Abstract

Recently, more and more seaports have actively adjusted the energy structure of yard cranes to achieve green and low-carbon transition. Hydrogen energy, with its advantages of high efficiency and environmental friendliness, has become a crucial energy source for the low-carbon transition. Based on real options theory, this paper developed a cost-benefit model and proposed investment options for hydrogen-powered yard crane construction projects. The model incorporates uncertainty factors such as hydrogen price, carbon price and technology maturity, creating a multi-factor options model that provides scientific and reasonable investment decision support. Case study is conducted using the Qingdao Port. The results indicated that the optimal investment decision option for transition project is to invest in the construction of 12 new hydrogen-powered yard cranes between 2021 and 2025, with no further investment thereafter. In this invest plan, a total number of 18 hydrogen-powered yard cranes is built at the terminal, the project investment value is CNY 5.3566 million and the carbon emissions are reduced by 22,140 tons. Since hydrogen-powered yard crane construction is still in its early stages, after a small-scale upgrade to hydrogen power, the seaport can choose to observe the market and gradually advance the construction, thereby reducing investment risk. The changes of hydrogen and carbon prices have not impacted the project value. However, an increase of merely 0.1 in the technology readiness level parameter has led to a significant rise in the option value of option four from 5.3566 million to 8.2687 million, marking an increase of 54%. Sensitivity analysis revealed that cost changes due to technology maturity have the greatest impact on investment value. Strengthening research and development and upgrading hydrogen-powered yard crane equipment is an effective way to accelerate transition towards low carbon seaport. This research provides a groundbreaking framework for port authorities to evaluate hydrogen-powered equipment investments under multiple uncertainties, bridging the gap between theoretical modeling and practical decision-making. The findings offer actionable insights for global ports pursuing low-carbon transitions while managing financial risks.

Similar content being viewed by others

Introduction

As a crucial component of international shipping and logistics, seaports play a significant role in facilitating the global flow of goods and driving economic development. However, intensive shipping routes and seaport operations have led to substantial carbon emissions. In response, port enterprises are actively promoting the green transition of terminals by adjusting the energy systems.

The seaports are critical nodes in the global supply chain1. Seaports’ energy consumption and greenhouse gas emissions have led to global climate change and environmental protection issues, which are key research topics in the ecological domain2,3. Seaport’s operation is supported by substantial consumption of heavy fuel oil, which is increasingly recognized as a critical generator of greenhouse gas emissions4. Therefore, achieving low-carbon seaport operations do be an essential part of global seaport green development5.

Large-scale port machinery and equipment are the direct cause and main source of port carbon emissions. They are responsible for transferring, handling and overturning containers in the yard area during port production and operation activities. They usually rely on diesel, natural gas or other traditional energy sources to drive them, and emit large amounts of greenhouse gases and pollutants during use. The low-carbon transition of yard cranes has become a research focus in the field of green seaports. Early studies on the energy transition of yard cranes primarily concentrated on the conversion from diesel to electric power6,7. With the continuous development of clean energy, seaports have shifted their focus from traditional electric power to more efficient and environmentally friendly clean energy sources. They are tapping into the potential of photovoltaic power and adopting wind power to facilitate the transition. Among these efforts, the development of hydrogen energy has emerged as a key strategic choice for accelerating energy transition and upgrading8. At present, the port has carried out electric-to-hydrogen work on cranes, trucks, and other major mechanical parts. Among them, Qingdao Port has launched a pilot application of hydrogen-powered yard cranes and demonstrated significant emission reduction effects. Judging from the prospects of hydrogen energy use and the application effects of hydrogen-powered field bridges, large-scale investment and construction of hydrogen-powered yard cranes in the future will be of great significance to port energy conservation and emission reduction.

In the context of green seaports, the investment and construction of hydrogen-powered yard cranes will be influenced by various uncertainty factors. These uncertainty factors increase the complexity of the investment environment and risks. Therefore, to avoid project variability and ensure economic benefits, a comprehensive and systematic study of the investment decision for hydrogen-powered yard cranes is necessary. Seaports need to employ scientific investment decision-making methods to mitigate risks related to technological maturity, energy price fluctuations, and market changes and to ensure orderly construction of hydrogen-powered yard cranes.

Traditional investment decision models only consider the impact of a single factor on the project’s investment value9,10, which significantly differs from the actual investment environment of ports. To address the limitations of traditional option models in practical applications, this study introduces additional uncertainty factors, including hydrogen price, carbon price, and technological maturity, on top of considering single-factor changes, thereby increasing the complexity of the model. Compared to traditional option models, the multi-factor option model offers stronger applicability, more accurately depicts the fluctuations of uncertainties, and can account for more uncertainty factors in investment decision problems11. Moreover, it does not require uncertainty factors to follow geometric Brownian motion, making it more suitable for investment decision problems under multiple uncertainty factors.

Current research on hydrogen-powered yard cranes exhibits several significant limitations that need to be addressed. Most existing studies concentrate exclusively on analyzing single uncertainty factors such as either hydrogen price or carbon price in isolation. This narrow focus fails to account for the complex interactions between multiple dynamic variables that actually influence investment decisions. Furthermore, traditional investment models typically treat technological maturity as a static parameter, overlooking the substantial cost reduction potential that emerges through cumulative learning effects over time. Another critical shortcoming is that current applications of real options theory in port equipment transition scenarios lack comprehensive phased decision-making frameworks. This absence makes the models poorly adaptable to the practical realities of port investment planning where flexibility in timing and scale is crucial.

To overcome these limitations, this study develops an innovative multi-factor real options model that simultaneously integrates three key uncertainty factors: hydrogen price fluctuations, carbon price dynamics, and technology maturity progression. The model employs geometric Brownian motion to simulate hydrogen price variations, Markov chains to project carbon price trends, and learning curves to quantify technological cost reductions. More importantly, it introduces a novel phased construction approach with three strategic options - expand, delay, or abandon - at each decision point. This framework provides port authorities with a dynamic and practical tool for making optimal investment decisions under uncertainty.

Therefore, this study is based on real options theory and introduces three types of uncertainty factors to develop a multi-factor options model for investment, including hydrogen price, carbon price and technology maturity. Using the Seaport of Qingdao as a case study, the research identifies the optimal investment option. The innovations of this paper primarily encompass the following two aspects: Firstly, there is currently limited research on the investment decision-making issues related to hydrogen-powered yard cranes. This study elucidates the complex investment scenarios of hydrogen-powered yard cranes and constructs a theoretical framework for the investment decision-making model under the context of green ports, representing a further expansion of the current research domain in green port construction. Secondly, this study embeds multiple uncertainty factors into the model and employs methods, including the learning curve and Monte Carlo simulation, to provide a detailed characterization of these uncertainties. This approach can better describe and quantify uncertainty factors, thereby enriching the research scope and methods for investment decisions in low-carbon port infrastructure transition under green port initiatives.

This study makes three pivotal contributions. First, it develops the first integrated real options model that simultaneously capturing hydrogen price volatility, carbon market dynamics, and technological learning effects. This approach therefore can output solutions that are closer to real investment scenarios. Second, thre proposed approach, validated through large-scale port operational data, can serve as a practical and reliable decision-making framework for practitioners. It has the potential to aid ports in promoting the accuracy of investment assessments for upcoming energy equipment initiatives. Third, it provides empirical evidence on how technological maturation outweighs energy price fluctuations in green port investments - a finding with global implications for maritime decarbonization strategies.

The structure of this paper is as follows: “Literature review” provides a literature review, “Methods” outlines the methodology, “Real option model” introduces the investment decision model for the low-carbon transition of hydrogen-powered yard cranes and the solution methods, “Monte Carlo algorithm adopting in real option model” presents the results of the case study and performs sensitivity analysis, and “Case study” offers the conclusions of the paper.

Literature review

The literature review section will examine the current research on the adoption of hydrogen-powered equipment in the seaport domain. The explored content will focus on three key areas: the selection of clean energy sources at seaports; the rationale of equipment upgrades in the pursuit of low-carbon transitions; and the applicability of real options as a venture investment strategy in the seaports’ green transition of the seaport stage.

