Abstract

Digital transformation (DX) has become an important strategy for the sustainable development of traditional manufacturers. However, the impact of DX on the environment is still inconclusive, and whether it is beneficial for manufacturers to reduce total carbon emissions remains to be examined. Therefore, based on the carbon cap-and-trade policy, this paper employs a game-theoretic model to study the DX strategies of duopolistic manufacturers and to explore the influence of low-carbon policy on these strategies. Additionally, we compare the total carbon emissions before and after DX implementation by manufacturers, discussing the environmental implications of DX. And we innovatively segment the market into two scenarios: one with a low digital technology level and the other with a high digital technology level. Our research demonstrates that the appropriate DX strategy can not only boost manufacturers’ profits but also enhance their ability to withstand external shocks. In the scenario with a high level of digital technology, manufacturers can achieve greater profits and are more likely to reduce total carbon emissions, resulting in a win-win situation. Sensitivity analysis reveals that an increase in carbon trading prices encourages manufacturers to ramp up their investments, ultimately driving comprehensive DX. This study not only provides decision-making guidance for the DX of manufacturers, but also provides a direction for the government to promote DX and achieve carbon neutralization.

Similar content being viewed by others

Introduction

With the increasingly serious problem of global climate change, numerous countries have instituted the carbon cap-and-trade policy as an approach to control emissions, widely perceived as one of the most efficient methods to restrain emissions (Lim and Prakash 2023; Bai et al. 2023). The carbon cap-and-trade policy refers to a system where the government establishes an overall limit on greenhouse gas emissions (the “cap”) and allocates this limit to specific emitting entities, such as industries and companies, which can then buy and sell carbon allowances in the market (the “trade”). This policy is widely applied across various sectors, particularly in high-emission industries like electricity, manufacturing, and transportation. By setting a total emissions cap, the government encourages businesses to adopt sustainable reduction measures to achieve environmental protection goals. In examples such as the European Union Emissions Trading System (EU ETS) and the California cap-and-trade program, companies utilize market mechanisms to buy and sell carbon allowances, enabling flexible reduction strategies that effectively advance the development of a low-carbon economy. Additionally, this policy is employed in national and regional climate action plans, fostering collaboration among all stakeholders to tackle the challenges posed by climate change. As one of the largest carbon emitters in the world, China kickstarted pilot projects as early as 2011 and inaugurated the national carbon emission trading market in 2021. As of now, a growing number of manufacturers are becoming part of this system. The policy aims to reduce greenhouse gas emissions in a cost-effective manner by capping carbon emissions and allowing companies to trade emissions quotas. However, to achieve this goal requires not only the design at the policy level, but also the positive response and innovative practice at the enterprise level. Within the Chinese economic framework, industrial sectors represent one of the main carbon emission contributors. As a significant component of industry, the manufacturing industry shoulders the responsibility of carbon reduction.

In the past few years, the swift evolution of digital technologies, including big data, artificial intelligence, blockchain, and the Internet of Things, digital transformation (DX) has progressively become a crucial strategy for the sustainable advancement of traditional manufacturers (Wen et al. 2022). Industrial powerhouses globally are actively pushing for the digital evolution of their manufacturing sectors, such as “Advanced Manufacturing” in the U.S., “Industry 4.0” in Germany, and “Intelligent Manufacturing” in China. Manufacturing is foundational to socio-economic development, making its transformational upgrade an imperative for China in navigating global competition (Zhang and Gu 2024). DX refers to a series of activities undertaken by enterprises utilizing digital technologies, optimizing production processes and innovating business processes and models (Warner and Waeger 2019), thereby driving qualitative change, efficiency, and momentum across the manufacturing domain. Many manufacturing enterprises have already begun exploring DX. For example, after Siemens introduced digital technology into the process of producing high-efficiency motors, it greatly reduced the consumption of energy and raw materials in production. Midea’s microwave oven Shunde factory has launched related equipment interconnection, digital applications, automation, intelligent logistics and value flow traction and other related transformations and upgrades, reducing product costs by 6% and carbon dioxide emissions by 9.6%. Therefore, there is an inherent relationship between DX and carbon cap-and-trade policy: on the one hand, the DX serves a vital function in aiding the accomplishment of sustainable development objectives (Yousaf et al. 2023; Wang et al. 2023; Bocean and Varzaru 2024). On the other hand, the carbon cap-and-trade policy promote the DX of manufacturers through economic incentives in order to achieve long-term sustainable development.

DX has revolutionized traditional industry’s innovation paradigms, market demand characteristics, and collaborative competitive behaviors, significantly propelling the evolution and growth of emerging businesses (Zhang et al. 2021). While DX can substantially bolster enterprise competitiveness, it invariably incurs additional the DX investment costs. Excessive the DX expenses can lead to cost disadvantages, undermining an enterprise’s market competitiveness (Xin et al. 2024). For instance, the UK’s National Health Service initiated a DX project termed the “National Electronic Health Record System”, which was eventually terminated in 2013 after an expenditure of around 120 million pounds. The endeavor failed primarily due to an oversight in balancing the relationship between investment costs and returns, coupled with an inadequate digital technology level at the time to fully realize the project. Similarly, General Electric’s (GE) DX, after a 7-year endeavor costing 4 billion dollars, ended with the departure of its then CEO and a decline in stock prices. One contributing factor was the imbalance between the DX investment costs and benefits. Such instances underscore the significance of judiciously balancing the costs and benefits of DX, underlining the urgency to optimize the DX strategy.

During the DX, enterprises do not transition to a fully digital state immediately. Manufacturers may DX in a certain part of the production process or business process. For instance, Midea initiate DX underwent stages like information integration, internet assimilation, digital exploration, industrial internet, and comprehensive digitalization. Depending on the degree of DX, manufacturers would incur varying investment costs, and the optimal DX investment costs becomes one of the strategic considerations. Moreover, the DX investment costs are not only associated with the degree of DX, but are also influenced by the prevailing digital technological level. As digital technologies mature, the necessary investment costs for DX naturally decrease. For example, the prices of VR products and cloud services have been decreasing as their technologies mature. This paper categorizes the market into low and high digital technology levels to explore manufacturers’ DX strategy at different stages of digital technology advancement.

Although DX is widely regarded as the key to the sustainable development of the manufacturing industry, its specific impact and strategy choices under the carbon cap-and-trade policy have not been fully studied. Given this context, under the carbon cap-and-trade policy, we investigated the DX strategy of duopoly manufacturers in markets of varying digital technology levels, aiming to answer the following questions:

RQ1: Under the carbon cap-and-trade policy, what is the optimal DX strategy for manufacturers at different digital technology levels?

RQ2: How do the carbon cap-and-trade policy impact the DX strategy of manufacturers?

RQ3: What effects does the DX have on the total carbon emissions of manufacturers?

To answer these questions, we constructed a game model for duopoly manufacturers under three scenarios: both manufacturers implement DX (DD), one manufacturer implements DX while the other does not (DN), and neither manufacturer implements DX (NN). Through a comparison of equilibrium profits in these three scenarios, we have identified the manufacturers’ optimal DX strategy. Furthermore, we have discussed the impacts of carbon trading prices (CTP) on the DX strategy. Additionally, we have examined and compared the manufacturers’ carbon emissions before and after implementing the DX strategy, examining its effects on their total carbon emissions. This paper contributes in three main areas: Firstly, it integrates the degree of the manufacturers’ DX into the game model, exploring their optimal strategies and enriching the theory and application of DX in manufacturing. Secondly, by differentiating between low and high digital technology levels in the market, it aims to offer more appropriate DX strategy for manufacturers at varying stages of technological development. Thirdly, the study goes further to explore the manufacturers’ DX strategy under the low-carbon policy, discussing the policy’s influence on the DX strategy and the impact of DX on carbon emissions. The research reveals the uncertainty of DX’s effect on manufacturers’ carbon emissions, thereby broadening the research scope in this field.

