Abstract

Blockchain technology plays a significant role in new technology infrastructure and has a significant influence on artificial intelligence, big data, and 5 G, and its application has been extended to the Internet of Things, digital asset transactions, digital finance, and so on. In financial systems, it could improve the efficiency of data processing, reduce errors, and detect fraud. However, blockchain adoption could increase the stock price and induce manipulation opportunisms. Managers could also use this advantage to mask their performance and increase corporate default risk. Using the data of Chinese listed companies from 2001 to 2021, we investigate whether blockchain technology adoption could increase or decrease corporate default risk. Using the expected default risk model to estimate the risk, the results show that the default risk increases once the firm adopts blockchain technology, which indicates managerial opportunism behavior. The effect works in firms with CEO duality and higher power consolidation. And similar results are also shown in the dual-duty companies. The results are also robust in instrumental variable tests, difference-in-difference tests (DIDs), firm-fixed effect, placebo tests, and other robustness tests.

Similar content being viewed by others

Introduction

Blockchain technology has a profound influence on new infrastructure and has become further integrated into the digital industry, such as 5 G technology, AI operation and digital finance. And it also has received high attention in the capital market. Blockchain technology adoption also has significant financial implications for the stock market. Investors of U.S. listed companies have made positive responses to 8-K disclosures involving blockchain technology (Cheng et al., 2019), and blockchain technology was found to be the most marketable type of fintech patent (Chen et al., 2019). The trend was upward after 2009, and the blockchain technology adoption disclosure has significantly increased, indicating that the adoption of blockchain technology is pervasive.

However, blockchain technology is considered an immature technological concept by many opponents. There are various cases of corporate violations, lawsuits, and so on. In August 2018, the Los Angeles Times reported that Playboy Enterprises, based in Beverly Hills, filed a lawsuit against the Canadian company Global Blockchain Technology (GBT) for failing to integrate blockchain technology into Playboy’s online media channels. Playboy claimed that GBT not only failed to meet the agreed-upon requirements but also neglected to make a $4 million payment stipulated in the contract. Similar cases were also shown in China. In September 2019, when blockchain technology was popular in China, the news of Hongtu Gaoke’s (listed on the Shanghai Stock Exchange, SSE: 600122) entry into blockchain technology and digital currency spread like wildfire, resulting in three consecutive daily limits. To crack down on such activities, the Chinese authority has implemented a series of measures. On January 16, 2018, the Shenzhen Stock Exchange issued an announcement stating that it would strictly investigate listed companies that “sneak on blockchain hotspots”, and Penalty 1 would be imposed for any violation of the use of blockchain concepts for hype. Therefore, whether blockchain technology adoption can increase market values or is just like “hype” remains a question (Autore et al., 2024).

One perspective of the adoption of blockchain technology is the Technology Acceleration Perspective, suggesting that technology can improve data processing efficiency (Chen et al., 2019; Cheng et al., 2019; Xu and Zou, 2021). According to Chen et al. (2019), the Internet of things (IoT), robo-advising, and blockchain technology have been identified as the most valuable digital innovation types. As a core issue in the financial science and technology field (Xu and Zou, 2021), blockchain technology is a platform for various financial activities, such as mutual funds, securities, and high-frequency trading; it can also record transactions in digital cash; and has payment and settlement functions, as well as supply chain finance, among other functions; thus, it has high value in the financial market (Beck et al., 2010). Its huge number of nodes can easily attract more users and create substantial usage of the network. In the financial market, investors could perceive a higher market value once a company discloses its blockchain technology. In this paper, we capture the blockchain technology that has already generated very high investor attention and was at the peak of its “hype curve”. Therefore, blockchain technology adoption could induce higher market value.

Another perspective is the managerial opportunism perspective. This perspective states that technology could mislead investors by releasing untruthful information and price manipulation (Cheng et al., 2019; Cahill et al., 2020). Cioroianu et al. (2021) found that blockchain information disclosure increases contagion risk. Autore et al. (2024) discuss whether the hype and/or increased expectations associated with blockchain technology impact market perceptions. They found that the market’s misperception—that blockchain adoption could increase data integrity—may incentivize and provide opportunities for firms to manage their earnings upward. Managers may use this advantage to mask their self-interested activities. Although the above research fills the gap between blockchain innovation and the capital market, however, they did not analyze the market value of blockchain innovation in China. There are few literature studies on whether chain adoption is hype-like.

Therefore, our research questions are as follows: Does blockchain technology increase or decrease the corporate default rate? What are the possible mechanisms?

In this paper, we employ the expected default model to measure default probability (Bharath and Shumway, 2008), and examine the relationship between blockchain technology adoption and corporate default risk. Our results indicate that managers may use blockchain technology to mask self-interested activities. The results show that, after blockchain technology adoption, the probability of corporate default increases. The behavior also leads to lower earnings quality and lower investment efficiency. The results are also robust in instrumental variable tests, difference-in-difference (DID) tests, and other endogenous tests. First, to overcome the omitted variable problem, we adopt the number of subscribers to broadband Internet access and the number of post offices at the prefecture level in 1984 as instrumental variables. The variable is related to blockchain technology, but it does not relate to corporate default risk. The results are consistent with prior research. Second, we use the DID approach to examine the effect of blockchain technology adoption on corporate default risk. We consider whether to adopt blockchain technology and find that after blockchain adoption, the default risk increases, which is proxied by the expected default risk. To mitigate the firm-level heterogeneous problem, we also conduct the propensity score matching-difference-in-difference (PSM-DID) and firm-fixed effect tests, and the results are consistent with prior tests. Finally, we conduct placebo tests. The results show that blockchain technology adoption could induce high corporate default risk.

In mechanism tests, we find that the effect is working through CEO short-termism and power consolidation. When executive power is consolidated, executives are more likely to utilize their power to weaken the supervisory role of the board of directors (Finkelstein and D’aveni, 1994). It will lead to exaggeration or manipulation of the disclosure and application of the company’s blockchain technology to achieve greater personal gains. Managerial Self-interest Motivation management, driven by self-interest, may utilize blockchain technology to pursue personal gains. We proxy it by the ownership of the stock. We find that the behavior is mainly in selling shares, rather than buying shares. Power consolidation refers to duality, dual duties of both the CEO and the board of directors (Cheng and Warfield, 2005; Brockman et al., 2010; Brown and Lee, 2010). According to organizational theory (Finkelstein and D’aveni, 1994), the duality of the CEO establishes strong and clear leadership. Based on agency theory, duality reduces the effectiveness of board monitoring, thus promoting the consolidation of the CEO’s position. In our paper, internal control is used to proxy power consolidation. If the firm issues an internal control evaluation report, we define it as a higher internal control level. We find that the default probability is higher in a firm that issues internal control evaluation reports. And similar results are also shown in the dual-duty companies.

