Abstract

In light of the quest to achieve economic development without compromising environmental quality, we empirically examine whether institutional quality (INSQY) can help moderate the possible harmful effects of foreign direct investments (FDI) and industrialisation on environmental quality in sub-Saharan Africa (SSA). We utilise the Driscoll and Kraay standard error estimation technique on a panel of 45 SSA countries from 2000 to 2019. The results indicate that FDI and industrialisation generally have a significant harmful effect on the environment. Our findings reveal that INSQY directly promotes environmental quality. Notably, the results confirm that INSQY plays a stimulating role in mitigating the adverse effects of FDI and industrialisation on environmental quality. The results further validate the environmental Kuznets curve (EKC) hypothesis in SSA. These findings contribute to environmental sustainability literature and offer policymakers insights on how INSQY can enhance environmental quality. Our empirical results are also robust to different estimation techniques, such as the two-stage least squares. We recommend SSA leaders strengthen institutional capacities, enforce environmental regulations, and implement strict policies to ensure environmental quality while promoting industrialisation and FDI inflows.

Similar content being viewed by others

Introduction

Climate change and global warming have become the most serious environmental topics over the past decades because of their possible adverse consequences, such as increasing food insecurity, rising health problems, climate-related disasters and transboundary conflicts, among other socioeconomic consequences (Gorus and Aslan, 2019; Jian et al. 2023). It is generally understood that environmental degradation results from greenhouse gas (GHG) emissions, such as carbon dioxide (CO2), which contribute to global warming (Amin et al. 2020; Amin and Dogan, 2021). The United Nations Framework Convention on Climate Change (UNFCCC) in 1992, later the Kyoto Protocol in 1997 and the Paris Contract in 2015, called on nations to pursue accelerated economic growth without compromising environmental quality (Leggett, 2020). Notwithstanding, a record temperature of 1.7 °C was recorded in 2020, heightening concerns about global warming (Magazzino, 2024). In Sub-Sahara Africa (SSA), available data reveal that CO2 emissions, which account for approximately 82% of GHG emissions, are witnessing a significant upward trend, particularly in the post-liberalisation period, partly due to industrial emissions (Acheampong et al. 2019; Ashraf et al. 2021; Gorus and Aslan, 2019). For instance, the average CO2 emissions in SSA increased from 801,760.00 kilotons in 2018 to 823,770.02 kilotons in 2019, representing 2.75% growth (World Bank, 2020). Furthermore, the evidence suggests that SSA suffer the most from the harmful effects of climate change (Atwoli et al. 2022).

Within the scope of achieving accelerated economic growth, there is abundant documentary evidence suggesting that industrialisation and Foreign Direct Investment (FDI) have the potential to positively impact economic growth, particularly for developing countries (Abdouli and Hammami, 2017a, 2017b; Iddrisu et al. 2023; Kang and Martinez‐Vazquez, 2022; Ofori and Asongu, 2021a). According to Mahembe and Odhiambo (2014), FDI can stimulate the adoption of new technologies in the production process through technological spillovers and facilitate knowledge transfers in labour training, better organisational management practices and skills acquisition. Despite the numerous benefits of FDI, it could also potentially degrade the host country’s environmental quality. The Pollution Haven Hypothesis (PHH) argues that firms seek to relocate carbon-intensive industries from countries with more strict environmental regulations to those with weaker regulations, thereby causing considerable environmental damage (Sarkodie and Adams, 2018; Sarkodie and Strezov, 2019; Kisswani and Zaitouni, 2023). On the other hand, the pollution halo hypothesis argues that FDI helps improve the environment because multinational corporations invest in green technologies in host countries (Seker et al. 2015; Sung et al. 2018; Ali et al. 2020). Similarly, both theoretical and empirical studies have revealed that industrialisation can potentially exert measurable influences on economic growth (Kaldor, 1975; Necmi, 1999). Following the lived experience of the economies of South Korea and China, as well as other experiences in the developed world, African leaders have placed industrialisation at the core of transformational economic growth in Africa (Gui-Diby and Renard, 2015; AfDB, 2017; Zamfir, 2016). This has culminated in the implementation of various policies by African governments, placing industrialisation at the centre of their growth agenda. For example, the New Partnership for Africa’s Development (NEPAD), Africa’s Agenda 2063 and the African Continental Free Trade Area (AfCFTA) are being implemented to help develop the industrial sector of the continent (Iddrisu et al. 2024; Opoku and Boachie, 2020; Ofori and Asongu, 2021b; UNCTAD, 2021). Nevertheless, increased energy consumption resulting from industrialisation can be a significant source of CO2 emissions, leading to environmental degradation (Halicioglu, 2009; Munir and Ameer, 2020; Shahbaz et al. 2018; Udemba, 2019).

Also, the environmental Kuznets curve (EKC) hypothesis, pioneered by Grossman and Krueger (1991), suggests that poor or developing countries may end up degrading their environment during the initial stages of economic development until an income threshold is attained before environmental degradation begins to decline (Zakaria and Bibi, 2019; Udemba, 2021; Magazzino et al. 2023). The validity of the EKC means that most SSA countries seeking to attract more FDI inflows and industrialisation face the dilemma of degrading their environment. However, it has been emphasised by the United Nations (UN) Sustainable Development Goal (SDG) 13 on the need to foster sustainable development, that is, pursuing economic growth without compromising the environment and the ability of future generations to meet their own needs, in conformity with some empirical studies (see e.g., Makki and Somwaru, 2004; De Gregorio, 2005; Opoku et al. 2019; Ofori and Asongu, 2021b; Ofori et al. 2022; Duodu and Baidoo, 2022).

The relationship between economic growth, a potential consequence of FDI, industrialisation and the environment remains contentious. The Porter Hypothesis (PH) states that host countries with strict environmental regulations tend to protect the environment by compelling firms to invest in clean and efficient technologies (Porter and Van Der Linde, 1995). This implies that institutional quality (INSQY) is an important explicator in the FDI, industrialisation and environmental quality link (Azam et al. 2021; Barrett and Graddy, 2000; Neumayer, 2002). Therefore, institutions are seen as crucial to the effective execution of national policies that directly affect the management of the environment (Amin et al. 2022). By implication, countries with stringent environmental standards are likely to enhance environmental quality by mitigating the harmful effects of FDI on the environment (Shahbaz et al. 2018; Sabir et al. 2020; Dutt, 2009; Lau et al. 2014).

In light of the above, the need to analyse the potential moderating effect of institutional quality on the relationships between FDI, industrialisation, and environmental quality for the SSA region is compelling and pertinent. First, FDI inflows into SSA have increased substantially even since the coronavirus disease 2019 (COVID-19) pandemic. FDI inflows into SSA reached a record US$83 billion in 2021 from US$1.690 billion in 1990 (UNCTAD, UN, 2022; Iddrisu et al. 2024). Second, SSA economies appear to be expanding due to increased industrialisation. For instance, the absolute size of manufacturing value added, the share of manufacturing exports, and the size of manufacturing employment reveal that the region is enhancing industrialisation (Abreha et al. 2021). Further, the SSA region experienced a 148% increase in jobs in the manufacturing sector between 1990 and 2018 (Abreha et al. 2021). Third, despite the low institutional development in SSA, Oduola et al. (2022) strongly argued that an opportunity exists for the quality of governance in SSA to improve, stressing that most SSA countries are beginning to exhibit gradual improvements in quality. Since SSA suffers the most from the harmful effects of climate-related disasters, there is a need to examine whether the expected institutional improvements in SSA can help mitigate the possible detrimental impact of FDI and industrialisation on environmental quality.

The literature on the critical question of whether INSQY can help mitigate the negative impact of FDI and industrialisation on environmental quality in SSA is very difficult to find. Duodu et al. (2021) and Acheampong et al. (2019) investigated the effect of FDI on environmental quality in SSA, providing valuable insight into the understanding of the relationship between FDI and CO2 at the macroeconomic level; however, these studies did not account for notable variables such as industrialisation, more importantly, they did not examine the moderating role of INSQY. Another recent study by Mentel et al. (2022) also investigated the effect of industrialisation on environmental quality, focusing on the mitigating role of renewable electricity, but ignored the role of INSQY.

Against this backdrop, this study distinguishes itself from previous studies and contributes to the literature in several ways: (1) We comprehensively examine the impact of FDI inflows and industrialisation on environmental quality in SSA. (2) We also examined the direct relationship between INSQY and environment quality. (3) More importantly, we contribute to the literature by testing whether INSQY can help mitigate the potentially harmful effects of FDI and industrialisation on the environment in SSA; in doing so, we construct a comprehensive index of INSQY by capturing all the six key individual governance indicators into one aggregate institutional index. (4) We also add to the literature by investigating the EKC hypothesis in relation to SSA. The primary objective of this investigation is to provide essential evidence, information, and a better understanding of policies that can help mitigate the adverse effects of FDI and industrialisation on the environment for key stakeholders.

