Abstract

The Rural Minimum Living Security (Rural Dibao) is a crucial social assistance program designed to alleviate poverty in rural China. While non-agriculture employment plays a significant role in boosting farmers’ income and reducing long-term poverty, little is known about the impact of Rural Dibao on non-agriculture employment. This study uses data from the China Household Finance Survey (CHFS) and employs Propensity Score Matching with Difference-in-Differences (PSM-DID) methods to assess the effects of Rural Dibao on non-agriculture employment and to investigate the underlying mechanisms. Our findings reveal that Rural Dibao significantly increases the likelihood of recipients’ participation in non-agriculture employment and extends their labor supply in such jobs. The program primarily boosts temporary work rather than formal employment or self-employment. The increase in temporary employment primarily originated from transitions from agriculture work, rather than from previously unemployed individuals. Mechanism analysis suggests that government-provided employment information and recommendations serve as key drivers for increasing temporary employment, while cash transfers and job-seeking cash subsidies alone do not effectively promote non-agricultural employment.

Similar content being viewed by others

Introduction

Poverty has significant, lasting, and adverse effects on an individual’s lifelong development. Globally, social assistance programs have been widely used to address poverty and have achieved notable success in poverty reduction. The key to escaping the poverty trap lies in enhancing the self-development capacity of beneficiaries. In recent years, increasing research has focused on how social assistance can strengthen this capacity, with the goal of achieving long-term, sustainable poverty alleviation (Boschman et al. 2021).

In China, the world’s largest developing country, more than 500 million people reside in underdeveloped rural areas. Although these individuals have emerged from absolute poverty, they remain vulnerable to falling back into it. The Rural Minimum Living Standard Guarantee (hereafter Rural Dibao) is China’s core policy tool for poverty governance and the most important social assistance program in rural areas. Its effectiveness in helping rural populations escape absolute poverty is well-documented (Golan et al. 2017; Kakwani et al. 2019). However, in recent times, the focus has shifted toward developing long-term, sustainable strategies to reduce poverty and prevent its resurgence. The key questions now are: Can Rural Dibao effectively contribute to long-term poverty reduction? If not, what optimizations are necessary?

Rural Dibao not only provides a safety net for vulnerable groups—such as the disabled, elderly living alone, and chronically ill individuals who are unable to work—but also assists those with the capacity to work. Achieving sustainable poverty reduction requires enhancing the self-development capacity of low-income individuals, particularly those who are capable of working, by improving their employability and enabling self-sufficiency. Non-agriculture employment is the most crucial pathway for rural residents to increase their income and escape poverty. In practice, Rural Dibao provides not only cash transfers but also implements several employment support measures, such as job referrals, public service positions, and job search subsidies. This raises important questions: Has Rural Dibao effectively promoted non-agriculture employment among beneficiaries? Is its impact sufficiently significant? Does it need to be integrated with other policies? Addressing these questions is essential to better understanding the role of Rural Dibao in long-term poverty reduction and to provide empirical evidence for future policy optimization. Nevertheless, empirical research on the association between Rural Dibao and non-agriculture employment remains limited, which may result in an underestimation of the actual policy impact of Rural Dibao. To fill this knowledge gap, this study utilizes data from the 2015 and 2017 China Household Finance Survey (CHFS) and employs the Propensity Score Matching with Difference-in-Differences (PSM-DID) methods to provide empirical evidence on the impact of Rural Dibao on non-agriculture employment.

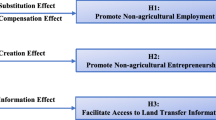

Our study contributes to the literature in three ways: First, we examine the association between Rural Dibao and non-agriculture employment. While existing studies primarily focus on labor participation rates and the employment intentions of the unemployed (Han, 2019; Huang and Cao, 2022), these indicators do not fully capture employment status or income levels. In contrast, non-agriculture employment is more effective at increasing income and reducing poverty risk (Shi et al. 2010), making it a more valuable area of study. This research offers new insights into the employment effects of Rural Dibao, enriching the literature on policy evaluation and offering empirical evidence from China that can inform similar international programs. Second, we explore the nature of non-agriculture employment and job transitions among workers, specifically investigating whether the increase in temporary work originates from previously unemployed individuals or transitions between different sectors. If non-agriculture employment growth results from new job creation, policy efforts should focus on generating more employment opportunities. Conversely, if growth stems from job transitions, policies should aim to enhance the stability and income levels of these new non-agriculture jobs to ensure sustained benefits post-transition. Our findings indicate that Rural Dibao predominantly facilitates the shift from agricultural to temporary non-agriculture jobs, suggesting there is room to improve the quality and stability of these jobs to support long-term poverty alleviation. Third, we explore the mechanisms through which Rural Dibao promotes non-agriculture employment. This paper examines both cash transfers and government employment assistance, providing a deeper understanding of how social assistance can enhance employment outcomes. It offers empirical evidence to inform the design of future social assistance programs, emphasizing the need for policymakers to consider whether to prioritize financial support or employment assistance when aiding low-income households. The study finds that employment information and job referrals are more effective at promoting non-agriculture employment than job search subsidies, suggesting that employment assistance should focus more on information dissemination and referrals.

The remaining sections of this paper are structured as follows: Section 2 offers a literature review and provides an overview of the background of Rural Dibao. Section 3 outlines the data sources and empirical methodologies employed in our analysis. Section 4 presents the key findings of the paper, accompanied by discussions on addressing endogeneity concerns and potential policy confounding resulting from targeting bias. In Section 5, we delve into the mechanisms of impact, exploring the effects of Rural Dibao on various forms of non-agriculture employment and examining its influence on job transitions. Finally, section 6 concludes the paper by presenting policy recommendations derived from our research findings.

