Abstract

The European Union Emissions Trading System (EU ETS) is designed to promote cost-effective carbon emission reductions through allowance trading. However, observed trade patterns suggest potential inefficiencies. This study conducts a province-level analysis of the EU ETS trade network of allowances, demonstrating that trades predominantly occur between entities within the same country and sector, even in recent phases of the system. To systematically examine the mesoscale structure of the trade network while accounting for geographical and sectoral homophily, we introduce a community detection framework based on the gravity model and optimal transport theory. By disentangling home and sectoral biases, we identify trade communities that align with cultural dimensions. Our findings reveal a complex interplay between geographical, economic, and cultural factors that shape carbon allowances trade patterns. These findings contribute to a deeper understanding of structural constraints within the EU ETS trade network and inform strategies for improving its cost-effectiveness.

Similar content being viewed by others

Introduction

The European Union Emissions Trading System (EU ETS) was launched in 2005 to promote greenhouse gases (GHG) reduction in line with Kyoto protocols and international targets of carbon abatement1. Liable entities under the EU ETS are required to surrender an amount of allowances covering their emissions produced during the compliance year, with one tonne equivalent of carbon dioxide corresponding to one European Union Allowance (EUA). The cap-and-trade structure of the EU ETS allows firms to trade these EUAs. Accounting for nearly 90% of the global carbon market trading in 20202, the EU ETS represents a prototype for many other ETS developed globally. The EU ETS was originally divided into three different phases with increasing environmental goals: Phase I (2005–2007), Phase II (2008–2012), and Phase III (2013–2020). Currently, Phase IV (2021–2030) is characterized by the decline of the overall amount of emissions at a faster annual rate of 2.2% during the 2021–2023 period, 4.3% from 2024 to 2027, and 4.4% from 2028 to 2030.

In order to be compliant with the regulation, EU ETS entities can either invest in innovative low-carbon technologies that reduce GHG emissions, or purchase the allowances that they need for compliance from the marketplace. Literature suggests that these systems allocate allowances to entities with high abatement costs while abatement activities are instead performed by entities with low abatement costs3,4. From a theoretical perspective, the well-known Hotelling’s model5 provides a framework for studying the economic theory of exhaustible resources. For instance,6 establishes a dynamic optimization model demonstrating that an intertemporal cost-effective market equilibrium exists when entities minimize their costs over time by banking or borrowing allowances. The EU ETS fits this framework because the total amount of EUAs is capped and declines over time, thereby creating value for the EUAs, and trading EUAs can be assumed to provide benefits whenever the relative costs of carbon abatement differ among the entities within the system7,8.

The EUA price represents a reference value to be compared to the marginal abatement cost, with larger differences in the marginal costs across entities implying greater opportunities for gain from trade. Robust EUAs market prices provide therefore a relevant economic rationale and incentive for the promotion of investments in clean and low-carbon intensive technologies and processes9. Hence, a proper market of EUAs is of utmost importance for the functioning of the EU ETS as an efficient and successful framework to reach environmental goals10,11. By comparing the EUA price with their marginal abatement costs, EU ETS entities have thus the possibility of tailoring cost-effective strategies to their own needs. In doing so, their decision process includes a large variety of factors affecting the functioning of the EU ETS, such as policy commitment and technological changes, expectations on energy commodity markets and weather conditions, funding opportunities and taxation issues12,13.

Several trade patterns characterize how EUAs are exchanged. From a theoretical perspective, Authors in14,15 argue that a firm’s level of active engagement in the trade of EUAs should be independent of its initial allocation of allowances. However, varying levels of trading activity have been linked to the allocation procedures across sectors, with firms facing a shortage of allocated allowances tending to trade more actively and in larger volumes16,17,18. For example, entities in the energy sector often receive fewer allocated allowances18,19 and trade more intensively20, while those in carbon leakage sectors (i.e., in businesses at risk of relocating outside Europe) typically receive a greater share of free allocated allowances21,22. Additionally, market frictions can influence trading behavior23. Several studies indicate that high transaction costs contribute to the low trading levels among smaller entities and the much higher involvement of financial institutions16,24,25,26,27. Geographical location and firm size are also significant determinants of trading intensity; for instance, larger and more productive firms, or those based in Nordic countries, tend to be more active in the allowance trade network17. As noted in ref. 28, entities with financial constraints may find it challenging to navigate the EU ETS, resulting in their under-participation in the allowances trade market.

Importantly, information retrieval and search costs have been shown to lead to a strong home-country bias, meaning that EU ETS entities tend to trade more intensively with counterparts established in the same country. This is an odd bias since EUAs are dematerialized contracts with no transportation costs. As found in ref. 29, the home-country bias arises to overcome search costs but it differs across entities, hence marginal abatement costs are not equalized across trading counterparts. The equalization of marginal abatement costs is at the ground level of the cost-effectiveness of the emission trading schemes, especially when compared to command-and-control regulation or carbon taxes. Such a bias might therefore undermine the correct functioning of the EU ETS.

In our research, we employ graph-based methodologies to analyze EUAs trade patterns within the EU ETS network. Our aim is to assess how geographical and sectoral constraints influence the connectivity of the trade network we construct by aggregating data from EU ETS installations located in the same administrative NUTS-3 province. We treat NUTS-3 units as individual nodes linked by connections that represent the volume of transferred EUAs. This approach allows us to examine the trade flows of EUAs among the most detailed administrative units that are comparable across Europe, striking a balance between the granularity of installation-level data and the available socio-economic dimensions at the provincial level. Against this background, we first exploit the gravity model, extensively applied in trade networks30,31,32, to study the role of home and sectoral biases in the formation of trade links. Then, we propose an approach to modeling the network community structure33,34 by incorporating insights derived from gravity estimation into the benchmark model of the modularity function. This allows us to explore the mesoscale structure of the EU ETS network and evaluate how the emerging communities, representing cohesive trade relationships, behave when accounting for domestic and sectoral biases.

There are only a few examples of gravity models applied in emissions trading schemes. Authors in ref. 35 rely on this econometric technique to specifically study the emissions of the aviation sector and the impact of taxation in Austria and Germany, while gravity models are utilized in refs. 36,37 to analyze how carbon leakage differs across sectors and relates to the ratification of the Kyoto Protocol. Additionally,38 utilizes gravity models to explore interactions between climate and trade policies, focusing on the removal of tariffs and non-tariff barriers. In particular, Authors in ref. 29 study EU ETS interlinkages at the firm (buyer)—country (seller) level, where the dependent variable represents allowance trades and data are aggregated to the country-level on the selling side to reduce the computational burden. We opt for a similar representation but fully based on territorial units (around 1.2k) to estimate home and sectoral biases.

Our results highlight that the flows of allowances are strongly characterized by country preferences, a pattern that appears to persist even in more recent years. Hence, the enlargement of the EU ETS to include additional countries and sectors does not diminish the clustering of trades within countries. This preferential behavior remains consistent across various model specifications and is robust to the inclusion of socio-demographic characteristics and environmental factors. Furthermore, we find that, although the distance between NUTS-3 units matters, with more distant units less likely to trade, this effect is blurred when we take into account same country membership. Therefore, two closer units tend to trade more than two distant units, especially if they refer to the same country. To put it differently, two neighboring units situated on the border of two separate countries do not engage in substantially more trades than two units from the same country that are further apart. Furthermore, after having assigned each province with the sector providing the largest aggregate emissions on the territory, we find that sectoral affiliation plays a crucial role in shaping trade linkages. As a result of that, beside the presence of the home bias, our analysis reveals evidences of a sectoral bias. Indeed, NUTS-3 provinces with a certain dominant sector covered by EU ETS regulations tend to engage in more intensive trading with other provinces specializing in the same sector. Once combined, home and sectoral biases strongly support the idea that EU ETS entities prefer to trade allowances with others that are closer, both geographically and technologically. These results spotlight the emergence of homophily patterns in the EU ETS trade network, with NUTS-3 provinces belonging to the same country and with similar production activities that are more likely to attach to each other than dissimilar ones.