Severe pollution emissions not only bring negative influences on the environment around seaports but also make significant impacts on global climate change12. As the scale of seaport operations expands, the energy consumption of seaports continuously grows; meanwhile, related pollution emissions are consequently increasing. Martínez-Moya, et al.13 demonstrated that the energy consumption of handling equipment such as yard cranes and AGVs is the primary source of seaport carbon emissions, where related carbon dioxide emissions account for 68.1% of the total emissions in seaport operations. Severe pollution emissions both have negative influences on the environment around seaports and significantly affect carbon emissions14. Seaports, as the vital infrastructure, face the challenges and risks of reducing energy consumption and carbon emissions from operational equipment without impacting normal operations and reasonable profits15. Thus, exploring feasible methods of reductions achievement has become a high-value research question15.

In order to address the challenges posed by energy consumption and carbon emissions in seaports, which have led the academic community to propose a range of strategies aimed at the development of green seaports. Early research, in which the primary focus was on achieving reductions in energy consumption and carbon emissions through the optimization of the collaborative operation and scheduling management of seaport equipment, laid the groundwork for subsequent advancements in sustainable seaport operations16,17. Taking an example, in a study by Niu, et al.18, it was proposed that adopting optimizing the scheduling of yard cranes, quay cranes, and trucks, waiting times and blockages during equipment operation could be reduced, thereby lowering energy consumption. However, as clean energy technologies are developed and advanced, researchers have increasingly focused on the application of new clean energy solutions to seaport equipment transformation, thereby reducing carbon emissions and driving the transition toward green seaports19. Wang, et al.20 highlighted that, compared to the limitations of traditional operational optimization measures in emission reduction, low-carbon strategies focused on adjusting the clean energy implementation offer significantly greater potential. In the update of seaport equipment, Yang and Chang21 demonstrated that by converting diesel-powered rubber-tired gantry cranes (RTGs) to electric rail-mounted gantry cranes (E-RTGs), a clean energy solution was implemented that significantly reduced energy costs and greenhouse gas emissions. This research finding reveals that the green transformation of seaports requires not only traditional operational optimization but also a shift toward more forward-looking energy structure optimization to achieve greater carbon reduction.

Hydrogen energy, wind energy and solar energy are the three main types in the clean energy selection and update for seaports. Compared to wind and solar energy, which are significantly impacted by external environmental factors and exhibit lower stability22,23. Hydrogen energy is increasingly being adopted in the retrofit and upgrade of seaport machinery because it has characteristics recognized for its efficiency and cleanliness24. Pivetta, et al.25 demonstrated that the benefits of hydrogen fuel cell technology involve decreasing greenhouse gas emissions and improving energy conversion efficiency. Hydrogen-powered yard cranes have been deployed in various seaports, which is adopted as a crucial clean energy in the low-carbon transition. According to seaport history data and analytic reports, cranes could reduce carbon dioxide emissions by 3.5 kg and sulphur dioxide emissions by 0.11 kg when handling a standard container26. The hydrogen fuel cell technology, emerging as a clean energy solution, demonstrates significant potential in emission reduction and energy efficiency27,28. Although positive characteristics of hydrogen energy present the suitability of hydrogen fuel cell technology for energy transformation and upgrades in seaports, the challenges and risks (such as limited technological maturity, significant market volatility, and high investment costs) should be considered dynamic changes and analyzed investment situation in energy update project of seaport equipment29.

From the perspective of the applicability of real options in the clean energy update project of seaport hydrogen-powered yard crane, the project planning is typically divided into several decision periods; meanwhile, each corresponding will generate decision-making results in different construction phases. The decision periods refer to the point in time during the project process when specific investment decisions and strategic adjustments are made according to the predetermined time period or stage. Each decision period can reflect the situation at the current stage and provide a basis for decision-making in the next stage. The company needs to make flexible and real-time adjustments to the project based on the actual situation at the time to ensure that the project can be implemented more flexibly and efficiently in an uncertain environment, thereby achieving the preset goals and investment returns. During each decision period, the project will be executed according to the pre-established construction schedule, which could ensure that the pre-set modification objectives are effectively met at each stage. Therefore, the real options approach, which is a potentially effective tool for investment management in seaport enterprises, plays a vital role in the analysis and evaluation of investment value during the yard crane energy retrofit process30. Through the real option applications (involving “option to expand”, “option to delay”, and “option to abandon”31, the real option method allows for a flexible assessment of investment decisions across various project stages, which will assist the enterprise in making optimized choices under conditions of uncertainty.

The current research results associated with upgrading and investing in hydrogen energy equipment for seaports reveal that numerous uncertainties remain. Related uncertainty factors include technology maturity32, market volatility, and negotiation pricing. Each of these factors is required to be deeply explored through a suitable analytic model. The investigation and analysis of these uncertainties are crucial because accurate analytic results of uncertainty factors will decisively impact the large-scale investment, promotion, and application of hydrogen-powered equipment. Uncertainty factors will directly affect the evaluation of the project investment value, which brings investment risks for seaports33. In the hydrogen-powered transformation projects, Zhang et al.34 suggested that it is important to identify uncertainty factors which could be used to reduce the negative impact of uncertainty factors on the investment value assessment. Nunes et al.35 and Chevalier-Roignant et al.36 proposed that multiple factors involving changes in equipment investment costs would affect the decision-making of investment, equipment energy conversion, hydrogen energy market fluctuations, carbon trading market fluctuations, and changes in technology maturity. Highlight that energy prices and technology maturity are the two main uncertainties in the investment and construction of the QC hydrogen-powered updating project due to their large fluctuations37. From the aspect of energy price, hydrogen and carbon prices are two uncertain factors in seaport equipment energy updating project. Walwyn et al.38 stated that the development of hydrogen technology would bring the safe and cost-effective characteristics to make hydrogen as main clean energy. Li and Kimura39 predicted the cost of hydrogen energy will drop significantly in the future due to economies of scale in the discussion of hydrogen fuel cell vehicle development. Moreover, Lin and Liu40 found that carbon prices significantly affect the investment value, so they evaluate the investment value of flexible electricity based-on real options method with the carbon emissions trading mechanism. In the other study associated with the uncertainty investment decision-making problem of coal-fired power plants transforming towards clean energy. Zhang et al.41 stated the same opinion that considering the carbon prices in carbon emissions trading, which could motivate investors to invest in the transformation program. From the technology maturity aspect, Ofori et al.42 stated that technology maturity as an uncertainty factor directly impacts the decision-making in real option methods, which can decrease the risk of technology cost in the investment process.

The real options approach, which is well-suited for the energy upgrade of hydrogen-powered yard cranes, offers an effective analytical tool for addressing the related uncertainty factors. In investment decision-making and risk management of energy updates in seaport equipment, the Least Squares Monte Carlo simulation within the real options framework provides a reliable and flexible method for analyzing uncertainties in the hydrogen-powered update of yard cranes. It is worth noting that existing research primarily focuses on the theoretical construction and simulation analysis of models. Thus, how to construct effective real options models still requires the exploration of research. These models are adopted to assess the viability of seaports’ hydrogen-powered yard crane upgrade projects. The relational practicality, cost-effectiveness, and accuracy of carbon emission analysis in actual seaport investments require further validation as well. As increased low-carbon demand for global seaport transformations, the cost-benefit analysis of hydrogen-powered yard crane retrofits will become a topic worthy of investigation.

Existing research results indicate that when the hydrogen energy market, carbon market, or technological conditions deteriorate, the seaport can choose to abandon the investment strategy in updating hydrogen-powered yard crane equipment. By flexibly utilizing suitable real options tools, the seaport industries can effectively manage uncertainty, optimize investment decisions, and enhance the investment returns of the energy updating project43. This strategy assists the enterprise in making more prudent choices in unfavourable conditions of the external environment.

From the aspect of the real option algorithms applicability, Zhang, et al.34 stated the real options approach demonstrates high reliability in evaluating equipment transitions of emission reduction projects. In the clean energy update projects, uncertainty factors analysis is a significant challenge in algorithm selection of the real option model. Specifically, Partial differential equations and Monte Carlo simulations are the practical algorithms applied in continuous-time real options models44,45. While partial differential equations can compute analytical solutions to the models, the limitations of partial differential equations are hardly analyzed with multiple uncertainties. Compared with the partial differential equations, Monte Carlo simulations could be built as a mathematical model with numerous uncertainties and complex random distributions46,47.

