Abstract

An examination of the scale of energy trade between China and the countries along the Belt and Road, as well as the terrorist activities in these countries from 2008 to 2019, has been conducted in this study. The spatial and temporal evolution law is revealed through the use of exploratory spatial data analysis. The spatial Durbin model is employed to investigate the impacts and spatial spillover effects of terrorist activities along the Belt and Road on China’s energy trade with these countries. The findings of the study are as follows: Spatial clustering is exhibited by the energy scale of China’s imports and exports with countries along the routes and terrorist activities along the routes, with energy imports concentrated in West Asia and North Africa, energy exports concentrated in Southeast Asia, and terrorist activities concentrated in West Asia and North Africa, South Asia, and Central Asia. A negative effect on the scale of China’s energy imports from the countries along the route is exerted by the terrorism index, and a positive spatial spillover effect is present. The number of terrorist activities and deaths have a negative effect on the scale of China’s energy imports from the countries along the route, but there is no spatial spillover effect. The terrorism index does not affect the scale of energy exports from China to countries along the route, but there is a negative spatial spillover effect. There are differences in the spatial spillover effects of the number of terrorist activities and deaths on the scale of China’s energy exports. The level of economic development, liner transportation convenience, and energy exports dependence of the countries along the route also significantly influence China’s energy trade with these countries.

Similar content being viewed by others

Introduction

Throughout the transition from the coal-dominated era to that of oil and gas, energy has steadily emerged as a pivotal force sculpting the worldwide geopolitical map, wielding ever greater influence within the discourse of international relations.(Costa-Campi et al., 2017; Schuetze and Hussein, 2023; Vakulchuk et al., 2020; Yang et al., 2023; Yang et al., 2020). Over the years, the close relationship between energy and geopolitical competition, geopolitical conflicts, and even interstate wars has been demonstrated by events such as the Gulf War, the Iraq War, the Libyan War, the Syrian War, and the attacks on Saudi oil fields (Bradshaw, 2010; Firat, 2023; Painter, 2014). The conflict between Russia and Ukraine, which is set to commence in 2022, is anticipated to be a significant energy game involving the United States, Russia, and the European Union (Zhang et al., 2024). Daniel Yergin astutely observes that politics is an innate characteristic of energy, contending that in the case of oil, its composition is 90% political and merely 10% economic (Yergin, 2011). The Belt and Road route encompasses the “heartland” of the global energy supply. By 2019, it was reported that the proven oil and natural gas reserves along the route accounted for 57 and 78% of the world’s total, respectively. The recoverable resources yet to be discovered were found to account for 32 and 47% of the world’s total, respectively (Dudley, 2018). The maritime channels along the route, such as the North Indian Ocean, the Strait of Malacca, and the South China Sea, are important lifelines for global energy transportation. Overall, the security and stability of energy production, supply, and transportation in the countries along the Belt and Road are of utmost importance, which is not merely tied to the trajectory of the international energy market, but is also deeply interconnected with the broader geopolitical climate and the worldwide economic framework (Burke and Stephens, 2018; Palle, 2021; Pascual and Zambetakis, 2010; Rhodes, 2018; Zhang et al., 2015).

However, the frictions and conflicts between religious religions, nationalities, and races in countries along the Belt and Road are escalating, extremist forces are intertwined, and terrorist activities are showing a trend of proliferation and rampant. According to statistics from the Study of Terrorism and Responses to Terrorism, nearly 85% of global terrorist attacks have erupted in regions along the route since 2003, resulting in 81.6% of global casualties. Among them, there were over 10 thousand global terrorist attacks in 2013, with over 9 thousand occurring in the region. Terrorist activities pose a substantial threat to the energy production, supply, and transportation along the route, thereby exposing the international energy market to significant vulnerabilities and risks (Klinger, 2020; Minyan et al., 2016). For instance, in 2012, terrorist attacks on Syria’s gas pipelines led to a severe strain on international gas supplies and a surge in prices. In 2019, drone strikes on two Saudi oil facilities caused the most significant disruption to energy supply in history, slashing global crude oil production by nearly 5.7 million barrels per day and reducing ethane and liquefied natural gas supplies by around 50%. Obviously, terrorist activities play a crucial role in the international energy market, with its impacts notably affecting energy prices and causing substantial fluctuations (Li et al., 2023; Ramiah et al., 2019; Song et al., 2022). Meanwhile, extensive research has confirmed that terrorist activities have a strong spatial spillover effect and exhibit obvious diffusion characteristics (Gong et al., 2023; Jin et al., 2023). The question of whether these spatial spillover effects amplify risks across a broader scope of energy transactions, and how such effects propagate in space, has emerged as a crucial topic requiring meticulous examination. Delving into these issues is of immeasurable strategic value for countries along the Belt and Road to accurately assess security risks in energy trade, and to enhance the effectiveness and resilience of their external energy cooperation endeavors.

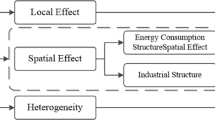

This paper attempts to make marginal contributions in the following three aspects: Firstly, it provides a comprehensive measurement of the spatial characteristics of energy imports and exports trade and terrorist activities at the national level. It discusses the spatiotemporal impact relationship between energy imports and exports trade and terrorist activities using scientific and quantitative research methods. Secondly, by integrating spatial interdependence theory and employing spatial econometric models, the paper separately explores the pathways through which terrorist activities influence energy imports and exports. It delves into whether these pathways exhibit spatial effects and comprehensively evaluates the impact of terrorist activities on energy imports and exports. Thirdly, the paper utilizes disaggregated indicators of terrorist activity to more accurately gauge the differential impacts of terrorist activities of varying severity on energy imports and exports.

The rest of this paper proceeds as follows: “Literature review” reviews the available literature on the spatial measurement and driving factors of energy trade, and the impact of terrorist activities on energy trade. “Theoretical analysis and hypotheses” is theoretical analysis and hypotheses, which provide theoretical support for exploring the impact of terrorist activities on energy imports and exports trade and the spatial spillover effects of terrorist activities on energy imports and exports trade. “Data and methodology” introduces the study area, the data, and the methods used in the study. “Results” presents the results, including the temporal and spatial evolution of energy imports and exports and various indicators of terrorist activities between China and countries along the Belt and Road, as well as the analysis of the mechanism of terrorist activities on energy imports and exports trade. The conclusion and implication are provided in “Conclusions and implications”.

Literature review

It has been observed that spatial dislocations in the supply and demand of energy necessitate the trade of energy as a pivotal conduit linking centers of energy production with those of consumption (Balta-Ozkan et al., 2015). The scholarly examination of the spatial dimensions of energy trade and the corridors of energy transportation is an area that has seen a burgeoning of interest. The genesis of spatial analysis in energy trade can be traced to the year 1948, wherein Barber provided a comprehensive delineation of the situation of oil-producing countries in the Middle East, and the spatial configuration of energy reserves, production, and consumption was analyzed on the basis of geographic units (Barber, 1948). Subsequently, Wagstaff offered a refinement and an update to the pattern of global energy distribution and its developmental trajectory, engaging in a more granular discussion on the distribution and consumption of energy, among other aspects (Wagstaff, 1974). The advent of the U.S. shale technology breakthrough has positioned the United States as a significant exporter within the global energy market, prompting notable shifts in the patterns of global energy production and consumption. Scholars have identified two principal shifts in the epicenter of global energy production: the initial shift transpired around the period of the Second World War, transitioning from the Gulf of Mexico region to the Gulf region; the subsequent shift was witnessed in the 1990s, moving from the Gulf region to the Middle East, Russia, and the Central Asia-Caspian Sea region, with the Americas adopting a predominantly multicentric pattern. The pattern of energy consumption is increasingly characterized by a trend towards multipolar decentralization, with Asia emerging as the region with the most rapid growth in oil and gas consumption (Bridge and Dodge, 2022). The formation of two energy export belts, encompassing Russia, the Middle East, Central Asia, and North America, and three energy imports centers in Asia, Europe, and North America, is indicative of an evolving pattern of energy trade (Du et al., 2016; Hao et al., 2016; Wang and Chen, 2016). In the year 2013, with the advancement of the Belt and Road, the study of energy imports and exports trade between China and the countries along the route has emerged as a focal point of research (Ahakwa, 2023; Xiang et al., 2022; Yu, 2018; Zhao et al., 2019). It has been demonstrated by certain studies that a spatial correlation exists among the energy production activities within the countries aligned with the Belt and Road, and a spatial spillover effect of energy trade is observed amongst these countries(Lin et al., 2020; Zhang et al., 2019). To illustrate, countries that produce energy are predominantly located in the Middle East and Central Asia, while the hubs for energy processing are generally found in proximity to the energy-producing countries (Thomson and Horii, 2009; Zhao, 2008). While the spatial agglomeration of energy trade has been depicted extensively in the existing body of literature, the spatial mechanisms governing the energy trade warrant further investigation.

