Abstract

This study aims to investigate blockchain technology (BC) adoption behavior and potential barriers in the Libyan context. Leveraging the Unified Theory of Acceptance and Use of Technology (UTAUT) model, we empirically validated the extended UTAUT model in Libyan oil and gas firms. We used a quantitative and exploratory approach, collecting and analyzing data from 342 managers in Libyan oil and gas firms using the Partial Least Squares Structural Equation Modeling (PLS-SEM) method. Our findings emphasize that facilitating conditions, perceived trust, regulatory support, and subjective norms are key enablers for blockchain adoption in Libyan oil and gas firms. Crucially, blockchain literacy emerged as a significant moderating variable, amplifying the effects of these enablers on behavioral intention. This highlights the pivotal role of blockchain literacy in strengthening the influence of organizational and institutional factors, particularly in low-digital-literacy environments such as Libya. This research contributes to the theoretical understanding of blockchain adoption behavior in emerging economies. The extended model, which incorporates blockchain literacy not only as a contextual driver but as a key moderator, offers valuable insights for policymakers and practitioners in industries with similar cultural and institutional environments.

Similar content being viewed by others

Introduction

In today’s rapidly evolving commercial landscape, the integration of advanced technologies has become essential for firms striving to maintain a competitive edge1). Among these technologies, blockchain stands out as a transformative force reshaping traditional business models2). The explosive growth of e-commerce over the past decade has further underscored the critical role of technological innovation in modern commerce [https://www.insiderintelligence.com/insights/blockchain-technology-applications-use-cases/]. In this context, blockchain technology emerges as a key driver of transformation3,4).

Blockchain technology is a decentralized, peer-to-peer ledger that securely and immutably records transactions in blocks. It creates a transparent and reliable environment, eliminating the need for traditional intermediaries in transaction validation and recordkeeping5). Its applications span various domains, including payment systems, health records, provider directories, data security and exchange, and intellectual property management6,7).

Blockchain’s ability to ensure traceability, origin verification, and transparency makes it particularly valuable in complex global ecosystems, especially where operational efficiency, responsiveness, and social sustainability are priorities8). Its core attributes are expected to significantly influence corporate governance, digital transformation, and strategic decision-making processes. Moreover, when integrated with technologies such as the Internet of Things (IoT), big data analytics, and artificial intelligence (AI), blockchain technology can enhance management operations, promote agility, and support legitimacy and transparency9,10,11).

Despite its potential, the adoption of blockchain technology faces notable barriers. Its technical complexity and high implementation costs deter many firms, particularly in developing economies12,13). Nonetheless, blockchain technology continues to transform sectors such as intellectual property management and patent commercialization3,4), and its influence is expected to grow across industries2,14).

While substantial research has focused on blockchain technology implementation in developed countries15,16,17), limited studies explore its adoption in developing contexts18,19). This gap is particularly striking in fragile or post-conflict environments, such as Libya, where institutional trust is low, infrastructure is weak, and digital literacy is limited. Strategic industries like oil and gas, central to economic development and organizationally complex, remain largely unexamined in this regard.

Blockchain technology holds significant promise for developing nations, particularly in areas such as property registration, financial inclusion, and operational efficiency. It can provide solutions to long-standing issues of trust and transparency within governmental and commercial infrastructures20,21). Despite concerns over cryptocurrency volatility, the broader blockchain ecosystem offers new pathways for modernizing financial systems in developing contexts.

However, blockchain technology adoption in industries such as oil and gas faces additional hurdles, including regulatory uncertainty, scalability concerns, and digital infrastructure gaps22). Even so, initial findings suggest that blockchain technology can enhance collaboration, support international transactions, and streamline supply chains in these sectors23).

The underdevelopment of financial technologies in the petroleum sector, particularly in developing nations, is well-documented24). Many firms still rely on outdated tools and processes, and research on mediating variables like blockchain literacy remains sparse25).

This study addresses these gaps by exploring the enablers of blockchain technology adoption in the Libyan oil sector, a high-stakes and under-researched environment. Existing research often relies on models such as the Technology Acceptance Model (TAM) or the Technological, Organizational, and Environmental (TOE) framework. However, these models fall short in capturing behavioral intention (BI) and actual usage in volatile, low-digital-readiness environments23).

To gain deeper insights, this study adopts the Unified Theory of Acceptance and Use of Technology (UTAUT), a framework capable of explaining over 55% of the variance in individuals’ intention to adopt new technologies26). The study extends UTAUT by integrating additional factors relevant to the Libyan context, such as perceived trust, regulatory support, and blockchain literacy as a moderating variable.

The adoption of blockchain technology in developing countries is a complex and multifaceted process. Acknowledging that adoption drivers vary by context, we draw from emerging literature to develop a comprehensive UTAUT-based model that incorporates Technology Readiness and Trust, two factors shown to influence adoption significantly27,28,29,21). We also introduce Blockchain Literacy as a moderator to enhance the model’s predictive capacity30).

Accordingly, the main objective of this study is to empirically investigate the behavioral intentions of managers in Libyan oil firms regarding blockchain technology adoption. Specifically, it addresses the following research questions:

(1) What are the main determinants of managers’ behavioral intention to adopt blockchain technology in Libyan oil firms?

(2) What is the moderating effect of blockchain literacy on the relationship between blockchain enablers and the behavioral intention to adopt this technology?

To answer these questions, we conduct a thorough review of the relevant literature and propose a conceptual model rooted in an extended UTAUT framework. The contribution of this research is threefold. Theoretically, it enriches the UTAUT model by incorporating trust, regulatory support, and blockchain literacy, elements critical to adoption in fragile and developing economies. Empirically, it provides new evidence from the underexplored Libyan context, contributing to the growing body of research on technology adoption in conflict-affected settings. Practically, it delivers actionable insights for policymakers and managers in the oil and gas sector to design strategies that overcome adoption barriers and promote digital transformation.

Finally, this study sheds light on the role of industry context and digital literacy in shaping blockchain technology adoption behavior, offering a valuable contribution to both academia and practice. It is among the first to explore blockchain technology adoption in the North African region, with a particular focus on the Libyan oil industry.

The rest of the paper is organized as follows: Sect. 2 "Literature review" reviews the literature, Sect. 3 "Research model and hypothesis development" presents the research model and study hypotheses, Sect. 4 "Methodology" describes the methodology, Sect. 5 "Results" discusses the results, Sect. 6 "Discussion and implications" provides a discussion along with the study’s theoretical and managerial implications, and Sect. 7 "Conclusion" concludes the paper.

Literature review

While blockchain technology is applicable across diverse sectors, comprehensive research frameworks for its adoption within industrial firms remain scarce. In this domain, blockchain technology is often perceived as a vague solution due to limited knowledge about the currently available services and the potential benefits it can offer to firm stakeholders. Consequently, this study aims to address the information gap identified in the existing literature by clarifying the value blockchain technology can add to management operations and by examining the key enablers that facilitate its effective implementation within the Libyan industry.

Investigating the impact of blockchain technology usage on the operational efficiency of management processes

Although the literature acknowledges blockchain’s transformative potential, enhancing transparency, security, and trust in operational processes, its implementation remains at an early stage and faces several technical, organizational, and behavioral challenges(31,32,33,34,35,36), for instance, examined the role of blockchain technology in creating immutable distributed records to support operational networks, while11 provided a systematic review identifying both the advantages and obstacles of blockchain technology in process management. Similarly9, highlighted knowledge gaps and a lack of understanding as key barriers to adoption.

37 integrated the Technology Acceptance Model (TAM), Technology Readiness Index (TRI), and Theory of Planned Behavior (TPB) to investigate user perceptions of blockchain technology in supply chains. Their findings showed that while perceived usefulness and behavioral control significantly affect intention to adopt, certain TRI constructs like Insecurity and Discomfort have little impact38., using the Unified Theory of Acceptance and Use of Technology (UTAUT), found that social influence had minimal impact on adoption intention, whereas inter-organizational trust significantly influenced adoption.

