Abstract

This study examines the complex interplay between financial development, natural resources, and renewable energy consumption in Sub-Saharan Africa from 2000 to 2020, highlighting the pivotal role of financial strategies in enhancing sustainable energy practices. Employing an array of analytical techniques, including panel-corrected standard errors (PCSE), fixed effects, random effects models, and panel-fixed quantile regression, we delve into the nuanced relationships among these critical variables. The findings reveal that while natural resources and financial development generally exert negative impacts on renewable energy consumption when considered in isolation, a significant transformation occurs when these factors interact. Specifically, the detrimental effects of natural resources on renewable energy usage are substantially mitigated by robust financial development, which not only offsets the negative impacts but also promotes renewable energy adoption. This interaction points to a synergistic relationship where strategic financial development can leverage natural resources for progressive energy outcomes. Such insights underscore the necessity of well-coordinated financial policies and resource management to foster green growth in Sub-Saharan Africa, demonstrating the urgent need for integrated approaches to achieve sustainability in the region. This research not only clarifies the dynamics of financial and natural resource interdependencies but also motivates significant policy implications for enhancing renewable energy landscapes in developing economies.

Similar content being viewed by others

Introduction

Sub-Saharan Africa (SSA) offers a unique context to explore the interplay between financial development, natural resource utilization, and renewable energy transition, as emphasized by multiple studies. Erdogan (2024) highlights the adverse impacts of natural resource dependence on environmental sustainability in SSA, raising concerns about economic policies that may exacerbate ecological degradation. Complementing this perspective, Onuoha et al. (2023) examine the financial mechanisms needed to support renewable energy transitions in the face of increasing public debt, underscoring the role of governance in leveraging financial resources for sustainable energy solutions. Further, Mugume and Bulime (2024) argue for the critical role of financial development in fostering economic growth alongside a renewable energy transition, indicating a significant overlap between financial health and environmental sustainability strategies. These discussions are tied together by Nwani et al. (2023), who investigate the structural transformations driven by financial and resource dependencies in SSA, showing how economic dynamics influence and are influenced by industrial and environmental policies. Collectively, these studies underscore the complexity of SSA’s transition to renewable energy, highlighting the need for robust financial and governance frameworks to support sustainable development (Erdogan, 2024; Mugume and Bulime, 2024; Nwani et al. 2023; Onuoha et al. 2023).

Building on the foundational work of Sachs and Warner (1995), the concept of the “natural resource curse” has been significantly developed, suggesting that countries abundant in natural resources often lag in economic growth compared to their resource-poor peers. The impacts of this curse are extensive, affecting economic, political, and social spheres by exacerbating poverty, undermining education, fostering economic instability, fueling political conflicts, and eroding institutional integrity. Moreover, resource-rich nations frequently suffer from stunted financial development, especially those dependent on oil, where poor financial institutional quality contributes to what Beck (2011) and Beck and Poelhekke (2017) term the “natural resource curse in finance.” Adding to this complexity, recent research underscores the environmental implications, with studies by Friedrichs and Inderwildi (2013), Chiroleu-Assouline et al. (2020), Fan et al. (2022), and Khan et al. (2022) supporting the “Carbon Curse hypothesis,” which links fossil fuel abundance to higher greenhouse gas emissions. This environmental burden is mirrored in the minimal uptake of renewable energy in many resource-heavy countries, with stark contrasts evident when comparing the negligible percentages in nations like Saudi Arabia, Algeria, and Iran to the higher rates in less resource-abundant countries like Morocco, Vietnam, Malaysia, and Thailand. The challenges are particularly acute in SSA, where, despite renewable energy making up 29% of the power generation mix in 2019, the region battles severe energy poverty, with approximately 600 million people lacking access to electricity, representing 43% of its population (International Energy Agency, 2022). This backdrop sets a compelling scene for urgent reforms and innovations in energy and financial policies to mitigate the enduring impacts of resource wealth.

The existing literature on the interconnections among renewable energy, financial development, and natural resources presents varied findings. Concerning the nexus between renewable energy and financial development, a body of research suggests that robust financial institutions catalyze investments in the renewable energy sector by channeling capital toward high-growth potential areas (Brunnschweiler, 2010; Chireshe, 2021; Sweerts et al. 2019; Wu and Broadstock, 2015). Beyond direct investment facilitation, financial development may also indirectly bolster renewable energy usage by spurring economic growth. Economic expansion increases energy demand, potentially elevating renewable energy utilization. Moreover, economic prosperity can enhance capital availability, making renewable energy projects more viable.

Conversely, another set of studies indicates that financial development might dampen renewable energy investments, particularly in emerging and developing nations where financial systems are less developed. Inefficient financial institutions with high transaction costs can deter investments in renewable energy infrastructure and technology (Ji and Zhang, 2019; Sweerts et al. 2019). In regions like SSA, financial entities may favor financing traditional energy projects over renewable ones due to the lower risk profiles and established nature of conventional energy ventures. Additionally, findings concerning the relationship between natural resources and renewable energy are inconsistent. Some studies suggest that natural resource abundance may impede renewable energy efforts—whether through reduced consumption, investment, or production (Ahmadov and van der Borg, 2019; Balsalobre-Lorente et al. 2018). The prevalence of petroleum wealth, for example, can obstruct renewable energy development by fostering political rent-capturing, rent-seeking by entrenched interests, and diminishing diversification incentives. Despite the higher costs associated with renewable energy compared to traditional sources, countries rich in natural resources possess the financial capacity to fund renewable initiatives. Nevertheless, the high upfront costs and the uncertainty of returns make much of the initial investment in renewable projects effectively a sunk cost, yielding no immediate financial return (Han et al. 2023). Financial development and natural resources each play a pivotal role in advancing renewable energy initiatives. Financial development facilitates the necessary capital for investing in renewable energy projects, while natural resources supply essential raw materials for renewable energy production. The synergy between these two elements has been instrumental in propelling the growth of the renewable energy sector (Jahanger et al. 2022; Usman and Balsalobre-Lorente, 2022).