Energy trade is influenced by a multitude of factors, including the resource endowment, pricing, transportation, and the trade policies of the exporting countries, as well as the geographical positioning, associated risks, and bilateral trade agreements. Spatial distance is one of the crucial factors affecting the cost of international trade, with a particularly significant impact on energy trade. Research conducted by Kitamura and Managi, utilizing the gravity model to analyze the global oil trade network, has indicated that spatial distance acts as a barrier in the selection of trade partners, compelling countries to engage in energy trade with geographically proximate oil-exporting countries due to transportation costs (Kitamura and Managi, 2017). Similarly, Leung has highlighted that, under identical conditions of resource endowment and other variables, transportation costs are a critical factor in the energy trade, leading to a preference for geographically neighboring countries for energy imports (Leung, 2011). The economic condition of energy-exporting countries has a direct influence on their capacity to export energy. It has been noted that economic expansion, population growth, and urbanization within these countries generate substantial domestic energy demands, thereby diminishing the reliance on energy exports. A case in point is Indonesia, which, during the early 1990s, was a major exporter of crude oil to China. However, with the acceleration of Indonesia’s economic development, a marked decrease in energy exports to China was observed (Shao et al., 2017). Trade and investment agreements between countries, political relations, and market access conditions all have profound effects on energy trade. Established trading partnerships and bilateral agreements serve as structural links in the international energy market, with stable relations mitigating trade risks and fostering future energy transactions between the involved entities (Du et al., 2017). It has been demonstrated that overseas energy investments constitute a pivotal method by which countries can fulfill their escalating energy requirements (Shao et al., 2017). Furthermore, the influence of geopolitical risks upon energy commerce warrants considerable scrutiny, encompassing fluctuations in oil prices, internal political strife, piracy, terrorism, and additional hazards (Sun et al., 2017). For instance, when engaging in trade with the Middle East and Africa, regions that are hubs of global energy resources, the potential perils present within the supplier’s locale must be taken into account. Research by Mohamed and Jebli suggests the existence of a causal relationship between energy dynamics and terrorist activities (Mohamed et al., 2019). Terrorist actions exert a profound effect on the trade of energy, particularly given the heightened susceptibility of energy trading networks, where an isolated incident of energy export disruption due to terrorism can result in the crippling of the entire network (Ji et al., 2014).

Following the September 11 Attacks, terrorist activities being the first of the five major non-traditional security issues along the route, have been identified as the largest uncertainty factor for energy imports and exports trade (Bandyopadhyay and Sandler, 2014; Bandyopadhyay et al., 2018). The impact of these activities on energy trade has been extensively studied. It is believed by some scholars that the potential for energy trade between China and countries along the route has been largely inhibited by terrorist activities (Bouri et al., 2019; Cheng and Chiu, 2018; Stokes, 2015). For instance, a significant reduction in the production and supply of energy, an increase in China’s energy transaction costs (Bandyopadhyay et al., 2014; Seung-Whan, 2015), threats to sea lanes such as the Malacca Straits and land lanes such as the China-Myanmar Pipeline, and an increase in China’s energy transportation risks have all been attributed to terrorist activities along the routes. The Middle East, where terrorist activities and great power games are intertwined and agitated, has been identified as the main geopolitical risk zone for China’s energy imports (Kelemen and Fergnani, 2020; Smith, 2009). Contrarily, other scholars hold the belief that the impact of terrorist activities along the route on China’s energy imports and exports trade has regional characteristics. For example, it has been observed that despite the frequent occurrence of terrorist activities along the route, the trade of imports and exports between China and the countries along the route has not decreased but increased (Bove et al., 2014; Martin et al., 2012). This is primarily attributed to the entrepreneurial and adventurous spirit of China’s economic and trade personnel, the “five principles of peaceful coexistence” foreign policy that can escort China’s economic and trade, and the comparative advantage of immunity to terrorist activities that China’s energy imports and exports trade possesses (Blustein, 2009). In addition, the existence of a spatial spillover effect of terrorist activities along the border has been discovered by other scholars(Kelejian and Mukerji, 2022; Pham and Doucouliagos, 2017). For instance, De Sousa has concluded that neighbors adjacent to terror, even when they do not source it, have trade reduced through enhanced security measures (De Sousa et al., 2018). Minyan has pointed out that the distribution of terrorist activities along the route takes the form of an arc-shaped shock zone (Minyan et al., 2016). Neumayer and Plümper have concluded that there is a spatial spillover effect of terrorist activities in China, Mongolia, Russia, Central Asia, Southeast Asia, South Asia, and West Asia (Neumayer and Plümper, 2016). However, little research exists in the current literature on whether the spatial spillover effect of terrorist activities along the routes affects the energy imports and exports trade between China and the countries along the routes.

Reviewing the existing literature, there is a scarcity of studies that explore the spatial association between energy imports and exports trade and terrorist activities, and even fewer that investigate the spatial spillover effects of terrorism on energy trade. In light of this gap, this paper takes China’s energy imports and exports with countries along the Belt and Road as a case study. Utilizing exploratory spatial data analysis methods, we aim to objectively reveal the spatial patterns and associations of energy trade between China and these countries, alongside the spatial distribution of terrorist activities in the region. We construct a Spatial Durbin Model to further analyze how terrorist activities and their spatial spillover effects impact China’s energy trade with the Belt and Road countries. This research addresses questions such as whether terrorist incidents in one country affect the energy trade of neighboring countries and to what extent. The study endeavors to furnish more cogent perspectives on the energy security concerns of the Belt and Road countries and to lay a scientific foundation for the formulation of counter-terrorism policies.

Theoretical analysis and hypotheses

Terrorism poses a significant threat to national economies and acts as a major impediment to international trade. Numerous studies have demonstrated that terrorism has a pronounced negative impact on imports and exports trade (Shang, 2020). Research by Nitsch and Schumacher indicates that a doubling of terrorist attacks in a trading partner country can lead to a reduction of approximately 4% in bilateral trade, with this decrease largely attributable to the effects of transnational terrorism (Nitsch and Schumacher, 2004). Moreover, the mechanisms through which terrorism affects imports and exports trade exhibit heterogeneity. Firstly, different types of terrorist activities have varying impacts. According to Mirza and Verdier, for every 1% increase in the frequency of terrorist attacks, the total value of goods imported by the United States from countries experiencing such attacks decreases by about 0.01% (Mirza and Verdier, 2014). Gulazat and Adiljan empirically tested the relationship between trade and terrorism risk between China and India, Pakistan, and Afghanistan, finding that higher casualties from terrorist attacks correlate with larger reductions in China’s exports to these three countries (Gulazat and Adiljan, 2018). Secondly, terrorism impacts different categories of traded goods differently. Bandyopadhyay et al., using country-pair data from 1995 to 2012, applied a gravity model to assess the effect of terrorism on bilateral trade among 151 countries worldwide. They discovered that terrorism does not significantly affect primary product trade but does notably suppress trade in manufactured goods (Bandyopadhyay et al., 2014). Thirdly, the influence of terrorism shows temporal variations. Egger and Gassebner, utilizing monthly data on terrorism and bilateral trade, revealed that transnational terrorist attacks only have negative effects on U.S. bilateral and multilateral trade in the medium to long term, with negligible short-term impacts (Egger and Gassebner, 2015). Additionally, some scholars argue that terrorism has differential impacts on imports versus exports, suggesting that each should be studied separately (Li and Yan, 2018).

