Abstract

Central Bank Digital Currencies (CBDCs) have gained significant attention as potential innovations in the global financial landscape. The incorporation of artificial intelligence (AI) in the financial sector has brought transformative changes, particularly in the adoption and usage of CBDCs. Therefore, this study explores the impact of artificial intelligence (AI) on consumers’ intentions toward adopting CBDCs in the Chinese banking sector through digital technology awareness, addressing privacy concerns, and ease of use with the moderating role of government support. This research study examined the relationships of a sample of 420 employees in the Chinese banking sector. The current study uses the partial least squares structural equation modeling (PLS-SEM) method to assess these parameters. The findings show that artificial intelligence positively impacts consumers’ willingness to use CBDCs in the Chinese banking sector through digital technology awareness, addressing privacy concerns, and ease of use. Furthermore, government support significantly influences the link between AI, digital technology awareness, addressing privacy concerns, and ease of use. This study contributes to the literature on digital currency adoption by highlighting the critical role of AI in enhancing user experiences and trust in financial innovations. It also provides practical insights for policymakers and financial institutions to leverage AI technologies to strategically foster CBDCs adoption in China.

Similar content being viewed by others

Introduction

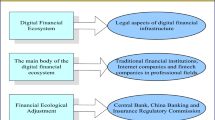

Technological advancement and the digitization of all aspects of society, as well as the worldwide financial realm, are experiencing significant and fundamental upheaval. Central Bank Digital Currency (CBDCs) is considered a significant advancement in financial innovation, potentially fundamentally transforming the underlying principles of monetary systems (Wu et al. 2024). CBDCs, as a state-backed digital currency, are a financial innovation with the potential to reshape the landscape of money and payments. Simultaneously, artificial intelligence (AI) is rapidly progressing and bringing about a revolutionary impact on several industries, surpassing previous rates of change (Wang 2023). The Chinese banking sector significantly converges two influential factors: AI and CBDCs. This combination has not only become a futuristic vision but has also materialized into a tangible reality. The undeniable rise of China as a prominent global technical force is mirrored in its financial industry (Ma et al. 2023). The idea of CBDCs is in perfect harmony with the Chinese government’s dedication to technology advancement and the promotion of digital empowerment. China’s proactive stance towards CBDCs is demonstrated by its ambitious implementation of the Digital Currency Electronic Payment (DCEP) system (Choithani et al. 2024). This strategy reflects China’s commitment to improving financial inclusion, facilitating efficient transactions, and promoting economic development.

Using AI technologies, individuals can analyze consumer data to provide personalized recommendations and services that encourage the use of CBDCs. For instance, AI-driven apps can suggest using CBDCs for specific transactions or savings, making the currency more accessible and user-friendly (Sood et al. 2023). AI algorithms can detect and prevent fraudulent activities, making CBDCs more secure and trustworthy for users. Improved trust can lead to higher willingness among consumers to adopt CBDCs. AI-powered chatbots and virtual assistants can help consumers understand CBDCs, guiding them through onboarding and answering their questions (Choithani et al. 2024). This can demystify CBDCs, reducing hesitation or fear of the unknown. In China’s banking sector, where both AI and CBDCs are rapidly advancing, the relationship between the two becomes even more relevant. China’s “Digital Yuan” project and its emphasis on AI for fintech innovation provide a fertile ground for exploring this relationship (Wang, 2023). Chinese banks and financial institutions leverage AI for credit scoring, customer relationship management, and automated customer support—all of which can intersect with CBDCs adoption strategies (Liu et al. 2024).

The consumer’s understanding, their perception of the user-friendliness of CBDCs, and their confidence in the security of their personal information all play a significant role in determining their inclination to incorporate this currency into their everyday routines (Rennie and Steele 2021). The global consideration of CBDCs by governments and financial institutions prompts notable advancements in this field, which proves its dedication to technological expertise and economic dominance (Prodan et al. 2024). The DCEP initiative undertaken by China represents a bold endeavor in the field of CBDCs, highlighting the country’s commitment to leveraging AI and digitalization to fundamentally transform the nature of the currency (Xia et al. 2023). A past study by Prodan et al. (2024) highlighted the innovative methods of financial interaction, and consumers must have an inclusive understanding of the primary technologies and CBDC (Alonso et al. 2021). An in-depth examination of the influence of consumers’ awareness of digital technology on their inclination to adopt CBDCs can shed light on the degree to which well-informed individuals are more inclined to embrace this digital shift (Wang 2023; Wu et al. 2024). CBDCs, supported by AI technology, represent a fundamental transformation in monetary transactions and storage. The Chinese banking industry offers a unique context for examining the relationship between technical advancement and customer adoption, given its incorporation of advanced AI algorithms and CBDCs infrastructure (Allen et al. 2022).

Digital technology awareness is essential because it determines how well consumers understand the benefits and risks associated with CBDCs. A higher awareness level can lead to a more informed decision-making process, potentially increasing the likelihood of adoption (Gupta et al. 2023b). Additionally, addressing privacy concerns is paramount in the digital currency domain, as issues related to data security and privacy breaches can significantly deter users from embracing CBDCs (Pocher and Veneris 2022). The ease of use of AI-driven platforms further contributes to consumers’ adoption intentions by ensuring that these platforms are user-friendly, accessible, and efficient (Gupta et al. 2023b). Support from the government, such as regulatory frameworks, incentives, and public education campaigns, can moderate the relationship between AI and digital technology awareness, privacy concerns, and ease of use (Dashkevich et al. 2020). With solid governmental backing, consumers may perceive AI-driven digital technologies, such as CBDCs, as more credible and trustworthy, thus enhancing their willingness to engage with these technologies (Yuan et al. 2023).

While there is an emerging body of literature on the adoption of CBDCs, most studies (Liu et al. 2024; Soana and de Arruda 2024; Wang 2023) primarily focus on its technological, economic, and regulatory aspects. However, the specific impact of AI on consumers’ willingness to use CBDCs remains underexplored. The integration of AI in financial technologies (FinTech) has transformative potential, yet the role of AI in influencing consumer adoption behaviors toward CBDCs has not been thoroughly examined. Although some studies have explored the mediating role of factors like digital literacy, perceived security, and user experience in technology adoption, there is a lack of research that specifically examines how digital technology awareness, addressing privacy concerns, and perceived ease of use mediate the relationship between AI and consumers’ willingness to use CBDCs. Understanding these mediating variables is crucial, as they can provide deeper insights into the psychological and cognitive processes that drive consumer adoption of AI-enabled CBDCs solutions. Therefore, this study has three main objectives. First, this research objective examines the core aspects of implementing AI technology to use CBDCs currency. Second, digital technology awareness, addressing privacy concerns, and ease of use significantly link AI technology and willingness to use CBDCs. Third, government support significantly moderates the link among AI, digital technology awareness, addressing privacy concerns, and ease of use. The current study used the TAM model to support the conceptual framework. Since its inception Davis (1989), TAM has served as a widely utilized framework for analyzing user acceptance of new technologies and behavior.

Literature review and supporting theory

Theoretical background: technology acceptance model (TAM)

This study incorporated the TAM model, which explains how users come to accept and use technology, and it can be extended to incorporate additional factors like AI, digital technology awareness, privacy concerns, ease of use, and government support. TAM, proposed by Davis (1989), suggests that two main factors influence an individual’s decision to use a new technology. The degree to which an individual feels that utilizing a specific system would improve their performance at work or for personal usage is known as perceived usefulness (PU). The degree to which a user believes that utilizing a specific technology will be effortless is known as ease of use (EOU) (Shahzad et al. 2024a). These two factors affect the attitude toward use, influencing the willingness or intention to use the technology.

Incorporating this study, AI can impact the willingness to use CBDCs by enhancing the ease of use. AI-driven technologies can provide robust security measures (like fraud detection, identity verification, and privacy protection) that address consumers’ concerns about using digital currencies, thereby enhancing the ease of use (Gupta et al. 2023b). AI can help in providing a more tailored user experience, making it easier for consumers to navigate and use CBDC platforms. AI can provide automated processes and user-friendly, intuitive interfaces to streamline the user experience (Sood et al. 2023). A simplified experience leads to a higher ease of use, directly affecting the behavioral intention to use CBDCs. This study incorporated TAM variables, such as ease of use and willingness to use CBDCs, to support our study model.

