Abstract

Green technology is crucial for achieving sustainable and high-quality development. Government environmental protection expenditure and fiscal transparency are key drivers of this process. Utilizing panel data from 254 Chinese cities between 2013 and 2020, this paper applies a panel least squares method with robust standard errors to explore the impact of government environmental protection expenditure on green technology, focusing on the role of fiscal transparency. The results reveal that fiscal transparency significantly moderates this relationship, a finding that withstands a series of robustness tests. Furthermore, the impact varies significantly across regions with different economic statuses and cities at various administrative levels. Fiscal transparency fosters the advancement of green technology by improving institutional frameworks, boosting corporate confidence, and increasing social investment, thereby enhancing green technology development through both government and social investment. Accordingly, it is recommended that the Chinese government emphasize the moderating effect of fiscal transparency on the impact of government environmental protection expenditure on green technology and implement effective strategies to reduce excessive regional disparities in these effects. Moreover, by enhancing fiscal transparency, the government should enhance the contribution of social capital to green technology development.

Similar content being viewed by others

Introduction

Against the backdrop of global climate change and deteriorating ecological environments, green development and sustainable economic growth have emerged as central concerns for governments and various sectors of society worldwide (Shao et al., 2021). Green technology is the pivotal driver of green development, with its innovation and application directly contributing to enhanced resource utilization efficiency, reduced environmental pollution, and ecosystem restoration. However, the development of green technology faces challenges such as high costs, long cycles, and high risks, which hinder rapid progress through market mechanisms alone (Li et al., 2021). As a crucial policy tool, government environmental protection expenditure plays a vital role in promoting environmental protection, resource conservation, and ecological restoration. The effectiveness of this expenditure depends not only on its scale but also on its efficiency, transparency, and external constraints. Specifically, the impact of fiscal transparency on the development of green technology has become a critical concern for academics and policymakers.

Fiscal transparency refers to the openness and quality of fiscal information disclosed by governments, including revenue, expenditure, budget execution, and fund utilization. High fiscal transparency enhances government accountability, reduces corruption and rent-seeking behaviors, and improves fund efficiency, thus boosting the effectiveness of environmental protection expenditure in advancing green technology. Conversely, low fiscal transparency may lead to irregular fund utilization, inefficient resource allocation, and even corruption, undermining the effectiveness of these expenditures. This study aims to explore the effects of government environmental protection expenditure on green technology and its impact mechanisms from the perspective of fiscal transparency. It will address the following questions: (1) Does this expenditure significantly advance green technology development from the perspective of fiscal transparency? (2) How does fiscal transparency influence the effectiveness of this expenditure on green technology? (3) Given differences in geographical location, economic development levels, and urban hierarchies, are there significant variations in the green technology effect of government environmental protection expenditure due to fiscal transparency? Through comprehensive research on these questions, this study not only advances theoretical understanding of the relationship between government environmental protection expenditure and green technology but also offers critical policy insights for optimizing these expenditures, enhancing fiscal transparency, and fostering green technology development.

The paper is structured as follows: section “Literature review” reviews the literature. Section “Research hypotheses” examines the impact of government environmental protection spending on green technology with a focus on fiscal transparency and proposes research hypotheses. Section “Analytical framework of empirical research” introduces the foundational model, variables, and data sources. Section “Results and analysis” discusses the regression results and their implications and tests the robustness of the conclusions. Section “Heterogeneity analysis and mechanism discussion” investigates regional differences and underlying mechanisms.

Literature review

Economic and environmental effects of green technology

In the global pursuit of sustainable development, green technology stands as a pivotal driver profoundly altering the trajectory of economic and environmental development, with notable economic and environmental effects. From an economic perspective, green technology has opened up new avenues for economic growth (Du and Li, 2019; Zhang et al., 2022). On one hand, green technology has sparked the emergence of a series of emerging industries, such as the thriving renewable energy sectors of solar, wind, and biomass energy. These industries have not only attracted significant investments, created new economic growth points, but also fostered the coordinated development of upstream and downstream industrial chains (Valero et al., 2018; Zhou et al., 2023; Liu and Qian, 2024). On the other hand, green technology has driven the transformation and upgrading of traditional industries. By introducing green manufacturing technologies, clean production processes, and other innovations, traditional industries can reduce energy consumption, decrease costs, and enhance product quality and market competitiveness (Cao and Wang, 2017; Madaleno et al., 2022).

In terms of environmental effects, green technology plays an irreplaceable role. It is dedicated to solving various environmental problems and effectively promoting ecological improvement. In the energy sector, the widespread application of renewable energy technologies has reduced dependence on traditional fossil fuels, lowered emissions of greenhouse gases such as carbon dioxide, and made significant contributions to mitigating global warming (Kong and Chen, 2024). In pollution control, green technology has developed a series of efficient pollution treatment technologies, such as wastewater treatment and air pollution control, which can effectively reduce the pollution of industrial wastewater, waste gas, and solid waste to the environment and protect the balance of ecosystems. Furthermore, green technology has promoted the recycling of resources, improved resource utilization efficiency, reduced resource waste, and alleviated environmental pressure from the source (Xie and Teo, 2022; Radmehr et al., 2024).

The role of government environmental protection expenditure in promoting green technology

Government environmental protection expenditure can provide solid financial support for green technology research and development. Green technology R&D often requires substantial upfront investments, has long cycles, and involves high risks, making it difficult for enterprises to bear alone (Xiong et al., 2020; Xiao et al., 2022). By allocating funds directly to green technology R&D projects through financial allocations and research grants, the government can effectively alleviate the shortage of R&D funds and encourage research institutions and enterprises to actively engage in green technology R&D (Shao and Chen, 2022; Hossain, 2024). For instance, in the renewable energy sector, the government’s financial support for R&D in clean energy technologies such as solar and wind energy has led to significant breakthroughs, improving energy conversion efficiency and reducing costs. Government environmental protection expenditure can also promote the development of the green technology industry (Yang et al., 2019). On one hand, by purchasing green technology products and services, the government creates a stable market demand for green technology enterprises, incentivizing them to increase R&D investments, expand production scales, and enhance technological levels (Moshiri and Daneshmand, 2020; Zhang et al., 2022). On the other hand, the government can utilize environmental protection expenditure to build green technology industrial parks, improve infrastructure, attract related enterprises and talents to cluster, form industrial cluster effects, and accelerate the transformation and application of green technology achievements (Li et al., 2021). Taking the electric vehicle industry as an example, government environmental protection expenditure policies such as subsidies for purchasing electric vehicles and charging piles have driven the rapid development of the electric vehicle industry, making it gradually mature (Shi et al., 2023).