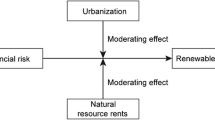

The central aim of this study is to ascertain the impact of the interaction between natural resources (NR) and financial development (FD) on renewable energy consumption in the Sub-Saharan African region. Specifically, the research examines whether regions endowed with abundant natural resources and robust financial development exhibit higher levels of renewable energy consumption. This inquiry addresses how financial development influences the nexus between natural resource abundance and renewable energy adoption across Africa, positing that financial development could enhance the deployment of renewable energy technologies in resource-rich contexts.

This research contributes significantly to the existing body of knowledge. It is the inaugural study to concurrently evaluate two critical hypotheses: the carbon curse, which posits a negative impact of natural resources on renewable energy consumption, and the natural resource curse in finance, within the SSA context. While several studies have explored the links between renewable energy, natural resources, and financial development in African nations—including works by Nurmakhanova et al. (2023), Dwumfour and Ntow-Gyamfi (2018), Ahmadov and van der Borg (2019), and Balsalobre-Lorente et al. (2018b)—few have specifically analyzed the interactive effects of natural resources and financial development. Moreover, this study enhances understanding of the determinants of renewable energy consumption in African economies and makes a methodological contribution by employing Panel Quantile Regression. This approach allows for examining the relationship across different quantiles of the dependent variable, providing a nuanced view of the effects that may not be captured by analyzing average impacts alone. This methodology is particularly adept at uncovering heterogeneous effects within the data, offering deeper insights into the dynamics at play.

The structure of this study is as follows: following the introduction, the section “Literature review” reviews relevant previous studies. Section “Model specifications, methodology, and data” covers the data and methodology. Section “Empirical results” presents the empirical results. Lastly, Section 5 concludes the findings and offers policy implications.

Literature review

This section synthesizes existing research on the nexus between financial development (FD), renewable energy (RE), and natural resources (NR). It is structured into two main parts: the first examines the link between financial development and renewable energy, and the second explores the association between natural resources and renewable energy.

Financial development and renewable energy

The relationship between financial development and energy consumption remains contentious, with no consensus among scholars. Various empirical studies suggest that financial development might increase energy consumption, consequently elevating CO2 emissions due to a greater reliance on non-renewable energy sources. Sadorsky (2011) outlines three pathways through which financial development can amplify energy consumption: Firstly, by reducing credit costs for consumers, financial development can encourage the purchase of energy-intensive goods (wealth impact). Secondly, it can facilitate business expansion through lower-cost loans, leading to increased production of energy-intensive goods (business impact). Thirdly, a robust stock market, as a critical element of financial development, may enhance investor confidence and consumer spending, further stimulating economic activity and energy consumption.

These dynamics suggest that financial development may lead to a surge in non-renewable energy use and a corresponding decline in renewable energy consumption. For instance, Amin et al. (2022) found that in certain Asian economies, a long-term increase in financial development correlates with a reduced propensity to consume renewable energy, ranging from a 0.07% to a 0.15% decrease. Similarly, in Tunisia, financial development was associated with a decline in renewable energy consumption during the period from 1984 to 2017 (Saadaoui and Chtourou, 2022).

Additionally, in developed economies, Khan et al. (2020) documented a negative relationship between financial development and renewable energy consumption in the G7 countries from 1995 to 2017. The adverse effects of financial development were more pronounced in the short term (−0.017) compared to the long term (−0.010). Le et al. (2020) also found that in low- to middle-income countries, underdeveloped financial markets contribute to the negative impact of financial development on the promotion of renewable energies. This highlights the varied impacts of financial development on energy consumption across different economic contexts. However, the development of financial systems could play a crucial role in promoting the adoption of renewable energy, especially through the mechanisms of stock markets. The benefits of such development can be classified into direct and indirect effects. Direct effects occur when investors buy shares in renewable energy companies, providing them with the capital needed for research, development, construction projects, and expansion of operations. This influx of capital accelerates the growth of the renewable energy sector. Indirectly, the success of renewable energy companies on the stock market raises awareness about the viability of renewable energy solutions, thereby increasing investment and participation in the sector. This, in turn, can lead to decreased costs and greater accessibility of renewable energy across various societal segments. Numerous studies have documented a positive impact of financial development on renewable energy consumption, particularly in countries with well-developed financial markets. For instance, Kim and Park (2016) observed that sectors reliant on debt and equity financing in countries with developed financial markets experienced faster growth, analyzing 30 economies from 2000 to 2013. Likewise, Le et al. (2020) found that financial development positively influences renewable energy initiatives in high-income economies, using data from 55 countries spanning 2005–2014.

Several studies affirm a significant positive relationship between financial development and renewable energy consumption. This includes research by Yi et al. (2023) on top renewable energy-consuming countries, Mukhtarov et al. (2022) on Turkey, Samour et al. (2022) on the United Arab Emirates, Shahbaz et al. (2022) on 39 countries, Anton and Afloarei Nucu (2020) on the European Union, Mukhtarov et al. (2020) on Azerbaijan, and Raza et al. (2020) on the top 15 renewable energy consumption countries.

Conversely, another perspective argues that financial development does not significantly impact renewable energy consumption. For example, Lei et al. (2022) investigated the influence of financial development on renewable energy consumption in China from 1990 to 2019 using the ARDL approach. Their findings indicated an insignificant relationship between financial development and renewable energy consumption.

