Abstract

Digital information networks have deeply integrated into various aspects of global economic development, and empowering enterprises through digitalization in terms of environment, society, and governance is key to achieving sustainable development. Using textual analysis and a sample of A-share listed companies in China from 2009 to 2022, we examine the impact and external mechanisms of digital transformation on companies’ ESG performance. The study demonstrates that digital transformation significantly enhances ESG performance. The ESG incentive effect of digital transformation is particularly pronounced in firms that disclose environmental information, in heavily polluting industries, and in regions with lower level of market distortions. Given the three distinct differences among companies, industries, and regions, factors such as investor attention, government environmental regulations, and the optimization of the business environment create favorable external conditions that further strengthen the incentive effect of digital transformation on ESG performance. In conclusion, digital transformation cannot rely solely on the self-directed efforts of enterprises; rather, it requires the influence and direction of suitable external governance to effectively advance the sustainable development.

Similar content being viewed by others

Introduction

As a crucial means of achieving the United Nations’ 2030 Sustainable Development Goals, enterprise ESG performance has been progressively prioritized by countries worldwide in recent years. According to KPMG’s Survey of Sustainability Reporting (2022), the rate of ESG disclosure among the largest 100 companies in each of the 58 countries surveyed reached 79% in 2022. Furthermore, the ESG disclosure rate for the top 250 companies in the Fortune 500 has attained an even higher level of 96%. China is no exception to this trend. Since 2006, China has gradually established a system of regulations governing the disclosure of ESG information by listed companies. Subsequently, in excess of 1,800 listed companies have elected to divulge their ESG reports by 2023, as China persists in its emphasis on sustainability concerns. ESG practices have emerged as a crucial means for businesses worldwide to foster a balance between environmental concerns and economic growth, ultimately aiming for sustainable development.

However, as the number of enterprises engaged in ESG activities continues to grow, so too do the challenges and issues that arise in this context. On the one hand, the current corporate ESG performance is poor due to insufficient capital, inadequate environmental awareness, and a limited level of green technology1,2,3. On the other hand, ESG alienation behaviors, such as ESG decoupling and greenwashing in some enterprises have led to skepticism regarding the rationality and authenticity of ESG performance4,5. The need for effective strategies to enhance ESG and improve its development has become an urgent priority.

Nowadays, the advancement of digitalization offers enterprises the opportunity to enhance their ESG performance. On one side, the digital transformation of tangible industry will significantly accelerate the growth of the real economy and enhance the efficiency of resource utilisation6. This will markedly reduce the rate of resource and environmental consumption associated with economic development. Moreover, the expansion of digitalized industries will facilitate the transformation and upgrading of the regional economy, which will subsequently result in a reduction of regional pollution emissions and environmental governance costs7. In essence, digital transformation can be defined as the process of enhancing the effectiveness of data flow, improving the efficiency of factor allocation, and strengthening the core competitiveness of enterprises through the utilisation of cutting-edge digital technologies8. This process entails the pioneering development and implementation of cutting-edge digital information technology, exemplified by artificial intelligence, big data, blockchain and etc. These technologies not only offer economic benefits to enterprises but also serve as a significant driving force for the advancement of enterprise ESG.

The exploration of ESG factors is a well-established area of research. An increasing number of studies have examined how various intrinsic factors within companies, such as technological innovation, governance frameworks, corporate culture, and information transparency, affect their ability to meet ESG obligations9,10,11,12. Furthermore, there is a significant amount of literature that looks into how policies, regulations, and capital markets influence corporate ESG practices13,14. With the rise of the digital age, digital technology is significantly altering the competitive landscape for businesses, making the study of digital transformation’s effects on ESG a prominent topic in recent years. Most researchers agree that digitalization positively impacts corporate ESG. A review of existing literature reveals that this positive influence is primarily evident in three areas: first, from the standpoint of enhancing enterprise capabilities, digital transformation improves various abilities such as dynamic, innovative, and management capabilities, enabling companies to better meet their ESG responsibilities15,16. Second, regarding information dissemination, digital platforms facilitate the sharing of information and enhance transparency within organizations, effectively addressing agency issues17,18 and aiding in internal monitoring and the prompt identification of control weaknesses19 thereby boosting firms’ ESG performance. Lastly, from the perspective of strategic decision optimization, digital transformation achieves optimal decision-making for enterprise resource allocation by integrating environmental, social, and governance multidimensional data20 and using intelligent algorithms to identify cost-benefit correlations of ESG actions21 which ultimately promotes the systematic enhancement of the enterprise’s comprehensive ESG performance. However, some scholars present differing views. Wang and Hou22; Zhang23 suggest that there is a delay in aligning organizational resources within companies, and the inherent uncertainties of digital transformation introduce hidden costs that can diminish ESG performance. Moreover, over-digitization will lead to a “rebound effect” that will increase the use of corporate resources, thus counteracting the incentives of the initial phase of digitization, and may even have a negative impact24.

The above literature provides inspiration for further research in this paper, but there are still the following areas to be expanded: first, there is still uncertainty about the impact of digital transformation on ESG. This is the reason why some scholars believe that digital transformation negatively affects or fails to affect ESG. At the same time, firms with different attributes differ in the impact of digital transformation on ESG performance. However, the causes of these heterogeneous impacts and their means of governance may have been overlooked in existing studies. Second, the digital transformation process lacks the intervention of external corporate governance factors. Most studies are limited to the internal governance factors of digital transformation, often ignoring the role of external agents in guiding, supervising and regulating enterprises. In the absence of external governance, enterprises may pursue efficiency excessively due to “technological rationality”, neglect social responsibility, and even allowing digitalization to negatively impact their ESG performance. Therefore, the linkage effect of internal and external governance needs to be explored urgently.

The potential contributions of our study can be summarized as follows: firstly, by constructing a framework that links ESG performance with digital transformation, this paper systematically demonstrates the contribution of digital transformation to the overall ESG performance of enterprises. It also provides an in-depth analysis of its differentiated impacts on the three components of environmental, social, and governance performance. This analysis not only enriches the study of corporate ESG performance drivers but also reveals the boundaries of technological empowerment’s penetration depth across different ESG dimensions, offering an innovative extension to the corporate ESG theoretical framework in the digital economy era. Furthermore, the study transcends the traditional technology value assessment paradigm and delivers quantifiable decision support for enterprise technology strategy deployment.

Secondly, based on the heterogeneity analysis, we deduce and confirm the key role of external governance mechanisms in corporate digital transformation for ESG practices. We also innovatively reveal the complementary and synergistic logic of the three external governance mechanisms: informal supervision, formal regulation, and market-based mechanisms. Specifically, regarding differences in environmental information disclosure, external supervision dominates the digital transformation path to enhance ESG performance, indicating that investor attention is the core mechanism. In terms of differences in market factor allocation, the degree of development of market-based mechanisms plays a decisive role, highlighting the key mechanism of optimizing the business environment. And concerning differences in industry pollution attributes, the formal regulatory mechanism serves as the primary regulatory function, ensuring the effectiveness of government environmental regulation.

The remainder of the study is structured as follows: section “Hypothesis development” presents the theoretical analysis and outlines the hypotheses. In section “Data and model”, we detail the research methods and the data utilized. Section “Empirical results” focuses on the analysis of the research results. Section “Mechanism analysis” offers further examination of the moderating effects. Lastly, section “Conclusions and recommendations” wraps up the study with conclusions and recommendations.

Hypothesis development

Direct effect

The primary impetus for organizations to pursue digital transformation arises from the dual challenges of addressing external environmental pressures and meeting the varied expectations of stakeholders. The increasing rigor of environmental regulations, crises related to resource scarcity, and heightened demands for sustainability from stakeholders, including investors, necessitate that companies mitigate environmental externalities and enhance resource efficiency. Concurrently, factors such as reputation management, competition for talent, the need for supply chain resilience, and the inadequacies of traditional governance in fostering collaborative efficiency and risk management collectively motivate organizations to improve their ESG performance through strategic transformation, thereby ensuring long-term legitimacy.