Incentive effects and constraint mechanisms of fiscal transparency on government expenditure

From the perspective of incentive effects, enhanced fiscal transparency can significantly strengthen the government’s sense of responsibility (Xiao and Fan, 2019; ElBerry and Goeminne, 2021; Wang and Wang, 2024). When government expenditure information is fully disclosed and subject to public supervision, government departments become acutely aware of their significant responsibilities. This pressure from public supervision prompts the government to actively fulfill its duties and optimize the structure of fiscal expenditure (Zhang et al., 2022). To maintain a good government image and credibility, the government will more cautiously plan fund allocations, investing more resources in key areas related to people’s livelihood and social development, such as education, healthcare, and infrastructure construction, thereby improving the quality and efficiency of public services (He et al., 2023).

In terms of constraint mechanisms, fiscal transparency regulates the fund utilization process of government expenditure. Public fiscal information requires the government to follow strict norms and procedures in budget preparation, execution, and final settlement, preventing funds from being diverted or abused. Every fund flow is under public supervision, ensuring that fiscal funds are truly used for designated projects and improving the normativity and security of fund utilization (Gootjes and de Haan, 2022; Chen and Ganapati, 2023). At the same time, fiscal transparency can effectively curb rent-seeking and corruption. In an opaque fiscal environment, government expenditure may become a breeding ground for rent-seeking, with some officials potentially using their power for personal gain. However, increased fiscal transparency greatly reduces opportunities for rent-seeking and corruption, constrains improper behavior in the expenditure process, and ensures the reasonable use of fiscal funds (Zhang and Wang, 2020; Yao, 2024).

Research hypotheses

The promotion effect of government environmental protection expenditure on the development of green technology is significantly constrained by external conditions represented by fiscal transparency

Although the overall scale of government environmental protection expenditure continues to expand, it is not necessarily positively impactful on green technology development due to multiple factors, including expenditure structure, information disclosure, and policy continuity. Firstly, the structure of environmental protection expenditure may be irrational. Considering political performance pressure, social expectations, and the long-term and risky nature of green technology development, the government often places more emphasis on its short-term effects when allocating environmental protection funds, pouring a large amount of fiscal funds into short-term environmental governance projects such as ecological infrastructure construction and ecological relocation, or dispersing funds to multiple post-pollution prevention projects, thereby limiting breakthroughs and applications in green technology (Shao and Chen, 2022; You et al., 2024). Secondly, the information disclosure of environmental protection expenditure is very limited, and an efficient evaluation system is needed. Accurate, timely, and comprehensive government environmental protection financial information can improve regulatory agencies' attention and public awareness in environmental protection expenditure and green technology areas, further affecting the supervision and performance evaluation of expenditure. However, in allocation of financial funds in the environmental protection field, many departments still hold the incorrect philosophy of “emphasizing application over management”, ignoring full information collection and evaluation throughout the process of related projects. At the same time, there is a time lag between investment and performance, so short-term evaluation cannot reflect the actual situation, leading to government decision-making deviating from green technology, which with longer payback periods (He et al., 2018; Du and Song, 2023). What’s more, a lack of transparency raises the possibility of corruption in local government environmental protection expenditure, leading to a rent-seeking space in this area. This largely hinders its effectiveness and undermines fair competition in green technology research and development, reducing social awareness and support for green technology. Finally, there is a lack of stability and coherence in environmental protection expenditure and its related policies. It changes frequently at the section level and item level and is more susceptible to external environmental shocks than expenditure in other areas. Since 2020, due to the impact of the COVID-19 epidemic, financial expenditure has prioritized areas with greater rigidities, such as livelihood security, and government environmental protection expenditure has significantly decreased.

As an indicator of information disclosure degree of responsibilities, rules, and goals related to government activities, fiscal transparency is an external key factor for government environmental protection expenditure to exert its effect on green technology. On the one hand, fiscal transparency pressures local governments to optimize the structure of government environmental protection expenditure and increase investment in green technology (Zhang and Wang, 2020; Li et al., 2024). In a high-transparency fiscal environment, it is subject to more supervision and attention from the public and social investors, requiring government departments to re-examine the investment structure based on the needs and strategic significance of green development, identifying what key areas the expenditure should lie. Given the importance of green technology in the process of green transformation and development, local governments will strengthen their financial investment and guidance in the field to drive more social capital to support the development of green technology. On the other hand, fiscal transparency improves the positive effect of government environmental protection expenditure on green technology by improving the institutional environment. Transparent fiscal reports and clear expenditure plans provide a cleaner, more predictable environment for social investors, making it easier for them to evaluate the government’s commitment and support in the green technology field, as well as more accurately assess its long-term benefits and innovation potential. This reduces uncertainty and risk in green technology investment and improves the feasibility and attractiveness of such projects, guiding social capital to flow from short-term environmental protection investment to the field of green technology (Ofori et al., 2023). High fiscal transparency in environmental protection expenditure brings a fair, innovative, and efficient business environment. By promoting policy-industrial synergy, establishing green innovation funds, simplifying project approval and access procedures, and improving bidding procedures and other related normative documents, laws, and regulations, green technological innovation is incentivized, enabling stakeholders such as governments, enterprises, and social investors to collaborate more closely on the basis of trust to jointly promote the development of green technology.

Based on this, this paper proposes the following two hypotheses.

H1: The positive effect of government environmental protection expenditure on green technology depends on the level of fiscal transparency, i.e., when fiscal transparency is high, government environmental protection expenditure can effectively promote the development of green technology.

H2: The impact of fiscal transparency on government environmental protection expenditure in promoting green technology mainly lies in enhancing social investment.

