Abstract

Amid escalating economic complexity, can digital transformation address persistent corporate investment inefficiencies? Utilizing data from Shanghai and Shenzhen A-share listed companies during 2012–2023, this study examines how digital transformation influences inefficient investment under the dual pressures of operational diversification and environmental uncertainty. We employ a corporate digital transformation index evaluation system encompassing strategic guidance, technological enablement, organizational empowerment, environmental support, digital achievements and applications, and also ensure research reliability through neural network language models and Python crawlers. Empirical results demonstrate that digital transformation significantly inhibits inefficient investment, effectively mitigating both underinvestment and overinvestment. This inhibitory effect intensifies in firms with higher diversification levels and those operating in stable environments. Mechanism analysis identifies three key channels: improving internal governance, reducing information asymmetry, and alleviating financing constraints. Cross-sectional heterogeneity reveals more pronounced effects in high-tech firms, large enterprises, and companies in China’s economically advanced eastern and central regions. Our findings systematically clarify digital technology’s governance applications while providing actionable insights for optimizing corporate investment efficiency.

Similar content being viewed by others

Introduction

The global digital revolution is catalyzing transformative paradigm shifts, redefining value creation and operational efficiency across industries. Recent data from the International Data Corporation (IDC) reveals that global IT investments in big data analytics soared to $354 billion in 2024, with projections nearing $644 billion by 2028, achieving a 16.8% compound annual growth rate. Furthermore, digital transformation has evolved beyond mere technological adoption to become a strategic imperative, catalyzing systemic organizational restructuring, agile governance, and the reinvention of business models (Liang et al., 2017; Sun et al., 2023; Cao et al., 2023; Fu et al., 2025). This transformation has redefined corporate value creation models and enhanced investment decision-making efficiency. However, enterprises now confront two major challenges. First, the widespread adoption of diversification strategies has increased organizational complexity and internal information asymmetry, thereby raising agency costs (Jensen and Meckling, 1976; Jiang and Xin, 2022). Second, external environments have become increasingly volatile due to global economic fluctuations, geopolitical conflicts, and climate policy uncertainties. These challenges highlight the urgent need to integrate corporate diversification and environmental uncertainty into analytical frameworks. Therefore, researchers must dynamically investigate how digital transformation influences inefficient investment under diverse conditions.

Inefficient investment, a persistent challenge in corporate governance, arises from the dual constraints of agency conflicts and information asymmetry, severely undermining firms’ value creation capabilities (Almeida and Campello, 2007; Chen et al., 2017; Habib and Hasan, 2017). The deep integration of next-generation digital technologies, such as artificial intelligence (AI), blockchain, and cloud computing, has introduced transformative opportunities to address this issue. Beyond enhancing operational efficiency, these technologies systematically reshape governance frameworks through institutional innovation (Babina et al., 2024). Real-time analytics and intelligent data integration break down informational barriers, replacing experience-based biases with empirically grounded strategies to minimize misallocation risks. Simultaneously, blockchain-powered audit trails and AI-driven monitoring systems mitigate managerial opportunism, thereby aligning stakeholder incentives and reducing agency costs. Machine learning models further improve demand forecasting accuracy, while agile supply chains enable dynamic resource allocation, sharpening investment precision. Together, these digital technologies streamline operational workflows and reshape governance priorities, offering a multifaceted framework to address persistent inefficiencies in corporate investment.

Industry practice has also shown that digital transformation has become the core path for enterprises to break through complex environmental constraints and improve investment efficiency. According to the “Annual Report on China’s Digital Transformation Market Research from 2023 to 2024” released by China Center for Information Industry Development (CCID), China’s digital transformation expenditure reached 2.3 trillion yuan in 2023, a year-on-year increase of 9.5%, and is expected to reach 3.1 trillion yuan by 2026. For example, Bosideng Co., Ltd. has developed an intelligent manufacturing platform for clothing, enabling flexible production for large-scale customization. This innovation has led to a 45.92% reduction in energy consumption per unit product and a 42.11% decrease in energy consumption per unit output value. Meanwhile, Hangzhou Jinhui Trading Co., Ltd. has implemented 3D clothing design software, cutting sample delivery time from 30 days to just 3 days. This shift has increased adoption rates from 30% to 50% and reduced material costs for sample clothing by 60%. These cases demonstrate the practical worth of digital transformation in optimizing resource allocation and mitigating inefficient investments.

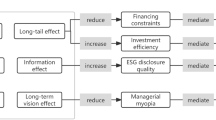

This study explores the impact of digital transformation on inefficient investment and its underlying mechanisms, using a sample of A-share listed companies in China from 2012 to 2023. By developing a digital transformation index with neural network models and Python-based web scraping tools, we empirically test these relationships while considering the effects of corporate diversification and environmental changes. Our analysis reveals three critical insights: First, we systematically map the mechanisms through which digitalization reduces investment inefficiencies, establishing an integrative “digital transformation—investment efficiency” paradigm. Second, by innovatively integrating organizational diversification and environmental volatility as dual moderators, we pioneer evidence-based strategies for optimizing digital investments in turbulent markets. Third, we propose differentiated digital governance pathways, empirically validating that high-tech industries, large enterprises, and firms in eastern/central regions can more effectively correct investment efficiency deviations through digitalization. This provides mechanistic evidence for targeted policy interventions and corporate strategic realignment. The research framework is illustrated in Fig. 1.

Literature review, theoretical analysis, and hypothesis development

Literature review

Digital transformation has emerged as both a strategic imperative for sustainable corporate growth and a catalyst for high-quality development in the digital economy (Brynjolfsson et al., 2019). Measuring the level of corporate digital transformation has become a critical research topic in this field. While early measurement approaches relied on simplistic IT adoption metrics (Tambe and Hitt, 2012; Yoo et al., 2012), recent methodological breakthroughs leverage neural network web-crawling techniques to extract nuanced digital signatures from multi-source unstructured data (Wu et al., 2021; Wu and Li, 2024). Cutting-edge research now integrates these advances into multidimensional measurement systems, incorporating dimensions such as technological implementation, organizational enablement, and strategic foresight (Zhen et al., 2023). These efforts establish rigorous empirical foundations to assess digital transformation’s economic ramifications.

Scholars have devoted substantial attention to the economic consequences of digital transformation, yet findings on its corporate governance implications remain divergent. The literature predominantly views digital transformation as a mechanism to address information asymmetries through real-time data transparency, enhancing capital market performance (Bharadwaj et al., 2013) and improving stock liquidity (Wu et al., 2021). Beyond these market effects, digitalization strengthens core dynamic capabilities and resource orchestration prowess, driving both business model innovation and disruptive technological advancements (Wu and Li, 2024). However, critical perspectives caution that digitalization-induced valuation premiums may fuel managerial overconfidence, potentially resulting in a cognitive bias that distorts investment rationality (Malmendier and Tate, 2005).

Corporate investment, as the central nexus of resource allocation, is essential for enhancing firm value (Modigliani and Miller, 1958). Identifying the determinants of corporate investment efficiency constitutes a central research focus in this field. Research on investment efficiency determinants evolves along two axes: external factors including economic policy uncertainty, industry competition dynamics, and capital market volatility significantly constrain investment decisions (Bloom, 2009; Yang et al., 2023), while internal elements such as governance structures, managerial attributes, and financial health constitute critical efficiency determinants (Jensen and Meckling, 1976). Emerging research now illuminates digital elements’ influence, such as Xue et al. (2024) demonstrating that digital financial services curb investment inefficiencies through dual resource-governance mechanisms. From a regulatory perspective, Feng et al. (2024) reveal media scrutiny’s regulatory power in enhancing investment efficiency among pollution-intensive firms by aligning corporate conduct with stakeholder expectations.

