Abstract

Promoting low-carbon agricultural development is essential for achieving carbon neutrality and peak carbon emission goals. The emergence of digital inclusive finance has opened a new pathway to reduce agricultural carbon emissions. This study uses data from various provinces in China from 2011 to 2021 to explore the impact of digital inclusive finance on agricultural carbon emissions and its mechanism of action. The results show that during the study period, agricultural carbon emissions first increased and then decreased, with the emission gap between the eastern and western regions narrowing, while the gap between the southern and northern regions widened. Digital inclusive finance has an inverted “U-shaped” nonlinear impact on agricultural carbon emissions, with the depth of use and the degree of digitization being key factors. Agricultural carbon emissions only begin to be effectively suppressed when the scale of digital inclusive finance exceeds the peak value. Additionally, the development of agricultural green cooperatives weakens the emission reduction effect of digital inclusive finance, indicating a decoupling between their developments, while the accumulation of human capital enhances its emission reduction effect. Based on this, the government is advised to continue promoting low-carbon strategies and the development of digital inclusivity in rural areas. Financial institutions should develop financial products suitable for agricultural green cooperatives, and agricultural green cooperatives should also provide timely feedback and communication to achieve coordinated development between the two. Furthermore, education and training for farmers should be strengthened to encourage them to learn and adopt new technologies.

Similar content being viewed by others

Introduction

The continuous rise in global average temperature leads to the problems of increased extreme weather phenomena, frequent agricultural disasters, and reduced biodiversity (Kumar et al., 2021; Muluneh, 2021; Shivanna, 2022), while flood disasters caused by melting of ice sheets threaten the survival and development of human beings themselves (Zeng et al., 2023), and these problems mainly stem from greenhouse gas emissions (Zhang et al., 2023). Against this backdrop, many countries have made low-carbon development an important goal (Wei et al., 2019). In 2020, China announced to the international community its ambition to achieve a peak in carbon emissions before 2030 and to strive for carbon neutrality by 2060. While carbon emissions are mainly caused by the industrial and service sectors, the emissions from the agricultural sector should not be underestimated (Chang, 2022; Huang et al., (2022)). The IPCC’s Fifth Assessment Report stated that greenhouse gas emissions from agriculture account for 24% of global greenhouse gas emissions, mainly from methane (CH4) and nitrous oxide (N2O) emissions (Masson-Delmotte et al., 2019). As a large agricultural country, China has substantial agricultural carbon emissions, accounting for 16% to 17% of China’s total emissions (Nayak et al., 2015). It is predicted that by 2050, these emissions could account for 30% of China’s total emissions, making agriculture one of the largest sources of carbon emissions (Bao et al., 2024). Therefore, achieving green and low-carbon development in agriculture has become one of the main avenues for China to realize its dual-carbon strategy.

Existing research indicates that finance plays an important role in agricultural development as it can achieve effective resource allocation, thus promoting the advancement of agriculture (Okunlola et al. (2019); Fang, Zhang (2021)). Many scholars have studied the relationship between finance and carbon emissions, and their findings consistently point to a significant impact between financial development and carbon emissions (Guo et al., 2022; Xu et al., 2022; Sun et al., 2022). On one hand, some scholars argue that financial development can increase carbon emissions. For instance, Xiong & Qi (2016) and Fang et al. (2020) found that finance, in supporting economic growth, leads to an increase in carbon emissions. Specifically, a bank-dominated financial structure significantly increases the emission of carbon dioxide in various regions (Chen, 2020). This is because financial development can lower the cost of financing and expand the scale of enterprises, leading to increased energy consumption and carbon emissions (Shahbaz, Lean (2012); Shahbaz et al. (2016)). On the other hand, some scholars believe that financial development can suppress carbon emissions (Guo et al. (2022); Zhang, 2023). Obtaining financial support in agricultural production tends to favor environmentally friendly production methods, reducing the input of fertilizers and other agricultural materials and thereby reducing carbon emissions (Guo et al. (2022)). Finance can also reduce agricultural carbon emissions by promoting technological progress (Deng, Zhang (2024)). Furthermore, some scholars have discovered a nonlinear relationship in the impact of finance on agricultural carbon emissions, presenting an inverted “U-shaped” curve from stimulation to suppression (Liu et al., 2024; Xu et al., 2022). This is due to a decoupling between financial development and agricultural development, which will play a corrective role as the financial system matures.

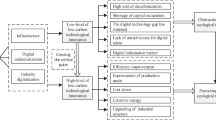

The issue of carbon emissions in agriculture not only concerns the ecological environment of each country but is also a key factor in global climate change. However, due to scale discrimination, the cost of credit allocation, and low financing efficiency, traditional finance is prone to uneven credit allocation, which severely restricts the support for low-carbon technological innovation and development in agriculture (Yin et al., 2019; Xiao et al., 2023). Digital inclusive finance primarily empowers traditional inclusive finance through digital technology, placing more emphasis on affordability, comprehensiveness, and commercial sustainability compared to traditional finance. It is not simply “Internet information technology + traditional financial services” but rather a new mode of promoting inclusive financial development through digital technology, encompassing a variety of business areas such as payments, financing, credit, insurance, wealth management, and credit (Li et al., 2022). Digital inclusive finance can break through the physical limitations of traditional financial branches with digital technology, improving the availability of financial products and services so that more individuals and businesses can enjoy them (Li et al., 2023). The rise of this financial model has brought new development opportunities to the agricultural field, especially in terms of capital flow, technological application, and market expansion (Li et al., 2023). This offers more possibilities for farmers and various new types of agricultural business entities to actively choose green production practices.

Some studies have found that digital finance can significantly slow down carbon emissions, mainly by promoting technological innovation and upgrading industrial structures to suppress the increase in carbon emissions (Cai & Song, 2022; Wu et al., 2022; Ma et al., 2022). It can also encourage enterprises to make reasonable use of their own factor endowments, achieving a rational allocation of resources to reduce the intensity of carbon emissions (Yang et al., 2023; Liu et al., 2022). Specifically, Chang (2022) empirically analyzed using a two-way fixed effects model, how digital finance can reduce agricultural carbon emissions by affecting farmers’ entrepreneurship and agricultural technological innovation. Sun (2022) verified through constructing a spatial Durbin model that digital inclusive finance has a spatial spillover effect on reducing agricultural carbon emissions, capable of driving adjacent provinces to achieve emission reductions. Su, Wang (2023), based on kernel density estimation and spatial autocorrelation analysis, found that the intensity of agricultural carbon emissions is continuously decreasing, and there is a certain misalignment between digital inclusive finance and the spatial overlay pattern of agricultural carbon emission intensity. Zhao et al. (2021) found that digital inclusive finance can suppress carbon emissions overall; from a detailed dimension perspective, its depth of use has a suppressive effect on carbon emissions, while the breadth of coverage does not have a significant suppressive effect, and the degree of digitization actually plays a promotional role in carbon emissions. Moreover, the suppressive effect of digital finance on carbon emissions is gradually weakening and exhibits a marginally decreasing non-linear characteristic (Xue et al., 2022), with significant regional heterogeneity between the two (Shi (2022)). From the perspective of digital finance on individual behaviors of farmers, as rational economic agents, their decision-making behavior is driven by interests. Faced with new technologies that can improve agricultural production efficiency, farmers will seize the opportunities provided by digital finance to overcome the dilemma of insufficient own funds and adopt agricultural technology (Zhou et al., 2022). In other words, digital finance can encourage small farmers to choose sustainable agricultural development by easing credit constraints (Zhao et al., 2022). Beyond easing credit constraints, digital finance can also encourage farmers to choose green control technologies by facilitating access to information and enhancing social trust (Yu et al., 2020).

