Abstract

The semiconductor industry serves as a key enabler of technological progress and economic growth on a global scale. With Southeast Asia emerging as a region of increasing importance in the global supply chain landscape, understanding the potential for its countries to participate in the semiconductor supply chain becomes crucial. Despite extensive research on global supply chain dynamics, a focused analysis on the role of Southeast Asia within this crucial industry has been notably absent, particularly considering recent geopolitical and economic shifts. This gap has been filled by employing a rigorously designed Multi-Criteria Decision Making (MCDM) approach that integrates the Criteria Importance Through Intercriteria Correlation (CRITIC) method and the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS). Data on fifteen indicators, including economic stability, technological innovation capacity, and infrastructural capabilities, were collected and identified through an extensive literature review and consultations with stakeholders. These indicators were weighted using the CRITIC method to reflect their relative importance, and each country’s position relative to an ideal solution was assessed using the TOPSIS method. It was revealed that countries such as Singapore and Malaysia possess significant potential due to their advanced technological infrastructure and stable economic environments. Other countries, like Vietnam and Indonesia, were also found to exhibit promising capabilities, albeit with certain limitations. The study highlights the varying strengths and strategic areas that should be considered by policymakers and investors to enhance integration into the global semiconductor supply chain. Significant contributions to the strategic decision-making process have been made by providing a nuanced analysis of the region’s readiness and identifying specific areas for investment and policy intervention. By offering a methodological framework that can be adapted to other regions and sectors, not only has an existing research void been filled, but the practical understanding of effectively leveraging Southeast Asia’s potential in the semiconductor industry has also been enhanced.

Similar content being viewed by others

Introduction

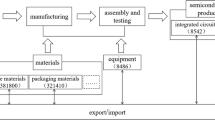

The semiconductor supply chain plays a crucial and indispensable role in today’s technology-driven world. Semiconductors are the foundation of modern electronics, powering everything from smartphones and laptops to advanced medical devices and automotive systems (Saif M. Khan, Alexander Mann, & Peterson, 2021). According to the Worldwide Semiconductor Trade Statistics (WSTS), as shown in Fig. 1, the forecasted global semiconductor market in 2024 is US$576 billion (WSTS Semiconductor Market Forecast Spring 2023, 2023). The supply chain encompasses a complex network of companies involved in various stages, including semiconductor design, fabrication, assembly, testing, and distribution (Mönch, Uzsoy, & Fowler, 2018a, 2018b). It is a highly interconnected and globalized system, where any disruptions or delays in one part can have far-reaching impacts on industries and economies worldwide (Kuo, Ponsignon, Ehm, & Chien, 2019). Ensuring a robust and resilient semiconductor supply chain is vital for maintaining innovation, competitiveness, and the continued advancement of technology across sectors (Chang et al., 2021). As demand for electronics and cutting-edge technologies continues to surge, effective supply chain management becomes even more critical in meeting the needs of consumers and businesses alike. In the semiconductor supply chain, one of the main players is the semiconductor manufacturers, also known as semiconductor fabs (Keil, 2017). These companies are responsible for the design, development, and production of integrated circuits and other semiconductor devices. They are at the forefront of technological advancements and play a pivotal role in driving innovation in the electronics industry (Cui, Li, & Wang, 2021). Semiconductor manufacturers operate state-of-the-art fabrication facilities that utilize highly sophisticated processes to create microchips on silicon wafers. These facilities are known as fabs, and they require substantial investments in terms of capital, research and development, and skilled workforce (Okada & Shirahada, 2022). Leading semiconductor manufacturers often have multiple fabs strategically located around the world to cater to global demand (Hsiao, Hibiya, Nakano, Cheng, & Wen, 2015). Some of the major semiconductor manufacturers in the industry include Intel, Samsung Electronics, Taiwan Semiconductor Manufacturing Company (TSMC), and GlobalFoundries, among others (Tsujimura, 2020). These companies are consistently pushing the boundaries of semiconductor technology, striving to make chips smaller, faster, and more energy efficient (Hwang & Lu, 2013). As the demand for advanced electronics and cutting-edge technologies increases, semiconductor manufacturers must continuously enhance their capabilities and capacities to stay competitive. They collaborate closely with various stakeholders in the supply chain, such as semiconductor equipment suppliers, materials providers, and design houses, to ensure a seamless flow of products from concept to market (Lin, Spiegler, & Naim, 2018). Given the critical role they play in the semiconductor supply chain, these companies’ decisions and actions can significantly impact the global technology landscape and have far-reaching consequences for industries, economies, and consumers worldwide (Semiconductor Supply Chain: Policy Considerations from Selected Experts for Reducing Risks and Mitigating Shortages, 2022). As a result, semiconductor manufacturers are constantly navigating the challenges of supply and demand fluctuations, technological complexity, and geopolitical factors to maintain their position as key players driving innovation in the semiconductor industry.

Projected global semiconductor market size from 2020 to 2024. Source: (WSTS Semiconductor Market Forecast Spring 2023, 2023).

The semiconductor supply chain is a highly globalized and interconnected ecosystem, and countries participate based on their strengths and priorities, working together to drive innovation and meet the demands of a technology-driven world as shown in Table 1 (Khan et al., 2021). For example, the fabrication segment contributes 38.4% of the value of the entire semiconductor supply chain. In this segment, Taiwan’s market share is 19%. Some countries have established themselves as major players in semiconductor manufacturing, hosting semiconductor fabs operated by both domestic and international companies (Bridwell & Richard, 1998). These countries invest heavily in infrastructure, research and development, and skilled labor to attract semiconductor manufacturers. China, the United States, Taiwan, South Korea, and Japan are among the key countries with a significant presence in semiconductor fabrication (Chau, 2018). Southeast Asian countries are increasingly playing a vital role in the semiconductor supply chain, driven by their growing electronics market and the rise of semiconductor manufacturing hubs in countries like Malaysia, Singapore, and the Philippines (Pasadilla, 2023; Salleh, Musaddad, & Elyas, 2023). These nations attract investment from multinational semiconductor companies with competitive facilities and skilled labor. Additionally, Southeast Asian countries are making strides in semiconductor design and intellectual property development, fostering innovation, and building a talented workforce (Maini, 2023). By focusing on supporting industries, such as semiconductor equipment and materials, and investing in research and development, they are positioning themselves as important contributors to the semiconductor industry’s growth. Government policies and incentives, along with regional cooperation, further enhance their chances in the global semiconductor landscape (Kim, 2023). Leveraging their strategic location and political stability, Southeast Asia countries are poised to become reliable and resilient partners in the semiconductor supply chain amid geopolitical disruptions, contributing to the industry’s continued success.

The application of Multiple Criteria Decision Making (MCDM) is particularly advantageous for assessing Southeast Asian countries’ roles in the semiconductor supply chain. MCDM facilitates complex decision-making by systematically evaluating multiple conflicting criteria, such as strategic location, political stability, and resilience to geopolitical disruptions—key factors in identifying potential regional leaders in the semiconductor industry (Wang, Nhieu, & Liu, 2024). However, there is a notable research gap in applying MCDM specifically to analyze how these countries can leverage their unique geopolitical and economic attributes to enhance their integration and performance within the global semiconductor market. Addressing this gap could provide deeper insights into effectively harnessing the strengths of Southeast Asian countries, ensuring a more resilient and successful semiconductor supply chain on a global scale.