Moreover, the least squares Monte Carlo method, which combines Monte Carlo simulation with least squares regression, can be used to evaluate real options and provide optimal investment timing results for decision-making44. Hassi, et al.48 pointed out that applying the least squares Monte Carlo method to complex investment evaluations with multiple uncertain variables, which demonstrates this approach is practical in the reduction of risk investment and optimization of returns. In the hydrogen-powered yard crane projects, the least squares Monte Carlo method can provide better management of uncertainty in the investment decision-making process to the seaport, which is used to ensure the maximization of returns. Therefore, through flexibly adopting the real options approach in the decision-making of project investment, the seaport can obtain more optimized investment choices when facing multiple uncertainties, which can ultimately assist the seaport industry in enhancing the economic benefits of investment projects.

To conclude, the construction of green seaports has become an inevitable trend in the development of green seaports. The hydrogen fuel cell technology, emerging as a clean energy solution, demonstrates significant potential in emission reduction and energy efficiency27. This trend highlights the growing importance of integrating sustainable energy associated with hydrogen into seaport operations. Through the literature reviewing and analyzing the existing research results, it is clear that what emerges as an effective low-carbon transformation strategy is the adoption of hydrogen-powered equipment updates by seaports. The current research results associated with upgrading and investing in hydrogen energy equipment for seaports reveal that numerous uncertainties remain. Related uncertainty factors include technology maturity, market volatility, and negotiation pricing. Each of these factors is required to be deeply explored through a suitable analytic model. The investigation and analysis of these uncertainties are crucial because accurate analytic results of uncertainty factors will decisively impact the large-scale investment, promotion, and application of hydrogen-powered equipment.

From the existing research, the real options method is more suitable for investment in the R&D and transition stages. At present, some studies have tried to apply the real options method to evaluate the investment decisions of energy projects. And the real options method has been proven to be reliable in the transformation evaluation of emission reduction projects. The real options approach, which is well-suited for the energy upgrade of hydrogen-powered yard cranes, offers an effective analytical tool for addressing the related uncertainty factors. In investment decision-making and risk management of energy updates in seaport equipment, the Least Squares Monte Carlo simulation within the real options framework provides a reliable and flexible method for analyzing uncertainties in the hydrogen-powered update of yard cranes. It is worth noting that existing research primarily focuses on the theoretical construction and simulation analysis of models. Thus, constructing effective real options models still requires the exploration of research. These models are adopted to assess the viability of hydrogen-powered yard crane upgrade projects in seaports. The relational practicality, cost-effectiveness, and accuracy of carbon emission analysis in actual seaport investments require further validation as well. As increased low-carbon demand for global seaport transformations, the cost-benefit analysis of hydrogen-powered yard crane retrofits will become a topic worthy of investigation.

Methods

Existing research on the low-carbon transformation of port equipment in the context of green ports has made progress, but research on investment decisions for hydrogen-powered quay cranes remains limited. It is necessary to comprehensively consider the characteristics of equipment investment decisions and establish a theoretical framework for hydrogen-powered yard crane investment. This study addresses this need by providing a systematic analysis. Large-scale investment in hydrogen-powered port machinery can effectively advance the construction of green ports, but scholars have paid little attention to investment decisions regarding the large-scale deployment of hydrogen-powered quay cranes. Current research primarily focuses on the impact of changes in multiple uncertain factors during the equipment investment process on investment decisions. How to fully account for uncertainty factors in the investment process and incorporate them scientifically into the decision-making process is a key issue to address when making equipment investment decisions.

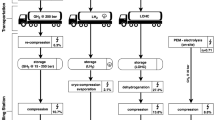

In the study of low-carbon transition investment strategies for hydrogen-powered yard cranes, the real options approach was employed, taking into account uncertainty factors and cost-benefit indicators to develop a multi-factor selection real options model. First of all, the investment method with real options for hydrogen-powered yard cranes was based on “option to expand”, “option to delay” and “option to abandon” to formulate phased construction investment decision options. Next, three sperate mathematical models were constructed to analyze three types of uncertainty factors, including carbon price, hydrogen price and the technology maturity of hydrogen-powered yard crane equipment transition. Specifically, the dynamic variation in hydrogen price was simulated by geometric Brownian motion. The dynamic variation in carbon price was simulated using the Markov chain. The dynamic variation in the technology maturity of hydrogen-powered yard crane equipment retrofitting was simulated using the learning curve.

Then, combined with the results of the literature review, the cost-benefit model mainly analyses six indicators, including the investment cost of hydrogen-powered yard cranes, annual hydrogen energy consumption cost, annual regular maintenance cost, annual cost savings, annual carbon emission reduction income and government subsidies for the transition of hydrogen-powered yard cranes.

To elaborate, the investment cost indicators for hydrogen-powered yard cranes is associated with the number of cranes and the unit price per crane. The annual hydrogen energy consumption cost indicator depends on the number of cranes, the annual number of containers handled, the hydrogen consumption per unit and the hydrogen price. The annual regular maintenance cost indicator is linked to the number of cranes and the annual maintenance cost. The annual cost savings indicator is tied to the annual savings in energy consumption and maintenance costs. The annual carbon emission reduction benefits indicator is connected to the number of cranes, the annual number of containers handled, the carbon emissions per container and the carbon price. The government subsidy indicator for the transition of hydrogen-powered yard cranes is related to the number of cranes and the subsidy provided per crane.

Next, this study combines the three uncertainty factors with the six cost-benefit indicators to develop a multi-factor investment model for the low-carbon transition of hydrogen-powered yard cranes. Integrated with the phased construction investment decision options for hydrogen-powered yard cranes, this cost-benefit model forms a multi-factor options model for the low-carbon transition of hydrogen-powered yard cranes.

Finally, the study addresses the research problem of investment strategies for the low-carbon transition of hydrogen-powered yard cranes by solving the multi-factor options model. The analysis focuses on the option value and carbon emissions of different investment decision options. Sensitivity analysis is conducted on the three uncertainty factors: carbon price, hydrogen price, and technology maturity. Through the real options approach, a feasible investment option for the low-carbon transition of hydrogen-powered automated yard cranes is obtained. The methodology of this paper is illustrated in the Fig. 1.

Real option model

The real options method of hydrogen-powered yard cranes construction projects will adopt three options -- option to expand, option to delay, and option to stop. This study sets the project starting time as \(\:{T}_{0}\), the number of initially held hydrogen-powered ARMGs is m, and the project is divided into three decision-making periods: \(\:{T}_{0}-{T}_{1}\), \(\:{T}_{1}-{T}_{2}\), and \(\:{T}_{2}-{T}_{3}\). Based on the probability prediction method for the phased construction process of proposed hydrogen energy facilities, survey and expert consultation is used to obtain the predicted probability results(\(\:{P}_{ij}\)). As shown in Table 1, the probability scheme illustrates the various possible paths leading to later decision-making stages in a hydrogen-powered ARMG construction project.

Based on the probability statistics results of the phased construction process, the expected construction number of hydrogen-powered ARMGs in the three processes can be obtained, as shown in Eq. 1:

In this equation, \(\:m\) represents the number of the existing hydrogen-powered ARMGs at time \(\:{T}_{0}\), \(\:N\) represents the total number of the existing yard cranes at the terminal, \(\:{S}_{i}\) represents the expected number of hydrogen-powered ARMGs to be built j scale number during the \(\:i\) stage, and \(\:{P}_{ij}\) represents the probability that the hydrogen-powered ARMGs construction project enters the construction processes.

Therefore, starting from \(\:{T}_{0}\), the hydrogen-powered ARMG construction project goes through three decision-making periods: \(\:{T}_{0}-{T}_{1}\), \(\:{T}_{1}-{T}_{2}\) and \(\:{T}_{2}-{T}_{3}\). The construction process includes partial transformation and construction (\(\:{S}_{1}\)), large-scale transformation and construction (\(\:{S}_{2}\)) and transformation completion (\(\:{S}_{3}\)). A seaport may decide to “continue”, “delay”, or “abandon” in each decision-making period, which results in eight investment decision options, as shown in Fig. 2.