Although many studies have focused on the relationship between digital inclusive finance and carbon emissions, offering some valuable insights, the characteristics of digital inclusive finance dictate its significantly more important role for the “long tail” groups (Li et al., 2022). In other words, the impact of digital inclusive finance on agricultural carbon emissions may be more pronounced. From the literature mentioned above, it is evident that existing research on digital inclusive finance and agricultural carbon emissions revolves around spatial distribution and intermediary impacts such as entrepreneurship and technological progress, overly emphasizing the impact of individual farmers on agricultural carbon emissions and neglecting the role of digital inclusive finance on rural business entities, that is, whether digital inclusive finance affects rural business entities thereby increasing or reducing agricultural carbon emissions? Based on this, this study selects a two-way fixed effects model and a panel threshold model to empirically test the impact of digital inclusive finance on agricultural carbon emissions and to analyze the moderating effect of agricultural green cooperatives.

The possible contributions are: First, this study enriches the theoretical research on the impact of digital inclusive finance on agricultural carbon emissions, helping to assess the social benefits of digital inclusivity and better address environmental issues; Second, it provides theoretical analysis and empirical testing of the nonlinear relationship between digital inclusive finance and agricultural carbon emissions, finding that the main aspects that have a suppressive effect on agricultural carbon emissions are the depth of use and the degree of digitization of digital inclusive finance; Third, it attempts to incorporate agricultural green cooperatives into the research framework to analyze their role in the process of digital inclusive finance affecting agricultural carbon emissions, finding a decoupling phenomenon between the two developments, offering new references for financial institutions on how to further support the development of various business entities.

The rest of this study is organized as follows: “Theoretical Analysis and Research Hypotheses” proposes the mechanisms and hypotheses linking digital inclusive finance with agricultural carbon emissions. “Research Design” details the methods and data used. “Empirical Results and Analysis” discusses the findings, and “Conclusion and Policy Implications” summarizes the main conclusions and policy implications.

Theoretical analysis and research hypotheses

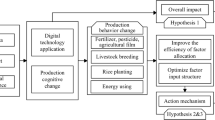

Digital inclusive finance can provide farmers with more convenient and reliable financial services, including loans, insurance, and payment methods (Li et al., 2022). These financial services can help farmers purchase more advanced agricultural equipment and technology, reduce reliance on traditional agricultural methods, improve productivity, and further lower carbon emissions (Liu et al., 2021; Yu et al., 2020). For instance, digital inclusive finance can offer farmers more convenient and flexible financing options, thereby encouraging innovation and sustainable development in the agricultural sector (Lee et al., 2022). Farmers can utilize digital inclusive finance to buy energy-saving and more efficient agricultural machinery, reducing energy consumption and carbon emissions. At this point, the widespread application of digital finance will improve the efficiency of information transmission, technological innovation, and resource allocation, making agricultural production methods smarter, more refined, and more sustainable (Jin et al., 2023). Meanwhile, digital inclusive finance influences agricultural carbon emissions by increasing farmers’ income levels. When the income levels of rural residents improve, farmers are more likely to shift from pursuing yield to pursuing sustainable development quality, which will contribute to green production behaviors and benefit the reduction of agricultural carbon emissions (Liu et al., 2022; Wang et al., 2021). Based on this, we propose the following hypothesis:

Hypothesis 1: Digital inclusive finance can have a suppressive effect on agricultural carbon emissions.

During the initial development stage of digital inclusive finance: on one hand, this new technology of digital inclusive finance has not yet accumulated to a considerable scale, unable to fully reflect the scale economy effect of data and other production factors (Brynjolfsson et al. (2019)). When the development level of digital inclusive finance exceeds a certain threshold, the marginal cost of its financial products and services tends to zero, meaning the suppressive effect on rural carbon emissions shows a marginally increasing trend; On the other hand, agricultural carbon reduction lacks the technical capacity to undertake investments in terms of capital input, facility accumulation, etc., i.e., the complementary investment of new technology is insufficient. Agricultural business entities need to rely on increased funding and policy incentives to invest in digital complementary technological equipment, creating a certain crowding-out effect on agricultural carbon reduction. Specifically, digital finance can promote economic growth in its initial development stage, but this will increase energy demand, leading to increased CO2 emissions (Liao, Ru (2022)). However, when the development level of digital finance is high, the expanding digital advantages will drive structural reforms and shift the economic transformation towards lower energy use and higher environmental protection modes (Song et al., 2023). At this point, digital inclusive finance will suppress agricultural carbon reduction. Based on this, we propose the following hypothesis:

Hypothesis 2: Digital inclusive finance has a non-linear impact on agricultural carbon emissions.

Encouraging the evolution of agricultural green cooperatives is vital for constructing a green, low-carbon, and circular development economic system, and it is a crucial aspect of China’s strategy to reach peak carbon dioxide emissions and carbon neutrality. Agricultural green cooperatives, as emerging agricultural business entities, often face financial constraints, hindering their transition and development. Digital inclusive finance avails financial services such as loans, financing, and insurance to these cooperatives, facilitating the procurement of eco-friendly equipment, the adoption of green agricultural technologies, and the improvement of agricultural production conditions (Yu et al., 2020). This financial assistance propels enterprises towards sustainable development (He et al., 2022). Moreover, digital inclusive finance enables the delivery of cutting-edge agricultural technologies and knowledge to farmers and agricultural enterprises via digital platforms and mobile payments, augmenting agricultural productivity, minimizing the utilization of pesticides and fertilizers, and mitigating adverse environmental impacts (Fang et al., 2021). Additionally, digital financial inclusion can bolster agricultural green cooperatives in broadening their markets and augmenting the value-addition and competitiveness of their products (Guo et al., 2022). Leveraging digital platforms and e-commerce channels, enterprises can engage and transact directly with consumers, offering green and organic agricultural products, fulfilling consumers’ demands for health and environmental conservation, and hence facilitating the enhancement of revenues and the reduction of emissions in agricultural products. In light of these observations, we formulate the subsequent hypothesis:

Hypothesis 3: Digital financial inclusion is capable of fostering the growth of green cooperatives in agriculture, subsequently suppressing agricultural carbon emissions.

In the agricultural production process, carbon emissions primarily originate from the use of chemical fertilizers, the operation of agricultural machinery, and soil management. Digital inclusive finance, by offering smart technologies, data analysis, and financial services, can provide farmers with more effective agricultural management and production methods, thereby reducing carbon emissions. However, this impact may not be immediately apparent and depends to a certain extent on the prevalence of digital inclusive finance and the acceptance level among farmers. This is because individuals with higher levels of education have a greater ability to acquire and understand new technological knowledge (Manda et al., 2016; Du et al., 2023). At the same time, rural residents with higher education levels are likely to choose low-carbon agricultural production methods, thereby contributing to the reduction of agricultural carbon emissions (Liu et al., 2024). It is evident that education level may have a certain impact on the relationship between digital inclusive finance and agricultural carbon emissions. With an increase in education level, the acceptance and usage of digital inclusive finance are likely to be higher. However, when the level of education is low, the impact of digital inclusive finance may be relatively small. This is because, in the initial stages, farmers may face multiple challenges such as the digital divide, lack of technological infrastructure, and unfamiliarity with new technologies and financial services, all of which could limit the role of digital inclusive finance in reducing carbon emissions (Li et al., 2023). In view of this, we propose the following hypothesis:

Hypothesis 4: A threshold effect exists concerning the impact of digital financial inclusion on agricultural carbon emissions.