We employ the Driscoll and Kraay (1998) standard errors estimation methodology, which caters for heteroskedasticity, providing substantially robust outcomes among the cross-sectional units (Hoechle, 2007; Shah et al. 2021). We also adopt the Two-Stage Least Squares (2SLS) estimator, which effectively manages endogeneity as a robustness check. We used data from a panel of 45 SSA countries from 2000 to 2019 and found some significant findings. First, we found that FDI and industrialisation significantly contribute to degrading the environment in SSA economies, which aligns with the PHH. The documented results also show that INSQY helps minimise the negative effects of FDI and industrialisation on the environment. Additionally, we find the presence of an EKC or inverted U-shaped relationship between economic growth and environmental quality in SSA. The results of this study can help policymakers in SSA and their development partners appreciate ways to mitigate the possible risk associated with current policies, such as Agenda 2063 and the AfCFTA, which aim to promote industrialisation and attract foreign capital such as FDI. For example, endogenous growth models pay limited attention to the government’s role in economic growth. The results produced in this paper highlight a possible governmental policy for attracting FDI and promoting industrialisation to achieve accelerated economic growth in host economies without compromising environmental quality by strengthening INSQY. Our findings provide the opportunity for compelling policy implications, which we discuss in detail at the end of the study.

The rest of this paper is organised as follows. Section “Theoretical and empirical literature review” provides an overview of the theoretical and empirical literature. In Section “Data and methodology”, we present the methodology. Section “Empirical results and discussion ” discusses the results of the empirical investigations, and Section “Conclusion and policy implications” concludes with policy recommendations.

Theoretical and Empirical Literature Review

The theoretical linkage amongst FDI, industrialisation, INSQY and their potential impact on environmental quality are discussed within the context of three (3) prominent hypotheses: (i) the EKC hypothesis, (ii) the PHH and pollution halo hypothesis, and (iii) PH.

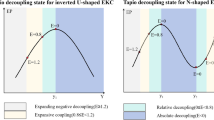

The EKC hypothesis, pioneered by Grossman and Krueger (1995), suggests a nonlinear (inverted U-shaped) relationship exists between economic growth and environmental pollution. That is, pollution rises during the initial stages of economic development until a threshold beyond which emissions begin to decline. However, Lorente and Álvarez-Herranz (2016) note that wealth alone cannot control pollution; hence, stricter enforcement of environmental regulations is required to help achieve a cleaner environment. From the empirical perspective, the relationship between economic growth and the environment, which tests for the validity of the ECK hypothesis, has generated mixed and sometimes controversial (Magazzino et al. 2023). These studies have adopted different variables, such as nitrous oxide, CO2, methane, and total greenhouse gas emissions, for the environment. The main results from these studies either confirm or reject (Ben Jebli and Ben Youssef, 2015; Özokcu and Özdemir, 2017; Sapkota and Bastola, 2017) the ECK hypothesis; however, some studies have shown mixed or insignificant results. For example, Opoku and Boachie (2020) examined several economic variables such as FDI, industrialisation, and GDP and their effects on environmental degradation on a panel data set of 36 African economies from 1980–2014, and their results confirmed the EKC hypothesis.

Additionally, by applying an autoregressive distributed lag (ARDL) model to a panel of 55 countries from 1995 to 2020, Ahmed et al. (2022) showed evidence for the EKC hypothesis for the Asia-Pacific region. The results confirmed the presence of the EKC hypothesis for the selected countries. Similarly, Nguyen and Kakinaka (2019), who applied a panel cointegration analysis to 107 countries from 1990 to 2013, also found results that validated the EKC hypothesis. Similar results were obtained by some researchers using different proxies for environmental pollution (Apergis et al. 2017; Ben Amar, 2021; Fosten et al. 2012; Sapkota and Bastola, 2017; Sephton and Mann, 2016). In contrast, Sapkota and Bastola (2017), using time series analysis to examine data from 1980 to 2010 for 14 Latin American countries, concluded that the EKC hypothesis is invalid for 14 Latin American countries. Using the Driscoll-Kraay standard errors technique on 26 OECD countries, Özokcu and Özdemir (2017) also obtained results that did not support the EKC hypothesis. Ben Jebli and Ben Youssef (2015), using the ARDL bounds testing approach and the vector error correction model (VECM) estimation technique for Tunisia from 1980–2009, concluded that the EKC for Tunisia was not valid. On the other hand, Golpîra et al. (2023) examined the EKC hypothesis in OECD countries and found an N-shaped or cubic relationship between economic growth and the environment. The inconsistent conclusions may result from important country differences in the samples used for the study.

Other studies have shown mixed results on the relationship between economic growth and environmental degradation. For instance, Saidi and Hammami (2017) investigated the causal relationships among transportation, economic growth, and the environment of 75 countries during 2000–2014 using the GMM estimation technique, and they revealed a bidirectional relationship with economic growth. Ahmad et al. (2017) tested for the EKC in Croatia using quarterly data from 1992Q1 to 2011Q1 using the ARDL and VECM models. Their findings revealed bidirectional causality between CO2 and economic growth in the short run. A related study by Neequaye and Oladi (2015)also showed evidence suggesting that economic growth increased CO2 for 27 selected developing countries from 2002 to 2008 but had opposite results when nitrous oxide was used as a proxy for greenhouse gas. The literature reviewed implies that the relationship between economic growth and environmental degradation requires further study. Thus, we test the EKC hypothesis for completeness for a sample of 45 SSA economies to add to the literature of knowledge.

From the theoretical front, the PHH suggests that as countries open up their economies for trade and FDI inflows, high-polluting multinational corporations facing stringent environmental policies in developed regions may move their investments into countries with weak environmental regulations, thereby polluting the host economies’ environments. Therefore, host economies become “pollution havens” (see e.g., Bommer, 1999; Eskeland and Harrison, 2003; Walter and Ugelow, 1979). Thus, a negative relationship between FDI and industrialisation and environmental quality can be proposed under the PHH theory. As developing countries compete to attract FDI into their economies, regulations may be relaxed, allowing polluting firms to relocate from developed countries with stringent regulations into such developing countries.

On the other hand, the pollution halo hypothesis supports the argument that countries with stringent and enforceable regulations may encourage multinational companies to transfer modern and clean technologies from FDI inflows, thereby improving the environment of host countries (Mert and Bölük, 2016; Zhu et al. 2016b). Within the PHH and halo hypothesis framework, some studies have examined the effect of FDI and industrialisation on environmental quality. Shah et al. (2021) adopting the Driscoll and Kraay standard error estimation method for South Asian countries from 2001 to 2019, found a positive relationship between FDI and CO2. In addition, Shahbaz et al. (2019) examined the association between FDI and carbon emissions for the Middle East and North African (MENA) region during 1990–2015 by applying the generalised method of moments (GMM) and revealed that FDI increases CO2 emissions. By exploring the impact of industrialisation and FDI on the environment in the Asia-Pacific region from 1995 to 2000, Ahmed et al. (2022), using the ARDL, showed that FDI generally has a significantly negative environmental impact. The evidence from these studies largely confirms the PHH. Wang et al. (2020) also confirmed that FDI inflows deteriorate environmental quality, validating the PHH for China using a panel of 29 provinces from 1994 to 2015.

Similar results were obtained from other studies, which confirmed that FDI leads to environmental pollution (Moreno and Lo’pez, 2008; Ren et al. 2014; Dogan and Seker, 2016; Zhang and Zhou, 2016; Sapkota and Bastola, 2017; Gharni et al. 2020). However, other research findings have suggested that FDI does not deteriorate environmental quality, corroborating the pollution halo hypothesis. For example, Demena and Afesorgbor (2020), adopting a meta-analysis of 65 primary studies on the effect of FDI on the environment, concluded that FDI significantly reduces environmental pollution. In the same vein, Al-mulali, Foon Tang (2013) used the fully modified ordinary least squares (FMOLS) estimation method to estimate data between 1980 and 2009 on Gulf Cooperation Council (GCC) countries and found that FDI reduces environmental pollution; they concluded that energy consumption and GDP growth promote environmental pollution, whereas FDI dampens environmental pollution. Zafar et al. (2019) analysed US data from 1970 to 2015 and found that FDI was helpful in curtailing the ecological footprint, confirming the halo effect. These findings were validated by numerous studies that established that an increase in FDI does not significantly deteriorate environmental quality (Demena and Afesorgbor, 2020; Lee and Brahmasrene, 2013; Mert and Bölük, 2016; Safiullah et al. 2022; Zhu et al. 2016a). Sung et al. (2018) used a 14-year (2002–2015) dataset for 28 subsectors of the Chinese manufacturing sector, where the results from the system GMM showed an inverse relationship between GDP and CO2 emissions. The literature reviewed thus far reveals inconclusive results, which calls for additional empirical studies to understand the relationship between FDI and environmental quality, especially for SSA countries.