The willingness to use CBDCs as a means of trade has received very little scholarly attention in the constantly changing field of digital currencies (Prodan et al. 2024; Wu et al. 2024). In order to fill this vacuum, our research aims to develop a theoretical framework that is solidly based on TAM and provides insight into the factors that influence the willingness to use CBDCs. It is crucial to recognize that intentions are powerful forerunners of actions and that an individual’s use is always influenced by their attitudes and views of a particular undertaking (Davis 1989; Shahzad et al. 2024a). Table 1 demonstrates some recent literature reviews on CBDCs and other study variables.

Artificial intelligence and willingness to use CBDCs

AI and CBDCs revolve around their capacity to fundamentally transform monetary policy implementation and financial systems’ functioning (Cheng 2023a). AI algorithms on the optimization of monetary policy, focusing on improving efficiency and responsiveness. By examining extensive datasets and market dynamics, AI algorithms present the potential to enhance the optimization of interest rate changes, asset purchases, and liquidity management (Choithani et al. 2024). Implementing such strategies can result in more accurate and targeted policy measures in response to economic volatility. Past study Mukesh et al. (2023) literature underscored the importance of establishing a comprehensive regulatory framework that ensures transparency, audibility, and impartiality in AI-powered financial decision-making. Research emphasizes the significance of maintaining a harmonious equilibrium between algorithmic autonomy and human control to address potential ethical issues (Cheng 2023b). Within contemporary finance and economics, a noteworthy convergence is materializing between AI and the notion of CBDCs—concerns about the level of openness and accountability around monetary decisions influenced by artificial intelligence (Sood et al. 2023). The utilization of AI in CBDCs has promise in providing customized financial solutions and services, hence promoting fairness among persons who have historically faced exclusion from conventional banking systems (Tong and Jiayou 2021).

The unique position of AI in the financial sector is attributed to its capacity to handle large volumes of data efficiently, recognize patterns, and produce valuable insights (Morgan 2022). AI algorithms demonstrate proficiency in analyzing intricate market dynamics, executing prompt trading decisions, and accurately forecasting market trends (Li et al. 2022). The digitization of currency enables governments and central banks to enhance the efficiency of payment systems, decrease transaction expenses, and effectively combat illicit financial activities. Integrating AI with CBDCs can establish a financial ecosystem where AI-powered algorithms supervise transactions, improve fraud detection capabilities, and facilitate real-time risk evaluation (Gupta et al. 2023b). The fundamental basis of this alliance resides in the capacity to establish a mutually beneficial association between AI and CBDCs. AI algorithms have the potential to enable real-time modifications to interest rates, asset purchases, and liquidity management by using current economic data and indicators (Choithani et al. 2024; Sood et al. 2023). These advanced systems would utilize AI-driven policies to adapt to economic changes independently, thus reducing the necessity for human involvement in routine monetary decisions (Ahamad et al. 2022). Therefore, we hypothesized,

H1: Artificial intelligence impacts on willingness to use CBDCs.

Mediating role of digital technology awareness

Digital technology awareness encompasses an individual’s level of acquaintance, understanding, and ease of use with digital tools and platforms (Mhlanga 2020). Within CBDCs, awareness is a cognitive conduit that links an individual’s pre-existing comprehension of digital technology with their views and attitudes toward these innovative financial instruments (Morgan 2022). Positive attitudes are derived from the perception of a favorable equilibrium between advantages and potential drawbacks. The stated advantages encompass better transaction efficiency, decreased expenses, and improved accessibility to financial services (Dashkevich et al. 2020). On the other hand, there are apprehensions around security, safeguarding of data privacy, and ambiguities surrounding the operating structure of CBDCs (Akin et al. 2023). A past study constantly demonstrated the level of understanding regarding digital technology and individuals’ views towards CBDCs and their inclination to adopt and utilize them (Wu et al. 2024). The heightened level of consciousness enables individuals to understand CBDCs’ benefits through enhanced operational effectiveness, increased convenience and heightened security measures (Kim et al. 2022). This motivation makes individuals more inclined to embrace CBDCs.

Financial institutions can customize user interfaces to accommodate different degrees of digital literacy (Ozturkcan et al. 2022). The significance of digital technology awareness in adopting CBDCs highlights the interdependence between technology, cognition, and comportment. The concept spans a range of knowledge, from effectively navigating the virtual landscape to knowing the fundamental mechanics that drive these technological advancements (Bhaskar et al. 2022). Cultivating knowledge and understanding of digital technology fosters favorable dispositions toward CBDCs (Pocher and Veneris 2022). As individuals acquire knowledge about the underlying mechanisms of digital currencies and the robust security measures supporting them, their skepticism diminishes, allowing curiosity and optimism to emerge (Gupta et al. 2023a). The inclination to adopt CBDCs represents a process of investigation and contemplation driven by the desire to envision the potential opportunities they may bring forth (Allen et al. 2022). The dissemination of knowledge regarding the intricacies of digital technology has a dual purpose; not only does it provide valuable information in its own right, but it also plays a crucial role in creating a conducive environment for the widespread acceptance and implementation of CBDCs (Wu et al. 2024). Therefore, our study focuses on the mediating role of digital technology awareness in adopting CBDCs. Therefore, we hypothesized,

H2: Digital technology awareness mediates the relationship between artificial intelligence and willingness to use CBDCs.

Mediating role of addressing privacy concerns

CBDCs have brought forth novel aspects of privacy concerns. With the increasing prevalence of digital transactions, individuals are apprehensive about collecting, storing, and utilizing personal financial data by central banks and financial organizations (Pocher and Veneris 2022). Privacy concerns surrounding CBDCs pertain to the possible infringement on financial privacy through central banks’ tracking and monitoring of individual transactions (Elsayed and Nasir 2022). This study pertains to the measures in place for safeguarding personal and financial data from cyber risks and breaches. Third parties, such as government agencies or business entities, are granted access to individuals’ transactional data (Prodan et al. 2024). The multidimensional dynamic of government backing plays a crucial role in determining the readiness to adopt and implement CBDCs, substantially impacting their overall adoption and success (Wang et al. 2022). Government assistance can substantially influence public opinion, the regulatory landscape, infrastructure advancement, and the general confidence level in CBDCs. AI technologies, including financial services, are adopted in businesses to improve versatility (Brannon et al. 2022). The degree of acceptance and preparedness individuals and businesses exhibit in embracing CBDCs for conducting financial transactions. The utilization of AI in financial systems gives rise to privacy concerns that significantly impact individuals’ perceptions of the dependability and safety of technology (Aldboush and Ferdous 2023).

Moreover, this underscores the significance of effectively addressing privacy concerns in influencing the perceptions and interactions of individuals, corporations, and governments concerning digital currencies that central banks issue (Wenker 2022). Addressing these concerns, central banks may effectively negotiate the hurdles associated with digital financial transactions and enable a seamless transition to a digital currency ecosystem, all while upholding user trust and safeguarding data protection (Brannon et al. 2022). The affiliation between the resolution of privacy issues, AI, and the inclination to utilize CBDCs highlights the significant influence of privacy considerations on the acceptance of revolutionary digital financial solutions (Aldboush and Ferdous 2023). The ongoing transformation of the financial landscape by AI and the emergence of CBDCs have significant implications for individuals’ faith in these technologies. The key factor influencing this trust is the efficient management of privacy (Gupta et al. 2023b). By conscientiously considering privacy concerns, financial institutions and regulators may cultivate an atmosphere of trust, innovation, and security that facilitates a prosperous transition to the era of CBDCs (Islam and IN 2022). Incorporating privacy concerns as a mediating factor within the framework of CBDCs can substantially influence the adoption and integration of CBDCs within the economy. Therefore, we hypothesized,

H3: Addressing privacy concerns mediates the relationship between artificial intelligence and willingness to use CBDCs.

Mediating role of ease of use

CBDCs have emerged as revolutionary instruments within the ongoing digital revolution in finance (Hoang et al. 2023). This delicate interaction is pivotal in shaping the future currency adoption trajectory. Ease of use refers to the overall user experience during interactions with a certain technology or system (Wu et al. 2024). CBDCs encompass the seamless ability of individuals to browse, engage in transactions, and incorporate these digital currencies into their everyday routines (Gupta et al. 2023b). This aspect encompasses a spectrum of factors, including the user interfaces’ level of simplicity and the transactions’ level of seamlessness (Keister and Monnet 2022). The inclination to adopt CBDCs signifies a convergence of purpose and disposition towards these digital forms of currency. This phenomenon can be characterized as a synthesis of economic rationality, emotional resonance, and a prospective outlook on the financial terrain (Liu et al. 2024). The willingness described here reconciles the disparity between a passive state of acceptance and an active process of integrating CBDCs into an individual’s financial trajectory (Bhaskar et al. 2022). Ease of use arises as a mediator facilitating the transition from a state of willingness to the concrete implementation of CBDCs (Gupta et al. 2023b).