We then employ optimal transport (OT) theory39,40,41 to develop an advanced null model for the study of the mesoscale structure of the EU ETS trade network. A null model in network analysis represents the expected structure under certain constraints but without any organizing principles beyond those constraints. The OT framework can effectively model the flow of allowances while taking into account the biases and patterns identified by the gravity model as additional constraints in the maximization of the modularity. In our case, this creates a null model that respects both the strength constraints of each node, as in standard modularity function, and the trade preferences identified by the gravity model. Specifically, the OT approach enables us to determine the most efficient way to transport the probability mass of the in-strength distribution to align with the out-strength distribution, subject to the “costs” (or “constraints”) derived from the gravity model estimates.

Carbon allowances are intangible instruments without physical transportation costs. The concept of cost in the OT model is used to represent the statistical likelihood or ease of trading between different nodes. It serves therefore as a conceptual tool to incorporate observed trade biases into the optimization problem. For instance, if the gravity model indicates that provinces in different countries are less likely to trade with each other, this is represented as a higher cost in the OT model. Conversely, if provinces with the same dominant sector are more likely to trade, this is represented as a lower cost. In neither case do these OT costs correspond to monetary flows; rather, they represent additional constraints within the OT-based null model. By adding these additional constraints in the modularity maximization problem, the OT framework can effectively model the flow of allowances while taking into account the biases and patterns identified by the gravity model. The aim of this approach is to identify community structures in the EU ETS trade network that persist even after accounting for the country and sector trade patterns identified through the gravity estimation. To achieve this, we introduce the proposed OT null model, which is integrated into the modularity function and incorporates spatial and sectoral biases recognized for their critical impact on EU ETS trade linkages. Our null model is based on OT theory and leverages estimates derived from the gravity model to introduce additional constraints beyond those of the standard Newman-Girvan approach33,42. Indeed, when examining the mesoscale structure of the EU ETS trade network, where geographical distances and sectoral affiliation heavily influence link distribution among nodes, OT provides a suitable technique for developing a null model that effectively addresses these trade patterns. We refer to our proposed approach as the OT-gravity modularity.

To explore the extent to which the community structure can be attributed to residual sources of heterogeneity beyond home and sector biases, we examine the potential relationships between cultural dimensions and the mesoscale structure of the EU ETS trade network. By factoring out the effects of home and sectoral biases, we reveal a clearly defined structural organization of the EU ETS trade network. The emerging functional relationships between nodes are shown to correlate with cultural dimensions43. A consistent pattern emerges across cultural dimensions: within-community cultural distances are generally lower than between-community distances. This suggests that provinces within the same trade community tend to share more similar cultural values. These findings indicate that cultural similarities play an important role in shaping the community structure, with provinces that share similar cultural values being more likely to form cohesive trade relationships. While trade flows may be affected by various biases, the formation of communities also reflects cultural outcomes, suggesting that persistent trade relationships of regulated entities arise from a combination of geographical, business, and cultural proximity.

Results

EU ETS trade network: gravity model estimation

We represent the EU ETS as a graph G = (V, E), where V is the set of NUTS-3 provinces (nodes) with size ∣V∣ = N and E is the set of all connections among them (edges) with size ∣E∣ = L. Links are weighted by EUAs trade flows between NUTS-3 provinces. The resulting network is a directed graph, where a link e is oriented and weighted, connecting a source node i (exporter) with a destination node j (importer). The graph G is then represented by the binary, \(A\equiv {({a}_{i,j})}_{1\le i,j\le N}\), and weighted, \(W\equiv {({w}_{i,j})}_{1\le i,j\le N}\), adjacency matrices, where ai,j = 1(ai,j = 0) indicates the presence (absence) of an edge between nodes i and j, while wi,j represents its value (i.e., the amount of EUAs traded from node i to node j). It is worth noting that generally ai,j ≠ aj,i as the network is directed and wi,j ≠ wj,i. Moreover, for the reader’s convenience, we remind the concept of out- and in-strength used in next sections. The out-strength of node i is defined as \({s}_{i}^{out}={\sum }_{j}{w}_{i,j}\), while the in-strength of i is computed as \({s}_{i}^{in}={\sum }_{j}{w}_{j,i}\), representing the total amount of transferred and acquired EUAs by node i, respectively. The total amount of traded EUAs in our system is given by wtot = ∑i,jwi,j.

We provide a visual inspection of the aggregate EU ETS trade network over the entire sample period 2005-2020 in Fig. 1, where each node represents a NUTS-3 province and links are colored in red or black depending on whether they refer to intra-country or inter-country flows, respectively. Intra-country flows are very dense compared to inter-country ones, supporting the fact that EU ETS regulated entities typically tend to trade with counterparts in the same country. Remarkably, intra-country flows map very well on the administrative borders of the countries. For instance, Italy, Spain or France can be almost perfectly depicted by these flows. We also observe that the United Kingdom, Germany and the Benelux are very inter-connected, while more peripheral geographical areas are less likely to connect to outside country provinces. This pattern can be ascribed to business and trade relationships, which seem to influence also the way EUAs are exchanged29.

The figure shows the aggregate EU ETS network over the entire sample. Nodes represent NUTS-3 provinces and links are the amounts of allowances exchanged between couple of nodes. Nodes' size is proportional to the in-strength while nodes' color (from dark to brighter blue) is proportional to the out-strength. Links in red color identify intra-country flows, while the black color is used for inter-country flows.

To offer insights into how home and sectoral biases affect the formation of trade links within the EU ETS, we incorporate these features into augmented gravity models. We consider a standard gravity model that accounts for the geographical distance between two units alongside three proxies for their size that are homogeneously available in the EU at this scale of resolution (namely, the GDP, area and population). The first objective of our investigation is to empirically evaluate the hypothesis that geographical proximity between provinces is positively correlated with a higher amount of allowance trades, after accounting for the confounding effect of the size of the provinces. It is plausible that larger provinces with more robust economic activities have in fact a greater number of carbon-emitting installations. Consequently, in order to be compliant with the EU ETS regulatory framework, these provinces might exhibit a heightened propensity to engage in allowances trade operations. Additionally, we include the verified emissions and allocated allowances for each territory to take into account environmental performances that may influence trading patterns. To do so, we aggregate the compliance information of the installations in our sample at NUTS-3 level. For instance, provinces with higher emissions might be more active in trading permits to fulfill surrendering requirements.

Then, we introduce a country dummy variable, which takes the value of one if both NUTS-3 provinces in the trade are located in the same country, and zero otherwise. Similarly, we add a sector dummy variable, set to one if the origin and destination provinces share the same dominant economic sector, based on the aggregate emissions of the installations for each sector in a province and year, and zero otherwise. These two variables help us investigate whether provinces within the same country or those involved in similar business activities exhibit any trade preferences. The general formulation reads as:

where wi,j, with i, j = 1, …, N, is the N2-dimensional vector of bilateral EUAs flows and β and ζ are unknown coefficients to be estimated. The variable GDP represents the province gross-domestic product (in million Euro), DIST is the geodesic distance between two NUTS-3 provinces, calculated with the Haversine formula (in km). AREA and POP stand for the area (in km2) of each province and its population, respectively. Variables EMIS and ALLOC represent the amount of emissions and allocated allowances referring to the installations located in a certain province. Finally, variables C and S represent country and sector dummies taking value 1 if i, j provinces share the same country or dominant sector, respectively. We estimate Equation (1) separately for each year, employing the Poisson Pseudo-Maximum Likelihood (PPML) method44 as detailed in Section 4 Material and Methods.

