Abstract

Corporations are under increasing pressure to adapt their strategies to mitigate the adverse effects of climate risk. This study explores the theoretical and empirical relationship between climate risk and corporate collaborative innovation, highlighting the mechanisms involved. Theoretical analysis suggests that climate risk, by intensifying stranded assets and cross-risks, acts as a compensatory driver for collaborative innovation among corporations. Digital transformation strengthens this compensatory mechanism, while corporate risk-taking diminishes its impact. Empirical analysis using data from Chinese A-share listed companies supports the theoretical framework, revealing that climate risk compels companies to “band together” for technological advancement to manage external challenges. The mediating effect of digital transformation enhances the flow of innovation elements among firms, bolstering collaborative innovation, whereas risk-taking weakens this effect. This paper deepens the understanding of how climate risk shapes corporate strategy. It provides practical insights for corporate strategists seeking collaborative responses to environmental volatility and supports policymakers in designing sustainability-oriented policies.

Similar content being viewed by others

Introduction

As extreme weather events become increasingly frequent worldwide, climate change has emerged as a critical global concern. Since the adoption of the United Nations Framework Convention on Climate Change (UNFCCC) in the late 20th century, governments worldwide have introduced and implemented various climate and environmental protection policies to mitigate the uncertainty risks associated with climate change. According to the Global Climate Risk Index 2025 published by Germanwatch, from 1993 to 2022, over 765,000 lives were lost and nearly USD 4.2 trillion in inflation-adjusted direct economic losses were recorded, driven by more than 9400 extreme weather events (Lina et al. 2025). These figures underscore the severe threat that extreme weather events pose to human lives and property, as well as their significant impact on social and economic stability, making climate risk a major factor influencing global economic and societal resilience (Du et al. 2023b).

For enterprises, climate risk imposes significant pressures on production, supply chains, and asset valuation, while also profoundly affecting financial asset pricing, corporate trade credibility, and technological innovation (Campiglio et al. 2023; Yen et al. 2024; Ren et al. 2024b). Against this backdrop, how to adopt effective innovation strategies to navigate climate uncertainty and achieve high-quality corporate development has become a pressing issue at the microeconomic level (Ren et al. 2024b). Existing research suggests that technological innovation is an effective tool for reducing uncertainty, particularly in developing countries (Subramaniam and Loganathan, 2022). This is especially relevant for China, which has transitioned from a latecomer relying on imitative technology to an innovation-driven economy (Fu et al. 2016). However, most prior studies have focused on unilateral innovation within firms (Feng et al. 2024; Chen et al. 2025), with limited attention to collaborative innovation among firms as a strategy to navigate climate challenges.

The impact of climate risk on corporate behavior has been widely discussed across various domains, including its effects on firms’ cost of equity, cross-border capital flows, and total factor productivity (Du et al. 2023b; Song et al. 2023; Li et al. 2023). In recent years, increasing attention has been given to the influence of subjective risk perception on corporate strategic decision-making. Studies have found that, on the one hand, positive climate risk perception can drive firms to engage in more sustainable innovation activities (Tian and Zhao, 2025); on the other hand, excessive risk pressure may lead to behavioral biases or even regulatory violations (Sun et al. 2024). Regarding collaborative innovation, existing research suggests that external institutional environments, resource accessibility, and cost-risk sharing are key drivers of firms’ engagement in collaborative innovation (Xie et al. 2023; Wang et al. 2024c; Li et al. 2024). However, there has been no systematic exploration of the direct relationship between climate risk and collaborative innovation. In particular, when firms face increasing climate uncertainty, their strategic choices between inter-organizational collaboration and independent innovation remain unclear. Therefore, integrating climate risk and collaborative innovation decision-making to identify the underlying mechanisms represents a significant research gap.

The selection of cooperation strategies among multiple entities during crises has long been a focal issue in academic research. In the context of shared public resources, “the tragedy of the commons” is one of the most representative collective action dilemmas (Hardin, 1968). Since collaborative innovation involves inter-organizational cooperation, resource sharing, and information exchange, firms may be concerned that their knowledge or technology investments could be exploited by others without reciprocation, reducing their willingness to engage in collaboration. Additionally, potential moral hazard and opportunistic behavior may further destabilize inter-firm cooperation, posing challenges to the implementation of collaborative innovation. However, even under highly uncertain external risks, firms may still pursue collaboration. Through cooperation, firms can optimize resource allocation to enhance their competitiveness and sustainability. For example, the resource-based view (RBV) theory suggests that a firm’s competitive advantage stems from its possession of scarce resources and unique capabilities (Barney, 1991). However, when facing significant environmental changes, firms may struggle to respond effectively due to organizational inertia (Boyer and Robert, 2006). In such cases, inter-organizational collaboration enables firms to access resources that would otherwise be unattainable, creating opportunities for cooperation (Ozdemir et al. 2023).

Against the backdrop of intensifying climate change, many firms face challenges such as a lack of innovation resources, high R&D costs, and increased market uncertainty. As a result, there is an urgent need to leverage external resources to compensate for internal limitations. Collaborative innovation offers a viable solution, enabling firms to access key resources through joint R&D, technology sharing, and inter-organizational cooperation, thereby enhancing their capacity to adapt to climate risks (Ozdemir et al. 2020). From the perspective of the RBV theory, collaborative innovation is not only a means of optimizing resource allocation but also a strategic response to environmental uncertainty. Firms with a heightened perception of climate uncertainty and urgency are more likely to actively seek external partners for collaborative innovation, integrating diverse knowledge, technology, and financial resources. This, in turn, strengthens their resilience and innovation performance in uncertain environments.

In this context, this study explores how climate risk influences firms’ innovation strategies through both theoretical and empirical analyses. The theoretical framework suggests that firms’ collaborative innovation efforts, driven by climate risk, can mitigate the inherent risks associated with cross-risk contagion in business networks and the depreciation of corporate assets. Empirical analysis based on China’s A-share listed companies indicates that a one-standard-deviation increase in climate risk perception leads to a 0.0474 standard deviation increase in corporate collaborative innovation. A four-step mediation analysis confirms that climate risk promotes collaborative innovation through two primary channels: the amplification of cross-risk contagion and the increase in stranded assets. Additionally, the moderation analysis reveals that firms’ digital transformation strengthens the motivation for collaborative innovation, whereas corporate risk-taking weakens this effect.

Compared to existing literature, this study makes three key contributions. First, there is ongoing debate regarding firms’ collaborative innovation strategies in times of crisis. While the tragedy of the commons theory suggests that firms struggle to engage in effective cooperation, some scholars argue that firms may still pursue collaborative innovation under uncertainty to enhance resilience (Wang et al. 2024b). This study focuses on climate risk perception and examines whether firms opt for collaborative innovation as a strategic response to uncertainty caused by climate risk. Second, existing research has extensively explored the macro- and micro-level determinants of collaborative innovation from both internal and external perspectives (Huang et al. 2023a), yet few studies have examined risk mitigation as a driving force. This study fills this gap by empirically testing how climate risk promotes collaborative innovation through stranded assets and cross-risk contagion, enriching the understanding of the mechanisms underlying collaborative innovation. Third, this study further investigates the heterogeneous effects of climate risk on collaborative innovation under different firm-level conditions. By examining the moderating roles of digital transformation and corporate risk-taking, this study highlights how firms’ individual characteristics influence their responses to climate risk. These findings provide valuable insights for firms seeking to leverage collaborative innovation as a strategic approach to mitigate external climate risks and foster sustainable development under environmental uncertainty.

Literature review

Climate risk and corporate behavior

Definition and consequences of climate risk

In existing research, climate risk is typically categorized into two main types: physical risk and transition risk (TCFD, 2017; Zhang et al. 2024). From the perspective of corporate operations, physical risk refers to the direct impact of extreme weather events and natural disasters on business activities, such as factory damage and supply chain disruptions, leading to both direct and indirect asset losses (Zhou et al. 2023). Transition risk, on the other hand, arises from technological advancements, tightening government policies and regulations, and shifts in consumer preferences, which may result in asset restructuring. For example, government initiatives such as carbon peak policies and clean energy transition strategies can lead to stranded assets (Le et al. 2023). At a broader societal level, climate risk has significant implications across various sectors, including agricultural production, energy security, transportation, and financial markets (Huang et al. 2024c).

The impact of climate risk on corporate behavior

Focusing on corporate behavior, climate risk primarily affects firms in two key areas: financing capacity and production operations.

(1) Financing capacity: Climate risk directly increases corporate financing costs. In equity financing, high-carbon-emission firms often struggle to secure low-cost financing in international capital markets. This is because investors generally perceive high-carbon firms as yielding lower stock returns and carrying higher potential risks and costs (Bolton and Kacperczyk, 2021). As a result, carbon emissions are increasingly integrated into investment decision-making, with investors avoiding firms exposed to high carbon risks (Ren et al. 2025). Furthermore, based on the arbitrage pricing theory, risk factors influence asset returns by affecting firms’ expected future cash flows, leading to corresponding changes in stock prices and increasing firms’ cost of equity capital. The decline in corporate profitability further reduces the likelihood of obtaining external financing, strengthening financial constraints (Cai and Dong, 2016; Cai, 2019). In the Chinese stock market, climate transition risk negatively impacts the cost of equity capital by raising financing costs, though increased information transparency can mitigate this adverse effect (Du et al. 2023b). Climate transition risk also directly affects U.S. stock prices, especially under government intervention, as climate policies introduced by the U.S. government significantly influence stock prices, whereas physical risks do not have a direct impact (Faccini et al. 2023).

In debt financing, climate risk further reduces banks’ risk appetite and restricts deposit availability, ultimately suppressing loan supply, making it harder for firms to obtain financing through loans (Li and Wu, 2023). Additionally, as early as 2020, scholars highlighted that climate change affects municipal bond pricing. Subsequent research explored how corporate-level climate policy uncertainty impacts corporate bond credit spreads, suggesting that the pricing effect of climate policy uncertainty also applies to the Chinese bond market (Wang and Zhou, 2023). Consequently, firms often respond to climate risk by increasing cash holdings to hedge against future uncertainties (Ma et al. 2024).

(2) Production and operations: Uncertainty in climate policies directly influences corporate production and operational decisions. Early research primarily focused on the impact of climate change on agricultural production (Aguinis et al. 2017), but subsequent studies expanded into other industries. For instance, Yin et al. (2016) identified a mechanism linking climate risk to firms’ total factor productivity (TFP) through “climate change-R&D investment-technological advancement-TFP”, illustrating how climate risk affects technological development. Further studies have found that climate risk significantly weakens both manufacturing firms’ TFP and profitability (Liu et al. 2023a; Song et al. 2023). Recent research suggests that climate risk not only affects firms’ short-term operations but also has long-term implications for strategic decision-making (Huang et al. 2024c). The volatility of climate policies introduces uncertainty into firms’ long-term planning, impacting investment returns and technological innovation (Ren et al. 2024b). Additionally, climate risk disclosure has been recognized as a key measure to enhance market transparency and reduce carbon emissions, thereby encouraging firms to adopt more proactive green transition strategies (Wang et al. 2024d).

It is particularly important to note that climate risk influences corporate decision-making not only through direct effects on financing and operations but also by shaping managerial perceptions. Studies indicate that executives’ cognitive biases regarding climate risk can affect corporate debt structure—when executives overestimate climate risk, firms tend to adopt more conservative financing strategies, which may reduce investments in innovation and transformation (Huang et al. 2025). Overall, climate risk has become a crucial factor in global financial markets, significantly impacting asset pricing, market volatility, and investor behavior (Zhai et al. 2024).

Determinants of corporate collaborative innovation

Collaborative innovation is essentially an organizational model in which firms, governments, knowledge production institutions (such as universities and research institutes), intermediaries, and customers cooperate across various domains to achieve significant technological advancements (Chen and Yang, 2012; Zhuang and Zhao, 2022; Di et al. 2024). This process not only enhances firms’ core competitiveness but also significantly increases overall corporate value through mutual innovation benefits (Huang et al. 2023a). Existing research on the drivers of collaborative innovation primarily focuses on two dimensions: external factors and internal motivations.

(1) External drivers: Institutional environments and interactions with external entities are key areas of academic focus. At the institutional level, some scholars argue that formal governmental support positively influences collaborative innovation. Government policies, public investment, and legal frameworks play essential roles in fostering corporate collaborative innovation (Zhang et al. 2016; Fu et al. 2024; Yan et al. 2025). Additionally, informal institutional elements such as cultural norms and shared values also contribute positively to collaborative innovation (Zhao et al. 2018). Regarding external interactions, both spatial proximity and institutional proximity significantly impact firms’ likelihood of engaging in collaborative innovation, as geographic and regulatory similarities facilitate inter-firm cooperation (Dang and Gong, 2013; Gu et al. 2023).

(2) Internal motivations: Internal drivers of collaborative innovation include access to external resources, cost and risk-sharing, interaction with external entities, and performance enhancement. First, high-tech enterprises and firm size positively influence corporate innovation behavior (Su et al. 2023). However, firms engaging in independent innovation often face resource constraints. Early studies suggested a synergy between external knowledge acquisition and internal innovation, encouraging firms to adopt open innovation strategies that leverage diverse drivers such as private enterprises and multinational corporations (Fu et al. 2016). The RBV posits that firms’ competitive advantages depend on their ability to acquire scarce resources and core capabilities (Barney, 1991). Through collaborative innovation, firms can share technological resources, distribute R&D costs, and mitigate the risks associated with independent innovation (Zhang et al. 2018). By leveraging collaboration, firms can access knowledge and other critical resources from external partners (Xie and Liu, 2015), enabling complementary advantages and more efficient resource allocation, thus enhancing responsiveness to external changes.

Second, innovation activities are inherently risky, requiring sustained investment with uncertain returns. Collaborative innovation allows firms to share the costs and risks of R&D, reducing the burden of innovation expenditures (Hottenrott and Lopes-Bento, 2016). Moreover, frequent communication and trust-building among collaborative partners further facilitate corporate collaborative innovation (Drejer and Jørgensen, 2005; Hong et al. 2019). Finally, improving innovation performance is another key motivation for engaging in collaborative innovation. The formation of collaborative innovation networks has been shown to enhance firms’ innovation outcomes (Liu et al. 2024).

While extensive research has examined the impact of climate risk on corporate behavior, studies directly addressing the link between climate risk and collaborative innovation remain limited. A review of related literature suggests that climate risk may indirectly influence corporate collaborative innovation decisions through multiple mechanisms. First, studies have shown that both physical and transition risks associated with climate change increase firms’ operational and R&D costs, thereby affecting their financial performance (Ren et al. 2024a). Responding to climate change often necessitates increased R&D investment in new technologies and products, further raising corporate expenses (Ren et al. 2024b). Second, firms facing rising costs may adopt collaborative innovation strategies to share expenses and mitigate risks (Hottenrott and Lopes-Bento, 2016). By cooperating with external organizations, firms can not only pool resources and distribute R&D expenditures but also foster knowledge exchange and complementary capabilities, ultimately enhancing innovation efficiency. Additionally, research indicates that individuals tend to seek external resources and information to strengthen adaptability when perceiving environmental uncertainty (van Valkengoed et al. 2022). For firms, this adaptive strategy may manifest as increased collaboration with external institutions, allowing them to acquire knowledge and technologies at a lower cost, thereby enhancing their innovation capacity and market competitiveness. Overall, while direct research on the relationship between climate risk and corporate collaborative innovation is still scarce, existing literature provides valuable insights. It suggests that climate risk may influence firms’ innovation strategies, shaping their responses to environmental uncertainty. These studies support the analytical framework of this research and lay a strong foundation for further exploration of this issue.