The structure of this paper is organized as follows: Section “Literature review” conducts a review of pertinent literature. Section “Problem description and assumption” provides a comprehensive description of the problem and the assumptions made in the model. In Section “Model construction and solution”, the game models for the three scenarios are established and solved. Section “Model analysis” undertakes an analysis of the equilibrium solutions of the three models. Section “Numerical simulations” presents a numerical simulation of the results. Section “Discussion” delves into a detailed discussion of the findings, offering managerial implications. Section “Conclusion” concludes the full text.

Literature review

This paper primarily delves into the DX strategy of manufacturers under the carbon cap-and-trade policy. The research mainly touches upon three aspects: the application of digital technology in manufacturing, the DX of manufacturers, and the impact of DX on carbon emissions.

Application of digital technology in manufacturing

As the foundation of the real economy, the application of digital technology in manufacturing has garnered widespread attention from academia. Traditional manufacturers can overcome conventional operational management challenges by introducing disruptive digital technologies (Tortorella et al. 2020; Lai et al. 2023). For instance, automation of smart manufacturing systems is achieved through digital technologies (Xia et al. 2021), smart manufacturing platform has become an important carrier of DX of manufacturing industry (Han et al. 2023). The realization of Industry 4.0 through digital means (Aheleroff et al. 2021). As well as manufacturers drive service innovation through artificial intelligence to promote the DX of manufacturers (Dou et al. 2024). The transformation and upgrading of manufacturing can be realized by constructing digital platforms (Jovanovic et al. 2022). Many scholars have endeavored to uncover how digital technologies facilitate the transformation of manufacturers. Sundarakani et al. (2021) and Sarfraz et al. (2023) both indicate the positive effect of blockchain technology on the enhancement of corporate performance. Stentoft et al. (2021) posited that the advancement of technologies like Industry 4.0 offers new possibilities for manufacturers’ DX. Tian et al. (2022) conducted an interpretive study on four apparel manufacturing companies based on platform leverage theories, revealing companies’ strategic roadmaps for digitalization, intelligence, and servitization under platform leverage. Li and Zhang (2024) developed a game theory model to solve the problem of network security investment in the Internet of things environment, and found that the higher the service level of the Internet of things platform, the higher the security responsibility, which provides valuable decision-making guidance for enterprises seeking DX. Smania et al. (2024) proposes that effective collaboration among manufacturers, technology providers and customers is a critical issue in the digital services ecosystem. Wei et al. (2024) believes that manufacturers can use digital technology to innovate traditional products and produce more innovative digital products. Ghobakhloo and Fathi (2020) carried out an in-depth study over five years on a manufacturer using digital technologies for the DX. They found that DX necessitates organizational integration based on digital technology and digitization of the entire value chain. The DX of manufacturers is inextricably linked with digital technology, and the evolution of digital technology is intimately related to the manufacturers’ DX. Hence, this paper innovatively considers both high and low digital technology level market scenarios.

Digital transformation in manufacturing

Research on the DX of manufacturing predominantly focuses on definitions and driving factors. Regarding the definition of the DX, researchers and practitioners have been using the term “DX” to describe the phenomenon associated with changes caused by the increased use of digital technologies (Riedl et al. 2024). Warner and Waeger (2019) perceive DX as a process that utilizes digital technologies to drive substantial business advancements. These advancements can take the form of enhancing customer experiences, streamlining operations, or even developing entirely new business models. Wessel et al. (2021) distinguished DX from IT-driven organizational transformation through two case studies. They believed that the DX uses digital technologies to define an organization’s value proposition, accompanied by the emergence of a new organizational identity. Kao et al. (2024) believes that DX is an adaptive strategy in the ever-evolving technology and business environment. It can help organizations enhance operations and customer experiences to stay competitive. Regarding the driving factors for DX, some scholars believed leadership, organizational culture, and employee participation are the determinants of a successful DX (Jiang et al. 2023; Bilal et al. 2024). Zhang et al. (2023) showed that top managers have a significant positive moderating effect on the relationship between IT infrastructure and DX strategy, as well as the relationship between DX strategy and DX. Yao et al. (2024) obtained data from 351 Chinese technology enterprises, and the research results proved that digital leadership has a positive impact on DX. DX is becoming a coveted model for the manufacturing industry. Through the DX, businesses can effectively enhance competitiveness. Chiu et al. (2022) discovered that the DX based on deep learning not only reduces manpower for product orchestration but also shortens processing times and expands production capacity. Chatterjee, Mariani (2022) used survey results from 312 managers, found that the DX helps organizations become more agile and ultimately increase their competitiveness. Some studies have shown that DX can also alleviate financial distress by reducing operational risks and easing financing constraints (Cui and Wang 2023). Wang and Shao (2024) found that DX can significantly improve the production efficiency of manufacturers. Llopis-Albert et al. (2021) believed that appropriate investment of DX is necessary, and manufacturers will eventually achieve higher profits, productivity, and competitiveness. Stentoft et al. (2021) posited that manufacturers would offer products and services to the market at competitive costs after DX. Due to resource integration and optimized production methods, manufacturers reduce resource consumption, thereby lowering per unit carbon emissions after DX (Sepasgozar 2021). Therefore, manufacturers decision-makers must formulate appropriate DX strategy, leveraging digital technologies to achieve traditional manufacturers’ DX and enhance corporate competitiveness. In this paper, we assume that manufacturers will reduce production costs, reduce unit carbon emissions, and increase market product demand after DX.

There is limited literature directly studying manufacturers’ DX strategy. Zhang et al. (2021) researched the coordination mechanisms and the optimal DX strategy among traditional manufacturers, digital technology providers, and governments. The results indicate that cooperative games can achieve a Pareto optimum for the system. Liu et al. (2022) constructed a game model for supply chain DX, examining the impacts of monetary and symbolic incentives on suppliers’ DX participation. Zhang and Gu (2024) considered two competing supply chains and used a dynamic game model to analyze manufacturers’ game equilibrium and optimal strategy choices for the DX. Xin et al. (2024) researched the strategy of data capital investment in competitive supply chains and found that two manufacturers would make investments in data capital only when the returns on digital capital investment are relatively significant. Chen et al. (2024) studied the DX decisions of monopoly manufacturers under the carbon cap-and-trade mechanism. In this paper, we take the degree of DX and product pricing together as decision variables to explore the DX strategy of competitive manufacturers.

Impact of digital transformation on environmental

The environmental problem has always been one of the important issues concerned by the academic circles. With the development of digital technology, the impact of DX on the environment has become a hot topic in the current academic circles. At present, it is generally accepted that DX can help enterprises reduce resource consumption and improve resource utilization in production and operation. Specific digital technologies, including big data technology (Wang et al. 2016), blockchain technology (Saberi et al. 2019) and the Internet of things (Liu et al. 2023), have been shown to have a positive impact on green sustainability. In addition, artificial intelligence can monitor energy consumption in real time and optimize production, thereby reducing unit carbon emissions (Fang et al. 2016). Tong et al. (2023) analyzed the digital work of intelligent cement plants in China, using a variety of digital technologies, such as special integrated robots, online equipment, information factory forms, artificial intelligence, and so on, to achieve fine management through a variety of ways. The results show that cement plants usually save 2–5% of energy and 20% of staff simplification. Apple is trying to make it green by using recycling robots to disassemble phones. BYD, a Chinese new energy car maker, has developed an ecosystem that supports blockchain with supply chain partners to reduce its carbon footprint (Han et al. 2020). Lai et al. (2023) conducted in-depth exploration and interviews on the DX of six enterprises, including Huawei and Lenovo, and found that DX has improved the environmental performance of enterprises. It can be seen that in the actual production and operation, DX can help enterprises to reduce resource consumption, thus reducing unit carbon emissions.

