Abstract

Numerous market phenomena show that social media can have an impact on investor behavior, but there is a lack of exploration in existing literature regarding the impact mechanism of social media on fund investment behavior and performance. This paper studies the impact of social media attention on fund net capital flow and fund performance, and further examines how it affects the relationship between fund net capital flow and fund rally. Fixed-effect model of fund-time two-way fixed effects is employed and the following main conclusions are drawn: firstly, a fund’s social media attention has a significant positive impact on the fund net capital flow; in large-scale funds, positive (negative) media attention has a positive (negative) impact on the fund net capital flow, and the impact of positive emotions on the fund net capital flow is greater than that of negative emotions. Secondly, fund net capital flow will have a positive impact on fund performance in the short term. Thirdly, social media attention may strengthen the positive correlation between fund net capital flow and fund rally.

Similar content being viewed by others

Introduction

In 2020, China’s public mutual fund industry achieved explosive growth. According to the “Chinese Household Wealth Index Survey Report” released by the China Household Finance Survey and Research Center and Ant Group Research Institute in the second quarter of 2020, after the outbreak of the COVID-19 epidemic, the proportion of fund allocation of China’s household wealth has increased significantly. And the investment targets of family wealth are gradually shifting from stocks to mutual funds, and this trend is expected to persist in the medium to long term. The process of institutionalization is an inevitable path for the development of financial markets as the new generation of investors recognizes the limitations of individual investors and is willing to entrust their assets to professional institutions for management (Southwestern University of Finance and Economics and Ant Group Research Institute, 2020; Barber and Odean, 2000). The enthusiasm for fund investment is growing, and the fund industry is flourishing as a result.

According to the China Asset Management Association, as of December 31, 2020, China had 146 public fund management institutions. These institutions managed 7,913 public funds with a total asset management scale of 19.89 trillion yuan (all figures are in yuan, unless otherwise noted). This represents a 34.7% increase from the end of 2019. Among them, the scale of equity public funds reached 6.42 trillion yuan, accounting for 32.28% (China Asset Management Association, 2021). In 2020, fund investors enjoyed an average return of over 14%, while stock investors only earned an average of 3.6%. The “China Household Financial Management Trend Report” released by Alipay in collaboration with Southwestern University of Finance and Economics in the second quarter of 2020, revealed that among new fund investors in 2020, those under the age of 30 accounted for more than 50%. Post-90s and Post-00s generations’ fan-like investing is characterized by following trends in subscriptions, buying high and selling low, focusing on short-term performance, and being greatly influenced by the media (Focke et al. 2020; Barber et al. 2022). In the information age, individual investors can easily find forums for niche investment sectors to share investment experiences or insights (Renault, 2017) reducing the cost of information acquisition (Kaniel and Parham, 2017).

At the beginning of 2021, the GameStop incident in the U.S. stock market triggered academic and industry thinking and discussions on the impact of social media. In this battle between individual investors and institutions, the Reddit Forum became an important position for individual investors, and social media indeed has a significant impact in driving speculative funds into the market (Barber et al. 2022; Barber, Lin, and Odean, 2024). Compared to the United States, the proportion of individual transactions in China is larger. It is necessary to take the GameStop incident as a lesson, pay attention to the impact of social media on individual investment behavior, and strengthen regulation and reasonable supervision of social media information. Similarly, social media has also had a certain impact on the behavior of China’s fund investors (Ding et al. 2018). With the increasing popularity of the term “fund” on social media, the enthusiasm of fund investors has surged. The scale of equity and hybrid funds has risen from 5.62 trillion yuan in October 2020 to 7.28 trillion yuan in February 2021, an increase of approximately 29.54% (China Asset Management Association, 2021).

Given the significant role of social media in influencing investor sentiment and behavior (Antweiler and Frank, 2004; Rakowski et al. 2021; Farrell et al. 2021; Zhou et al. 2024), it is of practical significance to study the impact of social media on fund capital flows and performance. Social media is distinct from traditional media like newspapers and television. With its increasing penetration into the financial investment sector in recent years, and the widespread use of applications like fund forums, Bilibili, Xiaohongshu (Little Red Book) by investors has made the influence of social media on investment behavior a topic worthy of study. The main contributions of this paper are: (1) Enriching the relevant literature research. There is a wealth of research on the impact of media on stock prices, and in the field of funds, there are abundant studies on the factors affecting fund flows, fund investment strategies, and the impact of fund managers’ personal characteristics on fund investment styles and performance (Tetlock et al. 2008; Tetlock, 2007; 2010; 2011; Garcia, 2013; Manela and Moreira, 2017; Zhang et al. 2024; Zhou et al. 2024). However, there is less literature on the impact of social media attention on funds. Unlike the one-way flow of information in traditional media, social media possesses interactivity, and it is worth investigating whether social media attention has an impact on the financial market that is different from that of traditional media. This paper explores the impact of social media attention on fund performance, enriching related research in the field of behavioral finance. This paper innovatively integrates multiple sources of social media information, including forum data, news media, and the Baidu Index, to systematically explore the mechanisms through which social media attention affects fund capital flows and performance. Unlike traditional media, which is characterized by one-way communication, the interactivity and emotional propagation characteristics of social media result in differential impacts on investor behavior. This paper extends prior research by demonstrating the asymmetric effects of social media sentiment (positive, neutral, negative) on fund capital flows, finding that in large-scale funds, the promotional effect of positive sentiment significantly outweighs the inhibitory effect of negative sentiment. This finding provides new evidence for the “sentiment bias” in investor behavior. (2) It reveals the dynamic characteristics of the short-term “smart money” effect in the fund market. Using a two-way fixed-effects model, this paper confirms the positive predictive power of net capital inflows on fund performance in the short term, thereby supporting the existence of the “smart money” effect. It also uncovers the potential reversal risks in the long term, offering a more nuanced perspective on the temporal relationship between capital flows and performance. (3) From the perspective of fund rally, the possible mechanism of the impact of media attention on fund performance is proposed. This paper uses fund net capital flow to measure the short-sighted behavior of fund managers, and from the perspective of fund rally, it proposes that there is a positive correlation between fund net capital flow and fund rally and funds with high social media attention have a stronger positive correlation than those with low media attention.

In addition, methodologically, this study innovatively employs the Baidu Senta sentiment pre-training model to classify the sentiment of a vast amount of social media text and combines instrumental variable methods to mitigate endogeneity issues, thereby enhancing the robustness of the research conclusions.

Literature review

Media attention and stock investor behavior

Existing literature mainly studies the relationship between social media and stock investor behavior by constructing various media attention indicators. Antweiler and Frank (2004) found that social media information could predict stock market volatility and positive messages had a significantly negative impact on the next day’s returns, but the impact was economically small in value by using stock information message boards on Yahoo Finance and RagingBull websites as sample data. Fang and Peress (2009) studied the impact of mass media coverage on stock returns and found that stocks without media coverage achieved higher returns than those with media coverage. Da et al. (2011) used Google Trends to measure investor attention and found it increased stock prices in the short term, while it had a negative impact on stock prices in the long term. Sul et al. (2014) found that the sentiment value of social media of Twitter posts has a direct impact on future stock market returns, and the number of followers of Twitter users has a moderating effect on the relationship between the sentiment value of the tweets and stock returns. Posts by Twitter users with more fans can spread relatively quickly and be fully reflected in stock prices, thus having a significant impact on the stock returns of the day; conversely, posts by Twitter users with fewer fans have no significant impact on the stock returns of the day, but will have a significant impact on the stock returns of the next 10 days. Jin and Li (2017) classified the opinions in the posts on the East Money Stock Bar forum to construct a peer opinion indicator and found that there is a positive correlation between peer opinions and future stock returns and the greater the investor’s recognition, the greater the impact of peer opinions on future stock returns. Yang and Guo (2019) used Baidu indexes and media indexes for terms such as “haze”, “PM2.5 concept stocks” and other indicators to study the impact of investor attention on PM2.5 concept stocks and they found that an increase in investor attention to haze and PM2.5 concept stocks can boost the stock prices of PM2.5 concept stocks, and also enhance the trading activity and the likelihood of hitting the upper limit of these stocks.

