Abstract

Offshore projects hold significant importance in the construction industry by fostering innovation, enabling large-scale infrastructure development, and supporting the expansion of renewable energy sources, enhancing global energy security and economic stability. Effective risk management is crucial in offshore projects to ensure operational safety, sustainability, and financial viability by identifying, assessing, and mitigating potential hazards. Selecting an appropriate project delivery method (PDM) is pivotal for efficient risk management, as it facilitates the proper allocation and mitigation of risks throughout the construction process. This study aims to investigate the impact of PDM on the risk assessment of the lifecycle of offshore platform projects and to identify and evaluate risks associated with offshore projects to improve understanding and optimize performance outcomes. In order To achieve the study’s objective, the Best Worst Method (BWM) and the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) are utilized for a lifecycle-focused risk assessment to identify the optimum PDM for offshore projects. A BWM–TOPSIS system is developed specifically for offshore projects, starting with organizing risks identified from the literature into a Risk Breakdown Structure (RBS) and subsequent evaluation using the Delphi technique for comprehensive and reliable risk analysis. The findings indicate that Integrated Project Delivery (IPD) and Construction Manager at Risk (CMAR) are the most effective methods due to their higher levels of integration, collaboration, and proactive risk management.

Similar content being viewed by others

Introduction

Offshore projects are frequently exposed to various risks; however, these challenges are mitigated by implementing risk management tools and techniques to ensure the safety of employees and organizations1. Oil, a critical energy resource for modern economies, is experiencing increasing demand as countries develop and refine their industrial capabilities. The global Offshore Oil and Gas market, valued at USD 119,755.31 million in 2022, is projected to grow at a CAGR of 8.5%, reaching USD 195,358.52 million by 2031, highlighting the increasing reliance on offshore production to meet energy demands. As per the International Energy Agency report in 2023, emerging economies such as China and India are expected to significantly increase their oil consumption in the future2.

In 2021, the leading oil and gas-producing nations represented 69.67% of worldwide output. The United States led crude oil and natural gas production, accounting for 26.10% and 34.23%, respectively, among leading producers, with a notable emphasis on unconventional resources such as shale oil and gas. Russia emerged as a leading producer of natural gas and a significant contributor to crude oil production, propelled by its onshore conventional resources. Saudi Arabia excelled in both onshore and offshore conventional crude oil production, making a substantial contribution to world oil supply. Canada achieved a high ranking because to its output of unconventional crude oil, encompassing oil sands and shale gas. Iran and Qatar were distinguished for their offshore natural gas extraction, with Qatar’s North Gas Field serving a pivotal function. The UAE, Iraq, and Norway made substantial contributions, with the UAE concentrating on both offshore and onshore crude oil, Iraq on onshore conventional crude oil, and Norway as a prominent European producer, mostly from offshore areas. These nations collectively underscore the varied sources and tactics in worldwide oil and gas production, encompassing both conventional and unconventional methods3. Despite sanctions and limitations, Iran remains a key producer, while Brazil’s offshore resources enhance its production. Due to its significant reserves, Kuwait is a major exporter in the Persian Gulf. These countries’ strategic roles and resources substantially impact global energy policies.

As the world is heading toward more sustainable projects, an effective risk assessment implementation is vital for maintaining sustainability in offshore projects. An effective risk management process plays a crucial role in avoiding delays, cost overruns, and environmental effects, which can impede the long-term capability of offshore operations. Incorporating sustainability objectives into the risk management process helps offshore projects align with environmentally friendly practices, such as decreasing the environmental impact and complying with environmental regulations.

It is essential to integrate environmental standards across the whole project lifespan to guarantee the sustainable execution of the construction process. This process includes the selection of environmentally sustainable suppliers, the implementation of energy-efficient technology, and the minimization of waste. Sustainable construction relies on effective decision-making frameworks that account for uncertainty in supplier performance, resource availability, and environmental effects4. Abbasnejad et al.5 established a human-technology cooperative framework to achieve significant efficiency targets for the sustainable construction industry. This framework facilitates communication during project realization, shortens construction schedules, increases material efficiency, reduces material and emissions pollution, and enables predictive maintenance evaluation within the project. They stated that the main challenges impeding their broad implementation are high costs, technical barriers, and data management issues.

The project delivery strategy aims to reduce inefficiencies by selecting the most appropriate organizational structure and considering the extent of client participation and risk sharing. Selecting an appropriate project delivery mechanism (PDM) affects the project’s outcome. The three conventional methods are Design-Build, Design-Bid-Build, and Construction Management, each with distinct advantages and disadvantages suitable for various construction projects under different conditions6.

By exploring databases such as NS Energy Business7, Offshore Technology8, Equinor Energy9, Gulf Oil and Gas10, and Aramco11 a comprehensive understanding of global oil and gas projects can be achieved, with insights into project scopes, geographies, and technologies. Approximately 55% of these nations utilize EPC (Engineering, Procurement, and Construction) and EPCI (Engineering, Procurement, Construction, and Installation) as the most prevalent project delivery methods. IPD (Integrated Project Delivery) has gained recent popularity in developed countries such as the USA, China, UAE, Kuwait, and Norway, while CMAR (Construction Manager at Risk) is the least used method employed explicitly in Kuwait. See Fig. 1.

The project management process in oil and gas development typically progresses through a series of critical stages: (1) conceptual design, (2) Front End Engineering Design (FEED), (3) procurement of long-lead equipment, (4) detailed design, (5) construction and fabrication, (6) onshore pre-commissioning, (7) transportation and installation specific to offshore platforms, and (8) hook-up and commissioning before the project is handed over to the end user. The final phase, Operations and Maintenance, focuses on regular maintenance and supervision to ensure the continued functionality and safety of the offshore facility. Each stage is vital and requires precise collaboration across different teams to address the unique challenges encountered in marine environments12.

Risk management, a critical aspect of project management, aims to enhance the likelihood of project success. Project risk management involves two main processes: risk identification and risk assessment. Depending on their probability and impact, risks can affect project objectives, including cost, time, scope, and quality13. The lifecycle of offshore projects inevitably involves risks. Several studies have highlighted the risks associated with traditional delivery methods in construction projects. However, there is a gap in the research focused on identifying risk factors linked to different project delivery methods throughout the offshore project lifecycle and how these risks influence the choice of the most suitable method. Effective risk management ensures that most project issues are identified early without exceeding the project budget or deviating from the project schedule14. Even though extensive studies on risk management in offshore projects exist, significant gaps still need to be studied to understand the impact of various Project Delivery Methods (PDMs) on risk management across the projects’ lifecycle. Additionally, a sufficient decision-making approach for determining the most suitable PDM is lacking. This research gap highlights the need for a systematic approach that combines risk assessment across the project lifecycle with PDM to improve project performance and reduce risks associated with offshore construction projects15.

Implementing various Multi-Criteria Decision-Making (MCDM) techniques in construction project management is considered essential due to the complex nature of these projects. Several objectives, such as cost, time management, HSE, and technical performance, are usually encountered in construction projects. Risks across the projects’ lifecycle phases must be considered. These techniques offer a systematic process to evaluate several project factors to ensure that choices consider a complete perspective of the project’s risk profile. They also help project managers consider various projects’ goals in the decision-making process. Furthermore, using MCDM methodologies improves the efficiency of risk management processes. Utilizing various MCDM approaches ensures that risk management in building projects is systematic, data-informed, and effective at dealing with the complex issues associated with large-scale, different activities.