Facilitating user-friendly experiences fosters favorable perceptions of CBDCs by mitigating uncertainty and streamlining the intricacies associated with digital transactions (Li 2023). As users become acquainted with CBDCs as a user-friendly instrument, their initial skepticism gradually transforms into a feeling of comfort and confidence. The level of user-friendliness serves as a facilitator that enables users to act upon their intentions effectively (Ma et al. 2023). The inherent user-friendliness of CBDCs empowers people, including those with limited technological proficiency, to effectively and securely navigate the digital landscape (Hoang et al. 2023). The enhanced accessibility resulting from user-friendly interfaces facilitates the integration of CBDCs into individuals’ financial practices, thereby bridging the divide between intention and implementation (Gupta et al. 2023b). As the usability of CBDCs improves, individuals’ perceptions are further bolstered. These views drive subsequent investigation and utilization, establishing a perpetual cycle of heightened inclination and acceptance (Shkliar 2020). Developing user interfaces that prioritize simplicity, provide a secure yet uncomplicated transaction process, and provide user-centric assistance can help foster an ecosystem in which CBDCs are accessible and straightforward to integrate (Gupta et al. 2023b). Therefore, we hypothesized,

H4: Ease of use mediates the relationship between artificial intelligence and willingness to use CBDCs.

Moderating the role of government support

Government support is a need for well-defined regulations and legislation about the application, dissemination, and administration of CBDCs (Dashkevich et al. 2020). The objective is to provide citizens with comprehensive knowledge regarding the advantages, potential drawbacks, and operational aspects of CBDCs (Bibi and Canelli 2023). Establishing an appropriate technological framework and infrastructure is crucial to facilitate the smooth functioning of CBDCs. It engages in partnerships with technology companies, financial institutions, and other relevant entities to guarantee the efficacy of CBDCs (Xia et al. 2023). Robust governmental backing can enhance the confidence level of the general public in CBDCs. The government’s active promotion and endorsement of CBDCs instills a sense of legitimacy and security (Allen et al. 2022). The potential decline in perceived dangers associated with the novel digital currency may lead to an increased inclination among individuals to embrace CBDCs (Jabbar et al. 2023). Insufficient or lackluster support for CBDCs may give rise to uncertainties regarding the currency’s safety, security, and durability, potentially reducing public enthusiasm and participation in CBDCs (Pocher and Veneris 2022). Government support for CBDCs comprises diverse activities, laws, and actions that validate and recognize these digital currencies as a feasible and lawful medium of exchange (Ngo et al. 2023).

Clear regulations foster a sense of assurance among users and businesses as they establish the legal and institutional legitimacy of CBDCs (Alfar et al. 2023). Governments possess the capacity to initiate educational initiatives aimed at enlightening the general populace regarding CBDCs, elucidating their advantages, and providing guidance on their utilization (Ngo et al. 2023). These initiatives significantly address misunderstandings and increase knowledge of the potential benefits of CBDCs. Governments have the potential to engage in partnerships with financial institutions, technology companies, and other pertinent players to establish a resilient infrastructure for CBDCs development (Xu 2022). Governments can emphasize the potential benefits of CBDCs in enhancing financial inclusion. This can be achieved by facilitating access to banking services for persons now underserved by conventional financial systems (Alonso et al. 2020). Governments can demonstrate a commitment to transparency in the administration and supervision of CBDCs, thereby assuring the general public of the responsible implementation and utilization of these digital currencies (Wu et al. 2024). The potential engagement of governments in this matter may give rise to apprehensions regarding the protection of data privacy and the extent of surveillance, potentially impeding users’ acceptance and usage of the system (Clayton et al. 2018). Therefore, we hypothesized,

H5a: Government support moderates the relationship between artificial intelligence and digital technology awareness toward willingness to use CBDCs.

H5b: Government support moderates the relationship between artificial intelligence and addressing perceived concern toward willingness to use CBDCs.

H5c: Government support moderates the relationship between artificial intelligence and ease of use toward willingness to use CBDCs.

Figure 1 below describes a study research model.

Methodology

Sample and procedure

China has been a leader in technological adoption and innovation, with a thriving digital payments ecosystem and widespread use of mobile payment platforms like Alipay and WeChat Pay (Wu et al. 2024). Therefore, this study focused on integrating AI in the financial sector, including banking, and adopting CBDC currencies. It has garnered substantial attention due to its potential to reshape the landscape of financial services and consumer behavior. The country’s economic growth and employment possibilities are largely attributed to the banking industry, which is a sizable industry. Therefore, the primary reason that banking industry employees were chosen as the target market was because they are regarded as the core of an organization’s performance and productivity, especially front desk staff. The questionnaire was created for people who engage in everyday payment behaviors because this study aimed to evaluate the characteristics of individual users and their willingness to use CBDCs. The survey’s introduction now includes an introduction to CBDCs. The Yangtze River Delta and Pearl River Delta, the Beijing-Tianjin-Hebei region, and central, northeast, and northwest China are all primarily covered by CBDC trials. CBDCs are not a made-up invention. Different banks and governmental organizations have also supported using CBDCs to prevent fraud.

The most popular payment methods were first reviewed when the questionnaire was distributed. The questionnaire underwent three revisions throughout the pre-experiment phase, depending on the total time needed and feedback from the general public regarding any additional issues that might have arisen during completion. For this study, the quantitative research technique is best for various reasons. Quantitative research is useful for making predictions and validating or testing a theory or hypothesis (Celo et al. 2008). Additionally, obtaining perspectives from future CBDC users is another goal of the study’s data collection process. As a result, it makes sense to employ a sizable sample size to accurately represent the research population as a whole (Bagozzi and Edwards 1998). A lot of data is gathered using quantitative methods, such as surveys. Additionally, the quantitative technique is regarded as reasonable and objective in science because it offers reliable data and noteworthy statistical conclusions that can improve the study’s quality and generalizability (Allwood 2012).

Questionnaires were distributed through links and QR codes, and surveys were collected on various occasions, such as wenjuanxing.com, QQ, and WeChat. For two weeks, surveys were formally collected as part of the pre-experiment, and those who completed them were given cash incentives. Data for the current study were gathered from Beijing-based banks (both public and private) in the first quarter of 2023. Employees from various bank branches are the unit of analysis in this method. As the population from the banking sector is unknown, the convenience sample technique is employed (Babin et al. 2015). The survey (questionnaire) method is utilized in this study to get employee data. In order to confirm that each respondent has actively participated, the evidence for analysis is often collected by visiting the branches of various banks and sending them an online questionnaire. In the beginning, 510 questionnaires were given out for data collection and returned by respondents. Data were checked for unengaged replies, multivariate outliers, and missing data. Additionally, 40 of the remaining responses were outliers, 28 had missing values, and 22 responses were eliminated. This indicates an 82% response rate. 420 valid questionnaires were retrieved after invalid questionnaires were eliminated based on test items and filling times. Table 1 shows the basic demographic facts for the respondents, including gender, age, and educational attainment.

59% of the 420 responders are men, while 41% are women. Regarding age, 38% of respondents were among the ages of 20–30 years, 44% were between the ages of 31–40, and 18% were among the ages of 41–45. Furthermore, 23% of the respondents had intermediate/diploma degrees, 44% had a graduation, and 33% had a postgraduation in their educational backgrounds. The sample’s composition with a designating reference. A total of 38% of respondents were working in operations, 30% of respondents were working in finance, 27% of respondents were working in risk control and 5% belonged to others. According to experience in dealing with transactions, 35% of respondents have between one and six years of experience, 45% have between seven and twelve years, and 20% have between thirteen and twenty years. Table 2, shows demographic details.