Affected by factors such as geographical location, resource elements, and economic development, the effect of government environmental protection expenditure on green technology under the perspective of fiscal transparency is of obvious heterogeneity

There are significant differences between the eastern, central, and western regions of China. The eastern region has convenient transportation; not only it is the earliest region of reform and opening-up, but also the Yangtze River Delta and Pearl River Delta are the regions with the highest economic level (Chen et al., 2020). However, though experienced decades of rapid development, there remain significant gaps between the central, western regions, and the eastern region in many aspects, such as industrial foundation and infrastructure. Especially after the transfer of a large number of industrial sectors from the eastern region to the central and western regions, the environmental pollution pressure in these areas has increased significantly. At the same time, with the development of urbanization in China, the gap between urban and rural areas and between different cities is continuously widening, and the siphonage of resources in capital cities has been further strengthened (Yao and Zhang, 2019; Wang and Wang, 2024). Economic situation, environmental pressure, and resource elements are important external factors that affect how green technology is influenced by government environmental protection expenditure. Difference in economic situations led to the discrepancy in local governments’ investment in green technology, while greater environmental pressure will force governments in central and western areas to invest more financial resources in short-term environmental treatment projects, thus causing regional disparities in green technology (Sun et al., 2022). In addition, administrative levels and resource attractiveness will also lead to significant differences between capital cities and general cities in their attention and amount to investment in green technology development. In terms of fiscal transparency, there are also significant differences between regions and cities at different levels in China. Taking 2020 as an example, the fiscal transparency scores of Beijing, Guangzhou, Hangzhou, and other large coastal cities in the eastern region are almost 2–3 times that of Jiuquan, Gansu, Sanmenxia, Henan and other ordinary cities in the central and western regionsFootnote 1.

Based on this, this paper proposes the following hypothesis.

H3: Due to gaps in geographical location, economic situation, and urban administrative level, there is obvious heterogeneity in the effect of government environmental protection expenditure on green technology under the perspective of fiscal transparency.

Analytical framework of empirical research

Model specification

Based on the preceding hypothesis analysis and the research conducted by scholars such as Wang et al. (2022) and Fang et al. (2024), this study integrates government environmental protection expenditure, fiscal transparency, and green technology into a unified analytical framework. The model is set as follows:

Where:

-

\(i\) represents the city;

-

\(t\) represents the year;

-

\({lngpaten}{t}_{{it}}\) is the dependent variable, representing the development of green technology in cities;

-

\({lneni}{v}_{{it}}\) is the proxy indicator for government environmental protection expenditure, reflecting the financial investment of local governments in environmental protection within their regions;

-

\({lnfisca}{l}_{{it}}\) is the fiscal transparency variable, reflecting the fiscal transparency status of each city;

-

\({lneni}{v}_{{it}}\times {lnfisca}{l}_{{it}}\) is the interaction term between government environmental protection expenditure and fiscal transparency, with its estimated coefficient reflecting the moderating effect of fiscal transparency on the impact of government environmental protection expenditure on the development of green technology in cities;

-

\({\mu }_{i}\) is the city-fixed effect;

-

\({\tau }_{t}\) is the year-fixed effect;

-

\({\varepsilon }_{{it}}\) is the random disturbance term;

-

\({X}_{{it}}\) represents a series of other factors that influence the development of green technology in cities, which are controlled for in this study following the practices in the existing literature.

Selection of variable

Explained variable: The explained variable in the baseline regression is green technology, specifically measured by the number of green patent applications (\({gpatent}\)). Patents are categorized into three types: invention patents, utility model patents, and design patents. Invention patents protect new technical solutions, including products, methods, or their improvements. In contrast, utility model patents protect novel and practical products or methods, focusing more on physical shape, construction, or structural improvements. They typically exclude abstract concepts and algorithms (Liu, 2015). In addition, invention patents involve a more rigorous application process, a longer review period, and a longer protection term compared to utility model patents, which have a lower application difficulty, a shorter review period, and a shorter protection term. This study focuses on green invention patents due to their greater relevance to technological innovation in environmental protection (Lin et al., 2022).

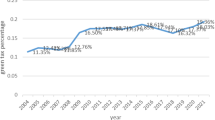

Main explanatory variable: The independent variable is government environmental protection expenditure (\({envi}\)). Utilizing methodologies from Fan et al. (2022) and Li and Bai (2021), as well as definitions from the Chinese government, this study defines it as expenditures incurred by local governments for ecological and environmental protection within their jurisdictions. The moderating variable is fiscal transparency (\({fiscal}\)), measured by city government fiscal transparency scores from the 2013–2020 “China Municipal Government Fiscal Transparency Research Report,” which serves as the measurement indicator. This report collects and analyzes over one hundred fiscal transparency-related indicators published by approximately 300 prefecture-level and above municipal governments nationwide. It is extensively utilized by scholars like Sun and Andrews (2020) and Liu and Zhang (Liu and Zhang 2023), and has become a critical data source for current research on China’s fiscal transparency.

As the interaction term is included in the regression model, according to common practice, we normalize both \({envi}\) and \({fiscal}\).

Control variables: Referring to the practices of Chen (2008), Zheng et al. (2021), and Abbas and Khan (2022), we control the following factors, which affect the development of urban green technology. Foreign direct investment (\({fdi}\)), drawing on the methods employed by Zhao (2023), is represented by the logarithm of the actual amount of foreign capital used in each city that year. For China, multinational enterprises bring advanced technology and management experience. But they prefer China to maintain low production costs and environmental costs; China’s significant breakthroughs in technological innovation and green development are against their will. Secondary industry (\({second}\)), drawing on the methods employed by Li et al. (2021), represented by the proportion of the output value of secondary industry to GDP in that year. As the secondary sector mainly consists of industries and manufacturing, it is closely related to environmental pollution. China’s manufacturing industry has a generally low-profit margin, leading to weaker motivation for investing in green technology for enterprises. They are negative about the continued improvement of overall level of green technology, which would lead to a significant increase in their green research and development spending (Zhang et al., 2020). Per capita GDP (\({pgdp}\)), drawing on the methods employed by Tan et al. (2021), represented by the ratio of GDP to the resident population. A higher level of economic development not only brings a higher demand for green technology but also provides strong financial support for its development. R&D funding input (\({rnd}\)), represented by the total amount of science and technology expenditure in each city. The improvement of green technology is not only closely related to economic development but also requires significant financial support. Human resources (\({human}\)), drawing on the methods employed by Zhang and Chen (2024), represented by the proportion of the population with a college degree, bachelor’s degree, or above to the total resident population in the city. The development of green technology is not only closely related to financial investment but also significantly affected by local human resources. Urbanization (\({urban}\)), drawing on the methods employed by Zhang et al. (2022), represented by the proportion of the urban population to the total population. Urbanization not only reflects the distribution of population but also forms a significant agglomeration effect, such as specialization and diversification, when there is a high-density distribution of population in cities.

