Abstract

To achieve the goals of “carbon peaking and carbon neutrality” and promote high-quality economic development, China is vigorously developing new energy and strategic emerging industries. Based on the enterprises, customs trade data from 2000 to 2022, this study applies kernel density estimation, standard deviation ellipse, and spatial Durbin model to discuss the battery electric vehicle (BEV) industry’s spatial organization pattern in China and worldwide, along with the characteristics of its development stage and driving factors. The results demonstrated that: (1) from internal circulation (ICI), China's BEV industry’s inter-firm linkages are spatially heterogeneous, multinuclear, with increasingly indicated characteristics of “large dispersion and small agglomeration”. (2) From external circulation (ECI), the BEV industry shows notable path dependence and agglomeration effects. Upstream imports are highly dependent on lithium-rich countries. Midstream export is active, with more trade-advantage regions than trade-disadvantage regions. Downstream supply and demand are growing, and its exports are on an upward trajectory. (3) From dual circulation (DCI), the organizational structure presents a network pattern with the eastern coastal region serving as the nucleus of commodity trading. The main drivers for industrial spatial organization have progressively transformed from being policy-driven to a multi-dimensional focus on technology and market. (4) Economic development, industrial structure and technological innovation have significantly influenced the spatial distribution of China’s BEV industry and propelled the evolution of global BEV trade patterns. This research illustrates the fundamental principles regarding the spatial organization of China’s BEV industry, clarifies each region’s status within DCI, and promotes the green and low-carbonization of economic development.

Similar content being viewed by others

Introduction

Since the twenty-first century, the global economy, geopolitics and technological advancements have undergone systematic and structural changes. Environmental problems are getting worse, sustainable development is facing serious challenges, and the risk of energy security is becoming increasingly prominent. Reducing carbon emissions, accelerating the transition from fossil fuels, and guaranteeing energy security have emerged as common strategies for countries around the world (Lee and Hussain, 2022). In September 2020, China proposed a “dual-carbon” goal, aiming for carbon peaking by 2030 and carbon neutrality by 2060. These efforts not only provide to address climate change and protect the environment, but also serve as vital methods to promote sustainable development (Wang and Dou, 2023; Liu et al., 2024).

In the context of ensuring energy security and achieving the “dual-carbon” goal, new energy vehicles, which reduce greenhouse gas emissions, foster high-quality economic advancement, and illustrate high efficiency with low emissions, have emerged as an essential direction for the green development and transformation of the global automotive industry. It becomes a common choice for countries to enhance the ecological environment and secure energy stability (Zheng et al., 2025). New energy vehicle (NEVs) includes battery electric vehicle (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). BEV is entirely powered by rechargeable batteries and has emerged as the predominant model of new energy vehicles due to its simple structure, high energy conversion efficiency, non-pollution, and low noise. Utilizing renewable electricity can achieve both enhanced energy efficiency and significant decarbonization (Onat et al., 2015; Hill et al., 2019; Hu et al., 2021). The BEV industry serves as a crucial component of the value and industrial chains within the NEV industry, constituting a fundamental industry pertinent to national strategy and forming an important part of strategic emerging industries. Improving the ecological environment and advancing green development are of paramount importance for the current and future development of the global automobile industry.

In 2020, the Standing Committee of the Political Bureau of the Central Committee of the Communist Party of China (CPC) first proposed to “accelerate the formation of a new development pattern with the internal circulation as the mainstay and the internal and external circulation mutually reinforcing”. The report from the Twentieth Congress of CPC also emphasized the necessity to improve the endogenous dynamics and dependability of ICI, promote the quality and ability of ECI, and try to enhance the resilience and security of the industrial supply chain. “Taking the ICI as the mainstay” requires expanding domestic demand, promoting the modernization of the industrial chain, advancing supply-side structural reforms and promoting coordinated regional development. “Mutual promotion of ICI and ECI” means that China should base itself on the ICI, better attract and utilize global resources and factors, connect the domestic and international markets, enhance the efficiency and level of ICI, and promote the integration of international resources. The aim is to enhance the efficiency and level of ICI, promote a high level of opening up to the outside world and facilitate the integration of international resources (Liu and Du, 2025). The DCI, while a new concept, is not a simple and random invention. The characteristics and advantages of a large country’s economy is the internal economic cycle, the essence of the national economic cycle is the process of social reproduction, the smooth realization of this process, it is necessary to coordinate the promotion of supply-side structural reforms and demand-side management, unimpeded economic cycles (Cheng and Zhang, 2021; Bi, 2025). The BEV industry participates in the economic cycle by way of trade, and enhances its ability to transform itself into a green, low-carbon cycle by absorbing environmentally friendly, low-carbon and recycling technologies (Li et al., 2024). It is not only a growth for domestic consumption upgrading, but also an important field to participate in international competition, and has become the main direction for the transformation and development of China’s automobile industry, as well as an important engine to promote the sustained growth of the world economy. In 2024, China’s BEV exports exceeded 2 million for the first time, and lithium battery exports hit a record high of 3.91 billion units. However, this year, the United States Trade Representative (USTR) issued additional Section 301 tariffs on a number of Chinese products, including 25% and 100% tariffs on lithium batteries and electric vehicles, respectively. China’s BEV industry is facing new challenges, including heightened competition in the domestic market and significant international trade barriers. To secure strategic opportunities under the double challenges of domestic high-quality development and international order imbalance, it is essential to explore the current situation DCI development of China’s BEV industry and integrate into the new development paradigm (Fu and Zhao, 2021). Therefore, this study firstly constructs the BEV industry chain scientifically based on the perspective of DCI, applies technical methods such as GIS spatial analysis, and uses POI and United Nations trade data to identify the industrial agglomeration centers. It conducts quantitative research on the spatial distribution and agglomeration of the BEV industry chain’s components, and analyzes the development trends and evolutionary patterns of China’s BEV industry spatial organization to facilitate the industry’s high-quality advancement.

The marginal contributions of this study are as follows. (1) Research perspective. Existing research on NEV mainly focuses on technological innovation and policy research, with scholars studying the direction and intensity of the effects of various industry policies from the perspective of canceling the purchase subsidies for new energy vehicles, to adjusting industrial policy (Du et al., 2024). Based on the new economic geography (Krugman, 1991), this study explores the evolution of China's BEV industry’s spatial pattern from ICI, ECI and DCI perspectives, respectively, identifies the important role of China’s urban scale in the different development stages of this industry and analyzes China’s participation in the international market. It provides a basis of site selection for BEV industry development in major cities and serves as a reference for the formulation of China’s BEV industry planning and regional development policies. (2) Research content. This study has systematically defined the BEV industry chain, covering products across the entire chain, thus improving the examination of BEV industry components and expanding the research framework of industrial spatial organization. It contributes to the establishment of a robust economic system for China’s green, low-carbon and recycling development and the realization of high-quality economic development. This research enriches the related research on spatial agglomeration drivers from a DCI perspective and reveals the existence of spatial spillover effects within the BEV industry in major cities. Upstream is resource-directed agglomeration, while midstream and downstream industries are labor-directed and economy-directed agglomeration.

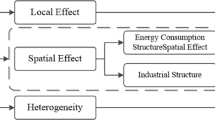

The remainder of this study is organized as follows. Section “Literature review” briefly reviews the existing literature on the new development pattern of DCI and the BEV industry. Section “Material and methods” introduces the research methodology and data processing process. Section “Results” demonstrates the evolution of the spatial pattern of China’s BEV industry under the DCI perspective, and discusses the driving factors affecting the evolution of its spatial pattern. Section “Discussion and policy implications” demonstrates the discussion of new findings and policy implications. Finally, the section “Conclusions” summarizes the conclusions, shortcomings and future outlook. The research framework is summarized in Fig. 1.