Literature review

Earlier studies

Social assistance and employment

Social assistance is a form of minimum living protection provided by governments or other organizations to improve the living conditions of impoverished populations. It aims to meet their basic needs through various forms of support, including cash transfers, material aid, medical subsidies, and unemployment benefits. For recipients with the capacity to work, social assistance often includes both cash transfers and complementary employment services to facilitate their participation in the labor market. For example, Argentina’s Plan Jefes y Jefas program provided direct income support to unemployed families, significantly reducing aggregate unemployment (Galasso and Ravallion, 2004). Similarly, Zambia’s Child Grant program redirected labor from wage employment to non-agriculture enterprises and family farming, thereby reducing reliance on wage labor (Daidone et al. 2015).

However, social assistance can also lead to welfare dependency and have adverse effects on labor market participation. For instance, Indonesia’s large-scale unconditional cash transfer (UCT) programs, Bantuan Langsung Tunai (BLT) and Bantuan Langsung Sementara Masyarakat (BLSM) resulted in a 2% reduction in employment and an 8% decrease in job formality on average (Pritadrajati, 2023). French and Song, (2014) found that the United States Disability Insurance program reduced labor force participation among beneficiaries by 26%. Several factors contribute to these negative impacts. First, non-labor income can suppress labor supply, leading recipients to reduce their labor market participation or opt for lower-intensity work(Cesarini et al. 2017). Second, some social assistance programs are structured so that increased income results in reduced benefits, diminishing the incentive to work longer hours or seek higher-paying jobs, a marginal effect that weakens work motivation (Ravallion and Chen, 2015). Third, certain program designs may unintentionally create negative incentives, such as strict income or asset limits that encourage recipients to maintain low incomes to continue receiving benefits (Hoynes and Schanzenbach, 2012).

To mitigate welfare dependency, many countries have successfully integrated social assistance with employment support, particularly through conditional cash transfers (CCTs), which have shown promise in promoting employment. For instance, Argentina’s AUH program reduced the incidence of informal work in households with children, with no significant impact on households without children (Garganta and Gasparini, 2015). Brazil’s Bolsa Família program led to a shift from formal to informal labor sectors (de Brauw et al. 2015), while Uruguay’s PANES program resulted in decreased earnings among workers in the formal sector (Amarante et al. 2011).

Dibao and employment

The existing literature on the impact of China’s Dibao on labor market participation is inconclusive. Some studies suggest that Dibao may create disincentives for labor. For instance, Du and Park, (2007) found that poor households receiving urban Dibao exhibit significantly lower labor supply compared to non-recipients. Gao et al. (2015) analyzed the time-use patterns of heads of Rural Dibao households and observed that they spend more time on leisure and less on work, socializing, and studying. Similarly, Han, (2019) using panel data from the 2012 and 2014 China Family Panel Studies (CFPS) and employing the PSM-DID method, concluded that receiving Rural Dibao significantly reduces recipients’ employment intentions of the unemployed.

Conversely, some studies argue that Dibao can encourage employment. Yuan, (2013) contends that China’s urban Dibao positively impacts the labor market by reducing the unemployment rate. Han and Guo, (2012), through interviews with urban Dibao recipients, found that they generally demonstrate a strong willingness to seek employment and improve their living conditions. This may be due to the limited financial assistance provided by urban Dibao, which only covers basic living expenses and therefore does not discourage work but rather motivates recipients to pursue flexible job opportunities (Xu and Zhang, 2009). Furthermore, Ravallion and Chen, (2015) measured the benefit withdrawal rate (BWR) of urban Dibao and noted that although the BWR is theoretically 100%, in practice, it is only around 12–14%, insufficient to significantly undermine work incentives.

In summary, the effects of social assistance programs on employment vary by country and program design, with differences potentially arising from variations in program structure, eligibility criteria, and benefit levels. While there is no direct research on the relationship between Rural Dibao and non-agriculture employment, evidence from unconditional cash transfer programs in other countries and studies on urban Dibao provide valuable insights for this paper. The impact of Rural Dibao on non-agriculture employment should be examined considering the specific policy details and the actual circumstances of rural workers. Although the marginal tax rate for Rural Dibao has not been directly measured, the relatively low BWR for urban Dibao (12–14%) may suggest that Rural Dibao recipients are unlikely to rely solely on assistance for basic sustenance. Additionally, Zhang, (2014) argues that Chinese cultural values emphasize self-reliance, which may prevent Dibao recipients from falling into welfare dependency and instead encourage them to actively seek employment to escape poverty. Therefore, this paper hypothesizes that Rural Dibao has the potential to promote non-agriculture employment.

Rural Dibao in China

To ensure the basic well-being of low-income individuals, the Chinese government implemented the “Rural Minimum Living Security” in rural areas in 2007. This program targets families whose per capita household income falls below the minimum “Dibao standard” and who meet specific household property requirements. Eligibility is determined by local officials through a community-based targeting approach, which considers factors such as household financial status, fixed expenses (e.g., education and healthcare), and labor conditions (Han and Gao, 2020). As a result, individuals engaged in various occupations, including farmers, formal salaried workers, informal salaried workers, self-employed individuals, or those not economically active, may qualify for assistance under this program. However, eligible families do not always receive continuous cash transfers. Rural Dibao eligibility involves dynamic management, with periodic reviews leading to the exclusion of families who no longer meet the criteria for assistance. In 2022, Rural Dibao assisted 15,391,041 individuals, of whom 7,858,066 were able-bodied working-age adults—a significant group that may receive assistance due to temporary hardships. One of the critical objectives of Rural Dibao is to help these individuals overcome their difficulties. If the program can successfully promote the employment of these young and able-bodied beneficiaries, it would not only enhance their potential for self-reliance through labor but also unlock additional labor resources. This could help China address challenges related to population aging and the declining young and adult labor force.