In summary, although the significance of corporate digital transformation has been well-documented in scholarly research, fundamental disagreements persist regarding its standardized measurement and operational mechanisms across organizational contexts. While some scholars have recognized the significance of digital transformation in addressing corporate investment inefficiencies (Firk et al. 2021; Xu et al. 2023; Chen and Jiang, 2024), critical gaps remain regarding its operational mechanisms and contextual contingencies. To address these limitations, we employ a corporate digital transformation index evaluation system with ensures research reliability using neural network language models and Python crawlers. Furthermore, this study pioneers a dual-dimensional analytical framework encompassing “internal structure - external environment”. Through this lens, we decode the dynamic mechanisms through which digital transformation impacts investment efficiency, advancing a dynamic capability perspective on digital-era corporate investment strategies.

Theoretical analysis and hypothesis development

Digital transformation and inefficient investment

Enterprise digital transformation is a strategic process that fundamentally reshapes organizational management structures, information systems, and operational workflows. It is driven by digital technologies such as big data, cloud computing, and artificial intelligence. This transformation involves not only the digitization of business processes but also the restructuring of resource systems and the enhancement of capability frameworks. The result is a new governance model characterized by the “technology penetration” effect, which improves internal governance mechanisms (Fang and Liu, 2024). From the perspective of resource-based theory, digital transformation provides enterprises with valuable digital resources that are scarce, difficult to replicate, and complementary, such as data assets and algorithmic models (Kohtamaki et al., 2019). These resources improve information processing efficiency and the precision of resource allocation, thereby reducing inefficient investment behaviors. Furthermore, the dynamic capabilities theory suggests that digital transformation enhances an enterprise’s ability to perceive, acquire, and reconfigure resources (Teece et al., 1997; Helfat and Winter, 2011). This, in turn, strengthens its strategic adaptability in dynamic environments. Concurrently, the development of digital infrastructure and platforms can break down information barriers both within and outside the organization, fostering a highly interactive information ecosystem. Internally, this improves management’s comprehensive understanding of investment projects and reduces the inertia often associated with experience-based decision-making. Externally, it enhances financial institutions’ ability to assess corporate quality, thereby alleviating investment inefficiencies caused by financing constraints (Goldstein et al., 2021). As a result, this paper outlines the impact of digital transformation on inefficient investment through three key dimensions: optimizing internal governance, reducing information asymmetry, and easing financing constraints.

Firstly, digital transformation reduces inefficient investment by restructuring enterprise resource systems and decision-making processes. According to the resource-based view, technologies such as AI and blockchain create valuable digital resources (Bharadwaj et al., 2013). These technologies convert unstructured data into verifiable and traceable standardized information, significantly minimizing information distortion and reducing opportunities for management opportunism, such as overinvestment (Cheng et al., 2024). The dynamic capability theory further highlights that digitalization strengthens an enterprise’s ability to restructure through process automation and intelligent decision support systems, such as RPA and digital twins. These systems reduce manual intervention points, thus minimizing risks in business processes (Celino et al., 2025). By standardizing intelligent decision-making, enterprises can dynamically optimize capital allocation. This dual governance model of “data-driven + process embedding” allows enterprises to monitor investment execution in real-time and quickly correct deviations, ultimately enhancing the scientific rigor of investment decisions and reducing inefficient investment.

Secondly, Digital transformation can reduce information asymmetry and improve investment decision accuracy. According to resource-based theory, digital technologies enable firms to create structured, verifiable information assets, enhance the authenticity and completeness of data, and establish traceable information flows. This addresses the limitations of traditional financial data and improves information disclosure quality. The dynamic capability perspective highlights the use of data mining techniques to capture market signals, allowing for real-time analysis of potential value in unstructured data (Simsek et al. 2019). By improving information quality, digital transformation reduces the risk of adverse selection in capital markets, providing high-quality signals externally and eliminating internal decision-making blind spots (Zhu, 2019). This, in turn, helps to correct biases between overinvestment and underinvestment and mitigates inefficient investment.

Third, digital transformation can enhance enterprises’ access to resources, reduce financing constraints, and address investment insufficiencies by overcoming bottlenecks through policy adaptability and stronger market signals. At the policy level, businesses aligned with the “Digital China” strategy gain priority access to financial technology funding and tax incentives (Lino et al., 2022), benefiting from policy-driven external financing. This resource acquisition supports digital transformation and aligns with resource optimization principles. At the market level, digital platforms lower credit evaluation costs by integrating supply chain data (Sonar et al., 2023) and improve financial institutions’ ability to identify high-quality enterprises (Chit and Rizov, 2023), fostering efficient connections between businesses and financial institutions. This alleviates the challenges of costly and difficult financing. In sum, digital transformation has alleviated financing challenges and supported more efficient investment through multidimensional resource integration and capability enhancement. Based on this, this paper proposes the hypothesis H1.

H1: Enterprise digital transformation can reduce the degree of inefficient investment.

Digital transformation, diversified operation, and inefficient investment

Based on the frameworks of agency theory and information asymmetry theory, the complex information transmission systems arising from the diversified operations of enterprises exacerbate issues such as moral hazard and adverse selection. These problems make it easier for management to pursue personal benefits through inefficient investments. Digital transformation, by reducing agency costs and enhancing information transparency, can significantly mitigate these inefficiencies (Stallkamp et al., 2023). First, digital transformation fosters unique and complementary resource endowments, overcoming the barriers to resource integration within diversified firms. By implementing a cross-departmental data-sharing platform, information friction is reduced, and decision-making accuracy is enhanced through intelligent support systems, creating institutional constraints on inefficient investments. Second, digital technology empowers dynamic capabilities, enabling real-time market perception and improved responsiveness across multiple domains. Firms can promptly detect market shifts and optimize resource allocation by adjusting investment strategies in real-time. Additionally, digital transformation drives dual governance effects by restructuring organizational frameworks. On the one hand, the adoption of networked structures reduces the rent-seeking opportunities inherent in traditional bureaucracies and limits managerial discretion. On the other hand, cloud-based collaboration platforms provide full-cycle process visibility, boosting internal transparency and creating a supervision network involving all stakeholders. This governance approach shows increasing marginal benefits in diversified enterprises with complex structures. Based on this, this paper proposes hypothesis 2.

H2: When the degree of diversification is high, the digital transformation of enterprises has a stronger inhibitory effect on inefficient investment.

Digital transformation, environmental uncertainty, and inefficient investment

In an environment of increasing economic uncertainty, the transmission mechanism affecting corporate investment efficiency follows a dual path. On one hand, heightened uncertainty exacerbates information friction, leading to inaccurate cash flow forecasts and overinvestment due to opportunistic behavior by management. On the other hand, the cost of capital rises due to the real options effect, forcing companies to abandon potentially profitable projects and resulting in insufficient investment. How does digital transformation impact inefficient investment in such an uncertain environment? Digital transformation can improve investment efficiency through three main mechanisms: (1) big data models reduce market information costs and enhance demand forecasting accuracy, (2) modular structures increase organizational agility, allowing dynamic resource restructuring, and (3) real-time data monitoring reduces management’s ability to manipulate information (Rehman et al., 2021; Akhter and Hassan, 2024). However, when environmental uncertainty exceeds a critical threshold, the effectiveness of tools like big data analytics and predictive models is significantly reduced. Additionally, information noise can distort signal transmission, leading to “information overload” for investors despite high-frequency disclosures (Blanco-Mesa et al., 2017; Lin et al., 2018). Lastly, in highly uncertain environments, capital market risk premium adjustments may offset the financing cost savings provided by digital technologies. Based on these insights, this article proposes the following hypothesis:

H3: When environmental uncertainty is low, digital transformation has a stronger inhibitory effect on inefficient investment.