Literature review

DCI development pattern

The pattern of China’s economic development has gone through many adjustments in accordance with the needs of domestic development and changes in the international situation. Initially, it was primarily influenced by ICI. Following the reform and opening-up, China has become increasingly integrated into ECI. Currently, the economy operates within a DCI framework of ICI and ECI, with the ICI serving as the foundation. Before 1978, China was in the stage of unified management of foreign trade under the planned economic system, and economic development was dominated by ICI. In 1988, the Economic Research Institute of the State Planning Commission put forward the concept of “international economic development strategy”, marking the emergence of an outward-oriented economic development pattern (Wang, 1988). However, its limitations were fully exposed after the outbreak of the international financial crisis. Some scholars have pointed out that ECI has the disadvantage of “low-end locking”, which has put China in a dependent position at the low end of the industrial chain in the international division of labor, resulting in a “dual economy” characterized by a disjunction between internal demand and external orientation (Xu, 2020; Qian and Pei, 2021). The crisis of the conventional economic cycle model has generated new opportunities for the emerging economic cycle model. The proposal of the new development pattern promoting the DCI of internal and external economies in 2020 has clarified the strategic trajectory of China’s modernization. This strategy is not a passive response to global economic shifts, but rather an active choice in the new development stage.

At present, the research related to the DCI new development pattern mainly focuses on the definition of connotation, the measurement of the development level and the implementation path. In terms of research content, it covers a wide range of industries, such as ports and manufacturing (Zeng et al., 2022; Xu et al., 2022). Economic activity is essentially a process in which information, capital, and commodities circulate among different subjects, such as residents, enterprises and the government, based on the economic division of labor and value-added. The economic cycle is referred to as ICI when it occurs within a closed space, and ECI is the opposite (Huang and Ni, 2021). Coupled with a relatively complete supply chain, the intensive division of labor between cities in the region constitutes a mature internal cycle of the industry chain. Meanwhile, establish an ECI with other global nodes, and ultimately transform the fragmented global industrial chain into a new norm characterized by a multi-node, DCI system (Huang et al., 2022). Feng and Qiu analyze the participation of cities as key nodes of interregional inputs and outputs in the ICI and ECI (Feng and Qiu, 2023). In terms of research methodology, the indicator and input-output approaches are mostly used (Jiang and Meng, 2021; Ding and Zhang, 2022; He et al., 2022; Liu et al., 2022; Liu et al., 2023b). The measurement scale is mostly focused on the national and provincial levels. For example, Abula points out that logistics infrastructure, as a bridge between China and Central Asian countries, plays an important role in shaping the new development pattern (Abula et al., 2022).

Some scholars propose that establishing a DCI development pattern, focused on ICI, signifies the execution of an economic globalization strategy founded on domestic demand. The rationale for leveraging domestic demand as a competitive advantage is to encourage enterprises’ involvement in the international economic cycle. It is the transition from increasing domestic demand to facilitating industrial advancement (Liu, 2020). In the context of the COVID-19 pandemic, global economic growth has decelerated or experienced negative growth, while the specialization of the global industrial chain has revealed three emerging trends: regionalization, chain clustering, and redundancy. Driven by the emerging trend, the global industrial chain has progressively transformed into various industrial chain nodes, with major countries as the core and adjacent economies serving as collaborative regions (Liu et al., 2022; Chen et al., 2024). The organic integration of economic connections can establish an efficient economic cycle. Any disruption in these connections will cause the entire system to malfunction. Therefore, when establishing a new DCI development pattern, the synergistic advancement of economic connections must not be overlooked.

BEV industry

As an important way to enhance energy security and pressure on air pollution, NEV’s industrial development is seriously constrained by the availability of key minerals, and is regarded as a strategic emerging industry in China (Yu et al., 2023). BEV, one of the main models of new energy vehicles, is a vehicle that is powered entirely by rechargeable batteries, contains motor-driven wheels, and complies with road traffic and safety regulations. Now, existing research primarily concentrates on the NEV industry, with insufficient focus on the BEV industry, and there is a scarcity of studies conducted from a geographical perspective.

Research on the BEV industry primarily focuses on development direction, driving mechanism and industrial policy effects. Some scholars claim that the advancement of China’s electric vehicle industry is progressing favorably, with several prominent enterprises exhibiting agglomeration effects in vehicle manufacturing and essential components, resulting in the establishment of an electric vehicle industry chain. But there remains a risk of excessive growth without corresponding strength, and a noticeable gap exists between essential core technologies and international standards (Zhao and Ma, 2020). Pavlínek identified that the shift from manufacturing internal combustion engine vehicles to electric vehicles in Eastern Europe, along with the automotive value chain, production networks, and labor division in these countries, played a significant role in transforming the European automotive industry’s position (Pavlínek, 2023). Ke Rong compares the electric vehicle ecosystems in China and Europe. The Chinese government is primarily advocating for greater integration of the electric vehicle industry and regulations within the ecosystem. Conversely, in Europe, market forces propel the ecosystem (Rong et al., 2017). Regarding the research on the BEV industrial policies’ effects, Zihao Xu examines China’s NEV power battery industrial policies through the perspective of the product life cycle, focusing on four dimensions: the number of policies, the policy issuing department, the policy content and the policy tools (Xu et al., 2024). By analyzing the current situation, environment and opportunities of China’s BEV industry development, Yuntian Luo thinks that it is crucial to formulate countermeasures for BEV industry development that are in line with the current situation and industrial base of China (Luo, 2021). In recent years, the use of BEVs in underground mining has increased significantly (Hooli and Halim, 2025), creating a healthier work environment for miners and reducing carbon emissions. However, there are some concerns about BEV in terms of productivity, fire safety, economic feasibility, user-friendliness and potential electrical-related issues, and there is still much space for progress.

While China has a significant technological advantage and market size advantage in BEV, it also faces challenges. The autonomy of automotive-grade chips and operating systems is limited, with critical chips dependent on foreign sources, while China relies significantly on imports for essential raw materials such as lithium, nickel, and cobalt (Van Den Brink et al., 2020; Shao et al., 2022; Sun et al., 2022). The overall industry chain, including the spatial correlation and continuity among upstream, midstream, and downstream industries, will influence the healthy growth of the entire industry.

Evaluation of the literature

China’s BEV industry started later than those in Europe, the United States, and Japan. However, due to robust national policy support, it has now achieved significant advancements across the entire industry chain. Currently, the existing research mainly focuses on the NEV and pays less attention to the BEV. And there is a scarcity of research carried out from the perspective of geography. The relationship between DCI and the BEV industry has not been systematically studied. Furthermore, no scholars have investigated the BEV industry’s degree of participation, interaction and spatial organization from the DCI. They have also not uncovered the domestic and international development dynamics of this industry or explored the differences in the industry’s development. Domestic industry chain components’ spatial concentration and dispersion should be identified in the order of “ICI-ECI”, and the domestic market’s interaction with international components should be examined simultaneously.

Material and methods

Data sources

ICI enterprises data is from Enterprise Search websiteFootnote 1. First, combined with the BEV industry chain structure, five keywords, namely lithium mineral, lithium industry, lithium battery, battery electric vehicle and charging pile are set. These keywords correspond to the supply of raw materials, parts and components manufacturing, BEV manufacturing, energy supply services and other industry chain links. A total of 40,118 data points were collected, and some abnormal and repetitive data were cleaned, eliminated, checked and corrected, and finally, 37,785 BEV industry information data were obtained. Furthermore, due to the lack of enterprise geographic coordinates on the Enterprise Search website, the Baidu Maps open platform is utilized to obtain corresponding geographic coordinates based on the enterprise’s locationFootnote 2. Finally, geocoding technology transforms the registered address of the enterprise into its corresponding geographic coordinates (Wang et al., 2022).