Theoretical derivation and hypothesis formulation

Model setup

This study constructs a three-stage model (t = 0, 1, 2).

At t = 0, enterprises have the opportunity to make strategic decisions, choosing whether to engage in collaborative innovation with external businesses to reshape subsequent production. However, as discussed in the next section, not all collaborative innovation efforts made by enterprises succeed in benefiting their production and operations.

At t = 1, enterprises organize production. According to the Cobb–Douglas production function, referring to Chen (2023), enterprise output requires the input of two factors: labor \(L\) and capital \(K\), with the production function given by \(M={G}^{\phi }{K}^{\chi }{L}^{\psi }\). Given the focus of this paper on the impact of climate risk on enterprises, it has been proposed that technological upgrades can result in stranded assets in some industries (Wang and Wang, 2023). Stranded assets refer to assets that undergo premature devaluation or fail to generate expected returns due to external environmental changes, ultimately leading to financial losses. When firms experience stranded assets that no longer create value or cash flow, their operational and financial stability is negatively affected. To comprehensively measure firms’ production inputs, this study introduces \(A\), representing all assets utilized in business operations. Additionally, inherent risk factors in business operations must be considered. Therefore, this study incorporates \(R\) to adjust the production function for risk-related effects. Moreover, firms’ degree of business diversification also influences operational stability. Business overlap and balance sheet interdependencies may amplify cross-risk contagion effects (Han et al. 2023). Here, cross-risk specifically refers to the horizontal transmission of business risks resulting from corporate diversification. Firms with higher diversification levels may face heightened operational complexity due to interdependencies among different business segments, increasing overall risk exposure.

At t = 2, enterprises produce output, represented by \(Y\left(R,A\right)\). The enterprise’s output function is set as \(Y\left(R,A\right)={M}^{\theta }{R}^{\alpha }{A}^{\beta }\).

The enterprise’s profit function is

where \(r\) and \(w\) represent the external conditions of no cross-risk contagion and no stranded assets, respectively. \(C\) represents the intensity of climate risk. \({\delta }_{1}={\delta }_{1}(C)\) and \({\delta }_{2}={\delta }_{2}(C)\) represent the proportions by which climate risk causes enterprise cross-risk transmission and asset stranding, leading to a reduction in the value of enterprise assets, with \({\delta }_{1}^{{\prime} }\, > \,0\) and \({\delta }_{2}^{{\prime} }\, > \,0\) indicating that the greater the climate risk, the higher the degree of enterprise cross-risk contagion and asset depreciation.

Taking the first-order partial derivatives of Eq. (1) with respect to \(R\) and \(A\), the conditions for maximizing enterprise profit are derived:

Given the second-order conditions \(\frac{{\partial }^{2}\pi }{\partial {R}^{2}}\, < \,0,\frac{{\partial }^{2}\pi }{\partial {A}^{2}}\, < \,0\) always hold, this results in a unique equilibrium solution for profit maximization:

Substituting \({R}^{* }\) and \({A}^{* }\) into Eq. (1) yields the profit in equilibrium:

Climate risk and corporate collaborative innovation

Drawing on the research methodology of Sun and Cheng (2020), using social network analysis, enterprises are nodes within the collaborative innovation network, and joint patent applications between enterprises represent the edges in this network. The weight matrix \(\omega =[{\omega }_{{ab}}]\) is used to measure the strength of associations within the collaborative innovation network, where \({\omega }_{{ab}}={\omega }_{{ba}}\), and \({\omega }_{{ab}}\) represents the number of joint patent applications between enterprises \(a\) and \(b\). Referring to Freeman (1978), this study utilizes degree centrality to measure the strength of collaborative innovation linkages, calculated as

At stage t = 0, enterprises can choose to engage in collaborative innovation to counter perceived external climate risks, or they may opt not to adopt a collaborative innovation strategy.

Let \(e\) represent the level of effort in corporate collaborative innovation, where \(e={{{\rm {DC}}}}_{a}\). For a given \(e\), the probability of successful collaborative innovation is denoted by \(q(e)\). This paper posits that successful corporate collaborative innovation implies that enterprises have mitigated cross-risk contagion and improved the situation of stranded assets through collaborative efforts. Conversely, if collaborative innovation fails, it does not produce positive effects.

If collaborative innovation is successful at t = 0, optimal decisions regarding risk management and asset investment are made at t = 1, and the enterprise’s equilibrium profit can be obtained using the formula:

If collaborative innovation fails at t = 0, the best decisions regarding risk management and asset investment at t = 1 are represented using the formula (6).

Additionally, it is assumed that \({q}^{{\prime} }\left(e\right)\, > \,0\) and \({q}^{{\prime} {\prime} }\left(e\right) \,< \,0\), with \(q\left(0\right)=0\), indicating that increasing efforts in collaborative innovation correspondingly increase the probability of success, but the marginal effect of these efforts is diminishing. Enterprises aiming to enhance their production technology strive to occupy central positions in the collaborative innovation network, as being in a central position entails more connections but also implies higher investment costs (Sun and Cheng, 2020). The cost of collaborative innovation for enterprises is denoted by \(S\left(e\right)\), with \({S}^{{\prime} }\left(e\right)\, > \,0\), \({S}^{{\prime} {\prime} }\left(e\right)\, > \,0\), and \(S\left(0\right)=0\), indicating that the costs of implementing collaborative innovation are continuously increasing.

Since the probability of successfully correcting the expansion of cross-risk contagion and the increase in stranded assets caused by climate risks through collaborative innovation is \(q(e)\), combining formulas (6) and (8), the expected profit from collaborative innovation for an enterprise can be expressed as

It is evident that \(E{\pi }_{e}\left(C,0\right)={\pi }_{1}\left(C\right)\).

For enterprises not engaging in collaborative innovation, the remaining profit is \({\pi }_{1}\left(C\right)\). Thus, for enterprises that do engage in collaborative innovation, there exists an incentive compatibility constraint related to the level of effort d > 0 as follows:

Rearranging this gives:

Taking first and second derivatives with respect to \(e\):

Since \(\frac{{\partial }^{2}E{\pi }_{e}\left(C,e\right)}{\partial {e}^{2}}\, < \,0\) always holds, there exists a specific \(e={e}^{* }\) that maximizes \(E{\pi }_{e}\left(C,e\right)\), and the first-order condition is zero, i.e.,

where \({\delta }_{1}(C)\) represents the degree of cross-risk contagion among firms caused by climate risk due to business interdependencies, and \({\delta }_{2}(C)\) denotes the extent of stranded assets resulting from climate risk. Because\(\,{q}^{{\prime} {\prime} \left(e\right)}\, < \,0\), \({T}^{{\prime} {\prime} \left(e\right)}\, > \,0\), for \(e\, < \,{e}^{* }\), \(\frac{\partial E{\pi }_{2}\left(C,e\right)}{\partial e}\, > \,0\), when \(E{\pi }_{2}\left(C,0\right)={\pi }_{1}\left(C\right)\). Therefore, for any \(e\in \left(0,{e}^{* }\right]\), \(E{\pi }_{2}\left(C,e\right) \,> \,{\pi }_{1}\left(C\right)\), implying that \(\Delta \left({e}^{* }\right) \,> \,0\) is always true. This leads to Hypothesis H1:

H1: Climate risk promotes corporate collaborative innovation.

The mechanisms linking climate risk to corporate collaborative innovation

This section further explores the pathways through which climate risk influences corporate collaborative innovation, focusing on two channels: cross-risk contagion and the increase in stranded assets.