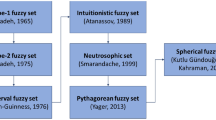

MCDM approaches have been adopted over the years to solve some of the complex project challenges in the construction sector, such as risk management, supplier selection, safety evaluation, and sustainability. It involves making decisions based on numerous criteria that frequently present inconsistencies. Each criterion may exhibit unique characteristics, units of measurement, and relative weight scales16. You et al.17, utilized a hybrid BWM/TOPSIS methodology to analyze the operational performance of grid organizations, employing BWM for indicator weight calculation and TOPSIS for performance ranking. Furthermore, many research studies have combined fuzzy methodologies with MCDM techniques to address uncertainties and subjective evaluations more effectively, enhancing their adaptability to dynamic conditions. These approaches facilitate the prioritization of alternatives, optimize resource allocation, and increase overall project outcomes by systematically evaluating many criteria. The reviewed studies are summarized in Table 1, which outlines the aims, fields of applications, MCDM used, and how each MCDM is used.

Selecting the best alternative based on specific criteria is a crucial aspect of construction management. Multi-Criteria Decision Making (MCDM) refers to evaluating various alternatives. Previous studies have utilized several analytical methodologies to support the selection of specific alternatives, such as the Analytic Hierarchy Process (AHP), for determining the optimal strategy and retaining systems24,23,33. Quality Function Deployment (QFD) has also been used to find the optimal structural system for buildings25. Additionally, the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) has been used to determine the best construction technique for bridge piers26.

By comparing various MCDM techniques, such as AHP, ELECTRE, TOPSIS, PROMETHEE, and VIKOR, Nestico, and Somma observed that TOPSIS efficiently handles a large number of criteria and alternatives while eliminating those with low normalized weights across most features. TOPSIS ranks options according to their closeness to the ideal solution to determine the best alternative across all parameters34. MCDM methods, including AHP, TOPSIS (Technique for Order Preference by Similarity to Ideal Solution), and DEMATEL, are particularly helpful in offshore projects, which involve numerous stakeholders and capital investments and are situated in dynamic environments influenced by factors such as weather conditions and regulatory restrictions.

Traditional methods for calculating risk weights have many deficiencies, including inconsistency, subjectivity, complexity, and oversimplification. The Analytic Hierarchy Process (AHP) is comprehensive but can result in inconsistencies when evaluating several criteria. The SAW technique often yields biased and subjective weights. Fuzzy Logic, while useful for expressing uncertainty, employs complex mathematical formulas that impede comprehension. Rezaei presented the Best Worst Method (BWM), demonstrating that BWM requires less comparative data while producing more reliable and precise outcomes35. BWM reduces these challenges by minimizing the required comparisons, focusing mainly on high values—the best and worst criteria—thereby decreasing subjectivity while offering a more objective and reliable technique for computing risk weights. Thus, BWM is particularly proficient in delivering an accurate, reliable, and practical risk assessment relevant to complex undertakings like offshore building projects.

An analysis of the strengths and weaknesses of MCDM approaches revealed that the integration of BWM and TOPSIS provides significant benefits for decision-making processes. The Best–Worst Method (BWM) minimizes subjectivity and inconsistency in criteria weighting, whereas the Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS) methodically evaluates alternatives according to their closeness to an ideal solution. The study requires accurate criterion weighting and an effective ranking methodology, enabling the combination of BWM and TOPSIS very effective. This combination guarantees consistent criterion weighting and appropriate ranking of options36.

This research utilizes a hybrid BWM–TOPSIS methodology to evaluate lifecycle risks in offshore projects and determine the optimal project delivery mode. In the lack of a systematic database assessing hazards throughout the offshore project lifetime, the Delphi method was employed to obtain expert opinions, hence assuring reliability of data and consistency. This study examines the significance of risk assessment in determining the optimal project delivery method at the beginning phase of offshore projects, employing a hybrid BWM–TOPSIS model to fulfill its aims37.

The BWM–TOPSIS model systematically mitigates risks throughout the project lifecycle by assigning weights to essential risks and rating project delivery methods according to their proximity to optimal risk scenarios. A three-tiered technique was established to enhance this model, concentrating on the identification of critical risks within the offshore project lifecycle, prioritizing these risks, and determining the most suitable project delivery method based on the evaluation. This framework offers a methodical and effective strategy for decision-making in offshore initiatives38.

Literature review

Project delivery methods

Selecting an appropriate project delivery method (PDM) is a complex decision-making process that should occur during the project-scoping phase and certainly before the commencement of the final design process. However, project design often lacks precise and unambiguous specifications39,40. Project delivery approaches aim to reduce inefficiencies by assigning the most suitable organizational structure, considering varying levels of client involvement and risk distribution. A PDM, called a procurement route, outlines the organizational framework construction clients use to manage design, construction, and maintenance operations to achieve their goals and objectives by developing completed structures41.

Research conducted within the Trinidad construction sector aimed to identify the most suitable PDM for application in a developing context. The study highlighted the significance of the financing cycle and regulatory and legal constraints, emphasizing their influence on the political and regulatory environment in which the delivery method must be implemented42.

Design bid build

The design-bid-build (DBB) approach is the predominant method for global construction services. Typically, the selection of construction firms using this method is based on low-bid procurement43. The core principle of DBB involves the client entering into two separate contracts: one with the designer and another with the contractor44. In this arrangement, the contractor is primarily responsible for constructing the project according to the design specifications, while the designer’s role is to develop the project design based on the client’s requirements and to supervise the project as the owner’s representative41.

Although DBB offers clarity and control, it also presents particular challenges. The linear nature of this method can lead to extended project completion times, and any design issues or changes required post-bid can result in increased costs and delays. Additionally, the separation between design and construction means that contractors often have limited input into the design, potentially leading to practical challenges during the construction phase45.

Design-build

In the context of design-build (DB), it is essential to recognize that the contractual entity may not always be fully responsible for the design and construction processes due to the variety of design and build approaches. Nevertheless, this method mitigates the competitive relationship between design and construction teams in traditional methods. As a result, fostering innovation, communication, and cooperation throughout the project lifecycle reduces cost and time while enhancing client satisfaction46.

A notable advantage of the design-build approach is its ability to provide the owner with a single point of contact through a main contractor. However, this process is more complex than it might initially seem. Different iterations of the design and build approach exhibit unique characteristics that deviate from the precise definition provided by Crossman47.

The distinction between DB and design-bid-build (DBB) delivery approaches lies in the contracting strategy. In Design-Build approach, the design and construction services are combined into a single contract with one entity. Conversely, the design-bid-build separates these services into two contracts, with the design phase completed before the construction phase is put out for bidding and awarded to a contractor, as illustrated in Fig. 248.

Difference between DBB &DB48.

Construction management at risk

The Construction Manager at Risk (CMAR) project delivery method has recently gained popularity, particularly within the public sector6. CMAR was identified as the most suitable project delivery strategy for infrastructure projects due to its unique integration of the owner’s project control and the agency manager’s expertise, both critical factors influencing the project’s overall success. This balanced approach fosters a collaborative relationship between the owner and the manager, enhancing project management by facilitating comprehensive project control, efficient risk allocation, cost reduction, shortened project timelines, minimized need for specialized skills in the owner’s project team, and ensuring long-term project sustainability. A significant attribute of CMAR is the early involvement of the construction manager, promoting a collaborative approach to project planning and design. This early engagement allows the construction manager to provide valuable input on cost estimation, materials selection, and constructability issues, leading to more accurate budgeting and scheduling49.

Public private partnership (PPP)

Public–private partnership (PPP) is a highly significant approach to project delivery. Developed countries have employed this method to execute infrastructure projects across various sectors, such as transportation, telecommunications, power, water, sanitation, health, education, and correctional facilities, aiming to ensure project sustainability50. Following the contract award and financial closure, PPP projects advance into the partnership phase (P3), encompassing project construction, operation, and maintenance. The partnership phase is a critical component of the PPP lifecycle, as it marks the commencement of the implementation of a PPP project51. Infrastructure projects under PPP arrangements are particularly vulnerable to numerous risks, including technical, construction, operations, revenue, financial, resources, production, force majeure, political, regulatory, environmental, commercial, and unforeseen hazards52.