Some scholars explore the impact of DX on carbon emissions from a macro point of view. The impact of DX on the overall carbon emissions of enterprises is still controversial, there are mainly three views. The first viewpoint asserts that DX contributes to a reduction in carbon emissions. At present, many scholars have proved that DX is beneficial to the reduction of carbon emission intensity through empirical research (Huang et al. 2023). Yi et al. (2022) found that the digital economy significantly in decrease of carbon emissions via spatial spillover effects. Zhang et al. (2024) used the data of listed companies in the manufacturing industry and found that DX has a significant mitigation effect on carbon emissions in the manufacturing industry. The second viewpoint contends that DX is not certain lead to a decrease in carbon emissions. Hu (2023) employed a dynamic differential approach for analyzing panel data from prefecture-level cities, revealing that the incremental impact of digital economy growth on emissions reduction is subtle. Additionally, Gao et al. (2023) found that DX has a statistically significant negative effect on carbon emission intensity. The third viewpoint proposes that the impact of DX on carbon reduction is uncertain. Jia et al. (2023) estimated the carbon emissions brought by the DX of different industries, and the results showed that the labor productivity of the digital economy has not yet shown the promotion of carbon emission reduction. Chen et al. (2024) used a mathematical model to prove that the impact of DX on the total carbon emissions of monopoly manufacturers is uncertain. Therefore, this paper introduces low-carbon policy into the study of the DX strategy, assumes that DX can reduce unit carbon emissions, comparing the total carbon emissions before and after manufacturers’ DX, exploring its impact on carbon emissions.

To summarize, under the carbon cap-and-trade policy, this study investigates manufacturers’ DX strategies under varying levels of digital technology. In addition to proposing optimized DX strategies for manufacturers, the paper also examines the effects of low-carbon policies on manufacturers’ DX. Furthermore, the influence of DX on total carbon emissions is also explored. To emphasize the contributions of this study, relevant literature has been consolidated in Table 1.

Problem description and assumption

In this section, we will first define the symbols used within this paper, followed by a detailed outline of the problem in question. Furthermore, we will offer a series of basic assumptions to support our study.

For ease of analysis, Table 2 provides definitions and explanations for relevant symbols. In a duopoly market, let \(i=1\), \(i=2\) represent manufacturer 1 (M1), manufacturer 1 (M2). Let \(j=NN\) denote scenario NN, where both M1 and M2 adopt traditional technologies; \(j=DD\) represents scenario DD, where both M1 and M2 implement the DX; \(j=DN\) (\(j=ND\)) represents scenario DN (scenario ND), where M1 (M2) implements the DX, and M2 (M1) adopts traditional technologies.

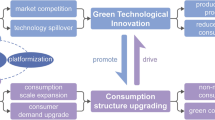

In the duopoly market, our study focuses on two traditional manufacturers who are involved in Bertrand competition. These manufacturers offer perfectly substitutable products to consumers. As a result, we can identify three different scenarios or market structures, which are illustrated in Fig. 1. That is, both M1 and M2 use traditional technology (i.e. scenario NN), both implement DX (i.e. scenario DD), M1 implements DX while M2 adopts traditional technology (i.e. scenario DN). M1 uses traditional technology while M2 implements the DX (i.e., scenario ND). Since scenarios DN and ND are symmetrical, we only consider scenario DN.

Different from the traditional technology, the DX is mainly manifested in two aspects to the production and operation of manufacturers. First, the use of digital technology to achieve product production process optimization and reengineering. Sensors deployed in all aspects of the plant can monitor energy consumption in real time and provide data for analyzing and optimizing energy efficiency. Use the algorithm to analyze the production process, optimize the operation and reduce the waste of raw materials. The use of digital tools in the product design stage can reduce the physical prototyping in the process of trial and error and reduce the waste of materials. The use of blockchain technology can optimize inventory management and reduce overproduction and waste. This part can be understood as the result of technological progress, which can reduce the cost per unit product (Moeuf et al. 2018; Stentoft et al. 2021; Gokalp and Martinez 2021; Xin et al. 2024) and carbon emissions (Han et al. 2020; Zheng et al. 2021; Liu et al. 2023). For example, Midea’s microwave oven Shunde factory has launched related equipment interconnection, digital applications, automation, intelligent logistics and value flow traction, resulting in a 6% reduction in product costs and a 9.6% reduction in carbon dioxide emissions. Siemens significantly reduced energy and raw material consumption in the production process after introducing digital technology into the efficient motor production process. Second, DX has transformed business model. This is also one of the biggest differences between digitalization and informatization. DX can help manufacturers to better analyze consumer demand, improve product quality and personalization, enhance user experience (Liu et al. 2024), so as to improve product demand (Liu et al. 2022; Zhang and Gu 2024). For example, Midea deepened the layout of intelligent transportation incremental parts, with shipments of 750,000 units in 2023, an increase of 400% over the same period last year.

To derive results that are simpler to analyze, we make the following assumptions:

Assumption 1: According to the above description, manufacturers can increase market demand after implementing DX (Liu et al. 2022; Zhang and Gu 2024). At the same time, DX has positive externalities, competitors to implement DX will produce technology spillover effects, but also can improve the market demand of manufacturers to a certain extent. Referring to the studies by Liu et al. (2022)and Niu and Xie (2020), we set the demand function as:

where Q represents the potential market demand. φ denotes the market demand increment coefficient due to the DX. λ represents the technology spillover coefficient of competitors, λ < φ.

Assumption 2: It is assumed that both manufacturers have the same unit production cost and unit carbon emissions, denoted as c and e respectively. According to the above description of DX on the production and operation performance of manufacturers, DX can reduce production costs and carbon emissions of per unit product (Stentoft et al. 2021; Xin et al. 2024; Chen et al. 2024). Therefore, after the manufacturer implements the DX, it is assumed that the production cost and carbon emissions of per unit product are c −αθ and e −βθ respectively. Where αθ and βθ is the unit product production cost and carbon emissions reduced by DX, respectively. α and β are production cost saving coefficient and carbon emission saving coefficient respectively. For instance, the Digital Manufacturing Innovation Program initiated in Germany has successfully supported SMEs in adopting advanced digital technologies, resulting in an average cost reduction of 20% in production. This approach can encourage similar initiatives to help manufacturers implement DT effectively. And Ford’s implementation of IoT and AI technologies in their manufacturing plants has resulted in a 15% decrease in operational costs and a significant reduction in carbon emissions.

Assumption 3: When manufacturers implement DX, there will be investment costs related to the degree of DX. Referring to Xin et al. (2023), Zhang et al. (2021), Liu et al. (2022), the relationship between Manufacturer i's degree of DX and investment cost is \({C}_{i}=m{\theta }_{i}^{2}\). Where m is the cost coefficient related to the level of digital technology development. The more advanced the level of digital technology, the lower the cost of DX, and consequently, the lower the cost coefficient. In this context, the level of digital technology refers to the current market development level of digital technology. Therefore, let \(\frac{1}{m}\) represent the level of digital technology.

Assumption 4: Under the carbon cap-and-trade policy, Ri is the carbon quota allocated to the manufacturer by the government. pe is CTP of unit carbon emissions. Manufacturers sell or purchase carbon quotas through the carbon trading market. It’s assumed in this paper that companies can always buy enough carbon quotas or sell surplus carbon quotas. Finally, it’s assumed that the market supply and demand are equal, that is, the manufacturer’s output is equal to sales.

Model construction and solution

In this section, we have constructed the profit functions of two manufacturers under three different scenarios and derived their equilibrium solutions. In order to ensure that the equilibrium solution is greater than 0, the condition is set to \(Q \,> \,\max \{\alpha +\beta {p}_{e}-\varphi -\lambda ,\frac{2(\alpha +\beta {p}_{e}-\varphi )-\lambda }{3}\}\).

