Abstract

This study examines the relationship between family-controlled companies and corporate social responsibility practice disclosure (CSRPD) and examines whether board independence influences this relationship. A self-constructed CSR disclosure index is developed to measure the CSRPD in a sample of 152 publicly listed companies in Saudi Arabia from 2016 to 2021. The findings from the pooled ordinary least squares (POLS) regression reveal that family-controlled companies exhibit lower levels of CSRPD than non-family companies. However, family-controlled companies with a higher number of independent directors on their boards show higher CSRPD, indicating a significant positive interaction effect of board independence. These results remain robust even after applying a variety of econometric techniques, including Newey-West regression, panel corrected standard error (PCSE), logistic regression, and addressing endogeneity problems, along with using different measures for CSRPD and family-controlled companies. These findings suggest that the governance structure of the boards, particularly independent directors, can support the prosocial and positive stimulus of socioemotional wealth (SEW) theory. Therefore, Saudi Arabian capital market regulators need to be aware of the importance of companies’ governance structures.

Similar content being viewed by others

Introduction

Corporate social responsibility (CSR) continues to be a significant topic in the corporate world. CSR emphasizes the necessity for companies to act ethically and consider the best interests of their operational environments (Benlemlih, 2017; Martinez-Conesa et al., 2017). In this context, stakeholders expect companies to explain their practices concerning employee welfare, environmental impacts, community engagements, governance practices, and human rights protections in their annual reports or standalone sustainability reports (Beji et al., 2021; Alotaibi and Hussainey, 2016).

Previous studies have demonstrated that CSR practices disclosure (CSRPD) significantly influences corporate financing decisions (Benlemlih, 2017), audit risk (Qasem et al., 2023b), investment efficiency (Shahzad et al., 2018), financial and market performance (Lu et al., 2022), foreign direct investment (Alregab, 2022), and serves as a significant intangible asset (Liu et al., 2021). According to de Villiers et al. (2024) and Su et al. (2016), investors place a great value on companies’ CSR practices and believe that these companies are better suited to address institutional voids and generate economic benefits.

Despite the importance of CSRPD, there are variations in the quality and quantity of associated information reported or communicated (Li et al., 2023; Villalonga and Amit, 2020). A few studies have demonstrated how corporate structure (e.g., family and non-family) can help in explaining the causes of these differences (see Al Fadli et al., 2022; Kavadis and Thomsen, 2023; Li et al., 2023). However, it is unclear if family companies engage in high-level practices and are more transparent in disseminating those practices to stakeholders than their non-family counterparts, which suggests that the level of social consciousness and responsibility among family companies may vary significantly (see Brunelli et al., 2024; Mariani et al., 2021; Li et al., 2023).

Extant literature has also shown that country-level institutions may have a significant impact on companies’ CSR practices, as well as the association between family companies and CSR disclosure (Ma, 2023; Shahid et al., 2022). For instance, family companies’ socially conscious behaviour may be explained by national or cultural differences (Dyer and Whetten, 2006). This is particularly true in developing countries, where policy and legal constraints may reduce family companies’ motivation to engage in socially conscious behaviour. Similarly, Le Breton-Miller and Miller (2016) indicated that family companies are drawn to both negative and positive extremes related to sustainable behaviour when they can develop crony-like associations with self-interested authorities.

In line with these notions, this study assumes that the governance structure of family companies may be influential in understanding how their CSR behaviour manifests. This is because socially conscious behaviour and the provision of high-quality information needed to reduce information asymmetry and drive investment levels may be a result of the governance structure (Ananzeh, 2022; Biswas et al., 2019; Chouaibi et al., 2022; Ebaid, 2022; El Ghoul et al., 2016; Jamali et al., 2008; López-González et al., 2019; Mariani et al., 2021). Therefore, in contrast to the dominant literature, this study focuses on a single country to investigate the CSR reporting practices of family and non-family-owned companies and examine the interplay between their governance structures, particularly board independence.

The environment where these issues are addressed is Saudi Arabia, because it is one of the Arab countries where the practice and reporting of CSR are still in their infancy (Al-Duais et al., 2021; Al-Gamrh and Al-dhamari, 2014; Issa, 2017). For instance, the global sustainability index ranks Saudi Arabia low among Arab and developed countries (Maswadi and Amran, 2023; Mahjoub, 2023). While the quantity of disclosed information on CSR practices is high, the quality remains low (Al-Gamrh and Al-dhamari, 2014; Alotaibi and Hussainey, 2016; Boshnak, 2022). Saudi Arabia is also a country that accounts for 25% of the Arab world’s gross domestic product (GDP) and is a major oil producer with other industries (e.g., petrochemicals, cement, and refining, among others) that could lead to high environmental pollution, which may have negative consequences for its people’s health (Al-Gamrh and Al-dhamari, 2014; Habbash and Haddad, 2020; Issa, 2017). In fact, in an effort to bring the country into line with global best practices, such as the principles of the Organization for Economic Cooperation and Development (OECD), the 2017 Saudi Code of Corporate Governance (SCCG) placed more emphasis on CSR initiatives.

Further, in terms of corporate structure, Saudi Arabia is a country where families are among the most significant economic entities. For instance, founding families hold 70% of publicly listed companies (Abdallah and Ismail, 2017; Alotaibi and Hussainey, 2016). Moreover, three Saudi families control 41% of executive positions and simultaneously dominate the boards of Saudi-listed companies (Al-Duais et al., 2021). Similarly, family members have strong family-oriented ambitions to warrant the sustainability of the family company and its role in society, which aligns with the socioemotional wealth (SEW) theory. This theory characterizes family-company-oriented goals as desires to preserve ownership, control, market self-identity, intergenerational transfer, and long-term orientation (Miroshnychenko et al., 2022). For instance, scholars like Cruz et al. (2014) reported that SEW can both promote and facilitate CSR activities.

Conversely, if the SEW is negative, Kellermanns et al. (2012) asserted that certain family companies may have little regard for non-family stakeholders. For instance, Kidwell et al. (2012), agency theorists, suggest that family businesses, despite their apparent strong family relationships and transgenerational intentions, may have strong incentives to exploit employees, expropriate minority shareholders, and instigate conflict in their local communities. Likewise, family companies typically have a lower proportion of independent, foreign, and highly educated directors (Beji et al., 2021; Vieira, 2018).

All these arguments suggest that Saudi family companies may disregard non-family stakeholders; however, the governance structure, particularly the degree of board independence, may be crucial in promoting the advantages of SEW by mitigating its drawbacks and augmenting the company’s long-term success. Given this premise, this study investigates the behaviours of family and non-family-owned companies in Saudi Arabia, as well as the impact of board independence on the dynamics between these types of companies in CSRPD. In a nutshell, the two questions addressed in this research are: 1) whether family control affects CSRPD for Saudi Arabian companies; and 2) what role board independence plays in shaping the behaviour of family control companies towards CSRPD.

Investigating these two pertinent issues enables the study to contribute to the relevant literature. For instance, this study appears to be the first to address the calls made by Li et al. (2023) and Krueger et al. (2021) for further research on family companies to shed light on the phenomenon within the particular context of the Arab world. For example, a detailed examination of 152 Saudi Arabian companies from 11 industry sectors from 2016 to 2021, using advanced econometric techniques, showed that family-controlled companies significantly underperformed in various CSR practices compared to non-family counterparts. Furthermore, the study found a strong negative association between family-controlled companies and CSRPD. These findings are robust against alternative measures of CSRPD in terms of both quality and quantity of information disclosed.

The study goes beyond demonstrating the direct association between family-controlled companies and CSRPD to illustrate the interacting effect of board independence, indicating that the more independent directors on the board, the greater the disclosure of CSR activities by family companies. This suggests that a deep understanding of the behaviour of family companies in Saudi Arabia requires knowledge of the governance structure of these companies. Thus, it is imperative for Saudi authorities to recognise that the board’s governance structure is critical in enabling companies to inform their employees about the goals of social responsibilities, thereby increasing their awareness and understanding of these obligations. These findings provide deeper insight into the corporate governance structure of Arab family companies and the role they play in ensuring that family companies engage in sustainable behaviour.