Build-operate-transfer (BOT)

The Build-Operate-Transfer (BOT) model is widely used for delivering infrastructure projects, particularly in developing countries53. In BOT projects, the private partner is responsible for constructing a facility that meets the agreed-upon criteria set by the public entity. After construction, the private partner operates the facility for a specified period before transferring ownership to the public entity at the end of the concession term. The project is designed to generate sufficient returns to cover the private sector’s investment over the concession period54. Investors must adopt several critical success factors (CSFs) to consistently secure BOT contracts. Key elements agreed upon by both parties typically include selecting the right project, leveraging the consortium’s strengths, offering a superior technical solution, presenting a unique financial package, providing guarantees, and demonstrating strong entrepreneurship and leadership. Integrating and prioritizing these factors can significantly enhance the likelihood of winning a BOT contract55.

Integrated project delivery (IPD)

Integrated Project Delivery (IPD) is a project implementation strategy designed to enhance contractual arrangements, improve precision in planning, boost productivity through collaboration, and increase communication effectiveness, thereby addressing the construction industry’s lag relative to other sectors56. The use of appropriate technology is a critical component in the implementation of IPD57. Adopting these concepts eliminates traditional contractual boundaries, leading to a clearer delineation of objectives and duties58.

Key contractual elements of IPD include equal rights for all parties, shared risks and profits, equal accountability, and early participation from all involved stakeholders. Behavioral components encompass mutual respect and trust, willingness to collaborate, open communication, collaborative definition of project objectives, and collective decision-making59. For contractors, essential aspects include cost reduction, precise planning, and profit sharing60. Shared goals between the employer and contractor, such as minimizing waste, claims, and resource inefficiencies, are crucial61.

IPD faces various challenges, including organizational, environmental, and capital macro factors. Financial difficulties represent a capital challenge, while organizational issues include managerial, contractual, educational, communication, and technological problems. Environmental concerns encompass cultural, legal, and political difficulties55,62.

Engineering, procurement and construction (EPC)

This approach integrates planning, material procurement, construction, and risk management under a single contract, with the general contractor in EPC projects managing these aspects from the initial phase, including immature technical and social elements 39,63. Under this model, driven by advancements in the building industry, the contractor is responsible for ensuring quality, safety, timeliness, and cost control. The complexity of the construction process and various contributing factors, such as the building environment and managerial skills, exacerbate the challenges of completing projects64.

EPC contracts typically address these challenges using more sophisticated techniques than traditional construction contracts. Effective implementation of the EPC strategy requires the contractor’s understanding, control, and ability to influence risk distribution and their readiness to accept the associated risks65. Figure 3 illustrates the fundamental structure of EPC.

The basic structure of the EPC contract65.

Risk management

Risks in project delivery method

Establishing a comprehensive set of criteria for selecting the appropriate project delivery method (PDM) significantly enhances the clarity of the project’s current status and refines the selection process. Extensive reviews have identified various factors influencing PDM selection, offering insights on how these criteria can be customized to address the specific requirements of diverse projects66. Four fundamental principles for effective risk allocation have been proposed, which include assigning risks to the party best equipped to manage them, ensuring that risk allocation aligns with the project’s objectives, sharing risks when they contribute positively to project outcomes, and striving to distribute risks in a manner that promotes team collaboration while aligning with customer-focused performance goals67. Additionally, it has been observed that risks within complex environments are often highly interconnected, resulting in amplified impacts68. Consequently, project management teams must collectively comprehend the cumulative effects of all project risks rather than formulating strategies for individual risks in isolation.

Risk Management in offshore projects

Risk management related to oil and gas construction (OGC) projects has been sporadically studied, with limited dedicated analyses focusing on this sector. Van Thuyet et al.69 conducted an in-depth assessment of 59 major risk factors within OGC projects in Vietnam, identifying ten as particularly critical, thereby indicating a growing but insufficient focus on comprehensive risk analysis in this high-stakes field. Building on these foundational studies, Mubin and Mannan70 explored the risk factors associated with Engineering, Procurement, and Construction (EPC) contracts, identifying 168 risks and categorizing them into seven groups. Similarly, research by Kassem et al.71 identified up to 51 risk factors in the Yemeni oil and gas sector, which were categorized into internal and external risk factors, highlighting the complex nature of risks inherent to this industry. Lenkova72 and others provided detailed categorizations of risks, dividing them into internal and external factors with subsequent structuring within each group, which is crucial for systematically managing risks by understanding their origins and potential impacts on projects.

In a comprehensive literature review, Dey et al.73 explored the general causes of project failures and risk factors that affect project success in the Indian oil industry, categorizing these risks across different phases of project development, including planning, implementation, and evaluation, while also addressing key areas such as project management processes, organizational transformation, and technology management. Khalilzadeh et al.74 focused on identifying and assessing key risks in the oil and gas sector, particularly during times of sanctions and uncertainty, identifying critical risks during the exploration and exploitation phases and categorizing them into seven groups: time and cost, human resources, quality, procurement, scope, communications, and other primary risks. Their study emphasizes the importance of management’s continuous risk identification and evaluation to mitigate impacts or likelihoods, facilitating an understanding of how managing one risk can influence others. However, the study acknowledges that not all risks can be eliminated, especially those with inherent traits that require careful consideration in managerial decision-making. Ketabchi and Ghaeli75 employed the Fuzzy Best Worst Method (FBWM) for risk weighting, identifying technical risk and project execution as significant concerns, particularly in offshore projects. This methodological innovation provides a quantitative approach to understanding and prioritizing risks. The necessity for an integrated methodology to effectively manage construction risks is emphasized in research by Al Mhdawi76, which focuses on oil and gas fields in Iraq and supports the development of analytical models and structured methodologies to formalize human knowledge and risk characteristics. Kraidi et al.77 identified several key risks affecting projects, including inadequate safety regulations, poor inspection and maintenance practices, limited detection and monitoring of potential threats, and a general lack of awareness regarding legal and moral responsibilities. Other significant issues noted include design, construction, and material defects, insufficient training, threats to employee safety, inadequate risk documentation, vulnerable infrastructure such as easily accessible pipelines, insufficient warning systems, a lack of modern IT services and equipment, frequent operational errors, disputes over land ownership, and inadequate research on relevant topics. In the oil and gas industry, implementing an effective risk management process is crucial in several key areas, as outlined by Alnoaimi and Mazzuchi1, including conducting job safety analyses to prevent workplace accidents, adhering to government regulations, managing environmental impacts, balancing supply and demand fluctuations, and controlling costs. Oil and gas companies are vulnerable to losses or crises due to any identified risk, making it imperative for these entities to monitor negative events to anticipate potential emerging risks. By analyzing these emergent risk properties, companies can foresee future hazards and identify potential new opportunities for enterprise development, as highlighted by Alnoaimi and Mazzuchi1. This proactive approach to risk management aids in navigating both the challenges and opportunities present in the dynamic oil and gas field.

