Abstract

The environmental impacts caused by the manufacturing of spent lithium-ion batteries (LIBs) and the supply risks of the valuable metals in electric vehicle (EV) batteries can be mitigated by recycling used LIBs. This study employed a Cradle-to-Gate life cycle assessment (LCA) and cost-benefit analysis, to evaluate the environmental and economic advantages of recycling and remanufacturing Nickel Manganese Cobalt (NMC) cells using hydrometallurgical and pyrometallurgical processes, compared to manufacturing with virgin materials. In the regional context, hydrometallurgy-based LIB remanufacturing has the potential to reduce energy consumption and greenhouse gas (GHG) emissions by 10.7%, accompanied by 11.3% cost savings, compared to virgin material manufacturing. However, despite its potential for GHG emission reduction, pyrometallurgy-based remanufacturing is economically unviable across all scenarios considered. The economics of LIB recycling are significantly influenced by spent LIB costs, requiring careful management of market trends and purchase expenses for feasibility. Challenges have arisen from the increasing volume of spent LIBs and production cost fluctuations. Various LIB chemical compositions yield nuanced outcomes, with NMC111 and NMC811 showing promise for economic and environmental aspects, respectively, while NMC532 and NMC111 demonstrate relative suitability for a cell remanufacturing. Preliminary analysis of Lithium Iron Phosphate (LFP) batteries, an emerging chemistry with growing adoption, highlights unique challenges underscoring the need for further research. This study marks the first economic and environmental evaluation of LIB recycling in the oil-rich Middle East, emphasizing the need for an assessment tailored to the UAE to inform regional policy development. This framework could be adapted for use in other Middle Eastern countries, aiding the formulation of effective regional policies and regulations.

Similar content being viewed by others

Introduction

In recent decades, due to increasing concerns about the depletion of fossil fuels, global warming, and GHG emissions, EVs have garnered significant attention, and their demand is expected to increase considerably owing to their performance and efficiency. Electric mobility is a promising technology that can play an essential role in lowering the environmental impacts caused by the transportation and burning of fossil fuels.

Most electric cars have a LIB as a power supply (Natkunarajah et al., 2015). LIBs are mainly used as a renewable resource to store energy and play a significant role in sustainability. This solution has been encouraged to reduce the global warming effects of traditional transportation methods. Therefore, the demand for LIBs for EVs is growing fast. Bloomberg New Energy Finance predicted that there would be a rapid increase in EV sales between 2025 and 2030, and EVs will constitute approximately one-third of the global car fleet by 2040 (Pinegar & Smith, 2019). In addition, it has been predicted that the LIB demand for EVs will reach approximately 4.7 TWh by 2030 from approximately 700 GWh in 2022 (McKinsey, 2023).

Along with the increasing demand for LIBs, the demand for Li is anticipated to increase from 9760 t in 2015 to 21,520 t by 2025, which equals 30% of the total Li that was produced in 2015 (32,500 t) and will be 66% by 2025 (Swain, 2017). Considering this escalation of global demand for LIBs, spent LIBs should become an essential secondary resource for several materials in the near future.

There are many reasons for the recycling of spent LIBs, such as shortage of valuable materials, environmental hazards, and economic effectiveness. First, Li, Co, Ni, and Mn are the main components of the cathode in LIBs. Co and Li are the most concerning raw materials because of their low geological availability and market limitations. Therefore, it is expected that Co and Li will face severe deficiencies in upcoming years (Meshram et al., 2020).

Second, spent LIBs would be disposed of in landfills if they are not sent to recycling processes. Disposing of vast amounts of spent LIBs results in toxic substance release and fire or explosion hazards, causing various severe environmental issues. Moreover, landfill pollutants might be transported to other locations outside landfills. These pollutants threaten human health and the environment (Winslow et al., 2018).

Third, while producing LIBs from raw materials may generate water pollution, air emissions, and solid wastes, recycling LIBs may reduce energy consumption and GHG emissions. A recent study showed that hydrometallurgical processes have a potential for 8.55% and 6.62% energy reduction and GHG emission mitigation, respectively, compared to battery production using virgin materials (Xiong et al., 2020). Another investigation showed that the GHG emissions of a lithium manganese oxide battery could be mitigated by up to 50% over its lifetime if it uses a recovered cathode, Al, and Cu instead of virgin materials (Meshram et al., 2020; Winslow et al., 2018).

Finally, from an economic standpoint, it has been found that remanufacturing LIBs with recycled components would save up to 40% of the total cost compared to manufacturing with virgin materials. In addition, a reduction of $1.87/kg can be achieved when recovered materials are used in production instead of virgin materials, exhibiting the high economic effectiveness of LIB recycling (Xiong et al., 2020).

Recycling cathode materials from spent batteries provides a green resource supply and a cost-effective substitute for high-value metals, such as Co and Ni. However, although cathodes manufactured from recovered materials could save up to 43% of their cost, only a small percentage of used batteries are collected and sent to recycling plants (Steward et al., 2019).

A previous study (Abdelbaky et al., 2021) indicated that the environmental consequences of recycling are minimal compared to those of manufacturing using virgin materials. In addition, recycling techniques are widely recognized as critical for attaining environmental sustainability for LIBs (Mossali et al., 2020). Recent studies investigated the global warming potential of the NMC111 battery upon hydrometallurgical and pyrometallurgical recycling (Ciez & Whitacre, 2019; Mohr et al., 2020). They found that the hydrometallurgical technique has lower direct global warming potential and effects from recycled feedstock than pyrometallurgical recycling.

Social and environmental factors may also influence the demand for increased end-of-life battery recycling. Cost, energy, and GHG emissions are the three main areas where savings may be achieved. In addition, with the current raw materials costs and battery compositions, all recycling processes have been proven cost-effective at large volumes. However, to fully utilize the economic and environmental benefits of recycling, the reverse logistics for LIBs must be optimized. A recent study investigated an optimized geospatial structure of a future LIB recycling industry in the UK. It provided an economic and environmental analysis using a customized EverBatt model, reporting the results by both pyrometallurgical and hydrometallurgical recycling technologies (Nguyen-Tien et al., 2022).