Scenario DD

In the scenario DD, the profit function of the manufacturer is

where \(({p}_{i}^{DD}-c+\alpha {\theta }_{i}^{DD}){q}_{i}^{DD}\) represents the proceeds from the sale of the product by the manufacturer. \([(e-\beta {\theta }_{i}^{DD}){q}_{i}^{DD}-{R}_{i}]{p}_{e}\) represents the carbon emission costs (or benefits) incurred by manufacturers buying (or selling) carbon quotas. \({\pi }_{i}^{DD}\) is a function of \({p}_{i}^{DD}\) and \({\theta }_{i}^{DD}\), and we can get the Hessian matrix of \({\pi }_{i}^{DD}\) as

In order to ensure that \({\pi }_{i}^{DD}\) has an optimal solution, Hessian matrix must be negative definite, that is, it satisfies \({H}_{1}=-2 \,< \,0\), \({H}_{2}=4m-{(\varphi +\alpha +\beta {p}_{e})}^{2} \,> \,0\). Therefore, when \(4m\, > \,{(\varphi +\alpha +\beta {p}_{e})}^{2}\), \({\pi }_{i}^{DD}\) has an optimal solution. By solving \(\frac{\partial {\pi }_{i}^{DD}}{\partial {p}_{i}^{DD}}=0\) and \(\frac{\partial {\pi }_{i}^{DD}}{\partial {\theta }_{i}^{DD}}=0\) together, we get \({\theta }_{i}^{DD}=\frac{(\varphi \,+\,\alpha \,+\,\beta {p}_{e})Q}{2m\,-\,(\varphi \,+\,\lambda )(\varphi \,+\,\alpha \,+\,\beta {p}_{e})}\). Since \(0 \,< \,{\theta }_{i}^{DD}\le 1\), when \(m\, > \,\frac{(Q\,+\,\varphi \,+\,\lambda )(\varphi \,+\,\alpha \,+\,\beta {p}_{e})}{2}={m}_{1}\), the manufacturer i’ optimal transformation degree is \({\theta }_{i}^{DD}\). Otherwise, when \({\theta }_{i}^{DD}=1\), the manufacturer can achieve maximum profit. Since m is inversely proportional to the digital technology level, we divide the two situations into low digital technology level (m > m1) and high digital technology level (m ≤ m1), represented by subscripts L and H respectively. Therefore, substituting \({\theta }_{i}^{DD}\) into Eq. (2), the equilibrium solution under the low digital technology level is

When m ≤ m1, substitute \({\theta }_{i}^{DD}=1\) into Eq. (2), and the equilibrium solution under the high digital technology level is

Scenario DN

In the scenario DN, the profit functions of M1 and M2 are

where \(({p}_{1}^{DN}-c+\alpha {\theta }_{1}^{DN}){q}_{1}^{DN}\) and \(({p}_{2}^{DN}-c){q}_{2}^{DN}\) represent the revenue generated by the sale of products by M1 and M2, respectively. \([(e-\beta {\theta }_{1}^{DN}){q}_{1}^{DN}-{R}_{1}]{p}_{e}\) and \((e{q}_{2}^{DN}-{R}_{2}){p}_{e}\) represent the cost (or benefit) of carbon emissions from M1 and M2 buying (or selling) carbon allowances, respectively. Similarly, it is found that when \(m > \frac{(3Q+2\varphi +\alpha +\beta {p}_{e}+\lambda )(\varphi +\alpha +\beta {p}_{e})}{6}={m}_{2}\), the equilibrium solutions of M1 and M2 under the low digital technology level are

When m ≤ m2, substituting \({\theta }_{1}^{DN\ast }=1\) into Eq. (5), the equilibrium solutions for M1 and M2 under the high digital technology level are

Scenario NN

In the scenario NN, the manufacturer \(i\)'s profit function is

where \(({p}_{i}^{NN}-c){q}_{i}^{NN}\) represents the revenue generated by the manufacturer from the sale of the product. \((e{q}_{i}^{NN}-{R}_{i}){p}_{e}\) represents the cost (or benefit) of carbon emissions resulting from the purchase (or sale) of carbon credits by the manufacturer. Similarly, the manufacturer i's equilibrium solution is

Model analysis

From the above, we can see that the equilibrium solutions in different scenarios are related to the level of digital technology. When \({p}_{e} \,< \,\frac{\varphi \,-\,\alpha \,+\,2\lambda }{\beta }={p}_{e0}\), m1 > m2. Otherwise, m2 > m1. To ensure that the equilibrium solution is non-negative, and the Hessian matrix is negative definite, \(m \,> \,\frac{(\varphi \,+\,\lambda )(\varphi \,+\,\alpha \,+\,\beta {p}_{e})}{2}={m}_{0}^{h}\) when pe < pe0 and \(m \,> \,\max \left\{\frac{(\alpha \,+\,\beta {p}_{e})(\varphi \,+\,\alpha \,+\,\beta {p}_{e})}{2},\frac{(\varphi \,+\,2\alpha \,+\,2\beta {p}_{e}-\lambda )(\varphi \,+\,\alpha \,+\,\beta {p}_{e})}{6}\right\}={m}_{0}^{l}\) when pe > pe0. Next, we will conduct a comparative analysis of the equilibrium solutions. All the propositions have been proven and are provided in the Appendix.

Comparison of equilibrium solutions

Proposition 1: Given M2 (M1)‘s strategy (N or D), the relationship between product prices of M1 (M2) in different scenarios is shown in Table 3. Where \({p}_{e1}=\frac{2\varphi \,-\,2\alpha \,+\,\lambda }{2\beta }\).

Proposition 1 indicates that when the CTP is low (pe < p e1), given M2 (M1)‘s strategy (N or D), the product pricing of M1 (M2) will be higher after DX, regardless of the digital technology level. The primary reason is that the investment cost of DX leads to increased costs, resulting in higher product prices. When the CTP is high (pe > pe1), M1 (M2) will reduce their product prices. This is because when the CTP is sufficiently high, DX helps manufacturers reduce carbon emissions, bringing more cost advantages. Manufacturers can then lower their product prices to attract more consumers to buy products, thereby promoting their business development.

Proposition 2: Given M2 (M1)‘s strategy (N or D), the relationship between the outputs of M1 (M2) in different scenarios is shown in Table 4.

Proposition 2 indicates that, given M2 (M1)‘s strategy (N or D), the output of M1 (M2) will increase after DX, regardless of the CTP or digital technology level. The reasons are: (1) DX has a direct market expansion effect. (2) DX helps reduce costs (production costs and carbon emission costs). When pe > pe1, M1 (M2) will lower the product price, which will ultimately have a positive impact on market demand. (3) When pe < pe1, product pricing may increase, suppressing market demand, but the output of M1 (M2) will still rise, as the market expansion effect of the DX dominates. Therefore, when manufacturers implement the DX, their product output will always increase.

Proposition 3: Given M2 (M1)‘s strategy (N or D), the profit relationship of M1 (M2) in different scenarios is shown in Table 5.

Proposition 3 indicates that, given M2 (M1)‘s strategy (N or D), the profit of M1 (M2) will increase after DX, regardless of the CTP or digital technology level. The reasons are: (1) DX has a direct market expansion effect and the utility of cost reduction (production costs and carbon emission costs). The profit generated is greater than the investment cost of the DX, resulting in profit growth. (2) While pe < pe1 may lead to an increase in product pricing, the market demand for M1 (M2) will still increase, leading to profit growth. Therefore, when manufacturers implement the DX, their profits will always increase.

Equilibrium strategy

Proposition 4: Strategy DD is the only Nash equilibrium.