39 applied an enhanced TAM framework to firms in China and the U.S., emphasizing that blockchain’s effectiveness in mitigating disruption risks and improving coordination was a key driver of managerial adoption. In a similar vein40, highlighted the technology’s ability to improve visibility and responsiveness as critical to its adoption among Malaysian SMEs.

Comparative studies by13 found that blockchain technology adoption among U.S. Fortune 500 companies was more effective than among their Chinese counterparts, largely due to greater resource availability and higher R&D investment. Meanwhile41,, using the DEMATEL approach, identified core adoption barriers such as inadequate knowledge dissemination, complex trust issues, and weak integration of advanced technologies.

Despite this growing body of work, the full potential and adoption behavior surrounding blockchain technology remain underexplored, particularly in the context of developing economies42. noted the lack of clear understanding around the drivers and outcomes of blockchain technology implementation, especially in relation to its impact on management performance.

The technology’s adoption has also been studied in emerging applications such as carbon trading and energy efficiency43. found that factors like firm size, compatibility, and contract mechanisms significantly influenced adoption intentions44., examining Iraqi oil companies, identified trust, facilitating conditions, and IT support as critical enablers of managers’ willingness to adopt blockchain technology-enabled smart contracts.

Broadening the scope45, explored AI adoption in Oman’s hydrocarbon sector. Their findings highlight the importance of innovation attributes, environmental conditions, and risk management, moderated by perceptions of usefulness and ease of use. Similarly46,, using an extended UTAUT2 model in Thailand’s energy sector, revealed that price value and hedonic motivation affect usage behavior via trust and behavioral intentions.

While studies on blockchain technology adoption in developing countries are emerging, comparative insights across MENA and oil-rich nations remain limited. Like other MENA countries such as Algeria and Iraq, Libya faces systemic challenges, including poor digital infrastructure, weak institutional capacity, and limited managerial awareness, all of which hinder blockchain integration47,48;). In contrast, other oil-rich MENA countries, such as the United Arab Emirates and Saudi Arabia, have demonstrated proactive national initiatives to support blockchain technology development. For instance, the UAE launched its Blockchain Strategy 2021, aiming to digitize 50% of government transactions using blockchain technology by 2021 (Emirates Blockchain Strategy, 2021), while Saudi Arabia partnered with IBM and ConsenSys to explore blockchain technology use in smart cities and e-government services49). These contrasting trajectories underscore how regulatory vision, institutional readiness, and investment in digital infrastructure affect blockchain adoption across oil-rich economies in the region, highlighting Libya’s relatively constrained position in this evolving technological landscape.

Extended unified theory of acceptance and use of technology (UTAUT) model

The Unified Theory of Acceptance and Use of Technology (UTAUT) is a comprehensive model designed to investigate users’ behavioral intentions toward adopting new technology50). Widely acknowledged for its robustness, the model provides a thorough explanation of user behavioral intentions. In psychological terms, behavioral intention refers to the extent of a user’s inclination to embrace new technology. UTAUT incorporates key factors derived from synthesizing eight acceptance theories and models, including the Theory of Reasoned Action, Motivational Model, Theory of Planned Behavior (TPB), Technology Acceptance Model (TAM), the combined TAM-TPB, Model of Personal Computer, Innovation Diffusion, and Extended Social Cognitive Theory.

Despite its popularity in Industry 4.0, the UTAUT model does not address certain behavioral and technical challenges related to blockchain adoption. Therefore, expanding the existing model becomes imperative, including the incorporation of technology readiness37), trust51), compatibility52), awareness53), and subjective norms54) as supplementary exogenous factors in our research framework to anticipate blockchain technology adoption intentions.

Technology readiness, considered crucial in determining a company’s information technology adoption, is influenced by factors such as conversion costs and compatibility with existing information systems and network technologies52). Adequate information technology infrastructure and skilled human resources facilitate the adoption of technologies like blockchain within businesses55). Awareness, reflecting one’s knowledge or perception of technology, subjective norms indicating social influence, and compatibility with Libyan industries are also examined in this study.

Trust, identified as a significant factor impacting technology adoption, plays a major role in users’ acceptance of new technologies, as observed in studies on cryptocurrency usage51), internet voting56), and e-government services57). In light of these considerations, a new framework is presented in this study, reflecting blockchain technology acceptance32) and its impact on the management operations of Libyan firms, incorporating elements from the aforementioned models.

The model incorporates the level of blockchain literacy as the moderating variable in the extended UTAUT model. The research is conducted to observe the differences by analyzing how performance expectancy, effort expectancy, and other factors impact behavioral intentions in adopting financial technology within Pakistan across varying educational backgrounds.

Research model and hypothesis development

Within the industrial landscape, the integration of blockchain technology is still in its early stages, with its full business potential yet to be realized. Despite the prevailing challenges, there is widespread agreement on the transformative potential of incorporating blockchain technology into processes58,59,60). Many businesses express concerns that delayed adoption of blockchain technology could lead to a loss of competitive advantage. The research model employed in this investigation is rooted in the UTAUT model, serving as the foundational theoretical framework. However, from a technological standpoint, there is a notable scarcity of skilled manpower, and numerous technical challenges associated with blockchain remain unaddressed60). Consequently, the model needs expansion to include technology readiness (TR), which functions as an indicator of individuals’ comprehensive technological perspectives, motivators, and barriers37). Moreover, the model incorporates the constructs of personal innovativeness (PI), performance expectancy (PE), facilitating conditions (FC), and perceived security (PS).

Additionally, the model is enhanced by integrating the constructs of perceived trust (PT), technology compatibility (TC), and technology awareness (TA). The industrial adoption of blockchain technology is still in its initial phases, presenting various practical challenges that businesses must overcome to harness its advantages61). Users who harbor skepticism toward a particular technology are less inclined to experiment with it, regardless of its merits37).

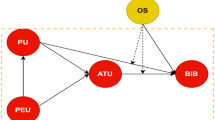

This research aims to investigate the acceptance of blockchain technologies within Libyan industries. The study builds upon the UTAUT theory by incorporating additional constructs proposed by other scholars in the field of information technology adoption, leading to the development of a conceptual model. The research concludes that the adoption of blockchain technology is influenced by the UTAUT theory and insights from the literature review. Figure 1 illustrates the UTAUT model as proposed by50.

Performance expectancy (PE)

Performance Expectancy (PE), often associated with perceived profitability, refers to the degree to which an individual believes that using a particular system will enhance their job performance50,14). Extensive research consistently highlights PE as a key determinant of technology adoption, particularly in developing countries19,44). In the context of this study, PE reflects the confidence of employees in Libyan enterprises that implementing blockchain technology will improve their performance. Drawing on prior empirical evidence, the following hypothesis is proposed:

H1

Performance Expectancy (PE) has a positive influence on users’ behavioral intention to adopt blockchain technology.

Perceived trust (PT)

According to62, trust is defined as the willingness to accept vulnerability by embracing new and potentially risky ideas. In the context of emerging technologies, Perceived Trust (PT) has been identified as a critical factor influencing behavioral intention, particularly in domains such as artificial intelligence and e-commerce28). PT refers to having accurate expectations about others’ actions when one must decide before those actions can be observed62). It reflects consumers’ trust in adopting disruptive technologies and plays a key role in mitigating perceived risks63).

Evidence from developing countries consistently underscores the importance of PT in blockchain technology adoption64., for example, identified trust as a common enabler of blockchain adoption across several nations, including Bangladesh, China, India, Brazil, and South Africa, by shaping users’ attitudes. Similarly29, found that trust significantly influenced blockchain technology adoption decisions among accounting managers in Indian firms.