Data sources

Data for the explained variable are sourced from the China City Statistical Yearbook and include green invention patents, foreign direct investment, secondary industry, per capita GDP, R&D funding input, and urbanization levels. Data on government environmental protection expenditure are derived from the annual financial statements of local governments and their treasuries, while fiscal transparency data are obtained from the Research Report on Fiscal Transparency of Chinese Municipal Governments. Given that data on Chinese urban government environmental protection expenditure only covers the years 2013 to 2020, the timeframe of this study is similarly restricted. As of 2020, China comprised four municipalities directly under the central government and 293 prefecture-level cities, totaling 297 citiesFootnote 2. Due to incomplete data on government environmental protection expenditure and fiscal transparency in some cities, the final sample size of this study is 254, representing 86% of the total number of Chinese cities. Therefore, it offers substantial representativeness. The descriptive statistics of the main variables are shown in Table 1

Results and analysis

Results of baseline estimate

Using Eq. (1), this paper employs panel least squares regression with robust standard errors to analyze the green technology effect of government environmental protection expenditure in relation to fiscal transparency. Based on the Hausman test results, a fixed effects estimation is applied for the relevant regression analysis. It should be noted that although this paper may face endogeneity issues due to omitted variables, the fixed effects model for panel data eliminates biases caused by unobservable factors, thus effectively mitigating this concern (Bai and Yu, 2019).

To address potential endogeneity issues, this study uses a two-way fixed effects panel model for estimation and delays all explanatory variables by one period. After the treatment, the baseline regression includes 1778 samples. The results, presented in columns (1) and (2) of Table 2, show that the estimated coefficient of government environmental protection expenditure is positive, but it fails the significance test, suggesting it does not significantly impact green technology. However, considering fiscal transparency, the green technology effect of government environmental protection expenditure becomes apparent. According to the results in column (4), when fiscal transparency exceeds 44.66%, the effect of government environmental protection expenditure on green technology is statistically significant at the 1% level. This outcome confirms hypothesis 1 from the previous section and is consistent with findings by Zhang and Wang (2020), which demonstrate that fiscal transparency significantly boosts the green technology effect of government environmental protection expenditure. These findings support the role of fiscal transparency in enhancing the efficiency of government expenditures. Additionally, this paper’s results align with Yao (2024), suggesting that in regions with higher fiscal transparency, government environmental protection expenditure more effectively promotes green technology. This is due to greater accountability and improved fund utilization efficiency under high fiscal transparency, which shifts spending from short-term environmental governance to long-term green technology research and development. Fiscal transparency significantly enhances the impact of government environmental protection expenditure on green technology by increasing government accountability and improving fund utilization efficiency. Although the estimated coefficient for government environmental protection expenditure was not significant, it remains crucial by providing necessary financial support for green technology research and development.

The findings in columns (1)–(4) reveal that after adding control variables, the estimated coefficient of fiscal transparency is not significant and does not directly affect green technology. However, it remains a critical factor influencing government environmental protection expenditure’s role in enhancing green technology. Therefore, the impact of fiscal transparency is primarily seen as a moderating condition for government environmental protection expenditure to effectively promote green technology improvement.

Endogeneity test

Despite the baseline regression accounting for city and year-fixed effects and considering the lagged effects of explanatory variables, endogeneity issues may persist among government environmental protection expenditure, fiscal transparency, and green technology. To address this, this paper employs the System Generalized Method of Moments (System GMM) for endogeneity testing. System GMM uses lagged terms of the dependent variable as instrumental variables, effectively resolving endogeneity and addressing autocorrelation in dynamic panel data.

Column (1) of Table 3 reports the estimation results from System GMM. These results show that the coefficient of government environmental protection expenditure is positive and significant, indicating a notable promotion of green technology. The coefficient of the interaction term between fiscal transparency and government environmental protection expenditure is also significantly positive, highlighting fiscal transparency’s substantial moderating role in this process. Furthermore, AR(1) being less than 0.1 indicates first-order autocorrelation in the random error term, while AR(2) being greater than 0.1 confirms the absence of second-order autocorrelation. The p-value of the Sargan test being greater than 0.1 suggests no over-identification issues. Passing these tests confirms that the regression results using System GMM are valid and reliable. In summary, the estimation results from System GMM align with the baseline regression, further affirming the robustness of the study’s conclusions.

Robustness test

To further verify the reliability of the results, we conducted robustness tests by adjusting the sample range, changing the measurement indicators of key variables, and considering only the contemporaneous effects of explanatory variables.

Firstly, we adjusted the sample range. Considering the four directly administered cities’ higher levels of population, capital, and industry aggregation, their government environmental protection expenditures are substantially higher than those of the 254 prefecture-level cities. For example, average expenditures during the sample period were 30.25 million yuan for Beijing, 14.67125 million yuan for Shanghai, 14.625 million yuan for Chongqing, and 9.02843 million yuan for Tianjin. We excluded these as heterogeneous samples and conducted the regression analysis again. The results in Table 3, column (2), indicate that the regression coefficients of the core variables decreased slightly, but the estimated results still align with the baseline regression.

Secondly, we changed the measurement indicators of key variables. The baseline regression results may be biased due to flaws in the establishment of indicators. Therefore, we conducted robustness tests by replacing the measurement indicators of key variables. In the baseline analysis, green invention patents were used as the proxy for green technology. For robustness, we substituted green invention patents with green utility model patents for the regression analysis. The results in Table 3, column (3), show that the interaction term between government environmental protection expenditure and fiscal transparency remains significantly positive. The coefficient of government environmental protection expenditure is positive but fails the significance test, consistent with the baseline regression results.