Since industrialisation, which involves transitioning from an agrarian-based to a manufacturing-focused economy, is closely related to natural resources and involves substantial energy consumption, various studies have linked energy with industrialisation and environmental quality. For example, Mentel et al. (2022) investigated the relationship among industry, renewable energy, and CO2 emissions for a sample of 44 SSA countries from 2000 to 2015. The results from the two-step system GMM estimation revealed that the share of industry in GDP has a significant positive impact on CO2 emissions, whereas renewable electricity output reduces CO2 emissions. Ahmed et al. (2022) utilised panel data from 55 countries in the Asia-Pacific region from 1995 to 2020 and the ARDL model to analyse the relationship between industrialisation and the environment. The authors concluded that industrialisation significantly and positively impacts the environment. Using the ARDL testing approach, Mahmood et al. (2020) examined the effects of industrialisation and urbanisation on CO2 emissions in Saudi Arabia, utilising an annual period from 1968 to 2014. The results revealed that both industrialisation and urbanisation impede the environment through the inelastic effect of industrialisation and the elastic effect of urbanisation on CO2. By accounting for subregional characteristics in a sample of 46 countries in the Asia-Pacific region during 1991–2017, Zafar et al. (2020) confirmed that industrialisation substantially impacts carbon emissions. Yu and Liu (2020) also confirmed the significant effect of industrialisation on environmental pollution in China. By examining the relationship between industrialisation and CO2 emissions in Pakistan from 1980 to 2018 using nonlinear ARDL models, Ullah et al. (2020) concluded that industrialisation has a negative impact on the environment. In South Turkey, Akbostancı et al. (2011) found that the changes in total industry and energy intensity are the primary factors determining the changes in CO2 emissions after employing the log mean Divisia index (LMDI) method from 1995 to 2001.

However, using nonparametric additive models, Xu and Lin (2015) found a U-shaped nonlinear relationship between industrialisation and CO2 emissions in their data analysis from 1990 to 2011. This finding contrasts with previous research suggesting a positive correlation between industrialisation and CO2 emissions. Using the ARDL bounds testing approach, Shahbaz et al. (2014) found a positive link between industrialisation and CO2 emissions in the case of Bangladesh during 1975–2010. Similarly, Ahmed et al. (2022), utilising panel data of 55 countries in the Asia-Pacific region from 1995 to 2020 with the ARDL model, concluded that industrialisation has a positive and significant impact on the environment. Thus, the analysis of the above hypothesis provides critical pathways towards achieving sustainable development and the realisation of carbon neutrality goals in SSA. Regarding the possible role of INSQY in promoting environmental quality, the PH suggests the presence of well-designed environmental regulations in the home country (Porter, 1991). This indicates that INSQY can reduce carbon dioxide emissions, enhance environmental quality, and improve economic growth (Ibrahim and Law, 2016; Salman et al. 2019; Sarkodie and Adams, 2018). For instance, Cheah et al. (2022), studying the impact of INSQY in explaining environmental degradation in Malaysia from 1980 to 2019, made a strong case for promoting strong institutions as a critical tool to promote environmental quality. In a related study, Pata et al. (2024), using quantile regression model on data from 1985 to 2018 in four emerging countries, confirmed that geopolitical risks negatively influence environmental quality. Huynh and Hoang (2019) examined whether INSQY moderated the impact of FDI for 19 developing Asian countries from 2002 to 2015 by using the feasible generalised least squares (FGLS) and system GMM techniques. The authors concluded that INSQY helps reduce the negative impact of FDI on the environment. Similarly, Abid (2016) used GMM and found that a high level of institutions in 25 SSA countries reduced CO2 emissions from 1996 to 2010.

Herrera-Echeverri et al. (2014) and Kerekes (2011), in their study on the relationship between institutions and CO2, argued that emerging economies with low per capita income may use their institutional frameworks to favour economic development to the detriment of the environment. Similarly, Ameer et al. (2022) used ARDL simulations to analyse the effects of financial development, INSQY, globalisation, natural resources, trade openness, and renewable and nonrenewable energy consumption on environmental pollution from 1996 to 2017. The study revealed that a decrease in INSQY increases CO2 emissions. Zhang et al. (2022) studied emissions in Brazil, Russia, India, China, and South Africa (BRICS) using the panel NARDL approach from 1996 to 2019. The study found that INSQY lowered CO2 directly and indirectly through FDI and economic growth. Salman et al. (2019) used a panel of three East Asian countries from 1990 to 2016 and adopted three different estimation techniques—FMOLS, dynamic ordinary least squares (DOLS) and VECM to determine how INSQY can reduce the CO2 emissions-growth nexus. The results show a positive and significant interaction between CO2 and INSQY, indicating that institutions are critical for increasing economic growth and decreasing carbon emissions. Jahanger et al. (2022) investigated the influence of democracy, autocracy, and globalisation on CO2 emissions in 74 developing countries from 1990 to 2016 by using the stochastic impacts by regression on population, affluence, and technology (STIRPAT) model framework. The results suggest that democracy helps reduce environmental pollution. Other studies have indicated that better institutions promote clean technologies, reducing environmental pollution. For instance, in a research study that investigated the role of INSQY and environment-related technologies on environmental degradation for BRICS economies using data from 1992 to 2016, Hussain and Dogan (2021) found that INSQY and clean technology improve environmental quality.

This review shows that various studies have examined the links between FDI, industrialisation, INSQY, and environmental quality. However, studies on the mitigating role of institutions on FDI and industrialisation on environmental quality in SSA are sparse and difficult to find. Despite efforts by Cheah et al. (2022) and Huynh and Hoang (2019) to investigate the moderating role of INSQY on FDI-environmental quality, they did not explore how institutions may also moderate industrialisation-environmental quality nexus. The industrial sector is acknowledged as a key contributor to carbon footprints, leading to environmental degradation (Akbostancı et al. 2011). Hence, there is a pressing need to investigate whether INSQY can help mitigate the harmful effect of industrialisation on environmental quality. Although Opoku and Boachie (2020) examined the environmental impact of FDI and industrialisation for 36 selected African countries, they did not account for INSQY. Similarly, Duodu et al. (2021) explored the relationships among FDI, institutions, and environmental quality in 23 SSA countries, they did not account for industrialisation. Considering the important role of institutions in governance and enforcement of regulations, examining the joint effect of institutions and FDI and institutions and industrialisation on CO2 is imperative. For example, countries with stringent environmental standards are likely to enhance environmental quality because countries with adequate laws mitigate the negative effect of industrialisation on environmental degradation (Dutt, 2009; Lau et al. 2014). Therefore, we add to the literature by examining (1) the effect of FDI and industrialisation on CO2, (2) the direct relationship between INSQY and CO2, (3) the moderation role of INSQY on FDI-CO2 nexus and (4) the moderation role of INSQY on industrialisation- CO2 nexus.

Data and methodology

Data

To test the objectives of this paper, we use panel data from 45 SSA countriesFootnote 1 from 2000 to 2019 due to data availability. We rely on macro data sourced from the World Bank [i.e., World Development Indicators (WDI) and World Governance Indicators (WGI)] and Energy Information Administration (EIA), as shown in Table 1. Environmental quality is the dependent variable and refers to the natural balance of animals, plants, natural resources, and man-made objects designed to sustain human livelihoods and nature.Footnote 2 In line with previous studies, we use CO2 measured in metric tons per emission as a proxy for environmental quality (Albulescu et al. 2019; Opoku and Boachie, 2020). Reduced CO2 levels suggest an improvement in environmental quality, while elevated CO2 levels indicate a decline in environmental quality. The main independent variables of interest are FDI, industrialisation and INSQY. FDI is measured as net inflow (% GDP), whereas industrialisation is measured as value addition, including construction (% GDP). We include FDI because it can trigger green innovations and spur environmental progress (Baskurt et al. 2022; Kisswani and Zaitouni, 2023; Muhammad et al. 2021; Neequaye and Oladi, 2015). We aslo include industrialisation on the notion that changes in the total activity of industries can primarily contribute to environmental degradation (Akbostancı et al. 2011; Xu and Lin, 2015).

