Abstract

This study examines the relationships between top management commitment (TMC), green investment (GI), corporate social responsibility (CSR) practices, environmental strategy (ES), and their collective impact on environmental sustainability performance (ESP) within the banking sector in China. Grounded in stakeholder theory, the research employed a structured online survey, targeting employees of Chinese banking institutions. The data were collected from a sample of 373 respondents and subsequently analyzed using structural equation modeling (SEM). The key findings revealed that TMC positively influences GI, CSR practices, and ES within the scrutinized institutions. Furthermore, GI was found to significantly enhance ESP, CSR practices, and ES. Additionally, both CSR practices and ES positively influenced ESP, while also serving as full mediators in the relationship between GI and ESP. The findings of this study provide both theoretical contributions and practical implications for researchers, practitioners, and policymakers in the domain of organizational environmental sustainability. This study significantly advances the understanding of how leadership commitment and strategic investments interact to drive environmental sustainability within the banking sector.

Similar content being viewed by others

Introduction

Environmental sustainability has become a critical focus in the global financial landscape, especially in the banking sector, due to heightened concerns about climate change, resource depletion, and increasing regulatory pressures (Al Amin et al., 2023; Shakil et al., 2019; Zheng, 2023). Banks, as pivotal institutions within financial ecosystems, are now expected to take active roles in driving sustainable development through environmentally responsible practices and investments (Dai et al., 2022; Guang-Wen & Siddik, 2022). This study is motivated by the urgent need to understand the role of leadership in shaping such sustainability initiatives, particularly in the context of China, where rapid industrialization and environmental degradation pose significant challenges. By addressing how top management commitment (TMC) influences key organizational strategies, namely green investment (GI), corporate social responsibility (CSR) practices, and environmental strategy (ES)—this research provides valuable insights into the mechanisms that enhance environmental sustainability performance (ESP) in the banking sector.

This study specifically examines the interplay of TMC, GI, CSR, and ES, aiming to fill critical research gaps in the literature. TMC refers to the active involvement and prioritization of sustainability goals by senior management, which is crucial in shaping strategic investment decisions and driving organizational change (Latan et al., 2018). GI encompasses financial allocations toward environmentally sustainable projects, while CSR practices involve the integration of environmental and social concerns into business operations (Carroll, 1979). Furthermore, ES reflects the strategic plans organizations adopt to achieve long-term environmental goals (Aftab et al., 2023). Finally, ESP measures the effectiveness of an organization in meeting its environmental goals and reducing its ecological footprint (Malsha et al., 2020; Zheng et al., 2021). Grounded in stakeholder theory, which asserts that organizations have responsibilities beyond profit maximization to a broader network of stakeholders, including the environment, this study seeks to explain the nuanced relationships among these variables (Indriastuti & Chariri, 2021). It is posited that TMC significantly influences organizational endeavors like GI and that such investments, coupled with CSR practices and ES, culminate in enhanced ESP, reinforcing the theoretical foundation of this research (Gallego-Álvarez & Ortas, 2017). The focus on China provides a unique context due to its significant economic footprint and recent surge in environmental initiatives (Li et al., 2023; Saqib & Usman, 2023). The country’s rapid industrialization and concurrent environmental degradation spotlight the need for sustainable practices within the financial sector, offering insights that may have global relevance given China’s substantial economic influence (Wang, 2023; Wu et al., 2023).

Recent studies have predominantly focused on the relationship between green finance and environmental performance (EP) (Bhuiyan et al., 2024; Dai et al., 2022; Gulzar et al., 2024; Hoang & Tuan, 2023; Khan et al., 2023), CSR and EP (Dai et al., 2022; Khaddage-Soboh et al., 2024; Liu, 2024; Owusu et al., 2024; Soomro et al., 2024), and ES and EP (Aftab et al., 2023; Ibrahim & Mahmood, 2022; Seroka-Stolka, 2023; Tan et al., 2022). Additionally, a few studies have examined the role of green finance in improving environmental sustainability performance (Guang-Wen & Siddik, 2022; Hussain et al., 2023; Siddik et al., 2023; Yan et al., 2022; Zheng et al., 2021). The literature suggests that TMC moderates the relationship between green banking adoption and environmental, operational, and financial performance (Newton et al., 2024). Another study by Kitsis and Chen (2021) found that TMC mediates the relationship between stakeholder pressures and green operations. Furthermore, TMC and corporate environmental strategy have been shown to significantly improve EP (Latan et al., 2018). However, there is a notable lack of studies examining how TMC promotes GI, CSR, and ES within banking institutions in a single study. Additionally, the mediating roles of CSR and ES in the link between GI and ESP are underexplored, particularly within the context of stakeholder theory.

This gap is critical as it leaves unanswered questions about the mechanisms through which TMC influences these factors to enhance ESP in the banking sector. Thus, this study aims to fill these gaps by examining the relationships among TMC, GI, CSR, ES, and ESP within the context of banking institutions in an emerging economy like China. By exploring these dynamics, the research will provide a comprehensive understanding of how TMC can drive environmental sustainability through GI, CSR, and ES, offering both theoretical and practical insights. The main research questions guiding this study are: (1) How does TMC influence GI, CSR practices, and ES in the banking sector? (2) What is the impact of GI on CSR practices, ES, and ESP? (3) How do CSR practices and ES mediate the relationship between GI and ESP? The primary objective is to investigate the intricate relationships among these variables to provide a comprehensive framework for understanding how TMC drives environmental sustainability in the banking sector.

This study presents significant theoretical and practical implications by interpreting the intricate interactions among TMC, GI, CSR practices, ES, and ESP in Chinese banking institutions. It extends the existing literature by emphasizing the pivotal role of leadership in fostering organizational sustainability and applying stakeholder theory to contextualize how these variables collectively enhance ESP. The findings demonstrate that TMC and GI positively influence CSR practices and ES, which subsequently improve ESP. This reveals that green investments alone are insufficient; they must be operationalized through comprehensive CSR practices and well-articulated environmental strategies to achieve substantial improvements in ESP. The study offers a comprehensive framework by integrating multiple variables, addressing a gap in existing literature, and aligning with calls for more integrative research frameworks. By providing a holistic perspective on the factors driving environmental sustainability, the study suggests that a multifaceted approach involving leadership commitment, strategic investments, and CSR initiatives is essential for ESP in the banking sector. This research enriches the theoretical discourse on environmental sustainability and offers actionable insights for practitioners and policymakers, paving the way for future research and practical implementation in sustainable business practices.

The subsequent sections of this paper detail the theoretical background and, hypothesis development, methodologies used, present the data analysis findings, discuss the implications, and conclude with the theoretical and practical contributions of the study. Additionally, limitations are acknowledged, and areas for future research are proposed to continue the academic dialog on environmental sustainability within the banking sector.

Literature review and development of research hypotheses

Theoretical background

Stakeholder theory broadly postulates that organizations have responsibilities to multiple groups and entities, not just shareholders (Freeman et al., 2010). These entities, or stakeholders, include employees, customers, suppliers, communities, governments, and the environment. This perspective suggests that businesses should make decisions that take the interests of all stakeholders into account. TMC often plays a crucial role in this context, as it reflects the degree of dedication and active involvement of an organization’s leadership in driving specific initiatives. In an emerging economy like China, where the need for sustainable development and resource utilization is pressing, this commitment towards green investment can be particularly pivotal. Applying stakeholder theory to green investment, we can view it from two perspectives: (1) the direct influence of stakeholders, where pressure or demand from stakeholders encourages banks to adopt more sustainable practices, commonly known as green finance (Acquah et al., 2023). These practices include prioritizing environmentally friendly projects when granting loans, offering green bonds, and investing in sustainable businesses (Dai et al., 2022; Indriastuti & Chariri, 2021). (2) The indirect influence occurs through the mediating variables of CSR practices and environmental strategies. Here, stakeholder pressure plays a critical role in driving banks to implement CSR practices and environmental strategies, which, in turn, facilitate green financing.

