Abstract

With an increasing number of customers relying on Islamic internet banking services, there is an urgent need to examine their satisfaction levels. Therefore, this study aims to analyze how internet banking services quality impacts customer satisfaction in major Islamic countries during the COVID-19 pandemic. A survey was conducted from March 2022 to April 2023 to gather data from clients, covering a variety of income levels, gender, age and educational backgrounds. 6961 questionnaires were analyzed using the SERVQUAL model and probit ordered model for empirical analysis. Both the SERVQUAL model and probit ordered model analysis yielded consistent findings indicating that reliability, response, online service quality, complaint aspects negatively influence customer satisfaction. Furthermore, the study found that factors such as efficiency and empathy contribute positively to customer satisfaction in the context of internet banking services during the COVID-19 pandemic. By understanding the factors that negatively impact customer satisfaction and usage of internet banking services, Islamic bank management can prioritize investments in security, website attributes, privacy, efficiency, responsiveness, fulfillment, and reliability. This proactive approach not only fosters customer loyalty but also strengthens the competitive position of the bank in the digital banking landscape. Furthermore, insights gained from the study can guide policy adjustments and operational improvements tailored to meet the evolving needs and expectations of customers in the internet banking sector.

Similar content being viewed by others

Introduction

The COVID-19 pandemic has profoundly affected various sectors worldwide, including the Islamic banking sector, which is a significant part of the financial markets in many countries, particularly in Islamic countries. With the implementation of lockdown measures and social distancing guidelines, customer behavior has shifted markedly towards internet banking services. This shift has led to a sharp increase in internet banking usage as customers sought safer alternatives to physical branch visits. Furthermore, the convenience and accessibility of online banking services have become paramount in ensuring customer satisfaction. The ability to conduct financial transactions and access account information conveniently and securely has become more critical than ever. The COVID-19 pandemic has expedited the digital transformation endeavors of banks in different countries, prompting financial institutions to swiftly enhance their digital platforms to meet the surging demand for online banking services. Assessing the impact of these digital transformations on customer satisfaction will offer insights into the effectiveness of banks’ efforts to address the evolving needs and expectations of customers, particularly during times of crisis. The factors that have influenced customer satisfaction include reliability, service quality, trust and security, customer support and communication, and the overall user experience of internet Islamic banking platforms.

The relevance of studying customer satisfaction and internet banking services in the post-pandemic era can be explained using different theoretical frameworks. The “Technology Acceptance Model”, suggested by Davis (1989), indicates the importance of perceived ease of use and perceived usefulness are significant determinants of user acceptance of technology. The circumstances of the COVID-19 pandemic pushed many consumers to use online banking services out of necessity, leading to a potential permanent change in consumer behavior as users became more comfortable, adept, and familiar with digital platforms. Another theoretical perspective is called the “Expectation-Confirmation Theory”, proposed by (Oliver, 1980) which suggests that customer satisfaction is significantly affected by the alignment of actual experiences with pre-adoption expectations. The COVID-19 pandemic provided a unique context where customers had lofty expectations for the efficiency, customer convenience, responsiveness and safety of online banking. Evaluating whether these expectations were met provides valuable insights into customer satisfaction that can inform future banking service improvements and innovations.

Empirical data underscores the lasting relevance of this study. According to a report by Deloitte (2021), there was a substantial surge in the use of online banking services during the COVID-19 pandemic, with many financial institutions noting a 30–40 per cent uptick in digital services and transactions. The changes in consumer behavior are expected to persist, as many customers have now integrated online banking into their daily routines. Further supporting this notion, a survey by the Federal Reserve (2022) observed that customer satisfaction with online banking services has a lasting impact on their loyalty and continued use of the banking services.

The strategic responses of banks during the COVID-19 pandemic also highlight the enduring impact of these changes. Financial institutions invested heavily in enhancing their digital infrastructure, improving user interfaces, and strengthening cybersecurity measures to accommodate the increased demand for transaction banking services. These developments have contributed to a more robust and secure digital banking environment, ensuring better service delivery and customer satisfaction (Accenture, 2021). Additionally, the World Bank reported in 2021 that the COID-19 pandemic showed the importance of financial inclusion. Online banking services enabled many underserved populations to access financial banking services remotely, thereby decreasing barriers to financial inclusion. Indeed, this shift has long-term implications for the financial industry, as it broadens the customer base and promotes more fair access to financial banking services.

This study finds that the trends seen during the COVID-19 pandemic about online Islamic banking services and customer satisfaction are not only relevant for the pandemic period but also offer valuable insights for the future. The theoretical frameworks of expectation-confirmation and technology acceptance, along with empirical evidence and strategic industry responses, suggest that the changes brought about by the COVID-19 pandemic are likely to endure. Hence, the empirical results of this study remain significant and worth publishing, providing guidance for improving customer satisfaction and service delivery in online Islamic banking.

Ordered probit regression, a commonly employed statistical technique in management and business research, will be used in this study. Ordered probit regression is a statistical technique used to analyze data from surveys and questionnaires with limited answers. Some studies that have used ordered probit regression include research conducted by Pandit et al. (2008), Hasegawa et al. (2010), Fiorillo and Nappo (2011), Zhang et al. (2012), Wang et al. (2015), Fetai et al. (2015), and Díaz and Duque (2021). However, there is a limited number of studies that have used ordered probit regression to analyze data collected during crisis periods, with a specific focus on measuring customer satisfaction. Ordered probit regression, nevertheless, is still a potent tool for understanding the factors that impact customer satisfaction. It presents a promising alternative for exploring and understanding the impact of a range of factors on consumer acceptance. In this study, the application of ordered probit regression enables a clear presentation of results and simplifies interpretation, in comparison to other methods commonly employed for analyzing this type of data.

This study bridges a substantial gap in the literature by offering a nuanced understanding of how the COVID-19 pandemic has influenced customer satisfaction in financial institutions running under Islamic banking principles and concepts. Specific indicators within the six key factors of service quality, efficiency, empathy, reliability, complaint, and responsiveness handling emphasize this impact. For example, Islamic banks’ commitment to Sharia principles ensures high reliability through fair and transparent transactions, which was fundamental during the COVID-19 pandemic as customers sought stable financial partners. A study by Abduh and Omar (2012) found that Islamic banks in Indonesia supported higher reliability scores compared to traditional banks due to their ethical guidelines. Efficiency was another key factor, with Islamic banks showing resilience by adapting quickly to increased digital transactions and remote banking services during the COVID-19 pandemic. Data from the Central Bank of UAE (2020) showed that Islamic banks had quicker response times in enhancing digital services compared to traditional banks. Responsiveness was also critical, with Islamic banks’ customer-centric services ensuring prompt responses to customer needs compared to traditional counterparts, as highlighted by Metawa and Almossawi (1998). Empathy, a cornerstone of Islamic banking, was evident as these banks provided financial relief and support to affected customers. Studies by Gait and Worthington (2009) said that customers perceived Islamic banks as more empathetic, contributing to higher satisfaction levels. Service quality, driven by high ethical standards and transparent dealings, remained superior in Islamic banks. Comparative studies by Hamid and Masood (2011) revealed that customers rated Islamic banks higher in service quality due to their adherence to ethical banking practices. Effective complaint handling, guided by Sharia principles, ensured that grievances were addressed efficiently and fairly. Research by Al-Khatib et al. (1999) showed that Islamic banks had a more satisfactory complaint resolution process compared to traditional banks. Relevant data from countries with dual banking systems, Moosa (2022a) found that Islamic banks outperformed traditional banks in empathy, service quality, and reliability. Ghazi and Marwa (2021) showed that Islamic banks had higher customer satisfaction and retention rates, attributed to their enhancements of the efficient digital service and ethical practices.

This paper offers valuable insights into how the COVID-19 pandemic has uniquely influenced customer satisfaction in Islamic financial institutions, distinguishing them from traditional banks in dual banking systems. This understanding is crucial for developing effective strategies that address customer needs after a pandemic. Additionally, the study goes beyond a broad examination of customer satisfaction to investigate the specific influence of Islamic banking principles and their adaptation to pandemic-related challenges. The integration of Islamic finance principles into the analysis contributes to the broader literature on Islamic finance and offers practical implications for institutions running under Sharia principles. The findings of this research offer actionable insights for Islamic financial institutions to enhance their strategies and navigate challenges, ensuring the continued delivery of high-quality services aligned with Islamic principles. Given the current global situation, the study’s prompt relevance makes it a valuable resource for policymakers, practitioners, and scholars interested in the intersection of customer satisfaction, Islamic banking, and the impact of external factors such as a pandemic. Indeed, this study significantly advances the understanding of customer satisfaction in Islamic banking during the COVID-19 pandemic, providing nuanced perspectives that inform strategic decision-making, policy formulation, and future research within the field.

Literature review

Brief Islamic banking history and its principles

Islamic banking, also known as Sharia-compliant banking or Islamic finance, is rooted in the principles of Sharia or, Islamic law. These principles shape the ethical and financial practices of Islamic banks, setting them apart from conventional financial institutions. The history of Islamic banking can be traced back to the early teachings of the Quran and the Hadith, which emphasize economic and social justice and prohibit usury, known as Riba. The formal establishment of Islamic banking started in the mid-20th century, with the Pilgrims Saving Corporation in Malaysia and the Mit Ghamr Savings Bank in Egypt being recognized as the first Islamic banks. Over the following decades, various Islamic banks and financial institutions emerged in Muslim-majority nations. These institutions aimed to provide financial services that adhered to Islamic principles. Islamic banking gained global recognition and expanded to non-Muslim countries, offering ethical financial solutions to a wide range of customers. Islamic jurists play a pivotal role in ensuring the Sharia compliance of products and services offered by Islamic banks. The industry has developed various financial instruments such as Sukuk, Murabahah, and Ijarah, each in line with Islamic law. Regulatory frameworks and supervisory bodies specific to Islamic finance have been established to maintain compliance with Sharia principles and ensure financial stability. Challenges arise from the need to reconcile modern financial practices with traditional Islamic principles, and the Islamic banking sector continues to innovate to meet customers’ evolving financial needs while staying true to Sharia compliance. Today, Islamic banking is an integral part of the global financial landscape, serving millions of customers who look for ethical and religiously aligned financial services. Islamic finance principles guide ongoing innovation within the industry to create products and services that meet the evolving requirements of customers while adhering to the tenets of Sharia law.

Customers display a heightened sense of rationality when deliberating upon the choice of a bank to entrust with their investments and financial dealings. Recent data provided by the IFSB (2022) reveals a projected surge in Islamic banking assets, expected to exceed $3.2 trillion by the culmination of 2022. Strikingly, merely 20% of this considerable sum originates from beyond the Middle East—the birthplace of Islamic banking—while the remaining 80% finds its roots within the region (Carranza et al. 2021). In this context, Saudi Arabia, Dubai, and Kuwait stand out as significant players, hosting major Islamic banks such as Al Rajhi Bank, Dubai Islamic Bank, and Kuwait Finance House (KFH). Established in 1957, 1975, and 1977 respectively, these institutions currently rank as the top three largest Islamic banking entities globally, contributing over 29.4% to the total global Islamic funding. Furthermore, their distinctive dual banking system allows for the coexistence of both Islamic and conventional financial institutions. It is noteworthy that Islamic banking holds a significant 38% share within financial sector (Sulaiman, 2021). Customer satisfaction with Islamic banks materializes when patrons display a willingness to recommend these institutions to others, as underscored by Fauzi and Suryani (2019). This growing trend finds its roots in the Islamic revival movement, propelled by an increasing demand for the elimination of interest and the embrace of profit-and-loss sharing models. Authors within the Islamic realm have been ardently delineating the functions and principles underpinning the Islamic economy. Additionally, some have meticulously outlined the operational intricacies of an Islamic bank functioning within an interest-based economy (Acharya et al. 2008; Usman et al. 2021).

Adoption theories for Islamic internet banking services (IIBS)

The advent of internet service has revolutionized many industrial and financial sectors, including the banking industry. In Islamic countries after advent banking follow Islamic culture, the adoption of online banking service has become a significant topic of interest for both academics and industry professionals. This shift towards digital banking has transformed traditional banking practices, offering enhanced convenience and efficiency for customers. Academics are particularly interested in understanding the factors driving this adoption, while industry professionals focus on leveraging technology to develop service delivery and customer satisfaction. The widespread acceptance of online banking in Islamic countries reflects broader global trends towards digitalization in the financial sector, highlighting the importance of adapting to technological advancements to stay competitive with traditional banks.

The Islamic banking sector has undergone a significant transformation in recent decades. The introduction of digital banking platforms has revolutionized the way customers interact with their banks. These platforms have provided customers with a convenient and efficient means to manage their finance and investment activities. The shift to digital trading has not only enhanced accessibility for a broader range of customers but has also increased transparency, reduced transaction times, and streamlined processes. Therefore, the banking landscape in Islamic countries has become more dynamic and inclusive, encouraging greater participation from both institutional investors and individual.

However, despite its advantages, the quality of internet banking services in Islamic countries remains relatively low compared to commercial banking, particularly during the COVID-19 pandemic. During this period, most customers preferred using online banking services instead of visiting physical branches due to the lockdown. The surge in the number of customers increased the pressure on these services, revealing many defects that directly changed the reputation of Islamic internet banking services trading. The integration of various theoretical frameworks offers a comprehensive view of the factors that can affect a user’s decision to adopt Islamic internet banking services. These factors include customer service quality, trust levels, regulatory environments, trust levels, ethical environment, and technological infrastructure. By integrating different theoretical frameworks, this study provides a comprehensive understanding of the factors influencing user adoption of internet banking services. The grand theory in banking provides general principles that can be used in different contexts. In the realm of internet banking, the Task-Technology Fit (TTF) theory proposed by Goodhue and Thompson (1995) is foundational. TTF theory posits that the alignment between task requirements and the characteristic of technology predicts both the utilization of performance of individuals and the technology and. This model suggests that when technology is well-suited to the specific needs of a task, it is more likely to be effectively utilized, leading to improved performance findings. The TTF theory emphasizes the importance of considering the compatibility between task demands and technology to improve both user effectiveness and technology adoption.

According to Spies et al. (2020), the TTF was the first theory analysis specifically designed to explore the post-adoption aspects of technology use. Unlike prior studies, which primarily focused on the antecedents of intention and use, the theory quantifies the effectiveness of technology within a system by assessing the relationship between the task and technology it aims to support. Essentially, task-technology fit is about the aligns between a technology (including the hardware, data, software, and services and tools they provide), an individual’s requirement (such as a technology user), and the specific characteristics (activities performed by individuals to generate the required outcome) of the task being performed. This concept posits that the use of an information system and the resulting performance benefits are maximized when the information system is well-suited to the tasks that need to be performed. The alignment of these elements ensures that the technology effectively supports the user’s activities, leading to enhanced productivity and efficiency. The TTF theory posits that the alignment between characteristics of technology and task requirements predicts the use of the individual performance and technology. In the context of internet banking, particularly with the Islamic internet banking service (IIBS), the TTF can offer significant insights.

Internet banking services is mainly a technology that allows customers to perform various banking tasks online by using the computer of mobile devices, such as applying for loans, paying bills, and transferring funds. The alignment between these tasks and the features provided by Islamic internet banking services (IIBS) can significantly influence the user-friendliness and system’s utility for customers. This compatibility ensures that the platform effectively meets the specific needs and preferences of its users, enhancing overall satisfaction and usability (Kyambade et al, 2023; Zainurin et al. 2023). For example, if a customer needs to transfer funds to another account, the online banking system should offer an intuitive and user-friendly interface for this task. Furthermore, it is imperative that the online banking system guarantees the security and safety of the transaction, as these are essential requirements for any banking operation. Ensuring these features not only enhances user satisfaction but also builds trust in the online banking system, which is crucial for encouraging widespread adoption and use.

If Islamic internet banking services (IIBS) successfully meets these requirements, it can be considered well-aligned with the task. However, achieving the best task-technology fit is often complex and not without challenges. Various obstacles may arise in this process. For instance, varying levels of digital literacy among customers can affect their ability in navigating internet banking platforms. Furthermore, technical issues such as slow internet speeds or network going down due to internet connectivity may pose challenges and disrupt the seamless execution of online banking tasks. To tackle these obstacles, it is crucial for Islamic banks to consistently check and enhance the functionalities of the IIBS. This may entail conducting frequent user feedback surveys to gain insights into customers’ challenges and requirements. Moreover, the Islamic bank should distribute resources towards upgrading the system’s infrastructure to enhance its reliability, efficiency and speed. By prioritizing these efforts, businesses can ensure a seamless and satisfactory internet banking experience for their customers, thereby fostering loyalty and trust towards their banking services. The TTF model offers a significant framework for understanding and enhancing internet banking practices in Islamic countries. By emphasizing the alignment between banking tasks and technology features, it aims to improve user experience and customer satisfaction. This approach not only helps a deeper understanding of the interactions between users and digital trading platforms but also looks to improve these interactions to meet the diverse needs of customers effectively.

Middle-range theories offer more specific frameworks that connect grand theories to empirical observations. The Unified Theory of Acceptance and Use of Technology (UTAUT), proposed by Venkatesh et al. (2003). The UTAUT is a model designed to elucidate user intentions for using an information system and their later usage behavior. In the context of internet banking, particularly with respect to internet banking especially for Islamic internet banking services (IIBS), the model can provide significant insights. The UTAUT model helps in understanding the factors that influence users’ decisions to adopt and consistently use internet banking systems, thereby guiding improvements in system design and regulatory frameworks to enhance user satisfaction and engagement.

The UTAUT theory was created by synthesizing and consolidating constructs from eight earlier models used in earlier studies to explain information systems usage behavior. This approach involved reviewing and integrating various components to form a comprehensive framework for understanding how users interact with information systems. In a longitudinal study conducted by Venkatesh et al. (2003), the next validation of the UTAUT model showed its ability to explain around 70 per cent of the variance in “Behavioral Intention to Use” and approximately 50 per cent in “actual usage”. This validation underscored the model’s efficacy in predicting and understanding user behavior towards information systems over time. This model supposed four main constructs: effort expectancy, helping conditions, performance expectancy, and social influence. These constructs are applicable for understanding the adoption and use of Islamic internet banking services (IIBS). Performance expectancy pertains to the extent to which users perceive that employing the system will enhance their job performance and achieve gains (Jakkaew and Hemrungrote, 2017).

In the context of Islamic internet banking services (IIBS), this concept examines how well the system eases banking activities. If users perceive that IIBS enables them to manage finances more efficiently than traditional banking systems, they are inclined to adopt it. Effort expectancy, on the other hand, measures the ease with which users can perform tasks using the system (Fedorko et al. 2021). This aspect evaluates the user’s belief of how straightforward or challenging it is to utilize IIBS for banking tasks. In the case of Islamic internet banking services (IIBS), this relates to the system’s user-friendliness. If users find IIBS easy to understand and navigate, they are more inclined to adopt and use it. Social influence, meanwhile, gauges the extent to which users perceive that influential individuals or groups endorse the use of the recent technology (Patel and Patel, 2018). In most of Islamic countries under investigation, where word-of-mouth recommendations hold significant sway, users are more inclined to explore IIBS if they hear favorable reviews from their peers. Furthermore, helping conditions pertain to the user’s belief of the organizational and technical infrastructure available to support the technology’s usage. This construct evaluates how confident users feel about having adequate resources and support to effectively utilize IIBS for their banking activities (Hamzat and Mabawonku, 2018).

In the context of Islamic internet banking services (IBSS), easing conditions encompass elements like reliable internet connectivity and responsive customer support by the bank. The first three factors directly influence users’ intention to use the system and their actual behavior. Additionally, the fourth factor directly affects user behavior. The voluntary usage, gender, experience and age with financial technologies are proposed to moderate the influence of the four main constructs on users’ intention to adopt and their later behavior. Arif et al. (2020) argues that applying the UTAUT model can provide insights into the factors influencing adoption of trading through internet banking services. This approach helps to understand why some users choose to adopt the platform while others do not. It examines a range of factors such as system usability and perceived benefits that influence users’ decisions on digital banking platforms.

Applied theories emphasize practical implications and specific contextual considerations. An example of such a theory is the Customer-Based Perspective (CBP), proposed by Aaker (1991). CBP is a theoretical framework designed to prioritize the needs and preferences of customers. It underscores the significance of understanding the customers’ viewpoint to deliver products and services that align with their expectations and needs. By adopting a customer-centric approach, businesses can better tailor their offerings. A notable model that employs this CBP is Customer Based Brand Equity (CBBE) approach, which integrates client feedback and data to refine its processes continually. Incorporating customer feedback not only improves service quality but also fosters customer satisfaction and loyalty (Suandi et al. 2023). CBP, through models like the CBBE approach, proves the practical application of theoretical principles to achieve improved outcomes. By focusing on the customer’s perspective, companies can develop more effective solutions and strategies that resonate with their target audience. Keller (1993) introduced a regression model to assess brand equity from a customer-centric viewpoint, with the aim of setting up a robust and marketable brand presence. This Based Brand Equity Model, known as CBBE model, encompasses four unique levels distributed among six branding components.

Relationship among the variables

When consumers engage in the consumption of a service, they have certain expectations of the benefits they will receive, which are based on their prior sacrifice of resources such as money, time, or effort. The perceived value is the evaluation of these expected benefits in relation to the service’s actual performance. In the context of online banking services, perceived value involves assessing whether the quality, reliability, and overall experience of the service-related offering meet or exceed the first expectations set by the customer. This evaluation is crucial as it influences customer satisfaction, loyalty, and future purchasing decisions. Numerous scholars have explored the relationship between online banking service quality and perceived value in their research, consistently finding a positive correlation. For example, Turel and Serenko (2006), Wu and Liang (2009), Lai et al. (2009), Hutchinson et al. (2009), Uddin and Akhter (2012), and Yesitadewi and Widodo (2023) all found this positive relationship. Their findings showed that a higher service quality level is associated with a higher perceived value among consumers. Additionally, service experience was found to have a significant and positive influence on a customer’s perceived value (Chen and Chen, 2010; Kusumawati et al. 2021).

However, the customer satisfaction model suggests client happiness is significantly influenced by service quality. When customers receive a high service quality that is higher to meet their expectations, their satisfaction levels increase, as highlighted by Hutchinson et al. (2009). Conversely, delivering a high-quality product is a key determinant of customer satisfaction, as noted by Cronin and Taylor (1992). Furthermore, by ensuring high service quality the factors that contribute to a good service experience, service providers can enhance overall customer satisfaction and happiness, as emphasized by Kuo et al. (2009). This underscores the importance of product quality in shaping customer beliefs and long-term loyalty. Service quality exerts a direct positive impact on customer satisfaction, as showed by Kim et al. (2004), and Myo et al. (2019). Consequently, it is hypothesized that

H1: Service quality has a positive effect on customer satisfaction on internet banking services during the COVID-19 pandemic.