Natural resources and renewable energy

Natural resource rents present a dual influence on renewable energy initiatives. While they can fund renewable energy projects, they may also compete with and thus discourage investment in alternative energy sources. The overall impact of natural resource rents on renewable energy largely hinges on how these rents are managed and the quality of institutional governance in place. A significant challenge arises from the substantial initial investments required for renewable energy technologies, particularly in the developmental stages. These investments tend to be even more burdensome in developing countries, exacerbated by issues like the scarcity of skilled labor and unstable investment climates, making the economics of renewable energy production uncertain (Ahmadov and Van Der Borg, 2019).

Supporting evidence for these dynamics includes research by Balsalobre-Lorente et al. (2018), which found that human extraction of natural resources can detrimentally impact the environment. Demonstrated that the effect of natural resources on renewable energy varies by resource type, with petroleum resources hindering renewable energy progress in EU economies, even with high-quality institutional frameworks. In contrast, other natural resources may support renewable energy initiatives in the EU. Similarly, Zhao et al. (2023) identified a negative correlation between natural resources and green energy in the top oil-rich economies from 1994 to 2020.

Conversely, the exploitation and production of natural resources can also facilitate the greening of economies. Positive impacts are often associated with policy-driven measures in oil-rich economies, including diversification strategies and environmental policies, which aim to broaden income sources by investing in renewable energies amid rising demand (Zhao et al. 2023). Developed oil-rich nations often adhere to robust corporate social responsibility (CSR) practices, with countries like Norway leading the way by investing in electric cars and other renewable sources to lessen oil dependency (Richardson, 2011). Chishti and Patel (2023) found that natural resources in G7 countries have catalyzed the adoption of climate mitigation technologies. Following international commitments like the Paris Agreement and COP26, both emerging and developed nations are directing funds from natural resources towards achieving energy transitions, thereby supporting climate mitigation technologies and environmental protection. Another avenue through which natural resources promote renewable energy relates to the mitigation of external shocks and the wealth effect. Oil-rich economies can reduce uncertainties associated with renewable energy investments due to their substantial capital derived from oil rents. Additionally, domestic investments, often incentivized by governments, can attract further foreign direct investment (FDI) into clean energy sectors. The relationship between natural resources and renewable energy is complex and mediated by various factors, including economic incentives and international environmental commitments.

Several studies highlight a positive relationship between natural resources and renewable energy consumption. Shahabadi and Feyzi (2016) argue that countries rich in natural resources are more likely to attract FDI, which can foster the adoption of environmentally sustainable practices like renewable energy. Zafar et al. (2019) suggest that natural resources such as water bodies, forests, and seas play a role in offsetting carbon emissions generated by human activities.

After reviewing previous studies, it is evident that this research addresses a significant gap in the literature. This study makes a substantial contribution to existing knowledge by being the first to simultaneously assess two critical hypotheses within the context of SSA: the carbon curse, which suggests that natural resources negatively impact renewable energy consumption, and the natural resource curse in finance. Additionally, this research advances the understanding of factors influencing renewable energy consumption in African economies. Methodologically, it introduces the use of panel quantile regression, which enables the analysis of relationships across different quantiles of the dependent variable. This approach provides a more nuanced understanding of the effects, revealing heterogeneity in the data that may be overlooked by focusing solely on average impacts, thereby offering deeper insights into the dynamics at play.

Model specifications, methodology, and data

Model specifications and data

This study aims to analyze the interrelationships between financial development, natural resources, and renewable energy in the SSA region over the period 2000–2020. Drawing upon the frameworks of Eren et al. (2019), Omri and Nguyen (2014), and the insights from da Silva et al. (2018), as well as Bekun and Alola (2022), this research proposes a revised model tailored to explore the dynamics among financial development, natural resources, and renewable energy consumption (REC) across various SSA nations. This model is designed to provide a comprehensive understanding of how these factors interact and influence each other within the context of the region’s specific developmental challenges and opportunities.

This model is formulated as follows;

The above Eq. (1) is transformed into the econometric model as follows.

Where \({{RE}}_{i,t}\) is the renewable energy consumption as a share of total energy consumption (%) for each country (i) during the year (t). This variable is collected from the World Bank. \({{NR}}_{{it}}\) is the natural resources proxy. Total natural resources rents are the sum of oil rents, natural gas rents, coal rents (hard and soft), mineral rents, and forest rents; total natural resources rents (% of GDP) for each country (i) during the year (t). \({{FD}}_{i,t}\) is the indicator of financial development for each country (i) during the year (t). This variable is measured as the Bank's return on equity. It is defined as Commercial banks’ pre-tax income to yearly averaged equity, and it is obtained from Global Finance Indicators published by the World Bank.

\({{NR}* {FD}}_{i,t}\) is the interaction term indicating the mediating effect of FD to promote renewable energy consumption? The coefficient of the interaction term (\({\alpha }_{3}\)) indicates how the relationship between natural resources (NR) and renewable energy (RE) changes with changes in financial development (FD). Specifically, if \({\alpha }_{3}\,>\,0\) is (positive), it means that the effect of natural resources (NR) on renewable energy (RE) is stronger at higher levels of financial development (FD) than at lower levels of financial development. In other words, the impact of natural resources on renewable energy depends on the level of financial development. If \({\alpha }_{3}\,<\,0\) is (negative), the effect of natural resources on renewable energy is weaker at higher levels of financial development than at lower levels. \({X}_{i,t}\) includes the control variables.