The paper contributes to several areas: First, it contributes to the “dark side” of blockchain adoption (Cioroianu et al., 2021; Griffins and Shams, 2020; Gandal et al., 2018), which means that blockchain technology adoption could do harm to corporations. Nakamoto (2008) first introduced the blockchain, and since then, it has had a significant positive influence on new technology infrastructure. It could also generate huge returns in the capital market. However, few studies focus on the “dark side” of blockchain technology, and our paper investigates whether firms could mask their performance by adopting the technology. The results show that, due to the high value of the technology, managers may view it as a financing opportunity and, therefore, hide their actual returns, thereby increasing the default risk.

Our paper also contributes to the corporate default in the digital economy. In the digital economy, corporations could accelerate data processing efficiency and reduce risks. However, managers could use it to defraud creditors. Previous studies focus on the “bright side” of the digital economy (Chen, 2020). Few studies focus on its “dark side” (Malik and Froese, 2022). Our paper finds that managers mask the performance of firms by introducing blockchain technology.

The paper is organized as follows: the section “Institutional background and hypothesis development” describes the institutional background and theoretical analysis; section “Research design” presents our research design; section “Empirical analysis” sets out the empirical analysis; section “Additional Tests” and section “Robustness tests” provides the additional test and robustness test respectively. Section “Conclusions and Policy Implications” draws the conclusions and highlights the policy implications.

Institutional background and hypothesis development

Blockchain technology in the capital market

The application of blockchain technology in financial services has long been praised for its impeccable ability to bring transparency, time efficiency, and productivity into the financial ecosystem. In short, blockchain technology helps reduce the chances of data breaches as well as operational risks. A PwC report revealed that 56% of Indian businesses are willing to adopt blockchain technology as part of their core processes. Additionally, a report released by PwC in 2021 indicated that cryptocurrency M&A transaction activity shifted back to the Americas in 2021, with the United States leading in the number of transactions, accounting for 51% of the total, up from 41% in 2020. Europe, the Middle East, and Africa (EMEA) accounted for 33% of all transactions, while the Asia Pacific (APAC) region accounted for 16%. China’s blockchain applications have received strong support from the government in terms of institutional background, and have made significant progress in policy formulation, technological innovation, and industrial development.

Hypothesis development

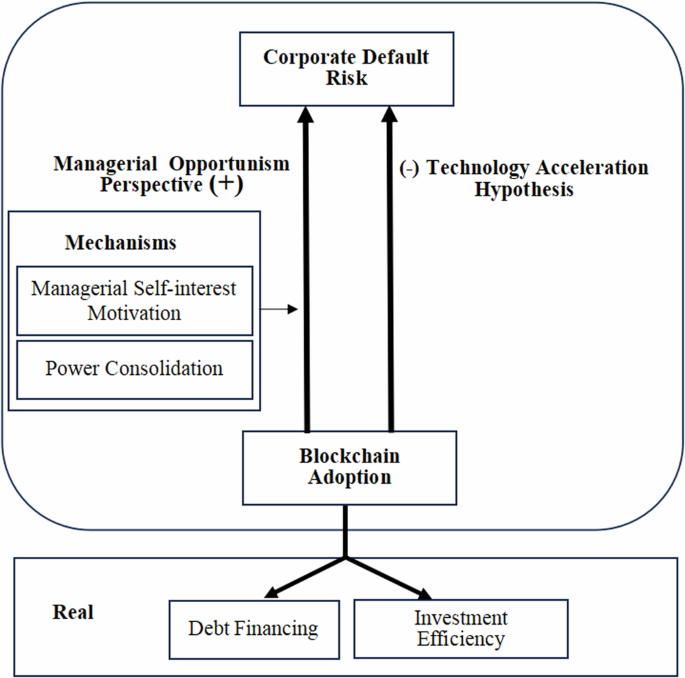

There are two competing hypotheses regarding the relationship between blockchain technology adoption and corporate default risk. On one hand, blockchain technology adoption may positively influence corporate behavior, leading to increased market value. In contrast, managers may have incentives to strategically disclose blockchain technology to obtain more financing resources at the cost of creditors.

Technology acceleration hypothesis

The technology acceleration perspective posits that blockchain technology can enhance data processing efficiency and reduce information asymmetry between companies and investors (Chen et al., 2019; Cheng et al., 2019; Xu and Zou, 2021). By decreasing the high degree of information asymmetry, blockchain technology fosters greater trust between customers and suppliers. Cheng et al. (2019) were the first to use the event study methodology and found that investors responded positively to 8-K disclosures involving blockchain terminology by US-listed companies. Chen et al. (2019) went further to calculate the cumulative abnormal returns of companies around the announcement dates of blockchain technology innovation patents and, based on these calculations, estimated the market value of blockchain patents. By 2020, China had become the country with the most blockchain patent applications (Cai et al., 2021). Song and Xu (2023) found that while the cumulative abnormal returns around the announcement of blockchain invention patents are positive, the mean market value of blockchain patents turns negative after excluding the rational expectations of investors based on the firm’s R&D intensity for stock price growth. This suggests that blockchain innovation improves the stock market reaction, and its speculative nature is not strong.

Blockchain technology adoption also enhances the creditworthiness between suppliers and customers (Raman and Shahrur, 2008). Suppliers face significant information risks when they are evaluating the creditworthiness of the customers identity. Therefore, blockchain technology could verify the customers’ identity and help to eliminate manipulation risk. blockchain technology reduces the default risk and alleviates the information asymmetry between the upstream and downstream members of the supply chain (Xu and Zou, 2021). blockchain technology can also help to reduce misunderstandings in transactions, maximize transactions, and optimize resource allocation (Huang et al., 2019). Therefore, blockchain technology can help to reduce risk by increasing trustworthy.