The support measures provided by Rural Dibao for low-income households include cash transfers and ancillary assistance. The amount of assistance is determined through a “gap-filling” approach, where the actual aid provided is based on the difference between a household’s per capita income and the Dibao standard. The average Dibao standard has consistently increased, rising from CNY 840 annually (USD 129.9) in 2007 to CNY 6985.2 annually (USD 991.4) by the end of 2022. By 2022, the national average Dibao standard was equivalent to 42.77% of the average per capita consumption expenditure of rural residents, representing a significant level of cash support. In addition to cash transfers, Rural Dibao offers medical assistance and educational support for children from low-income households. Local officials also provide employment assistance tailored to local conditions, such as encouraging low-income individuals to engage in manual labor or odd jobs and offering job-seeking subsidies.

Methods and data

The methodology

The presence of selection bias, as highlighted by Gao et al. (2014), complicates the determination of the “true effect” of Rural Dibao due to systematic differences between welfare recipients and non-recipients. Mistargeting within Rural Dibao has resulted in non-poor households receiving cash transfers while some deserving poor individuals have been excluded (Golan et al. 2017; Kakwani et al. 2019). However, this mistargeting offers an opportunity to employ non-experimental designs to identify comparable non-recipients as a control group for Rural Dibao recipients. By using propensity score matching (PSM), we can identify non-recipients with similar observed characteristics to those of Rural Dibao recipients, thereby reducing the endogeneity associated with selection bias. We can then apply the difference-in-differences (DID) method to estimate the impacts of Rural Dibao on non-agriculture employment. This research strategy, known as PSM-DID, was initially proposed and applied by Heckman et al. (1997) in policy evaluation research.

The PSM-DID approach relies on using propensity score matching to identify control group observations that closely resemble those in the treatment group, based on observable characteristics. These matched samples are then used as a substitute for the original control group in the DID estimation. Unlike the traditional DID method, PSM-DID better satisfies the assumption of parallel trends between the treatment and control groups. Moreover, compared to PSM alone, PSM-DID not only accounts for observed characteristics but also partially mitigates the influence of unobserved heterogeneity, thereby enhancing the accuracy of policy impact estimates.

In this study, we implemented the PSM-DID method through a three-step process. The empirical analysis is conducted at the individual level. We begin by designating 2015 as the initial year and narrowing the study sample to able-bodied workers during that period. Workers who did not receive Rural Dibao in 2015 but received Rural Dibao in 2017 form the treatment group, while those who did not receive Rural Dibao in either year constitute the control group. The first step involves examining how the characteristics of the sample in the initial period (2015) can predict the risk of poverty and the likelihood of receiving Rural Dibao in the subsequent period (2017). The regression model is specified as Eq. (1):

Where \({D}_{i,17}\) is a dummy variable representing whether sample \(i\) received Rural Dibao in the year 2017 (received = 1; not received = 0). \({X}_{i,15}\) is a set of community-based multidimensional indicators that were used to identify the eligibility of Rural Dibao in the year 2015.

In the second step, we employed the propensity scores acquired in the first step to match each sample in the treatment group to similar samples in the control group. Specifically, we use kernel matching to determine the weights and adopt logit regression to calculate the propensity score. The results of the PSM are shown in Table A1 (Appendix).

In the third step, Eq. (2) demonstrates the average treatment effect generated by the PSM-DID method:

In Eq. (2), the treatment group is denoted as \(T\), and the control group obtained through matching is denoted as \(C\), \({Y}_{15}\) represents the outcome variable before the intervention, \({Y}_{17}\) represents the outcome variable after the intervention, and \(D\) represents whether the sample received Rural Dibao.

Measures

The independent variable in this study is Rural Dibao. Data on a household’s receipt of Rural Dibao is sourced from the CHFS questionnaire, specifically from the question regarding “types of government subsidies received by the interviewed household in the past year.” Based on the household head’s response, we construct a dummy variable: a value of 1 is assigned to households that received Rural Dibao in the past year, and a value of 0 is assigned to those that did not.

The dependent variable in this study is the non-agriculture employment of able-bodied Rural Dibao recipients, measured through three distinct variables: an indicator for non-agriculture employment (dummy variable), labor supply time in non-agriculture employment (continuous variable), and the count of jobs in non-agriculture employment (continuous variable). The CHFS survey categorizes primary employment types as follows: employed by others or units (with formal labor contracts); temporary work (without formal labor contracts, such as casual labor), farming, self-employment, freelance work, and other (e.g., volunteers). To create the non-agriculture employment variable, individuals employed by others or units, temporary work, self-employment freelance work, and others (volunteers) are assigned a value of 1, indicating participation in non-agriculture employment; otherwise, a value of 0 is assigned. The total annual working hours across various types of non-agriculture work are then aggregated, and the natural logarithm is applied to create the variable representing labor supply time in non-agriculture employment. For samples with zero working hours, the log transformation is performed by adding one to the working hour variable. The CHFS survey also collects information on the type and number of other jobs, from which we calculated the number of jobs in non-agriculture employment.

Following existing research, we control three categories of variables, including individual characteristics, human capital conditions, and family care factors. First, individual characteristic variables include age (in years), gender (1 for male, 0 for female), and marital status (1 for married, 0 for unmarried). Second, we include human capital condition variables, given the established significance of education level and health in influencing labor decisions and supply (Acemoglu and Johnson, 2007; Cheng et al. 2016; Stiglitz, 1975). Education level serves as a proxy of labor skills, directly impacting employment opportunities, job types, and wages (Arcidiacono et al. 2008; Stiglitz, 1975). Health status is particularly relevant for low-income households engaged in manual labor, where health conditions directly affect labor participation and, consequently, income levels (Cheng et al. 2016). Accordingly, we include the average education level of family members and the presence of severe illness as indicators. Third, we account for family care responsibilities, as childcare and eldercare significantly impact labor decisions and supply (Baker et al. 2008). Therefore, we control variables such as the underage dependency ratio and the elderly dependency ratio.

