Abstract

In recent years, banks have incorporated sustainable development strategies to achieve competitiveness in the financial market. However, the primary concern for banks is the financial pressure to implement sustainable environmental practices. In addition, banks are obliged by different regulators to maintain standards in conducting their business and allocating funds. Previous studies examined the relationship between sustainability reporting, corporate social responsibility (CSR), and firms’ financial performance. Few empirical studies examined the impact of sustainable supply chain management (SSCM) operations on firm financial outcomes, yet the banking sector has been ignored in the analyses. To bridge this gap, we examine the dynamic effect of SSCM operations on deposit money banks’ (DMBs) financial performance. We selected seven banks in Nigeria with national, regional and international authorization and data spanning from 2005 to 2023. Based on the panel co-integration test and the Cross-sectional Dependence Autoregressive Distributed Lag model (CS-ARDL) model, we found that SSCM operations have a significant influence on the financial performance (market value and profitability) of the banks. Impliedly, banks’ SSCM operations and environmental consideration in the allocation of funds drive their corporate image and value. Integration of SSCM strategies for a sustainable environment can help enterprises/companies bridge information asymmetry among diverse stakeholders. We offer some policy suggestions in line with the empirical findings.

Similar content being viewed by others

Introduction

SSCM drives firms’ value and success within a competitive business environment while strictly adhering to sustainable business practices. SSCM, in a broad sense, is “the administration of environmental, social, and economic impacts alongside promoting good practices by corporations. It seeks to establish, safeguard, and enhance long-term corporate value for all the stakeholders concerned throughout the production of goods and services” (Rasche and Kell, 2010). Thus, it could be argued that firms that embrace the UN Global Compact principles in their SSCM have a better chance of achieving business ethics and good governance while promoting sustainable development goals. In the same vein, the evolving trends in climate change and global warming have become a top priority for governments across the globe, raising global environmental awareness and redirecting the attention of investors and other stakeholders to environmental sensitivity. Notably, financial institutions nowadays go beyond generating profits for providers of capital, other stakeholders such as the market regulators, investors, financial experts, and civil society groups, among others, increasingly demanding information of a non-financial nature (Sustainability reporting disclosure) to make more rational and informed investment decisions (Doktoralina and Apollo 2019).

SSCM practice was found to be cost-effective and environmentally friendly, as shown in agroforest, manufacturing, and tourism industries, particularly in developed economies (Parthiban et al. 2021; Mageto 2021; Zhou et al. 2021; Huang et al. 2021). In addition, Su et al. (2021) affirm that SSCM has been influenced by the proliferation of scholarly write-ups and practitioners in recent times as organizations acknowledge the significance of sustainable development and the execution of sustainable supply chain management strategies to achieve their social, environmental, and economic objectives. Conversely, minimal focus was directed towards emerging market economies such as Nigeria. This indicates that there is less knowledge of SSCM and the performance of enterprises in Nigeria’s banking sector. This study addresses the gap by offering empirical insights into the relationship between SSCM and banks’ financial performance, specifically focusing on the Nigerian banking sector.

Their business operations essentially informed the rationale for choosing the banking sector because of their involvement in the finances of business enterprises, irrespective of the nature of their business undertaking. As such, it creates sustainability risks, which poses a more significant challenge to SSCM (Dim and Ezeabasili 2015). The banking sector plays a significant role and serves as the financial hub of the economy. It finances companies in the extractive, oil and gas, and manufacturing sectors. Hence, they are susceptible to sustainability threats (Nwobu et al. 2017). Accordingly, the civil society organization financial research group Proshare Nigeria claim that lending to oil and gas companies accounted for about 40% of Nigeria’s bank loan assets. In addition, Fitch ratings opined that as of September 2019, oil and gas represented about 30% of Nigeria’s bank gross loan (Fitch Rating 2020). These indices suggest that one-third of the Nigerian total loan assets were channeled to one segment of the economy, neglecting other important sectors. Similarly, the pollutant effects of this industry, such as oil spills, deforestation, air pollution, and soil and water contamination, would continue to negatively impact the well-being of the people and environment (Mageto 2021). Hence, this study argues that the banking sector in Nigeria is directly or indirectly susceptible to SSCM risks due to channeling a substantial part of their loan assets to an industry prone to sustainable development.

The need for empirical quest in this area becomes necessary because previous studies such as Olaniyan et al. (2021), Adeyemi and Akanji (2020), Inoue and Lee (2011) concentrate more on corporate social responsibility as a sustainability measure of supply chain management. Some studies focused on sustainability reporting (SR), which is the financial performance nexus among firms in various economic sectors, and even in these studies, the banking sector has not received attention in their analysis. For example, Nwaiwu and Oluka (2018) investigated the impact of sustainability reporting (SR) on the financial capacity performance of industrial firms. They found a significant influence of SR on the firms’ performance over time. Nnamani et al. (2017) examined and found a positive impact of SR on firms’ performance in developing countries. However, others conducted firm-level analyses based on SR and financial performance indicators (Igbekoyi et al., 2021; Nazim et al. 2015; Othman and Ameer 2009).

While research on SR and firms’ financial performance is prominent, there is a dearth of empirical literature on the impact of SSCM on financial outcomes. The few extant literature that examined the effects of SSCM on the firms’ financial performance were primarily conducted in developed economies (see Seuring and Müller 2008; Doktoralina and Apollo 2019; Lee 2021; Mageto 2021). Studies conducted on emerging economies focused on the manufacturing, information technology, and transport sectors (see Zailani et al. 2012; Schaltegger and Burritt 2014; Jum’a 2020; Zimon 2020; Jum’a et al. 2021). In Nigeria, Dim and Ezeabasili (2015), Ojo, Mbohwa, and Akinlabi (2014) examined the effectiveness of strategic SSCM in the construction industry associated with procurement and firms’ management.

Given the importance of the finance and banking sectors in an economy, previous studies have ignored the role of SSCM in the financial industry. Specifically, how SSCM environmental disclosure financing impacts the performance of DBMs. To the best of the researchers’ knowledge, there is a limited empirical study in this direction, and to complement the extant literature, our study focuses on the impact of SSCM on the financial value of DBMs in Nigeria. Thus, research on this issue is imperative due to the emerging national and international importance of actualizing the United Nations’ SDGs. Against this background, the study seeks to provide answers to the question: Does SSCM environmental disclosure has dynamic effect on the financial performance of DMBs in Nigeria? To answer this question, the study uses annual data from 2005 to 2023 from seven DBMs in Nigeria with national, regional, and international authorizations. Using the panel cointegration test and CS-ARDL model, the empirical results show that SSCM environmental disclosure improves banks’ financial performance (value and profitability). However, the effect is higher in the short-run as sustainable financing is gaining momentum in the banking industry.

Furthermore, the study contributes to theory and has practical significance. Theoretically, it contributes to the extant theoretical submission linking sustainable financing and financial performance by extending the debate to the banking industry. Although the SSCM-performance nexus is gaining momentum in the theoretical and empirical literature, the current analysis covers the financial hub of the economy (banking industry), which mobilizes and channels funds for investment purposes. The empirical findings complement the literature on sustainable financing and firms’ performance. Practically, the findings provide a beacon light for stakeholders, including financial practitioners, investors, and policymakers, by informing their decision-making and enabling better-informed actions regarding sustainable practices. Additionally, the study contributes to the extant knowledge base on the SSCM-performance link within the Nigerian banking context, which can guide the monitoring and evaluation efforts of non-governmental organizations and civil society groups. The rest of the paper is structured as follows: Section two reviews relevant and related literature on SSCM and financial performance; section three discusses the data and empirical methods; section four dealt with the empirical analysis and results; section five discusses the empirical findings; section six provides the concluding remarks and recommendation.