Proposition 4 indicates that the scenario in which both manufacturers implement DX is the only equilibrium situation. This is because when M1 (M2) chooses traditional technology or DX, M2 (M1) will realize profit improvement. In order to maximize the benefits, M2 (M1) will implement DX on its own initiative or out of necessity, so as to achieve competitive balance in the market. This conclusion also corresponds to the actual situation. For example, both Gree and Midea have implemented DX. Manufacturers will implement DX regardless of digital technology level. However, the digital technology level determines the degree of DX and the investment cost of DX. In a market with low digital technology level, both manufacturers will partially transformation, degree of DX is \({\theta }_{iL}^{DD\ast }\) and investment costs of DX is \({C}_{iL}^{DD\ast }\). When the digital technology level exceeds a certain threshold, both manufacturers will implement complete transformation, investment costs of DX is \({C}_{iH}^{DD\ast }\).

Proposition 5: When m > m3 and pe < pe2, the two manufacturers fall into a prisoner’s dilemma, i.e., \({\pi }_{i}^{DD\ast } \,< \,{\pi }_{i}^{NN\ast }\).

Where \({m}_{3}=(\varphi +\lambda )(2Q+\varphi +\lambda )\), \({p}_{e2}=\frac{3\varphi\, -\,\alpha \,+\,4\lambda }{\beta }\).

Proposition 5 illustrates that a prisoner’s dilemma might occur amongst two manufacturers in a competitive environment. Specifically, when m > m3 and pe > pe2, the equilibrium strategy of both manufacturers is to implement DX, but their respective profits are smaller than that of scenario NN. Even if traditional technology can potentially lead to greater profits, both manufacturers will still adopt DX. This is because both manufacturers pursue their own profit maximization and will choose to implement DX. However, when the cost coefficient of DX is large, it will lead to a smaller degree of manufacturers’ DX, and the increase of CTP will also lead to an increase in carbon emission costs. If both manufacturers choose traditional technologies, they will also pay higher carbon emissions costs, but will still be able to maintain high profits because they do not invest in expensive digital technologies. Consequently, in scenario DD, each manufacturer’s profits are lower than in scenario NN, meaning both manufacturers succumb to the prisoner’s dilemma. This proposition indicates that the existence of a prisoner’s dilemma is not advantageous for manufacturers seeking to maximize their profits. Hence, under the aforementioned conditions, both manufacturers should seek strategies to mitigate the effects of the prisoner’s dilemma.

Figure 2 showcases the outcomes of Propositions 4 and 5. The shaded region signifies the infeasible domain. The top segment (indicated by a blue arrow) suggests partial transformation by manufacturers, while the central area (indicated by a red arrow) indicates complete transformation by manufacturers. Furthermore, the upper right corner signifies that both manufacturers are caught in a prisoner’s dilemma.

Impact of CTP on equilibrium results

Since scenario DD is the only Nash equilibrium, we only need to discuss the impact of the CTP on the equilibrium solution of scenario DD.

Proposition 6: The impact of CTP on equilibrium strategy.

(1) \(\frac{\partial {m}_{1}}{\partial {p}_{e}}\, > \,0\); (2) \(\frac{\partial {\theta }_{iL}^{DD\ast }}{\partial {p}_{e}} \,> \,0\); (3) \(\frac{\partial {C}_{iL}^{DD\ast }}{\partial {p}_{e}}\, > \,0\).

Proposition 6(1) implies that an increase in the CTP will serve as a catalyst for manufacturers to undergo a complete transformation, a phenomenon also depicted in Fig. 2. Propositions 6(2) and (3) suggest that at a lower digital technology level, an upsurge in the CTP can stimulate manufacturers to augment their DX investment, thereby enhancing their degree of DX. This is predicated on the idea that a higher CTP encourages manufacturers to actively seek ways to diminish carbon emissions for the dual purpose of reducing costs and boosting profits. By enhancing the degree of DX, manufacturers can use resources more efficiently and considerably decrease carbon emissions. Therefore, they will increase their investment in DX to achieve a higher level of DX and consequently, realize an increase in profits.

Proposition 7: The effect of CTP on manufacturers’ profits under scenario DD.

(1) When pe < pe3, \(\frac{\partial {\pi }_{iL}^{DD\ast }}{\partial {p}_{e}}\, > \,0\), otherwise, \(\frac{\partial {\pi }_{iL}^{DD\ast }}{\partial {p}_{e}}\, < \,0\); (2) \(\frac{\partial {\pi }_{iH}^{DD\ast }}{\partial {p}_{e}} \,> \,0\).

Where \({p}_{e3}=\frac{6m}{\beta (\varphi\, -\,\lambda )}+\frac{(2\times {2}^{1/3}\times {3}^{2/3}\beta {m}^{2}{Q}^{2})}{\beta \Theta }-\frac{{2}^{2/3}\times {3}^{1/3}\Theta }{\beta {(\varphi \,-\,\lambda )}^{3}{R}_{i}}-\frac{\varphi \,+\,\alpha }{\beta }\),

Proposition 7 reveals that in a market with a low digital technology level, as the CTP increases, manufacturers’ profits initially increase and then decrease post-DX. This is attributed to the fact that DX can curtail carbon emissions, and a rise in the CTP will decrease the manufacturer’s carbon emission expenses, thereby leading to an increment in profits. As CTP continue to rise, manufacturers will increase investment to achieve a higher degree of DX. However, the returns from DX fail to exceed the investment costs, hence leading to a decrease in manufacturers’ profits. Therefore, when the CTP is pe3, the manufacturers’ profit is maximized post-DX. In a market with a high digital technology level, CTP always positively impact manufacturers’ profits. This is because, in a high digital technology market, manufacturers always achieve a complete degree of DX, and an increase in CTP will reduce the manufacturers’ carbon emission costs, resulting in increased profits.

Analysis of total carbon emission

In the context of global carbon neutrality, environmental issues are increasingly garnering attention from governments worldwide. Manufacturers are compelled to focus on carbon emission issues too. Although DX can mitigate resource consumption, its impact on total carbon emissions remains uncertain. Therefore, we will discuss the effect of manufacturers’ DX on total carbon emissions in this section. As strategy DD is the only Nash equilibrium, we will only compare the total carbon emissions of scenario DD with scenario NN. The formula for calculating total carbon emissions is as follows:

Based on Eq. (13), we can calculate the total carbon emissions under both scenarios. In the DD scenario, total carbon emissions from manufacturers operating in markets with low and high levels of digital technology are given as follows:

In scenario NN, the total carbon emissions of manufacturers are:

Proposition 8: The relationship between total carbon emissions before and after the DX of manufacturers.

(1) When m > m1, \(C{E}_{iL}^{DD\ast }\, > \,C{E}_{i}^{NN\ast }\) if e > e1; otherwise, \(C{E}_{iL}^{DD\ast }\, < \,C{E}_{i}^{NN\ast }\);

(2) When m ≤ m1, \(C{E}_{iH}^{DD\ast }\, > \,C{E}_{i}^{NN\ast }\) if e > e2; otherwise, \(C{E}_{iH}^{DD\ast } \,< \,C{E}_{i}^{NN\ast }\).

Where \({e}_{1}=\frac{2m\beta Q}{(\varphi \,+\,\lambda )[2m-(\varphi \,+\,\lambda )(\varphi \,+\,\alpha \,+\,\beta {p}_{e})]}\), \({e}_{2}=\frac{\beta (Q\,+\,\varphi \,+\,\lambda )}{\varphi \,-\,\lambda }\).

