Abstract

Green financial technology (fintech) focuses on achieving sustainable development goals. The Ant Forest application is a typical example that reflects the characteristics of green fintech, serving as a focal point for investigation in this study. Environmental concerns and green trust are important factors in promoting the user acceptance and adoption of green services. As green fintech has green and technological features, however, the joint effects among environmental concerns and green trust and the technology adoption perspective on users’ sustainable use of green fintech (i.e., Ant Forest) remain unknown. To address this research gap, the expectation-confirmation model (ECM) is applied in this paper by integrating environmental concerns and green trust to construct a research model to investigate users’ continuous willingness to use green fintech. We employed a survey research method by collecting 653 responses to examine the model. A partial least squares structural equation modeling (PLS-SEM) approach was adopted for statistical examination. The results show that environmental concerns can improve green trust and that green trust can improve user satisfaction through confirmation and perceived usefulness, thus enhancing users’ willingness to continuously use green fintech. This paper provides theoretical contributions by extending two green antecedents (i.e., environmental concerns and green trust) to the ECM to further understand user decisions to continuously use green fintech. The findings also hold significant practical implications for green fintech vendors, especially in terms of designing fintech solutions and collaborating with environmental agencies to promote continuous public use of green fintech.

Similar content being viewed by others

Introduction

Financial technology (fintech) is any technological innovation related to financial services (Singh et al. 2020). Meanwhile, due to increasing environmental deterioration, people have gradually realized the importance of environmental protection, and green fintech has emerged (Udeagha and Muchapondwa 2023). Green fintech is a fintech-based innovation focused on addressing environmental protection and promoting sustainable development goals (Puschmann et al. 2020). Green fintech uses its sustainability to promote the implementation of individual low-carbon behaviors and to facilitate the green transformation of social financial services (Lin and Lee 2024a, 2024b). Ant Forest, which is a typical example of green fintech in China, is an application (app) developed by the Ant Financial Service Group that guides people to engage in green financial behaviors, such as buying tickets online and paying for public transportation (Nie et al. 2023; Yang et al. 2018). These low-carbon consumption behaviors allow individuals to plant virtual trees in the app, and then the Ant Financial Service Group helps users plant real trees (Ashfaq et al. 2021). By doing so, the public can subtly form good green consumption habits to finally achieve the goal of users protecting the ecological environment (Ashfaq et al. 2021, 2023). Ant Forest mirrors the characteristics and can be materialized of green fintech, and it has the most users worldwide (Ashfaq et al. 2022). Hence, we consider Ant Forest as a target green fintech (Zhao and Abeysekera 2024) to investigate in this study.

Users’ continuous use is a key factor in the success of green fintech (Franque et al. 2021a), which not only affects the future development of green fintech but is also crucial to environmental protection goals. Therefore, studying consumers’ willingness to continuously use green fintech holds great significance. Scholars have used various theories to explain users’ continuous use of green fintech, such as persuasion theory and motivation theory (Yang et al. 2018), use and satisfaction theory (Ashfaq et al. 2022; Mi et al. 2021), behavioral reasoning theory (Ashfaq et al. 2021), and the unified theory of acceptance and use of technology (UTAUT) (Lin and Lee 2024a, 2024b). These theories are able to focus on the willingness to continuously use green fintech; however, they do not realize that continued use is highly dependent on satisfaction and confirmation of user expectations (Franque et al. 2021b). Regarding this gap, the expectation-confirmation model (ECM) explains the dynamic cognitive processes experienced by users when making decisions about continuous use through the relationship between perceived usefulness, confirmation and satisfaction (Bhattacherjee 2001). ECM has been considered a robust theoretical foundation for predicting continuous usage (Franque et al. 2021b; Lee et al. 2023), and it has been widely applied to different types of fintech (Franque et al. 2021b; Kumar et al. 2018; Sinha and Singh 2023; Yuan et al. 2014). Therefore, to analyze the intent to continuously use green fintech in depth, this paper is based on the ECM.

Researchers have noted that green antecedents have significant impacts on consumers’ green purchases and the continued use of green fintech (Emekci 2019; Manaktola and Jauhari 2007). Specifically, environmental concerns and green trust are important drivers of users’ continued adoption of green services (Lam et al. 2016; Richardson 2013). Environmental concerns reflect the level of concern that consumers have regarding environmental threats (Lee et al. 2014). Users with higher levels of environmental concerns believe that green services or products can bring benefits to the ecological environment, which stimulates their motivations to use. Green trust reflects consumers’ confidence in the excellent performance of green fintech in terms of environmental performance (Chen 2010). Consumers with green trust will be more convinced that green products have the function of environmental protection, enabling their sustainable usage of the product. Scholars have realized that environmental concerns and green trust play key roles in the use of green services and products (Shanmugavel and Balakrishnan 2023). However, the operational mechanisms of environmental concerns and green trust on users’ willingness to continuously use green fintech via the ECM remain unknown and need further verification. Correspondingly, we can form the following research question:

RQ1: Do environmental concerns and green trust influence users’ continuous usage of green fintech through the function of ECM?

Moreover, green fintech can be seen as a composite that includes technological elements and green service features. From a technological perspective, the literature indicates that males are more likely to accept and use new technology than females (Sun and Zhang 2006). But from a green service perspective, compared to males, females are more willing to use green services or goods (Beutel and Marini 1995; García-Salirrosas et al. 2023). Based on the aforementioned studies, we are interested in further exploring and examining the effect of gender on users’ continuous usage of green fintech. Therefore, based on RQ1, we propose the following research question:

RQ2: Does gender contextually affect users’ continuous usage of green fintech in the ECM?

To answer these questions, a research model is developed for this study by incorporating green trust and environmental concerns into the ECM to provide a more comprehensive analysis of users’ willingness to continuously use green fintech. Ant Forest acts as a representative green fintech application to further investigate and examine its continuous usage. We used the survey method, collected 653 valid responses, and applied the partial least squares structural equation modeling (PLS-SEM) method to test this model. We further performed a multisample analysis based on gender to determine whether any difference exists in the model between the male and female groups. The organizational structure of this paper is as follows. We conduct the literature review on green fintech adoption (i.e., Ant Forest adoption), the ECM, environmental concerns and green trust in Section 2. Section 3 highlights the research model constructed and the hypotheses. We explain the survey research method used and data collection procedure in Section 4. Section 5 presents the statistical analysis of the data. We discuss the results and provide the theoretical contributions and practical implications in Section 6. Finally, the limitations of the paper and future research directions are presented.

Literature review

Green fintech and its adoption

Fintech refers to the use of technology in financial services, and green fintech, as a subset, focuses on promoting environmental protection and sustainable development goals (Udeagha and Muchapondwa 2023). Green fintech can transform various aspects of the financial system, such as payment, investment, and financing, helping to ensure sustainable financial practices while reducing the environmental impact of business activities (Udeagha and Muchapondwa 2023). A prominent example of green fintech is Ant Forest, a green financial service powered by fintech (Ashfaq et al. 2021, 2022, 2023; Yang et al. 2018). In Ant Forest, users generate “green energy” by engaging in low-carbon behaviors, such as using public transportation or electronic invoices (Ashfaq et al. 2022). This green energy can be collected to plant virtual trees, which correspond to real trees planted in regions needing ecological restoration. Tree planting not only helps combat the greenhouse effect but also prevents soil erosion. Ant Forest emphasizes the public’s contribution to sustainable development goals and promotes green finance by creating carbon accounts and encouraging green behavior (Ashfaq et al. 2022; Yang et al. 2018). As a widely adopted green fintech platform globally (Ashfaq et al. 2022; Chen et al. 2020; Zhao and Abeysekera 2024), Ant Forest serves as the focus of this study to explore and analyze its continuous usage in promoting green fintech adoption.