The mechanism of impact in the theoretical analysis can be referred to Fig. 1.

Research design

Study area

China is the world’s largest emerging economy, with its carbon dioxide emissions accounting for about 30% of the global carbon emissions (Shan et al. (2020)). Additionally, as a major agricultural country, the resource endowments and industrial structures vary among its provinces, leading to spatial differences in agricultural carbon emissions. This presents typical characteristics of a developing country. Therefore, choosing China as the research area holds significant practical relevance. It’s worth noting that due to data availability reasons, Tibet, Hong Kong, Macau, and Taiwan are excluded, making the study area encompass 30 provinces, municipalities, and autonomous regions (Fig. 2).

Calculation of agricultural carbon emissions

Method and data source for estimating agricultural carbon emissions

The current methods for calculating agricultural carbon emissions mainly include the emission coefficient method, model simulation method, and field measurement method (Hu et al., 2023). Many scholars choose to use the emission coefficient method recommended by the IPCC 2006 “Guidelines for National Greenhouse Gas Inventories” to calculate the carbon emissions of the agricultural sector (Chen, Li (2020); Wang et al., 2020). The advantage of this method is that it can represent the macro level well, but its disadvantage is that it cannot detail production methods and crop varieties. Some scholars use the model simulation method to measure agricultural carbon emissions, such as Shabani et al. (2021) who used the Inclusive Multi-Model (IMM) to estimate agricultural carbon emissions in Iran, and Jordon et al. (2022) who used the RothC model to estimate the CO2 amount in agricultural lands in the UK. The advantage of this method is that the results are more accurate due to the use of actual multi-parameters for calculations, but the disadvantage is the complexity of parameter acquisition and the simulation process, often used for calculations within a certain ecosystem. Additionally, some scholars use the field measurement method to estimate agricultural carbon emissions, for example, Cui et al. (2021) measured the carbon emissions of the maize planting system in the North China Plain at the Wuqiao Experiment Station in Hebei Province. The advantage of this method is that the results are the most accurate and require fewer steps, but the disadvantages include long time expenditure, high cost of investment, and difficulty in data acquisition and analysis. Overall, considering the large time span, wide coverage, and macro-level research of the study problem, as well as issues with data availability, this paper chooses the carbon emission coefficient method for accounting for agricultural carbon emissions.

Crop production, as the most crucial component of agriculture, generates carbon emissions directly or indirectly due to human production activities during the cultivation process. This paper focuses on agriculture in a narrow sense (crop production). According to previous studies (Tian, 2014; Huang et al., (2019); Cui et al. (2021); Liu et al. (2021)), carbon emissions from crop production mainly originate from the following aspects: (1) Carbon emissions directly or indirectly caused by the input of agricultural materials such as fertilizers, pesticides, and agricultural films. (2) Carbon emissions resulting from the consumption of diesel fuel by agricultural machinery. (3) Carbon emissions caused by the consumption of electrical energy in irrigation. (4) Loss of organic carbon due to tillage and turning over of soil. Hence, the agricultural carbon emissions calculated in this paper include these four aspects. According to the emission coefficient method of IPCC (2006) and the method of Ding (2022), the following formula for calculating agricultural carbon emissions has been constructed:

In Eq. (1), C represents the total carbon emissions from crop production, Qi represents the input amount of the i carbon source, and εi represents the emission coefficient of the ith carbon source. The main carbon sources and their emission coefficients in crop production are shown in Table 1.

The data used in the calculation, such as diesel for agricultural machinery, equivalent pure volume of fertilizer, pesticide usage, agricultural film usage, effective irrigation area, crop sowing area, etc., all come from the “China Rural Statistical Yearbook”, “China Statistical Yearbook”, and National Bureau of Statistics for each year from 2011 to 2022. In this, the fertilizer is represented as the equivalent pure volume of fertilizer for that year, agricultural films are represented as the actual usage for that year, pesticides are represented as the actual usage for that year, diesel is represented as the actual usage for agricultural machinery for that year, irrigation is represented as the effective irrigation area for that year, and tillage is represented as the crop sowing area for that year.

Benchmark regression model

Basic model

The two-way fixed-effects model can simultaneously solve the omitted variable problems that do not change over time but vary across individuals, as well as those that do not vary across individuals but change over time (Shaymal and Emir, 2020). Based on the aforementioned analysis, this paper introduces the quadratic term of digital financial inclusion (\({{{lndif}}^{2}}_{{it}}\)), focusing on the significance of the coefficient (\({\alpha }_{1}\)) of this core independent variable, to test whether there is a nonlinear impact between agricultural carbon emissions and digital inclusive finance. The basic model constructed in this paper is as follows:

In this, i represents the i province, and t represents the t year. lnCit is the dependent variable. \({\alpha }_{0}\) is the intercept term. \({{lndif}}_{{it}}\) is the digital financial inclusion index, used to indicate the level of digital financial development. \({{{lndif}}^{2}}_{{\!\!it}}={{lndif}}_{{\!it}}\times {{lndif}}_{{\!it}}\) is the quadratic term of \({{lndif}}_{{it}}\), and it is the core explanatory variable for the inverted “U” curve. \({{Control}}_{{it}}\) represents control variables, and \({\varepsilon }_{{it}}\) is the random disturbance term. \({\mu }_{i}\) and \({\gamma }_{t}\) are, respectively, the province fixed effects and year fixed effects. Through the Hausman test, the results show that this study should choose the fixed effects model.

Moderated Effects Model

Based on the analysis of theoretical mechanisms and drawing inspiration from the moderation effect model by Hou et al. (2022), this study explores the influence of agricultural green enterprises on the effects of digital financial inclusion on agricultural carbon emissions. The relevant model settings are as follows:

In Eq. (4), \({lndif}\times {gc}\) represents the moderating variable.

Threshold regression model

Given that there is more than a single influencing factor in the process of digital financial inclusion on agricultural carbon emissions, the threshold variable rural human capital is introduced in conjunction with the theoretical analysis in the previous section in order to analyse the existence of a non-linear relationship between digital financial inclusion on agricultural carbon emissions that may be due to differences in the accumulation of human capital:

In Eq. (4), hc is the threshold variable, \({y}_{1}\) is the threshold value, and the set of control variables, consistent with those included in the moderated effects model.

Variable selection, and data source

Explained variable

Explained Variable: Agricultural Carbon Emissions (C). It should be noted that considering the availability of data, the agricultural carbon emissions discussed in this paper are relatively narrow in scope, specifically referring to the carbon emissions produced from input factors during the cultivation process in agriculture. The selection of indicators, methodologies used, and referenced sources have all been detailed thoroughly in section “Research design”.