Deriving the partial derivative of formula (14) with respect to C yields formula (15) as follows:

Equation (15) outlines these two pathways, demonstrating how climate risk affects corporate collaborative innovation. First, cross-risk contagion refers to the horizontal transmission of business risks caused by corporate diversification. This concept differs significantly from traditional supply chain risk and systemic financial risk. Supply chain risk is typically transmitted vertically along the supply chain, where disruptions at one stage propagate sequentially to upstream and downstream firms (Liu et al. 2025). Systemic financial risk, on the other hand, operates at the macro level, spreading through financial markets and affecting multiple firms simultaneously, thereby influencing overall market stability (So et al. 2022). In contrast, cross-risk contagion, as defined in this study, emphasizes the horizontal transmission of risks across different business units within a firm or between firms with interconnected operations. When a risk event occurs in one business unit, it can quickly spread through operational linkages or financial interdependencies, amplifying and accumulating risks across multiple business areas or firms (Huang et al. 2023b; Han et al. 2023).

Equation (16) captures the increasing severity of cross-risk contagion as climate risk intensifies, as represented by \({\delta }_{1}^{{\prime} }\left(C\right)\):

In the model framework of this study, an increase in climate risk intensity directly translates into a rise in δ1(C), meaning that firms face a higher degree of cross-risk contagion as climate risk escalates. The amplification of cross-risk raises corporate risk management and operational costs, which, in turn, incentivizes firms to engage in collaborative innovation to mitigate these risks. According to the model, when δ1′(C) increases, firms are more likely to engage in collaborative innovation to counteract the growing burden of cross-risk contagion.

The underlying economic logic follows from externality theory, which posits that the actions of one economic entity can have either positive or negative spillover effects on others. The rising uncertainty in the business environment due to climate risk leads to greater exposure to uncontrollable risks for individual firms. Prior studies suggest that external climate risk exacerbates uncertainty in economic systems and financial markets, thereby increasing the likelihood of horizontal risk contagion among firms (Nakhli et al. 2024). Firms with higher diversification levels are particularly vulnerable to this phenomenon, as the interconnected nature of their business units intensifies risk transmission effects (Han et al. 2023). Furthermore, studies indicate that financial interdependencies in supply networks serve as a crucial driver of collaborative innovation. The cross-flow of financial resources between firms facilitates cross-risk contagion, while firms’ operational linkages also drive risk propagation (Huang et al. 2023b). As climate risk heightens market uncertainty and amplifies cross-risk contagion, firms are increasingly driven to pursue collaborative innovation as a strategic response to mitigate operational risks and enhance resilience.

Based on the above theoretical and empirical insights, the following hypothesis is proposed:

H2a: Climate risk promotes corporate collaborative innovation through increasing cross-risk contagion among enterprises.

Stranded assets refer to investments that, due to changes in market conditions and regulatory environments driven by climate policies, can no longer generate expected economic returns before the end of their economic lifespan (International Energy Agency, 2013). From a causality perspective, stranded assets primarily arise from climate risk-related external factors, such as stricter environmental policies and regulations, advancements in clean technology, and shifts in social norms and consumer preferences (Wei et al. 2021).

Beyond financial impairments recorded in corporate balance sheets, stranded assets also encompass additional costs incurred due to the internalization of environmental costs. For example, governments may require firms to integrate pollution control and resource consumption costs into their production expenses, which can significantly raise operational costs. In high-pollution, high-energy-consumption industries, such as fossil fuel-based infrastructure, assets may face accelerated depreciation or forced decommissioning due to increased costs or policy constraints, leading to heightened stranded asset risks (Chen et al. 2023; Du et al. 2023a). Firms that accumulate stranded assets experience declining expected profits, investor panic, and subsequent market devaluation, which can severely impact corporate valuation.

Equation (17) captures the relationship between climate risk and stranded assets, where \({\delta }_{2}^{{\prime} }\left(C\right)\) represents the increase in stranded asset proportion as climate risk escalates:

In the theoretical model, a rise in \({\delta }_{2}(C)\) indicates an increasing share of stranded assets in a firm’s asset portfolio, leading to higher asset management costs. This, in turn, drives firms to adopt collaborative innovation strategies as a means to mitigate the negative effects of stranded assets. According to the model, as \({\delta }_{2}^{{\prime} }\left(C\right)\) grows, firms become increasingly motivated to engage in collaborative innovation to offset the additional financial burden associated with stranded assets.

The underlying economic rationale is as follows: stranded assets caused by climate risk increase operational costs, lower expected corporate profits, and create mismatches between projected earnings and financial obligations. These mismatches expose banks to climate-related financial risks, potentially triggering significant asset price fluctuations (Campiglio et al. 2018; Ferreira et al. 2019). For large-scale, capital-intensive, and technology-dependent firms in carbon-intensive industries, the pressure from stranded assets is particularly severe. These firms face high barriers to technological transformation and resource constraints, making it difficult for them to navigate the transition to low-carbon operations (Laursen and Salter, 2006; Zobel et al. 2017; Yang and Zhao, 2020). Consequently, under the strain of stranded assets, firms are more likely to leverage collaborative innovation to access external technological expertise, financial resources, and knowledge networks. This effect is especially pronounced in carbon-intensive industries, where avoiding a sharp decline in corporate value requires firms to actively engage in collaborative innovation, break through technological bottlenecks, and adapt to climate-induced operational challenges.

Based on the above theoretical derivation, the following hypothesis is proposed:

H2b: The perception of climate risk increases stranded assets in enterprises, forcing them to cooperate and innovate.

Further exploration

Additionally, the formula \(S\left(e\right)=k(n,u){e}^{2}\) is established, with \(\frac{\partial k}{\partial n}\, < \,0\), \(\frac{\partial k}{\partial u}\, > \,0\). Here, \(n\) represents the degree of digitalization in enterprises, suggesting that smoother communication channels between companies reduce the marginal costs of collaborative innovation. \(u\) indicates a higher level of risk assumption by the enterprise, which results in higher associated costs. It is also determined that \(\frac{{\partial }^{2}{e}^{* }}{\partial C\partial n}\, > \,0\) and \(\frac{{\partial }^{2}{e}^{* }}{\partial C\partial u}\, < \,0\), implying that enhanced digitalization positively regulates collaborative innovation under climate risk, whereas higher risk assumption by enterprises negatively regulates it.

The adoption of digital technologies enhances firms’ ability to perceive, acquire, and integrate knowledge and technological resources, making innovation collaboration more efficient. Digital transformation has borderless connectivity and strong penetration capabilities, facilitating corporate engagement in collaborative innovation. First, digitalization breaks traditional constraints on the availability of production factors for innovation. It also reduces information asymmetry in capital markets by improving resource integration (Wang et al. 2024a), thereby promoting the flow and exchange of knowledge and innovation inputs among firms (Yang et al. 2021; Marchesani et al. 2023). Second, blockchain technology, a key component of digitalization, enables firms to establish transparent, trustworthy, and decentralized governance mechanisms, which enhances inter-firm trust and reduces transaction costs (Wan et al. 2022). By fostering more reliable relationships between innovation partners, digitalization mitigates concerns over opportunistic behaviors and free-riding, thus strengthening the incentive for collaborative innovation in response to climate risks.

Corporate risk-taking reflects a firm’s willingness to engage in uncertain activities in pursuit of high returns (Boubakri et al. 2013). Existing research categorizes risk-taking determinants into societal, corporate, and individual levels (Li et al. 2025). In financial markets, risk and return are inherently linked—higher risks are typically associated with higher expected returns. Consequently, firms with high levels of risk-taking are more adept at identifying and seizing investment opportunities to generate higher profits (Lv et al. 2023). Such firms tend to independently manage climate risk-induced uncertainties rather than engaging in collaborative innovation, as they prefer to retain the full economic benefits of their innovation rather than share them with partners. In contrast, collaborative innovation offers risk-averse firms a strategic means of reducing uncertainty and financial burden. Engaging in inter-firm collaboration allows companies to share R&D risks, increase efficiency, and benefit from economies of scale (Zhou et al. 2017). As a result, firms with lower risk-taking tendencies are more inclined to pursue collaborative innovation, leveraging partnerships to distribute risks and reduce cost pressures (Huang et al. 2024b).

