Abstract

This study investigates the relationship between human capital management strategies and corporate sustainability commitments while also examining the moderating role of CEO tenure in shaping this relationship. Drawing on a panel dataset of 413 S&P 500 companies spanning 2011 to 2023, we empirically tested the impact of various human capital management practices, including employee productivity, technology-enabled training investments, workforce diversity, pay equity, and employee benefits, on firms’ ESG performance. We further explored how CEO tenure influenced the effectiveness of these practices in driving sustainability outcomes. Our findings reveal significant positive associations between human capital management effectiveness and corporate ESG performance, highlighting the importance of talent management strategies in promoting sustainable business practices. Moreover, CEO tenure positively moderates the relationship between human capital management and ESG performance, suggesting that longer-tenured CEOs are better positioned to align their human capital strategies with sustainability goals. This study contributes to the literature by bridging the gap between human capital management and sustainability research, providing empirical evidence of the mechanisms through which talent management practices drive sustainability performance, and highlighting the critical role of leadership tenure in shaping these relationships. Our findings have important implications for corporate governance, strategic leadership, and sustainable human resource management practices and offer insights into how organizations can effectively integrate human capital and sustainability considerations to drive long-term value creation.

Similar content being viewed by others

Introduction

The business world has witnessed growing concerns over the role of corporations in addressing environmental and social challenges. A survey conducted by McKinsey & Company revealed that 83% of C-suite leaders and investment professionals believe that ESG programs will contribute more shareholder value in the next five years than today (Henisz et al. 2019). However, despite the increasing awareness of the importance of sustainability, many companies struggle to translate their commitments into tangible actions and outcomes. A study by the United Nations Global Compact found that, while 84% of CEOs believe that businesses should make efforts to define and deliver new goals on global priority issues, only 15% of companies have targets that are sufficiently ambitious, science-based, and aligned with societal goals (United Nations Global Compact, 2019).

A critical factor that has gained attention in this context is the role of human capital management. A growing body of research suggests that effective human capital management practices, such as employee engagement, diversity and inclusion, and talent development, can have a significant impact on corporate sustainability performance (Aust et al. 2020; Barrena-Martínez et al. 2019). However, despite the recognition of this link, many companies still struggle to align their human capital strategies with sustainability goals. A study by the Society for Human Resource Management found that only 18% of organizations have fully integrated sustainability into their HR practices (Bates, 2011). Moreover, a report by the World Business Council for Sustainable Development reveals that while 70% of companies recognize the importance of sustainability, only 25% have successfully integrated it into their business models (World Business Council for Sustainable Development, 2024).

The relationship between human capital management strategies and corporate sustainability commitments has gained increasing attention. Several studies have explored the impact of specific human resource management (HRM) practices on sustainability outcomes. For instance, research has examined the influence of green HRM practices on employees’ pro-environmental behaviors and organizational environmental performance (Longoni et al. 2016). Other studies have investigated the effects of socially responsible HRM practices on firms’ social and environmental sustainability (Ren et al. 2020). However, a comprehensive understanding of the relationship between human capital management strategies and sustainability commitment remains elusive.

While some studies have explored the impact of specific human resource management practices on sustainability outcomes, such as the influence of green HRM practices on employees’ pro-environmental behaviors and organizational environmental performance and the effect of socially responsible HRM practices on firms’ social and environmental sustainability, a comprehensive understanding of the relationship between overall human capital management strategies and sustainability commitments remains elusive.

Conceptual frameworks such as those proposed by Pham et al. (2024), Ehnert et al. (2015), and Vinnikova et al. (2024) attempted to integrate human capital and sustainability considerations, suggesting potential synergies and complementarities between the two domains. However, these frameworks are limited in terms of empirical validation and practical applicability. For instance, Pham et al. (2024) empirically demonstrated a strong positive relationship between firms’ ESG performance and intellectual capital across multiple countries, providing evidence for the link between sustainability practices and human capital outcomes. However, these frameworks are limited in terms of empirical validation and practical applicability. Similarly, Ehnert et al. (2015) provided a comparative analysis of HRM sustainability reporting practices but did not explore the specific mechanisms through which human capital management strategies contribute to sustainability outcomes. Likewise, Vinnikova et al. (2024) proposed a theoretical framework for sustainable HRM but did not provide empirical evidence supporting the framework’s effectiveness in driving sustainability performance.

However, empirical research examining the translation of prudent talent management into ESG goal attainment remains scarce (Barrena-Martínez et al. 2017). While studies have recognized the role of human capital in driving sustainability performance (Ogbeibu et al. 2023; Macke and Genari, 2019), there is a lack of research investigating the specific pathways and mechanisms through which this occurs. For example, while Barrena-Martínez et al. (2017) validated the importance of socially responsible human resource policies and practices, they did not empirically test the impact of these practices on sustainability commitments. Furthermore, although there have been calls for greater coordination between the roles of the Chief Human Resources Officer (CHRO) and Chief Sustainability Officer (CSO) roles (Sroufe, 2018), empirical evidence substantiating the impact of such coordination on sustainability outcomes is limited. Subsequently, the following research question is posed:

RQ1: How does the effectiveness of human capital management strategies connect with the realization of sustainability commitments for corporations?

While there is growing recognition of the importance of human capital management for corporate sustainability performance, little attention has been paid to the role of leadership in shaping the effectiveness of these practices. In particular, CEO tenure has been identified as a critical factor influencing strategic decision-making and organizational outcomes (Chen et al. 2019; Zhang et al. 2021). Despite the potential impact of CEO tenure on the relationship between human capital management and sustainability, research on this topic remains limited. Cahyadi et al. (2022) found that only 5% of the literature on sustainable human resource management considers leadership characteristics, such as tenure. This gap in understanding is particularly concerning given the increasing pressure on companies to integrate sustainability considerations into their business models and the critical role of CEOs in driving these efforts (Meng, 2021). Consequently, the following research question was raised:

RQ2: How does CEO tenure moderate the relationship between human capital management effectiveness and corporate ESG performance?

This study addresses two critical research questions that explore the relationship between human capital management and corporate commitment to sustainability. The first objective is to investigate how the effectiveness of human capital management strategies is connected to the realization of sustainability commitments for corporations (RQ1). By examining the impact of various talent management practices such as employee productivity, technology-enabled training investments, workforce diversity, pay equity, and employee benefits on a firm’s externally validated ESG scores (Keller et al. 2022), this study provides empirical evidence of the interconnection between human capital and sustainability management. Correlational analysis was conducted to evaluate whether sound human resources strategies translate into superior environmental and social responsibility demonstrations.

The second objective is to explore how CEO tenure moderates the relationship between human capital management effectiveness and corporate ESG performance (RQ2). Despite the growing recognition of the importance of human capital management for sustainability, little attention has been paid to the role of leadership in shaping the effectiveness of these practices. By investigating the interaction between CEO tenure and various human capital practices, this study provides insights into how top leadership tenure influences the translation of human capital strategies into sustainability outcomes. The findings of this study have the potential to inform corporate governance practices and succession planning and highlight the importance of leadership tenure in the design and implementation of sustainable human resource management practices.

To address these research questions, an explanatory examination of mechanisms and connectors is undertaken, spanning governance, culture, capability enhancement, and workflow improvements, through which prudent workforce focus manifests in ESG accomplishments (Deloitte, 2023; Wiengarten et al. 2015). This elucidates key channels that empower these two functions. Finally, implications are discussed for senior management in assimilating human and sustainability considerations as well as for investors incorporating workforce intangibles into the assessment of corporate responsibility (Dhaliwal et al. 2014; Neaime and Gaysset, 2017). As regulations worldwide sharpen focus on non-financial disclosures, policy perspectives are also outlined. Thus, the twofold objectives aim to provide empirical evidence, explore cascading mechanisms, and offer recommendations—all towards establishing synergistic integration of human resources and ESG priorities while considering the critical role of leadership tenure in shaping these relationships.