Sections “Robustness analyses: Adding voluntary opened accounts”, “Robustness analyses: Adding Country and Sector controls in the gravity model” and “Robustness analyses: Panel data framework” will present several robustness analyses, leveraging the panel dimension of the data and expanding the coverage of the accounts typically involved in allowance trades. Additional gravity model estimates are also included in the Supplementary Information, Sections 1.1–1.8. We confirm that the results of the year-by-year gravity model estimation, particularly the meaningful of home and sector biases, remain robust when analyzed using a panel model with high-dimensional fixed effects. By incorporating origin and destination fixed effects in the panel approach, we effectively control for unobserved heterogeneity at the NUTS-3 level, addressing concerns about potential omitted variable bias that may arise from relying solely on GDP, area, and other macroeconomic variables as controls. These robustness analyses provide additional evidence supporting the validity of our main findings discussed in this Section.

Figure 2 presents the deviance (on the y-axis) from 2005 to 2020 of nested gravity models. Vertical dashed lines mark distinct time intervals corresponding to the Phase I, Phase II, and Phase III. The different colored lines indicate progressively more complex model specifications, with each line showing the deviance of the model as additional variables are introduced. The Basic model, which contains only the distance, the area, the population and the GDP (dark blue line), shows the highest deviance across the entire period, indicating that it provides the poorest fit to the data. The inclusion of the allocations (cyan), emissions (red), the country dummy (brown), and the sector dummy (light blue) all progressively lower the deviance, providing an increasingly accurate fitting of the data. All models follow a similar pattern over time with a sharp increase during Phase II, followed by a steady decline through Phase III. The model with the lowest deviance throughout the sample period is the complete one of Equation (1), which suggests that the inclusion of country and sectoral dummies, along with the other controls, leads to a better fit compared to simpler models.

The plot illustrates the behavior of the deviance associated with different gravity models. Deviance refers to a measure of goodness-of-fit for statistical models. It is defined as twice the difference between the log-likelihood of the fitted model and that of a saturated model (a model that perfectly fits the data). Lower deviance values indicate a better fit to the observed data, as they imply that the fitted model closely approximates the saturated model. Deviance is particularly useful for comparing nested models, where the inclusion of additional explanatory variables is expected to reduce the deviance if they improve the model fit. The colored lines represent different model specifications, where each subsequent model includes one additional explanatory variable: Basic (dark blue), with only distance, area, population and gdp; Basic plus Allocation (cyan); Basic plus Allocation and Emission (red), Basic plus Allocation, Emission and Country dummy (brown); Basic plus Allocation, Emission, Country and Sector dummies (light blue). The complete model consistently shows the lowest deviance, indicating the best fit, while the Basic model exhibits the highest deviance, suggesting the least explanatory power. Vertical dashed lines indicate Phases I, II, and III.

Table S1 of the Supplementary Information shows the estimated coefficients and their standard errors (in parentheses) for the gravity model of Equation (1) for each year, over the period 2005-2020 (further details are reported in the Supplementary Information, Section 1.1). We observe that provinces that are more distant typically engage in fewer trades, particularly during Phases I and II of the EU ETS. This aligns with the low attitude of EU ETS-regulated entities to trade allowances in the early stages of the program, largely due to a lack of understanding of its functioning, as noted in early survey-based studies (see, e.g., refs. 45,46). For instance, most EU ETS-regulated entities were either not operating or operating minimally in the trade system during Phase I47 and Phase II24, while non-regulated entities were instead much more active.

Moreover, as expected, larger provinces tend to trade more allowances, and territories with stronger economic output (with potentially also higher emissions) are more actively engaged in trading. These relationships seem more pronounced for the characteristics of the destination node, possibly reflecting stricter compliance requirements. Interestingly, the role of the allocated allowances practically declined to zero after 2013, coherently with the reduced share of free allocations in Phase III. During this phase, sectors at risk of carbon leakage continue to receive a full free allocation based on the most efficient benchmark, while for other sectors, the percentage of free allowances declined from 80% in 2013 to 30% by 202048. In contrast, power generators have been required to purchase all of their allowances since Phase III. Firms receiving few free allowances may have a stronger need for additional permits from the market to meet compliance obligations. For instance,17 find that firms whose verified emissions exceed their free allocations in a given year are more likely to trade allowances, and when they do operate in the market of carbon allowances, they tend to trade in higher volumes than firms with a surplus of allowances.

Importantly, our estimates for the country dummy variable C are consistently positive, indicating that EU ETS regulated entities are more likely to trade with counterparts within the same country. Moreover, this relationship is both economically and statistically significant, with the coefficient values ranging between about 2 and 4.5, and p-values always below 0.001 (below 0.01 in 2005). Furthermore, the sector dummy variable S is also statistically significant and positive across all years, indicating that trades are more frequent between entities located in NUTS-3 provinces that share similar business activities. Although this coefficient is smaller than that of the country dummy C, it is not negligible, exhibiting a magnitude in absolute value comparable to the Distance variable. Authors in ref. 29 provide strong evidence for a home (country) bias in allowance transactions, noting that this bias varies across industries. By adopting a different layer of analysis (NUTS-3 provinces vs. firms) and extending the time period (2005–2020 vs. 2005–2013), we also find that EU ETS entities prefer to trade with counterparts in the same business context, as indicated by the positive and significant coefficients of the Country and Sector dummy variables.

Gravity model: replication of key trade patterns in the EU ETS network

To demonstrate that the estimated gravity model accurately replicates empirical patterns present in the data, we provide in Fig. 3 a comparative analysis between the observed real-world network and the fitted network derived from the gravity model estimation. This comparison concentrates on two crucial aspects: i) the proportion of trades occurring within the same country, sector or the combination of country-sector in each year, and ii) the average proportion (in logarithm) of traded allowances for border NUTS-3 provinces for each country, distinguishing their trades with counterparts within the same country from trades across national boundaries.

The upper panels report the percentage proportion of link weights for the real network (A) and for the fitted network obtained from the gravity model (B). Dark blue bars refer to links within the same country, while bright blue bars represent links between nodes belonging to the same dominant sector and red bars associate links between nodes belonging to the same country-sector. C reports the log-average of the links weights for NUTS-3 provinces in the real network at the border of each country by distinguishing among trades executed with NUTS-3 provinces in the same country (dark blue) and in different countries (light blue). D shows the same measure but for the fitted network. We do not consider as border provinces those defined based on borders with the sea. For similar reasons, we exclude island countries (Cyprus, Iceland, Malta and the United Kingdom).