Literature review and hypothesis development

According to the stakeholder’s theory, the social environment in which a company operates is constituted by its stakeholders: both internal (e.g., employees, managers, and stockholders) and external (e.g., customers and suppliers) constituents whose values and goals are crucial to the company’s strategies and operations (Freeman, 1984; Mohammadi and Saeidi 2022). Therefore, companies must integrate significant stakeholders into their strategic planning and decision-making procedures (e.g., Donaldson and Preston, 1995; Jones, 1995). CSR represents one such strategic plan, facilitating management in fulfilling their moral, ethical, and social obligations, which are instrumental in building social legitimacy (Dyer and Whetten, 2006; Freeman and Dmytriyev, 2017; Godfrey, 2005), shaping corporate ethical identity (Dutta et al., 2022), and enhancing performance (Lu et al., 2022). Nonetheless, the ownership structures of companies, whether family or non-family, may influence the decision-making process about the inclusion of specific CSR practices within the strategic plan.

Family companies distinguish themselves from non-family companies by evaluating strategic decisions based on their economic (financial impact) and non-economic (non-financial impact) goals. The non-financial impact is often referred to SEW, representing the benefit family members derive from the company’s operations (Gómez-Mejía et al., 2007). The SEW theory elucidates the unique behaviour of family companies, emphasizing that their primary goal is to safeguard and enhance socio-emotional values and family needs (Berrone et al., 2012; Miroshnychenko et al., 2022). These distinctive features of family companies motivate them to demonstrate concern for their stakeholders through actions such as proactive engagement, environmental consciousness, and community investment to foster a goodwill climate (Cennamo et al., 2012; Martínez-Ferrero et al., 2016).

Notwithstanding the arguments in favour of family companies being socially responsible, there are other arguments that suggest that family companies could be irresponsible social actors, raising serious societal issues (Dyer and Whetten, 2006) and unwilling to improve the community in which they work. This could be because family companies are extremely self-interested and solely seek to safeguard their own narrow interests at the detriment of society as a whole (Morck and Yeung, 2004). For instance, Kellermanns et al. (2012) contended that family members may view family control and transgenerational intentions as emotional burdens. As such, family companies may focus more on family interests than stakeholders’ interests. Similarly, CSR activities may be considered long-term investments and costly, thereby leading to lower shareholder value in the short term (Masulis and Reza, 2015). All these indicate that the SEW effects may not be linked with stakeholders’ care or social good.

Empirical studies on the behaviour of family companies vary based on these two opposing ideas. For instance, Dyer and Whetten’s 2006 study on S&P 500 companies revealed that family companies exhibit greater social consciousness than non-family companies in several areas. The specifics of the findings showed that companies, whether family-run or not, promote positive social initiatives. Compared to their non-family counterparts, family companies show less concern for societal issues, likely due to their desire to protect their image, reputation, and assets. Another study by Liu et al. (2017) also reported that family companies are more engaged in CSR activities than their non-family counterparts, which supports their legitimacy and preserves SEW. This evidence is similar to Ma’s (2023) findings for a sample of Chinese companies.

According to the study conducted by Garcia‐Sanchez et al. (2021) using a sample of 956 listed companies from 2006 to 2014, family companies exhibit higher levels of CSR and better stakeholder orientation than non-family companies, even in a hostile economic environment. However, the study did not include Saudi Arabia. Similarly, family companies use CSR programs and strike a balance between the needs of internal and external stakeholders to safeguard their SEW (affective and social) in times of fierce competition, resource constraints, and austerity. Likewise, in times of strong competition, resource constraints, and austerity. This implies that family companies tend to avoid any irresponsible behaviour that may harm their family reputation and make their stakeholders dissatisfied, which is critical for proving substantial resources and ensuring their survival during trying times.

Another international sample used by Lopez‐Gonzalez et al. (2019) that focuses on America, Europe, Asia, Africa, and the Middle East revealed that family companies display greater socially responsible behaviour aimed at preserving their socioemotional endowments. Battisti et al. (2023) conducted a study on a sample of 730 American and European companies, which revealed that family companies show a higher level of social responsibility when compared to non-family companies. In the same vein, Fehre and Weber (2019) found that family ownership in German HDAX companies from 2003 to 2012 led to increased focus on CSR in management due to a desire for socioemotional benefits. Madden et al. (2020) also reported a similar result.

Cabrera-Suárez et al. (2014) found that family companies with greater family participation exhibit higher levels of sustainability commitment and are more proactive when it comes to CSR activities using a sample of private Spanish companies. Shahzad et al. (2018) performed a comparable study utilizing a sample of Pakistani companies, which revealed that family-run companies are more inclined to participate in CSR initiatives to meet their non-economic objectives. Sharma et al. (2020) reported comparable outcomes for a sample of Indian family companies. A study by Campopiano and De Massis (2015), which used a sample of 98 large and medium-sized Italian companies, also documented that family companies disseminate a wider range of CSR reports, place more attention on various CSR issues, but are not as adherent to CSR standards. Sun et al. (2024) found a positive relationship between family ownership and control and economic, social, and environmental (ESG) scores in another sample of 1151 Chinese companies between 2014 and 2019. A distinctive study by Alazzani et al. (2018) also documented the positive role of royal family members on BODs in influencing the CSR reporting of selected GCC based companies.

Besides studies that found positive influence and a higher level of CSR reporting by family companies, other findings that focused on some aspects of CSR measurement, in particular environmental investments, also indicated that family companies engage in environmental activities. For instance, Abeysekera and Fernando’s (2020) analyses of companies in the US indicated that family companies are more responsible to shareholders than non-family companies when engaging in environmental investments. Rubino and Napoli (2020) also found that Italian family companies have better environmental performance compared to their non-family counterparts. All these suggest that family-controlled companies place more emphasis on SEW, such as reputation, longevity, and maintaining a positive image.

In contrast to the aforementioned results, Cruz et al.‘s (2014) examination of European companies revealed that family companies can be both irresponsible and socially responsible. The authors attributed this to SEW bias and excessive external spending. Furthermore, the authors find that family companies engage more in social categories associated with external stakeholders (community and environment) than those associated with internal stakeholders (governance and employees). This indicates that family companies can influence social norms in both positive and negative ways.

Block and Wagner (2014a) offer evidence to support this claim by showing that US family companies can be both responsible and irresponsible. The results of their investigation demonstrated that family ownership had a negative influence on CSR dimensions pertaining to the community but a positive impact on CSR dimensions pertaining to the environment, employees, diversity, and product quality. According to Block and Wagner (2014b), founders and family ownership are negatively associated with CSR, but their very existence has a positive influence. Memili et al. (2017) similarly found a negative association between family engagement and CSR initiatives. Biswas et al. (2019) found comparable findings for a sample of Bangladeshi companies, indicating that family ownership and control lower CSR reporting levels, particularly in the areas of environmental and employee disclosure. According to El Ghoul et al. (2016), family-controlled companies perform worse in terms of CSR across a sample of East Asian companies. This finding aligns with the expropriation hypothesis of family control. Other related studies have also documented that controlling shareholders are correlated with disclosing less CSR information (Ananzeh et al., 2023; Bartkus et al., 2002; Dam and Scholtens, 2013).

Nekhili et al. (2017) discovered that family companies disclose less information about their CSR plans than non-family companies, using longitudinal archival data from a French context. Aman et al., (2021) examined the annual reports of 771 listed Malaysian companies’ and found a negative relationship between family ownership and CSR reporting. According to a study by Gavana et al. (2023), which included a sample of non-financially listed companies from French, German, Italian, Spanish, and Portugal, family directors had a detrimental effect on the corporate sustainability performance of family-controlled companies. Cabeza-García et al. (2017) also found that family ownership and governance negatively affected the companies’ adherence to CSR activities of Spanish non-financial listed companies. Alsaadi (2022) showed comparable results using a sample of companies from 14 different European countries.