Birru and Young (2022) find that market uncertainty can enhance the predictive power of investor sentiment on future stock returns. Moreover, when uncertainty is high, sentiment has a stronger predictive ability for mispriced stocks. As a primary source of information for small investors, content on social media can influence their trading behavior. However, there is no consensus on whether the impact of social media on retail trading is positive or negative (Rakowski et al. 2021; Farrell et al. 2021). Ding et al. (2018)discovered that the “SSE e-Interactive” platform can improve retail investors’ ability to interpret and process information, thereby increasing the accuracy of market expectations for listed companies’ earnings and reducing information asymmetry during earnings announcement periods. Ammann and Schaub (2021), collecting data from a social media trading platform, found that investors copy others’ position information that is posted, but such copying does not lead to high returns. Zhou et al. (2024) found social media sentiment performs better at the daily level than news sentiment, and news sentiment has a stronger explanatory power on stock returns at the monthly level than social media sentiment.

“Smart money” effect and “dumb money” effect

Literature research has found that fund capital flow exhibit a “smart money” effect in the short term, but will become a “dumb money” effect in the long term. Zheng (1999) believes that fund capital flow has predictive power on the future performance of the fund, and funds with large capital inflows have better return performance than funds with capital outflows. Pollet and Wilson (2008) found that fund inflows will enhance the work enthusiasm of fund managers, leading to an increase in the breadth and depth of the investment portfolio, which in turn will improve fund performance. Shen et al. (2013) found that fund inflows lead to an increase in hidden trading by funds, thereby enhancing fund performance. Lin et al. (2014) believe that there is a “smart money” effect in China’s fund market, where the flow of funds has predictive performance, and funds with high inflow perform better than those with low inflow, indicating that investors have the ability to select funds. However, institutional fund flows do not demonstrate predictive performance, while individual investor fund flows drive the “smart money” effect.

Edelen (1999) argues that open-end funds provide liquidity for investors, which incurs hidden costs. The paper uses fund flows as a proxy for fund trading and finds that the excess returns of the funds are significantly negatively correlated with trading. Schwert (2005) believes that fund flow has a weak “smart money” effect in the short term, and the possible explanation is that investors identify the investment capabilities of fund managers. Fund flows reflect investors’ enthusiasm for stocks held by funds, which are typically growth stocks. In the long term, the returns of these stocks are lower than those of value stocks, thus ultimately manifesting as a “dumb money” effect. Both Chin and Chou (2009) and He and Chen (2018) have reached similar conclusions.

Recently, several scholars have explored the existence of a “smart money” effect in the Chinese market through various approaches. Mei, Yan, and Fang (2020) analyzed comprehensive trading data of stock market investors and proposed a method to identify “smart investors” based on historical performance. Their study found that these investors consistently achieved significant excess returns across different market conditions, demonstrating exceptional position management and stock selection skills. Chen et al. (2022) and Liao, Tang, Xu (2024) have provided new perspectives on informed trading and the performance of foreign investors in the Chinese financial market. Their research shows that specific indicators and mechanisms can track the flow of “smart money,” revealing complex links between market efficiency and investor behavior.

“Herding effect” and “rally phenomenon”

Based on existing literature, research related to the phenomenon of fund rally pertains to the herd effect in the stock trading process of institutional investors. The herd effect refers to the tendency of investors to abandon their personal investment strategies and imitate the investment behaviors of other investors when they find that their decisions based on private information differ from those of other investors (Bikhchandani and Sharma, 2000). Wu and He (2005) found that China’s open-end funds exhibit a strong herd behavior in the stock market, and that the stocks excessively bought (sold) by funds, driven by the funds’ excessive demand, lead to an increase (decrease) in stock prices. Xu et al. (2011) found that the investment behavior of funds exhibits a herd phenomenon at the industry level, and that this behavior affects the formation of stock prices and market efficiency. The difference and connection between the “rally phenomenon” and the “herd effect” of funds mentioned in this paper are that the “herd effect” focuses on the dynamic trading behavior of funds, reflecting whether they buy and sell the same stock at the same time; the “rally phenomenon” considers more the static situation of fund holdings, reflecting whether they hold the heavily weighted stocks of other fund products (Yu et al. 2015). Under the influence of reputation concerns and redemption pressure, rally holding becomes a safe choice for fund managers, which can push up the stock prices of holdings, leading to an increase in fund returns, and forming a positive feedback (Han and Cui, 2014).

The primary motivation for public mutual funds to engage in herding behavior is to enhance short-term performance (Liu et al. 2022;Ouyang et al. 2025). However, this behavior also leads to increased stock price volatility and risk (Agarwal et al. 2015; Deng et al. 2023; Su et al. 2024). However, there is a divergence of opinion in the literature regarding the economic consequences of herding behavior by institutional investors. Some studies suggest that institutional investors can improve corporate governance through external monitoring (Crane et al. 2019; Guo et al. 2020; Liu and Gao, 2021). This external oversight enables fund herding to produce positive governance effects on listed companies, accelerating leverage adjustments (Morellec et al. 2012; Jang et al. 2022). However, due to the performance ranking pressures faced by public mutual funds, long-term holdings are challenging (Jiang and Kim, 2015; Xiang and Feng, 2022), limiting their governance effects (He and Mi, 2022). Meanwhile, some scholars argue that fund herding can trigger market overreactions, increasing volatility and crash risk (Karagiannis and Tolikas, 2019; Deng et al. 2023; Su et al. 2024), and worsen the information environment, increasing information asymmetry between individual stocks and investors (Luo and Tian, 2020).

Research hypothesis

Social media attention and fund net capital flow

A substantial body of prior research has examined how investor attention influences the stock market. For instance, Vozlyublennaia (2014) demonstrated that investor attention, as gauged by the Google search index, can impact stock prices or indices. Similarly, Da et al. (2011) utilized the Google search index to quantify individual investors’ attention and discovered that heightened stock search frequency not only forecasts a rise in stock prices over the subsequent fortnight but also correlates with elevated returns on the initial trading day of IPO stocks. Yu and Zhang (2012) scrutinized the nexus between Baidu indexes and the performance of the ChiNext stock market, corroborating that investor attention can exert positive price pressure in the current period.

These studies collectively suggest that heightened investor attention to stocks tends to attract a greater influx of retail investors, thereby driving up stock prices. By extension, it is reasonable to posit that funds garnering substantial investor attention would similarly catalyze a surge in purchases by fund investors, consequently boosting fund net capital inflows.