Based on the above analysis, the following hypotheses are proposed:

H3: The higher the degree of digitalization of an enterprise, the more climate risk can promote collaborative innovation within the enterprise.

H4: The level of risk-taking by an enterprise negatively modulates the motivational effect of climate risk on collaborative innovation.

Research design

Sample selection and data sources

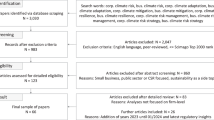

Considering that in December 2009, at the Copenhagen World Climate Conference, China first established binding carbon emission reduction targets. These were incorporated into the Twelfth Five-Year Plan as guiding principles for China’s economic development, aimed at reducing carbon emissions and controlling the use of fossil fuels. These targets have had a lasting and profound impact on China’s green and low-carbon development and carbon reduction policies over the subsequent years. This paper selects listed companies on China’s A-share market from 2010 to 2023 as the research sample. Information on collaborative innovation activities is sourced from the CNRDS database, while control variable data, including corporate financial and market information, is obtained from the CSMAR database, the RESSET database, and the Wind database. To enhance the validity of parameter estimation, the sample is selected according to the following criteria: (1) exclusion of the financial sector; (2) exclusion of ST and *ST listed companies; (3) all continuous variables are winsorized at the 1st and 99th percentile. After these adjustments, the final dataset consists of 43,678 observations.

Definition of key variables

-

(1)

Climate risk

Drawing on the method for constructing a climate risk index for U.S. listed companies outlined by Sautner et al. (2023), this study employs text analysis and word frequency statistics to develop a climate risk index for Chinese listed companies. The first step involves adopting Huynh et al. (2020) approach using a relevant vocabulary list and text analysis techniques to construct a national-level climate risk indicator. Specifically, this paper references official documents issued by the Chinese government, such as the State Council’s Notification on the Action Plan for Carbon Peaking Before 2030 and the State Council’s Notification on China’s National Climate Change Program to identify words related to climate change and risk, from which 100 foundational climate-related words were selected to form a climate risk vocabulary list.

In the second step, text analysis was conducted on the Management Discussion and Analysis sections from all Chinese listed companies from 2010 to 2023, using jieba (Hu et al. 2021), and sentence frequencies for all 100 relevant words were tallied. After excluding words that appeared less than ten times and manually adjusting for similar terms (e.g., solar energy and solar power generation), 48 high-frequency climate risk-related words were chosen to compile the climate risk dictionary, as detailed in Table 1. The third step calculates each company’s annual climate risk index (cc1) by dividing the word frequency of climate risk-related terms appearing in each year’s Management Discussion and Analysis by the total word count of the text. A higher frequency of climate risk-related words indicates a higher perception of climate risk for that company in that year. Additionally, the natural logarithm of the word frequency of climate risk-related terms plus one is used as an alternative measure of climate risk (cc2).

Table 1 Climate risk-related lexicon. -

(2)

Collaborative innovation

As China’s intellectual property protection system continues to improve, enterprises increasingly prioritize the exclusivity of their technology and knowledge, relying more on formal contracts to secure technological and knowledge resources (Fang et al. 2017). Collaborative innovation serves as a key method for mutual knowledge complementation and joint technological development between enterprises. To ensure the exclusivity of the technology and knowledge gained through collaborative innovation and to prevent competitors from free-riding at the expense of the participating enterprises’ rights, jointly filing for patents is an effective way to protect the interests inherent in collaborative innovation themes (Huang et al. 2024b). Compared to corporate R&D investment indicators, the number of patents jointly filed by listed companies reflects the attempts and efforts made in mutual communication and joint technological development with external entities. Moreover, according to the National Intellectual Property Administration, patent applications to grant can take six months to three years, so selecting the number of patents jointly applied for by companies as a measure of collaborative innovation considers a shorter lag time and more accurately reflects a company’s intention for collaborative innovation. Based on the research by Sun and Cheng (2019), this paper chooses the number of patents jointly applied for by companies to measure collaborative innovation and constructs the collaborative innovation index (ci1) by taking the logarithm of the sum of the number of jointly applied patents plus one.

-

(3)

Control variables

The model in this paper includes a series of control variables (Controls), encompassing debt level (leverage), total asset return rate (roa), company size (size), CEO-Chairman duality (dual), asset structure (tang), proportion of independent directors (indep), largest shareholder’s stake (top1), company growth (growth), company age (lnage), and cash flow from operating activities (cflow). Specific variable selection and calculation methods are detailed in Table 2.

Econometric model setup

To test the hypotheses proposed in this paper and considering the delayed response of firms to perceived climate risks in terms of joint patent applications, this study incorporates a lagged term in the regression model. The following econometric model (18) is established to examine the impact of climate risk on corporate collaborative innovation:

where \(i\) and \(t\) are used to differentiate between companies and years respectively. \({{Ci}}_{i,t}\) is the dependent variable, representing the level of collaborative innovation of firm \(i\) in year \(t\). \({{Cc}}_{i,t-1}\) is the climate risk index, representing the perceived climate risk by firm \(i\) in year \(t-1\), which is the main explanatory variable of interest. \({{{\rm {Controls}}}}_{i,t-1}\) includes a series of control variables as specified in Table 2. In addition to the control variables in the model mentioned above, time fixed effects (\({{{\rm {Years}}}}_{i,t-1}\)) and individual fixed effects (\({{{\rm {Companies}}}}_{i,t-1}\)) have also been included. \({\varepsilon }_{i,t-1}\) represents the residual term.

Additionally, this study employs a one-period lagged independent variable to examine the impact of climate risk on corporate collaborative innovation decisions. The rationale behind this approach lies in the lagged effect of corporate responses to climate risk perception. Specifically, firms require time to identify risks, evaluate decisions, formulate, and implement collaborative innovation strategies. This process involves decision-making and resource coordination, leading to a natural delay between risk perception and actual strategic action. By incorporating a one-period lagged explanatory variable, this study more accurately captures the causal relationship between climate risk perception and subsequent corporate decisions, while also helping to mitigate potential endogeneity issues, thereby enhancing the robustness of the findings.

Descriptive statistics

Table 3 presents the descriptive statistics of the main variables. In Panel A, the basic characteristics of the variables are reported. The Climate Risk Index 1 (cc1) shows a range from a minimum of 0 to a maximum of 2.070, indicating significant variability. This variability is even more pronounced in the alternative measurement (cc2). Similarly, the range for Corporate Collaborative Innovation (ci1) is substantial, spanning from 0.000 to 5.182. This demonstrates that the sample firms not only vary greatly in their perception of climate risk but also in their levels of collaborative innovation. The descriptive statistics for the other variables show no significant differences from those reported in existing studies.

Panel B further illustrates the evolution of the climate risk index from 2010 to 2023. Overall, the index shows an upward trend, with particularly sharp increases in 2012 and 2021, suggesting that climate risk surged dramatically during these periods.

Empirical results analysis

Unit root test

To ensure the robustness of the econometric analysis, this study follows the methodology of Li and Wei (2021) and applies the Fisher unit root test to examine the stationarity of the variables. This step is crucial to prevent spurious regression caused by non-stationary data. The Fisher unit root test results reject the null hypothesis of a unit root at the 1% significance level for all variables, indicating that the panel data used in this study are stationary. Therefore, these variables are suitable for subsequent regression analysis.