Core explanatory variable

The core explanatory variable in this study is the Digital Finance Development Level (dif). This research utilizes the digital finance index issued by the Digital Finance Research Center of Peking University as a substitute variable. This index is assembled relying on the extensive data from Alipay Ant Financial transaction accounts, merging digital technology and financial services. The index provides a more insightful reflection of the digital finance development level across various provinces in China, ensuring high reliability and research value (Li et al., 2023; Huang et al., (2022)).

Additionally, the indicator system scrutinizes the dif meticulously across three dimensions: the breadth of coverage (cb), depth of usage (ud), and degree of digitization (dl). These dimensions are crucial in this study to independently evaluate their influence on agricultural carbon emissions, based on credible sources (Li et al., 2022).

Moderating variable

Agricultural green cooperatives serve as a crucial conduit to assist small-scale farmers and a significant platform to vitalize rural resource elements. Positioned as a novel form of agricultural operational entity, the green production activities of agricultural green cooperatives during pre-production, mid-production, and post-production phases often lead to escalated costs. Their evolutionary trajectory is susceptible to financial stringencies and assorted challenges, complicating their transition towards more sustainable, green practices (Yu et al., 2020; Liu et al., 2021). In this context, the number of actively operating green cooperatives in various provinces over the years is selected as the moderating variable, with data sourced from the “China Academy for Rural Development-Qiyan China Agri-research Database (CCAD), Zhejiang University”.

Control variables

In the related research on the impact of agricultural carbon emissions, the selection of control variables mainly includes the level of agricultural production, agricultural technology level, gross domestic product, and agricultural land area, etc. (Pata (2018); Wang et al., 2020; Haseeb et al., 2018; Chang, 2022). Based on existing research (Yang et al., 2023; Su & Wang, 2023), this study selects urbanization rate (ur), degree of openness (od), level of transportation infrastructure (ti), and agricultural disaster situation (ac) as the four control variables. Among them, ur is measured by the ratio of urban permanent population to total permanent population, od is measured by the total import and export volume to regional GDP, ti is measured by the logarithm of highway mileage, and ac is represented by the sown area of crops that have reduced production by more than 30% due to disasters.

Data sources and descriptive statistics

Considering data availability and continuity, this research focuses on the analysis of data from 30 provinces in Mainland China from 2011 to 2020 (excluding Tibet due to missing data). The dependent variable is calculated by the author, as detailed in section “Research design”. while the core explanatory variable is sourced from Guo et al. (2022), and control variables are derived from the “Rural Statistics of China” and the National Bureau of Statistics. A few of these variables had missing values in individual years that were filled in using interpolation. To mitigate the impact of heteroscedasticity, logarithmic transformations have been applied to relevant variables, and descriptive statistics are presented in Table 2.

Results and discussion

Measurement results of agricultural carbon emissions

Based on the above Formula (1), the agricultural carbon emissions of 30 provinces in China from 2011 to 2021 were measured, and Figs. 1 and 2 were drawn. Looking at the trend of agricultural carbon emissions (Fig. 3), China’s agricultural carbon emissions show an “inverted U-shaped” trend, first rising and then declining. As early as 2011, the “Twelfth Five-Year Plan for Controlling Greenhouse Gas Emissions” clearly proposed to “optimize the energy structure and accelerate the establishment of a low-carbon industrial system”; the government work report in 2014 proposed to “increase efforts on energy conservation and emission reduction, and strengthen the reduction of major pollutants”; in 2015, the Ministry of Agriculture of China proposed to focus on the prevention and control of agricultural non-point source pollution, and in the same year, it proposed the “zero growth target of fertilizers, gradually controlling the annual growth rate of fertilizer use within 1% from 2015 to 2019, and achieving zero growth in the use of fertilizers for major crops by 2020.” The agricultural carbon emissions began to decline after reaching a peak in 2015. It can be seen that the decrease in agricultural carbon emissions starting from 2015 is directly related to a series of low-carbon agricultural policies implemented by the Chinese government that year (Ji et al., 2023; Liu et al., 2022). Since then, the Chinese government has continuously implemented a series of policy combinations to promote energy conservation and emission reduction efforts. For example, in 2016, “Opinions on Implementing the National Strategy for Climate Change Response” proposed the goal of peaking carbon dioxide emissions by 2030 and having non-fossil fuels account for 20% of primary energy consumption; in 2017, “Opinions on Promoting Green Development” proposed the development concept of “green, low-carbon, and circular development,” emphasizing the acceleration of the energy revolution and industrial transformation and upgrading; and in 2020, the “National Determined Contributions on Climate Change” proposed to peak carbon emissions by 2030, committing to achieve carbon neutrality by 2060. The implementation of the above policy combinations has promoted the concept of energy conservation and emission reduction and has played a significant role in reducing China’s agricultural carbon emissions.

From the spatial and temporal distribution of China’s agricultural carbon emissions from 2011 to 2021, the changes in agricultural carbon emissions in the regions of East, Central, and South China are not significant (Fig. 4). Among them, Shandong, Henan, Hebei, Jiangsu, and Anhui have maintained relatively high levels of agricultural carbon emissions, with Shandong and Henan consistently ranking in the top two nationwide. The mentioned regions, mainly plains, are rich in arable land resources and have developed planting industries, serving as China’s major grain-producing areas, where more agricultural inputs lead to more agricultural carbon emissions. Compared to 2011, the agricultural carbon emissions in Xinjiang, Inner Mongolia, and Jilin increased in 2021, possibly due to the relatively poor resource endowments in these regions compared to the central region, leading to additional agricultural carbon emissions in the development process centred on farming agriculture. The agricultural carbon emissions in Guangxi, Western China, have decreased, which may be related to Guangxi’s vigorous development of low-carbon agriculture in recent years. Figure 5 shows the spatial and temporal distribution trends of China’s agricultural carbon emissions from 2011 to 2021, with the Z-axis representing agricultural carbon emissions, the Y-axis representing the north direction, and the X-axis representing the east direction. Green represents the east-west trend line, and blue represents the north-south trend line. From Fig. 5, it is observed that China’s agricultural carbon emissions are characterized by more in the east and less in the west, more in the north and less in the south, and are developing towards a trend of narrowing east-west gaps and widening north-south gaps. The spatial distribution characteristics in 2021 have changed compared to 2011, with agricultural carbon emissions gradually increasing from west to east, and the east-west gap has narrowed, mainly because the growth rate of agricultural carbon emissions in Xinjiang has significantly increased during the study period, faster than that of eastern provinces. In the north-south direction, the increase and decrease differences from north to south are more evident, and the total amount has risen, which is because the growth rate of agricultural carbon emissions in Inner Mongolia and Jilin is faster than that in the southern regions. Therefore, China’s work on agricultural carbon emissions should not only focus on the differences between the east and west but also pay attention to the differences between the north and south.