When it comes to the impact of media attention on funds, Rao et al. (2013) meticulously examined open-end equity-oriented funds from 2004 to 2009, employing the number of Baidu news articles as a proxy for media attention. Anchored in the theory of limited investor attention, their empirical analysis unveiled a significantly positive correlation between media attention and fund net inflows. Kaniel and Parham (2017) corroborated these findings through a natural experiment, illustrating that funds drawing media attention tend to attract more subscriptions from investors, with the fund’s name visibility being pivotal in augmenting capital flows.

Given the finite nature of investor attention, it is plausible that investors, when faced with a plethora of investment options, gravitate toward funds that have garnered substantial media attention. This selective behavior is likely driven by the desire to capitalize on perceived opportunities and mitigate risks by opting for funds that are already in the public eye.

Drawing on these insights, this paper posits the following hypothesis:

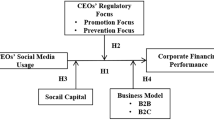

Hypothesis 1: Social media attention has a positive impact on fund net capital flow.

Sirri and Tufano (1998) and Rao et al. (2013) were constrained by technological limitations, unable to discern the sentiment or event nature of media reports and merely constructed a total media attention indicator. Cheng and Lin (2013) took Sina Weibo as a sample and utilized text analysis technology to generate an investor sentiment index on social media. Their results indicated that when the investor sentiment index on social media was optimistic (pessimistic), the securities market index returns would rise (fall) in the short term. The market would react positively (negatively), and trading volume would expand (contract) over a longer period of time.

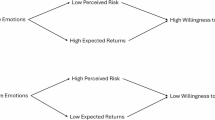

In research on the stock market, Teti et al. (2019) found that the sentiment of Twitter posts is highly correlated with stock returns. Positive sentiment is significantly positively correlated with stock returns, negative sentiment is significantly negatively correlated with stock returns, and neutral sentiment has no effect on stock returns.

Since stock returns can reflect stock trading behavior, with purchases leading to higher stock prices and increased returns, it can be concluded that positive (negative) sentiment is positively correlated with buying (selling) behavior. Similar to stocks, fund investors can be affected by social media sentiment. When media attention is positive, investors tend to increase investment, thereby increasing the fund net capital flow. When media attention is negative, investors tend to reduce investment, thereby reducing the fund net capital flow.

Based on the above analysis, the following hypotheses are put forward:

Hypothesis 1a: The impact of positive (negative) sentiment social media attention on fund net capital flows is positive (negative).

Hypothesis 1b: The impact of positive sentiment on social media on the fund net capital flow is greater than the impact of negative sentiment on the fund net capital flow.

Fund net capital flow and fund performance

The impact of fund net capital inflows on fund performance has been a topic of debate in the literature. While some studies have identified a “smart money” effect, suggesting that fund net capital inflows positively influence future performance (Zheng, 1999; Pollet and Wilson, 2008; Shen et al. 2013; Lin et al. 2014), others have found a significant negative correlation between fund excess returns and net capital flows in the long run (Edelen, 1999; Schwert, 2005; Chin and Chou, 2009; He and Chen, 2018).

In practice, fund managers face challenges when dealing with large capital inflows. To comply with regulatory requirements, they must quickly invest incoming cash into stocks and other assets. In the short term, substantial purchases by funds, especially of “rally stocks,” can drive up stock prices and enhance fund performance. However, in the long term, stock prices may revert to their intrinsic value. If fund managers fail to time their investments well and build positions at high levels, it can negatively impact future performance. Based on the above analysis, hypothesis 2 is put forward:

Hypothesis 2: There is a positive correlation between the increase in fund net capital flow and fund performance in the short term.

Social media attention, fund net capital flow and fund rally

The “herding effect” among funds has been extensively studied, with research identifying its presence and potential causes. For instance, Wermers (1999) documented the herding behavior of mutual funds in small-cap stock trading. This effect may stem from investors receiving similar information (Hirshleifer et al. 1994; Froot et al. 1992), preferences for assets with specific characteristics (Falkenstein, 1996), or agency issues (Scharfstein and Stein, 1990; Bikhchandani et al. 1992).

Scharfstein and Stein (1990) and Bikhchandani et al. (1992) argue that the market assesses fund managers’ investment skills based on their stock choices. If managers mimic others’ investments, the market cannot gauge their true abilities. Conversely, deviating from the norm and choosing poorly can label them as incompetent. This leads to a focus on others’ purchases rather than individual stock analysis, fostering herding. Han and Cui (2014) noted that fund managers engage in positive feedback trading due to professional reputation concerns and redemption pressures, amplifying the herding effect.

In the fund industry, a rally phenomenon is observed where multiple funds hold significant positions in a few stocks. This can be attributed to managers’ consistent expectations and rational resource allocation towards leading firms. However, it also reflects short-sighted behavior, where managers attempt to boost stock prices temporarily to create a “money-making effect.” Based on the above analysis, this paper investigates whether social media attention has intensified the fund rally phenomenon and proposes the following hypotheses.

Hypothesis 3a: There is a positive correlation between fund net capital flow and fund rally.

Hypothesis 3b: Social media attention strengthens the positive relationship between fund net capital flow and fund rally.

Research design

Data and sample

This paper selects open-end equity funds and open-end mixed equity funds established from January 1, 2006, to December 31, 2018, as the sample. Due to significant differences in trading systems and investor structures between the A-share and H-share markets, funds that invest in Hong Kong stocks or funds with important data missing are excluded. Wind indicates that the scale of China’s public fund market was relatively small before 2007, so the empirical testing period of this paper is chosen from January 1, 2008, to December 31, 2020. Data related to funds comes from the Wind database, CSMAR database, and the TianTian Fund website.

This paper adopts three types of data as indicators of media attention—forum-based, information-based, and Baidu Index, with sources including the official website of Finance.JR.com (http://www.jrj.com.cn/), the TianTian Fund Network Fund Bar forum, and the official website of the Baidu Index. While these sources provide a comprehensive view of media attention through professional financial news, investor discussions, and public search behavior, their use in previous research is limited. Most prior studies have focused on traditional news media or social media platforms like Twitter and Weibo. For instance, Wermers (1999) and Hirshleifer et al. (1994) concentrated on the impact of traditional media on investor behavior, whereas more recent studies, such as Teti et al. (2019), have leveraged social media data to analyze investor sentiment. Baidu Index, as a measure of public attention, has been used in some studies to analyze market trends and investor sentiment (Cheng and Lin, 2013), but its integration with fund data remains relatively uncommon. The selection of these three data sources is intended to cover different types of media attention, including professional financial news, investor forum discussions, and public search behavior. This diversity helps to more comprehensively capture the impact of media attention on fund investment behavior.

The first two types of media attention indicators use a Python crawler to collect a total of 789,000 articles from Finance.JR.com and 1,033,190 posts from the Fund Bar forum. The third type of media attention indicator selects the weekly Baidu Index values from January 1, 2011, to December 31, 2020 (a total of 522 values for each entry), and then takes the average of the 12 weeks of data for each entry as the corresponding quarterly media attention. A total of 87,174 fund product values and 43,326 fund manager values were manually collected, totaling 130,500 values. Use Stata to merge media attention data, fund data, and personal characteristic data of fund managers. Through data processing, a non-balanced panel data set is obtained, with a total of 20,306 fund-quarterly observations.

Model setting and variable definition

This paper employs a fixed-effects model with an unbalanced panel, controlling for fund fixed effects and time fixed effects to eliminate the impact of fund characteristics and time factors on the results. To address between-group heteroskedasticity and within-group autocorrelation, fund-level clustered robust standard errors are used.