Based on this evidence, the following hypothesis is proposed:

H2

Perceived Trust (PT) has a positive influence on users’ behavioral intention to adopt blockchain technology.

Facilitating conditions (FC)

Facilitating Conditions (FC) refer to the degree to which individuals perceive the availability of organizational and technological resources that support the use of a system50). Research has consistently identified FC as a key factor influencing behavioral intention toward technology adoption50,65,66,67). In the context of blockchain technology, FC encompasses access to critical resources such as infrastructure, technical expertise, and institutional support.

Several studies confirm the significant role of FC in encouraging blockchain technology adoption among developing firms, emphasizing that adequate technological infrastructure and technical support can motivate users to embrace such innovations63,68). However, the successful implementation of blockchain technology also requires careful alignment with business needs and the involvement of multiple stakeholders. When effectively integrated, blockchain technology can act as a seamless enabler within existing systems69).

Accordingly, this study proposes the following hypothesis:

H3

Facilitating Conditions (FC) have a positive influence on users’ behavioral intention to adopt blockchain technology.

Subjective norms

Social norms refer to the extent to which individuals feel motivated by their peers and family members to use new technologies. Numerous studies have found a strong correlation between social norms and users’ willingness to adopt blockchain technology. Research indicates that subjective norms positively affect behavioral intentions toward financial technologies70). For instance71, confirmed the encouraging effect of subjective norms on users’ intentions to use cryptocurrency. However44, reported a significant impact of subjective norms on blockchain technology adoption. It has been suggested that social influence plays a vital role in users’ intentions to adopt new technology, especially when information about that technology is scarce72).

Recent studies suggest that individuals within groups possessing technological expertise and financial literacy are more likely to adopt blockchain technology73,74).

Given the importance of social influence in technology adoption, the following hypothesis is proposed:

H4

Subjective Norms (SN) have a positive influence on users’ behavioral intention to adopt blockchain technology.

Regulatory support

Regulatory support plays a significant role in influencing adoption behavior. Studies have shown that regulatory support influences the intention to adopt in developing countries28,75,76,72,21). Thus, addressing regulatory uncertainties, intellectual property issues, and compliance is a priority for blockchain technology adoption18). Regulatory support fosters trust and influences the infrastructure needed for blockchain technology adoption, thereby impacting technology readiness and supporting conditions77). According to76, the lack of regulations and clear laws in developing countries creates an environment of legal and economic uncertainty, which can discourage stakeholders in various industries from adopting blockchain technology78. point out the crucial role of regulatory support in the practical and theoretical advancement of blockchain technology in the energy sector. Thus, regulatory support can play a crucial role in defining industry standards for blockchain technology, ensuring interoperability between different blockchain platforms and energy systems, which is essential for its adoption21).

Based on this premise, the following hypothesis is posited:

H5

Regulatory Support (RS) has a positive influence on users’ behavioral intention to adopt blockchain technology.

Literacy in blockchain technology

Blockchain literacy refers to the comprehensive knowledge and skills required to effectively understand, operate, and manage blockchain technology systems. This includes familiarity with core concepts such as decentralized networks, consensus mechanisms, and smart contracts. Recent studies emphasize that blockchain literacy, defined as the ability to make informed decisions in digital environments, is essential for navigating blockchain-based transactions79,80). Education enhances cognitive capabilities, enabling individuals to make better decisions regarding complex technologies.

24 highlight that individuals with higher financial literacy are more proficient in utilizing digital financial services. Similarly81, found that individuals with high cryptocurrency literacy make more informed decisions regarding usage, while79 reported that limited literacy leads to weaker decision-making in this area.

Despite blockchain’s potential, its adoption in Libyan firms remains slow, largely due to cultural and educational barriers. Studies have shown that stakeholders in Libya often lack a clear understanding of advanced technologies, including blockchain82). This lack of awareness regarding the benefits and functions of such technologies contributes to resistance and delays in adoption.

In many emerging countries, blockchain technology is perceived as a disruptive and complex innovation, often generating skepticism. Without sufficient literacy, decision-makers may be hesitant to adopt the technology due to perceived risks or limited confidence in its implementation83).

Therefore, an individual’s level of blockchain literacy is likely to influence how they perceive the usefulness and feasibility of adopting blockchain technology. It is thus posited that blockchain literacy moderates the relationship between the identified factors and behavioral intentions to adopt the technology. Based on this reasoning, the following hypotheses are proposed:

H6

Blockchain literacy positively moderates the relationship between Performance Expectancy (PE) and behavioral intention to adopt blockchain technology.

H7

Blockchain literacy positively moderates the relationship between Facilitating Conditions (FC) and behavioral intention to adopt blockchain technology.

H8

Blockchain literacy positively moderates the relationship between Perceived Trust (PT) and behavioral intention to adopt blockchain technology.

H9

Blockchain literacy positively moderates the relationship between Subjective Norms (SN) and behavioral intention to adopt blockchain technology.

H10

Blockchain literacy positively moderates the relationship between Regulatory Support (RS) and behavioral intention to adopt blockchain technology.

Methodology

To understand the adoption of blockchain technology, data were collected through a structured survey administered to 172 managers from various Libyan firms, selected using purposive sampling to ensure relevant knowledge of technology adoption. Structural Equation Modeling (SEM) was then used to examine the relationships among the constructs in the extended research model (see Fig. 1). SEM was employed to test the proposed hypotheses and uncover significant relationships between the model’s variables.

This study adopts a quantitative research approach using Partial Least Squares Structural Equation Modeling (PLS-SEM) via SmartPLS 4.0. PLS-SEM is appropriate for predictive modeling and theory development, especially in studies with moderate sample sizes, complex models involving multiple constructs and moderating effects, and non-normal data distributions84). This is particularly suitable for the exploratory nature of blockchain technology adoption in emerging markets like Libya.

The analysis followed a two-stage procedure. First, the measurement model was assessed to establish construct validity and reliability. This included evaluating the indicator reliability through factor loadings (retaining items with loadings ≥ 0.70), internal consistency reliability via Composite Reliability (CR), Cronbach’s alpha, and rho_A (threshold ≥ 0.70), convergent validity using Average Variance Extracted (AVE ≥ 0.50), and discriminant validity through the Fornell–Larcker criterion and Heterotrait-Monotrait (HTMT) ratio (HTMT < 0.85).

Second, the structural model was analyzed to test the hypothesized relationships. Path coefficients (β), t-values, and p-values were generated using bootstrapping with 5,000 subsamples (bias-corrected and accelerated method). Predictive relevance was assessed using the Stone-Geisser Q² test, and overall model fit was evaluated using the Standardized Root Mean Square Residual (SRMR), with SRMR < 0.08 indicating good fit.

Additionally, moderation effects of blockchain literacy were tested using the two-stage approach, which involved creating interaction terms and assessing their significance and effect sizes (f²). All constructs were measured reflectively using previously validated items from existing literature, adapted to the Libyan context, and rated on a 5-point Likert scale.

This quantitative strategy enables a robust evaluation of the proposed model and allows for the identification of significant predictors of blockchain technology adoption intention in the Libyan oil industry context.

Design of the survey

Surveys provide a practical and cost-effective method for gathering information and applying statistical methods to analyze relationships between various variables. Therefore, we developed the questionnaire following a thorough literature review to identify the constructs and scales necessary for testing the proposed hypotheses. The constructs and items were drawn primarily from the Unified Theory of Acceptance and Use of Technology (UTAUT)50) and extended with elements from recent empirical studies focused on blockchain adoption in organizational and emerging market contexts.

Each construct was measured using a multi-item scale with responses captured on a 5-point Likert scale ranging from 1 (“strongly disagree”) to 5 (“strongly agree”) (see Table 1). Items were selected based on their proven reliability and relevance, then adapted to reflect the blockchain context and the organizational environment of Libyan oil firms. For example, references to digital ledgers, smart contracts, and operational transparency were integrated to reflect blockchain-specific functionalities relevant to the industry.