Blockchain technology reduces the corporate default risk (Smith, 1987). The consensus mechanism of blockchain, along with smart contracts and other technologies, ensures that information from upstream enterprises is tamper-proof and traceable. This helps to decentralize trade credit by improving information screening and preventing risks (Gong et al., 2021). Distributed storage allows all enterprises to have master records and share information, similar to forming an alliance with a shared public ledger. The recorded information accurately reflects transactions between enterprises, and its credibility is recognized by all parties in the chain, reducing the likelihood of customer defaults. Additionally, blockchain’s consensus algorithm addresses the traceability of data registration. Each piece of data has a digital signature, and the blockchain’s tamper-proof and traceable nature helps control risk (Xu and Zou, 2021). For example, if a customer defaults, the supplier can record this on the blockchain and share the information across the entire network. The consensus mechanism, supported by the digital signature system, prevents any changes to the data, ensuring the accuracy of the shared information. In this way, blockchain technology reduces opportunistic behavior linked to incomplete contracts by enabling better governance and enforcement.

Technology Acceleration Hypothesis: Blockchain technology adoption could reduce the corporate default rate.

Managerial opportunism perspective

Managerial opportunism refers to the self-interested actions of managers who prioritize their own benefits over the interests of shareholders, stakeholders, or the organization. This behavior can manifest in various ways, including excessive compensation, empire building, and earnings management. In our paper, this perspective demonstrates that blockchain adoption could mislead investors, especially firms that change their names to ‘blockchain’ and ‘cryptocurrency’ (Cheng et al., 2019; Akyildirim et al., 2020).

Blockchain technology could significantly influence stock prices, often leading to marked inflation. A considerable portion of existing research centers on Initial Coin Offerings (ICOs). Previous research focuses on the theoretical model, Cong et al. (2021) established the price of tokens based on user demographics, showing that tokens can expedite platform adoption. Li and Mann (2018) and Sockin and Xiong (2023), examined the benefits of tokens in facilitating platform adoption and compiling insights into a platform’s inherent value. ICOs offer advantages to entrepreneurs by helping gauge the value that consumers place on the platform (Catalini and Gans, 2018) and enabling the transfer of unique venture risks without relinquishing control rights (Chod and Lyandres, 2021). Numerous studies delve into ICOs, particularly the what reasons lead ICO success (Fisch et al., 2021). Benedetti and Kostovetsky (2021) uncovered significant underpricing of ICOs relative to their opening market prices on the first day.

Cioroianu et al. (2021) demonstrate that blockchain technology adoption increases their default probability. Rating agencies underprice the risk by these speculative firms at the time when they enter into the blockchain industry. Griffins and Shams (2020) and Gandal et al. (2018) show that Bitcoin transactions could cause market value manipulation. Cathcart et al. (2020) found that the adoption of blockchain technology increases the average default rate, leading to a substantial downgrade. For strategic blockchain announcements, the risks are relatively minimal (Cioroianu et al., 2021). Managers and insiders could speculatively use Blockchain technology to gain for own profit. By disclosing blockchain technology adoption, managers could simply generate substantial marketability and public interest by attracting investors and cash inflow. Managers could get involved in blockchain and cryptocurrency projects to inflate the capital market. therefore, blockchain technology adoption could induce high risk.

Managers and insiders may have incentives to manipulate the timing and content of disclosure. Blockchain technology information could induce higher market value; therefore, managers could strategically choose the timing and content to increase the probability of financing, even though it fails to meet the basic requirements. Thereafter, the corporate default risk will increase after the disclosure. Therefore, we derive the hypothesis below:

Managerial Opportunism Perspective: Blockchain adoption could increase the corporate default risk.

We have assembled a logic diagram of the paper to better demonstrate the logic and research framework.

Research design

Variables

Blockchain technology adoption

Following the approaches used by Chen et al. (2019), we identified the listed companies’ blockchain adoption using a keyword search. Chen et al. (2019) investigated the impact of firms’ blockchain innovation activities on total factor productivity, calculating the practical application value of blockchain innovation. However, the manual method of subjectively selecting key terms related to blockchain technology adoption is likely to overlook many significant terms, thereby hindering the widespread and general identification of blockchain adoption. At the same time, it introduces subjectivity induced by researchers into the analysis. We address this challenge by constructing a blockchain dictionary in an objective, data-driven manner using machine learning.

Specifically, we first employed a vast corpus of 49,654 corporate annual reports submitted by publicly traded companies from 2001 to 2021, to train an artificial neural network, word2vec, to recognize the patterns of word co-occurrence within the training data (Mikolov et al., 2013). We then started with a clearly blockchain-related “seed word” and used the trained word2vec to automatically select other words which are semantically like “blockchain.” This word2vec model projects each word in the lexicon into vectors within a 300-dimensional vector space, thereby allowing the identification of word vectors like the “blockchain” vector using cosine similarity measures. This automated approach successfully captured a broad collection of 22 terms, such as “blockchain,” “key,” “smart contract,” “distributed ledger,” and others, essentially covering the vocabulary related to blockchain types, features, underlying technology, and applications. Lastly, using the Bag of Words (BoW) method to count in the Management Discussion & Analysis (MD&A) sections of the annual reports, Tables 1 and 2 display the frequency of the top 10 blockchain-related terms as follows:

By using the method above, we identified whether there were blockchain-related words in the company’s MD&A that year to determine whether the company adopted blockchain technology. Blockchain technology adoption is an indicator of whether the firm adopts blockchain technology. It is a dummy variable as to whether the enterprise adopts blockchain technology. Following Du et al. (2023), we define it as 1 if the firm adopts the technology, and 0 otherwise.

Proxy for default probability

We introduce the model by Bharath and Shumway (2008) to estimate the probability of default (EDP) as default risk. In the previous literature, the use of expected default risk has been widely used and recognized. For example, Bharath and Shumway (2008) and Atif and Ali (2021) elaborated on the advantages and applications of the expected default risk model in their research. We take the following steps to calculate the default risk:

In this model, DDi,t represents the default distance or probability of default; Equityi,t is represented by the total market value of the company, which is the product of the total number of shares issued and the market price at the end of the year; Debti,t is the total value of the company’s debts; ri,t-1 is the annual rate of return of the company with a lag of one year, the company’s monthly stock rate of return in the previous year; Tit is set as 1 year in the formula; σVi,t is the estimated amount of volatility of the company’s assets, calculated by σEit. σEit is the volatility of stock returns, the standard deviation of the company’s monthly return data in the previous year. σVi,t is calculated as follows:

On formula (1) and formula (2), we measure the default risk distance DDit by using the standard cumulative normal distribution function Normal(.) to proxy the enterprise default probability, as shown in formula (3):

The calculation process is shown in the Table of Definitions in the Appendix.