Measurements of variables

Every question on the survey was modified from previously validated and published research, and it was scored on a five-point Likert scale, with 1 being the strongest disagreement and 5 being the strongest agreement. The model’s pertinent variables were changed to consider CBDCs and the features of various payment methods. Six variables are used in this investigation. For the sake of this study, convenience and ease of use, two variables of the perceived benefits construct, were evaluated as first-order constructs. Artificial intelligence (AI) is assessed by ten items adapted from a past study (Mahboub and Ghanem 2024; Siddik et al. 2025). Five digital technology awareness (DTA) items were assessed by a past study (Kim et al. 2022; Shahzad et al. 2023). Addressing privacy concerns (APC), four items were adopted by past study (Jabbar et al. 2023). A past study assessed four items of ease of use (EOU) (Jabbar et al. 2023). Three items from a past study measured government support (GS) (Xia et al. 2023). Four items taken from a past study assessed willingness to use CBDCs (WTUCBDC) (Gupta et al. 2023a). Table 3 provides a complete list of the questionnaire’s items.

Pre-testing the questionnaire

The authors used Cronbach’s alpha to assess the measurement items’ internal consistency. This assisted the researchers in determining that the questions were clear and that the time allowed to complete the questionnaire was adequate (Tavakol and Dennick 2011). Twelve people made up the sample size, and values for every construct surpassed 0.70. As stated in Table 3, this demonstrates that all items accurately assess the corresponding structures.

Analysis and results

The authors used partial least squares (PLS) and the SmartPLS 4 software to analyze the structural equation modeling (SEM) method of data analysis. In order to provide a particular level of reliability and validity, the PLS-SEM can simultaneously and methodically estimate the measurement and structural model (Hair et al. 2017). This technique also makes alternative possibilities available when evaluating and validating links between constructs. Compared to covariance-based SEM, PLS-SEM is a useful technique for handling small sample sizes and data distributed normally and non-normally (Bagozzi and Edwards 1998). PLS-SEM is often preferred when the research is exploratory and aims to predict or identify key driver variables rather than confirm a well-established theory (Shahzad et al. 2025a). This study aims to explore the impact of AI on consumers’ willingness to use CBDCs without a strong theoretical foundation. Therefore, PLS-SEM is a more appropriate choice. Another reason to use PLS-SEM is more suitable when the sample size is relatively small or when data do not meet the strict assumptions required for CB-SEM (e.g., normality). Our study had a smaller sample size and non-normally distributed data, PLS-SEM would be more robust.

Common method variance

The data were collected using mail surveys and self-administration, making it impossible to assess non-response bias. It was not feasible to compare replies from non-respondents and respondents because every participant finished the questionnaires within the specified time range and sent in their answers on time (Podsakoff et al. 2003). First, the Harman single-factor test was used in this study to do factor analysis on each questionnaire item (Fuller et al. 2015). The first principal component produced without rotation, as shown in the study items, explained 20% of the variation. Therefore, homologous variance between measured variables wouldn’t impact the validity of the finding. Second, as proposed by Shahzad et al. (2025a), and this work detected common approach bias by employing VIF obtained by a rigorous collinearity test. Each construct’s VIF value was less than 3.30, which suggested that there was no CMB contamination, according to the analysis’s conclusions.

Measurement model

Initially, an evaluation of the data was done to test the measurement model. The factor loadings of the items on their designated constructs were tested in the first phase to evaluate the indication reliability (Shahzad et al. 2024b). These are all above the permissible range of 0.70, according to Table 3 and Fig. 2 results. The internal consistency reliability was assessed in the second phase by measuring Cronbach’s alpha and composite reliability (CR). Additionally, Table 3 shows that all values exceed the permissible cutoff of 0.7. The Cronbach’s alpha values of artificial intelligence = 0.958, digital technology awareness = 0.930, addressing privacy concern = 0.910, ease of use = 0.874, willingness to use CBDCs = 0.883, and government support = 0.834. The composite reliability values of artificial intelligence = 0.963, digital technology awareness = 0.947, addressing privacy concern = 0.937, ease of use = 0.914, willingness to use CBDCs = 0.920, and government support = 0.900. The average variance extracted (AVE) was evaluated in the third phase to determine the constructs’ convergent reliability. The AVE values of artificial intelligence = 0.724, digital technology awareness = 0.781, addressing privacy concern = 0.788, ease of use = 0.726, willingness to use CBDCs = 0.741, and government support = 0.750. Table 3 demonstrates that every AVE value is higher than a specified cutoff point of 0.5.

The discriminant was examined utilizing the HTMT (Heterotrait-Monotrait ratio) criteria in the fourth and final phase of the investigation. The HTMT ratio for each pair of constructs produced values that were smaller than the 0.90 cutoff suggested by (Shahzad and Xu 2024). This suggests that the measuring model has no problems with discriminant validity. The scale utilized in this investigation exhibited strong discriminative validity, as shown by the square root AVE value of the latent variable being greater than its correlation coefficient with other factors (Fornell and Bookstein 1982). Another technique to test discriminant validity as all explanatory variables’ variance inflation factors (VIF), which were below the threshold value of 5, indicating that the model did not clearly display a multicollinearity issue. Table 4 displays the values of discriminant validity.

Structure model

A structural assessment model was employed to examine the path of constructs. The findings of the path analysis conducted in this study using the SEM equation to confirm the research hypothesis are shown in Fig. 2. When p < 0.05, we believe this hypothesis is generally true. Similarly, the collinearity problems test, path coefficients, coefficient of determination (R2), and predictive relevance (Q2) were used to evaluate the structural model’s quality as well as the research’s underlying hypotheses (Shahzad et al. 2025b). According to Table 5, which shows that the VIF values for all constructs are below the collinearity test cutoff of 5, there is no evidence of multicollinearity problems that could cause bias in the path coefficients. This study demonstrates that the model’s R2 value for the main dependent variable (WTUCBDC) is 0.541, indicating that ease of use, digital technology awareness, and addressing privacy concerns account for 54% of the variability in WTUCBDCs. Furthermore, the Q2 value for the WTUCBDC value is placed in the range. According to these findings, the research makes the case that the proposed model has a high level of predictive potential.

Path coefficients obtained from a bootstrapping approach in SmartPLS 4 using 5000 subsamples were used to analyze the structural model’s hypothesized paths (Anser et al. 2024). The test results for the hypotheses are shown in Table 5. Regarding the construct’s hypothesis, artificial intelligence is positively associated with willingness to use CBDCs (β = −0.065, t = 2.180, and p < 0.029). The findings authenticated the H1. Similarly, artificial intelligence positively correlates with digital technology awareness (β = 0.324, t = 6.289, and p < 0.000). Digital technology awareness is positively associated with willingness to use CBDCs (β = 0.476, t = 6.155, and p < 0.000). Artificial intelligence is positively associated with addressing privacy concerns (β = 0.572, t = 11.244, and p < 0.000). Addressing privacy concerns is positively associated with willingness to use CBDCs (β = −0.130, t = 4.582, and p < 0.000). Artificial intelligence is positively linked with ease of use (β = 0.275, t = 5.070, and p < 0.000). Ease of use is positively associated with willingness to use CBDCs (β = 0.331, t = 4.434, and p < 0.000).

For mediation analysis, digital technology awareness significantly mediates the affiliation between artificial intelligence and willingness to use CBDCs (β = 0.155, t = 5.060, and p < 0.000). Secondly, addressing privacy concerns significantly mediates the connection among artificial intelligence and willingness to use CBDCs (β = −0.074, t = 4.153, and p < 0.000). Thirdly, ease of use significantly mediates the relationship between artificial intelligence and willingness to use CBDCs (β = 0.091, t = 3.264, and p < 0.001). Thus, H2, H3 and H4 was supported.

For moderation analysis, firstly, government support (GS) positively moderates the connection between artificial intelligence and digital technology awareness (β = 0.120, t = 2.003, and p < 0.044). Secondly, government support positively moderates the affiliation among artificial intelligence and addressing privacy concerns (β = −0.065, t = 2.362, and p < 0.018). Thirdly, government support positively moderates the association among artificial intelligence and ease of use (β = 0.116, t = 2.032, and p < 0.043). Thus H5a, H5b, and H5c was supported. The framework below was developed using the information mentioned above and demonstrates the outcomes of the structural model assessment. The main findings of this study are summarized in Fig. 2.

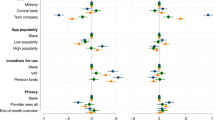

Figures 3–5 display the moderating graph of government support between AI, digital technology awareness, addressing privacy concerns, and ease of use. Figure 3 explains where AI and DTA are stronger under high GS. Similarly, Fig. 4 clarifies where AI and APC are powerful under high GS. Lastly, Fig. 5 describes where AI and EOU are more robust under high GS.