To ensure content validity and contextual appropriateness, the survey instrument was pre-tested by three academic experts in the field of technology adoption. Additionally, six managers from Libyan oil companies reviewed the questionnaire. Based on their feedback, we made minor modifications to improve wording clarity, cultural relevance, and ease of understanding for professionals with varying technical backgrounds.

Sample description and data collection

The recent emergence of advanced technologies in Libya has provided a suitable backdrop for this study. The country has developed a strategy to harness new technologies in industry and has implemented programs aimed at encouraging the adoption of emerging technologies to enhance decision-making processes and organizational skill sets. Libya is progressing toward digital transformation by supporting the adoption of new technologies, such as blockchain. Therefore, this research focuses on exploring the factors influencing user acceptance of blockchain technology to optimize operational efficiency and decision-making speed.

To collect data, we used a purposive sampling technique targeting managers with direct or indirect involvement in technology-related decisions within the Libyan oil sector. While this non-probabilistic sampling method was appropriate for reaching informed participants with relevant expertise, it may limit the generalizability of the findings to the broader population of Libyan firms. This potential sampling bias is acknowledged as a limitation and should be considered when interpreting the study’s results.

Participants were identified through professional networks, company directories, and referrals from industry contacts. The online questionnaire was distributed via email and professional platforms such as LinkedIn between November 2023 and January 2024. Inclusion criteria required respondents to hold managerial or technical roles and have at least one year of experience within their current organization.

The respondents consisted of various managers from companies operating in the Libyan oil industry (see Table 2). To determine the minimum required sample size, we conducted a power analysis using the G*Power method. Based on a multiple regression model with a medium effect size (f² = 0.15), five predictors, a significance level of 0.05, and a desired statistical power of 0.95, the recommended minimum sample size was 186 respondents. Based on our online survey, we received 342 valid responses between November 2023 and January 2024. This sample size not only exceeds the G*Power threshold but also meets the requirements of Partial Least Squares Structural Equation Modeling (PLS-SEM), which recommends that the sample be at least 10 times the maximum number of structural paths pointing at any latent construct84). Accordingly, the final sample size is considered robust and appropriate for the study’s analytical objectives.

The sample includes a diverse age range, with 17% aged 30–34 years, 23% aged 35–39 years, 45% aged 40–44 years, 5% aged 45–49 years, and 10% aged 50 years or older. Regarding gender distribution, 17% of respondents were female and 83% male. Participants held various managerial roles, including production directors (29%), marketing directors (15.29%), financial directors (14%), human resource directors (50%), and information technology engineers (2%). In terms of involvement with technology purchase decisions, 50% of respondents reported being involved in decision-making, 31% in recommending technology, 17% in both recommending and decision-making, while 2% indicated no involvement. Regarding education, most respondents held a bachelor’s degree (approximately 65%), while around 30% possessed postgraduate degrees (master’s or PhD), and the remaining 5% had diplomas or technical certifications. As for income level, about 10% of respondents reported low income, 55% middle income, 25% upper-middle income, and 10% high income, reflecting the varied managerial and technical roles across the Libyan oil sector.

All methods in this study were carried out in accordance with relevant guidelines and regulations. The study was approved by the Ethics Committee of the Faculty of Economics and Management of Sfax. Informed consent was obtained from all participants prior to their involvement in the study.

Results

Before presenting the results, we briefly outline the theoretical framework guiding this study, which is the Unified Theory of Acceptance and Use of Technology (UTAUT). This model assumes that users’ behavioral intention (BI) to adopt a technology is influenced by four main constructs: Performance Expectancy (PE), Facilitating Conditions (FC), Subjective Norms (SN), and Effort Expectancy (EE). In this study, we extend the traditional UTAUT model by incorporating Perceived Trust (PT), Regulatory Support (RS), and Blockchain Literacy (BL), which reflects the user’s ability to understand and engage with blockchain systems. Behavioral intention (BI), the main dependent variable, represents the likelihood that a respondent intends to adopt blockchain technology in their organization.

Common method bias issue

To mitigate the possible issue of Common Method Bias (CMB), which refers to measurement error that can occur when data for both independent and dependent variables are collected from the same source, we implemented both procedural and statistical remedies.

Procedurally, we reduced CMB risk by ensuring anonymity of responses, randomizing item order in the questionnaire, and clearly separating constructs conceptually and operationally in the survey design. These steps were taken to minimize respondents’ evaluation apprehension and the likelihood of consistency motifs.

Statistically, we applied Harman’s single-factor test, one of the most widely used post hoc diagnostic tools. All measurement items were entered into an exploratory factor analysis (EFA) using principal component analysis. The results in Table 3 revealed that the first unrotated factor accounted for 43.52% of the total variance, which is below the commonly accepted threshold of 50%, indicating that no single factor emerged to dominate the variance. This suggests that Common Method Bias is unlikely to pose a significant threat to the validity of our results85).

Measurement model

We assessed the validity and reliability of the outer measurement model following the methodology outlined by84. Initially, we used composite reliability (CR) and rho (pA) to evaluate construct reliability, drawing on prior research. The analysis revealed that all values exceeded the threshold of 0.7 for both indices, indicating strong reliability of the measurement model86) (see Table 4).

Subsequently, we employed average variance extracted (AVE) and individual factor loadings (FL) to examine convergent validity. As shown in Table 4, all AVE values for the constructs exceeded 50%, as recommended by87.

Furthermore, all factor loadings (FL) reported in Table 5, ranging from 0.70 to 0.97, exceed the recommended cut-off value of 0.7, providing evidence in favor of convergent validity88). The results also confirmed discriminant validity, as indicated by the square root of the Average Variance Extracted (AVE) for each construct on the diagonal being greater than the correlation coefficients with other constructs89).

The AVE for the construct “Behavior Intention,” with a value of 0.736, is the lowest among all constructs, yet it still exceeds the minimum threshold of 50%. Moreover, all factor loadings presented in Table 5, ranging from 0.88 to 0.97, surpass the recommended cut-off value of 0.7, thereby supporting convergent validity88).

Discriminant validity (DV) was evaluated in Table 6 using the TMT criteria.

Assessment of multi-collinearity

To ensure the robustness of the measurement model, we assessed multicollinearity among the predictor constructs by calculating the Variance Inflation Factor (VIF) values in Table 7. All VIFs were found to be below the commonly accepted threshold of 5, indicating that multicollinearity is not a concern in this study84). This suggests that the predictor variables are sufficiently independent to provide reliable estimates in the structural model.

Structural model

The results of the hypotheses testing highlight that FC was positively related to BI (β = 0.063, t = 0.589). However, H1 is not supported in this study. Consistent with our hypothesis, the results show that perceived trust, facilitating conditions, subjective norms, and regulatory support respectively positively impact BI (β = 0.199, t = 1.98), (β = 0.185, t = 4.65), (β = 0.35, t = 2.56), and (β = 0.112, t = 4.746). Thus, H2, H3, H4, and H5 are supported.

Furthermore, as shown in Table 8, blockchain literacy positively moderates the relationships between facilitating conditions, perceived trust, subjective norms, and regulatory support, respectively (β = 0.115, t = 1.962), (β = 0.162, t = 2.553), (β = 0.120, t = 1.972), and (β = 0.001, t = 1.995). Thus, H7, H8, H9, and H10 are supported. However, no moderating effect was found on the relationship between performance expectancy and behavioral intention (β = 0.087, t = 1.700).

We examined the predictive capacity of the model using Stone-Geisser’s Q² value (Geisser, 1974). The value for BI in this study is 0.231, which exceeds zero. According to the rule of thumb, a Q² value greater than zero indicates that the model has predictive relevance87). Finally, the ten quality indices indicate that the model fits the data well, as they fall within the range of generally accepted benchmarks for model fit85). These indices align with the standardized root mean square residual (SRMR) criterion for approximate model fit. The SRMR value of 0.089 in this study indicates a good fit for the PLS path model.