Both comparisons highlight the considerably proportion of within-country and sector trades present in both the real and fitted networks. Specifically, the upper panels of Fig. 3 illustrate that links within the same country (shown by dark blue bars) dominate the structure of the EU ETS trade network. In both the real and fitted networks, the proportion of within-country links exceeds 80%. This trend reflects a strong preference for trade within national boundaries, indicating that connections are more intense domestically. Although the proportions in the fitted network for both the sector and country-sector trades are lower than those in the real network, we still confirm the relative proportions. The lower panels further characterize the country bias by showing the log average weights of inside versus outside country trades for border NUTS-3 provinces in each country. In both the real and fitted networks, we consistently observe higher weights for inside-country trades (dark blue bars) compared to outside-country trades (light blue bars) across most of the countries. This stark difference highlights the substantial influence of national borders on trade intensity. A Kolmogorov-Smirnov test supports this finding on the real data, rejecting the null hypothesis that trades executed by border NUTS-3 provinces within the same country and across different countries come from the same continuous distribution (p-value 0.0015). The gravity model effectively replicates this key feature, with the Kolmogorov-Smirnov test on the fitted series yielding a p-value of 0.0138.

To further corroborate these findings, Fig. 4 illustrates the sum of link weights between NUTS-3 provinces across various distance ranges, distinguishing the trades between nodes within the same country (in blue) from those across different countries (in orange). This comparison is presented for both the real network data and the fitted network based on the gravity model. Such exploratory analysis clearly demonstrates a consistent disparity between the volume of traded allowances within national borders and those exchanged across countries. Notably, for the closest distance range (Distance < 25th percentile), the sum of link weights for provinces within the same country notably higher than that for provinces in different countries. This pattern is evident in both the real network and the gravity-fitted network, reversing for longer distances. Importantly, the differences in link weights between same-country and different-country nodes in the gravity-fitted network closely align with the patterns observed in the real network data.

The figure shows the sum of the link weights between NUTS-3 nodes belonging or not to the same country (Same Country vs. Diff. Country) when the distance between nodes increases (distances belonging to the first, second, third and fourth quartile are reported in (A, B, C and D), respectively). These measures are computed for both the real network (Real) and for the fitted network derived from gravity estimates (Fitted).

Overall, these results highlight the effectiveness of the gravity model in capturing also specific spatial and country-level dependencies that influence the structure of the EU ETS trade network of regulated entities.

EU ETS mesoscale community structure

To gain a deeper understanding of the structural configuration of the EU ETS trade network, we examine its mesoscale properties by employing a modularity-based community detection approach. This allows us to uncover the presence of densely connected groups of provinces (i.e., the communities) within the broader network that form cohesive trade relationships.

Traditional modularity-based community detection methods, such as the Newman-Girvan approach34,49,50, rely on null models that are based on the information embedded in the adjacency matrix of the network (see Section 4 Material and Methods). These null models are suitable when no additional information about the nodes is available. However, their effectiveness diminishes when additional constraints need to be incorporated into the null model51. In the context of the EU ETS trade network, accounting for the trade patterns identified by the gravity model analysis appears crucial for constructing a more realistic null model. In particular, the gravity model reveals that factors such as country and sectoral common memberships greatly influence the trade patterns observed in the network. Ignoring these aspects would lead to an oversimplified null model that fails to capture the nuances of the actual trade relationships.

To address this challenge, we employ the OT framework to construct a null model that integrates the insights from the gravity model estimation. The OT approach provides a convenient way to find the joint distribution between the total incoming and outgoing trade flows that minimizes the costs of statistically transferring a unit mass from one variable to the other. In our OT framework such costs do not constitutes a monetary flow. Rather, they refer to additional constraints in the modularity maximization problem. By framing the null model construction as an OT optimization problem, we can capture the interaction between the identified bias factors (such as country and sectoral common membership) and the constraints on the nodes’ strengths considered in standard approaches such as the Newman-Girvan model (i.e., the incoming and outgoing trade flows). The key advantage of the OT-based null model is that it offers a realistic benchmark for evaluating the mesoscale community structure of the EU ETS trade network. By comparing the real network to this null model, we can in fact uncover community partitions that remain persist even after considering the identified biases and constraints from the gravity model estimation. Hence, this approach provides a deeper understanding of the network’s configuration, potentially highlighting additional factors that influence trade relationships beyond merely geographical and sectoral common membership. For example, the OT-based community detection may uncover groups of nodes-provinces that trade more intensively with each other than would be expected based solely on their spatial or sectoral proximity. These communities may be driven, for instance, by additional environmental, institutional, policy, or economic factors that are not included in the gravity model.

Identifying community structures within the EU ETS trade network offers valuable insights into its underlying drivers and can inform policy decisions aimed at enhancing its efficiency and resilience. While the gravity model effectively highlights and quantifies some interesting biases in the trade patterns, the OT-based null model enables community detection while controlling for these identified biases. This approach uncovers connectivity patterns that extend beyond the features considered in the gravity model, revealing additional structural factors characterizing trading behaviors. Formally, we first define the in-strength distribution across the N nodes as \(\mu : \!={\sum }_{i=1}^{N}{\mu }_{i}{\delta }_{i}\), and the out-strength distribution as \(\nu : \!=\mathop{\sum }_{i=1}^{N}{\nu }_{i}{\delta }_{i}\). The variable δi represents a generic Dirac measure at i. Such distributions are fully characterized by the probability mass vectors on the simplex Σ, namely μ ∈ ΣN and ν ∈ ΣN, where \({\mu }_{i}={s}_{i}^{in}/{\sum }_{i} \, {s}_{i}^{in}\) and \({\nu }_{i}={s}_{i}^{out}/{\sum }_{i} \, {s}_{i}^{out}\). We then denote the distance between μ and ν as:

The cost matrix \(\Xi \in {{\mathbb{R}}}^{N\times N}\) specifies the transportation cost ξi,j between pairs i, j. To incorporate economic information into the modularity function we choose \({\xi }_{i,j}: \!=1/{\hat{w}}_{i,j}\) so to have a high probability of observing a link with high weight between i and j if the estimate \({\hat{w}}_{i,j}\) is high. The parameter γ > 0 serves for regularization and \(E({p}_{i,j})={p}_{i,j}\log ({p}_{i,j})\) is the negative entropy. The OT plan P ∈ Π(μ, ν) with elements pi,j thus determines the coupling between the in- and out-strength distributions on space \(\left\{1,\ldots,N\right\}\times \left\{1,\ldots,N\right\}\), namely the joint distribution which satisfies the OT principle and defines the null model for the modularity function (see Section 4 Material and Methods for details on the solution procedure). The modularity function accordingly reads as:

where d(ci, cj) stands for the Kronecker delta equal to 1 if nodes i and j belong to the same community (ci ≡ cj), and zero otherwise. In this formulation, pi,j represents the probability to observe a link between nodes i and j given some specific attributes, i.e., the constraints derived from the solution of Eq. (2).

Comparative assessment of community distributions and temporal stability

Figure 5 presents the distribution of the nodes across the identified communities using violin plots, where the violin shape illustrates the community distributions. The figure consists of four subplots, corresponding to partitions obtained from the Newman-Girvan model (panel A) and the OT-gravity method for various values of the parameter γ (panels B, C and D). It is worth noting that the parameter γ regulates the weighting attributed to the cost matrix within the Gibbs kernel. A higher value of this parameter produces a more uniform Gibbs kernel, thereby reducing the relevance of the cost matrix and, consequently, of the gravity model in the minimization of Equation (2). The y-axis denotes the number of communities, while the width of each violin is proportional to the number of nodes within each community, providing an intuitive visualization of the community structure. A narrow and elongated violin suggests a higher number of communities, each containing a small number of units. Conversely, wider and shorter violins indicate the presence of fewer communities comprising a larger number of units.