About ECI, this paper adopts a broader definition that includes all production stages involving the foreign components, specifically all cycles that include imports and exports (Dai et al., 2023). The data for BEV trade is from UN ComtradeFootnote 3. By utilizing the six-digit HS code, the data encompasses the year, importing country, exporting country and trade volume. The specific interpretation of the customs code is shown in Supplementary Table S1.

Kernel Density Estimation

The kernel density estimation method, which can utilize the spatial attributes of the sample data itself to study the distribution characteristics of spatial data, better reflects the distance attenuation effect in the spatial distribution of geographic phenomena (Yu et al., 2016). The formula for its calculation is as follows:

\(f(x)\) is the kernel function, h is the bandwidth, \(x-{x}_{i}\) indicates the distance from the valuation point to the output grid.

Interdependence index

This paper aims to elucidate the interdependence of China with other countries and regions in the BEV’s trade while assessing the strengths and weaknesses of China’s foreign trade in BEV industry products. Based on existing literature (Xia et al., 2022), it follows Grubel-Lloyd Index to establish China’s BEV trade interdependence index (Scott et al., 1975), thereby determining China’s position in various supply and demand markets. For specific formulas, refer to Supplementary Equation S1.

Standard deviation ellipse

Standard deviation ellipse is a statistical tool for assessing geospatial distribution, capable of characterizing the spatial distribution of the research subject from various angles, including centrality and directional orientation. It has been applied by numerous scholars to elucidate the primary spatial distribution characteristics and their dynamic transformations (Jiao et al., 2023; Han et al., 2022). This research adopts this method to characterize the different industries’ evolution of the spatial distribution pattern within China’s BEV industrial chain, for specific formulas, refer to Supplementary Equation S2.

Spatial Durbin model

This study uses the Spatial Durbin Model (SDM) to reveal ICI’s driving factors behind China’s BEV industry’s spatial organization pattern. By integrating a spatial weight matrix and incorporating both the spatial lag effect of the dependent variable and the spatial spillover effect of the independent variable, the model can be used to deal with the spatial interaction mechanism (Mur and Angulo, 2006; Koley and Bera, 2024). And this model can better analyze the driving factors for the formation of the BEV industry’s spatial distribution pattern in China’s each region. It can combine local spatial dependence effects and spatial spillover effects of neighboring regions among regions with complex associations, and has the advantage of overcoming the shortcomings of traditional regression models that ignore spatial dependence. The model not only improves the efficiency of parameter estimation but also analyzes economic phenomena more accurately.

Driving factors selection

Based on BEV industry development and literature (Xiao and Peng, 2023; Zhang et al., 2024, 2013; Zhang et al., 2024), this paper selects five indicators (Table 1), including the level of economic development, infrastructure, industrial structure, innovation investment, and governmental intervention, as the dependent variables to explore China’s driving factors of BEV industry distribution pattern in each prefecture-level city. The independent variables in this section use NEV ownership as a substitution. The specific reasons are as follows:

First, due to the lack of data on the segmented BEV ownership in China’s each prefecture-level city, only data on the NEV ownership can be obtained. Second, this study determines the exact proportion of BEV ownership to NEV ownership based on the information of data released by China’s Ministry of Public Security. From 2020 to 2024, BEV ownership ranges from 70.34% to 81.32% of NEV ownership (China’s Ministry of Public Security, 2021; 2022; 2023; 2024; 2025). This shows that BEV currently dominates the NEV market. Finally, BEVs have the advantages of low whole-life-cycle emissions and low-cost electricity, which are increasingly favored by consumers. For all these reasons, the study uses NEV ownership data as a substitution.

Spatial econometric models are typically classified into three categories: spatial error model, spatial lag model, and spatial Durbin model. The spatial lag model assumes significant spatial dependence of the explanatory variables and therefore a spatial lag term is introduced into the model. Spatial error disturbances in neighboring regions affect the explanatory variables of the region, so the spatial error model includes them in the regression term. The spatial Durbin model explains that the explanatory variables of a region are not only affected by its explanatory variables, but also by the explanatory variables of its neighboring regions, and also explains the spatial impact of random error shocks, which can well explain the spatial correlation of the dependent and independent variables. The specific formula is as follows:

spatial lag model:

spatial error model:

spatial Durbin model:

where i and t indicate city and year, \({y}_{it}\) denotes the explanatory variable for city i in year t, \({x}_{it}\) indicates explanatory variables, \({W}_{ij}\) is the spatial weight matrix, \({\varepsilon }_{it}\) and \({\mu }_{it}\) denote random error terms, \({\mu }_{i}\) and \({\lambda }_{i}\) represent spatial fixed effects and time-fixed effects, respectively. β is a constant term, \({\beta }_{i}\) is the estimated parameter for each variable, ρ is the spatial autoregressive coefficient, which mainly responds to spatial lag effects. \({\theta }_{i}\) is the coefficient to be estimated, \({W}_{ij}{y}_{ij}\) is the spatial lag term.

Spatial weight matrix

First, this research chooses the neighboring distance matrix. It is constructed based on whether the cities are in neighboring positions to each other in geographic space. Secondly, the geo-economic distance nested matrix and geographic inverse distance matrix are used in the robustness test section to make the results more accurate and objective. The formulas are as follows:

where \({W}_{ij}\) is the spatial weight matrix, as the spatial adjacency. When \({W}_{ij}\) is 1, the city and the neighbor are adjacent to each other; when \({W}_{ij}\) is 0, the city and the neighbor are not adjacent to each other.

Global spatial autocorrelation

Moran’s I is utilized to test whether there is spatial autocorrelation between different cities, revealing the spatial distribution characteristics and interrelationships of geographic or economic phenomena in a certain region. When Moran’s I > 0, it indicates a positive spatial correlation. When Moran’s I < 0, it indicates a negative spatial correlation. The definition is as follows:

where \({y}_{i}\) is the BEV of the city i, y is the mean value of the BEV for the region, and \({\omega }_{ij}\) is a normalized spatial geographic weight matrix.

Trade gravity model

The trade gravity model is commonly employed to assess the influence of various factors on disparities in total trade flows, exports and imports. The model dataset includes additional variables such as infrastructure, cost of trade at borders and variables such as tariffs, GDP, and GDP per capita of the partner and reporting countries are added to the model (Masood et al., 2023). Therefore, the model is more comprehensive than the basic gravity model. The dependent and independent variables of this study are shown below:

\(Ln(BE{V}_{ij},t)\) denotes the natural logarithm of country i’s total trade with country j, including country i’s net exports and imports to country j .\(pgdpx\) denotes the GDP per capita of China. \(pgdpy\) denotes the GDP per capita of other countries. \(tarif{f}_{ij}\) is the simple average tariff of country i to country j for transportation products under HS code .\(lith{B}_{ij}\) denotes the total trade in lithium batteries from country i to country j .\(pop\) represents the population size of other countries. \(dis{t}_{ij}\) denotes the distance between countries i and j. \(Rta\) indicates whether there is a regional trade agreement between country i and j, which is a dummy variable. ε represents the error term, t denotes time, and β is a parameter.

Results

Analysis of industrial spatial pattern

ICI spatial distribution pattern

Upstream enterprises include lithium mineral and lithium battery enterprises. Lithium mineral enterprises have increasing core points in space, indicating a trend towards multi-core evolution (Fig. 2). Specifically, in 2000, lithium mineral enterprises were spatially decentralized, with agglomeration cores formed in Xining and Chengdu city. In 2022, it showed a double-core evolution, with Chengdu and Yichun city developing rapidly and forming a center of agglomeration. Lithium battery enterprises’ distribution was centered on Shanghai city, Guangdong and Jiangsu province, showing the spatial distribution characteristics of “multi-core” mode. Between 2000 and 2022, lithium battery enterprises were centered in Shenzhen, Suzhou, and Shanghai city. The number of enterprises in these three cities has significantly increased, and their spatial distribution is growing, progressively creating an obvious multi-level structure in space.