This study makes significant theoretical contributions by empirically examining the relationship between human capital management strategies and corporate sustainability commitments, bridging the gap between these two important streams of management research. By investigating the specific mechanisms and pathways through which talent management practices influence sustainability performance and exploring the critical role of CEO tenure in moderating this relationship, this study provides a more nuanced understanding of the human capital management-sustainability nexus. This study advances theoretical knowledge by moving beyond broad conceptual frameworks and offering empirical evidence of the practices, processes, and leadership characteristics that drive sustainability performance through effective human capital management. This study combines the research on human capital management, sustainability, and strategic leadership. This study contributes to a comprehensive theoretical understanding of corporate sustainability. This approach paves the way for future studies to explore the interconnectedness of these domains further. In addition, it informs the development of new theoretical frameworks that account for the complex relationships between human capital, leadership, and sustainability.

Research background

Human capital has emerged as a crucial determinant of organizational success in today’s knowledge-based economy. Scholars have long recognized that investments in employees’ knowledge, skills, and capabilities can lead to enhanced organizational performance and innovation capacity (Becker, 1964; Vithana et al. 2023; Ray et al. 2023). The strategic importance of human capital has become particularly salient as organizations face increasing pressure to maintain competitiveness while simultaneously addressing environmental and social challenges (Zaragoza-Sáez et al. 2023). Studies have demonstrated that organizations with superior human capital management practices typically experience higher productivity, increased innovation, and better financial performance (Gallego and Ramírez, 2023; Islam and Amin, 2021; Malhotra et al. 2024).

The potential of human capital to create a sustainable competitive advantage is well explained through the Resource-Based View (RBV) of a firm. According to the RBV, organizations can achieve sustained competitive advantage through resources that are valuable, rare, inimitable, and non-substitutable (Barney, 1991). Human capital, with its inherent complexity and social embeddedness, often meets these criteria, making it a potential source of sustained competitive advantage (Shafiee et al. 2024). Furthermore, tacit knowledge and firm-specific skills developed through human capital investments are particularly difficult for competitors to replicate and enhance their strategic value (Ployhart et al. 2014).

Building on RBV, the Natural Resource-Based View (NRBV) extends this theoretical framework to incorporate environmental considerations, suggesting that firms can gain competitive advantages through environmentally sustainable practices (Hart, 1995). NRBV posits that organizations must develop capabilities for pollution prevention, product stewardship, and sustainable development to achieve environmental excellence while maintaining competitive advantage (Mishra and Yadav, 2021). This theoretical perspective has become increasingly relevant as organizations face mounting pressure to address environmental challenges while maintaining economic viability (Qiu et al. 2021). NRBV scholars argue that firms with superior environmental capabilities can achieve both environmental and economic benefits by reducing costs, enhancing reputation, and increasing legitimacy (Sehnem et al. 2022).

While NRBV emphasizes the importance of environmental capabilities for competitive advantage, stakeholder theory provides a complementary perspective by highlighting the broader social responsibilities of organizations. Stakeholder theory, as developed by Freeman (2010) in 1984 and elaborated upon by subsequent scholars (Donaldson and Preston, 1995; Mitchell et al. 1997), argues that firms must consider and address the interests of various stakeholders, including employees, customers, communities, and the natural environment. This theory suggests that successful organizations can effectively balance and integrate diverse stakeholder interests (Jones et al. 2018). Environmental and social performance has become increasingly important to stakeholders, leading to growing pressure on organizations to demonstrate commitment to sustainability principles (Bello‐Pintado et al. 2023).

Environmental, Social, and Governance (ESG) performance has emerged as a critical metric for evaluating organizational sustainability in response to stakeholder demands for greater accountability and transparency. ESG encompasses a broad range of issues, including environmental impacts, social responsibility, and governance practices (Rau and Yu, 2023). Recent studies have demonstrated that superior ESG performance can lead to enhanced financial outcomes, improved stakeholder relationships, and greater organizational resilience (Amosh et al. 2022). However, despite the rich literature on ESG performance and its outcomes, there remains a limited understanding of how an organization’s focus on human capital development and management contributes to ESG performance. This gap is particularly significant given the theoretical links between human capital capabilities and organizational ability to address environmental and social challenges.

The success of organizational initiatives, including those related to ESG performance, is significantly influenced by top management, particularly by chief executive officers (CEO). The Upper Echelons Theory, introduced by Hambrick and Mason (1984) and further developed by subsequent scholars (Hambrick, 2007), posits that organizational outcomes are partially predicted by managerial background characteristics and experiences. This theoretical perspective suggests that executives’ experiences, values, and personalities significantly influence their interpretations of strategic situations, and consequently, their strategic choices (Saiyed et al. 2023). Empirical studies have demonstrated that CEO characteristics influence various organizational outcomes, including innovation (Suherman et al. 2023), strategic change (Vantrappen and Wirtz, 2023), and corporate social responsibility (Riera and Iborra, 2023).

Despite the established importance of CEO characteristics in shaping organizational outcomes, there have been few investigations into how CEO tenure moderates the relationship between human capital management and ESG performance. This gap is particularly noteworthy given that CEO tenure has been shown to influence strategic decision-making processes and outcomes. Longer-tenured CEOs may develop a deeper understanding of their organization’s human capital capabilities and sustainability challenges, potentially enabling more effective integration of these elements (Simsek, 2007). However, they may also become more conservative in their strategic choices, potentially limiting innovative approaches to sustainability challenges.

This study addresses two critical gaps in the literature. First, it examines how organizations’ focus on human capital management influences their ESG performance, building on the theoretical foundations of RBV, NRBV, and stakeholder theory. Second, drawing on Upper Echelons Theory, this study investigates how CEO tenure moderates this relationship, providing insights into the conditions under which human capital investments most effectively contribute to ESG performance. By integrating these theoretical perspectives and empirically examining their interactions, this study contributes to our understanding of how organizations can effectively leverage human capital to achieve superior ESG performance while considering the crucial role of leadership tenure in this relationship.

Hypothesis development

Human capital management and talent allocation are critical factors influencing corporate performance in the current business landscape. The resource-based view suggests that unique and valuable human resources can provide sustained competitive advantage to firms (Barney, 1991). This advantage often manifests itself as a superior financial performance metric for each employee. Research shows that companies with higher human capital efficiency tend to achieve greater market value. For instance, one study found that investment in human capital contributes significantly to a firm’s market value. Specifically, a portfolio strategy based on firms’ human capital investments generated annualized value-weighted abnormal returns of 6.5%, which increased to 4.8–7.8% when considering both current and historical human capital investments. This indicates that companies with higher human capital investments tend to achieve superior market valuations, although the market often initially undervalues these investments initially (Regier and Rouen, 2023). Another study finds that human capital contributes significantly to firm value through innovation capabilities. Specifically, in economies with higher human capital, R&D-intensive firms show greater innovation quantity and quality, leading to increased labor productivity and higher equity values. These firms achieve this by optimizing their input mix through reduced employment and increased intangible capital investment, demonstrating how human capital accumulation enables innovative firms to enhance their market value (Wang and Yu, 2023). Additionally, a meta-analysis of 66 studies revealed a significant positive relationship between human capital and firm performance, with stronger effects in high-growth and highly regulated industries (Crook et al. 2011).