Furthermore, CSR practices involve actions that go beyond a bank’s legal obligations toward society and the environment. Stakeholder theory suggests that banks should consider the interests of all stakeholders, including the environment (Deng et al., 2013). As a result, banks are encouraged to adopt pro-environment CSR initiatives. These might include educating customers about green investments, supporting community environmental initiatives, or reducing their own carbon footprints. Environmental strategies, on the other hand, are the approaches a bank adopts to manage its relationship with the environment (Kraus et al., 2020). These strategies can be reactive (responding to environmental problems once they arise) or proactive (anticipating and preventing potential environmental issues). A proactive environmental strategy can greatly enhance a bank’s commitment to green investment. Moreover, stakeholders—both internal, such as employees and management, and external, such as customers, shareholders, regulators, and society—can exert pressure on banks to adopt CSR practices and proactive environmental strategies (Indriastuti & Chariri, 2021). These pressures may come in various forms, such as consumer demand for sustainable investments, regulatory requirements for transparency in green lending, or employee advocacy for sustainable internal operations. By responding to stakeholder interests with appropriate CSR practices and environmental strategies, banks can promote green investment, thereby enhancing their ESP. This approach not only benefits the environment but also provides significant advantages to banks, such as an improved reputation, increased customer loyalty, and potential risk mitigation.

Development of research hypothesis

Relationship between TMC and GI

Stakeholder theory suggests that businesses have responsibilities to various stakeholders, including employees, customers, the community, and the environment (Wijethilake & Lama, 2019). Consequently, strategic decisions, such as green investment, are influenced by these stakeholders. Organizations should consider the interests of all stakeholders, including environmental ones when making decisions (Indriastuti & Chariri, 2021). When top management commits to green investment, they are more likely to support environmentally beneficial projects like renewable energy or sustainable business practices. Companies are increasingly driven by internal stakeholder pressures to adopt environmentally responsible practices (Yen, 2018). This awareness is pushing companies towards sustainability and reducing their ecological footprint, reflecting a broader commitment to sustainable initiatives (Bukhari et al., 2022). Prior research highlights the significant role of top management in shaping an organization’s sustainability initiatives (Bukhari et al., 2022; Yen, 2018). For instance, Yen (2018) found that top management commitment is crucial for green collaboration, seen as a proxy for sustainability initiatives. However, in Taiwanese electronics companies, green investments were primarily driven by regulatory compliance and market demands rather than top management commitment (Shonte & Ji, 2022; Ye & Dela, 2023). In developing countries like Pakistan, customer and competitor pressures increase transparency in green banking initiatives, with top management commitment strengthening sustainable banking adoption (Bukhari et al., 2022). Thus, in Chinese banking institutions, we hypothesize that top management’s commitment to environmental sustainability is a major driving force promoting green investment. Therefore, the following hypothesis is formulated:

Hypothesis 1: TMC is positively associated with the implementation of GI.

Relationship between TMC and CSR

Commitment from top management is essential for fulfilling an organization’s objectives and enhancing its long-term performance, highlighting that senior management’s passion and involvement are crucial for achieving organizational goals (Wang et al., 2023). According to stakeholder theory, organizations should consider the interests of all their stakeholders, including employees, customers, suppliers, communities, and the environment (Freeman et al., 2010). When top management is committed to CSR, they are more likely to allocate resources to CSR initiatives, develop CSR policies and procedures, and communicate CSR goals to employees (Abbas, 2020; Shonte & Ji, 2022; Wang et al., 2023). This can lead to the implementation of CSR practices that promote environmental sustainability. Previous research supports the link between TMC and CSR practices. For example, a study of coffee-exporting enterprises in Ethiopia found that TMC was positively associated with the implementation of CSR practices to promote sustainable export performance (Shonte & Ji, 2022). The study also found that CSR partially mediated the link between TMC and sustainable export performance. Another study of SMEs in China found that top management commitment positively moderated the link between CSR practices and sustainability performance (Wang et al., 2023). Similarly, Chatterjee et al. (2023) argue that the engagement and dedication of top-level executives in CSR projects are critical to their success. Furthermore, research has shown that senior management’s strong dedication positively impacts the implementation of management systems (Wijethilake & Lama, 2019). Hence, TMC plays a critical role in promoting CSR practices. However, there is a lack of studies in the context of Chinese banks showing that TMC enhances CSR practices to improve environmental sustainability performance. Therefore, this research focuses on banking institutions in China to address this gap. The following hypothesis is developed:

Hypothesis 2: TMC is positively associated with the implementation of CSR practices.

Relationship between TMC and ES

Stakeholder theory posits that organizations are influenced by the expectations of their stakeholders, including customers, employees, shareholders, and the community. In the context of environmental sustainability, stakeholders increasingly demand that organizations adopt green practices. TMC’s environmental sustainability is a key factor in determining whether an organization will adopt green practices. When top management is committed to environmental sustainability, they are more likely to allocate resources to green initiatives, develop green policies, and foster a green culture within the organization. The literature has revealed that TMC has an indirect impact on environmental corporate strategy and environmental marketing strategies (Saleem et al., 2021). Furthermore, there is a growing body of evidence supporting the hypothesis that TMC is positively associated with the adoption of environmental green practices. For example, a study of tire manufacturing industries in Indonesia found that organizations with higher levels of TMC to environmental sustainability were more likely to adopt environmentally green practices (Hariadi et al., 2023). Similarly, Amir and Chaudhry (2019) found that TMC positively impacted environmental performance. Conversely, the banking sector in China is a major contributor to environmental degradation by funding harmful industries like petroleum and chemicals. Thus, TMC’s environmental sustainability is essential for the Chinese banking sector to reduce its environmental impact and promote sustainability through green environmental strategies. Consequently, it can be argued that TMC related to environmental sustainability is positively associated with the adoption of green environmental strategies by banking institutions. Therefore, the following hypothesis is developed:

Hypothesis 3: TMC is positively associated with the adoption of ES.

Relationship between GI and ESP

In recent times, there has been growing interest among researchers in GI, primarily because it helps companies enhance their EP. This is achieved by financing a diverse range of eco-conscious projects, from clean energy to waste management and pollution mitigation (Zheng et al., 2021). However, there has been a noticeable lack of studies exploring GI’s impact on a firm’s ESP. This research is timely, focusing on the influence of GI on the ESP of banks, particularly in emerging markets like China. For this study, GI is defined as the financing mechanism aimed at eco-friendly projects, ultimately bolstering an entity’s overall sustainability. Prior research has highlighted that the social, environmental, and economic facets of green finance play a pivotal role in shaping the ESP of banking entities (Zheng et al., 2021). Moreover, recent academic works underscore the importance of green finance in forecasting a company’s eco-centric performance (Wang et al., 2022; Xu & Li, 2020; Zhang et al., 2022). It has also been observed that green investments enhance both financial outcomes and ESP for businesses (Indriastuti & Chariri, 2021). By significantly reducing carbon footprints in both short and long durations, GI bolsters organizational sustainability (Al Mamun et al., 2022). Essentially, GI serves as a vital tool in curbing both internal and external environmental pollutants, thereby elevating an entity’s holistic ESP. Based on these insights, we propose the following hypothesis:

Hypothesis 4: GI has a significant positive impact on the ESP of banks.