Reliability describes a banking institution’s ability to consistently fulfill its responsibilities accurately and without errors. Ensuring the dependability of electronic banking services is essential for the successful execution of transactions. reliability in these services plays a significant role in influencing customer satisfaction, as highlighted by Jahan and Shahria (2022) and Cleming and Murhadi (2023). When customers perceive a service as reliable, their confidence in the institution increases, leading to greater satisfaction and potentially stronger long-term relationships. This underscores the importance of supporting ambitious standards of reliability in both internet banking services to enhance customer trust and satisfaction. Banking institutions prioritize security and accuracy to foster customer satisfaction and loyalty. Customers who use online banking services experience greater satisfaction and confidence when the banking institution can ensure the safety, security and confidentiality of their personal information. According to Md Kassim and Ramayah (2017) and Mustafa et al. (2021), the ability of a financial institution to safeguard sensitive information and take full responsibility for its protection is a key factor in fostering trust.

A robust level of reliability allows Islamic banks to effectively serve as financial solutions providers for their customers. However, this increased reliability can lead to an increase in customer satisfaction, as noted by Biscaia et al. (2017) and Jawaid et al. (2021). Based on this reasoning, the proposed hypothesis is as follows:

H2: Reliability has a positive effect on customer satisfaction on internet banking services during the COVID-19 pandemic.

The role of efficiency in online Islamic banking services has been found to have a negative impact on online banking satisfaction. Customers generally expect that any issues they face while using online banking services will be thoroughly addressed and resolved by the customer service and support team. According to Ul Haq and Awan (2020), this expectation can lead to decreased satisfaction when such support falls short. Based on this understanding, the suggested hypothesis is:

H3: Efficiency has a positive effect on customer satisfaction with internet banking services during the COVID-19 pandemic.

Responsiveness variable plays a crucial role in shaping customer satisfaction in online Islamic banking services. According to Matzler et al. (2006) and Jahan and Shahria (2022), prompt and effective responses from banking service operators significantly enhance customer satisfaction when users meet problems with online banking (mobile or website). Quick resolution of issues helps to improve overall customer satisfaction and loyalty. Building on this insight, the suggested hypothesis is:

H4: Responsiveness has a positive effect on customer satisfaction on internet banking services during the COVID-19 pandemic.

Empathy encompasses the care and personalized attention a bank provides to its cusotmers, including aspects such as accessibility, communication, and comprehension of the services offered. According to Miklós et al. (2019), demonstrating empathy involves not only addressing customer needs with sensitivity but also ensuring that customer feel understood and valued throughout their interactions with the online banking service. Tetteh (2021) emphasizes the importance of ease of use in online banking solutions. They argue that these solutions should be designed to be fast, simple, and user-friendly. Online banking platforms and mobile banking services should be intuitive, allowing customers to easily comprehend and navigate the procedures. This approach ensures that users can efficiently access and utilize the banking services without unnecessary complexity. Zeithmal et al. 2000 and Ketema (2020) propose that empathy is a significant factor influencing the model under study. They suggest that when a bank demonstrates empathy, it encourages customers to utilize alternative online banking services, such as internet banking platforms. This empathetic approach helps build customer satisfaction and trust, potentially leading to increased use of various online banking channels. Building on this insight, the proposed hypothesis is:

H5: Empathy has a positive effect on customer satisfaction on internet banking services during the COVID-19 pandemic.

Finally, Singh (1988) and Slack et al. (2020) found that effectively managing customer complaints is crucial for achieving customer satisfaction and maximizing retention in the banking industry. If customers perceive that their complaints have not been adequately addressed, they are more likely to escalate the issue by filing a complaint with regulatory authorities. Consequently, addressing customer grievances promptly and effectively is essential for maintaining positive customer relationships and preventing regulatory interventions. Therefore, the proposed hypothesis is:

H6: Complaint has a positive effect on customer satisfaction with internet banking services during the COVID-19 pandemic.

Challenges faced during the pandemic

The COVID-19 pandemic posed substantial challenges to the global financial landscape, with Islamic banking experiencing significant strain. Characterized by unstable financial markets and macroeconomic uncertainty, the pandemic adversely impacted Islamic bank operations and profitability. Maintaining liquidity and operational resilience amidst decreasing revenues and escalating credit risk emerged as critical challenges for Islamic banks, as highlighted Bitar et al. (2017) and Othman et al. (2023) Islamic banks especially in Islamic countries encountered additional hurdles during the COVID-19 pandemic by balancing the imperative of Shariah compliance with the need to address the economic challenges faced by their customers. Implementing innovative solutions, such as providing relief measures and restructuring financing, while upholding Shariah principles proved to be a complex task, as emphasized by Mustafa et al. (2021). Furthermore, as argued by Vilhena and Navas (2023), the accelerated adoption of digital banking during the COVID-19 pandemic underscored the critical importance of robust cybersecurity measures and advanced technological infrastructure to support remote banking services. Furthermore, as argued by Nawaz et al. (2022), the accelerated adoption of digital banking during the COVID-19 pandemic underscored the critical importance of robust cybersecurity measures, increase efficiency of online services and advanced technological infrastructure to support remote banking services. The COVID-19 pandemic also highlighted the necessity of incorporating resilience into Islamic banking frameworks to effectively manage future crises. Strengthening risk management protocols and developing comprehensive contingency plans are crucial for mitigating the impact of unforeseen challenges, as emphasized by Machmuddah et al. (2020).

Online banking service during COVID 19 pandemic

The banking sector, like many other industries, has faced substantial disruptions due to the global COVID-19 pandemic. Due to social distancing measures, many customers have moved to online banking channels, including mobile banking apps and websites, to fulfill various tasks such as account access, fund transfers, and bill payments. However, the pandemic’s influence on customer service within the realm of online banking has been noteworthy. The COVID-19 pandemic has sparked a substantial surge in the utilization of online banking services. According to a report from McKinsey and Company (2021), the number of digital banking users surged by 20% during the pandemic. This heightened demand has placed significant pressure on banks to uphold exemplary customer service. Still, the pandemic has challenged banks in supporting the same level of customer service as before the outbreak. The predominant hurdle faced by banks amid the pandemic is the closure of physical branches. As physical branches are still shuttered, customers are compelled to resort to online banking services, inevitably resulting in a surge of calls directed towards customer service centers. As per a report from JD Power (2021), the volume of calls to customer service centers escalated by 45% during the pandemic. This surge in call frequency has placed a notable strain on customer service centers, impeding their ability to promptly and effectively cater to customer needs. This shift in dynamics prompts inquiries into the ramifications of COVID-19 on customer satisfaction levels within the realm of online banking services. Limited studies have been conducted to comprehensively investigate the specific impact of COVID-19 on customer satisfaction levels within the banking sector. As an example, a notable study conducted by Liu et al. (2021) delved into the repercussions of COVID-19 on customer satisfaction with online banking services specifically within the context of China. The study found that the pandemic had a detrimental effect on customer satisfaction with online banking services, as customers reported reduced satisfaction with the speed and convenience of these services. In a parallel vein, another study conducted by Alalwan (2020) delved into the ramifications of COVID-19 on customer satisfaction levels, this time focusing on mobile banking services within the context of Jordan. The study revealed a significant pandemic-induced impact on customer satisfaction levels, as customers expressed reduced contentment with the reliability and security of mobile banking services. Building on the studies, further research has also highlighted adverse effects of the pandemic on other sides of banking services, encompassing aspects such as the accessibility of customer support and the user-friendliness of online banking platforms. To illustrate, an investigation conducted by the American Bankers Association reported that 60 per cent of bank customers faced heightened difficulties in reaching customer support during the pandemic. Furthermore, a study conducted by Forrester Research (2022) revealed that 40 per cent of bank customers met heightened challenges in using online banking platforms due to the pandemic. The outcomes of these investigations strongly indicate that the banking sector’s customer satisfaction levels have been notably affected by the pandemic. Consequently, banks must undertake proactive measures to address these concerns and ensure sustained customer satisfaction moving forward.

