Abstract

This study explores the application of a multi-layer deep neural network to identify green credit risks, with a focus on the role of anti-corruption measures. Using data from 36 Chinese banks, the model incorporates indicators of transparency and accountability to enhance risk prediction. Based on expert judgment and Analytic Hierarchy Process (AHP) analysis, the transparency and accountability indicators were weighted at 0.7 and 0.3, respectively. The model achieved strong performance, maintaining stability under data noise and outperforming traditional methods such as Support Vector Machine (SVM), Convolutional Neural Network (CNN), eXtreme Gradient Boosting (XGBoost), and Deep Belief Network (DBN), with a recall rate of 0.84. Performance improved as the intensity of anti-corruption measures increased, suggesting that governance factors significantly enhance model reliability. These results demonstrate the potential of advanced machine learning techniques in financial risk assessment and emphasize the importance of institutional transparency in promoting sustainable green finance.

Similar content being viewed by others

Introduction

Financial technology (FinTech) has significantly influenced sustainable development in the digital era. This study examines how FinTech may exacerbate greenwashing through data manipulation and explores the implications for green credit systems (Chang et al., 2023). While financial institutions are increasingly investing in environmentally friendly projects (Kwilinski et al., 2023), the rise of FinTech has, in some cases, facilitated greenwashing. Certain firms exploit FinTech tools—such as the manipulability of blockchain data, biases in AI-driven content filtering, and asymmetries in big data analytics—to misrepresent projects as environmentally compliant. These practices allow non-compliant projects to access green credit, misleading investors and undermining the credibility of green finance.

The rapid expansion of green credit also presents new challenges, particularly in the areas of risk identification and management (Adewumi et al., 2024). In response, this study investigates the use of multi-layer deep networks for identifying green credit risks. It aims to address the dual imperatives of environmental protection and financial sustainability. Drawing on existing literature and theoretical frameworks, the study proposes two hypotheses: H1: Multi-layer deep networks provide higher accuracy and robustness in green credit risk identification compared to traditional financial models. H2: The inclusion of anti-corruption measures significantly improves the predictive accuracy of green credit risk models. To test these hypotheses, the study applies a multi-layer deep learning approach, which offers superior pattern recognition and has demonstrated better performance than conventional models in prior research (Dou and Gao, 2022; Lyu et al., 2023). The model incorporates anti-corruption factors, specifically transparency and accountability, to further enhance predictive capabilities.

By leveraging deep learning, this study aims to provide financial institutions with more reliable tools for green credit decision-making. It also highlights the importance of integrating anti-corruption measures to improve transparency in green finance and reduce the risk of fraudulent behavior (Kazachenok et al., 2023). These advancements contribute to stronger financial sustainability and support environmentally responsible investment practices.

The remainder of the study is structured as follows: a review of relevant literature, a detailed methodology, empirical results, and the conclusion. Overall, this study offers practical and theoretical insights for advancing green credit risk assessment, with implications for both academic research and financial practice.

Literature Review

Green credit, deep learning technologies, and anti-corruption measures are critical components in the study of FinTech and sustainable finance. Although these areas have been extensively examined in the literature, their interrelationships remain insufficiently explored. Aghaei et al. (2024) investigated the application of ESG indicators in assessing bank clients’ creditworthiness, highlighting the essential role financial institutions play in promoting responsible lending and sustainable finance. Similarly, Debrah et al. (2023) analyzed the challenges facing green finance development, identified funding gaps, and called for more effective financing mechanisms to address these shortcomings. Udeagha and Ngepah (2023) further examined the impact of green finance and FinTech in emerging markets, demonstrating that FinTech not only improved access to green credit but also increased financial institutions’ willingness to support environmentally sustainable projects.

In recent years, the integration of big data and artificial intelligence (AI) into green finance has attracted growing interest. Li et al. (2023b) explored the role of big data in clean energy financial management and found that data-driven decision-making enhanced the efficiency and sustainability of environmental project financing. In related research, Li et al. (2024a) studied the effects of climate change on corporate Environmental, Social, and Governance (ESG) performance, emphasizing that strong governance—particularly anti-corruption practices—was vital in promoting sustainable investment behavior. Additionally, Li et al. (2024b) underscored the significance of intellectual property-backed financing in fostering corporate innovation and sustainability. Their findings revealed that such mechanisms incentivize companies within the green credit sector to adopt environmentally friendly technologies.

Deep learning has emerged as a powerful tool in FinTech, widely applied to enhance risk management and decision-making in financial markets. Hajek et al. (2024) used natural language processing and machine learning to analyze ESG report texts, demonstrating that AI could improve the accuracy of corporate credit ratings and support green finance risk identification. Giudici and Raffinetti (2023) introduced the concept of “secure AI” in finance, highlighting the need for transparency and security in AI-driven risk prediction to ensure system stability. Similarly, Kanaparthi (2024) proposed that machine learning not only improved the efficiency of financial risk management but also supported the development of sustainable finance. Mirza et al. (2023) further explored the influence of FinTech on green finance and banking profitability, showing that green financial technologies enhanced the profitability of green credit initiatives while reducing financial fraud and regulatory risks.

ESG considerations are also gaining traction in the FinTech landscape. Lim (2024) explored the integration of ESG principles and AI, showing that AI-enhanced ESG rating systems improved transparency in sustainable investments and helped reduce greenwashing by addressing data asymmetry.