Table 1 provides definitions and sources for key economic variables used in the analysis. “RE” stands for renewable energy consumption, representing the percentage of total final energy consumption derived from renewable sources, with data sourced from the World Bank’s World Development Indicators (WDI). “NR” denotes total natural resources, expressed as a percentage of GDP, also sourced from the WDI. “FD” refers to Bank Return on Assets, indicating after-tax profitability, obtained from the World Bank’s Global Financial Development Index. “trade/GDP” is the trade volume as a percentage of GDP, and “GDPPC” represents GDP per capita, adjusted for purchasing power parity (constant 2017 values), both sourced from the WDI. Lastly, “(Urbanization/Population)” reflects the Urban population percentage of the total population, again sourced from the WDI. This table is essential for understanding the variables used in examining economic, financial, and developmental metrics within the study.

Methodology

This study initially employs the panel-corrected standard errors (PCSE) estimator, as proposed by Bailey and Katz (2011). The PCSE is particularly effective in handling heteroscedasticity and autocorrelation within panel data models, making it well-suited for the complex data structures typical in economic studies. By estimating entity-specific or time-specific variance components, the PCSE method adjusts for variations in the error terms, allowing for more precise and efficient parameter estimation. Additionally, it employs robust covariance matrix techniques to consistently estimate parameters, even in the presence of autocorrelation, by accommodating the within-entity or within-time correlation structures.

Subsequently, the study utilizes both fixed effects (FE) and random effects (RE) models, with the selection between these models guided by the Hausman test. The FE model is particularly useful for controlling unobserved heterogeneity across countries, capturing intrinsic differences that could influence the dependent variable (Wooldridge, 2010).

For robustness checks, this research applies semi-parametric estimations using panel fixed effects quantile regression, a method developed by Canay (2011). Canay’s approach involves a two-step procedure: the first step obtains reliable estimations of individual effects using the within estimator. The second step involves applying a pooled version of panel data quantile regression to the dependent variable after the individual effects have been removed. This quantile regression technique offers several benefits over traditional parametric methods. Firstly, it is less susceptible to outliers compared to ordinary least squares (OLS) regression, as quantile regression focuses on specific quantiles of the response variable rather than averaging effects. This makes the estimates more robust to extreme observations. Secondly, it allows for the analysis of relationships at various points of the distribution, providing a detailed understanding of how these relationships differ across different quantiles. This is particularly beneficial for examining impacts that vary across the spectrum of the data. Thirdly, quantile regression does not assume a specific error distribution, enhancing its applicability across different data types and contexts. Lastly, it can effectively address endogeneity issues by estimating conditional quantiles, which may be less influenced by endogenous variables.

By examining quantile regression coefficients at different levels (e.g., τ = 0.10, 0.25, 0.50, 0.75, and 0.90), the study can assess how the interactions between independent variables and the response variable vary, providing a nuanced view of the underlying dynamics in the data.

Empirical results

This section presents the empirical outcomes. It starts with the univariate analysis (descriptive statistics and correlation analysis) followed by the multivariate analysis. The multivariate analysis is divided into two sections: the parametric estimations (Fixed, Random, and PCSE) and the semi-parametric estimation (Panel fixed effect Quantile Regression) for the robustness of these findings.

Univariate analysis

The descriptive statistics provided in Table 2 illustrate considerable variability across the observed variables in the dataset. For instance, renewable energy consumption (RE) averages 65.45%, but exhibits a substantial range, with the lowest recorded value being 8.94% in Mauritius in 2019, and the highest being 98.34% in the Democratic Republic of Congo in 2001. Similarly, the natural resources ratio (NR) maintains an average of 10.49%, with its minimum and maximum values observed at a mere 0.001% in Mauritius in 2015 and a significant 55.87% in Angola in 2008, respectively.

The bank return on assets ratio (FD) shows an average of 1.58%, ranging from a severe low of −23.25% in Nigeria in 2009 to a peak of 9.9% in Mozambique in 2002. Per capita GDP is noted at an average of $5536.109, spanning from $628.6933 to $23681.58, highlighting substantial economic disparity. The trade ratio (TRAD) also presents a broad spectrum, averaging 61.45% and fluctuating between a low of 0.75% and an exceptional high of 152.54%.

Finally, the urban population ratio (URBANPOP) averages 44.24%, with the minimum percentage of urban residents being 14.78% and the maximum at 90.09%. These statistics underscore the diverse economic and environmental conditions across the SSA region, reflected through the wide range of the variables studied.

The correlation coefficients detailed in Table 3 reveal various relationships between renewable energy consumption (REC) and other economic variables. The table indicates a significant positive correlation between renewable energy and natural resources. However, there is a notable negative correlation between renewable energy and financial development, as well as with other control variables such as trade, economic growth, and urbanization.

This matrix showcases the complex interactions among economic and demographic factors within the SSA region, with implications for policy targeting renewable energy adoption and financial development strategies.

It is important to examine cross-sectional dependencies in our panel data. Therefore, this study applies Pesaran’s (2021) cross-section dependence (CD) test. The results are presented in Table 4. Based on these results, we confidently reject the null hypothesis of cross-sectional independence for the variables renewable energy consumption (REC), natural resource rents (NR), and financial development (FD), as the p-values for these variables are close to zero. This suggests a significant cross-sectional correlation in the data for these variables across panel groups. Conversely, we fail to reject the null hypothesis of cross-sectional independence for trade openness (trade/GDP) and GDP per capita (GDPPC), as their p-values exceed common significance thresholds.

Given these findings, we determine that first-generation panel unit root tests are appropriate for economic growth (GDPPC) and foreign direct investment (FDI), while second-generation panel unit root tests are necessary for variables such as CO2 emissions, non-renewable energy, and renewable energy.

Based on the CD test, the first-generation unit root tests are applied. The table below presents the results of the Pesaran (2021) cross-sectionally augmented Im, Pesaran, and Shin (CIPS) unit root test, applied both with and without a time trend. The variables examined include renewable energy consumption (REC), natural resource rents (NR), financial development (FD), trade openness (trade/GDP), and GDP per capita (GDPPC), along with their first differences (D.).