According to Miroshnychenko and De Massis (2022), an examination of 2032 publicly traded companies across 45 countries and 19 industrial sectors, family-controlled companies exhibit poorer sustainability responsiveness in comparison to non-family companies. The authors suggest that this is because family-controlled companies generally employ fewer green product development and pollution control strategies than their counterparts. Furthermore, in developing countries and within the industrial and utility sectors, the sustainability practices of family-controlled companies are noticeably deficient.

However, Venturelli et al. (2021) documented a greater propensity for family companies in Italy to implement rather than communicate CSR practices. They found that while family engagement has a negative impact on CSR communication, family-controlled companies and CSR practices are positively correlated. Strong control and involvement by family members also negatively influence CSR communication. Other studies focusing on certain areas of CSR, such as environmental performance, have also documented the negative impact of family involvement (e.g., Dal Maso et al., 2020; Miroshnychenko et al., 2022). Another study by Al Fadli et al. (2022) that focused on a sample of 80 Jordanian companies between the periods of 2006 and 2015 revealed that family ownership has a negative impact on the extent of CSR disclosure. Collectively, these findings provide a considerable mix of evidence regarding the impact of family involvement on CSR.

Hypothesis development

Family control and corporate social responsibility practices disclosure

The stakeholder’s theory posits that companies should commit to being socially responsible in their way of responding, fulfilling, and promoting stakeholder interests (Freeman, 1984). However, extensive literature indicates differences in CSRPD between family and non-family companies (Brunelli et al., 2024). According SEW theory, family companies aim to transfer companies’ management to subsequent generations and prioritize long-term over short-term profit. Thus, family companies are likely to focus on long-term investments such as sustainable practices or behaviour. This implies that most family companies would engage in high-level sustainable practices and publicize these practices to the public in their annual reports.

Contrary to the theoretical premise of stakeholder and SEW’s theories, the agency theory posits that family companies might prioritize their continuity over concerns for environmental and social issues. Additionally, despite potential intergenerational motivations and long-term stability within the society, family companies could exhibit lower levels of CSR due to distinct governance dynamics (Broccardo et al., 2019). Notably, lower information asymmetry between family owners and managers may reduce the utility of CSR information as a control mechanism in family companies (Brunelli et al., 2024; Ho and Wong, 2001). Therefore, these companies might not prioritize transparency in CSR information to their stakeholders. This does not imply an absence of agency conflicts in family companies, conflicts between majority and minority shareholders are most prevalent, as the dominant owners potentially expropriating resources at the expense of minority shareholders for personal benefits (DeAngelo and DeAngelo, 2000; El Ghoul et al., 2016; Jensen and Meckling, 1976). Hence, resources intended for CSR-related initiatives may be redirected to other projects, leading to lesser engagement in CSRDP among family-controlled companies, contrasting the broad stakeholder and SEW perspectives on CSR disclosure with the specific predictions of agency theory, particularly the expropriation hypothesis of family control. Thus, the first hypothesis suggests that:

H1: Family control is negatively associated with CSRDP

The interaction of board independence on the association between family control and corporate social responsibility practices disclosure

Having discussed the contradictions in the empirical literature regrading whether family-controlled companies engage extensively in CSRPD than their non-family counterparts, it is crucial to consider how the make-up of the board of directors would contribute to improving the level of disclosed practices. In the realm of agency theory, the board of directors (BODs) is considered as an internal governance mechanism responsible for supervising and monitoring managers’ behaviour and decision-making processes, such as sustainable policies and strategies, in which managers may hesitate to invest because such investments provide no immediate benefits (Fernández‐Gago et al., 2018; Jensen and Meckling, 1976; Jeanne et al., 2023). Thus, an effective board should be able to act in the best interest of shareholders and stakeholders by applying a stakeholder model of corporate governance (Garcia-Torea et al., 2016; Webb, 2004).

For the BODs to function effectively, especially when decision-making relates to disclosure practices, the independence of directors is fundamentally important. Independent directors, not being members of the management team, are therefore less susceptible to pressure from shareholders and managers. They also ensure that managers utilize societal resources effectively and ethically (Al Amosh and Khatib, 2022; Garas and ElMassah, 2018; Jo and Harjoto, 2012). As such, independent directors may be instrumental in enhancing the quality of disclosure and guaranteeing that companies are transparent in disclosing information to stakeholders in a timely manner (Alodat et al., 2023; Ananzeh, 2022; Chau and Gray, 2010). Additionally, independent directors have a broader viewpoint that extends beyond the shareholders’ interests and encompasses philanthropic endeavours, environmental performance, and social responsibility (Husted and de Sousa-Filho, 2019). As a result, they possess an intense understanding of how to enhance or maintain the company’s legitimacy (Al Amosh and Khatib, 2022) and add value to CSR reporting credibility (Dah and Jizi, 2018).

Indeed, empirical evidence from prior studies has consistently demonstrated that an increased presence of independent directors exerts a significant positive influence on CSR disclosure (Al-Qudah and Houcine, 2023; Bataineh et al., 2023; Cuadrado-Ballesteros et al., 2015; Ebaid, 2022; Fernández‐Gago et al., 2018; Gavana et al., 2023; Garas and ElMassah, 2018; Garcia-Torea et al., 2016; Jo and Harjoto, 2012; Mousa et al., 2018; Webb, 2004; Zaid et al., 2019), particularly in the realms of social (Husted and de Sousa-Filho, 2019); environment (de Villiers et al., 2011); and governance (Beji et al., 2021). In contrast, Issa (2017) and Alotaibi and Hussainey (2016) reported a negative association between the presence of independent directors and CSR reporting within the Saudi Arabian market.

In the specific context of family-owned companies, prior researchers have asserted that one of the key determinants of sustainability in family companies is the percentage of independent directors on the board (Broccardo et al., 2019; El Ghoul et al., 2016; Mariani et al., 2021). However, the majority of research, including that by Cuadrado-Ballesteros et al. (2015), found no significant effect of independent directors on CSR reporting. In the similar vein, the research findings of Biswas et al. (2019) revealed that corporate governance significantly increases the level of CSR disclosure of Bangladeshi companies, but board independence is insignificantly correlated with CSR disclosure. Based on this, the authors came to the conclusion that family companies adopted the practise of having more independent directors on boards in order to conform to the new regulation on corporate governance.

Furthermore, several studies on sustainability reporting, including that by Chau and Gray (2010), have posited that the inclusion of independent directors on corporate board can alleviate the detrimental effect of family ownership on disclosure practices. This is because independent directors can ensure stakeholder demands are met and enhance transparency. For instance, Fernández‐Gago et al., 2018 contended, from a legitimacy theory perspective, that board independence promotes social responsibility disclosure, thereby enhancing the sustainability of Spanish companies’ operations.

Al Amosh and Khatib (2022) have also demonstrated that board independence slightly enhances the positive relationship between family ownership and CSR reporting in the context of Jordanian companies. This suggests that a higher percentage of independent directors on the board may improve family owners’ perceptions of the value of disclosing CSR information, this may be driven by a desire to meet stakeholder expectations and maintain legitimacy. Because independent directors are conscious of their reputation and image, likely ensure that companies engage in CSR activities that align with societal values. Thus, their presence on the board can enhance the benefits of SEW and mitigate its drawbacks (Fernández‐Gago et al., 2018).

Given the benefit of having more independent directors on board, it can be concluded that board independence is an essential instrument for monitoring all agency actions, improving transparency and governance, and encouraging family companies to pursue CSR-related strategies and reporting. This may also amplify the need for family owners to preserve of SEW, thereby satisfying stakeholders’ needs and enhancing the long-term value of the company (Brunelli et al., 2024). In Saudi Arabia, for example, board is expected to build plans and specify the appropriate techniques for presenting social initiatives by developing measures that link the company’s success to its social initiatives and compare it with other companies engaged in similar initiatives (Al-Duais et al., 2021; Issa, 2017). This suggests that the stakeholder model of corporate governance should be followed by the board of directors, ensuring transparency in the disclosure of CSR practices (Webb, 2004; Garcia-Torea et al., 2016). A stakeholder model of corporate governance is one in which the board of directors acts in a socially responsible manner. Thus, this study adopts the stakeholder perspective of corporate governance, which views board independence as a mechanism for control and monitoring, ensuring that companies are accountable to their stakeholders. Consequently, the next hypothesis posits that board independence positively influences the relationship between family-controlled companies and CSRDP.