Research methodology

This research focused on identifying potential risk parameters affecting the lifecycle of offshore projects by reviewing existing literature and resources. Building on established factors, the study aimed to enhance current knowledge and address relevant risks that could influence offshore project outcomes throughout their lifecycle. A closed-format questionnaire was developed as the initial step to systematically recognize the potential risks and challenges associated with offshore projects. This questionnaire gathered data on hazards throughout the lifecycle of offshore projects, which were then organized into a recommended framework. Experts were invited to incorporate, modify, or eliminate elements as necessary, ultimately achieving consensus among them by the conclusion of the process. The initial stage involved compiling fundamental structured data on hazards sources from the literature, resulting in a Risk Breakdown Structure (RBS) tailored explicitly for offshore projects. The questionnaire was designed to obtain expert assessments regarding the probability of risks occurring and their potential impact on project objectives. Figure 4 summarizes the considered methodology.

The distinctive characteristics of offshore projects pose challenges in sourcing a sufficient number of highly skilled workers, which may have affected the diversity of insights collected. Despite the limited sample size, the interviewed experts offered valuable and comprehensive insights crucial for understanding the complexities of offshore projects, drawing from their extensive experience in industry-related risk assessments.

The RBS served as the input for evaluating the probability and impact of the identified risks. Using quantitative research and expert opinions, 27 significant risks were selected for inclusion in the most appropriate project delivery approach selection model. These risks were systematically categorized into four groups for comprehensive analysis. The first category, Management Risks, encompasses issues related to project planning, decision-making processes, and organizational structures that could influence project success. The second category, Financial and Economic Risks, includes factors such as budget overruns, funding challenges, and economic instability that could jeopardize the project’s financial viability. The third category, External and Site Conditions, pertains to environmental factors such as ecological changes, ethical standards, and site-specific issues. Lastly, Technical Risks involve design, software engineering, and technology usage challenges that may result in operational difficulties or failures.

Due to the limited sample size in offshore projects, noticeable variations in risk weights emerged between the two rounds of questionnaires. The initial questionnaire concentrated on a smaller sample size to identify the most critical risks, while a larger sample size was employed in the second round to ascertain more precise risk weights. This approach, which yielded a more accurate and representative assessment of previously highlighted hazards, ensured a thorough and balanced evaluation. The process underscores the significance of sample size in accurately assessing and prioritizing risks in offshore projects.

Risk assessment and prioritization of Project delivery methods (PDM) within the context of offshore construction projects have been suggested in this research through the integration of the following techniques: extensive literature review, Delphi technique, Best–Worst Method (BWM), and Technique for Order Preference by Similarity to Ideal Solution (TOPSIS). Risk exposure is carried out using an extensive literature analysis relating to the two areas of concern: offshore construction projects and various PDMs. It follows a complete approach to risk analysis using the Delphi technique, wherein opinions are obtained from experts, and the trend of risk preference forms the basis for BWM. BWM calculates the risk weights in all the life cycle stages of an offshore project, hence quantifying the risks. Finally, the PDMs were ranked through TOPSIS, which integrates various aspects of risk issues into the decision-making process. The application of modern decision-making tools, including Delphi, BWM, and TOPSIS, in an integrated approach has provided a structured, efficient, and reliable way of performing risk management and optimization related to PDM and opened new evaluation dimensions in an offshore construction project.

The Delphi method typically commences with an initial round of feedback from a smaller, specialized group of experts, usually comprising approximately eight participants. This approach facilitates a comprehensive exploration of key issues and the development of a robust framework for the investigation. As the process advances to the second round, expanding the sample size to around 30 experts is beneficial, allowing for a broader range of perspectives and enhancing the depth of understanding. This increased diversity of expert viewpoints bolsters the reliability and accuracy of the findings, ensuring that the conclusions drawn are robust and representative of the wider expert community. Selected experts met at least one of the following three criteria: a minimum of eight years of experience overseeing offshore projects, ten years of academic research experience in offshore projects, or possessing a master’s degree in petroleum project management.

Figure 5 shows an overview of positions and years of experience for surveyed participants. The majority of respondents are General Managers (31%) and Project Managers (24%), followed by Engineering Managers (14%) and Assistant General Managers (14%). Years of Experience chart highlights that 45% of participants have over 20 years of experience, with 31% having more than 15 years. This distribution indicates a strong presence of experts in senior roles.

Risk identification for offshore projects

Risk analysis to develop the selection criteria

Due to the lack of a unified database detailing risks associated with the lifecycle of offshore projects, initial risk identification was undertaken by reviewing relevant literature and examining available technical documentation. This comprehensive review resulted in the identification of 117 distinct risks. Subsequently, a detailed inventory of potential risks for offshore project delivery was compiled, accompanied by a classification scheme for effective organization. This effort culminated in developing a Risk Breakdown Structure (RBS) for offshore drilling projects, which serves as a standardized repository of potential uncertainties. The RBS is organized hierarchically, featuring a top-level category, four primary risk areas, 26 subcategories, and a total of 117 specific risk items. The structured list of risks is delineated in the RBS for offshore projects, and Fig. 6 visually illustrates the four-tiered structure of the risk categories, with particular emphasis on external and site condition risks.

Expert opinions were utilized to evaluate the probability of risks and their potential impact on project objectives. Data collected from interview questionnaires were aggregated, with the total scores for each risk factor divided by five to derive the average, reflecting the overall score from all participants. The relative position of each factor indicated its level of risk performance, providing valuable insights into the risk management objectives of stakeholders. The estimated impacts of risks were inputted into relevant templates, which Primavera Risk Analysis subsequently utilized to construct a risk model, also referred to as an affected risk plan, for the project schedule. Developing this risk model involves estimating the potential consequences of identified risks and applying these to the project’s cost and schedule.

The risk score presents an overall risk effect on project objectives. Based on the 27 high risks that have been identified, the cutting line for top risks was determined to be a minimum score of 20 on project objectives.

Dividing the offshore project lifecycle into three distinct phases—development, Construction, and Operation—provides a structured approach to risk analysis and allows for targeted strategies at each phase.

-

Development Phase risk analysis focuses on regulatory approvals and financial feasibility, addressing uncertainties that could impact the project’s viability before significant investments are made.

-

The emphasis shifts to physical and logistical risks in the construction phase, such as engineering challenges, supply chain logistics, and workforce safety. This phase requires rigorous contingency planning to manage potential delays and cost overruns.

-

Operation Phase involves risks associated with the project’s ongoing maintenance and operational efficiency.

Results of best worst method (BWM)

The calculation of risk weights derived from the Best–Worst Method (BWM) is based on a structured process following identifying top risks from the first round of the Delphi technique. In the initial stage, data from expert evaluations is gathered, identifying the most critical risks in various categories—such as management, technical, financial, and external risks—based on the offshore project’s life cycle phases (development, construction, and operation). In the second round of the Delphi process, BWM is applied. Experts are asked to select the most important and least important risks within each category for each project phase. Additionally, they are asked to assess the preference of every other risk in relation to the most and least important risks. This preference scoring provides relative comparisons between risks. The data collected from these evaluations are then used to calculate the weights of each risk, ensuring that the most critical risks are given higher weightings. Combining expert judgment with BWM, this structured approach provides a consistent and accurate prioritization of risks across the project’s life cycle.

Table 2 represents the weight of each risk resulting from Best -worst method for project life cycle phases.

Financial risks are particularly pronounced during the start-up phases of offshore construction projects due to the substantial initial investments required. These risks are influenced by market volatility, currency value fluctuations, and the costs associated with conducting preliminary research, environmental assessments, and acquiring necessary licenses and permits. At this stage, any inaccuracies in cost estimation or unanticipated expenses could jeopardize the project’s sustainability. Consequently, meticulous risk management and financial planning are critical to ensure project success.

During the development phase, there is an increased vulnerability to design errors. Even minor inaccuracies can lead to significant rework, project delays, and safety concerns. As the project progresses, rectifying these errors may become more challenging and costly, potentially resulting in timeline extensions and budget overruns. Therefore, thorough inspections and precise design reviews are essential to identify and rectify shortcomings early in the process, facilitating smoother project advancement.