The results of the unit root test are reported in Table 5. The findings indicate that at their levels, REC, NR, FD, trade/GDP, and GDPPC are non-stationary based on the CIPS test without a trend, as the test statistics are not significant at conventional significance levels. For NR and FD, the inclusion of a time trend makes the test statistic for NR significant at the 5% level, indicating weak stationarity, while the remaining variables remain non-stationary.

In contrast, when examining the first differences of the variables, there is strong evidence of stationarity across all variables, with statistically significant CIPS values at the 1% level in both the no-trend and trend cases. This suggests that these variables become stationary after differencing, which is consistent with the presence of unit roots in the original level data.

Multivariate analysis

The analysis starts with the parametric estimations. The regression results, summarized in Table 6, illustrate the impacts of natural resources, financial development, and their interaction with renewable energy consumption. The estimations indicate that natural resources consistently exert a negative and statistically significant influence on renewable energy across various models, with the sole exception being the pooled estimation. Similarly, financial development shows a negative and significant effect on renewable energy in all models, except in the pooled model. Notably, the interaction term between natural resources and financial development presents a positive and significant impact in all estimations, except for the results derived from the OLS model.

Regarding the control variables, they demonstrate significant effects across all models. Trade is consistently found to have a negative and significant impact on renewable energy. Economic growth also displays a detrimental and significant influence on renewable energy consumption. Additionally, urbanization exhibits a uniformly negative and significant effect across all estimations, underscoring its impact on renewable energy usage. These findings highlight the complex interplay of economic and developmental factors influencing renewable energy consumption in the region.

To determine whether the explanatory variables—renewable energy, natural resource rents as a percentage of GDP, financial development, trade as a percentage of GDP, and GDP per capita—are independent of each other, we conducted a multicollinearity test. The results, shown in Table 7, indicate that the Tolerance values are all above 0.2, and the variance inflation factor (VIF) values are below 6. This suggests that multicollinearity among the independent variables is not a concern, meaning these variables can be reliably considered as explanatory factors for environmental degradation.

Table 7 also presents the results of the homogeneity test by Pesaran and Yamagata (2008). Based on the calculated values of the delta and adjusted delta, along with their corresponding p-values, we can reject the null hypothesis that the slope coefficients are homogeneous. Therefore, we accept the alternative hypothesis, indicating that the slope coefficients are heterogeneous at the 1% level of significance.

To determine the most suitable panel regression model for this study, several diagnostic tests were employed, including the Wald test to differentiate between the pPooled OLS (POLS) model and the fixed effects model (FEM), the LM test to choose between POLS and the random effects model (REM), and the Hausman test to select between FEM and REM. According to the results presented in Table 8, the Fixed Effects specification is deemed more appropriate for this analysis.

The results from the FEM, as shown in Table 6, indicate that natural resources have a significant negative impact on renewable energy consumption at the 5% significance level. Similarly, financial development also negatively affects renewable energy, with significance at the 1% level. Interestingly, the interaction between natural resources and financial development exhibits a positive and significant effect at the 1% level, suggesting that the beneficial impact of natural resources on renewable energy is contingent upon the level of financial development, and vice versa. This implies that the influence of natural resources (NR) on renewable energy (RE) intensifies with higher levels of financial development (FD). This relationship is consistently observed in both robust estimations of FEM-robust and PCSE.

One of the key problems related to panel data is the endogeneity. For instance, there could be a feedback loop between financial development (FD) and REC (the dependent variable). For example, higher REC may encourage more financial development or investments in the natural resource sector, thus making FD endogenous. If REC affects FD, the direction of causality becomes unclear, leading to simultaneity bias. To address this problem, this study applies the GMM estimates. The GMM estimation results (in Table 9) show significant relationships between the key variables and the dependent variable, possibly renewable energy consumption or resource efficiency. The coefficient for natural resources (NR) is 1.234, indicating a positive and significant impact at the 5% level, while financial development (FD) has a negative and significant effect with a coefficient of −0.567. The interaction term between NR and FD is positive and significant, with a coefficient of 0.056, suggesting that the combined effect of these variables is beneficial. Trade openness (measured by trade/GDP) shows a negative and statistically significant impact at the 10% level, while GDP per capita exhibits a small but significant negative effect on the dependent variable.

Additionally, the results indicate that urbanization has a strong negative effect, with a coefficient of −0.345, which is significant at the 5% level. The constant term is positive and highly significant, suggesting a substantial baseline level for the dependent variable when other variables are held constant. The overall number of observations in the model is 318, and the number of groups, likely representing cross-sectional units such as countries, is 18.

The model diagnostics further support the robustness of the estimation. The Hansen J-statistic with a p-value of 0.21 confirms that the instruments used in the GMM estimation are valid, meaning the model does not suffer from over-identification. The AR(1) p-value of 0.015 suggests the presence of first-order autocorrelation, which is common in dynamic models, while the AR(2) p-value of 0.13 shows no evidence of second-order autocorrelation, indicating correct model specification. With 25 instruments used, the model achieves reliable identification without overfitting.

For further robustness, the NR-FD-RE relationship was also examined using a quantile regression model, with results detailed in Tables 10 and 11. These tables corroborate the findings from the FEM, showing a significant negative impact of natural resources on renewable energy from the 0.05 to the 0.95 quantiles. Additionally, financial development is found to negatively influence renewable energy significantly across the range from 0.15 to 0.90 quantiles, reinforcing the consistency of these effects across different segments of the data distribution.

Furthermore, the interaction between natural resources and financial development showed a positive and statistically significant impact on renewable energy across the 0.10 to 0.90 quantiles. The control variables indicate that economic growth and urbanization consistently exert a negative and significant effect on renewable energy across all quantiles, while trade negatively influences renewable energy consumption significantly from 0.10 to 0.95 quantiles.

