Abstract

This study examines the impact of formal and informal credit participation on the adoption of new technologies by family farms. Drawing on micro-survey data from two demonstration areas in China —Wuhan (Hubei Province) and Langxi (Anhui Province)—the analysis employs the propensity score matching (PSM) method for empirical identification. The results show that formal credit serves as a key driver of technology adoption. Specifically, formal credit is strongly associated with the uptake of capital-intensive, low-risk technologies, whereas informal credit is more relevant for the adoption of low-capital, high-risk technologies. Further analysis reveals significant heterogeneity in credit effects across farm sizes. Large farms, with greater collateral capacity, tend to access formal credit to invest in mechanization, whereas small farms rely more on short-term informal loans to meet liquidity needs. The structure of credit instruments also plays a critical role. Collateral-backed loans effectively support mechanization on large farms but may lead to credit misallocation for small farms. Short-term credit facilitates small-scale technology adoption by easing liquidity constraints. In contrast, the effects of long-term credit vary notably across regions. Overall, the findings highlight the complementary roles and structural differences of formal and informal finance in agricultural technology adoption. They offer theoretical insights for designing a tiered rural credit system and for developing differentiated financial support policies.

Similar content being viewed by others

Introduction

Technological progress is the principal engine of contemporary agricultural development, streamlining production processes, enhancing resource use efficiency, and underpinning long-term sustainability (Self and Grabowski, 2007; Khan et al. 2021). Nevertheless, the diffusion and uptake of new technologies remain constrained by several factors. Constraints include farmers’ awareness, infrastructure quality, farm scale, and limited financial resources (Guo et al. 2022; Hu et al. 2022; Balana and Oyeyemi, 2022). As emerging intensive production units, family farms leverage economies of scale and specialized management to serve as vital conduits for technology dissemination (Wu, 2022). However, advanced technologies typically demand substantial capital outlays for equipment upgrades, technical training, and improved seed varieties. This imposes considerable financial burdens on these operations. In this context, external financing becomes indispensable to supplement limited internal funds required by increasingly capital-intensive agricultural technologies (Appleton and Holt, 2024). This raises a critical question: to what extent does access to credit facilitate technology adoption among family farms? Addressing this question is crucial both for guiding micro-level decision-making and for informing targeted agricultural finance policies. It also contributes to advancing technology dissemination and thereby supports sustainable agricultural development.

The Food and Agriculture Organization (FAO) defines family farms as agricultural production units centred around family households, relying primarily on family labour while fulfilling economic, environmental, social, and cultural functionsFootnote 1. Historically, China’s agriculture was characterized by smallholders, marked by limited scale, outdated practices, and weak market integration. Recent rural labour migration and structural economic shifts have spurred the emergence of family farms. These farms occupy an intermediate position between smallholders and agribusinesses and are regarded as key drivers of agricultural modernization. Compared with smallholders, family farms benefit from economies of scale, professional management, and higher rates of technology adoption, making them better aligned with contemporary agricultural demands (Xu et al. 2024). Recognizing this potential, the Chinese government has actively promoted family farms since 2013 via demonstration zones, subsidized loans, extension services, and infrastructure investments (Huang, 2014).

A substantial body of literature has demonstrated that the adoption of agricultural technologies significantly improves the productivity and profitability of family farms (Awotide and Awoyemi, 2016; Mariyono and Kuntariningsih, 2024). The adoption behaviour is influenced by three broad categories of factors. The first relates to individual characteristics of farm operators, such as gender, technological perceptions, and educational background (Gao et al. 2017; Guo et al. 2022). The second concerns farm-level operational attributes, including production scale, farming models, and credit participation (Morris et al. 2017; Wu et al. 2023). The third involves external environmental factors, such as policy support, social networks, and technology extension services (Liu and Liu, 2024; Li et al. 2024). Among these, credit participation is particularly pivotal, as it alleviates financial constraints and directly influences adoption decisions (Kipkogei et al. 2025; Zulu et al. 2024; Jiang et al. 2024).

In China, family farms obtain financing through both formal and informal credit channels. Formal credit is provided by regulated financial institutions, while informal credit is typically sourced from private lenders, relatives, or social acquaintances (Ayyagari et al. 2010; Madestam, 2014). Formal credit alleviates liquidity shortages, underwrites capital-intensive investments, and mitigates adoption risk, thereby increasing farmers’ capacity and willingness to innovate (Boucher et al. 2008). Specifically, formal rural credit bridges structural financing gaps, fostering investment in high-yield technologies and improving technical efficiency (Chen et al. 2022a; 2022b). Given rapid urbanization and evolving agronomic practices, the role of formal credit for family farms is particularly critical. Empirical evidence from developing contexts suggests that well-targeted financial interventions can substantially ease credit constraints and stimulate technology uptake (Mishra et al. 2023). Nevertheless, informal lending persists as a vital complement. This is especially true for smaller farms constrained by collateral shortages and restrictive risk assessments. Informal credit, often based on social capital and trust, provides a flexible financing alternative that helps overcome the limitations of formal financial institutions (Jia and Lu, 2017; Yuan and Gao, 2012). By lowering financial barriers, informal credit facilitates investment in agricultural technologies and enhances overall technology diffusion.

Despite extensive research on the nexus between credit access and agricultural technology adoption, three notable gaps persist. First, most studies investigate either individual technologies or aggregate adoption behaviour, yet they neglect heterogeneity across technology types. Decisions are influenced by differences in capital intensity and risk exposure, but these dimensions remain underexplored. Second, credit is frequently modelled as a uniform variable, overlooking the divergent paths by which formal and informal credit influence adoption. Third, spatial spillovers from demonstration farms remain underexamined, despite their potential to accelerate regional diffusion.

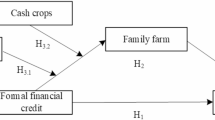

To address these gaps, this study develops a conceptual framework informed by portfolio-selection theory and empirically examines whether access to rural credit promotes the adoption of new agricultural technologies by family farms. The analysis uses micro-level survey data from two demonstration regions in China, namely the Wuhan model in Hubei Province and the Langxi model in Anhui Province. We employ propensity score matching (PSM) to isolate the effect of credit access on technology uptake. This study contributes to the literature in three important ways. First, by distinguishing formal and informal credit within a unified framework that accounts for farm scale, we elucidate nuanced financing channels and inform agricultural finance policy. Second, by leveraging micro-level data from targeted demonstration zones, we capture regional heterogeneity more effectively than national surveys. Finally, by incorporating neighbouring demonstration effects into our PSM analysis, we identify spatial spillovers and provide empirical guidance for optimizing demonstration programs. This work extends the literature on technology diffusion and offers empirical evidence to refine demonstration program design and technology transfer policies.

