbanization and international trade on CO2 emissions across 65 belt and road initiative countries. Energy 196, 117102 (2020).

Nasir, M. H. et al. Energy security and energy poverty in emerging economies: A step towards sustainable energy efficiency. Front. Energy Res. 10, 834614 (2022).

Khan, M. K. & Rana, A. T. Institutional quality and CO2 emission–output relations: The case of Asian countries. J. Environ. Manage. 279, 111569 (2021).

Behera, S. R. & Dash, D. P. The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew. Sustain. Energy Rev. 70, 96–106 (2017).

Narayan, P. K. & Smyth, R. A panel cointegration analysis of the demand for oil in the middle east. Energy Policy 35, 6258–6265 (2007).

Opoku, E. E. O., Adams, S. & Aluko, O. A. The foreign direct investment-environment nexus: Does emission disaggregation matter?. Energy Rep. 7, 778–787 (2021).

Mohanty, S. & Sethi, N. The energy consumption-environmental quality nexus in BRICS countries: The role of outward foreign direct investment. Environ. Sci. Pollut. Res. 29, 19714–19730 (2021).

Tamazian, A., Chousa, J. P. & Vadlamannati, K. C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Polic. 37, 246–253 (2009).

Shen, J., Wang, S., Liu, W. & Chu, J. Does migration of pollution intensive industries impact environmental efficiency? Evidence supporting “Pollution haven hypothesis”. J. Environ. Manag. 242, 142–152 (2019).

Yadav, S., Samadhiya, A., Kumar, A., Luthra, S. & Pandey, K. K. Nexus between fintech, green finance and natural resources management: Transition of BRICS nation industries from resource curse to resource blessed sustainable economies. Resour. Polic. 91, 104903 (2024).

Wang, Y., Han, M. & Liu, K. Towards sustainable path: Measuring the effectiveness of natural resource utilization, renewable energy resources, fintech, environmental investments, and research & development. Resour. Polic. 93, 105053 (2024).

Zeng, C., Ma, R. & Chen, P. Impact of mineral resource rents and fin-tech on green growth: Exploring the mediating role of environmental governance in developed economies. Resour. Polic. 89, 104547 (2024).

Albornoz, F., Cole, M. A., Elliott, R. J. & Ercolani, M. G. In search of environmental spillovers. World Econ. 32, 136–163 (2009).

Sun, Q., Ahmad, N. & Zhang, H. Renewable energy and energy poverty: An assessment of India’s progress. Energy 238, 121787 (2022).

Funding

The author(s) declare financial support was received for the research and/or publication of this article. This study was supported by the Recep Tayyip Erdoğan University Development Foundation (Grant ID: 02025007021616). The authors gratefully acknowledge the Foundation for its support.

Author information

Authors and Affiliations

Contributions

H.A Conceptualization, Methodology, Formal Analysis, Writing—Original Draft.: Literature Review, Data Collection, Writing—Review & Editing.T.E: Data Curation, Visualization, Writing—Review & Editing.A.B: Supervision, Funding Acquisition, Writing—Review & Editing. AE: Methodology, Validation, Writing—Original Draft,. A.P: Conceptualization, Methodology, Formal Analysis Supervision.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethics