Abstract

In recent years, the agent construction system has introduced novel mechanisms for coopetition between Urban Investment and Construction Companies (UICCs) and Real Estate Enterprises (REEs) in China’s real estate market. However, the dynamic evolutionary patterns of such interactions remain poorly understood. Under concurrent competition and cooperation, the interplay between UICCs and REEs has grown increasingly complex, involving multidimensional shifts in information transmission and mutual influence, which traditional methodologies struggle to comprehensively capture and analyze. This study constructs a dual-layer heterogeneous network model, integrating prospect theory (PT) and mental accounting (MA) with coopetition game theory, to rigorously analyze multilevel interdependencies between UICCs and REEs. The objective is to uncover evolutionary dynamics of coopetition under the agent construction system and accurately reflect multidimensional interactive behaviors among enterprises. Key findings include: (1) Synergistic enhancements in network connectivity and initial cooperation willingness significantly promote the deep diffusion of cooperative behaviors. However, REEs exhibit greater sensitivity to fluctuations in cooperation willingness compared to UICCs; (2) A nonlinear relationship between agency fees and project premium rates reveals REEs’ “preference for independent development” under brand advantages, whereas UICCs demonstrate strong reliance on balanced equity allocation. These conclusions offer managerial implications for governments to refine agent construction policies and for enterprises to formulate dynamic coopetition strategies.

Similar content being viewed by others

Introduction

In recent years, with the slowing pace of urbanization in China and strict government regulation of the real estate market, the Chinese real estate industry has undergone an important transformation toward high-quality development4. In 2022, urban investment construction companies (UICCs) acquired over 50% of the total national land sold through land auctions. However, the actual project commencement rate was only 8%. Although active in the land market, UICCs face challenges in project development and sales, resulting in low commencement rates and significant financial pressure, highlighting the urgent need for transformation to adapt to market competition40. Meanwhile, traditional real estate enterprises (REEs) are also mired in difficulties such as financing constraints, inventory backlogs, and liquidity crises. The current predicaments faced by both UICCs and REEs indicate that industry transformation is imperative. Only by enhancing market-oriented operations, optimizing asset structures, and innovating business models can new growth points be found under the dual pressures of policy regulation and market changes.

Against this background, the importance of the agent construction system model is increasingly evident. The agent construction system is a prevalent procurement approach for Chinese government investment in nonprofit public projects20,26. In recent years, it has begun to be adopted in the real estate development sector. In real estate construction by proxy, clients with development needs entrust projects to proxies with development capabilities and construction experience. Together, they participate in financing, design, development, management, and sales and ultimately achieve shared profits51. As an innovative business model, the agent construction system provides a reasonable mechanism for profit distribution and risk sharing between the client and the agent46. UICCs and REEs are competitors and partners in the field of real estate project development. Competition focuses primarily on the acquisition of land resources and project profits. In recent years, UICCs have entered into competition with REEs in the field of real estate project development. Moreover, both parties have found opportunities for win‒win cooperation through the agent construction system, which involves jointly developing projects. UICCs leverage their advantages in land acquisition and fundraising, whereas REEs provide specialized experience in project development and market operations. Such cooperation not only mitigates their respective weaknesses but also promotes healthy market development and efficient project advancement11. Innovative industry models are crucial for the healthy development of the real estate sector; thus, it is necessary to examine the competitive and cooperative evolution trends between UICCs and REEs under the agent construction system.

Under the agent construction system, the relationship between UICCs and REEs is complex and diverse, involving aspects such as cooperation, competition, resource sharing, and information exchange. Failure to comprehensively capture and analyze these diverse interactive relationships may lead to overlooking hidden cooperation opportunities and potential competitive threats. Moreover, similar enterprises engage in coopetition, mutual imitation and learning. UICCs cooperate and compete among themselves, and REEs engage in similar dynamics. It is evident that single-layer networks are incapable of accurately describing the behavioral characteristics of the two types of entities, nor can they effectively reflect the internal and cross-layer information transmission and influence pathways. This results in incomplete analyses of information flow and influence mechanisms. Ignoring the complex relationships and multidimensional information interactions between similar and dissimilar enterprises impacts the accuracy of corporate decision-making and adaptability to the market42. Therefore, this paper will utilize complex network theory to depict enterprise relationships with numerous nodes and complex connection structures. It will construct separate dual-layer subnetworks for UICCs and REEs, establish networks of competitive and cooperative relationships between these two types of enterprises, and describe the complex structure of their coupled systems. Additionally, Fermi learning algorithms and enterprise competition theory are introduced to reflect multidimensional information interactions among heterogeneous enterprises.

UICCs and REEs may need to cooperate in certain projects, but they may also compete in situations where markets and resources are limited. This alternating dynamic of cooperation and competition characterizes their relationship. Enterprises facing constantly changing market and policy environments continuously adjust their strategies based on their experiences and external information, demonstrating distinct dynamic evolutionary characteristics. Furthermore, owing to the heterogeneity of UICCs and REEs, they may have different value judgments and preferences for the same decision problem. For example, UICCs, possibly because of government backing, may have stronger risk tolerance and prefer long-term investment returns, whereas REEs may prioritize short-term profits and market responsiveness, resulting in greater risk aversion. However, previous studies have often relied on assumptions of complete information and bounded rationality, using expected utility theory to measure individuals’ perceptions of benefits while neglecting decision-makers’ risk preferences and perceived values49. This lack of examination of microdynamic changes in enterprise behavior leads to insufficient relevance for practical business decisions5. Therefore, this paper adopts evolutionary game theory to simulate the process of strategic adjustments and adaptations of enterprises in dynamic environments29, effectively characterizing the competitive and cooperative relationships between UICCs and REEs. Prospect theory and mental accounting theory (PT-MA theory) are introduced to better explain the decision-making behaviors of enterprises in environments of risk and uncertainty.

Therefore, this study adopts a dual-layer complex network game approach to investigate competitive and cooperative decisions among multiple entities. Starting from the information interaction mechanisms and decision-making patterns of individual enterprises embedded in complex networks, PT-MA theory can be applied to analyze the expected utility of REEs and UICCs, revealing the essence of enterprise coopetition behaviors. This research contributes to the literature in three aspects: (1) A multilayer heterogeneous complex network model is constructed to describe the complex relationships between UICCs and REEs. (2) Based on dynamic evolution and competitive‒cooperative game theory, a complex network evolutionary game model of coopetition between UICCs and REEs is established. (3) Aiming at the heterogeneous characteristics of UICCs and REEs under the agency construction system, this study, for the first time, integrates the existing PT-MA theory with a dual-layer complex network model to construct a decision-making analysis framework suitable for multidimensional competitive–cooperative relationships.

The other parts of this paper are as follows: “Literature review” briefly reviews the relevant literature; “Model design” elaborates on the modeling process of the dual-layer complex network game model; “Simulation” provides the parameter assignment of the model and discusses the simulation results; and “Conclusions” discusses the results based on the current status of industry development and literature and provides recommendations.