Theoretical analysis and research hypothesis

Rural credit and new agricultural technology adoption

Building on the theoretical frameworks proposed by Feder (1980) and Lin (1991), the adoption of new agricultural technologies can be conceptualized as a portfolio selection problem. In this framework, farmers allocate resources between old and new technologies to maximize their expected utility while managing associated risks. Let \({Y}_{i}\) represent the total output of family farm \(i\) and let \({r}_{i}\) denote the adoption rate of the new technology. The yields produced under the old and new technologies are represented by \({y}_{i,O}\) and \({y}_{i,N}\), respectively, with \({D}_{i}={y}_{i,N}-{y}_{i,O}\) capturing the expected yield gain from adopting the new technology. The total output \({Y}_{i}\) can be expressed as:

This equation assumes that the yield under the old technology remains constant, and adopting new technologies introduces both potential benefits and risks. The parameter \({r}_{i}\) reflects the extent to which family farm \(i\) integrates the new technology into its operations, balancing expected yield improvements against risk considerations. If family farm \(i\) fully adopts the new technology across its farmland, its income variance can be modelled as:

Here, \({L}_{i}\) represents available credit to family farm i, which acts as a critical enabler for absorbing the costs associated with new technology adoption. \({Z}_{i}\) encompasses household characteristics, including the education level of the farm operator, training participation, and demographic factors, which influence the capacity to manage technological change. E denotes the cost of acquiring and implementing the new technology, which varies depending on market conditions and regional resource endowments. When only a proportion ri of farmland is dedicated to the new technology, the associated income variance becomes:

The variance of a family farm’s income is positively associated with its new technology adoption rate (\({r}_{i}\)), and this variance increases at an accelerating rate as \({r}_{i}\) grows. The risk loss function can be expressed as:

Equations (4) and (5) imply that, under otherwise identical conditions, the risk loss increases at an accelerating rate with the adoption rate of new technologies. However, access to credit can mitigate this loss by providing financial flexibility.

Assuming no price difference between the old and new technologies in the market, the expected price of agricultural products is denoted as P. The expected return for family farm i is given by:

The family farm’s objective is to maximize its expected return by optimally choosing the adoption rate \({r}_{i}\) subject to the constraint \({r}_{i}\in [\mathrm{0,1}]\). This optimization problem reflects the economic decision-making process of balancing expected gains against associated risks. The optimization problem is as follows:

The first order condition of optimization is as follows:

Substituting the components of the model, this condition becomes:

This equation indicates that the marginal expected return from adopting new technology must equal the marginal risk loss. In other words, farmers will only increase their adoption rate if the additional expected returns from adoption outweigh the additional risks.

The second-order condition of the risk loss function \(C\left(\cdot \right)\), ensures that the solution \({{r}_{i}}^{* }\) maximizes the expected return. Using the implicit function theorem, the relationship between credit availability (\({L}_{i}\)) and the optimal adoption rate (\({{r}_{i}}^{* }\)) can be derived as:

This relationship demonstrates that expanded credit access eases financial constraints and elevates technology adoption rates among family farms. Credit availability not only enables investment in high-yield technologies but also mitigates the marginal risk burden of technology adoption.

Accordingly, we posit Hypothesis 1: Rural credit exerts a positive effect on family farms’ adoption of new agricultural technologies. This result underscores credit’s pivotal role in advancing technology diffusion—not only as a source of capital but also as a mechanism for reducing risk exposure. By bridging financial gaps and mitigating uncertainties, rural credit serves as a critical enabler of technology adoption and broader agricultural modernization.

Rural finance comprises two segments: formal credit and informal credit

In low-income economies, financial repression, institutional weaknesses, and market failures give rise to a pronounced duality in credit markets (Germidis et al. 1991). Formal credit functions within a regulated financial system—offered by entities such as commercial and policy banks—whereas informal credit stems from unregulated sources, including private lenders, relatives, and friends (Campero and Kaiser, 2013). As emerging rural enterprises, family farms increasingly rely on modern technologies to expand operations and enhance efficiency. This shift renders them more dependent on external financing compared to traditional smallholders (Huang et al. 2023). When new technology adoption entails substantial capital investment, family farms lacking adequate funds must resort to external credit (Croppenstedt et al. 2003). Ultimately, credit’s impact on technology adoption hinges on both the cost structures and accessibility of formal and informal credit.

Formal credit offers stable interest rates that alleviate liquidity constraints, thereby facilitating adoption of agricultural technologies (Yadav and Rao, 2024). However, in rural China, the formal financing requirements of family farm operators frequently remain unmet (Chen et al. 2022a; 2022b). Under asymmetric information, formal financial institutions internalize transaction costs via collateral requirements and credit-scoring mechanisms. This process systematically excludes high-risk technology projects (Stiglitz and Weiss, 1981). High operational risks, inadequate collateral, and persistent information asymmetries further impede access to formal credit; when technology adoption entails substantial risk, formal lenders often reject loan applications (Anang and Kabore, 2021).

In this context, the informal credit system serves as a critical complement, leveraging social networks and lower transaction costs. In rural China, informal credit is deeply rooted in kinship and local ties, effectively reducing financing transaction costs for family farms (Chai et al. 2019). Within stable social networks, repeated interactions foster reputational mechanisms that screen family farm operators’ credit risk and mitigate information asymmetries, thereby facilitating credit access (Greif, 1993; Banerjee et al. 1994). From a transaction cost perspective, the flexibility of informal credit aligns with the unique requirements of agricultural technology investments. Because agricultural production is spatially and temporally specific—certain crops depend on particular plots—standardized contracts from formal institutions often fail to accommodate such uncertainties (Rindfleisch, 2020). In contrast, informal credit employs flexible interest rates and install arrangements through informal negotiations, achieving adaptive efficiency under bounded rationality and opportunism (North, 1990).

The distinct features of formal and informal credit have thus shaped differentiated financing pathways for family farms in the adoption of technologies. Formal credit, with its stable interest rates and larger financing capacity, significantly reduces financing frictions for capital-intensive, low-risk projects (e.g., water-saving irrigation systems) (Halimi et al. 2025). In contrast, informal credit, which leverages close local social networks, provides more efficient and lower-cost financing that is better suited for projects with lower capital thresholds and higher operational risks (e.g., experimental cultivation of specialty crops) (Mansour et al. 2024).