The figure illustrates the annual community distribution using a violin plot. A corresponds to the Newman-Girvan modularity (Standard Modularity), while subsequent rows depict outcomes for the OT-gravity modularity at various entropy parameter values γ (B, C and D). The y-axis indicates the number of communities for each year, with the violin shape portraying the community distributions. A stretched, narrow violin suggests many communities, each with few units. In contrast, wider, shorter violins indicate fewer communities with more units in each.

We note that the Newman-Girvan modularity method typically results in a higher number of communities compared to our OT-gravity approach across various configurations. This trend is particularly pronounced when the entropy parameter is low, suggesting a stronger influence of the gravity estimates in the null model. Specifically, while the Newman-Girvan framework allows for a maximum of 100 communities, the OT-gravity method limits the maximum to 15 when the parameter γ = 0.001. This indicates that the OT-gravity approach is more selective in identifying meaningful community structures, potentially providing a clearer picture of the underlying trade dynamics. Additionally, we observe that for both the Newman-Girvan and the OT-gravity approaches, a few communities tend to encompass the majority of nodes, while most partitions consist of smaller sizes. In Fig. S37 of the Supplementary Information, we present the modularity values obtained from both the Newman-Girvan and our OT-gravity approach. As expected, while the optimal modularity value for our OT-gravity approach is high, it remains lower than that provided by the Newman-Girvan method. This is not surprising in this case, as a lower modularity value indicates that the null model is closer to the real structure of the data51, which is indeed the case for the OT-gravity approach.

To compare the communities generated by different methods and evaluate their relationship with home and sector biases, we draw on concepts from Information Theory. Specifically, we utilize the normalized mutual information, which measures how much two partitions align with each other by quantifying the degree to which two different classifications capture the same underlying patterns (see Section 4 Material and Methods for a formal definition). We compute this metric between the communities obtained through modularity maximization methods (Newman-Girvan and OT-gravity) and the partitions based simply on the countries or sectors to which the nodes belong to. Figure 6 shows the resulting normalized mutual information over time, when we discriminate by countries (panel A) or sectors (panel B). We find that the the partitions obtained applying the Newman-Girvan approach reflects country and sectoral membership, while instead our proposed OT-gravity approach lowers these features substantially. Once we account for the country and sectoral features through the OT-gravity approach, the emerging communities show therefore less overlap with these characteristics compared to the standard modularity method.

The figure illustrates the behavior of the normalized mutual information between communities obtained with modularity maximization methods and partitions resulting from the countries or sectors to which nodes belong to. A compares the communities with partitions using country as discriminatory variable. B instead compares the communities with the sector. The legend associates colors with their corresponding models.

Moreover, to assess the degree of overlap between the communities generated by our OT-gravity, which considers home and sectoral biases, and those produced by the Newman-Girvan model, which only constraints for the in- and out-strength, we report in Fig. S38 of the Supplementary Information the behavior of the normalized mutual information between communities obtained with the standard Newman-Girvan modularity maximization method versus those resulting from our OT-gravity approach. Results indicate a mild overlap, which decreases substantially for lower values of the entropy parameter γ. Hence, when we assign more importance to the constraints imposed by the gravity model, the communities that emerge from the OT-gravity approach reflect less country-sectoral features and differ more from those obtained from the standard Newman-Girvan modularity method.

OT-gravity communities are formed by ties that go beyond those captured by simple country-sector membership, thus embedding additional, non-trivial, information regarding the way nodes typically transfer carbon allowances and engage in persistent trade relationships. We test the persistence of such ties in Fig. 7, focusing on the community size (light blue), the stability of the community membership between two consecutive years (dark blue) and the stability with respect to the communities obtained pooling all the trades in a single aggregated network for the entire period (red). The four largest communities in each year (measured by Community Size) consistently encompass at least half of the nodes, with this proportion being higher in Phase I. Notably, the Jaccard Index, which measures stability between consecutive years, is correlated with the community size and indicates that larger communities tend to be very stable, with at least two-thirds of the nodes overlapping in consecutive years. Furthermore, when comparing the evolution of the communities over time to those derived from the aggregate network, we still find that a substantial proportion of nodes persist in these communities. This suggests that these ties generating communities exhibit stability over time, indicating the presence of some structural features that influence how nodes select counterparts for trading operations.

The figure reports the percentage of nodes included in the largest four communities over time and their stability in terms of the Jaccard score index of community membership computed either over two consecutive years or with respect to the communities obtained using the aggregate network. The light blue line represents the number of nodes inside the largest four communities, the dark blue line shows the relative stability of the community members along consecutive years, while the red line is the stability of the community members with respect to the aggregate network.

EU ETS communities and the role of cultural distance

Since OT-gravity communities are shaped by ties that extend beyond mere country-sector membership, thereby capturing additional information, our focus now shifts to elucidating other possible factors influencing the mesoscale structure of the EU ETS trade network. To explore the degree to which the community structure, as derived from the OT-gravity approach, can be attributed to residual sources of heterogeneity beyond home and sector biases, we investigate the potential relationships between some cultural dimensions and the OT-gravity communities. Cultural dimensions have been widely studied to explain trade patterns (see e.g., refs. 52,53,54), playing a role in gravity models that highlight cultural proximity55. For instance, cultural distance has been shown to influence international acquisitions56, inward investment57, compensation structures58, trade disputes59, both indirectly through transaction costs and more directly, as countries seem to prefer some trade partners than others60.

To explain bilateral trade patterns, the role of intangible barriers, such as incomplete information, institutional challenges, and cultural differences, has been related to various forms of search and information costs61,62,63,64,65. Existing literature on the EU ETS has already highlighted how search and information costs influence carbon trading relationships16,27,29,66. In this section, we adopt a cultural perspective to further examine these trade patterns, as it offers valuable insights for evaluating the effectiveness of a policy like the EU ETS designed to operate at the European level. If such cultural preferences exist within the EU ETS trade network, it indicates that communities not only reflect country-sectoral preferences but also embody cultural dimensions. This represents an intriguing angle for explaining why specific trade patterns emerge within the EU ETS trade network.

Hofstede’s43 seminal work on cultural dimensions provides a valuable framework for understanding how national cultures differ and affect economic behavior, particularly in business and organizational contexts. The original four dimensions introduced in 1980 were: Power Distance Index (PDI), Individualism vs. Collectivism (IDV), Masculinity vs. Femininity (MAS), and the Uncertainty Avoidance Index (UAI). PDI measures the extent to which less powerful members of a society accept and expect that power is distributed unequally. High PDI cultures have more rigid hierarchical structures, while low PDI cultures tend to be more egalitarian. IDV explores the degree to which people in a society are integrated into groups. Individualistic cultures emphasize personal achievements, while collectivist cultures prioritize group harmony and loyalty. MAS refers to the distribution of values between genders. “Masculine” cultures value competitiveness and material success, while “feminine” cultures place more emphasis on relationships and quality of life. UAI measures a society’s tolerance for ambiguity and uncertainty. High UAI cultures have rigid codes of belief and behavior, while low UAI cultures are more accepting of differing ideas. Hofstede later expanded the model to include two additional dimensions. Long-Term Versus Short-Term Orientation (LTO/LTOWVS) looks at a society’s time orientation, with long-term focused cultures emphasizing future-oriented values versus short-term focused cultures that are more rooted in the present or past. Indulgence Versus Restraint (IVR) measures the degree to which a society allows relatively free gratification of basic and natural human desires related to enjoying life and having fun. Together, these six cultural dimensions provide a powerful tool for understanding differences in cultural values, beliefs, and behaviors across countries.