Literature review

The Global Reporting Initiative (GRI) G4 guidelines issued in 2016 require financial organizations to be held responsible for their operations’ environmental, social, and economic impacts on society, which affect a diverse range of stakeholders. This has put the banking sector disclosure measures in place for banks’ compliance. The corporate existence of banking sectors around the world is mainly service delivery. However, because of the role they play in funding business enterprises, irrespective of the nature of their business operations, has posed a more significant challenge to SSCM practice as they indirectly affect the environment by providing funds to companies engaged in mining and extractive industries, oil and gas sectors, manufacturing sectors that are prone to sustainable environment risks (Nwobu et al. 2017; GRI, 2013). In the same line of argument, Usenko and Zenkina (2016) affirm that the financial outcome of business entities could not be adequately ascertained without examining their impact on economic, social and environmental factors, and the disclosures of positive and negative environmental externalities. Thus, this established that the financial institutions are not directly exposed to environmental degradation, greenhouse gas emissions, alternative energy, or climate change. This may be due to the choice of enterprises whose operations are financed. For example, oil and gas operations require intensive capital sum and as such, substantial parts of funding such massive projects are financed mainly by the banking sectors, which often pose a tremendous amount of risk to the host community because of adverse environmental impacts such as the oil spillage, CO2 emissions, and discharge to water.

The banking sector principally funds the operations of oil and gas, extractive, and manufacturing companies. Hence, this exposed their financiers to risks that could lead to environmental hazards (Nwobu and Iyoha 2018). In emerging markets such as Nigeria, SSCM practice is still voluntary. Hence, this research argues that socially responsible investments are critical for attaining sustainable development goals because financial institutions in Nigeria often fund and derive huge profits from unsustainable business activities that negatively impact the environment. The United Nations Environment Program on Finance Initiatives (UNEP-FI) roundtable (2020) report further buttressed the need for banks to incorporate sustainability issues into their financial reporting. This means incorporating SSCM practice into strategic planning and evaluation by developing sustainability management systems would help create awareness and mitigate environmental hazards. The UNEP Finance Initiative (UNEP 2011) offered banks directives for integrating sustainability reporting into their corporate operations and processes. The indices indicate that financial institutions that neglect to integrate sustainability issues into their operations and processes are susceptible to social, environmental, and financial repercussions (Lee 2021). The indices indicate that cost reduction and financial risk avoidance are among the advantages of enhanced SSCM. Consequently, the sustainable development strategy for banks presents issues that must be addressed by any enterprise seeking to maintain relevance among stakeholders (Neckel 2017).

Financial institutions in advanced economies such as the USA, UK, France, Spain, and other European nations have responded to the need to be accountable for sustainability reporting in different operations. This is further shown in Peeters (2012). The involvement of European banks in environmental issues commenced in the early 1990s. Financial organizations, including banks and insurance corporations, have shown interest in sustainable development due to the imperative to mitigate environmental risks associated with lending. Freeman and Phillips (2002) postulated the stakeholders’ theory, which upholds that so many interest groups within a business circle are affected by its operations. These categories encompass customers, suppliers, employees, and government entities. Amran and Haniffa (2011) assert that the theory addresses the dynamic and intricate link between firms and their environment and the company’s capacity to reconcile the often-conflicting needs of its diverse stakeholders. From another perspective, Abdulsalam (2017) posits that when businesses recognize their responsibility for accountability and transparency to stakeholders, sustainable business practices emerge as a crucial mechanism for fulfilling these duties. Previous research on SSCM demonstrated that environmental, social, and economic challenges arise from stakeholder pressure for transparent, accountable, and sustainable development, thereby safeguarding the interests of future generations. It proposed that organizations consider the aspirations of various stakeholders, with some solutions manifesting as strategic opinions.

Furthermore, Michael and Becker (1973) formulated the signaling theory based on the organizational setting. The author upholds that the board of directors (insiders) may deliberately withhold some vital information from other parties (outsiders) to gain an undue advantage because such information may send signals of the most likely situation of the company. Signaling theory focuses on bridging the information asymmetry by transmitting relevant information to market participants on SSCM practice. Signaling theory has four themes: signaler, signals, receiver, and feedback. Signalers are the executives, directors, managers, etc., with privileged information about the organization. Signals transmit information about stock price developments, dividend distributions, and environmental financing. Receivers are external parties who lack knowledge of the insider information. The form of investors, investment analysts, etc., whereas feedback reflects the interaction between signaler and receiver. Signaling is broadly classified as positive and negative. A positive signal improves firms’ value and performance. Meanwhile, negative signals decrease product demand and the firms’ stock prices. Therefore, organization performance lies in how the quality of information on SSCM and its reliability reach diverse stakeholders. Thus, there is a close link between SSCM and signaling and stakeholder theories such that stakeholder engagement, proactive environmental strategy, climate change commitment and other ethical issues serve as motives and drivers for firms to voluntarily integrate and report on the SSCM namely, environmental social and economy aspects into their annual reports and account.

Given the above, therefore, this study anchored on the stakeholders and signaling theories in understanding the motives and drivers of SSCM, which enhanced firms’ performance. The study investigates how SSCM influences firms’ performance. Accordingly, what signals does SSCM convey to the diverse stakeholders? The stakeholder theory and signaling theory, therefore, underpinned this research. The Stakeholders theory upholds the view that companies should be accountable to various stakeholders by recognizing the importance of integrating SSCM to strengthen the relationship between firms and the host communities in which they operate. Thus, ignoring the stakeholder interests might adversely impact the firm’s public image and financial performance and put the firm’s ongoing concerns at stake. The Signaling theory focuses on bridging the information asymmetry (communication gap) by sending relevant and quality information to different market participants on SSCM. The availability of relevant information on SSCM sends a signal to diverse users of accounting information and, thus, would change their perceptions about the firm’s commitment to implementing sustainable business practices.

SSCM entails a “sequence of activities in an organization designed to manage different stakeholders across the realm of supply chain efficiently” (Li et al. 2006). Several studies investigated the effect of SSCM on firms’ or organizational performance. For example, Menor et al. (2007), Boon-itt and Wong (2011), and Zimon (2020) examined the impact of diverse SCM-related organizational activities on a firm’s performance (both financial and market operations). Li et al. (2006) analyzed the impact of SCM practices on enhancing an organization’s competitiveness and overall market performance. The company’s performance is positively impacted by competitiveness, which stems from SSCM. The effect of SSCM practice on financial performance is contingent upon the supply chain’s position inside the firm (Cook et al. 2011; Jum’a, 2020). A sustainable environment is positively influenced by SSCM techniques, encompassing supplier relationships, processes, customer services, and human resource management (Bendehnezhad et al. 2012). Furthermore, Green et al. (2019) and Yildiz Çankaya and Sezen (2019) demonstrated a significant correlation between the consistent improvement of business operations, the Just in Time (JIT) delivery system, and green SCM practices, as well as their collective impact on the environmental; similarly, sustainability performance was notably affected by the dimensions and practices of green SCM. Le (2020) and Zimon (2020) discovered that green SCM activities, such as environment-friendly product development, positively influence three performance categories: social, financial, and environmental performance, with a substantial link between green supply chain practices and sustainable environment. Likewise, specific research indicated that sustainable/green performance was considerably and favorably affected by product design, customer interactions, equipment, and supplier connections (Iramanesh et al. 2019; Le, 2020). Previous research by Yang, Hong, and Modi (2011) found a positive and significant correlation between environmental management practices and lean manufacturing.

In contrast, Hofer, Eroglu, and Rossiter (2012) examined the influence of SSCM on corporate performance, as assessed by environmental management practices. The data demonstrated the negative effect of environmental management techniques on market and business performance, which diminished with enhanced environmental performance. The author discovered that inventory capacity partially mediated the relationship between production and sustainable financing. A study by De et al. (2020) utilized qualitative analysis and used sustainability-oriented innovation (SOI) as input criteria, while environmental, economic, social and organizational factors were evaluated as output criteria. The findings indicate that the integration of lean principles with SOI contributes to SMEs’ SCM sustainability. SCM practices and strategies, including ISO 14001 certification, reverse logistics, and adaptable sourcing methods that focus on waste reduction, supply chain risk management, and the adoption of Cleaner Production (CP) methodologies, positively influence sustainable development (Govindan et al. 2014; Ikram et al. 2020).