The assumptions of the multi-factor option model for hydrogen-powered ARMG investment decision-making are proposed as follows:

-

(1)

The discount rate of the hydrogen-powered ARMG construction project value is known and does not change over time.

-

(2)

The fluctuation of hydrogen price obeys geometric Brownian motion.

-

(3)

The drift rate of hydrogen price is known and constant.

-

(4)

The fluctuation rate of hydrogen price is known and constant.

-

(5)

The fluctuation of carbon price obeys geometric Brownian motion.

-

(6)

The drift rate of the carbon price is known and constant.

-

(7)

The fluctuation rate of the carbon price is known and constant;

-

(8)

The impacts of technology maturity on equipment direct investment costs conform to the learning curve.

-

(9)

Ignore the time consumption of the hydrogen-powered ARMG construction period;

-

(10)

Each investment stage follows in a chronological order. The time of making an investment can be appropriately postponed within a certain range. If over the maximum stipulated period, the investment is regarded as abandoned.

-

(11)

Investors are risk neutral.

As key components of the hydrogen-powered ARMG investment research, the uncertainty factors require corresponding simulation algorithms for hydrogen price, carbon price, and equipment investment cost.

Firstly, the simulation of hydrogen price will consider factors involving hydrogen production, transportation, and refuelling station costs. This research uses the geometric Brownian motion method to simulate the changing patterns of the hydrogen price, as shown in Eqs. 2 and 3. The hydrogen price dynamics adhere to the following assumptions: (i) markets are frictionless with continuous trading, (ii) price shocks follow a normal distribution, and (iii) volatility clustering effects are negligible over the investment horizon.

In specific, \(\:{p}_{h}\) represents the hydrogen price; \(\:{p}_{h,t}\) represents the hydrogen price at time \(\:t\); \(\:{\mu\:}_{h}\) represents the drift rate of the hydrogen price; \(\:{\sigma\:}_{h}\) represents the fluctuation rate of the hydrogen price; \(\:{dw}_{t}\) represents a Wiener process which is used to simulate the impact of random market changes on fuel prices; \(\:{\epsilon\:}_{t}\) follows the standard normal distribution.

Secondly, the simulation of the carbon price will adopt the geometric Brownian motion method to describe the dynamic carbon price trend, as shown in Eqs. 4 and 5:

Specifically, \(\:{p}_{c}\) represents the carbon price; \(\:{p}_{c,t}\) represents the carbon price at time \(\:t\); \(\:\:{\mu\:}_{c}\) represents the drift rate of the carbon price; \(\:{\sigma\:}_{c}\) represents the fluctuation rate of the carbon price; \(\:{dw}_{t}\) represents a Wiener process.

Lastly, the simulation of equipment investment associated with hydrogen-powered upgrade with cost will consider the factor of technology maturity. This study will adopt the learning curve method to characterize the investment cost of each piece of equipment. When producing the new hydrogen-powered ARMG, the port initially needed to spend a lot of time to familiarize itself with the process, and the production cost was high. As the transformation work continued, the production staff gradually became familiar with the process, production efficiency improved, the error rate decreased, and investment cost also decreased. The learning curve model reflects that as the technology matures, the cost of the hydrogen-powered ARMG gradually decreases, and the rate of decrease will gradually slow down with the accumulation of experience. As shown in Eqs. 6 and 7:

In the above equations, \(\:a\) represents the investment cost of a seaport’s initial hydrogen-powered ARMG; \(\:\:b\) represents the proportion of equipment investment cost decline as the technology maturity increases; \(\:x\) represents the manufactured number of hydrogen-powered ARGM; \(\:X\) represents the total number of hydrogen-powered ARMGs from the starting point to the completion of construction at a certain stage; \(\:I\) represents the total investment price of hydrogen-powered ARGMs.

To build the Cost-benefit model could be adopted to accurately analyse the cost of the hydrogen-powered ARMGs construction project and the total revenue of the hydrogen-power ARMG. Specifically, the cost of the hydrogen-powered ARMGs construction project (\(\:C\)) is the sum of the investment cost of the hydrogen-powered ARMGs (\(\:I\)), the annual hydrogen energy consumption cost (\(\:{C}_{coe}\)) and the annual regular maintenance cost (\(\:{C}_{rom}\)), as shown in Eq. 8:

① The investment cost (\(\:I\)) is the product of the investment cost of a single hydrogen-powered ARMG (\(\:a\)) and the total number of hydrogen-powered ARMG at the seaport as of time t (\(\:{x}_{t}\)), as shown in Eq. 9:

② The annual hydrogen energy consumption cost (\(\:{C}_{coe}\))is the product of the number of TEUs that each yard cranes needs to transport per year (\(\:Q\)), the hydrogen consumption per TEU transported (\(\:{V}_{coe}\)) and the price of hydrogen energy (\(\:{p}_{h}\)), as shown in Eq. 10:

③ The annual regular maintenance cost (\(\:{C}_{rom}\)) is the product of the annual maintenance cost per hydrogen-powered ARMG (\(\:{c}_{rom}\)) and the total number of hydrogen-powered ARMG at the seaport as of time t (\(\:{x}_{t}\)), as shown in Eq. 11:

Moreover, The total revenue of the hydrogen-power ARMG construction project (\(\:R\)) is the sum of annual cost savings (\(\:{R}_{save}\)), annual carbon emission reduction revenue (\(\:{R}_{cer}\)) and one-time related government subsidies (\(\:{R}_{gs}\)), as shown in Eq. 12:

① The annual cost savings (\(\:{R}_{save}\)) is the sum of the annual electrical energy consumption cost (\(\:{R}_{coe}\)) that hydrogen-powered ARMGs can save compared to traditional cranes (when the number of holdings is equal) and savings associated with annual maintenance costs (\(\:{R}_{rom}\)), as shown in Eq. 13:

The annual electricity cost of traditional cranes \(\:{R}_{coe,t}\) is the product of the number of TEUs that each yard crane transports per year(\(\:Q\)), the total number of hydrogen-powered ARMG at the seaport as of time t (\(\:{x}_{t}\)) and the electricity cost per TEU transported by yard cranes (\(\:{r}_{coe}\)), as shown in Eq. 14:

The savings in annual maintenance costs of traditional yard cranes \(\:{R}_{rom,t}\) is the product of the total number of hydrogen-powered ARMG at the seaport as of time t

(\(\:{x}_{t}\)) and the annual maintenance cost per traditional-powered ARMG (\(\:{r}_{rom}\)), as shown in Eq. 15:

② The annual carbon emission reduction income(\(\:{R}_{cer}\))is the product of the number of TEUs that each yard crane transports per year (\(\:Q\)), the total number of hydrogen-powered ARMGs at the seaport as of time t (\(\:{x}_{t}\)), the carbon emissions reduced by each hydrogen-powered ARMG transported TEU (\(\:{V}_{cer}\)), and carbon price (\(\:{p}_{c}\)), as shown in Eq. 16:

③ The one-time related government subsidy (\(\:{R}_{gs}\)) is set as a fixed value.

Combining cost and income modules, from the perspective of annual cash flow to analyze, the cash inflow includes annual cost savings (\(\:{R}_{save}\)) and annual equipment carbon emission reduction income (\(\:{R}_{cer}\)); the cash outflow includes annual hydrogen energy consumption cost (\(\:{C}_{coe}\)) and annual equipment regular maintenance cost (\(\:{C}_{rom}\)). Therefore, excluding the equipment investment cost (\(\:I\)) and one-time related government subsidies (\(\:{R}_{gs}\)), the annual net cash flow of hydrogen-powered ARMG (\(\:{V}_{t}\)) can be expressed as in Eq. 17:

The hydrogen and carbon prices obey geometric Brownian motion and are included as the future net cash flow formula variables of a hydrogen-powered ARMG construction project. The changes in the initial investment cost of equipment due to the technology maturity can be converted into a fixed value through the accumulation of single equipment costs and then included in the multi-factor option model. Assuming that the project discount rate is \(\:r\), the future net cash flow (\(\:NP{V}_{ij}\)) of the hydrogen-powered ARMG construction project from the decision point \(\:{T}_{i}\) to \(\:{T}_{j}\) can be calculated, as shown in Eq. 18:

The Real options model, as a solution, is used to analyse the rationality of investment decisions. Specifically, during the implementation progress of a hydrogen-powered ARMGs construction project, the decision maker can choose to continue or delay investment during each decision-making period, exhibiting clear time sequences. Therefore, we introduce the decision variable \(\:{t}_{ij}\): \(\:{t}_{ij}=1\) indicates that a seaport continues investing during the decision period\(\:\:{T}_{i}-{T}_{j}\); \(\:{t}_{ij}=0\) indicates that a seaport delays investment, as shown in Eq. 19.