On the basis of these observations, we posit Research Hypothesis 2: formal credit will promote adoption of capital-intensive, low-risk projects, whereas informal credit will more readily facilitate adoption of projects characterized by lower capital requirements and higher technological risks.

Research design

Data sources

This study utilizes data from a dedicated 2017 survey of family farm operations administered by the Economic Development Research Centre at Wuhan University (Hubei Province, China). The survey comprehensively recorded family farms’ 2016 fiscal-year credit status, adoption of new agricultural technologies, structural characteristics, and production and operational attributes. This survey encompassed all registered family farms in Wuhan (Hubei Province) and Langxi (Anhui Province). Both regions serve as pilot zones under China’s national family farm development strategy, yet they exhibit markedly different development models. The Wuhan model reflects an urban-oriented agricultural pathway fuelled by rapid urbanization and distinguished by high-value crop production. In contrast, the Langxi model represents a traditional agricultural transformation pathway in less-developed regions, emphasizing large-scale production and mechanization.

These two models illustrate China’s principal agricultural evolution pathways across diverse regional and resource contexts, providing valuable insights and benchmarks for other areas nationwide. The survey yielded 629 valid responses, including 331 from Wuhan and 298 from Langxi. This high-quality dataset offers a comprehensive overview of family farms’ production and operational characteristics in these regions, laying a robust foundation for ensuing empirical analyses.

Empirical model

To examine the impact of rural credit participation on the adoption of new agricultural technologies by Chinese family farms, the following model is specified:

Where \({Y}_{i}\) is the dependent variable, representing the number of new technologies adopted by family farm \(i\). \({{Credit}}_{i}\) is the core explanatory variable, indicating whether the family farm obtained rural credit. \(\alpha\) is the key parameter, capturing the effect of rural credit participation on the adoption of new agricultural technologies by family farms. \({\sum }_{k=1}^{n}{Z}_{{ik}}\) represents a vector of control variables that account for individual and farm-level unobservable characteristics. \({\varepsilon }_{i}\) is the random error term.

In using Eq. (1), potential selection bias arises if family farms’ decisions to participate in credit programs are influenced by unobserved individual or farm-level heterogeneity. Such heterogeneity may include factors influencing credit participation decisions, potentially leading to biased results. To address this issue, this study applies the Propensity Score Matching (PSM) method to mitigate self-selection bias. Based on the counterfactual analysis framework proposed by Rosenbaum and Rubin (1983), the average treatment effect of the treated (ATT) is defined as follows:

Where \({P}_{1i}\) and \({P}_{0i}\) represent the adoption of new technologies by family farm \(i\) under treatment and non-treatment conditions, respectively. Since \({P}_{0i}\) under \({D}_{i}=1\) is unobservable, counterfactual analysis is employed to estimate it.

In this framework, \({D}_{i}=1\) indicates that the family farm participates in rural credit programs, while \({D}_{i}=0\) denotes non-participation. \(P\left({\sum }_{l=1}^{n}{Z}_{{il}}\right)\) is the propensity score, estimated using a logit model. The vector \({Z}_{il}\) represents household and farm-level matching variables, ensuring comparability between treatment and control groups.

Variable selection

Dependent Variable

The dependent variable in this study is the number of new technologies adopted by family farms in their production and operations. Considering the potential role of rural financial credit in supplementing capital and mitigating risks to promote the adoption of new technologies, agricultural technologies are categorized into four groups based on their capital requirements and risk characteristics (as detailed in Table 1). New crop varieties and fertilizers are primarily used to enhance agricultural yields but require significant capital investment and are highly dependent on environmental conditions during application, making them high-capital, high-risk technologies. New machinery, while also capital-intensive, helps reduce output uncertainty by improving yields and product quality, classifying it as high-capital, low-risk technology. In contrast, new pesticides and pest control methods require relatively low capital investment but are highly dependent on complex environmental conditions, placing them in the low-capital, high-risk category. Lastly, new production and management methods demand minimal capital and remain in the early stages of adoption in China’s agricultural sector. These methods effectively reduce output uncertainty and are classified as low-capital, low-risk technologies.

Independent Variables

To evaluate the impact of rural credit participation on the adoption of new technologies, this study measures rural financial development using the accessibility of formal and informal financial resources. Specifically, formal financial development is assigned a value of 1 if a family farm secures financial support from formal institutions such as banks; otherwise, it is assigned a value of 0. Similarly, informal financial development is assigned a value of 1 if a family farm receives loans from relatives, friends, or informal financial organizations; otherwise, it is assigned a value of 0. This dual financial perspective enables the study to explore the differential effects of formal and informal credit on the adoption of new agricultural technologies.

Matching Variables

To control for potential confounding factors influencing the adoption of new technologies by family farms, several matching variables are selected based on prior studies and the research context. These include individual characteristics, such as the farm operator’s gender, age, educational level, and participation in vocational training, which reflect cognitive ability and receptiveness to new technologies. Household characteristics, including household labour supply and wealth levels, capture labour availability and capital accumulation capacity. Production and operational characteristics encompass access to government technical services, subsidies, operation type, revenue-to-cost ratio, operational size, financial system development, demonstration farm status, the availability of technical and managerial talent, and insurance coverage, all of which directly influence production efficiency and risk management. Additionally, interpersonal relationship factors are considered, including participation in cooperatives, holding village leadership positions, having family members employed in government or financial institutions, and proximity to demonstration farms.

Special attention is given to the proximity effect of demonstration farms as a matching variable. Due to the interplay of geographic and kinship factors, long-term residents in the same area often maintain close relationships that may influence decisions to adopt new technologies. However, given the profit-driven nature of production decisions, this study posits that proximity effects are significant only for larger-size and higher-income family farms. To measure this effect, family farms within the same township are treated as a cluster, and the average level of technology adoption by demonstration farms within the cluster is used as a proxy. This approach captures the potential influence of proximity effects on farmers’ decision-making. Detailed definitions of all variables are provided in Table 2.

Descriptive statistics

After data cleaning, 479 valid samples were obtained, including 233 from Wuhan and 246 from Langxi. Table 3 presents the descriptive statistics of the key variables. Significant regional differences are observed in the core independent variables of this study. In terms of credit access, 19.74% of family farms in Wuhan obtained formal financial loans, compared to a significantly higher proportion of 67.48% in Langxi. Conversely, 45.92% of family farms in Wuhan received informal financial loans, whereas only 24.39% did so in Langxi. Regarding farm operation types, family farms in Wuhan exhibited a relatively balanced distribution between crop farming (41.20%) and livestock farming (39.48%). In contrast, family farms in Langxi were predominantly engaged in crop farming, with 74.80% of farms falling into this category. Given these notable regional differences, the data from Wuhan and Langxi were analysed separately to ensure the scientific rigour and applicability of the study’s findings.