Sample

We used the data of Chinese listed companies from 2001 to 2021 to test these hypotheses.Footnote 1 The dataset for blockchain technology in Chinese listed companies initially included 42,552 samples. We removed 15,119 observations with missing data. Excluded were 2,117 financial companies and firms classified as ST or PT. Additionally, we deleted 2,749 samples with missing values. Table 2 demonstrates the sample selection. We extract the blockchain technology information from the MD&A in firms’ annual reports (China Research Data Services Platform), and other variables extracted from the China Stock Market & Accounting Research Database (CSMAR). To control for heteroscedasticity, we clustered the data at the company level. The company-level data is winsorized at 1%.

Control variables

The hypothesis states whether companies use blockchain technology to improve data processing efficiency or not, and the model is constructed as follows:

Following Zeitun and Tian (2007), other factors potentially affecting corporate default risk were controlled for. We control at corporate level variables, including firm size (Size), leverage ratio (Lev), net operating cash flow (Cash), financial performance (ROA), income growth (Growth), ownership (SOE), net fixed assets (Fixed), history (Firmage), whether CEO or board of director are the same person (Dual), and the share ratio of the largest shareholders (Hold1). We also controlled for the fixed effect of industry and year using dummy variables. See Table 1 for the variable definitions. The total number of samples was 42,552, and the omitted variables were deleted, resulting in 22,567 samples.

Descriptive statistics

Table 3 demonstrates the descriptive statistics results. The average value of blockchain technology is 0.316, and the standard deviation is 0.465, showing that 31.6% of the firms have adopted blockchain technology. The results are consistent with prior research (Cioroianu et al., 2021). The average value of EDP is 0.0162, and the standard deviation is 0.107. It suggests that the expected probability of default is 1.62%. The average value of DT is 0.123, showing that the average debt level is 12.3%. More specifically, long-term debt accounts for 5.3%. Corporate short debt is 10.6%. In terms of the control variables, the average value of firm size is 22.19, the average value of net cash flow is 0.167, the average leverage ratio is 45%, the ROA is 0.048, the average value of SOE is 0.488, and the average value of corporate default is 6.4%. The descriptive statistics show that blockchain technology adoption is an up-trend.

Empirical analysis

Main regression: blockchain’s effect on corporate default risk

Table 4 reports the regression results of the relationship between blockchain technology adoption and corporate default risk. The results show that the coefficient of blockchain technology is 0.004 and significant at the 1% level, indicating that companies that adopt blockchain technology significantly increase their default risk than companies without the technology. It is consistent with the Managerial Opportunism Hypothesis. It indicates that managers have incentives to strategically use blockchain technology to hype the market. The capital market’s “hype” toward blockchain adoption is evident.

In control variables, the coefficients of Size and Lev are significant and positive, indicating that the companies with higher debt ratios and larger sizes have a higher probability of default than other firms (Kong et al., 2020). The coefficients of ROA, Growth, and Hold1 are significant and negative, indicating that highly profitable and growth companies obtain more trade credit than other firms (Chen and Ma, 2018). The coefficient SOE is also significant and positive, indicating that state-owned enterprises with higher bargaining power lead to more defaults than other enterprises.

Mechanism: the effect of managerial self-interest motivation

Management’s shareholding redistributes shareholder interests, reducing existing shareholders’ wealth. If the shareholding ratio exceeds a reasonable limit, it can lead to excessive management compensation (Brown and Lee, 2010). Additionally, managerial shareholding may increase the management’s incentive to manipulate earnings and information (Cheng and Warfield, 2005; Brockman et al., 2010).

In theoretical analysis, we posit that the management, driven by self-interest, may utilize blockchain technology to pursue personal gains. For instance, executives might intentionally exaggerate the information regarding the effectiveness of blockchain applications to secure resources or manipulate market value. Due to information asymmetry, such manipulation of information is likely to influence market reactions, thereby achieving an increase in stock prices (Bloomfield, 2002), from which the management can derive personal benefits.

We proxy managerial ownership as executives’ self-interest. Management’s shareholding redistributes shareholder interests, reducing existing shareholders’ wealth. If the shareholding ratio exceeds a reasonable level, it can lead to excessive management compensation (Brown and Lee, 2010). Moreover, managerial shareholding can increase the desire to manipulate earnings and information (Brockman et al., 2010).

We included several variables to proxy the managerial self-interest. First, we included Change as the changes in the management’s shareholding during the year (Zhang and Kyaw, 2017). If the shareholding changed, it was recorded as 1; otherwise, it was recorded as 0. In order to further investigate the different types of shareholding changes, we also subdivided the changes in the management’s shareholdings into the following: the management’s shareholding reduced (Sell) during the inspection period, in which case, the management’s shareholding reduction was recorded as 1; otherwise, it was recorded as 0. If the management’s shareholding increased (Buy), the increase in the shareholding of the management during the above inspection period was recorded as 1; otherwise, it was recorded as 0.

In Column 1 of Table 5, the coefficient of the interaction Change*Blockchain is 0.008, at a 5% significance level. In Column 2, the interaction term Sell*Blockchain is 0.008, at the 1% significance level. In Column 3, the results are insignificant in Buy*Blockchain. The results indicate that managers could obtain benefits by changing their shareholding, especially in selling shares for profit, rather than buying.

Previous research only focused on the different ways of self-interested behavior related to blockchain technology adoption. Griffins and Shams (2020) found that purchases with Tether could lead significant increases in the price of Bitcoin. Similar results are found in Mt.Gox Bitcoin exchange theft (Gandal et al., 2018). Our research used to buy and sell activities to demonstrate the managerial self-interested behavior. The results show that managers are more likely to profit by selling rather than buying stocks.