Data and descriptive

This study utilizes data from the China Household Finance Survey (CHFS), conducted nationwide by the Southwestern University of Finance and Economics in 2015 and 2017, which covers 29 provinces (including autonomous regions, municipalities directly under the central government) and 345 counties, and is nationally representative. It provides comprehensive information on the economic status, demographic characteristics, and labor employment of sampled households, making it suitable for analyzing the impact of Rural Dibao on non-agriculture employment (The CHFS collects household tracking data. For individuals who are not present at home during the survey, their employment information is provided by family members, which significantly mitigates sample attrition).

In our empirical analysis, we focus on rural individuals aged 16 to 65 who are capable of working. We exclude those within this age range who are students or who have lost the ability to work due to illness or disability. The study focuses on the working-age population and follows a three-step process to select the appropriate research samples. First, all individual samples are matched with their corresponding household and regional data. Next, to align with the study’s objective of exploring the labor of receiving Rural Dibao among able-bodied recipients, we exclude students, retirees, and individuals aged 16 to 65 who are unable to work. Finally, after removing samples with missing key variables, we refined the dataset into two balanced panel datasets, resulting in a total of 22,657 workers (45,314 observations).

Table 1 presents descriptive statistics for the variables. The analysis reveals that 59.8% of workers in the sample are engaged in the non-agriculture sector. The average logarithm of labor supply time for non-agriculture work per worker is 3.427, and the average number of non-agriculture jobs per worker is 0.653. The average age of workers in the sample is approximately 43 years, with males comprising 52.2%, married individuals accounting for 85.5%, and an average of 8.367 years of education. About 2.6% of the sample reported having a severe chronic illness. Additionally, the average dependency ratio for minors is 0.112, and the average dependency ratio for elderly individuals is 0.234, indicating that, on average, every 4 young people support 1 elderly person.

The impact of Rural Dibao on non-agriculture employment

Main result

Table 2 presents the estimated results of the association between Rural Dibao and non-agriculture employment. All models include year dummies, and the standard errors are clustered at the provincial level, as reported in parentheses. The results in columns (1) and (2) demonstrate a significant association between Rural Dibao and non-agriculture employment, indicating that recipients of Rural Dibao are more likely to engage in non-agriculture jobs. Specifically, the results in column (2) show that Rural Dibao increases the likelihood of recipients engaging in non-agricultural work by 10.9%. Compared to unconditional cash transfer programs in other developing countries, the marginal impact of China’s Rural Dibao on non-agricultural employment is higher than that in Rural Mexico, but lower than that in Vietnam and Zambia (Daidone et al. 2015; Nguyen and Tarp, 2023; Skoufias et al. 2008). Columns (3) and (4) reveal a significant relationship between Rural Dibao and time in non-agriculture employment. Specifically, the results in column (4) indicate that after receiving Rural Dibao, workers extend their time in non-agricultural labor by an average of 37.3%, equivalent to approximately 0.38 hours per week. In comparison to other developing countries, the marginal effect size of Rural Dibao on weekly hours of non-agricultural work in China is similar to that in Italy and Indonesia (Del Boca et al. 2021) (Due to the existing research primarily focusing on the relationship between CCT programs and non-agricultural working hours, studies examining the impact of unconditional cash transfer (UCT) programs on non-agricultural working hours are relatively scarce. Consequently, we were unable to obtain direct evidence of the impact of UCT programs on non-agricultural working hours in other countries. In comparing coefficients related to non-agricultural working hours, this study uses data from UCT programs. Overall, the impact of China’s Rural Dibao, a UCT program, on non-agricultural working hours is lower than that of CCT programs in other countries). Finally, columns (5) and (6) reveal a significant association between Rural Dibao and the number of non-agriculture jobs, with recipients of Rural Dibao on average experiencing an increase of 0.111 units in the number of non-agriculture jobs they hold. For control variables, the probability of engaging in non-agriculture employment increases with younger age, higher educational attainment, and better health status. Additionally, males are more likely to participate in non-agriculture work compared to females.

Robustness check

Omitted variable bias

Despite addressing endogeneity issues using the PSM-DID method and controlling for observable variables affecting non-agriculture employment, there remains a possibility of omitting unobservable factors, potentially leading to biased coefficient estimates. To determine whether the conclusions of this study are held after accounting for potential unobservable omitted variables, we employ the robustness check method proposed by Oster, (2019).

Oster, (2019) demonstrated that when unobservable variables may be omitted, the estimator \({\beta }^{* }={\beta }^{* }\left({R}_{\max },\delta \right)\) can be used to obtain a consistent estimate of the true coefficient. This estimator requires specifying two parameters: \(\delta\) and \({R}_{\max }\). Here, \(\delta\) represents the selection proportionality, which measures the strength of the relationship between the observable variables and the variable of interest relative to the relationship between unobservable omitted variables and the variable of interest.\(\,{R}_{\max }\) represents the maximum goodness-of-fit of the regression equation if the unobservable omitted variables were observed. Following Oster, (2019), we perform the robustness check using the following methods: (1) set \(\delta\) to −1, \({R}_{\max }\) to 1.3 times the current regression goodness-of-fit, If \({\beta }^{* }={\beta }^{* }\left({R}_{\max },\delta \right)\) falls within the 95% confidence interval of the estimated parameter, the results pass the robustness check; (2) Use the same method for determining \({R}_{\max }\) and calculate the value of \(\delta\) that makes \(\beta =0\). If \(\delta\) exceeds 1, the results pass the robustness check. The results presented in Panel A in Table 3 indicate that our findings are robust.