The impact of terrorism on energy imports and exports trade can be understood through three primary pathways. Pathway 1: The negative effects of terrorist activities spill over into a series of economic activities including domestic production, distribution, exchange, and consumption, thereby affecting imports and exports trade (Sandler, 2015). Pathway 2: Terrorism alters government fiscal spending within the country, increasing expenditure on counter-terrorism measures, which can crowd out investment and production, further impacting trade (Blomberg et al., 2004). Pathway 3: Terrorism has a significant adverse effect on transportation, particularly more pronounced for short-distance transport, consequently affecting trade flows (Mitra et al., 2018). Thus, the influence of terrorism on energy trade can be summarized as direct and indirect impacts. Direct impacts include large-scale shutdowns or withdrawals by energy companies due to terrorism, leading to reduced energy production and supply. Illustratively, subsequent to the Syrian crisis’ inception, assaults on Syrian oil and natural gas installations by terrorists became commonplace, resulting in a precipitous decline in crude oil production from 400,000 barrels daily in 2011 to a mere 24,000 in 2019, alongside a reduction in natural gas output from 7.4 billion cubic meters to 3.6 billion over the same period. Concurrently, the protracted conflict in Yemen precipitated the near collapse of its oil market, with the volume of Chinese energy imports from Yemen diminishing by over fourfold. Indirect impacts involve threats to the security of energy transportation, increased transaction costs for energy, and instigating volatility in global energy prices. An illustration of this is the 2022 terrorist attack on the Nord Stream pipeline, which led to a nearly 200% increase in European gas prices. Similarly, every significant rise in international oil prices prompts China to tap into its strategic reserves to stabilize domestic inflation, thereby reducing its participation in international energy markets. Based on these insights, the following hypotheses are formulated:

Hypothesis 1: Terrorist activities inhibit energy exports, which having a negative impact on China’s energy imports from countries along the Belt and Road.

Hypothesis 2: Terrorist activities inhibit energy imports, which having a negative impact on China’s energy exports to countries along the Belt and Road.

The impact of terrorism often transcends geographical boundaries, spreading from one country to another, with the spillover effect initially manifesting in neighboring countries of where the terrorist acts occur. Doucouliagos used the gravity model of trade to examine the impact of terrorism in neighboring countries on trade across 160 nations globally from 1976 to 2014. He found that a 1% increase in terrorist attacks in a neighboring country reduces trade by approximately 6.4 million in the home country, and this negative impact is present even when the terrorist events in the neighbor result in zero casualties (Doucouliagos, 2017). De Sousa explored the causal chain between terrorism and imports and exports trade through geographic proximity, discovering that the closer a country is to the source of terrorism, the greater the negative spillover effect on its imports and exports trade. Regions adjacent to terrorist activities are more susceptible to disruptions and damage (De Sousa et al., 2009). Terrorism leads to heightened security measures, induces insecurity among trading partners, disrupts trade agreements, and results in constrained economic development in neighboring countries, all of which hinder their imports and exports trade (Anderson and Marcouiller, 2002; Czinkota et al., 2010). Terrorist activities can undermine bilateral or multilateral trade agreements, leading to higher trade barriers and costs. Countries that are geographically close often fall under the same trade agreements, so these impacts are not confined to the country where the terrorism occurs but also frequently affect neighboring countries (Doucouliagos, 2017). Terrorism increases insecurity among trading partners regarding the affected country, and this insecurity adds to the implicit costs of trade (Anderson and Marcouiller, 2002). Increased trade insecurity and risks in the supply chain can alter the trade preferences of partner countries, compelling them to seek alternative partners in the international market. For ordinary goods, there is a broader scope for international alternatives, and trading partners will opt for transactions with countries farther away from terrorist activities. However, energy as a special commodity in the international market, exhibits regional distribution, immobility of production, and concentration of supply, especially in regions like the Middle East and Central Asia, making it difficult to find international alternatives. Contrarily, terrorist activities can have a stimulating effect on energy exports from countries in close proximity to the area of occurrence. For instance, when Yemen’s energy exports were obstructed, other countries increased their imports from Saudi Arabia and Iraq. This demonstrates that terrorism has spatial spillover effects on trade, but these effects differ significantly between energy imports and exports.

The impact of terrorism on the energy exports of countries neighboring the affected country can be explained through two primary pathways. Pathway 1 involves the substitution mechanism in energy trade. When terrorism becomes prevalent, trading partners tend to prefer dealing with countries that offer political and social stability along with abundant energy resources, given that energy resources are geographically concentrated. Pathway 2 concerns fluctuations in international energy prices. Terrorism can trigger significant increases in global energy prices. Neighboring countries endowed with substantial energy resources might seize the opportunity presented by higher prices to boost their energy exports, aiming to maximize their economic returns. Based on these insights, the following hypothesis is formulated:

Hypothesis 3: Terrorism promotes the exports trade of countries neighboring the affected nation, resulting in a positive spatial spillover effect on China’s imports of energy from countries along the Belt and Road.

The impact of terrorism on energy imports in regions neighboring the affected countries can occur through three primary pathways. Pathway 1 involves enhanced border security measures by neighboring countries. Following terrorist incidents, countries in close proximity are likely to implement stricter border controls, amplifying spatial spillover effects. After the Paris attacks in 2015, European nations announced new measures to combat terrorism, which included tightened controls on goods and people crossing borders. These additional security costs are often borne by traders in the form of higher trade expenses, which can subsequently affect import volumes (Walkenhorst and Dihel, 2006). Pathway 2 relates to the spatial displacement of terrorist organizations. After terrorist acts, as counter-terrorism efforts intensify domestically, terrorists may flee to neighboring countries, posing a risk of renewed attacks, which in turn can impact imports (Peiyuan and Yafang, 2020). Pathway 3 involves the fear and panic induced by terrorist attacks in both the target country and its neighbors. This can dampen consumer demand, increase uncertainty about income, and lead to delays or interruptions in the purchase of imported goods (Czinkota et al., 2010). Based on these insights, the following hypothesis is formulated:

Hypothesis 4: Terrorism suppresses the imports trade of countries neighboring the affected nation, leading to a negative spatial spillover effect on China’s energy exports to countries along the Belt and Road.

Existing research indicates that both energy imports and exports trade and terrorist activities exhibit strong spatial correlations. Ignoring the inherent spatial spillover effects can lead to biased empirical results. Therefore, this study considers employing a spatial panel model for empirical analysis, incorporating the spatial lag terms of both variables into the model in order to control for their spatial correlations. Furthermore, spatial correlation can originate not only from the dependent variable itself but also from explanatory variables and error terms. The Spatial Durbin Model can effectively reflect spatial correlations from various sources (Elhorst, 2014). Consequently, integrating the theoretical analysis and research hypotheses outlined above, we opt to use the Spatial Durbin Model for our investigation.

Data and methodology

Study area

In alignment with the vision and actions to foster the construction of the “One Belt, One Road” initiative and the existing literature, this paper identifies Mongolia in Northeast Asia, 11 countries in Southeast Asia (Timor-Leste, the Philippines, Cambodia, Laos, Malaysia, Myanmar, Thailand, Brunei, Singapore, Indonesia, and Vietnam), 8 countries in South Asia (Afghanistan, Pakistan, Bhutan, Maldives, Bangladesh, Nepal, Sri Lanka, India), 19 countries in Western Asia and North Africa (UAE, Oman, Azerbaijan, Egypt, Palestine, Bahrain, Georgia, Qatar, Kuwait, Lebanon, Saudi Arabia, Turkey, Syria, Armenia, Yemen, Iraq, Iran, Israel, Jordan), 20 countries in Central and Eastern Europe (Albania, Estonia, Belarus, Bulgaria, North Macedonia, Bosnia and Herzegovina, Poland, Russia, Montenegro, Czech Republic, Croatia, Latvia, Lithuania, Romania, Moldova, Serbia, Slovakia, Slovenia, Ukraine, Hungary), and five countries in Central Asia (Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan), along with 64 other countries as the subjects of study (Fig. 1).

Notes: This study involves countries along the Belt and Road, including China and six regional areas: Northeast Asia (red legend), Southeast Asia (light green legend), South Asia (yellow legend), Central Asia (dark blue legend), Western Asia and North Africa (orange legend), Central and Eastern Europe (light blue legend).

Research methodologies

Exploratory spatial data analysis

Global spatial autocorrelation mainly studies the spatial distribution characteristics of energy imports and exports between China and countries along the Belt and Road. The formula for global spatial autocorrelation (Moran’s I) is given as follows:

where GMI represents the global spatial autocorrelation index; n is the number of countries; xi and xj are the values of country i and country j related to China’s energy imports scale or export scale or terrorist activity related indicators; \(\bar{x}\) is the mean value of x, and wij are the elements in the spatial weight matrix W. In this study, the border bordering carve-out is chosen. When there is a territorial bordering relationship between countries, wij = 1, otherwise wij = 0. For an island country, the country and the two nearest continental countries have matrix element wij = 1.

Local spatial autocorrelation reveals spatial agglomeration as well as spatial interactions using LISA diagrams (Yang et al., 2021), which is calculated using the following formula:

Where LMIi is the local spatial autocorrelation index; Zi and Zj are the normalized values of country i and country j in relation to China’s energy imports scale or export scale or terrorist activity indicators; xi is the value of country i in relation to China’s energy imports scale or export scale or terrorist activity indicators; \(\bar{x}\) is the mean value of x, and wij is the element in the spatial weighting matrix W as Eq. (1).

Spatial Durbin model

To circumvent the issue of multicollinearity in the model, this paper incorporates the terrorism index and three indicators of the number of terrorist activities, the number of deaths, and the number of injuries into the spatial Durbin model. Due to the strong correlation between the terrorism index and the number of occurrences, deaths, and injuries of terrorist activities, this article separates the terrorism index from these three variables and regresses them to form two independent models. Meanwhile, VIF test was conducted on the number of occurrences, the number of deaths, and the number of injuries, and the results showed that there was no multicollinearity with these three variables. This is done to explore the impact of terrorist activities on the scale of China’s energy imports and exports from countries along the route, and four models are established (Sterne, 2009). The energy imports model formula is as follows:

Where Iit is the energy scale of China’s importing country I in year t; terrorismIit, terrorismNit, terrorismDit, terrorismWit are the terrorism index, as well as the number of occurrences, deaths, and injuries of terrorist activities in country I in year t, respectively; GDPit, LSCIit, REPit are the GDP, liner shipping connectivity index, and energy exports dependence of country I in year t, respectively; W is the spatial weight matrix, as illustrated in Eq. (1); α is the constant term, l is the n × 1 order unit matrix; β(0−5) and θ(0−5) are the regression coefficients; ρ is the spatial autocorrelation coefficient and εit is the error term. The energy exports model equation is as follows:

Where Ejt is the energy scale of China’s exporting country j in year t; other variables and coefficients are as explained in the previous Eq. (4) And (5). The variables in the model are spatial panel data, and the model regression is realized with the help of MATLAB software.

Data

The study period for this paper is selected as 2008–2019, the dependent variable of this study is the energy scale of China’s imports and exports countries along the Belt and Road, the kernel variable is the terrorism index and its sub-indicators, and the control variable is gross domestic product, liner shipping connectivity index, and energy exports dependence (Table 1). Data on the scale of energy imports and exports between China and the countries along the Belt and Road are obtained from the United Nations Commodity Trade Statistics Database (UN Comtrade). The types of energy include coal, natural gas, Oil, and other fossil fuels. Countries along the route that have import and export relations with China have missing data in individual years. There are 17 instances of missing import data and 6 instances of missing export data, accounting for 2.54% and 0.90% respectively. These missing data are interpolated and supplemented by calculating the average values of the two years before and after. The data for the terrorism index and its sub-indicators (number of occurrences of terrorist activities, number of deaths, number of injuries) are sourced from the Global terrorism index Report and the Global Terrorism Database. The terrorism index is calculated by weighting the indicators related to terrorist activities, with a weighted value of 1 for the number of occurrences, 3 for the number of deaths, 0.5 for the number of injuries, and 0.5 for the total amount of property damage. The final dimensionless processing results in a value in the range of 0–10. The data of GDP, liner shipping connectivity index, and energy exports dependence were obtained from the World Bank Database. Liner shipping connectivity index mainly reflects the degree of connectivity between countries and the global maritime transportation network. Energy exports dependence is the share of energy exports in a country’s trade. The statistical characteristics of the variables are shown in Table 2. In order to eliminate the dimensional influence between different indicators, all independent variables are transformed by ln(x + 0.1) in this paper.

Results

Temporal evolution characteristics

A significant volatility is observed in the scale of China’s energy imports into countries along the route and the development of terrorist activities along the route (Fig. 2). It has been recorded that the value of energy imports by China from these countries experienced an increase from 98.8 billion U.S. dollars in 2008 to 207.3 billion U.S. dollars in 2014, followed by a decline to 107.4 billion U.S. dollars in 2016, and a subsequent rise to 211.3 billion U.S. dollars in 2019. Conversely, the scale of energy exports from China to these countries has been noted to exhibit a consistent year-on-year growth, albeit at a lower magnitude when juxtaposed with the imports, escalating from 6.6 billion U.S. dollars in 2008 to 21.2 billion U.S. dollars in 2019. The implementation of strategies for energy diversification and clean energy by China has been inferred to mitigate the dependency on energy imports from the aforementioned countries to a certain degree.

Notes: This figure shows the trends of various indicators over time for China and countries along the Belt and Road. The x-axis represents the years, the left y-axis represents the trade volume, and the right y-axis represents the number of incidents. The symbols used include: blue bars represent energy imports, orange bars represent energy exports, gray line represents the number of occurrences of terrorist activities, yellow line represents the number of deaths from terrorist activities, blue line represents the number of injuries from terrorist activities.

Regarding terrorism, a pattern of initial escalation followed by a reduction has been discerned in the frequency of terrorist incidents, deaths, and injuries. The number of occurrences of terrorist activities augmented from 3870 in 2009 to 12,584 in 2014, then diminished to 5432 in 2019. The number of deaths rose from 7175 in 2009 to 29,471 in 2014, then fell to 13,423 in 2019. The number of injuries escalated from 15,493 in 2009 to 34,559 in 2015, then decreased to 14,944 in 2019. The underlying causes have been attributed to the financial crisis precipitating substantial shifts in the geopolitical contours of the Middle East and Asia-Pacific regions, coupled with an intensification of terrorist activities. The interplay of influence exerted by the U.S. and Western countries has been linked to a concentrated surge in conflicts across the Belt and Road countries, while domestic policies, such as the curtailment of welfare expenditures, have incited societal unrest and a resurgence in ideologically driven terrorist acts. A series of counter-terrorism agreements and accords have been signed by the countries along the route, and a fortification of counter-terrorism cooperation has been observed, which to a certain extent has mitigated the prevalence of terrorist activities. For instance, China and Afghanistan have bolstered security and law enforcement operations and mobilized their cooperation with Tajikistan and Pakistan to hold the Senior Leaders’ Meeting on Counter-Terrorism Cooperation among the Military Forces of the Four Countries of Afghanistan, China, Pakistan, and Thailand. China and Vietnam have conducted the “Thien Thanh-2016” joint counter-terrorism exercise, and the border guard forces of the two sides have enhanced cooperation on terrorist activities.