Discussion and implications

Discussion

The current study aims to explore the extended UTAUT model by incorporating new dimensions, such as perceived trust and regulatory support, as independent variables. This research develops an innovative modified conceptual framework of the extended UTAUT model to examine blockchain technology adoption in Libyan oil firms, utilizing an additional moderating variable. The model was built around ten hypotheses (H1-H10) and aimed to understand how various enablers, with the moderation of blockchain literacy, influence managers’ behavioral intention to adopt blockchain technology.

The results clearly illustrate how Libya’s unique cultural and regulatory context shapes blockchain technology adoption differently compared to other emerging economies. Libya’s relatively low digital maturity, combined with a conservative organizational culture and limited familiarity with blockchain technology among oil firm managers, contributes to the non-significance of performance expectancy (PE) as a predictor of behavioral intention (BI). Prior studies indicate that in cultures with high uncertainty avoidance and risk aversion, such as Libya90,91), technological innovations often face resistance due to skepticism and a preference for traditional methods. Moreover, weak institutional support and fragmented regulatory frameworks exacerbate these challenges92). Unlike countries like Nigeria or Vietnam, where PE strongly influences adoption decisions due to greater digital infrastructure and supportive policies93), Libyan firms struggle with internal barriers, including a lack of knowledge, insufficient training, and inadequate organizational readiness94).

However, as shown in Table 5, PE was found to be an insignificant predictor of BI in our sample, diverging from most previous research, which suggests that performance expectancy positively impacts users’ behavioral intention to adopt blockchain technology in management operations (e.g93,14.,). Thus, Hypothesis H1, which posited a positive relationship between performance expectancy and behavioral intention, was not supported. According to19, successful blockchain technology integration in developing countries requires a thorough understanding and careful planning, particularly due to internal barriers, such as a lack of knowledge in implementing advanced technologies. Our results reflect that the majority of respondents do not have sufficient knowledge of blockchain technology. Therefore, awareness of the benefits of blockchain technology may influence decision-makers’ ability to comprehend and value its usefulness79).

Conversely, facilitating conditions (FC) were identified as a significant influencer of the intention to adopt blockchain technology. This finding supports recent research on blockchain technology adoption, which considered FC as an important strategic factor influencing behavioral intention in adopting blockchain technology69,93). This supports Hypothesis H3. The model was further expanded to incorporate regulatory support (RS) and perceived trust (PT), which were also observed to have a significant impact. This aligns with prior studies that have found trust and regulatory support to be critical components of blockchain technology adoption in industrial contexts28,18,75). Therefore, Hypotheses H2 and H5 were supported.

The significant roles of RS and PT highlight Libya’s urgent need for clear, stable policies and institutional backing to foster innovation adoption. Regulatory uncertainty and infrastructural constraints remain key hurdles, as blockchain technologies require robust legal frameworks to protect data privacy and ensure consumer protection89). Given Libya’s nascent digital infrastructure and evolving regulatory landscape, these factors create barriers to widespread blockchain technology implementation.

Authors assert that the adoption and successful implementation of blockchain technologies necessitate a deep understanding of the blockchain technology system, owing to the presence of intra-organizational barriers such as a lack of expertise and knowledge, as well as insufficient tools for blockchain technology implementation95,79). Among respondents in this survey, the majority reported limited knowledge about blockchain, underscoring the need for targeted educational efforts.

Despite its theoretical relevance, blockchain literacy (BL) was not found to be a significant direct predictor of behavioral intention to adopt blockchain technology. As a result, Hypothesis H6 was not supported. One plausible explanation is that while literacy enhances understanding and confidence, it may not be sufficient on its own to influence decision-making unless accompanied by enabling organizational or institutional support. In the context of Libya’s oil sector, where decision hierarchies are rigid and risk aversion is high, individual knowledge does not necessarily translate into action unless reinforced by external factors like peer pressure, trust, and supportive regulations. This finding aligns with research suggesting that in environments with weak digital ecosystems, individual awareness must be coupled with structural facilitators to convert intention into action44,79).

In the same vein, subjective norms appeared to significantly affect the prediction of behavioral intention to adopt blockchain technology in Libyan firms, supporting prior research conducted in developing countries (e.g73,74,44,72.,). This confirms Hypothesis H4. Our findings suggest that blockchain technology users in African countries influence behavior toward blockchain adoption in the Libyan context, reinforcing the role of cultural and peer influences in technology adoption decisions.

Furthermore, organizational policies play a crucial role in the usage of blockchain technologies, which are still in their early stages. Proper regulations and policies remain hurdles to the adoption of advanced technologies42). Libyan regulators need to address the differences between regulatory regimes and the advancement of technologies, particularly regarding data protection and consumer protection89). BC technology is still immature in supporting large transaction volumes96), and since it typically involves a large number of diverse stakeholders, there is a need for appropriate standards for the successful integration of these technologies into management operations.

Conversely, companies that successfully build on their understanding of blockchain technology will be able to leverage its capabilities to complement and augment their analytics capabilities. The absence of proper regulations and policies presents a significant obstacle to the widespread adoption of advanced technologies97). In Libya, regulators face the challenge of reconciling regulatory frameworks with the rapid advancement of technologies, particularly concerning areas such as data protection89). Additionally, blockchain technology is currently underdeveloped in handling large operations and transactions98). Given that BC implementations typically involve numerous stakeholders with diverse interests, establishing appropriate standards is essential for seamless integration into existing management operations. Constraints on technology access pose a significant barrier to blockchain technology implementation in management operations.

Importantly, when drawing comparisons with other oil-rich or MENA countries, it becomes clear that Libya lags in blockchain readiness. For example, the UAE’s “Blockchain Strategy 2021” and Saudi Arabia’s partnerships with firms like IBM have fostered a proactive environment for blockchain adoption. These countries have not only invested in digital infrastructure but have also introduced forward-thinking regulatory frameworks that inspire industry confidence. Similarly, Iraq and Algeria, despite facing structural constraints, have initiated pilot projects to explore blockchain applications in their public and energy sectors. In contrast, Libya’s limited institutional coordination and policy vision present major bottlenecks. These comparisons reinforce the policy implication that national strategies, cross-sector partnerships, and regulatory clarity are foundational pillars for successful blockchain adoption. Libya can learn from its regional peers by adopting similar top-down approaches that integrate blockchain literacy programs, regulatory reforms, and stakeholder engagement platforms to build a viable adoption ecosystem.

Finally, our results confirmed the moderating influence of blockchain literacy (BL) on the relationships between facilitating conditions (β = 0.115, t = 1.962), perceived trust (β = 0.162, t = 2.553), subjective norms (β = 0.120, t = 1.972), and regulatory support (β = 0.001, t = 1.995) in adopting blockchain technology. This supports Hypotheses H7, H8, H9, and H10. The results imply that the more individuals become blockchain literate, the better they comprehend the security of its operations and become motivated by their colleagues regarding blockchain technology, ultimately enhancing their behavioral intention to use this technology. This outcome broadens existing knowledge on the effect of blockchain literacy and the influential factors of behavioral intention to use blockchain, emphasizing the critical need for capacity-building and awareness programs tailored to Libya’s cultural and educational context.

The moderating effect of blockchain literacy underscores its pivotal role in enhancing the impact of facilitating conditions, perceived trust, subjective norms, and regulatory support on blockchain technology adoption intentions. As individuals gain deeper literacy, they not only understand blockchain’s technical security features better but also become more receptive to peer influences and institutional support, which collectively strengthen their willingness to adopt the technology. This dynamic indicates that blockchain literacy acts as a catalyst that transforms external factors into actionable motivation, especially in contexts like Libya, where organizational hierarchies and risk-averse cultures might otherwise dampen technology acceptance.