As discussed earlier, we focus on INSQY as the moderating variable because it can potentially play a crucial role in promoting environmental quality (Sarkodie and Adams, 2018); hence, the study examines the interactive term between FDI, industrialisation and INSQY, respectively. INSQY is indicative of the domestic institutional function of the host country. The study employs Principal Component Analysis (PCA) to develop an INSQY index using six World Bank’s governance variables: control of corruption, rule of law, government effectiveness, political stability and absence of violence, regulatory quality, and voice and accountability (see Table A1). Prior to generating the index, we conduct pre-estimation tests, including the Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy and Bartlett’s test of sphericity (see Appendix Table A2). The tests are performed in STATA 17 using the command “factortest with the six variables”. The KMO statistic of 0.8980 exceeds the threshold value of 0.5, indicating the adequacy of the sample for PCA. The Bartlett test further confirms the interrelation among the variables, with a Chi-square (X2) value of 6294.047 and a highly significant p-value (p = 0.000).

Once the pre-tests confirm the validity of proceeding, we calculate the index using the “pca” command, followed by an orthogonal rotation to maximise the variance of squared loadings on each factor (rotate command). The index is then extracted using the “predict insq, score” command. Post-estimation checks, such as the scree plot (Fig. 1) and eigenvalue analysis (see Appendix Table A2), are conducted to ensure the robustness of the PCA results. The PCA results demonstrate robustness, as the extracted components cumulatively explain over 81% of the dataset’s variation, with at least one principal component having an eigenvalue greater than 1 (see Fig. 1).

As the literature suggests (Alvarado et al. 2019; Grossman and Krueger, 1995; Khan et al. 2019; Lorente and Álvarez-Herranz, 2016; Muhammad et al. 2021), we control for energy consumption sourced from the EIA, economic growth and population density from WDI. We include energy consumption since higher energy consumption could increase climate breakdown and air pollution, resulting in environmental degradation (Appiah et al. 2021; Jinapor et al. 2023; Sarkodie and Adams, 2018). We include the urban population because SSA’s urban areas are mostly associated with high pollution, which could possibly explain the increase in pollution (Brauer et al. 2012; Amegah and Agyei-Mensah, 2017). Economic growth has the potential to pollute the environment for developing countries; hence, we control for the log of GDP per capita (Muhammad et al. 2021; Alvarado et al. 2019; Khan et al. 2019; Grossman and Krueger, 1995). We transform the variables into natural logarithms to address issues of percentage change of coefficient estimates.

A discussion of descriptive statistics for the main variables of interest is presented in Table 1. CO2 emissions have an average value of −1.038, with maximum and minimum values of 2.458 and −4.116 respectively, suggesting that the SSA region, on average, is associated with low carbon emissions. On a country level, we observe from the raw data that South Africa (2%), Equatorial Guinea (2%), and Seychelles (1.9%) show high carbon emissions, whereas Congo (−3.6%) and Burundi (−3.4) are countries with the least carbon emissions (see Fig. 2). It can also be observed from Table 1 that FDI has a mean value of 3.996% and a minimum of 0.002%, which shows that SSA still has a very low inflow of FDI. The wide variation between the minimum (0.002%) and maximum values (16.322%) of FDI shows potential outliers. This is addressed by winsorising the variables at the appropriate percentiles (Ghosh and Vogt, 2012). At the country level, Seychelles (10.8%) is shown to be the greatest recipient of FDI on average from 2000–2019. The least recipient of FDI among the SSA sample is Comoros (0.547%), as shown in Fig. 3.

Table 1 also indicates a low level of industrialisation in SSA since industry averaged 3.288% of GDP with minimum and maximum values of −14.557% and 13.445%. The data for the SSA sample suggest that Ethiopia has been developing its industrial level since, on average, industry contributed 12% to GDP from 2000 to 2019. However, the Central African Republic (−24%) has the least industrialisation (see Fig. 4). Table 1 shows that the INSQY for the SSA sample is weak since the mean value (0.013) falls within the low institution range. On the country level, Mauritius (5.2%) is associated with improved institutions and governance, whilst Congo Republic (−3.66) has a weak institution and governance (see Fig. 5). Table 1 shows that energy consumption has a mean value of 31.391% with its maximum and minimum values of 36.284% and 27.56%, respectively, which attests to the assertion by Appiah et al. (2021) that SSA is gradually increasing energy consumption.

We also provide some discussion on the issue of multicollinearity using the pairwise correlation matrix and Variance Inflation Factor (VIF) which are presented in Table 2. We identified that apart from population density, all the variables have significant associations with environmental quality. Additionally, we found a low correlation between the independent variables, except for the correlation between energy consumption and economic growth, which has a moderate correlation with a coefficient of 0.628. As this situation could potentially result in multicollinearity, we conducted a test of multicollinearity using VIF, which is also presented in Table 2. VIF result illustrates that multicollinearity is not evident, as the VIF for each variable is below 5 and the average VIF is below 10.

Model specification

Following the discussion in Section “Theoretical and empirical literature review”, Eq. (1) first tests the direct impact of FDI, industrialisation and INSQY on environmental quality in SSA. Subsequently, we examine the interactive effect of INSQY with FDI and industrialisation on environmental quality in SSA using the panel model specified in Eq. (2). The empirical model specified in Eq. (2) is based on the PH, which states that strict environmental regulations in the home country encourage or compel firms to invest more in clean and efficient technologies.

From the above equations, \({\rm{EQ}}_{{it}}\) denotes environmental quality of the countries over time, which is proxied by CO2; \({\rm{FDI}}_{{it}}\) denotes net FDI inflows (% GDP); \({\rm{IDS}}_{{it}}\) denotes industrialisation, which is proxied using industry (including construction) as a percentage of GDP, and \({\rm{INSQY}}_{{it}}\) represent institutional quality for countries over time, measured using an index from the PCA output as discussed earlier; \({{\rm{EC}}}_{{it}}\) is the log of total energy consumption (BTU) for countries over time; and \({{\rm{PoP}}}_{{it}}\) is population density measured as the number of people per square kilometre of land area. \({\rm{GDP}}_{{it}}\) is economic growth countries over time, measured with the log of GDP per capita (constant US$, 2015) and to capture EKC, we used the squared of economic growth denoted with \({\rm{GDP}}_{{it}}^{2}\). While \({\beta }_{0}\) and \({\varphi }_{0}\) are constants or the intercepts, \({\beta }_{1-7}\) and \({\varphi }_{1-9}\) are the coefficients to be estimated. Unobserved variables are captured as \({\varepsilon }_{{it}}\) and \({e}_{{it}}\).

Estimation technique

The paper employed Driscoll and Kraay methodology (DKraay) to examine the nexus between FDI, industrialisation and institutional quality on environmental quality in SSA. Dkraay is a statistical approach used to estimate robust standard errors in panel data models, particularly when dealing with cross-sectional dependence,Footnote 3 heteroscedasticity,Footnote 4 and autocorrelationFootnote 5 (Iheonu, 2019; Sarkodie and Strezov, 2019; Shah et al. 2021). Owing to the drive for trade and industrialisation integration among SSA countries, the likelihood of cross-sectional dependence and other related characteristics emerges, which can be effectively addressed using the DKraay methodology. To begin, we conducted tests for cross-country dependence, heteroskedasticity, and autocorrelation, with the results presented in the appendices (see Tables A.3–A.5). These tests confirmed the presence of cross-country dependence, heteroskedasticity, and autocorrelation in our data, necessitating the use of DKraay. Additionally, since DKraay relies on fixed effects estimation, a Hausman test was performed to determine the suitability of the fixed effects model (Shah et al. 2021). The results, provided in the appendix (see Table A.6), confirmed that the fixed effects estimator was appropriate, supporting our decision to proceed with the DKraay estimation. Subsequently, we applied the DKraay methodology to estimate our model.

DKraay with a fixed-effects estimator technique is superior to baseline estimators such as ordinary least squares (OLS) because it overcomes the problem of cross-country dependence that characterises panel data sets and is robust to general forms of spatial and temporal dependence (Iheonu, 2019; Sarkodie and Strezov, 2019; Shah et al. 2021). Another plausible reason we adopt the DKraay methodology is its ability to accommodate missing values and its flexibility without imposing any restrictions or limiting the number of panels. Most SSA countries are associated with limited data (Jinapor et al. 2023; Iddrisu, 2024); hence, DKraay is used. Following the work of Sarkodie and Strezov (2019), we conducted a post-estimation test using the marginal effects technique.Footnote 6

Although DKraay effectively addresses heteroskedasticity, cross-sectional dependence, autocorrelation and accommodating missing values, it is less capable of managing endogeneity. Endogeneity often arises from factors such as reverse causality, specification errors, and omitted variables (Agbloyor et al. 2013; Osabohien et al. 2022; Iddrisu et al. 2024). This study may face challenges related to omitted variables and reverse causality between environmental quality, FDI, and industrialisation. It is, therefore, crucial to empirically test whether these issues could undermine the relevance of the DKraay results. To address this, we applied the 2SLS estimator, which effectively manages endogeneity. We used the more effective 2SLS, which is the “xtivreg2” with a feasible two-stage generalised method of moment (GMM2s) option.Footnote 7 The GMM2s option improves efficiency over the one-step estimator by incorporating an optimal weighting matrix and includes diagnostic tests like the Hansen test for instrument validity and Durbin-Wu-Hausman for endogeneity (Baum et al. 2016; Schaffer and Stillman, 2016; Schaffer, 2020; Iddrisu et al. 2024; Iddrisu, 2024).