Financial institutions play a vital role in advancing anti-corruption efforts. Nguyen Thanh et al. (2025) incorporated the Corruption Perceptions Index into credit risk prediction models and used machine learning techniques to quantify its impact, providing empirical evidence for the role of governance in financial risk management. Lăzăroiu et al. (2023) examined blockchain-based FinTech systems and found that blockchain significantly enhanced transparency in financial transactions while reducing opportunities for corruption. Similarly, Lyeonov et al. (2024) conducted a bibliometric analysis on the role of artificial intelligence and machine learning in detecting and preventing illicit financial activities. Their findings emphasized the potential of these technologies to improve transparency and mitigate corruption risks. At the institutional level, Kong et al. (2023) analyzed anti-corruption measures across countries and regions, offering insights into regulatory variations within the financial sector. Their study proposed strategies to promote international collaboration and harmonize regulatory standards. Additionally, Li et al. (2023a) examined the impact of climate change on corporate ESG performance and underscored the importance of strong corporate governance—particularly anti-corruption mechanisms—in promoting sustainable investment.

While existing research has thoroughly explored green credit, deep learning technologies, and anti-corruption practices, these domains have mostly been studied in isolation. Although prior studies have addressed the role of FinTech in both green finance and anti-corruption strategies, few have integrated these components into a unified framework. This study seeks to fill that gap by developing a green credit risk identification model that combines multi-layer deep learning networks with anti-corruption mechanisms. The proposed framework aims to enhance both the accuracy and credibility of decision-making in green finance.

Research methods for risk identification of green credit and anti-corruption measures of green credit

Data collection

Acquisition of green credit-related data

This study collected comprehensive green credit data from 36 banks across mainland China, including state-owned, joint-stock, city commercial, and rural commercial banks. The state-owned banks in the dataset include the Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, and Bank of Communications. Joint-stock banks include China Merchants Bank, Shanghai Pudong Development Bank, Huaxia Bank, China Minsheng Bank, China Everbright Bank, and China CITIC Bank, among others. City commercial banks represented in the data include Bank of Beijing, Bank of Shanghai, Bank of Hangzhou, Bank of Nanjing, and Bank of Qingdao. Rural commercial banks primarily consist of Chongqing Rural Commercial Bank and Suzhou Rural Commercial Bank. These institutions differ in size, business models, and green credit policies, allowing the study to capture a wide range of operational contexts. This diversity enhances the generalizability and practical relevance of the findings.

The dataset spans from 2015 to 2023, a period marked by significant growth in green finance policy development. During these years, the Chinese government actively promoted green finance through key initiatives such as the Green Credit Guidelines (2012) and the Implementation Plan for Green Finance Reform and Innovation Pilot Zones (2017). As a result, the dataset provides a detailed overview of green credit trends and associated risk patterns during a transformative phase for China’s green finance sector.

The dataset comprises several key financial indicators. The green credit ratio (Xu et al., 2023) reflects the proportion of a bank’s investments directed toward environmentally sustainable projects. Return on assets (ROA) measures overall bank performance, while the liquidity ratio evaluates a bank’s capacity to meet financial obligations based on the maturity and repayment structure of its green credit projects. The non-performing loan ratio captures the level of credit risk within a bank’s loan portfolio. In addition to these core metrics, the dataset includes supplementary variables such as total bank assets, year-end total loans, the capital adequacy ratio, GDP growth rate, cost-to-income ratio, equity multiplier, and overall GDP. Together, these indicators offer a comprehensive view of green credit deployment and its influencing factors across the 36 banks studied. The dataset covers the years 2015 to 2023 and contains 6100 data points. These represent cumulative records across multiple variables rather than a simple product of the number of banks and years. Each data point corresponds to specific financial indicators such as the green credit ratio, ROA, and non-performing loan ratio, providing a robust basis for analysis.

The green credit data used in this study were primarily obtained from several publicly accessible and verifiable sources. These include Annual Reports, Sustainability Reports, and Environmental Information Disclosure Reports published on the official websites of individual banks. Additional data were sourced from regulatory bulletins and industry statistics released by the China Banking and Insurance Regulatory Commission (CBIRC). Supplementary information was gathered from reputable platforms such as Cninfo (www.cninfo.com.cn) and the Statistical Yearbook module of China National Knowledge Infrastructure (CNKI). Authoritative publications from institutions such as the People’s Bank of China and the Green Finance Committee—including the Green Credit Development Report and the Financial Statistics Bulletin—were also used to support the research.

Data preprocessing and cleaning

Following data collection, rigorous preprocessing and cleaning procedures are conducted to ensure the dataset’s accuracy and reliability. The specific steps involved are summarized in Table 1 (Udeagha and Muchapondwa, 2023).

The data preprocessing began with the systematic identification and treatment of missing values. Statistical techniques and visualization tools were then used to detect and manage outliers, ensuring the accuracy and consistency of the dataset. Next, standardization and normalization were applied to align indicators measured on different scales, enhancing comparability. Finally, data formatting was standardized to prepare the dataset for modeling. After preprocessing, the dataset contained 6000 entries. These were split into training, validation, and test sets using a 7:2:1 ratio.

Green credit risk identification was framed as a binary classification task, distinguishing between high-risk and low-risk projects. However, a class imbalance was identified—high-risk (positive) samples were significantly outnumbered by low-risk (negative) samples, a common issue in financial risk prediction.

To address this imbalance, a hybrid sampling strategy was used. Random undersampling reduced the number of low-risk samples, while the Synthetic Minority Over-Sampling Technique (SMOTE) generated synthetic high-risk samples. This approach balanced the dataset, reduced model bias, and improved the accuracy and reliability of classification results.