Baseline regression

Table 4 displays the regression results on the impact of climate risk perception on corporate operational strategies, thus testing Hypothesis 1 of this paper. The results in columns (1) and (2) indicate that when only the core explanatory variables are added for regression, the regression coefficients of corporate climate risk perception, measured by two different methods, are significantly positive at the 1% level. After incorporating control variables, the regression coefficients for the climate risk variable remain significantly positive. In terms of practical implications of the regression results, an increase of one standard deviation in the climate risk indexes, measured by both methods, would respectively enhance corporate collaborative innovation by 0.0432 (0.400*0.1310/1.212) and 0.0581 standard deviations (1.418*0.0497/1.212). These findings confirm the first hypothesis of this paper, that climate risk perception can promote corporate collaborative innovation.

Among the control variables, the coefficient of return on assets is significantly positive, indicating that firms with higher profitability have more abundant resources for innovation investment and are more likely to engage in collaborative innovation to achieve greater synergy. This finding aligns with the study by Li (2024). It suggests that highly profitable firms exhibit greater resource flexibility, enabling them to absorb the uncertainty costs of innovation and leverage collaborative innovation to enhance their market competitiveness.

The coefficient of firm size is significantly positive, demonstrating that larger firms are more inclined to participate in collaborative innovation, consistent with existing research (Wu and Ji, 2024; Chen et al. 2024). This supports the economies of scale and innovation resource integration perspectives, where larger firms have greater capacity to attract external resources and enhance collaboration efficiency. Larger firms also tend to have higher market influence, stronger R&D capabilities, and greater risk tolerance, making them better positioned for open innovation strategies.

The coefficient of firm age is significantly positive, suggesting that firms with a longer operating history tend to be more stable in the market, having accumulated more knowledge, experience, and social capital, which makes them more likely to engage in collaborative innovation. This finding implies that mature firms typically have richer cooperation experience and more stable market networks, giving them a competitive edge in innovation partnerships (Huang et al. 2023b).

Conversely, the coefficient of cash flow from operating activities is significantly negative, indicating that firms with higher cash flow are actually less inclined to engage in collaborative innovation. This phenomenon suggests that firms with ample cash flow may prefer in-house R&D over external collaboration, which aligns with the findings of Huang et al. (2024a).

Meanwhile, the coefficients of Leverage and dual are insignificant, suggesting that these factors are not primary determinants of corporate collaborative innovation, or that their impact might be context-dependent, varying based on specific institutional settings or market environments. This result is largely in line with prior studies (Wan et al. 2022; Wei et al. 2024; Chen et al. 2024).

Additionally, it is important to note that the R² value in the model is relatively low, which may indicate the presence of omitted variables affecting the explanatory power of the model. However, this does not undermine the validity of the results.

Robustness tests

In the aforementioned studies, this paper discussed the positive promotional effect of climate risk on corporate collaborative innovation. To further verify the stability of the empirical results, this study tests the baseline model by replacing the core explanatory variables, changing the measurement indicators of the dependent variables, and altering the estimation methods.

-

(1)

Replacement of core explanatory variables

Climate risk includes both physical risks and transition risks. In the robustness tests, following the approach of existing literature, we consider the impacts of both physical and transition risks on corporate collaborative innovation separately (Zhang et al. 2024). The keywords for physical and transition risks are listed in Table 1. The study measures physical risk using the natural logarithm of the frequency of physical risk-related words plus one (cc_p), and transition risk using the natural logarithm of the frequency of transition risk-related words plus one (cc_t). The results after substituting these two indicators for the core explanatory variable are shown in columns (1) and (2) of Table 5. The results indicate that the coefficients for both core explanatory variables are significantly positive at the 1% statistical level, confirming the robustness of the conclusions of this paper.

Table 5 Alternative core independent variable. -

(2)

Replacement of the dependent variable

Following the approach of Huang et al. (2023a), this paper adopts a method to remeasure corporate collaborative innovation. Given that patent applications are categorized into three types—utility model patents, invention patents, and design patents—and considering that substantial innovation contributes more significantly to the value of companies in distress than strategic innovation (Yan et al. 2023), this section excludes the number of design patents jointly applied for with other companies. Instead, it measures corporate collaborative innovation (ci2) using the logarithm of the sum of the number of invention and utility model patents jointly applied for with other companies plus one.

The regression results, as shown in columns (3) and (4) of Table 5, indicate that after changing the measurement method for the dependent variable, the perception of climate risk remains significantly positively correlated with the output of corporate collaborative innovation at the 1% levels, respectively. This further confirms the robustness of the conclusions of this paper.

-

(3)

Change in estimation method

Considering that the impact of climate risk varies across different industries and regions, to enhance the robustness and credibility of the results, this section incorporates both industry and regional fixed effects. As shown in Table 6, columns (1) and (2) display the results with added industry fixed effects, while columns (3) and (4) present the results with added regional fixed effects. After modifying the estimation method, the relationship between climate risk and corporate collaborative innovation remains positively correlated at the 1% levels respectively, confirming the robustness of the findings of this paper.

Endogeneity test

Due to potential issues of reverse causality and omitted variable bias, we have employed the instrumental variable (IV) approach in our analysis. Following the methodology of Fang et al. (2022), we use the average level of climate risk perception of other firms in the same industry and year as the instrumental variable (cc1_iv). This instrumental variable satisfies both relevance and exogeneity criteria: on one hand, a firm’s level of climate risk perception is influenced by its peer companies; on the other hand, the climate risk perception of other firms in the same industry and year does not affect the focal company’s collaborative innovation activities.

Column (1) of Table 7 presents the first-stage regression results of the instrumental variable (2SLS) approach, while Columns (2) and (3) report the second-stage regression results. The Kleibergen–Paap rk LM statistic is significant at the 1% level, rejecting the null hypothesis of under-identification of the instrumental variables. Additionally, the Cragg–Donald Wald F-statistic exceeds the critical value of the Stock-Yogo weak instrument test at the 10% significance level, rejecting the null hypothesis of weak instrument variables. Overall, these results confirm that the selected instrumental variables are valid and reliable. Furthermore, the coefficient of climate risk perception remains significantly positive at the 1% level, indicating that climate risk pressures firms to adopt collaborative innovation strategies. This further validates the robustness of the regression results.

In summary, the various robustness tests confirm that climate risk has a significant positive impact on corporate collaborative innovation, aligning with existing research findings. For instance, Xu et al. (2025) examined the historical perspective and found that in regions with higher historical climate risk, firms exhibit higher levels of collaborative innovation. Similarly, Liu et al. (2023b) indicated that in uncertain environments, stakeholders tend to adopt collaborative innovation strategies to mitigate risks. The findings of this study further support the positive effect of risk on collaborative innovation, reinforcing the risk-avoidance tendency of firms in the Chinese context.

DID estimation under extreme weather shocks

To accurately identify the impact of climate risk on corporate collaborative innovation and mitigate potential reverse causality between climate risk and innovation, this study employs an extreme climate event as an exogenous shock and applies the difference-in-differences (DID) model to evaluate the impact of the July 20, 2021, Henan torrential rain disaster on corporate collaborative innovation. From July 17 to 23, 2021, Henan Province experienced an unprecedented torrential rain, leading to severe flooding, particularly in Zhengzhou on July 20, which caused significant casualties and economic losses (Guo et al. 2023).

This event serves as an exogenous shock due to its sudden onset and regional concentration, which ensures both an external shock characteristic and a localized impact, making it a suitable natural experiment for constructing treatment and control groups. Firms in Henan Province are classified as the treatment group, while firms from other provinces constitute the control group. The post-event period is defined as 2022–2023, while the pre-event period covers 2019–2020. The DID estimation model is specified as follows:

where \({Y}_{i,t}\) represents the collaborative innovation level of firm \(i\) in year \(t\); \({{{{Treat}}}}_{i,t}* {{{{Post}}}}_{i,t}\) is the interaction term between the regional dummy variable and the post-event period dummy variable; \({X}_{i,t}\) is a set of control variables; \({\mu }_{i}\) represents firm fixed effects; \({\lambda }_{t}\) represents time fixed effects; \({\varepsilon }_{i,t}\) is the error term.