Empirical results and discussion

The Driscoll-Kraay results for FDI, industrialisation, INSQY and environmental quality

We estimate the regression models using the DKraay estimated through fixed-effect regression, and the results are presented in Table 3. We started with the discussion of the direct effect of FDI and industrilisation on environmental quality. The results from Table 3 show that FDI inflows contribute to environmental degradation which hampers environmental quality. The reported coefficient (0.008) in column (1) of Table 3 is positive and statistically significant. This outcome aligns with the PHH, suggesting that FDI inflows have a negative impact on the environment, which reinforces previous research findings (see Opoku and Boachie, 2020; Sarkodie and Strezov, 2019; Zhang and Zhou, 2016). This result can be explained by the tendency of many SSA leaders to ease environmental laws and regulations in an effort to attract vital FDI. As a result, multinational companies often relocate their polluting operations to SSA, leading to detrimental effects on the environment (Jinapor et al. 2023).

We also find that industrialisation significantly increases CO2 emissions for the SSA sample, with a coefficient of 0.002 at the 5% significance level, as shown in column (2) of Table 3. The positive effect of industrialisation on CO2 emissions implies that industries’ total activities could be detrimental to environmental quality. The results provide evidence in support of the EKC, where an effort to attain greater economic growth and development through industrialisation may ultimately contribute to environmental degradation. Since diverse policies (e.g., NEPAD and AfCFTA) have been implemented to promote industrialisation, this could deteriorate the environment if unchecked. Our empirical results also corroborate a strand of empirical studies that concluded that industrialisation promotes environmental pollution (see e.g., Zafar et al. 2020; Yu and Liu, 2020; Ahmed et al. 2022; Shahbaz et al. 2014).

Second, we discussed the impact of INSQY on environmental quality. The direct effect of institutions on CO2 emissions reveals that INSQY can minimise CO2 emissions, given its significant negative coefficient of 0.037. This finding suggests that INSQY is an effective instrument for reducing carbon dioxide emissions, thereby enhancing environmental quality and economic development (Ibrahim and Law, 2016; Sarkodie and Adams, 2018). This finding indicates that robust institutions are more effective at enforcing environmental regulations and policies designed to lower carbon emissions. The effective implementation of these policies can lead to stricter emission standards for foreign investors, industries, cleaner energy production, and sustainable land use practices. Our findings support some empirical studies (see Abid, 2016; Salman et al. 2019; Zhang et al. 2022).

Third, we are interested in the differential effects of FDI and industrialisation on environmental quality. Hence, we include both FDI and industrialisation in one model, and the results are presented in column (4) of Table 3. The results revealed that FDI (coefficient of 0.007) contributes more to CO2 emissions than industrialisation (coefficient of 0.002). Our empirical results indicate that industrialisation negatively impacts environmental quality, but to a lesser extent than FDI, likely due to the relatively low levels of industrialisation in SSA. For instance, industrial contribution to GDP decreased from 37.96% in 1980 to 26.5% in 2015, whereas the share of manufacturing to GDP on the continent decreased from 18% in 1975 to 11% in 2014 (World Bank, 2020). The low level of industrial activities is also evident in our SSA sample, where some countries, such as Angola (−0.62%), the Central African Republic (−24%), Equatorial Guinea (−3.5%), Gabon (−1.8%), Gambia (−0.08%), Guinea (−4.9%) and Zimbabwe (−1.2%), recorded negative industry value added to their economies (see Fig. 4).

Fourth, we examine the existence of the EKC in Africa, as the continent’s leaders strive for greater economic growth. The results of Table 3 reveal the presence of the EKC in our results since GDP induces CO2 emissions, and the squared term of GDP reduces CO2 emissions. This suggests that in the initial stages of economic development for the SSA sample, growth is achieved with little attention paid to environmental quality. For instance, as economic growth progresses, it often leads to structural changes in the economy, typically accompanied by higher energy consumption (Xu and Lin, 2015). However, in the later stages of economic development, when incomes rise, governments, businesses, and households may invest more in efforts to combat environmental pollution (Dinda, 2004; Song et al. 2013; Lorente and Álvarez-Herranz, 2016).

Fifth, we examine the joint effect of both FDI and institutions and of industrialisation and institutions on environmental performance. Table 3 shows that the unconditional effects of both FDI and industrialisation and their unconditional effects (interaction terms) on environmental quality are statistically significant (see columns 5 and 6). Since FDI has a positive coefficient of 0.007, and its conditional effect has a negative coefficient of 0.03 (see column (5) of Table 3), it implies that while FDI increases CO2 emissions, INSQY dampens the negative impact of FDI on the environment. In the same vein, industrialisation (0.002) increases CO2 emissions, whereas INSQY dampens the negative effects of industrialisation on the environment, as the interaction coefficient of 0.002 is negative (see column (6) of Table 3). This result is consistent with the findings of Cheah et al. (2022) and Huynh and Hoang (2019). and confirms the intuition raised by the PH that quality institutions in host countries restrict FDIs and industries from investing in cleaner and more efficient technologies.

Sixth, we examine the effect of the control variables on environmental quality. Table 3 shows that all control variables have a statistically significant negative effect on environmental quality (see Table 3). For instance, we find that the urban population enhances CO2 emissions. This is possible because as the population increases, the rate of infrastructural development increases, with its considerable energy demand arising from the high demand for transportation and machinery needed for energy, high demand for goods and services, and high deforestation (Birdsall, 1992; Shahbaz et al. 2014). We also identified energy consumption as a factor contributing to poor environmental quality. While energy consumption in Africa remains relatively low, there has been a recent uptick in electricity use. This empirical result confirms with some existing studies (Khan et al. 2019; Sarkodie and Strezov, 2019; Zaman and Moemen, 2017). According to these studies, the high emissions rate was due to an increase in the share of fossil fuel consumption for economic activities. This could be because most SSA counties depend on fossil fuel energy consumption (especially coal) to drive their economic activities.

Last, the post-estimation test for the DKraay is discussed and presented in Table 4. Using the marginal effect approach, it is necessary for the coefficients of the marginal effect to align with the coefficients of the DKraay (see Sarkodie and Strezov, 2019). From Table 4, our results are robust since the marginal effect reveals similar results with the DKraay.

Robustness checks

The paper proceeds to conduct some robustness checks using a different estimation technique, the 2SLS, and the results are presented in Table 5. We employed the 2SLS approach to address the limitations of the DKraay, specifically its challenges in handling endogeneity. Our objective was to assess whether these limitations could affect the robustness of the DKraay results. The findings in Table 5 indicate that endogeneity did not affect the robustness of the DKraay results, as the 2SLS method produced outcomes consistent with those of the DKraay. For instance, the DKraay results (see Table 3) indicate that both FDI and industrialisation hamper environmental quality. Similarly, the 2SLS estimation (see Table 5) confirms this finding. Furthermore, both methods demonstrate that when INSQY is accounted for, FDI and industrialisation enhance environmental quality.

Conclusion and policy implications

We empirically investigate whether INSQY can moderate the otherwise harmful effect of FDI and industrialisation on environmental quality. We employ macro data from 2000 to 2019 for 45 SSA countries using the DKraay estimation technique. Consistent with the literature, the results confirm the EKC hypothesis since economic growth reduces environmental quality at the initial level until a threshold is reached, beyond which economic growth enhances environmental quality. The results also show that both FDI and industrialisation dampen environmental quality. This finding suggests that increased FDI inflows and industrialisation have a harmful effect on the environmental quality of SSA. The result also reveals that quality institutions can promote environmental quality of SSA. Notably, the results reveal that INSQY can mitigate the negative impact of FDI and industrialisation on the environment, underscoring the importance of building institutional capacity in SSA.