From a practical standpoint, these findings highlight the need for targeted educational programs and capacity-building initiatives within firms and across the broader industry. Enhancing blockchain literacy can empower employees and decision-makers to better evaluate blockchain’s benefits and risks, thereby fostering a more favorable environment for adoption. Moreover, literacy serves as a critical link that can mitigate the inertia caused by regulatory uncertainties and infrastructural weaknesses by equipping users with the knowledge required to navigate and advocate for supportive policies.

Theoretically, this research contributes to the UTAUT model literature by validating blockchain literacy as a significant moderator, which enriches our understanding of technology adoption in emerging markets with low digital maturity. Future research could further explore how different dimensions of literacy, such as technical know-how, strategic understanding, and legal awareness, uniquely influence adoption behaviors.

Overall, recognizing and investing in blockchain literacy is essential for accelerating blockchain technology diffusion in Libya’s oil sector and similar contexts, transforming hesitant interest into confident and informed usage.

Theoretical implications

The outcomes of this study have contributed to the existing literature on new technology adoption, particularly in the context of blockchain technology usage in emerging nations, by expanding the understanding of the factors that affect the intention to adopt blockchain.

Existing literature on blockchain technology adoption has predominantly been conducted from the TAM perspective (e.g37)., or the standard UTAUT model (e.g29).,. The current study extends the UTAUT model by proposing and confirming regulatory support and perceived trust as reformulated influential factors in blockchain technology adoption behavior. The behavior of managers in oil firms regarding blockchain adoption is rational and requires regulatory support, facilitating conditions, subjective norms, and perceived trust.

Therefore, we propose that the intention of managers in Libyan firms to adopt blockchain technology is a planned behavior, influenced by factors such as perceived trust (PT), facilitating conditions (FC), subjective norms (SN), regulatory support (RS), and blockchain literacy (BL).

This study also enriches the literature by incorporating blockchain literacy as a moderating factor within the extended UTAUT model. This integration provides a deeper understanding of how various factors influence managers’ intentions to engage with blockchain, ultimately redefining the nature of management operations.

Our study validates the Unified Theory of Acceptance and Use of Technology (UTAUT) in explaining the behavioral intentions of managers in oil and gas firms. More specifically, our research introduces and validates a modified version of the UTAUT model in the Libyan context50).

By highlighting the significance of blockchain literacy in technology adoption behaviors within the Libyan context, this addition strengthens the theoretical model.

Thus, blockchain literacy appears to be a crucial factor that could act as a moderator of blockchain adoption behavior in Libyan oil companies. Consequently, a high level of understanding and knowledge regarding the performance and role of blockchain technology could motivate decision-makers to adopt this technology in their management operations.

Indeed, Libya appears to be significantly behind in blockchain literacy compared to other developing countries such as Nigeria, Vietnam, India, and the UAE. Studies conducted in these countries have shown that performance expectancy is a key factor in the adoption of this technology99,48,100).

In contrast to our findings, managers of petroleum firms in Libya are not yet aware of blockchain’s performance and strategic role. This highlights the technological lag in Libya. Our findings align with82, who emphasizes that the lack of digital literacy in Libyan firms is a crucial barrier to adopting new technologies.

Consequently, our study provides valuable guidance for policymakers and blockchain technology developers to design effective strategies that foster blockchain adoption in the Libyan oil and gas industry, an area where empirical research is notably scarce and difficult to access due to the sensitivity of information.

Managerial implications

The results of this research provide concrete, actionable insights for practitioners in Libyan oil and gas firms and policymakers aiming to foster blockchain technology adoption. By identifying the key drivers and barriers to adoption, including facilitating conditions (H3), perceived trust (H2), regulatory support (H5), and blockchain literacy (H6-H10), this study equips managers with targeted areas to focus on. For instance, firms can develop tailored training programs to enhance blockchain literacy, invest strategically in technological infrastructure, and collaborate with regulators to shape supportive policies. These managerial recommendations are grounded in the empirical validation of H2 through H5, reinforcing the critical role these factors play in shaping behavioral intention. Policymakers can also leverage these insights to design regulatory frameworks and awareness campaigns that remove obstacles and promote a trustworthy environment for blockchain integration. Thus, this study bridges theory and practice by offering clear guidance on how to translate behavioral intention drivers into effective managerial strategies and policy actions.

This research aims to clarify the intention to adopt blockchain technology in oil and gas companies, offering valuable insights to help managers make informed decisions about its implementation. Specifically, the study provides evidence on how decision-makers can effectively address the key factors that facilitate blockchain technology integration into operational management.

In our study, the impact of Performance Expectancy (PE) was found to be insignificant. Thus, the majority of respondents expressed uncertainty regarding the use of blockchain technology within their firms. This indicates that participants do not perceive blockchain technology as crucial for management operations. Consequently, when making decisions about adopting blockchain technology, managers should prioritize understanding users’ competencies with this new technology and its applications.

This lack of recognition may stem from limited knowledge and a reluctance among Libyan managers to adopt new, advanced systems101). In fact, the organizational culture in Libya is characterized by resistance to change, particularly in relation to complex and advanced technologies. Organizations tend to favor established, traditional solutions over the adoption of emerging technologies such as blockchain, often due to perceived risks associated with innovation102).

Given this, it is recommended that managers in the oil and gas industry focus on strategies such as training and education to improve the understanding and competencies of key personnel regarding blockchain applications48). Furthermore, managers should facilitate the transfer of successful experiences from developing countries in the petroleum industry (e.g., Brazil, Nigeria, India) to key users of blockchain technology in Libyan firms to enhance their perception of its usefulness and strategic benefits. These initiatives will foster a greater appreciation of blockchain’s role in management operations.

Capacity Building

-

Enhance blockchain literacy (aligned with H6-H10): Launch structured training programs and awareness campaigns in collaboration with universities, technology providers, and industry experts to build internal capabilities and reduce resistance to blockchain technology usage.

-

Facilitate knowledge transfer (linked to H2 and H4): Organize workshops and exchange programs to learn from successful blockchain technology implementation in comparable oil-rich developing countries.

These capacity-building initiatives directly address the empirical findings showing the moderating role of blockchain literacy (H6-H10), the significance of perceived trust (H2), and the impact of subjective norms (H4) on behavioral intention. Improving user competencies can empower managers to better understand and trust the technology.

Infrastructure development

-

Invest in technical infrastructure (supports H3): Allocate resources to upgrade IT infrastructure and ensure compatibility with blockchain-based systems, especially in supply chain management.

-

Strengthen perceived trust and security (supports H2): Collaborate with cybersecurity providers to secure blockchain technology operations and communicate these safeguards transparently to increase employee trust.

-

Encourage top management support: Senior executives should take ownership of blockchain technology initiatives by aligning them with strategic goals, allocating sufficient resources, and communicating their importance across all departments.

These infrastructure-related recommendations are aligned with the significant roles of Facilitating Conditions (H3) and Perceived Trust (H2) identified in the study’s findings.

Governance and policy support

-

Engage regulatory stakeholders (aligned with H5): Actively work with government bodies to develop a supportive regulatory environment that facilitates blockchain technology adoption and provides legal certainty for digital transactions.

-

Form strategic partnerships (linked to H4 and H5): Establish collaborations or consortia with blockchain solution providers, public institutions, and other firms in the sector to share costs, expertise, and implementation strategies.

These recommendations reflect the importance of Regulatory Support (H5) and Subjective Norms (H4) as critical drivers of adoption identified through empirical testing.

Based on this, a key implication is that top management in Libyan oil firms must invest more effort to ensure that the necessary infrastructure is in place to support the implementation of blockchain technology in management operations. Our study identified that Facilitating Conditions (H3), Subjective Norms (H4), Perceived Trust (H2), and Regulatory Support (H5) influence the adoption of blockchain technology in management operations. Therefore, the behavioral intention of Libyan oil firms primarily depends on whether they possess the required infrastructure, receive positive influence from key personnel, and have regulatory support to explore these new technologies.

