Abstract

Resource-based cities (RBCs) face persistent challenges from the “resource curse,” making industrial transition imperative for sustainable development. While the necessity of this transition is clear, the optimal pathways for implementation remain debated. This study investigates how external factor flows drive national value chain (NVC) upgrading in RBCs across different development stages. This study uses a city-level multiregional input-output table and a dynamic panel model to analyse how technology, capital, and labor flows affect the NVC positions of resource- and nonresource-based sectors across 80 Chinese RBCs. Our findings reveal that external technology and capital inflows enhance overall NVC positions, with capital specifically boosting resource-based sectors and both factors elevating nonresource-based sectors. The effectiveness of these factors varies significantly across urban development periods: during the growth period, capital and skilled labor drive respective upgrades in resource- and nonresource-based sectors. During the maturity period, technology inhibits the upgrading, with capital only restraining the upgrading of nonresource-based sectors and skilled labor upgrading nonresource-based sectors. During the depletion period, only capital drives the upgrading of resource-based sectors. In the regeneration period, technology drives the upgrading of both resource- and nonresource-based sectors, whereas capital and skilled labor drive the upgrading of nonresource- and resource-based sectors, respectively. These findings offer strategic guidance for RBC policymakers to align external engagement strategies with specific development stages, advancing sustainable development goals.

Similar content being viewed by others

Introduction

The global push toward sustainable development, driven by ESG (Environmental, Social, and Governance) imperatives and climate action goals, has placed unprecedented emphasis on value chain transformation (Yang et al. 2024). Value chain upgrading has emerged as a critical strategy for enhancing production efficiency and environmental sustainability, particularly as organizations worldwide align with the Sustainable Development Goals (SDGs) and net-zero commitments (Işık et al. 2024b). This upgrading encompasses technological advancement, production efficiency optimization, and the development of sustainable business models that meet increasingly stringent ESG criteria. National policies increasingly reflect this integrated approach to economic and environmental sustainability. China’s “New Quality Productivity” policy (Liu and He 2024) and Europe’s “Smart Specialization” policy (Balland et al. 2019) exemplify how governments are incentivizing value chain innovations that align with global sustainability frameworks (Balsa-Barreiro et al. 2019). In value chain analysis, the term “upgrading” emphasizes the ways in which producers in a city or region can “move up the value chain” (Gereffi 1999). The process of value chain upgrading refers to creating higher product added value and greater production efficiency on the basis of existing industries through revolutionary technological breakthroughs, innovative allocation of production factors, and deep industrial transition and upgrading (Ponte et al. 2014). In the face of global climate change and mounting environmental pressures, value chain upgrading has emerged as a vital strategy for China to combat climate change and drive high-quality economic development. This is particularly evident in resource-based cities (RBCs), which focus primarily on extracting and processing natural resources. The development of these cities heavily relies on resource-intensive industries (such as mining and energy-intensive industries), which are typically characterized by high energy consumption, pollution, and emissions. These industries have a severe impact on China’s carbon reduction progress and often fall short of stringent ESG metrics (Li et al. 2022; Yu et al. 2019; Işık et al. 2024c).

RBCs have long faced the dual challenges of resource dependence and environmental pollution. Resource-intensive industries typically generate low added value and are positioned at the lower end of the value chain, resulting in a “value chain lock-in effect” (Mao et al. 2021). For example, in Shanxi Province, coal mining and processing account for approximately half of the province’s total assets, whereas oil and gas extraction and the chemical industry account for only 5% of the province’s total assets. Under the policy framework targeting traditional industries with high energy consumption and emissions, these industries face severe adjustment pressures, leading to the gradual elimination of outdated production capacity. The carbon neutrality strategy not only imposes restrictions on carbon emissions but also promotes value chain upgrading in RBCs through constrained development, thereby increasing industry technology levels and product added value (Jia et al. 2021).

The dissolution of “self-contained entities” and the emergence of “space of flows” provide key opportunities for value chain upgrading in RBCs. These changes are evident in the gradual elimination of market segmentation, the improved allocation of production factors across cities, the reduction of cross-regional business costs, and the enhanced enthusiasm of enterprises for engaging in cross-regional divisions of labor and cooperation (Bathelt et al. 2004; Liu et al. 2024). By addressing the challenges of production factor shortages associated with value chain upgrading, these developments contribute to strengthening the sustainable development capacity of local economies. Overall, upgrading the value chains of RBCs is not only a critical pathway for achieving dual carbon goals but also an essential strategy for promoting high-quality economic development.

The existing research on the transition of RBCs can be divided into two main streams. On the one hand, studies explore the impact of local factors on the transition of RBCs. These studies focus primarily on perspectives such as policy (Li et al. 2022a; Zhang et al. 2022a), external investment (Sun and Anwar 2019), and the industrial structure (Goch 2002; Mathews and Tan 2011). Among these, the perspective of industrial structure upgrading within cities is a common focus in existing research. For example, Bellandi et al. (2021) and Xie et al. (2020) explored the impact of “learning by doing” and “independent innovation” on the industrial structural transition in resource-based regions. Zeng et al. (2016) and Zhang et al. (2018) reported that educational investment and foreign direct investment (FDI) promote the industrial transition of resource-depleted cities. Li et al. (2021) and Andreoni and Tregenna (2020) discovered that a policy mix is an important tool for achieving industrial upgrading, in which policies promote the industrial transition of RBCs through economic diversification (He et al. 2017). Most of the abovementioned studies address only the issue of industrial structure changes.

On the other hand, research has also examined the impact of external factors on the transition of RBCs. These studies focus primarily on the influence of external technologies. Using data from 16 interviews with Norwegian mineral enterprises, Ghassim explored the impact of external knowledge on the sustainable transition of enterprises (Ghassim and Foss 2021). Liu et al. (2019) examined the mechanism by which external technology affects local innovation performance. Among the relatively few papers that focus on external forces, however, most consider only a single factor, primarily external knowledge and technology (Wang and Lin 2018). However, relying on a single factor is inherently insufficient, as the influence exerted by an individual factor is limited. Multifactor synergy better reflects the true external forces. As Kastelli defines absorptive capacity as a fundamental organizational capability, the collaboration of patents, talent, and investments is crucial for enhancing the application of technology and innovation performance. This indicates that when exploring the impact of external factors on urban transition, multiple factors must be considered (Kastelli et al. 2022). Furthermore, different factors play different roles in various industries at different stages of urban development (Fuentes and Mies 2021). Relying solely on one external factor makes it difficult to clarify how external factors influence urban transition. Therefore, the synergy mechanism of external factors must be a focal point in understanding their impact on transition.

In sum, existing research on the driving mechanisms of RBCs transitions has primarily focused on the singular perspective of industrial structure adjustment, with limited incorporation of geographical contexts and value chain upgrading into the analytical framework (Waggoner and Ausubel 2002; York et al. 2003). Value chain upgrading represents a crucial dimension for measuring industrial competitiveness, offering clearer insights into technological advancement and industrial maturity compared to mere structural adjustments (Bernhardt and Pollak 2016). Current studies largely equate industrial structure adjustment with transition. However, changes in industrial structure merely reflect the redistribution of proportions across different sectors, failing to capture how technological progress, industrial competitiveness, or the mechanisms of domestic value chain upgrading contribute to these changes. In particular, they do not explain how external factors influence value chain upgrading through different pathways. This issue is especially prominent in resource-based cities that have experienced long-term isolated development, leading to low-end value chain lock-in. For instance, many cities in Northeast China remain trapped in low-end value chains due to industrial lock-in, struggling to achieve high-value-added industrial upgrading (Wu and Kung 2020). Further analysis reveals that the pathways and effectiveness of value chain upgrading largely depend on geographical contexts. Different industry types determine regional resource endowments and economic foundations, while various stages of urban development influence both resource dependence and transformation challenges in resource-based cities (Zhang et al. 2022b). For example, early-stage resource-based cities typically rely on primary resource extraction, characterized by low technological levels and significant vulnerability to external environmental influences. In contrast, mature cities like Pittsburgh (USA), Ruhr (German), and Lorraine (France) have achieved diversified transformation through the introduction of external capital and technology. Therefore, geographical characteristics not only affect the mechanisms of external factors but also directly determine the feasibility and pathways of value chain upgrading.