Since the EU ETS network data covers multiple years, we aggregate the temporal subnetworks into a single network that represents the total interactions from 2005 to 2020. We then perform community detection on this aggregated network. This aligns with the Hofstede’s cultural dimensions, which tend to show minimal year-to-year variation. For example, research has shown that the effects of cultural distance on firms’ internationalization are more influenced by the home country of the company rather than by time67. The stability observed in Fig. 7 supports the validity of this approach.

To quantify the relationship between cultural dimensions and the community structure, we impute the Hofstede’s cultural dimension values, originally reported at the country level, to the NUTS-3 provincial level by assigning identical values to all provinces within the same country. Subsequently, we compute pairwise cultural distances between NUTS-3 provinces i, j for each dimension d as: \(C{D}_{i,j}^{d}={({I}_{i,d}-{I}_{j,d})}^{2}.\)

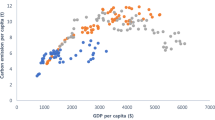

Then, we aggregate these pairwise distances to the communities resulting from the OT-gravity approach, enabling a comprehensive analysis of both within-community and between-community cultural distances. Figure 8 presents a comprehensive analysis of such cultural distances within and between communities in the EU ETS aggregate network, based on the Hofstede’s six cultural dimensions. Each subplot represents a different cultural dimension.

Blue bars represent within-community distances, while orange bars show between-community distances. The Power Distance Index (PDI) dimension is reported in (A), Individualism vs. Collectivism (IDV) in (B), Masculinity vs. Femininity (MAS) in (C), and the Uncertainty Avoidance Index (UAI) in (D). E shows the Long-Term Versus Short-Term Orientation (LTO/LTOWVS) while Indulgence Versus Restraint (IVR) is shown in (F). The generally lower within-community distances across dimensions indicate that cultural similarities play a role in shaping the network’s community structure.

Across all dimensions, a consistent pattern emerges where the within-community cultural distances (blue bars) are generally lower than the between-community distances (orange bars). This trend suggests that provinces within the same community tend to share more similar cultural values, supporting the hypothesis that cultural factors play a role in shaping the EU ETS mesoscale structure. In particular, PDI (panel A) shows a pronounced difference of the within and between-community distances, indicating that hierarchical structures and power distribution expectations are more homogeneous within communities. The IDV dimension (panel B) also displays notable differences, suggesting that communities tend to group provinces with similar societal integration levels. The MAS dimension (panel C) exhibits less stark contrasts for the within- and between-community distances, implying that gender-related values might have a more nuanced influence on community formation. The UAI dimension (panel D) shows marked differences especially across some communities, pointing to the importance of risk and ambiguity tolerance in certain network partitions. Finally, LTOWVS and IVR dimensions (panels E and F) also contribute to the overall pattern, albeit with some communities showing less pronounced differences. This could indicate that time orientation and societal permissiveness play varying roles in different parts of the EU ETS network.

We then explore the community behavior with respect to an aggregate of cultural distances by taking a weighted average of the previous dimensions as in ref. 68. In particular, the average cultural distance between NUTS-3 provinces is computed as:

where Vd is the variance of the index of the d-th dimension. In this exercise, we have employed two sets of cultural aggregate dimensions. In the first case, we have employed the original four dimensions introduced in 1980 by Hofstede. In the second case, we have employed all the six dimensions. Overall, results shown in Fig. S39 of Supplementary Information strongly suggest that cultural similarities contribute to the community structure observed in the EU ETS trade network, with provinces sharing similar cultural values more likely to form cohesive communities.

To further investigate the role of the cultural distance in shaping the EU ETS trade network, we embed this cultural factor into the gravity equation and we re-estimate the model. By incorporating cultural distance, calculated using Eq. (4), as an additional explanatory variable in the gravity model, we aim to evaluate whether the estimates remain meaningful and statistically significant. We also seek to determine if accounting for cultural factors enhances the model’s overall performance in predicting allowances trade patterns. If the augmented model demonstrates superior performance and the cultural distance term results statistically significant, this would provide further evidence that cultural factors influence the structure of the EU ETS trade network.

Figure 9 illustrates the logarithm of the difference of the deviances of the gravity model when cultural factors are either excluded or included. The blue line in the figure represents the difference in the deviances between the two nested models, while the dashed red lines stand for the 95% confidence intervals. The positive values within these confidence intervals reported in Fig. 9 indicate that the gravity model augmented with cultural distances provides a better fit to the data compared to the model that excludes these factors.

The figure reports the logarithm of the difference in the deviance of the gravity model when cultural factor are excluded or included. The blue line represent the difference in the deviances of the nested models while confidence intervals at 95% are represented by dashed red line. The statistically significant positive values suggest that the inclusion in the gravity model of the cultural distances as an additional regressor produces a better fitting of the data.

Finally, Fig. 10 presents the dynamics of the regression coefficients for the four crucial variables in our framework, namely the distance, the country and sector dummies and the cultural distance. Panel A shows that the coefficient for distance remains negative throughout the period. Panel B presents the coefficient for the country dummy variable, which is consistently positive, while the coefficient for the sector dummy variable in Panel C is also positive but of lower magnitude. These estimates align closely with those discussed in “EU ETS trade network: Gravity model estimation”. Panel D displays the coefficient for cultural distance. The relationship between traded allowances and cultural distance is generally negative, particularly in the first two phases of the EU ETS. This indicates that more culturally similar NUTS-3 provinces tend to engage in more trades than dissimilar ones. Notably, the magnitude of the coefficient for cultural distance is generally smaller compared to the other variables, suggesting that while cultural distance does influence trade patterns, its impact may be less pronounced than factors such as geographical distance or belonging to the same country or sector. Overall, these findings highlight that geographical, business, and cultural proximity facilitate increased trading activity within the EU ETS. For instance,69 find that the moderating effects of geographic and cultural distances interact with technology distance in the trade of environmental goods, ultimately influencing trade patterns.

Robustness analyses: adding voluntary opened accounts

Installations are required by the EU ETS regulations to open Operator Holding Accounts (OHAs), and previously Former Operator Holding Accounts (FOHAs), to monitor their carbon emissions surrendering requirements and manage their trading of allowances. Our analysis primarily focuses on trades between these mandatory accounts of regulated entities. However, in addition to OHAs and FOHAs, voluntary accounts can be opened to facilitate trading activities. During the period under analysis, these include Personal Holding Accounts (PHAs) and Trading Accounts (TAs). According to Article 39.3 of Registry Regulation No. 389/2013, trades involving PHAs are subject to a 26-h delay. TAs, introduced in 2013, allow real-time trading of allowances with accounts on their Trusted Account List (TAL), while the 26-h delay applies when trading with accounts outside their TAL. Both PHAs and TAs can be held by liable entities under the EU ETS to support the compliance needs of their installations. Alternatively, these accounts can be opened by non-liable entities such as financial intermediaries, brokerage firms, non-governmental organizations, or private individuals. As of January 2021, existing PHAs have been converted into TAs.

Each installation typically corresponds to an OHA or FOHA responsible for conducting its allowance trades. In the main analysis, the assignment of NUTS-3 locations to OHAs and FOHAs is based on the location of their respective installations. However, for voluntarily opened accounts, this direct matching is more complex, as a single PHA or TA may manage allowances for multiple installations, located in different NUTS-3 provinces but belonging to the same firm.