Literature review

Competition and cooperation often coexist in the interactive relationships between enterprises. An in-depth study from the perspective of coopetition helps reveal the core of these intertwined relationships1,3, deepening the understanding of their complexity12. Current research has focused mainly on the impact of coopetition on firm performance and technological innovation25,30,31, where game theory serves as an effective tool for analyzing competitive and cooperative behaviors among firms. Nalebuff3 was among the first to apply game theory to explain issues related to firm coopetition, arguing that coopetition combines cooperative and competitive strategies to achieve successful business activities. Shang et al.34 established a coopetition game model among manufacturers, studying the impact of green behaviors on supply chain profits and decisions. Wu et al.47 developed a two-stage game model between land ports and sea ports, investigating how cooperation and competition with land ports affect adaptive investments in sea ports. Yu et al.48 researched coopetition among multiple automobile companies and evaluated the effects of cooperation incentives and price competition from policy and organizational perspectives. Cooperation between UICCs and REEs often stems from shared interests, but concerns over the loss of competitive advantages can turn them into competitors. Therefore, coopetition, as a situation that is both oppositional and nonexclusive, where it plays a dual role and mutually influences, is a dynamic game2. Evolutionary game theory, developed based on traditional game theory and biological evolution theory, is used to describe the dynamic evolution process of decision-making in firms and is thus widely used in studies of competitive and cooperative behaviors among groups7,36. Liu24 applied evolutionary game theory to analyze the coopetition between e-commerce platforms and commercial banks and reported that cooperation is more likely to be promoted when additional revenue distribution is more equitable. Li et al.18 constructed an evolutionary game model of digital alliance coopetition in the construction industry, exploring the dynamic impacts of various factors on the stability of digital alliance construction. Previous research has shown that game theory, through the construction of different game models, reveals the strategic choices and influencing factors of firms in coopetition. Evolutionary game theory further extends the static analysis of traditional game theory, describing the behavioral evolution of firms in dynamic decision-making processes and providing richer theoretical tools for studying coopetition among enterprises. Studying the coopetition between UICCs and REEs from the perspective of evolutionary game theory can better reveal the essence of coopetition among enterprises and enhance the scientificity of decision-making.

Connections between individuals in the real world are neither completely coupled nor entirely random. UICCs and REEs establish connections through capital, technology, transactions, and information flow, exhibiting specific topological and statistical characteristics that can be abstracted as complex network systems. Rouyre et al.32 argued that managing competitive and cooperative relationships among multiple parties in a networked environment requires a combination of cooperation network management offices and contract and relationship mechanisms. Gao et al.10 constructed a two-layer network model to study the intrinsic and network dynamics of renewable energy trade among countries along the Belt and Road Initiative, revealing the complex coexistence of cooperation and competition. Zhao et al.50 proposed a unified cooperation and competition multifeature coupling diffusion framework, demonstrating that low-intensity competition is more likely to generate positive effects compared with high-intensity competition and suggesting a control strategy to effectively manage network diffusion. Complex network evolutionary game theory considers the dynamic turnover of network topology and inter-firm connections, providing crucial theoretical support for understanding the evolution of competitive and cooperative behaviors among enterprises in networked environments44. In the evolutionary coopetition of UICCs and REEs, firms do not adopt fixed strategies but continuously adjust their coopetition strategies based on the behavior of neighboring nodes in the network22. Chen et al.5 developed a complex network game model for the diffusion of electric vehicle charging facilities, simulating the impacts of various incentive policies, such as investment subsidies, construction subsidies, operation subsidies, and user charging subsidies, on the deployment of electric vehicle charging networks. Hu et al.13 addressed issues in electric vehicle promotion by establishing a game model among automobile manufacturers based on NW small-world networks, studying decision-making by automobile production companies under the influence of multiple factors and providing relevant recommendations. Li et al.21 constructed an evolutionary game model based on complex networks, simulating the impact of government policies on the diffusion of electric vehicles in networks of different scales. The above research indicates that complex networks, as a research paradigm abstracting complex systems into network structures, can deeply analyze the complex coopetitive relationships among enterprises and reveal behavioral correlations under the interaction of multiple factors. In particular, complex network evolutionary game theory integrates evolutionary game theory with complex network theory, dynamically and systematically reflecting the complex interactive behaviors among enterprises. This provides crucial theoretical support for studying the evolution of competitive and cooperative behaviors within networked enterprises.

Significant heterogeneity exists between UICCs and REEs, with their cooperative or interdependent relationships being influenced by shifts in interests and resource dependencies. This, in turn, leads to potential competitive risks or opportunistic behaviors within organizational networks27. The decision-making processes of UICCs and REEs are inherently complex owing to the high levels of uncertainty and risk inherent in these decisions39. Li et al.21 examined the impact of risk factors on corporate investment and financing behaviors, devising an evolutionary game model grounded in agency theory to dissect decision-making under risk conditions. Chen et al.6 devised a tripartite evolutionary game model for the safe supervision of tower crane operations, accounting for variations in risk perception among stakeholders and refining the game’s payoff function through the incorporation of preference coefficients. Li et al.19 examined the impact of fraudulent behavior on stakeholders by constructing an evolutionary game model that incorporates bounded rationality assumptions. They introduced Gaussian noise to simulate random disturbances encountered in evolutionary game processes. While these studies provide a theoretical foundation, the decision-making frameworks in the literature predominantly rely on expected utility theory. This theory assumes rational decision-making, which contradicts bounded rationality assumptions and fails to fully capture irrational factors such as decision-maker biases and risk preferences, thereby limiting its explanatory power. In highly competitive markets, overlooking these factors may lead enterprises to inadequately assess risks in project investment decisions, potentially resulting in a loss of competitive advantage35. To better understand decision-making behaviors, Tversky and Kahneman38 proposed prospect theory grounded in cognitive psychology, which effectively explains how game participants perceive benefits and risk preferences. Subsequently, Thaler28 introduced the concept of mental accounting, which was further refined by Kahneman to suggest that behavioral decisions are influenced by a comprehensive evaluation of costs and benefits. Significant heterogeneity in risk preferences and value perceptions exists between UICCs and REEs, influencing their decision-making processes. UICCs, often funded by local governments, prioritize social benefits and long-term returns, indicating lower risk preferences. In contrast, REEs emphasize market-oriented attributes, focusing on maximizing financial returns and short-term profitability, thus demonstrating greater risk preferences. These advancements underscore the importance of considering multiple factors—including risk, uncertainty, and psychological preferences—in understanding and explaining complex coopetitive relationships among enterprises. PT-MA theory provides critical theoretical frameworks that accurately reflect the behavioral characteristics of enterprises in decision-making processes43.

Through a comprehensive review of the literature, academic research on corporate coopetition has extensively utilized methodologies such as game theory and complex networks. For instance, game theory elucidates the strategic selection patterns in coopetition, while evolutionary game theory on complex networks dynamically captures multi-agent interactive behaviors. Through a comprehensive review of the literature, academic research on corporate coopetition has extensively utilized methodologies such as game theory and complex networks. For instance, game theory elucidates the strategic selection patterns in coopetition, while evolutionary game theory on complex networks dynamically captures multi-agent interactive behaviors. However, three critical gaps persist in existing research: (1) Limitations of Homogeneity Assumptions. Prevailing studies often oversimplify firms as homogeneous entities, neglecting intrinsic heterogeneities between Urban Investment and Construction Companies (UICCs) and Real Estate Enterprises (REEs). For example, UICCs, backed by governmental affiliations, prioritize long-term stability in decision-making, whereas REEs focus on short-term market returns. This divergence renders conventional models inadequate in explaining strategic differentiation between these entities within agent construction systems. (2) Insufficient Explanatory Power of Single-Layer Networks. Although complex networks have been adopted to analyze coopetition, single-layer structures fail to disentangle intra-group collaboration (e.g., UICC-UICC alliances) from cross-group competition (e.g., UICC-REE rivalry). Such multi-layered interactions necessitate modeling via heterogeneous networks to capture hierarchical complexities. (3) Flaws in Rational Decision-Making Assumptions. Existing models predominantly rely on expected utility theory, disregarding psychological biases in strategic choices. While Prospect Theory (PT) and Mental Accounting (MA) are well-established in consumer behavior research, their integration into corporate coopetition games remains nascent[57, 58]. This gap hinders the explanation of strategy evolution driven by risk aversion or irrational preferences. To address these limitations, this study constructs a dual-layer heterogeneous network model, separately characterizing intra-group relationships (e.g., UICC-UICC collaboration) and cross-group dynamics (e.g., UICC-REE competition), thereby achieving refined modeling of multi-level coopetition. We integrate PT-MA theory into the evolutionary game mechanism. By optimizing payoff matrices through value functions and mental accounting thresholds, we reveal how heterogeneous risk preferences shape strategic evolutionary paths. Practical insights for agent construction systems are distilled. These innovations not only bridge theoretical gaps but also enhance the model’s explanatory power for real-world decision-making, providing a scientific foundation for enterprises to navigate coopetition in complex market environments.

Model design

In this section, a dual-layer network evolutionary game model based on PT-MA theory is constructed to explore the evolutionary patterns of cooperative construction between REEs and UICCs. The model consists of three main parts: network structure, game model, and evolutionary rules.

Network structure

Network construction logic

In a fiercely competitive market environment, participants are closely interconnected through information, capital, and technology, resulting in the real estate industry exhibiting characteristics of complex networks. The complex network characteristics of the market have significant implications for the coopetition between UICCs and REEs. Integrating network characteristics into the study of multiagent decision-making and corporate competitive games helps reveal the impact of cooperative construction systems on the competition between UICCs and REEs, which is highly practical.

There is a relationship of coopetition between UICCs and REEs, with each group internally maintaining ordinary social relationships. Using a complex network as a medium, a network model of UICCs and REEs is constructed. The UICCs network is denoted as \({G_1}=\left( {{V_1},{E_1}} \right)\). The UICCs network is denoted as \({G_2}=\left( {{V_2},{E_2}} \right),\) where the node degree value represents the strength level of the REEs.

Construction of subnetworks for UICCs and REEs

Complex network theory provides a method to describe individual relationships in the real world and is widely used to study various issues between enterprises15,21. Duncan J. Watts and Steven H. Strogatz published their pioneering study in “Nature” in 1988 and proposed the small-world network model45. With the rapid development of the internet, information dissemination has become more convenient, and the connections between enterprises have grown closer, exhibiting typical small-world network characteristics. In a fully competitive environment, enterprise relationships conform to small-world network characteristics and are more suitable for studying issues such as the strategic evolution between enterprises in the same industry8,9. Therefore, this paper employs the WS small-world network to depict the relationships between UICCs and REEs.

Construction of competitive networks between UICCs and REEs

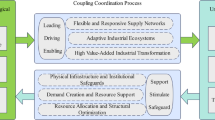

This paper draws on the algorithm used in the study by Luo et al.56 to construct a competitive network between UICCs and REEs. When selecting partners for cooperation or competition, companies tend to favor those with greater strength, a characteristic known as degree preference. Therefore, the following algorithm is used in the construction of the competitive network: first, a basic competitive network is generated based on the degree values, including the top \({m_0}\)ranked UICC and the top \({n_0}\) REE. In each time period, the competitive network relationships are subsequently incrementally added based on the subsequent rankings of the strength of UICCs and REEs. Specifically, for UICCs, at time t, those ranked outside the basic competition network, designated as \({m_0}+t\), will establish connections with the top m REEs within the current period. For REEs, at time t, those ranked outside the basic competition network, designated as \({n_0}+t\), will establish competitive relationships with the top n UICCs within the current period. Ultimately, this results in a dual-layer cooperative‒competitive network for UICCs and REEs, which is constructed based on the strength indices of both types of enterprises. The dual-layer complex network structure is shown in Fig. 1.

Game theory model

Problem description and parameter assumptions

Agency construction cooperation between UICCs and REEs can be divided into two main types: (1) Agency fee model: In this model, The UICCs act as the client, signing a construction contract with REEs, and paying a construction service fee. The entire sales revenue belongs to the client, while the REEs only receives part of the agency fee. The UICCs are responsible for providing project land, funds, and other resources, while the REEs are responsible for project design, construction, and sales. (2) Equity-based construction: In this model, the construction party holds a certain equity stake in the project, and sales revenue is distributed according to agreed-upon proportions. UICCs and REEs form a cooperative alliance to jointly bid for land. After successfully acquiring the land, they jointly invest in project development, sharing their respective resources and advantages. For example, UICCs have close relationships with the government, providing them with certain policy and compliance advantages, whereas REEs typically have rich project development experience, enabling them to offer more competitive products.

In this paper, the parameters and assumptions are primarily derived from two sources. Firstly, consultations were conducted with experts and frontline operators in the field of real estate development. Secondly, professional books served as the source of information. Under current market conditions, the profit margin for UICCs developing real estate projects is denoted as I, whereas for REEs, owing to their extensive development experience and market reputation, the profit margin is denoted as\(I*\left( {1+\theta } \right)\), where \(\theta\) represents the project premium rate. UICCs typically have governmental backgrounds, and their financing is often supported and implicitly guaranteed by local governments, which enhances investor trust and thereby reduces financing costs. Given the current market environment, the volatility and uncertainty of the real estate sector give rise to heightened financing risks for REEs, resulting in higher interest rates than those provided for UICCs. Therefore, the capital cost for UICCs developing real estate projects is denoted as \({Q_1}\), and for REEs, it is \({Q_2}\), with \({Q_1}<{Q_2}\). Land costs constitute a significant expense in the development of real estate projects. The base price for purchasing land is denoted as L. When both UICCs and REEs are optimistic about project returns and opt for a competitive strategy, the land concession price tends to increase, with the land premium rate denoted as \(\delta\). The development of projects requires the payment of various taxes, including land use taxes, property taxes, and income taxes, and these costs are denoted as B. The construction safety and other costs for UICCs are denoted as D. Owing to their extensive experience in project development, REEs have more precise cost control, and their construction safety and other costs are denoted as \(D*\left( {1 - \gamma } \right)\), where \(\gamma\) is the cost control factor. REEs acting as trustees, undertake real estate development on behalf of owners and charge an agency service fee rate, denoted as \(\alpha\).

Traditional profit matrix

This section elaborates on the possible strategic spaces for UICCs and REEs during cooperation and competition.

Cooperation, Cooperation: Both parties reach an intention for cooperative agency construction. UICCs obtain the base sales revenue and premium income from the project, whereas REEs, acting as agents, collect the agency service fee. In this scenario, UICCs acquire land at low prices in the market, which is then developed by REEs under an agency construction model. Owing to the REEs’ good brand reputation and quality control, agency projects are more likely to gain market favor, thereby achieving better project returns.

Cooperation, Competition: REEs initiate a competitive strategy to develop acquired land plots, increasing development profits. In this case, UICCs, for conservative reasons, seek to cooperate with REEs in agency construction development. REEs, optimistic about the project’s prospects, choose to independently purchase land for development.

Competition, Cooperation: UICCs intend to independently bid for land development, and REEs seek agency construction, but no cooperation is achieved. At this time, UICCs proceed with independent development, optimistic about the project’s prospects, but owing to their own development capabilities and brand influence, the project’s sales revenue is low.

Competition, Competition. Both parties adopt competitive strategies, bid independently, are unable to share resources and profits, and no cooperation is achieved. However, with their richer development experience and professional teams, REEs will purchase land. At this time, both UICCs and REEs are optimistic about the development prospects of the project, intending to purchase land for development, thereby increasing the land concession price.

The game payoff situations corresponding to the four strategic spaces are shown in Table 1.

Profit matrix based on PT-MA theory

Under uncertain prospects, due to varying individual risk preferences, decision-makers’ perceptions of decision value may not align with traditional expected values16. For gains, decision-makers tend to be risk-averse, whereas for costs, they tend to be risk-seeking. Mental accounting theory is the process by which people categorize, encode, evaluate, and budget potential outcomes in their minds38. Therefore, the profit function of the strategy is optimized according to mental accounting theory, denoted as \(V=f\left( {\Delta \pi } \right)g\left( p \right)\). Here, \(f\left( {\Delta \pi } \right)\) represents the value function; \(g\left( p \right)\) represents the decision function; \(\Delta \pi\) represents the difference between the perceived value and reference point; and p represents the probability. This paper utilizes mental accounting theory to further divide the value function \(f\left( {\Delta \pi } \right)\)into a cost account \(S\left( x \right)\) and a utility account \(T\left( x \right)\). If the payout is less than the reference point, a perception of gain is obtained. Conversely, a perception of loss is experienced. The details are as follows:

Where \(T\left( x \right)\) represents the value function of the utility account; \(S\left( x \right)\) represents the value and cost account; \(\rho ,\mu\) denotes loss aversion sensitivity; \(\omega ,\nu ,\chi ,\delta\)is the risk preference coefficient; \({U_1}\) indicates the cost reference point; and \({U_2}\) represents the utility reference point. Decision-makers make subjective judgments based on the probability of an event occurring, assigning decision weight values that represent the degree of preference for choices. The corresponding decision weight function can be represented as:

.

Where \({g^+}\left( p \right)\) represents the decision weight function in the context of gains; \({g^ - }\left( p \right)\)represents the decision weight function in the context of losses; and e and r represent decision impact coefficients.

UICCs compare the costs and benefits of independently developing real estate projects, setting their utility reference point at I and their cost reference point at \(L+B+{Q_1}+S+D\).

REEs compare the utility and cost of independent development projects to decide whether to choose a cooperative development strategy. Therefore, the utility reference point is set at \(I(1+\theta )\), and the cost reference is set at \(L+B+{Q_2}+S+\left( {1 - \gamma } \right)*D\). The game payoff matrix under PT-MA theory, which is based on the aforementioned theories, is shown in Table 2.

Evolution rules

Basic assumptions of network games

Assumption 1

REEs and local UICCs are both bounded rational agents.

Assumption 2

REEs and UICCs only compare profits with neighboring nodes within their respective networks.

Assumption 3

REEs and UICCs update their strategies according to a predefined update rule, which is based on the payoff from the previous round of the game.

Strategy update rules

In the real estate development industry, characterized by complex network features, cooperative agency construction and independent development strategies diffuse among participants through the edges of the network. Initially, each participant in the game adopts a pure strategy (cooperation or competition), with a proportion \({\alpha _1}\) of UICCs and a proportion \({\alpha _2}\) of real estate development companies in the network adopting a cooperative agency construction strategy. At time t, participant i randomly selects a neighbor j, observes the strategies of itself and its neighbor at time \(t - 1\), and calculates the difference in payoffs according to Formula (5). The update of the participant’s own strategy is calculated and executed according to the Femi update rule, which incorporates PT-MA theory, as described by Formula (6).

Where \(\Delta {U_{ij}}\) represents the perceived profit differential between the company and a selected neighboring node. When Company j‘s perceived profit is greater than that of Company i, Company i is more likely to adopt the Company j strategy; if Company i profit is greater than that of Company J, then Company i is likely to maintain its current choice. The parameter k indicates the intensity of irrational decision-making. When k approaches 0, it suggests that the player is approaching complete rationality, meaning that the strategy update is solely dependent on the magnitude of profit. Figure 2 illustrates the process of strategy update among nodes in the network.

Simulation

Initializing parameters

To ensure the reliability of the simulation results, this study initializes parameters based on existing literature and engineering cases for simulation analysis. Referencing the theoretical and applied research of Tversky and Kahneman, as well as Van Schie and Van Der Pligt41, values are assigned to \(\rho ,\mu ,\omega ,\nu ,\delta ,\chi\). Based on research by relevant scholars, the neutral noise intensity is used to assign values to k. Combining the Chinese local government’s management methods for agency construction projects54,55 and results from related project case studies, and based on opinions from experts in the field, values are assigned to \(\alpha ,\gamma ,\delta ,\theta ,{Q_1},{Q_2},D,L,B,S\) and other parameters. \({P_C},{P_D}\) represent the initial proportions of UICCs and REEs in the network choosing a cooperative strategy. The base profit, i, is set to 1, and other parameters are handled as percentages of the base profit. In summary, the details of the parameter assignments are shown in Table 3.

Numerical simulation steps

Step One: Based on Sect. 3.1.2, construct the subnetwork \({G_1}=\left( {{V_1},{E_1}} \right)\) for UICCs and the subnetwork \({G_2}=\left( {{V_2},{E_2}} \right)\) for REEs. \({N_1}=200,{K_1}=4,{P_1}=0.2,{N_2}=200,{K_2}=4,{P_2}=0.2\).

Step Two: Define the initial parameter values. The initial cooperative-competitive strategy for each node is randomly assigned and set, with the cooperative strategy valued at 1 and the competitive strategy at 0. The game begins after strategy allocation is completed.

Step Three: After each round of the game, UICCs and REEs randomly select a neighboring node to compare profits, calculate probabilities according to the rules in Sect. 3.3.2, and determine the likelihood of adopting the opposing party’s cooperative‒competitive strategy in the next round.

Step Four: Repeat the above steps until the game concludes after t rounds.

Step Five: To eliminate computational errors due to randomness, perform model simulations based on the above parameters, repeat Steps One to Four, and calculate the average outcome from 1000 independent simulations. The workflow of a single simulation experiment is shown in Fig. 3.

Impact of agency Fee_\(\alpha\)

With other parameters held constant, the agency fee rate \(\alpha\) varies from 0 to 10% with steps of 1%, and the real estate brand premium factor \(\theta\) varies from 2 to 30% with steps of 2% to study the diffusion process of the cooperative agency construction strategy under the agency fee model. Figure 4 illustrates the trend of the proportions of UICCs and REEs adopting the cooperative subcontracting strategy with changes in parameter combinations. The diffusion rate of the subcontracting cooperative strategy refers to the proportion of nodes adopting the subcontracting cooperative strategy in the networks of UICCs and REEs relative to the total number of nodes. It can reflect the overall acceptance of subcontracting cooperation in the market and can also be seen as the acceptance level of the cooperative strategy by individual enterprises. Figure 4 shows that under different agency fees, as the premium factor \(\theta\) for real estate brands increases, and the proportion of UICCs adopting subcontracting cooperation strategies gradually increases, whereas the proportion of REEs decreases step by step. With the gradual increase in the agency fee \(\alpha\), the enthusiasm of REEs to implement subcontracting development gradually increases, whereas the enthusiasm of UICCs to choose cooperative strategies gradually decreases.

When viewed by subgroup, UICCs are moderately influenced by increases in agency fees and brand premium rates \(\theta\), showing a moderate change in the willingness to choose cooperative subcontracting. In contrast, REEs are more sensitive to changes in brand premium rates and agency fees. When the agency fee is 6% and the project premium rate is 10%, the diffusion rate of subcontracting cooperation among REEs is 36.15%. If the agency fee decreases by 1% under these conditions, the diffusion rate of subcontracting cooperation decreases to 20.49%, showing a more pronounced fluctuation. Owing to the subcontracting service fee model, changes in agency fees directly affect the profitability of REEs. Even minor changes can significantly impact developers’ profitability. With the agency fee maintained at 6% and the project premium rate changing to 12%, the diffusion rate of subcontracting cooperation among REEs decreases from 36.15 to 15.06%. At this point, REEs prefer to independently develop projects using their brand advantages to pursue greater profit margins rather than cooperating with UICCs.

Impact of initial corporate intentions

With all other parameters held constant, the initial cooperation ratio of UICCs \({P_C}\) is set to vary from 0 to 100%, in increments of 10%, and the initial cooperation ratio of REEs \({P_D}\) is set from 0 to 100%, in increments of 10%, to study the diffusion process of cooperative agency construction strategies under the agency fee model. Figure 5 illustrates the trend of changes in the proportions of UICCs and REEs adopting a cooperative agency construction strategy as a function of parameter combinations. Figure 5 shows that under different initial cooperation intention combinations, whether the initial cooperation intentions of homogeneous groups or heterogeneous groups increase, both favor the diffusion of the agency cooperation strategy within the networks of UICCs and REEs. However, when the initial intentions of the homogeneous group are at a lower level, even if the initial cooperation intentions of the heterogeneous group reach 100%, the agency cooperation strategy cannot be fully diffused within the homogeneous group, leading enterprises to opt for a competitive strategy.

Considering subgroups, UICCs are influenced by the initial intentions \({P_C}\) of homogeneous groups and the initial intentions \({P_D}\) of REEs groups, changes in the diffusion rate of the agency cooperation strategy in a stable state are relatively uniform, approaching a linear change. Notably, REEs are more significantly affected by the prior cooperation intentions of heterogeneous groups. The average variance in the willingness of REEs to cooperate, influenced by changes in the initial intentions \({P_C}\) of heterogeneous groups, is 11.8%. is set to vary from 0 to 100%, in increments of 10%, and the initial cooperation ratio of REEs \({P_D}\) of heterogeneous groups is 5.7%. This finding indicates that REEs are significantly more sensitive to changes in the initial intentions of heterogeneous groups compared with UICCs. REEs often adjust their strategies and actions according to the intentions of UICCs to ensure the smooth and successful completion of cooperative construction projects.

Impact of average network degree_k

Keeping other parameters constant, set the agency fee rate \(\alpha =0\). With REEs contributing \(\beta =0.3\), a scenario where REEs contribute 30% and UICCs contribute 70% is simulated to study the evolutionary patterns of competitive-cooperative strategies in equity-based agency construction models. Figure 6 illustrates the diffusion of the agency cooperation strategy in a small-world network at different average network degrees. The average network degree k is an effective indicator of the density characteristics of the diffusion network. A higher average network degree k implies more neighboring nodes for a company, leading to more frequent information transfer and interaction between companies.

Overall, when the average network degrees of both UICCs and REEs increase, both groups tend to adopt cooperative agency construction strategies. By subgroup, the sensitivity of REEs to network degree values is significantly greater than that of UICCs; increases in either their own network degree \({K_2}\) or that of UICCs’ \({K_1}\) lead to a marked increase in the diffusion rate of REEs adopting cooperative strategies. As highly market-oriented entities, REEs typically possess greater market insight and rapid response capabilities, allowing them to quickly capture market information and swiftly adjust their strategies for greater decision-making benefits. Therefore, whether it is an increase in the homogeneous group’s degree average or that of UICCs, REEs react more swiftly, strengthening their position by choosing cooperative strategies. This frequent interaction not only facilitates the sharing of information within the group but also promotes the formation of collaborations and alliances between UICCs and REEs, thereby achieving a win‒win situation when facing common challenges and opportunities.

Impact of equity participation ratios

Figure 7 shows the proportions of UICCs and REEs adopting cooperative agency construction strategies in an equity-based model and how these proportions vary with different par ameter combinations. With all other parameters held constant, the agency fee rate \(\alpha =0\). The real estate brand premium factor \(\theta\) varies from 0–30% in increments of 2%, and the REEs equity participation rate \(\beta\) ranges from 0–100% in increments of 5%. At this time, the UICCs ' participation rate is \(1 - \beta\). This setup is used to study the evolution of corporate competitive and cooperative strategies.

Overall, the relationship between the equity participation ratios of the two groups and the diffusion rate of cooperation is not linear but generally follows an inverted U shape. As the value of \(\beta\) increases, the diffusion of the cooperative agency construction strategy between the two parties initially increases and then decreases. Additionally, as the real estate premium factor \(\theta\) increases, the range of equity participation ratios at which both parties reach a cooperative strategy gradually narrows. Looking at the subgroups, REEs are more sensitive to the project premium rate \(\theta\) and the equity participation ratio \(\beta\) than UICCs are. Figure (7a) shows that UICCs choose cooperative strategies at a high rate, i.e., over 80%, when the equity participation ratio \(\beta\) ranges from 0.2– to 0.8. Conversely, in the ranges of 0.1– to 0.2 and 0.8– to 1.0 for the equity participation ratio \(\beta\), the proportion selecting competitive strategies is higher, approximately 60–70%. Figure (7b) shows that the differences in strategy choices for REEs in a stable evolutionary state are significant. Within the range of 0.2– to 0.7 for equity participation ratio \(\beta\), the diffusion rate of cooperative strategies exceeds 70%, but within the range of 0.7– to 1.0, the probability of cooperation falls below 10%, with REEs tending toward a competitive strategy.