Other studies have found that the COVID-19 pandemic has positively impacted customer satisfaction in internet banking. For instance, a study by Haapio et al. (2021) revealed that the pandemic has resulted in a significant increase in online banking usage. Customers have shifted towards digital channels for their banking needs due to social distancing measures and the closure of physical branches. Furthermore, the study highlights an improvement in customer satisfaction with online banking services during the pandemic. Customers’ feeling of online banking as a secure and safe choice for their financial transactions has significantly contributed to higher satisfaction levels. Similarly, a study by Gupta et al. (2021) concluded that the COVID-19 pandemic has hastened the adoption of online banking services. Customers who previously hesitated or were reluctant to use online banking have shown increased interest and willingness to embrace digital channels for their banking needs. Factors such as the fear of contracting the virus, lockdown measures, and the closure of physical branches have collectively contributed to this shift in customer behavior. In addition to the studies cited above, further research has indicated a positive impact of the pandemic on customer satisfaction concerning various aspects of online banking. These aspects encompass the availability of customer support and the user-friendliness of online banking platforms. For instance, a study conducted by the American Bankers Association revealed that 60% of bank customers reported that the pandemic had helped easier access to customer support. Similarly, research by Forrester Research highlighted that 40% of bank customers found it more convenient to use online banking platforms due to the pandemic. The findings from these studies indicate that the impact of the COVID-19 pandemic on customer satisfaction levels in online banking has been mixed. While some studies have reported a decline in customer satisfaction, others have seen an improvement. The varying impact of the pandemic on customer satisfaction is likely influenced by several factors, including the severity of the pandemic in specific countries or regions, the accessibility of online banking services, and individual customer preferences. The COVID-19 pandemic has significantly reshaped banking behaviors, prompting many customers to transition towards online banking services. A study conducted by Ismail and Gharleghi (2020) revealed that several factors played a pivotal role in driving the adoption of online banking during the pandemic. These factors encompassed perceived usefulness, ease of use, trust, security, and the availability of customer support. Those customers who perceived online banking as secure, reliable, user-friendly, and beneficial were more inclined to embrace these services amidst the COVID-19 crisis. Furthermore, the study highlighted those factors such as ease of use, responsiveness of customer support, perceived security, and website quality had direct and significant impacts on customer satisfaction during the pandemic. Additionally, the study revealed that customer trust and the perceived financial performance of banks acted as mediators in the relationship between these factors and customer satisfaction. The paper underscores the crucial importance of enhancing ease of use, responsiveness of customer support, security measures, and website quality as key avenues for elevating customer satisfaction with online banking services amid the COVID-19 pandemic. By addressing these factors, banks can cultivate greater customer trust and satisfaction in their digital banking offerings.

While some studies have reported that COVID-19 either positively or negatively influenced customer satisfaction levels with online banking services, others have showed no significant impact, as proved by Ahanger (2011), Bala et al. (2021), Baicu et al. (2020), Arum et al. (2021), and Ayinaddis et al. (2023). For instance, a study conducted by Hassan and Hassan (2021) in Egypt revealed that the pandemic had no discernible effect on customer satisfaction levels with online banking services. This lack of impact could be attributed to pre-pandemic digital banking investments made by Egyptian banks, enabling them to provide high-quality online banking experiences to their customers. The extent to which COVID-19 affects customer satisfaction with online banking services is likely contingent upon several factors, including the severity of the pandemic in specific countries or regions, the availability of online banking services, and individual customer preferences. Banks that have proactively invested in digital banking and can offer top-tier online banking services may experience less disruption from the pandemic compared to those that have not.

Structure of the customer satisfaction survey

Sample selection

A direct interview survey was undertaken in major Islamic countries, reaching out to 7058 (A total of 6961 clients were included in the data analysis) customers from March 2022 to April 2023. This extensive survey covered the customer base of leading Islamic banks across key Islamic countries, including, Kuwait, Qatar, Saudi Arabia, Bahrain, the United Arab Emirates, Oman, Malaysia, Turkey, Indonesia, Jordan and Egypt. The selection of these banks was based on their size, with the larger institutions boasting a more extensive customer base and a broader array of products and services, thereby helping a holistic assessment of customer satisfaction. Smaller banks, on the other hand, tend to be more attuned to customer feedback and may offer more direct access to decision-makers. The estimated total number of customers at each bank ranged from 239 to 780. A sample survey was executed using the ‘reasoned choice’ method. To enhance precision and ensure a representative sample, interviews were conducted on different days of the week and at various times throughout the day. Interviewers were also rotated among different branches of the banks to mitigate potential interviewer bias.

The COVID-19 pandemic posed significant challenges to traditional research methods, particularly face-to-face interviews. To adapt, various approaches were employed based on the geographic location of the Islamic banks. In GCC countries, including Kuwait, Saudi Arabia, United Arab Emirates (UAE), Qatar, Bahrain and Oman, interviews were conducted face-to-face, over the phone, and via WhatsApp, eased by branch managers who coordinated meetings and provided contact information with customer consent. In other countries, such as Egypt, Jordan, Indonesia Turkey, and Malysia, social media platforms like LinkedIn, email communications, and support from academic colleagues was used to reach respondents. These colleagues played a crucial role in giving the survey, tapping into their networks to ensure a diverse and representative sample. Pre-interview briefings were conducted to ensure transparency and build trust, and strict health protocols were followed for face-to-face meetings, including the use of personal protective equipment (PPE), sanitization, and social distancing. Few respondents (around 97 people) were excluded from the study for distinct reasons, including being new customers, not using online banking services during the pandemic, and unwilling to engage with the interviewer. This careful selection ensured that the study focused on relevant respondents who could offer meaningful insights into the impact of the pandemic on customer satisfaction. The exclusion criteria helped support the study’s integrity and relevance, ensuring that the data collected was both correct and representative of the target customer’s experiences and behaviors.

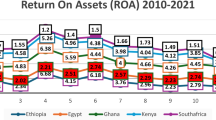

The questionnaire typically needed 5–10 min for completion. In this study, the classification of Islamic banks into large and small sizes is based on five key financial performance indicators: (i) Sharia-complaint assets, (ii) total assets, (iii) pre-tax profit, (iv) return on asset, (v) return on capital, and (vi) branch network, as illustrated in Supplementary Table S1. The classification of Islamic banks into small and large banks is an essential tool for conducting comprehensive surveys and analyzing data effectively. This distinction allows for a nuanced understanding of how several types of banks run and respond to crises like COVID-19 Pandemic, particularly in terms of customer satisfaction. Furthermore, in Supplementary Table S1 provides a detailed breakdown of the total number of respondents for each bank.