Although many papers have reported on commercial recycling techniques for spent LIBs, their methods are still insufficient to achieve viable industrialization of LIB recycling. All agree that further research and development are needed to ensure cost-effective and environmentally friendly alternatives for complex battery systems. Therefore, current and future economic and environmental analyses of recycled materials from the evolving recycling methods are necessary. In some circumstances, government-led incentives to stimulate new industries that use the recovered materials are required (Sommerville et al., 2021).

In particular, the UAE government has a target of having more than 42,000 EVs on the roads by 2030 (Rai, 2023). Thus, EVs will play a significant role in the UAE’s transportation sector in the upcoming years, making recycling LIBs attractive. However, because no academic studies or industrial efforts have investigated the LIB recycling industry in the Middle East, the environmental and economic impacts of having such a plant in an oil-rich country need to be clarified. Dubai, one of the major cities in the UAE, serves as a central gateway to the economy of the Middle East. Therefore, studying the UAE’s case would provide fundamental groundwork in terms of EV market circumstances that can be applied to other Middle Eastern countries.

Hence, the objectives of this study are to assess the environmental and economic impacts of LIB remanufacturing compared with manufacturing using virgin materials in the UAE, as a typical example of the oil-rich countries in the Middle East, and to investigate the impacts of several factors on the environmental and economic performances of LIB recycling via sensitivity analysis, identifying key variables that significantly influence recycling outcomes.

By quantifying the environmental footprint of the processes, this study can contribute to a deeper understanding of sustainable practices in resource-rich regions, potentially informing policies and practices aimed at reducing carbon emissions and resource depletion. Moreover, this research may provide stakeholders with valuable insights for investment decisions and resource allocation strategies, ultimately contributing to the economic sustainability of the region. Thus, we expect that this work thereby would foster more efficient resource utilization and environmental stewardship in the UAE and beyond.

The remainder of this paper is structured as follows. Section “Problem Statement” provides the problem statement. Section “Methods” discusses the methods used to solve the problem. Section “Case Study Scenario” delivers the primary case scenario for this study. Section “Results” provides the sensitivity analysis results. Section “Discussion” discusses the findings and some challenges, and Section “Conclusions” concludes the paper.

Problem statement

Increasing EVs will lead to a vast amount of LIB waste, resulting in a growing need for new LIBs to replace the spent ones. Accordingly, to fulfill the needs of LIB consumers, two possible paths should be followed: manufacturing new cells using virgin materials or remanufacturing spent LIBs using recovered contents.

This study explicitly estimated and compared the environmental and economic effects of manufacturing LIBs with virgin and recycled materials in the UAE. For the detailed analysis, the manufacturing process using virgin materials was broken down into the cathode production phase, where virgin materials are used to produce the cathode powder, and the cell manufacturing phase, which includes cell assembly and battery electrochemistry activation.

The remanufacturing process with recycled materials comprises spent LIB recycling, cathode reproduction, and cell remanufacturing using recycled materials. Some metals, such as Co, Ni, and Mn, are recycled in the recycling stage, while Al and Cu are sold. Other extra components (e.g., graphite, separator, and carbon black) are disposed of in landfills or gathered as scrap due to their insignificance for the battery portion, price, and environmental impacts. The recycled contents are used to produce the cathode powders for the cathode reproduction phase. Finally, cell remanufacturing using recovered materials is similar to production using virgin materials. Because sufficient literature is not available regarding the remanufacturing of a battery pack, this research limits the evaluation at the cell level.

Methods

This research employed the 2023 version of EverBatt, an Excel-based tool developed first in 2018 by Argonne National Laboratory in the U.S., to evaluate the cost and environmental impacts of the several lifecycle stages of a LIB (Argonne National Laboratory, 2024). EverBatt has been used in a few recent studies for hydrometallurgical remanufacturing of NMC batteries in China (Xiong et al., 2020), efficient direct recycling of lithium iron phosphate batteries in the U.S. (Xu et al., 2020), and both hydrometallurgical and pyrometallurgical remanufacturing of NMC batteries in the U.K. (Nguyen-Tien et al., 2022).

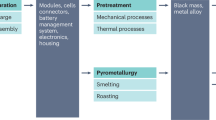

EverBatt consists of three primary modules as depicted in Fig. 1: (1) battery manufacturing with virgin materials, (2) battery recycling, and (3) battery manufacturing with recycled materials. Module (1) operates independently, while Modules (2) and (3) are executed sequentially and compared against Module (1) to assess their environmental and economic performance.

The recycling module includes six sub-modules: battery collection and transportation, battery disassembly, preprocessing of batteries and manufacturing scrap, critical materials recovery through pyrometallurgical, hydrometallurgical, or direct recycling technologies, material conversion, and cathode production. It considers several chemistries of battery cathodes, such as that with lithium cobalt oxide (LCO), NMC111, NMC532, NMC622, NMC811, lithium nickel cobalt aluminum oxide (NCA), lithium manganese oxide (LMO), and LFP.

The user interface of EverBatt comprises 17 interconnected worksheets, the details of which are summarized in Table B1 in Appendix. These worksheets are categorized into four groups: (1) description, (2) high-level input-output data, (3) detailed input-output data for each life cycle stage, and (4) background data. General business parameters, such as factory capacity and battery type, are entered into the “Input” worksheet. For country-specific analyses, worksheets 5–14 must be carefully adjusted to reflect localized data. Additionally, when applying the model to a new country, the background data worksheets need to be updated using BatPac and GREET to ensure accurate results.

For the case study, several relevant datasets must be input into EverBatt, including all fields under the manufacturing using virgin materials, collection and transportation, recycling, cathode production, and manufacturing using recycled materials sections in the input sheet. Specifically, the battery level (cell/pack), throughput, battery chemistry, geographic location, battery model collected, transported, and recycled travel distance, and processing capacity fields were changed based on the case study scenario, as further discussed in Section “Case Study Scenario”.

EverBatt considers several geographic features for its geographic regions, including California, the U.S. national average, China, and Korea. We added the UAE as a user-defined location into EverBatt by collecting all the recent data for the required geographic parameters.