Researchers developed various performance measures grounded in market and financial success. Financial performance has garnered significant attention from researchers as it quantitatively represents the efficacy of a firm’s strategies and operations (Yang et al. 2011; Hofer et al. 2014; Feng et al. 2018). It can be defined as the extent to which an organization achieves profit-oriented goals, such as sales and investment returns (Yang et al. 2011). Numerous metrics exist to evaluate an organization’s financial success. Hofer et al. (2014) assessed the firm’s economic success through revenue and sales growth, whereas additional metrics, including return on assets (ROA), have been employed in some studies (Jum’a et al. 2021). This study examines the financial performance of individual DMBs using two indicators: ROA and Tobin’s Q, as suggested by Yang et al. (2011) and Jum’a et al. (2021), to provide a more accurate representation of the firm’s financial condition and performance.

Recently, supply chain management has been associated with environmental development and sustainability. Environmental sustainability denotes the “practices, methods and actions that exert a discernible positive impact on the ecosystem” (Sendawula et al. 2020). Empirical literature posits three primary elements of sustainability: environmental, economic, and social, which are directly interconnected and significant in operations and supply chain management (Marshall et al. 2014). The World Commission on Environment and Development (WCED) defines sustainability as economic practices that meet the demands of the current generation without jeopardizing the capacity to satisfy the needs of future generations (Imperatives 1987). Baliga et al. (2019) and Panigrahi et al. (2019) have shown that an organization’s economic success directly results from implementing sustainable practices, particularly the integration of SSCM in their operations. Chardine-Baumann and Botta-Genoulaz (2014) noted that the impact of SCM on sustainability must be assessed through the three fundamental characteristics of sustainability: environmental consideration, social responsibility, and economic benefits. Marshall et al. (1987) observed that prior literature on sustainability has emphasized environmental factors more prominently. This shift towards environmental sustainability is influenced by different stakeholders, including government regulators, investors, consumers, employees, NGOs, and local communities, which compel businesses to mitigate their environmental impact and adhere to environmental standards (Bendehnezhad et al. 2012; Jum’a et al. 2021).

Moreover, Wisner et al. (2009) have shown that effective environmental procedures substantially affect enterprises’ internal performance. Consequently, managers should employ SSCM methods to enhance the organization’s performance. Certain studies have identified SSCM environmental practices as determinants of industrial or company performance. Goyal et al. (2018) identified twelve determinants of environmental sustainability and categorised them into four principal types of supply chain practices. Näyhä and Horn (2012) categorised sustainable environmental practices into high and low impact to establish an appropriate environmental assessment for an industry. Previous studies on environmental sustainability have primarily addressed issues related to indicators such as the reduction of air emissions, waste minimization, decrease in solid waste and hazardous materials, mitigation of environmental risks, and enhancement of a firm’s overall environmental performance (Vu and Dang 2020; Singh et al. 2019; Ikram et al. 2019). Numerous studies have correlated environmental practices with corporate environmental commitment.

However, studies on SSCM practices and firms’ performance, as highlighted above, concentrated on specific industries (building, manufacturing and industrial sectors), mainly in developed economies. There is a dearth of empirical studies on the banking sector, which is critical in mobilizing and channeling funds for investment in various sectors of the economy. Environmental disclosure and SSCM commitment in the banking sector can significantly influence environmental sustainability practices, further influencing the banks’ market value and operational profitability. The current study seeks to bridge this gap by empirically examining the dynamic effect of SSCM environmental disclosure on the financial outcomes of DBMs in Nigeria.

Methods

Data

The study employed the ex-post research design for its suitability as the events occurred over time; hence, the research was conducted retrospectively. As widely used by previous studies (see Kerlinger and Lee 2000), annual statements reports and statements were used by this study to investigate the potential impact of SSCM environmental disclosures on the financial performance of DMBs in Nigeria. However, the ex post facto design is not without some limitations. It lacks random assignment, making it difficult to rule out alternative explanations, leading to issues with internal validity (Shadish et al. 2002). The retrospective nature of ex-post facto research can introduce biases and errors in the data collection (Gall et al. 2007). Nonetheless, we intend to minimize the effect of these issues using appropriate empirical analysis and diagnostic tests in Section “Empirical Analysis and Results”. The study used annual data from the London Stock Exchange Group (LSEG) workspace, formerly Refinitiv Eikon DataStream workspace. The data span from 2005 (after the consolidation exercise in the banking sector) to 2023 based on available data. The study’s population consisted of the specified deposit money banks operating in Nigeria. However, the sample was selected through a three-level filtering process: (i) banks that had been in operation throughout the period from 2005 to 2023, (ii) banks with national, regional and international authorization, (iii) banks that are listed on the Nigerian Stock Exchange, and (iii) banks with the available data on corporate annual reports, accounts, and sustainability reporting for the period covered. Based on the assessment, seven banks met the selection criteria for the study. These include Access Bank Plc, Fidelity Bank Plc, First Bank Nigeria Plc, First City Monument Bank Plc, United Bank of Africa Plc, Guaranty Trust Bank Plc, and Zenith Bank Plc.

Variables definitions and measurement

To account for the heterogeneity of the DMBs in Nigeria, the study used ROA and Tobin’s Q (market value) as measures of financial performance. The independent variables included in the model were SSCM environmental disclosure, bank size, capital structure, and corporate social responsibility. The use of ROA is well-justified in the literature. ROA is a widely accepted and commonly used metric to assess the profitability and efficiency of a firm’s asset utilization (Acharya et al. 2013; Athanasoglou et al. 2008), and it provides a valuable indicator of how effectively a bank generates profits from its assets, which is particularly relevant for the banking sector (Siddik et al. 2017; Sufian and Habibullah 2009). Furthermore, prior studies examining the financial performance of DMBs in Nigeria have employed ROA, demonstrating its suitability as a comprehensive measure that captures a bank’s ability to generate returns from its asset base (Obansa and Ohiri 2013; Nworji et al. 2011).

Tobin’s Q (TQ) reflects a company’s prospective market value and enduring profitability. This metric can signify investors’ opinions of a company’s future and intangible economic potential (Lee and Park 2009). Yoon and Chung (2018) posited that Tobin’s Q and ROA might be disconnected due to the conflicts arising from enterprises’ pursuit of short-term vs long-term economic objectives. The influence of SSCM on these variables would vary. We employed the methodology of Chung and Pruitt (1994) as follows:

MV denotes the product of stock price and number of outstanding common shares; OPS signifies the liquidating value of issued preferred stock; DEBT is the value of short-term liabilities less short-term assets, in addition to the value of long-term assets and inventories; and TA represents total assets.

Accordingly, the use of TQ is well-documented in the literature. It is a widely recognized metric that assesses a bank’s value and efficiency in utilizing shareholders’ equity (Akhtar et al. 2011; Flamini et al. 2009). It is particularly relevant for the banking sector, as it measures a bank’s capacity to generate returns for its equity holders, a crucial aspect of its business performance (Dietrich and Wanzenried 2011; Athanasoglou et al. 2008). Additionally, numerous studies on the financial capacity in the banking industry have employed Tobin’s Q, further reinforcing its suitability as a robust and well-established measure for the current research (Olokoyo 2013).

However, the use of the Environmental Disclosure Index to measure the environmental disclosure practices of DMBs in relation to their supply chain management is established. This index, ranging from 0 to 100%, captures the DMBs’ sensitivity to sustainable environmental practices, such as ecological impact, emissions, waste management, and decommissioning, providing a comprehensive assessment of their environmental sustainability efforts (Yang et al. 2011; Carter and Easton 2011). Testing the effect of SSCM-related index on the financial performance of DMBs is supported by the existing literature, which highlights the potential benefits of SSCM, including improved operational efficiency, cost savings, enhanced reputation, and better stakeholder relationships, all of which can positively influence a bank’s financial performance (Brandenburg et al. 2019; Carter and Rogers 2008).

In addition, we also included the banks’ size and capital structure as potentially relevant factors determining financial performance. The existing literature suggests that larger banks perform better than smaller ones, often exhibiting lower costs, higher returns, and greater net profit margins (Gelles and Mitchell 1996). This study employed total revenue to measure bank size, as in Koh et al. (2009) and Yoon and Chung (2018). To normalize the distribution of the total revenue variable, the researchers applied a natural log transformation to the data before incorporating it into the analysis.