Theoretical Framework and Hypotheses

To build a theoretical foundation linking green credit risk, anti-corruption measures, and deep learning, this study draws on stakeholder theory and institutional theory as its core frameworks. According to stakeholder theory, banks issuing green credit must balance the interests of multiple stakeholders, including shareholders, government agencies, environmental groups, and the public. Strengthening transparency and accountability—through anti-corruption measures—helps build trust between banks, regulators, and society. This, in turn, reduces the credit risk associated with green lending.

Different stakeholders have varying demands regarding green credit practices. Shareholders focus on long-term returns and corporate reputation, favoring prudent and compliant green credit policies. Government regulators emphasize policy enforcement and carbon neutrality goals, encouraging banks to align with green policy directives. Environmental organizations are concerned whether funds genuinely support environmental projects and may exert pressure through public opinion or ratings. Meanwhile, the general public and customers increasingly prefer to deposit or invest with banks that demonstrate strong ESG performance. To maintain reputation, legitimacy, and compliance, banks must therefore strengthen information disclosure (transparency) and supervisory accountability mechanisms. This rationale forms the practical basis for embedding the Anti-Corruption Measure Factor (ACMF) in the model developed in this study.

Institutional theory posits that financial institutions’ green credit policies are shaped by external regulatory pressures. Anti-corruption measures—such as mandatory information disclosure and environmental performance audits—help prevent fund misallocation, promote more efficient use of green credit, and reduce systemic financial risk.

Institutional theory suggests that financial institutions’ behavior in green credit activities is influenced not only by market forces but also by formal institutions—such as regulatory policies and ESG standards—and informal institutions, including industry norms and cultural perceptions. Transparency and accountability serve as key institutional mechanisms, aligning with two dimensions of institutional theory: normative institutions (e.g., disclosure obligations) and regulatory institutions (e.g., audit procedures and accountability systems). Therefore, this study incorporates transparency and accountability as core variables representing anti-corruption mechanisms within the proposed model. The study hypotheses are also grounded in institutional theory. Hypotheses H2 through H5 explore how these mechanisms improve risk identification by responding to institutional pressures that drive organizations to strengthen internal controls and external communication. Specifically, H5 examines the interaction between transparency and accountability, drawing on the view that coordinated institutional elements can enhance organizational legitimacy. These institutional considerations provide a foundational rationale for the selection of model variables and the structure of the study hypotheses.

Drawing on these theoretical foundations, this study posits that deep learning technologies enhance the accuracy of green credit risk prediction by detecting complex patterns in financial data. Additionally, anti-corruption measures—such as improved transparency and accountability—strengthen governance, reduce fund misappropriation, and support more effective credit risk management.

Based on this framework, the study proposes two core hypotheses:

H1: A multi-layer deep neural network model achieves higher accuracy and robustness in identifying green credit risks compared to traditional financial models.

H2: Incorporating anti-corruption measures (e.g., transparency and accountability) significantly improves the accuracy of green credit risk prediction.

To further explore the influence of anti-corruption mechanisms on risk identification, the following extended hypotheses are proposed:

H3: Enhanced banking transparency (e.g., improved information disclosure) reduces uncertainty in green credit projects and increases the stability of risk prediction models.

H4: Strengthened accountability mechanisms (e.g., internal audits and external oversight) decrease credit fund misallocation and improve the performance of deep learning-based risk assessments.

H5: The combined effect of transparency and accountability significantly improves green credit risk management, contributing to better credit ratings for financial institutions engaged in green finance.

These hypotheses will be tested using deep learning techniques and validated through statistical analysis in the empirical section of the study.

Model construction

Design of the multi-layer deep network

Before building the model, input features are carefully selected to ensure both accuracy and effectiveness, with detailed steps provided in the Appendix.

This study employs a multi-layer deep neural network to identify green credit risk. The model combines deep learning techniques with traditional financial risk assessment methods to capture a wide range of influencing factors. Specifically, it adopts a Multi-Layer Perceptron (MLP) architecture, which includes input, hidden, and output layers (Wan et al., 2023). The model structure is shown in Fig. 1.

In Fig. 1, X represents the input feature vector, which includes key indicators such as the green credit ratio, ROA, and liquidity ratio. The hidden and output layers are denoted as H and Y, respectively. The model’s weight parameter matrices are represented as Win, Whidden, and Wout, while the bias parameter vectors are denoted as bin, bhidden, and bout.

The forward propagation process is described by the following equations (Hou et al., 2023):

Σ denotes the activation function. X represents the input feature vector, which includes the green credit ratio, ROA, liquidity ratio, environmental performance scores, and corporate governance structure. The activation function σ is set to Rectified Linear Unit (ReLU) in this study. The ReLU function is applied to both the hidden and output layers. The final output, Z, is used for green credit risk classification. To improve generalization and prevent overfitting, regularization techniques are implemented.

The performance of multi-level deep networks largely depends on effective parameter tuning. To enhance green credit risk identification, this study optimizes key parameters through the following steps:

Hidden Layers and Neurons: The number of hidden layers and neurons per layer is adjusted using cross-validation. The optimal configuration consists of two hidden layers, with 128 neurons in the first and 64 in the second, selected based on validation performance.

Activation Function: Different activation functions are tested to assess their impact on convergence speed and model performance. While Tanh and Sigmoid are considered, ReLU proves to be the most effective and is used throughout the model.

Learning Rate: The learning rate is optimized through Grid Search and Random Search. The final setting uses an initial learning rate of 0.001, which is reduced by half every 10 epochs to enhance convergence.

Regularization: To prevent overfitting, L2 regularization (weight decay) and Dropout are applied. The optimal parameters, determined through validation, are an L2 penalty of 0.01 and a dropout retention rate of 0.5 for each hidden layer.