To bridge these gaps, this study investigates the mechanisms through which external factors drive value chain upgrading in RBCs, making both theoretical and empirical contributions to the field. Theoretically, it develops an innovative framework that examines how factor flows—including capital, technology, and labor—influence value chain upgrading in RBCs, while considering the crucial role of geographical contexts such as industry types and urban development stages. The empirical contribution stems from a comprehensive analysis utilizing diverse data sources, including prefecture-level city input-output tables, population migration statistics, sector-specific new investment data, and patent information. Through econometric modeling, this study explores not only the direct driving effects of factor flows on value chain upgrading but also examines the heterogeneous impacts arising from variations in industry types and urban development stages, thereby providing a nuanced understanding of these relationships within different contextual settings.

The remainder of this paper is organized as follows. Section “Theoretical framework” describes the theoretical framework and hypotheses. Section “Data and methodology” provided details of the research methods and data. Section “Results” includes the description of factor flow patterns and econometric results. Section “Value chain upgrading mechanisms” provides mechanisms and policy implications. Finally, Section “Conclusions” presents the conclusions and limitations.

Theoretical framework

RBCs are often regarded as self-contained entities and frequently face challenges due to path dependence stemming from their abundant resource endowments (Boschma 2005; Neffke et al. 2011; Zhu et al. 2017). This results in local industries being unable to engage in more complex or higher-value activities (Hidalgo et al. 2007). Two principal avenues exist for RBCs to enhance their value chains. The first involves upgrading existing sectors and extending production chains that leverage local resources. The second focuses on developing unrelated high-tech sectors aimed at achieving path-breaking innovation (He et al. 2017). In both cases, importing production factors from other regions is necessary.

In the context of “the space of flows”, it is evident that establishing extraregional linkages will inevitably result in the influx of novel resources, including the capital, technologies and skilled labor, for RBCs (Xiao et al. 2024). This will then foster value chain upgrading through the following two types of effects. (1) One is the direct effects. Production factors imported from other regions can be directly incorporated into the production process to compensate for the deficiencies in RBCs, thereby facilitating the upgrading of established industries. (2) The other is the spillover effects. The introduction of production factors may prompt regions to branch out into unrelated high-tech industries (Zhu et al. 2017). The interaction between extraregional direct investments and local traditional resource-based sectors has led to the recombination of old ideas (e.g., through face-to-face contacts, expanding the knowledge base, and sharing the labor pool), thereby facilitating innovation (Bathelt et al. 2004). This process aligns with the SDGs, ESG criteria (Işık et al. 2024d), and the global climate agenda (Balsa-Barreiro et al. 2023). Specifically, the rationalization of value chains supports the integration of local resources to lower production costs, promote resource recycling, and implement low-carbon technologies that foster the development of green industries (Liu et al. 2018).

“The shrinkage of a certain place, embedded in local, regional, national and global contexts, is a result of diverse causes and has different shrinking trajectories due to place-specific background and features” (He et al. 2017). Geographical context plays a significant role in determining the factors affecting regional innovation (Lao et al. 2021; Xiao et al. 2024). In this context, the impact of extraregional linkages on value chain upgrading in RBCs is complex, with varying effects according to different production factors, industries, and even stages of the urban life cycle. This complexity, which has been overlooked by previous studies, forms the foundation of our hypotheses as outlined below. To address this complexity, a theoretical framework has been developed that is applicable to heterogeneous and detailed contexts (See Fig. 1).

Previous studies have highlighted capital, technology, and labor as key drivers of industrial development and value chain upgrading. The impact of factor flows on value chain positions depends on the factor type: capital drives industrial expansion, technology fosters innovation, and labor facilitates the exchange of knowledge and skills. Specifically, capital is often seen as the engine of industrial expansion, enabling cities to invest in new ventures and scale up existing industries. Technological factors foster innovation, enhance productivity and efficiency, and advance the technological sophistication of industries, particularly in sectors requiring high skill levels and technological integration (Işık et al. 2024a). Labor, particularly skilled labor, plays an essential role in the knowledge and skills exchange that strengthens industries and facilitates the creation of new industries. The impact of production factor flows on the value chain position of RBCs varies depending on the type of factor being absorbed—capital, technology, or skilled labor (Alonso 2013). In this context, the current study proposed the first hypothesis as follows:

Hypothesis 1: Absorbing production factors affects the value chain position of RBCs, the effects of which vary according to different factor types.

Different industries have varying dependencies on specific types of production factors. Specifically, industries with different technological, labor, and capital requirements will absorb and integrate these factors into their value chains differently, leading to varying outcomes in value chain upgrading. For example, technology-intensive industries, such as electronics or high-tech manufacturing, will benefit more from the inflow of technological knowledge and innovations, which can improve their competitiveness in global value chains (Xiao et al. 2024). Conversely, labor-intensive industries, such as textiles or agriculture, may see more significant shifts in value chain positioning due to (skilled) labor mobility, as an influx of labor can increase production capacity and lower costs. Thus, industries with differing factor requirements will experience distinct patterns of value chain evolution depending on the type and flow of factors (Dai et al. 2018). In this context, the current study proposed the second hypothesis as follows:

Hypothesis 2: The impact of factor flows on value chain position differs significantly across industries.

The life cycle of an RBC influences the way external factors such as capital, technology, and labor interact with the urban economy. RBCs pass through distinct stages—growth, maturity, depletion, and regeneration—that affect the flow of production factors and their impact on value chains. During the early growth period, RBCs tend to have limited external linkages and low factor flows, which may restrict their ability to upgrade their value chains. However, as these cities mature, factor flows, especially in terms of technology and capital, increase, enabling more significant value chain repositioning and industrial upgrading (Işık et al. 2024e). In the depletion phase, RBCs often experience a reduction in factor flows as resource-based sectors shrink, leading to stagnation or even a reversal in value chain position. Finally, during the regeneration phase, as RBCs diversify their economies and develop new industries, factor flows intensify, resulting in economic revitalization and enhanced value chain positions. This cyclical pattern suggests that the impact of factor flows on value chain position is closely tied to the urban life cycle and its various phases (Yu et al. 2019). Details of which are discussed in sub-section ‘Patterns of factor flow evolution’. In this context, the current study proposed the third hypothesis as follows:

Hypothesis 3: The impact of factor flows on value chain position varies significantly at different periods of urban development.

By integrating these hypotheses with a detailed analysis of factor flows in different geographical contexts, such as each production factor, industry, and period of the urban life cycle, we aim to elucidate the complexities of the role of extraregional linkages in value chain upgrading in RBCs. In a nutshell, the current theoretical framework contributes to a new perspective on value chain upgrading (versus thrice industrial structure) and the complex role of extraregional linkages in value chain upgrading, taking into account geographical contexts (i.e. different production factors, industries, and stages of the urban life cycle) in RBCs (versus global effects of a single factor without considering varying effects according to geographical contexts).

Data and methodology

Variables

In-Degree Centrality of Technology Factor Flow Network (CEN_TI)

The data on technology factor flows in this study are based on patent data obtained from the IncoPat Technology Innovation Intelligence Platform (https://www.incopat.com/), which maintains comprehensive records of patent transactions in China. Patent transfer records for 312 prefecture-level cities were collected, including the following details: Patent identification information (names, application dates), Original rights holder details (applicants, addresses) and Transfer information (transfer dates, new rights holders, addresses). Applicant and rights holder addresses were mapped to their corresponding cities, enabling the construction of a city-level technology transfer network based on these mapped relationships.

Degree centrality is an important concept in network analysis that measures the number of direct connections a node has with other nodes in the network (Xu et al. 2024). It intuitively represents the node’s level of activity and influence within the network. In the case of a directed network, both in-degree centrality and out-degree centrality can be calculated separately. The formulas are as follows:

In this context, wij represents the weight of the edge between nodes i and j, ki represents the degree of node i (the number of edges adjacent to node i), and n denotes the number of nodes in the network. The formula indicates that the weighted relative centrality of node i is equal to the average of the weighted edge weights between node i and other nodes, divided by the average of the total degree of node i with other nodes. The higher the value of the weighted relative centrality, the greater the relative importance of the node within the network (Lu et al. 2024).