In Table 1, we summarize research on users’ continuous adoption of green fintech, focusing on the case of Ant Forest. Various theories have been applied to explain this behavior, including uses and gratification theory (Ashfaq et al. 2022; Mi et al. 2021), behavioral reasoning theory (Ashfaq et al. 2021), flow theory (Ashfaq et al. 2022), persuasion theory and motivation theory (Yang et al. 2018), self-expansion theory (Nie et al. 2023), and the unified theory of acceptance and use of technology (UTAUT) (Lin and Lee 2024a, 2024b). Notably, uses and gratification theory has been a focal point in two major studies on Ant Forest to explain ongoing user engagement. Mi et al. (2021) identified entertainment, achievement, social interaction, and environmental protection as core motivators that drive user satisfaction and continued usage. Expanding on these findings, Ashfaq et al. (2022) introduced altruism and self-promotion, demonstrating how Ant Forest meets both practical and emotional user needs. Together, these studies show how Ant Forest fosters long-term loyalty by aligning personal gratifications with ecological goals. Additionally, Ashfaq et al. (2023) integrate ECM with green task-technology fit, illustrating how users’ perceptions of the alignment between Ant Forest’s functionalities and their environmental tasks lead to confirmation and heightened satisfaction.

Most studies incorporate green or environmental variables to better understand the continued use of green fintech applications like Ant Forest, which focuses on eco-friendly practices (See Table 1). Examples include environmental concerns (Zhang et al. 2020), environmental awareness (Chen et al. 2020), environmental protection (Mi et al. 2021), environmental benefits and knowledge (Ashfaq et al. 2022), green skepticism (Ashfaq et al. 2021), and green task–technology fit (Ashfaq et al. 2023), as well as consumer social responsibility and long-term orientation (Lin and Lee 2024a, 2024b). Notably, Zhang et al. (2020) found that environmental concerns directly enhance user satisfaction, which subsequently increases the intention to continue using Ant Forest. However, their study does not explore the mechanisms linking environmental concerns and user satisfaction in depth. To address this gap, we integrate environmental concerns and green trust into the ECM to provide a more comprehensive understanding of user intentions to continue using green fintech Ant Forest.

Expectation-confirmation model

The expectation-confirmation model (ECM), based on Oliver’s (1980) expectation-confirmation theory, is a cognitive model that explains how users make decisions to continue using an information system (IS) or technology (Bhattacherjee 2001). The ECM includes four main variables: confirmation, perceived usefulness, satisfaction, and IS continuance intention. Confirmation refers to how well the actual performance of an IS aligns with user expectations (Bölen 2020). When expectations are met, perceived usefulness and satisfaction increase, and when expectations are not met, they decrease (Jumaan et al. 2020). Perceived usefulness is the user’s perception of the benefits of using an IS, reflecting the belief that using the IS will improve task performance (Bhattacherjee 2001; Lee et al. 2023). Satisfaction is the emotional response users experience when their expectations are fulfilled (Bölen and Özen 2020). The ECM posits that confirmation positively influences perceived usefulness and satisfaction, and both perceived usefulness and satisfaction enhance the intention to continue using the IS.

Table 2 summarizes studies that integrate additional variables into the ECM to investigate users’ continuance intention regarding various fintech applications. It is clear that adding specific variables, depending on the type of fintech, can enhance the ECM’s explanatory power. Key fintech types include mobile banking (Bhatnagar et al. 2024; Nguyen and Dao 2024; Hidayat-ur-Rehman et al. 2021, 2023; Lee et al. 2023; Sinha and Singh 2023; Yuan et al. 2014), mobile payment (Franque et al. 2021a), financial robo-advisors (Cheng 2023), digital currencies (Hariguna et al. 2023), and E-wallets (Daragmeh et al. 2022). For instance, in the context of AI-powered fintech, studies by Lee et al. (2023) and Bhatnagar et al. (2024) incorporate two AI-specific variables—intelligence and anthropomorphism—into the ECM to examine users’ continuous use of AI-enabled mobile banking.

While existing literature frequently uses the ECM to explain user behavior across various fintech applications, most research does not incorporate environment-specific and green variables, especially in the context of green fintech. Ashfaq et al. (2023) examined the relationship between green task-technology fit and ECM variables; however, they did not address key environmental factors such as environmental concerns and green trust. These two variables have been shown to significantly influence user adoption behavior in green products and services (Chauhan and Goyal 2024; Dhir et al. 2021). In the context of green fintech, particularly Ant Forest—a financial service characterized by environmentally friendly and green features—this study seeks to integrate two critical green factors: environmental concerns (Chauhan and Goyal 2024) and green trust (Guerreiro and Pacheco 2021). Adding these variables to the ECM aims to enhance its effectiveness in predicting and explaining users’ continued use intentions toward green fintech, specifically Ant Forest. This research thus explores how environmental concerns and green trust jointly impact users’ ongoing engagement with green fintech, using the ECM framework. By incorporating these green-specific variables, this study provides a more comprehensive understanding of how values related to environmental sustainability influence users’ intentions for continuous use.

Environmental concerns

The new ecological paradigm (NEP) provides a deep understanding of how individuals perceive their relationship with the environment (Dunlap and Van Liere 1978). NEP emphasizes the importance of recognizing the finite limits of natural resources and advocates for fostering a harmonious relationship between humans and nature (Dunlap 2008; Cruz and Manata 2020). Environmental concerns, rooted in the NEP, reflect individuals’ beliefs and values that reject the notion of human dominance over nature, instead promoting coexistence within the ecosystem (Stern et al. 1995). Specifically, environmental concerns refer to individuals’ personal value orientation toward the environment and their awareness of environmental issues (Schuitema et al. 2013). These concerns manifest as a green personal characteristic, showing spontaneous care for the environment and a willingness to engage in environmentally friendly behaviors (Si et al. 2022). In line with the NEP framework, individuals with high environmental concerns are more likely to take actions to improve the environment and engage in behaviors that support environmental protection (Saari et al. 2021). This elevated environmental awareness leads them to prioritize green technologies and initiatives (Dunlap 2008; Cruz and Manata 2020), making them more likely to adopt solutions like green fintech that align with their sustainability values.

Environmental concerns are used to examine consumers’ purchase intentions or behaviors across various green services and products, such as green residential buildings (Tan and Goh 2018), green food (Troudi and Bouyoucef 2020), environmentally friendly smart homes (Schill et al. 2019), digital banking (Saif et al. 2022), water-saving initiatives (Si et al. 2022), and electric vehicles (Shanmugavel and Balakrishnan 2023). In the green fintech context, users with environmental concerns believe that green fintech can benefit the environment, support sustainable development goals, and meet their expectations regarding environmental protection, which leads to confirmation. Furthermore, they view green fintech as a tool to help achieve environmental improvement, significantly enhancing their perceived usefulness. Therefore, this study examines environmental concerns as a precursor in the ECM to explore its impact on users’ continuous adoption intention of green fintech.

Green trust

The trust-commitment theory emphasizes the critical role of trust and commitment in building and maintaining long-term customer relationships (Morgan and Hunt 1994). According to this theory, establishing trust is essential for customers to develop commitment and maintain ongoing engagement with a particular brand or product (Morgan and Hunt 1994; Wang et al. 2020; Ravichandran et al. 2024). In consumer relationships, trust fosters positive expectations about a product’s performance and intentions, encouraging consumers to invest in and engage with the product. Trust-commitment theory is particularly useful for understanding consumer relationships in areas where trust is crucial, such as in green fintech.

In the green fintech context, green trust refers to the degree of consumer confidence that a product, service or brand performs well in terms of environmental protection (Guerreiro and Pacheco 2021). Green trust is considered an incentive factor guiding consumers toward the long-term adoption of green products and services (Ahmad and Zhang 2020). Scholars have widely discussed the willingness and behavior of consumers in the green context through green trust. This context includes a variety of green scenarios, such as green transportation (Chen and Lu 2015), green hotels (Yadav et al. 2019), green apparel (Dhir et al. 2021), green buildings (Tao et al. 2022) and green agricultural products (Xu et al. 2022). As an important variable in the green field, green trust affects customers’ assessment of environmental value and economic value, thus affecting consumers’ perceived utility and confirmation (Ahmad and Zhang 2020).

In our research context, as a sustainable financial service, a green fintech is a green service designed to improve the environment. Therefore, consumers with higher green trust will be more aware that green fintech can promote the realization of sustainable development goals; thus, they will raise their expectations for green fintech and think that they can meet their expectations after use, thus forming confirmation. In addition, consumers with green trust help constitute a good impression of green fintech and can more fully realize that green fintech can support environmental protection, thus increasing their perceptions of the utility of green fintech, and ultimately choose to continuously use green fintech (Yadav et al. 2019). Thus, relying on trust-commitment theory, this study analyzes green trust as a precursor variable of the ECM to investigate the ongoing usage of green fintech.