Midstream enterprises show the evolution from “single core” to “multi-core” and the characteristics of “large dispersion and small agglomeration”, as shown in Fig. 3. In 2000, the single-core model was presented; the number of enterprises in that year was relatively small, and the distribution was concentrated in Shanghai city. In 2022, the double-core model emerged, and Shenzhen and Shanghai gradually developed into the first level of agglomeration core. BEV’s headquarters and research and development centers prefer to choose the location of mega-cities, among which Shanghai city is particularly obvious. The proliferation trend of downstream enterprises is obvious, while the space pattern is more stable. The spatial pattern of charging pile enterprises is relatively stable, forming a multi-core pattern centered on Beijing and Shanghai cities, Sichuan and Guangdong provinces. From 2000 to 2022, the number of enterprises gradually increases, their distribution expands, and the diffusion of enterprises strengthens.

ECI spatial distribution pattern

From 2000 to 2022, the import and export trade patterns for upstream products in China’s BEV industry exhibit significant concentration and pronounced path dependence, as illustrated in Fig. 4. China’s lithium mineral import market was predominantly sourced from nations with abundant lithium resources, including Chile, Argentina, and the United States. Over the past two decades, China’s lithium mineral import market has expanded to the Asia-Pacific, Europe, and the United States. Nonetheless, it remained predominantly concentrated in Chile and Argentina, exhibiting significant oligopolistic advantages. The concentration of China’s lithium mineral export pattern has intensified, resulting in a more concentrated export market, which was primarily located in South Korea, Japan and Netherlands.

a Lithium mineral in 2000. b Lithium mineral in 2022. c Lithium battery in 2012. d Lithium battery in 2022. e Battery electric vehicle in 2017. f Battery electric vehicle in 2022. Note: Produced according to the standard map GS (2016) 1667 on the Department of Natural Resources Standard Map Service website, without alterations to the base map boundaries, same below.

Lithium battery import market in China has shifted principally from Japan and South Korea to Malaysia and Singapore, while the export market has grown increasingly diverse, resulting in a diminishing reliance on the United States, Japan, and South Korea. Lithium battery export market was centered in the United States and Japan, with exports increasingly directed towards global markets. The number of trading partners is gradually expanding, resulting in a diminished reliance on the primary exporting countries.

Between 2017 and 2022, the market concentration of China’s BEV midstream industry experienced a decline. The import market remained relatively stable, whereas the export market displayed significant heterogeneity. China’s import market is primarily sourced from the United States, Germany, and Japan. The market exhibits a trend towards diversification in export patterns, accompanied by a decline in concentration levels. The main export trading countries evolved from Bangladesh, Israel, the Netherlands and the United States to Belgium, the United Kingdom, Spain and Slovenia. The import and export market of midstream products exhibits path dependence and diversified characteristics.

To illustrate China’s advantageous position in the pattern of trade interdependence in the higher, medium, and lower ranges of the industrial chain, the interdependence index is used to sort out the position of China’s trade interdependence with other nations. This process is illustrated in Fig. 5.

First, China’s lithium mineral trading advantage has declined from 2000 to 2022. The number of countries that are unilaterally dependent on lithium minerals from China has decreased from 38 to 29. The number of very dependent ones has increased from 6 to 8. Meanwhile, the number of moderately or lowly dependent ones has dropped from 2 to 0. Furthermore, the number of countries that are dependent on lithium battery commerce from China has grown rapidly, increasing from 97 to 150. The number of very reliant ones has risen from 24 to 40, while the number of moderately and lowly reliant ones has decreased by one each. Secondly, from the BEV trade perspective, the number of trading entities that are one-way dependent on China has risen from 103 to 140. The number of highly dependent ones has increased from 3 to 12, while the number of moderately or minimally dependent ones has increased by 1 and 2. The rising trend is obvious. China’s trade advantage significantly exceeds its trade disadvantage, indicating a trend of optimization in trade relationships. Lastly, China’s charging pile export market mainly focuses on Europe, the United States and Southeast Asia. According to the latest cross-border index of Alibaba International Station, the United Kingdom, Germany, Ireland, the United States, and New Zealand are the top 5 countries with hot searches for charging piles. However, there are certain restrictions on the export of charging piles. One is that the charging pile export needs to pass the certification standard of the trade subject, and the cost of mainstream certification ranges from 50 million to 1 billion yuan. The second is that subsidies have become more difficult to obtain.

DCI spatial distribution pattern

During 2000 and 2022, the ICI of China’s lithium mineral firms predominantly exhibited a spatial distribution pattern oriented from northwest to southeast (Fig. 6). The industry’s gravity center shifted from Longnan City to Chongqing City in the southeast, the center of gravity shifted southeastward before extending due east. The external cycle was predominantly oriented in the northwest-southeast direction, with a diminishing elliptical area. Initially, the center of gravity shifted southeastward before extending due east (Fig. 7). The distance between ICI and ECI was smaller in 2022 than in 2012, indicating that the lithium mineral industry’s DCI has high spatial organizational coherence. The gravity center of lithium battery industry was in Anqing city and Huanggang city, shifting first to the northeast and then to the southeast.

Domestic BEV manufacturing enterprises typically exhibit a “Northeast-Southwest” orientation (Fig. 8). The gravity center has shifted from Huanggang City to Xinyang City and subsequently to Lu’an City, primarily indicating a development trend towards the “East-South”. The DCI’s gravity center is concurrently shifting from the Pacific region to the Middle East region (Fig. 7). This suggests that the spatial organization of international circulation in the midstream industry exhibits greater volatility than its domestic counterpart, with a tendency towards diversification in the international market and a reduction in the degree of concentration.

Charging piles generally showed a spatial distribution pattern of Northeast-Southwest. From the distribution center, the center of gravity of this industry moved from Wuhan city to Huanggang city in the north and then to Xiaogan city in the west. After years of research and application as well as continuous policy support, China’s domestic market for charging piles has been in a relatively stable stage.

ICI driving factors analysis

Correlation test

Before conducting spatial empirical tests, it is required to first ascertain whether the variables have spatial autocorrelation. In this study, spatial autocorrelation is examined using a global Moran index for BEV ownership in each of China’s 272 prefecture-level cities from 2017 to 2022, and the results are presented in Supplementary Table S2.

Supplementary Fig. S1 and Supplementary Table S2 indicate that the Moran’s I index for BEV ownership across prefecture-level cities in China is positive and exhibits an upward trend. The distribution of the BEV industry in China exhibits notable positive spatial correlation. In conclusion, spatial correlation plays a significant role, and the selection of the spatial measurement model is appropriate.

LM, LR, Wald, and Hausman tests

This study examines the specific factors influencing the distribution of the BEV industry across prefecture-level cities in China, and utilizes a spatial Durbin model (SDM) to assess the degree and direction of these influences. The determination of whether the SDM will reduce to a spatial lag model (SAR) or a spatial error model (SEM) should initially be conducted using the LM, LR, and Wald tests. Secondly, the Hausman test is needed to determine whether a fixed effects model or a random effects model is more appropriate for estimating the results. Table 2 presents the test results of the spatial econometric model.

Firstly, all four LM tests rejected the original hypothesis at the 1% level of significance, identifying that this study contains both spatial errors and autocorrelation effects of spatial lag. Therefore, SDM will be used for analysis in this study. Second, the Hausman test for SDM in this study produced a test value of 153.27, which passed the 1% significance level test, prompting the usage of the fixed effect model. Finally, the LR test values were 49.56 and 556.62, respectively, indicating that the original hypothesis was rejected at the 1% significance level, implying that the regression analysis did not need to degenerate into spatial error or spatial autoregressive models. Based on the results of the preceding tests, SDM was used to undertake empirical analysis.