This study aims to assess the ability and opportunity to join the supply chain of Southeast Asian countries in the near future. Accordingly, the factors, indicators, and criteria for assessing the status and potential of Southeast Asian countries are determined. Based on those indicators, the potential, advantages, and limitations of each Southeast Asian country are analyzed and evaluated through an integrated MCDM approach. The method employed in this study takes inspiration from two established decision-making methodologies: CRITIC (Criteria Importance Through Intercriteria Correlation) and TOPSIS (Technique for Order Preference by Similarity to Ideal Solution). The CRITIC method is chosen for its robust ability to objectively determine the weights of various criteria based on their statistical variance and inter-correlations, without necessitating subjective input from decision-makers. This attribute is particularly beneficial in the semiconductor industry, where an objective, data-driven approach is crucial for minimizing biases in strategic decision-making. Furthermore, TOPSIS is utilized due to its efficiency in handling multiple criteria, effectively identifying solutions that are closest to the ideal solution and farthest from the nadir point. This capability is vital for providing a clear, rank-ordered result that underscores which countries are best suited for integration into the semiconductor supply chain, based on the specified criteria. The ability of TOPSIS to accommodate both beneficial and non-beneficial attributes makes it exceptionally suitable for evaluating the complex facets of semiconductor supply chain readiness. The integration of CRITIC and TOPSIS provides a comprehensive and systematic framework for assessing and comparing the potential of Southeast Asian countries within the semiconductor industry. This approach, though not commonly applied in existing regional supply chain analyses, offers a novel contribution to the field by ensuring that the evaluation is not only extensive but also anchored in rigorous quantitative analysis. Such a methodological alignment enhances the reliability and validity of the study’s conclusions, making it a transparent, reproducible, and rigorous framework well-suited for addressing the intricate dynamics of the semiconductor industry’s supply chain in Southeast Asia.

The structure of this article includes problems statement and research objectives in Section 1, Literature review in Section 2, Methodology in Section 3, Numerical results in Section 4, and Conclusions in Section 5.

Literature review

The semiconductor supply chain studies

The global semiconductor supply chain has been a subject of extensive research due to its crucial role in technological advancement and economic growth. Scholars have investigated various aspects of the semiconductor supply chain, including its structure, challenges, resilience, and the impact of disruptions. Several studies have examined the structure and coordination mechanisms within the global semiconductor supply chain. Researchers have explored the relationships between semiconductor manufacturers, suppliers of raw materials and equipment, distributors, and end-users (Bui et al.; Guan et al., 2020; Lohmer, Silva, & Lasch, 2022; Khan et al., 2021; Shekarian & Flapper, 2021). They have analyzed strategies for effective coordination, collaboration, and information sharing among the supply chain partners to optimize production, reduce lead times, and enhance overall supply chain performance. Given the long lead times and complex manufacturing processes in the semiconductor industry, risk management and resilience have received significant attention in the literature (Craighead, Blackhurst, Rungtusanatham, & Handfield, 2007). Studies have focused on identifying and mitigating risks, such as supply disruptions, natural disasters, geopolitical tensions, and demand volatility (Guan et al., 2020; Gurtu & Johny, 2021; Hasan, Bellenstedt, & Islam, 2023). The recent global shortages and bottlenecks in the semiconductor industry have spurred research on the causes, impacts, and potential solutions (Semiconductor Supply Chain: Policy Considerations from Selected Experts for Reducing Risks and Mitigating Shortages, 2022). Scholars have investigated factors contributing to the shortages, such as increased demand, supply constraints, and supply chain vulnerabilities (Hasan et al., 2023). The global nature of the semiconductor supply chain necessitates collaboration and coordination across borders. Researchers have examined collaborative practices, partnerships, and alliances among semiconductor companies, suppliers, research institutions, and government entities (Bui et al.; Khan et al., 2021; Shekarian & Flapper, 2021). With growing concerns about environmental sustainability, research has also focused on sustainable practices in the semiconductor supply chain. Scholars have investigated energy efficiency, waste management, recycling, and the reduction of environmental impact throughout the lifecycle of semiconductor products (Tsai, 2023; Yang & Wang, 2020). The semiconductor supply chain is closely intertwined with technological advancements and innovation. Researchers have explored the impact of technological developments, such as advanced manufacturing processes, Internet of Things (IoT), artificial intelligence (AI), and blockchain, on the supply chain (Frederico, 2021; Lohmer et al., 2022). Scholars have proposed strategies for building resilient supply chains, addressing shortages, enhancing collaboration, promoting sustainability, and leveraging technological advancements in the semiconductor industry. This literature review demonstrates the breadth of research on the global semiconductor supply chain, covering various dimensions such as structure, coordination, risk management, collaboration, sustainability, and technological advancements. The existing body of knowledge provides valuable insights for practitioners, policymakers, and researchers seeking to understand and improve the efficiency, resilience, and sustainability of the semiconductor supply chain on a global scale. Research on the semiconductor supply chain in the Southeast Asian region has garnered significant attention due to the region’s potential and opportunities in the global semiconductor industry (Lin et al., 2018; Mönch et al., 2018a). Scholars have conducted numerous studies, examining various aspects of the semiconductor supply chain within Southeast Asian countries (Ehm et al., 2019; Lin et al., 2018). These studies have encompassed comparative analyses of Southeast Asian countries to assess their industry development, competitiveness, and supply chain capabilities (Ehm et al., 2019; Mönch et al., 2018a). They have explored factors such as strategic location, investment climate, skilled labor force, domestic market potential, technological capabilities, and government initiatives (Ehm et al., 2019; Lin et al., 2018). Collaboration and partnerships within the industry have also been investigated, focusing on regional integration programs, research collaborations, joint ventures, and industry-government partnerships aimed at strengthening the semiconductor supply chain in Southeast Asian (Ravenhill, 2016; Trinidad, 2018). The role of government policies and investment incentives in promoting the semiconductor industry has been scrutinized, including tax incentives, research funding, infrastructure development, and intellectual property rights protection (Chang et al., 2021).

Collectively, as shown in Table 2, this literature review provides insights into the semiconductor supply chain in Southeast Asian, informing policymakers, industry leaders, and researchers about industry development, collaboration opportunities, risk management, government policies, technological advancements, and sustainability practices. Further research in this field can contribute to identifying and enhancing the competitiveness of the semiconductor supply chain within Southeast Asia countries.

Multiple criteria decision-making methods’ trends and applications

MCDM is a dynamic field of research that addresses the complexities of decision-making involving multiple conflicting criteria (Tzeng & Shen, 2017). MCDM methods were witnessing significant advancements driven by emerging trends. Integration with Artificial Intelligence (AI) techniques, such as machine learning and deep learning, was enhancing decision-making processes, while big data and data analytics were enabling the handling of large datasets for better insights (Nguyen, Nguyen, & Nguyen, 2022; Tronnebati, El Yadari, & Jawab, 2022). Multi-criteria optimization sought to find optimal solutions considering all objectives simultaneously, and sustainability concerns prompted MCDM’s application to address environmental and green-related decisions (C.-N. Wang, Nhieu, Chung, & Pham, 2021; C.-N. Wang, Nhieu, & Tran, 2021). Moreover, group decision-making, multi-level structures, and hierarchical approaches were accommodated to address complex real-world scenarios (Liu, Eckert, & Earl, 2020; J. Rezaei, 2015). MCDM methods were diversifying their application domains, including healthcare, smart cities, and finance, and being adapted for real-time decision support (Deveci, Pamucar, & Gokasar, 2021; Ramírez Ríos, Ramírez Polo, Jimenez Barros, Castro Bolaño, & Maldonado, 2013). These trends underscored the growing relevance of MCDM in making informed decisions across diverse fields, paving the way for continued research and innovation in this essential area. Another of the significant trends in the development of MCDM methods was the integration of fuzzy theory (Mardani, Jusoh, & Zavadskas, 2015). Fuzzy theory, rooted in fuzzy logic, deals with handling uncertainty and imprecision in decision-making processes(Djenadic et al., 2022; Le & Nhieu, 2022a, 2022b; Peng & Li, 2022).