We provide some useful, practical policy implications based on the findings of the study. First, SSA governments and policymakers must strengthen their regulatory frameworks by developing and enforcing stringent environmental regulations. These includes enacting well-defined and unambiguous laws and guidelines for companies operating in SSA. There is also the need to put in place the requisite and effective implementation framework to ensure a robust monitoring, enforcement and compliance mechanism for all stakeholders towards achieving sustainable development. Developing and promoting a transparent and accountable decision-making process while ensuring strict adherence to environmental regulations related to FDI and industrial projects is necessary to promote environmental quality. With the rapid advancement of information and communication technology (ICT), SSA can leverage these tools to efficiently disseminate and monitor information. SSA leaders must promote cooperation and coordination to ensure synergy in formulating environmental regulations, such as the Arusha Declaration on eliminating promulgated (POPs) by African nations. SSA countries can also leverage support from reputable international organisations and governments to help build the capacity of regulatory institutions to formulate, implement, and enforce environmental standards effectively. SSA governments are encouraged to adopt incentives and policy proposals, such as tax holidays, public-private partnerships and tax breaks, to encourage FDI inflows and investments in clean technologies (halo). Finally, environmental, institutional, and governance goals must be clearly established and measurable against internationally acceptable standards such as the SDGs.

Limitations

This study undoubtedly contains some limitations. First, since data availability is the primary determining factor of sample selection, some SSA countries were inevitably excluded from the analysis. The sample size can, therefore, be increased as data becomes available in the future. Second. This study focused on a single institutional component index; future studies could explore the effect of the individual unique components of INSQY. Further research can extend this study by examining sectoral FDIs and their relationship with the environment. The empirical analysis of this study should motivate similar research for other developed and developing countries.

Data availability

The datasets generated during and/or analysed during the current study are available from the corresponding author upon reasonable request.

Notes

Angola, Benin; Botswana, Burkina Faso, Burundi, Cabo Verde, Cameroon, Central African Republic, Chad, Comoros, D.R. Congo, Congo, Cote d’Ivoire, Equatorial Guinea, Eswatini, Ethiopia, Gabon, Gambia The, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Mozambique, Namibia; Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, South Africa, Sudan, Tanzania, Togo, Uganda, Zambia and Zimbabwe.

Cross-sectional dependence is where observations in different cross-sectional units (e.g., countries, firms, etc.) are not independent of each other, which is a common feature in panel data.

Autocorrelation is errors in one time period may be correlated with errors in subsequent periods within the same cross-sectional unit.

The methodology provides robust standard errors even when the variance of errors is not constant across observations.

Table 4 shows that our results seem robust since the marginal effect reveals similar results to that of the DKraay coefficients.

See more information on 2SLS with GMM option: http://www.repec.org/bocode/i/ivreg2.html#:~:text=Citation%20of%20ivreg2-,Description,%2C%20and%20k%2Dclass%20estimators.

References

Abdouli M, Hammami S (2017a) The īmpact of FDI inflows and environmental quality on economic growth: an empirical study for the MENA countries. J Knowl Econ 8:254–278. https://doi.org/10.1007/s13132-015-0323-y

Abdouli M, Hammami S (2017b) Exploring links between FDI inflows, energy consumption, and economic growth: further evidence from MENA countries. J Econ Dev 42:95–117. https://doi.org/10.35866/caujed.2017.42.1.005

Abid M (2016) Impact of economic, financial, and institutional factors on CO2 emissions: evidence from sub-Saharan Africa economies. Util Policy 41:85–94. https://doi.org/10.1016/j.jup.2016.06.009

Abreha KG, Kassa W, Lartey EKK, et al. (2021) Industrialisation in Sub-Saharan Africa: Seizing Opportunities in Global Value Chains. The World Bank

Acheampong AO, Adams S, Boateng E (2019) Do globalisation and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Sci Total Environ 677:436–446. https://doi.org/10.1016/j.scitotenv.2019.04.353

AfDB (2017) African Economic Outlook 2017 Entrepreneurship and Industrialisation: Entrepreneurship and Industrialisation. OECD Publishing. https://doi.org/10.1787/aeo-2017-en

Agbloyor EK, Abor J, Adjasi CKD, Yawson A (2013) Exploring the causality links between financial markets and foreign direct investment in Africa. Res Int Bus Financ 28:118–134. https://doi.org/10.1016/j.ribaf.2012.11.001

Ahmad N, Du L, Lu J et al. (2017) Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123:164–172. https://doi.org/10.1016/j.energy.2016.12.106

Ahmed F, Ali I, Kousar S, Ahmed S (2022) The environmental impact of industrialisation and foreign direct investment: empirical evidence from Asia-Pacific region. Environ Sci Pollut Res 29:29778–29792. https://doi.org/10.1007/s11356-021-17560-w

Akbostancı E, Tunç Gİ, Türüt-Aşık S (2011) CO2 emissions of Turkish manufacturing industry: A decomposition analysis. Appl Energy 88:2273–2278. https://doi.org/10.1016/j.apenergy.2010.12.076

Al-mulali U, Foon Tang C (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819. https://doi.org/10.1016/j.enpol.2013.05.055

Albulescu CT, Tiwari AK, Yoon SM, Kang SH (2019) FDI, income, and environmental pollution in Latin America: Replication and extension using panel quantiles regression analysis. Energy Econ 84:104504. https://doi.org/10.1016/j.eneco.2019.104504

Ali S, Yusop Z, Kaliappan SR, Chin L (2020) Dynamic common correlated effects of trade openness, FDI, and institutional performance on environmental quality: evidence from OIC countries. 11671–11682. https://doi.org/10.1007/s11356-020-07768-7

Alvarado D, Moreira A, Moreno R, Strbac G (2019) Transmission network investment with distributed energy resources and distributionally robust security. IEEE Trans Power Syst 34:5157–5168. https://doi.org/10.1109/TPWRS.2018.2867226

Ameer W, Amin A, Xu H (2022) Does institutional quality, natural resources, globalization, and renewable energy contribute to environmental pollution in China? Role of financialisation. Front Public Heal 10:1–10. https://doi.org/10.3389/fpubh.2022.849946

Amegah AK, Agyei-Mensah S (2017) Urban air pollution in Sub-Saharan Africa: time for action. Environ Pollut 220:738–743. https://doi.org/10.1016/j.envpol.2016.09.042

Amin A, Ameer W, Yousaf H, Akbar M (2022) Financial development, institutional quality, and the influence of various environmental factors on carbon dioxide emissions: exploring the nexus in China. Front Environ Sci 9:1–10. https://doi.org/10.3389/fenvs.2021.838714

Amin A, Dogan E (2021) The role of economic policy uncertainty in the energy-environment nexus for China: evidence from the novel dynamic simulations method. J Environ Manage 292:112865. https://doi.org/10.1016/j.jenvman.2021.112865

Amin A, Dogan E, Khan Z (2020) The impacts of different proxies for financialisation on carbon emissions in top-ten emitter countries. Sci Total Environ 740:140127. https://doi.org/10.1016/j.scitotenv.2020.140127

Apergis N, Christou C, Gupta R (2017) Are there environmental kuznets curves for US state-level CO2 emissions? Renew Sustain Energy Rev 69:551–558

Appiah M, Li F, Korankye B (2021) Modeling the linkages among CO2 emission, energy consumption, and industrialisation in sub-Saharan African (SSA) countries. Environ Sci Pollut Res 28:38506–38521. https://doi.org/10.1007/s11356-021-12412-z

Ashraf A, Doytch N, Uctum M (2021) Foreign direct investment and the environment: disentangling the impact of greenfield investment and merger and acquisition sales. Sustain Account Manag Policy J 12:51–73. https://doi.org/10.1108/SAMPJ-04-2019-0184

Atwoli L, Erhabor GE, Gbakima AA et al. (2022) COP27 Climate Change Conference: urgent action needed for Africa and the world. Lancet Oncol 23:1486–1488. https://doi.org/10.1016/S1470-2045(22)00645-3

Azam M, Liu L, Ahmad N (2021) Impact of institutional quality on environment and energy consumption: evidence from developing world. Environ Dev Sustain 23:1646–1667. https://doi.org/10.1007/s10668-020-00644-x

Barrett S, Graddy K (2000) Freedom, growth, and the environment. Environ Dev Econ 5:433–456. https://doi.org/10.1017/S1355770X00000267

Baskurt BB, Celik S, Rafay A, Oke T (2022) FDI and environmental degradation: evidence from a developed country. Handb Res Energy Environ Financ 4:446–471. https://doi.org/10.4018/978-1-7998-8210-7.ch018

Baum CF, Schaffer ME, Stillman S (2016) IVREG2: Stata module for extended instrumental variables/2SLS and GMM estimation. Stat Softw. Components

Ben Amar A (2021) Economic growth and environment in the United Kingdom: robust evidence using more than 250 years data. Environ Econ Policy Stud 23:667–681. https://doi.org/10.1007/s10018-020-00300-8

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sustain Energy Rev 47:173–185. https://doi.org/10.1016/j.rser.2015.02.049

Birdsall N (1992) Another look at population and global warming. Policy Research Working Paper Series 1020. The World Bank