Assuming that within the decision-making period \(\:{T}_{i}-{T}_{j}\), the optimal investment opportunity for hydrogen-powered ARMGs is \(\:{t}^{*}\), the hydrogen price at \(\:{t}^{*}\) is \(\:{p}_{h}^{*}\), and the carbon price at \(\:{t}^{*}\) is \(\:{p}_{c}^{*}\). Then, the investment value of the hydrogen-powered ARMGs construction project at this stage is shown in Eq. 20:

\(\:\left(NP{V}_{ij}\right({p}_{h}^{\text{*}},{p}_{c}^{\text{*}})-{I}_{ij}+{R}_{gs})\) represents the investment income of the hydrogen-powered ARMGs construction project during the decision period \(\:{T}_{i}-{T}_{j}\).

Monte Carlo algorithm adopting in real option model

This study adopts the least squares Monte Carlo simulation method of the real option model to simulate the hydrogen-powered ARMGs investment decision-making path. The core idea is to move backward from the end to the initial point, determine the maximal value by comparing the current income with the next moment’s income, obtain the optimal solution through continuous iteration, and solve the real options problem. The algorithm work flow is shown in Fig. 3.

(1) Set and input the following parameters: the number of simulation paths \(\:M\); the number of investment time points included in each simulation path \(\:N\); the step length between adjacent decision points \(\:\varDelta\:t\).

(2) According to the discrete process of random changes in uncertainties associated with the hydrogen and carbon prices, the Monte Carlo method is used to simulate the change paths, as shown in Eqs. 22–23:

\(\mu\) represents the drift rate; \(\sigma\) represents the fluctuation rate; \(\in\) comes from the normal distribution.

(3) Adopting the random values of uncertain factors, the investment value of the project corresponding to the end decision point in each simulation path can be calculated.

(4) In the process of applying the least squares Monte Carlo method, by moving from the end investment decision point to the initial point in each path to compare the benefits between the immediate and delayed investment, the maximum value is attainable when the iteration process is completed. A pool of value of all investment decision points on the path is available to be compared. Then, The optimal investment value and timing can be identified.

(5) Repeat step (4) to obtain the optimal investment value for each of the W paths.

(6) Summarize the investment value of all simulation paths through M times simulations at each stage. The average value is taken as the final expected investment value of each decision period, as shown in Eq. 24.

Case study

In order to verify the feasibility of the model, this research selected the Qingdao Seaport Automated Terminal as a research case. Based on the actual survey and relevant literature49,50,51,52. The relevant data required for investment decision-making regarding hydrogen-powered yard cranes at Qingdao Port has been collected.

Qingdao Seaport’s automated terminal currently has 76 automated rail-mounted gantry cranes (\(\:N=76\, Unit\)), also includes 6 hydrogen-powered yard cranes (\(\:m=6\,Unit\)), with an annual throughput of 40,000 TEUs (\(\:\text{Q}=40000\text{T}\text{E}\text{U}\)).

The annual maintenance cost per yard crane after transition is \(\:{c}_{rom}=10000RMB/Unit\), while the annual maintenance cost for each traditional yard crane is \(\:{r}_{rom}=64000RMB/Unit\). The hydrogen consumption for each standard container transported by the yard crane is \(\:{V}_{coe}=0.2 kg/TEU\), and the electricity consumption is \(\:{r}_{coe}=6RMB/TEU\). The carbon emission reduction for each standard container transported by the hydrogen-powered yard crane is \(\:{V}_{cer}=2.1 kg/TEU\). The direct investment cost for the first hydrogen-powered yard crane is a = 2.4 million CNY.

From 2021 to 2025, Qingdao Seaport will use by-product hydrogen from local industries as the energy source for the hydrogen-powered yard cranes, significantly reducing fuel costs. In this phase, the renewable energy cost of hydrogen-powered yard cranes is set to 0. According to the “Guidelines on Promoting the Development of High-Quality Green and Low-Carbon Ports” issued by the Development and Reform Commission, hydrogen prices are expected to drop to as low as 30 CNY/kg by 2025. Accordingly, the initial hydrogen price in 2026 for the hydrogen-powered yard cranes is set at \(\:{P}_{{h}_{2026}}^{initial}\)=30 CNY/kg.

China’s carbon emission trading started in July 2021, with an initial price of 48 CNY/ton. Therefore, the initial carbon price for the hydrogen-powered yard crane project in 2021 is set at \(\:{P}_{c0}\)= 48 CNY/ton.

The other data involved in the model include: Discount rate: r=0.12, hydrogen price drift rate: \(\:{\mu\:}_{h}=-0.07\), hydrogen price fluctuation rate: \(\:{\sigma\:}_{h}=0.07\), carbon price drift rate: \(\:{\mu\:}_{c}=0.075\), carbon price fluctuation rate:\(\:\:{\sigma\:}_{c}=0.07\), learning curve parameter: \(\:b=0.1\).

The parameters of the Qingdao Seaport hydrogen-powered ARMG multi-factor investment decision-making model are set as shown in Table 2. All price simulations assume no extreme geopolitical events affecting energy markets:

In this research, the starting time of the phased investment project was from 202149, and the time interval is set as five years. The predicted probability and the calculated expect construction progress are shown in Table 3

Considering that Qingdao seaport automated terminal adopts the double-yard crane loading and unloading technologies, the transformation of two-yard cranes will be carried out at the same time. Therefore, the phased construction process of hydrogen-powered ARMGs is specified as follows: (1) maintaining the current number of pilot modifications (6 units), (2) completing partial transformation (18 units), (3) completing further transformation (32 units), and (4) making the transformed facilities the main equipment at the seaport (40 units). Starting from 2021, the seaport had made/is going to make a series of decisions regarding continuing, delaying, or abandoning investment during the decision-making periods of 2021–2025, 2026–2030 and 2031–2035, yielding eight investment decision-making options, as shown in Table 4. Option 1 did not make any investment in 2021–2035. Option 2 invests 12 hydrogen-powered yard cranes in 2031–2035. Option 3 invests 12 hydrogen-powered yard cranes in 2026–2030. Option 4 invests 12 hydrogen-powered yard cranes in 2021–2025. Option 5 invests 12 hydrogen-powered yard cranes in 2026–2030 and 14 hydrogen-powered yard cranes in 2031–2035. Option 6 invests 12 hydrogen-powered yard cranes in 2021–2025 and 14 hydrogen-powered yard cranes in 2031–2035. Option 7 invests 12 hydrogen-powered yard cranes in 2021–2025 and 14 hydrogen-powered yard cranes in 2026–2030. Option 8 invests 12, 14 and 8 hydrogen-powered yard cranes in 2021–2025, 2026–2030 and 2031–2035 respectively.

A multi-factor real option model is constructed for a hydrogen-powered automated yard crane construction project. The following analysis process is adopted for the case analysis of Qingdao Seaport Automated Terminal:

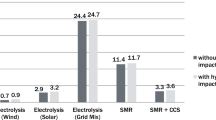

The hydrogen price and the carbon price is separately simulated 100 times using geometric Brownian motion. The initial investment cost of hydrogen-powered yard cranes is simulated using the learning curve of technology maturity. This research simulates the cost decrease of yard cranes from the first yard crane to 80 th yard cranes. The simulation results of hydrogen price, carbon price and equipment investment cost during the investment period are obtained.