Batch Size and Iterations: The batch size and number of training iterations are tuned to balance convergence and overfitting. A batch size of 64 and 100 training iterations yield the best performance.

Optimization Algorithm: AdaGrad is employed to improve training efficiency and model accuracy.

Selection of training and optimization algorithms

After designing the multi-layer deep network, selecting suitable training and optimization algorithms is essential for effective green credit risk identification. To address common challenges in training deep models, this study adopts the Adaptive Gradient Descent algorithm (AdaGrad) (Al-Raeei, 2024). AdaGrad improves parameter convergence by dynamically adjusting the learning rate for each parameter. This adaptability is especially effective for handling sparse features and enables the model to better capture key factors related to green credit risk. The update rule used follows Eq. (4) (Dharmayanti et al., 2023).

In Eq. (4), θt,i represents the value of the i-th parameter at time step t; gt,i indicates the gradient of the parameter; η denotes the learning rate; ϵ stands for smoothing items.

Anti-corruption measures embedded in the model

To enhance the robustness of the green credit risk identification model and incorporate anti-corruption factors, this study introduces an Anti-Corruption Measures module. This module integrates financial institutions’ transparency and accountability into the risk assessment process to help mitigate potential corruption risks (Adeleye et al., 2019).

The Anti-Corruption Measures Factor (ACMF), defined in Eq. (5), quantifies transparency and accountability within financial institutions. Transparency indicators (M) include the rate of information disclosure and reporting frequency. Accountability indicators (N) evaluate the effectiveness of internal audits and external supervision (Lorente et al., 2023). The weights and measurement methods for these indicators are established through expert evaluations (Yoon, 2020; Moodaley and Telukdarie, 2023).

Here, β1 and β2 represent the weights of each indicator. The weights β₁ (transparency) and β₂ (accountability) were determined using expert scoring combined with the Analytic Hierarchy Process (AHP).

The ACMF is then integrated into the green credit risk identification model through the following steps:

-

(1)

Data Preprocessing: Alongside standard financial data and risk indicators, transparency and accountability metrics for each financial institution are collected and calculated. These metrics are incorporated into the model’s input feature set.

-

(2)

Model Training: The multi-level deep network is trained using the expanded input data. In addition to traditional financial indicators—such as the green credit ratio, return on total assets, and liquidity ratio—the input feature vector X now includes transparency and accountability metrics.

-

(3)

Anti-Corruption Measure Integration: During the model’s output stage, the original risk assessment result Z is first generated. The ACMF is then applied to adjust this output, refining the final risk prediction.

The adjusted output \({Z}_{{adjusted}}\) is represented as Eq. (6):

In Eq. (6), α functions as an adjustment parameter that controls the influence of the ACMF on the model’s output. To determine the optimal value of α, a sensitivity analysis was conducted using multiple values (0.05, 0.10, 0.20, and 0.30). Each was evaluated based on the average F1 score and recall under ten-fold cross-validation. The results are summarized in Table 2:

As shown in Table 2, the model performs best when α = 0.10. This value is therefore selected as the final adjustment parameter. The findings indicate that a moderate incorporation of the anti-corruption factor improves risk identification accuracy. In contrast, higher values of α may cause overfitting or reduce the model’s responsiveness to key financial variables.

-

(4)

Model Evaluation and Optimization: After integrating the anti-corruption measures, the model is evaluated through cross-validation and empirical testing. This step ensures that the enhancements improve the model’s predictive accuracy and its capacity to mitigate corruption-related risks.

By embedding transparency and accountability indicators directly into the model, the risk assessment process becomes more robust. This integration not only enhances the reliability of green credit risk identification but also promotes more transparent and accountable decision-making within financial institutions.

Analysis of research results on green credit risk identification and anti-corruption measures

Analysis of weight adjustment of ACMF

To simplify model design and analysis, this study assumes equal weighting across financial institutions for transparency and accountability indicators. Two weighting schemes are applied—one emphasizing transparency and the other prioritizing accountability—to evaluate model performance under varying societal expectations. The selection of weights is informed by a comprehensive literature review and expert interviews to ensure a reasonable and theoretically grounded range.

The weights for the transparency and accountability indicators were determined through a combination of expert evaluation and the AHP. Initially, ten financial regulatory experts and eight banking professionals were invited to assess the importance of anti-corruption measures. Their evaluations were processed using AHP to calculate the weight distribution. To validate the theoretical results, a series of model experiments were conducted using different weight configurations. Under Weighting Scheme 2, the weights were set to 0.4 for transparency and 0.6 for accountability. To determine the relative importance of these two dimensions within the anti-corruption framework, participants rated the sub-indicators—transparency (M) and accountability (N)—on a 10-point scale, based on their relevance to green credit risk control. The average scores were 7.8 for transparency and 3.4 for accountability. These scores were used to construct a pairwise comparison matrix in the AHP framework. After confirming that the consistency ratio (CR) was below the acceptable threshold of 0.1, the resulting weights were calculated as 0.69 for transparency and 0.31 for accountability. For ease of implementation, these were rounded to 0.7 and 0.3, respectively, and applied in the ACMF computation. Table 3 presents the expert evaluation results.

As shown in Table 3, experts rated transparency as more important than accountability for controlling green credit risk (7.8 vs. 3.4). Using the AHP method, the final weight ratio was calculated as 0.69 to 0.31, which rounds to 0.7 to 0.3, confirming the validity of this distribution.

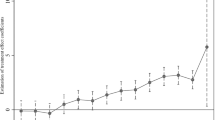

To further validate these weights, three alternative configurations (0.6/0.4, 0.7/0.3, and 0.4/0.6) were tested. Their impact on the model’s F1 score was analyzed using data from 10 banks. The results of these adjustments are presented in Table 4.