Fortunately, the EUTL provides information on the account holders, which are the entities responsible for managing both mandatory and voluntary opened accounts. We leverage this information to assign PHAs and TAs to NUTS-3 provinces. First, since our focus is on the relationship between trade networks and environmental factors within the functioning of the EU ETS policy, we only consider PHAs and TAs linked to account holders that also manage OHAs or FOHAs. This allows us to exclude voluntary opened accounts managed by entities outside the scope of the EU ETS. Additionally, since multiple OHAs and FOHAs, potentially referring to installations located in different NUTS-3 provinces, may belong to the same account holder managing PHAs and/or TAs, we implement three distinct criteria for assigning PHAs and TAs to NUTS-3 provinces.

Voluntarily opened accounts are usually employed to manage the net positions of several installations referring to the same firm. The first criterion assigns PHAs and TAs of a certain account holder to the location of its installation with the highest average verified emissions during the sample period. The rationale for this criterion is based on the assumption that PHAs and TAs are likely located near the installation with the largest surrendering obligations, as this installation could be more actively engaged in allowance trading to meet compliance needs. Similarly, in the second criterion, instead of considering verified emissions, we base the assignment on the average amount of allocated allowances. This approach is particularly relevant due to the large portion of allowances that were freely allocated in the earlier phases of the EU ETS, especially in sectors at risk of carbon leakage. In this case, we assume that PHAs and TAs are established close to the installations receiving the largest allocations, as their management may benefit from the use of such more flexible accounts opened specifically for trading purposes. Lastly, the third criterion simplifies the assignment by restricting the sample to cases where an account holder manages only one OHA or FOHA. In such cases, we directly assign the PHAs and/or TAs to the location of the installation linked to the unique OHA or FOHA.

There are relevant caveats regarding these criteria. First, we require that all the PHAs and/or TAs of a given firm be situated within the same NUTS-3 territory. We view this as a minor issue, as concentrating these voluntary trading accounts in one location seems reasonable for minimizing trading costs. Second, we assume that PHAs and TAs cannot be located in areas without installations for that firm. This is a more substantial concern, as major carbon emitters frequently operate facilities in multiple territories, while their trading desks might be near their legal headquarters, often in cities where carbon-intensive activities are less common. Finally, we overlook temporal displacement, which could be substantial given the extended sample period from 2005 to 2020. Our study focuses on pure trades, which account for approximately 40% of the total trades within the EU ETS that are included in our sample. However, only about 2.4% of these trades involve exclusively OHAs and/or FOHAs, as the majority of trading activity is carried out by PHAs and/or TAs, particularly those of non-liable entities24,70,71. When including trades involving voluntarily opened accounts of liable entities, there is an increase of about 86% in the total volume of traded allowances in our sample for cases based on emissions and allocations criteria. In contrast, for the third criterion, the increase is just 0.27%.

Besides these concerns, the estimates reported in the Supplementary Information (Sections 1.2–1.4) are largely in line with those presented in the main analysis, reinforcing the finding that more trades occur between geographically closer territories. When including their voluntarily opened accounts, we confirm that EU ETS regulated entities are more likely to trade with geographically closer counterparts, often within the same country. However, the inclusion of PHAs and TAs appears to facilitate allowance exchanges across different sectors. This is noteworthy, as it suggests that voluntarily opened accounts can foster trades between counterparts, typically within the same country but engaged in different business activities, which may reflect differing compliance needs.

Robustness analyses: adding country and sector controls in the gravity model

We consider augmented gravity models to account for the possibility that NUTS-3 provinces may have unique characteristics not fully captured by the dimensions of the gravity model of Equation (1). Specifically, to control for any other potential confounding effects that vary over territories, we introduce two additional categorical variables: one for the country and one for the dominant sector. Both variables are included in the gravity model as distinct regressors of the origin and destination NUTS-3 provinces in each pair of trade. In our sample, there are 29 countries and 15 sectors. While the country variable remains constant over time, the sectoral variable can change, reflecting the sector with the highest emissions at any given time. We estimate these models in cross-sections for each year separately.

We first estimate a model by adding for each NUTS-3 province the country categorical variable to Eq. (1), followed by a second estimation where we also include the sector variable. The estimates are provided in the Supplementary Information (Sections 1.5 and 1.6, respectively). The results of these two model variants are very similar to each other and largely consistent with those reported in “EU ETS trade network: Gravity model estimation”, with only a few exceptions concerning the statistical significance of the coefficients for the macro controls. Importantly, these findings further support the conclusion that NUTS-3 provinces within the same country or sharing the same dominant sector are more likely to engage in trade with each other.

Robustness analyses: panel data framework

We also consider a model specification that exploits the panel structure of the data. We thus fit (unpenalized) Poisson Pseudo Maximum Likelihood (PPML) models with high-dimensional fixed effects (HDFE)72,73,74. We consider combinations of time fixed effects and NUTS-3 province fixed effects. Additionally, we include fixed effects at country level. The use of these fixed effects have also the added advantage of controlling for multilateral resistance75. We estimate a parsimonious model, similarly to ref. 29, including only both the same Country and same Sector categorical variables.

The estimates in Table S7 of he Supplementary Information (Section 1.7) indicate a substantial and positive coefficient of the same Country variable, which increases when both time and territorial fixed effects are included. In contrast, the coefficient of the same Sector variable lowers when we control for territorial fixed effects. We also notice that the estimates including either NUTS-3 level or Country fixed effects are very similar. Importantly, these results confirm that allowance trades are more likely between provinces in the same country and/or sharing the same dominant business activities, with such relationships that are in the panel analysis even stronger than those estimated in the cross-section.

Additionally, the Supplementary Information (Section 1.8) presents further analyses in which we interact time year dummies with either the same Country or the same Sector variables, for different specifications of the gravity model. These estimates confirm the relationships for both variables, indicating how allowance trades are more likely between NUTS-3 provinces in the same country or sharing the same dominant sector.

Discussion

A range of policy instruments has been proposed to promote carbon abatement and mitigate the uncertainty associated with adopting cleaner and more innovative technologies76. These instruments include feed-in tariffs, tax incentives, green procurement, and emissions trading schemes. Among these, the EU ETS is the cornerstone of climate policy in Europe and serves as a model for similar emissions trading systems developed worldwide. It represents an example of a policy package aimed at facilitating cost-effective reductions in GHG emissions. Cost-effectiveness is reached by allowing the full transferability of carbon allowances. For a discussion, see e.g.,66. When firms bid for allowances based on their marginal abatement costs, the price of these allowances reflects their scarcity in the market15,77. EU ETS is recognized as an effective environmental policy tool for achieving emissions targets at minimal cost. However, this efficient outcome relies heavily on firms’ willingness and ability to trade allowances.

In practice, whether this cost-effective result is realized depends on market efficiency, particularly the transaction costs associated with trading activity. A key theoretical insight from Stavins 23 highlights how transaction costs can impact trade patterns. He demonstrated that, when transaction costs are present, the efficient equilibrium of the trading system may be compromised due to reduced trading volumes of allowances. Transaction costs can in fact deter some firms from operating in the marketplace of allowances, influencing trading surplus and altering potential efficiency gains. An overview of transaction costs in the EU ETS is discussed e.g., in refs. 78,79. For instance, using transaction data from Phase I and firm-level indicators of search and information costs,16 demonstrated that trading costs influence firms’ decisions to operate in the carbon market, as well as whether to trade directly or through intermediaries. Similarly,27 analyzed trading costs during Phase II and quantified entry costs at the firm level, finding that firms with excess permits are generally more reluctant to engage in trading.