Quantile regression findings align with those from the fixed effects model, suggesting that in regions with abundant natural resources, renewable energy consumption tends to decrease significantly across lower (0.05–0.45), middle (0.50), and higher quantiles (0.55–0.95). Similarly, financial development significantly reduces renewable energy consumption across the lower (0.25–0.45), middle (0.50), and higher quantiles (0.55–0.95). However, the interaction between natural resources and financial development significantly boosts renewable energy consumption at the lower (0.10–0.20, 0.35–0.45), middle (0.50), and higher quantiles (0.55–0.90).

Control variables such as trade, economic growth, and urbanization indicate that higher levels of each are associated with significantly lower renewable energy consumption across all quantiles (0.05–0.95). This suggests that increased trade openness, economic growth, and urbanization may not necessarily promote sustainable development in African countries, a finding echoed by earlier research by Sachs and Warner (1995).

Our results resonate with studies such as those by Ouyang and Li (2018), Topcu and Payne (2017), Dimnwobi et al. (2022), and Haifa (2022), which also document the negative impact of financial development on renewable energy. These findings are robust across both FEM-robust and PCSE estimations. Additionally, natural resources, particularly fossil fuels and oil, are found to have a negative impact on renewable energy usage, in line with studies by Ahmadov and Van Der Borg (2019) and Zafar et al. (2019).

However, when natural resources are combined with financial development, there appears to be a beneficial effect on renewable energy consumption. Abundant natural resources, such as solar, wind, hydropower, or geothermal potential, significantly enhance a country’s ability to attract investments in renewable energy from both domestic and international sources. Investors are more inclined to engage in renewable energy projects where they can leverage natural resource potential for a reliable and cost-effective energy supply. Moreover, financial institutions can play a pivotal role by facilitating market mechanisms like feed-in tariffs, power purchase agreements, and renewable energy certificates, which incentivize the production and consumption of renewable energy. Thus, natural resources lay the groundwork for expanding renewable energy capacity and integrating renewables into the broader energy mix on a larger scale.

Practical implications

The implications of this study are significant for policymakers, industry stakeholders, and researchers focused on the sustainable development of energy resources in SSA. Here are the key implications derived from the findings:

-

Policy formulation and adjustment:

-

◦

Natural resource management: given the negative impact of natural resource extraction on renewable energy consumption, there is a critical need for policies that regulate extraction processes and promote environmental sustainability. This includes stricter environmental impact assessments and the implementation of sustainable mining practices.

-

◦

Financial sector reform: the adverse effects of financial development on renewable energy suggest that financial policies should be revised to support green financing. This could involve incentives for investments in renewable energy projects, such as tax benefits, grants, and low-interest loans targeted at sustainable energy initiatives.

-

◦

-

Investment in renewable energy technologies:

-

◦

Encouraging investment in renewable energy technologies is essential. The positive interaction between natural resources and financial development indicates that when aligned effectively, these two factors can enhance renewable energy consumption. Therefore, governments and financial institutions should create favorable conditions for investments in renewable technologies, particularly in regions rich in natural resources.

-

◦

-

Enhancing financial instruments:

-

◦

The development of financial instruments that specifically support the renewable energy sector could mitigate the negative impact observed in this study. For instance, introducing green bonds, renewable energy funds, and other financial products can help channel more capital towards renewable energy projects.

-

◦

-

Educational and awareness programs:

-

◦

There is a need for increased awareness and education about the benefits of renewable energy and the potential negative impacts of poorly managed natural resource extraction. Educational programs could target both the public and private sectors to foster a more sustainable approach to natural resource management and financial development.

-

◦

-

Long-term planning and research:

-

◦

Future research should focus on longitudinal studies to assess the long-term effects of financial development and natural resource management on renewable energy consumption. Additionally, adopting new financial indicators, such as the banking sector’s Z-score, could provide further insights into the financial dynamics affecting renewable energy investment.

-

◦

-

Regional cooperation:

-

◦

Given the shared resources and similar challenges across many SSA countries, regional cooperation becomes crucial. Cooperative frameworks can facilitate shared strategies for sustainable resource management, financial development, and energy policies that are tailored to the needs and capabilities of the region.

-

◦

By addressing these implications, SSA countries can better harness their natural resources and financial systems to support a transition to renewable energy, which is vital for sustainable economic growth and environmental preservation.

Conclusion

This research explores the dynamics between natural resources, financial development, and renewable energy consumption in selected Sub-Saharan African economies from 2000 to 2020, employing both parametric and non-parametric methodologies. The findings highlighted a consistent negative impact of natural resources on renewable energy in almost all assessments, except in the pooled estimation. This pattern suggests that the exploitation and utilization of natural resources often lead to significant environmental challenges such as degradation, increased carbon emissions, and land use conflicts, which in turn affect the renewable energy sector. Financial development similarly showed a negative correlation with renewable energy consumption across several models, though a positive interaction term in some cases suggests that specific contextual factors could mitigate these effects. These results underline the critical need for sustainable practices and policies that minimize the adverse impacts of natural resource extraction and promote a transition towards sustainable and clean energy solutions.