Including bank capital structure as an additional variable in the analysis is imperative. Capital structure, which represents the mix of debt and equity financing a bank uses, is a critical determinant of financial performance (Rajan and Zingales 1995; Myers 2001). Accordingly, financial institutions with higher equity levels tend to have greater financial stability and better withstand economic downturns, leading to improved profitability (Berger and Bonaccorsi di Patti 2006; Tan and Floros 2013). Conversely, banks with higher debt levels may face greater financial risk and higher borrowing costs, which can negatively impact their financial performance (Abor 2005; Zeitun and Tian 2007). Therefore, understanding the link between capital structure and banks’ performance, as measured by ROA or TQ, is essential for evaluating the banking sector’s overall financial health and sustainability.

Finally, the inclusion of CSR as another control variable is well-justified. Stakeholder theory suggests that effective stakeholder management, as reflected in CSR, can enhance long-term financial success (Jamali 2008). The proponents of resource-based theory posit that CSR can be a valuable, rare, and inimitable resource providing a competitive advantage (McWilliams and Siegel 2011). CSR can also improve a bank’s legitimacy, reputation, and risk mitigation, positively influencing its financial outcomes (Hasan et al. 2018). Furthermore, as banks increasingly integrate CSR into their strategic approach, examining this relationship can provide valuable insights (Eyasu and Arefayne 2020). Based on the earlier discussion, the variables captured by the study are summarized in Table 1.

Specifications

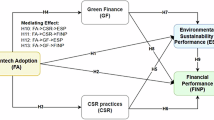

Following the work of Yoon and Chung (2018), this study specifies the functional form model as follows:

Where x represents banks’ financial performance measured as ROA and TQ (market value), sscm is the sustainable supply chain management, bs stands for bank size, bcs is the banks’ capital structure and csr is the corporate social responsibility.

Thus, Eq. (2) presents the analytical model for Eq. (1):

Where: \(x,sscm,bs,bcs,csr\) are defined earlier in Eq. (1); α0 is the intercept; α1 to α4 represent the slopes of the estimated parameters; i is the cross-section of banks under consideration; t represents the period considered by the study and \({\mu }_{it}\) denotes the error term. Equation (2) suggests that the performance of DBMS in Nigeria at a given time t is a function of the bank’s sustainable supply chain management, bank size, capital structure, corporate social responsibility, and other unobserved factors captured in the error term.

Furthermore, this study employed the appropriate pre-estimation techniques for panel data to improve the modeling and empirical analysis. One pre-estimation test employed was the Lagrange Multiplier (LM) test for cross-sectional dependence by Breusch and Pagan (1979). The LM test statistic is calculated as:

Equation 3 captures the LM test, which frequently produces inconsistent results when the sample size (N) is large (Balli et al. 2021). To address this issue, as (N, T) → ∞, the presence of cross-sectional dependence (CD) among the series can be assessed using Eq. 4 as proposed by Pesaran (2004). The null hypothesis of zero dependence across the panel is computed as follows:

N and T denote the number of selected banks and the time considered. The null hypothesis posits the absence of CD. The test statistics \({\tau }_{{ij}}^{2}\) represents the pair-wise correlation coefficient of the residuals derived from the OLS regressions. Following the cross-section dependence test, we estimated the 2nd generation panel unit root tests. The methods employed are cross-sectional augmented Dickey-Fuller (CADF) and CIPS. The CADF test, as referenced in Chen et al. (2024), assesses panel stationarity. The formula for the CADF test statistics is expressed as follows:

\({\alpha }_{i}\) and \({\bar{Z}}_{t-1}{t}_{i}(N,{T})\) measures the unit root’s deterministic term \(\left(\frac{1}{N}\right){\sum }_{i=1}^{N}{Z}_{i,t-1}\), and \({\rho }_{i}\) estimates the ADF individual statistics. However, the CIPS developed by Pesaran (2007) tests unit roots in heterogeneous panels. It resolves the challenges of cross-sectional dependence by allowing for individual dynamic specifications in each regression. The model is given as:

In this model, \({\rm{D}}\_{{\rm{y}}}_{t}\) is the differenced response variable for panel member i at time t, yt-1 represents the lagged dependent variable, MEAN_yt-1 measures the cross-sectional mean of the lagged value of the response variable, MEAN_D_yt represents the cross-sectional mean of the differenced response variable, and et represents the error term. The CIPS test allows for individual dynamics specifications in each regression, capturing potential heterogeneity across panel members. The p-value of the serial correlation Breusch-Godfrey Lagrange multiplier test is utilized to assess the individual regressions and determine the presence of unit roots in the panel. Accordingly, The study employed the method of Pesaran and Yamagata (2008), derived from Swamy (1970), to assess the homogeneity of slope coefficients by calculating the delta (Δ) and adjusted delta (Δ-adj.) statistics. Δ statistic is an altered variant of Swamy’s (1970) test (S), estimated as follows:

The error terms are presumed to follow a normal distribution under the null hypothesis as (N, T) approaches infinity. The Δ test may be performed utilizing the subsequent expression:

The expression for the delta in a small sample can be derived from Eq. (9).

Subsequently, after assessing the variables’ CD and panel unit root, the study utilized the Pedroni and Kao cointegration method to ascertain the long-term relationship among the variables. The study assessed the dynamic short- and long-term impacts of SSCM on the financial performance of DBMs utilizing the augmented autoregressive distributed lag (ARDL) model. The model incorporates CD within the panel framework, as Chudik and Pesaran (2015) established in their Cross-sectional Dependence ARDL (CS-ARDL) model. This method resolves the problems associated with CD in panel estimations. Consequently, following Chen et al. (2024), the CS-ARDL equation is articulated as follows:

Where Xit is the vector of independent variables, to address the issues of CD and slope homogeneity, the augmented form of Eq. (10) is expressed as follows:

\({\bar{Z}}_{t-I}=({\bar{D}}_{i,t\bar{I}}\,{\bar{X}}_{i,t\bar{I}}\)) measures the averages of the explained and explanatory variables. Consequently, the lags are represented by \(p,{q},{r}\) and \({D}_{{it}}\) represents the dependent variable, and \({X}_{{it}}\) is the vector of explanatory variables. \(\bar{Z}\) is a dummy variable measuring the time effect. Equation (12) represents the model for estimating the long-run coefficients:

Equation (13) estimates the mean group coefficients:

Similarly, the equations for estimating the short-run dynamics and coefficients can be expressed as:

Accordingly, the short-run coefficients are estimated using the following expressions. All parameters are defined earlier in Eqs. (11), (12).

\(\begin{array}{ccc}\hat{{\alpha }_{i}}=-\left(\mathop{\sum }\limits_{I=1}^{\rho D}{\hat{\theta }}_{I,i}\right); & {\hat{\varphi }}_{i}=\frac{\mathop{\sum }\limits_{I=0}^{{qX}}{\hat{\gamma }}_{I,i}}{{\hat{\alpha }}_{i}}; & {\hat{\bar{\varphi }}}_{{MG}}=\mathop{\sum }\limits_{i=1}^{N}{\hat{\varphi }}_{i}\end{array}\)

Descriptive statistics

The statistical features of the data are described and summarized in Table 2. The summary statistics provide some preliminary information on the characteristics of the variables used to study the link between financial outcomes and sustainability practices of the banking sector in Nigeria. Based on the results, TQ and the ROA have a mean value of 0.034 and 0.112, respectively. This implies that the value and profitability of the sampled banks recorded a growth rate for the period covered. The analysis indicates that the average value relative to total assets is about 3.44%, while the return on equity suggests a return of around 11.21%, indicative of effective utilization of shareholders’ equity.

The average score of 51.782 reflects moderate SSCM practices in the sampled banks. Furthermore, the results indicate that CSR has the highest standard deviation (36.26) in the distribution, while TQ has the lowest standard deviation (0.01). This implies that CSR is the most volatile variable in the distribution, while return on asset is the least volatile series. The summary statistics suggest that the distributions of the variables are non-normal, with varying degrees of skewness and kurtosis. The coefficients of the Jarque-Bera test are significant, rejecting the null hypothesis of non-normally distributed series. This is expected because financial variables are subject to various degrees of volatility. Knowing the series’ descriptive nature, we further estimate the correlation coefficients summarized and reported in Table 3.