Baseline regression results

According to Table 3, the goodness of fit for the baseline regression model is excellent, at 0.9965 and 0.9966 respectively, indicating good explanatory power for changes in agricultural carbon emissions. Without including the squared term of digital inclusive finance (dif2), digital inclusive finance (dif) significantly promotes agricultural carbon emissions (ace), suggesting that dif contributes to an increase in agricultural carbon emissions. After adding the squared term, the coefficient of digital inclusive finance (dif) is significantly positive, and the coefficient of the squared term (dif2) is significantly negative, with stable coefficient values that pass the significance test at the 5% confidence level. This indicates that the relationship between digital inclusive finance and agricultural carbon emissions is nonlinear, consistent with findings by Chang (2022) and Xue et al. (2022). In the early stages of digital inclusive finance development, agricultural carbon emissions increase, but after digital inclusive finance crosses a critical value, this promotional effect turns into a suppressive effect, specifically showing an inverted “U-shaped” curve trend, supporting the “Environmental Kuznets Curve” hypothesis (Grossman, Krueger (1995); Kang et al., 2016). The above results confirm that hypotheses 1 and 2 are valid. According to the results, we can calculate the turning point of the inverted “U-shaped” curve (\({dif}=-0.7662/(2\times (-0.1019)\) = 3.7596). Specifically, when dif is less than 3.7596, dif tends to increase agricultural carbon emissions; when dif is higher than 3.7596, the development of dif helps to suppress agricultural carbon emissions.

The Solow growth model and new structural economics both emphasize the key role of technological advancement in promoting industrial upgrading and improving production efficiency. Combining empirical results, it can be seen that in the initial stage, the development of dif might promote technological upgrades in agriculture and expansion of production scale. More financial resources can enable farmers to access more advanced agricultural technology and equipment. At this time, the carbon reduction effect of technological progress requires a certain period, so it is more about the scale effect brought by digital inclusive finance, which increases agricultural carbon emissions while promoting the expansion of agricultural scale. In the accelerated development stage of dif, it will more likely support sustainable and environmentally friendly agricultural activities, such as organic agriculture and precision agriculture, which will help reduce agricultural carbon emissions (Jin et al. 2023). Meanwhile, dif might encourage more investment in human resources, capital, and other production factors, thereby promoting agricultural technological progress, such as smart agriculture, which can effectively reduce energy consumption and carbon emissions (Liu et al., 2022). Furthermore, as finance continues to develop, resource allocation will become more optimized, reducing ineffective and excessive investments, improving resource use efficiency, and lowering carbon emissions (Shen et al. 2023). At this point, the effect of technological progress is fully realized, achieving agricultural low-carbon technological innovation and thus reducing agricultural carbon emissions. Based on this, our proposed Hypothesis 1, that digital inclusive finance can reduce agricultural carbon emissions and that there is a nonlinear relationship between the two, is confirmed.

Robustness test

The research results indicate that digital inclusive finance has a significant inverted “U-shaped” nonlinear impact on agricultural carbon emissions. The paper verifies the robustness of this result by examining different dimensions and excluding some samples, as shown in Table 4. First, by examining the dimensions of coverage breadth, depth of use, and degree of digitization, it not only validates the aforementioned conclusion but also identifies the heterogeneous impacts of different dimensions of digital inclusive finance on agricultural carbon emissions. The results show that the depth of use and degree of digitization still have an inverted “U-shaped” nonlinear impact on agricultural carbon emissions. In line with the Environmental Kuznets Curve, it is observed that with the increase in the depth of use and degree of digitization of dif, agricultural carbon emissions first increase and then decrease, showing a nonlinear trend of change. Understandably, the depth of use and degree of digitization of dif deepen the dependence of agricultural development on digital finance, highlighting its carbon reduction effect, while the coverage breadth of dif mainly expands the coverage of financial services in agriculture without reflecting its carbon reduction effect. In the early stages of development, due to extensive production methods, disorderly use and consumption of resources, carbon emissions surge. However, with the development of digital inclusive finance, its depth and degree of digitization further improve the level of financial tool utilization and benefit, extending financial services vertically, effectively raising farmers’ environmental awareness and improving their production behaviors. As the agricultural economy develops, environmental pollution gradually decreases. This further explains that dif needs to be deeply integrated with agricultural carbon reduction to fully exert its effectiveness. Thus, it is proven that the impact of digital inclusive finance on agricultural carbon emissions mainly comes from the depth of use and degree of digitization of digital inclusive finance. The study by Zhao et al. (2021) found that the depth of dif use suppresses carbon emissions, while the degree of digitization promotes carbon emissions, which is different from the conclusions reached in this study. Analyzing the possible reasons for this is that the characteristics of dif determine that it is more effective in facing relatively underdeveloped areas, and the object of this study is agricultural carbon emissions, and the depth of use of dif can more deeply solve the financial difficulties faced in the process of agricultural development, thus suppressing agricultural carbon emissions.

To avoid the influence of individual extreme outliers, the related samples are tail-truncated by 1% at both ends. The results show that the coefficient of the linear term of digital inclusive finance (dif) is significantly positive, and the coefficient of the quadratic term (dif2) is significantly negative. Digital inclusive finance still has an inverted “U” shaped nonlinear effect on agricultural carbon emissions.

Endogeneity test

Considering that agricultural carbon emissions may have a certain time lag effect, meaning there could be autocorrelation between sequences, and that some significant factors affecting agricultural carbon emissions might have been overlooked when selecting control variables, both of these issues could lead to significant endogeneity bias in the analysis. Therefore, the Difference Generalized Method of Moments (Difference GMM) model is further used to conduct an endogeneity test on the econometric results. The results show that the coefficient of the linear term of digital inclusive finance (dif) is significantly positive, and the coefficient of the quadratic term (dif2) is significantly negative, indicating that digital inclusive finance still has an inverted “U” shaped nonlinear impact on agricultural carbon emissions. This shows that the results are robust.

Moderating effect

To further explore the moderating effect of green agricultural cooperatives on the impact of digital inclusive finance on agricultural carbon emissions, we introduce the green agricultural cooperatives (gc) and the interaction term between green agricultural cooperatives and the primary term of digital inclusive finance (dif×gc) into the baseline regression model (1). In the baseline regression model (2), we incorporate the green agricultural cooperatives (gc), the interaction term of green agricultural cooperatives with the primary term of digital inclusive finance (dif×gc), and the interaction term between green agricultural cooperatives and the secondary term of digital inclusive finance (dif2×gc) (Model (1) represents only the primary term dif, while Model (2) includes dif 2). The results are shown in Table 5.

Haans et al. (2016) noted that when the main effect is an inverted U-shape, the examination of the moderating effect primarily focuses on the sign and significance of the coefficient of the interaction term between the squared independent variable and the moderating variable. A coefficient less than zero indicates that the moderating variable enhances the positive or negative effect of the main effect, while the opposite suggests a weakening of the main effect. According to the results in column (2) of Table 4, the coefficient of the interaction term between the squared digital inclusive finance and green agricultural cooperatives (dif2×gc) is significantly positive. This implies that green agricultural cooperatives make the curve on both sides of the main effect’s inflection point flatter, thereby weakening the impact of digital inclusive finance on agricultural carbon emissions, thereby rejecting the original hypothesis. The reason behind this is that, as agricultural green cooperatives have invested in green technology and sustainable practices following traditional development paths, early experiences and habits have become a self-reinforcing process, leading to path dependence. When digital inclusive financial services are introduced, internal management and decision-making capabilities may reduce the dependency on external financial support, thus weakening the potential impact of digital inclusive finance. At the same time, with the strengthening of agricultural green cooperatives, resource optimization has been achieved to some extent, reducing the marginal effect of digital inclusive finance in promoting agricultural decarbonization. Moreover, the efficiency of resource allocation and use by agricultural green cooperatives may not meet expectations. Although digital inclusive finance provides funds to cooperatives, if these funds are not effectively used for low-carbon technology or green practices, their potential for carbon reduction may be weakened. In summary, under the current development model of digital inclusive finance, the stronger the agricultural green cooperatives, the less likely it is for digital inclusive finance to impact agricultural carbon emissions.