As shown in Table 3, the average adoption of new technologies by family farms in Langxi (1.59) is higher than that in Wuhan (1.36). However, the smaller standard deviation in Langxi indicates less variation in technology adoption among farms. In terms of formal financial loans, the proportion of family farms in Langxi (0.67) is much higher than in Wuhan (0.20). Conversely, the proportion of informal financial loans is significantly higher in Wuhan (0.46) than in Langxi (0.24). Other variables, such as gender, education level, labour availability, government technical services, and subsidies, also exhibit regional differences.

To further investigate the impact of financial credit on the adoption of new technologies, the samples were divided into treatment and control groups based on whether the farms received credit. Table 4 reports the mean differences in technology adoption across different types of loans. The results indicate that family farms receiving formal financial loans exhibit significantly higher levels of technology adoption compared to those without formal credit. This trend is particularly pronounced in high-capital, low-risk technologies (e.g., new machinery) and low-capital, low-risk technologies (e.g., new management methods). In contrast, the effect of informal loans on technology adoption is relatively limited, with some variation between Wuhan and Langxi.

The data in Table 4 provide a more detailed breakdown of technology types and the influence of credit support. In Wuhan, the adoption rate of high-capital, low-risk technologies among the treatment group with formal loans (0.3261) is significantly higher than that of the control group (0.1497). A similar trend is observed in Langxi, where the adoption rate is 0.2651 for the treatment group compared to 0.0750 for the control group. The effect of informal loans on high-capital technologies is weaker, while its impact on low-capital technologies is more balanced, as evidenced by smaller mean differences between the treatment and control groups.

These findings highlight the critical role of financial credit in promoting the adoption of new technologies by family farms, particularly the strong influence of formal financial loans on high-capital, low-risk technologies. This preliminary analysis provides a solid foundation for subsequent empirical investigations.

Empirical analysis

Selection of matching variables and propensity score calculation

Table 5 presents the propensity score estimation results for formal rural credit, highlighting notable differences between Wuhan and Langxi. These differences may reflect variations in regional resource endowments, economic structures, and institutional environments. In Wuhan, access to formal loans is closely associated with operation type, farm size, financial regulation, agricultural insurance, and demonstration effects. This aligns with Wuhan’s urban-oriented agricultural model, where farms specializing in high-value crops or diversified operations tend to exhibit economies of size, enhanced profitability, and improved creditworthiness. The region’s developed financial system and widespread agricultural insurance likely reduce lending risks, increasing the likelihood that formal financial institutions extend credit. Demonstration farms also appear to play an important role, as their success may influence neighbouring farmers’ credit decisions and technology adoption.

In contrast, Langxi’s rural credit determinants emphasize policy-driven factors and social capital. Government subsidies, cooperative membership, and demonstration farm status are important correlates of loan access, reflecting the region’s reliance on public support mechanisms. Given Langxi’s underdeveloped financial infrastructure, cooperative membership may facilitate access to joint loans and group guarantees, helping to address lender concerns about individual borrower risk. Demonstration farms may serve as a channel for technology diffusion and financial access, reinforcing the role of local networks in rural credit markets.

Despite these insights, several key variables exhibit statistical insignificance, warranting further discussion. Individual attributes, including gender, age, and education, show no significant effect on loan access, which may reflect a tendency among formal lenders prioritize financial metrics such as assets, collateral, and profitability over personal characteristics. Training participation similarly lacks significance, suggesting that general agricultural training may not directly enhance a farm’s creditworthiness unless it explicitly improves financial literacy or risk management capabilities. Family wealth does not significantly influence credit access, which could reflect financial institutions’ reliance on fixed assets rather than liquid wealth as collateral. Additionally, agricultural technical services fail to yield a significant effect, possibly due to limited access to such services or a disconnect between technical assistance and lenders’ credit evaluation criteria. Government or financial sector work experience also lacks significance, suggesting that such affiliations may have limited weight in a system where loan approval probabilities in a system driven by formal financial metrics rather than social capital. These findings underscore the complexity of rural credit allocation and highlight the varying roles of financial, policy, and social factors in different regional contexts.

Common support assumption and balance test

This study employs the nearest-neighbour matching method to analyse propensity scores and ensure the quality of matching between the treatment and control groups. The estimated propensity score density functions suggest the presence of a substantial common support region between treatment and control groups, with the vast majority of observations falling within this domain. This suggests that the data adequately satisfy the common support assumption. During the matching process, only a small number of observations were excluded, which is unlikely to substantially the overall representativeness of the matched sample.

The results of the balance test further suggest that the matching process improved covariate balance. After matching, the absolute standardized biases of most variables fall within 10% (see Appendix Table A1), which is generally considered acceptable under the balance assumption. These findings lend support to the validity of the matching method, providing a reasonable basis for subsequent analysis.

Analysis of average treatment effects

The results in Table 6 indicate that formal financial credit has a significant positive average treatment effect (ATT) on the adoption of new agricultural technologies by family farms in both Wuhan and Langxi. Specifically, the estimated ATT for family farms in Wuhan is 0.5498, significant at the 10% level, while the ATT for Langxi is 0.6074, significant at the 5% level. These findings suggest that access to formal financial credit enhances the likelihood of technology adoption, providing empirical support for Hypothesis H1. This highlights the potential importance of formal credit in facilitating agricultural innovation, strengthening farm productivity, and promoting technological diffusion within the rural economy.

From a technology classification perspective, the estimation results reveal that formal financial credit is significantly associated with increased adoption of high-capital, low-risk technologies in both Wuhan and Langxi. In Wuhan, the ATT for these technologies is 0.1792, significant at the 10% level, whereas other categories—high-capital, high-risk; low-capital, high-risk; and low-capital, low-risk—yield ATT estimates of 0.1500, 0.1750, and 0.0500, respectively, none of which are statistically significant. A similar pattern emerges in Langxi, where formal financial credit strongly influences high-capital, low-risk technologies but exerts limited effects on other technology types. These findings suggest that credit availability may differentially influence all technology adoption decisions but is contingent on the risk-return profile of different agricultural innovations.