Research design

Sample selection and data sources

China’s rapid digital economy expansion and the accelerated enterprise adoption of digital technologies have predominantly emerged post-2010. Accounting for digital transformation’s implementation lag, the study utilizes 2012–2023 annual data from A-share listed companies for empirical analysis. Among them, the data of digital transformation in robust testing is obtained by building a digital keyword lexicon through neural network language models, and scraping the text corpus of “management discussion and analysis” (MD&A) in the annual reports of relevant listed companies with the help of a Python crawler tool. The other data are from CSMAR, WIND, and other databases. To ensure data quality, the following preprocessing steps were implemented: (1) Exclusion of financial institutions and ST/*ST firms to control for atypical financial characteristics; (2) Removal of companies undergoing IPOs, delistings, or trading suspensions; (3) Elimination of observations with missing critical variables. The final sample comprises 31,984 firm-year observations. Continuous variables were winsorized at the 1st and 99th percentiles to mitigate outlier effects.

Variable setting

Explained variable

Investment inefficiency is measured following residual-based model from Richardson (2006):

In the above model, Inv represents the capital expenditure of the enterprise, the ratio between the total cash paid for the construction of intangible assets, fixed assets and other long-term assets and the total assets; Tobin’s Q ratio signifies a firm’s growth opportunities; Lev is the asset-liability ratio; Cash is the ratio of the balance of cash and cash equivalents held at the end of the year to total assets; Age is the number of years that an enterprise has been listed; Size is represented by the logarithm of total assets; Ret is the annual return rate of the stock. Ind and Year are industry and year control variables, respectively; i denotes firm and t denotes year. The residual ε is obtained by regression of Model (1), where a positive ε represents overinvestment and a negative ε represents underinvestment.

Explanatory variable

Recent empirical research on digital transformation has predominantly employed two measurement approaches. The first quantifies digital adoption through tangible inputs such as digital asset investments (Aral and Weill, 2007), IT workforce size (Tambe and Hitt, 2012; Yoo et al., 2012), and specific technology implementations (Teece et al., 1997; Verhoef et al., 2021). The second approach utilizes text-mining techniques to analyze the frequency of digital-related keywords in corporate disclosures (Wu et al., 2021; Wu and Li, 2024). However, given its multifaceted nature encompassing infrastructure development, innovation ecosystems, organizational restructuring, and human capital enhancement (Verhoef and Bijmolt, 2019), digital transformation resists adequate characterization through singular metrics. While text-based measures capture managerial intent more comprehensively, empirical evidence reveals potential disclosure biases in corporate digital transformation reporting (Zhou et al., 2024). In summary, adopting a digital indicator system enables a more multidimensional, forward-looking, and holistic approach to comprehensively capture the full picture of enterprise digital transformation.

This study adopts the enterprise digital transformation index from the CSMAR Database’s research dataset on digital transformation of Chinese listed companies to measure the level of corporate digital transformation. A higher digitalization index indicates a more advanced stage of enterprise digital transformation (Table 1). The index is constructed based on content extracted from annual reports, fundraising announcements, qualification certifications, and other disclosures of listed companies. It primarily encompasses six dimensions: strategic guidance, technological enablement, organizational empowerment, digital achievements and digital applications at the corporate level, and environmental support at the macro level, thereby establishing a comprehensive evaluation system for the digital transformation index. Compared to existing literature that narrowly focuses on digital transformation content in MD&A, this dataset offers broader coverage and richer contextual details, enabling a more effective and holistic assessment of corporate digitalization levels.

Moderating variable

Building on Kim and Ra (2018), we quantify diversified operation using the adjusted Herfindahl-Hirschman Index:

Among them, pi is the proportion of the i-th industry in the total revenue, and the adjusted Herfindahl-Hirschman Index is a positive indicator to measure the degree of corporate diversification.

Environmental uncertainty is quantified using a text-based index derived from the co-occurrence of “economic policy” and “uncertainty” terms within sentences of corporate MD&A sections (Table 2). Adapting Chen and Zhang (2024), we employ a Python-based web crawler to systematically extract and analyze textual data. This metric captures firms’ perceived economic policy uncertainty.

Control variables

To mitigate endogeneity concerns stemming from omitted variables, this study incorporates controls based on the work of Wu et al. (2021) and Xue et al. (2024). The controlled variables include board size (Board), Big Four audit (Big4), CEO-chair duality (Dual), cash flow (Cfo), debt-to-asset ratio (Lev), largest shareholder ownership (Top1), return on assets (Roa), revenue growth rate (Growth), firm age (Firmage), and the proportion of independent directors (Indep). We also account for industry (Ind) and year (Year) effects. For detailed variable definitions, refer to Table 3.

Model construction

To examine H1 concerning digital transformation’s impact on investment inefficiency, we specify Model (3):

The coefficient α1 on Digital captures the core effect, where a statistically significant negative value would substantiate digital transformation’s capacity to mitigate inefficient investment. Control variables encompass financial characteristics and corporate governance. Industry fixed effects (Ind) employ a dual classification system: 2-digit CSRC codes for manufacturing sectors and 1-digit codes for others, effectively addressing inter-industry heterogeneity. Year fixed effects (Year) account for temporal shocks, with σ representing idiosyncratic errors.

To examine H2, Model (4) assesses how diversification moderates the relationship between digital transformation and inefficient investment:

The interaction coefficient β₃ serves as critical test parameter. A significantly negative β₃ would indicate amplified investment discipline from digital transformation in highly diversified firms. Following Aiken (1991), all interactive terms are mean-centered to mitigate multicollinearity while preserving interpretability.

Model (5) tests H3 by evaluating the moderating effect of environmental uncertainty on the digital transformation-inefficient investment relationship.

In this model, a positive significant λ3 suggests digital transformation exerts stronger investment discipline under stable environmental conditions. This aligns with real options theory, where reduced uncertainty enhances firms’ capacity to execute long-term digital strategies. The consistent application of mean-centering ensures methodological parity across interaction analyses.

Empirical analysis

Data description

Table 4 presents descriptive statistics. The inefficient investment measure exhibits a mean of 0.0389 with a median of 0.0236 and a standard deviation of 0.0511, indicating widespread inefficiency in corporate investment across Chinese firms. The digital transformation index spans a range from 0 to 4.2030 with a mean of 3.5773 and standard deviation of 0.2717, revealing marked inter-industry divergence in digital maturity despite an aggregate upward trajectory. Diversification levels show strategic prevalence through a mean of 0.7863 and median of 0.9122, with a left-skewed distribution indicating widespread adoption, albeit suppressed by a minority of undiversified firms. Environmental uncertainty displays limited volatility with a mean of 0.0078 and a median of 0.0072, indicating relative stability in perceived uncertainty despite cross-firm heterogeneity. Control variables exhibit distributions consistent with prior literature, confirming data reliability.