Mistargeting

As previously discussed, cash transfer programs often suffer from mistargeting, and the Rural Dibao is no exception (Gao et al. 2014). The mistargeting results in some non-poor individuals erroneously identified as Rural Dibao beneficiaries, potentially obscuring the program’s actual impact on the truly poor population. To address the bias that mistargeting may introduce into our estimation results, we adopt the method proposed by Chen et al. (2022) and employ the Alkire-Foster multidimensional poverty measurement framework to identify “eligible households” for Rural Dibao (see the Appendix for details). Specifically, we distinguish between two groups: multidimensionally poor workers who should receive Rural Dibao but do not (referred to as “eligible but not receiving” workers), and multidimensionally poor workers that should receive Rural Dibao and do (referred to as “eligible and receiving” workers). We then conducted an empirical analysis comparing these two groups of multidimensionally poor households. This approach allows us to assess the program’s effects on multidimensionally poor households and non-recipient households at \(k=30 \%\) of the multidimensional poverty threshold. The estimated results, presented in Panel B of Table 3, align with the main regression findings, indicating that even after correcting for mistargeting, the regression results in this study remain robust.

Inverse probability weighting

While PSM-DID has certain limitations, such as potential bias from misspecification of the first-stage model or inadequate selection of observable variables, we addressed these concerns using the approach proposed by Asfaw et al. (2014). In the FE-IPW model, inverse probability weights are calculated based on the matching model. We assigned weights to the control group equal to the reciprocal of its propensity score \({\rm{w}}=\frac{{\widehat{{\rm{P}}({\rm{Z}})}}}{1-\widehat{{\rm{P}}({\rm{Z}})}}\), while the weight for the treatment group was set to 1. These weights were then incorporated into the subsequent regression equation using a fixed-effect model. As noted by Hirano et al. (2003), this weighted method is “doubly robust,” ensuring consistent estimates as long as either the matching model or the outcome equation is correctly specified. Panel C of Table 3, demonstrates that the IPW-FE method produces consistent estimates with the main regression results.

Multiple hypothesis testing

Since hypothesis tests are conducted on each variable individually, this increases the chance of finding at least one significant result by chance alone, thus raising the Type I error rate. To correct for the potential issue arising from simultaneous inference, we employ multiple hypothesis testing. Following Benjamini and Hochberg, (1995), we adopt the concept of the false discovery rate (FDR) to conduct inference when conducting many tests. Intuitively, FDR allows researchers to tolerate a certain level of false discoveries across multiple tests, such that an FDR-adjusted q-value of 0.05 indicates that 5% of the significant results are expected to be false positives. Panel D of Table 3 presents standard errors based on both unadjusted p-values and FDR-adjusted q-values, accounting for the multiple hypotheses tested within a given family of outcomes. We focus on three key indexes and compute the FDR-adjusted q-value, which are reported in brackets. Results remain statistically significant for the indexes (non-agriculture employment, time in non-agriculture employment, number of non-agriculture jobs) in our main tables.

Additional analyze

The impact of Rural Dibao on types of non-agriculture employment

The main types of employment can be categorized into three groups: formal jobs, temporary jobs, and self-employment (Bosch and Campos-Vazquez, 2014). In this section, we explore which type of non-agriculture jobs have contributed to the increase in non-agriculture employment. One plausible explanation is that Rural Dibao recipients face difficulties in securing formal employment or engaging in self-employment. Although formal employment provides greater job security, most Rural Dibao beneficiaries are low-skilled workers who struggle to find opportunities in the formal sector (Cao and Chen, 2016). While self-employment can potentially offer higher income, it requires more startup capital or assets as collateral. The cash assistance provided by Rural Dibao is likely too limited (Ravallion and Chen, 2015), to support workers in pursuing self-employment. Furthermore, low-income households often lack sufficient assets to use as collateral (Blank and Barr, 2009), making self-employment less accessible for them.

Table 4 presents the impact of Rural Dibao on the primary types of non-agriculture work. The regression results in column (1) and column (2) reveal a significant positive correlation between Rural Dibao and temporary work, as well as the labor supply time associated with temporary work. Conversely, the findings in column (3) and column (4) suggest that Rural Dibao does not significantly impact self-employment. For the three primary types of non-agricultural employment, our findings indicate that the increase in non-agricultural employment among recipients is primarily driven by a rise in temporary work. The formal sector offers better job security, and self-employment tends to provide higher hourly income compared to wage employment in China (Huang and Cao, 2022). So, why do workers choose temporary work rather than formal work or self-employment? One explanation is that Rural Dibao recipients find it difficult to obtain opportunities for formal employment or self-employment. Formal employment, while providing better security, is less accessible to low-skilled Rural Dibao recipients (Cao and Chen, 2016). On the other hand, self-employment, despite its potential for higher income, requires startup capital or collateral. The cash provided by Rural Dibao is likely to be too low (Ravallion and Chen, 2015), which the modest cash provided by Rural Dibao is unlikely to cover. Additionally, low-income households typically lack the necessary assets for collateral (Blank and Barr, 2009), further limiting their ability to pursue self-employment.

The impact of Rural Dibao on job transitions

The previous section demonstrated that Rural Dibao promotes temporary work. The question now is whether the increase in temporary work stems from previously unemployed workers or from transitions between different employment sectors.

As previously mentioned, if Rural Dibao makes temporary work more attractive, we might expect to see an increase in individuals engaging in temporary work alongside a decrease in those employed in other sectors. To investigate this, we examine transitions from non-employment to temporary work, from formal work to temporary work, from self-employment to temporary work, and from agricultural to temporary work, assessing the changes in the probability of these transitions. Following the approach of Azuara and Marinescu, (2013), these transitions are encoded as changes in employment status from 2015 to 2017. For instance, if an individual was unemployed in 2015 and engaged in temporary work in 2017, the variable “transition from unemployed to temporary work” takes the value 1; otherwise, it takes the value 0. Similarly, if an individual was formally employed in 2015 and engaged in temporary work in 2017, the variable “ transition from formal to temporary work “ takes the value 1; otherwise, it takes the value 0, and so forth. In this model, the explanatory variable represents changes in Rural Dibao status for households from 2015 to 2017, while the dependent variable captures changes in employment status over the same period.