Basic model

To verify the relationship between social media attention and fund net capital flow, this paper establishes the following model:

Among them, \({{flow}}_{i,t}\) is the net capital flow of fund i in period t and \({{media}}_{i,t}\) is media attention (the main explanatory variable). The controls variable represents a series of control variables, including the ordinary return rate of the fund in the previous period (\({{return}}_{i,t-1}\)), the fund age (\({{lnage}}_{i,t}\)), the net asset value of the fund (\(\mathrm{ln}{{tna}}_{i,t}\)), the net asset value of the fund manager (\({{lnfamsize}}_{i,t}\)), volatility of the fund’s ordinary return rate (\({{Stdret}}_{i,t}\)), total dividend amount of the fund (\({{div}}_{i,t}\)), number of fund dividends (\({{divnum}}_{i,t}\)), market return rate (\({{Rm}}_{t}\)). The variables of fix_fund and fix_time are fund fixed effects and time fixed effects respectively.

In order to verify the relationship between fund net capital flow and fund performance, the following model is established:

Among them, \({{return}}_{i,t}\) is the ordinary return rate of fund i in period t. The variable of \({{flow}}_{i,t}\) is the net capital flow of the fund, and controls represents a series of control variables, including the fund age (\({{lnage}}_{i,t}\)), the net asset value of the fund (\(\mathrm{ln}{{tna}}_{i,t}\)), the net asset value of the fund manager (\({{lnfamsize}}_{i,t}\)), volatility of the fund’s ordinary return rate (\({{Stdret}}_{i,t}\)), total dividend amount of the fund (\({{div}}_{i,t}\)), number of fund dividends (\({{divnum}}_{i,t}\)), market return rate (\({{Rm}}_{t}\)), the fund manager’s stock-picking ability (\({{pick}}_{i,t}\)), the fund manager’s timing ability (\({{timing}}_{i,t}\)), the fund manager’s gender (\({{gender}}_{i,t}\)), the fund manager’s education level (\({{edu}}_{i,t}\)), the fund manager’s experience (\({\exp }_{i,t}\) or \({{expmax}}_{i,t}\)), the fund team’s management model (\({{team}}_{i,t}\)). The variables of fix_fund and fix_time are fund fixed effects and time fixed effects respectively.

Moderating effect model

To verify the impact of social media attention on the relationship between fund net capital flow and the fund rally phenomenon, this paper establishes the following moderating effect model (Hayes, 2018; Ouyang et al. 2025):

Among them, \({ra{lly}}_{i,t}\) is the degree of rally of fund i in period t. \({{flow}}_{i,t}\) is the fund net capital flow, \({{media}}_{i,t}\) representing the media attention, \({{flowmedia}}_{i,t}\) representing the intersection of the fund net capital flow and the media attention, \({{return}}_{i,t}\) representing the fund’s ordinary rate of return, \({{flowret}}_{i,t}\) representing the intersection of fund capital flow and fund ordinary rate of return. controls represents a series of control variables, including the fund’s age (\({{lnage}}_{i,t}\)), the net asset value of the fund (\(\mathrm{ln}{{tna}}_{i,t}\)), the net asset value of the fund manager (\({{lnfamsize}}_{i,t}\)), volatility of the fund’s ordinary return rate (\({{Stdret}}_{i,t}\)), the market return rate (\({{Rm}}_{t}\)), the fund manager’s stock-picking ability (\({{pick}}_{i,t}\)), the fund manager’s timing ability (\({{timing}}_{i,t}\)). The variables of fix_fund and fix_time are fund fixed effects and time fixed effects respectively. See Table 1 for specific variable definitions.

In the baseline model, this study examines the direct relationships between social media attention and fund net capital flows, as well as between fund net capital flows and fund performance. According to Hypothesis 3, social media attention intensifies the positive correlation between fund net capital flows and fund herding. Specifically, heightened social media attention can trigger increased fund net capital flows, which in turn exacerbate fund herding. To further investigate how social media attention influences the relationship between fund net capital flows and fund herding, social media attention is designated as a moderating variable.

This choice is supported by both theoretical and empirical evidence. Theoretically, social media attention, as an exogenous variable, significantly impacts investor behavior and decision-making. High levels of social media attention can draw more investors to specific funds, increasing capital inflows and potentially amplifying herding behavior. Empirically, studies such as those by Teti et al. (2019) and Cheng and Lin (2013) have shown a significant positive correlation between social media attention and market behavior. By incorporating social media attention as a moderating variable, the model extends the analysis beyond the baseline, offering a more nuanced understanding of its multifaceted role in fund investment behavior.

Model testing and selection

This article conducts a modified Wald test and concludes that there is heteroscedasticity between groups in the sample. Therefore, the fixed effects model in this article adopts fund-level clustering robust standard errors. The data in this article are unbalanced short panel data, and the longest time dimension is 52 periods, which is much smaller than the number of 807 sample individuals, so the intra-group autocorrelation problem is not considered. Based on the Hausman test results, the fixed-effects model is chosen for this paper. At the same time, the results of the multicollinearity test show that there is no situation where VIF > 10, so there is no serious multicollinearity problem.

To address potential endogeneity issues, including omitted variable bias and reverse causality, this study carefully selects a comprehensive set of control variables based on both theoretical considerations and empirical evidence from prior research. Specifically, the control variables chosen reflect fund characteristics such as size, historical performance, and volatility, which are well-documented determinants of investor behavior and fund performance (Sirri and Tufano, 1998; Pollet and Wilson, 2008). The inclusion of fund company size acknowledges the influence of organizational scale on fund operations and investor perceptions, as larger fund companies may have more resources and brand recognition, potentially affecting investor decisions (Brown et al. 1999). Market trends are incorporated to account for macroeconomic conditions and broader market movements that could impact fund performance and investor sentiment (Fama and French, 1993). Additionally, personal characteristics of the fund manager, such as gender, education, and experience, are included as control variables, recognizing the significant role that managerial attributes play in shaping investment strategies and fund performance (Barber and Odean, 2008; Cremers and Petajisto, 2009). These variables have been shown to influence decision-making processes and outcomes in various contexts, and their inclusion helps to mitigate the endogeneity problem arising from omitted variables.

To further address endogeneity concerns, this study employs a panel data fixed-effects model, which controls for unobserved, time-invariant individual fund characteristics and time-specific effects, thereby minimizing the influence of unobservable variables that may change over time (Baltagi and Baltagi, 2008). This approach effectively isolates the impact of the variables of interest from other confounding factors that could bias the results.

Regarding reverse causality, where the direction of causation between the explanatory variables and the dependent variable might be bidirectional, this study utilizes lagged values of the explanatory and control variables. This methodological choice helps to ensure that the explanatory variables are determined prior to the dependent variable, thus reducing the likelihood of reverse causality biasing the results (Wooldridge, 2010). Additionally, robustness tests are conducted by constructing residual media attention and residual net fund flow variables, which provide further assurance that the findings are not driven by reverse causality or other endogeneity issues.