The construction phase of offshore projects presents notable risks, particularly concerning financing availability and the potential for rising costs. Financial challenges pose substantial threats to the timely and effective execution of projects. Additionally, delays in securing government approvals may disrupt project schedules and increase costs.

Among the most significant risks identified during the operational phase are the environmental impacts associated with the project. The potential harm to local ecosystems, water quality, and marine life can result in long-term ecological damage and stringent regulatory consequences. Inadequate safety measures may lead to accidents and injuries, adversely affecting team morale and incurring legal penalties. Furthermore, poor quality control represents a significant risk, as it can result in substandard construction, structural deficiencies, higher maintenance costs, and a diminished project lifespan. Employing improper operational techniques can undermine the efficiency and effectiveness of a project, leading to delays, increased costs, and operational hazards. Notably, water depth at the project site is considered a lower-risk factor during both the construction and operational phases, as preliminary studies and historical data indicate adequate water depths in the project locations, thereby reducing the likelihood of hazardous conditions.

Prioritize project delivery methods alternatives using TOPSIS

The primary objective of this study was to develop a model that facilitates the selection of the optimal project delivery method through comprehensive risk analysis. It examined seven project delivery methods commonly employed in the construction industry: Design Bid Build (DBB), Design-Build (DB), Construction Manager at Risk (CMAR), Public–Private Partnership (PPP), Build-Operate-Transfer (BOT), Engineering, Procurement and Construction (EPC), and Integrated Project Delivery (IPD). A thorough review of the literature was conducted to assess these methods. The study evaluated the influence of risks on project objectives throughout the project lifecycle and employed the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) to rank these methods based on their risk profiles and overall impact assessments.

By incorporating risk, weights calculated using the Best Worst Method (BWM) into the TOPSIS analysis, the decision-making process for selecting the optimal project delivery method is significantly enhanced. The BWM effectively determines the relative importance of each risk through comparative analysis of the best and worst criteria, thereby establishing a precise and prioritized weighting system. These weights are subsequently utilized within the TOPSIS framework, which ranks the various project delivery options by measuring each method’s proximity to an ideal solution. By using weighted risks as a critical factor in the TOPSIS analysis, decision-makers can ensure that the evaluation of project delivery methods is comprehensive and accurately reflects the significance of each risk concerning the project’s success. This integrative approach offers a robust framework for objectively assessing the potential effectiveness of each delivery method in managing the inherent risks associated with construction projects.

Ranked PDM

In assessing the efficiency of various project delivery methods utilizing the TOPSIS approach, the ranking of methods is determined by the normalized distance (Dj) values calculated for each method. These (Dj) values indicate the proximity of each method to the ideal solution, which directly influences their respective rankings. The findings illustrate a comparative analysis of different project delivery methods throughout the lifecycle of offshore projects based on their normalized weights. Integrated Project Delivery (IPD) emerged as the most effective method, with a weight of 0.188, indicating a 2.4% higher effectiveness than Construction Manager at Risk (CMAR) and a 7.5% higher effectiveness than Public–Private Partnership (PPP). The IPD approach is distinguished by its superior integration and stakeholder coordination, rendering it particularly suitable for complex offshore projects.

Meanwhile, CMAR demonstrates high effectiveness due to its emphasis on early risk management. Build-Operate-Transfer (BOT) is advantageous for projects necessitating a long-term operational focus. The Engineering, Procurement, and Construction (EPC) method provides a single point of responsibility, ensuring consistency; however, it relies heavily on the contractor’s expertise, achieving a 1.2% higher effectiveness than PPP. The Design-Build (DB) method may encounter challenges related to diminished monitoring and quality control. The delivery methods ranking are summarized in Table 3 and graphically presented in Figs. 7 and 8.

The study indicates that IPD is the optimum PDM, followed by CMAR and BOT; hence, it provides insight into the effective management of complex offshore projects. It also brings out the importance of IPD could be due to its nature in ensuring cooperation, sharing of risk, and integrating stakeholders in ways that become of essence in high-risk environments like offshore projects. While a tendency toward CMAR reflects the importance of early contractor involvement and proactive risk management, BOT has shown its potential in large infrastructure projects. There is a high probability that application of the IPD/CMAR methodology will significantly reduce the significant risks high risks weights derived from BWM for risk categories in every phase of an offshore project, including the risks of design inaccuracy, project scope changes, changes in economic policy, changes in currency exchange rate, and project financing problems.

IPD allows integration and collaboration between owners, contractors, engineers, and suppliers from the project’s initiation phase. These findings would be helpful to project managers and decision-makers in the offshore construction industry, as they provide evidence-based guidelines on selecting the best PDM for a project’s complexity, risk profile, and lifecycle concerns.

Validation

A case study (located in Egypt) was chosen to validate the proposed hybrid BWM–TOPSIS model by investigating a real-world example that supports the study’s objectives. The available real data of the selected case study provided a source of offshore project risk assessment, enhancing the analysis’s credibility.

The model findings with actual project outcomes were compared to evaluate the model’s sensitivity to the different risk scenarios associated with offshore projects. Project conditions, the number and type of identified risks, and the comprehensiveness of the risk assessment process impact ranking changes.

This case study discusses a real offshore project in the Egyptian sector. During the project’s life cycle, including the development, construction, and operation stages, 52 risks were identified and categorized into four main classes.

The Validation process for the optimum PDM selection based on risk analysis started by identifying all the potential risks that could impact PDM selection. These identified risks were then categorized into four main categories: external and site conditions, technical and management risks, and financial and economic risks. Moreover, these risks were categorized as part of the project’s development, construction, and operational phases. After this, the BWM is applied. Experts were asked to select each category’s most important (best) and the least important (worst) risks for all project phases. Concerning their choices, the relative importance of each risk is determined, and the risk weights are calculated by applying the BWM Solver in Excel. Then, for each identified risk, the occurrence probability and the impact level for each PDM are determined. Finally, TOPSIS calculates a normalized weight for each PDM by ranking the potency of all methods to mitigate the identified risks.

The identified risks were grouped as follows: Management risks were the most prominent in 23 instances (44%), highlighting the challenges of project planning, coordination, and leadership involved during the entire course. Technical risks constituted 15 instances (29%) that highlighted engineering and operational challenges experienced, in particular during the construction phase. Accordingly, the Financial & Economical risks included 6 risks, or 12%, concerning budgetary limitations, cost overruns, and the greater economic climate, while it influenced all phases with a greater emphasis on the development and operation stages. The External & Site Conditions risks totaled 8 risks, or 15%, influencing environmental factors, regulatory challenges, and site-specific issues, primarily impacting the construction and operation phases. The distribution of risks along the life cycle shows a significant share of management and technical obstacles, while financial and external ones, though fewer, are also important for project success.

The outcomes of applying the BWM–TOPSIS model and applying the suggested hybrid BWM–TOPSIS to the selected case study are summarized in Table 4 graphically presented in Figs. 9 and 10.

Due to variations in projects’ conditions and constraints, the amount and types of risks in each risk category, evaluated using the Best Worst Method, the produced model, and case study analysis, have different results. Each project has unique qualities and conditions, thus different risk profiles. Variation in risk weights for each category affects the normalized Dj for TOPSIS-derived Project Delivery Methods (PDMs). Since each project’s risks are different, the PDM values will also change, underscoring the need to choose the best delivery mechanism for each project. Thus, due to value differences, individual risk evaluations are needed to pick PDMs accurately and effectively.