The simulation results of the uncertainty factors are input as parameters into the multi-factor real option model of hydrogen-powered automated yard crane construction project. The least squares Monte Carlo simulation method is used to solve the real option model. Eight investment decision-making schemes are developed for the simulation. A total of 10,000 times simulations are conducted to obtain the project investment value and carbon emission reduction of eight investment options. The case study process of this research is shown in the Fig. 4.

The switch to hydrogen-powered cranes requires significant investment in both technology and infrastructure. Ports would need to establish hydrogen supply chains, including production, transportation, and refueling facilities. Additionally, investment in the maintenance and repair of fuel cell systems would be necessary to ensure long-term operational efficiency. However, the long-term economic benefits could outweigh the initial costs. With decreasing hydrogen production costs and increasing fuel efficiency of hydrogen-powered equipment, the overall operating cost could become competitive with diesel alternatives, particularly in regions where diesel fuel prices are high. The transition could also lead to the creation of new jobs and reskilling opportunities, as the demand for maintenance personnel with expertise in hydrogen systems increases. This would benefit the local workforce and contribute to economic growth in port cities.

Results of uncertainty factors simulation

Hydrogen price simulation

According to Eq. 23, combined with the current hydrogen energy industry construction situation of Qingdao Seaport and the parameter settings, 100 times simulations were conducted to map the potential trends of hydrogen energy prices from 2025 to 2035. Figure 5 shows a band chart of the mean ± standard deviation of the Monte Carlo simulation of hydrogen prices. The hydrogen price projection in Fig. 5 reveals a clear downward trend from 2026 to 2035, consistent with the negative drift rate specified in our model. The standard deviation band narrows over time, indicating reduced uncertainty in later years. This convergence pattern suggests that industrial-scale hydrogen production and distribution networks are expected to mature, leading to more stable pricing. The temporary widening of the band during 2028–2031 reflects the model’s incorporation of short-term market volatility during the transitional phase of energy infrastructure development. From 2021 to 2025, the hydrogen produced by industrial by-products around Qingdao Seaport will be the energy source for the hydrogen-powered bridges, which will significantly save fuel costs. During this period, the hydrogen energy consumption cost is negligible compared to overall operating costs. In the simulation, the initial price \(\:{P}_{{h}_{2026}}^{initial}\) of hydrogen energy used by the hydrogen yard crane is 30 CNY/kg. Among these 100 simulation paths, the highest hydrogen price in 2030 is 30.89 CNY/kg and the lowest is 16.19 CNY/kg; the highest hydrogen price in 2035 is 25.27 CNY/kg and the lowest is 8.96 CNY/kg. The results of 100 times simulated hydrogen prices are detailed in Appendix A.

Carbon price simulation

This research simulates the trends of carbon prices using the above data and the parameter settings as input of Eq. 3.23. Figure 6 shows a band chart of the mean ± standard deviation of the Monte Carlo simulation of carbon prices, showing a steady upward trend from 48 CNY/ton to approximately 150 CNY/ton by 2035. The expanding standard deviation band indicates increasing price variability as the carbon market matures, capturing the expected policy fluctuations during China’s carbon market development. Notably, the price surge around 2030 coincides with China’s anticipated carbon neutrality milestones, reflecting the model’s sensitivity to regulatory changes. The sustained upward drift confirms the effectiveness of carbon pricing as a long-term emission reduction mechanism. The initial value of the carbon price is set at 48 CNY/ton at the starting point of decision-making in 2021. During the simulation period of investment decisions, the Chinese government is expected to strengthen supervision over the carbon market, resulting in a reduction in carbon quotas and an increase in the price of certified voluntary emission reductions. The carbon price is expected to rise significantly. Among all the carbon price simulation paths, the highest carbon price in 2025 is 93.86 CNY/ton and the lowest is 50.05 CNY/ton; the highest carbon price in 2030 is 149.88 and the lowest is 59.79; by 2035, at the end of the construction period of the hydrogen-powered field bridge project, the highest carbon price will reach 234.76 CNY/ton and the lowest will reach 67.66 CNY/ton. The results of 100 times simulated carbon prices are detailed in Appendix B.

Initial investment cost change simulation

As a large-sized seaport handling equipment, hydrogen-powered ARMGs require relatively high initial investment. This research uses the learning curve to calculate the changes in the initial investment cost. The simulation results of the changes are shown in Fig. 7. As technology maturity increases, the cost of hydrogen-powered ARMGs will decrease, therefore reducing the overall investment cost. At the beginning of the project, the investment cost of a single hydrogen-powered ARMG was 2.4 million CNY. When the number of invested units reaches 40, the average investment cost of a single hydrogen-powered ARMG can be reduced to 1.67 million CNY.

The simulation outcome of the hydrogen price, carbon price and equipment investment cost are leveraged as input variables to solve the multi-factor real options model of the construction project. The least squares Monte Carlo simulation method was used to simulate the project investment value of eight investment decision-making options. A total number of 10,000 simulations were conducted to eliminate the errors caused by randomness. Then, the project investment value of eight different options was obtained respectively, as shown in Table 5.

Option 1 did not make any investment in 2021–2035, so the investment value is 0 and the carbon emissions are 0.

Option 2 invests in the construction of 12 hydrogen-powered yard cranes in 2031–2035; the project investment value is 2.9741 million CNY, and the carbon emissions are reduced by 12,300 tons;

Option 3 Invest in the construction of 12 hydrogen-powered yard cranes in 2026–2030. The project investment value is 2.9079 million CNY, and the carbon emissions are reduced by 17,220 tons;

Option 4 Invest in the construction of 12 hydrogen-powered yard cranes in 2021–2025. The project investment value is 5.3566 million CNY, and the carbon emissions are reduced by 22,140 tons;

Option 5 Invest in the construction of 12 hydrogen-powered yard cranes in 2026–2030 and 14 hydrogen-powered yard cranes in 2031–2035, and the project investment value is −15.1268 million CNY, reducing carbon emissions by 22,960 tons;

Option 6: Invest in the construction of 12 hydrogen-powered yard cranes in 2021–2025 and 14 hydrogen-powered yard cranes in 2031–2035, with a project investment value of −13.9765 million CNY, reducing carbon emissions by 27,880 tons;

Option 7: Invest in the construction of 12 hydrogen-powered yard cranes in 2021–2025 and 14 hydrogen-powered yard cranes in 2026–2030, with a project investment value of −15.0967 million CNY, reducing carbon emissions by 33,620 tons;

Option 8: Invest in the construction of 12, 14 and 8 hydrogen-powered yard cranes in 2021–2025, 2026–2030 and 2031–2035 respectively, with a project investment value of −23.5259 million CNY, reducing carbon emissions by 36,900 tons.

The investment value of different options is shown in the Fig. 8. According to the results, the project investment plans with positive investment value are options four, two, three and one, ranking from high to low, respectively. The rest of the investment options generate negative value, meaning that they will cause economic losses.

As shown in Fig. 9, among the above four investment decision-making options that generate positive economic value, the ranking of carbon emission reductions from high to low are respectively options four, three, and two. The core criteria to determine the optimal investment scheme in this research is to select the plan with the highest carbon emission reduction while ensuring that the seaport does not experience economic losses. On this basis, option 4 is the optimal investment decision.

To conclude, with the lens of the multi-factor option model of hydrogen-powered ARMG investment decision-making, the optimal investment scale and investment timing of the Qingdao Seaport Automated Terminal is to invest in 12 hydrogen-powered ARMGs by 2025. The accumulated project investment value is estimated to be 5.3566 million CNY, and the cumulative carbon emission reduction is about 22,140 tons.

This study uses hydrogen power technology to carry out energy efficiency transformation of port equipment. The reduced carbon emissions reflect the emission reduction potential of hydrogen energy as a clean energy alternative to traditional fuels in practical applications. Energy transformation not only reduces energy consumption costs, but also achieves significant carbon emissions reduction. The application of green energy can not only reduce carbon emissions in the short term, but also continue to promote the realization of carbon emission reduction goals in the long term, prARMGoviding solid technical support for sustainable development. As green energy gradually replaces traditional fossil energy, the reduction in systemic carbon emissions reflects the important role of green energy in achieving global climate goals.