Concurrently, Stakeholder orientation, as reflected through ESG engagement, has been linked to enhanced firm value. A comprehensive meta-analysis of over 2200 empirical studies found that roughly 90% of the studies showed a non-negative relationship between ESG criteria and corporate financial performance, with the majority reporting positive effects (Friede et al. 2015). Strong ESG practices can make companies more attractive to top talent and potentially boost their workforce productivity (Edmans, 2011). The interconnection between human capital and ESG factors is particularly evident in areas such as diversity and inclusion, which are associated with increased innovation and creativity (Hunt et al, 2015). Furthermore, companies with robust environmental and social policies have been found to exhibit higher employee productivity and lower turnover rates (Delmas and Pekovic, 2013). These findings suggest a potential relationship between the employee productivity metrics and ESG performance. Therefore, we hypothesize as follows:

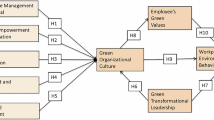

H1: Firms with higher employee productivity metrics (such as revenue or EBITDA per employee) will have higher ESG performance.

Investment in upgrading employee skills through training programs can boost productivity (Subramony et al. 2022; Black and Lynch, 1996). Today, many such investments are enabled by technology access such as online courses, video tutorials, and simulation-based learning. Virtual and digitally enabled training options are increasing exponentially (Lukowski et al. 2021, Hartzler et al. 2023; Laundon et al. 2023). They enable personalized, flexible, and scalable capability building across a globally distributed workforce. Interestingly, the focus of analytics for such initiatives has been mainly on employee retention and direct cost savings, rather than sustainability goals (the analysis is optimized for).

However, one can reasonably expect technology-leveraged training programs to have spillover effects on ESG commitment. Employees can be exposed to sustainability concepts, codes of ethics, and diversity values alongside domain skills. Indeed, employee training is an interconnected objective that contributes to service quality and sustainability and improves firm performance in sustainable development (Joao et al. 2019). Therefore, we hypothesize that increased technology-enabled training expenditure per employee directly translates to superior ESG performance. As businesses invest in digital tools for individual-level knowledge expansion, ESG orientation can be cultivated simultaneously.

H2: Firms with higher technology-enabled training expenditure per employee will have higher ESG performance.

Workforce diversity among dimensions such as gender, ethnicity, age, and the balance of junior and senior employees has been a staple discussion in the human resources literature. However, the discourse has recently moved from just fair representation to linking diversity to tangible business outcomes. Multiple studies associate gender-balanced leadership with superior financial performance, risk oversight, and resilience (Ahmadi et al. 2018; Provasi and Harasheh, 2020). Additionally, companies with gender diversity on their boards showed a 20.1% increase in patent numbers, whereas those with age diversity demonstrated an 8% increase in innovation output (Cumming and Leung, 2021; Dolunay, 2023). Thus, the emphasis on diversity and inclusion has shifted from conformance to performance.

Simultaneously, capturing workforce diversity across managerial and operational levels has emerged as a top priority for companies’ ESG assessments. Metrics tracking women in leadership, minority representation, non-executive employee voice, and equal opportunity are now mainstream (Nekhili et al. 2021a; 2021b). This mirrors societal expectations of equality from corporations, not just in principle, but in practice. Therefore, we hypothesized that companies scoring higher on diversity and inclusion markers, such as the percentage of non-executive and minority workers, as well as better gender balance, would achieve higher overall ESG performance.

H3: Firms with greater workforce diversity and inclusion (higher percentage of non-executive and board gender diversity, employees gender diversity) will have higher ESG performance.

Executive compensation practices have come under greater scrutiny in recent years as the gap between average workers and top management pay has reached extreme levels in many organizations. Numerous studies have linked higher CEO-to-worker pay ratios with lower future shareholder returns (Przychodzen and Gómez-Bezares, 2021) have a negative impact on consumer and employee perceptions (Benedetti and Chen, 2018). The cited reasons include poor board oversight, short-term thinking, higher employee turnover, and low trust in leadership resulting from large pay disparities. Most firm incentive systems do not address this imbalance. However, investors are increasingly prioritizing pay parity, as evidenced by numerous shareholder proposals in recent years urging companies to disclose and address their CEO-to-median worker pay ratios (Cheng and Zhang, 2023).

At the same time, income inequality within firms captured by CEO-to-median salary ratios has also featured more regularly in ESG rating frameworks (Le and Ngo, 2024; Kaur, 2024). Pay equity reflects how businesses share value with stakeholders. Excessive executive payouts may crowd out investment in sustainability initiatives. Hence, we hypothesize that companies with lower CEO-to-average worker pay ratios, and thus greater parity, demonstrate superior ESG performance and responsibility.

H4: Firms with more equitable CEO-to-median pay ratios will have higher ESG performance.

Employee benefits including healthcare, insurance, retirement plans, wellness programs, and other offerings have become important components of talent acquisition and retention strategies. Organizations offering comprehensive compensation packages experience significantly higher retention rates through employee satisfaction (Michael and Chacko, 2016), while the lack of tangible benefits such as food services and employee clubs can increase turnover by up to 24% (Geremew, 2020). Younger workers prefer purpose-driven cultures that offer extensive benefits. In fact, nearly 60% of millennials quit jobs due to substandard benefits, and 63% view health plans among the top five recruitment factors (Deloitte, 2016). Thus, benefit expenditure that directly affects employees is pivotal for constructive worker relationships. However, coverage remains uneven, with part-time and frontline workers often excluded.

Organizations that invest in comprehensive employee benefits, from equity incentives to flexible work arrangements, demonstrate stronger ESG performance through enhanced worker satisfaction, increased production efficiency, and improved environmental sustainability (He, 2023; Bastos and De Barros Neto, 2024). Generous and equitable employee benefits signal socially responsible employers per the rating agency. They also boost productivity and retention, and ultimately enhance business sustainability. Therefore, we hypothesized that companies offering more health, insurance, and welfare benefits per person achieve superior ESG performance ratings, reflecting their holistic stakeholder approach.

H5: Firms providing greater health, welfare, and other benefits per employee will have higher ESG performance.

In recent years, CEO tenure has emerged as a critical factor that influences corporate strategy and performance. Longer-tenured CEOs often possess deep firm-specific knowledge, extensive stakeholder relationships, and significant influence over organizational culture (Darouichi et al. 2021). These attributes shape how effectively human capital management practices translate into ESG performance. CEO tenure has been linked to various strategic outcomes such as innovation (Li and Yang, 2019), risk-taking (Atayah et al. 2021), and corporate social responsibility (Chen et al. 2019). As CEOs accumulate experience and build credibility over time, they gain more discretion in prioritizing long-term sustainability initiatives that leverage human capital.

Moreover, CEOs with longer tenures tend to have a more comprehensive understanding of a firm’s human resource capabilities and align them with strategic goals (Bernstein et al. 2016; Bragaw and Misangyi, 2015). They are better positioned to integrate human capital considerations into ESG efforts, thus ensuring a coordinated approach. Longer-tenured CEOs may also face less short-term pressure from investors, allowing them to invest in human capital development initiatives that pay off over time (Flammer and Bansal, 2017). Sustained people-focused investment can enhance the impact of human capital management on ESG performance. Conversely, shorter-tenured CEOs may prioritize immediate results and cost-cutting, potentially undermining the effective implementation of human capital best practices.