The data in Table 4 was visualized, and the results are revealed in Fig. 2.

Table 4 and Fig. 2 present the model’s green credit risk evaluations for various financial institutions under three weighting scenarios: the initial weights, adjustment weight 1, and adjustment weight 2. For instance, at Institution 1, the model output rises from 0.75 with the initial weights to 0.82 under adjustment weight 1, then slightly decreases to 0.76 with adjustment weight 2. This pattern is consistent across other institutions. Overall, model outputs tend to be higher with adjustment weight 1 and lower with adjustment weight 2 compared to the initial weights. These results suggest that, within the simulated dataset, emphasizing transparency improves green credit risk identification more effectively than prioritizing accountability. For example, Institution 3’s output increases from 0.82 to 0.88 under adjustment weight 1 but falls to 0.81 under adjustment weight 2, underscoring the importance of transparency. Based on these findings, the model adopts a weight distribution of 0.7 for transparency and 0.3 for accountability indicators in its anti-corruption measures.

Robustness analysis of models

To evaluate the model’s resilience under different conditions, various levels of noise and interference are introduced. The results of this robustness analysis are presented in Table 5.

The results of the model’s robustness are depicted in Fig. 3.

Under the initial dataset, the model’s green credit risk assessments vary among institutions. Institution 3 records the highest output at 0.82, while Institution 9 has the lowest at 0.55. When mild noise is introduced, the model outputs show slight fluctuations but remain relatively stable, demonstrating robustness against minor perturbations. However, with stronger data interference, output variations become more pronounced—Institution 3’s output increases slightly, whereas Institution 9’s decreases. These findings highlight the impact significant data interference can have on model performance and underscore the importance of evaluating robustness in real-world applications. Despite these changes, the results provide valuable insights into the model’s stability under varying noise levels and data perturbations.

To further assess the model’s adaptability, this study also employs 10-fold cross-validation. This common technique divides the dataset into 10 subsets, using 9 for training and 1 for testing in each iteration. Repeating this process 10 times reduces reliance on any single data split. The results are summarized in Table 6.

As shown in Table 6, the model achieves an average F1 score of 0.84, with a standard deviation of 0.008. This indicates stable performance across different data splits, with minimal variation. The highest F1 score observed is 0.86, while the lowest is 0.83, demonstrating consistent results across test sets. Compared to single-run evaluations, cross-validation reduces randomness caused by dataset partitioning, thereby improving the reliability of the findings.

Accuracy and effectiveness analysis of model risk identification

To assess the model’s performance in risk identification, three experiments are conducted. The results are presented in Figs. 4–6.

An analysis of the three experiments (Figs. 4–6) shows that the model maintains stable performance across datasets from different financial institutions. Key metrics—F1 score, accuracy, precision, and recall—remain consistently within a narrow range. Institution 3 stands out with the highest performance in all experiments, achieving accuracy and recall values above 0.85. Although the model performs relatively lower for Institution 9, its results still fall within an acceptable range. These findings indicate that the model effectively identifies green credit risks across diverse institutional datasets.

To further validate the model’s performance, five different models—MLP, Support Vector Machine (SVM), Convolutional Neural Network (CNN), eXtreme Gradient Boosting (XGBoost), and Deep Belief Network (DBN)—were evaluated using data from 10 banks. These banks represent various types, including state-owned, joint-stock, city commercial, and rural commercial banks. The comparative results are summarized in Table 7:

The visualization of these results is shown in Fig. 7.

As shown in Table 7 and Fig. 7, the MLP model outperforms all others across key metrics—precision, accuracy, recall, and F1 score. It demonstrates especially strong performance in recall (0.85) and F1 score (0.84). This indicates that MLP not only excels at identifying high-risk credit but also offers greater robustness and generalization across different institutional contexts. In contrast, SVM and DBN exhibit relatively weaker performance. While CNN performs well in image-related tasks, its adaptability to financial sequential data is limited. XGBoost approaches MLP’s precision but falls short in recall and overall balanced performance. These results further confirm the broad applicability of MLP for green credit risk identification.

Impact of anti-corruption measures on model performance

To further assess the model’s performance across varying levels of anti-corruption measures, three institutions representing low, medium, and high levels were selected for comparison. These results are illustrated in Fig. 8.

Figure 8 shows that as the intensity of anti-corruption measures increases, the model’s accuracy, precision, recall, and F1 score steadily improve. At the highest level of these measures, the model achieves its best performance in identifying green credit risks, with a maximum recall of 0.9. While institutions vary in their sensitivity to anti-corruption efforts, the overall trend is consistent, indicating that stronger measures correlate with enhanced model performance.

To further explore this relationship, a regression analysis was conducted. The F1 score served as the dependent variable, and the intensity of anti-corruption measures was the main independent variable. Controls for different banks and datasets were included to reduce bias from individual differences. A multiple linear regression model was used for statistical testing. The results are summarized in Table 8.

Based on Table 8, the intensity of anti-corruption measures significantly affects the F1 score (p = 0.002). This indicates that as the intensity increases, the model’s performance improves correspondingly. The regression coefficient (β₁ = 0.086) suggests that for each unit increase in anti-corruption measure intensity, the F1 score rises by an average of 0.086. In contrast, the effects of the bank and dataset variables are not statistically significant (p > 0.05), implying that the model’s performance is mainly driven by anti-corruption measures, with minimal influence from differences across banks or datasets.