SDM regression analysis

Further empirical tests were carried out utilizing the SDM based on the results of the preceding tests. By comparing the R2 for individual, time, and two-way fixed effects, it was discovered that the R2 for time-fixed effects was greater, implying that the study of time-fixed effects estimates was more accurate (Xu et al., 2023) (Table 2).

Given that SDM elucidates the spatial economic correlation among prefecture-level cities and its parameter estimation results inadequately represent the actual roles of direct and spatial spillover effects, the spatial effect is categorized into direct effect, indirect effect, and total effect, referencing the partial differential method proposed by LeSage and Pace (2009). The direct effect relates to the influence of the driving factors on the distribution of the BEV industry within this city. The indirect effect refers to the spatial spillover effect, indicating the impact of various factors on the distribution within the BEV industry in neighboring prefecture-level cities. The overall effect consists of the aggregation of direct and indirect impacts, with specific effects outlined in Table 3.

Direct effect. The direct effect of GDP per capita and infrastructure level passes the 1% significance test, with values of 1.134 and 0.277, respectively. This means that, under the condition of 1% confidence, the change in BEV ownership in the region is directly promoted by 1.134% and 0.277% when the explanatory variables are increased by 1% correspondingly. This research finds that the level of economic development is a significant factor, and the increase in BEV ownership in prefecture-level cities can be significantly influenced by the level of regional economic development. Specifically, the economically developed regions exhibit a high degree of industrial agglomeration. The consumption capacity, inclination to purchase BEV, and the number of vehicles will all increase as the per capita disposable income of the public increases. Economic development will also foster the popularization and improvement of environmental awareness. Urban residents have begun to prioritize the environmental performance of their vehicles. The level of infrastructure affects BEV’s industrial distribution. When urban road infrastructure and charging facilities are improved, it reduces consumers’ range anxiety to a certain extent and improves their purchase intention. Innovation investment and government intervention boost regional BEV ownership. Technological innovation can promote the improvement of charging infrastructure, such as building more charging piles and improving charging efficiency, to promote the popularization of BEVs in China. However, the results show that this facilitating effect is not very significant, which suggests that a single innovation input level and government intervention level need to work together with other factors to be realized.

Indirect effect. The indirect effects of economic development, infrastructure, and industrial structure satisfy the 1% significance test, suggesting that surrounding cities in each region also affect BEV distribution. At the same level of confidence, a 1% rise in the economic development level and infrastructure level of nearby places will change the number of people who own BEV in the region by 2.900% and 0.707%, respectively. The negative coefficients for the industrial structure level and the government intervention level show that as the industrial structure level and government intervention level rise in a city, they have a negative effect on the BEV’s industrial distribution in cities nearby. The great attraction of particular cities to the resources of other regions due to policy tilting and industrial agglomeration makes them more appealing than others, and the siphoning effect is enormous. Increased innovation investment benefits surrounding regions, and variables such as technological spillover, factor flow, and regional synergistic development foster innovation and development in neighboring cities.

Robustness test

In order to verify the scientific validity and rationality of the previously mentioned empirical findings, this article applies a variety of spatial weight matrices to evaluate and enhance the persuasiveness of research findings. The improvement of infrastructure reduces the influence of geographic barriers between regions, and the spatial correlation in the sense of economic distance is also demonstrated to be particularly significant, as the geographic distance weight matrix only reflects the influence of geographic location. The results of the robustness test are presented in Table 4, and the adjacency matrix is replaced with a geo-economic distance nested matrix and a geographic inverse distance matrix. The empirical results of this paper are more robust, as the positive and negative signs of variable coefficients and the significance are essentially identical to those mentioned before.

ECI driving factors analysis

Verification of models

This section selects the relevant data of 79 countries trading BEV with China from 2017 to 2022 for empirical evidence. Before the empirical analysis, first of all, the regression model should be selected. Using the STATA17 software to perform the xttest0 test, a result of Prob > chi2 = 0.0000 was obtained, leading to the rejection of the original hypothesis and the conclusion that the random effect is better than the mixed effect. Subsequently, the Hausman test was conducted, yielding a result of Prob > chi2 = 0.355, which accepts the original hypothesis, indicating that the random effect is better than the fixed effect. Finally, the random effect model is chosen to analyze the influencing factors between China and 79 BEV trading countries, and the regression results are shown in Table 5.

Regression results

The empirical results affecting the trade of BEV under the ECI are shown in Table 6. Lngdpx and Lngdpy coefficients are both positive and significant at the 1% level. This indicates that when the economic scale of China and its trading partner countries expands, the import and export value of BEV between China and its trading partner countries increases accordingly. Further exploration of the estimated coefficients reveals that the estimated coefficient of China’s GDP per capita (10.481) is higher than the estimated coefficient of GDP per capita of the importing countries (1.101), suggesting that the size of China’s own economy has a stronger positive impact on promoting its BEV exports. Lnlithb coefficient is positive and significant at the 5% level, indicating that increased trade in lithium batteries between the two countries plays a facilitating role in the trade of BEV. When the trade volume of lithium batteries between the two countries increases, it means that the supply of lithium batteries is more abundant, and the price is therefore more stable or decreases, which helps to reduce BEV manufacturing costs and improve their market competitiveness. Lnpop coefficient is positive and significant at 1% level, which suggests that the expansion of the population size of the trading partner countries plays a facilitating role in the export of China’s BEV. With the increase of population size, the overall demand for all kinds of goods and services will also increase accordingly. For BEV, this means that the expanding market size and increasing demand in importing countries provide a broader market space for exports. Lndist coefficient is negative, which indicates that geographical distance does not constitute a major factor affecting the export of BEV from China. This is because the improvement of the modern logistics system has greatly reduced the obstacle of geographical distance to trade. The coefficient of Rta is positive but not significant. Whether or not there is a trade agreement between China and its trading partners has a positive impact on the trade of BEV in terms of lowering tariff barriers and promoting trade facilitation. The absence of trade agreements may face potential risks such as tariff barriers and increased trade uncertainty. Therefore, China should continue to strengthen cooperation with its trading partner countries and promote the signing and implementation of trade agreements, aiming to facilitate the healthy development of trade in BEV.

Mechanisms of DCI interactions

The interaction of BEV industry drivers of DCI is essentially a coordinated reconfiguration for China’s industrial base and international resource elements, as well as a dynamic balance between geographic proximity and institutional proximity. This interaction involves not only the physical flow of production factors, but also a deeper game of technical standards, institutional rules and spatial power.

From ICI, China’s BEV industry presents a “point-axis” distribution pattern. “Points” are mainly located in the Yangtze River Delta and Pearl River Delta, which often have good spatial advantages as well as favorable resource endowments, and have a significant radiation effect on the development of their surrounding areas, such as Beijing, Shanghai, and Shenzhen. These are the core areas for smooth ICI and connection to DCI. “Axes” mainly refer to the transportation arteries between these cities, which play an important role in connecting the various core areas. From DCI, China’s BEV industry presents a spatial organization network pattern of several regions interacting and cooperating with each other. The import and export trade between China and other countries can have a greater impact on the trade between other countries and third countries, and at the same time generate trade links with related industries in countries around the world, realizing the horizontal and vertical integration of industrial chains on a global scale. Under the interaction of “ICI-ECI”, the spatial organization pattern is mainly reflected in a network pattern with the eastern coastal region as the hub of commodity trading. The extent to which different regions are embedded in the ICI and ECI varies according to their geographical location, level of development and resource endowment.

In general, ICI promotes DCI, while DCI promotes and constrains ICI. At present, with the profound and complex changes in the international situation, the risk of export-driven operation of the ECI has intensified, and the domestic market has to become the main position. Through BEV, lithium batteries and other new energy industries, to enhance the efficiency level of the ICI with the “export-oriented” ECI.