The structure of the questionnaire

The questionnaire is structured into three sections, prefaced with a brief introduction outlining the survey’s aims. The first segment focuses on assessing customer satisfaction factors, including reliability, efficiency, responsiveness, empathy, online service quality, and complaints related to online banking services amidst the COVID-19 pandemic. Reliability pertains to the frequency at which the service functions as expected and the presence of any issues. Efficiency evaluates the promptness and efficacy of customer service representatives in resolving concerns. Responsiveness gauges the representatives’ ability to understand and address customer needs proficiently. Empathy entails understanding and sharing customers’ emotions, particularly when they meet issues with online banking services. Online service quality quantifies the extent of customer contentment with the online services provided. It encompasses how well the online platform aligns with customer needs and expectations, encompassing user-friendly interfaces and clear, concise information dissemination. The final area addresses complaints concerning online banking services. These complaints may encompass technical glitches, security apprehensions, customer service matters, and fees. In the questionnaire’s next section, respondents were prompted to show their degree of overall contentment with the online banking service amid the pandemic. The concluding segment of the survey delved into the personal attributes of the interviewees. This encompassed inquiries about age, educational background, employment situation, occupation, income bracket, duration of their banking relationship, and any added accounts supported with the bank.

Hierarchical structure of customer satisfaction and frequency distribution of scores

During the survey, participants were requested to express their comprehensive contentment with the online banking service amid the COVID-19 pandemic, using a five-point Likert scale. This scale, a common psychometric tool, gauges agreement or disagreement and spans from 1 (strongly dissatisfied) to 5 (strongly satisfied). An identical scale was employed to gauge satisfaction across six categories of customer contentment. These six categories were further subdivided into various subcategories, with the composite score for each category being the average of the subcategory scores within it. This scoring approach enables us to evaluate overall satisfaction within each category and assess contentment with the specific subcategories composing that category. Such insights help pinpoint areas of low or high customer satisfaction, aiding in resource allocation. Furthermore, to find the impact of each of these six categories on customer satisfaction, respondents were prompted to assign a percentage value to each category. Figure 1 visually illustrates the hierarchical relationship between the aspects considered significant by bank customers and their respective influence on overall customer satisfaction.

The initial analysis of the study data revealed that 12.25% of the respondents indicated being “strongly satisfied,” 21.16% were “satisfied,” 31.50% expressed being “neither dissatisfied nor satisfied,” 19.24% were “dissatisfied,” and 15.85% were “strongly dissatisfied.” Evidently, the frequency distribution of overall customer satisfaction is skewed towards the left. This indicates a greater presence of respondents who are either strongly dissatisfied or dissatisfied, contrasted with a smaller number of respondents who reported being satisfied or strongly satisfied. Figure 2 illustrates the average customer satisfaction attributed to the six categories depicted in Fig. 1, alongside their respective weights. The customer satisfaction index for each category was computed by averaging the scores from all respondents and then scaling the data to a 100-point system.

Figure 2 illustrates a total customer satisfaction index of 68 out of 100. Notably, the category “Reliability” reached the highest score at 76 out of 100, despite having one of the lowest relative weights at 12.75 out of 100. This underscores the substantial influence of reliability on the formation of the customer satisfaction index (CSI). Following closely, the category of “Efficiency” garnered the second-highest score of 59 out of 100 in the customer satisfaction index, coupled with the highest relative weight of 23.5 out of 100. This highlights efficiency as the most significant determinant in shaping the customer satisfaction index (CSI). In terms of the customer satisfaction index (CSI), the “Responsiveness” and “Empathy” categories secured scores of 31 out of 100 and 29 out of 100, respectively. Their corresponding percentage weights were 14.30 out of 100 for Responsiveness and 12.85 out of 100 for Empathy. These scores denote a satisfactory level of customer satisfaction achieved by both categories. The “Online Service Quality” category attained a modest score of 36 out of 100, yet its substantial weight of 21.30 out of 100 accentuates its considerable role in overall customer satisfaction. Conversely, the “Complaint Resolution” category garnered the lowest score of 18 out of 100, accompanied by a relatively low percentage weight of 15.15 out of 100.

Methodologies

Hypothesis development

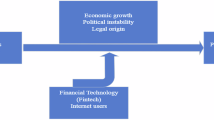

The current study formulated a hypothesis to examine the impact of the quality of Islamic internet banking services on customer satisfaction during the COVID-19 pandemic, building on the findings from previous studies that employed the SERVQUAL model (Johnston, 1997; Belay and Ebisae, 2013; Kumar and Shenbagaraman, 2017; Sardana and Bajpai, 2020; Rupal and Singh, 2023). Based on the study conducted by Miklós et al. (2019), which found six key factors—reliability, efficiency, responsiveness, service quality, empathy and complaint—that significantly influence customer service satisfaction, the following hypotheses are proposed to further investigate these relationships as shown in Fig. 3.

This figure illustrates the hypotheses proposed to further explore the relationships among the six key factors — reliability, efficiency, responsiveness, service quality, empathy and complaint—that significantly influence customer service satisfaction, as identified in the study by Miklós et al. (2019).

H1: Islamic internet banking service quality has a positive effect on customer satisfaction during the COVID-19 pandemic.

H1−1: Reliability has a positive effect on customer satisfaction during the COVID-19 pandemic.

H1−2: Efficiency has a positive effect on customer satisfaction.

H1−3: Responsiveness has a positive effect on customer satisfaction during the COVID-19 pandemic.

H1−4: Service quality has a positive effect on customer satisfaction during the COVID-19 pandemic.

H1−5: Empathy has a positive effect on customer satisfaction during the COVID-19 pandemic.

H1−6: Complaint has a positive effect on customer satisfaction during the COVID-19 pandemic.

Research method

Following the earlier discussion, customer satisfaction can be assessed through the variables that influence it. An added aspect of the post-positivist philosophy is that attitudes and behaviors can be seen and quantified using a numerical approach (Gale and Beeftink, 2005; Creswell, 2009). In this study on customer satisfaction, quantitative research was employed. Primary data was collected through surveys to investigate customer beliefs and experiences. The SERVQUAL method was employed for the analysis, incorporating descriptive statistical techniques to analyze the data. The descriptive statistical analysis involves computing averages and variances among variables under investigation. In addition, the internal consistency and reliability are assessed using the Cronbach’s alpha test (The test was developed by Cronbach in 1951). In addition, the factor analysis method was performed using the SPSS software to enhance the accuracy of the empirical results. in Supplementary Table S2 provides a sample of operationalization of concepts.

Ordinary least squares regression (OLS)

As previously mentioned, participants were requested to distribute a percentage weight to six categories considered pivotal for overall customer satisfaction. To be precise, they were tasked with distributing 100 points across these categories, where higher scores denoted a heightened level of importance attributed to a given category. The coherence of customer satisfaction was assessed through ordinary least squares regression (OLS), incorporating all six categories as regressors, as outlined below:

In the context where \(y\) is the level of customer satisfaction, the regressor coefficient \({\beta }_{i}\), is to be estimated for six distinct categories: reliability, efficiency, responsiveness, empathy, online service quality, and complaint. The stochastic error term is denoted as \({\varepsilon }_{i}\). The superscript \(w\) signifies that the values have been weighted using the percentage weights provided by each individual client.

Ordered probit model

The dependent variable, \(y\), has a natural ranking order (or dichotomous variable) and so cannot be treated as a continuous variable, because the dependent variable is unobservable. As a result, using OLS to estimate the multiple regression model between \(y\) and \({{x}^{\prime}{s}}\) other regressors lead to inefficient estimates (Greene, 2012). Considering the dependent variable y has more than two levels, a suitable estimation procedure involves a natural extension of the standard probit model. This type of probit model, characterized by multiple levels of the dependent variable, is known as the “ordered choice model”.

Based on the theory, an ordered probit model can be expressed as:

where, \({Y}_{i}^{* }\) indicates the laten variable for client \(i\)., \(\theta\) is a vector of parameters, \({x}_{i}\) is a vector of explanatory variables while random error term is denoted by \({\varepsilon }_{i}\,{where}\,{\varepsilon }_{t} \sim \left(\mathrm{0,1}\right)\). The continuous latent variable \({y}_{i}^{* }\) can take on different threshold values, or cutoffs, as shown in Fig. 4. These cutoffs separate adjacent categories of the observed variable \(y\).