Overall, in the negotiation process between parties, UICCs usually have a strong market dominance. When their investment proportion in a project is low, they tend to be more cautious and conservative in choosing partners. This is because a relatively lower investment proportion means that they have less control over the project, which may diminish their ability to control profits. Furthermore, as the project premium rate \(\theta\) increases, the range of \(\beta\) values that result in a cooperative agency construction strategy decrease. This finding indicates that in cases of high brand premiums, REEs are more inclined to develop projects independently rather than adopting safer investment strategies that involve cooperation with partners.

Conclusions

To deepen the understanding of the competitive–cooperative relationship between UICCs and REEs under the agency system, this study constructed a game model based on a dual-layer complex network, innovatively integrating PT-MA theory and Fermi updating strategies to better capture the psychological characteristics and decision preferences of enterprises during decision-making, providing a new perspective and method for studying corporate competitive–cooperative games. The simulation comprehensively captured the dynamic evolution of cooperation and competition strategies between local UICCs and REEs, considering various parameters, including agency fee rates, network connectivity, initial cooperation intentions, equity participation ratios, and premium rates, that affect the diffusion of the agency system. The main conclusions drawn are as follows:

-

(1)

How do the construction management fee rate and brand premium affect the cooperation intention between city investment companies and real estate enterprises? The construction management fee rate and brand premium rate have opposite effects on the cooperation intention of both parties: the cooperation intention of city investment companies increases with the rise of the brand premium rate, but an increase in the construction management fee rate will suppress their enthusiasm. The cooperation intention of real estate enterprises increases with the rise of the construction management fee rate, but an increase in the brand premium rate will prompt them to turn to independent development. Therefore, the cooperating parties should set a reasonable construction management fee rate for real estate enterprises to balance their profit demands and the cost pressure of city investment companies; for real estate enterprises with high brand premium, city investment companies can provide additional policy support to offset their tendency to develop independently; for projects with low premium, the construction management fee rate can be increased to attract real estate enterprises to cooperate.

-

(2)

How does the initial intention to cooperate affect the diffusion efficiency of the construction management strategy? The initial intention to cooperate has an asymmetric transmission effect on the diffusion of the strategy: an increase in the initial intention to cooperate within homogeneous groups (such as within real estate enterprises) can significantly promote the diffusion of cooperation between the two parties, but the transmission efficiency between heterogeneous groups is limited (if the initial intention of the homogeneous group is less than 30%, even 100% cooperation from the other party cannot achieve complete diffusion). Therefore, it is necessary to prioritize improving the initial intention of real estate enterprises to cooperate: by policy guidance or the demonstration effect of benchmark projects, quickly increase the intention of real estate enterprises to cooperate, and use their high sensitivity to leverage the adjustment of city investment strategies. In addition, it is necessary to establish a cross-group trust mechanism: promote the joint establishment of a cooperation platform by city investment and real estate enterprises to reduce the strategy transmission resistance between heterogeneous groups.

-

(3)

How does the network interaction intensity (the average network degree K) affect the diffusion of the cooperation strategy? The increase of the average network degree (K value) significantly promotes the diffusion of cooperation, and it has a more significant impact on real estate enterprises: the increase of network density (the rise of K value) accelerates the interaction of information and the imitation of strategies, and the cooperation rates of both parties increase. Real estate enterprises are more sensitive to the intensity of network interaction and can quickly adjust their strategies to capture the benefits of cooperation.Therefore, it is necessary to optimize the structure of the enterprise interaction network: encourage city investment and real estate enterprises to join industry alliances or digital collaboration platforms, expand the scope of information sharing, and improve the network connection density.

-

(4)

How do the capital contribution ratio and brand premium jointly affect the stability of the cooperation strategy? The diffusion rate of the cooperation strategy has an inverted U-shaped relationship with the capital contribution ratio, and the increase of the brand premium rate will compress the cooperation range: the cooperation rate of city investment remains high when the capital contribution ratio is between 20% and 80%, while the cooperation rate of real estate enterprises is higher when the capital contribution ratio is between 20% and 70%. After the brand premium rate exceeds 10%, the intention of real estate enterprises to cooperate drops rapidly. Therefore, it is necessary to set a safe range for equity distribution: it is recommended to control the capital contribution ratio of city investment and real estate enterprises between 3:7 and 7:3 to avoid cooperation breakdown caused by extreme capital contributions. In addition, pre - negotiation for high - premium projects cooperation: for projects with high brand premium rate, it is necessary to clarify the profit distribution mechanism (such as the distribution of excess profits) before cooperation, or introduce a third - party guarantee to reduce the risk of real - estate enterprise default.

This study investigates the impact of relevant factors on the coevolution process between UICCs and REEs, and through simulation analysis, valuable conclusions have been drawn. However, the study still has certain limitations. First, the model assumes that the number of enterprises is static and does not consider the dynamic impact of market entry and exit. Second, the small-world network is used to simplify the real topological structure; future research could reconstruct the competitive network by integrating real transaction data of Chinese real estate enterprises. Third, the study does not involve dynamic game analysis of policy shocks (such as the “Three Red Lines”). Future research could explore the cooperative evolution under the coupling of multilevel networks and introduce deep reinforcement learning to optimize the adaptive mechanisms of corporate strategies.

Data availability

The datasets used and analysed during the current study available from the corresponding author on reasonable request.

References

Bengtsson, M. & Raza-Ullah, T. A systematic review of research on coopetition: toward a multilevel Understanding. Ind. Mark. Manag. 57, 23–39. https://doi.org/10.1016/j.indmarman.2016.05.003 (2016).

Bengtsson, M., Raza-Ullah, T. & Vanyushyn, V. The coopetition paradox and tension: the moderating role of coopetition capability. Ind. Mark. Manag. 53, 19–30. https://doi.org/10.1016/j.indmarman.2015.11.008 (2016).

Brandenburger, A. M. & Nalebuff, B. J. Co-opetition (Doubleday, 2020).

Cai, Z., Liu, Q. & Cao, S. Real estate supports rapid development of China’s urbanization. Land. Use Policy. 95, 104582. https://doi.org/10.1016/j.landusepol.2020.104582 (2020).

Chen, R., Fan, R., Wang, D. & Yao, Q. Effects of multiple incentives on electric vehicle charging infrastructure deployment in China: an evolutionary analysis in complex network. Energy 264, 125747. https://doi.org/10.1016/j.energy.2022.125747 (2023).

Chen, Y., Zeng, Q., Zheng, X., Shao, B. & Jin, L. Safety supervision of tower crane operation on construction sites: an evolutionary game analysis. Saf. Sci. 152, 105578. https://doi.org/10.1016/j.ssci.2021.105578 (2022).