Combining the findings from Fig. 8 and Table 7, it is clear that higher anti-corruption intensity leads to steady improvements in both the model’s F1 score and recall rate. The regression analysis confirms that each unit increase in anti-corruption intensity raises the F1 score by 0.086 on average (p = 0.002). Under high-intensity conditions (ACMF = 3), F1 scores across all datasets exceed 0.83, reaching a maximum of 0.88. These results align with theoretical expectations, showing that stronger transparency and accountability mechanisms improve the accuracy of green credit risk identification.

Additionally, a multiple regression analysis was performed using the F1 score as the dependent variable and transparency (T) and accountability (A) as the main independent variables. Control variables such as bank size and capital adequacy ratio were included. The results are detailed in Table 9.

Based on Table 9, the results from Model 2 show that each unit increase in transparency (T) improves the F1 score by 0.217 (p < 0.01). This suggests that higher transparency significantly enhances the model’s ability to accurately identify green credit risks. Similarly, each unit increase in accountability (A) raises the F1 score by 0.141 (p < 0.05), indicating a positive but slightly weaker effect compared to transparency. Model 3 reveals that the interaction between transparency and accountability (T × A = 0.184, p < 0.01) further boosts model performance. This means that when a bank simultaneously strengthens both transparency and accountability, the F1 score improves more than if either factor is increased alone. The coefficients for bank asset size and capital adequacy ratio are small and not statistically significant (p > 0.1) across all models. This implies that these factors have little influence on predicting green credit risk, highlighting that improvements in anti-corruption measures more directly drive enhanced model performance. In summary, transparency has a strong positive effect on model performance (p < 0.01), while accountability also has a significant, though smaller, effect (p < 0.05, β = 0.141). The significant interaction effect (p < 0.01) indicates that combining transparency and accountability leads to greater improvements, with the R² rising from 0.42 to 0.53. These findings suggest that strengthening accountability alongside transparency more effectively reduces green credit risk. Banks can achieve this by integrating information disclosure, internal auditing, and external supervision to improve overall green credit management.

To further examine the alignment between the model developed in this study and existing policies, regulations, and international sustainable finance standards, two key regulatory frameworks—the Task Force on Climate-related Financial Disclosures (TCFD) and the European Union (EU) Taxonomy—were incorporated. The transparency and accountability variables used in the model were compared against the requirements of these frameworks. A consistency comparison matrix (see Table 10) was constructed to evaluate how well the model variables correspond to actual regulatory standards. This evaluation enhances the model’s institutional relevance and policy applicability.

As shown in Table 10, the two key transparency variables—information disclosure frequency and reporting frequency—align closely with the specific disclosure requirements of both the TCFD and the EU Taxonomy. This suggests that the model’s transparency metrics are well grounded in current policy frameworks and can be directly applied to ESG compliance assessments. For accountability-related variables, some indicators, such as the external audit score, correlate positively with EU standards but are not mandated by the TCFD, resulting in partial alignment. This indicates that while the model is anchored in international standards, it also explores areas not fully addressed by existing regulations. The variable measuring the completeness of the accountability mechanism extends beyond current regulatory frameworks by focusing on institutional governance behaviors. This reflects both a theoretical broadening of institutional considerations in the study and the introduction of practical governance recommendations that go beyond existing regulations.

Discussion

This study investigates the effectiveness of a multilayer perceptron (MLP) model for identifying green credit risk and examines how anti-corruption measures—specifically transparency and accountability—affect prediction accuracy. The findings strongly support H1 (the superiority of MLP in green credit risk identification), H2 (anti-corruption measures significantly enhance prediction accuracy), H3 (transparency reduces uncertainty), and H5 (the combined effect of transparency and accountability improves financial institutions’ credit ratings). However, H4 (that accountability mechanisms reduce credit fund misuse and improve risk identification) receives only partial support. The limited impact of accountability mechanisms on risk identification may stem from challenges in their practical implementation. Although some banks have established internal audit and compliance systems, accountability lacks mandatory enforcement and sufficient transparency, reducing its effectiveness in curbing fund misuse. Moreover, accountability tends to function as a corrective, “after-the-fact” measure rather than a proactive, “early warning” system, which limits its responsiveness in dynamic risk environments. In contrast, transparency facilitates earlier risk detection through information disclosure and regulatory pressure, enhancing its explanatory power within the model. Therefore, the full potential of accountability mechanisms likely depends on integration with external oversight and automated technologies. In model comparisons, MLP consistently outperforms SVM, CNN, XGBoost, and DBN on recall and F1 score, demonstrating deep learning’s suitability for complex financial risk prediction and stability across diverse datasets. Transparency emerges as the most effective factor in reducing uncertainty in credit projects. While accountability alone does not necessarily improve risk prediction, its combination with transparency further enhances credit risk control. This study thus confirms the promising application of FinTech in sustainable finance and underscores the critical role of institutionalized regulatory measures. From a policy perspective, three practical recommendations are proposed for financial institutions: 1. Strengthen information disclosure mechanisms to improve green credit transparency. Data show transparency as a key driver of risk prediction accuracy. Banks should regularly publish detailed reports on green loans, covering fund allocation, environmental impact assessments, and compliance. Governments and regulators should mandate disclosure requirements and enforce standardized ESG reporting frameworks to ensure transparency and comparability. 2. Develop a comprehensive accountability system to complement transparency improvements. China’s green finance development is influenced by multiple intertwined institutional factors. First, significant regional differences exist in policy enforcement, local government involvement, and green finance incentives. These regional policy dynamics directly affect the depth of accountability practices and the level of data disclosure. Second, the Chinese financial regulatory system is characterized by a strong “relationship-based governance culture.” In the absence of institutional trust, transparency often becomes a form of “legitimizing performance” for firms seeking green credentials, rather than reflecting substantive improvements. This trust deficit weakens the effectiveness of some anti-corruption mechanisms and limits the explanatory power of accountability variables in the model. Therefore, intelligent green credit evaluation models need to incorporate mechanisms to recognize institutional heterogeneity and regional policy contexts. This will improve their applicability in real-world settings. The study finds that accountability alone does not significantly enhance credit risk identification; however, combined with transparency, it effectively improves model prediction performance. Financial institutions should therefore strengthen internal audit systems to ensure senior management takes direct responsibility for green credit decisions. Additionally, independent external regulators should be established to perform compliance reviews. The adoption of blockchain technology could further enhance accountability by guaranteeing data integrity and reducing manipulation risks. Moreover, financial institutions should implement data-driven green credit management systems that leverage deep learning models to optimize risk assessment. The MLP model demonstrates strong generalization ability and adaptability across different economic environments. Banks are encouraged to invest in AI technologies to automate green credit approval and risk monitoring. Despite MLP’s superior performance in green credit risk identification, its nature as a black-box model raises ethical concerns. In finance, AI algorithms can inadvertently replicate systemic biases present in historical data, potentially exacerbating discrimination against small or regional banks and high-emission industries during green finance ratings. Additionally, the opacity of algorithms complicates accountability, making it difficult to trace responsibility when misclassifications occur. These issues can erode trust among financial consumers and conflict with principles of fair finance. To address these challenges, financial institutions should prioritize model interpretability and algorithmic fairness when deploying deep learning solutions. Establishing dedicated AI ethics review mechanisms is essential to oversee the entire lifecycle of models—including input data, training processes, and prediction logic—to prevent unfair risks from technological misuse.