Distance-based MCDM methods are a family of approaches that use distance metrics to assess the proximity of alternatives to reference points or ideal solutions (Yao & Wu, 2000). These methods are particularly useful when there is no explicit mathematical function to aggregate criteria or when dealing with non-numeric or qualitative data (Donyatalab et al., 2022). Distance-based MCDM methods offer some advantages, such as simplicity, transparency, and ease of implementation, particularly when dealing with qualitative or ordinal data (Ataei, Mahmoudi, Feylizadeh, & Li, 2020; Kutlu Gündoğdu & Kahraman, 2019; P. Wang, Zhu, & Wang, 2016). In which, CRITIC and TOPSIS are two robust Distance-based MCDM methods (Chodha, Dubey, Kumar, Singh, & Kaur, 2022; Peng, Zhang, & Luo, 2020; M. Rezaei, Mostafaeipour, Qolipour, & Tavakkoli-Moghaddam, 2018; Sánchez-Lozano, Teruel-Solano, Soto-Elvira, & Socorro García-Cascales, 2013; Sandberg, Klementsen, Muller, de Andres, & Maillet, 2016). CRITIC focuses on determining the relative importance of criteria in a decision problem based on their intercriteria correlations (Diakoulaki, Mavrotas, & Papayannakis, 1995). It involves two main steps: first, the intercriteria correlations are calculated based on the performance of each alternative against the criteria. These correlations represent how criteria are related to each other. Second, the importance weights of criteria are derived from the intercriteria correlations. The idea is that criteria with higher correlations among them are considered more important in the decision-making process. CRITIC provides a systematic way to allocate appropriate weights to each criterion, considering the relationships between criteria, which can lead to more accurate and insightful decision outcomes. TOPSIS is used to identify the most suitable alternative based on its similarity to the ideal solution (Kutlu Gündoğdu & Kahraman, 2019). In TOPSIS, each alternative is represented as a vector of criteria values, and the distance between each alternative and the ideal solution (maximizing criteria) and the anti-ideal solution (minimizing criteria) is calculated using a distance metric (e.g., Euclidean distance). The relative closeness of each alternative to the ideal and anti-ideal solutions determines its ranking. TOPSIS is a straightforward and intuitive method that provides a clear ranking of alternatives based on their overall performance, making it widely used in various decision-making scenarios (Youssef, 2020). Inspired by these two methods, this study proposes an integrated MCDM approach based on distance.

The MCDM applications in semiconductor industries

MCDM techniques have seen diverse applications across various facets of the semiconductor industry, adapting to strategic challenges and opportunities as shown in Table 3. For instance, Chen et al. utilized SCDT (the selectively calibrated derivation technique)—GFTOPSIS (generalized fuzzy TOPSIS) for optimal facility location in response to geopolitical pressures, demonstrating its efficacy in Singapore (Chen, Wang, & Jiang, 2023). Meanwhile, Saputro et al. integrated Fuzzy AHP (Analytical Hierarchy Process) and Interval TOPSIS for robust supplier selection, blending multi-criteria decision-making with simulation-optimization to manage supplier risks effectively (Saputro, Figueira, & Almada-Lobo, 2023). He and Chen applied DEMATEL (The decision making trial and evaluation laboratory) and ANP (The analytic network process) to develop a green supplier evaluation system in China, emphasizing environmental responsibility (He & Chen, 2023). Wang et al. employed FRST-PSO (fuzzy rough set theory with particle swarm optimization) and Fuzzy DEMATEL to dissect the complexities of sustainability reporting in China’s semiconductor sector, prioritizing strategic improvements for sustainability practices (Wang, Wang, & Ou, 2023). Recently, Moktadir and Ren innovated with a DFS (Decomposed Fuzzy Set)-based Delphi WINGS (Weighted Influence Non-linear Gauge System) and QFD (Quality Function Deployment) model to assess resilience in global supply chains, highlighting the urgency of addressing geopolitical tensions and natural disasters (Moktadir & Ren, 2024). In the same year, Magdy et al. explored the potential of blockchain to mitigate the bullwhip effect within the supply chain, particularly in the context of the Middle East (Magdy, Grida, & Hussein, 2024). Besides, Qiu et al. combined several advanced analytics techniques to facilitate a sustainable transition within the semiconductor supply chain (Qiu, Tseng, Zhang, Huang, & Wu, 2024). These studies collectively showcase the expansive use of MCDM methods to address both operational and strategic challenges in the semiconductor industry, yet they highlight a critical research gap in applying these methods specifically to evaluate and enhance the semiconductor supply chain capabilities of Southeast Asian countries. This study aims to fill this gap by focusing on the unique attributes and strategic needs of Southeast Asia, utilizing a tailored MCDM approach that leverages the strengths of CRITIC and TOPSIS methodologies to offer a nuanced evaluation of the region’s potential and limitations in the semiconductor industry.

Methodology

To conduct the assessment of Southeast Asia countries’ ability to participate in the semiconductor supply chain, this study proposes a multi-criteria assessment framework, which is inspired by the CRITIC and TOPSIS methods. As shown in Fig. 2, Phase I of the proposed methodology focuses on setting a solid foundation through a comprehensive literature review, indicator identification, and meticulous data collection. The literature search was conducted using multiple academic databases such as Scopus, Web of Science, and Google Scholar. Search criteria were defined to include key terms like “semiconductor supply chain,” “multi-criteria decision making,” “CRITIC method,” and “TOPSIS,” combined with Boolean operators to refine and target the retrieval of relevant literature effectively. The selection process started with screening titles and abstracts for relevance, followed by an in-depth review of full texts to confirm their applicability to the study’s objectives. This ensured the inclusion of the most pertinent and recent publications, thus encapsulating the latest insights and developments in the field over the last 5 years. Following the literature review, a systematic data collection process was undertaken to gather quantitative data necessary for developing a robust case study. This involved identifying key variables and indicators from the literature that influence semiconductor supply chain efficiency and effectiveness. Data sources encompassing industry reports, governmental publications, and statistical databases relevant to the semiconductor industry in Southeast Asia. Thereby, the decision matrix, which have \(m\) alternatives and \(n\) indicators, is established in Phase I.