H2: Board independence positively interacts with the association between family control and CSRDP.

Research methodology and data

Data and sample

To study potential differences in CSR practices between family-owned and non-family-owned companies, in addition to examine the significant influence of board independence, a sample of 154 non-financial companies listed on the Saudi Arabian capital market (SACM or Tadawul) over the of 2016 and 2021 period (837 company-year observations) was employed. These companies spanned 11 sectors, in line with the Tadawul classification (see Table 1). The sample periods are notably broader than those used by previous studies (e.g., Al-Gamrh and Al-dhamari, 2014; Bazhair, 2020; Issa, 2017; Boshnak, 2022; Maswadi and Amran, 2023). For example, recent research by Maswadi and Amran (2023) and Boshnak (2022) used a sample of 114 companies for the year 2017 and the top 70 companies between 2016 and 2018. The research objectives of these earlier studies differ somewhat from those of the present study.

To achieve corporate efficiency and economic growth, the Saudi government unveiled Saudi Vision 2030, a strategic plan emphasizing the sustainability of social development goals (Alregab, 2022; Ammer et al., 2020; Boshnak, 2022; Qasem et al., 2022). Therefore, the study’s sample period begins in 2016. Additionally, the time period falls within the 2017 debut of the upgraded SCCG. Both policies aimed to enhance Saudi companies’ CSR reporting. Data on CSR disclosures, family control, and other aspect of corporate governance variables were manually gathered from companies’ annual reports accessible on the Tadawul website. The Thomson Reuters DataStream database was used to obtain financial information.

Variable measurement

Dependent variable: corporate social responsibility practices disclosure

The dependent variable under examination in this study is the CSRPD. Prior literature delineates CSR into several practices, which are often classified into different subthemes. To determine the quality of CSRPD within the annual reports of the sampled companies, several methodological steps were undertaken. Initially, a thorough review of previous studies, particularly those conducted in settings akin to the SACM (e.g., Al-Gamrh and Al-dhamari, 2014; Boshnak, 2022; Ebaid, 2022; Habbash, 2016; Issa, 2017; Qasem et al., 2023b) or other emerging markets (e.g., Alkayed and Omar, 2023; Alshbili et al., 2020; Ananzeh, 2022; Ananzeh et al., 2024; Badru and Qasem, 2024; Dakhli, 2021; Ullah et al., 2019; Wan-Hussin et al., 2021; Zaid et al., 2019, 2020), was conducted to determine the items and categories of CSR practices investigated. Subsequently, these identified categories and items were scrutinised to choose those that are most appropriate to the Saudi context (Ebaid, 2022). Furthermore, guidance from The Global Reporting Initiative (GRI-G4), ISO 26000, and the Capital Market Authority (CMA) ESG disclosure guidelines for 2022, focusing on environmental, economic, and social aspects, were taken into account in creating the checklist for each category of information. As a result of these deliberations, a comprehensive checklist comprising 37 disclosure items was formulated, encompassing six information categories: community, customer, employees, energy, environment, and products and services. This checklist aligns with prior research focusing on the SACM (Al-Gamrh and Al-dhamari, 2014; Boshnak, 2022; Alotaibi and Hussainey, 2016; Ebaid, 2022; Habbash, 2016; Habbash and Haddad, 2020; Issa, 2017; Mahjoub, 2019; Qasem et al., 2023b). However, this checklist is slightly different from those employed by Al-Gamrh and Al-dhamari (2014) and Issa (2017) in the SACM, by considering CMA ESG disclosure guidelines 2022 and some disclosure items related to the Saudi environment such as Ongoing charity (WAGFF), Charitable society for the holy Quran memorisation, and others disclosure related to Sharia activities.

Finally, based on the checklist, a manual content analysis was conducted to assess the CSR practices disclosed in the sampled companies’ annual reports. This comparison of CSRPD items, as per the checklist, helps to assess the quality of disclosure. According to specified criteria, content analysis is employed to transform text (or content) into codes for different categories (Ebaid, 2022; Ullah et al., 2019). This technique has been widely employed by scholars in the field of CSR to evaluate both the quality and quantity of companies’ CSRPD (e.g., Badru and Qasem, 2024; Boshnak, 2022; Habbash and Haddad, 2020; Hussainey et al., 2003).

Each CSR practice, if disclosed, within the company’s annual reports, is assigned a score in accordance with the items listed on the checklist. Scores are graded on a scale range from zero (0) to three (3) (see Appendix A). Companies receive a score of zero (0) if they do not provide information regarding their CSR practices for a specific index item. A CSR index is calculated for each company once scores have been assigned to each item on the checklist. This computation involves dividing the sum of scores awarded to the company by the total number of items (see Equation 1).

where CSRPDj = The company’s CSRPD score ranging from 0 to 3.

nj = Sum of 37 items for jth company.

Xij = The ith item receives a score of 3 if the company disclosed quantitative data, a score of 2 if the company disclosed qualitative data with detailed explanation, a score of 1 if the company gave generic qualitative data, and a score of 0 if no data was released.

Independent variables

Family control

A company is deemed to be family-controlled when a specific proportion of its outstanding shares is held by family members. This measurement has been extensively used by prior literature that focused on family companies to measure the extent of family ownership within a company (Al-Duais et al., 2021; Jaggi et al., 2009; Nekhili et al., 2017; Reddy and Wellalage, 2023; Saeed et al., 2023). According to Reddy and Wellalage (2023), this measurement is assumed to address issues associated with the arbitrary dichotomization of variables. Beyond previous studies, this study used a varied percentage threshold for family control ownership to identify family-controlled companies.

Board independence

Board independence (BIND) is the interacting variable in this study. It is defined as the percentage of independent directors on the board (Ma, 2023; Qasem et al., 2023a, 2023c; Zaid et al., 2020).

Control variables

In accordance with the prior studies on CSRPD (e.g., Al-Gamrh and Al-dhamari, 2014; Al Amosh and Khatib, 2022; El Ghoul et al., 2016; Issa, 2017; Ma, 2023; Memili et al., 2017; Saeed et al., 2023; Sun et al., 2024; Zaid et al., 2020), a set of company-specific and corporate governance variables were integrated into the study model to account for other factors that may influence a company’s CSRDP.

The study considered several corporate governance variables: (1) board size (BSIZE), denoting the total number of directors on the board; (2) ownership concentration (OWCO), indicating the proportion of shares held by major shareholders of the company (>5%); (3) institutional investors’ ownership (IOW), calculated as the percentage of shares held by institutional investors; (4) foreign ownership (FOWN), representing the percentage of shares owned by foreign directors of the company.

Other company-specific variables considered in the model are financial in nature. These include: (1) company age (FAGE), measured as the natural logarithm of the number of years since the company was incorporated; (2) sales growth (SGROWTH), calculated by subtracting sales in year t from sales in year t - 1 and dividing by sales in year t – 1; (3) return on assets (ROA), measured as net income to total assets; (4) company size (FSIZE), the natural logarithm of the company’s total assets; (5) the debt ratio (LEVGE) computed as the total debt to total assets ratio; (6) the market-to-book ratio (MTB), calculated by dividing the company’s market capitalization by its book equity; (7) loss (LOSS), a dummy variable denoting 1 if the company has a loss and 0 otherwise; (8) systematic risk (BETA), where market risk is defined as the relationship between stock volatility and market volatility. The study also controlled for the company’s industry classification (sector) and the year’s effect (year). This is crucial as much research asserts that CSRPD is an industry-specific characteristic. Therefore, failing to account for industry impacts may lead to biased conclusions (Block and Wagner, 2014b).