Spatial evolution characteristics

Characteristics of global spatial autocorrelation

Overall, the scale of China’s energy imports and exports from the countries along the route and the terrorism index of the countries along the route exhibit spatial clustering (Table 3). Except for the Moran’s I of energy imports in 2009 and energy exports in 2008, which are not significant, all other years are significant and have positive coefficients. This indicates that countries with a high scale of China’s energy imports and exports are geographically close to each other, as are countries with a high terrorism index.

The spatial pattern of China’s energy imports exhibits a tendency towards polarization. The Moran’sI2008 to 2011 were modest, all falling below 0.20, whereas those from 2012 to 2019 ranged between 0.23 and 0.31, peaking at 0.304 in 2014 and reaching a nadir of 0.235 in 2017. Conversely, the spatial pattern of China’s energy exports appears more decentralized, with only the 2017 Moran’sIattaining 0.22, while all other years remained below this threshold. Lastly, the spatial pattern of the terrorism index along the route initially demonstrated a trend towards dispersion, followed by subsequent polarization. The Moran’sIdeclined from 0.261 in 2008 to 0.206 in 2012, suggesting a diffusion of terrorist activities. However, from 2013 to 2019, the index rose from 0.230 to 0.360, indicating a contraction in the spatial extent of terrorist activities in the countries along the route.

Characteristics of local spatial autocorrelation

The LISA agglomeration map is categorized into four spatial types (Fig. 3). High-High Agglomeration Area (H-H): Countries with a high scale of energy imports and exports with China or a high terrorism index are neighbored by countries that also have a high scale of energy imports and exports with China or a high terrorism index. High-Low Agglomeration Area (H-L): Countries with high energy imports and exports to and from China or a high terrorism index are neighbored by countries with low energy imports and exports to and from China or a low terrorism index. Low-High Agglomeration Area (L-H): Countries with low energy imports and exports with China or a low terrorism index are neighbored by countries with high energy imports and exports with China or a high terrorism index. Low-Low Agglomeration Area (L-L): Countries with a low scale of energy imports and exports with China or a low terrorism index are neighbored by countries that also have a low scale of energy imports and exports with China or a low terrorism index.

High-high agglomeration area (H-H)

China’s energy imports are concentrated in West Asia and North Africa. Kuwait, Oman, Saudi Arabia, and the United Arab Emirates in 2008 and 2019 were all of this type. This type added Iraq, Mongolia, and Qatar in 2019 compared to 2008, and removed Yemen. These countries, alongside their neighboring territories, serve as pivotal growth poles for China’s energy importation endeavors. The aforementioned regions of West Asia and North Africa are strategically situated within the ‘energy heartland’, a locale reputed for harboring approximately half of the global reserves of oil and natural gas, thereby constituting a critical zone for China’s energy importation. Conversely, China’s energy exportation is notably concentrated in Southeast Asia, with Singapore and the Philippines being the sole recipients in 2009 and 2019, respectively. The rapid industrialization phase currently experienced by Southeast Asian countries necessitates the importation of substantial coal quantities due to inherent energy structure limitations, hence the focal concentration of China’s energy exports in this region. Furthermore, the areas registering high values on the terrorism index—South Asia, Central Asia, and West Asia North Africa—demonstrate a spatial coupling with China’s energy importation patterns. The years 2008 and 2019 have seen Jordan, Iran, Pakistan, and Syria categorized under this typology, with an increase in Iraq, Bangladesh, Israel, and Palestine, and a decrease in India and Bhutan for the latter year. The regions of West Asia and North Africa have been historically entangled in political and economic challenges, compounded by issues related to terrorist activities, which have escalated in their global proportion. South Asia, with its many religious sects and a large number of terrorist organizations, is the region of the contemporary world with the most intense terrorist activity outside of the Middle East. Religious extremist organizations, such as the Taliban, are frequently responsible for terrorist activities in eastern Tajikistan, southern Kyrgyzstan, and the Ferghana Valley of Uzbekistan, and have become a major problem for regional security in Central Asia.

High-low agglomeration area (H-L)

The number of countries in this category is limited, with only terrorism index of Russia appearing in this type of region in the 2019. After the dissolution of the Soviet Union, Russia became one of the major countries in the world that suffered the most terrorist attacks, with a much higher frequency of terrorist activities than neighboring Eastern European and East Asian countries. Russia inherited a significant number of the erstwhile superpower’s challenges, including ethnic separatism and regional conflicts. These issues have been particularly pronounced in areas like Chechnya, where incidents of terrorism are frequently instigated by ethnic separatist factions. Additionally, religious extremism has been identified as a contributing factor, with certain organizations exploiting religious doctrines to foment and facilitate acts of terror, thereby undermining the societal stability and security of the Russian Federation. The Islamic State, for instance, has been implicated in sowing discord and devastation within the country. Economic disparities, such as the pronounced divide between affluent and impoverished demographics, alongside economic instability, unemployment, and poverty, have been recognized as pivotal elements influencing the prevalence of terrorism in Russia. Between the years 2008 and 2019, Russia experienced 1245 terrorist incidents, resulting in 3477 casualties. Despite a reduction in terrorist activities in 2019, the frequency of such events in Russia remains elevated when compared to neighboring countries, including Estonia, Latvia, and Belarus.

Low-high agglomeration area (L-H)

The low-high agglomeration area of China’s energy imports is distributed in Central and Eastern Europe and West Asia. In 2008, this included Azerbaijan, Mongolia, Qatar, Bahrain, Iraq, and Timor-Leste, and in 2019, it included Yemen, Bahrain, Jordan, Estonia, and Kazakhstan. China imports less energy from these countries than from its neighbors. China’s import of energy from Yemen and Iraq have changed considerably. The conflict in Yemen, triggered by the struggle between the Houthis and the remaining forces of the Hadi government in 2015, led to a sharp decline in China’s import of energy from Yemen, from 3.12 billion dollars to 0.63 million dollars. China’s import of energy from Iraq were hampered by the U.S. war in Iraq at the beginning of the twenty-first century. Following the end of the war in Iraq in 2010, China’s import of Iraqi energy rose sharply, from 1.32 billion dollars to 13.81 billion dollars. China’s energy cooperation with Central and Eastern Europe focuses on renewable energy, and the traditional energy imports and exports scale is low. The low-high agglomeration area of China’s energy exports is distributed in Southeast Asia, specifically in Cambodia and Brunei in 2008 and 2019. Cambodia and Brunei have low energy demand, and the energy exported by China to these two countries differs greatly from its neighboring countries. The low-high agglomeration area for terrorism index includes Kuwait and the Maldives. Kuwait has a low frequency of terrorist activity compared to Saudi Arabia and Iraq. The Maldives, being far away from Eurasia, is thus protected from the volatility of South Asia.

Low-low agglomeration area (L-L)

The low-low agglomeration areas for China’s energy imports and exports from countries along the route, as well as for terrorist activities in countries along the route, are all located in Central and Eastern Europe. China’s energy imports Low-Low agglomeration area included India, Serbia, Croatia, Bosnia and Herzegovina, and Montenegro in 2008. Apart from India, all other countries belong to Central and Eastern Europe. In 2019, there were Central and Eastern European countries such as Serbia, Croatia, Bosnia and Herzegovina, Romania, Montenegro, and Albania. China’s energy exports low-low agglomeration area included Serbia, Croatia, and Romania in 2009. In 2019, it included Serbia, Croatia, Romania, Hungary, and North Macedonia, all of which belong to Central and Eastern Europe. The development of oil and gas resources in Central and Eastern European countries is limited, and these countries are highly dependent on Russia. Consequently, the scale of China’s energy imports and exports to Central and Eastern European countries is low. Terrorism index low-low agglomeration area included Serbia, Hungary, and the Czech Republic in 2008. In 2019, it included Serbia, Croatia, Hungary, North Macedonia, and Bosnia and Herzegovina. These countries all belong to Central and Eastern Europe. After the September 11 Attacks, European counter-terrorism cooperation has been strengthened. It has evolved from initial passive emergency response measures into a multi-dimensional counter-terrorism policy system with medium- and long-term strategic planning, which has played a positive role in European security.