The research model and hypotheses

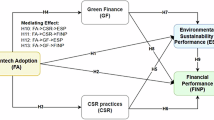

In this section, we introduce two green variables, environmental concerns and green trust, including both in the ECM as precursor variables, as shown in Fig. 1. Specifically, we investigate how environmental concerns and green trust affect users’ perceived usefulness, confirmation and satisfaction with green fintech, which in turn influence their willingness to continue adoption. The proposed model and the hypotheses are as follows:

The ECM and continuous use of green fintech

Given that ECM is employed as a fundamental theory, this study first hypothesized the relationships modeled by the ECM in the green fintech context. Scholars have shown that green determinants significantly influence individual decisions about green behavior (Wijekoon and Sabri 2021; Guerreiro and Pacheco 2021; Si et al. 2022; Shanmugavel and Balakrishnan 2023). Environmental concerns and green trust are the key factors affecting users’ adoption of green products or services (Lam et al. 2016; Richardson 2013). On this basis, this study applies these two green influencers to the field of green fintech, combined with the original variable relationships of the ECM, and it further explores the willingness of users to continuously adopt green fintech.

When users can have a better experience in terms of receiving assistance to complete financial services or transactions, thereby realizing environmental protection and achieving sustainability, it confirms their expectations (Lee et al. 2023). In this case, using green fintech can meet users’ expected benefit or performance of green fintech, and their perceived usefulness will be improved and strengthened. In addition, the literature has shown that satisfaction is a reliable and critical prerequisite for continued willingness to use an information system (Bhattacherjee 2001; Franque et al. 2021). When individuals can confirm their expected value or performance by using green fintech, they can have a pleasing user experience, which serves to enhance their contentment with green fintech (Lee et al. 2023). Scholars have demonstrated the impact of users’ confirmation on perceived usefulness and satisfaction in other fintech contexts, such as mobile banking (Kumar et al. 2018; Lee et al. 2023; Yuan et al. 2014). Thus, we hypothesize the following:

H1: Confirmation increases perceived usefulness.

H2: Confirmation increases satisfaction.

Existing research has indicated that perceived usefulness is a key determinant affecting individuals’ satisfaction in using a technology (Bhattacherjee 2001; Franque et al. 2021; Shin et al. 2010). Hence, if users are satisfied with the effectiveness of green fintech usage, such as effective matching to meet their financial and environmentally friendly needs, they are more likely to sense the ecological benefits and advantages that green fintech produces to increase their perceptions of usefulness and helpfulness. Additionally, in the ECM, perceived usefulness and satisfaction both strengthen user intentions to continuously use a technology (Bhattacherjee 2001). In the green fintech context, users who are satisfied with green fintech are more likely to continue to use green fintech than those who are not satisfied (Franque et al. 2021). Users with a higher degree of satisfaction regarding the environmental and sustainable development of green fintech will be willing to continually use green fintech. Research has authenticated the relationships of perceived usefulness and satisfaction on user continuance intention with fintech (Kumar et al. 2018; Lee et al. 2023). Therefore, this study develops the following hypotheses:

H3: Perceived usefulness improves satisfaction.

H4: Perceived usefulness increases the willingness to continue to use green fintech.

H5: Satisfaction improves the willingness to continue to use green fintech.

The impact of environmental concerns on the ECM

Environmental concerns pertain to individuals’ value orientation toward the environment and their awareness of environmental issues (Schuitema et al. 2013), deeply rooted in the principles of the NEP (Stern et al. 1995). The NEP framework highlights that individuals who possess a strong ecological worldview are more inclined to recognize the interdependence between humans and nature while rejecting the notion of human dominance over the environment (Dunlap and Van Liere 1978). Richardson (2013) discovered that individuals with environmental concerns are significantly more likely to engage in environmentally friendly behaviors compared to those who lack such concerns. These individuals are motivated by a belief in the imperative of environmental protection and actively seek to promote sustainability through the adoption of green products or services (White and Sintov 2017).

For individuals with environmental concerns, green fintech represents a valuable avenue for contributing to ecological preservation and advancing sustainable development goals (Zhang et al. 2020). Individuals who prioritize environmental issues believe that their actions, particularly financial behaviors, should align with principles of environmental sustainability (Lin and Lee 2024a, 2024b). As a result, green fintech emerges as an appealing option for these users (Zhao and Abeysekera 2024). Such environmental concerns motivate users to recognize the positive impact of green fintech on the environment, reinforcing the notion that humanity should coexist harmoniously with nature (Zhang et al. 2020). This alignment between their ecological values and the principles of green fintech enhances their sense of confirmation. Users’ expectations of utilizing green fintech to foster environmental sustainability are consistently validated by their experiences with the technology (Zeng 2023).

Additionally, individuals with environmental concerns are increasingly aware of the effectiveness and utility of green products or services that provide direct benefits to the environment (De Silva et al. 2021). When engaging with green fintech, these users perceive their financial activities as not only meeting their financial needs but also positively contributing to environmental protection, such as promoting a low-carbon lifestyle (Zhao and Abeysekera 2024). This dual benefit reinforces their belief in the capacity of green fintech to aid them in achieving their environmental protection goals, thereby significantly enhancing their perceived usefulness of green fintech. In conclusion, environmental concerns not only assist users in recognizing the ecological advantages of green fintech, fulfilling their expectations, but also elevate its perceived usefulness as they acknowledge both financial and environmental benefits. Based on these descriptions, we hypothesize the following:

H6: Environmental concerns enhance users’ confirmation.

H7: Environmental concerns enhance users’ perceived usefulness.

Green trust, environmental concerns and the ECM

Green trust refers to the confidence that consumers have in a product or service based on its reputation for environmental protection and its capacity to positively influence the environment (Chen 2013). According to the trust-commitment theory (Morgan and Hunt 1994), trust is essential for cultivating strong and lasting relationships between consumers and products or services, which in turn fosters commitment (Wang et al. 2020; Badrinarayanan and Ramachandran 2024). In the realm of green products and services, including green fintech, green trust significantly affects not only consumer loyalty but also their long-term engagement and commitment to the service (Abbas et al. 2018). In the context of green fintech, consumers who possess a high level of green trust are more likely to believe that such services have a solid reputation for environmental stewardship and provide authentic benefits to the ecological environment (Chen 2013). The trust-commitment theory further suggests that this trust fuels consumers’ commitment (Badrinarayanan and Ramachandran 2024), thereby increasing their willingness to engage more meaningfully with green fintech. Consumers with a strong sense of green trust are also more inclined to perceive that the performance of green fintech meets their expectations regarding environmental advantages (Dhir et al. 2021), resulting in a heightened feeling of confirmation.

Furthermore, according to trust-commitment theory, trust enhances consumers’ perceptions of product or service as reliable and aligned with their values, thereby reinforcing their commitment to ongoing engagement (Morgan and Hunt 1994; Badrinarayanan and Ramachandran 2024). In the context of green fintech, consumers who possess a strong sense of green trust believe that green fintech can effectively contribute to addressing environmental challenges, accelerate the transition to a sustainable society, and significantly increase their perceived usefulness of the technology (Lin and Lee 2024a, 2024b). As the sense of green trust deepens, users feel that their participation in green fintech not only satisfies their financial needs but also actively supports ecological preservation and sustainable development (Lin and Lee 2024a, 2024b). This belief bolsters their confidence and loyalty toward green fintech. Viewed through the lens of trust-commitment theory, green trust cultivates a stronger relationship between consumers and green fintech, ultimately enhancing both their confirmation and perceived usefulness of this technology. Based on these descriptions, we hypothesize the following:

H8: Green trust enhances users’ confirmation.

H9: Green trust enhances users’ perceived usefulness.