In Phase II, the decision matrix is normalized according to the min-max method. The min-max normalization method was chosen because it is suitable for determining the standard deviation within the indicators and the linear correlation coefficient between the indicators, in later steps. The values of the standard deviations and linear correlation coefficients refer to the amount of information that the indicators provide. Based on that amount of information, the weights of the indicators are determined. In this study, the min-max normalization method was selected for its efficacy in scaling the data into a fixed range—typically [0,1]—which simplifies comparison across different units and magnitudes. This method is particularly suitable for our data as it preserves the original distribution of values while adjusting for scale, ensuring that no single indicator disproportionately influences the outcome due to its unit or range of values. This standardization is crucial in a multi-criteria decision-making framework where indicators such as GDP, which might naturally have higher numerical values, are compared alongside lower magnitude indicators like the Global Peace Index. The weighting of indicators was conducted using the CRITIC method, which provides an objective basis for assigning weights by considering both the contrast intensity (measured by the standard deviation) and the conflict (measured by the correlation coefficients among indicators). This method was chosen because it reduces subjective bias in determining the importance of each criterion, which is essential in ensuring that the decision-making process is as robust and defensible as possible. By utilizing statistical variance and correlations, the CRITIC method quantitatively assesses how much unique information each indicator contributes to the overall evaluation, enhancing the reliability of the analysis. These methodologies impact the results by ensuring that all indicators are equally considered in their correct context and significance, leading to a balanced and nuanced assessment of each country’s potential in the semiconductor supply chain. The use of these specific normalization and weighting methods enhances the analytical rigor of the study, providing a transparent and methodologically sound basis for the comparative analysis conducted. The procedure of this phase is described in the following steps:

Step II-1: Consider the decision matrix \(A\) as shown in Eq. (1). In which, \({a}_{{ij}}\) represents the rating of the \({ith}\) alternative corresponding to the \({jth}\) indicator. The min-max normalized decision matrix \(B\) is constructed according to Eqs. (2, 3).

where

The \({BI}\) and \({NBI}\) represent the set of benefit indicators and non-benefit indicators, respectively.

Step II-2: For each indictor, the evaluation vector (\({v}_{j}\)) is define as Eq. (4).

Step II-3: Determine the standard deviation within each indicator according to Eq. (5).

Step II-4: For each pair of the \({jth}\) indicator and \({kth}\) indicator, the linear correlation coefficient is calculated. As a result, the correlation coefficient matrix (\(R\)) according to Eq. (6).

where \({r}_{{jk}}\) represents the linear correlation coefficient between the vectors \({v}_{j}\) and \({v}_{k}\).

Step II-5: The amount of information content of \({jth}\) indicator is estimated as Eq. (7).

Step II-6: The indicators’ weights are determined according to Eq. (8).

In Phase III, the overall score of alternatives is determined based on the distance between them and the reference points. The reference points applied in this framework are ideal and negative ideal solutions. Because the calculations in this Phase are based on distance, the vector normalization method is believed to be more suitable. The procedure of Phase III is described in the following steps:

Step III-1: The vector normalized decision matrix \(C\) is constructed according to Eqs. (9, 10).

where

Step III-2: The weighted vector normalized decision matrix \(T\) is constructed according to Eqs. (11, 12).

where

Step III-3: The ideal solution (\({X}^{+}\)) and negative ideal solution (\({X}^{-}\)) is determined according to Eqs. (13–16).

where

where

Step III-4: The Euclidean distance from the ideal (\({D}_{i}^{+}\)) and negative ideal (\({D}_{i}^{-}\)) of alternatives is determined according to Eqs. (17, 18).

Step III-5: The overall score of alternatives is calculated according to Eq. (19). The higher the overall score, the better alternative.

Case study

Indicator identification and data collection

The selection of indicators for this case study was meticulously justified through an extensive literature review, pinpointing the key dimensions critical for evaluating the capabilities of countries within the semiconductor supply chain (Chang et al., 2021; Hsiao et al., 2015; Kuo et al., 2019; Mönch et al., 2018a; Saif M. Khan et al., 2021; Sugano, 1994). Stability, research and development (R&D), technology infrastructure, and economic efficiency were identified as pivotal. Stability is crucial as it affects investment decisions and the operational environment essential in semiconductor production. R&D was chosen for its role in fostering innovation and technological advancement, which are vital for maintaining competitiveness in this rapidly evolving industry. Technology Infrastructure is integral for supporting sophisticated manufacturing processes characteristic of semiconductor production. Lastly, Economic Efficiency assesses how effectively countries convert their technological capabilities into productive outputs, a vital factor for sustaining competitive advantage in the high-tech sector. These indicators collectively provide a robust framework for assessing each country’s potential and strategic fit within the global semiconductor supply chain, ensuring the study’s alignment with industry-specific requirements and strategic objectives.

In this study, the data collection process was meticulously designed to ensure reliability and accuracy, crucial for the robust assessment of Southeast Asian countries’ capabilities in the semiconductor supply chain. Data were systematically gathered from transparent, trustworthy, and open databases published by recognized international organizations such as the World Bank, the UNESCO Institute for Statistics, the World Intellectual Property Organization, and the United Nations Industrial Development Organization. These sources provided up-to-date and standardized data across various indicators including economic performance, technological infrastructure, educational achievements, and innovation capacities. The time frame for the data collection spanned the most recent full calendar year available to ensure relevance and applicability to current conditions. Each data source was vetted for its credibility and consistency, with data extraction being carefully documented to facilitate reproducibility and transparency in research methods. The detailed breakdown of the data sources and the specific indicators sourced from each is systematically presented in Table 4 of the study. Despite the high quality of the sources, potential biases and limitations in the data collection were also considered. These include the inherent lag in data publication, which may not fully capture the most recent industry developments or economic shifts. Additionally, while these international databases provide extensive coverage, variations in data reporting standards across countries could introduce discrepancies. Recognizing these challenges, the study undertook additional verification steps where possible and acknowledges these limitations in interpreting the findings. This thorough approach to data collection not only strengthens the credibility of the research but also provides a solid foundation for analyzing the dynamics of the semiconductor supply chain in Southeast Asia. Accordingly, fifteen indicators are considered in this study to assess the opportunities of Southeast Asia countries to participate in the global semiconductor supply chain as summarized in Table 4. The description, units of the indicators are presented in Table A1, Table A2, Table A3, and Table A4 in the supplementary information. Because statistical data for countries are published at unequal intervals, this study uses the most recent published data for each country. This assumption is seen as a major limitation of this study.

Indicator weighting

The result of the data collection process is the formation of a decision matrix as shown in Table 5. The purpose of this phase is to determine the weights of the indicators objectively based on the nature of the data. The min-max normalization process is used to transform raw data with different scales and units into a common scale according to Eq. (3). The purpose of min-max normalization is to bring all the criteria to a comparable range between 0 and 1, without distorting the relative relationships among the criteria. Accordingly, the min-max normalized decision matrix is construct as shown in Table 6.

Then, the standard deviation of each indicator is calculated according to Eq. (5). As shown in Fig. 3, it seems that the Global Occurrences from Natural Disasters (I2) has the highest standard deviation (0.490), suggesting that the data points for this indicator are more widely spread from the mean compared to others, indicating higher variability. The government effectiveness (I3), GDP (I11), E-participation Index (I12), ICT Development index (I13), and Logistics performance index (I14) have relatively low standard deviations (ranging from 0.306 to 0.331), implying that these indicators have less variation, and the data points are closer to the mean. The other indicators have moderate standard deviations, indicating a moderate amount of variation in their respective datasets.

The next factor affecting the amount of information in the data is the correlation between indicators. As mentioned in Step II-4, the linear correlation coefficient between indicators’ data is determined as shown in Fig. 4. Those correlation coefficient measures the strength and direction of a linear relationship between two variables. It ranges from −1 to +1, where −1 indicates a perfect negative linear relationship, +1 indicates a perfect positive linear relationship, and 0 indicates no linear relationship.

The results show that most indicator pairs have positive correlation coefficients, suggesting that they have a positive linear relationship. This means that when one indicator increases, the other tends to increase as well, and vice versa. The strongest positive correlation is between Logistics performance index (I14) and Competitive Industrial Performance Index (I15), with a correlation coefficient of 0.965, indicating a very strong positive linear relationship between them. Some indicator pairs exhibit negative correlation coefficients, indicating a negative linear relationship. This means that when one indicator increases, the other tends to decrease, and vice versa. The strongest negative correlation is between Patents applications (I8) and Logistics performance index (I14), with a correlation coefficient of −0.892, indicating a very strong negative linear relationship between them. There are also some weakly correlated indicator pairs, as seen in low correlation coefficient values (close to 0).