Discussion

CBDCs have gained significant attention worldwide as a potential replacement for physical cash (Wu et al. 2024). In China, the DCEP project has been at the forefront of CBDCs development (Xia et al. 2023). This study aims to explore the effect of AI on consumers’ willingness to use through digital technology awareness, ease of use, and privacy concerns. Furthermore, this study investigates government support’s moderating role between AI and digital technology awareness, ease of use, and privacy concerns within the Chinese banking sector. The data was received from 420 banking sector employees to check their experience using CBDCs. To gauge people’s opinions regarding CBDCs, the questionnaires were divided into a sample of specifically chosen individuals. The outcomes are divided into five main categories.

Firstly, AI significantly impacts consumers’ willingness to use CBDCs. AI chatbots and virtual assistants can deliver better customer support and assistance in using CBDCs. This can make the experience more user-friendly, boosting consumers’ confidence in using digital currencies. A past study by Yigitcanlar et al. (2021) focused on how AI can be used for advanced security measures, such as biometric authentication and fraud detection. Consumers are more likely to trust CBDCs systems that are fortified with AI-based security features, reducing concerns about digital currency fraud or hacking. AI algorithms can analyze consumer spending habits and preferences to offer personalized financial advice and services. This can make CBDCs more attractive to consumers by providing tailored recommendations for saving, investing, or managing their digital currency (Choithani et al. 2024). AI can help central banks and financial institutions predict economic trends and consumer behaviors. This information can be used to fine-tune monetary policies and ensure the stability of CBDCs, making consumers more confident in their value and reliability (Ding et al. 2022). AI-powered tools can assist in identifying and verifying the identity of unbanked or underbanked individuals, potentially expanding financial inclusion in China. When more people have access to CBDCs, their adoption can increase (Sood et al. 2023).

Secondly, digital technology awareness positively mediates the affiliation between artificial intelligence and willingness to use CBDCs. Digital technology awareness explains the level of understanding and knowledge individuals or organizations have about digital technologies. In the context of AI and CBDC, it could include knowledge about how these technologies work, their potential benefits, and their implications (Wang 2023). AI replicates human intellect in machines, enabling them to carry out responsibilities, decision-making, and data-driven learning that normally need human intelligence. AI can significantly optimize various processes in China’s banking sector, including fraud detection, customer service, and risk assessment. CBDCs, on the other hand, could revolutionize the payment system and monetary policy (Ngo et al. 2023). The relationship between AI and CBDCs could involve AI-powered tools and systems that facilitate CBDC transactions, enhancing their efficiency and security. Similarly, digital technology awareness can positively mediate the willingness to use CBDCs. Understanding the benefits and mechanics of CBDCs, due to factors including its ability to improve security, lower transaction costs, and expand financial inclusion, it may become more widely accepted and used (Ozturkcan et al. 2022).

Thirdly, ease of use positively mediates the relationship between artificial intelligence and willingness to use CBDCs. Ease of use refers to how user-friendly and accessible AI technologies are designed to be easy to understand and interact with, which can increase their adoption. Natural language processing, computer vision, and machine learning are just a few of the many technologies that make up AI. In the banking sector, AI can be used for customer service, fraud detection, and personalized recommendations, among other things (Wenker 2022). The central bank issues and controls a country’s digital currency, or CBDCs. The willingness of individuals and businesses to use CBDCs depends on various factors, including their trust in the currency, its convenience, and its perceived benefits (Sandhu et al. 2023). Past study Gupta et al. (2023b) suggested that if AI technologies in China’s banking sector are easy to use, it will positively impact people’s willingness to use CBDCs. This connection makes sense as user-friendly AI applications can enhance the overall banking experience and increase trust in digital financial services, potentially leading to greater acceptance of CBDCs.

Fourthly, addressing privacy concerns significantly mediates the relationship between artificial intelligence and willingness to use CBDCs. China has led the way in creating and implementing CBDCs. Digital yuan (e-CNY) initiatives have been intensively investigated and piloted by the People’s Bank of China (PBOC) (Lee et al. 2021). These online currencies offer a safe and effective way to conduct digital transactions because they are made to be issued and controlled by the central bank. AI technologies, including China, have been increasingly integrated into the banking sector worldwide. AI is used for various purposes, such as customer service, fraud detection, risk assessment, and personalization of services (Ridzuan et al. 2024). The use of AI in the banking sector raises concerns about data privacy and security. This is particularly important in China, where there are stringent data protection and cybersecurity regulations. A past study by Jabbar et al. (2023) suggested that addressing privacy concerns can influence the relationship among AI and people’s willingness to use CBDCs. This implies that privacy concerns related to AI in the banking sector are adequately addressed. It may positively impact people’s trust and confidence in using CBDCs (Pocher and Veneris 2022).

Fifthly, government support significantly moderates the relationship among AI and digital technology awareness, ease of use, addressing perceived concern, and willingness to use CBDCs. Government support likely refers to the policies, regulations, and initiatives implemented by the Chinese government to promote the adoption of AI and CBDCs in the banking sector. A past study by Themistocleous et al. (2023) suggested that government support can influence the connection between AI adoption and the willingness of banks in China to use CBDCs. The government may offer incentives or subsidies to banks to adopt AI in their operations or to use CBDC. This support can encourage banks to be more willing to embrace these technologies (Soana and de Arruda 2024). Government regulations can either facilitate or hinder the adoption of AI and CBDC. Favorable regulations can lead to a more positive relationship, while restrictive regulations may have the opposite effect (Syarifuddin and Bakhtiar 2022). Government investment in the necessary infrastructure for AI and CBDC adoption, such as a secure digital payment system, can make it easier for banks to use CBDC and AI, strengthening the relationship. Government support can include educational programs and awareness campaigns to help banks understand the benefits of AI and CBDC, potentially increasing their willingness to adopt these technologies (Morales-Resendiz et al. 2021). Government support in terms of robust cybersecurity and data protection measures can mitigate concerns that banks may have about the security of using AI and CBDC.

Theoretical implications

This study contributes to a deeper understanding of how AI technologies can impact the adoption of CBDCs. It sheds light on how AI can enhance the user experience and promote CBDC adoption. The research highlights the importance of digital technology awareness in influencing consumers’ willingness to use CBDCs. It underscores the need for financial institutions and policymakers to invest in consumer education and awareness programs. The study explores the significance of ease of use in driving CBDC adoption. It highlights the reputation of user-friendly interfaces and streamlined processes in making CBDCs accessible to a wider audience (Wu et al. 2024). Privacy concerns are a critical factor in CBDCs adoption. This research examines strategies and technologies to address these concerns, paving the way for greater acceptance of CBDCs. The study highlights the pivotal role of government support in fostering CBDC adoption. It emphasizes how crucial legal frameworks and government-backed programs are to advancing CBDCs as a trustworthy digital currency (Wang 2023). Banks and financial institutions can use the insights from this study to develop strategies that leverage AI to enhance CBDC adoption. This includes investing in AI-driven customer service and user-friendly digital platforms. Focusing on ease of use and user experience is critical. Banks can use AI to develop intuitive interfaces and user-centric features, making CBDCs more attractive and accessible to consumers. To address privacy concerns, financial institutions can implement robust security measures and transparent data handling practices. They can also educate consumers about the security features of CBDCs. Collaboration with government bodies is essential for the successful rollout of CBDCs. Banks should actively engage with regulators and policymakers to ensure a supportive regulatory environment (Gupta et al. 2023b). This research emphasizes the need for educational campaigns to increase digital technology awareness. Banks can partner with government agencies to educate the public about the benefits and usage of CBDCs.

The role of AI in the Chinese banking sector has revolutionized customer interactions, risk management, and personalized financial services. AI-driven recommendation systems can provide tailored advice and alerts to users, enhancing their engagement with digital currencies. This personalized experience can lead to consumers’ willingness to adopt CBDCs (Prodan et al. 2024). AI algorithms enhance security by predicting fraudulent activities and providing robust cybersecurity measures. Improved safety perceptions can mitigate privacy concerns and positively influence consumer adoption. AI enhances efficiency in banking operations, such as faster transactions, automated customer service, and streamlined KYC (know your customer) processes, reducing friction and increasing the perceived ease of use for CBDCs. Awareness and familiarity with digital technologies are crucial for adopting CBDCs as they reduce uncertainty and increase trust in digital financial solutions. If AI-driven initiatives increase awareness, they can bridge the gap between technological complexity and user comprehension (Bhaskar et al. 2022). AI’s ability to provide enhanced data privacy solutions (such as differential privacy techniques or advanced encryption) can alleviate concerns, thereby increasing consumer trust. When consumers perceive that AI-driven systems can effectively safeguard their personal information, they are more likely to adopt CBDCs. AI can simplify the user interface and experience by providing seamless, intuitive interactions with digital currency platforms. The perceived ease of use, enhanced by AI, can reduce the cognitive load and increase user satisfaction, ultimately leading to higher adoption rates.