Environmental concerns and green trust

Customers who are concerned about the environment tend to show a greater interest in green products or services, as they prioritize both the environmental reputation and the ability of these offerings to protect the environment (Sultana et al. 2022). In the context of green fintech, users with higher levels of environmental concern will focus more on the environmental benefits and advantages that green fintech provides in supporting sustainable development (Zhang et al. 2020). This heightened focus on sustainability strengthens users’ belief in the credibility and environmental performance of green fintech. Gil and Jacob (2018) discovered that customers who hold strong environmental preferences are more inclined to trust green products or services. This trust fosters their belief that these offerings are in harmony with their ecological values and contribute positively to environmental preservation (Srivastava and Mittal 2024). Additionally, Chauhan and Goyal’s (2024) meta-analysis has shown that environmental concerns serve as a key antecedent to green trust. Based on this insight, it is reasonable to suggest that environmental concerns can enhance users’ green trust, as their concern for the environment drives them to place greater confidence in the environmental benefits promised by green fintech. Therefore, we hypothesize the following:

H10: Environmental concerns enhance green trust.

Research method

Data collection and sample

In this paper, we collected sample data through a questionnaire survey to test the model. The target samples of participants were those who have used green fintech (i.e., Ant Forest in this study). This is because these participants have actually used and experienced Ant Forest’s effectiveness, which facilitates our appraisal of their continuous usage of Ant Forest. Since we performed the investigation in China, the original English scale was translated into Chinese using a back-translation procedure (Brislin 1970). Then, to performing the pilot test, three experts in green fintech and two university professors were invited to check the questionnaire. This test helped us guarantee that the questionnaire was clear, meaningful and understandable. After modifying the content of the questionnaire based on professional suggestions to further test whether the wording of the questionnaire questions was compatible with users’ language traditions, the questionnaire was sent to multiple Ant Forest users for pretesting. Based on user feedback and suggestions, the formal questionnaire was officially established.

Before the formal release of the questionnaire, this study needed to consider the minimum number of questionnaires collected to statistically examine the model. The minimum sample size for social science research should be greater than 15 times the number of variables adopted (Baptista and Oliveira 2015). The proposed model included 6 variables, meaning that at least 90 questionnaires should be collected. The literature suggests that a professional questionnaire platform, Credamo (www.credamo.com), can be used to help collect quality samples more effectively (He et al. 2023; Liu et al. 2022; Wang et al. 2022). This platform has several advantages; for example, it has rigorous online identity verification for user registration, and it confines each internet address (IP) to a solitary response to prevent repetitive answers by users (Wang et al. 2022). The platform also has established a large user database covering all provinces, cities, and regions in China that can assist us in gathering samples from a random sampling mode rather than convenience sampling. Therefore, the survey sample is diverse and representative (Zhou et al. 2024). Through the sampling assisted by the platform, we issued 400 questionnaires to Ant Forest users. After removing 42 invalid questionnaires (e.g., irrational time in filling out the questionnaires (e.g., <30 s), a total of 358 valid questionnaires were collected.

In addition to employing a random sampling method, a nonprobability sampling approach was also utilized. Specifically, we implemented a snowball sampling technique aimed at targeting Ant Forest user groups that are typically difficult to reach (Emerson 2015). Through this technique, we relied on existing Ant Forest users within our social network to assist in distributing the questionnaire. These users subsequently shared the questionnaire with other Ant Forest users in their networks, allowing us to access a broader sample population. This strategy proved particularly effective in collecting data from middle-aged and elderly users, thereby complementing the samples gathered through random sampling. As a result of the snowball sampling method, we received a total of 310 completed questionnaires. After excluding 15 invalid responses, we were left with 295 valid questionnaires available for analysis. In summary, the integration of two sampling strategies leads to more comprehensive and robust research outcomes. This combination effectively mitigates the risks associated with common method bias. By blending random sampling with nonrandom sampling methods, this study successfully collected a total of 653 questionnaires, which surpasses the minimum sample requirement of 90 to examine the model. The demographics of the sample are presented in Table 3.

Measurement

The measurements of all the variables were adapted from existing validated studies and tailored to Ant Forest continuous usage scenarios (see Supplementary Appendix). We utilized a seven-point Likert scale to calculate the measurement items of each variable. Specifically, the two-item scale used to measure environmental concerns is adapted from Dhir et al. (2021). Green trust was measured using the four items adapted from Yadav et al. (2019). In terms of the ECM, perceived usefulness was calculated using the four items adapted from Bhattacherjee (2001) and Venkatesh and Davis (2000). A 3-item scale adapted from Bhattacherjee (2001) and Lee et al. (2023) was used to assess confirmation. The measure of satisfaction relied on four items adapted from Bhattacherjee (2001) and Lee et al. (2023). Finally, continuance intention of Ant Forest was assessed by the 3-item scale adapted from Zhang et al. (2020). Moreover, we controlled several variables (i.e., the age, educational background, and average monthly income of users as well as the frequency of Ant Forest use) that may have potential impacts on fintech continuous use (e.g., Lin and Lee 2024a, 2024b).

Common method bias

Since common method bias (CMB) may occur in self-report questionnaires, this study adopted three different methods to check this issue. First, we conducted Harman’s single-factor test, and the results showed that the first factor accounted for only 36.2% of the variance. No single factor can predict more than 50% of the total variance, supporting that CMB is not a significant concern (Harman 1976). The second method is to use the full collinearity test suggested by Lee et al. (2021). According to Table 4, we found that all the values of variance inflation factors were less than the accepted value of 3.3 (Lee et al. 2021). Finally, following Simmering et al. (2015), we used a marker variable approach to test for CMB. Based on Lee et al. (2023), average annual income was chosen as the marker variable, as it is not theoretically linked to ECM, environmental concerns, or green trust. The results showed no significant relationships between income and any model variables, indicating that CMB was not a concern in this study. According to the results of the aforementioned approaches, CMB did not threaten the investigation.

Data analysis

A partial least squares (PLS) method was employed to assess the model. PLS is categorized as a type of structural equation modeling (SEM), specifically as a variance-based SEM (Hair et al. 2017; Legate et al. 2023). In contrast to traditional SEM, commonly known as covariance-based SEM (CB-SEM), PLS-SEM offers several significant advantages. One of the primary benefits of PLS-SEM is its flexibility in accommodating small sample sizes and models with fewer indicators per construct, making it a suitable choice when utilizing a limited number of measurement items (Sarstedt et al. 2022). CB-SEM is typically less effective for analyzing constructs that depend solely on two measurement items, as it relies on the covariance among multiple measurement items to estimate the underlying latent variable. Consequently, the use of only two items can lead to less reliable and potentially biased estimations (Hair et al. 2017; Legate et al. 2023). In this study, environmental concerns are assessed using only two items (Dhir et al. 2021). Given this reliance on two measurement items for environmental concerns, adopting PLS-SEM proves to be a more robust and suitable method for our analysis.

Although our sample size (N = 653) is sufficiently large for CB-SEM, we selected PLS-SEM due to several additional methodological advantages. First, PLS-SEM is more appropriate for models with smaller effect sizes and complex path relationships, as it handles measurement errors more efficiently and is less affected by model complexity (Sarstedt et al. 2022). Second, PLS-SEM is especially well-suited for research that focuses on prediction (Hair et al. 2013). This aligns closely with the goal of our study, which aims to predict users’ intention to continuously use green fintech. Third, PLS-SEM provides more reliable estimates in models where constructs are operationalized using fewer indicators, as is the case with environmental concerns. These considerations collectively reinforce the rationale for adopting PLS-SEM over CB-SEM in this study. This study adopted SmartPLS 3 software (Ringle et al. 2015) for data analysis. The PLS-SEM estimation can be separated into two steps (i.e., measurement model and structural model), which is expressed as follows.

Measurement model

Measurement model analysis mainly verifies the reliability, convergent validity, and discriminant validity of the variables (Hair et al. 2013). Reliability includes several parameter requirements, which are composite reliability (CR), Cronbach’s alpha and factor loading. In particular, the CR value should be greater than 0.7, each measurement item’s factor loading should exceed 0.7, and Cronbach’s alpha value should be greater than 0.7 (Hair et al. 2013). According to Table 5, we found that the reliability of all the variables was established. In terms of validity, we assessed convergent validity using average variance extracted (AVE). Hair et al. (2013) indicated that the AVE should exceed the threshold of 0.5, signifying that 50% or more of the variance can be interpreted by the items of the variable (Hair et al. 2013). We found that all the AVE values of the variables exceed the accepted value of 0.50, ranging from 0.585 to 0.811, which supports convergent validity (see Table 5). Finally, we examined the discriminant validity using a heterotrait-monotrait ratio of correlations (HTMT) approach suggested by Henseler et al. (2016a, 2016b). Henseler et al. (2016a, 2016b) indicated that the HTMT values should be less than the threshold of 0.85, signifying that discriminant validity was supported and our results met the criterion (see Table 6).