Spatial model analysis results

Baseline regression analysis

The presence of spatial autocorrelation in the indicators related to energy imports and exports, as well as terrorist activities between China and the Belt and Road affiliated countries, was identified, leading to the selection of the spatial Durbin model for analysis. It was observed in Table 4 that the original hypothesis was rejected by both the LR test and the Wald test at the 1% significance level, which substantiated the appropriateness of the spatial Durbin model’s application. Furthermore, the rejection of the original hypothesis by the Hausman statistic at the 1% significance level, as indicated in Table 4, necessitated the adoption of the fixed effects model in this research. Significance at the 1% level was confirmed for both individual and temporal fixed effects across Models 1 to 4.

Subsequently, the Variance Inflation Factor (VIF) test was administered to all variables within the model to ascertain the extent of covariance issues. The findings, as presented in Table 5, revealed that the VIF values for the variables did not exceed 8.5, and the aggregate VIF for each model did not surpass 2.21, a figure considerably below the threshold of 10, thereby eliminating concerns of multicollinearity within the regressions. Given that the spatial Durbin model incorporates a lagged dependent variable, its estimation was conducted utilizing the maximum likelihood (ML) method.

In Table 4, the regression outcomes of the spatial Durbin model are presented, having incorporated fixed effects, and it is observed that the models exhibit a commendable fit, evidenced by R2 values surpassing the 0.85 threshold, thereby indicating a high level of regression reliability. The import model’s ρ (Model 1 and 2) is validated at the 1% significance level, as is the export model’s ρ (Model 3 and 4), with both coefficients being positive, denoting the presence of spatial spillover effects in China’s energy trade, both imports and exports, with the Belt and Road countries, aligning with the positive Moran’sIvalue. TerrorismI is found to be significant at the 1% level with a negative coefficient in the import model, yet it does not hold significance in the export model. This differential suggests that the terrorism index variably impacts the magnitude of China’s energy trade with these countries, with terrorist activities ostensibly impeding China’s energy imports from the countries along the route. This outcome is consistent with the expectations set by Hypothesis 1, but it does not conform to what was anticipated by Hypothesis 2. This impediment is attributed to the concentration of China’s energy imports from the West Asia and North Africa region, which is notably afflicted by terrorism, with such activities curtailing energy production and supply in the region and escalating the costs associated with energy transactions. In the realm of economic geography, it has been observed that the exportation of energy by China to countries within Southeast Asia correlates with a diminution in terrorist attacks, attributed to the enhanced counter-terrorism measures undertaken by these countries. A divergence is noted when the influence of terrorist activities on merchandise trade is considered. Some studies have elucidated that terrorist activities exert a substantial detrimental effect on the importation and exportation of commodities by China from countries aligned with the Belt and Road. The magnitude of the impact wrought by terrorist attacks on trade is comparable to an escalation in tariffs by 30% (Bing and Xiaochen, 2018). In a similar vein, Shang has identified that terrorist activities adversely affect China’s bilateral trade with Central Asian countries, albeit the extent of this impact is relatively marginal (Shang, 2020). Furthermore, Bandyopadhyay have accentuated that terrorist activities predominantly curtail trade in manufactured goods, whilst concurrently presenting the potential for an augmentation in the trade of primary commodities (Bandyopadhyay et al., 2018).

Spatial effects decomposition

In the decomposition of spatial effects, it has been elucidated by Dubé and Legros that the bias in spatial regression estimations can be circumvented through the segregation of spatial effects into constituent direct and indirect influences (Dubé and Legros, 2014). Pursuant to this methodology, the decomposition of spatial effects was executed in the present analysis, yielding the subsequent findings.

The regression outcomes pertaining to direct effects, as delineated in Table 6, elucidate the repercussions of terrorist activities within a nation upon the energy trade between China and the said nation. It is discerned from Model 1 that TerrorismI inversely correlates with the magnitude of China’s energy imports from the nation in question, as evidenced by a coefficient of −0.339 at a 1% significance threshold. Model 2 further reveals that both TerrorismN and TerrorismD are inversely proportional to Chinese energy imports, with coefficients of −0.359 and −0.719 respectively, surpassing the 10% significance criterion, which means that the frequency of terrorist activities and the number of injured individuals will suppress China’s energy imports. These findings are in alignment with the research by Shang, which posits a negative and significant correlation between the frequency of terrorist attacks and a nation’s export volume of goods, while the impact of injuries and fatalities resulting from such attacks on export volumes is negative yet not statistically significant (Shang, 2020). In the conducted analyses, it has been demonstrated through Models 1 and 2 that the control variables of GDP and REP are positively correlated with energy exports to China, as evidenced by their passage of the 1% significance level test. This suggests that a larger economic size and a higher reliance on energy exports are associated with increased energy exports to China. Conversely, the TerrorismI was not found to be significant in Model 3, indicating a negligible impact on China’s energy exports to countries along the Belt and Road. However, Model 4 reveals a different aspect, where TerrorismN is positively correlated with the scale of China’s energy exports, as it passes the 5% significance level with a coefficient of 0.125, which means that the frequency of terrorist activities has a positive impact on the energy scale of countries along China’s export routes. This finding aligns with the previous studies, which observed that frequent terrorist activities in a country lead to a substantial decrease in energy imports from neighboring countries, thereby triggering a substitution mechanism in energy trade that indirectly boosts China’s energy exports (Bing and Xiaochen, 2018). Furthermore, De Sousa have identified a positive influence of terrorist activities on the enhancement of trade security measures in proximate countries, which in turn benefits the export trade of more distant countries (De Sousa et al., 2018). Lastly, the analyses of Models 3 and 4 also confirm that countries with a larger economic scale and a higher Liner Shipping Bilateral Connectivity Index are likely to import more from China, as indicated by the positive coefficients and passage of the 1% significance level test for these control variables.

In the regression analysis of indirect effects presented in Table 6, it is demonstrated that the terrorist activities within a nation’s adjacent countries exert an influence on the energy imports and exports of China from said nation. It is indicated by Model 1, wherein TerrorismI attains a coefficient of 0.207, surpassing the 10% significance threshold, that a positive spatial spillover effect is exerted by the terrorism index on the energy imports by China from countries situated along the route. This effect is characterized by an augmentation in the magnitude of China’s energy imports commensurate with the escalation of the terrorism index in a neighboring country. This outcome is consistent with the expectations set by Hypothesis 3, and it presents a divergence from studies on general merchandise trade. For example, Nitsch and Rabaud found that in the six months after the attack on France, there was a decrease of over 6 billion euros in commodity trade, and the impact on commodity exports from partner countries with lower border barriers to France was stronger (Nitsch and Rabaud, 2022). De Sousa have posited that the implementation of more stringent border security measures by countries in proximity to terrorist activities culminates in escalated trade costs and a contraction in the volume of merchandise exports (De Sousa et al., 2018). The disparity between the outcomes of this investigation and those pertaining to other commodity trades is principally attributable to the unique nature of energy as a commodity, characterized by geographical concentration and agglomeration of production. While general commodity trade is susceptible to international substitution, prompting the long-distance relocation of substitutable commodity trade in response to terrorist activities, the energy production and supply along the Belt and Road is predominantly centralized in the Middle East. Consequently, in the event of the emergence of terrorist activities in a particular country, China is compelled to engage in energy trade with neighboring countries that are endowed with abundant energy resources. In the analysis presented within Model 2, it is observed that the variables TerrorismN, TerrorismD, and TerrorismW hold no significant weight. Similarly, the control variables GDP, LSCI, and REP are deemed to be of no consequence in both Models 1 and 2, from which it can be inferred that the economic growth, maritime commerce, and reliance on energy exports of the adjacent countries exert no notable influence on the magnitude of energy imports by China from said countries. Within the confines of Model 3, TerrorismI is found to surpass the threshold of significance at the 10% level, with a coefficient of −0.774, suggesting the presence of a negative spatial spillover effect stemming from the terrorism index on the exportation of energy by China from countries in route, whereby an elevated terrorism index in a neighboring country correlates with a diminished scale of energy exports from China to that country. This outcome is consistent with the expectations of Hypothesis 4, primarily influenced by factors such as the displacement of terrorist groups and the reinforcement of border controls by neighboring countries. In Model 4, TerrorismN is significant at the 5% level, and TerrorismD at the 10% level, with coefficients of 0.335 and −0.398, respectively, indicating that while recurrent terrorist activities in a neighboring country amplify the scale of China’s energy exports to that nation, an excessive tally of fatalities due to terrorism inversely affects the scale of these exports. This phenomenon corroborates the assertion that terrorist activities incite shifts in international trade over extended distances (De Sousa et al., 2018). GDP attains significance at the 10% level in both Models 3 and 4, with coefficients of 2.096 and 0.540, respectively, denoting a spatial spillover effect of the economic magnitude of a country on the scale of China’s energy exports, with the implication being that a higher economic stature of a neighboring country enhances the scale of China’s energy exports thereto.