The hindrances caused by the absence of tools for blockchain technology implementation and the lack of awareness about its usefulness in management processes have been studied as barriers to blockchain technology adoption95). Therefore, companies aiming to harness the benefits of blockchain technology in management operations must prioritize raising awareness about this system and developing the expertise and interest necessary for successful implementation.

However, when managers perceive blockchain technology operations as secure and efficient for digital financial dealings, they are inclined to trust its long-term utility103). To enhance its adoption level, firms should improve the security of blockchain operations.

It is also important to provide legal certainty for those who wish to use blockchain technologies. Therefore, the Libyan government should implement policies that encourage the use of blockchain technology for tracking oil and gas resources from extraction to delivery and for expanding the supply chain in international markets. This can reduce fraud, improve accountability, and enhance transparency in operations. Furthermore, strategies should be established to encourage collaboration between government bodies, oil and gas firms, and technology providers. A regulatory framework that supports joint ventures, knowledge sharing, and cross-industry partnerships can also accelerate blockchain technology adoption in the Libyan context. This would not only enhance the positive perception that key users should have of the use of blockchain technology but also ensure security.

In summary, blockchain technology is widely discussed and holds the potential to revolutionize data management, potentially leading to the emergence of new management models. However, predicting its successful implementation remains challenging. Based on the findings of this study, there is still a low level of awareness among users, contributing to considerable doubt regarding blockchain technology. Furthermore, blockchain literacy seems to be a potential moderator of the associations between facilitating conditions, social influence, perceived trust, regulatory support, and behavioral intention to adopt blockchain.

Thus, developing blockchain literacy could empower managers to evaluate financial technologies and make informed decisions regarding blockchain technology adoption. Therefore, industrial firms in Libya should enhance their blockchain literacy to improve their ability to make better decisions regarding blockchain usage. The Libyan government and firms should introduce policies to provide training programs for employees in blockchain technology. This should include partnerships with universities, technology providers, and oil and gas industry experts to build a skilled workforce, enabling them to understand the strategic benefits of blockchain in petroleum operations and accelerate its adoption.

In this vein, the government also needs to develop national strategies to raise users’ awareness of the benefits of blockchain technology, improve their blockchain skills, and encourage the use of cryptocurrency as an alternative means of financial transactions.

Conclusion

This study explores the factors influencing the behavioral intention of Libyan managers to adopt blockchain technology in management operations using an extended adoption model. However, its adoption is still limited by the assumption that respondents have a certain degree of familiarity with blockchain technology. Despite considerable hype and discussion about blockchain in African and MENA countries, there has been little validation regarding managers’ perceptions and knowledge of blockchain technology. Furthermore, practical experience and implementation among Libyan oil firms face several organizational barriers. Therefore, we suggest that successful blockchain technology adoption in the Libyan context requires integration both from within and among organizational parties. These findings have significant implications. Thus, our proposed model offers insights into the new application of a unified theory of acceptance technology based on a novel extension of the UTAUT model. Our results also identify the key antecedents to blockchain adoption in oil and gas firms.

Hence, the behavioral intention to adopt blockchain technology in these firms is planned behavior that requires subjective norms, facilitating conditions, perceived trust, and regulatory support.

Importantly, a key theoretical contribution of this research lies in the identification and empirical validation of blockchain literacy as a moderating variable. Our findings highlight the role of blockchain literacy as a moderator in the relationship between the key enablers of blockchain and the intention to adopt it. The moderating role of blockchain literacy is considered original in studies conducted in developing countries. Its inclusion in the model strengthens the understanding of how individual-level capabilities interact with organizational and environmental factors. Blockchain literacy enhances or weakens the impact of perceived trust, facilitating conditions, regulatory support, and social influence, depending on the user’s knowledge and familiarity with the technology. This makes it a critical variable to consider when analyzing behavioral intention in low-literacy or early-stage adoption environments.

By demonstrating that blockchain literacy amplifies the effectiveness of the primary adoption drivers, this study provides practical insight for managers and policymakers seeking to accelerate blockchain diffusion in similar settings. Consequently, the more individuals become blockchain literate, the better they comprehend the benefits of blockchain technology and its security, and they become motivated by their colleagues and partners to engage in digital financial operations.

The Libyan government should empower the oil and gas sector, along with other relevant industries where appropriate, to effectively integrate blockchain technology into their management operations in order to expand their partnerships and supply chains in international markets. Therefore, policymakers should enhance blockchain literacy through education, training, and awareness campaigns, which could significantly boost the adoption of blockchain in Libya’s oil and gas industry, contributing to modernization and increased efficiency across various sectors.

This outcome broadens the existing knowledge on the effect of blockchain literacy and highlights the influential factors of behavioral intention to use blockchain in one emerging Arab economy, specifically within the context of Libya’s oil and gas sector.

This study identifies key factors affecting managers’ behavioral intentions toward blockchain technology in the Libyan oil industry. However, several limitations should be acknowledged for transparency and to guide future research efforts.

First, the study employed a cross-sectional design, which limits the ability to observe changes in behavioral intentions over time. Second, the extended UTAUT model was validated specifically within petroleum firms in Libya, a context that has been rarely addressed in the literature. While this enhances the novelty of the study, it limits the generalizability of the findings to other industries or regions. Third, the study did not examine the potential mediating effects of any variables, which could provide deeper insights into the mechanisms influencing adoption behavior. Finally, the use of a non-probabilistic sampling method, though suitable given the data collection constraints in Libya, may introduce selection bias. As such, caution is warranted when generalizing the findings to the broader population of firms.

To build on the present findings, future studies should consider adopting a longitudinal design to capture the dynamic evolution of blockchain adoption behavior over time. Researchers are also encouraged to test the proposed extended UTAUT model in other sectors and in different developing countries to enhance external validity and enable comparative analysis.

Further work could incorporate mediating variables such as perceived security or national culture, as well as additional moderators like perceived risk, organizational readiness, or top management support. Exploring these elements may offer a more comprehensive understanding of the factors shaping behavioral intention.

Experimental or quasi-experimental designs could also be employed to evaluate the effects of interventions, such as blockchain training programs or changes in regulatory frameworks, on adoption behavior. In addition, future research should use probability-based sampling techniques and expand sample sizes across various industries or geographic areas to improve representativeness.

Lastly, qualitative methods such as interviews, focus groups, or case studies are recommended to provide richer insights into the contextual and organizational barriers affecting blockchain implementation. These approaches would complement the quantitative results by uncovering deeper managerial perceptions, organizational culture, and structural challenges.

This is particularly important in Libya’s unique sociopolitical environment, which is characterized by institutional uncertainty, regulatory fragmentation, and cultural resistance to technological change. In such a context, qualitative methods can capture the nuanced realities of decision-making, interpersonal dynamics, and informal practices that shape adoption behavior, factors that are often difficult to quantify. These methods also allow researchers to explore how managers within specific organizational and political conditions interpret trust, risk, and technological unfamiliarity.

Data availability

“Data availability: The datasets generated and/or analysed during the current study are not publicly available because they were personally collected using a questionnaire sent to managers in Libyan oil and gas firms but are available from the corresponding author on reasonable request.”