Mechanism: the effect of power consolidation

A critical prerequisite for the logical analysis is that when executive power is relatively concentrated, executives are more likely to utilize their consolidated power to weaken the supervisory role of the board of directors (Finkelstein and D’aveni, 1994). This allows them to exaggerate or manipulate the disclosure and application of the company’s blockchain technology to achieve greater personal gains. Existing research has found that the dual role of chairman and CEO is a significant indicator of concentrated executive power. A CEO who also serves as chairman can use this power to manipulate board decisions to serve their own interests (Tuggle et al., 2010), upwardly adjust the company’s earnings (Davidson et al., 2004) and ultimately undermine the company’s value (Castañer and Kavadis, 2013). It arises when a CEO also serves as board chair, which can limit the board’s ability to discipline and harm the organization (Duru and Zampelli, 2016; Desai et al., 2003). When a company’s CEO also serves as chairman of the board, directors have conflicting goals. According to organizational theory (Finkelstein and D’aveni, 1994), this duality of the CEO establishes strong, clear leadership. However, according to agency theory, duality reduces the effectiveness of board monitoring, thus promoting the consolidation of the CEO’s position. Therefore, when the chairman also serves as CEO, due to his relatively concentrated power, it is more likely to strengthen the self-interested motives of executives, making the negative relationship between blockchain technology and corporate defaults more significant.

On the other hand, a good internal control environment helps to constrain the power of executives, so that the company has a better information environment (Jin and Myers, 2006), and can also reduce the information asymmetry between enterprises and investors, thereby constraining the self-interested behavior of executives (Hutton et al., 2009). On the contrary, if the internal control environment of the company is poor, it will not be able to effectively constrain the self-interested behavior of executives, making executives more likely to take self-interested actions, making the company more likely to default. Therefore, when the company’s internal control is poor, the constraints on the power of executives are weaker, making it more likely that executives will have a higher risk of default due to self-interested motives.

We used Internal Control and CEO dual responsibility as the proxy for CEO power consolidation. Internal control was measured by whether to issue the conclusion of the internal control evaluation report: if yes, the value was recorded as 0; otherwise, it was recorded as 1. Dual represents the chairman and the general manager concurrently in one person. The value is 1 if it is true, and 0 otherwise.

In Table 6 Column 1, we use CEO duality as a proxy for power consolidation. We define if CEO is appointed as a member of the board of directors at the same time, the power of the CEO will be consolidated. The results show that the coefficient of the interaction term Dual*Blockchain is 0.009, at the significance level of 10%. The results indicate that the default risk is higher in a firm with duality.

Similar results are shown in Table 6, column 2: we find that the interaction term Internal Control*Blockchain is 0.039, at a significance level of 1%, while the interaction term Dual*Blockchain is 0.009, at a significance level of 10%. The results indicate that the relationship is more pronounced in firms in which the CEO’s power consolidation is high.

The results are consistent with the research of Yermack (2017). This paper shows that CEO power consolidation could exist in firms with lower costs, greater liquidity, more accurate record-keeping, and transparency of ownership. Our results demonstrate that CEO power concentration could distort the transparency of the power and reduce the accuracy of the record-keeping. The default risk increases after a firm adopts blockchain technology.

Additional tests

Blockchain real effect: corporate debt financing

We further explored the real effect of blockchain technology, including debt financing, earning management, and investment efficiency. In terms of debt financing, blockchain has an impact on the different types of debt financing. For long-term debt, companies aim at long-term growth through blockchain technology, while for short-term debt, the CEO has a strong incentive to use blockchain technology to achieve short-term goals.

Table 7 shows that blockchain technology adoption could increase the debt level in Column 1. The coefficient is 0.003, at the significance level of 10%. The results show that blockchain technology can increase debt financing. In Column 2, the coefficient of blockchain is −0.002, at the significance level of 5% in the subsample of long-term debt. In contrast, in Column 3, the coefficient is 0.005, at the significance level of 1% in the subsample of short-term debt. The results show that blockchain technology adoption could significantly increase debt financing. And the results are mainly driven by short-term debt financing.

The results are consistent with those of prior research. Chod and Lyandres (2021) further point out that blockchain technology provides the capability to secure favorable financing conditions at lower signaling costs. Chod et al. (2020) also contend that the decentralized governance facilitated by blockchain technology mitigates the barriers for new users entering platforms, thereby alleviating the financing burden on entrepreneurs. In summary, blockchain technology adoption could help alleviate financial burdens through debt financing.

Blockchain real effect: investment efficiency

To further explore the impact of blockchain technology adoption, we investigated the relationship between blockchain and investment efficiency. The investment efficiency was measured by Richardson (2006). The model tries to calculate the optimal level of investment, where εi,t > 0 indicates that the enterprise overinvests (Overinvest), and εi,t < 0 indicates that the enterprise underinvests (Underinvest). The absolute value of the sample of εi,t < 0, is used to measure the degree of insufficient investment of the enterprise (Efficiency). In Table 8, the blockchain coefficient is 0.002, at the significance level of 10%. The results indicate that blockchain adoption results in low investment efficiency. Moreover, the coefficients in Columns 2 and 3 are 0.003 and −0.001 respectively. The results show that low investment efficiency is mainly driven by overinvestment.

Prior research focused on the blockchain information disclosure and its responses. Cheng et al. (2019) found that investors responded positively to the 8-K disclosure by US-listed companies involving blockchain vocabulary. Chen et al. (2019) further analyzed the cumulative differences between US-listed companies before and after the announcement of blockchain technology innovation patents. Based on Richardson’s (2006) model, we found that blockchain technology adoption could increase corporate default by distorting the investment efficiency.

Robustness tests

To ensure the robustness of our results, we performed the following robustness tests.

Alternative measurement of blockchain adoption

To add validity to our research, we used alternative variables to measure blockchain adoption. We extracted the total vocabulary discussed and analyzed by management and the number of blockchain words and used the ratio of blockchain vocabulary to the total vocabulary extracted via management discussion and analysis (PBTV) to measure blockchain technology. In Table 9, the coefficient of PBTV is 1.344, at the significance level of 1%. The results show that blockchain adoption helps to increase the default probability, and they are consistent with prior results.

Alternative measurement of default risk

We alternative the measurements of the probability of default by different variables. Defaults were calculated via the natural logarithm of the number of corporate defaults (Table 10 column 1) and the dummy variable for default or not as the dependent variable (Table 10 column 2). The similar results show that after the firms adopt the blockchain technology, the default increases. The results are consistent with prior research. Firms can obtain an advantage from the market by trading with bitcoin. Specifically, the companies can expand their debt financing by announcing their involvement in the blockchain industry. However, Cioroianu et al. (2021) only used data from the US market, while our research was expanded into the Chinese market.