In this framework, digital transformation transcends a mere technological adaptation; it represents a strategic reconfiguration of capabilities that serves as a fundamental catalyst for enhancing ESG performance. The operational mechanisms of this transformation can be understood through the lenses of dynamic capability theory and stakeholder theory. According to dynamic capability theory, digitalization equips organizations to cultivate essential dynamic capabilities, thereby significantly bolstering their capacity to respond to external pressures and optimize resource allocation25. Furthermore, from the perspective of stakeholder theory, digital transformation alters the patterns of interaction and information exchange between organizations and their various stakeholders (including shareholders, employees, and customers), thereby diminishing information asymmetry and enabling organizations to more effectively identify, address, and reconcile the expectations of all involved parties26.

Specifically, from an ecological and environmental perspective, digital transformation leverages technologies such as the Internet of Things and big data analytics to facilitate real-time, precise monitoring and tracking of energy consumption, material usage, and pollutant emissions. Additionally, artificial intelligence is utilized for process simulation, predictive maintenance, and intelligent optimization27. Grounded in the theory of technology-enabled empowerment, this approach builds dynamic environmental management capabilities, enabling enterprises to continuously identify efficiency bottlenecks and swiftly adjust process parameters or resource allocation. This, in turn, significantly reduces resource waste and lowers pollutant emission intensity28 ultimately enhancing the enterprise’s environmental performance. From a social responsibility perspective, digital transformation empowers companies to fulfill their responsibilities to employees, consumers, and communities more efficiently and transparently. Digital technologies, such as automation and intelligent customer service, can optimize business operations and reduce costs, thereby freeing up resources to enhance employee well-being and strengthen the value of products and services. This, in turn, improves employee satisfaction, customer loyalty, and community recognition29. On the other hand, digital transformation has a powerful external governance effect. Digital platforms greatly enhance the transparency of information on corporate behaviour in areas such as labour rights protection and supply chain compliance30. This transparency significantly reduces information asymmetry between companies and external stakeholders, forcing companies to be more proactive in ensuring the social benefits of their operations. From a corporate governance perspective, digital technology significantly enhances companies’ capabilities in data mining, processing, and analysis. It provides management with more comprehensive and real-time insights, thereby improving the scientific basis and timeliness of strategic and operational decisions, ultimately enhancing overall production and operational efficiency31. Additionally, digital office solutions effectively dismantle organizational information silos and hierarchical or departmental barriers, promoting efficient information flow and sharing32. This reduction in internal information asymmetry enhances collaboration efficiency, internal control, and risk response capabilities, fundamentally strengthening the company’s coordination, risk management, and overall governance effectiveness. Based on this analysis, the following hypothesis is proposed.

Hypothesis 1

Digital transformation can improve companies’ ESG performance.

Moderating effects

As an external governance mechanism for publicly traded companies, investor attention serves to discipline and oversee management, thereby emerging as a significant catalyst for corporate digital transformation and ESG initiatives. Based on stakeholder theory analysis, companies should create value for all stakeholders and respond to their demands. It can be posited that heightened investor attention generates external monitoring pressure, which may incentivize firms to allocate resources for digital transformation towards ESG-related endeavors rather than short-term profit-oriented projects. This strategic shift aims to mitigate share price fluctuations or reputational damage stemming from inadequate ESG performance33. Investors force management to fulfill their ESG commitments by “voting with their hands” (participating in AGM proposals) or “voting with their feet” (selling shares) to strengthen the strategic synergy between digital transformation and ESG34. Moreover, companies that attract significant investor attention are more likely to secure low-cost financing options, such as green bonds or ESG-specific funds, to support projects that synergize digital transformation and ESG efforts35. Furthermore, institutional investors can facilitate the integration of digital technologies into ESG practices by providing access to technical expertise and management experience in ESG36. Additionally, in an environment characterized by rigorous investor scrutiny, firms are motivated to convey “credible signals” of their commitment to ESG through digital transformation initiatives, thereby appealing to long-term value investors37. Increased investor attention amplifies market responses to corporate ESG activities, prompting management to leverage digital tools for the ongoing enhancement of ESG performance38. Based on this analysis, the following hypothesis is proposed.

Hypothesis 2

The intensification of investor attention is conducive to reinforcing the ESG incentives of digital transformation.

As a means of better harmonizing economic growth and environmental protection, environmental regulation has assumed a more prominent role in the government’s environmental governance system in recent years. On the one hand, environmental regulations can effectively promote industrial restructuring, thereby helping enterprises to carry out digital transformation and improve their ESG performance. According to market entry theory, the government can screen market entities by setting standards and licensing barriers, thereby optimising the market structure39. As the intensity of environmental regulation has increased, many outdated production capacities and sunset industries have been standardized and banned. And outdated production methods and skills have been replaced by more digital and green methods, thus facilitating the digitalization process of enterprises and the improvement of ESG performance40. On the other hand, as environmental regulation is further implemented, local governments’ environmental protection work will be more accurately assessed, which will affect the promotion process of local government officials41. This will motivate local government officials to give higher weight to environmental protection in their actual work, which will objectively strengthen the local government’s punitive efforts against environmental pollution and exert stronger pressure on enterprises. The intensification of environmental regulations is compelling organizations to realign their existing business strategies and to devise and implement developmental decisions that reconcile environmental protection with business operations, thereby enhancing their ESG performance. In light of the aforementioned analysis, we put forth the following hypothesis:

Hypothesis 3

The enhancement of environmental regulation is conducive to reinforcing the ESG incentives of digital transformation.

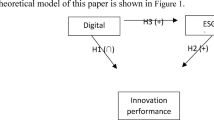

A favourable business environment in a region will facilitate accelerated economic growth and enable market forces to exert a more profound influence on the distribution of resources42,43. Firstly, a superior business environment is indicative of an enhanced institutional environment within the region. Institutional economics theory holds that institutions (including formal rules and informal constraints) are the fundamental determinants of economic performance, influencing the behaviour of economic agents by shaping incentive structures and reducing transaction costs44,45. In regions characterized by superior institutional quality, businesses develop stable expectations and are motivated to invest in carrying out digital transformation and improving environmental, social and corporate governance performance to realize long-term gains. Secondly, transaction cost economics theory suggests that enterprises face lower opportunistic risks in regions with higher marketisation39. The business environment exerts a significant influence on the market transactions of enterprises46. When the level of marketization and contract enforcement efficiency is enhanced, the scope for the implementation of opportunistic behaviors in inter-firm cooperation is constrained. Consequently, enterprises are exposed to diminished market risk. Only in an environment that is devoid of risk will enterprises engage in long-term decision-making, such as the implementation of digital transformation and improvements in ESG performance. Ultimately, an enhanced business environment gives rise to a greater frequency of market transactions and information transfers between firms, thereby facilitating a more efficient allocation of resources47. The occurrence of frequent and efficient market transactions facilitates enterprises’ access to the production factors and high-end talents required for digitalization. Furthermore, such transactions enable enterprises to recognize the necessity of implementing digital strategies and fulfilling ESG responsibilities in the context of market competition. This recognition then allows enterprises to carry out digital transformation and improve ESG performance. In light of the aforementioned analysis, we put forth the following hypothesis and the research framework (Fig. 1):

Hypothesis 4

The optimization of business environment is conducive to reinforcing the ESG incentives of digital transformation.