In-Degree Centrality of the Capital Factor Flow Network (CEN_CP)

The data for capital factor flows are calculated using enterprise data from the China Industrial and Commercial Enterprise Database for the period 2012–2019. This database includes enterprise registration information, external investment records, investment amounts and branch locations. In this study, the enterprise investment relationship data are aggregated at the prefecture-level city scale, thereby constructing the capital factor flow network between cities. The method for calculating in-degree centrality is the same as that described previously.

In-Degree Centrality of the Skilled Labor Flow Network (CEN_SL)

The foundational sample for labor factor flow data is derived from the National Health Commission’s China Migrant Population Dynamic Monitoring Data for the years 2012–2017. The survey scope includes 31 provinces (autonomous regions, municipalities), excluding Hong Kong, Macau, and Taiwan. The target population includes individuals aged 15 and above who have resided in a location different from their registered residence (county or city) for more than one month for work or life purposes. The selection criteria for skilled labor include individuals with at least a bachelor’s or an associate’s degree and whose registered and current residences are located in different cities. Importantly, the China Migrant Population Dynamic Monitoring Data does not provide information on the prefecture-level city of the respondents’ registered residence for the years 2012–2016; only province-level information is available. To address this, Tencent location big data, which tracks daily intercity inflows and outflows via automobile, train, and airplane travel, was employed. A statistical downscaling method was applied to project respondents’ registered residences from the provincial to the city level, enhancing the precision of the analysis. The downscaling model is as follows:

where \(S{L}_{abi}\) represents the skilled labor moving from city i in province b to city a. \(S{L}_{ab}\) represents skilled labor moving from province b to city a according to the China Migrant Population Dynamic Monitoring Data. \(PO{P}_{abi}\) represents the population moving from city i in province b to city a according to the Tencent Population Migration Data.\(PO{P}_{ab}\) represents the population moving from province b to city a according to the Tencent Population Migration Data. By using these variables, an intercity skilled labor flow network is constructed. The method for calculating in-degree centrality is the same as previously described.

National Value Chain Position (NVC)

The measurement methodology adopts the global value chain (GVC) framework, specifically utilizing the city-level multiregional input-output model (MRIO). This approach builds upon established methods, from Hummels’ HIY analysis to Wang et al.‘s GVC participation index (Hummels et al. 2001; Koopman et al. 2014; Wang et al. 2017). In this paper, the forward and backward average production chain length (APL) and the position of the NVC of resource-based sectors in RBCs are measured via the city-level multiregional input-output model (MRIO), which draws on the measurement methodology of Wang et al. This measurement is particularly applicable for analyzing inter-regional industrial linkages and value chain integration patterns (Supplementary Text 1).

Economic Development (ED)

The measurement utilizes nighttime light data as a proxy variable for economic development levels, following Deng’s research methodology (Deng et al. 2020). Compared with traditional GDP data, nighttime light data have advantages such as objectivity and spatiotemporal continuity, making them a more objective measure of a region’s economic development level. The DMSP-OLS and NPP-VIIRS datasets are two widely used sources of nighttime light data. Due to differences in spatial resolution and sensor design between these datasets, cross-sensor calibration is required to analyze long-term urbanization. The extended time series (2000–2023) nighttime light data used in this study are available online at https://doi.org/10.7910/DVN/YGIVCD (Chen et al. 2020). The light density representing ED is calculated by dividing the total nighttime light intensity of a region by the number of grids in that region.

Technological Innovation (TI)

In line with relevant studies, this study quantifies the technological innovation level of each region by the number of patent applications (Pipkin and Fuentes 2017). This metric specifically captures formal innovation activities within urban areas and provides a standardized measure for cross-city comparisons.

Population Size (POP)

The population density within a city’s built-up area is used to represent the population size of an individual city.

Empirical model

This study develops a dynamic panel econometric model to examine how the reallocation of urban production factors influences cities’ positions within the national value chain. This model captures the dynamic adjustment process of value chain positioning through the lagged dependent variable. Using panel data from 80 resource-based cities over the period 2012–2017.

\(NV{C}_{it}\) represents the value chain position of resource-based city i in year t, including the value chain position of resource-based sectors (NVC_RB) and nonresource-based sectors (NVC_NRB). The dependent variable is lagged by one period and incorporated into the econometric model. \(CE{N}_{it}\) represents the in-degree centrality of the factor flow network for city i in year t, including \(CEN\_C{P}_{it}\), which denotes the in-degree centrality of the capital factor flow network for city i in year t; \(CEN\_T{I}_{it}\), which denotes the in-degree centrality of the technology factor flow network for city i in year t; and \(CEN\_S{L}_{it}\), which denotes the in-degree centrality of the labor factor flow network for city i in year t. Following (Zhong et al. 2021), this study further selects factors that may influence the division of labor in the urban value chain as control variables \({X}_{nit}\). According to the three-dimensional value chain upgrading indicator system proposed by Tian et al. (2019), the main factors influencing environmental impact are population size, economic development level, and technological level. The population size and economic development level are represented by POP and ED, respectively, whereas the technological level is represented by TI. To account for heterogeneity in industrial structure, categorical controls are introduced for cities based on their resource-based industry intensity: high-, medium-, and low-energy-consumption regions. This enhanced specification provides a robust framework for analyzing how factor reallocation drives changes in urban value chain positions while controlling for relevant economic and structural characteristics. These categories are controlled for in the model \({\mu }_{i}\). \({\mu }_{t}\) represents the time-fixed effect. εit represents the random disturbance term.

Results

Characteristics of factor flow evolution

The factor flow patterns of RBCs are closely related to the development stages of resource-based sectors and exhibit significant stage-specific characteristics. Based on the “National Sustainable Development Plan for RBCs” and the life cycle classification method for RBCs proposed by Yu et al. (2019), the factor flow patterns of RBCs can be analyzed through four periods: growth, maturity, depletion, and regeneration. During the growth period, RBCs demonstrate limited network embeddedness in technology and capital flows, characterized by low levels of both inflow and outflow. This finding aligns with the observation of Camagni et al. (2016) that early-stage cities often face difficulties in establishing robust external connections due to their singular economic focus. The data shows relatively high mobility in skilled labor, contrasting with previous studies that primarily emphasized capital constraints in emerging resource economies. As RBCs enter the maturity period, technology and capital flows show moderate increases, primarily concentrated in resource-based sectors. This pattern supports Sun et al. (2024)‘s findings on the path-dependent nature of RBCs development. The stability in skilled labor flows during this period diverges from traditional assumptions about mature industrial regions attracting skilled labor, suggesting unique challenges in resource-dependent economies. For RBCs in the depletion period, the inflow and outflow of all factors significantly decline, extending beyond the findings of Martinus (2016) on economic contraction in declining resource regions. This decline indicates that the external connections established during the maturity period were primarily based on resource-based sectors. As resources deplete and resource-based sectors contract, external connections diminish accordingly. During the regeneration period, RBCs experience a significant increase in the inflow and outflow of all factors. This increase demonstrates that the cultivation of emerging sectors and the transformation of old and new driving forces significantly increase the number of external connections for RBCs, with their strength far surpassing those in other periods. This finding provides empirical support for Zhou et al. (2024) theoretical framework on industrial diversification in post-resource economies. From the perspective of factor flows, the characteristics of technology and capital factor flows are similar in that during the growth, maturity, and depletion periods, the inflow of these factors far exceeds the outflow. This is particularly evident with capital factors, where external inflows are predominantly policy-driven funds. In contrast, the flow characteristics of labor factors are opposite those of technology and capital; in all development stages of RBCs, the outflow of skilled labor exceeds the inflow. This indirectly confirms the long-standing issue of population loss in RBCs. Notably, as cities transition from the depletion to the regeneration period, the inflow of skilled labor into RBCs significantly increases, indicating that constructing a diversified industrial system enhances the attractiveness of RBCs to skilled labor (Machacek and Hess 2019). Overall, the factor flows in RBCs reflect the adaptive changes in their external connections and internal structures across different development stages, as well as stage-specific demands for technology, capital, and skilled labor (See Fig. 2).