Duan, W., Li, C., Zhang, P. & Chang, Q. Game modeling and policy research on the system dynamics-based tripartite evolution for government environmental regulation. Clust Comput. Tools Appl. 19 (4), 2061–2074. https://doi.org/10.1007/s10586-016-0642-1 (2016).

Fan, R., Dong, L., Yang, W. & Sun, J. Study on the optimal supervision strategy of government low-carbon subsidy and the corresponding efficiency and stability in the small-world network context. J. Clean. Prod. 168, 536–550. https://doi.org/10.1016/j.jclepro.2017.09.044 (2017).

Fan, R. et al. How do government policies affect the diffusion of green innovation among peer enterprises? - An evolutionary-game model in complex networks. J. Clean. Prod. 364, 132711. https://doi.org/10.1016/j.jclepro.2022.132711 (2022).

Gao, C., Tao, S., Su, B., Mensah, I. A. & Sun, M. Exploring renewable energy trade coopetition relationships: evidence from belt and road countries, 1996–2018. Renew. Energy. 202, 196–209. https://doi.org/10.1016/j.renene.2022.11.053 (2023).

Gnyawali, D. R. & Park, B. J. Co-opetition between giants: collaboration with competitors for technological innovation. Res. Policy. 40 (5), 650–663. https://doi.org/10.1016/j.respol.2011.01.009 (2011).

Hoffmann, W., Lavie, D., Reuer, J. J. & Shipilov, A. The interplay of competition and Cooperation. Strateg Manag J. 39 (12), 3033–3052. https://doi.org/10.1002/smj.2965 (2018).

Hu, Y., Wang, Z. & Li, X. Impact of policies on electric vehicle diffusion: an evolutionary game of small world network analysis. J. Clean. Prod. 265, 121703. https://doi.org/10.1016/j.jclepro.2020.121703 (2020).

Kahneman, D. & Tversky, A. Prospect theory: an analysis of decision under risk. World Sci. Handb. Financ Econ. Ser. 99–127. https://doi.org/10.1142/9789814417358_0006 (2013).

Kamal, S. M., Al-Hadeethi, Y., Abolaban, F. A., Al-Marzouki, F. M. & Perc, M. An evolutionary inspection game with labour unions on small-world networks. Sci. Rep. 5, 09799. https://doi.org/10.1038/srep09799 (2015).

Kim, H., Choi, H., Hong, T., Ji, C. & Lee, J. Evolutionary game analysis of green loans program to achieve the National carbon emissions reduction target in South Korea. J. Manag Eng. 38 (3), 04022018. https://doi.org/10.1061/(ASCE)ME.1943-5479.0001041 (2022).

Li, J., Jiao, J. & Tang, Y. An evolutionary analysis on the effect of government policies on electric vehicle diffusion in complex network. Energy Policy. 129, 1–12. https://doi.org/10.1016/j.enpol.2019.01.070 (2019).

Li, L., Yi, Z., Zhang, S. & Shao, Z. Competitive threat or win-win cooperation? Evolutionary analysis of digital alliances in construction. Dev. Built Environ. 15, 100182. https://doi.org/10.1016/j.dibe.2023.100182 (2023).

Li, M., Liu, W., Yan, C. & Zhang, M. Motor vehicle insurance Anti-Fraud dynamic system based on tripartite evolutionary game. IEEE Trans. Comput. Soc. Syst. 11 (2), 2901–2917. https://doi.org/10.1109/TCSS.2023.3313626 (2024).

Li, S. N. & Wang, D. L. Study on agent construction system in engineering projects. Appl. Mech. Mater. 584–586, 2568–2571 (2014). https://doi.org/10.4028/www.scientific.net/AMM.584-586.2568

Li, S. & Wang, B. Evolutionary game simulation of corporate investing and financing behavior from a risk perspective. Clust Comput. 22, S5955–S5964. https://doi.org/10.1007/s10586-018-1734-x (2019).

Li, X., Hu, Z. & Zhang, Q. Environmental regulation, economic policy uncertainty, and green technology innovation. Clean. Technol. Environ. Policy. 23 (10), 2975–2988. https://doi.org/10.1007/s10098-021-02219-4 (2021).

Liu, H., Song, Y. & Yang, G. Cross-efficiency evaluation in data envelopment analysis based on prospect theory. Eur. J. Oper. Res. 273 (1), 364–375. https://doi.org/10.1016/j.ejor.2018.07.046 (2019).

Liu, X. Evolution and simulation analysis of co-opetition behavior of E-business internet platform based on evolutionary game theory. Clust Comput. 22, S10241–S10250. https://doi.org/10.1007/s10586-017-1265-x (2019).

Liu, Y., Luo, Y., Yang, P. & Maksimov, V. Typology and effects of Co-opetition in Buyer-Supplier relationships: evidence from the Chinese home appliance industry. Manag Organ. Rev. 10 (3), 439–465. https://doi.org/10.1111/more.12070 (2014).

Liu, Z., Jiang, W., Wu, Y. & Peng, Y. Risk factors of Building apartments for university talent through the agent construction mode in China: interrelationship and prioritization. Sustainability 8 (4), 325. https://doi.org/10.3390/su8040325 (2016).

Crick, M. J. The dark side of coopetition: when collaborating with competitors is harmful for company performance. J. Bus. Ind. Mark. 35 (2), 318–337. https://doi.org/10.1108/JBIM-01-2019-0057 (2019).

Thaler, R. H. Mental accounting matters. J. Behav. Decis. Mak. 12, 183–206. https://doi.org/10.1002/(SICI)1099-0771(199909)12:3%3c183::AID-BDM318%3e3.0.CO;2-F (1999).

Narbaev, T., Hazir, O. & Agi, M. A review of the use of game theory in project management. J. Manag Eng. 38 (6), 03122002. https://doi.org/10.1061/(ASCE)ME.1943-5479.0001092 (2022).

Park, B. J., Srivastava, M. & Gnyawali, D. Walking the tightrope of coopetition: impact of competition and Cooperation intensities and balance on firm innovation performance. Ind. Mark. Manag. 43 (2), 210–221. https://doi.org/10.1016/j.indmarman.2013.11.003 (2013).

Ritala, P. & Sainio, L. M. Coopetition for radical innovation: technology, market and business-model perspectives. Technol. Anal. Strateg Manag. 26 (2), 155–169. https://doi.org/10.1080/09537325.2013.850476 (2013).

Rouyre, A., Fernandez, A. S. & Bruyaka, O. Big problems require large collective actions: managing multilateral coopetition in strategic innovation networks. Technovation 132, 102968. https://doi.org/10.1016/j.technovation.2024.102968 (2024).

Senbil, M. & Kitamura, R. Reference points in commuter departure time choice: A prospect theoretic test of alternative decision frames. J. Intell. Transp. Syst. 8 (1), 19–31. https://doi.org/10.1080/15472450490437726 (2004).

Shang, W., Wang, B. & Xia, D. A game between green and non-green supply chains considering two-way government intervention and manufacturer competition. Front. Environ. Sci. 10, 1002124. https://doi.org/10.3389/fenvs.2022.1002124 (2022).