Data and model

Data

Core explanatory variable

The advent of the digital economy has prompted a significant increase in interest among scholars in the study of enterprise digital transformation. Some scholars prefer qualitative analysis methods to test the impact of digital transformation policies by constructing dummy variables48. This approach, however, fails to accurately represent the level of digital transformation. Another group of researchers prefers quantitative methods, measuring digital transformation by the ratio of intangible assets to total enterprise assets49. Yet, intangible assets encompass not just the application of digital technology, but also financial assets, patents, and trademarks. As a result, this methodology lacks the comprehensiveness needed to effectively gauge digital transformation. The widespread use of crawler technology offers researchers new perspectives. By analyzing the frequency of terms related to digital transformation in companies’ annual reports and filtering out unrelated words, the depiction of digital transformation becomes more precise.

This study employs the methodology established by Wu et al.50. to develop an indicator system for assessing corporate digital transformation. This is achieved by extracting 76 pertinent keywords associated with digital transformation from the annual reports of corporations. The process involves several specific steps: first, feature words are identified from the annual reports of publicly listed companies, focusing on two dimensions: the application of underlying technologies and the application of technological practices. These feature words are subsequently utilized for searching, matching, and counting word frequencies. The frequencies of key technological areas are categorized and aggregated, and the logarithm of the total word frequency is computed to formulate the digital transformation indicator (DT) for enterprises. The dimension of underlying technology application encompasses four categories: artificial intelligence, blockchain, cloud computing, and big data. The dimension of technological practice application pertains to the utilization of digital technologies. A comprehensive list of relevant digital transformation terminology can be found in Appendix A.

Explained variable

In this paper, ESG rating (ESG) is the explained variable. According to the research conducted by Wang et al.17 and Lu et al.51 the Huazheng ESG index serves as a tool for evaluating the ESG performance of companies. This index, in conjunction with widely recognized international ESG assessment methods, comprises 16 themes, 44 key indicators, and over 300 fundamental metrics. The ESG scores are categorized into nine levels and evaluated quarterly. To assess ESG performance, we calculate the average of a company’s four quarterly scores, which are rated on a scale of 1 to 9, representing the range from lowest to highest.

Moderating variables

-

(1)

Investor attention (Investor). To determine the moderating role played by investor attention, drawing on Chen et al.52 we use the institutional investor shareholding of a firm at year-end to measure investor attention to the firm. Institutional investors usually have specialized analytical teams and resources, and conduct systematic research on firms before investing. Therefore, a higher percentage of their shareholding indicates that the firm has passed the screening of professional institutions and gained a higher degree of investor attention and recognition.

-

(2)

Environmental regulation (Government). This study employs a measure of environmental regulation that considers whether a firm is recognized as a key regulatory unit. Local governments in China are responsible for determining and managing the list of key units for environmental supervision in their administrative regions, and for carrying out key environmental regulation and management of the units on the list. Therefore, if a firm is recognized as a key pollution monitoring unit in that year, the Government moderator variable is assigned a value of 1, indicating that the firm is subject to environmental regulation. Conversely, the firm is not subject to environmental regulation by the government and is assigned a value of zero.

-

(3)

Business environment (Marketization). We measure business environment using the provincial marketization index to explore the moderating role of regional business environment. The index is derived from the China Market Index Database and considers five key aspects, including the relationship between the government and the market, the development of the non-state economy, the development of the product market, the development of the factor market, and the development of market intermediary organizations and the legal and institutional environments. Each ‘aspect index’ reflects a specific aspect of marketisation, and each aspect index is composed of several ‘sub-indices,’ some of which have secondary sub-indices. We refer to the lowest level of sub-indices as the base indices. There are currently 23 base indices that form the basis of this index system, all of which are derived from objective statistical data or survey data.

Regarding the calculation of the index, we define the maximum and minimum values of each positive basic indicator in the base year for each province as 10 points and 0 points, respectively (negative indicators are defined as 0 points and 10 points, respectively). The scores for each province are determined based on the relative position of their indicator values in the base year compared to the maximum and minimum indicator values, thereby forming the basic index corresponding to that indicator. Several base indices are combined to form the next-level sub-index or aspect index, and the five aspect indices are combined to form the overall marketisation index.

Control variables

Drawing on Lu et al.51 relevant control variables are added to the model. Specifically, they include: firm size (Size), gearing ratio (Lev), total return on assets (Roa), Tobin’s Q (Tobinq), the number of years the firm has been listed (Listage), management expense ratio (Mfee),independent director ratio (Indep), shareholding concentration (Top1), book-to-market ratio (Bm), and total assets growth rate (Growth). All control variables are defined as shown in Table 1.

Model construction

To explore the impact of digital transformation on ESG performance, we use a fixed effects model and create the following equation for estimation:

where i indicates the firm and t indicates the year. \({\text{E}\text{S}\text{G}}_{i,t}\) is the explanatory variable, denoting ESG performance. \({DT}_{i,t}\) is the core explanatory variable, indicating digital transformation. \({X}_{i,t}\) are control variables, including firm size, gearing ratio, etc. \({\theta}_{i}\), \({\delta}_{t}, {\lambda}_{j}, {\mu}_{k}\) are firm fixed effects, year fixed effects, industry fixed effects, and city fixed effects, respectively. On the one hand, both digital transformation and firms’ ESG performance show great differences at the industry level. In particular, there is a stronger demand from industrial firms in terms of digital technology adoption and environmental responsibility fulfillment. On the other hand, the rapid development of the digital era has led to a gradual imbalance in the level of digital economy in the cities where enterprises are located. In order to prevent the city geographical differences from causing large bias to the study, we additionally include city fixed effects. The constant term and the disturbance term, respectively. \({\alpha}_{0}\:\text{a}\text{n}\text{d}\:{\epsilon}_{i,t}\) are the regression coefficients of the core explanatory variables, reflecting the net effect of the impact of digital transformation on firms’ ESG performance.

To explore how investor attention, business environment and environmental regulation affect the effectiveness of firms’ digital transformation, we draw on previous studies to construct the following model17,53,54:

where i indicates the firm and t indicates the year. \({M}_{it}\) are moderator variables representing investor attention (Investor), business environment (Marketization), and environmental regulation (Government). \({DT}_{it}\times\:{M}_{it}\) is the cross-multiplier of the moderating variables with the core explanatory variables after centering, and its coefficient captures the moderating effect on digital transformation and firms’ ESG performance. The rest of the variables are set as in Eq. (1).

This research utilizes data from Chinese A-share listed companies spanning from 2009 to 2022 for its empirical analysis. The data were primarily sourced from the CSMAR database, the Wind database, and the annual reports of the enterprises in question. To guarantee the precision of the research sample, the data underwent the following processing: firstly, those classified as ST, PT and financial industry listed enterprises were excluded. Secondly, enterprises with irregular and significantly incomplete data sets were excluded. Thirdly, firms with up to three years of continuous data were excluded from the sample. Subsequently, all the principal continuous variables were subjected to winsorisation at the upper and lower 1% levels, resulting in a total of 33,187 samples.

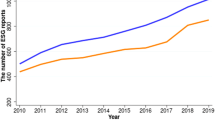

Prior to undertaking descriptive statistical analysis of the full-text variables, it is first necessary to conduct an in-depth examination of the regularity characteristics of digital transformation and ESG in both the industry and time dimensions. Figure 2, Panel A, illustrates the ten industries with the highest ESG scores. The real estate industry has the highest ESG score (4.685), which may be attributed to the industry’s sustained commitment to green building, energy conservation, and emission reduction. Additionally, the culture, sports and entertainment industry exhibits a notable ESG score (4.615), potentially reflecting its role in advancing social and cultural advancement. In comparison, the manufacturing (4.090) and mining (4.028) sectors have comparatively low ESG scores. This may be attributed to the intricate nature of environmental governance in the manufacturing sector and the considerable environmental impact of the mining sector during the extraction of natural resources. With regard to digital transformation, the information transmission, software and information technology services industry has the highest score (3.883), which is closely related to the industry’s own characteristics of being technology-focused and naturally highly digitised. In contrast, the mining industry has the lowest digital transformation score (0.514), which may be attributed to the industry’s traditional production model limiting the rapid penetration of technology, as well as the difficulty and high cost of digital transformation. The discrepancies in the industry scores can be attributed primarily to the differing technological attributes, business models, and social environments of the various sectors.