Proposition 8 indicates that while DX can reduce carbon emissions of the unit product, the change in manufacturers’ total carbon emissions is uncertain. In the low digital technology level market, the relationship between total carbon emissions before and after manufacturers’ DX is related to unit carbon emissions. When unit carbon emissions are small (e < e1), DX can reduce manufacturers’ total carbon emissions, benefiting environmental protection. When unit carbon emissions are large (e > e1), the manufacturers’ total carbon emissions will increase after DX, which is not conducive to environmental protection. This is due to the market expansion effect caused by manufacturers’ DX. Raising CTP can increase this threshold (e1), so a higher CTP can reduce manufacturers’ total carbon emissions. Similar conclusions can be drawn for the high digital technology level market. When unit carbon emissions are small (e < e2), DX can reduce manufacturers’ total carbon emissions. When unit carbon emissions are large (e > e2), the manufacturers’ total carbon emissions will increase after DX. Interestingly, due to e1 < e2, it’s more likely that manufacturers will reduce total carbon emissions after DX at the high digital technology level market. The government must strengthen digital infrastructure, encourage digital technology research and development, and enhance the market’s digital technology level. In conclusion, the DX of traditional manufacturers is inevitable. In the context of global carbon neutrality, it is also inevitable for manufacturers to reduce total carbon emissions. Therefore, manufacturers must continuously introduce and develop green technologies, reduce unit carbon emissions in production, effectively reduce total carbon emissions, and achieve the goals of transformation, upgrading, and sustainable development.

Numerical simulations

In this section, we will conduct numerical simulations predicated on the model’s analysis results. As pointed out in the white paper “The Impact of the Fourth Industrial Revolution on the Supply Chain”, DX has the potential to cut down manufacturing costs by 17.6% and enhance revenue by 22.6% (World Economic Forum 2017). Referring to Xin et al. (2024) and Liu et al. (2022), we set the parameters as follows: Q = 1, α = 0.176, β = 0.226, φ = 0.25, λ = 0.1, Ri = 0.5. Next, we use numerical simulations to demonstrate the impact of manufacturers’ DX strategy and CTP on the strategy.

Figure 3 shows the profit relationship of M1 (M2) under four scenarios, set respectively as pe = 0.5 (left) and pe = 1 (right). As seen from Fig. 3, regardless of whether competitors choose traditional technology or DX, M1 (M2) can achieve higher profits after DX. Thus, manufacturers will always opt for DX. This is consistent with Proposition 3 and Proposition 4. In Fig. 3 (right), the shaded part indicates that both manufacturers are trapped in the prisoner’s dilemma, i.e., \({\pi }_{i}^{DD\ast }\, < \,{\pi }_{i}^{NN\ast }\). This is consistent with Proposition 5.

Figure 4 shows the impact of CTP on manufacturers’ product prices at different digital technology levels, set respectively as m = 0.3 and m = 0.7 to reflect high and low digital technology levels. From Fig. 4, as the CTP increases, the product price also rises. Comparing scenario DD with scenario NN, we find that the slope in scenario DD is smaller. This means that after manufacturers implement DX, the impact of CTP on product prices diminishes. As an external environmental variable, CTP reveal an intriguing conclusion: DX enhances the manufacturers’ ability to handle external shocks, i.e., organizational resilience.

Figure 5 shows the effect of CTP on the degree of DX and investment costs at a low digital technology level, set as m = 0.4, m = 0.6, and m = 1.0 to reflect different digital technology levels. From Fig. 5, as CTP rise, both the optimal degree of DX and investment costs for manufacturers increase. This is in line with Proposition 6. Comparing results across different digital technology levels, we also find that the higher the digital technology level (i.e., m is smaller), the greater the degree of DX and investment costs. Additionally, the higher the digital technology level, the more sensitive the manufacturers’ DX strategy is to market reactions.

Figure 6 depicts the effect of CTP on manufacturers’ profits in the different digital technology level market. In the low digital technology level market, the impact of CTP on profits follows an inverted “U” pattern, meaning that as CTP rise, manufacturers’ profits first increase and then decrease. There exists a unique CTP (pe3) that maximizes manufacturer profits. In the high digital technology level market, CTP positively affect manufacturer profits. This is consistent with Proposition 7. Moreover, comparing m = 0.2, m = 0.3, and m = 0.4, we find that the higher the digital technology level, the larger the manufacturer profits.

Figure 7 compares the total carbon emissions before and after manufacturers’ DX. The influence of DX on overall carbon emissions is linked to the carbon emissions per unit. Only when per unit carbon emissions are below a certain threshold (e1 or e2), is DX environmentally beneficial for manufacturers. Since e1 < e2, the market with a higher digital technology level benefits the environment more when implement DX. This aligns with Proposition 8.

Discussion

This section compares the research findings with previous literature and examines whether the research results can support the current industrial practices of DX. Based on the research results, some management insights are provided for decision-makers in manufacturers and the government.

Regardless of the digital technology level in the market, the benefits of the manufacturers’ DX in equilibrium always exceed the investment costs, meaning that DX can always increase the manufacturer’s profits. As profit-maximizing manufacturers, they will choose to implement DX. However, under a different digital technology level market, the manufacturers’ optimal strategy of the DX will also differ. In a low digital technology level market, manufacturers opt for partial transformation. When the digital technology level exceeds a certain threshold, the manufacturers’ profit is maximized by the complete transformation. Current studies indicate that DX can enhance manufacturers’ competitiveness (Chatterjee and Mariani 2022; Llopis-Albert et al. 2021; Chiu et al. 2022; Li et al. 2024), which is consistent with our findings. Moreover, real-world examples, such as Midea and SAIC Maxus, have increased product sales and profits through DX. However, differing from this study, Xin et al. (2024) argue that only when the investment in data capital is relatively significant will the two manufacturers invest in data capital. This is because they did not consider the degree of DX as a decision variable. In this paper, manufacturers implement the optimal degree of DX and make the best investment in the DX. Notably, under certain conditions, duopoly manufacturers might fall into a prisoner’s dilemma, where neither undergoing DX might yield higher profits.

CTP may influence manufacturers’ DX strategy. In a low digital technology level market, an increase in CTP will drive manufacturers to invest more in DX, thus achieving a higher degree of DX. In other words, carbon cap-and-trade policy promotes manufacturers’ DX, consistent with the findings of Zhao et al. (2023). Numerical simulations show that the higher the digital technology level, the more sensitive the manufacturers’ DX strategy is to market reactions. This finding resonates with Troise et al. (2022), suggesting that digital technology capabilities can enhance organizational agility. At different digital technology levels, the impact of CTP on manufacturer profits differs after DX. In a low digital technology level market, as CTP increase, profits for manufacturers first rise and then decrease after DX. In contrast, in a high digital technology level market, CTP consistently positively influence manufacturer profits. Importantly, DX can enhance a manufacturer’s ability to respond to external crises, improving organizational resilience. This aligns with the views of Fletcher and Griffiths (2020). They believe that organizations with limited digital maturity are more vulnerable in volatile, uncertain, complex, and ambiguous external environments. Rauniyar et al. (2023) also suggest that DX can reduce supply chain risks.

The impact of DX on a manufacturers’ total carbon emissions is uncertain and is related to the unit carbon emissions of the produced products. When unit carbon emissions are small, DX can reduce a manufacturers’ total carbon emissions. When unit carbon emissions are large, the manufacturers’ total carbon emissions will increase after DX. Our research conclusions support the third view mentioned in Section “Impact of digital transformation on environmental” (Jiang et al. 2023; Chen et al. 2024). Increasing CTP to control total carbon emissions can only be achieved in a low digital technology level market. Interestingly, implementing DX is more environmentally beneficial in a high digital technology level market. Under carbon neutrality, it’s imperative for manufacturers to implement green technology, reducing per unit carbon emissions and consequently, the total carbon emissions. This outcome is in line with the research results of Xue et al. (2022) and Yang et al. (2023), indicating that DX is advantageous for corporations in fostering innovation in green technology.