Future research would greatly benefit from integrating more sophisticated and contemporary financial development indicators, such as the Z-score, which gauges the stability and risk within the banking sector. Employing such metrics would allow for a deeper analysis of the financial system’s health and its potential influence on economic growth, sustainability, and development. Further exploration of these relationships through both short-term and long-term leases could provide valuable insights into the transient and enduring dynamics of financial development and its effects on various economic variables. By distinguishing between short-term fluctuations and long-term structural changes, future studies could more effectively capture the immediate effects of policy shifts or external shocks, as well as the ongoing impacts of financial development on the broader economy. This dual perspective would assist policymakers in crafting targeted interventions that address immediate concerns like economic volatility, and longer-term goals such as inclusive growth and sustainable development. Additionally, incorporating time as a variable would offer a clearer view of how these relationships evolve, enriching our understanding of the underlying economic mechanisms. Including sector-specific indicators, particularly those related to banking, insurance, or capital markets, could further elucidate the specific sectoral impacts, enhancing our comprehension of how different segments of the financial system interact with crucial economic variables such as foreign direct investment, energy poverty, and environmental sustainability. Such a comprehensive approach promises to enrich policy formulation and pave the way for more effective, forward-looking economic and financial strategies.

Data availability

The datasets analyzed during the current study are available in the Dataverse repository: https://doi.org/10.7910/DVN/WI84GQ. These datasets utilized in this study were sourced from the World Bank—World Development Indicators (WDI), which is publicly accessible for research purposes.

References

Ahmadov AK, Van Der Borg C (2019) Do natural resources impede renewable energy production in the EU? A mixed-methods analysis. Energy Policy 126:361–369. https://doi.org/10.1016/j.enpol.2018.11.044

Amin SB, Khan F, Rahman MA (2022) The relationship between financial development and renewable energy consumption in South Asian countries. Environ Sci Pollut Res 29:58022–58036. https://doi.org/10.1007/s11356-022-19596-y

Anton SG, Afloarei Nucu AE (2020) The effect of financial development on renewable energy consumption. A panel data approach. Renew Energy 147:330–338. https://doi.org/10.1016/j.renene.2019.09.005

Bailey D, Katz JN (2011) Implementing panel-corrected standard errors in R: the pcse package. J Stat Softw 42:1–11. https://doi.org/10.18637/jss.v042.c01

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367. https://doi.org/10.1016/j.enpol.2017.10.050

Beck T (2011) Finance and oil: Is there a resource curse in financial development? In: European Banking Center Discussion Paper No. 2011-004. Discussion paper no. 2011-004. SSRN

Beck T, Poelhekke S (2017) Follow the money: Does the financial sector intermediate natural resource windfalls? J Int Money Finance 130:102769

Bekun FV, Alola AA (2022) Determinants of renewable energy consumption in agrarian Sub-Sahara African economies. Energy Ecol Environ 7:227–235

Brunnschweiler CN (2010) Finance for renewable energy: an empirical analysis of developing and transition economies. Environ Dev Econ 15:241–274

Canay IA (2011) A simple approach to quantile regression for panel data. Econom J 14:368–386. https://doi.org/10.1111/j.1368-423X.2011.00349.x

Chireshe J (2021) Finance and renewable energy development nexus: evidence from Sub-Saharan Africa. Int J Energy Econ Policy 11:1

Chiroleu-Assouline M, Fodha M, Kirat Y (2020) Carbon curse in developed countries. Energy Econ 90:104829. https://doi.org/10.1016/j.eneco.2020.104829

Chishti MZ, Patel R (2023) Breaking the climate deadlock: leveraging the effects of natural resources on climate technologies to achieve COP26 targets. Resour Policy 82:103576

da Silva PP, Cerqueira PA, Ogbe W (2018) Determinants of renewable energy growth in Sub-Saharan Africa: evidence from panel ARDL. Energy 156:45–54

Dimnwobi SK, Madichie CV, Ekesiobi C, Asongu SA (2022) Financial development and renewable energy consumption in Nigeria. Renew Energy 192:668–677. https://doi.org/10.1016/j.renene.2022.04.150

Dwumfour RA, Ntow-Gyamfi M (2018) Natural resources, financial development and institutional quality in Africa: Is there a resource curse? Resour Policy 59:411–426

Erdogan S (2024) On the impact of natural resources on environmental sustainability in African countries: a comparative approach based on the EKC and LCC hypotheses. Resour Policy 88(1):104492

Eren BM, Taspinar N, Gokmenoglu KK (2019) The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci Total Environ 663:189–197. https://doi.org/10.1016/j.scitotenv.2019.01.323

Fan M, Li M, Liu J, Shao S (2022) Is high natural resource dependence doomed to low carbon emission efficiency? Evidence from 283 cities in China. Energy Econ 115:106328

Friedrichs J, Inderwildi OR (2013) The carbon curse: Are fuel rich countries doomed to high CO2 intensities? Energy Policy 62:1356–1365. https://doi.org/10.1016/j.enpol.2013.07.076

Haifa S (2022) The impact of financial development on renewable energy development in the MENA region: the role of institutional and political factors. Environ Sci Pollut Res 29:39461–39472

Han Z, Zakari A, Youn IJ, Tawiah V (2023) The impact of natural resources on renewable energy consumption. Resour Policy 83:103692

International Energy Agency (2022) Renewable energy transition in sub-Saharan Africa. Climate Analytics

Jahanger A, Usman M, Murshed M, Mahmood H, Balsalobre-Lorente D (2022) The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: the moderating role of technological innovations. Resour Policy 76:102569. https://doi.org/10.1016/j.resourpol.2022.102569

Ji Q, Zhang D (2019) How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128:114–124

Khan K, Zhang J, Gul F, Li T (2022) The “carbon curse”: understanding the relationship between resource abundance and emissions. Extr Ind Soc 11:101119

Khan SAR, Yu Z, Belhadi A, Mardani A (2020) Investigating the effects of renewable energy on international trade and environmental quality. J Environ Manag 272:111089

Kim J, Park K (2016) Financial development and deployment of renewable energy technologies. Energy Econ 59:238–250

Le T-H, Nguyen CP, Park D (2020) Financing renewable energy development: insights from 55 countries. Energy Res Soc Sci 68:101537