Figure 2, Panel B, illustrates the trend in the temporal dimension. The data indicate a high degree of volatility in the ESG performance of listed companies, with two peaks in 2012 (4.238) and 2018 (4.200), respectively, and a subsequent decline. The emergence of the two peaks reflects the incremental progress made by Chinese companies at each stage, driven by a combination of policies, market demand and increased awareness of social responsibility. Nevertheless, the subsequent decline and volatility indicate that the sustainable development of ESG still faces significant challenges, including insufficient governance capacity and a lack of long-term strategies, which require further improvement. The Digital Transformation Index (DT) has continued to grow at a relatively steady rate from 0.250 in 2009 to 1.902 in 2022. This indicates that Chinese companies have gradually accelerated the pace of digital transformation over the past decade or so. Furthermore, it provides possible paths and solutions to address the challenges faced by companies in ESG practices.

The results of the descriptive statistics are presented in Table 2. The mean of DT is 1.369 (exceeding the median of 1.099), indicating a right-skewed distribution. In addition, the proportion of enterprises exhibiting DT = 0 has exhibited a gradual decline, from 81.82% in 2009 to 16.64% in 2022. This suggests that the number of enterprises undergoing digital transformation is increasing, although it also indicates that a proportion of enterprises have yet to embrace digital transformation. The mean ESG value of the sample enterprises is 4.124, while the median is 4. This suggests that the overall ESG scores of enterprises are relatively low and that there is considerable scope for improvement. The statistical distribution of the remaining control variables is more reasonable and aligns with existing literature.

Empirical results

Baseline results

Table 3 presents the estimated results of the impact of digital transformation on the ESG performance. The estimated coefficient on digital transformation in column (1) is significantly positive at the 1% level when no fixed effects and control variables are included. This suggests that digital transformation is a driver of improved ESG performance among firms. The incentive effect remains statistically significant when firm, time, industry and city fixed effects are included in column (2). In order to prevent the missing firm characteristic variables from exacerbating the endogeneity problem, the corresponding control variables were added in column (3). The findings in column (3) indicate that the estimated coefficient for DT is 0.022, which is statistically significant at the 5% level. This implies that digital transformation improves companies’ ESG performance by about 2.2%. This serves to validate hypothesis 1.

In addition, we use the three sub-indicator scores of E, S, and G as dependent variables to further examine the specific impact of digital transformation on firms. As shown in the results in columns (4) to (6) of Table 3, the estimated coefficients of DT on E and S are significantly positive at the 1% level, while they are not significant for G. The estimated coefficients of DT on E and S are significantly positive at the 1% level, while those on G are not significant. This suggests that digital transformation may be improving overall ESG performance mainly by improving firms’ environmental and social scores, while the impact on corporate governance needs to be further investigated. We speculate that this difference may stem from the fact that governance involves areas of institutional rigidity such as decision-making mechanisms, power checks and balances, and its optimization relies on deep organizational change. Digital tools, on the other hand, are more likely to directly improve the efficiency of environmental protection and the transparency of social responsibility through technological empowerment, but have yet to have an impact on the endogenous reshaping of governance structures.

Endogenous treatment

The preceding study may be susceptible to the influence of endogeneity issues. While firms’ digital transformation has been shown to enhance their ESG performance, it is also the case that firms with superior ESG performance may be inclined to adopt digital technologies in order to facilitate transformation. Furthermore, issues such as modelling bias and omitted variables may also give rise to endogeneity. In light of the aforementioned considerations, this research employs the instrumental variable method and exogenous event shocks with the objective of addressing the endogeneity issue.

Instrumental method

Considering the issue of omitted variables and reverse causality, the enterprise management digitalization strategy driven score from CSMAR database has been selected as an instrumental variable (IV) in the study, with the aim of mitigating endogeneity to the greatest extent possible.

Combined with the consideration of the five aspects of the management’s digitalization position, innovation-orientated foresight, innovation-orientated persistence, innovation-orientated breadth and innovation-orientated intensity, this score better reflects the importance and initiative of the management of the enterprise towards digital transformation. On the one hand, we believe that executives’ digital awareness will drive firms to invest in digital assets to realize digital transformation55; On the other hand, executives’ identification and awareness of ESG concepts may directly affect corporate ESG performance. However, digital awareness is not directly related to ESG concepts, so it does not directly affect corporate ESG performance, in line with the relevance and exogeneity requirements of instrumental variables. Therefore, the study uses this instrumental variable and estimates it using two-stage least squares.

The findings from the first stage of the instrumental variable method are shown in column (1) of Table 4. The regression coefficient indicating the link between management’s digital awareness and digital transformation reveals a significant positive correlation at the 1% level. The results from the second stage of the instrumental variables method are displayed in column (2). After incorporating instrumental variables, the estimated coefficient for digital transformation in relation to ESG shows a significant positive correlation at the 1% level. Additionally, the Kleibergen-Paap rk LM statistic is significant at the 1% level, providing empirical support to dismiss the initial hypothesis of under-identification of instrumental variables. The Cragg-Donald Wald F statistic exceeds the Stock-Yogo critical value for the weak instrumental variable identification F-test at the 10% significance level, thus rejecting the initial hypothesis of weak instrumental variables. In summary, the instrumental variable approach effectively addresses the problem of endogeneity.

Difference-in-differences (DID)

To further mitigate the endogeneity concerns, we employ policy shocks that promote digital transformation of firms as a quasi-natural experiment, with the aim of mitigating the endogeneity problem. In 2014, China initiated a nationwide pilot project on the integration of informatization and industrialization. Since that time, China has annually identified a group of enterprises that comply with the “Assessment Norms for the Integration of Informatization and Industrialization in Industrial Enterprises.” The establishment of standards for the integration of informatization and industrialization serves as a crucial policy mechanism for the government in promoting the digital transformation of businesses.

In this context, we utilize the pilot standards for the convergence of informatization and industrialization as a proxy for digital transformation policies. Our objective is to investigate the concrete impact of policy shocks related to digital transformation on ESG performance of enterprises. The model is constructed as follows:

Digit is a digital transformation policy dummy variable. Digit takes the value of 1 if the firm is approved as a pilot enterprise for the integration of informatization and industrialization in 2014 and later years, and 0 otherwise. \({\beta}_{2}\)is the regression coefficient of the core explanatory variable capturing the net effect of the pilot policy on the firm’s ESG performance. The rest of the letters and symbols are the same as in Eq. (1). In addition, since the integration of industrialization and informatization is only for manufacturing enterprises, in order to comply with the basic setting of DID, the study only uses 2,353 manufacturing enterprises, including 760 pilot enterprises, to conduct the policy shock tests.

The policy shocks to ESG resulting from enterprise informatization and industrialization integration pilots are reported in columns (3), (4) and (5) of Table 4. The estimated coefficient for the policy pilot is found to be significantly positive at the 1% level when fixed effects and control variables are not included in the analysis. The estimated coefficients for the policy pilots remain significantly positive at the 5% level even after the gradual inclusion of fixed effects and control variables. This indicates that firms that implement the policy exhibit a more pronounced positive impact on ESG performance compared to firms that do not participate in the informatization and industrialization integration pilot.

In order to satisfy the basic assumption of DID, the study employs a parallel trend test using the initial year preceding the policy implementation as the baseline period. As illustrated in Fig. 3, the coefficient of Digit prior to policy implementation is not statistically significant. This suggests that there is no notable discrepancy between the control group and experimental group firms prior to policy implementation. Upon implementation of the policy, the coefficient of Digit exhibits a statistically significant positive value. This indicates that, subsequent to the implementation of the policy, enterprises that have participated in the pilot program are more able to enhance their ESG performance than those that have not.