Relationship between GI, CSR, and ESP

Researchers today focus on GI and CSR due to their significant influence on an organization’s environmental outcomes (Dai et al., 2022). Over the past few decades, GI and CSR have emerged as pivotal business practices globally (Guang-Wen & Siddik, 2022; Indriastuti & Chariri, 2021). GI is understood as a contemporary economic trend that amalgamates economic, social, and environmental advantages (Wang & Zhi, 2016; Zheng et al., 2021). Conversely, Carroll (1979) described CSR as the spectrum of a firm’s social obligations, encompassing societal expectations related to regulatory, economic, moral, and discretionary aspects (Carroll, 2016). Sinha et al. (2021) further postulated that certain GI processes could inadvertently exert detrimental effects on firms’ environmental and social commitments. Firms adopt GI and CSR strategies to satisfy various stakeholders, including the public, shareholders, and customers, enhance their fiscal outcomes, and address social and environmental challenges (Indriastuti & Chariri, 2021). By channeling funds into diverse environmental endeavors, GI can potentially steer a firm’s corporate sustainability, thereby bolstering its environmental performance (Chen et al., 2022; Dai et al., 2022; Zhang et al., 2022). A recent study by Guang-Wen and Siddik (2022) corroborated the positive impact of GI and CSR on the environmental performance of banking institutions. Similar outcomes indicating the positive correlation between CSR and environmental performance have been noted in research focusing on small and medium enterprises (SMEs) (Abdulaziz-al-Humaidan et al., 2022) and large corporate entities. Nonetheless, there have been instances where the influence of CSR on environmental performance was deemed inconclusive (Kraus et al., 2020). This presents a dichotomy in the relationship between CSR and environmental performance, highlighting the need for more in-depth scrutiny. Given this backdrop, this study introduces the following hypotheses:

Hypothesis 5: GI greatly influences the CSR of banks in a positive way.

Hypothesis 6: CSR greatly influences the ESP of banks in a positive way.

Relationship Between GI, ES, and ESP

Research outputs on the relationship between ES and CSR are abundant (Kraus et al., 2020; Tan et al., 2022); however, studies emphasizing how ES is related to GI and ESP, particularly from the banking sector perspective, are minimal. To close this gap, this study investigates the relationship between GI, ES, and ESP. GI can be characterized as financial strategies undertaken by firms to achieve environmental sustainability (Dai et al., 2022). These include investments in innovations that minimize carbon footprint, reduce energy use, promote reliance on clean energy, reduce waste, and encourage pro-ecological activities (Do & Nguyen, 2020). On the other hand, ES refers to a set of measures taken through purchases, productions, and business rules to minimize the environmental impact of operations (Latan et al., 2018). Recent studies have found that GI significantly enhances ESP (Yan et al., 2022; Zheng et al., 2021) and EP (Chen et al., 2022; Dai et al., 2022; Guang-Wen & Siddik, 2022; Zhang et al., 2022). Similarly, a positive relationship has been observed between ES and an organization’s EP (Kraus et al., 2020; Tan et al., 2022). In another study, green marketing as an ES significantly enhanced corporate ESP. An organization can achieve better ESP by integrating environmental and societal needs into its business operations (Ara et al., 2019). Additionally, the adoption of environmental supply chain strategies was observed to significantly improve the environmental, social, and economic performance of organizations (Ara et al., 2019). Based on the literature review, it can be concluded that GI and ES are essential for improving the environmental sustainability performance of an organization. Hence, the following research hypotheses are developed:

Hypothesis 7: GI greatly influences the ES of banks in a positive way.

Hypothesis 8: ES greatly influences the ESP of banks in a positive way.

The mediating role of CSR practices and ES

A prior conceptual understanding has suggested a potential relationship among GI, CSR, ES, and ESP. This theoretical proposition suggests that GI might be a precursor to firms adopting CSR and ES, leading to enhanced ESP. Despite this, there is a notable absence of empirical investigation into these relationships, particularly within financial institutions in China. This research aims to fill this gap and contribute to the growing literature on GI. Empirical studies have found a direct, positive, and statistically significant relationship between GI and CSR with EP (Dai et al., 2022; Guang-Wen & Siddik, 2022). However, Kraus et al. (2020) reported no tangible impact of CSR on EP within the manufacturing sector. Emerging research trends suggest that both green investments and CSR initiatives are potent catalysts for improving ESP (Indriastuti & Chariri, 2021). For instance, Abdulaziz-al-Humaidan et al. (2022) identified CSR’s mediating role between managerial sustainability orientations and ESP in Tunisian SMEs. Similarly, Abbas (2020) found that the relationship between Total Quality Management and corporate green performance is partially dependent on CSR interventions. Aftab et al. (2022) demonstrated that green human resource management significantly enhances environmental performance in manufacturing firms in developing countries, emphasizing the mediating roles of green innovation, environmental strategy, and pro-environmental behavior. Additionally, Aftab et al. (2023) found that CSR positively impacts financial performance in Pakistani manufacturing firms, with green dynamic capabilities and green innovation mediating this relationship, and perceived environmental volatility moderating the link between green innovation and financial performance. Historical scholarship has shown that strategic alignment with CSR mediates the relationship between dedicated sustainability committees and overall corporate EP (Orazalin, 2020). Kraus et al. (2020) further illustrated an indirect pathway between CSR and EP, mediated through ES. A study by Guang-Wen and Siddik (2023) added that green innovation serves as a mediator between fintech adoption and EP. This comprehensive literature review suggests that CSR and ES can act as intervening variables, influencing the relationship between GI and ESP outcomes in banking institutions. Given this theoretical foundation and empirical evidence, the study aims to formulate the following research hypotheses:

Hypothesis 9: The link between GI and ESP is mediated by CSR.

Hypothesis 10: The link between GI and ESP is mediated by the ES.

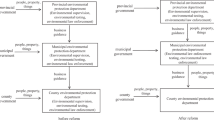

Figure 1 depicts the conceptual framework utilized in this study.

Research methods

Sample and data collection

This investigation examines the complex relationships between TMC, GI, CSR practices, ES, and ESP within the Chinese banking sector. Data for this study were collected from staff working in Chinese banks using a structured questionnaire and convenience sampling to obtain broad insights. An online survey was administered through the WJX platform between February and April 2023, allowing sufficient time for participant engagement. To mitigate issues such as incomplete responses and low response rates, the sample size was increased by sending invitations to 700 bankers across various organizational levels. A total of 410 completed questionnaires were received, resulting in a 58.57% response rate. After excluding 37 incomplete surveys, the final analytical sample consisted of 373 respondents. Among these respondents, 75.3% identified as male and 24.7% as female. The majority, around 65%, were aged between 20 and 30 years, offering a youthful perspective on the data. Additionally, 63.65% of the participants held a master’s degree, reflecting a high level of educational attainment, which potentially enriched the survey results with well-informed insights. This diverse and robust sample enhances the relevance and applicability of the findings to the Chinese banking sector, providing a comprehensive understanding of the relationships among TMC, GI, CSR, ES, and ESP.