The Pearson correlation matrix in Fig. 2 quantifies linear associations between core variables. All correlation coefficients fall below 0.60 in absolute value, remaining well under the 0.80 multicollinearity threshold. Variance inflation factors further negate collinearity concerns, safeguarding regression estimator stability. Control variables demonstrate distributional consistency with prior studies, systematically capturing firm-level heterogeneity. This structured variation isolates confounding factors, sharpening identification of the digital transformation–investment inefficiency linkage through quasi-experimental triangulation.

Regression result analysis

Table 5 examines the impact of enterprise digital transformation on inefficient investment in Model 3, with Column (1) showing univariate regression results and Column (2) introducing industry-year fixed effects and control variables. The statistically significant coefficient (−0.0098, p < 0.01) confirms that digital transformation robustly reduces inefficient investment, substantiating hypothesis H1. Subsample analyses (Columns 3–4) further reveal its dual corrective effects on both under-investment and over-investment, reinforcing H1. The underlying mechanisms may include: First, digital technologies enhance information transparency and real-time data interactions, mitigating principal-agent asymmetries and managerial opportunism. Second, Intelligent algorithms optimize resource allocation and bolster dynamic capabilities, thereby enhancing internal control quality to strengthen decision-making frameworks and market responsiveness. Third, digital platforms break traditional financing barriers by expanding funding channels through supply chain finance and data asset pledge models. A systematic analysis of these mechanisms follows in subsequent sections.

To examine how enterprise diversification moderates digital transformation’s impact on inefficient investment, this study employs Model (4) (Table 6, Column 1). Results indicate a persistently negative coefficient for digital transformation (Digital) at the 1% significance level, and its interaction term with diversification (Digital × Dyh) also shows significant negativity (β3 = −0.0163, p < 0.01). These findings confirm that heightened diversification strengthens digital transformation’s inhibitory effect on inefficient investment, validating hypothesis H2. Diversification intensifies operational complexity and exacerbates agency conflicts, while expanded organizational structures induce information distortion during cross-departmental and external data flows, eroding transparency. In highly diversified firms, digital transformation counteracts inefficient investment by mitigating interdepartmental agency costs, restoring information symmetry, and optimizing resource integration efficiency, which collectively amplifying its governance impact.

Extending this analysis, Model (5) tests economic policy uncertainty’s moderating role in the digital transformation–investment inefficiency nexus (Table 6, Column 2). While digital transformation retains its significant negative main effect, its interaction with environmental uncertainty (Digital×EU) displays a positive coefficient (λ3 = 0.3905, p < 0.10), demonstrating that external uncertainty undermines digital governance efficacy, a result supporting hypothesis H3. Two mechanisms drive this attenuation: First, elevated uncertainty, such as policy volatility and demand shocks, degrades the signal-to-noise ratio (Bloom, 2014), inducing algorithmic overfitting and decision errors. Second, the dynamic capability rigidity paradox (Autio et al., 2018) traps firms in digital path dependence, as legacy systems resist rapid adaptation to discontinuous environmental shifts, impairing investment precision. Accordingly, firms should develop adversarial learning-enabled AI models to overcome technological rigidity, while governments must establish policy coordination frameworks to stabilize the external conditions for digital governance.

Robustness test

Endogeneity analysis

The baseline regression faces potential endogeneity from bidirectional causality. Specifically, while digital transformation curbs inefficient investment by strengthening internal controls, improving information transparency, and easing financing constraints, enhanced investment efficiency may conversely motivate firms to intensify digitalization through performance feedback loops. These reciprocal dynamics risk biasing coefficient estimates, requiring robust identification strategies.

To disentangle this causality, we implement a dual IV approach: (1) IV1 is constructed as the lagged regional-industry peer mean of digital transformation (Li et al., 2023). This leverages spatial-technological spillovers while the lag structure eliminates contemporaneous reverse causation. (2) IV2 uses 1984 city-level landline telephone penetration, a historical quasi-natural experiment reflecting path-dependent IT infrastructure that predates modern corporate strategies but shapes digitalization trajectories (Huang et al., 2019).

Table 7 presents two-stage least squares (2SLS) results with rigorous diagnostic tests. The Kleibergen-Paap LM statistic (p < 0.001) rejects underidentification, while the Wald F statistics (IV1 = 7,282.13; IV2 = 173.12) significantly exceed the critical value of 16.38 threshold, confirming instrument strength. Empirical results show that after controlling for endogeneity, digital transformation retains a significant inhibitory effect on inefficient investment. In the first-stage regression, both IV1 and IV2 exhibit statistically significant positive predictions for corporate digitalization levels. The second-stage estimation indicates that enhanced digitalization significantly reduces inefficient investment. These tests affirm that our conclusions remain robust even after accounting for potential reverse causality.

Variable respecification

In robustness tests, we follow Chen et al. (2011) to reconstruct corporate inefficient investment metrics (CInefficient) as a proxy for Inefficient and re-estimate Model (3). Results are reported in Column (1) of Table 9.

Concurrently, we have revised the methodology for measuring digital transformation indicators by implementing a neural network language model and Python-based web-scraping techniques. This approach constructs text-based digitalization metrics through systematic keyword frequency analysis of corporate disclosures. The updated results, shown in Column (2) of Table 9, highlight the robustness of this framework.

Neural network language model is a deep learning-based natural language processing (NLP) method that learns distributed representations and contextual semantic relationships from large-scale textual data training, enabling the capture of complex patterns in text. Python crawlers are technical tools that automate the collection of publicly available internet data through programming. By leveraging probabilistic keyword expansion, the deep learning-driven textual analysis achieves enhanced contextual breadth and adaptability. Its dynamic weight adjustment mechanism aligns with evolving textual patterns, ensuring greater precision, comprehensiveness, and metric reliability compared to conventional methods.

This study employs a three-phase methodology to develop robust digital transformation indicators: (1) Keyword Identification and Expansion. Building on existing digital economy literature and policy frameworks, seed words “Big Data,” “Cloud Computing,” “Internet of Things,” and “Artificial Intelligence” were selected to capture digital transformation themes. To mitigate subjective bias, synonym expansion was conducted using the Skip-gram-based Word2Vec neural network, trained on a corpus of 100,000 financial texts within the Wengoo Financial Text Data Platform. The model identified semantically related terms with cosine similarity thresholds ≥0.4, yielding a comprehensive lexicon of 90 keyword clusters in Table 8. (2) Data Acquisition and Preprocessing. Annual reports of Shanghai and Shenzhen listed firms were programmatically retrieved using Python’s Scrapy framework. PDF documents were batch-converted to text format via PyPDF2, with integrity validation to ensure fidelity. The MD&A sections were isolated using regular expression matching, optimizing data relevance for subsequent analysis. (3) Text Analysis and Index Construction. A customized dictionary was integrated into the “jieba” Chinese text segmentation system to quantify the frequency of digitalization-related keywords in MD&A texts. Following Wu et al. (2021), triple manual verification was conducted to correct mismatched terms. Subsequently, aggregated keyword frequencies underwent logarithmic transformation (ln(word_count + 1)) to construct the Digital Transformation Index (Dig), which served as the metric for robustness testing.

The results presented in columns (1) and (2) of Table 9 demonstrate that, after substituting the key variables, the conclusions remain consistent with those drawn earlier, thereby illustrating the robustness of the core findings in this paper.

Lagged effects validation

Digital transformation needs time to establish a comprehensive system and for firms to adapt, so its inhibitory effect on inefficient investment may be lagged. This section examines one- and two-period lags of digital transformation. Regression results in Columns (3) and (4) of Table 9 show that both lags are significantly and negatively correlated with inefficient investment, consistent with previous findings and further demonstrating the study’s robust conclusions.