Discussion and policy implications

Discussion of the findings

BEV industry is of great significance in promoting the transformation of China’s energy structure from traditional fossil energy to clean energy, thereby reducing greenhouse gas emissions, alleviating the pressure of global climate change, and promoting high-quality economic development. This study analyzed the industry’s spatial organization, pattern evolution and driving factors. Furthermore, relevant policy recommendations are proposed based on the findings of the study.

Firstly, from ICI, China’s BEV industry exhibits spatial heterogeneity and gradually forms heterogeneity of spatial agglomeration. Lithium mineral companies have formed agglomeration cores in Xining and Chengdu city. Lithium battery enterprises have formed agglomeration centers and industrial clusters in Shenzhen, Suzhou and Shanghai city. Upstream enterprises are more dependent on mineral resources, such as lithium and cobalt energy (Shao et al., 2022; Sun et al., 2022). China’s Sichuan, Tibet and Yunnan provinces possess abundant yet underdeveloped unconventional brine-type lithium resources. However, the development technology remains insufficiently advanced (Liu et al., 2023a). Midstream enterprises mainly respond to changes in market demand and rely more on the supportive role of policy. The profits of downstream charging piles are relatively smaller than those of lithium mineral, lithium battery and BEV manufacturing. They are less technology-intensive and are more inclined to be distributed in transportation hubs. The rapid development drove downstream enterprises to construct charging piles, which are gradually driven by policy to market demand-driven transformation, presenting consumer market agglomeration characteristics.

Secondly, about ECI, there is a certain path dependence and agglomeration effect in the upstream industries. As the world’s largest lithium consumer, China’s domestic lithium supply is insufficient, with a high degree of dependence on foreign countries, a flawed lithium resources market industry chain and weak enterprise international competitiveness (Xing et al., 2023). Midstream export trade is more dynamic than import trade and improves its market position. The downstream foreign charging pile market and the domestic market have different classification and certification standards. In the context of economic globalization, head enterprises with strong technical strength, earlier business layout in overseas markets, closer cooperation with overseas manufacturers, and stronger combination of hardware and software tend to occupy an advantageous position in the export market. Currently, international trade barriers are significant, and restrictions on BEVs are emerging, leading to heightened competition in the global market. China must actively diversify its markets to mitigate reliance on a singular market.

Lastly, the examination of the factors that contribute to the industry’s spatial agglomeration in China shows that the BEV industry has spatial spillover effects in major cities. As the gathering place of the BEV industry, Shanghai, Shenzhen and Guangzhou not only have advanced R&D capability, a perfect industrial chain and rich market resources, but also have a positive influence on neighboring cities. From the perspectives of technological overflow, market expansion and industrial linkage, these cities present diversified characteristics regarding industrial layout, and are able to drive the construction of related industrial infrastructures in the neighboring cities and create industrial clusters with scale effects.

Policy implications

Improving the synergistic domestic industrial chain, fostering regional competitive advantages

Under the DCI strategic system, synergistic development of the industrial chain’s upstream, midstream, and downstream promotes the competitiveness of China’s BEV industry. We should focus on industrial chain synergy and regional specialized development, rationalize the geographical distribution of electric vehicle industry segments according to resource endowment, industrial foundation, market demand and form industrial clusters with unique features and complementary advantages to build a Chinese-style modern BEV industry system. Qinghai, Sichuan and Jiangxi need to strengthen technological innovation and industrial upgrading. Guangdong, Shanghai and Beijing should continue to optimize the production process, enhance the level of vehicle manufacturing, and build a number of leading enterprises. The construction and layout of charging facilities should gradually expand from the eastern region to the central and western regions to meet the growing demand for charging. Encourage the establishment of a new ICI pattern that prioritizes “innovation leadership in the east, hub support in the center and green transformation in the west”.

Facilitating structured industrial transfer and collaborative development in the central and western regions

The eastern region has advantages in manufacturing technology, capital accumulation and market demand, while the central and western inland regions have advantages in labor, lithium and land resources. Actively promote the diffusion of advanced manufacturing technologies from the Yangtze River Delta and the Pearl River Delta to the central and western regions, and actively guide BEV manufacturing enterprises in the eastern coastal provinces of Shanghai, Jiangsu and Guangdong to migrate to the central and western inland provinces such as Anhui, Jiangxi, Hubei, Hunan, Sichuan and Henan. It will form a division of labor model with “research and development in the east, and manufacturing in the central and western inland”. The eastern coastal region should strongly support leading enterprises within the BEV industry cluster, such as BYD, Ideal, and Azure, to develop and produce products through technology, branding, equity investment, and production capacity cooperation. These will enhance industrial concentration and capacity utilization, and to achieve large-scale and intensive development.

Strengthening international production capacity cooperation, safeguarding the industrial chain supply chain security

As the world’s largest electric vehicle market, China’s demand for lithium continues to rise. Previously, most of China’s lithium carbonate imports came from Chile, forming a symbiotic relationship of “China’s demand—Chile’s supply”. However, the Chilean government launched a nationalization reform of lithium mines in 2023, triggering a fight for the leading role in resource development. Chinese companies can consolidate their advantages through the “technology for resources” model, and prevent the risk of trade friction between China and the US affecting supply chain security. Explore new modes of the BEV industry chain going to sea, accelerate the promotion of “one vehicle going to sea to drive the whole chain”, “technology going to sea” and “production capacity going to sea” and other localized cooperation modes. The Chinese government should encourage the upstream and midstream leading enterprises to accelerate the global industrial layout. For example, Ningde Times has built battery factories in Germany and Hungary to supply Volkswagen and BMW, accelerating the globalization process of BEV core parts. Chinese BEV enterprises should strengthen overseas cooperation with countries along the “Belt and Road” to reduce the impact of direct export risk.

Conclusions and limitations

Conclusions

The DCI industry’s spatial organization is a perspective and mapping of the various industry components, as well as the social and economic relationships. By analyzing the spatial pattern and industrial spatial organization of China’s BEV industry from DCI, this study reveals the development situation and mode of China’s BEV industry, and provides layout references for relevant enterprises according to their own characteristics, regional resource endowments and national strategic policies. The specific conclusions are as follows:

-

(1)

Since 2000, with the technological progress and the expansion of market demand, domestic enterprises related to the BEV industry chain have been gradually expanding on the east side of the Hu Huanyong Line, with the spatial organization mode mainly reflecting the eastern coastal area as the hub of commodity trading. The upstream industry is highly dependent on resources, the midstream industry is highly dependent on technology and market, and the downstream industry is highly dependent on policies. Driven by factors such as China’s infrastructure construction and technological innovation, a relatively complete industrial chain cluster has been formed in China.

-

(2)

The overall external dependence of China’s BEV industry has been declining, and its competitive position in foreign markets has been improving. It gradually formed a trade pattern with upstream relying on resource-oriented countries such as Chile, midstream relying on China by other countries, and downstream with high market thresholds in various countries. China’s BEV industry is broadly similar to the trend of global trade changes, with certain path dependence and agglomeration effects. The participation of relevant Chinese enterprises in ECI is strongly influenced by tariffs and geopolitical relations.

-

(3)

Factors such as economic development, industrial structure, level of technological innovation and tariffs, as well as geopolitical relations between China’s regions and countries around the globe, affect the spatial pattern of China’s BEV industry to a certain extent. The level of technological innovation in various regions of the country varies greatly, and the relevant enterprises are mainly distributed in the eastern coastal provinces. The ICI still needs to forge the resilience of the industrial chain and expand the consumer market. The tariff barriers in the global market have appeared, and the global trade network of ECI is relatively fragile.

Limitations and future research

First, the BEV industry includes several subsectors, and due to a lack of basic data, this paper only covers the representative industries in the industry chain components. Without a customs code for charging piles, import and export data cannot be obtained, and the downstream industry cannot be measured in the ECI. Secondly, this paper provides only a macro-level overview of the spatial organization pattern of the DCI industry, lacking an examination of the underlying mechanisms. In the future, new research techniques and data can be used for research, and the research scale can be extended. A systematic micro-scale analysis of the BEV industry’s spatial organization should be discussed.