Furthermore, CEOs with longer tenures often enjoy greater trust and buy-in from their employees (Luo et al. 2014), which can be crucial for the success of ESG initiatives. Employees are more likely to engage in and contribute to sustainability efforts when they perceive their leaders to be committed and credible (De Roeck and Maon, 2016). Longer-tenured CEOs have more time to build such trust and demonstrate their dedication to ESG causes, thus amplifying the impact of human capital management on sustainability performance. They may also have developed stronger relationships with key stakeholders such as customers, suppliers, and communities, further enhancing the firm’s ability to drive ESG progress through its human capital (Chen et al. 2019). Consequently, we hypothesize that CEO tenure positively moderates the relationship between human capital management effectiveness and ESG performance, with the impact more pronounced for longer-tenured CEOs.

H6: CEO tenure moderates the relationship between human capital management effectiveness and corporate ESG performance, such that the positive relationship is stronger for companies with longer-tenured CEOs compared to those with shorter-tenured CEOs.

This study proposes a conceptual model (see Fig. 1) that elucidates the relationship between key aspects of human capital management effectiveness and corporate ESG profiles, while also considering the moderating role of CEO tenure. The talent factors of employee productivity, technology-enabled training investments, workforce diversity, pay parity, and employee benefits were hypothesized to directly influence ESG performance. Specifically, companies with higher revenue, profits, and value generation per employee (H1); greater technology access for capability building (H2); a more diverse and inclusive workplace composition (H3); lower CEO-to-median pay ratios (H4); and superior health and welfare coverage (H5) are proposed to demonstrate substantially higher ESG commitment and responsibility. Additionally, we hypothesized that CEO tenure moderates the relationship between human capital management effectiveness and ESG performance, with the positive impact being stronger for companies with longer-tenured CEOs (H6). The conceptual framework thus encapsulates the study’s core premise that prudent human capital management, transcending operations to strategy, governance, and culture, correlates strongly with corporations’ demonstration of sustainability principles.

Empirical analysis

Research design and data

This research utilizes a 12-year balanced panel dataset of 413 major listed corporations spanning 2011–2023 to empirically examine the hypotheses. The companies represented were S&P 500 constituents. Ensuring consistency in data availability across the study duration solely determines the sample selection. The human capital management variables are constructed by combining multiple archival databases: employee productivity metrics tap Compustat data, technology training investments, and benefits expense use figures reported across company annual reports and company financial statements; workforce diversity and pay equity extract compensation particulars rely on proxy statement disclosures. The ESG performance leverages the score dataset from the MSCI. The control variable information uses Compustat for financial figures, CRSP for risk and returns, BoardEx for governance attributes, and business registers for company founding years.

The sample selection process began with all the S&P 500 constituents as of 2011. Several filtering criteria were applied to ensure data consistency and reliability. First, we required companies to have complete ESG performance data from the MSCI throughout the study period, eliminating 42 firms. We excluded 15 companies that lacked complete financial information from Compustat. In addition, 18 firms were removed because of incomplete human capital data (employee metrics, benefits information, or training investments). Finally, 12 companies were excluded because of missing CEO tenure information from the proxy statements or BoardEx. This filtering process resulted in a final balanced panel of 413 firms with complete data for all the variables.

The compiled dataset comprises 413 firms mapped to their primary activities, representing 59 sectors designated by the two-digit SIC industry classification codes. In total, 1827 firm-year data points were included in the panel analysis, providing substantial analytical power. The multi-period entity-level data structure allows for the evaluation of both associations and temporal effects between talent management and sustainability commitment over the 2011–2023 corporate reporting cycles. Table 1 documents the breadth of sectors covered by the sample organizations to enable generalizability.

Variables and models

ESG performance

The key dependent variable in this study is a firm’s overall ESG Performance. Following conventions in related research linking human capital and sustainability (Carnahan et al. 2017), ESG Performance was measured using the total normalized scores from the MSCI. These specialized agencies evaluate company's demonstration of responsibility across environmental, social, and governance dimensions using multiple underlying criteria (Úbeda-García et al. 2021). The aggregated rating reflects achievements across factors, such as emissions reduction, product safety, board independence, and transparency. Such independent ESG ratings avoid reliance on self-reported corporate metrics, which may involve greenwashing risks (Christensen et al. 2021). The total score taps the breadth of a firm’s sustainability commitment through a synthesized evaluation of reputed third-party providers. Hence, it serves as a reliable proxy for ESG Performance, which is frequently used in emerging literature on human capital precursors of social outperformance (Grewatsch and Kleindienst, 2015).

Revenue per employee

Workforce productivity, represented by revenue generation per employee, offers strategic human capital insights while linking ESG priorities in lean operations. According to resource-based theory, optimizing human potential and rare workforce capabilities boosts productivity, manifesting as superior revenue per employee (Pfeffer, 1994). Lagging individual output underscores human capital risks, which can constrain financial and social outperformance alike (Ulrich and Dulebohn, 2015). In fact, accelerated revenue per employee lowers the utilization need for resources such as energy, water, and real estate per unit of economic generation. This inadvertently benefits environmental commitment and reflects the efficiency of strategy execution efficiencies (Carnahan et al. 2017). With both financial and ESG lenses prioritizing maximizing revenue contribution per person, this metric offers dual performance and sustainability insights. Evaluating realized workforce potential through sales efficiency also covers human capital development, often missing physical and financial capital intensity measures in conventional business analysis (Grewatsch and Kleindienst, 2015).

EBITDA per employee

Operating profitability, represented by earnings before interest, taxes, depreciation, and amortization (EBITDA) per employee, is another key measure of workforce productivity (Bouwens et al. 2019). This metric captures how efficiently employees generate operational value by measuring the core operating profit per worker before accounting adjustments (Kale et al. 2019). A higher EBITDA per employee indicates superior operational execution and resource optimization by the workforce. Similar to revenue per employee, this measure aligns with both financial performance goals by demonstrating the efficient use of human capital (DiBernardino, 2011). This metric complements revenue-based productivity by focusing specifically on operational profitability generation and offering insights into how effectively employees contribute to a firm’s core earnings capacity (Kale et al. 2019).

Research and development expense per employee

With accelerating digitalization, technology-enabled training programs represent pivotal investments in talent development investments (Evans et al. 2021). Research and development provide a proxy for such capability upgrades, as learning expenses are rarely broken out. According to human capital advancement models, individual-level competence expansion invites parallel mindset shifts, creating spillovers for sustainability orientation (Carnahan et al. 2017). Thus, beyond direct productivity links, strategic learning investments per employee stimulate purpose, community spirit, and ESG advancement (Sciarelli et al. 2021). In fact, dedicated training time metrics enter employee engagement and corporate responsibility frameworks, recognizing human capital enrichment as a conduit for positive workplace culture and retention. Hence, analyzing R&D expenses normalized by workforce count offers insights into dual technology adoption and inclusion. This measure simultaneously targets two interconnected ESG priorities to leverage next-generation tools to improve employee experience and social performance.

Percentage of non-executive employees

Workforce diversity and inclusion extend beyond executive ranks to the broad employee base represent pivotal markers of ESG leadership (Harjoto et al. 2014). The percentage of non-executives quantifies how inclusive talent policies achieve frontline roles. Several studies have demonstrated that empowering marginalized employee voices boosts innovation, agility, and ethical governance, all of which benefit sustainability commitment (Kang and Moon, 2011). With the expansion of social activism, corporations have promoted wider stakeholder participation through non-hierarchical structures that signal value congruence with younger talent pools. Recent research on human resource systems recommends tracking non-executive workforce coverage as a lead indicator of both productivity and ESG gains from grassroots diversity (Slawinski et al. 2016). Thus, monitoring the percentage representation widens the aperture of diversity measurements to ignore blind spots. Extending workforce participation in this manner also plays a role in societal inclusion for industrial advancement.