The lack of significance for high-capital, high-risk technologies suggests that although these technologies offer high return potential, their elevated uncertainty discourages widespread adoption, particularly among risk-averse farm operators. Formal financial institutions may also exhibit hesitancy in financing such technologies due to concerns over default risks and investment failures, which do not align well with their risk control frameworks. Similarly, the non-significant ATT estimates for low-capital, high-risk and low-capital, low-risk technologies suggest that their adoption is not heavily dependent on external credit support. Given their lower capital requirements, these technologies can often be financed through self-funding or informal lending channels rather than formal financial credit. Additionally, the decision to adopt low-capital technologies is likely influenced more by operational feasibility, resource availability, and farm-specific production strategies rather than financial constraints.

These findings highlight the selective nature of formal financial credit in shaping technological upgrading among family farms. Formal lenders appear to favour technologies that maximize financial stability while minimizing risk exposure, reinforcing the broader risk-return trade-off inherent in farm operators’ investment decisions.

Comparative analysis of formal and informal rural credit

To further examine the heterogeneous effects of rural credit on the adoption of different types of agricultural technologies by family farms and to compare the roles of formal and informal credit, this study estimates the ATTs of both credit types on technology adoption. The results are presented in Table 7. As previously discussed, formal financial credit is significantly associated with increased adoption of high-capital, low-risk technologies. However, in rural areas where access to formal financial services is limited, informal credit may serve as an important alternative financing channel. Given its flexible lending structure, the impact of informal credit on technology adoption may vary under different conditions. A systematic comparison of formal and informal credit provides a more comprehensive understanding of their respective roles in agricultural technology adoption.

The estimates in Table 7 suggest that formal financial credit is more strongly associated with the adoption of capital-intensive, low-risk technologies. This pattern may arise because financial institutions perceive these loans as more manageable in terms of risk control. In contrast, informal financial credit exhibits a different pattern of influence. While its overall effect on technology adoption is not statistically significant in either region, disaggregated results suggest that informal credit may be more frequently associated with the adoption of high-risk technologies. In Wuhan, informal credit significantly increases the likelihood of adopting low-capital, high-risk technologies, with an ATT of 0.1402, significant at the 10% level. A similar effect is observed in Langxi, where the ATT for this category is 0.1905, also significant at the 10% level. These results suggest that informal credit may be more commonly used to finance riskier technologies, likely due to its flexible lending conditions and reliance on social network-based credit mechanisms.

These findings are consistent with the descriptive statistics presented earlier and lend further support to the distinct patterns observed for formal and informal credit in agricultural technology adoption. Formal credit alleviates financial constraints primarily for high-capital, low-risk technologies, whereas informal credit serves as a supplementary financing channel that supports the adoption of high-risk technologies. The differences in the mechanisms of formal and informal credit highlight the diverse financial strategies employed by family farms in agricultural technology upgrading. They also suggest the potentially complementary functions of different credit systems in influencing farm investment decisions.

Discussion

Discussion of size heterogeneity in the adoption effects of new technologies

Agricultural production generally exhibits increasing returns to size, making farm size a key factor in productivity and technology adoption (Zhang, 1996; Li et al. 2015). Compared to small, fragmented farms, larger farms are often better positioned to meet modern agricultural demands, tend to allocate resources more efficiently, and are more likely to adopt advanced technologies. Thus, farm size may serve as an important factor in assessing how rural credit influences technology adoption, affecting marginal costs, credit accessibility, and risk management. To examine the heterogeneity in technology adoption, this study classifies farms into large-size and small-size groups based on operational area. We estimate the average treatment effects (ATT) of formal and informal credit participation separately. To ensure robustness and minimize potential bias from matching method selection, we employ three techniques: nearest-neighbour, radius, and kernel matching.

Table 8 presents the ATT estimates for technology adoption across different matching methods, categorized by farm size and credit type. The results indicate substantial variation in the estimated effects of credit participation, with both direction and significance varying by credit type, farm size, and matching method. Specifically, formal credit consistently associated with increased technology adoption among large-scale farms in Wuhan and Langxi, as evidenced by positive and statistically significant ATT estimates across all specifications. This finding suggests that formal credit may help ease financial constraints, enabling large-scale farms to invest more readily in technological upgrading. In contrast, the impact of formal credit on small-scale farms is generally insignificant, which may reflect constraints such as insufficient collateral or risk aversion, though this interpretation warrants further empirical verification.

The effects of informal credit exhibit greater complexity. In Wuhan, informal credit is significantly associated with higher technology adoption among small-scale farms under kernel matching (ATT = 0.4108, significant at the 10% level), whereas in Langxi, informal credit appears to exert a more positive effect on technology adoption among large-scale farms. These findings suggest that informal credit may serve as a supplementary financing channel, though its effectiveness appears contingent on local social capital and financial market conditions. While informal credit may serve as an alternative financing source when access to formal credit is constrained, its impact remains inconsistent and highly context-dependent.

Overall, formal credit primarily facilitates technology adoption among large-scale farms, enabling greater investment in productivity-enhancing technologies. Small-scale farms, constrained by financial limitations, are relatively less likely to benefit from formal credit. Informal credit can, under certain conditions, support technology adoption—particularly when social networks provide alternative financing mechanisms—yet its broader impact remains limited and subject to contextual influences.

Discussion of heterogeneity in the size of adoption of specific new technologies

To further investigate the heterogeneous effects of formal and informal credit on technology adoption across farm sizes, this study separately estimates their impacts on the adoption of specific agricultural technologies. Table 9 presents the average treatment effect (ATT) estimates for the adoption of new seed varieties, machinery, fertilizers, pesticides, pest control methods, new production techniques, and management practices among large and small farms in Wuhan and Langxi.

The results indicate that in Wuhan, formal credit is significantly associated with increased mechanization adoption among large farms (ATT = 0.2083, 1% level). However, its effect on small farms in Wuhan is not statistically significant across all technology categories, which may limit their ability to fully utilize formal credit for technology adoption. In Langxi, a similar pattern emerges, where formal credit significantly enhances mechanization adoption among large farms (ATT = 0.2449, 5% level). Unlike in Wuhan, small farms in Langxi also show significant associations with formal credit, particularly in adopting new machinery, pesticides, and pest control methods, reflecting differences in credit access, policy incentives, and production risks across regions.