The geographic variations of utility, waste disposal, direct labor, equipment, building, transportation costs, and environmental impacts are parameters in the EverBatt geographic parameters sheet. However, because the materials consumed in the battery market are often global commodities, the same material costs are assumed for all geographical areas. Therefore, battery production and transportation parameters for the UAE were gathered, assumed, or calculated depending on the required parameters in the geographic parameters sheet to conduct this case study for the UAE.

In addition, all the default environmental parameters in EverBatt were calculated using Argonne’s Greenhouse gases, Regulated Emissions, and Energy use in Transportation (GREET) model. Therefore, the UAE’s environmental parameters needed for the geographic parameters were also calculated using the “Electric” sheet in GREET 2022. However, because Greet 2022 uses energy data for the UAE from 2019, this study updates it with the latest energy data from the UAE in 2022 (Panos et al., 2022). The type of data and methods used to find these parameters are further discussed in Section “Environmental impacts from electricity generation”.

Case study scenario

This section describes the basic case study scenario, including the selected locations and production volume of recycling plants, selected battery chemistry, considered recycling technologies, and the collected data.

Location and processing volume of recycling plants

The UAE does not currently have an EV battery market. Thus, as illustrated in Fig. 2, we assumed the locations of the expected recycling plants, including LIB recycler, manufacturer, cathode producer, and collection points, considering the geographical location of major cities (e.g., Abu Dhabi, Dubai, and Ras AlKhaimah) and current industrial complexes (e.g., Khalifa Industrial Zone) in the UAE.

One of the collection points was chosen to be in Abu Dhabi, specifically in the Musaffah industrial district because it is where almost everyone in Abu Dhabi goes for car repairs. Similarly, another collection point was assumed to be located in Dubai as it has a vast population, more precisely in the AlQusais 1 industrial area. The other collection point is AlTurfa in Ras AlKhaimah, which was chosen to serve the northern UAE. The recycling plant and its facilities are assumed to be located in the Khalifa Industrial Zone because it is the largest industrial zone in the UAE, with considerable market access, low operating expenses, and ease of running businesses in the region and globally.

The production volume of future recycled plants is very challenging to forecast and heavily depends on the business environment and government policies. According to Naser Albahri, Director of the Electric Vehicle Innovation Summit held in 2023, EVs are expected to exceed one million by 2030 (Rai, 2023). Analysts anticipated that the total number of EVs would exceed 370,000 by 2032, representing 11% of the UAE’s passenger vehicles (Sambidge, 2023). Considering the broad range of the anticipated number of EVs, this study adopted the mid-range and assumed the number of EVs in the UAE in 2030 would be approximately 700,000.

Following a prior study (Nguyen-Tien et al., 2022), the average lifetime of EVs in the UAE was assumed to be 8 years. Hence, on average, 12.5% ( = 1/8) of EV batteries may need to be recycled annually. Tesla vehicles remain popular in the UAE (Sambidge, 2023). Considering the battery weights of popular Tesla models of 478 kg (Model 3) to 544 kg (Model Y) (Lisa Conant, 2023), this study assumed that an average EV battery pack weighs approximately 500 kg. Hence, the recycling plant’s feedstock (battery pack) processing volume was estimated to be 43,750 tons per year ( = 700,000/year × 12.5% × 500 kg). Moreover, the sensitivity analysis in Section 5.3.3 considers higher (120%) and lower (80%) processing volumes. Of note, the unit ‘ton’ in this paper represents a metric ton.

Battery cell chemistry

There is a wide variety of LIB cell chemistries available on the market. Recently, NMC batteries have emerged as the favored model of original manufacturers in the automotive industry. Moreover, in the mid-2020s, NMC will prevail in the EV market primarily due to its superior electrochemical capability (Boukhalfa & Ravichandran, 2019). Li–Ni–Mn–Co oxide in NMC batteries is a dominant constituent in the cathode, whereas graphite is typically used for the anode. Compared to other batteries, NMC cells contain a relatively high amount of Co, which has a high market value but a limited supply globally. Therefore, it may have supply risks in the future, making its recycling more attractive.

This study considered NMC batteries to demonstrate the environmental and economic benefits of recycling spent LIBs. Specifically, prismatic NMC111 was selected as a basic type as it has the highest fraction of Co compared to other NMC batteries, such as NMC532, NMC622, and NMC811 (Olivetti et al., 2017). The sensitivity analysis for battery chemistry in Section 5.3.4 compares the economic and environmental performances of recycling these types of NMC batteries.

Recycling technology

Because of the complicated assembly of LIBs and the diversity of electrode materials, a typical LIB recycling needs physical and chemical processes. The physical process includes pretreatments and direct physical recycling, which enables the recovery of spent LIB materials without any complex chemical reactions.

The chemical process is mainly used for metal extraction and is classified into pyrometallurgy, hydrometallurgy, and biometallurgy. Pyrometallurgy is the shortest process and is mainly used for Co recovery. Moreover, hydrometallurgical approaches are the major processes because they are used in more than 50% of metal recovery processes from spent LIBs. Finally, biometallurgy is a recycling method that involves bioleaching processes to recover valuable metals in spent LIBs (Huang et al., 2018).

This study considered pyrometallurgical and hydrometallurgical recycling processes because they are commonly used major processes. The pyrometallurgical recycling process mainly recovers Co, Ni, and Cu fractions (Georgi–Maschler et al., 2012; Zheng et al., 2018). This method does not require pretreatments but only the disassembly of big battery packs before recycling. Afterward, the cells are placed in a furnace with three consecutive temperature zones: pre-heating, plastic pyrolyzing, and smelting and reducing. The pre-heating zone heated below 300°C releases the electrolyte vapor without explosion. Next, in the plastics pyrolyzing zone, the plastic components of the spent LIBs are incinerated at 700°C. Finally, the smelting and reducing zone smelt the materials and recovered Co, Ni, Cu, and Fe. Most Li and Al are slagged during the process and cannot be recovered. Although a method exists to recover Li, the extra process is not worth it unless the Li price is high enough to compensate for the operating costs.

Hydrometallurgy recycling is a powerful method used to recover Li and valuable metals from batteries and other components, such as graphite and Al. Currently, China has the biggest LIB recycling companies, GEM High-Tech Co. and Brunp Co., where cathode materials are recovered via a closed-loop hydrometallurgical process (Pinegar & Smith, 2019).