Table 5 reports the impact of Rural Dibao on transitions between different types of employment. The results in column (4) show a positive correlation between Rural Dibao and the transition from agricultural to temporary work, with the effect being statistically significant at the 1% level. This finding suggests that Rural Dibao facilitates the transition of workers from agricultural to temporary work. However, the results in columns (1) to (3) suggest that Rural Dibao does not significantly influence transitions from unemployment to temporary work or transitions from self-employment or formal worker to temporary work. This implies that the increase in temporary work among Rural Dibao recipients is primarily driven by their transition from the agricultural sector to temporary work.

Possible mechanisms

In this section, we analyze the mechanisms through which Rural Dibao influences non-agriculture employment by examining three forms of government-sponsored employment assistance. Beyond cash transfers, Rural Dibao offers various supplementary benefits, including government-sponsored employment assistance. This paper categorizes government-sponsored employment assistance into three primary types based on CHFS: technical guidance or training, employment information, job recommendations, and job-seeking cash subsidies. Using a regression approach, we apply the Difference-in-Differences-in-Differences (DDD) technique, creating interaction terms between Rural Dibao and each form of assistance. Table 6 presents the results, with column (1) reporting on the mediating effect of technical guidance, where no statistically significant evidence is found. In contrast, column (2) shows a positive and statistically significant mediating effect for employment information and job recommendations, suggesting that these forms of assistance effectively promote non-agriculture employment among Rural Dibao recipients. However, in column (3), the coefficient for the interaction term with job-seeking cash subsidies alone is significantly negative, indicating that exclusive reliance on job-seeking cash subsidies does not encourage non-agriculture employment and may even produce counterproductive outcomes.

Heterogeneity analysis

According to policy, Rural Dibao provides gap-filling cash transfers based on the difference between a household’s per capita income and the Dibao standard. As a result, the amount of cash transfer received by beneficiaries can vary significantly across different households. To address this variation, it is necessary to explore how different levels of cash transfer impact non-agriculture employment. We categorize individuals based on the amount of cash they receive, those receiving cash below the median (¥3,250 per year) are classified as receiving lower levels (N = 309), while those receiving cash above the median are classified as receiving higher levels (N = 318). Methodologically, following the approaches of Gao et al. (2014) and Han, (2019), we use an ordered Probit model to estimate the probability of each sample, considering three scenarios: the absence of Rural Dibao, receiving a lower cash transfer, and receiving a higher cash transfer. We then matched non-Rural Dibao samples with similar characteristics to those receiving lower and higher cash transfers, respectively. Finally, using the matched treatment and control groups, we apply the Difference-in-Differences (DID) method to identify the respective policy effects.

Table 7 presents the results. Columns (1) and (2) report the impact of Rural Dibao on samples receiving lower cash transfers, while columns (3) and (4) correspond to those receiving higher cash transfers. The comparison reveals that lower levels of cash transfer have a significant positive effect on non-agriculture employment, whereas higher levels of cash transfer significantly increase the number of non-agriculture jobs but may also create negative employment incentives. Due to the income effect of the transfer, adult labor supply decisions may vary at the intensive margin (Kabeer et al. 2012). As non-labor income, the more cash received from Rural Dibao, the stronger the disincentive for labor participation (Han, 2019).

Conclusions and implications

This study represents the first empirical investigation into the relationship between Rural Dibao and non-agriculture employment. Using data from the 2015 and 2017 CHFS, we employ the PSM-DID method to identify the causal impact of Rural Dibao on non-agriculture employment. The research findings indicate that Rural Dibao significantly increased the likelihood of recipients’ participation in non-agriculture employment, extended their labor supply time in non-agriculture work, and increased the total number of non-agriculture jobs. This increase is largely attributed to a rise in temporary work. Notably, the likelihood of temporary employment is predominantly driven by Rural Dibao’s role in facilitating the transition from agricultural work to temporary employment, rather than from unemployment. Mechanism analysis results indicate that the enhancement in non-agriculture employment among Rural Dibao recipients is chiefly due to government-provided employment information and job recommendations, rather than direct financial transfers or job-seeking cash subsidies.

The conclusions drawn from this study carry significant policy implications for enhancing labor force participation and fostering self-sufficiency among Rural Dibao recipients. Firstly, we recommend developing targeted employment assistance programs specifically designed for Rural Dibao recipients with work capabilities. Such programs should aim to improve the effectiveness of labor market integration for those able to work, facilitating their transition into non-agricultural employment as a means to achieve greater self-sufficiency. Secondly, our research indicates that the increase in non-agriculture employment among Rural Dibao recipients primarily results from agricultural work to temporary non-agriculture jobs. To maximize the impact of policy interventions, it is essential to focus on improving the stability and income levels of these non-agriculture positions, ensuring that the benefits of labor market participation are sustained over time. Thirdly, evidence suggests that employment information and job referrals are more effective in promoting non-agriculture employment than offering job-seeking subsidies. We recommend enhancing coordination between Rural Dibao and employment support services, advocating for more targeted employment assistance measures. Governmental agencies and policymakers could prioritize the provision of comprehensive job information and job recommendations, reducing reliance on mere job-seeking cash subsidies, and thereby enhancing the efficiency of Rural Dibao. Finally, our heterogeneity analysis reveals that workers receiving higher cash transfers may be disinclined to pursue non-agriculture employment due to concerns about losing their support status. To mitigate these disincentives, future designs of conditional cash transfer programs should incorporate requirements for recipients capable of working to seek employment in exchange for continued support.

Despite its contributions and policy implications, this study has several limitations that should be acknowledged. Firstly, due to the lack of data on workers’ attitudes towards self-reliance, we cannot evaluate whether the impact of Rural Dibao on non-agriculture employment is influenced by the traditional Chinese cultural emphasis on self-reliance. Future research could investigate this potential mechanism in greater detail. Secondly, we employ the PSM-DID method to estimate the potential effects of Rural Dibao with greater precision than alternative approaches. However, it is important to recognize the inherent limitations of treating panel data as cross-sectional for matching purposes, which may introduce “self-matching” biases (Böckerman and Ilmakunnas, 2009). While this approach can produce consistent estimates (Xie et al. 2021), it restricts the capacity to provide direct policy recommendations. Therefore, although our findings are consistent with the existing literature and have passed robustness checks, they should be interpreted with caution. As Barrientos, (2012) highlights, many developing and transitioning economies lack the longitudinal datasets necessary to rigorously evaluate the causal effects of welfare programs. As Rural Dibao expands and data collection systems continue to improve, future research could capitalize on high-quality longitudinal data to provide a more comprehensive assessment of its impacts.