Data availability

All data analyzed during this study was collected by the researchers from Enterprise Search website at [https://www.qcc.com/](https://www.qcc.com), the UN Comtrade at [https://www.comtradeplus.un.org/](https://www.comtradeplus.un.org), the World Bank database at [https://www.data.worldbank.org.cn/](https://www.data.worldbank.org.cn), the CEPII database at [https://www.cepii.fr/CEPII/en/welcome.asp](https://www.cepii.fr/CEPII/en/welcome.asp), the WTO database at [https://www.wto.org/](https://www.wto.org), the WIT database at [https://www.wits.worldbank.org/WITS/WITS/Default-A.aspx?Page=Default](https://www.wits.worldbank.org/WITS/WITS/Default-A.aspx?Page=Default), the China Statistical Yearbook at [https://www.stats.gov.cn/sj/ndsj/](https://www.stats.gov.cn/sj/ndsj), which is also uploaded as a supplementary information file.

References

Abula K, Abula B, Hu Q et al. (2022) Research on the high-quality development path of the cross-border agricultural product supply chain between China and Central Asia. Agronomy 12(10):2558. https://doi.org/10.3390/agronomy12102558

Bi YQ (2025) Political economy analysis of the construction of the new development pattern of the “dual circulation”—based on the perspective of the temporal and spatial cycle of capital. J Hubei Univ Econ 23(2):5–12. https://doi.org/10.3969/j.issn.1672-626x.2025.02.001

Chen W, Wang X, Long Y et al. (2024) Resilience evolution of the trade betworks in regions along the Belt and Road. Econ Geogr 44(1):22–31. https://doi.org/10.15957/j.cnki.jjdl.2024.01.003

Cheng E, Zhang F (2021) Political economy analysis of the new “dual circulation” development pattern. Seeker 1:108–115. https://doi.org/10.16059/j.cnki.cn43-1008/c.2021.01.012

China’s Ministry of Public Security (2021) In 2020, 33.28 million new motor vehicles will be registered nationwide, and 4.92 million new energy vehicles will be registered. https://www.mps.gov.cn/n2254098/n4904352/c7647179/content.html. Assessed 7 Jan 2021

China’s Ministry of Public Security (2022) The country’s new energy vehicle ownership has exceeded 10 million vehicles. https://www.mps.gov.cn/n2254314/n6409334/c8577234/content.html. Assessed 6 Jul 2022

China’s Ministry of Public Security (2023) In the first half of 2023, the country’s motor vehicles reached 426 million vehicles and 513 million drivers, and the number of new energy vehicles reached 16.2 million vehicles. https://www.mps.gov.cn/n2254314/n6409334/c9106375/content.html. Assessed 8 Jul 2023

China’s Ministry of Public Security (2024) The number of motor vehicles in China reached 435 million, the number of drivers reached 523 million, and the number of new energy vehicles exceeded 20 million. https://www.mps.gov.cn/n2254098/n4904352/c9384864/content.html. Assessed 11 Jan 2024

China’s Ministry of Public Security (2025) The number of motor vehicles in the country reached 453 million, the number of drivers reached 542 million. https://www.mps.gov.cn/n2254314/n6409334/c9939035/content.html. Assessed 18 Jan 2025

Dai Y, Shen W, Xiao Y et al. (2023) A study on the pattern and measurement of Chinese industries participation in domestic and international circulation. Polit Econ Q 2(3):81–118

Ding X, Zhang S (2022) Measurement and analysis of China’s economic dual circulation. Economist 2:74–85. https://doi.org/10.16158/j.cnki.51-1312/f.2022.02.009

Du Y, Guo Z, Bao H (2024) Smooth sailing ahead? Policy options for China’s new energy vehicle industry in the post-subsidy era. Energy Res Soc Sci 107:103359. https://doi.org/10.1016/j.erss.2023.103359

Feng X, Qiu S (2023) Measurement and influencing factors of dual circulations at the city level in China. Acta Geogr Sin 78(8):2019–2040

Fu C, Zhao X (2021) Study on the path of dual circulation development strategy to promote the conversion of old and new dynamics-interpretation of the fifth plenary session of the nineteenth central committee of the Chinese people’s political consultative conference on constructing new development pattern. Theor Investig (1):82–87. https://doi.org/10.16354/j.cnki.23-1013/d.2021.01.011

Han Z, Tong Y, Wang G (2022) Spatial-temporal differentiation and evolution trend of marine ecological security in China. Sci Geogr Sin 42(7):1166–1175. https://doi.org/10.13249/j.cnki.sgs.2022.07.004

He C, Ren Z, Wang W (2022) “Dual circulation” and Beijing-Tianjin-Hebei high-quality coordinated development: from the division in the value chain and factor mobility perspective. Acta Geogr Sin 77(6):1339–1358

Hill G, Heidrich O, Creutzig F (2019) The role of electric vehicles in near-term mitigation pathways and achieving the UK’s carbon budget. Appl Energy 251:113111. https://doi.org/10.1016/j.apenergy.2019.04.107

Hooli J, Halim A (2025) Battery electric vehicles in underground mines: Insights from industry. Renew Sustain Energy Rev 208:115024. https://doi.org/10.1016/j.rser.2024.115024

Hu JW, Javaid A, Creutzig F (2021) Leverage points for accelerating adoption of shared electric cars: Perceived benefits and environmental impact of NEVs. Energy Policy 155:112349. https://doi.org/10.1016/j.enpol.2021.112349

Huang QH, Ni HF (2021) Measurement of domestic and international double cycle of China’s economy: the essential characteristics of the new development pattern. Manag World 37(12):40–58. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0182

Huang XH, Yu P, Song XY et al. (2022) Strategic focus study on the new development pattern of “dual circulation” in China under the impact of COVID-19. Transnatl Corp Rev 14(2):169–177. https://doi.org/10.1080/19186444.2021.1959822

Jiang XJ, Meng LJ (2021) Mainly inner circulation, outer circulation empowerment and higher level double circulation: international experience and Chinese practice. Manag World 37(1):1–19. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0001

Jiao M, Lu L, Niu FC et al. (2023) Spatial distribution characteristics of national key cultural relics protection units and their driving factors in the Grand Canal cultural belt. Econ Geogr 43(3):228–239. https://doi.org/10.15957/j.cnki.jjdl.2023.03.024

Koley M, Bera AK (2024) To use, or not to use the spatial durbin model?—That is the question. Spat Econ Anal 19(1):30–56

Krugman P (1991) Increasing returns and economic geography. J Polit Econ https://doi.org/10.1086/261763

Lee CC, Hussain J (2022) Carbon neutral sustainability and green development during energy consumption. Innov Green Dev 1(1):100002. https://doi.org/10.1016/j.igd.2022.100002

LeSage J, Pace RK (2009) Introduction to spatial econometrics. Chapman and Hall/CRC

Li YM, Fu LY, Chi YY (2024) Interactive relationship between green low-carbon circular development and dual circulation in Beijing. Econ Geogr 44(11):24–32. https://doi.org/10.15957/j.cnki.jjdl.2024.11.003. 72

Liu CJ, Chen YT, Chen QJ et al. (2022) Evolution characteristics and driving mechanism of China’s dual circulation coordinated development. Econ Geogr 42(11):1–8. https://doi.org/10.15957/j.cnki.jjdl.2022.11.001

Liu JM, Ma XY, Zhao B et al. (2024) Steering toward sustainability: Can dual circulation development mitigate CO2 emissions?—Evidence from China. J Clean Prod 474:143548. https://doi.org/10.1016/j.jclepro.2024.143548

Liu JS, Du L (2025) Study on the path of international circulation to promote domestic circulation—analysis based on Marx’s Theory of Capital Cycle. Contemp Econ Stud 5:14–26