Moreover, considering that the regression results in Eq. (3) could be due to other unobservables, we follow the practice of Cornaggia and Li56 and use a random sample placebo test to analyse whether the impact of the pilot policy on firms’ ESG is due to these unobservables. Specifically, we randomise the digit variable and run 500 regressions. The logic is that if the coefficients on the pseudo-policy dummy variables remain significant in the dummy scenario, this suggests that the original estimates may be biased and that changes in the dependent variable ESG are likely to be influenced by other policies or random factors. Figure 4 presents the regression results. The distribution of most of the estimated coefficients in the random sampling process is close to zero, so the regression results of Eq. (3) are not affected by random factors.

Robustness test

The first is replacing explained variable. There is still a significant degree of variation in international ESG rating standards57,58. To circumvent the potential issue of bias stemming from disparate measurement approaches, the study employs the CNRDS ESG ratings as a substitute for the explanatory variable. Column (1) of Table 5 presents the regression results obtained by replacing ESG indicators. The impact of digital transformation on CNRDS ESG performance remains statistically significant at the 10% level. This serves to reinforce the reliability of the study’s findings.

The second is replacing core explanatory variable. In order to avoid the possibility of a less comprehensive capture of the digital transformation vocabulary, the number of relevant words for digital transformation was increased from 76 to 197, following the work of Lu et al.51. Furthermore, to ensure greater accuracy, the reconstructed digital transformation (DT2) is calculated as the sum of the frequencies of related words divided by the length of the MD&A segment of the annual report. As shown in column (2) of Table 5, the coefficient of DT2 is significantly positive at the 1% level. This confirms the robustness of the digital transformation variable.

The third is hysteresising the observation window. It is possible that digital transformation may exert a reverse causal effect on ESG performance. Consequently, a correlation analysis was conducted between ESG and digital transformation, with a one-year lag. As demonstrated in column (3) of Table 5, the impact of digital transformation with a one-period lag on firms’ ESG performance remains statistically significant at the 5% level. This somewhat excludes the possibility of reverse causality, whereby ESG influences digital transformation.

The fourth is exclusion of companies that exaggerate strategic information. To be the one of the key strategic development approaches adopted by firms, there is a risk that the digital transformation information derived from textual analysis may be subject to a degree of exaggeration. In order to eliminate the potential for bias resulting from the inclusion of exaggerated strategic information, as discussed by Chen et al.59 we have limited our analysis to firms with passing or above results in their strategic information assessment, as recognized by the stock exchange. As demonstrated in column (4) of Table 5, the estimated coefficient on digital transformation exhibits a slight change from 0.022 to 0.025 after the exclusion of firms with exaggerated strategic information, with minimal impact on the coefficient. This suggests that the influence of exaggerated strategic information on the research findings is minimal.

Heterogeneity analysis

Environmental disclosure heterogeneity

In this study, companies that disclose environmental information in their annual reports will be recognized as environmental information disclosure companies, while those that do not will be classified as companies without environmental information disclosure. Our objective is to examine whether the effects of digital transformation on ESG performance exhibit variability based on the presence of environmental disclosure. The findings presented in columns (1) and (2) of Table 6 reveal a statistically significant positive coefficient for DT at the 5% significance level among firms that engage in environmental disclosure. Conversely, the coefficient for DT among firms that do not disclose environmental information is not statistically significant. This suggests that the act of disclosing corporate environmental information enhances the ESG incentive effects associated with digital transformation. This enhancement is primarily attributed to the reduction of information asymmetry between firms and external stakeholders. Specifically, ESG rating agencies can leverage disclosed environmental information to more accurately assess corporate adherence to environmental responsibilities. Consequently, this mitigates the risk of inaccurate or suboptimal ratings that may arise from insufficient corporate environmental disclosures. Therefore, firms that disclose environmental information are positioned more favorably in their digital transformation efforts aimed at improving ESG outcomes.

Industry pollution heterogeneity

To investigate the potential heterogeneity in the effects of digital transformation on firms’ ESG performance, this study classifies industries based on their environmental impact, specifically identifying those characterized by high energy consumption and significant emissions as heavily polluting industries. Conversely, industries that do not exhibit these characteristics are categorized as non-heavily polluting industries for the purposes of group regression analysis. The regression outcomes presented in columns (3) and (4) of Table 6 indicate that the coefficients for DT are significantly positive at the 5% level for firms operating within heavily polluting industries, whereas the coefficients for DT are not statistically significant for firms in non-heavily polluting industries. This finding implies that digital transformation is more likely to enhance the ESG performance of firms in heavily polluting sectors. This phenomenon can be attributed to the heightened environmental regulatory pressures faced by these industries, which inspire the adoption of digital technologies to improve resource management, thereby increasing energy efficiency and ESG performance. In contrast, non-heavily polluting industries, such as finance and services, experience less environmental pressure and consequently lack sufficient motivation to implement digital solutions, resulting in limited improvements in their ESG performance.

Factor market allocation heterogeneity

To explore whether the impact of digital transformation on firms’ ESG is heterogeneous due to factor market distortions, we conduct group regressions according to the annual median in calculating the coefficients of factor market distortions for each province in each year60. As presented in columns (5) and (6) of Table 6, the coefficients for digital transformation (DT) exhibit a statistically significant positive relationship at the 10% level in regions characterized by lower levels of factor market distortions. Conversely, in regions with higher levels of such distortions, the coefficients for DT are not statistically significant. This finding indicates that digital transformation exerts a more pronounced positive influence on firms’ ESG performance in areas with reduced factor market distortions. The underlying reason for this phenomenon is that factor market distortions tend to exacerbate the deterioration of the local business environment, create numerous rent-seeking opportunities, impair the efficiency of resource allocation among incumbent firms, diminish research and development (R&D) investments, and ultimately reduce total factor productivity. These adverse effects collectively hinder the digitalization process and the enhancement of firms’ ESG performance.

Mechanism analysis

The moderating effect of investor attention

The heterogeneous impact of digital transformation on environmental disclosure, as influenced by ESG incentives, may be significantly affected by information asymmetry. Existing literature indicates that the attention of investors, serving as external monitors, effectively reduces information asymmetry61. It is plausible to hypothesize that increased investor attention towards firms will catalyze digital transformation efforts aimed at enhancing ESG performance.

Utilizing the framework established in Eq. (3), Table 7 evaluates the moderating effect of investor attention. In column (1), the coefficient for the interaction term DT*Investor is significantly positive at the 1% level, suggesting that investor attention positively moderates the relationship between digital transformation and ESG performance enhancement. Specifically, as a crucial external corporate governance tool, investor attention not only enhances the external monitoring pressure on companies to allocate their digital transformation resources toward ESG objectives, but it also significantly amplifies the positive impact of digital technologies on sustainable development by facilitating financing and providing incentives related to market reputation.

Additionally, the sample is categorized based on the classification of firms as high-tech or non-high-tech. In columns (2) and (3), while the moderating effect of investor attention appears to be less pronounced for high-tech firms compared to their non-high-tech counterparts, the coefficients for the moderating effect remain significantly positive at least at the 10% level across both categories. This finding reinforces the robustness of the moderating role of investor attention and substantiates the validity of Hypothesis 2.

The moderating effect of government environmental regulation

Digital transformation exhibits a more significant effect on ESG incentives among firms operating in heavily polluting sectors compared to those in less polluting industries. This phenomenon is closely linked to the environmental regulatory pressures that these companies encounter. The findings presented in Table 8 illustrate the results of an analysis concerning the moderating influence of governmental environmental regulations.