Data availability

The data used in this paper are sourced from the China Household Finance Survey (CHFS). Due to license restrictions, users are prohibited from publishing or disclosing the data in any form, and as such, we are unable to release or publicly share this data. However, researchers may access the data upon reasonable request and with CHFS authorization. The raw CHFS data are available at the following link: https://chfser.swufe.edu.cn/datas/Products/Datas/DataList. For inquiries, please contact: contactus@chfs.cn. Researchers granted access to the CHFS raw data can filter it according to the procedures outlined in the “Methods and data” section of this paper. For any questions regarding the data used in this paper, please contact the authors directly.

References

Acemoglu D, Johnson S (2007) Disease and Development: The Effect of Life Expectancy on Economic Growth. J Polit Economy 115:925–985. https://doi.org/10.3386/w12269

Amarante V, Manacorda M, Vigorito A, Zerpa M (2011) Social Assistance and Labor Market Outcomes: Evidence from the Uruguayan PANES. IDB. https://socialdigital.iadb.org/en/node/11018

Arcidiacono P, Bayer P, Hizmo A (2008) Beyond Signaling and Human Capital: Education and the Revelation of Ability. Amer Econ Rev 2:76–104. https://doi.org/10.1257/app.2.4.76

Asfaw S, Davis B, Dewbre J et al. (2014) Cash Transfer Programme, Productive Activities and Labour Supply: Evidence from a Randomised Experiment in Kenya. J Dev Stud 50(8):1172–1196. https://doi.org/10.1080/00220388.2014.919383

Azuara O, Marinescu I (2013) Informality and the expansion of social protection programs: Evidence from Mexico. J Health Econ 32(5):938–950. https://doi.org/10.1016/j.jhealeco.2013.07.004

Baker M, Gruber J, Milligan K (2008) Universal Child Care, Maternal Labor Supply, and Family Well‐Being. J Polit Economy 116(4):709–745. https://doi.org/10.1086/591908

Barrientos A (2012) Social Transfers and Growth: What Do We Know? What Do We Need to Find Out? World Devel 40(1):11–20. https://doi.org/10.1016/j.worlddev.2011.05.012

Benjamini Y, Hochberg Y (1995) Controlling The False Discovery Rate - A Practical And Powerful Approach To Multiple Testing. J Royal Statist Soc 57:289–300. https://doi.org/10.2307/2346101

Blank RM, Barr MS (2009) Insufficient Funds Savings, Assets, Credit, and Banking Among Low-Income Households. Russell Sage Foundation,New York

Böckerman P, Ilmakunnas P (2009) Unemployment and self‐assessed health: evidence from panel data. Health Econ 18(2):161–179. https://doi.org/10.1002/hec.1361

Bosch M, Campos-Vazquez RM (2014) The trade-offs of welfare policies in labor markets with informal jobs: The case of the “Seguro Popular” program in Mexico. Am Econ. J Econ Policy 6(4):71–99. https://doi.org/10.1257/pol.6.4.71

Boschman S, Maas I, Vrooman JC, Kristiansen MH (2021) From social assistance to self-sufficiency: Low income work as a stepping stone. Eur Sociol Rev 37(5):766–782. https://doi.org/10.1093/esr/jcab003

Cao Y, Chen C (2016) From the “subsistence allowance” standard to the “family operation standard” - the reform and design of the social assistance system. Mod Econ Res 4:30–34. https://doi.org/10.13891/j.cnki.mer.2016.04.006

Cesarini D, Lindqvist E, Notowidigdo MJ, Östling R (2017) The effect of wealth on individual and household labor supply: evidence from Swedish lotteries. Amer Econ Rev 107(12):3917–3946. https://doi.org/10.1257/aer.20151589

Chen D, Zheng X, Fang X (2022) The Effect of Rural Minimum Living Standard Guarantee on Household Consumption for Poor Families. Chin J Popul Sci (5): 108-125+128

Cheng M, Gai Q, Jin Y, Shi Q (2016) Focusing on Human Capital Improvement and Income Growth. J Eco Res 51(01): 168-181+192

Daidone S, Davis B, Dewbre J et al. (2015) Zambia’s Child Grant Programme: 24-month impact report on productive activities and labour allocation. FAO. http://www.fao.org/3/a-i3692e.pdf

de Brauw A, Gilligan DO, Hoddinott J, Roy S (2015) Bolsa Família and Household Labor Supply. Econ Devel Cult Change 63(3):423–457. https://doi.org/10.1086/680092

Del Boca D, Pronzato C, Sorrenti G (2021) Conditional cash transfer programs and household labor supply. Europ Econ Rev 136:103755. https://doi.org/10.1016/j.euroecorev.2021.103755

Du Y, Park A (2007) Urban Poverty in China:Social Assistance and Its Effects. J Eco Res 12:24–33

French E, Song J (2014) The effect of disability insurance receipt on labor supply. Am Econ J Econ Policy 6(2):291–337. https://doi.org/10.1257/pol.6.2.291

Galasso E, Ravallion M (2004) Social protection in a crisis: Argentina’s Plan Jefes y Jefas. World Bank Econ Rev 18(3):367–399. https://doi.org/10.1093/wber/lhh035

Gao Q, Wu S, Zhai F (2015) Welfare Participation and Time Use in China. Social Indicators Research 124(3):863–887. https://doi.org/10.1007/s11205-014-0826-0