Correlation analysis

The correlation analysis in Table 3 reveals some fascinating degree of association between the banks’ financial performance and sustainability practices. The TQ has a positive correlation (0.10) with sustainable supply chain management, indicating a positive association between TQ and sustainable supply chain practices. Accordingly, the ROA positively correlates (0.17) with sustainable supply chain management, suggesting a positive association between profitability and sustainable supply chain management.

Moreover, regarding the association between financial performance and BCS, the result indicates a positive correlation (0.25) between return on assets and capital structure of the sampled DBMs, suggesting a positive association between profitability and the composition of BCS. Conversely, TQ negatively correlates (−0.02) with banks’ capital structure, indicating a negligible inverse association between the value of the sampled DBMs and the structure of capital. Finally, the correlation between financial performance and CSR reveals a negative correlation (−0.12) between ROA and corporate social responsibility, implying an inverse association between profitability and CSR. In contrast, TQ has a positive correlation (0.08) with CSR, suggesting an infinitesimal positive association between the market value of banks and CSR.

Based on the results of the correlation coefficients (Table 3), it is evident that no multicollinearity exists among the variables. The threshold commonly used to detect the presence of multicollinearity is a correlation coefficient above 0.9 (Hair et al. 2014; Gujarati and Porter, 2009). The absence of any correlation coefficients above 0.9 suggests that multicollinearity is not a concern among the variables included in the analysis. This indicates that the variables measure distinct and independent concepts and can be used together in a model without the risk of multicollinearity issues.

Empirical analysis and results

CD test results

The CD test results show substantial cross-sectional dependence evidence (see Table 4). All three test statistics - Breusch-Pagan LM, Pesaran scaled LM, and Pesaran CD - exhibit statistically significant probabilities at the 1 and 5% levels. The CD test indicates that the variables correlate across the sample’s cross-sectional units (e.g. banks). Due to the presence of CD, first-generation unit root tests, which presume cross-sectional independence, are considered unsuitable for analysing the dynamic behavior of the variables. The research acknowledges that second-generation unit root tests incorporating cross-sectional dependence are appropriate for the analysis.

Panel unit root tests

The unit root tests result provides the stationarity properties of the variables. The series exhibits a mix of stationarity characteristics (see Table 5). The CADF test results show that TQ, bank size, bank capital structure, and corporate social responsibility are stationary at the level values I(0), while SSCM is stationary at the I(1) level. Similarly, the cross-sectional augmented IPS (CIPS) test found that TQ, bank size, and BCS are stationary at level I(0). In contrast, ROA, SSCM, and CSR are stationary at the I(1) level. These results imply that the variables are stationary based on I(0) and I(1) levels. Given this mix of stationarity properties, the study identifies that the Cross-Sectional Autoregressive Distributed Lag (CS-ARDL) model is suitable for examining the effect of SSCM on the financial performance of DBMs. The CS-ARDL approach is well-suited for analyzing datasets with variables integrated into different orders, as it can accommodate both I(0) and I(1) variables within the same model.

Panel cointegration test

Assessing cointegration among the variables is a critical step before estimating both the long-run and short-run relationships. This study employed two cointegration techniques by Pedroni and Kao to ascertain the long-run dynamics among the variables, and the findings are summarized in Table 6. The Pedroni (2004) test found strong evidence of cointegration among the variables. The null hypothesis is rejected at the 1% significance level for six test statistics. This suggests that the series share a common long-run dynamic equilibrium relationship. Furthermore, the Kao ADF co-integration test also affirmed the earlier findings of the Pedroni test. The Kao ADF test is significant at a 1% level, providing additional evidence of cointegration among the series.

Slope homogeneity test

The result of the slope homogeneity test formulated by Pesaran and Yamagata (2008) is presented in Table 7. It shows evidence of heterogeneity (variability) among the variables. This is attributable to the statistically significant values of the Delta and Adjusted Delta. The finding rejects the null hypothesis of slope homogeneity. Rejection of the null hypothesis signifies significant disparities in the slope coefficients among the variables analyzed in the study. The effect of these variables on the dependent variable is expected to vary among different subgroups or cross-sectional units within the dataset.

CS-ARDL results

Table 8 presents the result of the short- and long-run dynamics of the CS-ARDL model. The results found that sustainable supply chain management significantly impacts the financial performance (measured by ROA) of DBMs in Nigeria. This implies that increased environmental disclosure by banks increases their short- and long-term profitability. This implies that positive changes in SSCM practices drive the financial performance of DMBs, given that the coefficient of SSCM (Long-run: β = 0.1795, p < 0.05; Short-run: β = 0.2025, p < 0.01) is significant. The coefficient of BS has a positive and significant impact on ROA, supporting the notion that the size of a bank positively affects its operational profitability.

The findings presented in Table 8 suggest a nuanced picture when examining the short-term impacts on the performance of DBMs in Nigeria. In the short term, the findings indicate that the effect of SSCM on financial performance is prominent and higher. This implies that an increase in the implementation of SSCM practices can lead to an increase in the financial performance of the banking industry in the near term. Conversely, the findings indicate that bank size and corporate social responsibility do not significantly impact the banks’ performance. This implies that the scale or size of the banks and their engagement in CSR activities may not be the primary drivers of immediate financial performance, at least within the context of the Nigerian banking industry.

However, the error correction term exhibits a negative sign and is statistically significant. The coefficient implies that in case of any disruptions or shocks that cause the banking sector’s performance to divert from its long-term equilibrium path, the error correction mechanism will work to restore the system to equilibrium. The speed of this adjustment process is estimated to be around 46% annually, suggesting that the banking sector in Nigeria has a relatively fast self-correcting mechanism to address any imbalances or deviations from the long-run sustainable path.

The findings presented in Table 9 show that SSCM and banks’ capital structure significantly impact banks’ financial performance in Nigeria, as measured by market value and long-term profitability (TQ). This further reinforces the notion that implementing sustainable supply chain practices drives Nigeria’s banking sector’s performance. This finding conforms with the conventional wisdom that a well-structured and optimized capital composition is a key driver of bank financial outcomes. Conversely, the findings show that CSR has a negative and significant effect on the performance of the DBMs in the short run. However, over the long term, the impact of CSR on banks’ market value is positive and significant. This implies that banks allocate more resources towards CSR activities, affecting their overall financial outcomes. The results imply that a 1% increase or decrease in the banks’ CSR engagement will lead to approximately a 0.78% decrease in the short run but an increase of 0.0047% in the long run. Notably, the results suggest that any disturbance or disequilibrium in the Nigerian banking sector will be corrected relatively. Specifically, the analysis shows that approximately 78% of any error or distortion in the economy, particularly within the banking sector, will be corrected within the subsequent period.

Discussion and implications of the findings

The study examined the potential effect of SSCM practices on the financial performance of DBMs in Nigeria. To achieve this, the authors disaggregated financial performance into banks’ operational profitability and market value and assessed how variation in SSCM activities related to environmental disclosure influences each performance indicator. To determine how the SSCM practices impact banks’ performance, the study used a panel co-integration test and CS-ARDL on a panel of seven filtered banks with national, regional and international authorization and data from 2005 to 2023. Based on the empirical analyses, the study finds that SSCM influences the financial performance of DMBs in two ways. On the long-run equilibrium relationship, SSCM and financial performance co-move, implying that banks’ initiatives toward SSCM environmental disclosure on various stakeholders (e.g. employees, managers, clients, government) effectively increase the banks’ long-term profitability and value. The finding aligns with those of Baliga et al. (2019) and Panigrahi et al. (2019), who suggested that the long-term economic success of an enterprise has a direct link with implementing sustainable practices, explicitly integrating SSCM in their operations. Accordingly, the banks’ attention to SSCM through the natural environment, consumer well-being and community development could raise their intangible resources (e.g., goodwill, reputation, positive consumer feedback) (Jum’a et al. 2021; Zimon 2020).