The regression analysis in column (1) indicates that the coefficient for the interaction term DT*Government is significantly positive at the 5% significance level, suggesting that environmental regulations positively moderate the impact of digital transformation on the ESG performance of firms. More specifically, governmental environmental regulations can facilitate industrial advancement, support the digital transformation of companies towards more sustainable practices, and encourage firms to meet their ESG obligations. Additionally, such regulations heighten the penalties associated with environmental pollution, compelling enterprises to pursue green transformations and enhance their ESG performance.

To further assess the robustness of this moderating effect, firms were categorized into two groups based on their location in either provincial capitals or municipalities. The coefficients for DT*Government in columns (2) and (3) also demonstrate significant positivity at the 5% level, reinforcing the robustness of the moderating effect. This analysis substantiates the existence of a positive moderating effect of environmental regulation, thereby confirming Hypothesis 3.

The moderating effect of business environment optimization

Distortions in factor markets result in a heterogeneous incentive effect of digital transformation on ESG performance. However, optimizing the business environment can diminish rent-seeking behavior, enhance the allocation of factors in the market, and alleviate these distortions62. Consequently, alterations in the business environment of firms are expected to influence the ESG incentive effect of digital transformation.

The findings presented in Table 9 substantiate this hypothesis. Specifically, the results in column (1) indicate that the coefficient for the interaction term DT*Marketization is significantly positive at the 5% significance level, implying that the optimization of the business environment positively moderates the incentive effect of digital transformation on firms’ ESG performance. To be specific, enhancing the business environment entails minimizing excessive administrative intervention in the market, refining the legal framework, and fostering a spirit of contractual engagement among entrepreneurs. Such improvements lead to more efficient allocation of factors in the market, mitigate distortions, reduce transactional risks faced by firms, and create a more conducive institutional environment, thereby facilitating digital transformation and enhancing ESG performance.

Additionally, we conducted group regressions based on the ownership status of the firms. The regression outcomes in columns (2) and (3) reveal that the coefficients for the moderating effects are significantly positive at least at the 5% level, suggesting that the beneficial moderating effect of business environment optimization is evident in both state-owned and non-state-owned enterprises. This further corroborates the moderating influence of improvements in the business environment and validates Hypothesis 4.

Previous empirical studies have shown that investor attention, government environmental regulations, and improvements in the business environment all have a significant positive moderating effect on the ESG incentive effects of digital transformation: investors exert pressure by strengthening shareholder rights protection and information disclosure requirements, driving companies to focus on long-term value creation; governments internalise environmental costs through regulations, standards, and punitive oversight, compelling companies to balance economic gains with social responsibility; markets leverage competitive selection and factor mobility mechanisms to create a driving force, prompting companies to continuously optimise resource allocation and enhance innovation efficiency. These three regulatory effects collectively form a multi-layered, complementary corporate governance framework, jointly driving companies to deeply integrate ESG into their digital transformation. From the perspective of new institutionalism theory, this reflects the joint shaping of three institutional pillars: regulatory, normative, and cultural-cognitive63,64. Government environmental regulations (regulatory pillar) set mandatory bottom lines and compliance requirements; investor attention (normative pillar) conveys social expectations and value norms, creating reputational pressure; business environment optimisation (cultural-cognitive pillar) shapes the shared cognitive understanding that ‘ESG is essential for survival and development’ through market mechanisms. The three pillars are intertwined, forming a collaborative governance system based on government regulation, investor guidance, and market mechanisms. Together, they influence corporate decision-making, compelling/incentivising companies to systematically integrate ESG considerations into their digital transformation, thereby strengthening their overall governance framework and sustainable competitiveness.

Conclusions and recommendations

In the context of global sustainable development and the pursuit of high-quality growth, the concurrent enhancement of corporate digital transformation and ESG performance has emerged as a pivotal factor in facilitating the green transition of the economy. This study utilizes a sample of Chinese A-share listed companies from 2009 to 2022 to construct an index of corporate digital transformation through text analysis. It empirically investigates the influence of digital transformation on ESG performance at the micro level, while also considering investor attention, the optimization of the business environment, and government environmental regulations as moderating variables. These external factors are examined for their role in regulating the mechanisms through which digitalization impacts ESG performance. The results of the study show that, first, digital transformation facilitates ESG performance, a conclusion that still holds after a series of robustness tests. Meanwhile, the ESG incentive effect of digital transformation mainly stems from driving the growth of firms’ environmental and social performance under technological empowerment, while the effect on governance is not significant. Second, the boosting effect of digital transformation on firms’ ESG performance is more significant among firms that disclose environmental information, and firms in heavily polluted industries with low factor market distortions. This is related to the fact that environmental information disclosure alleviates information asymmetry between firms and outsiders, factor market distortion reduces firms’ resource allocation efficiency, and heavily polluting industries face stricter environmental regulation. Third, investor attention, business environment optimization and environmental regulation positively moderates digital transformation to improve firms’ ESG performance. This is because investor attention brings monitoring pressure and goodwill incentives to firms, the optimization of the business environment makes resource allocation more efficient, and government environmental regulations will force firms to upgrade their industries, which together promote the ESG incentive effect of digital transformation.

Based on these results, we offer several policy recommendations here.

Firstly, it is imperative that companies adapt to the prevailing zeitgeist and give due consideration to the central role of digital transformation in strengthening ESG performance and advancing the cause of sustainable development. Business leaders must recognize the central role digital transformation plays not only in driving economic performance, but also in driving environmental, social and corporate governance performance. At the strategic level, it is important for companies to seize the opportunity of digital transformation. This requires the active integration of digitalization into all aspects of a company’s production and operations management. It also requires the adoption of digital technology to moderately tilt towards green development, the strengthening of greening through digitalization, and the ultimate achievement of sustainable development.

Secondly, as the central hub connecting market expectations with corporate strategies, the policy should aim to guide investors from “passive” to “active”: institutional investors must leverage their management strengths to actively engage in corporate governance and collaborate with enterprises within the same industry to advance the development of ESG. At the same time, it is imperative for investors to leverage digital tools to mitigate information asymmetry and enhance the effective communication of monitoring pressures directed at investors.

Thirdly, the enhancement of ESG performance of enterprises by digital transformation is contingent upon the existence of a favourable business environment. It is therefore necessary to establish and improve relevant laws, policies, and systems, and to work together to build a more dynamic market environment. From the government’s perspective, it is essential to reduce excessive intervention in the market, eliminate differential treatment of enterprises caused by administrative factors, and establish a fair and stable market system. Concurrently, enterprises must operate in good faith, respect the spirit of contract, and promote entrepreneurial spirit to stimulate the vitality of the main body of the enterprise.

Ultimately, the government is also an important participant in market activities, local governments should be guided to increase their attention to environmental protection, improve the quality of environmental regulation in a targeted manner, adopt a rich variety of environmental regulation means, and promote local governments to allocate more resources to the field of environmental protection. It is also imperative to develop and enhance the intergovernmental collaboration framework for environmental regulation, so that the policy strength of environmental regulation can be fully utilized, avoiding the strategic relocation of enterprises due to the differences in the intensity of environmental regulation in different places, and forcing enterprises to strategically pay attention to the digital transformation and the fulfillment of environmental social responsibility.

In summary, this study explores the relationship between corporate digital transformation and ESG performance from an external governance perspective. It first examines the direct effect and its heterogeneity. It also explores the channels of the role of external governance instruments from multiple perspectives. On the one hand, the ESG incentive effect of digital transformation is demonstrated, which complements the evidence related to digital technology-enabled corporate sustainability and theoretically expands existing research. On the other hand, this study unveils the governance logic of complementary external interventions of “informal supervision - formal regulation - market-based mechanism.” This finding provides a reference for countries to manage enterprises and further develop the digital economy.