Bommer R (1999) Environmental Policy and Industrial Competitiveness: The Pollution-Haven Hypothesis Reconsidered. Rev Int Econ 7:342–355. https://doi.org/10.1111/1467-9396.00168

Brauer M, Amann M, Burnett RT et al. (2012) Exposure assessment for estimation of the global burden of disease attributable to outdoor air pollution. Environ Sci Technol 46:652–660. https://doi.org/10.1021/es2025752

Cheah CF, Abdul-Rahim AS, Saari MY, Naseem NAM (2022) Economic Openness, Institution, and Environmental Degradation in a Small Open Dynamic Economy: Recent Evidence from Malaysia. J Knowl Econ. https://doi.org/10.1007/s13132-022-00974-3

De Gregorio J (2005) The role of foreign direct investment and natural resources in economic development. In Multinationals and Foreign Investment in Economic Development. 179–197

Demena BA, Afesorgbor SK (2020) The effect of FDI on environmental emissions: evidence from a meta-analysis. Energy Policy 138:111192. https://doi.org/10.1016/j.enpol.2019.111192

Dinda S (2004) Environmental Kuznets Curve hypothesis: a survey. Ecol Econ 49:431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439. https://doi.org/10.1016/j.renene.2016.03.078

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80:549–560. https://doi.org/10.1162/003465398557825

Duodu E, Baidoo ST (2022) The impact of capital inflows on economic growth of Ghana: does quality of institutions matter? J Public Aff 22. https://doi.org/10.1002/pa.2384

Duodu E, Kwarteng E, Oteng-Abayie EF, Frimpong PB (2021) Foreign direct investments and environmental quality in sub-Saharan Africa: the merits of policy and institutions for environmental sustainability. Environ Sci Pollut Res 28:66101–66120. https://doi.org/10.1007/s11356-021-15288-1

Dutt K (2009) Governance, institutions and the environment-income relationship: a cross-country study. Environ Dev Sustain 11:705–723. https://doi.org/10.1007/s10668-007-9138-8

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23. https://doi.org/10.1016/S0304-3878(02)00084-6

Fosten J, Morley B, Taylor T (2012) Dynamic misspecification in the environmental Kuznets curve: evidence from CO 2 and SO 2 emissions in the United Kingdom. Ecol Econ 76:25–33. https://doi.org/10.1016/j.ecolecon.2012.01.023

Gharni S, Bouzahzah M, Soussane JA (2020) Foreign direct investment and pollution havens: evidence from African countries. Arch Bus Res 7:244–252. https://doi.org/10.14738/abr.712.7531

Ghosh D, Vogt A (2012) Outliers: an evaluation of methodologies. In Joint Statistical Meetings. San Diego

Golpîra H, Sadeghi H, Magazzino C (2023) Examining the energy-environmental kuznets curve in OECD countries considering their population. Environ Sci Pollut Res 30:94515–94536. https://doi.org/10.1007/s11356-023-28923-w

Gorus MS, Aslan M (2019) Impacts of economic indicators on environmental degradation: evidence from MENA countries. Renew Sustain Energy Rev 103:259–268. https://doi.org/10.1016/j.rser.2018.12.042

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. National Bureau of Economic Research, Inc

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110:353–377. https://doi.org/10.2307/2118443

Gui-Diby SL, Renard MF (2015) Foreign Direct Investment Inflows and the Industrialization of African Countries. World Dev 74:43–57. https://doi.org/10.1016/j.worlddev.2015.04.005

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37:1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Herrera-Echeverri H, Haar J, Estévez-Bretón JB (2014) Foreign direct investment, institutional quality, economic freedom and entrepreneurship in emerging markets. J Bus Res 67:1921–1932. https://doi.org/10.1016/j.jbusres.2013.11.020

Hoechle D (2007) Robust standard errors for panel regressions with cross-sectional dependence. Stata J 7:281–312. https://doi.org/10.1177/1536867x0700700301

Hussain M, Dogan E (2021) The role of institutional quality and environment-related technologies in environmental degradation for BRICS. J Clean Prod 304:127059. https://doi.org/10.1016/j.jclepro.2021.127059

Huynh CM, Hoang HH (2019) Foreign direct investment and air pollution in Asian countries: does institutional quality matter? Appl Econ Lett 26:1388–1392. https://doi.org/10.1080/13504851.2018.1563668

Ibrahim MH, Law SH (2016) Institutional quality and CO2 emission-trade relations: evidence from Sub-Saharan Africa. South African J Econ 84:323–340. https://doi.org/10.1111/saje.12095

Iddrisu K (2024) Foreign bank presence and income inequality in Africa: what role does economic freedom play? Futur Bus J 10:60. https://doi.org/10.1186/s43093-024-00357-x

Iddrisu K, Abor JY, Banyen KT (2024) Financial development, globalisation and foreign direct investment nexus: an empirical study from Africa. SN Bus Econ 4:69. https://doi.org/10.1007/s43546-024-00667-w

Iddrisu K, Ofoeda I, Abor JY (2023) Inward foreign direct investment and inclusiveness of growth: will renewable energy consumption make a difference? Int Econ Econ Policy 20:367–388. https://doi.org/10.1007/s10368-023-00562-z

Iheonu CO (2019) Governance and domestic investment in Africa. Eur J Gov Econ 8:63–80. https://doi.org/10.17979/ejge.2019.8.1.4565

Jahanger A, Usman M, Balsalobre‐Lorente D (2022) Autocracy, democracy, globalisation, and environmental pollution in developing world: fresh evidence from STIRPAT model. J Public Aff 22:. https://doi.org/10.1002/pa.2753

Jian Z, Rahman NFA, Ong J (2023) Assessing the impacts of climate change on water resources carrying capacity using venism. J Law Sustain Dev 11:e1426. https://doi.org/10.55908/sdgs.v11i8.1426

Jinapor JA, Suleman S, Cromwell RS (2023) Energy consumption and environmental quality in Africa: does energy efficiency make any difference? Sustainability 15:2375. https://doi.org/10.3390/su15032375

Kaldor N (1975) What iS Wrong with Economic Theory. Q J Econ 89:347. https://doi.org/10.2307/1885256

Kang H, Martinez‐Vazquez J (2022) When does foreign direct investment lead to inclusive growth? World Econ 45:2394–2427. https://doi.org/10.1111/twec.13236

Kerekes CB (2011) Property rights and environmental quality: a cross-country study. Cato J 31:315–338

Khan MK, Teng JZ, Khan MI, Khan MO (2019) Impact of globalisation, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436. https://doi.org/10.1016/j.scitotenv.2019.06.065

Kisswani KM, Zaitouni M (2023) Does FDI affect environmental degradation? Examining pollution haven and pollution halo hypotheses using ARDL modelling. J Asia Pacific Econ 28:1406–1432. https://doi.org/10.1080/13547860.2021.1949086

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: DO foreign direct investment and trade matter? Energy Policy 68:490–497. https://doi.org/10.1016/j.enpol.2014.01.002

Lee JW, Brahmasrene T (2013) Investigating the influence of tourism on economic growth and carbon emissions: Evidence from panel analysis of the European Union. Tour Manag 38:69–76. https://doi.org/10.1016/j.tourman.2013.02.016

Leggett JA (2020) The United Nations framework convention on climate change, the Kyoto protocol, and the Paris agreement: A summary. In: Climate Change: Legislative Issues and Economic Costs. Nova Science Publishers, Inc., pp 221–240

Lorente DB, Álvarez-Herranz A (2016) Economic growth and energy regulation in the environmental Kuznets curve. Environ Sci Pollut Res 23:16478–16494. https://doi.org/10.1007/s11356-016-6773-3

Magazzino C (2024) Ecological footprint, electricity consumption, and economic growth in China: geopolitical risk and natural resources governance. Empir Econ 66:1–25. https://doi.org/10.1007/s00181-023-02460-4

Magazzino C, Gallegati M, Giri F (2023) The Environmental Kuznets Curve in a long-term perspective: parametric vs semi-parametric models. Environ Impact Assess Rev 98:106973. https://doi.org/10.1016/j.eiar.2022.106973

Mahembe E, Odhiambo NM (2014) Foreign direct investment and economic growth: a theoretical framework. J Gov Regul 3:63–70. https://doi.org/10.22495/jgr_v3_i2_p6

Mahmood H, Alkhateeb TTY, Furqan M (2020) Industrialisation, urbanisation and CO2 emissions in Saudi Arabia: asymmetry analysis. Energy Reports 6:1553–1560. https://doi.org/10.1016/j.egyr.2020.06.004

Makki SS, Somwaru A (2004) Impact of foreign direct investment and trade on economic growth: evidence from developing countries. Am J Agric Econ 86:795–801. https://doi.org/10.1111/j.0002-9092.2004.00627.x