Conclusion

This study develops a multilayer deep network model to improve the accuracy of green credit risk identification while examining the roles of transparency and accountability as anti-corruption measures. Using green credit data from 36 banks, the model outperforms SVM, CNN, XGBoost, and DBN across key metrics including accuracy, precision, recall, and F1 score. Results show that increased transparency significantly reduces credit risk uncertainty. Moreover, accountability has a stronger positive effect when combined with transparency, enhancing credit decision-making in financial institutions. While the study confirms the benefits of integrating deep learning with anti-corruption measures, it has limitations. The dataset coverage is somewhat limited, and the model architecture could be further optimized. Future research should expand the dataset to cover more diverse financial markets, boosting the model’s generalizability. Additionally, exploring more advanced deep learning architectures may further improve risk identification.

Data availability

The data that support the findings of this study are available on request from the corresponding author, upon reasonable request.

References

Adeleye I, Luiz J, Muthuri J et al. (2019) Business ethics in Africa: the role of institutional context, social relevance, and development challenges. J Bus Ethics 161:717–729. https://doi.org/10.1007/s10551-019-04338-x

Adewumi A, Oshioste EE, Asuzu OF et al. (2024) Business intelligence tools in finance: a review of trends in the USA and Africa. World J Adv Res Rev 21:608–616. https://doi.org/10.30574/wjarr.2024.21.3.0333

Aghaei V, Seiedkhani R, Mohammadipour R et al. (2024) Identifying ESG indicators in the context of bank customer credit assessment. Bus Mark Financ Open 1:99–113. https://doi.org/10.61838/bmfopen.1.6.9

Al-Raeei M (2024) The smart future for sustainable development: artificial intelligence solutions for sustainable urbanization. Sustain Dev 33:508–517. https://doi.org/10.1002/sd.3131

Chang L, Taghizadeh-Hesary F, Mohsin M (2023) Role of artificial intelligence on green economic development: joint determinates of natural resources and green total factor productivity. Resour Policy 82:103508. https://doi.org/10.1016/j.resourpol.2023.103508

Debrah C, Amos D, Chan APC (2023) A bibliometric-qualitative literature review of green finance gap and future research directions. Clim Dev 15:432–455. https://doi.org/10.1080/17565529.2022.2095331

Dharmayanti N, Ismail T, Hanifah IA et al. (2023) Exploring sustainability management control system and eco-innovation matter sustainable financial performance: The role of supply chain management and digital adaptability in Indonesian context. J Open Innov Technol Mark Complex 9:100119. https://doi.org/10.1016/j.joitmc.2023.100119

Dou Q, Gao X (2022) The double-edged role of the digital economy in firm green innovation: micro-evidence from Chinese manufacturing industry. Environ Sci Pollut Res 29:67856–67874. https://doi.org/10.1007/s11356-022-20435-3

Giudici P, Raffinetti E (2023) SAFE artificial intelligence in finance. Financ Res Lett 56:104088. https://doi.org/10.1016/j.frl.2023.104088

Hajek, P, Sahut, J-M & Myskova, R 2024. Predicting corporate credit ratings using the content of ESG reports. Ann Oper Res. https://doi.org/10.1007/s10479-024-06385-8

Hou H, Zhu Y, Wang J et al. (2023) Will green financial policy help improve China’s environmental quality? The role of digital finance and green technology innovation. Environ Sci Pollut Res 30:10527–10539. https://doi.org/10.1007/s11356-022-22887-z

Kanaparthi V (2024) Transformational application of artificial intelligence and machine learning in financial technologies and financial services: a bibliometric review. Int J Eng Adv Technol 13:71–77. https://doi.org/10.35940/ijeat.d4393.13030224

Kazachenok OP, Stankevich GV, Chubaeva NN et al. (2023) Economic and legal approaches to the humanization of FinTech in the economy of artificial intelligence through the integration of blockchain into ESG Finance. Humanit Soc Sci Commun 10:167. https://doi.org/10.1057/s41599-023-01652-8