Although this study employs both theoretical and empirical tests to explore the positive impact of digitization on ESG, some research limitations should be noted. First, we conjecture in our study that the non-significant effect of digitization on governance (G) is due to the fact that firms have not yet completed the endogenous reshaping of governance structure by digitization, which still relies on further examination in the future. Second, we revealed three external regulatory mechanisms in our study, namely, investor attention, business environment optimization, and environmental regulation, while there are still many external governance factors of firms that are worth exploring, such as laws and regulations, industry associations, customers, and supply chains, which may point to the direction of future research.

Data availability

No datasets were generated or analysed during the current study.

References

Truant, E., Borlatto, E., Crocco, E. & Bhatia, M. ESG performance and technological change: Current state-of-the-art, development and future directions. J. Clean. Prod. 429, 139493. https://doi.org/10.1016/j.jclepro.2023.139493 (2023).

Gao, J., Hua, G. & Huo, B. Green finance policies, financing constraints and corporate ESG performance: Insights from supply chain management. Oper. Manag. Res. https://doi.org/10.1007/s12063-024-00509-w (2024).

Ren, X. & Ren, Y. Public environmental concern and corporate ESG performance. Finance Res. Lett. 61, 104991. https://doi.org/10.1016/j.frl.2024.104991 (2024).

Li, J. & Wu, D. (Andrew). Do corporate social responsibility engagements lead to real environmental, social, and governance impact? Manag. Sci. 66(6), 2564–2588. https://doi.org/10.1287/mnsc.2019.3324 (2020).

Yu, E. P., Luu, B. V. & Chen, C. H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Finance 52, 101192. https://doi.org/10.1016/j.ribaf.2020.101192 (2020).

Liao, F., Hu, Y., Chen, M. & Xu, S. Digital transformation and corporate green supply chain efficiency: Evidence from China. Econ. Anal. Policy 81, 195–207. https://doi.org/10.1016/j.eap.2023.11.033 (2024).

Hu, J. Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy. J. Environ. Manag. 337, 117755. https://doi.org/10.1016/j.jenvman.2023.117755 (2023).

Wessel, L., Baiyere, A., Ologeanu-Taddei, R., Cha, J. & Blegind Jensen, T. Unpacking the difference between digital transformation and IT-Enabled organizational transformation. J. Assoc. Inf. Syst. 22(1), 102–129. https://doi.org/10.17705/1jais.00655 (2021).

Arayssi, M., Jizi, M. & Tabaja, H. H. The impact of board composition on the level of ESG disclosures in GCC countries. Sustain. Acc. Manag. Policy J. 11(1), 137–161. https://doi.org/10.1108/sampj-05-2018-0136 (2020).

Arvidsson, S. & Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strategy Environ. 31(3), 1091–1110. https://doi.org/10.1002/bse.2937 (2021). Portico.

Bai, F., Shang, M. & Huang, Y. Corporate culture and ESG performance: Empirical evidence from China. J. Clean. Prod. 437, 140732. https://doi.org/10.1016/j.jclepro.2024.140732 (2024).

Yang, J., Zuo, Z., Li, Y. & Guo, H. Manufacturing enterprises move towards sustainable development: ESG performance, market-based environmental regulation, and green technological innovation. J. Environ. Manag. 372, 123244. https://doi.org/10.1016/j.jenvman.2024.123244 (2024).

Xue, Q., Wang, H. & Bai, C. Local green finance policies and corporate ESG performance. Int. Rev. Finance 23(4), 721–749. https://doi.org/10.1111/irfi.12417 (2023). Portico.

Lu, S. & Cheng, B. Does environmental regulation affect firms’ ESG performance? Evidence from China. Manag. Decis. Econ. 44(4), 2004–2009. https://doi.org/10.1002/mde.3796 (2022). Portico.

Wang, S. & Esperança, J. P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs. J. Clean. Prod. 419, 137980. https://doi.org/10.1016/j.jclepro.2023.137980 (2023).

Zhang, L., Ye, Y., Meng, Z., Ma, N. & Wu, C.-H. Enterprise digital transformation, dynamic capabilities, and ESG performance. J. Glob. Inf. Manag. 32(1), 1–20. https://doi.org/10.4018/jgim.335905 (2024).

Wang, H., Jiao, S., Bu, K., Wang, Y. & Wang, Y. Digital transformation and manufacturing companies’ ESG responsibility performance. Finance Res. Lett. 58, 104370. https://doi.org/10.1016/j.frl.2023.104370 (2023).

Fang, M., Nie, H. & Shen, X. Can enterprise digitization improve ESG performance? Econ. Model. 118, 106101. https://doi.org/10.1016/j.econmod.2022.106101 (2023).

Bloom, N., Garicano, L., Sadun, R. & Van Reenen, J. The distinct effects of information technology and communication technology on firm organization. Manag. Sci. 60(12), 2859–2885. https://doi.org/10.1287/mnsc.2014.2013 (2014).

Wamba, S. F., Dubey, R., Gunasekaran, A. & Akter, S. The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. Int. J. Prod. Econ. 222, 107498. https://doi.org/10.1016/j.ijpe.2019.09.019 (2020).

Liu, X. et al. Data-driven ESG assessment for blockchain services: A comparative study in textiles and apparel industry. Resour. Conserv. Recycl. 190, 106837. https://doi.org/10.1016/j.resconrec.2022.106837 (2023).

Wang, L. & Hou, S. The impact of digital transformation and earnings management on ESG performance: Evidence from Chinese listed enterprises. Sci. Rep. 14(1). https://doi.org/10.1038/s41598-023-48636-x (2024).

Zhang, S. The impact of digital transformation on ESG performance and the moderation of mixed-ownership reform: The evidence from Chinese state‐owned enterprises. Corp. Soc. Responsib. Environ. Manag. 31(3), 2195–2210. https://doi.org/10.1002/csr.2656 (2023).

Ahmadova, G., Delgado-Márquez, B. L., Pedauga, L. E., Hiz, L. & D. I Too good to be true: The inverted U-shaped relationship between home-country digitalization and environmental performance. Ecol. Econ. 196, 107393. https://doi.org/10.1016/j.ecolecon.2022.107393 (2022).

Ghosh, S., Hughes, M., Hodgkinson, I. & Hughes, P. Digital transformation of industrial businesses: A dynamic capability approach. Technovation 113, 102414. https://doi.org/10.1016/j.technovation.2021.102414 (2022).

Aben, T. A. E., van der Valk, W., Roehrich, J. K. & Selviaridis, K. Managing information asymmetry in public–private relationships undergoing a digital transformation: The role of contractual and relational governance. Int. J. Oper. Prod. Manag. 41(7), 1145–1191. https://doi.org/10.1108/ijopm-09-2020-0675 (2021).

Xu, J., Yu, Y., Zhang, M. & Zhang, J. Z. Impacts of digital transformation on eco-innovation and sustainable performance: Evidence from Chinese manufacturing companies. J. Clean. Prod. 393, 136278. https://doi.org/10.1016/j.jclepro.2023.136278 (2023).

Maiurova, A. et al. Promoting digital transformation in waste collection service and waste recycling in Moscow (Russia): Applying a circular economy paradigm to mitigate climate change impacts on the environment. J. Clean. Prod. 354, 131604. https://doi.org/10.1016/j.jclepro.2022.131604 (2022).

Fernandes, C. I., Veiga, P. M., Ferreira, J. J. M. & Hughes, M. Green growth versus economic growth: Do sustainable technology transfer and innovations lead to an imperfect choice? Bus. Strategy Environ. 30(4), 2021–2037. https://doi.org/10.1002/bse.2730 (2021). Portico.

Veile, J. W., Schmidt, M. -C. & Voigt, K. I. Toward a new era of cooperation: How industrial digital platforms transform business models in industry 4.0. J. Bus. Res. 143, 387–405. https://doi.org/10.1016/j.jbusres.2021.11.062 (2022).