Selection bias mitigation

The study’s empirical results may be affected by sample selection bias, as digital transformation is not random and is influenced by internal factors. To address this, Propensity Score Matching (PSM) is employed. Following Hui and Xie (2024), a dummy variable for digital transformation is constructed, with high-transformation firms as the treatment group. Propensity scores are calculated using control variables, and 1:3 nearest neighbor matching identifies a similar control group. Treatment effects are then calculated. Results in Column (5) of Table 8 show that PSM-adjusted results still support the original hypothesis.

Additional robustness tests

While the digital transformation index system developed in this study enhances measurement foresight, timeliness, and comprehensiveness, its limitations warrant scrutiny. Specifically, MD&A disclosures subject to managerial discretion may reflect strategic corporate priorities influenced by internal objectives and macroeconomic environments (Zhou et al., 2024). Firms could opportunistically amplify “Internet+” narratives or adopt trend-driven disclosure practices to overstate digital commitments. Additionally, unaudited reporting of digital asset investments in MD&A obscures the delineation between “in-progress” and “completed” initiatives, risking overstatement. To mitigate these validity threats, we implement the following robustness checks: (1) High-quality firm subsample: Restricting analyses to CSRC-rated “excellent” or “good” firms minimizes strategic disclosure biases (Table 10, column 1). (2) GEM-listed firm exclusion: Removing Growth Enterprise Market firms mitigates sector-specific distortions from their inherent digital integration (column 2). (3) Post-2015 sample refinement: Omitting data from the 2015 stock market crash period eliminates confounding disruptions to digital initiatives (column 3). (4) Provincial clustering: Shifting clustering standards to the provincial level accounts for higher-order spatial dependencies, reinforcing regression robustness (column 4). (5) Industry-year fixed effects: Following Pan et al. (2019), we incorporate industry-year joint high-dimensional fixed effects into the baseline model (column 5). Collectively, the consistently negative and statistically significant coefficients for Digital across all specifications underscore the robustness of our research.

Mechanism analysis

Having established robust empirical evidence of digital transformation’s governance effect on inefficient investment, this study now investigates its underlying mechanisms through sequential mediation analysis. Drawing upon the methodological frameworks of Baron and Kenny (1986), we systematically examine three interconnected pathways: internal governance optimization, information asymmetry reduction, and financing constraint alleviation. This approach rigorously reveals the underlying logic between digital transformation and inefficient investments.

Digital transformation drives internal governance optimization by restructuring firms’ dynamic capabilities, primarily through enhanced resource orchestration efficiency and organizational adaptability that mitigate shareholder-management agency conflicts. Aligned with the “digital transformation—improving internal governance—inhibiting inefficient investment” framework, we measure the quality of internal control (IC) as a mediating variable from the “Dibo Listed Company Internal Control Index”. As demonstrated in Table 11, the coefficient of Digital in Column (1) is significantly positive, indicating that digital transformation effectively elevates internal control quality. In Column (2), after incorporating the mediator, Digital retains a significantly negative coefficient, confirming the validity of the internal governance optimization pathway. These results substantiate dynamic capability theory’s central tenet: Digitally-enabled governance constitutes strategic resource reconfiguration that strengthens environmental responsiveness, where technological and organizational systems co-evolve to sustain competitive advantage.

This study examines the mediating role of information disclosure quality in the “digital transformation—reducing information asymmetry—inhibiting inefficient investment” pathway. Following Kim and Verrecchia (2001), the KV index quantifies information opacity by measuring stock return sensitivity to trading volume. Mayer (2021) argued that the greater the sensitivity of stock returns to trading volume, the larger the component of stock price driven by trading volume changes, and the smaller the component driven by firm-specific information, indicating higher information opacity. Therefore, higher KV index values indicate lower information transparency. It can be seen from Column (3)–(4) of Table 12 that the implementation of digital transformation by enterprises enhances information transparency, thus inhibiting the inefficient investment behavior of enterprises, which confirms the action path of digital transformation to alleviate information asymmetry.

Digital transformation enables enterprises to leverage digital platforms to build external financing networks, accessing financial support from external investors and supply chain companies, thus diversifying financing channels, reducing financing constraints, preventing insufficient investment in high-quality projects, and rectifying inefficient investment behavior of enterprises. Based on this, this paper conducts a mediating effect analysis based on the path of “digital transformation—alleviating financing constraints—inhibiting inefficient investment”. Following the method designed by Whited and Wu (2006), the WW index is selected as the proxy variable for corporate financing constraints. The larger the WW index, the greater the financing constraint. From Column (5) of Table 10, it can be seen that the coefficient before Digital is −0.0531, which is significant at the level of 1%, indicating that digital transformation can reduce financial constraints and alleviate financing difficulties. After adding the mediating variable WW index to Column (6), the coefficient before Digital is still significantly negative, confirming that digital transformation reduces inefficient investment both directly and by lowering financing costs and constraints.

Heterogeneity analysis

In the benchmark regression analysis, this paper investigates how digital transformation affects inefficient investment. Given China’s digital development landscape, the effectiveness of digital transformation varies significantly among firms. High-tech firms, leveraging their technological expertise, can more easily integrate into the digital economy. Regionally, firms in the eastern area, facing fierce competition, are more inclined to pursue digital innovation to gain a competitive edge. Regarding firm size, larger enterprises, with stronger financing capabilities and abundant resources, can advance digital transformation more swiftly. Considering these factors, conducting heterogeneity tests based on industry nature, regional differences, and firm characteristics not only offers a more comprehensive understanding of the impact of digital transformation on inefficient investment but also provides empirical support for policy-making by the government and relevant authorities.

Heterogeneity Analysis Based on Industry Characteristics. Columns (1) and (2) in Table 12 report the regression results for high-tech and non-high-tech firms. The findings indicate that digital transformation suppresses inefficient investment in both groups, with a stronger effect observed in high-tech firms (coefficient = −0.0105, significant at the 1% level). This enhanced effect likely stems from high-tech firms’ superior informatization and robust software and hardware infrastructure, which enable them to effectively manage the long-term and uncertain nature of digital transformation. These firms can rapidly implement digital technologies and significantly boost investment efficiency. Conversely, non-high-tech firms, with weaker technological foundations, must allocate considerable time and resources to identify their digital transformation pathways. This leads to slower digital technology integration into production management, decision-making, and business models, resulting in a weaker suppression of inefficient investment compared to high-tech firms.

Heterogeneity Analysis Based on Regional Differences. Consistent with the methodology of Zhao and Dong (2025), the sample firms are categorized into three regional groups: eastern, central, and western. Columns (3) to (5) in Table 12 display the regression results for these groups. The findings indicate that digital transformation significantly reduces inefficient investment in the eastern and central regions (coefficient = −0.0111 and −0.0124, significant at the 1% level), whereas no significant effect is observed in the western region. This divergence likely stems from the higher marketization and more intense competition in the eastern and central regions. Specifically, firms in the eastern region demonstrate a strong inclination toward digital transformation, supported by more mature applications of digital technologies. These firms can rapidly achieve tangible benefits from digital transformation, thereby effectively curbing inefficient investment.