Threshold effect

Before analyzing the threshold effect, the number of thresholds should be determined. The study conducts “self-sampling method” 300 times, obtains the threshold test results, and then observes the F-statistics and P-values to determine the number of thresholds. According to the results in Table 6 and Fig. 6, human capital (hc) passes the double threshold test, and the subsequent sections will analyze using a double threshold model.

Using human capital as the threshold variable, where human capital is expressed as the weight of the number of students enrolled in higher education as a proportion of the total population. The regression results of the double threshold model for the impact of digital inclusive finance on agricultural carbon emissions are shown in Table 7. When hc ≤ 2.313, the estimated coefficient of digital inclusive finance is 0.0164 but not significant; when 2.313 < hc ≤ 2.443, the estimated coefficient of digital inclusive finance is significantly negative at −0.047; when hc > 2.443, the estimated coefficient of digital inclusive finance is significantly negative at −0.1493. This indicates that as hc crosses the threshold value, the absolute value of the estimated coefficient of dif increases, enhancing its suppressive effect on ace. Overall, the suppressive effect of dif on ace significantly strengthens as hc crosses the threshold value, thereby validating Hypothesis 4. Behavioral decision theory suggests that higher levels of education are usually associated with higher environmental awareness. When the education level of residents increases, they have the cognitive ability to grasp relevant knowledge and skills, which further influences economic decisions, allowing for better use of digital software and acceptance of new digital inclusive financial products (Li et al., 2022). At the same time, when the level of education is high, farmers have a clearer awareness of environmental protection and sustainable development, which is conducive to reducing agricultural carbon emissions (Hong et al., 2022).

Conclusions and recommendations

Conclusions

The rapid development of digital inclusive finance has brought about significant changes in agricultural production and operations, affecting agricultural input factors and carbon emissions. This study first selected six indicators to measure the carbon emissions of the planting industry. The results show that between 2011 and 2021, China’s agricultural carbon emissions presented an inverted “U” development trend, peaking in 2015 and then gradually declining. The overall trend shows an increase in the west and a decrease in the east, narrowing the gap between the south and the north. Subsequently, using panel data from 30 provinces in China from 2011 to 2021, the two-way fixed-effects model empirically tested the impact of digital inclusive finance on agricultural carbon emissions. The study found:

First, there is a significant nonlinear relationship between digital inclusive finance and agricultural carbon emissions, specifically characterized by a “first promoting, then suppressing” dynamic impact of digital inclusive finance on agricultural carbon emissions. Second, the depth of use and the degree of digitization are the main drivers for reducing agricultural carbon emissions within the scope of digital inclusive finance. Third, the moderating effect shows that there is a decoupling between the development of digital inclusive finance and agricultural green cooperatives, with no evidence of a mutually enhancing effect between them. Fourth, the impact of digital inclusive finance on agricultural carbon emissions exhibits significant threshold characteristics. As the accumulation of human capital increases, the suppressive effect of digital inclusive finance on agricultural carbon emissions gradually strengthens.

Recommendations

Based on the above conclusions, we can propose the following four policy recommendations:

Firstly, the government should formulate emission reduction and carbon sequestration measures for provinces with high agricultural carbon emissions. While ensuring food security, it should explore the path of high-yield and low-carbon agriculture to reduce emissions and increase carbon sequestration. The focus should be on the development of agricultural modernization and technological progress, improving production and operational efficiency, and reducing energy consumption. Secondly, the financial infrastructure in rural areas should be improved. The government should encourage, support, and guide the penetration of digital inclusive finance into rural areas, enhancing its popularity to meet the financial service needs of different farmers and agricultural business entities. Thirdly, financial institutions should fully understand the funding needs and actual development conditions of agricultural green cooperatives. Based on the cooperatives’ production and operational characteristics and business needs, they should precisely tailor financial products and services to match the development needs of agricultural green cooperatives. Meanwhile, agricultural green cooperatives should timely present their funding demands and business directions to financial institutions, establishing a regular feedback and communication mechanism to achieve deep integration and coordinated development between the two parties. Lastly, the farmer training and education system should be improved, enriching the training content and forms to enable farmers to master as many skills as possible to participate in the digital wave. The formulation and implementation of talent introduction policies should be increased, and various new types of agricultural business entities should enhance the introduction and training of agricultural professionals, fully leveraging the spillover effects of human capital. Meanwhile, farmers should fully embrace new advancements, achieving sustainable development of agricultural production and operations through new products and technologies.

Limitations and further research

This study has some limitations that should be considered in further research. First, the current research sample spans 11 years and only studies the overall sample of 30 provinces nationwide. Next, it could be considered to extend the sample period and divide the research into eastern, central, and western regions to explore the impact effects between different regions over long-term development. Secondly, this study takes China as an example; the next step could extend the research object to other countries to compare the similarities and differences between them. Finally, the role of digital inclusive finance in the development of agricultural green cooperatives, the deeper impact mechanism between the two, and how to achieve coordinated development between them require further study.

Availability of data and materials

All data can be downloaded from https://doi.org/10.6084/m9.figshare.26014120.v2. This data includes relevant data from the Digital Finance Research Center of Peking University and data released by the National Bureau of Statistics.

References

Bao B, Fei B, Ren G, Jin S (2024) Study on the impact of digital finance on agricultural carbon emissions from a spatial perspective: an analysis based on provincial panel data. Int J Low-Carbon Technol 19:497–507

Brynjolfsson E, Rock D, Syverson C (2019) Artificial intelligence and the modern productivity paradox. Econ Artif Intell: Agenda 23:23–57

Cai X, Song X (2022) The nexus between digital finance and carbon emissions: evidence from China. Front Psychol 13:997692

Chang J (2022) The role of digital finance in reducing agricultural carbon emissions: evidence from China’s provincial panel data. Environ Sci Pollut Res 29(58):87730–87745

Chen X (2020) Financial structure, technological innovation, and carbon emissions: also on the development of the green financial system. Guangdong Soc Sci 04:41–50

Chen Y, Li M (2020) The measurement and influencing factors of agricultural carbon emissions in China’s Western Taiwan straits economic zone. Nat Environ Pollut Technol 19:587–601

Cui Y, Khan SU, Deng Y, Zhao M (2021) Regional difference decomposition and its spatiotemporal dynamic evolution of Chinese agricultural carbon emission: considering carbon sink effect. Environ Sci Pollut Res 28:38909–38928

Deng Y, Zhang S (2024) Green finance, green technology innovation and agricultural carbon emissions in china. Appl Ecol Environ Res 22(2):1415–1436

Duan H, Zhang Y, Zhao J, Bian X (2011) Carbon footprint analysis of China’s farmland ecosystem. J Soil Water Conserv 05:203–208

Eggleston HS, Buendia L, Miwa K, Ngara T, Tanabe K (2006) 2006 IPCC guidelines for national greenhouse gas inventories

Fang D, Zhang X (2021) The protective effect of digital financial inclusion on agricultural supply chain during the COVID-19 pandemic: evidence from China. J Theor Appl Electron Commer Res 16(7):3202–3217