Hydrometallurgical recycling begins with mechanical pretreatments, including shredding, sieving, and other physical processes to separate different components. Discharging waste batteries during the mechanical treatment is required to avoid explosions. After mechanical pretreatments, the recovered fine cathode materials are treated via leaching, which dissolves the metallic fraction and metal solutions for further recovery. The last stage is a recovery of metals by solvent extraction, chemical precipitation, and electrochemical deposition (Liu et al., 2019). In solvent extraction, extractants separate metals in a liquid–liquid extraction process. Chemical precipitation precipitates valuable metals in the leach liquor. Finally, the electrochemical deposition recovers metals from the pure metal or metal hydroxide from the leach liquor.

Notably, the complexity and large material options of LIBs make it very difficult to disassemble battery components. Thus, the economic feasibility of the processes mentioned above relies considerably on the yields of Co and Ni to counterweigh the product quality. If not, the recycled materials barely compensate for the operating costs of the recycling methods.

Data

This section explains the details of the data used in this case study about battery manufacturing costs, transportation costs, and environmental impacts of electricity generation.

Battery manufacturing costs

The cost parameters for battery production in the UAE were obtained from public databases, expert opinions, and literature. The collected data are required for input in the ‘geographic parameters’ sheet of EverBatt to calculate the costs spent for the battery manufacturing stage in the UAE. The data include building costs, direct labor, electricity, water, landfill, wastewater discharge, and natural gas. We refer readers to Table A1 in Appendix for further details. The building cost was assumed based on the default building cost of the U.S. in EverBatt. The direct labor cost was calculated based on the average working hours in the UAE. The electricity cost was computed based on the Abu Dhabi Distribution Company rates. Some of these cost parameters are based on assumptions rather than actual data because of the need for more information about the LIB market in the UAE.

Transportation costs

The default transportation modes in EverBatt are heavy-duty and medium-duty trucks. From the most typical types of trucks in the UAE, the Ford 3548 T tractor head was selected as a heavy-duty truck and the Ford F-Max as a medium-duty truck, respectively. The transportation costs of non-hazardous materials were estimated to be $0.57/km for a heavy-duty truck and $0.48/km for a medium-duty truck, respectively. In addition, the transportation costs of hazardous materials were estimated to be $0.72/km for a heavy-duty truck and $0.60/km for a medium-duty truck. The truck’s lifetime is assumed to be 10 years based on the average lifetime of any car or truck. The driver cost is the average wage of a truck driver in the UAE, and the fuel cost was the UAE’s gasoline price in 2023 (see Table A2 in Appendix).

Environmental impacts from electricity generation

EverBatt incorporates geographical differences in energy sources for electricity generation into its environmental modeling because each region has different energy sources for generating electricity. According to the database provided by Our World in Data (Panos et al., 2022), 49.8% of the electricity generated in the UAE in 2022 was from natural gas, 43.3% was from petroleum, 3.6% was from nuclear, 2.0% was from coal, and 1.3% was from other sources including solar. Moreover, the transmission and distribution loss in 2022 was reported to be 2.2% (Zawya, 2022).

Using GREET 2022 with these data, the environmental impacts of electricity consumption at wall outlets in the UAE were determined. In the ‘Electric’ sheet of GREET 2022, Section 10 details the calculation of fuel-cycle energy use, water consumption, and emissions for various regional generation mixes. For this analysis, the UAE’s energy mix, located in Column “AI,” was updated with 2022 data. The GREET model subsequently calculated the environmental impacts based on the revised energy mix, with the results displayed below the energy mix section. These calculated environmental impacts were then transferred to Section 2.1, “Environmental impacts of electricity by geographical locations,” in the “Geographic Par.” sheet of EverBatt. A summary of the changes from 2019 to 2022 is provided in Table A3 of the Appendix. In addition, the calculated environmental impacts of electricity consumption are presented in Table A4 within Appendix

Results

This section presents the results of the basic business scenario regarding environmental and economic performance. Then, the sensitivity analysis follows. We report the analysis results from two aspects: (1) recycling (open-loop model) and (2) cell remanufacturing (closed-loop model). The scope of recycling is from the collection of spent LIBs to the recycling of collected batteries. Then, the recycled materials were assumed to be sold in the market, making the material flow in an open loop. Moreover, cell remanufacturing includes collection and transport, recycling, cathode remanufacturing with the recycled materials, and cell remanufacturing with the remanufactured cathode, forming the material flow closed loop.

Environmental evaluation

The primary goal of promoting EVs is to decarbonize the transportation sector, i.e., reducing energy consumption and GHG emissions. Figure 3 illustrates the total energy consumption and GHG emissions in recycling and cell (re)manufacturing. The recycling by pyrometallurgy process consumes approximately 4.59 MJ/kg cell of energy and emits 1224.12 g/kg cell of GHGs and that by hydrometallurgy process utilizes 23.73 MJ/kg cell of energy and releases 1730.79 g/kg cell of GHGs.

A cell manufactured using virgin materials consumes 297.51 MJ/kg cell of energy associated with 20,847.50 g/kg cell of GHG emissions. A cell remanufacturing with recycled materials consumes approximately 256.51 MJ/kg cell of energy and emits 20,167.43 g/kg cell of GHGs for pyrometallurgy and 266.14 MJ/kg cell of energy and emits 18606.58 g/kg cell of GHGs for hydrometallurgy. The results show a potential to reduce energy consumption and GHG emissions by approximately 10.7% when batteries are produced by hydrometallurgy using recycled contents instead of virgin materials.

The lower environmental impacts of cell remanufacturing with recycled materials are primarily because LIB recycling avoids part or all of the virgin material extraction and refining activities required in cell manufacturing with virgin materials. Recycling is frequently referred to as urban mining and is a part of the solution to lower the environmental impacts of LIB manufacturing (Beaudet et al., 2020).

While the recycling outputs in EverBatt give outcomes only from the recycling process, excluding collection and transport, this study reports the recycling outputs, including collection and transport, and recycling itself, for a more explicit analysis. However, for the basic business scenario considered, the outputs from collection and transport are relatively insignificant. Thus, the energy use is 0.16 MJ/kg feedstock, and the GHG emission is 12.34 g/kg feedstock. This is because the considered geographical structure requires a short average distance from collection sites to the recycling plant, i.e., 95.7 km (60 miles).