Government support plays a crucial role in implementing rules and regulations in the banking sector. This support can take various forms, such as regulatory frameworks, financial incentives, or public endorsements. When the government actively supports AI-driven digital financial systems, it enhances public trust. In China, where government influence is substantial, such support can amplify AI’s impact on increasing digital technology awareness and addressing privacy concerns. Government regulations that promote AI in financial services while ensuring data privacy and security can bolster consumer confidence (Xia et al. 2023) This, in turn, enhances the perceived benefits of AI-driven CBDC platforms and encourages their adoption. This study extends the TAM by incorporating AI as a significant technological advancement affecting perceived ease of use and usefulness. It introduces ease of use as a dimension, which is critical for individuals to use CBDCs. This study provides valuable insights that can guide policymakers, financial institutions, and researchers in promoting the adoption of CBDCs and harnessing the potential benefits of AI in the evolving digital financial landscape.

Practical implications

Banks and financial institutions should leverage AI to conduct consumer education campaigns that raise awareness about digital technology, including CBDCs, to bridge the knowledge gap. Financial institutions must implement AI-driven privacy-preserving techniques to address privacy concerns, ensuring robust security measures that meet consumer expectations. Financial service providers should utilize AI to develop intuitive interfaces and provide personalized services to make CBDC usage more accessible and user-friendly (Wu et al. 2024). Government support should focus on creating an ecosystem that facilitates trust, technological awareness, and ease of use, promoting broader CBDC adoption. Banks should develop comprehensive AI-based training and education programs to enhance employees’ and consumers’ awareness of digital technology. Leveraging AI tools like chatbots, virtual assistants, and interactive modules can help demystify CBDC and digital technologies, highlighting their benefits and use cases. Banks can foster a more positive attitude toward adopting CBDCs by increasing digital technology awareness. AI can personalize content based on the user’s knowledge level and learning preferences, ensuring that employees and consumers receive relevant and digestible information. This approach can make digital technology more accessible and comprehensible, encouraging CBDC adoption (Hoang et al. 2023).

AI can play a pivotal role in developing privacy-enhancing technologies like federated learning, differential privacy, and homomorphic encryption. These technologies ensure that data privacy is maintained while enabling data analysis and machine learning tasks, alleviating consumer concerns about data misuse. AI systems that provide real-time fraud detection, behavioral analytics, and predictive risk management can help alleviate consumer concerns about the safety of their transactions. Communicating these capabilities effectively can improve consumer trust in CBDCs (Gupta et al. 2023b). Banks should employ AI to develop transparent communication strategies that provide consumers with clear insights into managing and protecting their data. AI-driven tools can help in creating dynamic, real-time dashboards that educate consumers about their privacy rights and data usage. AI can analyze user behavior and provide insights into optimizing CBDC-related digital platforms’ UI and UX. By simplifying the onboarding process, providing intuitive navigation, and offering AI-driven recommendations, banks can enhance the ease of use, making CBDCs more attractive to consumers. Implementing AI-based conversational interfaces and voice assistants can make transactions easier, particularly for less tech-savvy users.

AI chatbots and virtual assistants can offer 24/7 support to consumers, answering queries related to CBDC transactions and resolving issues promptly. This can enhance user experience and reduce friction, promoting the willingness to adopt CBDCs. Governments can use AI to simulate the impact of various policy measures on CBDC adoption. These simulations can help understand the potential outcomes of supportive policies and refine them to ensure they effectively promote digital technology awareness, address privacy concerns, and enhance ease of use (Bhaskar et al. 2022). Collaborative AI projects between the banking sector and government can help develop standardized practices for CBDC usage, ensuring consistency and reliability. Such initiatives can build consumer trust, particularly when there is visible government support. Government support in implementing AI compliance tools can ensure that banks adhere to the highest data privacy and security standards. AI tools can monitor compliance in real-time and flag any potential breaches, ensuring a safer environment for CBDC transactions. The government can leverage AI to run targeted awareness campaigns that educate the public about CBDCs, their benefits, and the safety measures in place (Dashkevich et al. 2020). Developing AI-based feedback mechanisms can help banks understand consumer concerns and preferences in real-time. By analyzing this feedback, banks can make iterative improvements to CBDC-related services, enhancing user experience and fostering trust. AI can ensure transparency in the collaboration between the government and banks regarding CBDC implementation.

Conclusion

The current study elaborates on the link between artificial intelligence and consumers’ willingness to utilize CBDCs among workers in the banking industry. Three important conclusions emerged from the results. First, artificial intelligence significantly impacts consumers’ willingness to use CBDCs. Secondly, digital technology awareness positively mediates the relationship between artificial intelligence and willingness to use CBDCs. Third, ease of use positively mediates the relationship between artificial intelligence and willingness to use CBDCs. Fourth, addressing privacy concerns significantly mediates the affiliation among artificial intelligence and willingness to use CBDCs. Fifth, government support significantly moderates the relationship between artificial intelligence and digital technology awareness, ease of use, addressing perceived concern, and willingness to use CBDCs. By conducting a comprehensive examination of extensive datasets and complex market dynamics, AI algorithms can provide valuable insights pertaining to the most advantageous interest rate modifications, asset acquisitions, and liquidity administration. Consequently, this facilitates the implementation of monetary policies that are more agile and adaptable, thereby enhancing their ability to mitigate economic swings effectively. In conclusion, the impact of AI on consumers’ willingness to use CBDCs in the Chinese banking sector is a dynamic and evolving area of research. This study has shed light on important factors, but addressing the limitations and exploring future directions will contribute to a more comprehensive understanding of this complex phenomenon.

Limitations and future directions

This study has some limitations. Firstly, this study primarily focuses on the Chinese banking sector, making it difficult to generalize the findings to other countries or regions. Future research could explore the impact of AI on CBDCs adoption in a more diverse set of contexts. Secondly, the data used in this study are cross-sectional, which limits our ability to establish causal relationships between AI, CBDCs, and consumer behavior. Longitudinal studies could provide deeper insights into the dynamics over time. Similarly, the accuracy and reliability of the data collected, especially in surveys and interviews, may be affected by respondent biases or errors. Future research should aim to mitigate these issues through more robust data collection methods. Thirdly, this study primarily focuses on the impact of AI on CBDCs adoption. Future research should consider other factors, such as economic stability, financial literacy, and cultural influences, that may also affect consumer willingness to use CBDCs. Fourthly, this study only focuses on banks located in Beijing, China. For a future perspective, we compare the findings from the Chinese banking sector with those from other countries or regions with different regulatory environments and technological landscapes to identify common trends and unique factors influencing CBDCs adoption. Fifth, in this study, we focused on investigating and developing advanced privacy-preserving technologies that can address consumer concerns about data security and privacy in CBDC transactions. For future studies, explore the role of behavioral economics in shaping consumer decisions regarding CBDC adoption and how AI can be leveraged to influence behavior positively. Lastly, investigate opportunities for international collaboration in AI development and CBDCs implementation to create standardized solutions that can foster global CBDC adoption.

Data availability

The data used in this study can be made available by the corresponding author(s) upon reasonable request.