However, on the long-run dynamics of SSCM and financial performance, the study found a positive impact of SSCM practices on the market value of DMBs in Nigeria. More specifically, the environmental dimension in SSCM positively affected Tobin’s Q of banks. The impact of SSCM on the banks’ operational profitability is positive and significant. The findings suggest that The incorporation of SSCM practices by DMBs in Nigeria creates favorable indicators that enhance their value and profitability. The findings are in tandem with Margolis et al. (2009), Yang et al. (2011), Yildiz Çankaya and Sezen (2019) and Green et al. (2019), who found a positive impact of environmental sustainability on firm’s performance. Conversely, Buallay et al. (2019) found an inverse relationship between sustainable environmental practices and financial performance in a cross-sectional study. The co-movement between SSCM and DBMs’ financial performance of Nigeria’s DMBs raises concerns regarding mitigating environmental risks associated with lending to some specific economic sectors. The financial performance of banks is properly ascertained by examining the effects of environmental, economic, and social aspects, along with the disclosures of both favorable and unfavorable environmental externalities about their supply chain management. This is a crucial component that influences the sustainable development of DMBs.

Moreover, this study has theoretical and practical implications. Deducting from Freeman’s (1984) stakeholder theory, a bank’s commitment toward its stakeholders promotes short-term and long-term strategies and corporate value. In addition, the research findings have some implications for bank managers, public sector officials, policy analysts, market participants and other stakeholders in the country that are directly or indirectly linked to the banking sector. The effect of SSCM practices on the performance of DMBs in Nigeria suggests that banks need to integrate SSCM in their critical decisions, remain committed to environmental sustainability, and implement such decisions. Furthermore, stakeholders (communities and government) need to appreciate environmental initiatives from banks and adopt more strategies leading to sustainable development and socially responsible activities. These will go a long way in upgrading sustainable financing and environmental quality at local and national levels through the lens of profile and selective financing to reduce costs and increase SSCM practices in the economy.

Conclusions

Following the empirical findings, the study concludes that there is a positive and significant relationship between SSCM and the financial performance of DMBs in both short- and long terms. Banks adhering to SSCM principles stand a chance to create and sustain their shareholders’ wealth while taking into cognizance all possible steps in mitigating risk tied to their corporate identity and value. SSCM communicates environmental practices to various stakeholders, indicating the responsibility of corporate entities, such as banks, through environmental awareness and assessment. Consequently, the research recommends that DMBs incorporate SSCM principles and enhance the regulatory framework to address challenges and mitigate information asymmetry among various stakeholders. Strategic goals of SSCM through profile and selective financing are imperative in mobilizing and channeling funds to environmentally friendly investment, which is in tandem with sustainable financing and sustainable development goals.

However, the study used non-probability sampling (availability sampling) and concentrated on the environmental aspect of sustainable financing of only seven banks based on available data filtered on authorization levels. So, due to these challenges faced by the study, generalization of the empirical findings may be challenging. Future studies can overcome these challenges by applying large samples and accommodating the social and governance indices of sustainable financing on financial institutions with available data.

Nevertheless, a rising trend of literature was identified in the areas of sustainability reporting and financial outcomes (Adams and Narayanan 2010; Amran and Haniffa 2011; Adeyemi and Akanji 2020), and SSCM and environmental sustainability to performance (Jum’a 2020; Zimon 2020; Jum’a et al. 2021). As such, future studies may investigate the potential effects of environmental, social, and governance aspects of SSCM and sustainability reporting strategies on the performance of DMBs. The current study examined and concentrated only on the environmental aspect of the SSCM related to Nigeria’s banking sector. Therefore, future studies may replicate it in other countries and industries.

Data availability

The data that support this study’s findings are sourced from the London Stock Exchange Group (LSEG) workspace, formerly Refinitiv Eikon DataStream, but restrictions apply. These data were used under license for the current study and are not publicly available. However, they are available from the corresponding author upon reasonable request and with the permission of LSEG DataStream.

References

Abdul-Salam Y, Phimister E (2017) Efficiency effects of access to information on small‐scale agriculture: Empirical evidence from Uganda using stochastic frontier and IRT models. J Agric Econ 68(2):494–517

Abor J (2005) The effect of capital structure on profitability: an empirical analysis of listed firms in Ghana. J Risk Finance 6(5):438–445

Acharya VV, Cooley TF, Richardson MP, Walter I (2013) Regulating Wall Street: The Dodd-Frank Act and the new architecture of global finance. John Wiley & Sons

Adams C, Narayanan V (2010) The standardization of sustainability reporting. In Sustainability accounting and accountability. Routledge, New York, U.S.A, 89-104

Adeyemi MS, Akanji AA (2020) Role of bookkeeping on sustainability of Small and Medium Enterprises (SMEs) in Nigeria: A case study of selected SMEs in Osun State. Methods 4(9):140–154

Akhtar MF, Ali K, Sadaqat S (2011) Factors influencing the profitability of Islamic banks of Pakistan. Int Res J finance econ 66(66):1–8

Amran A, Haniffa R (2011) Evidence in development of sustainability reporting: A case of a developing country. Bus Strategy Environ 20(3):141–156

Athanasoglou PP, Brissimis SN, Delis MD (2008) Bank-specific, industry-specific and macroeconomic determinants of bank profitability. J Int Financ Mark, Inst Money 18(2):121–136

Balli E, Sigeze C, Ugur MS, Catik AN (2021) The relationship between FDI, CO2 emissions, and energy consumption in Asia-Pacific economic cooperation countries. Environ Sci Pollut Res 30:42845–42862. https://doi.org/10.1007/s11356-021-17494-3

Baliga R, Raut RD, Kamble SS (2019) Sustainable supply chain management practices and performance. Manag Environ Qual 31(11):1147–1182

Bendehnezhad M, Zailani S, Fernando Y (2012) An empirical study on the contribution of lean practices to environmental performance of the manufacturing firms in northern region of Malaysia. Int J Value Chain Manag 6(11):144–168

Berger AN, Bonaccorsi di Patti E (2006) Capital structure and firm performance: A new approach to testing agency theory and an application to the banking industry. J Bank Financ 30(4):1065–1102

Berman SL, Wicks AC, Kotha S, Jones TM (1999) Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad Manag J 42(5):488–506

Boon-itt S, Wong CY (2011) The moderating effects of technological and demand uncertainties on the relationship between supply chain integration and customer delivery performance. Int J Phys Distrib Logist Manag 41(3):253–276

Brandenburg M, Gruchmann T, Oelze N (2019) Sustainable supply chain management—A conceptual framework and future research perspectives. Sustainability 11(24):1–15

Breusch TS, Pagan AR (1979) A Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica 47(5):1287–1294. https://doi.org/10.2307/1911963

Buallay A, Cummings R, Hamdan A (2019) Intellectual capital efficiency and bank's performance: A comparative study after the global financial crisis. Pac Account Rev 31(4):672–694

Carter CR, Easton PL (2011) Sustainable supply chain management: Evolution and future directions. Int J Phys Distrib Logist Manag 11(6):67–73

Carter CR, Rogers DS (2008) Framework of sustainable supply chain management: Moving toward new theory. Int J Phys Distrib Logist Manag 38(3):360–387

Chardine-Baumann E, Botta-Genoulaz VA (2014) Framework for sustainable performance assessment of supply chain management practices. Comput Ind Eng 76:138–147

Chen D, Gummi UM, Lu S, Hassan A (2024) Oil price, economic policy uncertainty and food prices in oil-exporting and oil-importing developing economies. Econ Change Restruct 57(4):151

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econ 188(2):393–420

Chung KH, Pruitt SW (1994) A simple approximation of Tobin’s q. fin manag 23(3):70–74

Cook LS, Heiser DR, Sengupta K (2011) The moderating effect of supply chain role on the relationship between supply chain practices and performance. Int J Phys Distrib Logist Manag 41:104–134

Cormier D, Magnan M, Van Velthoven B (2005) Environmental disclosure quality in large German companies: economic incentives, public pressures or institutional conditions? Eur Account Rev 14(1):3–39

De D, Chowdhury S, Dey PK, Ghosh SK (2020) Impact of lean and sustainability oriented innovation on sustainability performance of small and medium sized enterprises: A data envelopment analysis-based framework. Int J Prod Econ 219:416–430