Fang L, Hu R, Mao H, Chen S (2021) How crop insurance influences agricultural green total factor productivity: evidence from Chinese farmers. J Clean Prod 321:128977

Fang Z, Gao X, Sun C (2020) Do financial development, urbanization and trade affect environmental quality? Evidence from China. J Clean Prod 259:120892

Feng G, Jingyi W, Fang W, Tao K, Xun Z, Zhiyun C (2020) Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ Q 19(4):1401–1418

Gong M, Li H, Dou X (2022) Research progress, hotspot exploration, and trend outlook of digital inclusive finance - based on citespace bibliometric analysis. Lanzhou Acad J 07:45–57

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Guo H, Gu F, Peng Y, Deng X, Guo L (2022) Does digital inclusive finance effectively promote agricultural green development?—a case study of China. Int J Environ Res Public Health 19(12):6982

Guo L, Guo S, Tang M, Su M, Li H (2022) Financial support for agriculture, chemical fertilizer use, and carbon emissions from agricultural production in China. Int J Environ Res Public Health 19(12):7155

Guo L, Zhao S, Song Y, Tang M, Li H (2022) Green finance, chemical fertilizer use and carbon emissions from agricultural production. Agriculture 12(3):313

Haans RF, Pieters C, He ZL (2016) Thinking about U: theorizing and testing U‐and inverted U‐shaped relationships in strategy research. Strateg Manag J 37(7):1177–1195

Haseeb A, Xia E, Danish, Baloch MA, Abbas K (2018) Financial development, globalization, and CO 2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25:31283–31296

He C, Li A, Li D, Yu J (2022) Does digital inclusive finance mitigate the negative effect of climate variation on rural residents’ income growth in China? Int J Environ Res Public Health 19(14):8280

Hong M, Tian M, Wang J (2022) Digital inclusive finance, agricultural industrial structure optimization and agricultural green total factor productivity. Sustainability 14(18):11450

Hou X, Yu G, Li X (2022) Risk aversion, non-pastoral use, and herders’ grassland transfer behavior. J Nat Resour 01:233–249

Hu Y, Zhang K, Hu N, Wu L (2023) A review of research on the calculation of agricultural carbon emissions in China. Chin J Eco-Agric 31(2):163–176

Huang W, Wu F, Han W, Li Q, Han Y, Wang G, Wang Z (2022) Carbon footprint of cotton production in China: composition, spatiotemporal changes and driving factors. Sci Total Environ 821:153407

Huang X, Xu X, Wang Q, Zhang L, Gao X, Chen L (2019) Assessment of agricultural carbon emissions and their spatiotemporal changes in China, 1997–2016. Int J Environ Res Public Health 16(17):3105

Ji X, Li Z, Zhang Y (2023) The impact of farmland circulation on agricultural carbon emissions and its spatial characteristics. Resour Sci 01:77–90

Jin S, Chen Z, Bao B, Zhang X (2023) Study on the influence of digital financial inclusion on agricultural carbon emission efficiency in the Yangtze river economic belt. Int J Low-Carbon Technol 18:968–979

Jordon MW, Smith P, Long PR, Bürkner PC, Petrokofsky G, Willis KJ (2022) Can regenerative agriculture increase national soil carbon stocks? Simulated country-scale adoption of reduced tillage, cover cropping, and ley-arable integration using RothC. Sci Total Environ 825:153955

Kang YQ, Zhao T, Yang YY (2016) Environmental Kuznets curve for CO2 emissions in China: a spatial panel data approach. Ecol Indic 63:231–239

Kumar A, Nagar S, Anand S (2021). Climate change and existential threats. In: Global climate change (pp. 1–31)

Lee CC, Wang F, Lou R (2022) Digital financial inclusion and carbon neutrality: evidence from non-linear analysis. Resour Policy 79:102974

Li H, Shi Y, Zhang J, Zhang Z, Zhang Z, Gong M (2023) Digital inclusive finance & the high-quality agricultural development: Prevalence of regional heterogeneity in rural China. PloS one 18(3):e0281023

Li H, Zhang S, Gong M (2022) An impact analysis of digital inclusive finance on family education investment. Credit Res 07:74–80

Li H, Zhuge R, Han J, Zhao P, Gong M (2022) Research on the impact of digital inclusive finance on rural human capital accumulation: a case study of China. Front Environ Sci 10:936648

Liao ZZ, Ru SF (2022) Theoretical analysis and empirical test of the superposition effect of digital finance development on the increase and decrease of carbon dioxide emissions. Inq into Econ Issues 9:117–132

Liu H, Wen S, Wang Z (2022) Agricultural production agglomeration and total factor carbon productivity: based on NDDF–MML index analysis. China Agric Econ Rev 14(4):709–740

Liu L, Wang G, Song K (2022) Exploring the role of digital inclusive finance in agricultural carbon emissions reduction in China: Insights from a two-way fixed-effects model. Front Environ Econ 1:1012346

Liu L, Zhang L, Li B, Wang Y, Wang M (2024) Can financial agglomeration curb carbon emissions reduction from agricultural sector in China? Analyzing the role of industrial structure and digital finance. J Clean Prod 440:140862

Liu M, Yang L (2021) Spatial pattern of China’s agricultural carbon emission performance. Ecol Indic 133:108345

Liu Y, Ji D, Zhang L, An J, Sun W (2021) Rural financial development impacts on agricultural technology innovation: evidence from China. Int J Environ Res Public Health 18(3):1110

Liu Y, Li Y, Wang W (2021) Challenges, opportunities, and actions for china to achieve “dual carbon” goals. China Popul Resour Environ 09:1–5

Liu Y, Liu C, Zhou M (2021) Does digital inclusive finance promote agricultural production for rural households in China? Research based on the Chinese family database (CFD). China Agric Econ Rev 13(2):475–494

Ma Q, Tariq M, Mahmood H, Khan Z (2022) The nexus between digital economy and carbon dioxide emissions in China: the moderating role of investments in research and development. Technol Soc 68:101910

Manda J, Alene AD, Gardebroek C, Kassie M, Tembo G (2016) Adoption and impacts of sustainable agricultural practices on maize yields and incomes: evidence from rural Zambia. J Agric Econ 67(1):130–153

Masson-Delmotte, V, Pörtner, HO, Skea, J, Buendía, EC, Zhai, P, & Roberts, D (2019). Climate change and land. IPCC Report

Muluneh MG (2021) Impact of climate change on biodiversity and food security: a global perspective—a review article. Agric Food Secur 10(1):1–25

Nayak D, Saetnan E, Cheng K, Wang W, Koslowski F, Cheng YF, Zhu WY, Wang JK, Liu JX, Moran D (2015) Management opportunities to mitigate greenhouse gas emissions from Chinese agriculture. Agric Ecosyst Environ 209(1):108–124

Okunlola FA, Osuma GO, Omankhanlen EA (2019) Agricultural finance and economic growth: evidence from Nigeria. Bus: Theory Pract 20:467–475

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Shabani E, Hayati B, Pishbahar E, Ghorbani MA, Ghahremanzadeh M (2021) A novel approach to predict CO2 emission in the agriculture sector of Iran based on inclusive multiple model. J Clean Prod 279:123708