EPC, CMAR, DB, BOT, and IPD Project Delivery Methods (PDMs) show strong alignment with relative errors of less than 15% between theoretical studies and actual outcomes. The theoretical models closely match the amount and types of hazards in the data, explaining this tiny inaccuracy. Early stakeholder participation in IPD and contractor responsibility in EPC and CMAR assist in identifying and resolving issues before they worsen. Effective planning and execution, especially in DB and BOT approaches, analyze project timeframes, budgets, and technical needs to reduce execution variations. CMAR and BOT’s flexibility allows projects to react to unexpected events, reducing the error margin. IPD and CMAR’s collaborative techniques encourage early problem-solving. Resource management in EPC and DB improves operations and reduces costs.

The amount and types of risks revealed in case study data generally explain the significant inaccuracy between theoretical and practical studies in Project Delivery Methods (PDMs) like PPP and DBB. DBB projects have technical and schedule risks owing to the separation of design and construction, whereas PPP projects have financial and political risks due to their long-term public–private partnerships. The practical scenario’s PPP and DBB values differ from the theoretical one if the case study identifies more risks or if certain risks (like political instability or environmental conditions) are more impactful due to project circumstances. This risk-based divergence in data generates a relative inaccuracy, affecting PDM ranking and selection.

The high-ranked approach in this study was IPD, which indicates the importance of collaboration and stakeholder integration, which are vital in managing the complex offshore environment. The investigation into how the selected PDM influences the total risk profile empowers a manager to make necessary decisions, thus minimizing potential risks and enhancing the probability of project success.

This study’s outcome can benefit project managers and practitioners, as it provides a systematic methodology for obtaining the optimum PDM selected for the offshore construction project based on comprehensive risk analysis. The integrated BWM–TOPSIS model has allowed for the ranking of PDMs according to their capabilities of minimizing risks throughout the project’s entire life cycle.

The developed hybrid BWM–TOPSIS model can be applied effectively when certain critical factors are considered during project initiation, these factors are as follows:

-

1.

Conduct an extensive identification of project risks across the entire project lifecycle, ensuring that potential risks are systematically identified at every stage.

-

2.

Apply the BWM to calculate the weights of identified risks based on their significance, enabling a clear and accurate interpretation of the diverse risks associated with offshore projects.

-

3.

Integrate the weights derived from BWM into the TOPSIS technique to rank project delivery methods (PDMs) according to their proximity to ideal solutions.

-

4.

Evaluate the effectiveness of the highest-ranked PDM by analyzing its impact on the overall project risk assessment to confirm that the selected PDM adequately mitigates identified risks.

-

5.

Establish a framework for continuous monitoring to evaluate the model’s performance and adapt it dynamically to changing project circumstances.

All these elements enable a methodical and efficient decision-making, risk management, and prioritization process for project delivery management in the offshore construction sector. Examples of worldwide projects utilizing the IPD method include the Johan Sverdrup Field in the North Sea, which is estimated to hold approximately 2.7 billion barrels of oil equivalents, marking it as one of the most significant discoveries on the Norwegian continental shelf in recent decades, with an expected operational lifespan exceeding 50 years. The Johan Sverdrup Project primarily employed the Engineering, Procurement, and Construction (EPC) method, noted for its integrated project management, efficient execution, and risk mitigation strategies. While elements characteristic of Integrated Project Delivery (IPD) are incorporated, contributing to enhanced project efficiency and success, the predominant framework remains EPC. This project also integrated advanced technologies, such as digital twinning and reservoir optimization, utilizing data analytics to improve operational efficiency and minimize environmental impact9.

Halliburton’s contract with Kuwait Oil Company (KOC) for implementing digital transformation solutions across Kuwait’s oil fields is based on the IPD approach. This initiative includes deploying automated work processes to optimize operational efficiency and increase production.

Conclusions

The Best Worst Method (BWM) and TOPSIS are employed to determine the best project delivery strategy for each step of an offshore project’s lifecycle. The study presented the Risk Breakdown Structure (RBS) and a BWM–TOPSIS technique for choosing the most suitable delivery method for offshore projects. A comprehensive literature assessment is carried out to identify risks associated with various project delivery approach and offshore project life cycle.

Delphi techniques, combining qualitative and quantitative assessments, were used to identify critical risks and their impact on project objectives, with mitigation strategies proposed accordingly. The Risk Breakdown Structure categorized risks into Management, Technical, External & Site Conditions, and Financial & Economical hazards. Management risks were 52%, technical hazards 24%, and finance risks were more dispersed across all project delivery techniques except IPD. Weather, government laws, and improper waste management were the highest environmental risks. In two rounds of expert surveys, Primavera risk analysis was used to assess risks. The significant risks were weather, regulatory delays, money, project schedule mistakes, and managing waste. A second set of questions evaluated risks across stages using the Best–Worst Method (BWM). The significant development risks were design errors, economic policy changes, and inadequate feasibility studies. Site knowledge and financing were construction risks. Throughout operations, safety and the environment were important.

The hybrid BWM–TOPSIS model was subsequently created to choose the best PDM for offshore projects by comparing risk weights. TOPSIS ranked PDMs and found that Integrated Project Delivery (IPD) and Construction Manager at Risk (CMAR) were best for cooperation and risk management. Third was Build Operate Transfer (BOT), followed by inefficient Design Bid Build (DBB). IPD stakeholder integration enhanced risk management, cost predictability, and efficiency in construction. Two case studies validated the methodology, confirming IPD as the top PDM, with project-specific risks affecting other PDM rankings.

Analyzing normalized deviations to verify the model and show that real data matches theoretical conclusions, EPC, BOT, IPD, and CMAR balanced quality, integration, and flexibility. Due to their complexity, offshore projects must prioritize these objectives over cost and time. In conclusion, the BWM–TOPSIS model helps offshore decision-makers choose PDMs that mitigate project risks and optimize resource efficiency and success.

Early collaboration among all stakeholders in integrated project delivery (IPD) significantly enhances project outcomes by facilitating the early assessment of risks, resource optimization, allocation, and improving decision-making processes during the development phase. During the construction phase, where financial risks are highest, IPD’s collaborative nature involving all stakeholders from the outset improves risk management, cost predictability, and efficiency, thereby reducing the likelihood of delays and cost overruns. IPD ensures environmental effects are considered at every stage, resulting in improved resource efficiency, decreased waste, and minimal ecological disruption. Implementing IPD minimizes risks associated with improper operating techniques by establishing and consistently following the most efficient operating procedures. All these factors make IPD the best alternative for delivering offshore projects. DBB was deemed inefficient due to its limited collaboration and sequential structure, which often led to delays and cost overruns. EPC has been widely used for managing complex offshore projects due to its integrated approach. Design-Build (DB) is popular for its efficiency in combining design and construction. BOT and CMAR solve different difficulties in varied geographical environments, addressing the global offshore project market’s needs. For offshore projects where installation is critical, EPCI adds installation services to the EPC and lets a single contractor oversee all stages.

Due to political and logistical instability, Iraq and Iran need strict security. Without local knowledge, local content laws restrict employment and procurement. EPC is the best option since its integrated approach reduces risks and enhances production. Project delivery approaches that cover all stages, permit smooth transitions, and assess risk are the best. Development and construction approaches may focus on immediate outputs to satisfy project timelines and prices, whereas IPD prioritizes long-term value and sustainability. This restricted focus may favor solutions that improve initial project phases but not essential operational difficulties, increasing lifespan costs and performance issues after construction.