For informal credit, the effects exhibit a different pattern. While its impact on large farms in Wuhan is generally weak, it significantly increases the adoption of pest control technologies (ATT = 0.1800, 10% level). Among small farms, informal credit is associated with the adoption of new pesticides, pest control technologies, and new management practices, indicating its role in financing lower-capital, higher-risk agricultural inputs. A similar pattern is observed in Langxi, where informal finance is linked to the adoption of high-uncertainty new technologies among family farms. Specifically, it significantly increases the adoption of pest control technologies among large-scale farms, while enhancing the adoption of both pest control technologies and new pesticides among small-scale farms.

Overall, formal credit is more commonly associated with the adoption of capital-intensive, low-risk technologies, particularly mechanization, among large farms, while its effect on small farms is weaker, becoming significant only in Langxi, where policy interventions may have improved access to credit via risk-sharing mechanisms and government-backed guarantees. In Wuhan, where the financial market is more developed, formal credit remains concentrated among large farms, reflecting the natural segmentation of the credit market. By contrast, informal credit is frequently used by small farms, particularly in the adoption of low-capital, higher-risk technologies such as pest control and new pesticides. In Wuhan, small farms also utilize informal financing to improve farm management practices, suggesting it may play a role in supporting short-term, flexible investments. Among large farms, informal credit is mainly used for pest control technologies, suggesting that even well-capitalized farms may turn to informal financing when formal credit constraints persist.

Discussion of size heterogeneity under different credit characteristics

In examining farm size heterogeneity, differences in credit structures may also emerge. Credit access is not solely determined by farm size but is also influenced by collateral requirements and loan terms. To investigate these variations, this study analyses the differential effects of formal credit constraints, focusing on collateral-backed loans, short-term loans, and long-term loans. Table 10 presents ATT estimates for these credit conditions across farms of different sizes in Wuhan and Langxi.

The results indicate that is significantly associated with increased technology adoption among large farms in both Wuhan and Langxi, with ATT estimates of 0.6267 and 0.5357, respectively. However, its effect on small farms is not significant and even negative in Langxi (−0.2099). When distinguished by loan terms, short-term loans do not significantly affect technology adoption among large farms in either region but is significantly associated with increased adoption among small farms, with a stronger effect in Langxi (ATT = 0.8889). Long-term loans, in contrast, are significantly associated with higher technology adoption among large farms in both Wuhan and Langxi, with the effect being more pronounced in Wuhan (ATT = 0.9375). For small farms, long-term loans significantly influence technology adoption only in Langxi, reflecting potential differences in financial market conditions and policy interventions.

Overall, collateral-backed loans may play an important role in facilitating technology adoption among large farms, while their impact on small farms remains weak and inconsistent. In terms of loan terms, long-term loans effectively support technology adoption among large farms, whereas their effect on small farms varies by region. By contrast, short-term loans primarily benefit small farms, with no significant impact on large farms. These findings suggest the presence of distinct credit–technology allocation patterns between large and small farms. Large farms tend to allocate loans toward mechanization investments, as these assets are well-suited for collateral-backed financing, which may form a cycle linking credit investment, asset accumulation, and productivity improvement. Consequently, when large farms access collateralized loans, their mechanization efficiency improves significantly. The limited economies of scale resulting from land fragmentation constrain small farms’ capacity to invest efficiently in mechanization. As a result, collateral-backed loans are more likely to be diverted toward non-productive uses, potentially contributing to the unstable and insignificant estimates observed.

The heterogeneous effects of loan terms further reflect the capital requirements associated with different technologies. Mechanization investments typically require large-scale financing and longer payback periods. As a result, long-term credit is more compatible with the investment needs of large farms and increases the likelihood of successful technology adoption and asset accumulation. In contrast, short-term credit alleviates liquidity constraints and is significantly associated with higher adoption of low-capital, short-cycle technologies such as pest control. This effect is particularly pronounced in Langxi, where stronger policy interventions help mitigate financial barriers, suggesting that this may reflect the interaction between technology type, risk profile, and institutional support mechanisms.

Conclusions and policy suggestions

This study utilizes micro-survey data from family farms in Wuhan (Hubei) and Langxi (Anhui) collected in 2017 to systematically examine the impact of rural credit on agricultural technology adoption and its heterogeneity. The empirical analysis yields several key findings. First, formal and informal credit are associated with distinct patterns in technology adoption. Formal credit is significantly associated with the adoption of capital-intensive, low-risk technologies. In contrast, informal credit serves as a complementary financing channel, primarily supporting the adoption of low-capital, high-risk technologies. This division may reflect a dynamic alignment between the credit system and the risk-return characteristics of agricultural innovation. Second, credit allocation mechanisms vary significantly across regions. In Wuhan, where financial markets are more developed, credit distribution appears to be shaped mainly by farm characteristics and risk mitigation tools. In Langxi, credit access tends to depend more on policy support networks, with government subsidies and cooperative-based mutual credit playing a central role. Social capital, particularly through joint liability mechanisms, supplements the function of formal financial institutions. Third, the effect of credit on technology adoption differs by farm size. Large farms, with stronger collateral capacity and scale advantages, are more likely to access long-term formal credit for mechanization. In contrast, small farms, constrained by limited assets and higher risk aversion, derive relatively smaller benefits. Their credit use primarily targets short-term liquidity needs, with observed empirical associations in pest control and new pesticide adoption. However, their overall capacity for technology upgrading remains limited. Fourth, credit structure appears to influence the pathways through which technology adoption occurs. Collateral-backed loans primarily support mechanization investment among large farms but may lead to credit misallocation risks for small farms. Long-term credit is more suitable for capital-intensive technology adoption in large farms, although policy interventions in Langxi enable small farms to benefit as well. Short-term credit primarily alleviates operational constraints for small farms. These findings highlight the structural segmentation of rural financial markets and the differentiated role of credit in facilitating technology adoption.

The empirical findings suggest that optimizing rural credit systems may be essential for fostering agricultural technology adoption. Different types of credit play distinct roles in supporting technological upgrading, and their effectiveness is shaped by regional financial environments and farm-specific characteristics. Therefore, rural financial reforms should adopt a structured and targeted approach, aligning credit instruments with loan terms, farm size, and regional conditions to enhance resource allocation efficiency and strengthen financing support for agricultural innovation.

First, strengthening formal credit systems is crucial to improving access to financing for capital-intensive technologies. Formal credit plays a key role in enabling mechanization and technology adoption among large farms, yet small farms remain constrained by collateral requirements and creditworthiness limitations. Expanding access to long-term, low-interest agricultural technology loans with targeted fiscal subsidies can reduce financing costs, particularly for investments in mechanization and smart irrigation. A rural credit risk compensation fund should be introduced to partially cover loan defaults, incentivizing financial institutions to increase agricultural lending. Establishing a pre-approval mechanism for financially stable farms can further enhance lending efficiency and expand access to formal credit.