Model specification

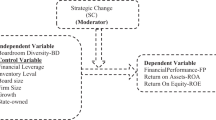

The following model is estimated to assess the relationship between family ownership and CSRPD, alongside the interacting effect of board independence:

Empirical results

Descriptive statistics

Table 2 shows the descriptive statistics and the results of the univariate mean difference analysis. Panel A of Table 2 exhibits the summary statistics for the study variables, where Panel B presents the findings of the Mann–Whitney U-test for the univariate test. This test facilitates comparison CSRPD and other company characteristics between family-controlled and non-family-controlled companies. As per Panel A of the table, the mean (median) CSRPD scores for the Saudi companies over the 2016–2021 period is 0.991 (33%), with values ranging from 0.000 to 2.784 (out of a possible 3). This finding aligns with prior research conducted within Saudi Arabia, such as the studies by Qasem et al. (2023b) documenting 33%, Ebaid (2022) reporting 27%, Issa (2017) observing 17%, Habbash (2016) discovering 24%, Abdulhaq and Muhamed (2015), and Al-Gamrh and Al-dhamari (2014) indicating 36% and 16.5%, respectively. These results collectively demonstrate a consistent trend of comparatively lower average CSR scores observed among Saudi companies. Regarding the independent variables, the mean (median) percentage of family ownership (Family) is 6.948% (0.001%). The proportion of board independent ranges from 0 to 100 percent, with a mean of 0.476 (47.6%) and a median value of 0.444 (44.4%).

As for the control variables, the mean of BSIZE is roughly eight directors. The average of OWCO is 35.851%, whereas the mean values of IOW and FOWN are 8.588% and 1.391%, respectively. Concerning the financial characteristics of the company, FAGE has a mean value of 3.146, SGROWTH stands at 0.157, ROA at 3.669%, FSIZE at 14.605, LEVGE at 24.360%, MTB at 2.388, LOSS at 0.278, and BETA at 1.055.

Based on the results presented in Panel B of Table 2, the scores for CSRPD and its six constituent dimensions are significantly lower in family-controlled companies compared to non-family companies. This indicates a lesser inclination among family-controlled companies to disclose their CSR practices compared to their non-family counterparts. In addition, family-controlled companies show significantly lower BIND, BSIZE, OWCO, IOW, and FOWN compared to non-family companies. Moreover, the results show that family-controlled companies tend to be older and have higher financial performance than non-family companies. This may suggest that family-controlled companies in SACM are more interested in immediate financial gains than potential long-term benefits that may arise from investments in CSR activities. However, in terms of SGROWTH and FSIZE, family-controlled companies have a significantly lower levels of sales growth and are significantly smaller than non-family companies. These significant differences between family and non-family companies underscore the necessity of incorporating other corporate governance and company-specific characteristics variables in the regression model as discussed in Section 3.3.

Correlation matrix

Table 3 displays the correlation matrix for the variables under investigation in this study. The tabulated results reveal significant correlations between the variables. For example, the coefficient between Family and CSRPD shows a substantial negative association, in line with findings presented in Panel B of Table 2. In addition, the correlation study results indicate minimal to negligible correlations among variables. Specifically, there are no instances of large coefficients between independent variables or between independent and dependent variables. This suggests the absence of multicollinearity concerns in this research. Furthermore, the variance inflation factor (VIF) values in Table 4 are below 10.

Regression results

In Table 4, the POLS regression findings for the association between Family and CSRPD and the interacting effect of BIND, after controlling for the year- and industry-fixed effects and employing two-way cluster-robust standard errors (company and year), are presented. This approach allows the study to address issues that might arise from heteroscedasticity and autocorrelation (Al-Qadasi et al., 2023; Ma, 2023; Petersen, 2009; Qaderi et al., 2024). Additionally, to alleviate the influence of outliers, all continuous variables are winsorized at the 1st and 99th percentiles. Therefore, Column (1) provides the regression findings for the association between Family and CSRPD, while Column (2) displays the findings for the interacting effect of BIND on the family-CSRPD nexus.

According to the results reported in Column (1), there is a statistically significant negative relationship (β = −0.004, p < 0.001) between family-controlled companies and CSRPD. This finding contradicts the SEW theory’s assertion that family ownership enhances companies’ disclosure and sustainable practices. However, it is offset by the family’s motivation for non-economic utility gains, such as longevity and preserving a positive family image and reputation resulting from ownership stakes. Consequently, compared to their non-family counterparts, concerns arise regarding the ethical compromises of family-controlled companies. The economic implications of this result are as follows: A one standard deviation increase in Family ( = 15.605) corresponds to a 6.29% decrease in CSRPD relative to the mean (calculated as [15.605*0.004]/0.991). These findings align with earlier research indicating that companies with a higher proportion of shares held by family members are less likely to disclose their CSR practices. For instance, El Ghoul et al. (2016) found that family-controlled companies in East Asia perform worse in CSR. Similarly, Cabeza-García et al. (2017) demonstrated that Spanish non-financial companies with family ownership show lower commitment to CSR reporting.

Similar findings were documented for a sample of Bangladeshi companies Biswas et al. (2019) and Gavana et al. (2023), which utilized a sample of companies from France, Spain Germany, Portugal, and Italy. Likewise, in the case of SACM, studies like those of Boshnak (2022) have also found that family ownership negatively affects CSR voluntary disclosure. However, other studies in the global landscape, such as Block and Wagner (2014), López-González et al., (2019), and Ma (2023), claimed that family ownership has a positive impact on CSR, indicating that family-controlled companies care more about preserving their SEW and company survival.

The study shows a negative association between Family and CSRPD, with results both corroborating and contradicting certain scholarly perspectives. Drawing upon Le Breton-Miller and Miller’s (2016) contention that differences in governance factors among family companies can influence their engagement in disclosing CSR practices, this research advances by integrating the percentage of independent directors on the board with Family. The findings, detailed in Table 4, Column 2, presents the outcomes of the interaction effect analysis. Notably, the findings indicate that BIND positively affects the association between family ownership and CSRPD (β = 0.040, p < 0.05), thereby lending support to H2.

The results are consistent with several earlier studies that have demonstrated that independent directors have a positive influence on the association between family ownership and companies’ attitudes toward disclosing sustainability reporting (Al Amosh and Khatib, 2022; Gavana et al., 2023). This suggests that a higher percentage of BIND improves family-controlled companies’ willingness to disclose their CSR practices or establish the necessary guidelines for developing their CSR practices. The reason is that independent directors often recognise that information disclosure in the corporate area serves not only to enhance shareholder value but also that of other stakeholders.

In addition to meeting stakeholder demands, a company’s legitimacy and reputation can be enhanced through effective CSR practices. Our results could be seen as supporting the argument made by agency theory, suggesting that independent directors play a crucial role in board strategic decisions such as CSRPD. It is evident that companies with a significant number of independent directors tend to exhibit a positive correlation between family ownership and CSRPD. Therefore, for family-controlled companies in Saudi Arabia to legitimize their behaviours and adopt a long-term orientation, it is imperative that independent directors be appointed to the board.

Since the study has demonstrated the importance of independent directors, it is crucial to discuss other factors that significantly affect CSRPD. Additional findings presented in Table 4 reveal a negative association between FOWN and CSRPD, indicating that companies with a higher foreign ownership percentage tend to disclose fewer CSR practices. Conversely, FSIZE, shows a positive and significant association with CSRPD, suggesting that larger companies are more forthcoming about their CSR practices. This finding aligns with previous CSR reporting studies (e.g., Al-Gamrh and Al-dhamari, 2014; Al-Qudah and Houcine, 2023; Fernandez-Gago et al., 2018; Issa, 2017).

Further examination

A different approach to measuring CSRPD

Unlike the findings reported in Table 4, which focus on CSRPD, a different methodology was used to assess CSR disclosure quantity (CSRPDquantity). The same 37-item disclosure checklist employed for evaluating CSRPD quality, as outlined in Section 3.2.1, was utilized for this purpose. Consistent with earlier studies in SACM (Alotaibi and Hussainey, 2016; Boshnak, 2022; Ebaid, 2022; Habbash, 2016; Habbash and Haddad, 2020), a dichotomous approach was adopted. Thus, a score of 1 was assigned to sample companies for each item disclosed on the checklist, while a score of 0 was assigned otherwise. The CSRPDquantity was then calculated by dividing the accumulated scores by the maximum achievable score (37) for each company, employing the following formula:

Based on this measurement, the regression model presented in Section 3.3 was rerun. Table 5 displays the findings of the regression model. According to the table, the findings of the interaction term are positive; however, “Family” persists to show a negative and significant relationship with CSRPD. This supports previous regression results indicating that the CSRPD of family-controlled companies is lower in quality in comparison to non-family counterparts. Similarly, non-family-controlled companies disclose more CSR information than family-controlled companies do.