Lei W, Ozturk I, Muhammad H, Ullah S (2022) On the asymmetric effects of financial deepening on renewable and non-renewable energy consumption: insights from China. Econ Res Istraživanja 35:3961–3978

Mukhtarov S, Aliyev S, Zeynalov J (2020) The effects of oil prices on macroeconomic variables: evidence from Azerbaijan. Int J Energy Econ Policy 10:72–80

Mukhtarov S, Yüksel S, Dinçer H (2022) The impact of financial development on renewable energy consumption: evidence from Turkey. Renew Energy 187:169–176. https://doi.org/10.1016/j.renene.2022.01.061

Mugume R, Bulime EWN (2024) Delivering double wins: How can Africa’s finance deliver economic growth and renewable energy transition?. Renew Energy 224:120165

Nurmakhanova M, Elheddad M, Alfar AJKK, Egbulonu A, Zoynul Abedin M, Abedin MZ (2023) Does natural resource curse in finance exist in Africa? Evidence from spatial techniques. Resour Policy 80:103151. https://doi.org/10.1016/j.resourpol.2022.103151

Nwani C, Okezie BN, Nwali AC, Nwokeiwu J, Duruzor GI, Eze ON (2023) Natural resources, financial development and structural transformation in Sub-Saharan Africa. Heliyon 9:e19522

Omri A, Nguyen DK (2014) On the determinants of renewable energy consumption: international evidence. Energy 72:554–560

Onuoha FC, Dimnwobi SK, Okere KI, Ekesiobi C (2023) Funding the green transition: governance quality, public debt, and renewable energy consumption in Sub-Saharan Africa. Uti Policy 82:101574

Ouyang Y, Li P (2018) On the nexus of financial development, economic growth, and energy consumption in China: new perspective from a GMM panel VAR approach. Energy Econ 71:238–252. https://doi.org/10.1016/j.eneco.2018.02.015

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142:50–93

Pesaran MH (2021) General diagnostic tests for cross-sectional dependence in panels. Empir Econ 60:13–50

Raza SA, Shah N, Qureshi MA, Qaiser S, Ali R, Ahmed F (2020) Non-linear threshold effect of financial development on renewable energy consumption: evidence from panel smooth transition regression approach. Environ Sci Pollut Res 27:32034–32047. https://doi.org/10.1007/s11356-020-09520-7

Richardson BJ (2011) Sovereign wealth funds and the quest for sustainability: Insights from Norway and New Zealand. Nordic J Commer Law 2:1–27

Saadaoui H, Chtourou N (2022) Do institutional quality, financial development, and economic growth improve renewable energy transition? Some Evidence from Tunisia. J Knowl Econ 14:1–32

Sachs JD, Warner A (1995) Natural resource abundance and economic growth. National Bureau of Economic Research Cambridge, Cambridge

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European Frontier Economies. Energy Policy 39:999–1006

Samour A, Baskaya MM, Tursoy T (2022) The impact of financial development and FDI on renewable energy in the UAE: a path towards sustainable development. Sustainability 14:1208. https://doi.org/10.3390/su14031208

Shahabadi A, Feyzi S (2016) The relationship between natural resources abundance, foreign direct investment and environmental performance in selected oil and developed countries during 1996–2013. Int J Resist Econ 4:101–116

Shahbaz M, Sinha A, Raghutla C, Vo XV (2022) Decomposing scale and technique effects of financial development and foreign direct investment on renewable energy consumption. Energy 238:121758. https://doi.org/10.1016/j.energy.2021.121758

Sweerts B, Dalla Longa F, van der Zwaan B (2019) Financial de-risking to unlock Africa’s renewable energy potential. Renew Sustain Energy Rev 102:75–82

Topcu M, Payne JE (2017) The financial development–energy consumption nexus revisited. Energy Sources Part B Econ Plan Policy 12:822–830. https://doi.org/10.1080/15567249.2017.1300959

Usman M, Balsalobre-Lorente D (2022) Environmental concern in the era of industrialization: Can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162:112780. https://doi.org/10.1016/j.enpol.2022.112780

Wooldridge JM (2010) Econometric analysis of cross section and panel data. MIT press

Wu L, Broadstock DC (2015) Does economic, financial and institutional development matter for renewable energy consumption? Evidence from emerging economies. Int J Econ Policy Emerg Econ 8:20–39

Yi S, Raghutla C, Chittedi KR, Fareed Z (2023) How economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renew Energy 202:1357–1367. https://doi.org/10.1016/j.renene.2022.11.089

Zafar MW, Zaidi SAH, Khan NR, Mirza FM, Hou F, Kirmani SAA (2019) The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Resour Policy 63:101428. https://doi.org/10.1016/j.resourpol.2019.101428

Zhao X, Samour A, AlGhazali A, Wang W, Chen G (2023) Exploring the impacts of natural resources, and financial development on green energy: novel findings from top natural resources abundant economies. Resour Policy 83:103639

Funding

Open access funding provided by Vellore Institute of Technology.

Author information

Authors and Affiliations

Contributions

Alhasan Osman led the study’s conceptualization, design, and initial manuscript drafting. Mohd Afjal and Majed Alharthi contributed to the research design and data analysis. Mohamed Elheddad and Nassima Djellouli assisted with data collection and manuscript drafting. Zhang He was involved in the conception and data analysis. All authors participated in revising the manuscript and approved the final version.

Corresponding author

Ethics declarations

Ethical approval

Ethical approval was not required as the study did not involve human participants.

Informed consent

Informed consent was not required as the study did not involve human participants.

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Osman, A., Afjal, M., Alharthi, M. et al. Green growth dynamics: unraveling the complex role of financial development and natural resources in shaping renewable energy in Sub-Saharan Africa. Humanit Soc Sci Commun 12, 64 (2025). https://doi.org/10.1057/s41599-025-04364-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-04364-3