Results

Descriptive statistics

The empirical research sample of this paper consists of open-end ordinary equity funds and open-end mixed equity funds established from January 1, 2006, to December 31, 2018. Starting from 2007, China’s public fund industry began to make significant progress. In 2005, China carried out the reform of shareholding structure, and it was not until the end of 2007 that most domestic companies completed it. This event had a significant impact on China’s stock market, thereby affecting the market performance of equity funds and mixed equity funds. Therefore, the empirical testing interval selected in this paper is from January 1, 2008, to December 31, 2020. Through data processing, the maximum cross-sectional number of fund samples obtained from the Fund Bar is 783, which is an unbalanced short panel data, all of which are fund-quarter data.

Table 2 reports the descriptive statistical results. Within the sample period, the maximum value of media attention reaches 11.138, while the minimum value is only 0.693, indicating significant differences in media attention to funds. The maximum value of fund capital flow is 2.964, and the minimum value is −1.188, indicating different situations of fund inflows and outflows. The maximum value of the fund’s ordinary return rate is 0.878, and the minimum value is −0.421. Fund manager’s gender, fund manager’s education level, and fund team’s management model are dummy variables. The values of other variables are within reasonable ranges.

Basic model regression results

Social media attention and fund net capital flow

Table 3 shows the results of regression of model (1). All regressions control individual fund and time fixed effects. Columns (1) and (2) are grouped regressions according to fund size without distinguishing media sentiment. Fund sizes are divided according to the median of each quarter. Funds greater than or equal to the median are large funds (large), and funds less than the median are small funds (small). As shown in Columns (1) and (2) of Table 3, in both the full sample and the large fund sample, the coefficients of current and lagged media attention are significantly positive at the 1% level, indicating that media attention has a positive impact on fund net capital flow, supporting hypothesis 1.

Using the sentiment judgment pre-trained model Senta from Baidu PaddleHub, media sentiment is divided into three categories: positive, neutral, and negative, and regressions are conducted separately according to the size of the fund. Columns (3) and (4) of Table 3 show that in the full sample, regardless of sentiment, the impact of current and lagged media attention on fund net capital flow is positive, but only the coefficients of current negative sentiment media attention and lagged neutral sentiment media attention are significant at the 5% and 10% levels, respectively, with the remaining of the coefficients being insignificant. When regression is conducted by grouping according to the size of the fund, in the large fund sample, the coefficients for current and lagged positive and neutral sentiment media attention are positive, while the coefficient for negative sentiment media attention is negative. The coefficients for current and lagged positive sentiment media attention are significant at the 1% level, and the coefficient for lagged negative sentiment media attention is significant at the 10% level. Judging from the absolute values of the coefficients, in the large fund sample, the impact of positive sentiment is greater than that of negative sentiment, indicating that hypotheses 1a and 1b are established in large fund. In small fund, the coefficients for current media attention are all positive but not statistically significant. In summary, the total amount of media attention has a positive impact on the fund net capital flow, indicating that social media attention can influence the behavior of fund investors. In the large fund sample, positive sentiment media attention has a positive effect on fund net capital flow, while negative sentiment media attention has a negative effect. A possible explanation is that fund investors exhibit limited attention, and positive or negative media sentiment can reduce the search costs for investors, who then make investment decisions (subscribing or redeeming corresponding funds) based on positive or negative feedback from other investors.

Table 4 presents the results of regression of model (2), with all regressions controlling for individual fund and time fixed effects. All regressions control individual fund and time fixed effects. The coefficient of the current fund net capital flow in column (1) is 0.000733, which is significant at the 10% level. The coefficient of the lagged one-period fund net capital flow L. flow in column (2) is 0.00398, significant at the 1% level, indicating that both the current and one-lagged fund net capital flows have a significant positive impact on fund performance. The empirical results are consistent with those of Zheng (1999), Pollet and Wilson (2008), and Lin et al. (2014), confirming the “smart money” effect, which means that fund net capital flows have some predictive power for fund performance, supporting hypothesis 2.

Fund net capital flow and fund rally

This paper considers how social media affects the relationship between fund net capital flow and fund rally. The regression results of model (3) are shown in Table 5. In Table 5, all regression results control for individual fund and time fixed effects. Specifically, column (1) only controls for relevant fund characteristics, and on this basis, column (2) also controls for company and market characteristics, while column (3) further includes fund manager characteristic variables in the control variables. However, no matter what combination of control variables is used, the coefficients of flow are positive and significant at the 5% level, showing that fund net capital inflows are positively correlated with fund rally, indicating that when fund net capital inflows increase, the degree of fund rally increases. The coefficients of the interaction term between fund net capital flow and media attention flowmedia are also significantly positive, indicating that social media attention strengthens the above-mentioned positive correlation, i.e., under the same amount of fund net capital inflow, the fund rally phenomenon is more pronounced with high media attention. A possible explanation is that high media attention exacerbates the reputation concerns of fund managers, leading to more severe short-sighted behavior and strengthened the tendency of funds to form alliances. The social media attention amplifies the link between fund flows and rally behavior which support hypothesis 3b.

The impact of media attention from different media sources

This paper categorizes media sources into three types: social media, information media, and Baidu Index. Chapter 5 uses empirical tests with social media data from the TianTian Fund Network Fund Bar. In this section, we will use information from the financial section of the Finance.JR.com website, which was crawled using Python, and manually collected Baidu search index values for fund products with Baidu Index entries for comparative analysis, discussing whether the impact of different media sources on fund performance differs.

Columns (1) and (2) in Table 6 are the results of the regression of model (1) using the Finance.JR.com sample data, with all regression results controlling for individual fund and time fixed effects. In the group regression of the full sample, large fund sample and small fund sample, the information media attention in the current period and one lagged period has a significant positive effect on the fund net capital flow. However, in the results of the regression on the small fund sample in Section 5, where social media was used, the positive impact of lagged media attention on fund net capital flows is not significant. A possible explanation is that small funds receive less attention on both social media and information media and compared to large funds, but the authority of information media is higher than that of social media. Therefore, its positive effect in guiding capital flows to small funds is more enduring. Additionally, information on social media updates more quickly, with old posts quickly buried by new ones, making the cycle of impact on capital flows relatively short, while the media effect of information media in the lagged period remains significant.

Columns (3) and (4) in Table 6 are the results of the regression of model (1) using the Baidu Index sample data, with all regression results controlling for individual fund and time fixed effects. In the full sample and large fund sample regressions, the attention from media in the current and one lagged period has a significant positive impact on fund net capital flows. The coefficients for the small fund sample are not significant, and the possible reasons are: first, the Baidu Index is calculated based on the search volume on the Baidu official website, while fund investors mainly use the TianTian Fund Network as their information platform, and this part of social media attention is not included in the Baidu Index calculation. Moreover, the Baidu Index cannot judge sentiment, so its impact on fund flows may be affected by unobserved media sentiment; second, in the sample, large fund names usually have entries, while small fund names are not included in the Baidu Index entries. The media attention for fund products without entries is replaced by the media attention of the corresponding fund company, so there is an error in the small fund sample.

Table 7 presents the results of the regression of model (2) using the Finance.JR.com sample data and the Baidu Index sample data, with the first two columns and the last two columns respectively. All regression results control for individual fund and time fixed effects. From Table 7, it can be seen that the lagged fund net capital flow of the Finance.JR.com sample and the fund net capital flow of the Baidu Index sample have a significant positive effect on the ordinary return rate of the fund, which is consistent with the conclusions from the Fund Bar sample. This indicates that different media attention measurement methods have a relatively similar impact on fund performance. From another perspective, it also suggests that no obvious differences have been found in the behavior of fund investors and fund managers when influenced by different media sources.