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shan Y, Huang Q, Guan D, Hubacek K (2020) China CO2 emission accounts 2016–2017. Sci Data 7(1):54

Shaymal CH, Emir M (2020) Smoothed LSDV estimation of functional-coefcient panel data models with two-way fxed efects. Econ Lett 192:109239

Shen Y, Guo X, Zhang X (2023) Digital financial inclusion, land transfer, and agricultural green total factor productivity. Sustainability 15(8):6436

Shi, S (2022). Study on the impact of digital finance on carbon emissions. BCP Business & Manag 21:161–169

Shivanna KR (2022) Climate change and its impact on biodiversity and human welfare. Proc Indian Natl Sci Acad 88(2):160–171

Song X, Yao Y, Wu X (2023) Digital finance, technological innovation, and carbon dioxide emissions. Econ Anal Policy 80:482–494

Stocker TF, Qin D, Plattner GK, Tignor MMMB, Allen SK, Boschung J, Midgley PM (2013) The physical science basis. Contribution of working group I to the fifth assessment report of the intergovernmental panel on climate change. Comput Geom 18(2):95–123

Su P, Wang L (2023) The spatial effects and mechanisms of digital inclusive finance on the intensity of agricultural carbon emissions in China. Resour Sci 45(3):593–608

Su P, Wang L (2023) Spatial effects and mechanisms of digital inclusive finance on the intensity of China’s agricultural carbon emissions. Resour Sci 03:593–608

Sun L, Zhu C, Yuan S, Yang L, He S, Li W (2022) Exploring the impact of digital inclusive finance on agricultural carbon emission performance in China. Int J Environ Res Public Health 19(17):10922

Wang B, Zhang W (2016) Measurement and temporal and spatial differences of china’s agricultural ecological efficiency. China Popul Resour Environ 06:11–19

Wang G, Liao M, Jiang J (2020) Research on agricultural carbon emissions and regional carbon emissions reduction strategies in China. Sustainability 12(7):2627

Wang H, Guo J (2022) Impacts of digital inclusive finance on CO2 emissions from a spatial perspective: evidence from 272 cities in China. J Clean Prod 355:131618

Wang L, Vo XV, Shahbaz M, Ak A (2020) Globalization and carbon emissions: is there any role of agriculture value-added, financial development, and natural resource rent in the aftermath of COP21? J Environ Manag 268:110712

Wei Y, Li Y, Wu M, Li Y (2019) The decomposition of total-factor CO2 emission efficiency of 97 contracting countries in Paris Agreement. Energy Econ 78:365–378

West TO, Post WM (2002) Soil organic carbon sequestration rates by tillage and crop rotation: a global data analysis. Soil Sci Soc Am J 66(6):1930–1946

Wu M, Guo J, Tian H, Hong Y (2022) Can digital finance promote peak carbon dioxide emissions? Evidence from China. Int J Environ Res Public Health 19(21):14276

Xiao Q, Wang Y, Liao H, Han G, Liu Y (2023) The impact of digital inclusive finance on agricultural green total factor productivity: A study based on China’s provinces. Sustainability 15(2):1192

Xiong L, Qi SZ (2016) Financial development and carbon emission of Chinese provinces: based on STIRPAT model and dynamic panel data analysis. J China Univ Geosci (Soc Sci Ed) 16:63–73

Xu G, Li J, Schwarz PM, Yang H, Chang H (2022) Rural financial development and achieving an agricultural carbon emissions peak: An empirical analysis of Henan Province, China. Environment, Development and Sustainability, 1–27

Xue Q, Feng S, Chen K, Li M (2022) Impact of digital finance on regional carbon emissions: an empirical study of sustainable development in China. Sustainability 14:8340

Yang X, Wang Y, Wang J (2023) The impact of digital rural development on the intensity of agricultural carbon emissions and an examination of its mechanism of action. Stat Decis 11:66–71

Yang G, Ding Z, Wu M, Gao M, Yue Z, Wang H (2023) Can digital finance reduce carbon emission intensity? A perspective based on factor allocation distortions: evidence from Chinese cities. Environ Sci Pollut Res 30(13):38832–38852

Yin Z, Gong X, Guo P, Wu T (2019) What drives entrepreneurship in digital economy? Evidence from China. Econ Model 82:66–73

Yu L, Zhao D, Xue Z, Gao Y (2020) Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol Soc 62:101323

Yun TIAN, Zhang JB, HE YY (2014) Research on spatial-temporal characteristics and driving factor of agricultural carbon emissions in China. J Integr Agric 13(6):1393–1403

Zeng L, Li RYM, Zeng H, Song L (2023) Perception of sponge city for achieving circularity goal and hedge against climate change: A study on Weibo. Int J Clim Change Strateg Manag. https://doi.org/10.1108/IJCCSM-12-2022-0155

Zhang S, Dou W, Wu Z, Hao Y (2023) Does the financial support to rural areas help to reduce carbon emissions? Evidence from China. Energy Econ 127:107057

Zhang Y, Feng M, Fang Z, Yi F, Liu Z (2023) Impact of digital village construction on agricultural carbon emissions: evidence from mainland China. Int J Environ Res Public Health 20(5):4189

Zhao H, Yang Y, Li N, Liu D, Li H (2021) How does digital finance affect carbon emissions? Evidence from an emerging market. Sustainability 13(21):12303

Zhao P, Zhang W, Cai W, Liu T (2022) The impact of digital finance use on sustainable agricultural practices adoption among smallholder farmers: an evidence from rural China. Environ Sci Pollut Res 29(26):39281–39294

Zheng H, Wang H, Wang J, Li Y, Wang W (2023) Comparison of climate policies, energy structures, and carbon emissions in BRICS countries in the context of carbon neutrality. China Popul Resour Environ 06:67–79

Zhi J, Gao J (2009) Comparative analysis of carbon emissions from food consumption of urban and rural residents in China. Prog Geogr 03:429–434

Zhou Z, Zhang Y, Yan Z (2022) Will digital financial inclusion increase Chinese farmers’ willingness to adopt agricultural technology? Agriculture 12(10):1514

Acknowledgements

We are grateful for publicly available data from organizations such as the Office for National Statistics.

Author information

Authors and Affiliations

Contributions

Hanjin Li was responsible for the overall conceptualization, data collection, empirical modeling, writing and final checking of the article. Hu Tian was responsible for updating the data collection, analyzing the measurement results, expanding the introduction and literature review, and writing some of the proposed conclusions and study limitations. Xinyu Liu was responsible for the literature review, data estimation and analysis. JianSheng You was responsible for the elaboration of the article’s viewpoints, the measurement of agricultural carbon emissions, the production of pictures, the analysis of the empirical part, and the overall control of the article.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethics approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

All authors of this article have agreed to publish. All authors of this paper have agreed to participate and there is no dispute over the contribution role.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Li, H., Tian, H., Liu, X. et al. Transitioning to low-carbon agriculture: the non-linear role of digital inclusive finance in China’s agricultural carbon emissions. Humanit Soc Sci Commun 11, 818 (2024). https://doi.org/10.1057/s41599-024-03354-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03354-1

This article is cited by

-

Unlocking the potential: the role of digital inclusive finance in addressing energy poverty

Environment, Development and Sustainability (2025)

-

Has the application of agricultural green technologies achieved carbon reduction? Evidence from China

Clean Technologies and Environmental Policy (2025)