Survey items

This research employs a structured survey to explore the relationships between TMC, GI, ESP, ES, and CSR practices within banking institutions in China. The survey instrument comprises a series of items designed to gauge perceptions and practices related to these variables, utilizing a 5-point Likert scale ranging from 1 (Strongly Disagree) to 5 (Strongly Agree) for respondent’s convenience and accuracy of responses. For TMC, items derived from Wei et al. (2023) and Yong et al. (2022), such as “Top management consistently demonstrates a strong commitment to environmental sustainability practices,” and “Leaders within our bank actively engage in the development and implementation of green investment strategies,” were employed to gauge the steadfastness and operationalization of management’s commitment to environmental stewardship. GI was assessed via items inspired by Indriastuti & Chariri (2021) and Zheng et al. (2021), addressing facets like resource allocation, strategic prioritization, and oversight of green projects. ESP, explored through lenses provided by Aftab et al. (2022) and Kraus et al. (2020), incorporated items evaluating the bank’s active engagement, communication, compliance, and strategic integration regarding environmentally sustainable activities.

Moreover, ES was examined via items rooted in literature by Aftab et al. (2022), Hussain et al. (2022), and Mustafa et al. (2023), such as investments in eco-friendly technologies and partnerships in conservation initiatives. Lastly, CSR practices were measured through items based on works by Guang-Wen & Siddik (2022), Kraus et al. (2020), and Suganthi (2019), focusing on community engagement, environmental impact reduction, communication efficacy, and ethical business operations. Respondents were invited to express their agreement or disagreement with each item, ensuring responses encapsulated perceptions across various dimensions of each construct, thereby facilitating a robust exploration of the interplay among the variables within the banking context (Table 1).

Common method bias

Common Method Bias (CMB) represents a considerable challenge, particularly pronounced in research employing self-reported data, having the capacity to skew and potentially misrepresent the perceived relationships among variables under consideration (Podsakoff & Organ, 1986). In the context of the present study, which utilized questionnaires to garner data encompassing both exogenous and endogenous variables from a singular source, there existed an inherent risk of CMB infiltrating the data collection process. To quantify and address this, Harman’s single-factor technique was invoked, revealing that a single factor revealed 29% of the total variance. Conventionally, the alarm for a CMB problem is sounded when a single factor explains over 50% of the variance (Podsakoff & Organ, 1986), thus the findings from the current study, residing below this benchmark, suggest that CMB does not substantively compromise the presented results. Nevertheless, in recognition of the pivotal role of methodological rigor, it remains pertinent for future research endeavors to explore and validate these findings further, employing a diverse array of methods and data sources to shield and fortify against potential CMB implications, thereby ensuring the robustness and replicability of the outcomes.

Data analysis and results

The employment of Structural Equation Modeling (SEM) played a crucial role in analyzing both the measurement and structural models within the scope of this research, effectively addressing the study’s objectives and enhancing the predictability of outcomes (Gerbing & Anderson, 1988; Hair et al., 2010; Henseler et al., 2015). The primary data were thoroughly analyzed using SPSS version 26 and SmartPLS 4. SEM was chosen for its well-known ability to mitigate biases from measurement inaccuracies and establish a clear hierarchy among latent variables (Prajogo & Cooper, 2010). To rigorously examine the research framework, a two-stage SEM technique was applied, following methodologies highlighted in previous research (Gerbing & Anderson, 1988). In the initial stage, the validity and reliability of the measurement model were tested using Confirmatory Factor Analysis (CFA) to assess the convergence and discriminant validity of the constructs. In the second stage, SEM was used to explore the structural relationships among the study variables, providing a comprehensive understanding of their dependencies and associations. Additionally, descriptive statistics were utilized to test data normality, ensuring the robustness and reliability of the findings (Kline, 2015). This structured, multi-stage analytical approach not only strengthens the study’s empirical foundation but also enriches its analytical depth, allowing for a nuanced understanding of the underlying patterns within the data. The rigorous methodology ensures that the research findings are both well-supported and contribute significantly to the existing body of scholarly work.

Descriptive statistics and data normality

Table 2 presents the descriptive statistics of the study variables, revealing mean values oscillating between 3.92 and 4.107 and suggesting a prevalent agreement among participants with the questionnaire items. Standard deviations are notably consistent, ranging from 0.715 to 0.895, thereby indicating a homogeneous dispersion of responses and facilitating comparably reliable subsequent analyses across all variables. Further empirical scrutiny divulged skewness and kurtosis values below 3 and 10, respectively, affirming the data’s appropriateness for SEM by reflecting a suitable symmetrical and tail-end distribution. The results were further subjected to a normality test, with variances aligning within the accepted thresholds as established by earlier studies (Kline, 2015), thus fortifying the robustness and reliability of the data for ensuing analyses. This statistical foundation ensures that further explorations and analyses, specifically utilizing SEM, rest on credible, validated data, thereby enhancing the validity and reliability of eventual findings and conclusions drawn from the study.

Measurement model: validity and reliability

The CFA method has been instrumental in evaluating the measurement model by examining the dynamic relationship between latent variables and their indicators. Prior studies (Hinkin, 1998) have highlighted that CFA not only scrutinizes but also validates the unidimensionality and overall validity of the measurement model. This model includes four pivotal tests: individual item reliability, internal reliability, convergent validity, and discriminant validity. A detailed review of the measurement model findings, as shown in Table 3, reveals that the individual factor loadings range from 0.711 to 0.859. This range exceeds the benchmark threshold value of 0.50 (Hair et al., 2010), affirming the reliability of the individual items. To evaluate the internal reliability of the variables, two statistical tools were utilized: Composite Reliability (CR) and Cronbach’s Alpha (CA). The results indicated that the CA and CR values for all the variables exceeded the conventional standard value of 0.6, a figure validated as acceptable in the academic domain (Hair et al., 2010). These findings confirm the robustness of the measurement model, ensuring that the variables are reliably measured and valid for further analysis.

Focusing on convergent validity, guidelines by Hair et al. (2010) suggest that an AVE value equal to or exceeding 0.50 for each construct is satisfactory. Alternatively, Fraering and Minor (2006) propose that an AVE value of 0.40 can also meet the requirements for convergent validity. However, Malhotra and Dash (2011) argue that the latter criterion is somewhat stringent and recommend relying primarily on CR to establish convergent validity. In the context of the present study, the CR values ranged from 0.71 to 0.826, while the AVE values spanned from 0.521 to 0.655. These values comfortably meet the convergent validity criteria set forth by Fraering and Minor (2006), Hair et al. (2010), and Malhotra and Dash (2011). Thus, the constructs in this study demonstrate adequate convergent validity, ensuring that the latent variables are well-represented by their indicators.

The discriminant validity of the study variables was assessed using the Fornell-Larcker method and the HTMT approach. According to Fornell-Larcker, the AVE for each factor exceeded the square root of its correlation with any other construct. Additionally, HTMT values (refer to Table 4) for each variable were below the 0.90 threshold, confirming the absence of discriminant validity issues (Henseler et al., 2015). This thorough validation process ensures the reliability and validity of the constructs, reinforcing the credibility and generalizability of the study’s findings.

Structural modeling and hypothesis testing

In the subsequent analysis, the measurement model was carefully executed, followed by a thorough investigation of the SEM using SmartPLS 4 to validate the initially proposed research framework. Key fit indices, such as a p-value of 0.00 and an SRMR of 0.068, were evaluated, both of which are considered adequate and satisfactory according to various prior studies (Bagozzi & Yi, 1988; Browne & Cudeck, 1992; Hu & Bentler, 1999; Salisbury et al., 2002). Additionally, the p-values and t-values within the SEM were calculated to assess the study’s hypotheses, with the results visually presented in Fig. 2.

This research framework highlights the estimated direct and indirect relationships among the study variables, including Top Management Commitment, Green Investment, CSR Practices, Environmental Strategy, and Environmental Sustainability Performance in the Chinese banking sector. Significant at ***p < 0.001 and **p < 0.01.