References

Ahamad S, Roshan A, Lourens M, Shekher V, Joshi K, Alanya-Beltran J (2022) The critical role played by big data management in effectively addressing the security and overall privacy concerns through correlation analysis. In: 2022 2nd international conference on advance computing and innovative technologies in engineering, 130–134, https://doi.org/10.1109/ICACITE53722.2022.9823900

Akin I, Khan MZ, Hameed A, Chebbi K, Satiroglu H (2023) The ripple effects of CBDC-related news on Bitcoin returns: Insights from the DCC-GARCH model. Res Int Bus Financ 66:102060. https://doi.org/10.1016/j.ribaf.2023.102060

Aldboush HHH, Ferdous M (2023) Building trust in Fintech: an analysis of ethical and privacy considerations in the intersection of big data, AI, and customer trust. Int J Financial Stud, 11(3), https://doi.org/10.3390/ijfs11030090

Alfar AJK, Kumpamool C, Nguyen DTK, Ahmed R (2023) The determinants of issuing central bank digital currencies. Res Int Bus Financ 64:101884. https://doi.org/10.1016/j.ribaf.2023.101884

Allen F, Gu X, Jagtiani J (2022) Fintech, cryptocurrencies, and CBDC: financial structural transformation in China. J Int Money Financ 124:102625. https://doi.org/10.1016/j.jimonfin.2022.102625

Allwood CM (2012) The distinction between qualitative and quantitative research methods is problematic. Qual Quant 46(5):1417–1429. https://doi.org/10.1007/s11135-011-9455-8

Alonso SLN, Fernández MÁE, Bas DS, Kaczmarek J (2020) Reasons fostering or discouraging the implementation of central bank-backed digital currency: a review. Economies, 8(2), https://doi.org/10.3390/ECONOMIES8020041

Alonso SLN, Jorge-Vazquez J, Forradellas RFR (2021) Central banks digital currency: detection of optimal countries for the implementation of a CBDC and the implication for payment industry open innovation. J Open Innov Technol Mark Complex 7(1):1–23. https://doi.org/10.3390/joitmc7010072

Anser MK, Shahzad MF, Xu S (2024) Exploring the nexuses between international entrepreneurship and sustainable development of organizational goals: mediating role of artificial intelligence technologies. Environ Dev Sustain 1–27, https://doi.org/10.1007/s10668-024-05580-8

Babin BJ, Griffin M, Hair Jr JF (2015) Heresies and sacred cows in scholarly marketing publications. J Bus Res 69:3133–3138. https://doi.org/10.1016/j.jbusres.2015.12.001

Bagozzi RP, Edwards JR (1998) A general approach for representing constructs in organizational research. Organ Res Methods 1(1):45–87. https://doi.org/10.1177/109442819800100104

Bhaskar R, Hunjra AI, Bansal S, Pandey DK (2022) Central bank digital currencies: agendas for future research. Res Int Bus Financ 62:101737. https://doi.org/10.1016/j.ribaf.2022.101737

Bibi S, Canelli R (2023) The interpretation of CBDC within an endogenous money framework☆. Res Int Bus Financ 65:101970. https://doi.org/10.1016/j.ribaf.2023.101970

Brannon GE, Mitchell S, Liao Y (2022) Addressing privacy concerns for mobile and wearable devices sensors: small-group interviews with healthy adults and cancer survivors. PEC Innov 1:100022. https://doi.org/10.1016/j.pecinn.2022.100022

Celo O, Braakmann D, Benetka G (2008) Quantitative and qualitative research: Beyond the debate. Integr Psychological Behav Sci 42(3):266–290. https://doi.org/10.1007/s12124-008-9078-3

Cheng P (2023a) Decoding the rise of Central Bank Digital Currency in China: designs, problems, and prospects. J Bank Regul 24(2):156–170. https://doi.org/10.1057/s41261-022-00193-5

Cheng Y (2023b) The current status of central bank digital currencies and their development. SHS Web Conf 170:01010. https://doi.org/10.1051/shsconf/202317001010

Choithani T, Chowdhury A, Patel S, Patel P, Patel D, Shah M (2024) A comprehensive study of artificial intelligence and cybersecurity on bitcoin, crypto currency and banking system. Ann Data Sci 11(1):103–135. https://doi.org/10.1007/s40745-022-00433-5

Clayton EW, Halverson CM, Sathe NA, Malin BA (2018) A systematic literature review of individuals’ perspectives on privacy and genetic information in the United States. PLoS ONE 13(10):1–26. https://doi.org/10.1371/journal.pone.0204417

Dashkevich N, Counsell S, Destefanis G (2020) Blockchain application for central banks: a systematic mapping study. IEEE Access 8:139918–139952. https://doi.org/10.1109/ACCESS.2020.3012295

Davis FD (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q Manag Inf Syst 13(3):319–339. https://doi.org/10.2307/249008

Ding S, Cui T, Wu X, Du M (2022) Supply chain management based on volatility clustering: the effect of CBDC volatility. Res Int Bus Financ 62:101690. https://doi.org/10.1016/j.ribaf.2022.101690

Elsayed AH, Nasir MA (2022) Central bank digital currencies: an agenda for future research. Res Int Bus Financ 62:101736. https://doi.org/10.1016/j.ribaf.2022.101736

Fornell C, Bookstein FL (1982) Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. J Mark Res 19(4):440–452. https://doi.org/10.2307/3151718

Fuller CM, Simmering MJ, Atinc G, Atinc Y, Babin BJ (2015) Common methods variance detection in business research ☆. J Business Res. https://doi.org/10.1016/j.jbusres.2015.12.008

Gupta M, Taneja S, Sharma V, Singh A, Rupeika-Apoga R, Jangir K (2023a) Does previous experience with the unified payments interface (UPI) affect the usage of Central Bank Digital Currency (CBDC)? J Risk Financial Manag 16(6):286. https://doi.org/10.3390/jrfm16060286

Gupta S, Pandey DK, El Ammari A, Sahu GP (2023b) Do perceived risks and benefits impact trust and willingness to adopt CBDCs? Res Int Bus Financ 66:101993. https://doi.org/10.1016/j.ribaf.2023.101993

Hair JF, Hult GTM, Ringle CM, Sarstedt M, Thiele KO (2017) Mirror, mirror on the wall: a comparative evaluation of composite-based structural equation modeling methods. J Acad Mark Sci 45(5):616–632. https://doi.org/10.1007/s11747-017-0517-x

Hoang YH, Ngo VM, Bich Vu N (2023) Central bank digital currency: a systematic literature review using text mining approach. Res Int Bus Financ 64:101889. https://doi.org/10.1016/j.ribaf.2023.101889

Islam MM, IN HP (2022) A privacy-preserving transparent central bank digital currency system based on consortium blockchain and unspent transaction outputs. IEEE Trans Serv Comput 16(4):2372–2386. https://doi.org/10.1109/TSC.2022.3226120

Jabbar A, Geebren A, Hussain Z, Dani S, Ul-Durar S (2023) Investigating individual privacy within CBDC: a privacy calculus perspective. Res Int Bus Financ 64:101826. https://doi.org/10.1016/j.ribaf.2022.101826

Keister T, Monnet C (2022) Central bank digital currency: stability and information. J Economic Dyn Control 142:104501. https://doi.org/10.1016/j.jedc.2022.104501

Kim JJ, Radic A, Chua BL, Koo B, Han H (2022) Digital currency and payment innovation in the hospitality and tourism industry. Int J Hospitality Manag 107:103314. https://doi.org/10.1016/j.ijhm.2022.103314

Lee Y, Son B, Park S, Lee J, Jang H (2021) A survey on security and privacy in blockchain-based central bank digital currencies. J Internet Serv Inf Security 11(3):16–29. https://doi.org/10.22667/JISIS.2021.08.31.016

Li J (2023) Predicting the demand for central bank digital currency: a structural analysis with survey data. J Monet Econ 134:73–85. https://doi.org/10.1016/j.jmoneco.2022.11.007

Li Z, Zhang Y, Wang Q, Chen S (2022) Transactional Network Analysis and Money Laundering Behavior Identification of Central Bank Digital Currency of China. J Soc Comput 3(3):219–230. https://doi.org/10.23919/JSC.2022.0011

Liu M, Li RYM, Deeprasert J (2024) Factors that affect individuals in using digital currency electronic payment In China: SEM and fsQCA approaches. Int Rev Econ Financ 95:103418. https://doi.org/10.1016/j.iref.2024.103418

Ma C, Wu J, Sun H, Zhou X, Sun X (2023) Enhancing user experience in digital payments: a hybrid approach using SEM and neural networks. Financ Res Lett 58:104376. https://doi.org/10.1016/j.frl.2023.104376

Mahboub R, Ghanem MG (2024) The mediating role of knowledge management practices and balanced scorecard in the association between artificial intelligence and organization performance: evidence from MENA region commercial banks. Cogent Bus Manag, 11(1), https://doi.org/10.1080/23311975.2024.2404484

Mhlanga D (2020) Industry 4.0 in finance: the impact of artificial intelligence (AI) on digital financial inclusion. Int J Financial Stud 8(3):1–14. https://doi.org/10.3390/ijfs8030045