Egyptian offshore projects rarely adopt IPD due to cultural resistance, limited awareness of its benefits, and challenges in adapting it to local norms. Instead, they prefer traditional project delivery. Early stakeholder engagement in the IPD framework increases risk assessment, resource optimization, and decision-making, improving project results. In IPD, risk-sharing and reward encourage cooperation toward common goals, improving efficiency. IPD encourages collaboration between disciplines to discover and address design concerns. By including all stakeholders early on, IPD may reduce financial risks, especially during construction, and improve risk management, cost predictability, and operational efficiency. Continuous communication and problem-solving reduce mistakes and rework in this integrated method. IPD addresses environmental consequences throughout operation to improve resource efficiency, waste minimization, and ecological disturbance. Risk-sharing improves worker safety and decreases project accidents. IPD reduces the risk of improper operating processes by identifying and implementing efficient standards. Egyptian offshore projects benefit from IPD in terms of teamwork, efficiency, safety, design defects, operational procedures, and environmental impact. This holistic strategy improves project outcomes, making IPD a viable offshore development method in Egypt. The BWM–TOPSIS analysis found that offshore sector decision-makers must adopt a project delivery strategy that meets project requirements and manages risks throughout the project. Offshore building is difficult. Thus, this technique enhances project success, resource allocation, and results.

Limitations and recommendations

Based on the process of conducting a risk assessment for the lifecycle of offshore projects through the development of a hybrid Best Worst Method (BWM) and Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) model to identify the most suitable project delivery method, several recommendations for improvement are proposed:

-

1.

This study relies on self-reported data from interviews and questionnaires, which may be subject to various biases. Respondents might underreport the most severe impacts of risks associated with different categories throughout the offshore project lifecycle. Future research could mitigate this limitation by incorporating additional project objectives, such as project performance metrics gathered from extensive corporate datasets.

-

2.

The risk assessment and evaluation conducted in this study are primarily qualitative in nature. Future investigations could quantitatively analyze the time and cost impacts associated with the proposed delivery methods, thereby providing further insights and recommendations for stakeholders.

-

3.

Future studies may explore applying alternative Multiple-Criteria Decision-Making (MCDM) approaches to enhance decision-making processes, such as integrating Fuzzy techniques.

Data availability

This manuscript does not report data generation or analysis.

References

Alnoaimi, F. & Mazzuchi, T. Risk management application in an oil and gas company for projects. TechManag. Innov. J. 1(1), 26–45 (2021).

Oil. Growth in global oil demand is set to slow significantly by 2028. Oil 2023, International Energy Agency. (2023).

Wang, C.-N. et al. A multi-criteria decision-making (MCDM) approach using hybrid SCOR metrics, AHP, and TOPSIS for supplier evaluation and selection in the gas and oil industry. Processes 6(12), 252 (2018).

Karamoozian, A. et al. Green supplier selection in the construction industry using a novel fuzzy decision-making approach. J. Constr. Eng. Manag. 149(6), 04023033 (2023).

Abbasnejad, B. et al. A systematic literature review on integrating Industry 4.0 technologies in sustainability improvement of transportation construction projects: state-of-the-art and future directions. Smart and Sustainable Built Environment ahead-of-print(ahead-of-print). (2024).

Hosseini, A. et al. Selection criteria for delivery methods for infrastructure projects. Procedia Soc. Behav. Sci. 226, 260–268 (2016).

NS Energy Business. (n.d.). Khafji field, Saudi-Kuwaiti neutral zone, From https://www.nsenergybusiness.com/projects/khafji-field-saudi-kuwaiti-neutral-zone/?cf-view

Offshore Technology. Karan gas field, from https://www.offshore-technology.com/projects/karan-gas-field/?cf-view

Equinor. Johan Sverdrup. From https://www.equinor.com/energy/johan-sverdrup

Gulf Oil and Gas. Saudi Arabia projects database. From https://www.gulfoilandgas.com/webpro1/projects/default.asp?nid=SA

Aramco. Manifa offshore oil field. From https://www.aramco.com/en/what-we-do/mega-projects/manifa-offshore-oil-field

Abdul Rahim, A. et al. Project management in oil and gas industry: A review. (2017).

Ahmed, M. M. R. et al. Mitigating uncertainty problems of renewable energy resources through efficient integration of hybrid solar PV/wind systems into power networks. IEEE Access 12, 30311–30328 (2024).

Tamak, J. & Bindal, D. An empirical study of risk management & control. Int. J. Adv. Res. Comp. Sci. Softw. Eng. 3(12), 4 (2013).

Su, G. & Khallaf, R. Research on the influence of risk on construction project performance: A systematic review. Sustainability 14(11), 6412 (2022).

Erdoğan, S., Aydın, S., Balki, M. K., & Sayin, C. Operational evaluation of thermal barrier coated diesel engine fueled with biodiesel/diesel blend by using MCDM method base on engine performance, emission and combustion characteristics. Renew. Energy 151, 698–706 (2020).

You, P. et al. Operation performance evaluation of power grid enterprise using a hybrid BWM–TOPSIS method. Sustainability 9(12), 2329 (2017).

Mahmoudi, A. et al. A novel model for risk management of outsourced construction projects using decision-making methods: A case study. Grey Syst. Theory Appl. 10(2), 97–123 (2020).

Yazdani, M. et al. A risk-based integrated decision-making model for green supplier selection: A case study of a construction company in Spain. Kybernetes 49(4), 1229–1252 (2020).

Kishore, R. et al. Designing a framework for subcontractors’ selection in construction projects using the MCDM model. Oper. Res. Eng. Sci. Theory Appl. 3(3), 48–64 (2020).

Chen, Y.-S. et al. A study for project risk management using an advanced MCDM-based DEMATEL-ANP approach. J. Ambient. Intell. Humaniz. Comput. 10, 2669–2681 (2019).

Tabatabaee, S. et al. Towards the success of building information modelling implementation: A fuzzy-based MCDM risk assessment tool. J. Build. Eng. 43, 103117 (2021).

Mahdi, I. M., Arafat, H., Ebid, A. M. & El-Kadi, A. F. Decision model to identify the optimum retaining wall type for restricted highway projects sites. Int. J. Constr. Manag. https://doi.org/10.1080/15623599.2021.1974151 (2021).

Mahdi, M., Ebid, A. M. & Khallaf, R. Decision support system for optimum soft clay improvement technique for highway construction projects. Ain Shams Eng. J. https://doi.org/10.1016/j.asej.2019.08.007 (2019).

Elhegazy, H., Ebid, A., Mahdi, I. M., Aboul Haggag, S. Y. & Rashid, I. A. Implementing QFD in decision making for selecting the optimal structural system for buildings. Constr. Innov. https://doi.org/10.1108/CI-12-2019-0149 (2020).

Ors, D. M. et al. Decision support system to select the optimum construction techniques for bridge piers. Ain Shams Eng. J. https://doi.org/10.1016/j.asej.2023.102152 (2023).

Karamoozian, A., Tan, C. A., Wu, D., Karamoozian, A. & Pirasteh, S. COVID-19 automotive supply chain risks: A manufacturer-supplier development approach. J. Ind. Inf. Integr. 38, 100576 (2024).

Gidiagba, J. et al. Sustainable supplier selection in the oil and gas industry: An integrated multi-criteria decision approaching. Procedia Comput. Sci. 217, 1243–1255 (2023).

Martins, I. et al. A review of the multicriteria decision analysis applied to oil and gas decommissioning problems. Ocean Coast. Manag. 184, 105000 (2020).

Khalidov, I. et al. Models for the multicriteria selection of options for decommissioning projects for offshore oil and gas structures. Energies 16(5), 2253 (2023).

Dehdasht, G. et al. DEMATEL-ANP risk assessment in oil and gas construction projects. Sustainability 9, 1420 (2017).

Tsakalerou, M. et al. An intelligent methodology for using multi-criteria decision analysis in impact assessment: The case of real-world offshore construction. Sci. Rep. 12(1), 15137 (2022).