Spatial heterogeneity analysis

In the context of the Belt and Road, significant regional disparities have been observed in the energy trade between China and the participating countries, as well as in the prevalence of terrorist activities. An analysis was conducted on the regional heterogeneity of the impacts that terrorist activities have on the eastern, central, and western regions along the Belt and Road (Table 7). The division of regions was based on the following criteria: Northeast Asia and Southeast Asia were classified as the eastern region; South Asia, Central Asia, West Asia, and North Africa as the central region; and Central and Eastern Europe as the western region. It was found through regression analysis that the terrorism index exerts a significant negative influence on the energy imports of China from all regions, with the central and western regions being notably affected. The magnitude of the coefficients indicates that the central region’s terrorist activities have the most substantial effect on China’s energy imports, surpassing those of the eastern region, and the western region’s impact being the least. This phenomenon is primarily attributed to the fact that South Asia, Central Asia, West Asia, and North Africa constitute the Eurasian continent’s peripheral zone, which is a hotspot for terrorist activities, thus posing the greatest geopolitical risk to the energy trade between China and the countries along the Belt and Road. Within the framework of the Terrorism Index’s sub-indicators, it has been observed that the incidence of injuries resulting from terrorist acts in the eastern and central regions exerts a negative influence on the energy trade between China and the countries within these areas. Notably, the central region’s impact magnitude surpasses that of the eastern region. Conversely, the occurrence of deaths due to terrorism in the central region is associated with a positive effect on the energy imports by China from the affected countries. This phenomenon is largely attributed to the nature of high-death terrorist incidents, which are typically political, radical, and ephemeral, leading to a substantial escalation in international energy prices. The volatility in energy prices, particularly in the short term, necessitates a risk premium that amplifies China’s energy imports volume from South Asia, Central Asia, as well as West Asian and North African countries. Regarding control variables, the central region’s economic development level is positively correlated with the energy trade between China and the regional countries. Furthermore, the liner shipping indices pertinent to the eastern and western regions are found to positively influence the energy trade. Lastly, the central region’s reliance on energy exports is seen to positively impact the scale of energy imports by China from the region, while simultaneously exerting a negative effect on the export scale.

Robustness test

To ensure the reliability of the empirical results, this paper employs three methods to test the robustness of the models: substituting the spatial weight matrix, lagging the explanatory variables and control variables by one period, and utilizing a dynamic spatial Durbin model. The outcomes indicate that, overall, there is little change in the sign and significance of the coefficients for the primary observed variables, suggesting that the conclusions drawn in this study exhibit good robustness.

Following the approach by Shao (Shao et al., 2022), this paper employs the geographic distance between countries to construct the spatial weight matrix for the robustness test. The outcomes, as depicted in Table 8, reveal that the variable coefficients’ directionalities are in alignment with the empirical observations documented in Table 6. Furthermore, it is observed that the absolute magnitudes of the coefficients associated with terrorist activities surpass those in Table 6. This phenomenon suggests an expanded spatial influence of terrorist activities on the energy trade dynamics, specifically the imports and exports transactions between China and the countries situated along the Belt and Road.

Drawing on Elhorst’s method (Elhorst, 2014), the explanatory and control variables are lagged by one period and replaced with the original variables for the robustness test. The results in Table 9 demonstrate that apart from the variable TerrorismD changing from insignificant to significant at the 10% level, the other regression outcomes remain consistent with those in Table 4, indicating the robustness of the empirical results.

The dynamic spatial Durbin Model offers improvements over the Static Spatial Durbin Model by addressing endogeneity issues to a greater extent. It does so by accounting for the spatial and temporal lags of the dependent variable, which helps mitigate potential biases arising from omitted variable problems and the autocorrelation of errors. The dynamic spatial Durbin model takes into account lagged dependent variables, spatial factors, and endogeneity issues, which can better explain the relationship between terrorist activities and energy imports and exports trade. Following the method by Liu (Liu et al., 2024), our re-estimation using the dynamic spatial Durbin Model (Table 10) yields stable results.

Conclusions and implications

Conclusions

Firstly, this paper analyzes the temporal dynamics and spatial heterogeneity of China’s energy imports and exports trade with countries along the Belt and Road, as well as the terrorism activities in these countries. Through the analysis, we find that all three phenomena exhibit characteristics of spatial agglomeration. In terms of time, there is significant fluctuation in China’s energy imports and terrorist activities in countries along the Belt and Road, roughly showing a “falling-rising-falling” trajectory, while China’s energy exports are relatively low and stable. Geographically, a clustering pattern is discernible, with energy imports and exports, as well as the incidence of terrorist activities, being regionally concentrated. Predominantly, the imports are centralized in West Asia and North Africa, with countries such as Saudi Arabia, Russia, the United Arab Emirates, Kuwait, and Iran being the primary contributors. In contrast, the exports from China are primarily directed towards Southeast Asian countries, including Singapore, Cambodia, and Brunei. The prevalence of terrorist activities is notably higher in regions where China’s energy importation is substantial, particularly in West Asia, North Africa, South Asia, and Central Asia. This correlation indicates that the countries with significant energy ties to China also experience a higher frequency of terrorist incidents.

Subsequently, this paper employed the spatial Durbin model to investigate the impact of terrorist activities on energy imports and exports trade between China and countries along the Belt and Road. Interestingly, we have found that terrorist activities have significant spatial spillover effects on energy imports and exports trade between China and countries along the Belt and Road. Terrorist activities have spatial spillover effects on energy trade, which can reduce the scale of energy trade with neighboring countries. This study distinguished the impact of terrorist activities on energy imports and exports.

Regarding the interrelation between terrorist activities and the importation of energy by China, it is observed that a reduction in energy production and market supply is caused by such activities. Consequently, an escalation in energy prices and transportation risks is witnessed, thereby hindering the importation of energy into China. It is discerned that the central region, encompassing South Asia, Central Asia, West Asia, and North Africa, experiences the most pronounced adverse effects of terrorist activities. This is followed by the eastern region, which includes Northeast Asia and Southeast Asia, while the western region, comprising Central and Eastern Europe, is affected to a lesser extent. The detrimental effects on China’s energy imports from countries situated along the routes are more significant when high-death occurrences are considered, as opposed to high-frequency events. Moreover, a positive spatial spillover effect is identified, wherein the impact of terrorist activities on China’s energy imports is augmented. The clustering of energy’s spatial distribution, coupled with the substitution mechanism inherent in international trade, results in the terrorism index of a nation’s neighboring countries exerting a positive influence on China’s importation of that nation’s energy. Additionally, the national economic development and the dependency on energy exports are factors that positively influence the importation of energy by China.