Patterns of factor flow evolution

The development and changes in factor flow in Chinese RBCs are closely related to the lifecycle stages of these cities, which exhibit unique stage-specific characteristics (Fig. 3). During the growth period, RBCs are in the rising stage of resource development, gradually expanding their energy extraction and processing capacities due to abundant resource reserves (Fan and Zhang 2021). The characteristic of factor flows during this period is the unidirectional flow of a few factors, which is reflected primarily in the external outputs of resources and energy products. Because RBCs are often located in remote areas and the ability of their industries to absorb labor is weak, this leads to an outflow of labor factors. This period shows an upward trend in the NVC position of resource-based sectors.

During the maturity period, resource extraction in RBCs reaches its peak and stabilizes over time, leading to the formation of a mature resource-based industrial system. This period demonstrates distinctive unidirectional factor flow patterns that both align with and extend previous findings. Research by Fernández-Vázquez (2022) identified similar outward resource and labor flows in mature mining regions. However, the mature resource-based industrial system provides a solid foundation for technological cooperation and investment and financing connections between RBCs and other cities, leading to an increase in the inflow of technology and capital factors. Importantly, during this period, the flow of resources, labor, capital, and technology factors remained predominantly unidirectional. The NVC position of resource-based sectors remains stable overall during this period. During the depletion period, resource extraction in RBCs is nearly exhausted, the resource-based sectors are contracting, and the development of nonresource-based sectors is still in the nurturing stage. Factor flows during this stage show a marked shift to unidirectional patterns, primarily manifesting as persistent labor outflows. This pattern aligns with the research of Dragan et al. (2024) on declining resource regions but reveals more severe mobility restrictions than previously documented. This period shows a decreasing trend in the NVC position of resource-based sectors. In the regeneration period, with the support of national policies and fiscal transfers, local governments begin to promote transformational development. RBCs gradually move away from resource dependence and enter a path of sustainable development. Recent research by Bole et al. (2023) on urban economic transformation identified similar patterns in successfully regenerating industrial regions. The characteristic of factor flows during this period is the bidirectional flow of multiple factors. RBCs actively integrate into the national factor flow network, acquiring the lacking and complementary factors to develop their advantageous sectors. This period shows a rapid development trend in the NVC position of nonresource-based sectors.

Empirical analysis of the impact of factor flows on value chain position

Different factors

According to the construction of the above model, PLOS, FE and RE were selected for regression, and according to the results of the Hausman test, the fixed effect model was chosen. The results show that factor flows have a significant heterogeneous effect on the NVC position of resource-based and nonresource-based sectors (Supplementary Text 2). Models 1–3 in Table 1 show the regression results of capital, skilled labor and technology factor flows on the NVC position in RBCs. The results of Model 1 show that technology factor flows have a significant positive relationship with the NVC position of RBCs (coefficient = 0.063, p < 0.01). The results of Model 2 in Table 1 show that capital factor flows have a significant positive correlation with the NVC position in RBCs (coefficient = 0.463, p < 0.01). In contrast, the intensity of the role of external capital in NVC upgrading is greater than that of technology introduction. The results of Model 3 indicate that the relationship of skilled labor factor flows with the NVC position in RBCs is not significant (coefficient = −0.034, p > 0.1). As noted in Part 4.1, RBCs face a long-term outflow of highly educated talent and a relatively small inflow of external skilled labor, resulting in a nonsignificant impact of skilled labor factor flow on the NVC position in RBCs. In summary, Hypothesis 1 is partially verified.

Different sectors

In analyzing the impact of three factors—technology, capital and skilled labor—on the NVC position requires accounting for inherent differences in industry types.

Table 2 presents regression results examining factor flows’ effects on NVC positions, with Models 1–3 focusing on resource-based sectors and Models 4–6 on nonresource-based sectors. (1) Technology factor flows have a nonsignificant negative correlation with the NVC position of resource-based sectors. External technology inflow presents a significant positive correlation (coefficient=0.088, p < 0.05) with the NVC position of nonresource-based sectors. This positive relationship likely stems from nonresource-based sectors’ increased dependence on technology-intensive upstream activities like R&D and design, which enhances their forward PLv share. (2) Capital factor flows exhibit a significant positive correlation with the NVC position of resource-based sectors (coefficient = 0.610, p < 0.05) and nonresource-based sectors (coefficient = 0.724, p < 0.01). External investment brings capital, technology, and management expertise that enables both vertical integration and market expansion. The stronger effect in nonresource-based sectors (such as manufacturing, services, and information technology) reflects their greater capacity for innovation and market development, whereas resource-based sectors (such as oil and minerals) face natural constraints on expansion due to their dependence on resource extraction. (3) Skilled labor factor flows show an insignificant negative correlation with the NVC position of nonresource-based sectors. This suggests that the introduction of skilled labor promotes a greater focus on technology-intensive segments and process optimization, resulting in more compact value chains and reduced forward PLy proportion. The results in Table 2 indicate that factor flows have a significantly heterogeneous effect on the positions of resource- and nonresource-based sectors; thus, Hypothesis 2 is verified.

The empirical results of the dynamic panel model confirm the theoretical framework, demonstrating that factor flows influence a city’s NVC division of labor within the country. Additionally, they reveal the heterogeneity in the impact of different production factors on the NVC position across various industries. From the perspective of technological factors, introducing external technology usually provides enterprises with the technological support needed to extend downstream, fundamentally changing the weak innovation capabilities inherent in RBCs and assisting in upgrading the NVC. From the perspective of capital factors, well-capitalized enterprises are more likely to invest in R&D and market expansion, thereby extending upstream or downstream in the NVC and enhancing their NVC position. From the perspective of labor factors, introducing skilled labor reduces the NVC position of resource-based sectors. On the one hand, skilled labor may promote the industrial structure of cities to shift from traditional, labor-intensive industries to technology- and knowledge-intensive industries. This shift may reduce reliance on traditional upstream industries (such as raw material manufacturing), thereby decreasing PLv. On the other hand, skilled labor is often associated with high automation and improved production efficiency, which may reduce the demand for certain traditional downstream industries (such as manual assembly and simple processing), thereby increasing PLy.

Different periods

As shown in Section ‘Characteristics of factor flow evolution’, the evolution patterns of factor flows are strongly influenced by the urban life cycle. This necessitates incorporating the stages of urban development into the research framework when investigating the impact of factor flows on NVC positions.

Table 3 presents regression analyses examining how factor flows affect NVC positions in cities during their growth period, with Models 1–3 focusing on resource-based sectors and Models 4–6 on nonresource-based sectors. The analysis reveals three distinct patterns in factor flow effects: (1) Technology factor flows show an insignificant negative correlation with the NVC positions of both resource- and nonresource-based sectors. The primary reason is that cities in the growth period predominantly experience an outflow of resources and labor, with minimal impact from the inflow of external technology. (2) Capital factor flows show a significant positive correlation only with the NVC position of resource-based sectors (coefficient = 2.267, p < 0.01). This also confirms that cities in the growth period primarily focus on developing resource-based sectors, with external investment activities concentrated in these sectors. (3) Labor factor flows show a significant positive correlation only with the NVC position of nonresource-based sectors (coefficient = 0.334, p < 0.01). The coefficient indicates that the inflow of labor factors has a relatively small impact on the NVC position of nonresource-based sectors, with the positive effects primarily concentrated in these industries. This is primarily because resource-based sectors in cities during the growth period, which are dominated by resource-based sectors, are engaged mainly in the primary processing of resources and are unable to attract highly educated labor. In summary, for RBCs in the growth period, the flow of capital and labor factors significantly promotes their NVC upgrading. The results for the control variables are similar to those in Table 2 and will not be elaborated further.