Gao Q, Zhai F, Yang S, Li S (2014) Does Welfare Enable Family Expenditures on Human Capital? Evidence from China. World Devel 64:219–231. https://doi.org/10.1016/j.worlddev.2014.06.003

Garganta S, Gasparini L (2015) The impact of a social program on labor informality: The case of AUH in Argentina. J Devel Econ 115:99–110. https://doi.org/10.1016/j.jdeveco.2015.02.004

Golan J, Sicular T, Umapathi N (2017) Unconditional Cash Transfers in China: Who Benefits from the Rural Minimum Living Standard Guarantee (Dibao) Program? World Devel 93:316–336. https://doi.org/10.1016/j.worlddev.2016.12.011

Han H (2019) Does Rural Subsistence Allowance Participation Induce Work Disincentives? An Empirical Test Based on CFPS Panel Data. J Popul 41(6):89–102. https://doi.org/10.16405/j.cnki.1004-129X.2019.06.008

Han H, Gao Q (2020) Does Welfare Participation Improve Life Satisfaction? Evidence from Panel Data in Rural China. J Happiness Stud 21(5):1795–1822. https://doi.org/10.1007/s10902-019-00157-z

Han K, Guo Y (2012) The Myth of Welfare Dependency in China:An empirical study on China’s Urban Minimum Living-hood Guarantee Scheme. Sociology Stud 27(02):149–167. https://doi.org/10.19934/j.cnki.shxyj.2012.02.008. 244-245

Heckman JJ, Ichimura H, Todd PE (1997) Matching as an econometric evaluation estimator: Evidence from evaluating a job training programme. Rev Econ Stud 64(4):605–654. https://doi.org/10.2307/2971733

Hirano K, Imbens GW, Ridder G (2003) Efficient estimation of average treatment effects using the estimated propensity score. Econometrica 71(4):1161–1189. https://doi.org/10.2139/ssrn.324940

Hoynes HW, Schanzenbach DW (2012) Work incentives and the food stamp program. J Public Econ 96(1-2):151–162. https://doi.org/10.1016/j.jpubeco.2011.08.006

Huang W, Cao Y (2022) Improvement of Regular Targeted Poverty-alleviation Policy: A Perspective of Reducing Welfare Dependency. J Eco Res 57(4):172–190

Kabeer N, Piza C, Taylor L (2012) What are the economic impacts of conditional cash transfer programmes? A systematic review of the evidence. EPPI Centre S S R U, Institute of Education, University of London. https://assets.publishing.service.gov.uk/media/57a08a6840f0b649740005a4/CCTprogrammes2012Kabeer.pdf

Kakwani N, Li S, Wang X, Zhu M (2019) Evaluating the effectiveness of the rural minimum living standard guarantee (Dibao) program in China. China Econ Rev 53:1–14. https://doi.org/10.1016/j.chieco.2018.07.010

Nguyen CV, Tarp F (2023) Cash Transfers and Labor Supply: New Evidence on Impacts and Mechanisms. Development Economics Research Group Working Paper Series

Oster E (2019) Unobservable selection and coefficient stability: Theory and evidence. J Bus Econ Stat 37(2):187–204. https://doi.org/10.1080/07350015.2016.1227711

Pritadrajati D (2023) Does social assistance disincentivise employment, job formality, and mobility? Lab Econ 84:102398. https://doi.org/10.1016/j.labeco.2023.102398

Ravallion M, Chen S (2015) Benefit incidence with incentive effects, measurement errors and latent heterogeneity: A case study for China. J Public Econ 128:124–132. https://doi.org/10.1016/j.jpubeco.2015.04.004

Shi X, Liu X, Nuetah A, Xin X (2010) Determinants of household income mobility in rural China. China World Econ 18(2):41–59. https://doi.org/10.1111/j.1749-124X.2010.01188.x

Skoufias E, Unar M, González-Cossío T (2008) The impacts of cash and in-kind transfers on consumption and labor supply: Experimental evidence from rural Mexico. World Bank Policy Research Working Paper (4778)

Stiglitz JE (1975) The Theory of “Screening,” Education, and the Distribution of Income. Amer Econ Rev 65(3):283–300. https://doi.org/10.1257/pol.6.4.71

Xie S, Fan P, Wan Y (2021) Improvement and Application of Classical PSM-DID Model. Stat Res 38(02):146–160. https://doi.org/10.19343/j.cnki.11-1302/c.2021.02.011

Xu Y, Zhang X (2009) Discussion on Several Issues of China’s Urban and Rural Minimum Living Security System. Dongyue Tribune 2:32–37

Yuan G (2013) Analysis on the Minimum Living Security’s Impact to the Labor Market in China. Chin J Popul Resour 23(S2):480–483

Zhang H (2014) Assistance,Employment and Welfare Dependence - Discussion on the Worries about “Raising Idler” by Minimum Living Standard Guarantee System in China. J Lanzhou Academic 05:163–169

Acknowledgements

This work was supported by the National Social Science Fund of China [21AJL015; 24CRK029]. Guizhou University Introduces Talents Scientific Research Project [2023008]. Guizhou University 2024 Annual Humanities and Social Sciences Project [GDYB2024011]. Humanities and Social Sciences Research Project in Guizhou Province’s Universities [2024RW277].

Author information

Authors and Affiliations

Contributions

Dian Chen: Conceptualization, Methodology, Formal analysis and Writing—Original Draft. Xiangming Fang: Conceptualization, Methodology, Project administration and Writing—Review and Editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

The submitted work is based on open-sources data. No ethical approval was obtained.

Informed consent

The submitted work is based on open-sources data: China Household Finance Survey. Informed consent was obtained by China Household Finance Survey.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Chen, D., Fang, X. Social assistance and non-agriculture employment in rural China: evidence from the Rural Minimum Living Security (Rural Dibao). Humanit Soc Sci Commun 12, 120 (2025). https://doi.org/10.1057/s41599-025-04443-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-04443-5