Robustness test

The residual media attention

There is a reverse causality relationship between social media attention and fund net capital flow. Funds with high media attention can attract more investor attention, leading to higher fund net capital flow. “Best-selling” funds have a large subscription volume, which can attract more media attention. Therefore, referring to the practices of Sirri and Tufano (1998), Yu (2008), and Lin et al. (2014), this paper regresses according to Eq. (4) to obtain the residual term, i.e., the residual media attention caused by factors other than fund net capital flow, fund returns, and fund size. Table 8 uses the residual media attention to replace the original Eq. (1) for regression. The empirical results show that in the full sample, large fund sample, and small fund sample, the residual social media attention media_res has a positive effect on fund net capital flow.

There may also be a reverse causality relationship between fund net capital flow and fund performance, with funds that have high returns attracting more capital inflows. Therefore, this paper regresses through Eq. (5) to obtain the residual term, which is the residual fund net capital flow caused by factors other than fund performance and fund size. Table 9 uses the residual fund net capital flow to substitute into Eq. (2) for regression. The empirical results show that the coefficient of flow_res is 0.176, which is significant at the 1% level, indicating that the residual fund net capital flow has a significant positive impact on fund returns.

GMM method

The Table 10 presents the estimation results of the impact of media attention on fund net capital flow, utilizing the Generalized Method of Moments (GMM) approach. This method is particularly suited for panel data and is employed to address potential endogeneity issues that may arise from reverse causality or omitted variable bias. The GMM estimator uses instrumental variables to provide consistent estimates of the parameters, which is crucial when dealing with variables that are correlated with the error term.

Focusing specifically on the effects of media attention, as captured by the variable “media,” the table reveals significant insights across different fund categories. For the entire sample of funds, media attention is associated with a substantial increase in net capital flow, with a coefficient of 0.253 and statistical significance at the 1% level, indicating a strong positive effect. This suggests that higher media attention is linked to increased investor interest and capital inflows. When the analysis is restricted to large funds, the coefficient increases to 0.0958, also significant at the 1% level, but the effect is less pronounced compared to the overall sample. This could imply that while media attention is still important for large funds, other factors might play a more dominant role in driving capital flows. In contrast, for small funds, the coefficient of media attention is considerably lower at 0.0251 and is not statistically significant.

Fixed fund company effect

The Table 11 provides a detailed analysis of the impact of media attention on fund net capital flow, with a particular focus on the role of fixed fund company effects. Fixed effects for fund companies are incorporated into the regression model to control for unobserved heterogeneity that could be attributed to the specific characteristics of each fund company. This approach helps to isolate the effect of media attention by accounting for any time-invariant factors that might otherwise influence the relationship between media coverage and capital flows.

The table synthesizes the impact of media attention on fund net capital flow across different fund sizes, highlighting significant positive relationships. For the entire sample of funds (Column 1), media attention shows a robust positive effect with a coefficient of 0.0854, significant at the 1% level. Large funds (Column 2) exhibit a smaller but still significant positive effect at 0.0280, also at the 1% level, suggesting a less pronounced impact compared to the overall sample. In contrast, small funds (Column 3) demonstrate a stronger positive impact with a coefficient of 0.116, significant at the 1% level. This indicates a robust positive relationship between media attention and fund net capital flow.

GDP growth

The table presents the regression results controlling for both media attention and GDP growth rate as potential macroeconomic influences on fund net capital flow. The inclusion of GDP as a control variable is to account for broader macroeconomic factors that could simultaneously affect social media discussions and fund flows.

The regression analysis presented in the Table 12 evaluates the impact of media attention on fund net capital flow, while controlling for macroeconomic factors such as GDP growth. Across all fund categories, media attention is positively associated with net capital flow, with coefficients of 0.0525, 0.0161, and 0.0728 for all, large, and small funds respectively. These results are statistically significant, indicating that increased media coverage leads to higher capital inflows.

Conclusion

This paper takes open-end equity funds and open-end mixed equity funds established from January 1, 2006, to December 31, 2018, as the sample, with the empirical interval from January 1, 2008, to December 31, 2020. Using a fixed-effects model, this study examines the impact of social media attention on fund net capital flow and fund performance, and explores the possible mechanisms by which social media attention affects the relationship between fund net capital flow and fund rally. The study found that a fund’s social media attention has a significant positive impact on fund net capital flow. Social media attracts the limited attention of investors and reduces their search costs, thus positively affecting net fund flows. Building on the work of Sirri and Tufano (1998) and Rao et al. (2013), this paper further divides media sentiment into positive, neutral, and negative types using the Senta sentiment prediction model, to study whether different emotional media attention has different impacts on fund net capital flow. The empirical results show that in the large fund sample, positive (negative) emotional media attention has a positive (negative) impact on fund net capital flows, and the impact of positive emotional media attention on net fund flows is greater than that of negative sentiment, which is consistent with the conclusion that media attention on the stock market affects the buying and selling behavior of stock investors (Teti et al. 2019; Barber and Odean, 2008). When faced with a multitude of investment options, investors tend to focus on funds that receive more media attention (Hypothesis 1).

The reason why negative emotions have a smaller impact on fund flows might be that investors may exhibit a “limited attention” bias toward negative emotions, meaning that they are more likely to ignore or downplay negative information, especially when the overall market performance is good. The empirical results in Section 5.2.1 show that negative emotions have a significantly negative impact on the capital flows of large-scale funds, but the extent of the impact is less than that of positive emotions (Table 3). This could be because investors are more cautious in their response to negative information, or they require stronger signals to take redemption actions. In 2020, China’s public fund market experienced explosive growth, with investors, especially the younger demographic, demonstrating short-term behaviors of “buying high and selling low” (Introduction section). Against this backdrop of market optimism, negative emotions may be partially offset. The study by Teti et al. (2019) indicates a stronger positive correlation between positive sentiment on social media and stock returns. Similarly, fund investors may be more susceptible to the “herding effect” (Hypothesis 3a), leading to a lower efficiency in the spread of negative emotions. “It is reasonable that negative emotions may have different impacts under different market conditions.” Although this paper does not directly analyze the influence of market cycles, the robustness tests in Section 7.4, where GDP growth rate is used as a control variable, show that the macroeconomic environment has a significant impact on capital flows. The current study did not disaggregate the moderating effect of market cycles on emotional effects. Given that risk-averse behavior may vary with market fluctuations, future research could introduce market state variables (volatility indices) to examine the amplifying effect of negative emotions during periods of crisis.

This paper uses empirical analysis to test the positive correlation between fund net capital flow and fund performance in the short term, supporting the “smart money” effect and consistent with literature conclusions (Zheng, 1999; Schwert, 2005; Pollet and Wilson, 2008; Chin and Chou, 2009; Lin et al. 2014). In addition, this article explores the possible impact mechanism of media attention on fund net capital flow and fund rally. Based on the research of Han and Cui (2014), using fund net capital flow as a proxy for the short-sighted behavior of fund managers, it is found that fund net capital flow are positively correlated with the degree of fund rally. This positive correlation is stronger in funds with high social media attention, i.e., media attention can strengthen the positive correlation between fund net capital flow and fund rally, verifying the amplifying effect of social media attention.