Table 5 shows the predictive relevance of the model variables, indicated by R-square, adjusted R-square, and Q2 values. CSR has an R-square of 0.296, an adjusted R-square of 0.292, and a Q2 value of 0.182, signifying moderate predictive relevance. Environmental Strategy has a lower predictive relevance with an R-square of 0.158, adjusted R-square of 0.153, and Q2 of 0.096. ESP shows higher predictive relevance with an R-square of 0.322, adjusted R-square of 0.316, and Q2 of 0.203. GI has an R-square of 0.172, an adjusted R-square of 0.170, and Q2 of 0.086. While these R-square values, particularly for Environmental Strategy and GI, may seem low, they are consistent with expectations in social science research, where multiple factors often interact in complex ways. In such contexts, R-square values typically capture only a portion of the variance explained by the model. In this study, the R-square values provide meaningful insights into the model’s predictive power, particularly in highlighting the significant influence of TMC and GI on key outcomes such as CSR and ESP. Furthermore, these values are aligned with prior sustainability research, where lower R-square values are common due to the multifaceted nature of the constructs (Siddik et al., 2023; Saunila et al., 2019). Therefore, despite the seemingly low values, the findings remain robust and theoretically significant. In addition to R-square values, the effect size (f2) presented in Table 6 provides further support for the model’s robustness. TMC significantly impacts GI (0.208) and CSR (0.096), while Green Innovation strongly affects ESP (0.163) and CSR (0.152). Although CSR and ES have smaller effects on ESP (0.032 and 0.028, respectively), these relationships still contribute meaningfully to the model. The effect size analysis helps to confirm the practical relevance of these relationships, even when R-square values are lower, suggesting that TMC and GI are critical drivers of CSR and ESP outcomes. Therefore, the model demonstrates moderate predictive relevance, with varying effect sizes across the variables, underscoring the importance of leadership commitment and strategic investments in fostering environmental sustainability within the banking sector.

The research adopted a fundamental statistical principle, wherein if the t-value exceeded 1.96 or, alternatively, the p-value was less than 0.05, the posited hypotheses were accepted, otherwise rejected. It is crucial to underscore that accepting or rejecting hypotheses carries substantial implications for the research’s contextual understanding; accepting a hypothesis, signaled by a t-value larger than 1.96 or a p-value below 0.05, indicates a statistically significant observation supportive of the research claims, while failure to meet these thresholds may necessitate a reevaluation of the foundational theoretical model or probing into alternative hypotheses to ensure the findings and subsequent conclusions are deeply rooted in rigorous statistical and empirical scrutiny.

Table 7 efficiently outlines a series of hypotheses tests, illustrating the relationships between various paths through β-values, standard errors (SE), t-values, p-values, and remarks on the support status of each hypothesis in a SEM framework. Hypotheses H1 through H8 assess direct paths between variables: TMC to GI (H1; β = 0.415***), TMC to CSR (H2; β = 0.286***), TMC to ES (H3; β = 0.208***), GI to ESP (H4; β = 0.399***), GI to CSR (H5; β = 0.359***), CSR to ESP (H6;β = 0.168***), GI to ES (H7; β = 0.263***), and ES to ESP (H8; β = 0.146**). All these hypotheses are supported, as indicated by their respective t-values (all exceeding the critical value of 1.96) and p-values (all below the threshold of 0.05), affirming significant relationships between the respective variables. Further, mediation analysis, evaluating indirect effects, demonstrated that GI to CSR to ESP (H9; β = 0.06***) and GI to ES to ESP (H10; β = 0.038**) pathways are fully mediated, denoting that the relationship between independent and dependent variables (GI and ESP) is accurately expressed through the mediators (CSR and ES, respectively). Both mediation hypotheses are supported, as indicated by t-values surpassing 1.96 and p-values less than 0.05, confirming the pivotal role of CSR and ES in connecting GI and ESP within the conceptual framework. This thorough analysis of the paths, direct and mediated, substantially contributes to the understanding and validation of the structural model under scrutiny.

Discussion and conclusion

The investigation of the relationships among TMC, GI, CSR practices, ES, and their collective impact on ESP has unveiled several critical findings through the lens of stakeholder theory. First, TMC is a significant catalyst in promoting GI, CSR practices, and ES within Chinese banking institutions. Stakeholder theory underscores the importance of organizational leaders in integrating environmental considerations into their strategies, showing that active leadership support for environmental stewardship leads to comprehensive environmental initiatives that benefit both internal and external stakeholders (Indriastuti & Chariri, 2021). Empirical findings reveal that GI significantly enhances the ESP of banks by financing sustainable projects such as renewable energy and clean technologies. This parallels previous studies, indicating that GI bolsters organizational sustainability performance (Indriastuti & Chariri, 2021; Zheng et al., 2021). Green investments not only provide financial returns but also address environmental impacts, aligning with stakeholder interests and elevating the sustainability performance of banks. Furthermore, GI positively influences CSR practices, suggesting that environmentally conscious banks refine their CSR policies to achieve organizational sustainability (Indriastuti & Chariri, 2021; Wang et al., 2022). Green investments enhance a company’s reputation among stakeholders, fostering better relationships and new opportunities.

The study also finds that CSR practices significantly augment banks’ ESP, consistent with other research affirming the role of CSR in sustainability (Indriastuti & Chariri, 2021). Banks can improve their sustainability by adhering to CSR activities, such as ethical, legal, economic, and discretionary initiatives. Additionally, GI positively impacts ES, reinforcing the relationship between green investments and environmental sustainability (Zakari & Khan, 2022). Stakeholder theory explains that green investments consider environmental consequences, aligning with the interests of various stakeholders, including consumers and regulators (Acquah et al., 2023). ES, in turn, significantly influences ESP, as supported by other studies (Aftab et al., 2022; Kraus et al., 2020; Rötzel et al., 2019).

The full mediation of CSR practices and ES in the relationship between GI and ESP suggests that green investments yield substantial environmental performance improvements when operationalized through robust CSR practices and coherent environmental strategies (Indriastuti & Chariri, 2021). While GI is a fundamental pillar, it is the subsequent practices and strategies that actualize the desired outcomes in ESP. Therefore, this study explains the interlinkages among TMC, GI, CSR practices, and ES in influencing ESP, intricately weaving these insights into the theoretical framework of stakeholder theory. The findings provide avenues for further research and practical implications for environmental sustainability within the banking sector in China, contributing to the existing body of knowledge and paving the way for sustainable organizational practices grounded in theoretical and empirical validations.

Study’s contributions, limitations, and directions for further study

Theoretical contributions

This study presents significant theoretical and practical implications by elucidating the intricate interactions among TMC, GI, CSR practices, ES, and ESP in Chinese banking institutions. It extends the existing literature by emphasizing the pivotal role of leadership in fostering organizational sustainability and applying stakeholder theory to contextualize how these variables collectively enhance ESP (Siddik et al., 2023; Dai et al., 2022; Zheng et al., 2021; Wei et al., 2023; Yong et al., 2022). The findings demonstrate that TMC and GI positively influence CSR practices and ES, which subsequently improve ESP. This reveals that green investments alone are insufficient; they must be operationalized through comprehensive CSR practices and well-articulated environmental strategies to achieve substantial improvements in ESP. This mediating role underscores the complexity of achieving environmental sustainability and the necessity for integrated approaches that combine financial commitments with strategic and operational initiatives. Furthermore, the study offers a comprehensive framework by integrating multiple variables, thereby providing a holistic perspective on the factors driving environmental sustainability. This approach addresses a gap in the existing literature and aligns with calls for more integrative research frameworks that consider the interplay of various organizational factors. The findings suggest that a multifaceted approach involving leadership commitment, strategic investments, and CSR initiatives is essential for ESP in the banking sector. Finally, this study enriches the theoretical discourse on environmental sustainability in the banking sector and provides actionable insights for practitioners and policymakers. By integrating stakeholder theory and identifying key mediating roles, it offers a robust framework for understanding and improving ESP, paving the way for future research and practical implementation in sustainable business practices.