Dietrich A, Wanzenried G (2011) Determinants of bank profitability before and during the crisis: Evidence from Switzerland. J Int Financ Mark Inst Money 21(3):307–327

Dim NU, Ezeabasili ACC (2015) Strategic supply chain framework as an effective approach to procurement of public construction projects in Nigeria. Int J Manag Sustainability 4(7):163–175

Doktoralina C, Apollo A (2019) The contribution of strategic management accounting in supply chain outcomes and logistic firm profitability. Uncertain Supply Chain Manag 7(2):145–156

Eyasu AM, Arefayne D (2020) The effect of corporate social responsibility on banks’ competitive advantage: Evidence from Ethiopian Lion International Bank SC. Cogent Bus Manag 7(1):1830473

Feng M, Yu W, Wang X, Wong CY, Xu M, Xiao Z (2018) Green supply chain management and financial performance: The mediating roles of operational and environmental performance. Bus Strategy Environ 27(7):811–824

Fitch Rating (2020) Credit Outlook 2020. Available at Credit Outlooks 2020::Fitch Ratings. Access on 20/11/2023

Flamini V, McDonald CA, Schumacher LB (2009) The Determinants of Commercial Bank Profitability in Sub-Saharan Africa (Janurary 2009). IMF Working Paper No. 09/15, Available at SSRN: https://ssrn.com/abstract=1356442

Freeman RE (1984) Strategic management. A stakeholder approach. Boston, MA: Pitman

Freeman RE, Phillips RA (2002) Stakeholder theory: A libertarian defense. Bus Ethics Q 12(3):331–349

Gall MD, Gall JP, Borg WR (2007) Educational research: An introduction (8th ed.). Pearson

Gelles GM, Mitchell DW (1996) Returns to scale and economies of scale: Further observations. J Econ Educ 27(3):259–261

Global Reporting Initiative-GRI (2013) G4 Sustainability Reporting Guidelines - Implementation Manual. Available at https://respect.international/g4-sustainability-reporting-guidelines-implementation-manual/. Access on 26/03/2022

Govindan K, Azevedo SG, Carvalho H, Cruz-Machado V (2014) Impact of supply chain management practices on sustainability. J Clean Prod 85:212–225

Goyal S, Routroy S, Shah H (2018) Measuring the environmental sustainability of supply chain for Indian steel industry. Bus Process Manag J 24:517–536

Green KW, Inman RA, Sower VE, Zelbst PJ (2019) Impact of JIT, TQM and green supply chain practices on environmental sustainability. J Manuf Technol Manag 30(7):26–47

Gujarati DN, Porter CD (2009) Basic econometrics. 5th edition, McGraw-Hill Irwin, New York, U.S.A

Hair JF, Gabriel M, Patel V (2014) AMOS covariance-based structural equation modeling (CB-SEM): Guidelines on its application as a marketing research tool. Braz J Mark 13(2):115–136

Hasan I, Kobeissi N, Liu L, Wang H (2018) Corporate social responsibility and firm financial performance: The mediating role of productivity. J Bus Ethics 149:671–688

Hofer C, Eroglu C, Rossiter HA (2012) The effect of lean production on financial performance: The mediating role of inventory leanness. Int J Prod Econ 138:242–253

Hofer RA, Hofer C, Waller A (2014) What gets suppliers to play and who gets the pay? On the antecedents and outcomes of collaboration in retailer-supplier dyads. Int J Logist Manag 25(2):226–244

Huang X, Yang S, Shi X (2021) How corporate social responsibility and external stakeholder concerns affect green supply chain cooperation among manufacturers: An interpretive structural modeling analysis. Sustainability 13(5):2518

Igbekoyi OE, Ogungbade OI, Olaleye AG (2021) Financial Performance and Environmental Sustainability Reporting Practices of Listed Manufacturing Firms in Nigeria. Glob J Account 7(1):15–24

Ikram M, Sroufe R, Rehman E, Shah SZA, Mahmoudi A (2020) Do quality, environmental, and social (QES) certifications improve international trade? A comparative grey relation analysis of developing vs. developed countries. Phys A Stat Mech Appl 545:123486

Ikram M, Zhou P, Shah SAA, Liu GQ (2019) Do environmental management systems help improve corporate sustainable development? Evidence from manufacturing companies in Pakistan. J Clean Prod 226:628–641

Imperatives S (1987) Report of the World Commission on Environment and Development: Our Common Future. United Nations, New York, U.S.A, pp. 94–99

Inoue Y, Lee S (2011) Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour Manag 32(4):790–804

Iramanesh M, Zailani S, Hyun S, Ali M, Kim K (2019) Impact of lean manufacturing practices on firms’ sustainable performance: lean culture as a moderator. Sustainability 11:1112

Jamali D (2008) A stakeholder approach to corporate social responsibility: A fresh perspective into theory and practice. J Bus Ethics 82:213–231

Jenkins H (2006) Small business champions for corporate social responsibility. J Bus Ethics 67:241–256

Jum’a L (2020) The effect of value-added activities of key suppliers on the performance of manufacturing firms. Pol J Manag Stud 22(5):231–246

Jum’a L, Zimon D, Ikram MA (2021) Relationship between supply chain practices, environmental sustainability and financial performance: evidence from manufacturing companies in Jordan. Sustainability 13:2152

Kacperczyk A (2009) With greater power comes greater responsibility? Takeover protection and corporate attention to stakeholders. Strateg Manag J 30(3):261–285

Kerlinger FN, Lee HB (2000) Foundations of behavioral research (4th ed.). Harcourt College Publishers

Koh Y, Lee S, Boo S (2009) Does franchising help restaurant firm value? Int J Hosp Manag 28(2):289–296

Kolk A (2005) Environmental reporting by multinationals from the Triad: convergence or divergence? Manag Int Rev, 37:45–166

Le TT (2020) The effect of green supply chain management practices on sustainability performance in Vietnamese constructionmaterials manufacturing enterprises. Uncertain Supply Chain Manag 8:43–54

Lee S, Park SY (2009) Do socially responsible activities help hotels and casinos achieve their financial goals? Int J Hosp Manag 28(1):105–112

Lee S-Y (2021) Sustainable supply chain management, digital-based supply chain integration, and firm performance: A cross-country empirical comparison between South Korea and Vietnam. Sustainability 13:7315

Li S, Ragu-Nathan B, Ragu-Nathan TS, Subba Rao S (2006) The impact of supply chain management practices on competitive advantage and organizational performance. Omega 34:107–124

Mageto J (2021) Big data analytics in sustainable supply chain management: A focus on manufacturing supply chains. Sustainability 13:7101

Margolis JD, Elfenbein HA, Walsh JP (2009) Does it Pay to Be Good...And Does it Matter? A Meta-Analysis of the Relationship between Corporate Social and Financial Performance (March 1, 2009). Available at SSRN: https://ssrn.com/abstract=1866371

Marshall D, McCarthy L, Heavey C, McGrath P (2014) Environmental and social supply chain management sustainability practices: Construct development and measurement. Prod Plan Control 26:673–690

Marshall G, Barber TJ, Boardman JT (1987) Methodology for modelling a project managementcontrol environment. In IEE Proceedings D (Control Theory and Applications) (Vol. 134, No. 4, pp. 287-300). IETDigital Library

McConnell JJ, Servaes H (1990) Additional evidence on equity ownership and corporate value. J financ econ 27(2):595–612

McWilliams A, Siegel DS (2011) Creating and capturing value: Strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. J Manag 37(5):1480–1495

Menor LJ, Kristal MM, Rosenzweig ED (2007) Examining the influence of operational intellectual capital on capabilities and performance. Manuf Serv Oper Manag 9(4):559–578

Michael RT, Becker GS (1973) On the new theory of consumer behavior. Swed J Econ 7(2):378–396

Myers SC (2001) Capital structure. J Econ Perspect 15(2):81–102

Nazim R, Yahya S, Malim MR (2015) A new approach to supplier selection problem: An introduction of AHP-SCOR integrated model. Int J Recent Innov Trends Comput Commun 3(1):338–346

Näyhä A, Horn S (2012) Environmental sustainability—aspects and criteria in forest bio-refineries. Sustain Account Manag Policy J 3:161–185