Based on the conclusions above, we can provide some management insights and countermeasure suggestions for manufacturers and the government. For manufacturers, first, no matter what stage of digital technology development they are in, they should implement DX. This is very important. DX can not only help manufacturers improve production processes and reduce costs to improve competitiveness, but also the transformation of business models can enhance consumer experience and thus increase product sales. Second, decision-makers should thoroughly assess the current market level of digital technology through evaluation, simulation, and other means. When the level of digital technology is low, manufacturers should implement partial transformation and make transformation investments based on evaluation results. When the digital technology level is high enough, manufacturers should complete transformation to enhance corporate competitiveness. Third, manufacturers should also continuously introduce and develop green technologies, reduce per unit carbon emissions of products. The results show that the impact of DX on total carbon emissions is uncertain, and it is not enough to rely on DX to achieve green production. Manufacturers must introduce green technology to ensure the green sustainable development.

For the government, firstly, active promotion of digital infrastructure development should be pursued while increasing investment in technology to improve the level of digital technology. This not only promotes the manufacturers’ DX but also has a positive impact on the environment. Secondly, the current market still has a low level of digital technology, and adjusting CTP can still effectively control carbon emissions. Specifically, the government can control total carbon emissions by raising carbon trading prices. Thirdly, subsidies for green technology should be provided to businesses to encourage green transformation, thereby promoting carbon neutrality. The results show that the impact of DX on the total carbon emissions of manufacturers is related to the carbon emissions of per unit product. At present, many green technologies to reduce unit carbon emissions are relatively mature, and high prices will prevent enterprises from adopting green technologies. By implementing green technology subsidy policies, the government can encourage manufacturers to adopt green technology, so as to ensure the reduction of total carbon emissions.

Conclusion

Against the backdrop of digitalization and carbon neutrality, this article studied the DX strategy of manufacturers. It was found that, in markets with different digital technology levels, manufacturers should implement different degrees of DX. Upon further analyzing the impact of low-carbon policy on the DX strategy of manufacturers and the environmental impact of DX, it was discovered that low-carbon policy is beneficial for manufacturers to increase investment in the DX, promoting their DX. However, the impact of DX on carbon emissions is uncertain. The findings of this study provide a reference for manufacturers to formulate DX strategies and offer a basis for the coordinated development of manufacturers’ digitalization and green transformation.

There are still some limitations in our research. Firstly, we considered a competitive market and assumed that the two manufacturers have the same costs for simplification purposes. This assumption might deviate from reality. Considering product heterogeneity in duopoly competition might be worth studying. Secondly, we assumed that the investment cost corresponds steadily to the degree of DX. However, DX may failure, and considering the risk attitude of enterprises and the uncertainty of DX success will be our future research focus.

References

Aheleroff S, Xu X, Zhong RY, Lu Y (2021) Digital Twin as a Service (DTaaS) in Industry 4.0: An Architecture Reference Model. Adv Eng Inform 47:101225

Bai QG, Chen JG, Xu JT (2023) Energy conservation investment and supply chain structure under cap-and-trade regulation for a green product. Omega-Int J Manag Sci 119:102886

Bilal M, Zhao X, Wu J, Sohu J, Akhta S (2024) Navigating the manufacturing revolution: identifying the digital transformation antecedents. Manag Decis 62(6):1775–1805

Bocean C, Varzaru A (2024) EU countries’ digital transformation, economic performance, and sustainability analysis. Humanities Soc Sci Commun 10(1):875

Chatterjee S, Mariani M (2022) Exploring the influence of exploitative and explorative digital transformation on organization flexibility and competitiveness. IEEE Trans Eng Manag 71:13616–13626

Chen A, Zhang H, Zhang Y, Zhao J (2024) Digital transformation or not? Manufacturer’s selection strategy under carbon cap-and-trade mechanism. Ind Manag Data Syst 124(2):541–563

Chiu M-C, Tsai H-Y, Chiu J-E (2022) A novel directional object detection method for piled objects using a hybrid region-based convolutional neural network. Adv Eng Inform 51:101448

Cui L, Wang Y (2023) Can corporate digital transformation alleviate financial distress? Financ Res Lett 55:103983

Dou R, Zhuang G, Liu X, Hou Y, Jing S (2024) Potential of AI for service performance of manufacturers: Analytical and empirical insights. Adv Eng Inform 60:102383

Fang C, Liu X, Pei J, Fan W, Pardalos P (2016) Optimal production planning in a hybrid manufacturing and recovering system based on the internet of things with closed loop supply chains. Oper Res 16(3):543–577

Fletcher G, Griffiths M (2020) Digital transformation during a lockdown. Int J Inf Manag 55:102185

Gao J, Xu N, Zhou J (2023) Does digital transformation contribute to corporate carbon emissions reduction? Empirical Evidence from China. Sustainability 15(18):13414

Ghobakhloo M, Fathi M (2020) Corporate survival in Industry 4.0 era: the enabling role of lean-digitized manufacturing. J Manuf Technol Manag 31(1):1–30

Gokalp E, Martinez V (2021) Digital transformation capability maturity model enabling the assessment of industrial manufacturers. Comput Ind 132:103522

Han C, Hu Z, Ma H, Liu F (2023) Dynamic cooperative value-added service strategies of the smart manufacturing platform considering the network effect and altruism preference. Computers Ind Eng 184:109560

Han J, Pun H, Wang W, Zhou S (2020) BYD: Blockchain-enabled green ecosystem, Ivey Publishing

Huang Y, Hu M, Xu J, Jin Z (2023) Digital transformation and carbon intensity reduction in transportation industry: Empirical evidence from a global perspective. J Environ Manag 344:118541

Hu J (2023) Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy. J Environ Manag 337:117755

Jiang A, Ma J, Wang Z, Zhou M (2023) Does knowledge of digital technology affect corporate innovation? Evidence from CEOs with digital technology backgrounds in China. Applied Economics. https://doi.org/10.1080/00036846.2023.2266605

Jia X, Liu Q, Feng J, Li Y, Zhang L (2023) The induced effects of carbon emissions for china’s industry digital transformation. Sustainability 15(16):12710

Jovanovic M, Sjodin D, Parida V (2022) Co-evolution of platform architecture, platform services, and platform governance: Expanding the platform value of industrial digital platforms. Technovation 118:102218

Kao L, Chiu C, Lin H, Hung Y, Lu C (2024) Unveiling the dimensions of digital transformation: A comprehensive taxonomy and assessment model for business. J Bus Res 176:114595

Lai K-H, Feng Y, Zhu Q (2023) Digital transformation for green supply chain innovation in manufacturing operations. Transp Res Part E-Logist Transp Rev 175:103145

Lim S, Prakash A (2023) Does carbon pricing spur climate innovation? A panel study, 1986–2019. J Clean Prod 395:136459

Liu L, Song W, Liu Y (2023) Leveraging digital capabilities toward a circular economy: Reinforcing sustainable supply chain management with Industry 4.0 technologies. Computers Ind Eng 178:109113

Liu W, Wang Z, Shi Q, Bao S (2024) Impact of the digital transformation of Chinese new energy vehicle enterprises on innovation performance. Humanities Soc Sci Commun 11(1):592

Liu W, Wei S, Li KW, Long S (2022) Supplier participation in digital transformation of a two-echelon supply chain: Monetary and symbolic incentives. Transp Res Part E-Logist Transp Rev 161:102688

Li X, Zhang Z (2024) Internet of Things Network Security Improvement Investment. Business & Information Systems Engineering. https://doi.org/10.1007/s12599-024-00864-9

Li Z, Chen J, Li Z, Zhang Y (2024) Strengthen or weaken? How industrial internet platform affects the core competitiveness of manufacturing companies. Oper Manag Res 17(1):220–232

Llopis-Albert C, Rubio F, Valero F (2021) Impact of digital transformation on the automotive industry. Technol Forecast Soc Change 162:120343