Second, reducing borrowing costs is essential to strengthening small farms’ capacity to adopt short-cycle technologies. Small farms face greater credit constraints and rely more on short-term financing for liquidity needs, particularly for investments in pest control and new pesticides. Offering higher interest rate subsidies for small-scale borrowers, particularly for short-term loans and low-capital investments, can enhance loan affordability. A tiered interest rate structure, with lower rates in the early investment period followed by a gradual return to market levels, can alleviate liquidity constraints and support small farms’ technology adoption.

Third, innovating collateral mechanisms is necessary to enhance the flexibility of rural credit financing. Existing collateral systems rely heavily on land assets, limiting small farms’ ability to secure long-term financing. Establishing a more flexible credit system, such as farm income-based credit ratings and social network-driven credit scoring, could expand access to unsecured credit. Encouraging cooperatives to establish mutual guarantee funds can enhance collective creditworthiness and improve loan approval rates. Expanding contract-based collateral mechanisms, allowing farmers to use long-term purchase agreements as collateral, would further address financing constraints and reduce the risk of credit misallocation.

Fourth, enhancing rural financial services is critical to improving the efficiency of credit allocation. Information asymmetry remains a significant barrier in rural financial markets, leading to credit mismatches, particularly for small farms with limited financial access. Strengthening linkages between financial institutions and demonstration farms through a “demonstration farm + financial support” model can enhance credit accessibility by allowing high-performing farms to serve as guarantors for neighbouring farmers. Expanding village-level financial service stations can improve loan application processes and credit assessment efficiency. The use of financial technology, including big data and blockchain, can further optimize loan approval procedures and reduce informational barriers in rural credit markets.

Finally, establishing a risk-sharing mechanism is essential to support high-risk agricultural innovation. Financial institutions are often reluctant to lend to high-risk agricultural projects, limiting investment in technology-intensive farming. Introducing a dedicated agricultural investment guarantee fund can mitigate lenders’ default risks and encourage credit supply for high-risk technologies. Expanding agricultural innovation insurance with government-subsidized premiums can reduce financial uncertainty for farmers, improving their willingness to invest in new technologies. A tripartite risk-sharing model, in which the government provides partial credit guarantees, banks issue loans, and farmers repay based on future revenues, can enhance financing efficiency while minimizing default risks.

While this study yields novel insights, several important limitations remain and merit further investigation. First, the data lack temporal relevance. The analysis relies on cross-sectional data from 2017, which limits the ability to capture the marginal effects of China’s rapidly evolving digital finance sector and post-pandemic rural revitalization policies. Future research should construct multi-period panel datasets to enhance temporal validity and assess dynamic trends. Second, the characterization of technological heterogeneity requires refinement. Although this study classifies technologies based on capital intensity and risk attributes, it does not incorporate a systematic framework to examine adoption timing, complementarity, or substitution patterns. Further studies could adopt more granular approaches to explore sequential adoption decisions, interaction effects, and long-term productivity outcomes. Finally, the identification of causal mechanisms remains insufficient. While the current analysis confirms a statistical association between credit access and technology adoption, it does not disentangle the mediating roles of risk perception, social capital, or other behavioural factors. Future work may consider structural equation modelling, mediation analysis, or randomized interventions to uncover underlying mechanisms and strengthen causal inference.

Data availability

The data used in this study were obtained from field surveys conducted by the Center for Economic Development Research at Wuhan University on family farms. Due to confidentiality agreements and institutional regulations, the dataset is not publicly available. However, aggregated or anonymized data may be provided upon reasonable request, subject to approval by the Center for Economic Development Research at Wuhan University. Researchers interested in accessing the data may contact czgangzc@whu.edu.cn for further inquiries.

Notes

Source: Food and Agriculture Organization of the United Nations (FAO). Master plan for the International Year of Family Farming (2013). Retrieved from https://www.fao.org/fileadmin/user_upload/iyff/docs/Final_Master_Plan_IYFF_2014_30-05.pdf

References

Anang SA, Kabore AA (2021) Factors influencing credit access among small-size poultry farmers in the Sunyani West District of the Bono region, Ghana. J Agric Ext Rural Dev 13(1):23–33

Appleton SW, Holt D (2024) Aligning strategy and digitalisation activity as an incremental or radical innovation in family farms. Int J Entrep Behav Res 30(2/3):498–519

Awotide BA, Awoyemi TT (2016) Impact of improved agricultural technology adoption on sustainable rice productivity and rural farmers’ welfare in Nigeria. In: Adjasi CKD, Berman N (eds) Inclusive growth in Africa. Routledge, London, p 232-253

Ayyagari M, Demirgüç‑Kunt A, Maksimovic V (2010) Formal versus informal finance: evidence from China. Rev Financ Stud 23(8):3048–3097

Balana BB, Oyeyemi MA (2022) Agricultural credit constraints in smallholder farming in developing countries: evidence from Nigeria. World Dev Sustain 1:100012

Banerjee AV, Besley T, Guinnane TW (1994) Thy neighbour’s keeper: the design of a credit cooperative with theory and a test. Q J Econ 109(2):491–515

Boucher S, Carter MR, Guirkinger C (2008) Risk rationing and wealth effects in credit markets: theory and implications for agricultural development. Am J Agric Econ 90(2):409–423

Campero A, Kaiser K (2013) Access to credit: Awareness and use of formal and informal credit institutions. World Bank Working Paper No. 2013-07

Chai S, Chen Y, Huang B, Ye D (2019) Social networks and informal financial inclusion in China. Asia Pac J Manag 36:529–563

Chen Z, Zhang Y, Zhou L (2022b) Has financial access improved agricultural technical efficiency? Evidence from two family farm demonstration zones in China. China Agric Econ Rev 14(1):142–164

Chen Z, Meng Q, Xu R, Guo X, Cai C (2022a) How rural financial credit affects family farm operating performance: an empirical investigation from rural China. J Rural Stud 91:86–97

Croppenstedt A, Demeke M, Meschi MM (2003) Technology adoption in the presence of constraints: the case of fertilizer demand in Ethiopia. Rev Dev Econ 7(1):58–70

Feder G (1980) Farm size, risk aversion, and the adoption of new technology under uncertainty. Oxf Econ Pap 32(2):263–283