Thirdly, we considered only the contemporaneous effects of explanatory variables. Although fiscal investment often has a delayed impact on technological innovation, we chose the number of applications for green invention patents as the explained variable, which has a shorter lag period. Additionally, green development is a key performance indicator for governments at all levels, and environmental regulation on enterprises is intensifying, thus motivating stronger green technological innovation. The results in Table 3, column (4), reveal no significant differences from the baseline regression.

Overall, considering the endogeneity test and the three aspects of robustness tests, the study’s estimated results demonstrate strong robustness, and the conclusions are reliable.

Heterogeneity analysis and mechanism discussion

This section conducts heterogeneity analysis and discusses mechanisms to further explore the conditions and paths influencing the effects of government environmental protection expenditure and fiscal transparency on green technology development.

Heterogeneity analysis based on geographical location

As the forefront of reform and opening-up, the eastern region enjoys convenient transportation, a high economic level, policy advantages, and a well-established industrial base, which together create favorable conditions for its development in green technology. In contrast, the central and western regions, with weaker industrial bases and infrastructure, have absorbed industrial transfers from the east, exacerbating environmental pollution pressures. Utilizing methods from Lv et al. (2021) and Liu et al. (2024), this paper categorizes China into four regions according to the National Bureau of Statistics: eastern, central, western, and northeasternFootnote 3. These regions encompass a varying number of cities: the eastern region with 2 municipalities and 8 provinces (83 cities); the central region with 8 provinces (76 cities); the western region with 1 municipality and 8 provinces (62 cities); and the northeastern region with 3 provinces (33 cities)Footnote 4. As demonstrated by the results in Table 4, the absence of fiscal transparency’s synergistic effect does not diminish the positive impact of government environmental protection expenditure on green technology in the eastern region. This result indicates that local governments in the eastern region consider both short-term and long-term benefits, such as the advancement of green technology when allocating funds for environmental purposes. With the inclusion of fiscal transparency, the impact intensifies, with the interaction term coefficient rising to 1.089 and achieving statistical significance at the 1% level—a figure significantly higher than those observed in the central, western, and northeastern regions. In the central region, the focus of local governments leans more towards short-term improvements in environmental conditions rather than the uncertain and prolonged returns from green technology investments. However, the incorporation of fiscal transparency reveals a notable promotion effect, as evidenced by the coefficient passing the significance threshold, thus confirming its substantial influence on green technology. Similar to the central region, the western region’s focus on short-term gains from environmental expenditures is more pronounced. However, the interaction between these expenditures and fiscal transparency yields a minimal coefficient, suggesting that other factors like market capacity and technological foundations mitigate the potential benefits of green technology in this region, even with fiscal transparency. The northeastern region, historically a hub for heavy industry, faces significant environmental challenges. Compounded by slow economic growth and a steady population decline, local governments have only limited funds to allocate towards environmental protection. Consequently, their focus is primarily on immediate projects such as land decontamination and sewage infrastructure development, leading to a negligible effect of environmental protection expenditure on the advancement of green technology. Moreover, even with fiscal transparency considered, the enhancement of this effect remains insignificant.

Heterogeneity analysis based on city economy and administrative level

The economic health of cities not only correlates closely with government environmental expenditure but also underpins the development of green technology. This study analyzes 254 cities, including both prefecture-level cities and 26 provincial capitals. Both municipalities and provincial capitals exhibit superior administrative levels and notable advantages in resource aggregation and distribution compared with prefecture-level cities. Accordingly, this paper conducts a heterogeneity analysis from two perspectives: economic conditions and urban administrative level. Firstly, the cities are divided into two categories based on per capita GDP for 2013–2020, with an average of 74,614.67 yuan, into groups with high and low GDP. Regression analysis, as shown in Table 5 (1) and (2), reveals a significant disparity between these groups. In cities with high per capita GDP, government environmental spending significantly boosts green technology development. This effect becomes more pronounced under the influence of fiscal transparency. Conversely, in cities with lower GDP, neither direct government environmental spending nor its interaction with fiscal transparency substantially promotes green technology. In addition, cities are also categorized by urban hierarchy into municipalities or capitals and prefecture-level cities. For the 4 municipalities and 26 provincial capitals, the impact of government environmental spending is considerable and statistically significant at the 5% level, indicating a direct promotion of green technology. With fiscal transparency considered, the cross-product coefficient increases to 1.113, indicating an enhanced promotional effect. Mechanism analysis in this paper suggests that fiscal transparency amplifies the effect of government environmental expenditures on green technology by boosting business confidence and social investment. This aligns with findings from Ofori et al. (2023), which suggest that fiscal transparency promotes green technology development by improving the institutional environment and reducing investment uncertainties. Additionally, Fang et al. (2024) note that fiscal transparency facilitates green technology innovation by strengthening social oversight and fostering government-business cooperation.

Mechanism analysis

Next, we further explore the mechanism by which fiscal transparency influences the effect of government environmental expenditures on the development of green technology. As previously stated, fiscal transparency strengthens the positive impact primarily because it not only provides enterprises with a clearer understanding of local government’s expenditure expectations and future trends but, more importantly, it enhances the local institutional environment and boosts enterprises’ confidence in investing in green development, which is anticipated to be a key focus in the future. This, in turn, invigorates the economy and promotes external investments that drive green development in the region. To test this mechanism, we use venture capital amount and frequency as dependent variables, and fiscal transparency and government environmental expenditures as independent variables in regression analyses to determine whether higher fiscal transparency correlates with increased investment attractiveness. The estimation results are presented in Table 6, with columns (1) and (2) showing the full sample, columns (3) and (4) focused on the eastern region, and columns (5) and (6) on the central, western, and eastern regions combined, reveal that whether analyzing venture capital amount or frequency, the estimated coefficient for fiscal transparency is significantly positive. This indicates that higher fiscal transparency enhances the capacity to attract venture capital, thereby supporting the proposed mechanism of fiscal transparency’s regulatory effect.