Board and employee gender diversity

Gender diversity at both the governance and workforce levels represents a critical dimension of organizational inclusivity and talent utilization (Gupta et al. 2023). Board gender diversity, measured as the percentage of female directors, reflects an organization’s commitment to inclusive leadership and diverse perspectives in strategic decision-making (Campopiano et al. 2022). Higher female representation on boards has been associated with enhanced monitoring, improved stakeholder engagement, and better ESG performance (Alhosani and Nobanee, 2023). Employee gender diversity, captured through the proportion of female employees across the organization, indicates workforce inclusivity at the operational level (Ferrary and Déo, 2023). Research suggests that a gender-diverse workforce contributes to improved innovation, problem-solving, and organizational performance (Luh and Kusi, 2023). Together, these complementary measures of gender diversity at the leadership and operational levels provide insights into an organization’s comprehensive approach to gender inclusion and its potential impact on sustainable business practices (Hazaea et al. 2023).

CEO pay to median employee pay ratio

Equity of pay distribution within corporations, encapsulated by CEO-to-median employee pay ratios, has entered prominent ESG measurement frameworks as a reflection of internal fairness (Carnahan et al. 2017). Numerous studies associate higher CEO-to-worker pay ratios with poorer board oversight, short-termism, higher employee turnover, and low trust in leadership, all of which undermine sustainability (Cronqvist et al. 2009). Excessive executive payouts strain the social contract and signal a lopsided value allocation. Tracking pay parity also covers compensation design, often missing governance metrics focused narrowly on structure and independence. As investee companies and asset managers prioritize fair worker treatment, pay ratios offer a normalized view of the human capital risks of imbalanced reward systems that challenge productivity and ESG efforts.

Employee benefits

Employees benefit from expenditures encompassing healthcare coverage, insurance plans, retirement provisions, and wellness programs, and represent a crucial component of total workforce investment and organizational commitment to employee welfare (Dulebohn et al. 2008). This metric, measured as the total benefits expense per employee, reflects the comprehensiveness of an organization’s benefits package and its dedication to employee wellbeing. Research indicates that generous benefit provisions correlate with enhanced employee satisfaction, reduced turnover, and improved organizational commitment (Piszczek et al. 2021). Companies offering superior benefits demonstrate stronger employer-employee relationships and typically experience higher workforce productivity (Gerhart, 2023). The strategic allocation of resources to employee benefits signals a long-term orientation toward human capital development and sustainable workforce management practices.

CEO tenure

The length of a CEO’s tenure has been identified as a critical factor influencing strategic decision-making and organizational outcomes (Chen et al. 2019; Zhang et al. 2021). Longer-tenured CEOs often possess deep firm-specific knowledge, extensive stakeholder relationships, and a significant influence on organizational culture, which can shape the effectiveness of human capital management practices in driving ESG performance (Meng, 2021). In this study, CEO tenure is measured as the number of years the current CEO has been in the position, calculated using data from proxy statements and BoardEx. This variable was used to test the moderating effect of CEO tenure on the relationship between human capital management effectiveness and ESG performance, as hypothesized in H6. By examining the interaction between CEO tenure and various human capital management variables, this study provides insights into how the length of CEO tenure influences the translation of human capital strategies into sustainability outcomes.

Control variables

Additional control variables are incorporated into the models to account for other potential drivers of ESG performance. The firm industry uses categorical SIC code classifications to control for sector-specific differences in sustainability policies and programs. Company size, measured through total revenues, accounts for the resource availability advantages that larger corporations possess for ESG initiatives. Firm age captures the years since the founding of proxies for the effects of maturity on social orientation. The annualized volatility of stock returns represents the risk preferences that shape the ESG positioning. The extent of independent directors as corporate governance signals is reflected in the board independence percentages. Past profitability (return on assets) and stock returns control historical performance enabling/constraining ESG efforts. Together these controls cover salient firm level factors that prior scholarly work has linked to differentiation in adoption of environmental and social policies (Carnahan et al. 2017). Their inclusion isolated the explanatory power of human capital management practices in ESG performance. Table 2 presents descriptive statistics of the study variables.

The hypothesized relationship between human capital management practices and ESG performance was analyzed using a panel regression approach. By exploiting the panel structure of the data across companies and years, we can control for time-invariant unobserved firm level factors by including firm fixed effects, denoted by αi for each firm i.

The dependent variable ESG Scoreit represents the ESG performance score of firm i at time t. The independent variables were as follows:

-

EmpProdMetricsit: Employee productivity metrics, such as revenue per employee, for firm i at time t.

-

TechTrainingit: Technology-enabled training investments per employee for firm i at time t.

-

Diversityit: Workforce diversity measures, such as the percentage of non-executive employees, for firm i at time t.

-

PayEquityit: Pay equity measures such as the CEO-to-median employee pay ratio for firm i at time t.

-

Benefitsit: Employee benefits expenditure per employee for firm i at time t.

-

CEOTenureit: The tenure (in years) for firm i at time t.

Coefficients β1 to β5 represent the direct effects of each human capital management variable on ESG performance. For example, β1 captures the impact of employee productivity metrics on ESG performance, holding all the other variables constant.

The coefficient β6 represents the direct effect of CEO tenure on ESG performance, independent of the human capital management variables.

The interaction terms (CEOTenureit × EmpProdMetricsit, CEOTenureit × TechTrainingit, CEOTenureit × Diversityit, CEOTenureit × PayEquityit, and CEOTenureit × Benefitsit) capture the moderating effects of CEO tenure on the relationship between each human capital management variable and ESG performance. The coefficients β7 to β11 represent the strength and direction of these moderating effects, respectively.

The term ΣkγkControlkit represents a set of k control variables such as firm size, industry, and financial performance, which are included to account for other factors that may influence ESG performance. Coefficient γk captures the impact of each control variable on ESG performance.

The term αi represents firm-specific fixed effects that control for the unobserved, time-invariant characteristics of each firm that may affect ESG performance.

Finally, εit is the error term that captures the unexplained variation in ESG performance of firm i at time t.

We lagged the key independent variables—employee productivity (EmpProdMetrics), training investment (TechTraining), diversity (Diversity), pay equity (PayEquity), and benefits (Benefits)–by one year relative to the ESG performance (ESG Score) dependent variable. Based on prior evidence, management initiatives often require more than a year to achieve ESG gains (Carnahan et al. 2017). Therefore, this accounts for lagged realization.

Alongside the firm fixed effects, we incorporate time (year) fixed effects, ΣtYeart, to control for temporal shocks, such as macroeconomic conditions and evolving sustainability policy landscapes, that concurrently influence firms. Standard errors, εit are clustered at the firm level to account for autocorrelations and within-firm dependencies over time. We test for multicollinearity between predictors using variance inflation factors (VIFs) but find that the maximum VIF remains under five (see Table 3), below the thresholds of concern (O’Brien, 2007). Thus, our parameter estimates were unbiased and efficient. The model enables the isolation of the longitudinal effect of strategic human capital decisions on realized ESG performance while addressing alternative explanations through an array of statistical controls.