Heterogeneity Analysis Based on Firm Size. Using the classification criteria from the National Bureau of Statistics of China, this study categorizes firms based on annual operating revenue, with those exceeding 400 million yuan classified as large-scale enterprises. Columns (6) and (7) in Table 12 show the regression results for different firm sizes. Digital transformation significantly reduces inefficient investment in large-scale firms (coefficient = −0.0078, significant at the 1% level), but no significant effect is observed in medium and small-scale firms. This divergence likely stems from large-scale firms’ greater resource availability, which facilitates more effective digital transformation and, in turn, curbs inefficient investment.

Conclusions and implications

Research conclusion

Amid the rapid global digitalization and the complex, dynamic environment confronting Chinese enterprises, this study examines how digital transformation affects inefficient investment, integrating diversification and environmental uncertainty into the analysis. Using A-share listed companies from 2011 to 2021 as the sample, we construct a digital transformation index using a neural network language model and Python web crawler tools. Our findings are as follows:

First, digital transformation significantly enhances investment efficiency and curbs inefficient investment behaviors, a conclusion that remains robust after rigorous endogeneity corrections and robustness tests. Second, the impact of digital transformation on reducing inefficient investment is stronger in firms with higher levels of internal diversification but weaker in those facing greater environmental uncertainty. Third, mechanism analysis reveals that digital transformation curbs inefficient investment by optimizing internal governance, alleviating information asymmetry, and easing financing constraints. Finally, heterogeneous analysis shows that digital transformation is particularly effective in reducing inefficient investment among high-tech firms, those in central and eastern regions, and larger firms.

Theoretical and practise implications

Theoretical significance

Drawing on agency theory, resource-based theory, and dynamic capabilities theory, this study explores how digital technology may enhance investment efficiency through governance restructuring. It offers a novel lens for examining governance theory innovation within the context of the digital economy. By incorporating diversification and environmental uncertainty into the analytical framework, the study reveals the context-dependent effects of digital transformation, thereby contributing to the applications of institutional complexity and contingency theories in this domain.

Practical significance

This research provides valuable insights for improving corporate governance practices and optimizing investment decision-making processes. By strategically leveraging digital transformation, firms can develop data-driven decision support systems that standardize workflows, enhance transparency, and strengthen dynamic capabilities. This offers management tools that can aid in more precise resource allocation. Additionally, the study offers practical guidance for firms operating in complex environments. For example, within diversified operations, digital platforms could facilitate cross-departmental data sharing and collaboration. Moreover, the findings suggest that digital governance initiatives may be more effective in relatively stable external environments. These insights can inform government efforts to build digital ecosystems, design targeted policies, and promote stability, thereby fostering the integration of the digital and real economies and driving high-quality economic growth.

Case practise

Digital Investment Governance Model

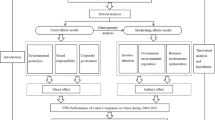

Building on the empirical findings of the preceding study, this research proposes the Digital Investment Governance Model (DIGM), offering a structured framework to analyze how digital transformation enhances corporate investment efficiency, as depicted in Fig. 3. The input layer includes key elements of digital transformation, such as investments in digital technologies, accumulation of data assets and reconfiguration of organizational processes. The core mechanism layer encompasses three primary pathways: improving internal governance, reducing information asymmetry, and alleviating financing constraints. The moderating effect layer captures the dynamic impact of contextual factors. While high diversification amplifies effectiveness through data sharing and collaboration, high environmental uncertainty dilutes digital technology benefits due to market noise. The output layer reflects the reduction of inefficient investment, with the ultimate aim of enhancing investment precision and optimizing resource allocation efficiency.

Case validation

As a global leader in new energy vehicles, batteries, and electronic manufacturing, BYD is recognized for its innovative technologies and sustainability commitment. At the input layer, the company established Industry 4.0 smart factories and the YunNian Intelligent Control Platform, supporting digital transformation and enhancing operational efficiency. At the core mechanism layer, BYD focuses on optimizing internal governance and maximizing production capacity. The implementation of automated production lines and AI-driven quality inspection has significantly enhanced capacity utilization. In 2023, BYD’s capacity utilization rate reached 159.5%, well above the industry average of 50%. The company also prioritizes information symmetry. Through the “Di Chain” platform, BYD has integrated over 3000 suppliers, reduced accounts payable turnover days to 150, and improved demand forecasting accuracy to 95%. Furthermore, digital transformation aligns with China’s “dual carbon” strategy, easing access to government subsidies and green credit. As a result, BYD’s financing costs have decreased significantly. For instance, in Q1 2024, interest expenses accounted for just 0.37% of revenue, a year-on-year reduction of 0.31 percentage points. At the regulatory level, BYD leverages its vertical integration across batteries, motors, electronic controls, and vehicle manufacturing to facilitate diversified collaboration. By 2023, cross-departmental data sharing had increased by 40%. Moreover, the stability of China’s new energy vehicle policies and technological pathways in recent years has further amplified the benefits of digital transformation. Ultimately, these efforts result in improved production efficiency, enhanced risk management, and reduced capacity mismatches at the output layer.

Policy recommendations

-

(1)

Align with digital economy trends and enhance digital governance effects. Policy-makers should guide enterprises toward digital transformation through supportive policies, addressing challenges in the digital transition. This will ensure that data-driven digital revolutions become a key contributor to economic and social development. Specifically, the government could enhance core mechanisms, such as alleviating financing constraints through digital transformation. For example, establishing a “Digital Technology Application Special Loan” program to provide low-interest financing for enterprises adopting cloud computing and big data analytics could serve as an effective measure.

-

(2)

Promote digital transformation in diversified enterprises and stabilize the macroeconomic environment. Encourage enterprises with diversified business portfolios to accelerate digital transformation by developing unified data platforms and intelligent decision-making systems. This will facilitate data sharing and resource integration across different business lines. Meanwhile, government departments should enhance policy foresight and continuity, improve the transparency and predictability of economic policies, and avoid frequent policy fluctuations that may interfere with corporate investment decisions. This will help reduce external environmental uncertainty and noise for enterprises.

-

(3)

Tailor policies to different entities and implement differential transformation strategies. For industry-specific differences, emphasize technological leadership and standard-setting in high-tech industries to encourage the deep integration of digital technologies with core business activities. This will fully leverage the governance effects of digital transformation in reducing inefficient investment. For regional disparities, increase investment in digital infrastructure in central and western regions to narrow the digital divide, while supporting eastern regions in exploring innovative digital models and creating benchmarks for digital transformation. In terms of firm size, develop a “chain leader-led and ecosystem-coordinated” model. Large enterprises should lead the digital transformation of their supply chains by sharing their digital capabilities and extending these capabilities to the downstream of the supply chain.

Limitations and future research

While this study offers a novel perspective on the relationship between digital transformation and inefficient investment, it is not without limitations. First, the digital transformation index, though integrating textual analysis and a multidimensional indicator system, primarily depends on information disclosed in annual reports. This reliance limits its ability to capture implicit digital capabilities, such as the reshaping of internal production processes and organizational cultural changes. Second, the study focuses on the moderating effects of diversification and environmental uncertainty but does not fully explore the dynamic interactions between digital transformation and emerging governance issues, such as algorithmic ethical conflicts and data monopoly risks.