Table 4 presents the regression results of capital, skilled labor, and technology factor flows on the NVC positions of resource- and nonresource-based sectors in the sample of cities in the maturity period. The analysis reveals three distinct patterns in factor flow effects: (1) The flow of technological factors shows a significant negative correlation with the NVC positions of both resource- and nonresource-based sectors (coefficient = −0.254, p < 0.05; coefficient = −0.162, p < 0.05). A possible reason for this is that cities in the maturity period predominantly experience inflows of technology and capital, primarily aimed at expanding the scale and capacity of resource-based sectors. This results in external technology inflows being utilized to serve mature resource-based sectors, enabling capacity expansion and streamlining production processes, which ultimately contribute to a decline in their NVC positions. (2) The flow of capital factors shows a significant negative correlation only with the NVC position of nonresource-based sectors (coefficient = −0.508, p < 0.01). This finding also supports the analysis in Section ‘Characteristics of factor flow evolution’, indicating that during this period, the inflow of external capital helps nonresource-based sectors streamline production processes, thus lowering their NVC positions. (3) The flow of labor factors shows a significant positive correlation only with the NVC position of nonresource-based sectors (coefficient = 0.197, p < 0.05). The coefficient value indicates that the impact of labor factor inflows on the NVC position of nonresource-based sectors is relatively small and mainly focused on nonresource-based sectors. This is primarily because nonresource-based sectors remain the main sectors of interest for skilled labor. In summary, for RBCs in the maturity period, the flow of labor factors significantly promotes their NVC upgrading.

Table 5 presents the regression results of capital, skilled labor, and technology factor flows on the NVC positions of resource-based and nonresource-based sectors in the sample of cities in the depletion period. The analysis reveals three distinct patterns in factor flow effects: (1) The flow of technological factors has an insignificant relationship with the NVC positions of both resource- and nonresource-based sectors. (2) The flow of capital factors shows a significant positive correlation only with the NVC position of resource-based sectors (coefficient = 1.961, p < 0.01). This period is marked by the depletion of resources, forcing cities to transform toward deep and fine processing. During this stage, external capital primarily consists of central government policy funds aimed at assisting RBCs in ecological restoration, clean production, and industrial upgrading (Li et al. 2013). (3) The flow of labor factors shows an insignificant positive correlation with the NVC positions of both resource-based and nonresource-based sectors. In summary, for RBCs in the depletion period, the flow of capital factors significantly promotes NVC upgrading.

Table 6 presents the regression results of capital, skilled labor, and technology factor flows on the NVC positions of resource- and nonresource-based sectors in the sample of cities in the regeneration period. The analysis reveals three distinct patterns in factor flow effects: (1) Technology factor flows demonstrate a significant positive correlation with NVC positions across both industry types (resource-based: coefficient = 0.242, p < 0.1; nonresource-based: coefficient = 0.178, p < 0.05). A possible reason for this is that RBCs in the regeneration period are at a critical stage of urban transformation, characterized by extensive flows and exchange of technology, capital, and labor between RBCs and non-RBCs. The introduction of external technology can greatly enhance the NVC positions of both resource- and nonresource-based sectors. (2) Capital factor flows show a significant positive correlation only with the NVC position of nonresource-based sectors (coefficient = 0.714, p < 0.05). This further confirms the rapid development stage of nonresource-based sectors, where the inflow of external capital has supported the extension of industrial chains and the upgrading of their positions in NVC. (3) Labor factor flows show a significant positive correlation only with the NVC position of resource-based sectors (coefficient = 0.285, p < 0.05). The modern coal chemical industry, energy recycling, and other deep processing sectors are important transformation directions for some RBCs (Işık et al. 2024a). These sectors combine both technology- and resource-intensive attributes, and introducing external skilled labor significantly enhances NVC positions in these resource-based sectors. In summary, for RBCs in the regeneration period, the technology, capital, and labor flow significantly promote NVC upgrading. Thus, Hypothesis 3 is partially verified.

Value chain upgrading mechanisms

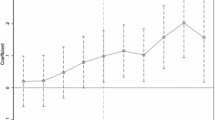

The empirical analysis above demonstrates that the impact of factors on the NVC cannot overlook the role of the urban life cycle. For cities at different stages of their life cycle, this paper proposes the following recommendations to help break the “resource curse” (Fig. 4).

Growth period

For RBCs in the growth period, capital and labor factors are key to improving their NVC positions, extending previous research on RBCs. While existing studies like Zou (2024) emphasized technological innovation as the primary driver of value chain upgrading, this research demonstrates that financial capital plays an equally significant role. Lu et al. (2024) emphasize the significance of technological spillovers through “borrowed size,” where external capital and labor flows contribute to local innovation and industrial upgrading. From the perspective of capital, the technological and equipment upgrades in resource-based sectors require substantial capital investment. External investors bring not only substantial funding but also advanced technical capabilities and R&D resources that can revolutionize production processes. This transformation materializes through specific pathways such as technological cooperation agreements, joint R&D initiatives, and direct implementation of advanced technologies like clean coal processing and high-end chemical production. From the perspective of labor, skilled labor has played a crucial role in driving industrial development and upgrading. On the one hand, they propel rapid industrial growth and upgrading by developing new products, technologies, and services. On the other hand, skilled labor, with its international perspective and market development capabilities, can help enterprises enter new market areas, expand cooperation channels, formulate scientific market strategies, and optimize management and operations.

Maturity period

For RBCs in the maturity period, labor factors are key to enhancing their NVC positions. The impact of skilled labor on the NVC often needs to be realized and amplified through innovation and capital investment, serving as crucial support for developing the innovation chain and NVC. Compared with technology and investment, the influence of skilled labor on the NVC is relatively smaller. This is primarily attributed to the lag effect of skilled labor, as its impact on the NVC often requires a longer period for adaptation and transition. In contrast, the effects of innovation and capital investment tend to be more immediate and rapid (Gillman, 2021). The flow of skilled labor has a significant promoting effect on the NVC position of nonresource-based sectors. Compared with resource-based sectors, skilled labor tends to migrate toward technology-intensive nonresource-based sectors, such as manufacturing and services, often occupying midstream or downstream positions in the NVC. These findings align with Zhang et al. (2024) findings on industrial transformation in Northeast China. Additionally, innovative products and services can create more downstream applications and markets, enhancing the NVC position of nonresource-based sectors.

Depletion period

For RBCs in the depletion period, capital factors are key to enhancing their NVC positions. On the one hand, financial investments have a “reservoir” effect, which can help enterprises expand production, improve facilities, and ensure sustained innovation efforts, thereby maintaining competitiveness within the NVC (Kleis et al. 2012). On the other hand, attracting external investment inherently introduces advanced technology and management experience. The transfer of these technologies and experiences can improve local industry production efficiency and product quality, fostering technological innovation (Işık et al. 2024b). The infusion of external capital aligns with the theory of comparative advantage, which suggests that regions should prioritize industries where they possess competitive strengths. External investments not only strengthen existing resource-based sectors but also support the development of emerging sectors with latent comparative advantages. This dual approach helps RBCs optimize their industrial structure and enhance their competitiveness in the domestic and global markets. For example, Hudson noted that external investment plays a significant role in the economic recovery and development of mining areas in Northeast England (Hudson 2005). Similarly, the old industrial region of Silesia in Poland initiated reindustrialization after the 1990s by leveraging an Industry 4.0 strategy. This approach focused on attracting branches of multinational companies and external funds to establish an advanced automotive manufacturing cluster through networked organizational connections (Grzegorz et al. 2022).