In the examination of the interplay between terrorist activities and the energy exportation endeavors of China, it has been observed that the terrorism index exerts an insubstantial influence on the energy exports directed towards the countries along the Belt and Road. Conversely, a discernible negative effect has been identified on the energy exports to the central and western regions, with a more pronounced impact in the central region compared to the western region. It is posited that an increase in the frequency of terrorist activities serves as a catalyst for the augmentation of China’s energy exports. This phenomenon can be attributed to the fact that escalated frequencies of terrorist incidents amplify the revenues derived from energy exports, thereby providing an impetus for Chinese trade and economic agents to intensify efforts in expanding energy exportation. Furthermore, such frequent terrorist occurrences have been found to diminish the accessibility of energy in adjacent regions, consequently fostering the importation of energy by China from countries along the route. Nevertheless, terrorist activities of a high-death nature are observed to curtail the magnitude of China’s energy exports to proximate countries. This is primarily due to the substantial geopolitical risks incited by high-death terrorist events, culminating in the closure of numerous international trade corridors. It is also noted that the progression of national economic development and the facilitation of liner shipping are factors that positively modulate the energy exports of China.

Implications

Considering the concentration of China’s energy imports and the adverse effects posed by terrorist activities, it is proposed that measures be adopted to enhance the security of China’s energy trade and the energy supply stability in the countries along the route. It is recommended that China’s energy reserve capabilities be augmented. Efforts to import energy from geopolitically stable countries, such as Saudi Arabia and Kuwait, should be intensified, and the strategic energy reserves expanded. The acceleration of reserve base construction near key coastal ports and petrochemical industry hubs is advocated, alongside the innovation of the oil and gas reserve model through the promotion of energy infrastructure development. The establishment of a multifaceted reserve system, integrating state, commercial, and societal reserves, is envisaged through the mobilization of the general populace and the engagement of private capital in oil reserves. Furthermore, the exploration of China’s indigenous energy resources should be escalated. A continuous increase in energy prospecting, development, and technological advancement is advised, with an emphasis on maritime energy expansion beyond terrestrial endeavors. Prioritization should be given to the enhancement of marine oil and gas resource exploitation and the augmentation of offshore oil drilling platform construction, leveraging progressively sophisticated scientific and technological methods and manufacturing capacities. The procurement of sea-based resources is anticipated to constitute a significant avenue for the realization of China’s energy diversification strategy. Thirdly, the development of international energy space ought to be further pursued by China. Energy cooperation with Russia is to be strengthened, and the expansion of energy imports from countries such as Kazakhstan, Turkmenistan, and Myanmar, which are geographically proximate and have a solid foundation for political and economic cooperation, is to be broadened. For instance, emphasis should be placed on the construction of the China-Russia crude oil pipeline, the acceleration of the western energy corridor’s construction linking Kazakhstan should be hastened, and the advancement of the oil corridor’s construction with Pakistan’s Gwadar Port is to be continuously promoted. Fourthly, the establishment of a coordinated counter-terrorism mechanism with pivotal countries along the route is imperative for China. The creation of terrorism databases and intelligence-sharing platforms in countries situated along the routes should be undertaken, the systematic assessment of the terrorism situation in these countries should be fortified, and the summarization of terrorism’s impact on the energy imports and exports trade between China and the countries along the Belt and Road should be compiled. Consequently, high-, medium-, and low-risk zones for terrorism are to be delineated, enabling the execution of more targeted counter-terrorism cooperation. Upon this foundation, it is proposed that an alliance for counter-terrorism cooperation be established. The deepening of policy and legal cooperation in counterterrorism with countries situated along the designated routes is to be pursued, and the formulation of a unified international counter-terrorism strategy at the highest echelon is necessitated. Furthermore, the establishment of a pragmatic mechanism for international criminal cooperation in counterterrorism is imperative. The enhancement of coordinated counter-terrorism capabilities through the strengthening of multi-party counter-terrorism joint exercises with countries in South Asia, Central Asia, West Asia, and North Africa is advocated. Additionally, it is incumbent upon China’s foreign energy enterprises to disseminate counter-terrorism security knowledge and devise contingency plans for terrorist incidents, thereby augmenting the counter-terrorism security consciousness and proficiency of their personnel.

Data availability

All data generated or analysed during this study are included in this published article.

References

Ahakwa I (2023) The role of economic production, energy consumption, and trade openness in urbanization-environment nexus: a heterogeneous analysis on developing economies along the Belt and Road route Environ Sci Pollut R 30(17):49798–49816

Anderson JE, Marcouiller D (2002) Insecurity and the pattern of trade: an empirical investigation. Rev Econ Stat 84(2):342–352

Balta-Ozkan N, Watson T, Mocca E (2015) Spatially uneven development and low carbon transitions: insights from urban and regional planning. Energy Policy 85:500–510

Bandyopadhyay S, Sandler T (2014) The effects of terrorism on trade: a factor supply approach. Fed Reserve Bank St Louis Rev 96(3):229–241

Bandyopadhyay S, Sandler T, Younas J (2014) Foreign direct investment, aid, and terrorism. Oxf Econ Pap 66(1):25–50

Bandyopadhyay S, Sandler T, Younas J (2018) Trade and terrorism: a disaggregated approach. J Peace Res 55(5):656–670

Barber CT (1948) Review of Middle East oil. Petroleum 10:48–62

Bing L, Xiaochen Y (2018) China’s new comparative advantage of trading with Belt and Road countries: public security perspectives. Econ Res J 53(1):183–197

Blomberg SB, Hess GD, Orphanides A (2004) The macroeconomic consequences of terrorism. J Monet Econ 51(5):1007–1032

Blustein P (2009) Misadventures of the most favored nations: Clashing egos, inflated ambitions, and the great shambles of the world trade system. Public Affairs, New York

Bouri E, Demirer R, Gupta R, Marfatia HA (2019) Geopolitical risks and movements in Islamic bond and equity markets: a note. Def Peace Econ 30(3):367–379

Bove V, Elia L, Sekeris PG (2014) US security strategy and the gains from bilateral trade. Rev Int Econ 22(5):863–885

Bradshaw MJ (2010) Global energy dilemmas: a geographical perspective. Geogr J 176(4):275–290

Bridge G, Dodge A (2022) Regional assets and network switching: shifting geographies of ownership, control and capital in UK offshore oil. Camb J Reg, Econ Soc 15(2):367–388

Burke MJ, Stephens JC (2018) Political power and renewable energy futures: a critical review. Energy Res Soc Sci 35:78–93

Cheng CHJ, Chiu CJ (2018) How important are global geopolitical risks to emerging countries? Int Econ 156:305–325

Costa-Campi MT, Del Rio P, Trujillo-Baute E (2017) Trade-offs in energy and environmental policy. Energy Policy 104:415–418

Czinkota MR, Knight G, Liesch PW, Steen J (2010) Terrorism and international business: a research agenda. J Int Bus Stud 41:826–843

De Sousa J, Mirza D, Verdier T (2009) Trade and the spillovers of transnational terrorism. Swiss J Econ Stat 145:453–461

De Sousa J, Mirza D, Verdier T (2018) Terror networks and trade: does the neighbor hurt? Eur Econ Rev 107:27–56

Doucouliagos H (2017) An injury to one is an injury to all: terrorism’s spillover effects on bilateral trade, IZA Discussion Papers, No: 10859. Bonn, Institute of Labor Economics

Du R, Dong G, Tian L et al. (2016) A complex network perspective on features and evolution of world crude oil trade. Energy Procedia 104:221–226

Du R, Wang Y, Dong G et al. (2017) A complex network perspective on interrelations and evolution features of international oil trade, 2002–2013. Appl Energ 196:142–151

Dubé J, Legros D (2014) Spatial econometrics using microdata. John Wiley & Sons, Hoboken, USA

Dudley B (2018) BP statistical review of world energy. London, British Petroleum

Egger P, Gassebner M (2015) International terrorism as a trade impediment? Oxf Econ Pap 67(1):42–62

Elhorst JP (2014) Spatial panel data models. Spat Econ: cross-Sect data Spat panels 10:37–93

Firat B (2023) Geopolitics, infrastructure and scale-making in the southern gas corridor. Ethnos 0(0):1–22