Conclusion and suggestion

Green technology not only brings environmental benefits, but also helps to achieve long-term economic growth and social well-being improvement. In recent years, it has gradually become a new engine for promoting coordinated social, economic, and environmental development. Although green technology has a promising future, there are still challenges, such as high costs, long R&D cycles, and high investment risks. To enable green technology to fulfill its role, policy support and market incentive mechanisms are indispensable. Therefore, it is of great significance to clarify the mechanism of how government environmental protection expenditure impacts green technology development. Based on the data of 254 cities in China from 2013 to 2020, this study examines the effect of government environmental protection expenditure on green technology from the perspective of fiscal transparency. The research finds that: (1) Fiscal transparency plays a regulatory role in the process of government environmental protection expenditure acting on green technology. A higher degree of fiscal transparency can effectively enhance the promoting impact of government environmental protection expenditure on green technology development. (2) The positive impact of government environmental protection expenditure on green technology under the perspective of fiscal transparency exhibits significant heterogeneity effects. Firstly, the impact in the eastern region is significantly stronger than that in the central and western regions. Secondly, stronger effects are also exhibited in cities with better economic development levels and higher administrative levels. (3) Fiscal transparency, by lifting corporate confidence and increasing social investment, forms a synergy with government environmental protection expenditure to jointly promote China’s green technology development.

The research findings of this paper are generally consistent with those of existing literature, but it further enriches the theoretical study on the relationship between government environmental protection expenditures and green technology by introducing the perspective of fiscal transparency. Compared with the research by Xiao et al. (2022), this paper not only focuses on the direct effects of government environmental protection expenditures but also explores the moderating role of fiscal transparency, revealing how fiscal transparency enhances the green technology effect of government environmental protection expenditures by boosting business confidence and social investment.

Therefore, this article mainly proposes the following suggestions:

Firstly, we should attach more importance to the regulatory role of fiscal transparency when promoting green technology through government environmental protection expenditure. An increase in fiscal transparency facilitates public supervision and evaluation of government budgets, thus further enhancing government accountability and driving them to pay more attention to long-term environmental benefits. Through the improvement of fiscal transparency, we promote the tilt of government environmental protection expenditure towards green technology areas. Further fiscal information disclosure in the field of green environmental protection is needed, and the legality of the procedures, the standardization of the accounting methods, the authenticity of the data, and the timeliness of the information should be ensured. A scientific and effective information disclosure mechanism needs to be established. We should coordinate and promote the regulatory accountability system to further deepen the regulatory role of social supervision.

Secondly, we should take multiple measures to alleviate excessive regional differentiation in the effect of government environmental protection expenditure on green technology fields. In economically developed regions, the positive impact of government environmental protection expenditure on green technology development is more significant. We should further utilize its spatial spillover effect, improve market rules, break down barriers among regions, narrow technological gaps, reduce market segmentation, establish a market with efficient liquidity of innovative factors, and encourage collaborative innovation and the exchange and sharing of achievements. At the same time, we should further emphasize the importance of green performance in official evaluations, encourage local governments to improve the structure of environmental protection expenditure according to local conditions, improving expenditure efficiency. Increase in local financial budget should be made by cultivating stable sources of revenue, thus governments are able to develop public services, promoting local green technology development.

Thirdly, we should further enhance fiscal transparency and promote social capital to increase its contribution to green technology promotion. We can enhance social capital’s confidence in investing in green technology through fiscal information disclosure, thus promoting more capital entering this field. By increasing fiscal transparency, we can promote the transparency of market information, establish a more transparent investment environment, and enable social capital to better understand the government’s environmental policies and investment directions. We can give play to the “attracting funds” role of government finance by improving systems such as transfer payments for energy conservation and environmental protection to cooperate with social capital, guide various entities to increase capital investment in the field of environmental protection, promote the overall improvement of energy conservation and environmental protection funding levels in regions, and create a good foundation for the development of the environmental protection industry.

While this paper delves into the green technology effect of government environmental protection expenditures from the perspective of fiscal transparency, it is subject to two limitations. Firstly, despite using green invention patents as a proxy for green technology, as done in many other studies, patents do not necessarily translate into commercialized green technologies. Some industries with significant green innovations, such as renewable energy and clean manufacturing, may not apply for patents at the same rate, potentially leading to an inaccurate assessment of the development level of green technology. Secondly, constrained by the availability of data, the research period covered in this paper is relatively short, failing to fully capture the long-term green technology effect of government environmental protection expenditures from the fiscal transparency perspective.

Data availability

The datasets generated and analyzed during the current study are available from the corresponding author upon reasonable request.

Notes

Source: Research Report on the Financial Transparency of Chinese Municipal Governments in 2020

Source: China Statistical Yearbook 2021

Division basis: National Bureau of Statistics of China http://www.stats.gov.cn/zt_18555/zthd/lhfw/2021/rdwt/202302/t20230214_1903926.html

The eastern region includes 10 provinces (municipalities) including Beijing, Tianjin, Hebei, Shanghai, Jiangsu,Zhejiang, Fujian, Shandong, Guangdong and Hainan; the central region includes 6 provinces including Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan; the westernregion includes 12 provinces (municipalities and autonomous regions) including Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang; the northeast region includes 3 provinces including Liaoning, Jilin and Heilongjiang.

References

Abbas J, Khan SM (2022) Green knowledge management and organizational green culture: an interaction for organizational green innovation and green performance. J Knowl Manag 27(7):1852–1870. https://doi.org/10.1108/JKM-03-2022-0156

Bai X, Yu Q (2019) How does labor costs affect China’s industrialization? Financ Trade Econ 40(8):132–145. https://doi.org/10.19795/j.cnki.cn11-1166/f.20190806.005

Cao B, Wang S (2017) Opening up, international trade, and green technology progress. J Clean Prod 142:1002–1012. https://doi.org/10.1016/j.jclepro.2016.08.145

Chen C, Ganapati S (2023) Do transparency mechanisms reduce government corruption? A meta-analysis. Int Rev Adm Sci 89(1):257–272. https://doi.org/10.1177/00208523211033236

Chen J, Chen Y, Chen M (2020) China’s high-quality economic development level, regional differences and dynamic evolution of distribution. J Quant Technol Econ 37(12):108–126. https://doi.org/10.13653/j.cnki.jqte.2020.12.006

Chen YS (2008) The driver of green innovation and green image—green core competence. J Bus Ethics 81(3):531–543. https://doi.org/10.1007/s10551-007-9522-1