Regeneration period

For RBCs in the regeneration period, technology, capital, and labor factors are key to enhancing NVC positions. From the perspective of technologies, during the regeneration period, RBCs often face obstacles in cultivating and developing nonresource-based sectors because of their weak foundation. Transplanting innovation-intensive and high-growth enterprises from external sources can rapidly drive the formation of substitute sectors at scale and lead them into a mature development path (Lechner and Dowling 2003). The flow of technological factors is a primary driver for the development of emerging nonresource-based sectors, which rely heavily on innovation compared to resource-based sectors. High-tech, services, and manufacturing sectors, in particular, demand advanced technological capabilities, superior management practices, and skilled talent. Research results from related case studies support this, such as the collaboration between Yulin, Shaanxi, the Clean Energy Innovation Institute of the Chinese Academy of Sciences, and Xi’an Jiaotong University. These partnerships exemplify how RBCs can overcome technological barriers by acquiring external knowledge and fostering innovation ecosystems. Located far from knowledge-intensive areas, RBCs can leverage urban networks to absorb external knowledge, benchmark innovative practices, and foster technological competition (Kogler et al. 2023). Mechanisms such as cross-regional cooperation, intellectual property protection, and investment promotion can facilitate knowledge spillovers and accelerate NVC upgrading.

From the perspective of capital, external investment is a crucial pathway for enhancing the NVC positions of both resource- and nonresource-based sectors. Beyond providing financial resources, external investment contributes to technological innovation, market access, management optimization, and talent acquisition. For example, Yulin in Shaanxi has led investment to drive the expansion of nonresource NVC, attracting 5 billion yuan to promote the full industrial chain project of wind turbine equipment manufacturing and 18 billion yuan to accelerate the entire industrial chain layout of the Huaqin Hydrogen Energy Industrial Park. Similarly, Baotou, Inner Mongolia, secured 23 billion yuan to establish the “Green Silicon Capital,” building an integrated industrial chain for silicon and photovoltaic technologies. Therefore, when RBCs face obstacles in extending the NVC of both resource- and nonresource-based sectors, they should focus on the multiple investment roles. By optimizing the business environment and actively attracting foreign capital, RBCs can achieve NVC upgrading and expansion through an “investment-led industrial” strategy.

From the perspective of labor, skilled labor plays a supportive role in upgrading resource-based sectors through technological R&D cooperation and investment decision-making, as does the cumulative effect of high-skilled labor. On the one hand, skilled labor can introduce and develop new technologies to improve the efficiency and safety of resource extraction. For example, skilled labor has been implemented in regions like Pajala, Sweden, to balance resource utilization with sustainability goals (Söderholm 2023). On the other hand, skilled labor can optimize production processes, enhancing production efficiency and product quality. Their cumulative effect on innovation and operational efficiency drives higher-value activities within the NVC, aligning with findings from comparative cases in the United States and Europe (Johns 2022).

Policy implications for different stages of urban life cycle

During the growth period, RBCs should implement a two-pronged approach to attract external investment and develop local capabilities. Specifically:

-

(1)

Create a conducive environment for external investors by targeting those with robust technical expertise and research and development (R&D) capabilities. Mechanisms such as public-private partnerships and incentive structures, including tax benefits for technology-driven investments, can play a pivotal role in achieving this goal. Additionally, fostering international collaborations in R&D and facilitating the adoption of advanced technologies.

-

(2)

Prioritize educational and vocational training programs to cultivate a skilled workforce capable of meeting the demands of high-value-added industries. To further strengthen local capacity-building efforts, RBCs should introduce incentives such as housing benefits, competitive salaries, and professional development opportunities to attract and retain skilled labor.

During the maturity period, RBCs must address workforce dynamics and economic diversification. Specifically:

-

(1)

Implement long-term workforce development programs to mitigate the lag effect of skilled labor shortages and ensure a steady supply of talent aligned with the demands of high-value industries.

-

(2)

Prioritize economic diversification efforts by focusing on nonresource-based sectors, leveraging their potential to attract and retain skilled labor, and fostering sustainable growth.

During the depletion period, RBCs require targeted strategies to attract industries with advanced technological and managerial expertise. Specifically:

-

(1)

Develop targeted external investment policies to align investments with local strengths, thereby enhancing adaptability and resilience to economic uncertainties.

-

(2)

Create investment-friendly environments by introducing tax incentives, improving infrastructure, and establishing industrial parks or free trade zones to attract high-value industries.

During the regeneration period, RBCs require a comprehensive approach to achieve value chain upgrading. Specifically:

-

(1)

Establish partnerships with universities, research institutions, and enterprises to facilitate the transfer of technology and foster innovation in nonresource-based sectors.

-

(2)

Develop investment-friendly environments by introducing tax incentives and streamlining regulations to attract capital investments in strategic industries.

-

(3)

Implement education and training programs tailored to the needs of high-value industries. These initiatives should be complemented by incentives such as housing benefits and career advancement opportunities, to attract, develop, and retain a skilled workforce.

Conclusions

Value chain upgrading is a crucial pathway for RBCs to overcome the “resource curse” and achieve a low-carbon transition. As the number of intercity connections increases, external network effects play an increasingly important role in the value chain upgrading of RBCs. To verify the role of factor flows in the value chain upgrading of RBCs, this study first measured the evolution characteristics of national technology, capital, and labor factor networks from 2012 to 2017. Life cycle theory was used to examine the evolution patterns of factor flows, revealing that the factor flow patterns in RBCs are closely related to their development stages, exhibiting a transition from “unidirectional to bidirectional, single-factor to multifactor” flows. The study calculated the value chain positions of various industries via a multiregional input-output table to identify the value chain upgrading processes of RBCs. A dynamic panel data model was then employed to estimate the relationship between external factor inflows and value chain positions from three perspectives: factor types, industry types, and the urban life cycle. The empirical results led to the following conclusions:

-

(1)

The inflow of external technology and capital factors contributes to enhancing the overall value chain positions in RBCs.

-

(2)

The inflow of external capital significantly promotes upgrading resource-based industry value chains, whereas the inflow of external technology and capital significantly boosts the value chain upgrading of nonresource-based sectors.

-

(3)

For RBCs in the growth period, the inflows of external capital and skilled labor upgrade the value chain of resource- and nonresource-based sectors, respectively. In RBCs in the maturity period, the inflow of external technology inhibits value chain upgrading of both resource- and nonresource-based sectors, whereas external capital inhibits the upgrading of nonresource-based value chains, and skilled labor promotes nonresource-based value chain upgrading. In the depletion period, only the inflow of external capital upgrades the resource-based value chain. In the regeneration period, external technology promotes upgrading both resource- and nonresource-based value chains, whereas external capital and skilled labor promote upgrading nonresource- and resource-based value chains, respectively.

These findings underscore the critical importance of selecting appropriate external engagement strategies tailored to the specific development stages of RBCs to ensure a successful transition. However, there is significant potential for further exploration, particularly in studying factor flows from a multiscale perspective, encompassing local, regional, and global levels. One major challenge lies in the diverse and complex nature of institutions interacting with these factor flows, as they vary significantly across cities in China. This variability suggests a need for more detailed investigations, such as in-depth fieldwork, to gain deeper insights into the unique dynamics at play in different contexts. Moreover, it is crucial to recognize that cities do not exist in isolation; they are integral components of a broader global network and value chains. Acknowledging this interconnectedness opens new research opportunities, encouraging the expansion of studies beyond domestic contexts to broader international perspectives. This broader approach could provide valuable insights into how global factors influence the transition processes of RBCs, especially under conditions of uncertainty (Işık et al. 2020). Challenges such as climate policy shifts, geopolitical conflicts, pandemics like COVID-19, and monetary instability further highlight the importance of understanding the interplay between local transitions and global influences.