Structural model

Structural equation model analysis refers to the estimation of the path coefficient (β) and the explanatory power (R² value) of the model (Hair et al. 2013). The path coefficient is used for testing the statistical significance of a hypothesis, while the R² value indicates the explanatory power of the extrinsic latent variables on the intrinsic latent variables as expressed in a value ranging from 0 to 1 (Hair et al. 2013). As suggested by Hair et al. (2013), we applied a bootstrap resampling method (10000 resamples) to assess the path coefficients of the proposed hypotheses and R2 value. The PLS-SEM analysis showed that all the hypotheses are supported (see Fig. 2 and Table 7). Because all the control variables exert nonsignificant impacts on the model, we do not show them in Fig. 2 to increase the quality of presentation.

In addition, concerning explanatory power, the R2 values of green trust, perceived usefulness, confirmation, satisfaction, and continuance intention are 0.145, 0.425, 0.243, 0.385, and 0.488, respectively. The R2 value of continuance intention exceeds 0.1, indicating the good explanatory power of the proposed model (Lee and Lin 2023). While the R² values for green trust (0.145) and confirmation (0.243) fall within the low to moderate range, they remain meaningful in the context of complex behavioral research. Users’ decisions to continue using green fintech are often shaped by a variety of psychological, social, and contextual factors (Nie et al. 2023; Lin and Lee 2024a, 2024b), making it unlikely for any single variable to account for a large proportion of the variance. In this study, the significant relationships leading to green trust and confirmation highlight the important roles of environmental concerns and green trust in driving sustained user engagement with green fintech. Although these factors do not explain the majority of the variance, their effects are stable and meaningful. As such, the findings offer practical implications: enhancing users’ environmental awareness and strengthening trust in green technologies can effectively encourage the ongoing use of green fintech services.

Moreover, this study employed PLSpredict to evaluate the model’s predictive power for new samples, following the recommendations of Shmueli et al. (2019). The analysis utilized 10-fold cross-validation with one repetition, conforming to the guidelines established by Shmueli et al. (2019) and Lee et al. (2023). The findings indicated that the (Q2) values for the measurement items related to continuance intention were greater than 0 (see Table 6). Additionally, the root mean squared error (RMSE) and mean absolute error (MAE) derived from the PLS-SEM analysis were lower than those predicted by the corresponding linear regression model (LM). This suggests that the PLS-SEM structural model significantly improves predictive performance compared to the LM, illustrating a robust predictive capability for new samples (Shmueli et al. 2019; Gong and Wang 2023) (refer to Table 8).

Mediation analysis

Moreover, we further examined the mediation effect of the model using Zhao et al.’s (2010) approach. Specifically, when evaluating the mediating effects, if both the direct and indirect effects are significant and the product of the two effects are positive (or negative), then a complementary mediation (or competitive mediation) is confirmed (Zhao et al. 2010). When using this method, the direct effects are not required to be significant. When the indirect effects are significant and the direct effect are nonsignificant, the direct effect can still reflect indirect mediation (Lee and Chen 2022). The mediating results show that all the mediating paths are complementary, as shown in Table 9. We go on to interpret the mediating findings in Section “Discussion of the results”.

Multisample analysis

The literature has shown that due to differences in cognition and decision-making between males and females, gender may affect users’ green behaviors (Beutel and Marini 1995; García-Salirrosas et al. 2023) and technology adoption behavior (Sun and Zhang 2006). Thus, we conduct a multigroup analysis to test whether the gender of the respondents has a significant influence on the model. Prior to multisample analysis, a measurement invariance of the composite models (MICOM) procedure suggested by Henseler et al. (2016a, 2016b) was confirmed. Table 10 displays the results of the multisample analysis for the male group (315 samples) and the female group (338 samples). We observed that two hypotheses (i.e., H1 and H4) present significantly different effects between the two sample groups. Specifically, the female groups showed stronger confirmation → perceived usefulness and perceived usefulness → continuance intention effects than the male group. We will elaborate on the findings of the multisample analysis on gender in Section “Discussion of the results”.

Discussion and contributions

Discussion of the results

As green fintech focuses on achieving environmental protection and sustainable development goals (Lin and Lee 2024a, 2024b), the impact of green factors on users’ willingness to continuously use green fintech should be considered. The main purpose of this study is to combine green antecedents and the ECM to explore users’ willingness to continuously use green fintech (i.e., Ant Forest in this study). Specifically, environmental concerns and green trust, as antecedent variables, have impacts on confirmation and perceived usefulness and subsequently affect user satisfaction, which influences users’ willingness to continue to use Ant Forest.

We found that most of the hypotheses are supported, with the exception that environmental concerns have no significant effect on confirmation (see Table 5). Such findings provide an answer to the first research question. The hypotheses of the ECM are guaranteed in the green fintech context (H1-H5), that is, confirmation can foster the perceived usefulness and satisfaction of Ant Forest users. In addition, perceived usefulness has a significant impact on satisfaction, and both perceived usefulness and satisfaction can be used to strengthen the continuous willingness to use Ant Forest. These results are consistent with previous research on other types of fintech (Hidayat-Ur-Rehman et al. 2021; Lee et al. 2023; Sinha and Singh 2023; Yuan et al. 2014).

In addition, this paper confirmed the influence of environmental concerns on users’ confirmation (H6) and perceived usefulness (H7). Users with strong environmental concerns are particularly sensitive to Ant Forest’s positive ecological impact, perceiving their actions as valuable contributions to an eco-friendly environment. They see Ant Forest as an effective tool aligned with their environmental values, supporting their commitment to sustainable development goals. This alignment strengthens both their confirmation and their perception of Ant Forest’s usefulness. The results showed that green trust significantly increases users’ confirmation of Ant Forest use (H8). Users with green trust have more confidence that Ant Forest has a good environmental reputation and commitment. In this case, they can more fully experience Ant Forest performance, which can promote the realization of environmental protection, thereby meeting users’ expectations. Green trust can also enhance users’ perceived usefulness (H9). Users with green trust believe that the use of Ant Forest can address environmental issues and accelerate the construction of a sustainable society, which enables them to feel positive and favorable; that is, users’ perceived usefulness of Ant Forest can be strengthened. Finally, environmental concerns were found to significantly enhance green trust (H10). Users with environmental concerns have more faith regarding the benefits the Ant Forest produces. This finding is consistent with a prior study that explores green purchase intention (Chairy and Alam 2019; Chen et al. 2015).

In the mediation analysis, we observed that all the mediating paths are complementary mediation. Concerning mediation paths 1 and 2, perceived usefulness acts as a partial mediator between environmental concerns and satisfaction and between environmental concerns and continuance intention. In other words, environmental concerns can directly foster satisfaction and continuance intention or indirectly foster satisfaction and continuance intention through perceived usefulness, which eventually enhances users’ satisfaction and continuance intention.

In mediation paths 3 and 4, confirmation acts as a partial mediator between environmental concerns and perceived usefulness and between environmental concerns and satisfaction. Specifically, confirmation directly enhances users’ perceived usefulness and satisfaction. Additionally, environmental concerns increase confirmation, which subsequently boosts users’ perceived usefulness and satisfaction.

Regarding paths 5 and 6, perceived usefulness partially mediates the associations between green trust and satisfaction and between green trust and continuance intention individually. Namely, green trust can either directly or indirectly strengthen users’ satisfaction and continuance intention by strengthening the effectiveness of perceived usefulness and subsequently enhancing users’ satisfaction and continuance intention. For mediation paths 7 and 8, green trust acts as a partial mediator between environmental concerns and confirmation and between environmental concerns and perceived usefulness, respectively. Namely, environmental concerns enhance users’ confirmation and perceived usefulness directly; alternatively, environmental concerns strengthen green trust, which in turn enhances users’ confirmation and perceived usefulness. With regard to paths 9 and 10, confirmation partially mediates the associations between green trust and perceived usefulness and between green trust and satisfaction individually. That is, green trust straightforwardly enhances users’ perceived usefulness and satisfaction; otherwise, green trust can facilitate users to confirm their expectations, which eventually promote users’ perceived usefulness and satisfaction.