Future research can address these limitations by adopting a mixed-methods approach. Combining quantitative empirical analysis with qualitative case studies can help construct a dynamic and multidimensional digital transformation index. In-depth interviews can reveal implicit barriers to digital transformation, such as managerial cognitive biases and organizational inertia, thereby enhancing the explanatory power of large-sample data on micro mechanisms. Additionally, future research should expand the exploration of the interaction between digital transformation and governance issues. For example, the challenges posed by algorithmic black boxes and accountability need further investigation: when AI algorithms dominate investment decisions, how can managerial responsibility be defined, and how can ethical risks be mitigated? Game theory models could be employed to explore data power imbalances, while complex adaptive systems theory could be introduced to view corporate digital transformation as a dynamic evolutionary process. This perspective would allow for analyzing its co-adaptation mechanisms with both internal and external environments.

As research dimensions in the field of digital transformation continue to expand and research methods evolve, these shortcomings can be effectively addressed. This will pave the way for research outcomes that are both academically rigorous and practically significant.

Data availability

The financial and governance data used in this study came from CSMAR database (https://data.csmar.com/) and WIND database (https://www.wind.com.cn/), while the data on digital transformation are derived from corporate annual reports. We have not been authorized to disclose the content of the relevant databases. If readers are interested in replicating this study, they can use crawling software or engaging professional companies to obtain it. We have provided a digitalization word list in the text. The datasets generated during the current study are available from the corresponding author upon reasonable request.

References

Almeida H, Campello M (2007) Financial constraints, asset tangibility, and corporate investment. Rev Financ Stud 20(5):1429–1460. https://doi.org/10.1093/rfs/hhm019

Akhter W, Hassan A (2024) Does corporate social responsibility mediate the relationship between corporate governance and firm performance? Empirical evidence from BRICS countries. Corp Soc Responsib Environ Manag 31(1):566–578. https://doi.org/10.1002/csr.2586

Aral S, Weill P (2007) IT assets, organizational capabilities, and firm performance: How resource allocations and organizational differences explain performance variation. Organ Sci 18(5):763–780. https://doi.org/10.1287/orsc.1070.0306

Aiken and West (1991) Multiple regression: testing and interpreting interactions. J Oper Res Soc. https://doi.org/https://www.jstor.org/stable/2583960

Autio E, Nambisan S, Thomas LDW, Wright M (2018) Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strateg Entrep J 12(1):72–95. https://doi.org/10.1002/sej.1266

Babina T, Fedyk A, He A, Hodson J (2024) Artificial intelligence, firm growth, and product innovation. J Financ Econ. https://doi.org/10.1016/j.jfineco.2023.103745

Brynjolfsson E, Hui X, Liu M (2019) Does machine translation affect international trade? Evidence from a large digital platform. Manage Sci. https://doi.org/10.1287/mnsc.2019.3388

Bharadwaj A, El Sawy OA, Pavlou PA, Venkatraman N (2013) Digital business strategy: toward a next generation of insights. MIS Q 37(2):471–482. https://doi.org/10.25300/MISQ/2013/37:2.3

Bloom BN (2009) The impact of uncertainty shocks. Econ 77(3):623–685. https://doi.org/10.3982/ecta6248

Blanco-Mesa F, Merigo JM, Gil-Lafuente AM (2017) Fuzzy decision making: a bibliometric-based review. J Intell Fuzzy Syst 32(3):2033–2050. https://doi.org/10.3233/JIFS-161640

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–175. https://doi.org/10.1257/jep.28.2.153

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173. https://doi.org/10.1037/0022-3514.51.6.1173

Cao S, Jiang W, Yang B, Zhang AL (2023) How to talk when a machine is listening: corporate disclosure in the age of AI. Rev Financ Stud 36(9):3603–3642. https://doi.org/10.1093/rfs/hhad021

Chen R, El Ghoul S, Guedhami O, Wang H (2017) Do state and foreign ownership affect investment efficiency? Evidence from privatizations. J Corp Financ 42:408–421. https://doi.org/10.1016/j.jcorpfin.2014.09.001

Chen Z, Jiang K (2024) Digitalization and corporate investment efficiency: evidence from China. J Int Financ Mark Inst Money 91:101915. https://doi.org/10.1016/j.intfin.2023.101915

Cheng WX, Li C, Zhao TJ (2024) The stages of enterprise digital transformation and its impact on internal control: Evidence from China. Int Rev Financ Anal 92. https://doi.org/10.1016/j.irfa.2024.103079

Cheng W, Li C, Zhao T (2024) The stages of enterprise digital transformation and its impact on internal control: Evidence from China. Int Rev Financ Anal 92. https://doi.org/10.1016/j.irfa.2024.103079

Celino I, Carriero VA, Azzini A, Baroni I, Scrocca M (2025) Procedural knowledge management in industry 5.0: Challenges and opportunities for knowledge graphs. Web Semant 84. https://doi.org/10.1016/j.websem.2024.100850

Chit M, Rizov M (2023) SMEs’ diversification of financing sources: strategy or desperation? Int J Financ Econ. https://doi.org/10.1002/ijfe.2822

Chen H, Zhang H (2024) Uncertainty perception and corporate innovation: a study of group effects. Econ Manag 46(10):106–125. https://doi.org/10.19616/j.cnki.bmj.2024.10.006

Chen S, Sun Z, Tang S, Wu D (2011) Government intervention and investment efficiency: evidence from China. J Corp Financ 17(2):259–271. https://doi.org/10.1016/j.jcorpfin.2010.08.004

Fu X, Yu HM, Dong X, Chen CH (2025) When the customers comes to you: mobile apps and corporate investment efficiency. Hum Soc Sci Commun 12:326. https://doi.org/10.1057/s41599-025-04625-1

Feng Y, Huang R, Chen Y, Sui G (2024) Assessing the moderating effect of environmental regulation on the process of media reports affecting enterprise investment inefficiency in China. Hum Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-024-02677-3

Firk S, Hanelt A, Oehmichen J (2021) Chief digital officers: An analysis of the presence of a centralized digital transformation role. J Manag Stud 58(7):1800–1831. https://doi.org/10.1111/joms.12718

Fang XB, Liu MT (2024) How does the digital transformation drive digital technology innovation of enterprises? Evidence from enterprise’s digital patents. Technol Forecast Soc Change 204. https://doi.org/10.1016/j.techfore.2024.123428

Goldstein I, Spatt CS, Ye M (2021) Big data in finance. Rev Financ Stud 34(7):3213–3225. https://doi.org/10.1093/rfs/hhab038

Habib A, Hasan MM (2017) Managerial ability, investment efficiency and stock price crash risk. Res Int Bus Financ 42:262–274. https://doi.org/10.1016/j.ribaf.2017.07.048

Hu R, Tian J, Wu X (2012) The empirical measurement of enterprise inefficient investment - Richardson-based investment expectation model. Inf Bus Intel (IBI 2011), p 461–467. https://doi.org/10.1007/978-3-642-29087-9_71

Helfat CE, Winter SG (2011) Untangling dynamic and operational capabilities: strategy for the (n)ever-changing world. Strateg Manag J 32(11):1243–1250. https://doi.org/10.1002/smj.955

Huang QY, Yu YZ, Zhang SL (2019) The impact of internet development on manufacturing industry production efficiency: Endogenous mechanism and Chinese experience. China Ind Econ. https://doi.org/10.19581/j.cnki.ciejournal.2019.08.001

Hui LL, Xie HB (2024) Intelligent manufacturing, innovation culture, and corporate cost stickiness. Manage Rev. https://doi.org/10.14120/j.cnki.cn11-5057/f.2024.05.015

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs, and ownership structure. J Financ Econ 3(4):305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jiang X, Xin BH (2022) Financial reporting discretion, managerial myopia, and investment efficiency. Acc Rev 97(2):291–316. https://doi.org/10.2308/tar-2017-0342