Sensitivity analysis

In order to more accurately evaluate the impacts of hydrogen price, carbon price, and technology maturity on the project’s optimal option and project value, it is necessary to conduct a sensitivity analysis of the main uncertainty factor parameters in the multi-factor option model. Parameter sensitivity analysis was performed regarding the drift and fluctuation rate of the hydrogen price, the drift and fluctuation rate of the carbon price, and the learning curve parameters. The technical breakthrough of this multi-factor modeling approach lies in its dynamic integration of three stochastic processes: geometric Brownian motion for hydrogen prices and carbon prices, and learning curves for technology costs. This integration enables ports to quantify previously unmeasurable cross-factor interactions, which is a critical insight for long-term planning.

Hydrogen price drift rate and fluctuation rate

Figure 10 shows the changes in project investment value in accordance with the hydrogen price drift and fluctuation rate within each investment decision option. It can be seen that in the multi-factor option model, a single change in the hydrogen price drift rate or fluctuation rate has no significant impact on the project value. The optimal investment timing and scale do not change either.

To evaluate the impact of the hydrogen price drift rate on project investment decisions, the range of drift rate was expanded and range from − 0.05 to −0.1 on the base level of −0.07 set at in the previous simulation. Then, based on the hydrogen price fluctuation of 0.07, the range of fluctuation was adjusted to 0.05 to 0.1. Figure 10 shows the changes in the project investment value of each investment scheme under various hydrogen price drift rates and fluctuation parameters.

Firstly, this research analyzes the impact of drift rate on investment decisions. In Fig. 10, the hydrogen price drift rate changes from − 0.050 to −0.100. The investment value of each investment option is as follows in Table 6.

Option 1: No matter how the drift rate changes, the investment value is always 0, indicating that this scheme is completely insensitive to the hydrogen price drift rate.

Option 2: The investment value fluctuates slightly between 2.7940 and 2.7941, indicating that it is extremely insensitive to changes in the drift rate; therefore, the drift rate has little effect on the investment value.

Option 3: Similar to option 2, the investment value fluctuates slightly between 2.9078 and 2.9079, showing low sensitivity.

Option 4: The investment value fluctuates between 5.3566 and 5.3567, which is the most stable of all schemes, indicating that this option has a strong capability of resisting uncertainty in the drift rate. Option four is the best choice.

Option 5, 6, 7, 8: The investment values of these schemes are all negative, and they hardly change when the drift rate changes, indicating that they are extremely risky and not suitable as investment options.

To summary, option 4 shows great stability under the condition of hydrogen price drift rate changes, while other schemes are either insensitive to drift rate and have low returns or show negative values and extremely high risks. Therefore, option 4 is the best choice.

Secondly, the impact of price fluctuation on investment decisions is analyzed, and the results are shown in Fig. 10. The fluctuation rate of hydrogen prices is set from 0.05 to 0.10, and the investment value of each investment option is as follows in Table 7.

Option 1: Similar to the case of the drift rate, the investment value of scheme 1 is still 0 when the volatility changes, indicating that it is also completely insensitive to fluctuation rate.

Option 2: The investment value fluctuates between 2.7940 and 2.7941, and the sensitivity to fluctuation rate changes is also extremely low.

Option 3: Similar to the performance of option 2, the investment values are changed between 2.9077 and 2.9078, showing extremely low volatility sensitivity.

Option 4: When the price fluctuates, the investment value changed slightly between 5.3566 and 5.3567, still showing the greatest stability.

Option 5, 6, 7, 8: The investment values of these options are all negative and almost unchanged when the price fluctuates, indicating that options’ risks are still high and are not suitable as investment options.

Summary: Similar to the analysis results of the drift rate, option 4 shows great stability with different levels of hydrogen price fluctuation and is the best investment option, while other options are not recommended due to high risks.

Lastly, this research conducts a comprehensive analysis of the eight options. In the multi-factor option model, when the hydrogen price drift rate ranges from − 0.05 to −0.1 and the fluctuation rate changes from 0.05 to 0.1, the investment value of the eight options does not change significantly. Plans 5, 6, 7 and 8 have extremely high risks due to significant negative returns. The optimal investment plan is still Plan 4 with an investment value stabling at 5.3566 million. The variance between investment values is used to measure the value changes of each investment plan related to hydrogen price drift and fluctuation rate. For the hydrogen price drift rate, the variance of the investment value of option two and option three is both \(\:3\times\:{10}^{-9}\). This extremely low variance indicates remarkable stability of the project investment value under different hydrogen price drift rates. Option four is the optimal investment option, with a variance of \(\:2.67\times\:{10}^{-9}\), indicating that option four can ensure stable investment value under different hydrogen price drift rates. For changes in fluctuation rate, the optimal investment plan is still Plan 4 with a variance of investment value at \(\:2.67\times\:{10}^{-9}\). Compared with Plan 2 and Plan 3, the variance of investment value is \(\:3\times\:{10}^{-9}\), \(\:1.67\times\:{10}^{-9}\), respectively. The results suggest that the project investment value shows extremely low sensitivity to both hydrogen price drift and fluctuation rate.

Carbon price drift rate and fluctuation rate

In order to evaluate the impact of carbon price drift and fluctuation rate on investment decisions, the change rate was expanded to a range of 0.05 to 0.10 based on the previous settings of carbon price drift rate and fluctuation rate. Figure 11 shows the changes in the project value of each investment decision-making option on different carbon price drift and fluctuation rate.

As indicated in Fig. 11, in the multi-factor option model, multiple uncertain factors are not mutually influential during the investment decision-making process.

Firstly, the impact of the carbon price drift rate on project investment value is analyzed. From Fig. 11, under different carbon price drift rates, the changes in the investment value of each investment option are as follows in Table 8.

The investment value of option 1 is always 0, indicating that the carbon price drift rate has no effect on option 1.

The investment value of option 2, 3, and 4 increases slightly with the increase of carbon price drift rate, but the amount of increase is small. Specifically, the investment value of option 2 increases by 0.0005, option 3 increases by 0.0004, and option 4 increases by 0.0010 (million). This shows that these options are sensitive to changes in carbon price drift rate, but the impact level is quite limited.

The investment values of option 5, 6, 7, and 8 are all negative, and the level of change associated with the carbon price drift is small. For example, the investment value of option 5 does not change significantly with the increase of carbon price drift rate, indicating that these options may not be economically feasible with an expanded carbon price drift rate.

Secondly, the impact of the carbon price fluctuation rate on the investment value of the project is analyzed (as shown in Table 9). From Fig. 11, the impact of the carbon price fluctuation rate on each investment option is smaller than the drift rate:

The investment value of option one is also 0, which is insensitive to carbon price volatility.

The investment value of options 2, 3, and 4 has almost no change under the fluctuation rate of 0.05 and 0.1, and the maximum change is at the fourth decimal point. This indicates that although the investment value of these options changes within the range of carbon price fluctuation rate, the impact on investment value is very small.

The investment value of other negative options (5, 6, 7 and 8) has almost no change at different fluctuation rate, which also suggests that the investment value of these options is insensitive to the carbon price fluctuation rate.

In general, option four shows the highest investment return within the expanded change range of carbon price drift rate and fluctuation rate, and is less sensitive to changes in these parameters; therefore, option four is the optimal investment decision.

Lastly, this research comprehensively analyze the eight options. When the carbon price drift rate changes between 0.05 and 0.1, the variance of the project investment value of option 4 is\(\:\:1.11\times\:{10}^{-7}\), which is more sensitive to the change of carbon price drift rate, but still provides the highest return on investment. For carbon price fluctuation rate within 0.05–0.1, the investment value variances of Options 2, 3, and 4 are \(\:3\times\:{10}^{-9}\), \(\:2.67\times\:{10}^{-9}\), and \(\:2.67\times\:{10}^{-9}\), respectively, indicating that the investment value is not sensitive to the change of carbon price volatility, and Option 4 still provides the highest return on investment. In the multi-factor option model, the investment decision-making process has the cross-effect of multiple uncertain factors such as hydrogen price, carbon price, and equipment technology maturity. With the interaction of multiple factors, the project investment value fluctuates slightly according to the changed carbon price, but the impact is very small. The optimal investment plan is still Option 4 with the expanded drift and fluctuation rate.