Based on standard deviation and correlation coefficient, the nature of the data reflects the amount of information content of the indicators, which are calculated according to Eq. (7) and presented in Table 7. The more information, the greater the weight. According to Eq. (8), the indicator weighting is performed and presented as Fig. 5.

According to the results, they can be classified into three distinct categories based on their assigned weight values. The categorization of indicators by weight values into high (above 10%), moderate (between 5% and 10%), and low (below 5%) was strategically chosen to reflect the varying levels of impact these indicators have on the overall assessment of countries’ capabilities within the semiconductor supply chain. This threshold-based categorization is rooted in statistical analysis and the principle of diminishing returns, where the most significant factors are assumed to have a disproportionately higher impact on the outcome relative to others.

The high weight threshold of over 10% was designated to identify indicators that are critical drivers of success in the semiconductor industry. These indicators, such as Patents Applications, Global Occurrences from Natural Disasters, and Graduates in Science and Engineering, are considered essential because they directly influence a country’s innovation capacity, resilience to disruptions, and availability of skilled manpower, respectively. These factors are pivotal in determining a country’s ability to sustain and grow within the highly competitive and innovation-driven semiconductor sector.

The moderate weight category (between 5% and 10%) encompasses indicators that, while significant, do not singularly dictate the outcome of the assessment but collectively contribute to a nuanced understanding of a country’s industrial and economic landscape. Indicators like GDP, High-tech Export, and ICT Goods Exports fall into this category as they reflect economic health and technological prowess, which are important but not the sole determinants of success.

The low weight threshold (below 5%) includes indicators that provide contextual and supporting insights which are useful in a holistic evaluation but are less critical in directly influencing the primary outcomes of the assessment. These indicators, such as the Rule of Law and Logistics Performance Index, while important, are supplementary in the context of this specific analysis focusing on the semiconductor industry’s dynamics.

The implications of these weight classifications are profound, as they influence the prioritization of strategies and policy formulations. For instance, a high weighting on innovation-related indicators suggests that policies encouraging R&D and intellectual property protection could yield significant competitive advantages. Conversely, the lower weighting on logistics performance may indicate that while necessary, improvements in this area alone will not be sufficient to dramatically enhance a country’s position in the semiconductor industry without simultaneous advancements in higher-weighted areas.

This structured approach to weighting not only ensures transparency and objectivity in the assessment process but also aligns the evaluation with the strategic objectives of enhancing regional capabilities in the semiconductor supply chain. It allows policymakers and stakeholders to focus their resources and interventions on areas that will have the most substantial impact on their strategic goals, thereby optimizing outcomes based on a clear understanding of priority areas.

Semiconductor industry opportunity assessment

In this phase, the opportunity to participate in the semiconductor supply chain of Southeast Asian countries is assessed. Because the computational procedures in this phase are based on the concept of distance, the decision matrix is normalized in a different way. As described in Eq. (10), the vector normalized decision matrix is established and presented in Table 8. In the next step, the influence of weighted indicators’ is applied to the decision matrix according to Eqs. (11, 12). The weighted vector normalized decision matrix is presented as Table 9. Then, the ideal and negative ideal solutions are defined as discussed in Eqs. (13–16).

In Step III-4, the Euclidean distance to ideal and negative ideal of alternatives are determined according to Eqs. (17, 18). As shown in Fig. 6, The country with the smallest distance to the ideal solution is Singapore, followed closely by Brunei Darussalam and Vietnam. These countries perform well according to the indicator and are considered closer to the ideal solution. On the other hand, the country with the largest distance to the ideal solution is the Philippines, indicating that it is relatively farther from the ideal solution based on the given indicator. Conversely, the country with the smallest distance to the negative ideal solution is the Philippines, implying that it is the closest to the worst-performing country in terms of the indicator. The country with the largest distance to the negative ideal solution is Indonesia, suggesting that it performs relatively better compared to the worst-performing country based on the given indicators.

The overall scores of countries obtained by the proposed approach are visualized in Fig. 7. These results indicate that Singapore has the highest overall score, making it the top-performing country in terms of the opportunity to participate in the semiconductor supply chain among the Southeast Asian countries considered. Singapore has emerged as a prominent player in the semiconductor industry in Southeast Asia. It has a well-developed infrastructure, a skilled workforce, and a business-friendly environment that attracts semiconductor companies. The country’s strategic location, excellent logistics capabilities, and strong government support for research and development also contribute to its high overall score. As a result, Singapore is likely to offer attractive opportunities for companies looking to participate in the semiconductor supply chain.

It is followed closely by Brunei Darussalam and Lao PDR, which also have relatively high overall scores, suggesting good potential for participation in the semiconductor supply chain. Brunei Darussalam also shows promising potential for participation in the semiconductor supply chain. While it may not have the same level of infrastructure and established semiconductor industry as Singapore, its geographic location and proximity to major markets in Asia could present advantageous opportunities. However, further developments in the semiconductor ecosystem and government initiatives to attract investments may be required to enhance its competitiveness. Lao PDR’s relatively high overall score suggests that it could be an emerging player in the semiconductor supply chain in Southeast Asia. Its low labor costs and growing economy might be appealing to semiconductor companies seeking cost-effective manufacturing and assembly options. However, infrastructure development and support for education and skill development will be crucial for sustaining and growing its participation in the semiconductor industry.

In the middle, Malaysia has been a significant player in the semiconductor industry for many years. It offers a well-established manufacturing base, skilled labor force, and a supportive business environment. Additionally, the government has actively promoted the semiconductor industry through various incentives and policies. Malaysia’s overall score reflects its attractiveness for semiconductor supply chain participants, although it may face increasing competition from other regional players. Vietnam has witnessed significant growth in the semiconductor sector in recent years. Its young and large labor force, competitive labor costs, and improving infrastructure have contributed to its overall score. The Vietnamese government’s efforts to promote the semiconductor industry and attract foreign investments have been instrumental in its growth. As the country continues to develop its capabilities, it is likely to become an even more appealing destination for semiconductor supply chain activities. Cambodia’s overall score indicates that it holds potential as a participant in the semiconductor supply chain. While it may not be as developed as some of its neighbors, it offers a relatively lower cost of doing business, making it attractive for companies seeking cost efficiencies. To enhance its competitiveness, investments in infrastructure and skill development initiatives will be essential.

Myanmar’s overall score reflects moderate potential for participation in the semiconductor supply chain. As the country opens to foreign investment and economic development, opportunities may arise in the semiconductor sector. However, it is essential to consider factors such as political stability and labor regulations before making investment decisions in Myanmar. Thailand has a well-established semiconductor industry and a supportive business environment. Its overall score suggests that it remains an attractive destination for semiconductor supply chain participants. The country’s strong manufacturing capabilities, skilled workforce, and strategic location in Southeast Asia contribute to its competitiveness.