Economic evaluation

The economic evaluations for recycling with hydrometallurgical and pyrometallurgical processes are illustrated in Fig. 4. The hydrometallurgical process ($3.50/kg feedstock) is more cost-effective than the pyrometallurgical process ($3.63/kg feedstock). In addition, the revenues from these processes are $4.05/kg feedstock and $3.06/kg feedstock, respectively. According to EverBatt, the revenue is estimated by assuming that recovered Cu and Al will be sold to the market. From these costs and revenue structures, the profit of the hydrometallurgical process is $0.55/kg feedstock, while that of the pyrometallurgical process is $−0.57/kg feedstock. Hence, for the open-loop business model (from the collection of spent LIBs to the recycling process), the pyrometallurgical process may not be economically feasible under the current market situation.

It is necessary to note that Everbatt 2023 provides a similar chart as Fig. 2 in the Output sheet, and its latest version has a minor bug in presenting the feedstock payment. We fixed the bug for our analysis and provided a bug report in Appendix B.

The significant factors affecting economic performance are material and capital costs. The pyrometallurgical process consumes less materials than the hydrometallurgical process. However, the capital cost, other fixed costs, and maintenance cost of the pyrometallurgical process are higher than for the hydrometallurgical process, making it less cost-effective.

For the closed-loop business model (from collection of spent LIBs to cell remanufacturing), Table 1 summarizes the costs of three possible cell (re)manufacturing processes using virgin materials and recycled materials from the pyrometallurgical and hydrometallurgical processes. The total costs of cell remanufacturing with recycled materials by hydrometallurgical and pyrometallurgical processes are $24.64/kg cell and $29.10/kg cell, respectively, while that of manufacturing using virgin materials is $27.74/kg cell. Therefore, pyrometallurgy may not be suitable for recycling because it is less cost-effective even than manufacturing with virgin materials under the current market situation. However, hydrometallurgy-based cell remanufacturing shows higher economic benefits than manufacturing with virgin materials, saving approximately 11.3% of the costs. The cost of materials primarily accounts for this cost saving.

According to the results, only hydrometallurgy-based cell remanufacturing may be economically and environmentally friendly compared to cell manufacturing using virgin materials.

Sensitivity analysis

The LIB recycling industry is still in its developing phase. Therefore, it may encounter several uncertainties regarding technological, industrial, and market environments. Hence, a sensitivity analysis specific to the UAE market was conducted to examine the influence of four different factors on the economic and environmental performances of LIB recycling: supply amount of spent LIBs, purchase cost of spent LIBs, market price of recovered metals, and LIB chemistry.

We constructed several test cases to examine these factors, as presented in Table 2. Case C1 with the spent LIB supply amount of ‘M’ represents the basic business scenario discussed in Section 5.2. In cases C2 and C3, the spent LIB purchase costs were changed from the basic case to 0.97 ( + 20%) and 0.64 ( − 20%), respectively. Cases from C4 to C7 examine the market price changes of Co and Ni of +20% and −20%, respectively, because they are the major recovered materials and have higher monetary values than other materials. For each case, the supply amount of spent LIBs was changed to +20% (H) and −20% (L) from the basic supply amount (M). Section “Battery chemistry” provides evaluations of different battery chemistries compared to the basic case, Case C1–M.

Purchase cost of spent LIBs

This subsection analyzes the impact of the change in the spent LIB purchase costs on the economic performances. Table 3 provides the results of cases with changes in the spent LIB purchase cost. As the purchase cost increases in case C2, the recycling and cell manufacturing costs also increase, and vice versa in case C3. Notably, the pyrometallurgical recycling is not profitable for higher and lower purchase costs than other processes. The cell remanufacturing with recycled materials by pyrometallurgy is more costly than that with virgin materials. Columns Δ12 and Δ13 show the relative change in the metrics from cases C1 to C2 and C3, respectively. Hydrometallurgy is more sensitive to the change in the spent LIB purchase costs than pyrometallurgy. Because energy use and GHG emissions do not change regarding the spent LIB purchase costs, the environmental results are the same as the basic case.

Metal market price

Because the costs of raw materials are the most significant components in the total cost of the entire remanufacturing process, we evaluated the impact of the market prices of valuable metals, including Co and Ni, on the economic performance of the recycling and manufacturing processes. The market prices of Co and Ni in the basic scenario are $28.70/kg and $16.00/kg, respectively. From this baseline, in Table 4, case C4 (C5) considers a + 20% ( − 20%) of the Co price, and case C6 (C7) considers +20% (-20%) of the Ni price.

The market price changes of Co and Ni monotonically affect the economic performance of the recycling process. As the metal prices increase, the costs and revenues of the recycling process increase and vice versa. The pyrometallurgical process is not profitable in all cases for the open-loop business model, resulting in it being more costly in all cases for cell (re)manufacturing compared with other processes. The hydrometallurgy-based cell manufacturing outperforms manufacturing with virgin materials in all cases. Importantly, the market price changes of Co and Ni did not affect energy use or GHG emissions.

Supply amounts of spent LIBs

The production volume of recycling plants is directly proportional to the supply amounts of spent LIBs. However, the amount of spent LIBs may vary according to societal movements, business environments, and government policies. Thus, we examined +20% and −20% changes in the supply amounts of spent LIBs in all cases to analyze the sensitivity of the economic performances to the supply amounts of spent LIBs. Figure 5 illustrates the results of recycling costs, recycling profit, and cell remanufacturing cost regarding the supply amounts of spent LIBs: +20% (H), basic (M), and −20% (L).

As shown in Fig. 5(a), in all cases for both recycling technologies, as the supply amount of spent LIBs decreases, the recycling cost ($/kg feedstock) increases. This is mainly due to the economies of scale in the recycling plants. Moreover, the pyrometallurgical process has a higher positive slope of the recycling cost than the hydrometallurgical process. This may be related to the costly facilities of the pyrometallurgical process, even for a small plant.