Liu X, Zheng JW, Liu WH et al. (2023a) Development status and research progress of unconventional brine-type lithium resources. Multipurp Util Min Resour 45(04):21–26+56

Liu XL, Chen R, Liu XJ (2023b) Measurement and spatial-temporal evolution of dual circulation of industrial products in China. Stat Decis 39(1):97–102. https://doi.org/10.13546/j.cnki.tjyjc.2023.01.018

Liu ZB (2020) A new logic for reshaping the internal and external circulation of China’s economy. Explor Free Views (07):42-49+157-158

Luo YT (2021) Optimization of support policies for China’s battery electric vehicle industry: based on a two-dimensional policy analysis model, 2021. Dissertation, Nanning Normal University

Masood S, Khurshid N, Haider M et al. (2023) Trade potential of Pakistan with the south asian countries: a gravity model approach. Asia Pac Manag Rev 28(1):45–51. https://doi.org/10.1016/j.apmrv.2022.02.001

Mur J, Angulo A (2006) The spatial Durbin model and the common factor tests. Spat Econ Anal 1(2):207–226

Onat NC, Kucukvar M, Tatari O (2015) Conventional, hybrid, plug-in hybrid or electric vehicles? State-based comparative carbon and energy footprint analysis in the United States. Appl Energy 150:36–49. https://doi.org/10.1016/j.apenergy.2015.04.001

Pavlínek P (2023) Transition of the automotive industry towards electric vehicle production in the East European integrated periphery. Empirica 50(1):35–73. https://doi.org/10.1007/s10663-022-09554-9

Qian XF, Pei T (2021) New development pattern of domestic and international dual cycle:Theoretical logic and endogenous power. J Chongqing Univ Sci Ed 27(1):14–26

Rong K, Shi YJ, Shang TJ et al. (2017) Organizing business ecosystems in emerging electric vehicle industry: structure, mechanism, and integrated configuration. Energy Policy 107:234–247. https://doi.org/10.1016/j.enpol.2017.04.042

Scott MFG, Grubel HG, Lloyd PJ (1975) Intra-industry trade: the theory and measurement of international trade in differentiated products. Econ J 85(339):646. https://doi.org/10.2307/2230917

Shao LG, Kou WW, Zhang H (2022) The evolution of the global cobalt and lithium trade pattern and the impacts of the low-cobalt technology of lithium batteries based on multiplex network. Resour Policy 76:102550. https://doi.org/10.1016/j.resourpol.2022.102550

Sun XQ, Shi Q, Hao XQ (2022) Supply crisis propagation in the global cobalt trade network. Resour Conserv Recycl 179:106035. https://doi.org/10.1016/j.resconrec.2021.106035

Van Den Brink S, Kleijn R, Sprecher B et al. (2020) Identifying supply risks by mapping the cobalt supply chain. Resour Conserv Recycl 156:104743. https://doi.org/10.1016/j.resconrec.2020.104743

Wang D, Dou W (2023) Research on the synergy mechanism of multiple subjects in global climate governance: based on the perspective of the evolutionary game of carbon neutral strategy between China, the US, and the EU. J Clean Prod 419:138306. https://doi.org/10.1016/j.jclepro.2023.138306

Wang PH, Zha RB, Huang JC et al. (2022) Experimental dataset on enterprise information mining using Enterprise Search and Baidu Map-A case study of the Pearl River Delta region (1980–2020). J Glob Change Data Discov 6(4):631–637+796–802

Wang J (1988) Wang jian on the possibility of and requirements for going for an international strategy of development of a large circular economy. Study Econ Reclam (2):33–36

Xia QF, Du DB, Duan DZ et al. (2022) Evolution and influencing factors of China’s foreign trade in rare earth metals. Acta Geogr Sin 77(4):976–995

Xiao M, Peng XZ (2023) Decomposition of carbon emission influencing factors and research on emission reduction performance of energy consumption in China. Front Environ Sci 10:1096650. https://doi.org/10.3389/fenvs.2022.1096650

Xing K, Zhu Q, Ren JP et al. (2023) Research on the characteristics and market development trend of global lithium resources. Geol Bull China 42(8):1402–1421

Xu JB, Wang JJ, Wang TY et al. (2023) Impact of industrial agglomeration on carbon emissions from dairy farming——empirical analysis based on life cycle assessmsent method and spatial durbin model. J Clean Prod 406:137081. https://doi.org/10.1016/j.jclepro.2023.137081

Xu L, Tang QY, Xu L et al. (2022) Research on the innovation-driving mechanism for the synergistic development of two-way FDI in China’s manufacturing industry: Based on the perspective of the new development pattern of “dual circulation”. Systems 11(1):17. https://doi.org/10.3390/systems11010017

Xu QY (2020) New development pattern of dual circulation: how to understand and build. Financ Forum 25(9):3–9. https://doi.org/10.16529/j.cnki.11-4613/f.2020.09.001

Xu ZH, Chang XY, Zhang N (2024) An analysis of China’s power battery industry policy for new energy vehicles from a product life cycle perspective. Environ Dev Sustain. https://doi.org/10.1007/s10668-023-04405-4

Yu WH, Ai TH, Yang M et al. (2016) Detecting “Hotspots” of facility POIs based on Kernel density estimation and spatial autocorrelation technique. Geomat Inf Sci Wuhan Univ 41(2):221–227. https://doi.org/10.13203/j.whugis20140092

Yu Z, Wang YL, Ma XQ et al. (2023) How critical mineral supply security affects China NEVs industry? Based on a prediction for chromium and cobalt in 2030. Resour Policy 85:103861. https://doi.org/10.1016/j.resourpol.2023.103861

Zhang C, Zhang YR, Zhang H et al. (2024) The impact of digital economy on energy conservation and emission reduction: evidence from prefecture-level cities in China. Sustain Futur 8:100288. https://doi.org/10.1016/j.sftr.2024.100288

Zhang N, Sun FC, Hu YL (2024) Spatio-temporal evolution, regional differences, and influencing factors of carbon emission efficiency in the Yangtze River Economic Belt. Resour Environ Yangtze Basin 33(6):1325–1339

Zhang ZG, Jin XC, Yang QX et al. (2013) An empirical study on the institutional factors of energy conservation and emissions reduction: evidence from listed companies in China. Energy Policy 57:36–42. https://doi.org/10.1016/j.enpol.2012.07.011

Zhao D, Ma J (2020) Development status, problems and future of electric vehicles in China. J Chang Univ Soc Sci Ed 22(4):51–61

Zheng X, Li WB, Cui K et al. (2025) Reevaluating the impact of new energy vehicles: a vehicle substitution pattern analysis on comprehensive emission reduction effects. Energy 134834. https://doi.org/10.1016/j.energy.2025.134834

Zeng S, Fang Z, He Y et al. (2022) An integrated Entropy-COPRAS framework for Ningbo-Zhoushan port logistics development from the perspective of dual circulation. Systems 10(5):131

Acknowledgements

This work was supported by the National Natural Science Foundation of China (No. 41701123) and sponsored by the National Social Science Fund Youth Project (No. 23CJY071).

Author information

Authors and Affiliations

Contributions

ZR: Conceptualization, formal analysis, methodology, data curation, writing. YJ: Methodology, software. JS: Conceptualization, validation. AY: Methodology. AW: Validation. PD: Conceptualization, validation. All authors reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain studies with human participants performed by any of the authors.

Informed consent

The informed consent was irrelevant as the research did not include any human participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Ruan, Z., Jiao, Y., Sun, J. et al. Localization to globalization: the spatial logic of dual circulation and its driving factors in China’s battery electric vehicle industry. Humanit Soc Sci Commun 12, 1445 (2025). https://doi.org/10.1057/s41599-025-05829-1

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1057/s41599-025-05829-1