On the other hand, the Philippines and Indonesia have lower overall scores compared to other countries in the list, indicating that they might have relatively less favorable conditions for participation in the semiconductor supply chain. Indonesia’s overall score indicates that it may have some challenges in attracting semiconductor supply chain participants compared to other Southeast Asian countries. While it is a large and growing market, infrastructure and bureaucratic hurdles might impact its appeal to semiconductor companies. However, Indonesia’s size and potential as a consumer market may still present opportunities for companies looking to participate in the supply chain. The Philippines receives the lowest overall score among the countries listed, suggesting that it may face significant challenges in attracting semiconductor supply chain activities. The country has struggled to keep up with some of its neighbors in terms of infrastructure development and ease of doing business. However, the Philippines’ skilled labor force and potential for domestic market growth could still offer some opportunities for niche segments in the semiconductor industry.

Discussion

Recent studies, such as those by Thadani and Allen (2023) and Prabheesh and Vidya (2024), have laid a significant groundwork in understanding the semiconductor supply chain dynamics within Southeast Asia (Prabheesh & Vidya, 2024; Thadani & Allen, 2023). This discussion aims to juxtapose our study’s findings against these established narratives to highlight both corroborations and deviations in the regional assessment of semiconductor supply chain capacities.

This study’s findings underscore Singapore’s preeminent status within Southeast Asia’s semiconductor supply chain, corroborating observations by Thadani and Allen, who highlight the region’s significant concentration of ATP facilities and OSAT providers. Consistent with these findings, our research confirms that Singapore’s advanced infrastructure, strategic positioning, and strong governmental support have cemented its role as a pivotal hub in the semiconductor industry. This alignment supports the notion that well-established industry bases combined with proactive government policies are critical drivers of success in the semiconductor sector. Moreover, our study identifies Brunei Darussalam and Lao PDR as emerging players with considerable potential, a perspective less commonly detailed in the existing literature. While Thadani and Allen focus primarily on the major hubs, our analysis suggests that these smaller markets may possess untapped potential due to strategic geographical positioning and growing economic frameworks. This introduces a nuanced layer to the regional analysis of semiconductor supply chains, suggesting that peripheral countries are gradually enhancing their capabilities and participation in this sector. In contrast, Prabheesh and Vidya underscore the centrality of Singapore in the semiconductor trade network, while noting the increasing integration of Vietnam, Malaysia, Thailand, the Philippines, and Indonesia. Our findings complement this perspective by detailing the specific attributes contributing to each country’s capacity and potential challenges within the supply chain. For instance, Malaysia’s established semiconductor base and supportive policy environment align with our identification of its sustained attractiveness to supply chain participants. Similarly, the emerging significance of Vietnam, highlighted by its robust growth and governmental promotion in Prabheesh and Vidya’s study, is mirrored in our analysis, which points to Vietnam’s competitive labor costs and improving infrastructure.

Conversely, the challenges faced by the Philippines and Indonesia, as noted in this study, reflect their lower rankings in the regional semiconductor network. Prabheesh and Vidya suggest these countries have improved their network participation, yet our findings indicate ongoing infrastructural and bureaucratic hurdles that could hinder their fuller integration into the supply chain. This divergence necessitates a closer examination of how each country’s unique socio-economic and political landscapes impact their roles within the semiconductor industry.

Lastly, the economic implications of the COVID-19 pandemic, as discussed by Prabheesh and Vidya, resonates with our observations of disrupted trade flows and its impacts on regional connectivity. This shared challenge across studies emphasizes the need for robust supply chain strategies that can withstand global disruptions and highlights the critical role of resilience planning in maintaining supply chain efficacy.

The managerial implications

Policymakers are advised to bolster R&D infrastructures and educational programs, particularly in emerging countries like Brunei Darussalam and Lao PDR, to catalyze technological advancements and align educational outcomes with industry needs. Investors should focus on countries with robust infrastructure and stable economies like Singapore and Malaysia but also consider emerging markets such as Vietnam and the Philippines for diversified investment opportunities due to their growth potential and governmental support. Industry stakeholders could benefit from diversifying their supply chains to include new regional players, thereby enhancing resilience and reducing dependency risks highlighted by recent global disruptions. Additionally, fostering collaborative projects and joint ventures can tap into regional innovations, driving mutual growth across the industry.

Future research should explore longitudinal studies to track changes in the semiconductor industry over time and conduct comparative analyses with other regions to deepen the understanding of global supply chain strategies. These efforts will not only provide a richer analytical framework but also enable stakeholders to make more informed decisions that align with evolving market conditions and technological trends.

Conclusion

This study is grounded in the context of Southeast Asian countries and their potential involvement in the semiconductor supply chain. It aims to explore the opportunities and challenges these countries face in integrating into this critical industry. Our research employs a comprehensive objectively weighting multi-criteria decision-making (MCDM) approach, which combines CRITIC and TOPSIS method, to evaluate the suitability of Southeast Asian countries for semiconductor supply chain integration. This method involves data collection, normalization, weight determination, and an overall assessment based on distance measures.

This study contributes significantly to the understanding of Southeast Asia’s role in the global semiconductor supply chain by employing a sophisticated MCDM approach. Integrating the CRITIC and the TOPSIS methodologies, the research provides a precise, quantitative framework that evaluates and ranks individual countries based on a comprehensive set of economic, technological, and infrastructural indicators. Unlike previous research, which generally offers broad overviews, this study’s contribution lies in its detailed assessment, offering nuanced insights into each country’s specific strengths and areas for improvement. These contributions are critical as they provide policymakers and business leaders with actionable information essential for strategic planning and investment decisions. Moreover, the innovative application of MCDM techniques enhances the methodological tools available for supply chain analysis, contributing a replicable model that can be adapted for other regions and sectors, thereby broadening the study’s relevance and applicability in the field of supply chain management and strategic decision-making.

The research findings indicate that Singapore emerges as the leading performer in the region, reaffirming its position as a prominent player in the semiconductor industry. Other countries like Brunei Darussalam and Lao PDR also exhibit promising potential. In contrast, the Philippines and Indonesia face challenges or have less favorable conditions for supply chain integration.

While this study provides valuable insights, it is not without limitations. The assessment is based on the selected indicators and weights, and the relevance of these factors may evolve over time. Additionally, the study focuses specifically on the semiconductor industry in Southeast Asia, and its findings may not directly apply to other regions or industries. Continuous monitoring and adjustments to the indicators and weights are necessary to maintain the framework’s relevance. Besides, the integrated MCDM approach also has limitations. One significant limitation is its dependence on static data, which may not fully capture the dynamic changes in the external environment or technological advancements. Additionally, the reliance on ideal and anti-ideal solutions in TOPSIS could oversimplify complex decision contexts, potentially overlooking subtle yet crucial factors. Future research should consider dynamic MCDM models that accommodate changes over time, enhancing responsiveness to industry shifts. Integrating qualitative assessments with quantitative data could also provide a more comprehensive analysis, reducing biases inherent in purely data-driven approaches. Additionally, comparative studies with other regions could offer broader insights and benchmarking opportunities, enriching the strategic understanding of Southeast Asia’s role in the global semiconductor supply chain.

Data availability

All data generated or analyzed during this study are included in this published article.