El-Aghoury, M. A., Ebid, A. M. & Mahdi, I. M. Decision support system to select the optimum steel portal frame coverage system. Ain Shams Eng. J. 12(1), 73–82 (2021).

Nesticò, A. & Somma, P. Comparative analysis of multi-criteria methods for the enhancement of historical buildings. Sustainability 11(17), 4526 (2019).

Rezaei, J. Best-worst multi-criteria decision-making method. Omega 53, 49–57 (2015).

Warda, M. A., Ahmad, S. E., Mahdi, I. M. & Sallam, H. M. The applicability of TOPSIS-and fuzzy TOPSIS-based Taguchi optimization approaches in obtaining optimal fiber-reinforced concrete mix proportions. Buildings 12(6), 796. https://doi.org/10.3390/buildings12060796 (2022).

Kassem, M., Ehab, A., Kosbar, M., Elbeltagi, E. & Mahdi, I. Off-site manufacturing: Determining decision-making factors. Buildings 13(11), 2856. https://doi.org/10.3390/buildings13112856 (2023).

Trivedi, P. et al. A hybrid best-worst method (BWM)–technique for order of preference by similarity to ideal solution (TOPSIS) approach for prioritizing road safety improvements. IEEE Access 12, 30054 (2024).

Kim, M.-H. & Lee, E.-B. A forecast model for the level of engineering maturity impact on contractor’s procurement and construction costs for offshore EPC megaprojects. Energies 12(12), 2295 (2019).

Tran, D. Q. et al. Project delivery selection matrix for highway design and construction. Transp. Res. Rec. 2347(1), 3–10 (2013).

Mahdi, I. M. & Alreshaid, K. Decision support system for selecting the proper project delivery method using analytical hierarchy process (AHP). Int. J. Project Manag. 23(7), 564–572 (2005).

Martin, H. et al. Factors affecting the choice of construction project delivery in developing oil and gas economies. Archit. Eng. Des. Manag. 12(3), 170–188 (2016).

Carpenter, N. & Bausman, D. C. Project delivery method performance for public school construction: Design-bid-build versus CM at risk. J. Constr. Eng. Manag. 142(10), 05016009 (2016).

Davis, R. P. et al. Building procurement methods. (2008).

Trimble.(n.d). Design-Bid-Build explained. From https://projectsight.trimble.com/project-delivery-methods/design-bid-build/. (2024).

Loulakis, M. et al. Review of WSDOT’s implementation of design-build project delivery, State of Washington Joint Transportation Committee. (2015).

Crossman, K. Design-build delivery: a method to reduce delays in the South African construction industry, University of Johannesburg (South Africa). (2018).

Ashworth, A. & Perera, S. Cost studies of buildings (Routledge, 2015).

Gransberg, D. D. & Shane, J. S. Construction manager-at-risk project delivery for highway programs, Transportation Research Board. (2010).

Sastoque, L. M. et al. A proposal for risk allocation in social infrastructure projects applying PPP in Colombia. Procedia Eng. 145, 1354–1361 (2016).

Yuan, J. et al. Selection of performance objectives and key performance indicators in public–private partnership projects to achieve value for money. Constr. Manag. Econ. 27(3), 253–270 (2009).

Marques, R. C. & Berg, S. Revisiting the strengths and limitations of regulatory contracts in infrastructure industries. J. Infrastruct. Syst. 16(4), 334–342 (2010).

Zou, W. et al. Identifying the critical success factors for relationship management in PPP projects. Int. J. Project Manag. 32(2), 265–274 (2014).

OECD Private financing and government support to promote long-term investments in infrastructure. from www.oecd.org/finance/lti. (2014).

Kahvandi, Z. et al. Analysis of the barriers to the implementation of integrated project delivery (IPD): A meta-synthesis approach. J. Eng. Project Prod. Manag. 9(1), 1672 (2019).

Sive, T. & Hays, M. Integrated project delivery: Reality and promise, a strategist’s guide to understanding and marketing IPD. Society for Marketing Professional Services Foundation (2009).

The American Institute of Architects. Integrated project delivery: A guide version 1. (2007).

Nejati, I. et al. Feasibility of using an Integrated Project Delivery (IPD) in mass housing collaborative projects. Adv. Environ. Biol., 211–219. (2014).

Cheng, R. IPD case studies. (2012).

Mollaoglu-Korkmaz, S. et al. Delivering sustainable, high-performance buildings: Influence of project delivery methods on integration and project outcomes. J. Manag. Eng. 29(1), 71–78 (2013).

Baiden, B. K. & Price, A. D. The effect of integration on project delivery team effectiveness. Int. J. Project Manag. 29(2), 129–136 (2011).

Kahvandi, Z. et al. Integrated project delivery implementation challenges in the construction industry. Civ. Eng. J. 5(8), 1672–1683 (2019).

Sholeh, M. N. & Fauziyah, S. Current state mapping of the supply chain in engineering procurement construction (EPC) project: A case study. In MATEC Web of Conferences, (EDP Sciences, 2018).

Li, H. et al. Selection of project delivery approach with unascertained model. Kybernetes 44(2), 238–252 (2015).

Pícha, J. et al. Application of EPC contracts in international power projects. Procedia Eng. 123, 397–404 (2015).

Zhong, Q. et al. A comprehensive appraisal of the factors impacting construction project delivery method selection: A systematic analysis. J. Asian Archit. Build. Eng. 22(2), 802–820 (2023).

Ashley, D. B. et al. Guide to risk assessment and allocation for highway construction management. FHWA COTR: Hana Maier, Office of International Programs (2006).

Thamhain, H. Managing risks in complex projects. Proj. Manag. J. 44(2), 20–35 (2013).

Van Thuyet, N. et al. Risk management in oil and gas construction projects in Vietnam. Int. J. Energy Sector Manag. (2007)

Mubin, S. & Mannan, A. Innovative approach to risk analysis and management of oil and gas sector EPC contracts from a contractor’s perspective. J. Bus. Econ. 5(2), 149 (2013).

Kassem, M. A. et al. Theoretical review on critical risk factors in oil and gas construction projects in Yemen. Eng. Constr. Archit. Manag. 28, 934 (2020).

Lenkova, O. V. Risk management of oil and gas company in terms of strategic transformations. (2018).

Dey, P. K. et al. Managing Challenges of Projects Management: A Case Study of Oil Industry. In Indian Business: Understanding a Rapidly Emerging Economy 166–183 (Routledge, 2019).

Khalilzadeh, M. et al. Risk identification and assessment with the fuzzy DEMATEL-ANP method in oil and gas projects under uncertainty. Procedia Comput. Sci. 181, 277–284 (2021).

Ketabchi, R. & Ghaeli, R. An application of fuzzy BWM for risk assessment in offshore oil projects. J. Project Manag. 4, 233–240 (2019).

Al Mhdawi, M. K. Proposed risk management decision support methodology for oil and gas construction projects. In The 10th International Conference on Engineering, Project, and Production Management (Springer, 2020).

Kraidi, L. et al. Analyzing the critical risk factors in oil and gas pipelines projects regarding the perceptions of the stakeholders. In Creative Construction Conference 2018, Budapest University of Technology and Economics. (2018).

Funding

Open access funding provided by The Science, Technology & Innovation Funding Authority (STDF) in cooperation with The Egyptian Knowledge Bank (EKB).

Author information

Authors and Affiliations

Contributions

Lamisse Raed carried out surveying and questionnaires , Ibrahim Mahdi puts the main concept and guidelines , Hassan Mohamed Hassan statistically analyzed the collected data , Ehab Rashad Tolba prepared figures and graphics, Ahmed M. Ebid wrote the main manuscript. All authors reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article