The conclusions of this study indicate that social media attention significantly impacts the level of fund subscription activities, reaffirming the significance of media attention in the fund investment process. Given that individual investors generally have weaker risk awareness, are prone to chasing gains and cutting losses, pay insufficient attention to information, and are overly confident, they are more susceptible to the influence of social media. With the increasing importance of social media, regulatory authorities should enhance the transparency requirements for information disclosure, ensure the openness, fairness, and justice of information disclosure on social media, and prevent the spread of false information and market manipulation through social media. In addition, investor education should be valued to improve investors’ financial literacy, enabling them to extract effective information from social media, allowing more individual and ordinary investors to understand the essence of financial investment, and to fully consider the risks undertaken while pursuing returns, avoiding blind following.

Specifically, we propose the establishment of an information authenticity verification mechanism, which requires social media platforms to tag posts related to financial products such as funds and stocks (e.g., indicating the source of information, whether it is an advertisement) and mandates real-name authentication for posters to reduce the spread of false information. Additionally, we suggest setting up a “Financial Rumor Reporting Channel” that allows investors to quickly report misleading statements. Platforms must verify and label or remove inaccurate content within 24 h and regularly publicize case handling to serve as a warning to the market. Mandatory disclosure of conflicts of interest is also recommended, requiring fund companies, fund managers, or third-party institutions to clearly state their relationships of interest when promoting on social media (e.g., holding positions, cooperation promotion agreements) to prevent covert manipulation.

Secondly, the development of intelligent risk warning tools is also suggested, embedding real-time sentiment analysis results (e.g., the current ratio of positive/negative discussions about the fund on social media) on the fund sales page, and automatically generating concise risk warnings. Strengthening basic financial literacy education is further recommended, with joint efforts with the Ministry of Education to include basic investment knowledge in high school curricula, and launching a series of popular science animations on short video platforms (such as Douyin, Bilibili), focusing on explaining concepts like “herding risks” and “harms of short-term speculation.”

Thirdly, we propose the establishment of a “social media-fund flow” linkage monitoring system, utilizing natural language processing technology (such as Baidu Senta model) to capture and analyze social media sentiment in real-time, combined with fund net inflow data, to identify abnormal fluctuation signals (e.g., a sudden high frequency of discussion about a fund and a sharp increase in capital inflow), triggering regulatory scrutiny. Setting “herding thresholds” and mandatory disclosure requirements is also suggested; when a single fund’s top ten holdings overlap with those of other funds exceeds 60%, the fund company is required to publicly explain its holding logic and limit the proportion of additional similar asset allocation to prevent excessive concentration risk. Regular stress testing is further recommended, requiring large fund companies to simulate liquidity risks under negative social media sentiment shocks (such as massive redemptions) and submit emergency response plans.

Data availability

No datasets were generated or analysed during the current study.

References

Agarwal V, Mullally KA, Tang Y, Yang B (2015) Mandatory portfolio disclosure, stock liquidity, and mutual fund performance. J. Financ. 70(6):2733–2776

Ammann M, Schaub N (2021) Do Individual Investors trade on investment-related internet postings? Manag. Sci. 67(9):5679–5702

Antweiler W, Frank MZ (2004) Is all that talk just noise? The information content of internet stock message boards. J. Financ. 59(3):1259–1294

Asset Management Association of China., 2021. 2020 China Public Fund Industry Data Report

Baltagi BH, Baltagi BH 2008 Econometric analysis of panel data (Vol. 4, pp. 135-145). Chichester: John wiley & sons

Barber BM, Odean T (2000) Trading is hazardous to your wealth: The common stock investment performance of individual investors. J. Financ. 55(2):773–806

Barber BM, Odean T (2008) All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Rev. Financial Stud. 21(2):785–818

Barber BM, Lin S, Odean T (2024) Resolving a paradox: Retail trades positively predict returns but are not profitable. J. Financ.Quant. Anal. 59(6):2547–2581

Barber BM, Huang X, Odean T, Schwarz C (2022) Attention‐induced trading and returns: Evidence from Robinhood users. J. Financ. 77(6):3141–3190

Bikhchandani S, Sharma S (2000) Herd behavior in financial markets. IMF Staff Pap. 47(3):279–310

Bikhchandani S, Hirshleifer D, Welch I (1992) A theory of fads, fashion, custom, and cultural change as informational cascades. J. Political Econ. 100(5):992–1026

Birru J, Young T (2022) Sentiment and uncertainty. J. Financ. Econ. 146(3):1148–1169

Brown SJ, Goetzmann WN, Park J (2001) Careers and survival: Competition and risk in the hedge fund and CTA industry. J. Finan. 56(5):1869–1886

Chen Z, Liu Z, Teka H, Zhang Y (2022) G12 Keywords: China’s a-share smart money trading aggressiveness fuzzy c-means clustering. Res. Int. Business Financ. 61:101656

Cheng W, Lin J (2013) Investors’ bullish sentiment of social media and stock market indices. J. Manag. Sci. 26(5):111–119

Chin HH, Chou PH (2009) Are both fund managers and fund investors smart? Evidence from US mutual funds. J. Financ. Stud. 17(4):31–55

Crane AD, Koch A, Michelnaud S (2019) Institutional investor cliques and governance. J. Financ. Econ. 133(1):175–197

Cremers KM, Petajisto A (2009) How active is your fund manager? A new measure that predicts performance. Rev. Financ. Stud. 22(9):3329–3365

Da Z, Engelberg J, Gao P (2011) In search of attention. J. Financ. 66(5):1461–1499

Deng M, Yang J, Mei C (2023) Information network of fund herding trading and tail risk of stock prices. Financ. Econ. Res. 38(5):129–144. (in Chinese)

Ding H, Lv CJ, Huang HJ (2018) Social media, investor information acquisition and interpretation ability, and earnings expectations—Evidence from the “SSE e-Interactive” platform. J. Econ. 53(1):153–168

Edelen RM (1999) Investor flows and the assessed performance of open-end mutual funds. J. Financ. Econ. 53(3):439–466

Falkenstein EG (1996) Preferences for stock characteristics as revealed by mutual fund portfolio holdings. J. Financ. 51(1):111–135

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J. Financ. Econ. 33(1):3–56

Fang L, Peress J (2009) Media coverage and the cross-section of stock returns. J. Financ. 64(5):2023–2052

Farrell M, Green TC, Jame R, Markov S(2021) The democratization of investment research and the informativeness of retail investor trading J. Financ. Econ. 145(2):2616–641

Focke F, Ruenzi S, Ungeheuer M (2020) Advertising, attention, and financial markets. Rev. Financ. Stud. 33(10):4676–4720

Froot KA, Scharfstein DS, Stein JC (1992) Herd on the street: Informational inefficiencies in a market with short-term speculation. J. Financ. 47(4):1461–1484

Garcia D (2013) Sentiment During Recessions. J. Financ. 68(3):1267–1300

Guo X, Wang P, Wu X (2020) Institutional investor network groups and corporate inefficient investment. World Econ. 43(4):169–192

Han Y, Cui X (2014) Study on the principal-agent relation in the mutual fund industry and fund managers’ myopic behaviors. Manag. Rev. 26(9):34–45

Hayes AF (2018) Partial, conditional, and moderated moderated mediation: Quantification, inference, and interpretation. Commun. Monogr. 85(1):4–40

He W, Mi L (2022) Institutional investors’ horizon and equity-financed payouts. J. Bank. Financ. 134:106324