Du J, Song M (2023) The nonlinear impact of green fiscal expenditure on the resources efficient—analysis of the moderating effect of government governance. J China Univ Geosci 23(5):31–43. https://doi.org/10.16493/j.cnki.42-1627/c.20230818.001

Du K, Li J (2019) Towards a green world: how do green technology innovations affect total-factor carbon productivity. Energy Policy 131:240–250. https://doi.org/10.1016/j.enpol.2019.04.033

ElBerry NA, Goeminne S (2021) Fiscal transparency, fiscal forecasting and budget credibility in developing countries. J Forecast 40(1):144–161. https://doi.org/10.1002/for.2695

Fan W, Yan L, Chen B, Ding W, Wang P (2022) Environmental governance effects of local environmental protection expenditure in China. Resour Policy 77:102760. https://doi.org/10.1016/j.resourpol.2022.102760

Fang G, Chen G, Yang K, Yin W, Tian L (2024) How does green fiscal expenditure promote green total factor energy efficiency?—Evidence from Chinese 254 cities. Appl Energy 353:122098. https://doi.org/10.1016/j.apenergy.2023.122098

Gootjes B, de Haan J (2022) Do fiscal rules need budget transparency to be effective? Eur J Political Econ 75:102210. https://doi.org/10.1016/j.ejpoleco.2022.102210

He L, Wang Y, Zhang X (2018) Fiscal decentralization, expenditure of energy saving and environmental protection and green development. Rev Econ Manag 34(6):25–35. https://doi.org/10.13962/j.cnki.37-1486/f.2018.06.003

He W, Guo L, Zhang G (2023) Do fiscal vertical imbalances affect local fiscal expenditure efficiency? —a concurrent discussion on the moderating effect of fiscal transparency. Manag Rev 35(11):3–15. https://doi.org/10.14120/j.cnki.cn11-5057/f.2023.11.012

Hossain B (2024) Do government spending on pollution abatement and targeted environmental policies promote green growth in Canada? J Clean Prod 434:140391. https://doi.org/10.1016/j.jclepro.2023.140391

Kong L, Chen J (2024) Impact of digital transformation on green and sustainable innovation in business: a quasi-natural experiment based on smart city pilot policies in China. Environ Dev Sustain. https://doi.org/10.1007/s10668-024-05643-w

Li Q, Zeng F, Liu S, Yang M, Xu F (2021) The effects of China’s sustainable development policy for resource-based cities on local industrial transformation. Resour Policy 71:101940. https://doi.org/10.1016/j.resourpol.2020.101940

Li RYM, Li YL, Crabbe MJC, Manta O, Shoaib M (2021) The impact of sustainability awareness and moral values on environmental laws. Sustainability 13(11):5882. https://doi.org/10.3390/su13115882

Li Y, Ding W, Luo X, Zhang T (2024) Study on the influence of fiscal transparency on the efficiency of local government debt expenditure. Collect Essays Financ Econ 11:35–45. https://doi.org/10.13762/j.cnki.cjlc.20240812.006

Li Z, Bai T (2021) Government environmental protection expenditure, green technology innovation and smog pollution. Sci Res Manag 42(2):52–63. https://doi.org/10.19571/j.cnki.1000-2995.2021.02.006

Li Z, Pan Y, Yang W, Ma J, Zhou M (2021) Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ 101:105426. https://doi.org/10.1016/j.eneco.2021.105426

Lin Z, Huang X, Li H (2022) Which type of industrial policy is more conducive to corporate innovation: selective or functional?—Empirical research based on patent data of Chinese listed companies. Public Financ Res 1:110–129. https://doi.org/10.19477/j.cnki.11-1077/f.2022.01.011

Liu A, Zhang S (2023) How does the setting of economic growth targets affect fiscal transparency? Empirical evidence from prefecture-level and above cities. Res Econ Manag 44(10):14–32. https://doi.org/10.13502/j.cnki.issn1000-7636.2023.10.002

Liu H, Wang X, Wang Z, Cheng Y (2024) Does digitalization mitigate regional inequalities? Evidence from China. Geogr Sustain 5(1):52–63. https://doi.org/10.1016/j.geosus.2023.09.007

Liu J, Qian Y (2024) A study of the influence of industrial symbiotic agglomeration on green technology innovation. Sci Res Manag 45(8):51–61. https://doi.org/10.19571/j.cnki.1000-2995.2024.08.006

Liu S (2015) The definition of patents and their statistics—an introduction to the “patent statistics manual. China Stat 12:27–28

Lv C, Bian B, Lee CC, He Z (2021) Regional gap and the trend of green finance development in China. Energy Econ 102:105476. https://doi.org/10.1016/j.eneco.2021.105476

Madaleno M, Dogan E, Taskin D (2022) A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ 109:105945. https://doi.org/10.1016/j.eneco.2022.105945

Moshiri S, Daneshmand A (2020) How effective is government spending on environmental protection in a developing country? An empirical evidence from Iran. J Econ Stud 47(4):789–803. https://doi.org/10.1108/JES-12-2018-0458

Ofori IK, Figari F, Ojong N (2023) Towards sustainability: the relationship between foreign direct investment, economic freedom and inclusive green growth. J Clean Prod 406:137020. https://doi.org/10.1016/j.jclepro.2023.137020

Radmehr R, Shayanmehr S, Baba EA, Samour A, Adebayo TS (2024) Spatial spillover effects of green technology innovation and renewable energy on ecological sustainability: new evidence and analysis. Sustain Dev 32(3):1743–1761. https://doi.org/10.1002/sd.2738

Shao X, Zhong Y, Liu W, Li RYM (2021) Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J Environ Manag 296:113189. https://doi.org/10.1016/j.jenvman.2021.113189

Shao Y, Chen Z (2022) Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Econ Anal Policy 74:716–727. https://doi.org/10.1016/j.eap.2022.03.020

Shi L, Wu R, Lin B (2023) Where will go for electric vehicles in China after the government subsidy incentives are abolished? A controversial consumer perspective. Energy 262:125423. https://doi.org/10.1016/j.energy.2022.125423