References

Ataei Y, Mahmoudi A, Feylizadeh MR, Li D-F (2020) Ordinal priority approach (OPA) in multiple attribute decision-making. Appl Soft Comput 86:105893. https://doi.org/10.1016/j.asoc.2019.105893

Bridwell L, Richard M (1998) The semiconductor industry in the 21st century: a global analysis using michael porter’s industry related clusters. Competitiveness Rev Int Bus J Incorporating J Glob Competitiveness 8:24–36

Bui TD, Tsai M, Tseng ML, Tan RR, Yu KDS, Lim MK (2021) Sustainable supply chain management towards disruption and organizational ambidexterity: a data driven analysis. Sustain Prod Consum 26:373-410

Chang M-F, Lin C, Shen CH, Wang SW, Chang KC, Chang RC-H, Yeh WK (2021) The role of government policy in the building of a global semiconductor industry. Nat Electron 4(4):230–233

Chau T (2018) Semiconductor industry in China: China and United States relationship. https://www.jstage.jst.go.jp/article/jcems/2/1/2_21/_pdf/-char/ja. Accessed 7 March 2018

Chen T, Wang Y-C, Jiang P-H (2023) A selectively calibrated derivation technique and generalized fuzzy TOPSIS for semiconductor supply chain localization assessment. Decis Anal J 8:100275

Chodha V, Dubey R, Kumar R, Singh S, Kaur S (2022) Selection of industrial arc welding robot with TOPSIS and Entropy MCDM techniques. Mater Today Proc 50:709–715

Craighead CW, Blackhurst J, Rungtusanatham MJ, Handfield RB (2007) The severity of supply chain disruptions: design characteristics and mitigation capabilities. Decis Sci 38(1):131–156

Cui X, Li X, Wang S (2021) On capacity reservation contract in semiconductor supply chain. Int J Model Oper Manag 8:251–265. https://doi.org/10.1504/IJMOM.2021.116799

Deveci M, Pamucar D, Gokasar I (2021) Fuzzy power heronian function based CoCoSo method for the advantage prioritization of autonomous vehicles in real-time traffic management. Sustain. Cities Soc 69:102846

Diakoulaki D, Mavrotas G, Papayannakis L (1995) Determining objective weights in multiple criteria problems: the critic method. Comput Oper Res 22(7):763–770

Djenadic S, Tanasijevic M, Jovancic P, Ignjatovic D, Petrovic D, Bugaric U (2022) Risk evaluation: brief review and innovation model based on fuzzy logic and MCDM. Mathematics 10(5):811

Donyatalab Y, Kutlu Gündoğdu F, Farid F, Seyfi-Shishavan SA, Farrokhizadeh E, Kahraman C (2022) Novel spherical fuzzy distance and similarity measures and their applications to medical diagnosis. Expert Syst Appl 191:116330. https://doi.org/10.1016/j.eswa.2021.116330

Ehm H, Neau C, Martens CJ, Lauer T, Ponsignon T, García J (2019) Research opportunities regarding tree and network productstructure representations in a semiconductor supply chain. Winter Simul Conf (WSC) 2019:2429–2440

Frederico GF (2021) From supply chain 4.0 to supply chain 5.0: findings from a systematic literature review and research directions. Logistics 5(3):49

GAO (2022) Semiconductor supply chain: policy considerations from selected experts for reducing risks and mitigating shortages. https://www.gao.gov/. Accessed 26 July 2022

Global Peace Index 2023 (2023) www.economicsandpeace.org Accessed 2023

Guan D, Wang D, Hallegatte S, Davis SJ, Huo J, Li S, Gong P (2020) Global supply-chain effects of COVID-19 control measures. Nat Hum Behav 4(6):577–587. https://doi.org/10.1038/s41562-020-0896-8

Gurtu A, Johny J (2021) Supply chain risk management: literature review. Risks, 9(1): 16. https://doi.org/10.3390/risks9010016

Hasan F, Bellenstedt MFR, Islam MR (2023) Demand and supply disruptions during the covid-19 crisis on firm productivity. Glob J Flex Syst Manag 24(1):87–105. https://doi.org/10.1007/s40171-022-00324-x

He Q-R, Chen P-K (2023) Developing a green supplier evaluation system for the Chinese semiconductor manufacturing industry based on supplier willingness. Oper Manag Res. 16(1):227–244

Hsiao HC, Hibiya T, Nakano M, Cheng Y-L, Wen H-C (2015) An analysis of managing sustainable competitiveness for semiconductor manufacturers

Hwang B-N, Lu T-P (2013) Key success factor analysis for e‐SCM project implementation and a case study in semiconductor manufacturers. Int J Phys Distrib Logist Manag 43:657–683

Industrial Development Organization (2023) United Nations https://stat.unido.org/cip/. Accessed 23 February 2023

Intellectual Property Statistics Data Center (2023) The world intellectual property organization (WIPO) https://www.wipo.int/portal/en/index.html. Accessed 1 February 2023

Keil S (2017) Design of a cyber-physical production system for semiconductor manufacturing. Proceeding of the hamburg international conference of logistics, epubli GmbH, Berlin, 2017

Khan SM, Mann A Peterson D (2021) The semiconductor supply chain: assessing national competitiveness. Retrieved from

Kim K (2023) Towards sustainable and resilient ASEAN-Korea economic integration 2.0. Asia Glob Econ 3(2):100061

Kuo HA, Ponsignon T, Ehm H, Chien CF (2019) Overall supply chain effectiveness (OSCE) for demand and capacity incorporation in semiconductor supply chain industry. 2019 IEEE international conference on smart manufacturing, industrial & logistics engineering (SMILE), 24–28

Kutlu Gündoğdu F, Kahraman C (2019) Spherical fuzzy sets and spherical fuzzy TOPSIS method. J Intell fuzzy Syst 36(1):337–352. https://doi.org/10.3233/jifs-181401

Le M-T, Nhieu N-L (2022a) A behavior-simulated spherical fuzzy extension of the integrated multi-criteria decision-making approach. Symmetry 14(6):1136. https://doi.org/10.3390/sym14061136

Le M-T, Nhieu N-L (2022b) A novel multi-criteria assessment approach for post-COVID-19 production strategies in Vietnam manufacturing industry: OPA–fuzzy EDAS model. Sustainability 14(8):4732. https://doi.org/10.3390/su14084732

Lin J, Spiegler VLM, Naim MM (2018) Dynamic analysis and design of a semiconductor supply chain: a control engineering approach. Int J Prod Res 56:4585–4611

Liu Y, Eckert CM, Earl C (2020) A review of fuzzy AHP methods for decision-making with subjective judgements. Expert Syst Appl 161:113738. https://doi.org/10.1016/j.eswa.2020.113738

Lohmer J, Ribeiro da Silva E, Lasch R (2022) Blockchain technology in operations & supply chain management: a content analysis. Sustainability 14(10):6192 https://doi.org/10.3390/su14106192

Magdy M, Grida M, Hussein G (2024) Disruption mitigation in the semiconductors supply chain by using public blockchains. J Supercomput 80(2):1852–1906

Maini TS (2023) China-US ties: economic and strategic ramifications for ASEAN. The Geopolitics

Mardani A, Jusoh A, Zavadskas EK (2015) Fuzzy multiple criteria decision-making techniques and applications—two decades review from 1994 to 2014. Expert Syst Appl 42(8):4126–4148. https://doi.org/10.1016/j.eswa.2015.01.003

Moktadir MA, Ren J (2024) Global semiconductor supply chain resilience challenges and mitigation strategies: a novel integrated decomposed fuzzy set Delphi, WINGS and QFD model. Int J Prod Econ 273:109280

Mönch L, Uzsoy R, Fowler JW (2018b) A survey of semiconductor supply chain models part III: master planning, production planning, and demand fulfilment. Int J Prod Res 56:4565–4584

Mönch L, Uzsoy R, Fowler JW (2018a) A survey of semiconductor supply chain models part I: semiconductor supply chains, strategic network design, and supply chain simulation. Int J Prod Res 56:4524–4545

Nguyen TMH, Nguyen V, Nguyen D (2022) A new hybrid pythagorean fuzzy AHP and COCOSO MCDM based approach by adopting artificial intelligence technologies. J Exp Theorl Artif Intell https://doi.org/10.1080/0952813X.2022.2143908