Practical implications

This study not only advances theoretical understanding in the academic realm but also offers practical implications that can be leveraged by organizational leaders, policymakers, and practitioners to enhance sustainability practices and outcomes in the banking sector. First, the study provides concrete evidence to top management in banking institutions, particularly in China, underscoring the crucial role their commitment plays in driving improved ESP through strategic GI and strong CSR practices. Second, by demonstrating how GI influences ESP, CSR practices, and ES, this research offers practical guidance for organizations on how to strategically plan their investments to achieve optimal sustainability outcomes. Additionally, organizations, especially in the banking sector, can use the findings about the impact and mediating role of CSR and ES to refine their CSR policies and environmental strategies, further enhancing their ESP. Third, policymakers could apply the insights from this study to develop or update policies related to CSR and environmental sustainability for banking institutions, ensuring that these institutions not only comply with regulations but also adopt best practices in sustainability. Furthermore, by understanding the pathways connecting investments, strategies, and practices to sustainability performance, organizations can create more effective benchmarking and performance measurement systems that ensure sustainability initiatives are well-implemented and deliver the desired outcomes. Finally, this research provides a framework for aligning organizational strategies with stakeholder expectations, improving stakeholder relationships, and fostering a positive organizational image—especially important in customer-centric sectors like banking.

Limitations and avenues for future studies

This research, while offering valuable insights into the dynamics of organizational variables influencing environmental sustainability performance in the banking sector, acknowledges its limitations and proposes several avenues for future studies. The first limitation relates to the potential subjectivity of the data, which is primarily based on bankers’ perceptions of their firm’s performance. Although these perceptions were validated through the measurement model, future research could enhance objectivity by comparing these subjective views with actual organizational data, such as annual financial statements, to provide a more comprehensive and bias-mitigated analysis of the relationships among TMC, GI, CSR practices, and ES. Additionally, this study exclusively gathered insights from bankers; incorporating perspectives from bank owners and managing directors in future research could reveal new dimensions in understanding organizational approaches to sustainability, given their strategic positions and potentially different viewpoints. Lastly, while the study focuses on private commercial banks in China, expanding the geographical and organizational scope in future investigations to include banks from other Chinese cities and emerging economies like Bangladesh, India, Vietnam, Pakistan, and Malaysia could not only improve the generalizability of the findings but also contribute to a more globally relevant theoretical framework that captures diverse economic and organizational contexts.

Data availability

The data that supports the findings of this study are available in the supplementary file.

References

Abbas J (2020) Impact of total quality management on corporate green performance through the mediating role of corporate social responsibility. J Clean Prod 242:118458. https://doi.org/10.1016/j.jclepro.2019.118458

Abdulaziz-al-Humaidan A, Ahmad N-H, Islam MS (2022) Investigating the mediating relationship between sustainability orientations and sustainable performance in the SME context of Tunisia. Vision 26(3):369–381. https://doi.org/10.1177/09722629211000481

Acquah ISK, Baah C, Agyabeng-Mensah Y, Afum E (2023) Green procurement and green innovation for green organizational legitimacy and access to green finance: the mediating role of total quality management. Glob Bus Organ Excell 42(3):24–41. https://doi.org/10.1002/joe.22183

Aftab J, Abid N, Cucari N, Savastano M (2023) Green human resource management and environmental performance: the role of green innovation and environmental strategy in a developing country. Bus Strategy Environ 32(4):1782–1798. https://doi.org/10.1002/bse.3219

Aftab J, Abid N, Sarwar H, Veneziani M (2022) Environmental ethics, green innovation, and sustainable performance: exploring the role of environmental leadership and environmental strategy. J Clean Prod 378. https://doi.org/10.1016/j.jclepro.2022.134639

Al Amin M, Ahad Mia MA, Bala T, Iqbal MM, Alam MS (2023) Green finance continuance behavior: the role of satisfaction, social supports, environmental consciousness, green bank marketing initiatives and psychological reactance. Manag Environ Qual Int J 34(5):1269–1294. https://doi.org/10.1108/MEQ-09-2022-0257

Al Mamun M, Boubaker S, Nguyen DK (2022) Green finance and decarbonization: evidence from around the world. Financ Res Lett 46:102807. https://doi.org/10.1016/j.frl.2022.102807

Amir M, Chaudhry NI (2019) Linking environmental strategy to firm performance: a sequential mediation model via environmental management accounting and top management commitment. Pak J Commer Soc Sci 13(4):849–867

Ara H, Leen JYA, Hassan SH (2019) GMS for sustainability performance in the apparel manufacturing industry: a conceptual framework. Vision 23(2):170–179. https://doi.org/10.1177/0972262919850931

Bagozzi RP, Yi Y (1988) On the evaluation of structural equation models. J Acad Mark Sci 16(1):74–94. https://doi.org/10.1007/BF02723327

Bhuiyan MA, Rahman MK, Patwary AK, Akter R, Zhang Q, Feng X (2024) Fintech adoption and environmental performance in banks: exploring employee efficiency and green initiatives. IEEE Trans Eng Manag 71:11346–11360. https://doi.org/10.1109/TEM.2024.3415774

Browne MW, Cudeck R (1992) Alternative ways of assessing model fit. Sociol Methods Res 21(2):230–258. https://doi.org/10.1177/0049124192021002005

Bukhari SAA, Hashim F, Amran A (2022) Pathways towards Green Banking adoption: moderating role of top management commitment. Int J Ethics Syst 38(2):286–315. https://doi.org/10.1108/IJOES-05-2021-0110

Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Acad Manag Rev 4(4):497–505. https://doi.org/10.5465/amr.1979.4498296

Carroll AB (2016) Carroll’s pyramid of CSR: taking another look. Int J Corp Soc Responsib 1(1):3. https://doi.org/10.1186/s40991-016-0004-6

Chatterjee S, Chaudhuri R, Vrontis D (2023) Investigating the impacts of microlevel CSR activities on firm sustainability: mediating role of CSR performance and moderating role of top management support. Cross Cult Strateg Manag 30(1):123–141. https://doi.org/10.1108/CCSM-12-2021-0228

Chen J, Siddik AB, Zheng G-W, Masukujjaman M, Bekhzod S (2022) The effect of green banking practices on bank’s environmental performance and green financing: an empirical study. Energies 15(4). https://doi.org/10.3390/en15041292

Dai X, Siddik AB, Tian H (2022) Corporate social responsibility, green finance and environmental performance: does green innovation matter? Sustainability 14(20). https://doi.org/10.3390/su142013607

Deng X, Kang J-K, Low BS (2013) Corporate social responsibility and stakeholder value maximization: Evidence from mergers. J Financ Econ 110(1):87–109. https://doi.org/10.1016/j.jfineco.2013.04.014

Do B, Nguyen N (2020) The links between proactive environmental strategy, competitive advantages and firm performance: an empirical study in Vietnam. Sustainability 12(12):4962. https://doi.org/10.3390/su12124962

Fraering M, Minor SM (2006) The Virtcomm scale: a virtual community measurement tool. In American Marketing Association Summer Educators Conference Proceedings. Chicago, IL

Freeman RE, Harrison JS, Wicks AC, Parmar B, de Colle S (2010) Stakeholder theory: the state of the art. Cambridge University Press