Because there is \(N=5\) alternativmodels, there are \(N-1=4\) threshold \({\mu }_{1},{\mu }_{2},{\mu }_{3}{and}\,{\mu }_{4}\), with \({\mu }_{1}\,<\, {\mu }_{2}\,<\,{\mu }_{3}\,<\,{\mu }_{4}\). The probit model does not contain an intercept, because it would be exactly collinear with threshold variables. If sentiment toward higher question is in the lowest category, then \({Y}_{i}^{* }\,\le\, {\mu }_{1}\) and the alternative “Strongly Dissatisfied” is chosen, if\(\,{\mu }_{1}\,<\,{Y}_{i}^{* }\,\le\, {\mu }_{2}\) then alternative “Dissatisfied” is chosen, if \({\mu }_{2}\,<\,{Y}_{i}^{* }\,\le\,{\mu }_{3}\) then alternative “Neither Dissatisfied nor Satisfied” is chosen, if \({\mu }_{3}\,<\,{Y}_{i}^{* }\,\le\, {\mu }_{4}\) then alternative “Satisfied” is chosen, and if sentiment toward higher question is in the highest category, then \({Y}_{i}^{* }\,>\,{\mu }_{4}\) and “Strong Satisfied” is chosen. That is,

Assuming a standard normal distribution, the random error is expected to follow a normal distribution with a mean of zero and a standard deviation of one, denoted as \(N(\mathrm{0,1})\), the ordered probit model can be used to be the probabilities of these outcomes. With this assumption, the probability that observation \(i\) will select alternative \(j\) is:

In the case of the ordered probit model, the standard normal cumulative distribution function (CDF), denoted as ∅, is used.

Utilizing the generic representation, the probabilities associated with the five categories can be derived as follows:

The probability that Y = 1

Proof:

For category 1:

Recall:

\({Y}_{i}^{* }=\theta {\acute{x}}_{i}+{\varepsilon }_{i}\) and substitute into above expression

The probability that \(Y=2\)

Proof:

The probability that \(Y=3\)

Proof:

The probability that \(Y=4\)

Proof:

The probability that \(Y=5\)

Proof:

As previously noted, and in line with the probit model, the \(\varnothing \left(.\right)\) is found by the assumed normal distribution of \({\varepsilon }_{i}\).

The log-likelihood function (LL) for a generic observation \(i\) is a mathematical function that describes the probability of seeing \(i\) given certain model. It is defined as follows:

where integral limits (L) are:

A generic customer can only use one of the five possible integrals, depending on their assigned satisfaction level. If the overall customer satisfaction level is equivalent to i∈{1,2,3,4,5}, then Kj = 1 if j = i and \({K}_{j}\) = 0 if j ≠ i. In this way, all observations are treated as individual, therefore the log-likelihood for all observations is equal to the product of the separate log-likelihoods.

As said previously, we treat customer satisfaction as a linear function of specified regressors. However, the probability of each score is certainly nonlinear. Based on the log-likelihood \((L.L.)\) function for a generic observation \(i\),

Marginal effects (MEs) in an ordered probit model

The MEs within an ordered probit model refer to the changes in the probability of transitioning from one category to another when a predictor variable undergoes a change. These effects can be calculated using the following formula:

where, \(P(y=j)\) is the probability of being in category \(j\), \(x\) is the predictor variable and \(\partial\) is the partial derivative operator. All the regressors are continuous variables:

Consider \({Y}_{i}=1\)

Consider \({Y}_{i}=2\)

Consider \({Y}_{i}=3\)

Consider \({Y}_{i}=4\)

Consider \({Y}_{i}=5\)

Using outcome (1) to illustrate, the marginal effect (ME) is computed thus:

The probability density function of a standard normal distribution is denoted by the ∅(.). This function is always positive, showing that the probability of a standard normal variable taking on a specific value is greater than or equal to zero. Therefore, the sign of the parameter θ aligns with the direction of the marginal effect for the highest category but opposes the direction of the marginal effect for the lowest category. In simpler terms, if the sign of θ is positive, then the marginal effect for the lowest category will be negative, and for the highest category, it will be positive. Conversely, if θ is negative, the marginal effect for the lowest category will be positive, while for the highest category, it will be negative. The direction of the marginal effect for the second, third, and fourth categories depends on the sign of the difference within the brackets. In other words, the marginal effect for these categories can be either positive or negative, contingent upon whether the difference inside the brackets is positive or negative.

Empirical results and discussion

Research method results

Table 1 presents information about the demographic characteristics of 6961 samples used in this study, as well as aid in finding any potential sample biases. As illustrated in Table 1, most respondents are male (54%), while 46% are female. Among the respondents, 781 people were KFH (11%), followed by Faisal Islamic Bank of Egypt 728 (10%) and Dubia Islamic Bank 663 (10%). The age group with the highest representation is 30–39 (26.5%). In terms of education, the majority hold a bachelor’s degree (27.4%), followed by those with a master’s degree (30.4%). About the education level, Table 1 provides a detailed breakdown. It shows that most of the participants, 43%, hold a bachelor’s degree. This is followed by 32% who have a master’s degree. Diploma degree holders make up 16% of the participants. Additionally, 7% of the participants have completed high school or less degree, and a small fraction, 1%, have PhD qualification.

To examine the level of customer satisfaction with the Islamic internet banking services during the COVID-19 pandemic provided by Islamic banks, a Likert Scale with five items was used. This scale was chosen to quantitatively measure customer responses and help the application of statistical tests for analysis. According to Boone and Boone (2012), the use of a Likert Scale is effective in capturing the nuances of customer response, providing a structured approach to assess various dimensions of customer satisfaction. The general trend of the hypothesis can be evaluated by calculating the averages of the survey questions and comparing these averages with the benchmark values of a five-item Likert scale. in Supplementary Table S3 shows these benchmark values, offering a visual representation that aids in the interpretation of the survey results.

In reliability factor, Table 2 shows that the highest percentage of the participants fall in the category of 34.35% “neither dissatisfied nor satisfied”, and the second highest percentage of the respondents fall in the 29.33% “dissatisfied” category. Fewer people responded that they were 2.39% “strongly satisfied”. The average rating of respondents in reliability factor is 2.49 on a five-item Likert scale, which is in the “Dissatisfied” category. This implies that most respondents are dissatisfied with the reliability of online banking services during the COVID-19 pandemic period. The low rating of reliability is likely due to the pandemic, which has caused a surge in internet banking activity. This has put a strain on the systems and infrastructure of online banking providers, leading to outages and delays. Additionally, the pandemic has made it more difficult for customers to get help from customer service representatives, which has further eroded trust in internet banking services. Table 2 shows that the majority of respondents (31.85% neither dissatisfied nor satisfied and 23.83% satisfied) found the Islamic internet banking services to be efficient, meaning that they were easy to use. Only 10.69% were strongly dissatisfied, while only 15.92% were dissatisfied. The average rating of respondents in efficiency factor is 3.07 on a five-item Likert scale, which is in the “Satisfied” category. This implies that Islamic banking provides a clear, easy to use, navigate, and simple internet service for their customers during the pandemic period. About the responsiveness factor, Table 2 shows that the majority of respondents lie between the “neither dissatisfied nor satisfied” and “dissatisfied” categories, with 31.85% and 27.03%, respectively. More surprisingly, the18.06% of customers were strongly dissatisfied compared to 9.34% of customers only were strongly satisfied. The average rating of respondents in efficiency factor is 2.61 on a five-item Likert scale, which is in the “dissatisfied” category. This implies that they did not get a quick response for help if there was any problem, especially since most of the customers were dependent on online purchasing during the COVID-19 pandemic period. The average of the responses of customers about the empathy level shown in Table 2, more than 32.84% respondents fall in the category of “neither dissatisfied nor satisfied”, only 14.08% fall in the category of “strongly satisfied”, however 20.28% fall in the category of “dissatisfied” and 10.67% “strongly dissatisfied” respectively.