We also proxy for default risk by Zscore. Referring to the research of Altman (1968), the Z-score model based on the analysis of Chinese enterprises was used to measure the debt default risk of enterprises. The model is Zscore = 0.517 – 0.46 × (total liabilities/total assets) − 0.388 × (working capital/total assets) + 0.932 × (net profit/average total assets) + 1.158 × (retained earnings/total assets). The larger the Zscore value, the stronger the solvency of the company and the lower the risk of default. The results are shown in Table 10, column 3. The blockchain coefficient is −0.003, at the significance level of 10%. The results suggest that companies use blockchain technology as a tool to mask their default risk. The results are consistent with prior research, showing that blockchain technology adoption could increase the default risk of firms.

Firm-fixed effect

In 2008, Satoshi Nakamoto first raised the “blockchain,” and since then, it has had a huge impact on technology, innovation, and the financial market. In this subsample of tests, we set 2008 as a time period and investigated the impact before and after this time. In Column 1 of Table 11, the blockchain coefficient is 0.004, at the significance level of 1%. We found that after the year 2008, firms which adopt blockchain technology have a higher expected default rate, after controlling for the industry and year fixed effect. In Column 2, the coefficient is 0.005, at the significance level of 1%, after controlling for the firm-fixed effect and year fixed effect. In contrast, after controlling for the firm-fixed effect, the full sample in Column 3 has insignificant results. The results show that blockchain technology has had a significant impact since 2008, and managers may use it to fool investors and obtain benefits for themselves.

Endogeneity

Endogenous issues should be considered. Firm-level heterogeneous problems and omitted variables could lead to biased results. To mitigate the endogenous problem, we included DID and PSM to find the change in corporate default before and after the adoption of a blockchain. And we also included the placebo tests. To mitigate the omitted variable problem, the instrumental variable approach was also employed.

Difference-in-difference

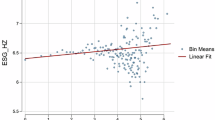

We consider blockchain technology adoption as an exogenous shock. Following Qian et al. (2018) and Beck et al. (2010), we recognized that we should also include the dynamic DID. DID is one and more years after the first year of using blockchain technology. Firstly, the results of DID are shown in Column 1 of Table 12. The coefficient of DID is 0.003, at the significance level of 5%. The results indicate that the corporate default rate increases after blockchain adoption. Secondly, in Column 2, the results show in dynamic DID procedure. We show the six periods’ results. The coefficients of pre2 and pre1 are insignificant. In contrast, the coefficients of the current period and post1, post2 and post3 are significant. The results show that the corporate default risk increases after blockchain technology adoption. Blockchain technology adoption could be viewed as an event to study that provides a clean setting to investigate the relationship between adoption and corporate default (Figs. 1 and 2).

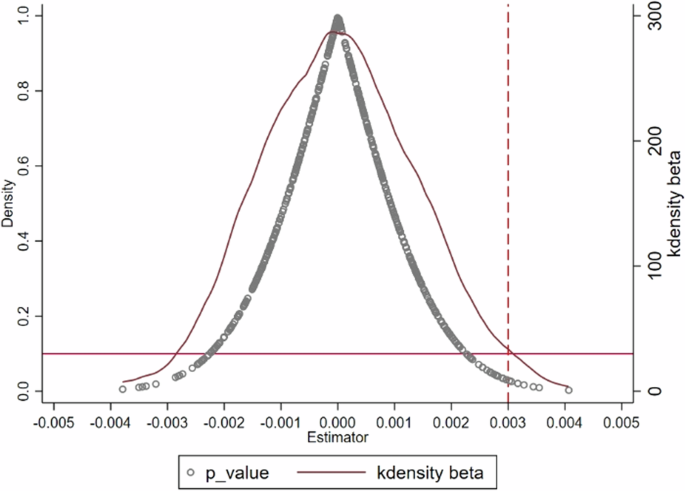

We also included a placebo. The interaction term, DID, was randomly sampled 500 times to see if the coefficients differed significantly from the baseline estimation results. The results are consistent with the previous ones.

Propensity score matching

We conducted the PSM test to mitigate the firm-level heterogeneous problem. In Table 13, Column 1, the results show that after the PSM, the blockchain coefficient is 0.004, at the significance level of 5%. The results are consistent and the coefficient level is much higher than previous results. We conducted the PSM-DID and the results in Column 2 are consistent with previous research, and the level of significance is higher. The results show that after blockchain technology adoption, the corporate default risk increases.

Instrumental tests

To mitigate the self-selection bias and omitted variable problems, we adopted an instrumental variable approach to solve the problem. Subsequently, Yuan et al. (2021), building upon the work of Huang et al. (2019), employed postal and telecommunications data from various cities and the lagged number of national internet users in conjunction with the number of fixed telephones per 10,000 people each city in 1984 as instrumental variables for the current level of digitalization of firms. Blockchain technology represents a significant component of digital technology innovation, making the instrumental variables evidently applicable to this study.

Therefore, this paper synthesizes the instrumental variable research methods of Huang et al. (2019) and Yuan et al. (2021). We use the cross-term of the number of post offices in the city where the headquarters was located in 1984 (Post1984) and the number of national internet users in the previous year as an instrumental variable. On the one hand, the layout of postal and telecommunications services would, to some extent, affect the preliminary layout of the internet infrastructure and thereby influence local internet usage habits (Huang et al., 2019); a blockchain, as the latest core innovation technology in the digital economy realm, with its decentralized distributed network, relies on internet infrastructure. From this perspective, after controlling for other variables, the cross-term of the number of post offices in the city where the company was in 1984 and the national internet user numbers from the previous year used in this paper can meet the requirement of instrumental variables well. We use Logitbaurnum to represent the log (itbaurnum + 1), and itbaurnum represents the number of users with broadband Internet access in year t – 1. Log_postoffice is the log (postoffice + 1), and postoffice is the number of post offices in prefecture-level cities in 1984. These variables are directly related to blockchain technology, but it is not related to corporate default risk. Therefore, they can be regarded as valid instrumental variables.

In Table 14, in the first stage, the coefficients of L1.logitbaurnum and Log_postoffice are significantly related to a blockchain, which means that they are valid IV. And in the second stage, the blockchain coefficient is 0.073, at the significance level of 5%. The results are consistent with prior research. The results are consistent with those of Huang et al. (2019) and Yuan et al. (2021).