Moeuf A, Pellerin R, Lamouri S (2018) The industrial management of SMEs in the era of Industry 4.0. Int J Prod Res 56(3):1118–1136

Niu B, Xie F (2020) Incentive alignment of brand-owner and remanufacturer towards quality certification to refurbished products. J Clean Prod 242:118314

Rauniyar K, Wu X, Gupta S, Modgil S, Jabbour A (2023) Risk management of supply chains in the digital transformation era: contribution and challenges of blockchain technology. Ind Manag Data Syst 123(1):253–277

Riedl R, Stieninger M, Muehlburger M, Koch S, Hess T (2024) What is digital transformation? A survey on the perceptions of decision-makers in business. Inf Syst E-Bus Manag 22(1):61–95

Saberi S, Kouhizadeh M, Sarkis J, Shen L (2019) Blockchain technology and its relationships to sustainable supply chain management. Int J Prod Res 57(7):2117–2135

Sarfraz M, Khawaja K, Han H, Ariza-Montes A, Arjona-Fuentes J (2023) Sustainable supply chain, digital transformation, and blockchain technology adoption in the tourism sector. Humanities Soc Sci Commun 10(1):557

Sepasgozar SME (2021) Differentiating digital twin from digital shadow: elucidating a paradigm shift to expedite a smart, sustainable built environment. Buildings 11(4):151

Smania G, Osiro L, Ayala N, Coreynen W, Mendes G (2024) Unraveling paradoxical tensions in digital servitization ecosystems: An analysis of their interrelationships from the technology provider’s perspective. Technovation 131:102957

Stentoft J, Adsboll Wickstrom K, Philipsen K, Haug A (2021) Drivers and barriers for Industry 4.0 readiness and practice: empirical evidence from small and medium-sized manufacturers. Prod Plan Control 32(10):811–828

Sundarakani B, Ajaykumar A, Gunasekaran A (2021) Big data driven supply chain design and applications for blockchain: An action research using case study approach. Omega-Int J Manag Sci 102:102452

Tian J, Coreynen W, Matthyssens P, Shen L (2022) Platform-based servitization and business model adaptation by established manufacturers. Technovation 118:102222

Tong R, Sui T, Feng L, Lin L (2023) The digitization work of cement plant in China. Cem Concr Res 173:107266

Tortorella GL, Vergara AMC, Garza-Reyes JA, Sawhney R (2020) Organizational learning paths based upon industry 4.0 adoption: An empirical study with Brazilian manufacturers. Int J Prod Econ 219:284–294

Troise C, Corvello V, Ghobadian A, O’Regan N (2022) How can SMEs successfully navigate VUCA environment: The role of agility in the digital transformation era. Technol Forecast Soc Change 174:121227

Wang D, Shao X (2024) Research on the impact of digital transformation on the production efficiency of manufacturing enterprises: Institution-based analysis of the threshold effect. Int Rev Econ Financ, 91:883–897

Wang G, Gunasekaran A, Ngai E, Papadopoulos T (2016) Big data analytics in logistics and supply chain management: Certain investigations for research and applications. Int J Prod Econ 176:98–110

Wang H, Yang G, Yue Z (2023) Breaking through ingrained beliefs: revisiting the impact of the digital economy on carbon emissions. Humanities Soc Sci Commun 10(1):609

Warner KSR, Waeger M (2019) Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan 52(3):326–349

Wei S, Liu W, Choi T, Dong J, Long S (2024) The influence of key components and digital technologies on manufacturer’s choice of innovation strategy. Eur J Oper Res 315(3):1210–1220

Wen H, Zhong Q, Lee C-C (2022) Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int Rev Financial Anal 82:102166

Wessel L, Baiyere A, Ologeanu-Taddei R, Cha J, Jensen T (2021) Unpacking the difference between digital transformation and IT-enabled organizational transformation. J Assoc Inf Syst 22(1):102–129

World Economic Forum (2017) Impact of the Fourth Industrial Revolution on Supply Chains

Xia K, Sacco C, Kirkpatrick M, Saidy C, Nguyen L, Kircaliali A, Harik R (2021) A digital twin to train deep reinforcement learning agent for smart manufacturing plants: Environment, interfaces and intelligence. J Manuf Syst 58:210–230

Xin B, Liu Y, Xie L (2024) Data capital investment strategy in competing supply chains. Ann Oper Res 336(3):1707–1740

Xin B, Liu Y, Xie L (2023) Strategic data capital investment in a supply chain. Oper Manag Res 16(4):1925–1948

Xue L, Zhang Q, Zhang X, Li C (2022) Can digital transformation promote green technology innovation? Sustainability 14(12):7497

Yang G, Nie Y, Li H, Wang H (2023) Digital transformation and low-carbon technology innovation in manufacturing firms: The mediating role of dynamic capabilities. Int J Prod Econ 263:108969

Yao Q, Tang H, Liu Y, Boadu F (2024) The penetration effect of digital leadership on digital transformation: the role of digital strategy consensus and diversity types. J Enterp Inf Manag, 37(3):903–927

Yi M, Liu Y, Sheng MS, Wen L (2022) Effects of digital economy on carbon emission reduction: New evidence from China. Energy Policy 171:113271

Yousaf AU, Hussain M, Schoenherr T (2023) Achieving carbon neutrality with smart supply chain management: a CE imperative for the petroleum industry. Ind Manag Data Syst 123(10):2551–2576

Zhang C, Fang J, Ge S, Sun G (2024) Research on the impact of enterprise digital transformation on carbon emissions in the manufacturing industry. Int Rev Econ Financ, 92:211–227

Zhang H, Gu X (2024) Equilibrium Analysis of Manufacturers’ Digital Transformation Strategy under Supply Chain Competition. Chin J Manag Sci 32(6):163–172

Zhang W, Zhao S, Wan X (2021) Industrial digital transformation strategies based on differential games. Appl Math Model 98:90–108

Zhang X, Xu YY, Ma L (2023) Information technology investment and digital transformation: the roles of digital transformation strategy and top management. Bus Process Manag J 29(2):528–549

Zhao S, Zhang L, An H, Peng L, Zhou H, Hu F (2023) Has China’s low-carbon strategy pushed forward the digital transformation of manufacturing enterprises? Evidence from the low-carbon city pilot policy. Environ Impact Assess Rev 102:107184

Zheng X-X, Li D, Liu Z, Jia F, Lev B (2021) Willingness-to-cede behaviour in sustainable supply chain coordination. Int J Prod Econ 240:108207

Acknowledgements

This research is supported by the Young Scientists Fund of the Natural Science Foundation of Sichuan (grant number 2023NSFSC1040), Sichuan Provincial University humanities and social sciences key research base, Yangtze River Key ecological functional area protection policy Research center (grant number YREPC2023-YB0033), Science and Technology innovation and new economy Research center of Chengdu-Chongqing economic circle (grant number CYCX2024YB22), Chengdu philosophy and social science planning project (grant number 2022CS111), Energy and Environment Carbon Neutrality Innovation Research Center (grant number YJ05202403).

Author information

Authors and Affiliations

Contributions

AC participated in study design, model construction and analysis, and paper writing. HZ participated in the study design and revised the paper. YZ was involved in the study design and model construction. JZ was involved in drawing the pictures and revising the paper.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Chen, A., Zhang, H., Zhang, Y. et al. Manufacturers’ digital transformation under carbon cap-and-trade policy: investment strategy and environmental impact. Humanit Soc Sci Commun 11, 1326 (2024). https://doi.org/10.1057/s41599-024-03862-0

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-03862-0

This article is cited by

-

Can carbon cap-and-trade policy promote digital transformation of manufacturers? An evolutionary game analysis

Clean Technologies and Environmental Policy (2025)