Learning curve parameter

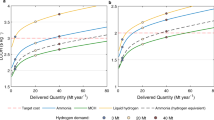

Since the development of hydrogen-powered ARMG is at the early stage of its development lifecycle, it is reasonable to set the value range of the learning curve parameter b as 0.1 to 0.4 Rogner53. A larger value of the learning curve parameter b means stronger learning effects of the equipment technologies, leading to lower average cost of an individual equipment regarding the initial investment cost. When the value of the learning curve parameter b ranges from 0.1 to 0.4, the calculation results of the project investment value are shown in Fig. 12.

As shown in Table 10, option one rejects building any hydrogen-powered ARMG during the decision-making period. Hence, the project value of this option is not affected. The project value of options 2 to 8 is positively correlated to parameter b. As the technological learning effect increases, the project investment value of each investment plan increases.

When the values of parameter b are set to 0.1 and 0.2, the optimal decision-making options are both option four. The corresponding project values are 5.3566 million CNY and 8.2687 million CNY, respectively, and the cumulative carbon emission reduction is 22,140 tons.

When the value of parameter b is 0.3, the optimal investment plan turns out to be plan seven. The plan proposes to invest 18 hydrogen-powered ARMGs by 2025 and 32 units by 2030. The investment value during the decision-making period is 3.1386 million CNY, and the cumulative carbon emission reduction is 33,620 tons.

When the value of parameter b is 0.4, the optimal investment decision is option 8. The proposal requires investment in 18 hydrogen-powered ARMGs by 2025, 32 units by 2030, and 40 units by 2035. The project value is 6.3295 million CNY, and the cumulative carbon emission reduction is 36,900 tons.

Since the hydrogen-powered ARMG construction project is characterized as a high investment and the initial investment cost accounts for a great proportion of the project’s cost, the initial investment cost of hydrogen-powered ARMG has a more significant impact than the hydrogen and carbon pricing. Sensitivity analysis results show that when technological maturity increases rapidly, the financial pressure on investment and construction will be released accordingly. Seaports are inclined to pursue more hydrogen-powered ARMG constructions during the decision-making period.

In the case scenario of the hydrogen-powered ARMGs investment decision-making problem, among the three types of uncertain influencing factors, namely hydrogen price, carbon price, and technology maturity, the change in the initial investment cost of equipment brought about by technology maturity has the greatest impact on the investment decision of the port hydrogen-powered ARMG construction project. Secondly, the carbon price has a greater impact on the investment decision. The more obvious the carbon price fluctuation, the lower the project investment value. The results of the sensitivity analysis show that when the technical maturity of the hydrogen-powered ARMG equipment increases rapidly, the financial pressure of the port investment and construction will decrease accordingly. In the context of green ports, ports will be more inclined to complete more hydrogen-powered ARMG equipment transformation within the decision-making period.

Conclusion

This study builds a multi-factor option model that includes hydrogen price, carbon emission price, and technology maturity. Unlike prior studies limited to single-factor analysis, this work advances the field by quantifying the synergistic impacts of hydrogen price volatility, carbon market dynamics, and technological learning effects, offering a replicable framework for ports worldwide. In this model, geometric Brownian motion is used to characterize the random fluctuations of hydrogen price and carbon price, and the learning curve is used to simulate the technology maturity, which causes a decrease in the unit cost of a hydrogen-powered yard crane.

To validate the effectiveness of multi-factor options model, this study conducted a case analysis based on the Qingdao Seaport’s automated terminal. The construction period of the hydrogen-powered yard cranes is divided into three stages: 2021–2025, 2026–2030, and 2031–2035. At each stage, one of the options (expansion option, delay option, or abandonment option) are selected, which forms eight investment plans. The case analysis results show that project plan four is the best investment decision from the perspective of project Investment value and carbon reduction effect. That is, choose the expansion option during 2021–2025 and build 12 new hydrogen-powered yard cranes; and do not continue to invest during the period of 2026–2030 and 2031–2035. In the invest plan, a total number of 18 hydrogen-powered yard cranes is built at the terminal; the project investment value is CNY 5.3566 million; and the carbon emissions are reduced by 22,140 tons.

The results suggest that the application of hydrogen-powered yard cranes is still in its early stages of development. After upgrading and renovating yard cranes with hydrogen power on a small scale, seaports could choose to wait and evaluate the market and technology advancement, then gradually continue the construction of hydrogen-powered yard cranes to reduce the investment risks.

This study also conducts a sensitivity analysis of hydrogen prices, carbon prices, and technology maturity under the case study scenario. The results show that the changes in the initial cost of equipment caused by technology maturity have the most significant impact on the investment decision. Also, investment plan four is the most stable plan with expanded fluctuation and drift rate, which suggests that plan four is more suitable.

Based on the research results, suggestions can be provided for port practitioners: technological breakthroughs in hydrogen-powered ARMG equipments can significantly promote port investment in hydrogen-powered ARMG construction projects, while the instability of the carbon market will affect the port’s investment in hydrogen power ARMGs. Economic benefits, thereby affecting port enthusiasm. Increasing the research and development and upgrading of equipment technology, actively utilizing hydrogen produced by industrial by-products around the port, and accelerating the construction of hydrogen energy markets and carbon emissions trading markets are effective ways to effectively promote the construction of port hydrogen power ARMGs.

Based on the research of this paper, further research could be conducted in the following aspects: (1) This study only considers the main uncertain factors affecting the cost-benefit of hydrogen-powered yard cranes construction projects. In the future, more factors can be introduced into the model to obtain a more realistic investment decision-making model, such as changes in electricity price and changes in seaport throughput caused by shipping market fluctuations. (2) The practical application time of hydrogen-powered yard crane equipment in seaports is less than five years. The relevant operational parameters for the multi-factor model are quite limited, which is one of the limitations of this study. (3) The hydrogen energy market and carbon trading market in the Chinese seaport domain are still in the early development stages. This study adopts the changes in historical hydrogen and carbon prices in other domains in China and abroad, which could cause certain deviations from the actual seaport investment environment. Future research can further improve the accuracy of the hydrogen and carbon prices simulation.

Data availability

The datasets used and/or analysed during the current study available from the corresponding author on reasonable request.

References

Zhang, Y., Kim, C. W., Tee, K. F. & Lam, J. S. L. Optimal sustainable life cycle maintenance strategies for Port infrastructures. J. Clean. Prod. 142, 1693–1709. https://doi.org/10.1016/j.jclepro.2016.11.120 (2017).

Hoang, A. T. et al. Energy-related approach for reduction of CO2 emissions: A critical strategy on the port-to-ship pathway. J. Clean. Prod. 355, 131772 (2022).

Di Vaio, A., Varriale, L. & Alvino, F. J. E. p. Key performance indicators for developing environmentally sustainable and energy efficient ports: Evidence from Italy. Energy Policy. 122, 229–240 (2018).

Bicer, Y. & Dincer, I. Clean fuel options with hydrogen for sea transportation: A life cycle approach. Int. J. Hydrog. Energy. 43, 1179–1193 (2018).

Wang, B., Liu, Q., Wang, L., Chen, Y. & Wang, J. J. E. P. A review of the Port carbon emission sources and related emission reduction technical measures. Environ. Pollut. 320, 121000 (2023).

Tan, Z., Zhang, Q., Yuan, Y. & Jin, Y. A decision method on yard cranes transformation and deployment in green ports. Int. Trans. Oper. Res. 29, 323–346 (2022).

Lin, S., Zhen, L. & Wang, W. I. Planning low carbon oriented retrofit of diesel-driven cranes to electric-driven cranes in container yards. Comput. Ind. Eng. 173, 108681 (2022).

Ma, N., Zhou, C. & Stephen, A. Simulation model and performance evaluation of battery-powered AGV systems in automated container terminals. Simul. Model. Pract. Theory. 106, 102146 (2021).

Guo, L., Ng, A. K., Jiang, C. & Long, J. Stepwise capacity integration in Port cluster under uncertainty and congestion. Transp. Policy. 112, 94–113 (2021).

Yue, Y. & Ying, Y. Real option analysis for emission reduction investment under the sulfur emission control. Sustain. Energy Technol. Assess. 45, 101055 (2021).