Results

Panel regression analysis examined the impact of key human capital management practices on firms’ overall environmental, social, and governance (ESG) performance (see Table 4). The sample covers 1827 firm-year observations spanning 413 unique companies across major 2-digit SIC sectors over a multi-year period. The employee productivity proxies of earnings before interest, taxes, depreciation, and amortization per worker (EBITDA/Employee) (β = 0.23, p = 0.011) and revenues generated per employee (Revenue/Employee) (β = 0.028, p = 0.012) both demonstrate positive associations with firms’ ESG performance ratings, supporting Hypothesis 1, that companies with higher employee productivity metrics lead to better ESG performance and greater social responsibility commitment. Additionally, in line with Hypothesis 2, greater technology-enabled training investments proxied by R&D expenses per employee (β = 0.043, p = 0.002) are associated with higher ESG ratings, indicating that a $1,000 increase in R&D spending per employee is associated with a 0.043-point increase in ESG ratings, which is a modest but significant effect. Workforce diversity measures associate directionally with ESG performance, providing support for Hypothesis 3, that greater diversity and inclusion lead to higher ESG. Specifically, the non-executive employee percentage (β = 1.23, p = 0.001) is significantly linked, indicating that flatter participative structures pursue responsibility. Additionally, higher female representation is observed both at the executive level, such as the board (β = 0.13, p = 0.081), and across the employee base (β = 0.03, p = 0.114) for leading sustainability organizations, even if the relationships are not statistically significant.

Furthermore, in line with Hypothesis 4, excessive CEO-to-median pay ratios prove detrimental to ESG positioning, as the negative pay equality coefficient suggests (β = −0.91, p = 0.045). Skewed internal allocations likely breed short-termisms. Lastly, supporting Hypothesis 5, Employee Benefits expenditures (β = 0.37, p = 0.025) link directly to social contract strength.

The control variables provided additional insights into the drivers of ESG performance. Firm size did not exhibit a statistically significant relationship with ESG commitment levels (0.031 coefficient, p = 0.067). The negative coefficient of firm age (β = −0.012) does not represent a statistically significant relationship between organizational maturity and ESG performance improvement (p = 0.141). Monitoring risks also matter, with lower stock return volatility linked to the adoption of responsible ESG practices (β = −1.82, p = 007). While the positive coefficients of board independence (β = 1.23) and profitability (ROA β = 1.92) potentially indicate that governance oversight and financial resources assist ESG performance, both relationships lack statistical significance at the conventional levels (p = 0.131 and p = 0.099, respectively). Intriguingly, prior shareholder returns correlate negatively with current ESG performance (β = −0.97, p = 0.003). This suggests that organizations that satisfy investor pressure for short-term stock gains may ignore long-term sustainability. Similarly, the analysis reveals that Return on Equity (ROE) does not have a statistically significant impact on ESG performance (β = 0.021, p = 0.453), suggesting that ROE’s profitability does not substantially influence a company’s ESG commitments. Additionally, the effect of firm size, as measured by Total Sales (log-transformed), is not statistically significant (β = 0.035, p = 0.371), further supporting the notion that the scale of a company’s operations does not necessarily determine its ESG performance.

Panel regression examining human capital factors linked to ESG achievement demonstrates adequate explanatory capacity. The model attained an in-sample predictive ability of 24%, as denoted by the R-squared value of 0.24. This indicates that nearly a quarter of the variation observed in companies’ sustainability performance can be attributed to the strategic human resources management practices tested here encompassing workforce productivity, skill development, inclusion, pay equity, and benefit provision. Furthermore, the overall relationship between the independent variables and ESG ratings was statistically significant, as reflected by the F-statistic of 42.11. Thus, holistically targeting human potential and welfare cultivation through corporate policies pays measurable dividends for leadership on environmental and social issues.

The empirical examination in this study reveals significant moderating effects of CEO tenure on the relationship between human capital management effectiveness and corporate ESG performance. As Table 4 shows, the interaction terms between CEO tenure and the various human capital management variables exhibit statistically significant coefficients. Specifically, positive and significant interaction effects were observed for CEO tenure and revenue per employee (β = 0.009, p = 0.023), EBITDA per employee (β = 0.011, p = 0.028), R&D per employee (β = 0.017, p = 0.015), the percentage of non-executive employees (β = 0.021, p = 0.020), board gender diversity (β = 0.008, p = 0.045), employee gender diversity (β = 0.005, p = 0.013), and employee benefits (β = 0.019, p = 0.018). These findings support hypothesis 6, indicating that the positive impact of human capital management effectiveness on ESG performance is stronger for companies with longer-tenured CEOs than for those with shorter-tenured CEOs.

Furthermore, the negative and significant interaction effect between CEO tenure and CEO pay ratio (β = −0.013, p = 0.031) suggests that the detrimental impact of excessive CEO-to-median employee pay disparity on ESG performance is mitigated by longer CEO tenure. This finding aligns with the notion that longer-tenured CEOs may have greater credibility and influence in promoting a more equitable value distribution among stakeholders, thereby enhancing a firm’s ESG standing.

Figure 2 provides a visual representation of the moderating effect of CEO tenure on the relationship between human capital management effectiveness and ESG performance. The graph illustrates the slopes of the relationship between high and low CEO tenure. As shown, the positive slope is steeper for companies with a higher CEO tenure than for those with a lower CEO tenure. This suggests that the impact of human capital management effectiveness on ESG performance is amplified when CEOs have longer tenures, likely because of their deep understanding of the firm’s human capital capabilities, greater credibility among stakeholders, and greater discretion in prioritizing long-term sustainability initiatives.

Addressing endogeneity

To address the potential endogeneity concerns, we employ several robustness checks. First, we use a two-stage least squares instrumental variable approach (Model 1 in Table 5), instrumenting the human capital variables with industry averages. The second-stage results remain significant, suggesting that our findings are robust to endogeneity. Second, we applied a continuous treatment effects model (Model 2 in Table 5) that inserts a correction term obtained by projecting ESG performance onto the instruments. Again, the hypothesized relationships remained significant. Finally, we utilize an endogenous switching regression (Model 3 in Table 5), confirming the positive association between emphasis on human capital and ESG performance.

Across these models, the positive effects of revenue per employee, R&D per employee, the CEO pay ratio, and employee benefit expenses remain statistically significant. The endogeneity correction terms in Table 4 are also consistently insignificant, further indicating that reverse causality is unlikely to drive the role of human capital orientation in enhancing sustainability. By isolating exogenous variations in talent management emphasis and accounting for potential simultaneity, these additional tests bolster the confidence in the findings. The use of instrumental variables, treatment effect adjustments, and endogenous switching regressions effectively addresses endogeneity concerns. These consistent results confirm that firms’ human capital and compensation policies that emphasize sustainability practices exert a causal impact on ESG performance. Multiple robustness checks lend greater credibility to the hypothesized talent management mechanisms for improving corporate social responsibility.

Robustness tests

We conducted a comprehensive set of additional analyses and sensitivity checks to establish the robustness of our findings and address potential concerns. These robustness tests aimed to validate the reliability and consistency of our results and to mitigate the influence of alternative explanations and methodological considerations.

Alternative Variable Specifications

First, we examine the robustness of our results to alternative measures of key variables. Specifically, we employed an alternative proxy for ESG practices sourced from Bloomberg, a reputable global provider of financial data and analytics. This alternate measure addresses potential concerns regarding reliance on a single rating agency’s methodology and ensures that our findings are not driven by idiosyncratic factors associated with the initial ESG measure. The results presented in Column (1) of Table 6 corroborate our main findings, indicating that the positive relationship between ESG practices and corporate human capital inflows remains significant when using this alternative independent variable.