Sun S, Andrews R (2020) The determinants of fiscal transparency in Chinese city-level governments. Local Gov Stud 46(1):44–67. https://doi.org/10.1080/03003930.2019.1608828

Sun Z, Fan J, Sun Y, Liu H (2022) Structural characteristics and influencing factors of spatial correlation network of green science and technology innovation efficiency in China. Econ Geogr 42(3):33–43. https://doi.org/10.15957/j.cnki.jjdl.2022.03.004

Tan C, He W, Liu Y (2021) Interregional transaction costs, industrial productivity and spatially-differentiated urbanization. Nankai Econ Stud 6:162–178. https://doi.org/10.14116/j.nkes.2021.06.010

Valero A, Valero A, Calvo G, Ortego A (2018) Material bottlenecks in the future development of green technologies. Renew Sustain Energy Rev 93:178–200. https://doi.org/10.1016/j.rser.2018.05.041

Wang C, Wang X (2024) A study on the impact of budget performance management reform on the efficiency of local government expenditures. Macroeconomics 3:78–92. https://doi.org/10.16304/j.cnki.11-3952/f.2024.03.006

Wang H, Liu T, Cui W (2022) Financial environmental protection expenditure, local government competition and environmental pollution control: based on 284 prefecture-level cities in China. Urban Probl 4:96–103. https://doi.org/10.13239/j.bjsshkxy.cswt.220410

Wang H, Wang J (2024) Industrial structure upgrading effect of building a strong capital: a quasi-natural experiment of provincial capital administrative division adjustment. Geogr Sci 44(11):1988–1996. https://doi.org/10.13249/j.cnki.sgs.20230744

Xiao P, Fan R (2019) Research on the range of fiscal transparency in the view of debt control. Public Financ Res 7:60–70. https://doi.org/10.19477/j.cnki.11-1077/f.2019.07.004

Xiao R, Chen X, Qian L (2022) Heterogeneous environmental regulation, government support and enterprises’ green innovation efficiency: from the perspective of two-stage value Chain. Financ Trade Res 33(9):79–93. https://doi.org/10.19337/j.cnki.34-1093/f.2022.09.007

Xie R, Teo TSH (2022) Green technology innovation, environmental externality, and the cleaner upgrading of industrial structure in China—Considering the moderating effect of environmental regulation. Technol Forecast Soc Change 184:122020. https://doi.org/10.1016/j.techfore.2022.122020

Xiong A, Ding Y, Hu Y (2020) Impact of low-carbon subsidies and green innovation on total factor productivity in view of the threshold effect of carbon emission reduction. Resour Sci 42(11):2184–2195. https://doi.org/10.18402/resci.2020.11.11

Yang X, He L, Xia Y, Chen Y (2019) Effect of government subsidies on renewable energy investments: the threshold effect. Energy Policy 132:156–166. https://doi.org/10.1016/j.enpol.2019.05.039

Yao H (2024) Study of the impact of fiscal transparency on local government debt. J Innov Dev 6(1):1–4. https://doi.org/10.54097/uundg8ve

Yao P, Zhang M (2019) Economic agglomeration, city type and urban productivity. Contemp Financ Econ 9:16–27. https://doi.org/10.13676/j.cnki.cn36-1030/f.2019.09.003

You C, Cifuentes-Faura J, Liu X, Wu J (2024) Can the government environmental vertical reform reduce air pollution? A quasi-natural experiment in China. Econ Anal Policy 81:947–963. https://doi.org/10.1016/j.eap.2023.12.009

Zhang H, Chen M, Liang C (2022) Urbanization of county in China: Spatial patterns and influencing factors. J Geogr Sci 32(7):1241–1260. https://doi.org/10.1007/s11442-022-1995-4

Zhang H, Shao Y, Han X, Chang HL (2022) A road towards ecological development in China: the nexus between green investment, natural resources, green technology innovation, and economic growth. Resour Policy 77:102746. https://doi.org/10.1016/j.resourpol.2022.102746

Zhang J, Chen Z (2024) Exploring human resource management digital transformation in the digital age. J Knowl Econ 15(1):1482–1498. https://doi.org/10.1007/s13132-023-01214-y

Zhang S, Wang L (2020) The influence of government transparency on governance efficiency in information age: the environmental governance behavior of Guangdong, China. J Enterp Inf Manag 34(1):446–459. https://doi.org/10.1108/JEIM-01-2020-0017

Zhang W, Chiu YB, Hsiao CYL (2022) Effects of country risks and government subsidies on renewable energy firms’ performance: evidence from China. Renew Sustain Energy Rev 158:112164. https://doi.org/10.1016/j.rser.2022.112164

Zhang X, Liu J, Li B (2020) Environmental regulation, technological innovation and the green development of manufacturing. J Guangdong Univ Financ Econ 35(5):48–57

Zhao W (2023) Can coordination of two-way FDI promote urban green development?—Empirical evidence from the Yangtze river delta urban agglomeration. J Nantong Univ 39(5):49–61

Zheng M, Feng GF, Jang CL, Chang CP (2021) Terrorism and green innovation in renewable energy. Energy Econ 104:105695. https://doi.org/10.1016/j.eneco.2021.105695

Zhou X, Jia M, Zhao X (2023) An empirical study and evolutionary game analysis of green finance promoting enterprise green technology innovation. China Ind Econ 6:43–61. https://doi.org/10.19581/j.cnki.ciejournal.2023.06.002

Acknowledgements

This work was financially supported by the Sichuan International Studies University 2024 Annual University-level Research Projects (Grant No. sisu202404) and the Scientific and Technological Research Program of Chongqing Municipal Education Commission (Grant No. KJQN202400904).

Author information

Authors and Affiliations

Contributions

CZ: data curation, writing—original draft preparation, software. ML: investigation, validation, writing—reviewing and editing. YZ: methodology, visualization, conceptualization. All authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper. The authors declare that no funding was received to assist with the preparation of this manuscript.

Ethical statement

Ethical approval was not required as the study did not involve human participants.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Zhou, C., Li, M. & Zhao, Y. Driving effect of government environmental protection expenditure on green technology from the perspective of fiscal transparency. Humanit Soc Sci Commun 12, 498 (2025). https://doi.org/10.1057/s41599-025-04791-2

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-04791-2