Neckel S (2017) The sustainability society: A sociological perspective. Cult Pract Europeanization 2(2):46–52

Ndukwe EOD, Nwakanma GN (2018) Corporate sustainability reporting and firm profitability: A survey of selected quoted companies in Nigeria. Nigerian acct 51(2):18–26

Nnamani J. N, Lucy O. U, Kevin O. U (2017) Effect of sustainability accounting and reporting on the financial performance of firms in Nigeria's Brewery Sector. Eur J Bus Innov Res 5(1):1–15

Nwaiwu N.J, Oluka N.O (2018) Environmental Cost Disclosure and Financial Performance of Oil and Gas Companies in Nigeria. Int j Adv acad res financ manag 4:1–23

Nwobu O, Iyoha FO (2018) Managerial perceptions of corporate sustainability reporting determinants in Nigeria. J Bus, Retail Manag Resour 12(2):123–135

Nwobu OA, Owolabi AA, Iyoha FO (2017) Sustainability reporting in financial institutions: a study of the Nigerian banking sector. J Internet Bank Commun 22(58):1–15

Nworji ID, Adebayo O, David AO (2011) Corporate governance and bank failure in Nigeria: Issues, challenges and opportunities. Res J Financ Account 2(2):1–18

Obansa SAJ, Ohiri A (2013) The role of commercial banks on economic development in Nigeria. IOSR J Econ Financ 1(5):12–21

Ojo E, Mbohwa C, Akinlabi E (2014) Green supply chain management in construction industries in South Africa and Nigeria. Int J Chem, Environ Biol Sci 2(2):146–150

Olaniyan ON, Efuntade AO, Efuntade OO (2021) Corporate social responsibility and firm financial performance in Nigeria: Mediating on ethical responsibility. Ann Spiru Haret Univ Econ Ser 21(1):71–95

Olokoyo FO (2013) Capital structure and corporate performance of Nigerian quoted firms: a panel data approach. Afr Dev Rev 25(3):358–369

Othman R, Ameer R (2009) Corporate social and environmental reporting: Where are we heading? A survey of the literature. Int J Discl Gov 6(4):298–320

Panigrahi SS, Bahinipati B, Jain V (2019) Sustainable supply chain management. Manag Environ Qual Int J 30:1001–1049

Parthiban A, Gopal A. A. R, Siwayanan P, Chew K. W (2021) Disposal methods, health effects and emission regulations for sulfur hexafluoride and its by-products. J Hazard Mater 417:126107

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2004) Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom Theory 20(3):597–625

Peeters J (2012) The place of social work in sustainable development: Towards eco-social practice. Int J Soc Welf 21(3):287–298

Pesaran MH (2004) General diagnostic tests for cross-sectional dependence in panels. Cambridge Working Papers in Economics 0435, Faculty of Economics, University of Cambridge. https://ideas.repec.org/p/cam/camdae/0435.html. Accessed 22 Apr 2024

Pesaran MH (2007) A simple panel unit root test in the presence of cross‐section dependence. J Appl Econometrics 22(2):265–312

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econom Rev 34(6-10):1089–1117

Pesaran MH, Yamagata T(2008) Testing slope homogeneity in large panels J Econ 142:50–93

Rajan RG, Zingales L (1995) What do we know about capital structure? Some evidence from international data. J Financ 50(5):1421–1460

Rasche A, Kell G (2010) The United Nations global compact: Achievements, trends and challenges. Cambridge University Press, New York, United States of America

Schaltegger S, Burritt R (2014) Measuring and managing sustainability performance of supply chains: Review and sustainability supply chain management framework. Supply Chain Manag: Int J 4(11):114–126

Sendawula K, Bagire V, Mbidde CI, Turyakira P (2020) Environmental commitment and environmental sustainability practices of manufacturing small and medium enterprises in Uganda. J Enterp Commun People Places Glob Econ 2020:347–362

Seuring S, Müller M (2008) From a literature review to a conceptual framework for sustainable supply chain management. J Clean Prod 16(15):1699–1710

Shadish WR, Cook TD, Campbell DT (2002) Experimental and quasi-experimental designs for generalized causal inference. New York: Houston Miffin

Siddik MNA, Kabiraj S, Joghee S (2017) Impacts of capital structure on performance of banks in a developing economy: Evidence from Bangladesh. Int J Financ Stud 5(2):13

Singh RK, Modgil S, Tiwari AA (2019) Identification and evaluation of determinants of sustainable manufacturing: A case of Indian cement manufacturing. Measures Bus Excell 23:24–40

Su Z, Zhang M, Wu W (2021) Visualizing sustainable supply chain management: a systematic scientometric review. Sustainability 13(8):4409

Sufian F, Habibullah MS (2009) Bank specific and macroeconomic determinants of bank profitability: Empirical evidence from the China banking sector. Front Econ China 4(2):274–291

Swamy PA (1970) Efficient inference in a random coefficient regression model. Econom J Econ Soc 38:311–333

Tan Y, Floros C (2013) Risk, capital and efficiency in Chinese banking. J Int Financ Mark Inst money 26:378–393

United Nations Environment Programme (UNEP) 2011 Towards a green economy: pathways to sustainable development and poverty eradication United Nations Environment Programme, Nairobi

Usenko L, Zenkina I (2016) Modern trends and issues of corporate reporting data disclosure on organization activities. Mediterr J Soc Sci 7(3):212–226

Vu TT, Dang VTW (2020) Environmental commitment and firm financial performance: A moderated mediation study of environmental collaboration with suppliers and CEO gender. Int J Ethics Syst 2:34–56

Wisner PS, Epstein MJ, Bagozzi RP (2009) Environmental proactivity and performance. Adv Environ, Account Manag 4:105–127

Wright C (2006) From ‘safeguards’ to ‘sustainability’: The evolution of environmental discourse inside the international finance corporation. In The World Bank and Governance: A Decade of Reform and Reaction, edited by Diane L. Stone, Christopher Wright, 67–87

Yang MGM, Hong P, Modi SB (2011) Impact of lean manufacturing and environmental management on business performance: An empirical study of manufacturing firms. Int J Prod Econ 129:251–261

Yildiz Çankaya S, Sezen B (2019) Effects of green supply chain management practices on sustainability performance. J Manuf Technol Manag 30:98–121

Yoon B, Chung Y (2018) The effects of corporate social responsibility on firm performance: A stakeholder approach. J Hosp Tour Manag 37:89–96

Zailani S, Jeyaraman K, Vengadasan G, Premkumar R (2012) Sustainable supply chain management (SSCM) in Malaysia: A survey. Int J Prod Econ 140(1):330–340

Zeitun R, Tian GG (2007) Capital structure and corporate performance: evidence from Jordan. Australas Account, Bus Financ J 1(4):3

Zimon D (2020) ISO 14001 and the creation of SSCM in the textile industry. Int J Qual Resour 14:739–748

Zhou Y, Liu XQ, Wong KH (2021) Remanufacturing policies options for a closed-loop supply chain network. Sustainability 13(12):1–16

Acknowledgements

The first author acknowledges the financial support from the Xi’an Social Science Research Program (Grant No.: 24JX126) and the Social Science Research Project of the Shaanxi Province (Item No. 2021D051).

Author information

Authors and Affiliations

Contributions

DC and UMG wrote the conceptual analysis and the methodology. MI and FAT reviewed the relevant and related literature, leading to the theoretical foundation. UMG conducted data curation, formal analysis, and validation. DC acquired the funding and managed the research. All the authors contributed to writing and approving the original draft of the paper.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This research does not contain any direct involvement with human participants by any of the authors. Ethical approval was not required as the study did not involve human participants. The research relies on quantitative analysis based on historical data of financial institutions.

Informed consent

The research does not require informed consent, as the analysis did not involve human participants. It used empirical analysis based on historical data published by financial institutions. The data is available upon subscription and does not require informed consent.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chen, D., Gummi, U.M., Ibrahim, M. et al. Sustainable supply chain management operations: does sustainable environmental disclosure matter for banks’ financial performance in Nigeria?. Humanit Soc Sci Commun 11, 1499 (2024). https://doi.org/10.1057/s41599-024-04008-y

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-024-04008-y