Figure 5(b) shows the profits of the recycling processes in all test cases for different LIB supply amounts spent. The same pattern appears in all cases, such that larger plants generate more profit per kg of feedstock. Moreover, the pyrometallurgical process is economically infeasible regardless of the different spent LIB supply amounts.

The production volume of the cell remanufacturing also depends on the supply amount of spent LIBs. Thus, we analyzed the impact of the supply amount of spent LIBs on the cell remanufacturing costs, as presented in Fig. 3(c). As the supply amount of spent LIBs decreases (H → M → L), the cell remanufacturing cost increases in all cases. Moreover, the cell remanufacturing cost from H to M shows a steeper increase compared to that from M to L. Thus, the cell remanufacturing cost may be more sensitive at a high production volume.

For the cost of cell manufacturing using virgin materials, EverBatt showed minimal variations with respect to the cell production volume. From our analysis, such variation may be related to numerical errors caused by rounding decimal values and several multiplications of decimal values. Thus, we consider that the cell manufacturing costs with virgin materials are consistent with varied production volumes.

Like the changes in spent LIB purchase cost and metal market price, different quantities of spent LIBs did not affect energy use or GHG emissions. This implies that financial and production volumetric factors may not affect the environmental outcomes per unit product.

Battery chemistry

The basic business scenario only considered the recycling of NMC111 (LiNi1/3Mn1/3Co1/3O2) cells. Thus, the last factor in the sensitivity analysis is battery chemistry to determine the environmental and economic impacts of recycling other NMC cells, including NMC532 (LiNi0.5Mn0.3Co0.2O2), NMC622 (LiNi0.6Mn0.2Co0.2O2), and NMC811 (LiNi0.8Mn0.1Co0.1O2) (Rinkel et al., 2022). Table 5 shows the results of this analysis, in which all other factors are the same as in case C1 except for the battery chemistry.

In terms of recycling cost, NMC111 is the most costly, while NMC532 is the least costly, regardless of the process technologies. For recycling profit, NMC111, with the hydrometallurgical process, is the most competitive at $0.55/feedstock compared to other battery chemistries. In addition, the pyrometallurgical recycling process was determined to be economically infeasible for all battery chemistries considered. All battery types with the pyrometallurgical process show similar results for energy use, while NMC811 consumes the lowest energy with the hydrometallurgical process. For GHG emissions with the pyrometallurgical process, NMC111 is more environmentally friendly than others, and with the hydrometallurgical process, NMC811 is more environmentally friendly.

In the open-loop business model, NMC111, with the hydrometallurgical process, shows the best economic performance but the worst environmental impact. However, NMC811, with the hydrometallurgical process, shows the best environmental benefit but the lowest economic performance.

The lower part of Table 5 provides the analysis results of the closed-loop model for different battery types. Owing to the different chemical compositions, each battery type results in slightly different production volumes of cathode materials from the same amount of spent LIBs, 43,750 tons/year. NMC532 yields the lowest cell manufacturing cost compared to others. Overall, in the closed-loop business model, NMC532 is the best in terms of economic aspects, and NMC111 is suitable in terms of environmental performance. However, NMC811 shows the worst economic and environmental outcomes and other battery types show similar results.

LFP battery

While NMC batteries have been the primary focus of this study due to their predominant usage in the UAE, the growing importance of LFP batteries in global markets, particularly in China, necessitates further investigation. LFP batteries are becoming increasingly prominent; however, their recycling poses distinct challenges. Unlike NMC and other cathode chemistries, LFP batteries have a lower economic value due to their reduced high-value metal content, making conventional hydrometallurgical or pyrometallurgical recycling methods less viable. Instead, direct recycling has been identified as a more suitable approach for LFP batteries (Roy et al. (2024)).

Xu et al. (2020) evaluated the economic and environmental impacts of direct recycling for LFP batteries using EverBatt 2019. Their analysis, based on the recycling of 10,000 tons of spent LFP batteries in the U.S., reported energy consumption of 3.5 MJ per kilogram of cell recycled, greenhouse gas (GHG) emissions of 650 grams per kilogram of cell recycled, and a cost-to-revenue ratio indicating potential profitability at $2.1 per kilogram for recycling costs and $3.2 per kilogram for revenue. However, these estimates were derived using EverBatt 2019, which lacked detailed modeling of the latest recycling process and did not incorporate the latest process data or economic inputs.

In contrast, this study utilized EverBatt 2023, which integrates significant updates, including detailed modeling of preprocessing stages to produce black mass, along with revised background data from BatPaC 5.0 (2022), GREET 2022, and the most recent material and labor cost data. Under the basic scenario C1, recycling 43,750 tons of spent LFP batteries required 30.0 MJ of energy per kilogram of cell recycled and resulted in 2,427 grams of GHG emissions per kilogram. The updated economic analysis revealed a reduced cost of $0.34 per kilogram of cell recycled and an increased revenue of $4.62 per kilogram, indicating a notable improvement in profitability compared to earlier estimates.

The updated process modeling and assumptions incorporated in EverBatt 2023 underscore the significant impact of the critical materials recovery module, which was not explicitly included in EverBatt 2019. This analysis demonstrates that while recycling LFP batteries remains a viable option, it involves higher energy consumption and GHG emissions compared to previous studies. These findings emphasize the importance of utilizing updated tools and methodologies to evaluate the environmental and economic implications of battery recycling processes comprehensively.

This analysis provides a preliminary exploration of LFP battery recycling, motivated by their growing global significance. While the findings offer valuable insights, they rely on initial assumptions and modeling that require further validation. The higher energy consumption and GHG emissions observed in this study highlight the need for careful scrutiny of factors such as regional recycling infrastructure and feedstock characteristics. Future research should focus on detailed sensitivity analyses and real-world validation to refine these results and support the development of tailored recycling strategies for LFP batteries.

Discussion

The results reveal that remanufacturing NMC111 batteries with hydrometallurgy technology will allow the UAE to lower energy consumption and GHG emissions by approximately 10–11%, with an approximate 11% cost savings compared to battery manufacturing using virgin materials.