Furthermore, we scrutinized the robustness of our findings to alternative operationalization of the dependent variable. Instead of utilizing the proportion of employees with a bachelor’s degree or higher as a proxy for human capital inflow, we employ the ratio of technical employees, such as R&D personnel, to the total workforce. This alternative measure captures the influx of highly skilled and specialized human capital, which may be particularly relevant in certain industry contexts. As reported in Column (2) of Table 6, our main results remain qualitatively unchanged, demonstrating the robustness of our findings to alternative measures of the dependent variable.

Supplementary robustness checks

We conducted a series of sensitivity analyses to validate the robustness of the results. First, to mitigate the potential influence of extreme observations, we winsorized our data at 2.5% and 97.5% percentiles. The results presented in column (3) of Table 6 are consistent with our main findings, suggesting that our conclusions are not driven by outliers or extreme values in the data.

Next, we address the potential lagged effect between ESG practices and human capital inflow. It is plausible that the effect of ESG practices on attracting and retaining talent manifests over an extended period. To account for this possibility, we re-estimated our models using the lagged values of the independent variables. Specifically, column (4) presents the results when the independent variable is lagged by one period, and column (5) displays the results when the independent variable is lagged by two periods. Across both specifications, our main findings remain qualitatively unchanged, indicating that our results are robust to potential time lags in the realization of the effects of ESG practices on human capital inflow.

Finally, we investigated the potential influence of specific events or periods on the results. We re-estimated our models after excluding data from 2020, which was marked by the COVID-19 pandemic and its associated economic disruptions. The results reported in column (6) of Table 6 remain consistent with our main findings, further strengthening the robustness of our analyses and suggesting that our conclusions are not unduly influenced by the unique circumstances of the pandemic.

The consistent and robust findings across these sensitivity analyses and alternative specifications provide strong empirical support for the validity and reliability of the main results. These comprehensive robustness tests enhance the confidence in our conclusions and mitigate potential concerns regarding alternative explanations and methodological issues.

Discussion

The empirical examination in this study reveals significant interlinkages between a company’s human capital management practices and demonstrates commitment across the ESG performance indicators. The results provide broad-based support for the conceptual model’s overarching premise that strategic investments toward empowering and uplifting the workforce translate into superior corporate responsibility. Specifically, the analysis indicates that companies that are able to foster higher employee productivity in terms of revenue, earnings, and value creation per worker correspond to superior ESG performance (H1 is supported). This aligns with the resource-based perspective that workforce optimization enables shared value across financial and social dimensions (Carnahan et al. 2017). Additionally, this research finds that technology-enabled investments in upgrading workforce skills are directly associated with external assessments of firms’ citizenship strengths (H2 supported). Training investment spillovers into purpose activation extend human capital advancement models (Šebestová and Popescu, 2022). Furthermore, organizations cultivating an inclusive culture across managerial tiers pursue sustainability agendas more proactively, as underscored by the non-executive workforce diversity linked to ESG gains (H3 supported). These results reinforce studies positing that decentralized participation fosters ethical governance and accountability (Kang and Moon, 2011). Moreover, the analysis suggests that excessive internal pay inequality likely breeds short-termism, which undercuts the credibility of external citizenship commitments (H4 is supported). The findings support existing research linking pay disparity to negative outcomes such as reduced trust in leadership, weaker governance, and higher employee turnover (Rathbone, 2022). Lastly, the study reveals that expenditures directed towards employee well-being correlate strongly with third-party evaluations of corporate ESG performance (H5 supported), consistent with the visions of socially responsible employers uplifting constituent health across the triple bottom line (Slawinski et al. 2016).

The empirical examination in this study reveals significant moderating effects of CEO tenure on the relationship between human capital management effectiveness and corporate ESG performance. These findings support Hypothesis 6, indicating that the positive impact of human capital management effectiveness on ESG performance is stronger for companies with longer-tenured CEOs than for those with shorter-tenured CEOs. These results align with the notion that longer-tenured CEOs possess deep firm-specific knowledge, extensive stakeholder relationships, and significant influence over organizational culture, which can shape the effectiveness of human capital management practices in driving ESG outcomes (Meng, 2021).

The significant positive interaction effects between CEO tenure and various human capital management variables, such as employee productivity metrics, technology-enabled training investments, workforce diversity, and employee benefits, suggest that longer-tenured CEOs are better positioned to leverage these practices to enhance ESG performance. This finding supports the idea that CEOs with longer tenures have a more comprehensive understanding of a firm’s human resource capabilities and can align them with strategic ESG goals more effectively (Bragaw and Misangyi, 2015). Longer-tenured CEOs may also face less short-term pressure from investors, allowing them to invest in human capital development initiatives that pay off over time, ultimately contributing to superior ESG performance (Flammer and Bansal, 2017).

Moreover, the negative interaction effect between CEO tenure and the CEO pay ratio suggests that longer-tenured CEOs can mitigate the detrimental impact of excessive pay disparity on ESG performance. This finding aligns with the argument that CEOs with longer tenures often enjoy greater trust and credibility among employees, which is crucial for the success of ESG initiatives (Meng, 2021). When employees perceive their leaders to be committed and credible, they are more likely to engage in and contribute to sustainability efforts (De Roeck and Maon, 2016). Longer-tenured CEOs have more time to build such trust and demonstrate their dedication to ESG causes, thus amplifying the impact of human capital management on sustainability performance.

The moderating role of CEO tenure has important implications for corporate governance and succession planning. These findings suggest that boards should consider the potential impact of CEO tenure on the effectiveness of human capital management practices and ESG performance when making leadership appointments and when evaluating CEO performance. Longer-tenured CEOs who have demonstrated a strong track record of aligning human capital strategies with ESG goals may be better equipped to drive sustainable value creation for firms and their stakeholders.

However, it is important to acknowledge that the benefits of a long CEO tenure may be contingent on other factors, such as the dynamism of the industry, stage of the firm’s life cycle, and specific challenges faced by the organization (Chen et al. 2019). Future research could explore these contingencies and boundary conditions to provide a more nuanced understanding of when and how CEO tenure influences the relationship between human capital management and ESG performance.

Key insights and implications

The empirical validation of talent management policies that spill over into the realization of sustainability goals has important scholarly and practical implications. The findings revealed a strong interdependence between workforce productivity improvements and corporate sustainability commitment. Companies with superior revenue and profitability per employee demonstrate markedly better ESG performance. This indicates synergistic value creation across both dimensions rather than a tradeoff between investing in human capital and environmental and social priorities. These results underscore the need to unify strategies for human capital advancement and ESG programs. As firms pursue productivity through automation, streamlining, and capability building, they can concurrently shape an ethical culture that reduces their environmental footprint and promotes inclusion. Such an integrated approach to managing people and purposes fosters high-quality growth (Schiemann, 2006).

The data validate that corporate investments aimed at amplifying workforce skills and knowledge using technology tools have tangible spillovers to realizing sustainability goals. As businesses subsidize access and learning to elevate individual competence, they can simultaneously expose employees to the concepts of ethics, citizenship, and green consciousness. Infusing such wider considerations alongside domain expertize allows capability building to cascade into purpose activation. The findings suggest that chief learning officers must collaborate better with heads of ESG and diversity/inclusion teams to shape content and curate integrated development initiatives that upgrade organizational excellence across operations and responsibilities (Khemakhem et al. 2022).