Gallego-Álvarez PI, Ortas PE (2017) Corporate environmental sustainability reporting in the context of national cultures: a quantile regression approach. Int Bus Rev 26(2):337–353. https://doi.org/10.1016/j.ibusrev.2016.09.003

Gerbing DW, Anderson JC (1988) An updated paradigm for scale development incorporating unidimensionality and its assessment. J Mark Res 25(02):186–192

Guang-Wen Z, Siddik AB (2022) Do corporate social responsibility practices and green finance dimensions determine environmental performance? An empirical study on Bangladeshi banking institutions. Front Environ Sci 10. https://doi.org/10.3389/fenvs.2022.890096

Guang-Wen Z, Siddik AB (2023) The effect of Fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: the role of green innovation. Environ Sci Pollut Res 30(10):25959–25971. https://doi.org/10.1007/s11356-022-23956-z

Gulzar R, Bhat AA, Mir AA, Athari SA, Al-Adwan AS (2024) Green banking practices and environmental performance: navigating sustainability in banks. Environ Sci Pollut Res 31(15):23211–23226. https://doi.org/10.1007/s11356-024-32418-7

Hair JF, Black WC, Babin BJ, Anderson RE (2010) Multivariate data analysis (fourth edn). Prentice Hall

Hariadi S, Moengin P, Maulidya R (2023) Impact of green practices through green product and service innovation: sustainable product-service system performance model. Int J Sustain Eng 16(1):1–15. https://doi.org/10.1080/19397038.2023.2205873

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43:115–135

Hinkin TR (1998) A brief tutorial on the development of measures for use in survey questionnaires. Organ Res Methods 1(1):104–121. https://doi.org/10.1177/109442819800100106

Hoang DC, Tuan DC (2023) Evaluating the role of green financing, international trade and alternative energies on environmental performance in case of Chinese provinces: application of quantile regression approach. Int J Energy Econ Policy 13(2):500–508. https://doi.org/10.32479/ijeep.14170

Hu LT, Bentler PM (1999) Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct Equ Model 6(1):1–55. https://doi.org/10.1080/10705519909540118

Hussain S, Rasheed A, Rehman S (2023) Driving sustainable growth: exploring the link between financial innovation, green finance and sustainability performance: banking evidence. Kybernetes. https://doi.org/10.1108/K-05-2023-0918

Hussain Y, Abbass K, Usman M, Rehan M, Asif M (2022) Exploring the mediating role of environmental strategy, green innovations, and transformational leadership: the impact of corporate social responsibility on environmental performance. Environ Sci Pollut Res 29(51):76864–76880. https://doi.org/10.1007/s11356-022-20922-7

Ibrahim M, Mahmood R (2022) Proactive environmental strategy and environmental performance of the manufacturing SMEs of Karachi city in Pakistan: role of green mindfulness as a DCV. Sustainability 14(19). https://doi.org/10.3390/su141912431

Indriastuti M, Chariri A (2021) Social responsibility investment on sustainable The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus Manag 8(1). https://doi.org/10.1080/23311975.2021.1960120

Khaddage-Soboh N, Yunis M, Imran M, Zeb F (2024) Sustainable practices in Malaysian manufacturing: the influence of CSR, transformational leadership, and green organizational culture on environmental performance. Econ Anal Policy 82:753–768. https://doi.org/10.1016/j.eap.2024.04.001

Khan MN, Omar AB, Azizan NA, Abidin SZ (2023) The role of green finance and green technology in improving environmental performance across OECD economies: an in-depth investigation using advanced quantile modeling. Cuad de Econ 46(132):157–169. https://doi.org/10.32826/cude.v46i132.1215

Kitsis AM, Chen IJ (2021) Do stakeholder pressures influence green supply chain practices? Exploring the mediating role of top management commitment. J Clean Prod 316. https://doi.org/10.1016/j.jclepro.2021.128258

Kline RB (2015) Principles and practice of structural equation modeling. Guilford Publications

Kraus S, Rehman SU, García FJS (2020) Corporate social responsibility and environmental performance: the mediating role of environmental strategy and green innovation. Technol Forecast Soc Change 160:120262. https://doi.org/10.1016/j.techfore.2020.120262

Latan H, Chiappetta Jabbour CJ, Lopes de Sousa Jabbour AB, Wamba SF, Shahbaz M (2018) Effects of environmental strategy, environmental uncertainty and top management’s commitment on corporate environmental performance: the role of environmental management accounting. J Clean Prod 180:297–306. https://doi.org/10.1016/j.jclepro.2018.01.106

Li M, Badeeb RA, Dogan E, Gu X, Zhang H (2023). Ecological footprints and sustainable environmental management: a critical view of China’s economy. J Environ Manag 347. https://doi.org/10.1016/j.jenvman.2023.118994

Liu L (2024) Environmental performance factors: insights from CSR-linked compensation, committees, disclosure, targets, and board composition. J Sustain Financ Invest. https://doi.org/10.1080/20430795.2024.2313497

Malhotra NK, Dash S (2011) Marketing research an applied orientation (paperback). Pearson Publishing, London

Malsha KPPHGN, Anton Arulrajah A, Senthilnathan S (2020) Mediating role of employee green behaviour towards sustainability performance of banks. J Gov Regul 9(2):92–102. https://doi.org/10.22495/jgrv9i2art7

Mustafa N, MansoorAsghar M, Mustafa R, Ahmed Z, Rjoub H, Alvarado R (2023) The nexus between environmental strategy and environmental performance: analyzing the roles of green product innovation and mechanistic/organic organizational structure. Environ Sci Pollut Res 30(2):4219–4229. https://doi.org/10.1007/s11356-022-22489-9

Newton S, Susainathan S, George HJ, Quttainah M, Parayitam S (2024) Top management commitment as a moderator in the relationship between green banking adoption practices and performance: evidence from India. Indian J Corp Gov 17(1):33–62. https://doi.org/10.1177/09746862241236553

Orazalin N (2020) Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus Strategy Environ 29(1):140–153. https://doi.org/10.1002/bse.2354

Owusu EA, Zhou L, Kwasi Sampene A, Sarpong FA, Arboh F (2024) Fostering ENvironmental Performance Via Corporate Social Responsibility and Green Innovation Initiatives: examining the moderating influence of competitive advantage. SAGE Open 14(2). https://doi.org/10.1177/21582440241242847

Podsakoff PM, Organ DW (1986) Self-reports in organizational research: problems and prospects. J Manag 12(4):531–544. https://doi.org/10.1177/014920638601200408

Prajogo DI, Cooper BK (2010) The effect of people-related TQM practices on job satisfaction: a hierarchical model. Prod Plan\Control 21(1):26–35. https://doi.org/10.1080/09537280903239383

Rötzel PG, Stehle A, Pedell B, Hummel K (2019) Integrating environmental management control systems to translate environmental strategy into managerial performance. J Account Organ Change 15(4):626–653. https://doi.org/10.1108/JAOC-08-2018-0082

Saleem F, Zhang-Zhang Y, Gopinath C, Malik MI (2021) Antecedents of environmental strategies: a study of the manufacturing industry in Pakistan. Int J Emerg Market. https://doi.org/10.1108/IJOEM-09-2020-1153

Salisbury WD, Chin WW, Gopal A, Newsted PR (2002) Research report: better theory through measurement—developing a scale to capture consensus on appropriation. Inf Syst Res 13(1):91–103. https://doi.org/10.1287/isre.13.1.91.93

Saqib N, Usman M (2023) Are technological innovations and green energy prosperity swiftly reduce environmental deficit in China and United States? Learning from two sides of environmental sustainability. Energy Rep. 10:1672–1687. https://doi.org/10.1016/j.egyr.2023.08.022