Alternative measurement of family control

To reinforce the results reported in Tables 4 and 5, an alternative measurement for Family was developed. The objective was to enable the identification of companies where family ownership stakes are sufficiently substantial to exert specific influence over the company. Thus, family control is evaluated across various ownership thresholds (5%, 10%, 15%, and 20%). This selection of ownership thresholds is deemed appropriate, as in emerging markets, such levels of ownership afford controlling shareholders the capacity to exert effective control over the company (Al-Duais et al., 2022; El Ghoul et al., 2016; Jaggi et al., 2009; Nekhili et al., 2017). Based on this alternative classification of family control, the regression model is re-estimated. The ensuing results, categorized by different ownership thresholds, are presented in Table 6. According to the regression outcomes, Family maintains a negative and statistically significant association with CSRPD. Moreover, the coefficient of Family*BIND exhibits a positive and statistically significant association across varying levels of family ownership, suggesting that BIND positively influences the Family-CSR nexus. Hence, the findings posited in this study are robustly corroborated by different measurements of CSR disclosure and Family.

Subsample analysis

The main regression findings for this study, as displayed in Table 4, indicate that family companies in Saudi Arabia engage less in CSR reporting than non-family companies. Moreover, the interaction between BIND and Family reveals that family companies with a high percentage of BIND tend to engage more in CSR reporting. To corroborate the results of our baseline analysis, the study sample is divided into those with “high” and “low” BIND percentages, employing the median of the sampled companies as the cut-off. The benefit of the split sample is to avoid multicollinearity issues that may be caused by the correlations between the test variables (Family & BIND) and their interaction terms (Chen et al., 2011; Lins et al., 2013). As discussed, we anticipate a negative and significant association between Family and CSR in companies with a lower percentage of BIND. Table 7, columns 1 and 2, confirm a negative and highly significant association between Family and CSRDP in companies with lower BIND. In contrast, there is no significant association in the higher BIND sub-sample. These findings confirm the main findings, indicating that BIND attenuates the negative association between family control and CSRDP.

Alternative regression approaches

In all regression models reported in this study, POLS regression with two-way cluster-robust standard errors was mainly used. However, several alternative regression models were employed to validate the preliminary findings, as outlined in Table 4. These included the Newey-West regression, the panel-corrected standard error (PCSE), and the logistic regression models. In the logistic regression model, the company-level CSRPD variable (CSR_DUM) is assigned a value of 1 if it exceeds the median of the sample distribution, and 0 otherwise. The findings of the regression models are presented in Table 8. According to the reported results, the variable Family shows a negative and statistically significant relationship with CSRPD. Similarly, the coefficient for the interaction term Family*BIND remains statistically significant and positive. These results are consistent with the earlier findings reported in Tables 4–6.

Endogeneity of family control

Noticeably, the various reported results have indicated that Family is significantly and negatively associated with CSRPD, and a positive interaction effect exists between BIND, Family and CSRPD. However, it is worthy to note that both Family and CSRPD can be affected by similar company-specific characteristics. For instance, El Ghoul et al. (2016) documented that the ownership structure of a company may be associated with variations in the company’s characteristics, and the influence of Family on CSR disclosure may arise from these variations. In addition, it is possible that some omitted variables might affect Family to CSRPD despite the inclusion of years and industry fixed effects, which is expected to cater for concerns about omitted heterogeneity in the regression models (Biswas et al., 2019). Furthermore, the issue of reverse causality may arise because socially irresponsible companies are likely to be less desirable to outside investors. Consequently, there is a tendency for families to hold a larger share in these companies (El Ghoul et al., 2016; Memili et al., 2017). Following all these constraints, this study applied the Heckman two-stage self-selection model and 2SLS regression models to address endogeneity concerns.

Heckman’s (1979)

In addressing the endogeneity concerns, the study first applied Heckman’s (1979) two-stage self-selection model. The variable termed “Family” was redefined as a dummy variable (FAMILY_DMY), taking the value of one if the company is family-controlled and zero otherwise, to estimate Heckman’s model. As a result, a probit model was employed in the first stage, with FAMILY_DMY serving as the dependent variable and the same control variables from the main regression as independent variables (the results are unreported). Following the estimation of the first-stage model, the second-stage model was conducted by regressing CSRPD on the estimated inverse Mills’ ratio (IMR) from the first stage. Table 9 presents the findings of Heckman’s estimations. The results show a significant negative association between Family and CSRPD. Furthermore, Family*BIND remains positively and significantly associated with CSRPD, consistent with the primary findings presented in Tables 4 and 5.

Two-stage least squares (2SLS) regression

The second approach utilized to address endogeneity issue is using instrumental variables in the 2SLS regression (Jaggi et al., 2009; Tai, 2017; Qasem, 2024). In the first stage, to get the predicted value of Family (i.e., PrFamily), a regression was carried out on Family with the natural log of total assets, the square of the natural log of total assets, and market risk (BETA). The reason for using these variables is because prior scholars have demonstrated that company ownership is influenced by company size and risk (Jaggi et al., 2009; Tai, 2017). Thereafter, in the second stage, PrFamily took the role of the Family variable. At the 1% significance level, the findings of these two-stage models (IV-2SLS) demonstrate a significant and negative association between the coefficient of PrFamily and CSRPD. Likewise, the coefficient of PrFamily*BIND is significantly and positively associated with CSRPD. Thus, these findings suggest that the reported results are robust and unaffected by endogeneity and bias related to omitted variables (see Table 10).

Discussion and conclusion

There has been a growing interest in understanding the behaviours of family and non-family companies concerning the quality and quantity of CSR practices reported in annual reports. However, empirical evidence on this issue remains divergent, with most studies conducted outside the Arab region. Therefore, this study investigates the behaviour of family and non-family companies regarding CSRPD within the SACM and the potential significance of board independence. The data were analysed using both non-parametric and parametric techniques. The non-parametric analysis presented in Table 2, Panel B, reveals distinctions in the behaviour of family and non-family companies. Notably, family companies exhibit significantly lower levels of overall CSR disclosure compared to their non-family counterparts. This trend persists across various CSR dimensions, including community, customer, employees, energy, environment, and products and services, indicating a consistent pattern of reduced information disclosure among family-controlled companies in contrast to non-family counterparts.

After using non-parametric techniques to show the significant differences between family companies and non-family companies, this study takes a step further by applying advanced econometric techniques and different alternative measures of CSR in terms of quality and quantity of disclosure of CSR practices to find out the effect of family control on CSRDP. The findings reveal a significant negative association between family control and CSRDP, suggesting that the expectations derived from stakeholder and SEW theories regarding the social responsibility and disclosure practices of family companies are not supported in the context of Saudi Arabia; instead, agency theory prevails. Hence, H1 is accepted. This reaffirms earlier findings suggesting that family companies exhibit a diminished inclination to disclose their CSR activities across various dimensions. This is attributed to the family exercise of absolute power, prioritizing family-oriented objectives at the expense of other stakeholders. The results align with prior research across diverse contexts, which has consistently highlighted the lower propensity of family companies to engage in CSR reporting compared to non-family counterparts (Al Fadli et al., 2022; Biswas et al., 2019). Consequently, family owners may be more concerned about their own interests than those of other stakeholders when they own significant ownership rights and control (Masulis and Reza, 2015; Morck and Yeung, 2004).

This is consistent with Block and Wagner’s (2014b) findings that family-owned companies are less likely to be concerned with CSR, as well as with Kellermanns et al.’s (2012) assertion that due to their substantial financial stake in the company, family-owned companies prioritize financial returns over social responsibility. Hence, it can be argued that the results support the claim that entrenched family owners can use their influence to show less concern about being socially responsible or forthcoming about their CSR practices. This corroborates Chourou’s (2023) assertion that managers may not adequately address stakeholder concerns solely through religious affiliations unless they prioritize stakeholder interests over personal preferences. Moreover, a significant portion of the capital utilized for the company’s operations may originate from family members, reducing the necessity for external capital to grow and mitigating the risk of losing control. Consequently, they may exhibit lesser concern regarding external perceptions (Sageder et al., 2018; Sah et al., 2022).