Empirical evidence indicates that more participative and decentralized organizational structures pursue ESG agendas more proactively. Specifically, higher representation of non-executive employees correlates with superior corporate sustainability demonstrations. Decentralized participation seemingly fosters a culture in which each stakeholder feels empowered to contribute ideas that benefit environmental and social priorities. Such inclusive architectural roles model wider community participation in shaping industrial advancement. As global discourse increasingly demands that corporations uphold higher standards of citizenship and accountability to all constituents beyond just shareholders, these results provide a blueprint for genuinely embedding such a multi-stakeholder orientation within management practices (Freeman et al. 2018).

The analysis revealed that extreme CEO-to-median pay ratios likely engender short-term thinking, eroding the credibility of external ESG positions. This corroborates the surveyed investor sentiment that excessive executive payouts crowd out resources for citizenship initiatives and undermine trust in leadership oversight (Grewal et al. 2020). These findings suggest that remuneration committees must pioneer incentive structures that promote internal pay parity to enable a balanced value allocation across all stakeholders. Tighter cross-functional coordination on integrated scorecards that track financial, customer, process, and learning metrics can address accountability gaps.

This research validates that corporate investments in employee well-being correlate strongly with externally assessed demonstrations of ESG commitment. Generous and equitable welfare policies seemingly foster loyalty, retention, and higher triple-bottom-line performance (Bode et al. 2015). As younger talent increasingly seeks purpose alignment between personal and organizational values while lacking job security nets, these results highlight that employees benefit from empathy as pivotal for socially responsible employers to attract top talent. Benefit parity across hierarchical levels also signals inclusive cultures that empower individual potential and voice.

The findings related to the moderating role of CEO tenure (H6) offer valuable insights into the boundary conditions of the relationship between human capital management effectiveness and corporate ESG performance. The empirical evidence suggests that longer-tenured CEOs amplify the positive impact of human capital management practices on ESG outcomes. This finding has important theoretical and practical implications. From a theoretical perspective, these results contribute to the growing literature on leadership’s role in shaping the effectiveness of human capital management and corporate sustainability initiatives. The findings highlight the need for a more nuanced understanding of how leadership characteristics, such as tenure, interact with human capital management practices to influence ESG performance. This study opens new avenues for exploring the complex interplay between leadership, human capital, and sustainability outcomes. From a practical standpoint, these findings underscore the importance of considering CEO tenure in the design and implementation of human capital management strategies to enhance ESG performance. Companies may benefit from leveraging the experience, credibility, and long-term orientation of long-tenured CEOs to champion ESG initiatives, and align human capital practices with sustainability goals. This insight can inform decisions related to CEO succession planning, board oversight, and sustainable human resource management practices. Moreover, the findings suggest that investors and stakeholders should consider CEO tenure a relevant factor when assessing a company’s ESG potential and engagement. Longer-tenured CEOs may be better positioned to drive meaningful and lasting progress on ESG issues, given their deep understanding of the firm’s human capital capabilities and their ability to foster a culture of sustainability.

Boundary conditions and contingencies

While this study provides evidence of consistent connections between human capital orientation strategies and ESG performance, boundary conditions qualify generalizability. The data indicate that although organization size and maturity enable the pursuit of citizenship goals, financial resources alone cannot explain the observed variations in sustainability commitment. This underscores the need to emphasize non-financial capital. Additionally, while historically higher profitability and market returns have provided flexibility for ESG programs, the analysis finds that past stock gains potentially breed short-term investor pressures that distract the focus from long-term citizenship. Hence, balancing both monitoring perspectives is crucial.

Avenues for future research

As one of the first empirical investigations to reveal talent management practices that significantly predict corporate ESG accomplishments, this study sets the foundation and triggers several fruitful research avenues to build upon. First, analyzing intermediate mechanisms fostering workforce policies to cascade into sustainability results can enrich the understanding of key connectors. Examining whether productivity and inclusion are linked to emissions and pay equity shapes circularity and net zero progress can unpack specific pathways. Second, exploring contingency conditions under which human capital strategies best translate into ESG returns can offer customized prescriptions. Testing whether training works better for eco-innovation in manufacturing, while benefit provision retains service talent more keyed to society, can outline sectoral nuances. Finally, long-term archival tracking can evaluate the persistence of identified associations as policies and priorities evolve. Overall, by substantiating the strong interconnection between talent empowerment and corporate citizenship demonstrations using robust econometric tests, this study highlights an integrated approach that unifies human capital and ESG excellence for mutual gain.

Conclusion

This study makes an important contribution by empirically substantiating the interconnections between a company’s human capital management strategies and its demonstrated commitment across environmental, social, and governance priorities while also highlighting the critical moderating role of CEO tenure in this relationship. The results validate that corporations able to engender higher workforce productivity, provide developmental opportunities, cultivate inclusive participation, promote pay equity, and invest in employee well-being correspond to superior external assessments of sustainability performance. Moreover, the findings reveal that the positive impact of these human capital management practices on ESG performance is amplified when CEOs have longer tenures, likely because of their deep understanding of the firm’s human capital capabilities, greater credibility among stakeholders, and greater discretion in prioritizing long-term sustainability initiatives. These insights have important implications for business leaders, investors, and policymakers seeking to promote sustainable value creation. Evidence suggests that companies should adopt an integrated approach to managing human capital and ESG strategies, recognizing the synergistic benefits of aligning talent management practices with sustainability goals. Furthermore, this study highlights the need to consider leadership tenure in the design and implementation of human capital management initiatives to enhance ESG outcomes. Boards and investors should pay close attention to CEO tenure when assessing a firm’s ESG potential and engagement because longer-tenured CEOs may be better equipped to drive meaningful progress on sustainability issues.

However, certain limitations provide avenues for enriching the discourse in this study. First, incorporating cultural and institutional variations across global regions can offer nuanced perspectives on localization needs when implementing integrated talent-ESG frameworks. Testing boundary conditions and contingencies can also help prescribe customized interventions for manufacturing, service, or digital platform business models. Additionally, analyzing intervening mechanisms fostering specific human capital policies to manifest into particular citizenship results can provide granular pathways for action.

Data availability

All data generated or analysed during this study are included in this published article.

References

Ahmadi A, Nakaa N, Bouri A (2018) Chief executive officer attributes, board structures, gender diversity and firm performance among French CAC 40 listed firms. Res Int Bus Financ 44:218–226. https://doi.org/10.1016/j.ribaf.2017.07.083

Alhosani NHI, Nobanee H (2023) Board gender diversity and corporate social responsibility: a bibliometric analysis. Heliyon 9:e12734. https://doi.org/10.1016/j.heliyon.2022.e12734

Amosh HA, Khatib SFA, Ananzeh H (2022) Environmental, social and governance impact on financial performance: evidence from the Levant countries. Corp Gov 23:493–513. https://doi.org/10.1108/cg-03-2022-0105

Atayah OF, Najaf K, Subramaniam RK, Chin PN (2021) The ascension of executives’ tenure, corporate risk-taking and corporate performance: evidence from Malaysia. Asia Pac J Bus Adm 14:101–123. https://doi.org/10.1108/apjba-05-2021-0189

Aust I, Matthews B, Muller-Camen M (2020) Common good HRM: a paradigm shift in sustainable HRM? Hum Resour Manag Rev 30:100705. https://doi.org/10.1016/j.hrmr.2019.100705

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17:99–120. https://doi.org/10.1177/014920639101700108

Barrena-Martínez J, López-Fernández M, Romero-Fernández PM (2017) Socially responsible human resource policies and practices: academic and professional validation. Eur Res Manag Bus Econ 23:55–61. https://doi.org/10.1016/j.iedeen.2016.05.001