Saunila M, Nasiri M, Ukko J, Rantala T (2019) Smart technologies and corporate sustainability: The mediation effect of corporate sustainability strategy. Comput Ind 108:178–185. https://doi.org/10.1016/j.compind.2019.03.003

Seroka-Stolka O (2023) Towards sustainability: an environmental strategy choice, environmental performance, and the moderating role of stakeholder pressure. Bus Strategy Environ 32(8):5992–6007. https://doi.org/10.1002/bse.3469

Shakil MH, Mahmood N, Tasnia M, Munim ZH (2019) Do environmental, social and governance performance affect the financial performance of banks? A cross-country study of emerging market banks. Manag Environ Qual Int J 30(6):1331–1344. https://doi.org/10.1108/MEQ-08-2018-0155

Shonte AN, Ji Q (2022) Management commitment and sustainable coffee export performance, evidence from Ethiopian companies: the mediating role of corporate social responsibility. Sustainability, 14(19). https://doi.org/10.3390/su141912630

Siddik AB, Yong L, Sharif A (2023) Do sustainable banking practices enhance the sustainability performance of banking institutions? Direct and indirect effects. Int J Bank Market. https://doi.org/10.1108/IJBM-02-2023-0109

Sinha A, Mishra S, Sharif A, Yarovaya L (2021) Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J Environ Manag 292(April):112751. https://doi.org/10.1016/j.jenvman.2021.112751

Soomro BA, Elhag GM, Bhatti MK, Abdelwahed NAA, Shah N (2024) Developing environmental performance through sustainable practices, environmental CSR and behavioural intentions: an online approach during the COVID-19 pandemic. Soc Responsib J 20(1):59–80. https://doi.org/10.1108/SRJ-11-2021-0481

Suganthi L (2019) Examining the relationship between corporate social responsibility, performance, employees’ pro-environmental behavior at work with green practices as mediator. J Clean Prod 232:739–750. https://doi.org/10.1016/j.jclepro.2019.05.295

Tan K, Siddik AB, Sobhani FA, Hamayun M, Masukujjaman M (2022) Do environmental strategy and awareness improve firms’ environmental and financial performance? The role of competitive advantage. Sustainability 14(17). https://doi.org/10.3390/su141710600

Wang H (2023) How to understand China’s approach to central bank digital currency? Comput Law Secur Rev 50. https://doi.org/10.1016/j.clsr.2022.105788

Wang L, Ur Rehman A, Xu Z, Amjad F, Ur Rehman S (2023) Green corporate governance, Green finance, and sustainable performance nexus in Chinese SMES: a mediation moderation model. Sustainability 15(13). https://doi.org/10.3390/su15139914

Wang Q-J, Wang H-J, Chang C-P (2022) Environmental performance, green finance and green innovation: what’s the long-run relationships among variables? Energy Econ 110:106004. https://doi.org/10.1016/j.eneco.2022.106004

Wang Y, Zhi Q (2016) The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104:311–316. https://doi.org/10.1016/j.egypro.2016.12.053

Wang Z, Shahid MS, An NB, Shahzad M, Abdul-Samad Z (2022) Does green finance facilitate firms in achieving corporate social responsibility goals? Econ Res Ekonomska Istraživanja 0(0):1–20. https://doi.org/10.1080/1331677X.2022.2027259

Wei F, Abbas J, Alarifi G, Zhang Z, Adam NA, Queiroz MJD (2023) Role of green intellectual capital and top management commitment in organizational environmental performance and reputation: moderating role of pro-environmental behavior. J Clean Prod 405. https://doi.org/10.1016/j.jclepro.2023.136847

Wijethilake C, Lama T (2019) Sustainability core values and sustainability risk management: moderating effects of top management commitment and stakeholder pressure. Bus Strategy Environ 28(1):143–154. https://doi.org/10.1002/bse.2245

Wu J, Wang D, Fu X, Meng W (2023) Antecedent configurations of ESG disclosure: evidence from the banking sector in China. Sustainability 15(17). https://doi.org/10.3390/su151713234

Xu X, Li J (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574. https://doi.org/10.1016/j.jclepro.2020.121574

Yan C, Siddik AB, Yong L, Dong Q, Zheng G-W, Rahman MN (2022) A two-staged SEM-artificial neural network approach to analyze the impact of fintech adoption on the sustainability performance of banking firms: the mediating effect of green finance and innovation. Systems 10(5). https://doi.org/10.3390/systems10050148

Ye J, Dela E (2023) The effect of green investment and green financing on sustainable business performance of foreign chemical industries operating in Indonesia: the mediating role of corporate social responsibility. Sustainability 15(14). https://doi.org/10.3390/su151411218

Yen Y-X (2018) Buyer–supplier collaboration in green practices: the driving effects from stakeholders. Bus Strategy Environ 27(8):1666–1678. https://doi.org/10.1002/bse.2231

Yong JY, Yusliza MY, Ramayah T, Seles BMRP (2022) Testing the stakeholder pressure, relative advantage, top management commitment and green human resource management linkage. Corp Soc Responsib Environ Manag 29(5):1283–1299. https://doi.org/10.1002/csr.2269

Zakari A, Khan I (2022) The introduction of green finance: a curse or a benefit to environmental sustainability? Energy Res Lett 03. https://doi.org/10.46557/001c.29977

Zhang, X, Wang, Z, Zhong, X, Yang, S, & Siddik, AB (2022). Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability, 14(2). https://doi.org/10.3390/su14020989

Zheng, G-W, Siddik, AB, Masukujjaman, M, & Fatema, N (2021). Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability (Switzerland), 13(18). https://doi.org/10.3390/su131810165

Zheng H (2023) The impact of bank’s engagement in shadow banking activities on bank’s sustainability: evidence from Chinese commercial banks. Environ Sci Pollut Res 30(19):54979–54992. https://doi.org/10.1007/s11356-023-25944-3

Acknowledgements

The authors express gratitude for the efforts and contributions of all individuals involved in the preparation and execution of this study. This study was partially funded by the Henan Provincial Soft Science Research Program Project (Grant no: 242400411245). This research was also partially funded by the Institute for Advanced Research, United International University, under Publication Grant Ref. No.: IAR-2024-Pub-077.

Author information

Authors and Affiliations

Contributions

HT: Led the study’s conceptualization, data collection, literature review, data analysis, and manuscript writing and editing; ABS: managed data analysis, developed research hypotheses, and contributed to manuscript writing and editing; FAS: provided methodological and statistical guidance, supervision, contributed to the discussion of findings and refined the manuscript. All authors approved the final version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethics approval

This study is exempted in line with the ethical guidelines of Zhoukou Normal University, ensuring participant anonymity and avoiding sensitive topics. In line with the Declaration of Helsinki and our institution’s ethical guidelines, this study was designed to protect the rights, dignity, and welfare of all participants involved. Consequently, ethical approval for this study was waived during data collection period (February to April 2023), and no ethical approval number has been assigned. Informed consent was obtained during the data collection period of February to April 2023, detailing purpose, data use, and risks, emphasizing voluntary participation. This reflects our commitment to ethical standards, prioritizing participant rights and welfare.

Informed consent

Written and oral consent was obtained from all individuals involved in this study from February to April 2023, during the data collection period.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Tian, H., Siddik, A.B. & Sobhani, F.A. From commitment to action: unraveling the pathways from top management commitment to environmental sustainability in the Chinese banking sector. Humanit Soc Sci Commun 11, 1645 (2024). https://doi.org/10.1057/s41599-024-04142-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-04142-7