Okada M, Shirahada K (2022) Organizational learning for sustainable semiconductor supply chain operation: a case study of a Japanese company in cross border M&A. Sustainability 14(22):15316. https://doi.org/10.3390/su142215316

Pasadilla G (2023) Technology, global value chains, and jobs: continuing ASEAN’s role in transformed global value chains. Asean and global value chains. https://www.eria.org/. Accessed 23 February 2024

Peng X, Li W (2022) Spherical fuzzy decision making method based on combined compromise solution for IIoT industry evaluation. Artif Intell Rev 55(3):1857–1886

Peng X, Zhang X, Luo Z (2020) Pythagorean fuzzy MCDM method based on CoCoSo and CRITIC with score function for 5G industry evaluation. Artif Intell Rev 53(5):3813–3847

Prabheesh, KP, Vidya, CT (2024) Interconnected horizons: ASEAN’s journey in the Global Semiconductor Trade Network Amidst the COVID-19 Pandemic

Qiu H, Tseng SW, Zhang X, Huang C, Wu K-J (2024) Revealing the compound interrelationships toward sustainable transition in semiconductor supply chain: a sensitivity analysis. Int J Prod Econ 271:109218

Ramírez Ríos DA, Ramírez Polo LA, Jimenez Barros MA, Castro Bolaño LA, Maldonado EA (2013) The design of a real-time warehouse management system that integrates simulation and optimization models with RFID technology. Int J Comput Sci 2(04)

Ravenhill J (2016) The political economy of an” Asian” mega-FTA: the regional comprehensive economic partnership. Asian Surv 56(6):1077–1100

Rezaei J (2015) Best-worst multi-criteria decision-making method. Omega 53:49–57. https://doi.org/10.1016/j.omega.2014.11.009

Rezaei M, Mostafaeipour A, Qolipour M, Tavakkoli-Moghaddam R (2018) Investigation of the optimal location design of a hybrid wind-solar plant: a case study. Int J Hydrog Energy 43(1):100–114. https://doi.org/10.1016/j.ijhydene.2017.10.147

Salleh AL, Musaddad HA, Elyas NA (2023) The impact of China and Vietnam’s economic growth on the exports performances of the ASEAN countries. In; finance, accounting and law in the digital age: the impact of technology and innovation in the financial services aector. Springer, pp 813–821

Sánchez-Lozano JM, Teruel-Solano J, Soto-Elvira PL, Socorro García-Cascales M (2013) Geographical information systems (GIS) and multi-criteria decision making (MCDM) methods for the evaluation of solar farms locations: case study in south-eastern Spain. Renew Sustain Energy Rev 24:544–556. https://doi.org/10.1016/j.rser.2013.03.019

Sandberg A, Klementsen E, Muller G, de Andres A, Maillet J (2016) Critical factors influencing viability of wave energy converters in off-grid luxury resorts and small utilities. Sustainability 8(12):1274. https://doi.org/10.3390/su8121274

Saputro TE, Figueira G, Almada-Lobo B (2023) Hybrid MCDM and simulation-optimization for strategic supplier selection. Expert Syst Appl 219:119624

Shekarian E, Flapper SD (2021) Analyzing the structure of closed-loop supply chains: a game theory perspective. Sustainability 13(3):1397. https://doi.org/10.3390/su13031397

Sugano T (1994) Suggestions toward enhancing collaboration between university and industry in semiconductor manufacturing science and technology research. International symposium on semiconductor manufacturing, extended abstracts of ISSM, 10-13

Thadani A, Allen GC (2023) Mapping the semiconductor supply chain: the critical role of the indo-pacific region. http://www.jstor.org/stable/resrep53721. Accessed 9 Dec 2023

the International Disaster Database (2023) The centre for research on the epidemiology of disasters (CRED) https://www.emdat.be/. Accessed 9 March 2023

The UNESCO Institute for Statistics database (2023) The UNESCO institute for statistics (UIS) http://data.uis.unesco.org/. Accessed 3 March 2023

Trinidad DD (2018) What does strategic partnerships with ASEAN mean for Japan’s foreign aid? J Asian Security Int Aff 5(3):267–294

Tronnebati I, El Yadari M, Jawab F (2022) A review of green supplier evaluation and selection issues using MCDM, MP and AI models. Sustainability 14(24):16714

Tsai W-T (2023) Perspectives on the promotion of solid recovered fuels in Taiwan. Energies 17(3):1-10

Tsujimura M (2020) Lead the future : semiconductor evolution as seen by CMP manufacturers. 2020 China semiconductor technology international conference (CSTIC), 1-4

Tzeng GH, Shen KY (2017) New concepts and trends of hybrid multiple criteria decision making: CRC Press

Wang C-N, Nhieu N-L, Tran TTT (2021) Stochastic chebyshev goal programming mixed integer linear model for sustainable global production planning. Mathematics 9(5):483. https://doi.org/10.3390/math9050483

Wang C-N, Nhieu N-L, Liu W-L (2024) Unveiling the landscape of fintech in ASEAN: assessing development, regulations, and economic implications by decision-making approach. Hum Soc Sci Commun 11(1):1–16

Wang C-N, Nhieu N-L, Chung Y-C, Pham H-T (2021) Multi-objective optimization models for sustainable perishable intermodal multi-product networks with delivery time window. Mathematics 9(4):379. https://doi.org/10.3390/math9040379

Wang J-B, Wang G-H, Ou C-Y (2023) The key factors for sustainability reporting adoption in the semiconductor industry using the hybrid FRST-PSO technique and fuzzy DEMATEL approach. Sustainability 15(3):1929

Wang P, Zhu Z, Wang Y (2016) A novel hybrid MCDM model combining the SAW, TOPSIS and GRA methods based on experimental design. Inf Sci 345:27–45

World Bank Open Data (2022) The World Bank https://data.worldbank.org. Accessed 12 June 2022

WSTS (2023) Semiconductor market forecast spring 2023. https://www.wsts.org/. Accessed 18 Nov 2023

Yang Y, Wang Y (2020) Supplier selection for the adoption of green innovation in sustainable supply chain management practices: a case of the Chinese textile manufacturing industry. Processes 8(6):717. https://doi.org/10.3390/pr8060717

Yao J-S, Wu K (2000) Ranking fuzzy numbers based on decomposition principle and signed distance. Fuzzy Sets Syst 116:275–288. https://doi.org/10.1016/s0165-0114(98)00122-5

Youssef AE (2020) An integrated MCDM approach for cloud service selection based on TOPSIS and BWM. IEEE Access 8:71851–71865. https://doi.org/10.1109/access.2020.2987111

Acknowledgements

This research work was partially supported by the National Science and Technology Council, Taiwan, under Grant No.: NSTC 113-2622-E-992-012.

Author information

Authors and Affiliations

Contributions

C-NW: methodology, supervision, validation, funding acquisition, writing—review and editing. N-LN: conceptualization, methodology, analysis, validation, writing—review and editing. C-TC: conceptualization, methodology, analysis, writing—original draft. Y-HW: conceptualization, analysis, writing—original draft. Corresponding author: N-LN.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wang, CN., Nhieu, NL., Chiang, CT. et al. Assessing Southeast Asia countries’ potential in the semiconductor supply chain: an objectively weighting multi-criteria decision-making approach. Humanit Soc Sci Commun 11, 1260 (2024). https://doi.org/10.1057/s41599-024-03768-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03768-x