Data availability

The dataset of our study is generated by secondary data sourced from the China Statistical Yearbooks (https://www.stats.gov.cn/sj/ndsj/) and city-level multiregional input-output model (MRIO) from CEADs (https://www.ceads.net/). The factor flow data was obtained from Tencent Location Big Data (https://heat.qq.com/wap_qqmap_big_data); the Incopat patent transfer data (https://www.incopat.com/); and the business enterprise database (https://www.gsxt.gov.cn/index.html). The datasets generated and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Alonso W (2013) Urban zero population growth. In The no-growth society (pp. 191-206): Routledge

Andreoni A, Tregenna F (2020) Escaping the middle-income technology trap: A comparative analysis of industrial policies in China, Brazil and South Africa. Struct Change Economic Dyn 54:324–340. https://doi.org/10.1016/j.strueco.2020.05.008

Balland PA, Boschma R, Crespo J, Rigby DL (2019) Smart specialization policy in the European Union: relatedness, knowledge complexity and regional diversification. Regional Stud 53(9):1252–1268. https://doi.org/10.1080/00343404.2018.1437900

Balsa-Barreiro J, Li Y, Morales A (2019) Globalization and the shifting centers of gravity of world’s human dynamics: Implications for sustainability. J Clean Prod 239:117923

Balsa-Barreiro J, Wang S, Tu J, et al. (2023) The nexus between innovation and environmental sustainability. In (Vol. 11, pp. 1194703): Frontiers Media SA

Bathelt H, Malmberg A, Maskell P (2004) Clusters and knowledge: local buzz, global pipelines and the process of knowledge creation. Prog Hum Geogr 28(1):31–56. https://doi.org/10.1191/0309132504ph469oa

Bellandi M, De Propris L, Vecciolini C (2021) Effects of learning, unlearning and forgetting on path development: the case of the Macerata-Fermo footwear industrial districts. Eur Plan Stud 29(2):259–276. https://doi.org/10.1080/09654313.2020.1745156

Bernhardt T, Pollak R (2016) Economic and social upgrading dynamics in global manufacturing value chains: A comparative analysis. Environ Plan A 48(7):1220–1243. https://doi.org/10.1177/0308518x15614683

Bole D, Mrdakovic MS, Tiran J (2023) From a mining town to a town of industrial multinationals: Explaining transformation through human agency and mining assets. Extractive Industries and Society, 14. https://doi.org/10.1016/j.exis.2023.101243

Boschma R (2005) Proximity and innovation: a critical assessment. Regional Stud 39(1):61–74

Camagni R, Capello R, Caragliu A (2016) Static vs. dynamic agglomeration economies. Spatial context and structural evolution behind urban growth. Pap Regional Sci 95(1):133–158. https://doi.org/10.1111/pirs.12182

Chen Z, Yu B, Yang C, Zhou Y, Qian X, Wang C, Wu J (2020) An extended time-series (2000–2018) of global NPP-VIIRS-like nighttime light data from a cross-sensor calibration. Earth Syst Sci Data Discuss 2020:1–34

Dai X, Xu M, Wang N (2018) The industrial impact of the Beijing-Shanghai high-speed rail. Travel Behav Soc 12:23–29

Deng T, Gan C, Perl A, Wang D (2020) What caused differential impacts on high-speed railway station area development? Evidence from global nighttime light data. Cities 97:102568

Dragan A, Cretan R, Jucu IS, et al. (2024) Revitalizing post-communist urban industrial areas: Divergent narratives in the imagining of copper mine reopening and tourism in a Romanian town. Cities, 154. https://doi.org/10.1016/j.cities.2024.105379

Fan F, Zhang X (2021) Transformation effect of resource-based cities based on PSM-DID model: An empirical analysis from China. Environ Impact Assess Rev 91:106648

Fernández-Vázquez E (2022) Mine closures and local diversification: Job diversity for coal-mining areas in a post-coal economy. Extractive Industries and Society, 12. https://doi.org/10.1016/j.exis.2022.101086

Fuentes JR, Mies V (2021) Technological Absorptive Capacity and Development Stage: Disentangling Barriers to Riches. Macroeconomic Dyn 25(6):1589–1624. https://doi.org/10.1017/s1365100519000804

Gereffi G (1999) International trade and industrial upgrading in the apparel commodity chain. J Int Econ 48(1):37–70. https://doi.org/10.1016/s0022-1996(98)00075-0

Ghassim B, Foss L (2021) Understanding the micro-foundations of internal capabilities for open innovation in the minerals industry: a holistic sustainability perspective. Resour Policy 74:101271. https://doi.org/10.1016/j.resourpol.2018.09.011

Gillman M (2021) Steps in industrial development through human capital deepening. Economic Modelling, 99. https://doi.org/10.1016/j.econmod.2021.02.011

Goch S (2002) Betterment without airs: Social, cultural, and political consequences of de-industrialization in the Ruhr. Int Rev Soc Hist 47:87–111. https://doi.org/10.1017/s0020859002000792

Grzegorz M, Krzysztof G, Arkadiusz K, Agnieszka SG, Agnieszka ŚK (2022) The role of critical conjunctures in regional path creation: a study of Industry 4.0 in the Silesia region. Reg Stud Reg Sci 9(1):23–44

He SY, Lee J, Zhou T, Wu D (2017) Shrinking cities and resource-based economy: The economic restructuring in China’s mining cities. Cities 60:75–83. https://doi.org/10.1016/j.cities.2016.07.009

Hidalgo CA, Klinger B, Barabási AL, Hausmann R (2007) The product space conditions the development of nations. Science 317(5837):482–487

Hudson R (2005) Rethinking change in old industrial regions: reflecting on the experiences of North East England. Environ Plan A 37(4):581–596. https://doi.org/10.1068/a36274

Hummels D, Ishii J, Yi KM (2001) The nature and growth of vertical specialization in world trade. J Int Econ 54(1):75–96. https://doi.org/10.1016/s0022-1996(00)00093-3

Işık C, Bulut U, Ongan S et al. (2024a) Exploring how economic growth, renewable energy, internet usage, and mineral rents influence CO2 emissions: A panel quantile regression analysis for 27 OECD countries. Resour Policy 92:105025

Işık C, Ongan S, Islam H (2024b) A new pathway to sustainability: Integrating economic dimension (ECON) into ESG factors as (ECON-ESG) and aligned with sustainable development goals (SDGs). J Ekon 6(1):34–39

Işık C, Ongan S, Islam H et al. (2024c) Evaluating the effects of ECON-ESG on load capacity factor in G7 countries. J Environ Manag 360:121177

Işik C, Ongan S, Islam H et al (2024d) Navigating sustainability: Unveiling the interconnected dynamics of ESG factors and SDGs in BRICS-11. Sustain Dev 32(5):5437–5451. https://doi.org/10.1002/sd.2977

Işık C, Ongan S, Ozdemir D et al. (2024e) Renewable energy, climate policy uncertainty, industrial production, domestic exports/re-exports, and CO2 emissions in the USA: a SVAR approach. Gondwana Res 127:156–164

Işık C, Sirakaya-Turk E, Ongan S (2020) Testing the efficacy of the economic policy uncertainty index on tourism demand in USMCA: Theory and evidence. Tour Econ 26(8):1344–1357. https://doi.org/10.1177/1354816619888346

Jia RN, Shao S, Yang LL (2021) High-speed rail and CO2 emissions in urban China: A spatial difference-in-differences approach. Energy Econ 99:105271. https://doi.org/10.1016/j.eneco.2021

Johns J(2022) Digital technological upgrading in manufacturing global value chains: The impact of additive manufacturing Glob Netw-a J Transnatl Aff 22(4):649–665. https://doi.org/10.1111/glob.1234910

Kastelli I, Dimas P, Stamopoulos D, Tsakanikas A (2022) Linking Digital Capacity to Innovation Performance: the Mediating Role of Absorptive Capacity. J Knowledge Econ. https://doi.org/10.1007/s13132-022-01092-w

Kleis L, Chwelos P, Ramirez RV, Cockburn I (2012) Information Technology and Intangible Output: The Impact of IT Investment on Innovation Productivity. Inf Syst Res 23(1):42–59. https://doi.org/10.1287/isre.1100.0338

Kogler DF, Whittle A, Kim K, Lengyel B (2023) Understanding Regional Branching: Knowledge Diversification via Inventor and Firm Collaboration Networks. Economic Geogr 99(5):471–498. https://doi.org/10.1080/00130095.2023.2242551

Koopman R, Wang Z, Wei S-J (2014) Tracing Value-Added and Double Counting in Gross Exports. Am Economic Rev 104(2):459–494. https://doi.org/10.1257/aer.104.2.459

Lao X, Gu H, Yu H, Xiao F (2021) Exploring the spatially-varying effects of human capital on urban innovation in China. Appl Spat Anal Policy 14(4):827–848