The average rating of respondents in empathy factor is 3.04 on a five-item Likert scale, which is in the “satisfied” category. This implies that the majority of customers in the survey are satisfied with the empathy level of the online banking management or call center management in Islamic banks suggests that these customer service representatives are doing an excellent job of understanding and responding to customer needs. About the online service quality factor, Table 2 shows that the higher percentages of participants fall into the categories of “dissatisfied” (31.64%) and “neither dissatisfied nor satisfied” (27.15%), scoring the second highest percentage. The “dissatisfied” category had the third highest percentage at 23.90%. Surprisingly, the “not satisfied “ and “strongly satisfied “ categories recorded lower percentages, with 9.43% and 7.88%, respectively. The average rating of respondents in online service quality factor is 2.37 on a five-item Likert scale, which is in the “dissatisfied” category. This dissatisfaction can be attributed to several factors, including slow response times, inaccurate information, unhelpful customer service representatives, lack of clear and concise information, and security concerns.

The average responses of customers regarding the level of complaints against the Islamic internet banking services during the COVID-19 pandemic are presented in Table 2. Notably, the two highest percentages of participants fall into the “dissatisfied” and “strongly dissatisfied” categories, with 39.97% and 28.13%, respectively. This shows a massive number of respondents expressing dissatisfaction with the service. The “ neither dissatisfied nor satisfied “ category scored the lowest percentage at 14.43% compared to other factors. In contrast, the “ satisfied “ and “ strongly satisfied “ categories recorded significantly lower percentages of survey participants, with scores of 10.82% and 6.65%, respectively. The average rating of respondents in complaint factor is 2.19 on a five-item Likert scale, which is in the “dissatisfied” category. So, the findings show that the Islamic internet banking services during the pandemic have a relatively high level of customer complaints. The finding suggests that respondents meet several challenges concerning online banking services. These challenges encompass issues such as slow responsiveness to complaints, complicated procedures for registering complaints, and prolonged resolution times for addressing their concerns. These problems have led to a decrease in overall customer satisfaction and highlight the importance of improving customer support and complaint-handling processes.

ANOVA empirical results

In Supplementary Table S4 displays the inferential test results for each model through an Analysis of Variance (ANOVA). Specifically, the F value and its degrees of freedom \((d.f.)\) serve as indicators of the model’s efficacy. Notably, all models show statistical significance, saying that each predictor variable significantly influences customer satisfaction, albeit to varying degrees. Among these predictors, compensation has the most substantial impact on the dependent variable, as shown by the following results: \(F=78.924\), \(d.f.=4,\) \(p\) less than 0.05. This suggests that while all predictors are important, complaint, efficiency and online service quality factors play a crucial role in deciding customer satisfaction. The statistical significance (denoted by sig.) shows the probability of obtaining an F value as high, or higher, if there was no true relationship in the overall population from which the sample was taken.

The correlation test

The results from the correlation test presented in Supplementary Table S5 indicate a strong and statistically significant positive relationship between customer satisfaction and two primary factors: efficiency and empathy. In contrast, there is a negative statistical relationship between customer satisfaction and several key factors, including reliability, online service quality, responses, and complaints. These findings align with the research conducted by Khatoon et al. (2020) and Pooya et al. (2020), who also seen similar correlations results among these variables.

The KMO test

The Kaiser-Meyer-Olkin (KMO) measure is a statistical test employed to find the suitability of a data for factor analysis. It calculates the degree of correlation among variables and evaluates whether the sample size is adequate for analysis. KMO values range from 0 to 1, with values closer to 1 suggesting that a factor analysis is useful for the dataset. According to the Kaiser (1974) argued that KMO value above 0.5 is considered acceptable, between 0.7 and 0.8 is good, and values above 0.9 are superior. A lower KMO value (less than 0.5) implies that the correlations between two variables cannot be explained by other variables and that factor analysis may be inappropriate. The KMO value for these datasets, as presented in Supplementary Table S6 is 0.932. This value falls within the “superior” range, providing convincing evidence that factor analysis is highly proper for these datasets. As a result, The KMO value suggests that the correlations among the variables are robust, thus justifying the use of factor analysis and ensuring the reliability and validity of the later findings. This empirical result is consistent with previous research, including studies such as Aam and Ihsanul (2022).

Bartlett’s test

About Bartlett’s test, it is used to find the level of correlation between variables before conducting factor analysis. Significance Bartlett’s test is found by a p-value of less than 0.05, suggesting that there is enough correlation among the variables to continue with factor analysis. If the correlation matrix is not an identity matrix, it confirms that factor analysis is proper for the data (Bartlett, 1950). In Supplementary Table S6 shows that the Bartlett test has a p-value less than 0.05. This finding shows that the null hypothesis, which states that the correlation matrix is an identity matrix, can be rejected. In other words, there are significant correlations among the variables, further supporting the appropriateness of factor analysis for these datasets. The Bartlett test confirms that the data structure is proper for uncovering underlying factors, thereby enhancing confidence in the analysis and interpretation of the findings. This combination of a high KMO value and a significant Bartlett test result underscores the robustness of the data for factor analysis. This empirical result is consistent with earlier research, including studies such as Khan et al. (2020).

Cronbach’s Alpha test

The value of the Cronbach’s Alpha is 0.953, as shown in Supplementary Table S7, suggesting an elevated level of internal consistency for the scale across all questions. According to Pallant (2007), a coefficient of the Cronbach of 0.70 or above is considered ideal. The value of 0.953 significantly surpasses this threshold, showing that the scale used in the study is exceptionally reliable. This strong internal consistency implies that the questions within the scale are measuring the same underlying construct and can be trusted to produce consistent findings across different samples. This empirical finding aligns with earlier studies such as Harahap et al. (2023).

Hypotheses test results

The findings of the hypothesis test can be presented in Supplementary Table S8. The statistical analysis includes the calculation of overall mean scores for respondents, which evaluates the dimensions \(({H}_{1-1}-{H}_{1-6})\) relevant to the hypotheses test (denoted by \(T-{value}\)). As displayed in Supplementary Table S8, these empirical results were further confirmed by a one-sample t- test statistic. This test showed that the overall mean difference for six dimensions had a high \(T-{value}\) and was statistically significant at the 1% level. Specifically, the efficiency and empathy factors showed a positive value, showing a generally favorable response in these areas. Conversely, other factors showed negative values, with significant levels of 1% and 5%. This shows that while efficiency and empathy factors may be areas of confidence, other dimensions such as reliability, responses, online service quality, and complaint are perceived more negatively by the respondents. This implies that while most dimensions reflected a significant negative trend, there were specific factors that contributed positively, highlighting areas for potential improvement and strategic focus. Additionally, it is important to highlight that the obtained scores are significantly higher than the critical tabular value (t-test statistic= 1.96). This statistical evidence leads to the conclusion that all six hypotheses \(({H}_{1},{H}_{2},{H}_{3},{H}_{4},{H}_{5},{and}\,{H}_{6})\) examined in this study are strongly accepted. The acceptance of these hypotheses underscores the robustness of the proposed model and its predictive capability on customer satisfaction in the context of Islamic internet banking services across different Islamic countries.

Ordinary least squares (OLS) empirical results