Furthermore, in terms of the multisample analysis on gender, we found that the path coefficients of H1 (confirmation → perceived usefulness) and H4 (perceived usefulness → continuance intention) between the male group and the female group differ significantly, while the other eight hypotheses are not significant in the two groups. In particular, H1 and H4 have stronger impacts in the female group than in the male group. When using Ant Forest, once female users confirm their expectations, their perceptions of usefulness are more intense than those of male users. In addition, when female users perceive usefulness toward Ant Forest, they are more likely to continue using it than male users. These findings reflect that females pay more attention to constantly adopting Ant Forest than males, which responds to previous studies showing that females are more inclined to engage in green behavior and are more willing to use environmentally friendly products than males (e.g., Beutel and Marini 1995; García-Salirrosas et al. 2023). Additionally, research indicates that females typically display greater emotional sensitivity and engagement, particularly in relation to environmental issues (Arnocky and Stroink 2010). This increased emotional sensitivity allows females to establish deeper and more meaningful connections with environmental causes, thereby enhancing their sense of perceived usefulness and emotional fulfillment when involved in eco-friendly activities (Milfont and Sibley 2016), such as utilizing green fintech. Females are more inclined to perceive such activities as personally rewarding, which reinforces their commitment to sustainability and further motivates their participation in green initiatives. Consequently, women may be more predisposed to continue engaging with Ant Forest, as this green fintech closely aligns with their emotional investment. The results detailed above have addressed the second research question; that is, gender is found to significantly and contextually influence the continuous use of green fintech by users based on the ECM.

Theoretical contributions

This study offers several theoretical contributions to the literature and the ECM. First, we simultaneously consider green personal traits (i.e., environmental concerns) and personal confidence and reliance on green fintech (i.e., green trust) to explore users’ adoption decisions to continuously use green fintech (i.e., Ant Forest). Few or no studies have focused on the integrated impact of environmental concerns and green trust with the ECM to predict and explain continuous Ant Forest adoption (Ashfaq et al. 2021, 2022; Mi et al. 2021; Yang et al. 2018; Zhang et al. 2020). We contribute to the literature by further revealing the impacts of environmental concerns and green trust on users’ confirmation, perceived usefulness and satisfaction, which eventually affect users’ continuance intention toward Ant Forest.

Second, Ashfaq et al. (2023) used the ECM as a theoretical basis with green task technology fit as an antecedent variable to explore users’ continuance intention toward Ant Forest. This paper contributes to the ECM by further identifying and exposing the potential roles of environmental concerns and green trust in the ECM, which helps amplify the suitability and interpretive ability of the ECM by spreading it to the Ant Forest adoption context. Green fintech has been proposed to promote sustainability, and this investigation can echo the development of green fintech in academia and industry, which can facilitate a deeper comprehension of users’ willingness to continue to use green fintech.

Finally, the literature has indicated that gender contextually influences users’ green behaviors (e.g., García-Salirrosas et al. 2023). Based on the multisample analysis on gender (see Table 7), we found that two proposed hypotheses are significantly distinct in this study: H1 (confirmation → perceived usefulness) and H4 (perceived usefulness → continuance intention). These findings showed that gender exerts a substantial impact on users’ confirmation as well as on their perception of the usefulness of continuous usage of Ant Forest. We contribute to the literature by further understanding the role played by gender differences in the green fintech context, which helps better individualize and propose targeted solutions to increase users’ continuance adoption intention toward green fintech.

Practical implications

This paper offers practical value for the development of green fintech. First, when designing and developing green fintech, development teams can add appropriate artificial intelligence algorithms and big data techniques to precisely grasp users’ green personal traits and demographics and assess their green inclination level. Through the use of this information, green fintech providers can afford green services based on the degree of users’ green inclination level. For users with lower green inclination levels, more green information can be pushed and displayed to the users. For example, green fintech applications can display practical environmental or sustainable achievement certified by nonprofit organizations with as much public credibility as possible. In doing so, the visualization of the realization path of sustainable development goals can be enhanced to deepen users’ green trust and the continuous usage of green fintech.

Second, development teams can improve the social attributes of green fintech applications and strengthen the interaction among users in terms of the exchange of green experience and information. Through users’ intensified communication in the social community, green issues and environmental protection could become a high-intensity discussion topic that allows users to mutually learn about the green experience to improve and raise users’ environmental concerns. This helps spur users’ low-carbon behaviors and further cultivate their green habits, thereby fostering their motivation to continuously use green fintech. Finally, low-carbon development and environmental protection have become a global economic trend. With people’s increasingly clear understanding of the ecological environment, users’ expectations for green fintech are gradually increasing. Therefore, green fintech should more fully reflect its environmentally friendly and sustainable characteristics to meet users’ expectations, thereby attracting and motivating users to constantly use green fintech. For example, green fintech providers can work with environmental bureaus to organize low-carbon campaigns to encourage users to conduct green financial consumption. With governmental assistance and credibility, it enables users to have higher green trust toward green fintech, which helps users reach their expectations concerning environmental protection and increase their satisfaction, thereby promoting the continuous use of green fintech.

Limitations and future research

In this study, we found that environmental concerns increase users’ green trust, which in turn enhances satisfaction—via confirmation of expectations and perceived usefulness—and ultimately drives their continued use of green fintech (Ant Forest). These results highlight the importance of fostering environmental awareness and trust to promote sustained adoption of green financial technologies. This paper has some limitations that can be addressed in subsequent research. First, the sample collected in this paper is solely from China, and thus our findings may not be generalizable to other countries or regions. Future studies can be conducted in multiple countries to ensure regional diversity, thereby increasing generalizability. Second, in this paper, we collected questionnaires only through a cross-sectional method (i.e., survey) to examine the model. Nevertheless, we recommended a long-term research design in subsequent investigations to further confirm the causality in the model. Third, Ant Forest is currently the most popular personal green fintech application in the world (Ashfaq et al. 2022; Chen et al. 2020); therefore, this study employed Ant Forest as our foremost research objective of green fintech to predict and explain its continuous usage. Subsequent researchers can utilize other green fintech as research targets to test whether there are differences between Ant Forest and other green fintech. Finally, green fintech is an important part of forming a green city. Chan (2019) indicated that the level of green situations in different cities is distinct, which may also have some impact on residents’ attitudes and motivation to use green services or products. On this basis, future research can integrate the green city concept and the ECM to explore the joint impacts on residents’ willingness to continuously use green fintech. Doing so can further facilitate the development of more perspicacious knowledge of users’ sustainable intentions to use green fintech under the varying degree effect of green cities.

Data availability

The data were collected and stored in accordance with the research data management policies of the authors’ institutions (Beijing Normal University at Zhuhai), ensuring the anonymity of the informants. The data are not publicly available due to privacy and ethical restrictions. However, the dataset can be obtained from the corresponding author upon reasonable request.

References

Abbas M, Gao Y, Shah SS (2018) CSR and customer outcomes: the mediating role of customer engagement. Sustainability 10(11):4243

Ahmad W, Zhang Q (2020) Green purchase intention: effects of electronic service quality and customer green psychology. J Clean Prod 267:122053

Arnocky S, Stroink M (2010) Gender differences in environmentalism: The mediating role of emotional empathy. Curr Res Soc Psychol 16(9):1–14

Ashfaq M, Tandon A, Zhang Q, Jabeen F, Dhir A (2023) Doing good for society! How purchasing green technology stimulates consumers toward green behavior: a structural equation modeling–artificial neural network approach. Bus Strategy Environ 32(4):1274–1291

Ashfaq M, Zhang Q, Ali F, Waheed A, Nawaz S (2021) You plant a virtual tree, we’ll plant a real tree: understanding users’ adoption of the ant forest mobile gaming application from a behavioral reasoning theory perspective. J Clean Prod 310:127394

Ashfaq M, Zhang Q, Zafar AU, Malik M, Waheed A (2022) Understanding ant forest continuance: effects of user experience, personal attributes and motivational factors. Ind Manag Data Syst 122(2):471–498

Badrinarayanan V, Ramachandran I (2024) Relational exchanges in the sales domain: A review and research agenda through the lens of commitment-trust theory of relationship marketing. J Bus Res 177:114644

Baptista G, Oliveira T (2015) Understanding mobile banking: the unified theory of acceptance and use of technology combined with cultural moderators. Comput Hum Behav 50:418–430