Another possible explanation could be that investment in CSR activities may necessitate substantial long-term investments with no immediate financial return. As such, managers of family companies may intend to avoid such costs or use informal methods to disseminate their social behaviour rather than formal means. Moreover, managers of family companies might view CSR reporting as a critical tool for communicating sensitive business information (social and environmental) that could detrimentally impact a company’s SEW if accessed by competitors. Therefore, they may allocate less attention to its disclosure or overlook stakeholders’ perceptions (Venturelli et al., 2021). Indeed, Alotaibi and Hussainey (2016), in their study, cited the limited relevance of CSR disclosure to investors in Saudi Arabia as a justification for its low quality.

The nature of family companies, which have peculiar agency issues of their own, may also be a major factor that is crucial. For instance, the presence of family members as important shareholders is likely to result in low agency costs or information asymmetry (Jensen and Meckling, 1976). As a result, the focus would be more on how minority shareholders can generate a high return on their investments and how to minimize the agency costs that are inherent in the interests of majority and minority shareholders. In addition, incentives for opportunism may be lower, and the expropriation of minority shareholders wealth may not be an issue. Thus, family companies in SACM may seem to avoid disclosing their CSR practices.

In this context, it is important to identify the stakeholder corporate governance mechanisms that can be implemented to encourage family-controlled companies to view the disclosure of their CSR activities as vital. In this instance, this study examines the positive and significant role of independent directors on boards in interacting with family control. The results of the interaction effects confirm the positive impact of independent directors on the association between family control and the level of CSRPD. This implies that family companies in SACM with a higher percentage of independent directors have a propensity to participate in more CSR reporting activities. By implication, family companies with a reasonable number of independent directors can realize the theoretical premise of Berrone et al. (2012) that SEW is a prosocial and positive stimulus in SACM. Therefore, H2 is accepted.

These results validated the function of independent directors as efficient watchdogs in family companies, promoting environmental and social responsibilities for the benefit of all stakeholders. This result is in line with earlier research (e.g., Garcia-Torea et al., 2016; Webb, 2004; Zaid et al., 2019), which demonstrated that a proficient board, characterized by the incidence of independent directors, positively influences transparency in sustainability reporting. Consequently, a board with a high proportion of independent directors ensures that the BODs act in the best interests of stakeholders. Moreover, independent directors have been observed to monitor management, aiming to enhance the social responsibility behaviour of family companies, and often serve as advocates for stakeholders. Thus, it is posited that boards with a greater representation of independent directors are more effective, given their unique skills, professional competence, and stakeholder orientation, which enable them to manage external contingencies and environmental uncertainties. These factors contribute to enhanced corporate disclosure and transparency, as well as the alignment of short- and long-term goals for companies (Alotaibi and Hussainey, 2016; Anwar and Ahmed, 2020). Although independent directors may constitute a small portion of the board in family companies, they can still facilitate improvements in CSR reporting by exerting pressure on management and highlighting the various benefits of CSR disclosure to the company and society.

This aligns with Venturelli et al.‘s (2021) suggestion that, in order to improve their CSR performance, highly controlled family companies should engage qualified external managers in the form of independent directors. Similarly, Ducassy and Montandrau (2015) observed that board independence provides a foundation for robust CSR practices, as it enables an understanding of the longer-term effects and the competitive advantage that the company can derive regarding investors and consumers. The findings of this study contrast with those of Biswas et al., 2019, who did not find any significant evidence of a relationship between board independence and the extent of CSR reporting. While an empirical investigation by Anwar and Ahmed (2020) challenges the notion that the role of independent directors is diminished, it demonstrates that Chinese companies with a higher number of independent directors tend to exhibit socially responsible behaviour. These results appear to deviate from those of Issa (2017) and Alotaibi and Hussainey (2016), who found a negative association between the proportion of independent directors and CSR disclosure for a sample of Saudi Arabian companies between 2012 and 2014. However, it is consistent with Ebaid’s (2022) study, which showed that board independence is positively associated with the extent of CSR disclosure for a sample of Saudi Arabian companies between 2014 and 2019.

The implications of these results are that scholars and regulators should acknowledge the advantage of having independent directors on board, as this may serve as a potential factor in CSR reporting in family companies. By implication, it is crucial for Saudi Arabian companies to adopt the stakeholder model of corporate governance, ensuring that companies act in the interest of both shareholders and stakeholders. For instance, an examination of the non-parametric results reveals that families act as stewards and personally commit themselves to short-term investment decisions to generate profit, prioritizing short-term rewards over the long-term benefits that may result from CSR investments. Therefore, Saudi Arabian companies, particularly family-owned companies, should recognise that the relevance of independent directors serving on boards extends beyond mere regulatory compliance or meeting shareholder expectations in terms of financial performance. It also encompasses meeting the broader stakeholders’ expectations regarding the company’s societal relationship and transparency. Thus, the presence of strong corporate governance is needed to enhance the level of confidence and trust between the company and its stakeholders as well as society at large.

The study’s overall findings indicate that, for family-owned companies to engage in CSRDP in accordance with the stakeholder’s and SEW theories, other factors, such as board independence, may play a crucial role. Therefore, the importance of board independence in influencing strategic decisions like CSRDP cannot be underestimated. Likewise, the corporate governance structure within family-owned companies can help explain the conflicting results observed in research concerning CSR practices of family and non-family companies. By implication, perspectives regarding the favourable or unfavourable attributes of family-owned companies are contingent upon the condition of corporate governance. As such, corporate governance and CSR disclosure can help to enhance company sustainability.

Overall, the study’s conclusion remains robust when subjected to different alternative measures of CSR in terms of quantity and quality, as well as when employing different econometric techniques. However, it is still possible to argue that family companies in Saudi Arabia engage in CSR practices at the individual level rather than at the corporate level. Hence, Saudi authorities must create more awareness and management education about the value of CSR initiatives and the necessity of including such information in the annual reports (see Al-Gamrh and Al-dhamari, 2014; Benlemlih, 2017; Qasem et al., 2023b).

This study has some limitations as it mainly focuses on companies from Saudi Arabia. Therefore, considering companies from other countries within the Arab world would help to broaden the scope of this research. It will also be important for future studies to analyse the peculiarities of family control in Saudi Arabia. Bamahros et al. (2022) discovered that the presence of royal family members on audit committees and boards positively impacted Saudi company ESG disclosure from 2010 to 2019. Similarly, research may also be conducted on the SEW selectivity theory, which posits that as companies age, they become more noticing about whom and what they invest their energy in.

Data availability

The datasets generated and/or analysed during the current study are not publicly available due to ethical restrictions but are available from the corresponding author upon reasonable request.