Shehadeh, A., Alshboul, O. & Hamedat, O. Risk assessment model for optimal gain-pain share ratio in target cost contract for construction projects. J. Constr. Eng. Manag. 148 (2), 04021197. https://doi.org/10.1061/(ASCE)CO.1943-7862.0002222 (2022).

Shi, Q., Wang, Z. & Zhu, J. Developing collaborative driving mechanism of prefabricated buildings using multiagent stochastic evolutionary game. J. Constr. Eng. Manag. 150 (6), 04024050. https://doi.org/10.1061/JCEMD4.COENG-14396 (2024).

Tian, Y., Govindan, K. & Zhu, Q. A system dynamics model based on evolutionary game theory for green supply chain management diffusion among Chinese manufacturers. J. Clean. Prod. 80, 96–105. https://doi.org/10.1016/j.jclepro.2014.05.076 (2014).

Tversky, A. & Kahneman, D. The framing of decisions and the psychology of choice. Science 211 (4481), 453–458. https://doi.org/10.1126/science.7455683 (1981).

Tversky, A. & Kahneman, D. Advances in prospect theory: cumulative representation of uncertainty. J. Risk Uncertain. 5 (4), 297–323. https://doi.org/10.1007/BF00122574 (1992).

Lin, G. C. S. & Yi, F. Urbanization of capital or capitalization on urban land? Land development and local public finance in urbanizing China. Urban Geogr. 32 (1), 50–79. https://doi.org/10.2747/0272-3638.32.1.50 (2011).

Van Schie, E. C. M. & Van Der Pligt, J. Influencing risk preference in decision making: the effects of framing and salience. Organ. Behav. Hum. Decis. Process. 63 (3), 264–275. https://doi.org/10.1006/obhd.1995.1078 (1995).

Verschoore, J. R. & Adami, V. S. Interplay of competition and Cooperation in wind farm interorganizational projects: relational approach. J. Manag Eng. 36 (1), 04019034. https://doi.org/10.1061/(ASCE)ME.1943-5479.0000723 (2020).

Wang, Y., Hang, Y. & Wang, Q. Joint or separate? An economic-environmental comparison of energy-consuming and carbon emissions permits trading in China. Energy Econ. 109, 105949. https://doi.org/10.1016/j.eneco.2022.105949 (2022).

Wang, Z. et al. Evolutionary dynamics of the interdependent security games on complex network. Appl. Math. Comput. 399, 126051. https://doi.org/10.1016/j.amc.2021.126051 (2021).

Watts, D. J. & Strogatz, S. H. Collective dynamics of ‘small-world’ networks. Nature 393 (6684), 440–442. https://doi.org/10.1038/30918 (1998).

Weisheng, L. et al. Procurement innovation for public construction projects: A study of agent-construction system and public-private partnership in China. Eng. Constr. Archit. Manag. 20 (6), 543–562. https://doi.org/10.1108/ECAM-09-2011-0084 (2013).

Wu, X. et al. How would co-opetition with dry ports affect seaports’ adaptation to disasters? Transp. Res. Part. - Transp. Environ. 130, 104194. https://doi.org/10.1016/j.trd.2024.104194 (2024).

Yu, X. et al. Will all autonomous cars cooperate? Brands? Strategic interactions under dynamic congestion. Transp. Res. Part. E-Logist Transp. Rev. 166, 102825. https://doi.org/10.1016/j.tre.2022.102825 (2022).

Zhang, M., Nazir, M. S., Farooqi, R. & Ishfaq, M. Moderating role of information asymmetry between cognitive biases and investment decisions: A mediating effect of risk perception. Front. Psychol. 13, 828956. https://doi.org/10.3389/fpsyg.2022.828956 (2022).

Zhao, D., Li, S., Wang, Z. & Peng, H. Cooperation and competition coupled diffusion of multi-feature on multiplex networks and its control. IEEE Trans. Netw. Sci. Eng. 10 (4), 2307–2318. https://doi.org/10.1109/TNSE.2023.3245567 (2023).

Yang, Z. X. The research on existing problems of agent construction system mode in China. 2nd Int. Conf. Inform. Sci. Eng. 3295–3298. https://doi.org/10.1109/ICISE.2010.5691787 (2010). Hangzhou, China.

Yuan, X. Y. Kingdom of Project Management 4.0: Methodology of Greentown Project Management Accessed May 8, 2024. (2020). https://books.google.nl/books?id=fSDBzgEACAAJ

Mo, T. Q. Blue Book on Development of China’s Real Estate Agent-construction Industry Accessed May 8, 2024. (2021). https://books.google.nl/books?id=6c_0zgEACAAJ

People’s Government of Hebei Province. n.d. Notice on Issuing the Management Measures for Government-Invested Projects in Hebei Province. Hebei Province People’s Government Portal Website. Accessed May 26. (2024). https://www.hebei.gov.cn/columns/b1b59c8c-81a3-4cf2-b876-8618919c0049/202308/14/f3fc9252-26cd-4945-b1a9-ac433c38c5a3.html

Bao’an District People’s Government of Shenzhen. n.d. Notice on Issuing the Management Measures for Government-Invested Projects in Bao’an District. Policy Document, Bao’an District People’s Government Portal Website. Accessed May 26. (2024). https://www.baoan.gov.cn/fgj/zwgk/lzyj/zcwj/content/post_10864762.html

Luo, Y. Y., Li, C. J. & Luo, B. Evolutionary mechanism of competition and Cooperation between third-party payment institutions and commercial banks based on a dual-layer network. Chin. J. Manag Sci. 31 (1), 238–247. https://doi.org/10.16381/j.cnki.issn1003-207x.2020.1390 (2023).

Cheng, X. & Cheng, M. An evolutionary game analysis of supervision behavior in public-private partnership projects: insights from prospect theory and mental accounting. Front. Psychol. 13:1023945. https://doi.org/10.3389/fpsyg.2022.1023945

Guo, B., Li, Y. & Wang, X. Steady-state analysis of social responsibility strategy of coal power enterprises from the perspective of game theory. Heliyon https://doi.org/10.1016/j.heliyon.2023.e23124

Acknowledgments

This work was supported by the Hubei Key Laboratory of Construction and Management in Hydropower Engineering (China Three Gorges University) Open Fund (Grant Number 2024KSD07); the Science and Technology Research Project of the Department of Education of Hubei Province (Q20231212); the Philosophy and Social Science Research Projectof the Department of Education of Hubei Province (220030); and the Open Fund of Hubei Key Laboratory of Hydropower Construction and Management (2023KSD29). The authors would like to acknowledge the support of the Discipline Innovation and Talent Introduction Base of Hydraulic Engineering.

Author information

Authors and Affiliations

Contributions

Li conducted model construction and result analysis. Zheng provided constructive suggestions on the topic selection and method selection of the article. Yan drew Figs. 1 and 2. Xue reviewed the draft and made improvements.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, S., Zheng, X., Yan, K. et al. Evolution of coopetition between real estate enterprises and urban investment construction companies under an agent construction system. Sci Rep 15, 9582 (2025). https://doi.org/10.1038/s41598-025-92853-5

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s41598-025-92853-5