Mentel U, Wolanin E, Eshov M, Salahodjaev R (2022) Industrialisation and CO2 emissions in Sub‐Saharan Africa: the mitigating role of renewable electricity. Energies 15:1–12. https://doi.org/10.3390/en15030946

Mert M, Bölük G (2016) Do foreign direct investment and renewable energy consumption affect the CO2 emissions? New evidence from a panel ARDL approach to Kyoto Annex countries. Environ Sci Pollut Res 23:21669–21681. https://doi.org/10.1007/s11356-016-7413-7

Moreno B, Lo’pez AJ (2008) The effect of renewable energy on employment. The case of Asturias (Spain) $. Renew Sustain Energy Rev 12:732–751. https://doi.org/10.1016/j.rser.2006.10.011

Muhammad B, Khan MK, Khan MI, Khan S (2021) Impact of foreign direct investment, natural resources, renewable energy consumption, and economic growth on environmental degradation: evidence from BRICS, developing, developed and global countries. Environ Sci Pollut Res 28:21789–21798. https://doi.org/10.1007/s11356-020-12084-1

Munir K, Ameer A (2020) Nonlinear effect of FDI, economic growth, and industrialisation on environmental quality. Manag Environ Qual An Int J 31:223–234. https://doi.org/10.1108/MEQ-10-2018-0186

Necmi S (1999) Kaldor’s growth analysis revisited. Appl Econ 31:653–660. https://doi.org/10.1080/000368499324093

Neequaye NA, Oladi R (2015) Environment, growth, and FDI revisited. Int Rev Econ Financ 39:47–56. https://doi.org/10.1016/j.iref.2015.06.002

Neumayer E (2002) Do democracies exhibit stronger international environmental commitment? A cross-country analysis. J Peace Res 39:139–164. https://doi.org/10.1177/0022343302039002001

Nguyen KH, Kakinaka M (2019) Renewable energy consumption, carbon emissions, and development stages: Some evidence from panel cointegration analysis. Renew Energy 132:1049–1057. https://doi.org/10.1016/j.renene.2018.08.069

Oduola M, Bello MO, Popoola R (2022) Foreign Direct Investment, Institution and Industrialisation in Sub-Saharan Africa. Econ Chang Restruct 55:577–606. https://doi.org/10.1007/s10644-021-09322-y

Ofori IK, Armah MK, Asmah EE (2022) Towards the reversal of poverty and income inequality setbacks due to COVID-19: the role of globalisation and resource allocation. Int Rev Appl Econ 1:1–33

Ofori IK, Asongu S (2021a) Foreign Direct Investment, Governance and Inclusive Growth in Sub-Saharan Africa

Ofori IK, Asongu SA (2021b) ICT Diffusion, foreign direct investment and inclusive growth in sub-Saharan Africa. Telemat Informatics 65:101718. https://doi.org/10.1016/j.tele.2021.101718

Opoku EEO, Boachie MK (2020) The environmental impact of industrialisation and foreign direct investment. Energy Policy 137:111178. https://doi.org/10.1016/j.enpol.2019.111178

Opoku EEO, Ibrahim M, Sare YA (2019) Foreign direct investment, sectoral effects and economic growth in Africa. Int Econ J 33:473–492. https://doi.org/10.1080/10168737.2019.1613440

Osabohien R, Iqbal BA, Osabuohien ES et al. (2022) Agricultural trade, foreign direct investment and inclusive growth in developing countries: evidence from West Africa. Transnatl Corp Rev 14:244–255. https://doi.org/10.1080/19186444.2021.1936986

Özokcu S, Özdemir Ö (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sustain Energy Rev 72:639–647. https://doi.org/10.1016/j.rser.2017.01.059

Pata UK, Kartal MT, Mukhtarov S, Magazzino C (2024) Do energy and geopolitical risks influence environmental quality? A quantile-based load capacity factor assessment for fragile countries. Energy Strateg Rev 53:101430. https://doi.org/10.1016/j.esr.2024.101430

Porter ME (1991) America’s green strategy. Sci Am 264:

Porter ME, Van Der L (1995) Green and competitive: ending the stalemate. Long Range Plann 28:128–129. https://doi.org/10.1016/0024-6301(95)99997-E

Ren S, Yuan B, Ma X, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: a case study of Chinas industrial sectors. China Econ Rev 28:123–134. https://doi.org/10.1016/j.chieco.2014.01.003

Sabir S, Qayyum U, Majeed T (2020) FDI and environmental degradation: the role of political institutions in South Asian countries. Environ Sci Pollut Res 27:32544–32553. https://doi.org/10.1007/s11356-020-09464-y

Safiullah M, Alam MS, Islam MS (2022) Do all institutional investors care about corporate carbon emissions? Energy Econ 115:106376. https://doi.org/10.1016/j.eneco.2022.106376

Saidi S, Hammami S (2017) Modeling the causal linkages between transport, economic growth and environmental degradation for 75 countries. Transp Res Part D Transp Environ 53:415–427. https://doi.org/10.1016/j.trd.2017.04.031

Salman M, Long X, Dauda L, Mensah CN (2019) The impact of institutional quality on economic growth and carbon emissions: evidence from Indonesia, South Korea and Thailand. J Clean Prod 241:118331. https://doi.org/10.1016/j.jclepro.2019.118331

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Econ 64:206–212. https://doi.org/10.1016/j.eneco.2017.04.001

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601. https://doi.org/10.1016/j.scitotenv.2018.06.320

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Schaffer M (2020) xtivreg2: Stata module to perform extended IV/2SLS, GMM and AC/HAC, LIML and k-class regression for panel data models

Schaffer M, Stillman S (2016) XTOVERID: stata module to calculate tests of overidentifying restrictions after xtreg, xtivreg, xtivreg2, xthtaylor

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sustain Energy Rev 52:347–356. https://doi.org/10.1016/j.rser.2015.07.118

Sephton P, Mann J (2016) Compelling evidence of an environmental Kuznets curve in the United Kingdom. Environ Resour Econ 64:301–315. https://doi.org/10.1007/s10640-014-9871-z

Shah AA, Hussain MS, Nawaz MA, Iqbal M (2021) Nexus of renewable energy consumption, economic growth, population growth, FDI, and environmental degradation in South Asian Countries: new evidence from Driscoll-Kraay standard error approach. iRASD J Econ 3:200–211. https://doi.org/10.52131/joe.2021.0302.0037

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and North African countries: Importance of biomass energy consumption. J Clean Prod 217:603–614. https://doi.org/10.1016/j.jclepro.2019.01.282

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Shahbaz M, Salah Uddin G, Ur Rehman I, Imran K (2014) Industrialisation, electricity consumption and CO2 emissions in Bangladesh. Renew Sustain Energy Rev 31:575–586. https://doi.org/10.1016/j.rser.2013.12.028

Song Q, Wang Z, Li J (2013) Environmental performance of municipal solid waste strategies based on LCA method: a case study of Macau. J Clean Prod 57:92–100. https://doi.org/10.1016/j.jclepro.2013.04.042

Sung B, Song W, Park S (2018) How foreign direct investment a ff ects CO 2 emission levels in the Chinese manufacturing industry: evidence from panel data. Econ Syst 42:320–331. https://doi.org/10.1016/j.ecosys.2017.06.002

Udemba EN (2019) Triangular nexus between foreign direct investment, international tourism, and energy consumption in the Chinese economy: accounting for environmental quality. Environ Sci Pollut Res 26:24819–24830. https://doi.org/10.1007/s11356-019-05542-y

Udemba EN (2021) Mitigating environmental degradation with institutional quality and foreign direct investment (FDI): new evidence from asymmetric approach. Environ Sci Pollut Res 28:43669–43683. https://doi.org/10.1007/s11356-021-13805-w

Ullah S, Ozturk I, Usman A et al. (2020) On the asymmetric effects of premature deindustrialisation on CO2 emissions: evidence from Pakistan. Environ Sci Pollut Res 27:13692–13702. https://doi.org/10.1007/s11356-020-07931-0

UNCTAD (2021) World Investment Report 2021. Investment in sustainable recovery

UNCTAD, UN (2022) World Investment Report 2022. World Invest Report; Int tax reforms Sustain Invest 48

Walter I, Ugelow JL (1979) Environmental Policies in Developing Countries

Wang S, Wang H, Sun Q (2020) The impact of foreign direct investment on environmental pollution in China: corruption matters. Int J Environ Res Public Health 17:6477. https://doi.org/10.3390/ijerph17186477

World Bank (2020) Sub-Saharan Africa Carbon (CO2) Emissions 1990-2023. In: www.macrotrends.net. https://www.macrotrends.net/countries/SSF/sub-saharan-africa-/carbon-co2-emissions. Accessed 10 Jan 2023