Gao Y, Zhang X, Lu J, Wu L, Yin S (2017) Adoption behaviour of green control techniques by family farms in China: evidence from 676 family farms in Huang-huai-hai Plain. Crop Prot 99:76–84

Germidis DA, Kessler D, Meghir R (1991) Financial systems and development: What role for the formal and informal financial sectors? OECD, Paris

Greif A (1993) Contract enforceability and economic institutions in early trade: the Maghribi traders’ coalition. Am Econ Rev 83(3):525–548

Guo Z, Chen X, Zhang Y (2022) Impact of environmental regulation perception on farmers’ agricultural green production technology adoption: A new perspective of social capital. Technol Soc 71:102085

Halimi E, Czakó K, Sahiti A (2025) Investigating determinants of credit growth in the case of Kosovo: A VAR model. Available at SSRN 5097626

Hu Y, Li B, Zhang Z, Wang J (2022) Farm size and agricultural technology progress: evidence from China. J Rural Stud 93:417–429

Huang PC (2014) Is “family farms” the way to develop Chinese agriculture. Rural China 11(2):189–221

Huang Z, Song W, Ye C (2023) The impact and mechanism of digital inclusive finance during the establishment of new agricultural operators: Evidence from 1,845 Chinese counties. J Financ Res 514(4):92–110

Jia R, Lu Q (2017) Credit constraints, social capital, and the adoption of water-saving irrigation technology: based on the survey in Zhangye of Gansu Province. China Popul Resour Environ 27(5):54–62

Jiang M, Li J, Mi Y (2024) Farmers’ cooperatives and smallholder farmers’ access to credit: evidence from China. J Asian Econ 92:101746

Khan N, Ray RL, Sargani GR et al. (2021) Current progress and future prospects of agriculture technology: gateway to sustainable agriculture. Sustainability 13(9):4883

Kipkogei S, Han J, Mwalupaso G et al. (2025) The synergistic effects of microcredit access and agricultural technology adoption on maize farmer’s income in Kenya. PLoS One 20(1):e0316014

Li W, Luo D, Chen J, Xie Y (2015) Moderate size operation of agriculture: size benefit, output level, and production cost—Based on the survey data of 1,552 rice growers. Chin Rural Econ 3:4–17

Li K, Zhai R, Wei J (2024) Examining the determinants of green agricultural technology adoption among family farms: empirical insights from Jiangsu, China. Pol J Environ Stud 33(1)

Lin JY (1991) Education and innovation adoption in agriculture: evidence from hybrid rice in China. Am J Agric Econ 73(3):713–723

Liu M, Liu H (2024) Farmers’ adoption of agriculture green production technologies: perceived value or policy-driven? Heliyon 10(1)

Madestam A (2014) Informal finance: a theory of moneylenders. J Dev Econ 107:157–174

Mansour S, Samak N, Gad N (2024) Credit choices in rural Egypt: a comparative study of formal and informal borrowing. J Risk Financ Manag 17(11):487

Mariyono J, Kuntariningsih A (2024) Empowering farmer community with technology modernisation to improve rice farming performance through demonstration farms in East Java, Indonesia. Int J Innov Sci

Mishra K, Gallenstein RA, Sam AG et al. (2023) Does bundling credit with index insurance boost agricultural technology adoption? Evidence from Ghana. Agric Econ 54(6):778–792

Morris W, Henley A, Dowell D (2017) Farm diversification, entrepreneurship and technology adoption: analysis of upland farmers in Wales. J Rural Stud 53:132–143

North DC (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

Rindfleisch A (2020) Transaction cost theory: past, present and future. AMS Rev 10(1):85–97

Rosenbaum P, Rubin D (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70(1):41–55

Self S, Grabowski R (2007) Economic development and the role of agricultural technology. Agric Econ 36(3):395–404

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Wu F (2022) Adoption and income effects of new agricultural technology on family farms in China. PLoS One 17(4):e0267101

Wu F, Guo X, Guo X (2023) Cooperative membership and new technology adoption of family farms: evidence from China. Ann Public Coop Econ 94(3):719–739

Xu Z, Liang Z, Cheng J et al. (2024) Comparing the sustainability of smallholder and business farms in the North China Plain: a case study in Quzhou. Agric Syst 216:103896

Yadav IS, Rao MS (2024) Agricultural credit and productivity of crops in India: field evidence from small and marginal farmers across social groups. J Agribus Dev Emerg Econ 14(3):435–454

Yuan Y, Gao P (2012) Farmers’ financial choices and informal credit markets in China. China Agric Econ Rev 4(2):216–232

Zhang G (1996) Agricultural size management and increasing unit yield run parallel—discussing with Comrade Ren Zhijun. Econ Res J 1:55–58

Zulu NS, Hlatshwayo SI, Ojo TO et al. (2024) The impact of credit accessibility and information communication technology on the income of small-size sugarcane farmers in Ndwedwe Local Municipality, KwaZulu-Natal Province, South Africa. Front Sustain Food Syst 8:1392647

Acknowledgements

This work was supported by the Humanities and Social Science Fund of the Ministry of Education of the People’s Republic of China (Grant no. 17JJD790017), the Philosophy and Social Sciences Fund of the Education Department of Hubei Province (Grant no. 23G058), and the Education Science Planning Fund of Hubei Province (Grant no. 2023GB213).

Author information

Authors and Affiliations

Contributions

LG conceptualized the study. QW developed the methodology and implemented the software. QM and QW conducted validation. QM performed formal analysis, and HW was responsible for the investigation. LG provided resources, and QW curated the data. QW wrote the original draft. QW and LG carried out manuscript review and editing. LG created the visualizations. JH supervised the project. QM administered the project, and HW acquired the funding. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article did not require additional ethical approval because it relies entirely on secondary data collected by the Family Farm Research Group at the Center for Economic Development Studies, Wuhan University, under the direct oversight of the School of Economics and Management. The original survey protocol was reviewed and approved by the School in accordance with institutional regulations and the ethical principles of the Declaration of Helsinki.

Informed consent

This article does not contain any studies with human participants performed by any of the authors. The original data collection process ensured that participants’ confidentiality and privacy were protected, with all personal information anonymized before data access.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wang, Q., Gui, L., Meng, Q. et al. Rural credit and new technology adoption among family farms: evidence from two demonstration areas in China. Humanit Soc Sci Commun 12, 1109 (2025). https://doi.org/10.1057/s41599-025-05491-7

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05491-7