To validate the model specification, a parallel trend test was conducted first. As shown in Column (1) of Table 8, the coefficients for pre-event years are statistically insignificant, indicating no significant difference between the treatment and control groups before the flood event, satisfying the parallel trend assumption. Next, the baseline DID regression results in Column (2) show that the key interaction term is significantly positive at the 1% level, confirming that the flood event had a significant impact on listed firms. Finally, the dynamic effect model in Column (3) further reveals that the impact effect varies across post-event years, showing a gradual increasing trend, which suggests that the shock effect is persistent and dynamically evolving over time.

Mechanism analysis

As discussed in the section “Theoretical derivation and hypothesis formulation”, collaborative innovation is an effective response to the deterioration of asset unavailability and increased risk contagion under business cross-relations due to climate risk. Therefore, this section focuses on the mechanistic impact of climate risk on corporate collaborative innovation, exploring from the dimensions of asset stranding and cross-risk contagion.

Given the growing body of research indicating potential flaws in the traditionally used three-stage mediation effect (Jiang, 2022), specifically, three models involving three sets of variables may exhibit three endogeneity problems, necessitating at least two instrumental variables (IV1: X → Y, X → M; IV2: M → Y) and requiring that the three error terms e1, e2, and e3 be uncorrelated with each other. As empirical research often uses observational data, addressing these endogeneity issues can significantly complicate the study. To address this issue, this paper primarily follows the design approaches of Aguinis et al. (2017) and Wen et al. (2022): on one hand, by using bootstrap-derived percentile-based confidence intervals, which relax the assumptions of the Sobel (1982) test—where the mediation effect relies on the assumption that the product of coefficients is normally distributed; on the other hand, considering the relationship between the mediating variable and the dependent variable within the mediation effect can help enhance the completeness of the empirical chain.

-

(1)

Cross-risk

Firstly, to test the aforementioned mechanism, this paper, following the method of Han et al. (2023), constructs a variable, Risk, to measure cross-risk, defined as 1 if a company’s main business income number is higher than the industry median in the same year, and 0 otherwise. Secondly, following the mediation effect analysis approach and drawing from the research by Wen et al. (2022) and combined with the design of Model (18), this paper constructs the following mediation effect models:

$${{{{Risk}}}}_{i,t}={\beta }_{0}+{\beta }_{1}{{Cc}}_{i,t}+\sum {{{{Controls}}}}_{i,t}+{{{{Years}}}}_{i,t}+{{{{Companies}}}}_{i,t}+{\varepsilon }_{i,t}$$(20)$${{Ci}}_{i,t}={\beta }_{0}+{\beta }_{1}{{{\rm {Risk}}}}_{i,t}+\sum {{{{Controls}}}}_{i,t}+{{{{Years}}}}_{i,t}+{{{{Companies}}}}_{i,t}+{\varepsilon }_{i,t}$$(21)$${{Ci}}_{i,t}={\beta }_{0}+{\beta }_{1}{{Cc}}_{i,t}+{\beta }_{2}{{{{Risk}}}}_{i,t}+\sum {{{{Controls}}}}_{i,t}+{{{{Years}}}}_{i,t}+{{{{Companies}}}}_{i,t}+{\varepsilon }_{i,t}$$(22)The regression results are presented in Table 9. Columns (1) and (2) show that the regression coefficient of cc2 on risk is significantly positive, indicating that an increase in climate risk leads to a higher level of cross-risk contagion among firms. This finding supports the theoretical expectation that when firms face greater climate risks, inter-firm risk contagion effects intensify due to factors such as business interdependencies and balance sheet linkages, thereby increasing operational uncertainty. However, in the stepwise regression analysis, columns (3)–(5) indicate that the regression coefficient of risk on ci1 is insignificant, suggesting that the direct impact of cross-risk contagion on collaborative innovation remains uncertain. At the same time, the regression coefficient of cc on ci1 remains significantly positive and increases compared to the baseline regression, confirming that climate risk remains a key driver of corporate collaborative innovation. To further examine whether cross-risk contagion serves as a mediating mechanism between climate risk and collaborative innovation, this study conducted a Sobel test and employed the Bootstrap method (500 resampling iterations). The results indicate that the Z-statistic is 4.10, which is significant at the 1% level, and the 95% confidence interval [0.001153, 0.0032624] does not contain zero. These findings confirm that cross-risk contagion acts as a transmission mechanism between climate risk and corporate collaborative innovation, thus validating Hypothesis H2a.

Table 9 Mechanism analysis of cross-risk contagion. -

(2)

Stranded assets

The measurement of stranded assets has been approached differently by scholars. Some prefer using a firm’s fossil fuel reserves, extraction, and consumption levels, multiplying these by the national climate risk index as a proxy for stranded assets (Grant et al. 2024). However, this method is unsuitable for China, where fossil energy resources are largely state-owned. Three primary approaches have been proposed to measure corporate stranded assets. The first, introduced by Jung et al. (2021), constructs a portfolio of stranded asset investments and analyzes their monthly returns. The second, suggested by Liu and Qiao (2021), uses external events impacting firms in fossil fuel-sensitive industries as a proxy for stranded assets. The third method involves analyzing management discussion and analysis (MD&A) texts to identify the frequency of stranded asset-related terms, thereby capturing managerial perceptions of stranded asset risk (Xiao, 2024). This study adopts the third approach, using textual analysis of MD&A reports from all Chinese publicly listed firms from 2010 to 2023. Leveraging the Jieba algorithm, we identified stranded asset-related terms across five dimensions and selected 50 high-frequency keywords to construct a climate risk dictionary (Table 10). Finally, we calculated the stranded asset index for each firm by taking the natural logarithm of the term frequency plus one. A higher frequency of stranded asset-related terms indicates a greater perceived risk of asset stranding for that firm in a given year.

Following the mediation effect analysis discussed earlier and referencing the study by Wen et al. (2022), combined with the design of Model (1), this paper constructs the following mediation effect model:

The regression results in Table 11 indicate that the coefficients of cc1 and cc2 on stranded are significantly positive in columns (1) and (2), suggesting that increased climate risk leads to a higher degree of asset stranding. This finding aligns with expectations, as enterprises facing greater climate risk may experience asset devaluation or obsolescence due to policy adjustments, market shifts, or technological advancements. However, in the stepwise regression, columns (3)–(5) show that the coefficient of stranded on ci1 is not statistically significant, implying that the direct impact of stranded assets on corporate collaborative innovation remains uncertain. Meanwhile, the coefficient of cc on ci1 remains significantly positive and increases compared to the baseline regression, indicating that climate risk continues to be a strong driver of corporate collaborative innovation. To further examine whether stranded assets mediate the relationship between climate risk and collaborative innovation, a Sobel test and a Bootstrap test (500 resampling iterations) were conducted. The results show that the Z-statistic is 2.69, significant at the 1% level, with a 95% confidence interval of [0.0010211, 0.0064681], which does not include zero. These findings confirm that stranded assets serve as a micro-level mediating mechanism between climate risk and collaborative innovation. That is, while climate risk presents a macro-level threat, at the firm level, it results in asset stranding, which in turn stimulates enterprises to engage in collaborative innovation. This supports the proposed hypothesis H2b.

Summary of findings

The empirical results demonstrate that climate risk drives firms to engage in collaborative innovation. From the perspective of public resource governance theory (Ostrom, 1990), climate risk resembles the tragedy of the commons, as it exhibits typical negative externalities. When firms attempt to address climate risk individually, they face substantial cost pressures, and their isolated efforts often yield limited returns, ultimately exacerbating environmental problems (Hardin, 1968). In contrast, the compensatory driving mechanism theory emphasizes that collaborative innovation facilitates resource sharing among firms, enabling effective knowledge and cost distribution. This, in turn, reduces the burden of risk management for individual firms and helps align the costs and benefits of risk mitigation (Laursen and Salter, 2006). Specifically, collaborative innovation not only lowers the costs associated with addressing climate risk at the firm level but also allows firms to leverage public governance mechanisms—such as government innovation subsidies and tax incentives—to foster collective action. This helps firms proactively respond to public challenges and mitigates the negative effects of the tragedy of the commons caused by climate risk.