The purchase cost of spent LIBs is a significant portion of the recycling costs and thus considerably affects the economic viability of LIB recycling. Moreover, the costs of the recycling process and cell manufacturing monotonically increase as the market prices of Co and Ni increase. As a result, market trends and spent battery purchase costs should generally be managed carefully to acquire the economic feasibility of recycling LIBs of any model. This analysis suggests implications for the UAE government, indicating that implementing a subsidy policy to stabilize spent battery purchase costs could facilitate the sustainable development of the LIB battery recycling industry.

The cell manufacturing cost revealed more sensitivity at a high production volume. Given the projected increase in the volume of spent LIBs in the UAE, further research is required to bridge the gaps between current technologies and future demands, with numerous challenges anticipated.

The different chemical compositions of LIBs showed relatively complicated results. NMC111 and NMC811 are the best in terms of the economic and environmental aspects of the closed-loop business scope, respectively. For the closed-loop business model, NMC532 and NMC111 are relatively good in terms of economic and environmental performance.

The overall results and analyses suggest that careful consideration of energy consumption, GHG emissions, and cost variations is crucial concerning battery type, spent LIBs purchase cost, and metal market prices to ensure environmentally friendly and economically viable recycling practices. Our proposed evaluation framework, utilizing EverBatt alongside a UAE-specific database, could serve as a critical decision-support tool for future studies, with the potential to be applied to other Middle Eastern countries.

One of the challenges is that the amount of spent LIBs might not be sufficient to sustain planned processing plants in the UAE. Furthermore, the UAE lacks comprehensive policies and regulations that explicitly tackle LIB supply and waste. Most waste regulations, including those on waste batteries, now occur at the Emirate or municipal government level. Each Emirate has its policies and rules for waste collection, transport, recycling, and maintaining records, posing a considerable obstacle to transferring and handling battery waste across all emirates. Hence, consistent, clear, uniform regulations for LIB products in the UAE will be needed to boost the collection rates across the country and spur innovation and technology development to recover valuable materials from spent LIBs.

In addition, although the collection and transport of spent LIBs are generally expected to require many operations and resources, the considered geographical layout of LIB recycling in the UAE allows for relatively short average transport distances, approximately 100 km. This is due to the close proximity of the country’s major cities, which are predominantly located along the coastal areas. This implies that the collection and transport of spent LIBs may play a minor role in LIB recycling in the UAE. Section 5.1 discusses the energy consumption and GHG emissions associated with the collection and transport stages, highlighting that they are minimal compared to other process stages. Notably, a recent case study of the U.K. (Nguyen-Tien et al., 2022) disregarded the collection and transport cost of spent LIBs between end-users and collection sites because they are negligible, while those between collection sites and each recycler were considered based on the optimized geographical structure.

Conclusions

This study examined the environmental and economic benefits of recycling and remanufacturing NMC cells with recycled contents using hydrometallurgy and pyrometallurgical processes compared to manufacturing using virgin materials, with a primary focus on the UAE.

For the basic regional scenario, hydrometallurgy-based LIB remanufacturing can lower energy consumption and GHG emissions by 10.7%, along with an 11.3% cost savings, compared to cell manufacturing with virgin contents. However, pyrometallurgy-based LIB remanufacturing is economically infeasible in all considered business environments, although it has good potential to reduce GHG emissions.

The cost of spent LIBs impacts recycling economics significantly. Market trends and purchase costs must be managed carefully for economic feasibility. The rising quantity of spent LIBs presents challenges, compounded by gaps in recycling research and production costs responsive to volume fluctuations. Different LIB chemical compositions yield complex results, with NMC111 and NMC811 being optimal in terms of economic and environmental aspects, respectively. NMC532 and NMC111 are relatively good for both in a closed-loop business model. Preliminary analysis of LFP batteries highlights unique challenges in recycling due to their lower economic value and high energy requirements, suggesting the need for further detailed studies, particularly in the Middle Eastern context.

This is the first study to evaluate the LIB recycling industry economically and environmentally in an oil-rich Middle Eastern country. Our suggested assessment framework using EverBatt combined with a database tailored for the UAE could serve as a crucial tool for further investigations to develop regional policies and regulations, with the potential for adaptation to other Middle Eastern countries.

Future research endeavors could broaden the analysis scope to encompass the potentially integrated EV battery market in Middle Eastern countries neighboring the UAE (e.g., Saudi Arabia and Qatar). Additionally, another further study could involve advanced uncertainty modeling within market contexts.

Data availability

The most core data generated or analyzed during this study are included in this published article and its supplementary information file. All other datasets generated during and/or used during the current study are available from the corresponding author on reasonable request.

References

Abdelbaky M, Schwich L, Crenna E, Peeters JR, Hischier R, Friedrich B, Dewulf W (2021) Comparing the environmental performance of industrial recycling routes for lithium nickel-cobalt-manganese oxide 111 vehicle batteries. Procedia CIRP 98:97–102. https://doi.org/10.1016/J.PROCIR.2021.01.012

Argonne National Laboratory (2024) EverBatt: Argonne’s closed-loop battery life-cycle model. https://www.anl.gov/amd/everbatt

Beaudet A, Larouche F, Amouzegar K, Bouchard P, Zaghib K (2020) Key challenges and opportunities for recycling electric vehicle battery materials. Sustainability 12:1–12. https://doi.org/10.3390/su12145837

Boukhalfa S, & Ravichandran K (2019) Who will win the battery wars? | GreenBiz. https://www.greenbiz.com/article/who-will-win-battery-wars

Ciez RE, Whitacre JF(2019) Examining different recycling processes for lithium-ion batteries Nat Sustain 2:148–156. https://doi.org/10.1038/s41893-019-0222-5

Georgi-Maschler T, Friedrich B, Weyhe R, Heegn H, Rutz M (2012) Development of a recycling process for Li-ion batteries. J Power Sources 207:173–182. https://doi.org/10.1016/J.JPOWSOUR.2012.01.152

Huang B, Pan Z, Su X, An L (2018) Recycling of lithium-ion batteries: recent advances and perspectives. J Power Sources 399:274–286. https://doi.org/10.1016/J.JPOWSOUR.2018.07.116

Lisa Conant (2023) Tesla Battery Weight Guide: Tesla Batteries per Tesla Model Answered, Plus Other EV Batteries. https://www.carparts.com/blog/how-heavy-is-a-tesla-battery/