References

Wamba, S. F. & Queiroz, M. M. et « Blockchain in the operations and supply chain management: Benefits, challenges and future research opportunities », Int. J. Inf. Manag., vol. 52, p. 102064, juin (2020). https://doi.org/10.1016/j.ijinfomgt.2019.102064

Welfare, A. Commercializing Blockchain: Strategic Applications in the Real World (Wiley, 2019). https://doi.org/10.1002/9781119578048

Gürkaynak, G., Yılmaz, İ., Yeşilaltay, B. & Bengi, B. et « Intellectual property law and practice in the blockchain realm », Comput. Law Secur. Rev., vol. 34, no 4, pp. 847–862, août (2018). https://doi.org/10.1016/j.clsr.2018.05.027

Wang, J. et al. « A summary of research on blockchain in the field of intellectual property ». Procedia Comput. Sci. 147, 191–197. https://doi.org/10.1016/j.procs.2019.01.220 (2019).

Wang, M. « effect of blockchain technology–supply chain risk fit on new product development performance: the moderating role of supply chain upgrading ». J. Gen. Manag. 50, 26–36. https://doi.org/10.1177/03063070231216679 (oct. 2024). no 1.

Williams, I. Cross-Industry use of blockchain technology and opportunities for the Future: in advances in data mining and database management. IGI Global. https://doi.org/10.4018/978-1-7998-3632-2 (2020).

Taherdoost, H. & « A Critical Review of Blockchain Acceptance Models—Blockchain. Technology Adoption Frameworks and Applications », Computers, vol. 11, no 2, p. 24, févr. (2022). https://doi.org/10.3390/computers11020024

Emrouznejad, A., Chowdhury, S. & Dey, P. K. « Blockchain in operations and supply Chain Management », Ann. Oper. Res., vol. 327, no 1, pp. 1–6, août (2023). https://doi.org/10.1007/s10479-023-05451-x

Verny, J., Oulmakki, O., Cabo, X. & Roussel, D. et « Blockchain & supply chain: towards an innovative supply chain design »:, Proj. Proyéctica Proj., vol. n°26, no 2, pp. 115–130, nov. (2020). https://doi.org/10.3917/proj.026.0115

Nandi, M. L., Nandi, S., Moya, H. & Kaynak, H. et « Blockchain technology-enabled supply chain systems and supply chain performance: a resource-based view », Supply Chain Manag. Int. J., vol. 25, no 6, pp. 841–862, août (2020). https://doi.org/10.1108/SCM-12-2019-0444

Casella, G., Bigliardi, B., Filippelli, S. & Bottani, E. « cases of application of blockchain on the supply chain: a literature review ». Procedia Comput. Sci. 217, 1416–1426. https://doi.org/10.1016/j.procs.2022.12.340 (2023).

Yousefi, S. et B. Mohamadpour Tosarkani, « An analytical approach for evaluating the impact of blockchain technology on sustainable supply chain performance », Int. J. Prod. Econ., vol. 246, p. 108429, avr. (2022). https://doi.org/10.1016/j.ijpe.2022.108429

Tseng, F. M., Liang, C. W. & Nguyen, N. B. et « Blockchain technology adoption and business performance in large enterprises: A comparison of the United States and China », Technol. Soc., vol. 73, p. 102230, mai (2023). https://doi.org/10.1016/j.techsoc.2023.102230

Al-Dmour, A., Al-Dmour, R. & Al-Dmour, H. et A. Al-Adwan, « Blockchain applications and commercial bank performance: The mediating role of AIS quality », J. Open Innov. Technol. Mark. Complex., vol. 10, no 2, p. 100302, juin (2024). https://doi.org/10.1016/j.joitmc.2024.100302

Bhimani, A., Hausken, K. & Arif, S. et « blockchain technology adoption decisions: developed vs. Developing economies », in Information for Efficient Decision Making, WORLD SCIENTIFIC, 91–113. doi: https://doi.org/10.1142/9789811220470_0003. (2020).

Mohammad Saif, A. N. et al. « Blockchain Implementation Challenges in Developing Countries: An evidence-based systematic review and bibliometric analysis », Technol. Innov. Manag. Rev., vol. 12, no 1/2, mai., (2022). https://doi.org/10.22215/timreview/1479

Mbaidin, H. O., Alsmairat, M. A. K., Al-Adaileh, R. & et « blockchain adoption for sustainable development in developing countries: challenges and opportunities in the banking sector ». Int. J. Inf. Manag Data Insights. 3, 100199. https://doi.org/10.1016/j.jjimei.2023.100199 (nov. 2023). no 2.

Jaradat, Z., Al-Hawamleh, A., Al Shbail, M. O. & Hamdan, A. et « Does the adoption of blockchain technology add intangible benefits to the industrial sector? Evidence from Jordan », J. Financ. Report. Account., vol. 22, no 2, pp. 327–349, avr. (2024). https://doi.org/10.1108/JFRA-03-2023-0164

Afifa, M. A., Nguyen, N. M. & Bui, D. V. et « Nexus among Blockchain Technology, Digital Accounting Practices, Transformational Leadership and Sustainable Performance: Moderated-mediating Model », Glob. Bus. Rev., p. 09721509241264648, août (2024). https://doi.org/10.1177/09721509241264648

Gillpatrick, T. & Boğa, S. et O. Aldanmaz, « How Can Blockchain Contribute to Developing Country Economies? A Literature Review on Application Areas », ECONOMICS, vol. 10, no 1, pp. 105–128, juin (2022). https://doi.org/10.2478/eoik-2022-0009

Ullah, N. et al. « Blockchain-powered grids: Paving the way for a sustainable and efficient future », Heliyon, vol. 10, no 10, p. e31592, mai 2024. https://doi.org/10.1016/j.heliyon.2024.e31592

Al-Sulami, Z. A., Ali, N., Ramli, R. & Lu, S. et « Towards a comprehensive understanding of blockchain technology adoption in various industries in developing and emerging economies: a systematic review », Cogent Bus. Manag., vol. 11, no 1, p. 2294875, déc. (2024). https://doi.org/10.1080/23311975.2023.2294875

Katuk, N., Vergallo, R. & Sugiharto, T. et Éd., The Future of Human-Computer Integration: Industry 5.0 Technology, Tools, and Algorithms, First edition. Boca Raton: CRC Press, (2024). https://doi.org/10.1201/9781003479727

Jones, M., Luu, T. & Samuel, B. (eds) et,, vol. 239, p. 111737, juin (2024). https://doi.org/10.1016/j.econlet.2024.111737

Ngxabani, K., Oosterwyk, G., Van Belle, J. P. & Budree, A. « Using Blockchain Technology in Providing Mobile Financial Services to Alleviate Financial Exclusion in South Africa », in Information Technology and Systems, vol. 933, Á. Rocha, C. Ferrás, J. Hochstetter Diez, et M. Diéguez Rebolledo, Éd., in Lecture Notes in Networks and Systems, vol. 933., Cham: Springer Nature Switzerland, pp. 183–194. (2024). https://doi.org/10.1007/978-3-031-54256-5_17

Queiroz, M. M. et S. Fosso Wamba, « Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA », Int. J. Inf. Manag., vol. 46, pp. 70–82, juin (2019). https://doi.org/10.1016/j.ijinfomgt.2018.11.021

Kumari, V. & Bala, P. K. et S. Chakraborty, « An Empirical Study of User Adoption of Cryptocurrency Using Blockchain Technology: Analysing Role of Success Factors like Technology Awareness and Financial Literacy », J. Theor. Appl. Electron. Commer. Res., vol. 18, no 3, pp. 1580–1600, sept. (2023). https://doi.org/10.3390/jtaer18030080

Chittipaka, V., Kumar, S., Sivarajah, U., Bowden, J. L. H. & Baral, M. M. et « Blockchain Technology for Supply Chains operating in emerging markets: an empirical examination of technology-organization-environment (TOE) framework », Ann. Oper. Res., vol. 327, no 1, pp. 465–492, août (2023). https://doi.org/10.1007/s10479-022-04801-5

Jena, R. K. « Investigating accounting professionals’ intention to adopt blockchain technology », Rev. Account. Finance, vol. 23, no 3, pp. 375–393, mai (2024). https://doi.org/10.1108/RAF-06-2023-0185