Conclusions and policy implications

Discussion

Blockchain technology is a platform for various financial activities (Xu and Zou, 2021). Thus, it has a high value in the financial market. However, according to the previous theoretical analysis, companies do have incentives to gain benefits by disclosing their blockchain technology adoption, but the cost of implementing blockchain technology is relatively high (Cheng et al., 2019; Chen et al., 2019). In this case, companies have incentives to use blockchain technology at a low cost. Strategic disclosure promotes individual self-interests. Our research is aligned with previous research (Cioroianu et al., 2021).

Conclusions

This paper investigates whether blockchain technology adoption could increase or decrease corporate default risk. Using the expected default risk model to estimate the expected default risk, the results show that the default risk increases once the firm adopts blockchain technology, which indicates managerial opportunism behavior. The effect is relevant in firms with CEO duality and higher power consolidation. The results are consistent with various robustness checks and endogenous tests.

Our paper sheds light on the “dark side” of blockchain technology when misused by managers. Previous literature shows the benefit of blockchain technology to a firm. Due to technology adoption, the firm also has high value. Managers could use the technology to mask their weakness, including default. Our paper provides the practical insights to detect the managerial opportunism behavior after the technology’s adoption.

Policy implications

The government should further strengthen the orderly guidance of enterprises in implementing blockchain technology, actively formulate relevant laws and regulations to strengthen the orderly development of enterprise blockchain technology innovation, prevent enterprises from using blockchain technology to mislead investors through information asymmetry, and thus protect the interests of investors. On the other hand, the government should actively promote the rational application of blockchain technology in enterprises, formulate a series of management measures to ensure the reasonable use of blockchain technology in enterprise business activities and make blockchain technology better serve the development of the real economy.

As one of the core technologies to promote the transformation of the digital economy, China has invested heavily in relevant research in the field of blockchain technology. Whether it is technological research and development or business model innovation, China is at the forefront of the world. However, this study also found that there are some shortcomings in the application of blockchain technology for enterprises. Since China and emerging market countries are highly similar in terms of development stage, economic model, and institutional perfection, this study will help emerging market countries learn from China’s blockchain technology and avoid the occurrence of such phenomena. It has high applicability and reference value for emerging market countries.

Limitations of the research

First, this paper may have some shortcomings in measuring the blockchain use by enterprises using the text analysis method. In the future, more dimensional data sources can be considered to measure the application of blockchain technology more accurately by enterprises, such as using enterprise blockchain investment and applying machine learning to judge blockchain applications.

Secondly, since the literature on the theme of blockchain technology and corporate behavior has only begun to emerge in recent years, the guiding significance of the theoretical framework and conclusions formed in this study for future research still needs to be tested and enriched via subsequent research. In the future, we can further explore the relevant issues from the perspective of relevant economic and management theories, such as digital technology innovation and multi-subject value co-creation, to expand the theoretical framework of blockchain-related research.

Finally, the applicability of our research in developed countries needs to be further explored. The market characteristics of developed countries may be different from those of China. They usually have more stringent market and legal norms and stricter constraints on managers. Therefore, whether and how our research is applicable to blockchain applications in developed countries still needs further exploration. Future research can actively explore the innovations and challenges of blockchain applications in different countries from an international perspective.

Data availability

The textual information used in this article is from the MD&A sections of the firms’ annual reports, and the data for the other variables are from the China Research Data Services Platform. Due to restrictions in the data use agreement, users are not allowed to publish or disclose the data in any form. Therefore, the data used in this article are not suitable for public disclosure. However, if the author makes a reasonable request and obtains permission from the data use agreement, the data provider can provide the data. All data processing codes are provided in the supplementary materials.

Notes

Despite the potential limitations of including earlier data, it is still valuable. First, it can better compare earlier and later data to help us understand the changes in the impact of blockchain technology adoption on business default risk, such as in difference-in-difference (DID) analysis, which more accurately identifies the causal impact of blockchain technology by comparing earlier and later data. Second, incorporating earlier data provides a long-term perspective that allows us to observe the changes before and after the adoption of blockchain technology. Finally, in the subsample test in Table 8, we show that our results are still robust when only the subsample test after 2008 is used.

References

Akyildirim E, Corbet S, Katsiampa P, Kellard N, Sensoy A (2020) The development of bitcoin futures: exploring the interactions between cryptocurrency derivatives. Financ Res Lett 34:101234

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23:589–609

Atif M, Ali S (2021) Environmental, social and governance disclosure and default risk. Bus Strategy Environ 30(8):3937–3959

Autore D, Chen HA, Clarke N, Lin J (2024) Blockchain and earnings management: evidence from the supply chain. Br Account Rev 56:101357

Beck T, Levine R, Levkov A (2010) Big bad banks? The winners and losers from bank deregulation in the United States. J Financ 65:1637–1667

Benedetti H, Kostovetsky L (2021) Digital tulips? Returns to investors in initial coin offerings. J Corp Financ 66:101786

Bharath ST, Shumway T (2008) Forecasting default with the Merton distance to default model. Rev Financ Stud 21(3):1339–1369

Bloomfield, RJ (2002). The ‘incomplete revelation hypothesis’ and financial reporting

Brockman P, Martin X, Puckett A (2010) Voluntary disclosures and the exercise of CEO stock options. J Corp Financ 16:120–136

Brown LD, Lee YJ (2010) The relation between corporate governance and CEOs’ equity grants. J Account Public Pol 29:533–558

Cahill D, Baur DG, Liu ZF, Yang JW (2020) I am a blockchain too: How does the market respond to companies’ interest in blockchain? J Bank Financ 113:105740

Cai YJ, Choi TM, Zhang J (2021) Platform supported supply chain operations in the blockchain era: Supply contracting and moral hazards. Decis Sci 52(4):866–892

Castañer X, Kavadis N (2013) Does good governance prevent bad strategy? A study of corporate governance, financial diversification, and value creation by French corporations, 2000–2006. Strategic Manage J 34(7):863–876

Catalini C, Gans JS (2018) Initial coin offerings and the value of crypto tokens (No. w24418). National Bureau of Economic Research

Cathcart L, Dufour A, Rossi L, Varotto S (2020) The differential impact of leverage on the default risk of small and large firms. J Corp Financ 60:101541

Chen MA, Wu Q, Yang B (2019) How valuable is FinTech innovation? Rev Financ Stud 32:2062–2106

Chen S, Ma H (2018) Loan availability and corporate commercial credit-quasi-natural experimental evidence of China’s interest rate marketization reform. Manag World 11:108–120