Liu C, Lin J, Cao H, Zhang Y, Sun Z (2019) Recycling of spent lithium-ion batteries in view of lithium recovery: A critical review. J Clean Prod 228:801–813. https://doi.org/10.1016/J.JCLEPRO.2019.04.304

McKinsey (2023) Lithium-ion battery demand forecast for 2030. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/battery-2030-resilient-sustainable-and-circular

Meshram P, Mishra A, Abhilash, Sahu R (2020) Environmental impact of spent lithium ion batteries and green recycling perspectives by organic acids – A review. Chemosphere 242:125291. https://doi.org/10.1016/j.chemosphere.2019.125291

Mohr M, Peters JF, Baumann M, Weil M (2020) Toward a cell-chemistry specific life cycle assessment of lithium-ion battery recycling processes. J Ind Ecol 24:1310–1322. https://doi.org/10.1111/JIEC.13021

Mossali E, Picone N, Gentilini L, Rodrìguez O, Pérez JM, Colledani M (2020) Lithium-ion batteries towards circular economy: a literature review of opportunities and issues of recycling treatments. J Environ Manag 264:110500. https://doi.org/10.1016/J.JENVMAN.2020.110500

Natkunarajah N, Scharf M, Scharf P (2015) Scenarios for the return of lithium-ion batteries out of electric cars for recycling. Procedia CIRP 29:740–745. https://doi.org/10.1016/J.PROCIR.2015.02.170

Nguyen-Tien V, Dai Q, Harper GDJ, Anderson PA, Elliott RJR (2022) Optimising the geospatial configuration of a future lithium ion battery recycling industry in the transition to electric vehicles and a circular economy. Appl Energy 321:119230. https://doi.org/10.1016/J.APENERGY.2022.119230

Olivetti EA, Ceder G, Gaustad GG, Fu X (2017) Lithium-ion battery supply chain considerations: analysis of potential bottlenecks in critical metals. Joule 1:229–243. https://doi.org/10.1016/J.JOULE.2017.08.019

Panos E, Densing M, Volkart K (2022) Energy. Our World Data 9:28–49. https://doi.org/10.1016/j.esr.2015.11.003

Pinegar H, Smith YR (2019) Recycling of end-of-life lithium ion batteries, part I: commercial processes. J Sustain Metall 5:402–416. https://doi.org/10.1007/S40831-019-00235-9/FIGURES/8

Rai B (2023) Range anxiety, accessibility pose concerns for EV adoption in the UAE. https://www.zawya.com/en/business/energy/range-anxiety-accessibility-pose-concerns-for-ev-adoption-in-the-uae-mxquy5em

Rinkel BLD, Vivek JP, Garcia-Araez N, Grey CP (2022) Two electrolyte decomposition pathways at nickel-rich cathode surfaces in lithium-ion batteries. Energy Environ Sci 15:3416–3438. https://doi.org/10.1039/D1EE04053G

Roy JJ, Phuong DM, Verma V, Chaudhary R, Carboni M, Meyer D, Cao B, Srinivasan M (2024) Direct recycling of Li‐ion batteries from cell to pack level: Challenges and prospects on technology, scalability, sustainability, and economics. Carbon Energy 6:e492. https://doi.org/10.1002/cey2.492

Sambidge A (2023) Electric car sales on the charge due to UAE policy. https://www.agbi.com/analysis/transport/2023/08/electric-car-sales-on-the-charge-due-to-uae-policy/

Sommerville R, Zhu P, Rajaeifar MA, Heidrich O, Goodship V, Kendrick E (2021) A qualitative assessment of lithium ion battery recycling processes. Resour Conserv Recycling 165:105219. https://doi.org/10.1016/J.RESCONREC.2020.105219

Steward D, Mayyas A, Mann M (2019) Economics and challenges of Li-ion battery recycling from end-of-life vehicles. Procedia Manuf 33:272–279. https://doi.org/10.1016/J.PROMFG.2019.04.033

Swain B (2017) Recovery and recycling of lithium: a review. Sep Purif Technol 172:388–403. https://doi.org/10.1016/j.seppur.2016.08.031

Winslow KM, Laux SJ, Townsend TG (2018) A review on the growing concern and potential management strategies of waste lithium-ion batteries. Resour Conserv Recycling 129:263–277. https://doi.org/10.1016/J.RESCONREC.2017.11.001

Xiong S, Ji J, Ma X (2020) Environmental and economic evaluation of remanufacturing lithium-ion batteries from electric vehicles. Waste Manag 102:579–586. https://doi.org/10.1016/j.wasman.2019.11.013

Xu P, Dai Q, Gao H, Liu H, Zhang M, Li M, Chen Y, An K, Meng YS, Liu P, Li Y, Spangenberger JS, Gaines L, Lu J, Chen Z (2020) Efficient Direct Recycling of Lithium-Ion Battery Cathodes by Targeted Healing. Joule 4:2609–2626. https://doi.org/10.1016/J.JOULE.2020.10.008

Zawya (2023) GRID GROWTH: Dubai Electricity and Water Authority shares T&D numbers for 2022. https://www.zawya.com/en/projects/utilities/grid-growth-dubai-electricity-and-water-authority-shares-t-and-d-numbers-for-2022-cv7vwkmz

Zheng X, Zhu Z, Lin X, Zhang Y, He Y, Cao H, Sun Z (2018) A mini-review on metal recycling from spent lithium ion batteries. Engineering 4:361–370. https://doi.org/10.1016/J.ENG.2018.05.018

Acknowledgements

This work was supported by the National Research Foundation of Korea (NRF) grant funded by the Ministry of Education (No. RS-2023-00248913).

Author information

Authors and Affiliations

Contributions

RA: data curation, analysis, experiments, writing—original draft preparation. HA: conceptualization, methodology, validation, analysis, experiments, writing—review and editing, supervision, project management, and funding acquisition. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not include any studies regarding consent.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Almahri, R., An, H. Evaluating economic and environmental viability of recycling lithium-ion battery for electric vehicles in the middle east: a case study in the UAE. Humanit Soc Sci Commun 12, 508 (2025). https://doi.org/10.1057/s41599-025-04629-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-04629-x