Lechner C, Dowling M (2003) Firm networks: external relationships as sources for the growth and competitiveness of entrepreneurial firms. Entrepreneurship regional Dev 15(1):1–26

Li B, Han YK, Wang CS, Sun W (2022a) Did civilized city policy improve energy efficiency of resource-based cities? Prefecture-level evidence from China. Energy Policy 167:1873–6777. https://doi.org/10.1016/j.enpol.2022.113081

Li HJ, Long RY, Chen H (2013) Economic transition policies in Chinese resource-based cities: An overview of government efforts. Energy Policy 55:251–260. https://doi.org/10.1016/j.enpol.2012.12.007

Li QY, Zeng FE, Liu SH, Yang MA, Xu F (2021) The effects of China’s sustainable development policy for resource-based cities on local industrial transformation. Res Policy 71. https://doi.org/10.1016/j.resourpol.2020.101940

Liu H, Li J, Long H et al. (2018) Promoting energy and environmental efficiency within a positive feedback loop: Insights from global value chain. Energy Policy 121:175–184

Liu XJ, Liu CL, Piao JX (2024) Unpacking technology flows based on patent transactions: does trickle-down, proximity, and siphon help regional specialization? Annal Reg Sci. https://doi.org/10.1007/s00168-024-01277-y

Liu Y, He ZC (2024) Synergistic industrial agglomeration, new quality productive forces and high-quality development of the manufacturing industry. Int Rev Econ Financ 94. https://doi.org/10.1016/j.iref.2024.103373

Liu Y, Deng P, Wei J, Ying Y, Tian M (2019) International R&D alliances and innovation for emerging market multinationals: roles of environmental turbulence and knowledge transfer. J Bus Ind Mark 34(6):1374–1387. https://doi.org/10.1108/jbim-01-2018-0052

Lu S, Liu Q, Xia S, Zhang W (2024). How does industrial transition drive low-carbon transition? Evidence from China’s resource-based cities. Environ Develop Sustain. https://doi.org/10.1007/s10668-024-04575-9

Machacek E, Hess M (2019) Whither ‘high-tech’ labor? Codification and (de-)skilling in automotive components value chains. Geoforum 99:287–295. https://doi.org/10.1016/j.geoforum.2017.11.023

Mao WX, Wang WP, Sun HF, Yao PY, Wang XL, Luo D (2021) Urban industrial transformation patterns under natural resource dependence: A rule mining technique. Energy Policy, 156. https://doi.org/10.1016/j.enpol.2021.112383

Martinus K (2016) Regional development in a resource production system: long distance commuting, population growth, and wealth redistribution in the Western Australia Goldfields. Geographical Res 54(4):420–432. https://doi.org/10.1111/1745-5871.12173

Mathews JA, Tan H (2011) Progress Toward a Circular Economy in China The Drivers (and Inhibitors) of Eco-industrial Initiative. J Ind Ecol 15(3):435–457. https://doi.org/10.1111/j.1530-9290.2011.00332.x

Neffke F, Henning M, Boschma R (2011) How do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Economic Geogr 87(3):237–265

Pipkin S, Fuentes A (2017) Spurred to upgrade: A review of triggers and consequences of industrial upgrading in the global value chain literature. World Dev 98:536–554

Ponte S, Kelling I, Jespersen KS, Kruijssen F (2014) The Blue Revolution in Asia: Upgrading and Governance in Aquaculture Value Chains. World Dev 64:52–64. https://doi.org/10.1016/j.worlddev.2014.05.022

Söderholm P (2023) How environmental permitting uncertainty in large-scale mining could influence subcontractors: The underlying chicken-and-egg problem. Resources Policy, 82. https://doi.org/10.1016/j.resourpol.2023.103585

Sun HJ, Ma L, Jin FJ et al. (2024) Path dependence or path creation of mature resource-based cities: A new firm entry perspective. J Geographical Sci 34(3):499–526. https://doi.org/10.1007/s11442-024-2215-1

Sun SZ, Anwar S (2019) R&D activities and FDI in China’s iron ore mining industry. Economic Anal Policy 62:47–56. https://doi.org/10.1016/j.eap.2019.01.003

Tian K, Dietzenbacher E, Jong-A-Pin R (2019) Measuring industrial upgrading: applying factor analysis in a global value chain framework. Economic Syst Res 31(4):642–664. https://doi.org/10.1080/09535314.2019.1610728

Waggoner PE, Ausubel JH (2002) A framework for sustainability science: A renovated IPAT identity. Proc Natl Acad Sci USA 99(12):7860–7865. https://doi.org/10.1073/pnas.122235999

Wang CC, Lin GCS (2018) Geography of knowledge sourcing, heterogeneity of knowledge carriers and innovation of clustering firms: Evidence from China’s software enterprises. Habitat Int 71:60–69. https://doi.org/10.1016/j.habitatint.2017.10.012

Wang Z, Wei S-J, Yu X, Zhu K (2017) Measures of participation in global value chains and global business cycles. Retrieved from

Wu T, Kung CC (2020) Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technological Forecasting and Social Change, 152. https://doi.org/10.1016/j.techfore.2019.119884

Xiao F, Wang J, Xiong M, Mo H (2024) Does spatiotemporal heterogeneity matter? Air transport and the rise of high-tech industry in China. Appl Geogr 162:103148

Xie WC, Yan TH, Xia SM, Chen FZ (2020) Innovation or Introduction? The Impact of Technological Progress Sources on Industrial Green Transformation of Resource-Based Cities in China. Front Energ Res 8. https://doi.org/10.3389/fenrg.2020.598141

Xu S, Lian G, Song M, Xu A (2024) Do global innovation networks influence the status of global value chains? Based on a patent cooperation network perspective. Humanities Soc Sci Commun 11(1):1–12

Yang Y, Zheng T, Wu J (2024) Green taxation, regional green development and innovation: Mechanisms of influence and policy optimization. Humanities Soc Sci Commun 11(1):1–21

York R, Rosa EA, Dietz T (2003) Footprints on the earth: The environmental consequences of modernity. Am Sociological Rev 68(2):279–300. https://doi.org/10.2307/1519769

Yu JH, Li JM, Zhang WZ (2019) Identification and classification of resource-based cities in China. J Geographical Sci 29(8):1300–1314. https://doi.org/10.1007/s11442-019-1660-8

Zeng LJ, Wang BC, Fan L, Wu JG (2016) Analyzing sustainability of Chinese mining cities using an association rule mining approach. Resour Policy 49:394–404. https://doi.org/10.1016/j.resourpol.2016.07.013

Zhang H, Sun X, Bi C, Ahmad M, Wang J (2022a) Can sustainable development policy reduce carbon emissions? Empirical evidence from resource-based cities in China. Sci Total Environ 838(Pt 3):156341. https://doi.org/10.1016/j.scitotenv.2022.156341

Zhang H, Xiong L, Li L, Zhang S (2018) Political incentives, transformation efficiency and resource-exhausted cities. J Clean Prod 196:1418–1428. https://doi.org/10.1016/j.jclepro.2018.06.093

Zhang SF, Zhu C, Li XJ, Yu XW, Fang Q (2022b) Sectoral heterogeneity, industrial structure transformation, and changes in total labor income share. Technol Forecast Soc Change 176:1873–5509. https://doi.org/10.1016/j.techfore.2022.121509

Zhang YF, Tang X, Yang JF (2024) Synergies of Technological and Institutional Innovation Driving Manufacturing Transformation: Insights from Northeast China. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-024-01982-1

Zhong Y, Wang ZG, Zhang YB (2021) China’s functional upgrading in global value chains and its drivers: a multi-country chaining structural decomposition analysis. Appl Econ 53(24):2727–2742. https://doi.org/10.1080/00036846.2020.1866161

Zhou JP, Xu WX, Yan D (2024) Breaking the resource curse: The impact of digital economy on the sustainable transformation of resource-based cities. Sustainable Cities and Society, 113. https://doi.org/10.1016/j.scs.2024.105707

Zhu S, He C, Zhou Y (2017) How to jump further and catch up? Path-breaking in an uneven industry space. J Economic Geogr 17(3):521–545