Further tests

Digital transformation

This paper employs two methods to measure digital transformation in enterprises. Firstly, following the research of Wu et al. (2021), a data pool is formed by extracting from the annual reports of listed companies using Python, categorizing and counting word frequencies based on 76 characteristic words, and then applying logarithmic processing to construct a measure of the degree of digitalization 1 (dg1). Secondly, drawing on Zhao et al. (2021), we build a corporate digitalization terminology dictionary comprising 197 words derived from national policy documents. Using the Jieba segmentation tool, we analyze the management discussion and analysis (MD&A) sections of annual reports to calculate the proportion of digitalization-related terms relative to the total length of the MD&A text, forming the second measure of digitalization (dg2).

The regression results, as shown in Table 12, indicate that in columns (1) and (2), the interaction terms between the first measure of digital transformation and climate risk indices (dg1*cc1 and dg1*cc2) are both significantly positive at the 1% level. Similarly, in columns (3) and (4), the interaction terms between the second measure of digital transformation and climate risk indices (dg2*cc1 and dg2*cc2) are also significantly positive at the 1% level. This suggests that digital transformation positively moderates the effect of climate risk on corporate collaborative innovation. Firms with a higher degree of digitalization have a natural advantage in engaging in collaborative innovation and are more inclined to cooperate with other firms to mitigate external climate risks, thereby confirming Hypothesis H3.

Corporate risk-taking

Following Wu et al. (2023), this paper uses the volatility of corporate cash flows to measure corporate risk-taking (Riskt). Specifically, we adopt a five-year rolling window approach to calculate the standard deviation of operating cash flow. This calculation includes the current year (t), the two preceding years (t−1, t−2), and the two following years (t + 1, t + 2) to capture fluctuations in cash flow. Compared to existing methods, this approach incorporates a longer time span and accounts for future cash flow variations, providing a more comprehensive reflection of a firm’s cash flow stability and potential liquidity risk.

As shown in Table 12, in column (5), the interaction term between corporate risk-taking and climate risk index 1 (riskt*cc1) has a regression coefficient that is significantly negative at the 5% level. Similarly, in column (6), the interaction term between corporate risk-taking and climate risk index 2 (riskt*cc2) is also significantly negatively correlated at the 5% level. This indicates that corporate risk-taking negatively moderates the motivational effect of climate risk on corporate collaborative innovation. Firms with higher risk-taking are more likely to act independently in the face of climate risk threats, rather than joining forces with other enterprises to undertake collaborative innovation, thus confirming Hypothesis H4.

Conclusions and implications

Research conclusions

This paper focuses on collaborative innovation among enterprises listed on China’s A-share market from 2010 to 2023, exploring the impact of climate risks on corporate innovation and development strategies. The main conclusion is that climate risks motivate companies to adopt a cooperative innovation model to mitigate risks rather than acting independently. This finding is supported by a series of robustness tests. Mechanism studies reveal that climate risks significantly drive collaborative innovation among listed companies by inducing stranded assets and increasing risk contagion. Tests on moderating effects show that the degree of digital transformation in enterprises facilitates communication and increases mutual trust among innovating entities, thereby enhancing the driving effect of climate risks on collaborative innovation; conversely, corporate risk-taking negatively moderates the motivational effect of climate risks on collaborative innovation. The conclusions of this study provide micro-level evidence that enterprises can effectively respond to abrupt external climate risks through collaborative innovation, offering insights and references for companies to use collaborative innovation to combat external climate risks and support their own high-quality development.

Policy recommendations

Based on the research findings, this study proposes the following policy recommendations to promote corporate collaborative innovation under climate risk conditions and facilitate high-quality development.

First, improve industrial policies to encourage low-carbon transformation and collaborative innovation. Climate risk perception has created dynamic shocks for enterprises in climate-sensitive industries, exacerbating business environment instability. Firms must continuously enhance their production technologies and reduce path dependence to overcome technological barriers and mitigate uncertainties caused by climate risk. Therefore, governments should formulate targeted industrial policies aligned with dual carbon goals, such as establishing incentives for low-carbon technology innovation, increasing fiscal support for green technology R&D, and encouraging enterprises to build collaborative innovation networks. When climate risk leads to stranded assets, firms can collaborate with upstream and downstream industry players, research institutions, and government agencies to advance green technology development and upgrade low-carbon production methods, enabling a smooth transition from carbon-intensive industries to sustainable development.

Second, optimize climate risk response mechanisms and promote cross-sectoral collaboration to share risks. Climate risk imposes both direct economic losses through physical risks and indirect constraints via stringent transition policies, reducing firms’ risk-taking capacity. This is particularly relevant for carbon-intensive industries, where policy adjustments may result in stranded assets, increased financing costs, and operational challenges. To address this, the government should implement policies that encourage firms to break traditional organizational boundaries and explore industry-wide collaborative innovation models, such as establishing technology alliances, sharing R&D platforms, and facilitating cross-industry knowledge exchange. Additionally, for firms affected by stranded assets due to climate policies, governments could introduce targeted subsidies or carbon reduction incentive funds to encourage joint R&D investment and risk-sharing with external partners, enhancing corporate resilience and competitiveness in the face of climate shocks.

Third, accelerate digital transformation to strengthen corporate collaborative innovation capabilities. The study finds that digital transformation positively moderates the impact of climate risk on corporate collaborative innovation. Therefore, governments and relevant agencies should accelerate digital transformation by establishing special funds for digitalization, creating smart manufacturing and green technology demonstration zones, and promoting the integration of AI, big data, and blockchain to enhance innovation resource allocation efficiency and collaborative innovation capacity. Firms should actively respond to policy initiatives by integrating digital technologies into production, operations, and supply chain management to enhance collaborative innovation capabilities and strengthen their competitiveness in the global green economy.

Research limitations and future directions

While this study explores the impact of climate risk on corporate collaborative innovation and validates its mechanisms through theoretical modeling and empirical analysis, it has certain limitations that future research can address.

First, although multiple control variables were included to mitigate omitted variable bias, data limitations may still lead to unobserved factors, such as government implicit guarantees, regional cultural differences, or industry policy support, which could significantly influence corporate collaborative innovation decisions. Future research could integrate more diverse data sources, such as firm-level surveys or government policy text analyses, to better account for these exogenous factors.

Second, this study focuses on listed firms in China, but the corporate landscape also includes a vast number of small and medium enterprises (SMEs), particularly unlisted private enterprises, whose collaborative innovation strategies may differ from those of listed companies. For instance, due to stronger financing constraints, SMEs may respond differently to climate risks and rely more on industrial clusters or supply chain collaborations for innovation. Future studies could expand the sample scope to examine how different types of firms engage in collaborative innovation under climate risk conditions.

Finally, this study primarily investigates how climate risk affects collaborative innovation through cross-risk contagion and stranded assets but does not explore firms’ adaptive responses under different policy environments. Under the dual carbon policy framework, various regional governments have implemented diverse low-carbon incentive policies, which may influence firms’ climate risk perceptions and responses. Future research could examine the heterogeneity of policy interventions to assess how government policies moderate the relationship between climate risk and collaborative innovation, providing more targeted empirical evidence for policymaking.

Data availability

All data generated or analyzed during this study are available in the published article and the accompanying supplementary information files.

References

Aguinis H, Edwards JR, Bradley KJ (2017) Improving our understanding of moderation and mediation in strategic management research. Organ Res Methods 20:665–685. https://doi.org/10.1177/1094428115627498

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17:99–120. https://doi.org/10.1177/014920639101700108