Wang, J., Omar, A. H., Alotaibi, F. M., Daradkeh, Y. I. & Althubiti, S. A. Business intelligence ability to enhance organizational performance and performance evaluation capabilities by improving data mining systems for competitive advantage. Inf. Process. Manag., 59(6), 103075. https://doi.org/10.1016/j.ipm.2022.103075 (2022).

Hamann-Lohmer, J., Bendig, M. & Lasch, R. Investigating the impact of digital transformation on relationship and collaboration dynamics in supply chains and manufacturing networks—a multi-case study. Int. J. Prod. Econ. 262, 108932. https://doi.org/10.1016/j.ijpe.2023.108932 (2023).

Dyck, A., Lins, K. V., Roth, L. & Wagner, H. F. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 131(3), 693–714. https://doi.org/10.1016/j.jfineco.2018.08.013 (2019).

Gillan, S. L., Koch, A. & Starks, L. T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Finance 66, 101889. https://doi.org/10.1016/j.jcorpfin.2021.101889 (2021).

El Ghoul, S., Guedhami, O., Kwok, C. C. Y. & Mishra, D. R. Does corporate social responsibility affect the cost of capital? J. Bank. Finance 35(9), 2388–2406. https://doi.org/10.1016/j.jbankfin.2011.02.007 (2011).

Barko, T., Cremers, M. & Renneboog, L. Shareholder engagement on environmental, social, and governance performance. J. Bus. Ethics 180(2), 777–812. https://doi.org/10.1007/s10551-021-04850-z (2021).

Cheng, B., Ioannou, I. & Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 35(1), 1–23. https://doi.org/10.1002/smj.2131 (2013). Portico.

Grewal, D., Hulland, J., Kopalle, P. K. & Karahanna, E. The future of technology and marketing: A multidisciplinary perspective. J. Acad. Mark. Sci. 48(1), 1–8. https://doi.org/10.1007/s11747-019-00711-4 (2019).

Loconto, A. & Busch, L. Standards, techno-economic networks, and playing fields: Performing the global market economy. Rev. Int. Polit. Econ. 17(3), 507–536. https://doi.org/10.1080/09692290903319870 (2010).

Qiu, L. D., Zhou, M. & Wei, X. Regulation, innovation, and firm selection: The Porter hypothesis under monopolistic competition. J. Environ. Econ. Manag. 92, 638–658. https://doi.org/10.1016/j.jeem.2017.08.012 (2018).

Li, D., Huang, M., Ren, S., Chen, X. & Ning, L. Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 150(4), 1089–1104. https://doi.org/10.1007/s10551-016-3187-6 (2016).

Li, N., Feng, C., Shi, B., Kang, R. & Wei, W. Does the change of official promotion assessment standards contribute to the improvement of urban environmental quality? J. Clean. Prod. 348, 131254. https://doi.org/10.1016/j.jclepro.2022.131254 (2022).

Li, Y. et al. How can china’s sustainable development be damaged in consequence of financial misallocation? Analysis from the perspective of regional innovation capability. Bus. Strategy Environ. 31(7), 3649–3668. https://doi.org/10.1002/bse.3113 (2022). Portico.

Acemoglu, D. & Johnson, S. Unbundling institutions. J. Polit. Econ. 113(5), 949–995. https://doi.org/10.1086/432166 (2005).

Holmes, R. M., Miller, T., Hitt, M. A. & Salmador, M. P. The interrelationships among informal institutions, formal institutions, and inward foreign direct investment. J. Manag. 39(2), 531–566. https://doi.org/10.1177/0149206310393503 (2011).

Zhang, F., Zhang, J., Gao, Y. & Wang, Z. How does optimizing the business environment affect the capital flows between Northern and Southern china?? From the perspective of enterprises’ location choice for out-of-town investment. Int. Rev. Financial Anal. 94, 103295. https://doi.org/10.1016/j.irfa.2024.103295 (2024).

Boamah, N. A. Segmentation, business environment and global informational efficiency of emerging financial markets. Q. Rev. Econ. Finance 84, 52–60. https://doi.org/10.1016/j.qref.2022.01.010 (2022).

Peng, Y. & Tao, C. Can digital transformation promote enterprise performance? —From the perspective of public policy and innovation. J. Innov. Knowl. 7(3), 100198. https://doi.org/10.1016/j.jik.2022.100198 (2022).

Guo, C., Zhao, Y., Miao, Z., Li, W. & Chen, H. Indigenous R&D, outsourcing technology, and sustainable digital transformation. J. Knowl. Econ. https://doi.org/10.1007/s13132-024-01983-0 (2024).

Wu, K., Fu, Y. & Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Finance Res. Lett. 48, 102888. https://doi.org/10.1016/j.frl.2022.102888 (2022).

Lu, Y., Xu, C., Zhu, B. & Sun, Y. Digitalization transformation and ESG performance: Evidence from China. Bus. Strategy Environ. 33(2), 352–368. https://doi.org/10.1002/bse.3494 (2024).

Chen, T., Dong, H. & Lin, C. Institutional shareholders and corporate social responsibility. J. Financ. Econ. 135(2), 483–504. https://doi.org/10.1016/j.jfineco.2019.06.007 (2020).

Ma, Y., Zhang, Q. & Yin, H. Environmental management and labor productivity: The moderating role of quality management. J. Environ. Manag. 255, 109795. https://doi.org/10.1016/j.jenvman.2019.109795 (2020).

Murshed, M., Apergis, N., Alam, M. S., Khan, U. & Mahmud, S. The impacts of renewable energy, financial inclusivity, globalization, economic growth, and urbanization on carbon productivity: Evidence from net moderation and mediation effects of energy efficiency gains. Renew. Energy 196, 824–838. https://doi.org/10.1016/j.renene.2022.07.012 (2022).

Chen, W. & Srinivasan, S. Going digital: Implications for firm value and performance. Rev. Acc. Stud. 29(2), 1619–1665. https://doi.org/10.1007/s11142-023-09753-0 (2023).

Cornaggia, J. & Li, J. Y. The value of access to finance: Evidence from m&as. J. Financ. Econ. 131(1), 232–250. https://doi.org/10.1016/j.jfineco.2018.09.003 (2019).

Widyawati, L. A systematic literature review of socially responsible investment and environmental social governance metrics. Bus. Strategy Environ. 29(2), 619–637. https://doi.org/10.1002/bse.2393 (2019). Portico.

Billio, M., Costola, M., Hristova, I., Latino, C. & Pelizzon, L. Inside the ESG ratings: (Dis)agreement and performance. Corp. Soc. Responsib. Environ. Manag. 28(5), 1426–1445. https://doi.org/10.1002/csr.2177 (2021). Portico.

Chen, X., Wan, P., Ma, Z. & Yang, Y. Does corporate digital transformation restrain ESG decoupling? Evidence from China. Humanit. Social Sci. Commun. 11(1). https://doi.org/10.1057/s41599-024-02921-w (2024).

Lin, B. & Chen, Z. Does factor market distortion inhibit the green total factor productivity in china?? J. Clean. Prod. 197, 25–33. https://doi.org/10.1016/j.jclepro.2018.06.094 (2018).

Cho, S. Y., Lee, C. & Pfeiffer, R. J. Corporate social responsibility performance and information asymmetry. J. Acc. Public Policy 32(1), 71–83. https://doi.org/10.1016/j.jaccpubpol.2012.10.005 (2013).

Du, J. & Mickiewicz, T. Subsidies, rent seeking and performance: Being young, small or private in China. J. Bus. Ventur. 31(1), 22–38. https://doi.org/10.1016/j.jbusvent.2015.09.001 (2016).

Aguilera, R. V., Rupp, D. E., Williams, C. A. & Ganapathi, J. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manag. Rev. 32(3), 836–863. https://doi.org/10.5465/amr.2007.25275678 (2007).