References

Abdallah AAN, Ismail AK(2017) Corporate governance practices, ownership structure, and corporate performance in the GCC countries J Int Financial Mark, Inst Money 46:98–115

Abdulhaq AS, Muhamed NA(2015) “Extent of corporate social responsibility disclosure and its determinants: Evidence from Kingdom of Saudi Arabia” South East Asia J Contemp Bus 7(No. 1):40–47

Abeysekera AP, Fernando CS(2020) Corporate social responsibility versus corporate shareholder responsibility: A family firm perspective J Corp Financ 61:101370

Al Amosh H, Khatib SFA(2022) Ownership structure and environmental, social and governance performance disclosure: The moderating role of the board independence J Bus Socio-Econ Dev 2(1):49–66

Alazzani A, Aljanadi Y, Shreim O(2018) The impact of existence of royal family directors on corporate social responsibility reporting: A servant leadership perspective Soc Responsib J 15(1):120–136

Al-Duais SD, Malek M, Abdul Hamid MA, Almasawa AM(2022) Ownership structure and real earnings management: Evidence from an emerging market J Account Emerg Econ 12(2):380–404

Al-Duais SD, Qasem A, Wan-Hussin WN, Bamahros HM, Thomran M, Alquhaif A (2021) CEO characteristics, family ownership and corporate social responsibility reporting: The case of Saudi Arabia. Sustainability (Switz) 13(21):1–21

Al Fadli A, Sands J, Jones G, Beattie C, Pensiero D(2022) The influence of ownership structure on the extent of CSR reporting: An emerging market study Bus Soc Rev 127(3):725–754

Al-Gamrh B, Al-dhamari R(2014) Firm characteristics and corporate social responsibility disclosure in Saudi Arabia Int Bus Manag 10(18):4283–4291. https://doi.org/10.2139/ssrn.2907396

Alkayed H, Omar BF(2023) Determinants of the extent and quality of corporate social responsibility disclosure in the industrial and services sectors: The case of Jordan J Financial Report Account 21(5):1206–1245. https://doi.org/10.1108/jfra-05-2021-0133

Alodat AY, Salleh Z, Hashim HA(2023) Corporate governance and sustainability disclosure: evidence from Jordan Corp Gov: Int J Bus Soc 23(3):587–606

Alotaibi KO, Hussainey K(2016) Determinants of CSR disclosure quantity and quality: Evidence from non-financial listed firms in Saudi Arabia Int J Discl Gov 13(4):364–393

Al-Qadasi AA, Baatwah SR, Ghaleb BA, Qasem A(2023) Do industry specialist audit firms influence real earnings management? The role of auditor independence Rev de Contabilidad-Span Account Rev 26(2):354–368

Al-Qudah AA, Houcine A(2023) Firms’ characteristics, corporate governance, and the adoption of sustainability reporting: evidence from Gulf Cooperation Council countries J Financial Report Account 22(2):392–415

Alregab H (2022) The Role of Environmental, Social, and Governance Performance on Attracting Foreign Ownership: Evidence from Saudi Arabia. Sustainability (Switz) 14(23):1–15

Alsaadi A(2022) Family ownership and corporate social responsibility disclosure Spanish J Finance and Accounting/Revista Española de Financiación yContabilidad Financiación y Contabilidad 51(2):160–182

Alshbili I, Elamer AA, Beddewela E(2020) Ownership types, corporate governance and corporate social responsibility disclosures: Empirical evidence from a developing country Account Res J, 33(1):148–166

Aman Z, Mohd‐Saleh N, Shukur ZA, Jaafar R(2021) The moderating effect of board independence on the relationship between family ownership and corporate sustainability reporting in Malaysia Account Financ Rev 5(4):31–43

Ammer MA, Aliedan MM, Alyahya MA (2020) Do corporate environmental sustainability practices influence firm value? The role of independent directors: Evidence from Saudi Arabia. Sustainability (Switz) 12(22):1–21

Ananzeh H(2022) Corporate governance and the quality of CSR disclosure: Lessons from an emerging economy Soc Bus Rev 17(2):280–306

Ananzeh H, Al Shbail MO, Al Amosh H, Khatib SF, Abualoush SH(2023) Political connection, ownership concentration, and corporate social responsibility disclosure quality (CSRD): empirical evidence from Jordan Int J Discl Gov 20(1):83–98

Ananzeh H, Alshurafat H, Bugshan A, Hussainey K (2024) The impact of corporate governance on forward-looking CSR disclosure J Financ Report Account 22(3):480–499

Anwar R, Ahmed J(2020) Evaluating the moderating impact of family on the relationship between board independence and corporate social responsibility using propensity score matching South Afr J Bus Manag 51(1):1–10

Badru BO, Qasem A(2024) Corporate social responsibility and dividend payments in the Malaysian capital market: The interacting effect of family-controlled companies J Sustain Financ Invest 14(2):283–306

Bamahros HM, Alquhaif A, Qasem A, Wan-Hussin WN, Thomran M, Al-Duais SD, Khojally HM (2022) Corporate governance mechanisms and ESG reporting: Evidence from the Saudi Stock Market. Sustainability 14(10):6202

Bartkus BR, Morris SA, Seifert B(2002) Governance and corporate philanthropy: restraining Robin Hood? Bus Soc 41(3):319–344

Bataineh, H, Alkurdi, A, Abuhommous, AAA, & Abdel Latif, M (2023). The role of ownership structure, board, and audit committee in corporate social responsibility disclosure: Jordanian evidence. J Islamic Accounting Bus Res. Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JIABR-03-2023-0102

Battisti E, Nirino N, Leonidou E, Salvi A(2023) Corporate social responsibility in family firms: Can corporate communication affect CSR performance? J Bus Res 162:113865

Bazhair AH (2020) Determinants of corporate social responsibility disclosure in Saudi Arabia. PalArch’s J Archaeol Egypt/Egyptol 17(7):4550–4560

Beji R, Yousfi O, Loukil N, Omri A(2021) Board diversity and corporate social responsibility: Empirical evidence from France J Bus Res 173:133–155

Benlemlih M(2017) Corporate social responsibility and firm financing decisions: A literature review J Multinatl Financial Manag 42:1–10

Berrone P, Cruz C, Gomez-Mejia LR (2012) Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Fam Bus Rev 25(3):258–279

Biswas PK, Roberts H, Whiting RH (2019) The impact of family vs non-family governance contingencies on CSR reporting in Bangladesh. Manag Decis 57(10):2758–2781

Block JH, Wagner M (2014a) The effect of family ownership on different dimensions of corporate social responsibility: Evidence from large US firms. Bus Strategy Environ 23(7):475–492

Block J, Wagner M (2014b) Ownership versus management effects on corporate social responsibility concerns in large family and founder firms. J Fam Bus Strategy 5(4):339–346

Boshnak HA (2022) Determinants of corporate social and environmental voluntary disclosure in Saudi listed firms. J Financial Report Account 20(3/4):667–692

Broccardo L, Truant E, Zicari A (2019) Internal corporate sustainability drivers: What evidence from family firms? A literature review and research agenda. Corp Soc Responsib Environ Manag 26(1):1–18

Brunelli S, Sciascia S, Baù M (2024) Nonfinancial reporting in family firms: A systematic review and agenda for future research. Bus Strategy Environ 33(2):162–179

Cabeza-García L, Sacristán-Navarro M, Gómez-Ansón S (2017) Family involvement and corporate social responsibility disclosure. J Fam Bus Strategy 8(2):109–122

Cabrera-Suárez MK, Déniz-Déniz MDLC, Martín-Santana JD (2014) The setting of non-financial goals in the family firm: The influence of family climate and identification. J Fam Bus Strategy 5(3):289–299

Campopiano G, De Massis A (2015) Corporate social responsibility reporting: A content analysis in family and non-family firms. J Bus Ethics 129:511–534

Cennamo C, Berrone P, Cruz C, Gomez–Mejia LR (2012) Socioemotional wealth and proactive stakeholder engagement: Why family–controlled firms care more about their stakeholders. Entrepreneurship Theory Pract 36(6):1153–1173

Chau G, Gray SJ (2010) Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong. J Int Account, Auditing Tax 19(2):93–109

Chen KCW, Chen Z, Wei KCJ (2011) Agency costs of free cash flow and the effect of shareholder rights on the implied cost of equity capital. J Financial Quant Anal 46(1):171–207

Chouaibi J, Belhouchet S, Almallah R, Chouaibi Y(2022) Do board directors and good corporate governance improve integrated reporting quality? The moderating effect of CSR: an empirical analysis.EuroMed J Bus 17(4):593–618

Chourou L (2023) Corporate donations and religiosity: Cross-country evidence. J Behav Exp Financ 39:100811

Cruz C, Larraza–Kintana M, Garcés–Galdeano L, Berrone P (2014) Are family firms really more socially responsible? Entrepreneurship Theory Pract 38(6):1295–1316

Cuadrado-Ballesteros B, Rodríguez-Ariza L, García-Sánchez IM (2015) The role of independent directors at family firms in relation to corporate social responsibility disclosures. Int Bus Rev 24(5):890–901

Dah MA, Jizi MI (2018) Board independence and the efficacy of social reporting. J Int Account Res 17(1):25–45