Beutel AM, Marini MM (1995) Gender and values. Am Socio Rev 60(3):436–448

Bhattacherjee A (2001) Understanding information systems continuance: an expectation-confirmation model. MIS Q 25(3):351–370

Bhatnagr P, Rajesh A, Misra R (2024) Continuous intention usage of artificial intelligence enabled digital banks: a review of expectation confirmation model. J Enterp Inf Manag 37(6):1763–1787

Bölen MC (2020) Exploring the determinants of users’ continuance intention in smartwatches. Technol Soc 60:101209

Bölen MC, Özen Ü (2020) Understanding the factors affecting consumers’ continuance intention in mobile shopping: the case of private shopping clubs. Int J Mob Commun 18(1):101–129

Brislin RW (1970) Back-translation for cross-cultural research. J Cross Cult Psychol 1(3):185–216

Chairy C, Alam M (2019) The influence of environmental concern, green perceived knowledge, and green trust on green purchase intention. J Manaj 10(2):131–145

Chan CS (2019) Which city theme has the strongest local brand equity for Hong Kong: green, creative or smart city? Place Brand Public Dipl 15(1):12–27

Chauhan S, Goyal S (2024) A meta-analysis of antecedents and consequences of green trust. J Consum Mark 41(4):459–473

Chen B, Feng Y, Sun J, Yan J (2020) Motivation analysis of online green users: Evidence from Chinese “ant forest. Front Psychol 11:1335

Chen SY, Lu CC (2015) Investigating the psychology of green transportation via the green service profit chain. Transp Lett 7(3):143–153

Chen YS (2010) The drivers of green brand equity: green brand image, green satisfaction, and green trust. J Bus Ethics 93(2):307–319

Chen YS (2013) Towards green loyalty: driving from green perceived value, green satisfaction, and green trust. Sustain Dev 21(5):294–308

Chen YS, Lin CY, Weng CS (2015) The influence of environmental friendliness on green trust: the mediation effects of green satisfaction and green perceived quality. Sustainability 7(8):10135–10152

Cheng YM (2023) How can robo-advisors retain end-users? Identifying the formation of an integrated post-adoption model. J Enterp Inf Manag 36(1):91–122

Cruz SM, Manata B (2020) Measurement of environmental concern: A review and analysis. Front Psychol 11:363. https://doi.org/10.3389/fpsyg.2020.00363

Daragmeh A, Saleem A, Bárczi J, Sági J (2022) Drivers of post-adoption of e-wallet among academics in Palestine: an extension of the expectation confirmation model. Front Psychol 13:984931

De Silva M, Wang P, Kuah ATH (2021) Why wouldn’t green appeal drive purchase intention? Moderation effects of consumption values in the UK and China. J Bus Res 122:713–724

Dhir A, Sadiq M, Talwar S, Sakashita M, Kaur P (2021) Why do retail consumers buy green apparel? A knowledge-attitude-behaviour-context perspective. J Retail Consum Serv 59:102398

Dunlap RE (2008) The new environmental paradigm scale: from marginality to worldwide use. J Environ Educ 40(1):3–18

Dunlap RE, Van Liere KD (1978) The “new environmental paradigm”. J Environ Educ 9(4):10–19

Emekci S (2019) Green consumption behaviours of consumers within the scope of TPB. J Consum Mark 36(3):410–417

Emerson RW (2015) Convenience sampling, random sampling, and snowball sampling: How does sampling affect the validity of research? J Vis Impair Blind 109(2):164–168

Franque FB, Oliveira T, Tam C (2021a) Understanding the factors of mobile payment continuance intention: empirical test in an African context. Heliyon 7(8):e07807

Franque FB, Oliveira T, Tam C, Santini FDO (2021b) A meta-analysis of the quantitative studies in continuance intention to use an information system. Internet Res 31(1):123–158

García-Salirrosas EE, Niño-De-Guzmán JC, Gómez-Bayona L, Escobar-Farfán M (2023) Environmentally responsible purchase intention in Pacific alliance countries: geographic and gender evidence in the context of the COVID-19 pandemic. Behav Sci 13(3):221

Gil M, Jacob J (2018) The relationship between green perceived quality and green purchase intention: a three-path mediation approach using green satisfaction and green trust. Int J Bus Innov Res 15(3):301–319

Gong T, Wang CY (2023) Unpacking the relationship between customer citizenship behavior and dysfunctional customer behavior: the role of customer moral credits and entitlement. J Serv Theory Pr 33(1):110–137

Guerreiro J, Pacheco M (2021) How green trust, consumer brand engagement and green word-of-mouth mediate purchasing intentions. Sustainability 13(14):7877

Hair JF, Hult GTM, Ringle C, Sarstedt M (2013) A primer on partial least squares structural equation modeling (PLS-SEM. Sage Publications, Thousand Oaks, CA

Hair Jr JF, Matthews LM, Matthews RL, Sarstedt M (2017) PLS-SEM or CB-SEM: updated guidelines on which method to use. Int J Multivar Data Anal 1(2):107–123

Hariguna T, Ruangkanjanases A, Madon BB, Alfawaz KM (2023) Assessing determinants of continuance intention toward cryptocurrency usage: extending expectation confirmation model with technology readiness. Sage Open 13(1):21582440231160439

Harman H (1976) Modern factor analysis. University of Chicago Press, Chicago

He J, Cui T, Barnhart WR, Cui S, Xu Y, Compte EJ, Murray SB, Nagata JM (2023) Validation of the muscularity-oriented eating test in adult women in China. Int J Eat Disord 56(6):1207–1218

Henseler J, Hubona G, Ray PA (2016a) Using PLS path modeling in new technology research: updated guidelines. Ind Manag Data Syst 116(1):2–20

Henseler J, Ringle CM, Sarstedt M (2016b) Testing measurement invariance of composites using partial least squares. Int Mark Rev 33(3):405–431

Hidayat-Ur-Rehman I, Ahmad A, Khan MN, Mokhtar SA (2021) Investigating mobile banking continuance intention: a mixed-methods approach. Mob Inf Syst 2021(1):9994990

Jumaan IA, Hashim NH, Al-Ghazali BM (2020) The role of cognitive absorption in predicting mobile internet users’ continuance intention: an extension of the expectation-confirmation model. Technol Soc 63:101355

Kumar RR, Israel D, Malik G (2018) Explaining customer’s continuance intention to use mobile banking apps with an integrative perspective of ECT and self-determination theory. Pac Asia J Assoc Inf Syst 10(2):5

Lam A, Lau M, Cheung R (2016) Modelling the relationship among green perceived value, green trust, satisfaction, and repurchase intention of green products. Contemp Manag Res 12(1):47–60

Lee JC, Chen X (2022) Exploring users’ adoption intentions in the evolution of artificial intelligence mobile banking applications: the intelligent and anthropomorphic perspectives. Int J Bank Mark 40(4):631–658

Lee JC, Chou IC, Chen CY (2021) The effect of process tailoring on software project performance: the role of team absorptive capacity and its knowledge-based enablers. Inf Syst Front 31(1):120–147

Lee JC, Lin R (2023) The continuous usage of artificial intelligence (AI)-powered mobile fitness applications: the goal-setting theory perspective. Ind Manag Data Syst 123(6):1840–1860

Lee JC, Tang Y, Jiang S (2023) Understanding continuance intention of artificial intelligence (AI)-enabled mobile banking applications: an extension of AI characteristics to an expectation confirmation model. Humanit Soc Sci Commun 10(1):333

Lee YK, Kim S, Kim MS, Choi JG (2014) Antecedents and interrelationships of three types of pro-environmental behavior. J Bus Res 67(10):2097–2105

Legate AE, Hair Jr JF, Chretien JL, Risher JJ (2023) PLS‐SEM: Prediction‐oriented solutions for HRD researchers. Hum Resour Dev Q 34(1):91–109

Lin RR, Lee JC (2024a) How the UTAUT motivates consumers’ continuous use of green FinTech: the moderation effect of consumer social responsibility and long-term orientation. Aslib J Inf Manag, https://doi.org/10.1108/AJIM-09-2023-0371

Lin RR, Lee JC (2024b) The supports provided by artificial intelligence to continuous usage intention of mobile banking: evidence from China. Aslib J Inf Manag 76(2):293–310