He M, Chen H (2018) Investor attention, capital flow and “smart money” effect - Empirical evidence from China’s open-end funds. Securities Mark. Herald (9):47–55

Hirshleifer D, Subrahmanyam A, Titman S (1994) Security analysis and trading patterns when some investors receive information before others. J. Financ. 49(5):1665–1698

Jang IJ, Kang N, Yezelgel A (2022) Common ownership, price informativeness, and corporate investment. J. Bank. Financ. 135:106373

Jiang F, Kim KA (2015) Corporate governance in China: A modern perspective. J. Corp. Financ. 32:190–216

Jin D, Li Y (2017) Wisdom of crowds: peer opinions and value discovery—empirical evidence of social media. Econ. Manag. J. 39(12):157–173. (in Chinese)

Kaniel R, Parham R (2017) WSJ category kings: The impact of media attention on consumer and mutual fund investment decisions. J. Financ.Econ. 123(2):337–356

Karagiannis N, Tolikas K (2019) Tail risk and the cross-section of mutual fund expected returns. J. Financ. Quant. Anal. 54(1):425–447

Liao C, Tang G, Xu X (2024) Smart money or chasing stars: Evidence from northbound trading in China. Int. J. Financ. Econ. 29(2):1781–1803

Lin Y, Chen X, Chi X (2014) Do mutual fund flows have information content? Econ. Res. J. 49(A01):176–188

Liu X, Gao C (2021) Can institutional investor herding suppress controlling shareholders’ private benefit activities? An analysis from the perspective of social networks. Nankai Bus. Rev. Int. 24(4):141–154

Liu YY, Liao N, Luo RH (2022) Funds make money, but fund investors do not: Perception of performance persistence and fund investor behavior. China Ind. Econ. 02:156–174

Luo RH, Tian ZL (2020) Fund networks, competitive isolation, and stock information environment. China Ind. Eco. 3(18):137–154

Manela A, Moreira A (2017) News Implied Volatility and Disaster Concerns. J. Financ. Econ. 123(1):137–162

Mei LX, Yan W, Fang J (2020) Performance attribution of “smart investors” in China’s stock market. Securities Mark. Herald, (3):20–29

Morellec E, Nikolov B, Schürhoff N (2012) Corporate governance and capital structure dynamics. J. Financ. 67(3):803–848

Ouyang HB, Liu XJ, Zhao Y, Huang K (2025) Fund herding and the speed of corporate leverage adjustment: Governance effect or pressure effect. Financ. Econ. Res. 40(2):56–74

Pollet JM, Wilson M (2008) How does size affect mutual fund behavior? J. Financ. 63(6):2941–2969

Rakowski D, Shirley SE, Stark JR (2021) Twitter activity, investor attention, and the diffusion of information. Financ. Manag. 50(1):3–46

Rao Y, Huang Y, Peng J (2013) Evaluation research on the patent innovation efficiency of China’s knowledge intensive industry based on DEA-Malmquist index approach. Manag. Rev. 25(8):48–55

Renault T (2017) Intraday online investor sentiment and return patterns in the US stock market. J. Bank. Financ. 84:25–40

Scharfstein DS, Stein JC (1990) Herd behavior and investment. Am. Econ. Rev. 80(3):465–479

Schwert GW (2005) Dumb money: mutual fund flows and the cross-section of stock returns. J. Financ. Econ. 88(2):299–322

Shen Y, Zhao J, He X (2013) Undisclosed information of the fund: Hidden trading and investment performance. J. Management World (08):53-66

Sirri ER, Tufano P (1998) Costly search and mutual fund flows. J. Financ. 53(5):1589–1622

Southwest University of Finance and Economics, & Ant Group Institute, 2020. China Family Wealth Index Survey Report

Su Z, He X, Zhang Y (2024) Fund “herding”: Net value growth and the risk of sharp declines. Manag. Rev. 36(3):30–44+145

Sul H, Dennis AR, Yuan LI (2014) Trading on twitter: The financial information content of emotion in social media. In 2014 47th Hawaii International Conference on System Sciences. IEEE: 806-815

Teti E, Dallocchio M, Aniasi A (2019) The relationship between twitter and stock prices. Evidence from the US technology industry. Technol. Forecast. Soc. Change 149:119747

Tetlock PC (2007) Giving Content to Investor Sentiment: The Role of Media in the Stock Market. J. Financ. 62(3):1139–1168

Tetlock PC (2010) Does Public Financial News Resolve Asymmetric Information? Rev. Financ. Stud. 23(9):3520–3557

Tetlock PC (2011) All the News that’s Fit to Reprint: Do Investors React to Stale Information? Rev. Financ. Stud. 24(5):1481–1512

Tetlock PC, Saar-Tsechansky M, Macskassy S (2008) More than Words: Quantifying Language to Measure Firms’ Fundamentals. J. Financ. 63(3):1437–1467

Vozlyublennaia N (2014) Investor attention, index performance, and return predictability. J. Bank. Financ. 41:17–35

Wermers R (1999) Mutual fund herding and the impact on stock prices. J. Financ. 54(2):581–622

Wooldridge JM (2010) Econometric analysis of cross section and panel data. MIT press

Wu X, He P (2005) Analysis of herding behavior of China’s open-end funds. J. Financial Res. (05):60–69

Xiang C, Feng L (2022) Is fund herding value investing or blind following? A study based on the impact of individual stock returns. Invest. Res. 41(12):67–90

Xu X, Zhang L, Zhang Z(2011) Herding phenomenon in industry allocation-an empirical study of open-end funds in China. J. Financ. Res. 4:174–186

Yang T, Guo M (2019) Investor attention and the stock market—a new perspective on PM2.5 concept stocks. J. Financ. Res. 467(05):190–206

Yu FF (2008) Analyst coverage and earnings management. J. Financ. Econ. 88(2):245–271

Yu Q, Zhang B (2012) Investors’ limited attention and stock returns—an empirical study using the Baidu Index as the degree of attention. J. Financ.Res. 08:152–165

Yu S, Wang X, Yi Z (2015) Does “holding together” create warmth? China J. Econ. 2(4):82–109

Zhang FP, Xu YX, Chen X, Zhou Y (2024) Forecasting Interval Valued Stock Returns Based on News Media Sentiments. China J. Econ. 4(1):204–230

Zheng L (1999) Is money smart? A study of mutual fund investors’ fund selection ability. J. Financ. 54(3):901–933

Zhou YG, Tang CW, Lin ZH (2024) Market sentiment, investment factors, and asset pricing: A comparative analysis based on news and social media. China J. Econ. 4(3):567–587

Acknowledgements

This research did not receive any specific grant from funding agencies.

Author information

Authors and Affiliations

Contributions

C.N. and Y.G. wrote the main manuscript text and T.R. reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This study did not require ethical approval because it exclusively analyzed publicly available, anonymized secondary data (e.g., fund performance metrics, social media trends, or commercial database records). No human participants, animal subjects, or private or identifiable information were involved in the research.

Informed consent

For this study, informed consent was not applicable as the data was sourced from public channels (for example, TianTian fund, The official website of Finance.JR.com, Baidu), with no direct involvement of individual participants and no access to any identifiable personal information.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Nie, C., Gao, Y. & Ren, T. The impact of social media on fund net capital flow and performance. Humanit Soc Sci Commun 12, 1442 (2025). https://doi.org/10.1057/s41599-025-05790-z

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05790-z