Kong Y, Agyemang A, Alessa N et al. (2023) The moderating role of technological innovation on environment, social, and governance (ESG) performance and firm value: Evidence from developing and least-developed countries. Sustainability 15:14240. https://doi.org/10.3390/su151914240

Kwilinski A, Lyulyov O, Pimonenko T (2023) Spillover effects of green finance on attaining sustainable development: spatial Durbin model. Computation 11:199. https://doi.org/10.3390/computation11100199

Lăzăroiu G, Bogdan M, Geamănu M et al. (2023) Artificial intelligence algorithms and cloud computing technologies in blockchain-based fintech management. Oecon Copernic 14:707–730. https://doi.org/10.24136/oc.2023.021

Li C, Liang F, Liang Y et al. (2023a) Low-carbon strategy, entrepreneurial activity, and industrial structure change: evidence from a quasi-natural experiment. J Clean Prod 427:139183. https://doi.org/10.1016/j.jclepro.2023.139183

Li C, Tang W, Liang F et al. (2024a) The impact of climate change on corporate ESG performance: the role of resource misallocation in enterprises. J Clean Prod 445:141263. https://doi.org/10.1016/j.jclepro.2024.141263

Li D, Guan X, Tang T et al. (2023b) The clean energy development path and sustainable development of the ecological environment driven by big data for mining projects. J Environ Manag 348:119426. https://doi.org/10.1016/j.jenvman.2023.119426

Li Y, Zhang Y, Hu J et al. (2024b) Insight into the Nexus between intellectual property pledge financing and enterprise innovation: a systematic analysis with multidimensional perspectives. Int Rev Econ Financ 93:700–719. https://doi.org/10.1016/j.iref.2024.03.050

Lim T (2024) Environmental, social, and governance (ESG) and artificial intelligence in finance: state-of-the-art and research takeaways. Artif Intell Rev 57:76. https://doi.org/10.1007/s10462-024-10708-3

Lorente DB, Mohammed KS, Cifuentes-Faura J et al. (2023) Dynamic connectedness among climate change index, green financial assets and renewable energy markets: Novel evidence from sustainable development perspective. Renew Energy 204:94–105. https://doi.org/10.1016/j.renene.2022.12.085

Lyeonov S, Draskovic V, Kubaščikova Z et al. (2024) Artificial intelligence and machine learning in combating illegal financial operations: bibliometric analysis. Hum Technol 20:325–360. https://doi.org/10.14254/1795-6889.2024.20-2.5

Lyu X, Wen S, Li H (2023) The impact and mechanism of internal informal institutions on green innovation: empirical evidence from Chinese listed companies. Sustainability 15:15743. https://doi.org/10.3390/su152215743

Mirza N, Umar M, Afzal A et al. (2023) The role of fintech in promoting green finance, and profitability: evidence from the banking sector in the euro zone. Econ Anal Policy 78:33–40. https://doi.org/10.1016/j.eap.2023.02.001

Moodaley, W & Telukdarie, A (2023) Greenwashing, sustainability reporting, and artificial intelligence: a systematic literature review. Sustainability 15. https://doi.org/10.3390/su15021481

Nguyen Thanh C, Phan HT, Tuyet PH et al. (2025) Credit risk prediction with corruption perception index: machine learning approaches. Cogent Bus Manag 12:2461731. https://doi.org/10.1080/23311975.2025.2461731

Udeagha MC, Muchapondwa E (2023) Green finance, fintech, and environmental sustainability: fresh policy insights from the BRICS nations. Int J Sustain Dev World Ecol 30:633–649. https://doi.org/10.1080/13504509.2023.2183526

Udeagha MC, Ngepah N (2023) The drivers of environmental sustainability in BRICS economies: Do green finance and fintech matter? World Dev Sustain 3:100096. https://doi.org/10.1016/j.wds.2023.100096

Wan Y, Sheng N, Wei X et al. (2023) Study on the spatial spillover effect and path mechanism of green finance development on China’s energy structure transformation. J Clean Prod 415:137820. https://doi.org/10.1016/j.jclepro.2023.137820

Xu J, Chen F, Zhang W et al. (2023) Analysis of the carbon emission reduction effect of Fintech and the transmission channel of green finance. Financ Res Lett 56:104127. https://doi.org/10.1016/j.frl.2023.104127

Yoon S (2020) A study on the transformation of accounting based on new technologies: evidence from Korea. Sustainability 12:8669. https://doi.org/10.3390/su12208669

Acknowledgements

This work was supported by the Discipline Co-construction Project on 2024 Guangdong Philosophy and Social Science Foundation (Grant No. GD24XGL026), Collaborative Innovation Center for Emissions Trading system Co-constructed by the Province and Ministry, Hubei University of Economics (Grant No. 24CICETS-ZD007), and National Social Science Foundation of China (Grant No. 24VSZ170).

Author information

Authors and Affiliations

Contributions

ZW: Writing – original draft, Writing – review & editing, Conceptualization, Funding, Resources; SS: Writing – review & editing, Methodology, Data curation, Project administration, Formal Analysis; CW: Writing – original draft, Visualization; ZB: Writing – original draft, Validation. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethic approval

This study did not involve animal or human clinical trials and was not unethical.

Informed consent

Informed consent was not applicable in the study.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wang, Z., Wang, C., Bai, Z. et al. Green credit risk identification and anti-corruption measures under the application of the multi-layer deep network. Humanit Soc Sci Commun 12, 1311 (2025). https://doi.org/10.1057/s41599-025-05616-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-025-05616-y