Chen Y (2020) Improving market performance in the digital economy. China Econ Rev 62:101482

Cheng Q, Warfield TD (2005) Equity incentives and earnings management. Account Rev 80:441–476

Cheng SF, De Franco G, Jiang H, Lin P (2019) Riding the blockchain mania: Public firms’ speculative 8-K disclosures. Manag Sci 65:5901–5913

Chod J, Trichakis N, Tsoukalas G, Aspegren H, Weber M (2020) On the financing benefits of supply chain transparency and blockchain adoption. Manag Sci 66:4378–4396

Chod J, Lyandres E (2021) A theory of ICOs: diversification, agency, and information asymmetry. Manag Sci 67(10):5969–5989

Cioroianu I, Corbet S, Larkin C (2021) The differential impact of corporate blockchain-development as conditioned by sentiment and financial desperation. J Corp Financ 66:101814

Cong LW, Li Y, Wang N (2021) Tokenomics: Dynamic adoption and valuation. Rev Financ Stud 34(3):1105–1155

Davidson R, Goodwin-Stewart J, Kent P (2005) Internal governance structures and earnings management. Acc Fin 45(2):241–267

Desai A, Kroll M, Wright P (2003) CEO duality, board monitoring, and acquisition performance: a test of competing theories. J Bus Strateg 20:137–156

Du J, Shi Y, Li W, Chen Y (2023) Can blockchain technology be effectively integrated into the real economy? Evidence from corporate investment efficiency. China J Account Res 16:100292

Duru A, Iyengar RJ, Zampelli EM (2016) The dynamic relationship between CEO duality and firm performance: The moderating role of board independence. J Bus Res 69(10):4269–4277

Finkelstein S, D’aveni RA (1994) CEO duality as a double-edged sword: How boards of directors balance entrenchment avoidance and unity of command. Acad Manag J 37:1079–1108

Fisch C, Masiak C, Vismara S, Block J (2021) Motives and profiles of ICO investors. J Bus Res 125:564–576

Gandal N, Hamrick J. T, Moore T, Oberman T (2018) Price manipulation in the Bitcoin ecosystem. J Monet Econ 95:86–96

Gong T, Tang Y, Zahra SA (2021) How global digitalization influences the attractiveness of a firm digital name to foreign investors. In: Academy of Management Proceedings. Academy of Management Briarcliff Manor, NY 10510, 14256

Griffin JM, Shams A (2020) Is Bitcoin really untethered? J Financ 75(4):1913–1964

Huang Q, Yu Y, Zhang S (2019) Internet development and productivity growth in manufacturing industry: Internal mechanism and China experiences. China’s Ind Econ 8:5–23

Hutton AP, Marcus AJ Tehranian H (2009) Opaque financial reports, R2, and crash risk. J financ econ 94(1):67–86

Jin L, Myers SC (2006) R2 around the world: New theory and new tests. J financ econ 79(2):257–292

Kong D, Pan Y, Tian GG, Zhang P (2020) CEOs’ hometown connections and access to trade credit: evidence from China. J Corp Financ 62:101574

Li J, Mann W (2018) Initial coin offering and platform building. SSRN Working Paper

Malik A, Froese FJ (2022) Corruption as a perverse innovation: the dark side of digitalization and corruption in international business. J Bus Res 145:682–693

Mikolov T, Sutskever I, Chen K, Corrado GS, Dean J (2013). Distributed representations of words and phrases and their compositionality. Adv Neur Inf Proc Syst 26. NIPS

Nakamoto S (2008) Bitcoin: a peer-to-peer electronic cash system. https://doi.org/10.2139/ssrn.3440802

Qian X, Kang J, Tang Y, Cao X (2018) Industrial policy, capital allocation efficiency, and enterprise total factor productivity: Based on the empirical research of natural experiments of China’s 2009 ten major industries revitalization plan. China Ind Econ 8:42–59

Raman K, Shahrur H (2008) Relationship-specific investments and earnings management: Evidence on corporate suppliers and customers. Account Rev 83:1041–1081

Richardson S (2006) Over-investment of free cash flow. Rev Acc Stud 11:159–189

Sockin M, Xiong W (2023) Decentralization through tokenization. J Financ 78(1):247–299

Smith JK (1987) Trade credit and informational asymmetry. J Financ 42:863–872

Song M, Xu H (2023) Can blockchain innovation improve the total factor productivity of enterprises?—an empirical study based on Chinese A-share listed companies. Nankai Bus Rev 8:1–30

Tuggle CS Sirmon DG, Reutzel CR, Bierman L (2010) Commanding board of director attention: investigating how organizational performance and CEO duality affect board members' attention to monitoring. Strategic Manage J 31(9):946–968

Xu Z, Zou C (2021) What can blockchain do and cannot do? China Econ J 14:4–25

Yermack D (2017) Corporate governance and blockchains. Rev Finance 21(1):7–31

Yuan L, Chen Y, Wang T, Yu W, Shi Y, Jiang ZH, Yan S (2021). Tokens-to-token vit: training vision transformers from scratch on imagenet. In: Proceedings of the IEEE/CVF international conference on computer vision. IEEE, pp. 558–567

Zeitun R, Tian GG (2007) Does ownership affect a firm’s performance and default risk in Jordan?. Corp. Gov.: Int J Bus Soc 7:66–82

Zhang H, Kyaw K (2017) Ownership structure and firm performance: an empirical analysis of Chinese companies. Appl Econ Financ 4(2):57–64

Acknowledgements

Our research is supported by the National Natural Science Foundation of China (Grant No.72002043; 72202079); Humanities and Social Sciences Planning Fund of the Ministry of Education (24YJAZH100); Guangdong Natural Science Foundation Project (No. 2024A1515011315); Guangdong Philosophy and Social Science Foundation (No. GD22XGL48).

Author information

Authors and Affiliations

Contributions

YL contribution: resources, writing, review and editing, and supervision; MF contribution: conceptualization, methodology, formal analysis; AL contribution: methodology, formal analysis, writing—original draft; writing—review and editing; SC contribution: software, writing, review and editing, and supervision.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Luo, Y., Fang, M., Li, A. et al. Opportunity or opportunism? Blockchain technology adoption and corporate default risk. Humanit Soc Sci Commun 11, 1360 (2024). https://doi.org/10.1057/s41599-024-03727-6

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03727-6