Kohtamaki M, Parida V, Oghazi P, Gebauer H, Baines T (2019) Digital servitization business models in ecosystems: a theory of the firm. J Bus Res 104:380–392. https://doi.org/10.1016/j.jbusres.2019.06.027

Kim Y, Ra G (2018) Impact of diversification strategy on real earnings management. Korean J Bus Admin 31(6):1117–1139. https://doi.org/10.18032/kaaba.2018.31.6.1117

Kim O, Verrecchia RE (2001) The relation among disclosure, returns, and trading volume information. Acct Rev 76(4):633–654. https://doi.org/10.2308/accr.2001.76.4.633

Liang H, Wang N, Xue Y, Ge S (2017) Unraveling the alignment paradox: How does business—IT alignment shape organizational agility? Inf Syst Res 28(4):863–879. https://doi.org/10.1287/isre.2017.0711

Lino AF, Aquino ACBD, Neves FR (2022) Accountants’ postures under compulsory digital transformation imposed by government oversight authorities. Financ Account Manag 38(2):202–222. https://doi.org/10.1111/faam.12313

Lin M, Xu Z, Zhai Y, Yao Z (2018) Multi-attribute group decision-making under probabilistic uncertain linguistic environment. J Oper Res Soc 69(2):157–170. https://doi.org/10.1057/s41274-017-0182-y

Li B, Wang QD, Gan TQ, Sheng TY (2023) The effect of corporate digital transformation on pollution reduction: An analysis framework based on “trilateral governance”. Ind Econ Res. https://doi.org/10.13269/j.cnki.ier.2023.05.008

Malmendier U, Tate G (2005) CEO overconfidence and corporate investment. NBER Working Paper. http://www.nber.org/papers/w10807

Modigliani F, Miller MH (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–297. https://www.jstor.org/stable/1809766

Mayer EJ (2021) Advertising, investor attention, and stock prices: evidence from a natural experiment. Financ Manag 50(1):281–314. https://doi.org/10.1111/fima.12324

Pan Y, Tang XD, Ning B, Yang LL (2019) The relationship between franchisee shareholders and corporate investment efficiency: governance cooperation or competitive conspiracy. China Ind Econ 02:136–164. https://doi.org/10.19581/j.cnki.ciejournal.2020.02.008

Rehman IU, Shahzad F, Latif KF (2021) Does corporate social responsibility mediate the influence of national culture on investment inefficiency? Firm-level evidence from Asia Pacific. J Financ Econ 26(3):3484–3503. https://doi.org/10.1002/ijfe.1972

Richardson S (2006) Over-Investment of free cash flow. Rev Acc Stud 11(2):159–189. https://doi.org/10.1007/s11142-006-9012-1

Sun G, Li T, Ai Y, Li Q (2023) Digital finance and corporate financial fraud. Int Rev Financ Anal 87:102566. https://doi.org/10.1016/j.irfa.2023.102566

Simsek Z, Vaara E, Paruchuri S (2019) New ways of seeing big data. Acad Manag J 62(4):971–978. https://doi.org/10.5465/amj.2019.4004

Sonar H, Ghag N, Kharde Y (2023) Digital innovations for micro, small and medium enterprises in the net zero economy: a strategic perspective. Bus Strat Dev 6(4):586–597. https://doi.org/10.1002/bsd2.264

Stallkamp M, Chen L, Li S (2023) Boots on the ground: foreign direct investment by born digital firms. Glob Strat J 13(4):805–829. https://doi.org/10.1002/gsj.1474

Tambe P, Hitt LM (2012) The productivity of information technology investments: new evidence from IT labor data. Inf Syst Res 23(3-part-1):599–617. https://doi.org/10.1287/isre.1110.0398

Teece DJ, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strateg Manag J 18(7):509–533. https://doi.org/10.1002/(sici)1097-0266(199708)18:7<509:aid-smj882>3.0.co;2-z

Verhoef PC, Broekhuizen T, Bart Y, Bhattacharya A, Dong JQ, Fabian N, Haenlein M (2021) Digital transformation: a multidisciplinary reflection and research agenda. J Bus Res 122:889–901. https://doi.org/10.1016/j.jbusres.2019.09.022

Verhoef PC, Bijmolt TH (2019) Marketing perspectives on digital business models: a framework and overview of the special issue. Int J Res Mark 36:341–349. https://doi.org/10.1016/j.ijresmar.2019.08.001

Wu F, Hu H, Li H, Ren X (2021) Enterprise digital transformation and capital market performance: empirical evidence from stock liquidity. Manag World 37:130–144. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0097

Wu Y, Li Z (2024) Digital transformation, entrepreneurship, and disruptive innovation: evidence of corpo-rate digitalization in China from 2010 to 2021. Hum Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-023-02378-3

Whited TM, Wu G (2006) Financial constraints risk. Rev Financ Stud 19(2):531–559. https://doi.org/10.1093/rfs/hhj012

Xue L, Dong J, Jiang S (2024) Digital financial development and inefficient investment: a study based on the dual perspectives of resource and governance effects. Hum Soc Sci Commun 11(1). https://doi.org/10.1057/s41599-023-02411-5

Xu GY, Li GG, Sun PB, Peng D (2023) Inefficient investment and digital transformation: What is the role of financing constraints? Financ Res Lett 51. https://doi.org/10.1016/j.frl.2022.103429

Yoo Y, Boland RJ, Lyytinen K, Majchrzak A (2012) Organizing for innovation in the digitized world. Organ Sci 23(5):1398–1408. https://doi.org/10.1287/orsc.1120.0771

Yang Y, Wang Y, Qi C (2023) The guiding effect of economic stimulus plan on corporate investment behavior in heterogeneous institutional environment. Econ Lett 224:111003. https://doi.org/10.1016/j.econlet.2023.111003

Zhen HX, Wang X, Fang HX (2023) Intellectual property rights protection and corporate digital transformation. Econ Res 58(11):62–79

Zhu C (2019) Big data as a governance mechanism. Rev Financ Stud 32(5):2021–2061. https://doi.org/10.2139/ssrn.3164624

Zhou B, Ma L, Yang S (2024) Catering behaviors in corporate digitization disclosures: Identification and analyst forecast accuracy loss. Res Int Bus Financ 68:102201. https://doi.org/10.1016/j.ribaf.2023.102201

Zhao X, Dong F (2025) Digital infrastructure construction and corporate innovation efficiency: evidence from broadband china strategy. Hum Soc Sci Commun 12(1). https://doi.org/10.1057/s41599-025-04614-4

Acknowledgements

This paper is supported by the National Social Science Fund of China (Grant No. 20CGL038), the Philosophy and Social Sciences Research Project of Hubei Provincial Department of Education(Grant No. 23Y081), and the Hubei Industrial Research Institute.

Author information

Authors and Affiliations

Contributions

Conceptualization: ZP, JR, and PZ; methodology: ZP and HZ; resources: ZP and JR; data curation: PZ and HZ; data collection and data analysis: HZ and ZP; writing—original draft preparation: ZP and PZ; writing—review and editing: ZP, HZ, JR, and YC; supervision: ZP and JR; funding acquisition: ZP and JR. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Peng, Z., Zhang, H., Zhou, P. et al. Enterprise digital transformation and inefficient investment: from the perspective of diversified operations and environmental uncertainty. Humanit Soc Sci Commun 12, 1234 (2025). https://doi.org/10.1057/s41599-025-05591-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-05591-4