Liu Y, Wang X, Wang S (2022) Research on service robot adoption under different service scenarios. Technol Soc 68:101810

Manaktola K, Jauhari V (2007) Exploring consumer attitude and behaviour towards green practices in the lodging industry in India. Int J Contemp Hosp Manag 19(5):364–377

Mi L, Xu T, Sun Y, Zhao J, Lv T, Gan X, Shang K, Qiao L (2021) Playing ant forest to promote online green behavior: a new perspective on uses and gratifications. J Environ Manag 278:111544

Milfont TL, Sibley CG (2016) Empathic and social dominance orientations help explain gender differences in environmentalism: A one-year Bayesian mediation analysis. Pers Individ Differ 90:85–88

Morgan RM, Hunt SD (1994) The commitment-trust theory of relationship marketing. J Mark 58(3):20–38

Nguyen GD, Dao THT (2024) Factors influencing continuance intention to use mobile banking: an extended expectation-confirmation model with moderating role of trust. Humanit Soc Sci Commun 11:276

Nie J, Wang X, Yang C (2023) The influence of self-expansion and consumer engagement on consumers’ continuous participation in virtual corporate social responsibility co-creation. Behav Sci 13(7):545

Puschmann T, Hoffmann CH, Khmarskyi V (2020) How green FinTech can alleviate the impact of climate change—the case of Switzerland. Sustainability 12(24):10691

Ravichandran S, Osakwe CN, Elgammal IMY, Abbasi GA, Cheah JH (2024) Feeding trust: exploring key drivers, moderators and consequences related to food app usage. J Serv Mark 38(7):872–891

Richardson DB (2013) Electric vehicles and the electric grid: a review of modeling approaches, impacts, and renewable energy integration. Renew Sustain Energy Rev 19:247–254

Ringle CM, Wende S, Becker JM (2015) SmartPLS 3. Boenningstedt: SmartPLS GmbH, http://www.smartpls.com

Saari UA, Damberg S, Frömbling L, Ringle CM (2021) Sustainable consumption behavior of Europeans: the influence of environmental knowledge and risk perception on environmental concern and behavioral intention. Ecol Econ 189:107155

Saif MAM, Hussin N, Husin MM, Alwadain A, Chakraborty A (2022) Determinants of the intention to adopt digital-only banks in Malaysia: the extension of environmental concern. Sustainability 14(17):11043

Sarstedt M, Hair JF, Pick M, Liengaard BD, Radomir L, Ringle CM (2022) Progress in partial least squares structural equation modeling use in marketing research in the last decade. Psychol Mark 39(5):1035–1064

Schill M, Godefroit-Winkel D, Diallo MF, Barbarossa C (2019) Consumers’ intentions to purchase smart home objects: do environmental issues matter? Ecol Econ 161:176–185

Schuitema G, Anable J, Skippon S, Kinnear N (2013) The role of instrumental, hedonic and symbolic attributes in the intention to adopt electric vehicles. Transp Res A Policy Pr 48:39–49

Shanmugavel N, Balakrishnan J (2023) Influence of pro-environmental behaviour towards behavioural intention of electric vehicles. Technol Forecast Soc Change 187:122206

Shen X, Wang L, Huang X, Yang S (2021) How China’s internet commonweal platform improves customer participation willingness? An exploratory study of Ant Forest. Chin Manag Stud 15(1):196–221

Shin YM, Lee SC, Shin B, Lee HG (2010) Examining influencing factors of post-adoption usage of mobile internet: focus on the user perception of supplier-side attributes. Inf Syst Front 12(5):595–606

Shmueli G, Sarstedt M, Hair JF, Cheah JH, Ting H, Vaithilingam S, Ringle CM (2019) Predictive model assessment in PLS-SEM: guidelines for using PLSpredict. Eur J Mark 53(11):2322–2347

Si H, Duan X, Zhang W, Su Y, Wu G (2022) Are you a water saver? Discovering people’s water-saving intention by extending the theory of planned behavior. J Environ Manag 311:114848

Simmering MJ, Fuller CM, Richardson HA, Ocal Y, Atinc GM (2015) Marker variable choice, reporting, and interpretation in the detection of common method variance: A review and demonstration. Organ Res Methods 18(3):473–511

Singh S, Sahni MM, Kovid RK (2020) What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag Decis 58(8):1675–1697

Sinha N, Singh N (2023) Revisiting expectation confirmation model to measure the effectiveness of multichannel bank services for elderly consumers. Int J Emerg Mark 18(10):4457–4480

Srivastava N, Mittal A (2024) How does green trust mediate the relationship between environmental concern and green brand knowledge during green purchases?. Glob Knowl Memory Commun, https://doi.org/10.1108/GKMC-04-2024-0229

Stern PC, Dietz T, Guagnano GA (1995) The new ecological paradigm in social-psychological context. Environ Behav 27(6):723–743

Sultana N, Amin S, Islam A (2022) Influence of perceived environmental knowledge and environmental concern on customers’ green hotel visit intention: mediating role of green trust. Asia Pac J Bus Adm 14(2):223–243

Sun H, Zhang P (2006) The role of moderating factors in user technology acceptance. Int J Hum Comput Stud 64(2):53–78

Tan WL, Goh YN (2018) The role of psychological factors in influencing consumer purchase intention towards green residential building. Int J Hous Mark Anal 11(5):788–807

Tao YT, Lin MD, Khan A (2022) The impact of CSR on green purchase intention: empirical evidence from the green building industries in Taiwan. Front Psychol 13:1055505

Troudi H, Bouyoucef D (2020) Predicting purchasing behavior of green food in Algerian context. EuroMed J Bus 15(1):1–21

Udeagha MC, Muchapondwa E (2023) Green finance, fintech, and environmental sustainability: fresh policy insights from the BRICS nations. Int J Sustain Dev World Ecol 30(6):633–649

Venkatesh V, Davis FD (2000) A theoretical extension of the technology acceptance model: four longitudinal field studies. Manag Sci 46(2):186–204

Wang L, Nelson LD, Gao RY, Jung M, Hung IW (2022) Validating a new tool for social scientists to collect data, https://sjdm.org/presentations/2022-Poster-Wang-Liman-validing-data-source~.pdf

Wang X, Tajvidi M, Lin X, Hajli N (2020) Towards an ethical and trustworthy social commerce community for brand value co-creation: A trust-commitment perspective. J Bus Ethics 167:137–152

White LV, Sintov ND (2017) You are what you drive: environmentalist and social innovator symbolism drives electric vehicle adoption intentions. Transp Res A Policy Pr 99:94–113

Wijekoon R, Sabri MF (2021) Determinants that influence green product purchase intention and behavior: a literature review and guiding framework. Sustainability 13(11):6219

Xu A, Wei C, Zheng M, Sun L, Tang D (2022) Influence of perceived value on repurchase intention of green agricultural products: from the perspective of multi-group analysis. Sustainability 14(22):15451

Yadav R, Balaji MS, Jebarajakirthy C (2019) How psychological and contextual factors contribute to travelers’ propensity to choose green hotels? Int J Hosp Manag 77:385–395

Yang Z, Kong X, Sun J, Zhang Y (2018) Switching to green lifestyles: behavior change of ant forest users. Int J Environ Res Public Health 15(9):1819

Yuan S, Liu Y, Yao R, Liu J (2014) An investigation of users’ continuance intention towards mobile banking in China. Inf Dev 32(1):20–34

Zeng Z (2023) Saving the world by being green with Fintech: Exploring the contradictions inherent in the case of Ant Forest. Cap Nat Social 34(4):139–158

Zhang Y, Xiao S, Zhou G (2020) User continuance of a green behavior mobile application in China: an empirical study of ant forest. J Clean Prod 242:118497

Zhao M, Abeysekera I (2024) The behaviour of FinTech users in the Alipay ant forest platform towards environmental protection. J Open Innov Technol Mark Complex 10(1):100201

Zhao X, Lynch JG, Chen Q (2010) Reconsidering Baron and Kenny: myths and truths about mediation analysis. J Consum Res 37(2):197–206

Zhou X, Tang J, Wang T (2024) Effect of the fit between situational regulatory focus and feedback focus on customers’ co-design behavior. Internet Res, https://doi.org/10.1108/INTR-11-2022-0861

Acknowledgements