More generally, different sources of frictions can lower the volume exchanged in each trade and may decrease the overall number of trades, thereby affecting the cost-effectiveness of the EU ETS. This is consistent with a key finding in ref. 11, who examined market and price dynamics during Phase II of the EU ETS. They show that transaction costs significantly interact with carbon prices, contributing to persistent differences in marginal abatement costs among firms. This underscores a major barrier to market efficiency that needs to be addressed.

Despite the extensive literature, there is a lack of clear understanding regarding the impact of policies implemented at national and international levels aimed to foster the transition toward sustainability80,81,82. Importantly, it is still unclear whether such different policies enhance the credibility of individual instruments, or if their overlap undermines the overall environmental objectives83,84. Our study reveals that the EU ETS trade network for EUAs is predominantly dense within individual countries, with trades of regulated entities between NUTS-3 provinces across different countries being relatively less common. This might raise concerns about the functioning of the EU ETS as a truly European-level cap-and-trade system.

Our findings complement existing literature in several ways. First, we thoroughly analyze the first three phases (2005–2020) of the EU ETS, showing that home-country bias persists even in the most recent data. This extends the evidence of such trade patterns over a longer period than the study by ref. 29, which concludes in 2013. Even in Phase III, when more entities participated in the EU ETS, we find a substantial preference for home-country transactions. As discussed in ref. 29, since EUAs are perfectly homogeneous, these trade patterns cannot be attributed to consumer preferences across borders. Additionally, because EUAs are dematerialized instruments without transportation costs, the economic burden of geographical distance is effectively eliminated. Hence, this preference for home-country trades appears relevant for assessing the effectiveness of the EU ETS as a European-level trading system. Such a bias may suggest that transaction and search costs are impeding the proper and efficient allocation of allowances across countries, even in the more mature phases of the system. This is an interesting finding, as the home-country bias continues to characterize trade patterns even in Phase III, when a single EU-wide cap on emissions replaced the previous system based on national allocation plans, the Union registry replaced national registries, and the European Union Transaction Log (EUTL) replaced the Community Independent Transaction Log (CITL)85.

Second, we delve deeper into the interplay between country and geographical trade preferences emerging from the gravity estimation. We find that although the gravity model estimates indicate that more distant NUTS-3 provinces are less likely to trade, this effect appears to be dominated by the same country membership. This is an interesting result since, from one side, EU ETS regulated entities are tempted to trade less with more geographically distant counterparts but, from the other side, they strongly prefer to trade with those established in the same country even if they are placed more distant than counterparts in closer countries. This trade behavior may limit the policy-regulators attempt to enforce a European-level market of carbon allowances since administrative national borders seem to heavily influence how the EUAs trade relationships are formed.

Third, we find that sectoral trade patterns are also in place. Flows tend to connect territories sharing similar production activities, as measured by the dominant emitting sector within the EU ETS for each NUTS-3 province. This, again, might be explained by information costs that facilitate searching for counterparts among entities with whom business or production relationships already exist. When combined with the home-country bias, these aspects may pose doubt on the correct mechanisms underlying the link trade formation in the EU ETS. In fact, we observe stronger connectivity within the same country and between areas with similar production characteristics, highlighting the influence of both geographical and business proximity on trading patterns. This homophily may lead to a greater concentration of flows among entities operating in very similar contexts, which are likely to experience shocks in a more homogeneous manner. From a policy perspective, this may signal weak diversification benefits that should be monitored when scrutinizing the EU ETS resilience to wider instability or local overlapping policies.

Fourth, we show that entities tend to cluster together, forming trade communities that, while reflecting country- and sector-specific trade patterns, are also shaped by cultural factors. These communities consist of counterparts that engage in more intensive trade with each other than with the rest of the system. Importantly, these communities are recurrent over time, suggesting the presence of stable trade patterns underlying these cohesive relationships. This is an important aspect to consider when assessing policy effectiveness, as cultural profiles play an major role in community formation, particularly when accounting for home and sectoral biases. Notably, the largest communities display remarkably similar cultural profiles, especially in the early stages of the EU ETS. This trade pattern can again be attributed to search and information costs, which facilitate the establishment of trade connections between entities with similar cultural profiles. This supports the idea that, in addition to geographical and business factors, cultural proximity plays a key role in fostering increased trading activity within the EU ETS.

The implications of these findings are far-reaching. They suggest that the EU ETS trade market may not be achieving efficiency, as these biases likely lead to a suboptimal allocation of allowances, potentially reducing the cost-effectiveness of the policy. As a consequence, the persistent national and sectoral segmentation could hinder the development of a truly unified carbon market at European level. If firms are not fully exposed to the broader European market, their decisions about emissions reductions might not be based on the most efficient EU-wide opportunities. This, in turn, may limit the ability of the EU ETS to achieve emissions reductions at the lowest possible cost across the entire system. Our findings underscore the need for policymakers to consider measures that could reduce these trade biases and promote a more integrated, efficient EU-wide carbon market. For instance, this could involve initiatives to lower transaction costs for cross-border trades and enhance information sharing between countries and sectors. Alternatively, a carbon tax, unlike a cap-and-trade system, inherently avoids the transaction costs associated with securing trading counterparts and navigating market frictions. While our results highlight the persistence of transaction cost-driven frictions in the EU ETS, a carbon tax could offer an alternative by eliminating the need for bilateral trades of allowances. However, given the institutional and policy commitments to the cap-and-trade framework within the EU, such a transition remains unlikely. Importantly, the environmental implications of these biases are more complex than they might first seem. While a more integrated market could, in theory, result in a more efficient allocation of allowances, it is not guaranteed that this would substantially affect overall emissions, since emissions are ultimately capped by the system. In fact, the cap itself-rather than the trade patterns-remains the primary driver of the system’s environmental impact.

There are some limitations in our work that can be ameliorated in future studies. For example, we decided to map installations at NUTS-3 level to offer a view on the EU ETS trading network able to capture also socio-economic dimensions of the territories where carbon emitters are located. This choice balances our need to provide a granular representation with the alternative of a hugely sparse adjacency matrix at installation level. For similar reasons, we are forced to aggregate data at annual level to provide a treatable representation, although it is well-known that there are specific periods within the year which are much more liquid (e.g., in December when the main futures contracts expire and in March-April when the surrendering activities take place). In addition, future research may provide a more in-depth analysis to isolate intra-group trades or extend the analysis to include trades in futures markets.

Methods

Gravity model

Estimating Eq. (1) poses several challenges, encompassing the treatment of zero-valued flows44,86, non-linearity, and heteroscedasticity44, as well as addressing issues of endogeneity and omitted-term biases87. To concurrently address these problems, we employ a Poisson model which reads as:

where zi,j is defined by the r.h.s of Eq. (1). By substituting wi, j! with \({{\Gamma }}[{w}_{ij}+1]\), as routinely done in packages for solving econometric models, the log-likelihood becomes:

whose optimization leads to the Poisson pseudo-maximum likelihood (PPML) estimator of ref. 44

It is worth noticing that the Poisson model remains the most used framework because it ensures that a network total weight is reproduced, a desirable feature to correctly estimate the weights of a network. A similar approach in the context of the EU ETS has been adopted by ref. 29.

Optimal transport null model

Our utilization of optimal transport (OT) revolves around finding a map between normalized in-strength and out-strength, essentially estimating the joint distribution between these two probabilities. This estimation incorporates the cost linked with transferring a unit mass from the in-strength distribution to the out-strength distribution. The resulting joint distribution indicates the most effective way to transport particles from one distribution to the other. Essentially, OT aids in pinpointing the optimal mapping between in-strength and out-strength distributions by minimizing the transportation costs involved.