Morales-Resendiz R, Ponce J, Picardo P, Velasco A, Chen B, Sanz L, Guiborg G, Segendorff B, Vasquez JL, Arroyo J, Aguirre I, Haynes N, Panton N, Griffiths M, Pieterz C, Hodge A (2021) Implementing a retail CBDC: lessons learned and key insights. Lat Am J Cent Bank 2(1):100022. https://doi.org/10.1016/j.latcb.2021.100022

Morgan J (2022) Systemic stablecoin and the defensive case for Central Bank Digital Currency: a critique of the Bank of England’s framing. Res Int Bus Financ 62:101716. https://doi.org/10.1016/j.ribaf.2022.101716

Mukesh D, Sangeetha S, Latha A (2023) Sentimental analysis of CBDC tweets using machine learning and deep learning techniques. In: 2nd International conference on advancements in electrical, electronics, communication, computing and automation, 1–6, https://doi.org/10.1109/ICAECA56562.2023.10199561

Ngo VM, Van Nguyen P, Nguyen HH, Thi Tram HX, Hoang LC (2023) Governance and monetary policy impacts on public acceptance of CBDC adoption. Res Int Bus Financ 64:101865. https://doi.org/10.1016/j.ribaf.2022.101865

Ozturkcan S, Senel K, Ozdinc M (2022) Framing the Central Bank Digital Currency (CBDC) revolution. Technol Anal Strat Manag 0(0):1–18. https://doi.org/10.1080/09537325.2022.2099261

Pocher N, Veneris A (2022) Privacy and transparency in CBDCs: a regulation-by-design AML/CFT scheme. IEEE Trans Netw Serv Manag 19(2):1776–1788. https://doi.org/10.1109/TNSM.2021.3136984

Podsakoff PM, MacKenzie SB, Lee JY, Podsakoff NP (2003) Common method biases in behavioral research: a critical review of the literature and recommended remedies. J Appl Psychol 88(5):879–903. https://doi.org/10.1037/0021-9010.88.5.879

Prodan S, Konhäusner P, Dabija DC, Lazaroiu G, Marincean L (2024) The rise in popularity of central bank digital currencies. A systematic review. Heliyon, 10(9), https://doi.org/10.1016/j.heliyon.2024.e30561

Rennie E, Steele S (2021) Privacy and emergency payments in a pandemic: how to think about privacy and a central bank digital currency. Law Technol Hum 3(1):6–17. https://doi.org/10.5204/lthj.1745

Ridzuan NN, Masri M, Anshari M, Fitriyani NL, Syafrudin M (2024) AI in the financial sector: the line between innovation, regulation and ethical responsibility. Information 15(8):1–30. https://doi.org/10.3390/info15080432

Sandhu K, Dayanandan A, Kuntluru S (2023) India’s CBDC for digital public infrastructure. Econ Lett 231:111302. https://doi.org/10.1016/j.econlet.2023.111302

Shahzad MF, Xu S (2024) Antecedents of international entrepreneurship and emerging technologies help to achieve sustainable development goals: moderating role of global mindset. Technol Forecast Soc Change 209:123831. https://doi.org/10.1016/j.techfore.2024.123831

Shahzad MF, Xu S, An X, Asif M, Javed I (2025a) Do generative AI technologies play a double-edged sword role in education? Findings from hybrid approach using PLS-SEM and fsQCA. Educ Inf Technol. https://doi.org/10.1007/s10639-025-13528-2

Shahzad MF, Xu S, An X, Zahid H, Asif M (2025b) Learning and teaching in the era of generative artificial intelligence technologies: an in-depth exploration using multi-analytical SEM-ANN approach. Eur J Educ, 1–19, https://doi.org/10.1111/ejed.70050

Shahzad MF, Xu S, Lim WM, Hasnain MF, Nusrat S (2024a) Cryptocurrency awareness, acceptance, and adoption: the role of trust as a cornerstone. Humanit Soc Sci Commun, 11(1), https://doi.org/10.1057/s41599-023-02528-7

Shahzad MF, Xu S, Liu H, Zahid H (2024b) Generative artificial intelligence (ChatGPT-4) and social media impact on academic performance and psychological well-being in China’s higher education. Eur J Educ, 1–15, https://doi.org/10.1111/ejed.12835

Shahzad MF, Xu S, Rehman O, Javed I (2023) Impact of gamification on green consumption behavior integrating technological awareness, motivation, enjoyment and virtual CSR. Sci Rep, 1–18, https://doi.org/10.1038/s41598-023-48835-6

Shkliar AI (2020) The phenomenon of central banks’ digital currencies (CBDC): key attributes and implementation perspectives. Ukrainian Soc 2020(1):123–137. https://doi.org/10.15407/socium2020.01.123

Siddik AB, Yong L, Du AM, Vigne SA, Sharif A (2025) Harnessing artificial intelligence for enhanced environmental sustainability in China’s banking sector: a mixed-methods approach. Br J Manag 0:1–18. https://doi.org/10.1111/1467-8551.12901

Soana G, de Arruda T (2024) Central bank digital currencies and financial integrity: finding a new trade-off between privacy and traceability within a changing financial architecture. J Bank Regul 25(4):467–486. https://doi.org/10.1057/s41261-024-00241-2

Sood K, Singh S, Behl A, Sindhwani R, Kaur S, Pereira V (2023) Identification and prioritization of the risks in the mass adoption of artificial intelligence-driven stable coins: the quest for optimal resource utilization. Resour Policy 81:103235. https://doi.org/10.1016/j.resourpol.2022.103235

Syarifuddin F, Bakhtiar T (2022) The macroeconomic effects of an interest-bearing CBDC: a DSGE model. Mathematics 10(10):1–33. https://doi.org/10.3390/math10101671

Tavakol M, Dennick R (2011) Making sense of Cronbach’s alpha. Int J Med Educ 2:53–55. https://doi.org/10.5116/ijme.4dfb.8dfd

Themistocleous M, Rupino da Cunha P, Tabakis E, Papadaki M (2023) Towards cross-border CBDC interoperability: insights from a multivocal literature review. J Enterprise Inf Manag, 1296–1318, https://doi.org/10.1108/JEIM-11-2022-0411

Tong W, Jiayou C (2021) A study of the economic impact of central bank digital currency under global competition. China Econ J 14(1):78–101. https://doi.org/10.1080/17538963.2020.1870282

Wang H (2023) How to understand China’s approach to central bank digital currency? Comput Law Security Rev 50:105788. https://doi.org/10.1016/j.clsr.2022.105788

Wang YR, Ma CQ, Ren YS (2022) A model for CBDC audits based on blockchain technology: learning from the DCEP. Res Int Bus Financ 63:101781. https://doi.org/10.1016/j.ribaf.2022.101781

Wenker K (2022) Retail central bank digital currencies (CBDC), disintermediation and financial privacy: the case of the Bahamian Sand Dollar. FinTech 1(4):345–361. https://doi.org/10.3390/fintech1040026

Wu J, Liu X, Zhang C (2024) Unveiling the influencing mechanism underlying users’ adoption and recommend intentions of central bank digital currency: a behavioral reasoning theory perspective. J Retail Consum Serv 81:104050. https://doi.org/10.1016/j.jretconser.2024.104050

Xia H, Gao Y, Zhang JZ (2023) Understanding the adoption context of China’s digital currency electronic payment. Financial Innov, 9(1). https://doi.org/10.1186/s40854-023-00467-5

Xu J (2022) Developments and implications of central bank digital currency: the case of China e-CNY. Asian Econ Policy Rev 17(2):235–250. https://doi.org/10.1111/aepr.12396

Yigitcanlar T, Corchado JM, Mehmood R, Li RYM, Mossberger K, Desouza K (2021) Responsible urban innovation with local government artificial intelligence (AI): a conceptual framework and research agenda. J Open Innov 7(1):1–16. https://doi.org/10.3390/joitmc7010071

Yuan YP, Dwivedi YK, Tan GWH, Cham TH, Ooi KB, Aw ECX, Currie W (2023) Government digital transformation: understanding the role of government social media. Gov Inf Q 40(1):101775. https://doi.org/10.1016/j.giq.2022.101775

Acknowledgements

This work received financial support from the Beijing Social Science Foundation [No. 24JCB028].

Author information

Authors and Affiliations

Contributions

HL: conceptualization, writing—original draft preparation, investigation, funding, and project administration. MAHJ: investigation, writing—review and editing, collection of data, and validation. SX: investigation, supervision, writing—review and editing, visualization and resources. MFS: conceptualization, writing—original draft preparation, methodology, software, conceptualization and project administration.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval