Abstract

This study leverages China’s staggered implementation of the intellectual property pilot and demonstration city (IPPDC) policy as a quasi-natural experiment to evaluate the impact of intellectual property protection (IPP) on enterprise supply chain resilience (SCR). The empirical analysis reveals that the establishment of the IPPDC significantly enhances SCR by promoting innovation, improving technology diffusion capabilities, and fostering a cooperative culture within enterprises. Additionally, when enterprise innovation and technology diffusion are treated as threshold variables, the positive effects of IPP on SCR intensify, exhibiting a nonlinear and progressively increasing spillover effect. In contrast, the influence of IPP on SCR through enterprise cooperation follows a U-shaped trajectory, with an initial decline followed by a subsequent rise. These findings emphasize the importance of interactions between policy-makers and enterprises in strengthening supply chain responsibility. Heterogeneity analysis indicates that IPPDC policies have a stronger effect on enterprises with robust SCR, with more significant improvements in the creation of SCR than in resistance and recovery abilities. This effect is consistently observed across primary, secondary, and tertiary industries, with particularly substantial impacts in western China. Moreover, private enterprises benefit more from IPP policies than do state-owned enterprises. These findings provide valuable insights for policy-makers by demonstrating the practical implications of IPP policies beyond their theoretical constructs. This study underscores the critical role of IPP in fortifying SCR, ultimately strengthening firms’ global competitiveness and resilience amid rising geopolitical risk and global uncertainty.

Similar content being viewed by others

Introduction

In recent years, the increasing uncertainty of the external environment has increased interest in supply chain resilience (SCR) among academics and practitioners. For example, the COVID-19 pandemic presented unprecedented challenges to enterprises, leading to significant global supply chain disruptions. Addressing these disruptions and promoting the rapid recovery of supply chains has become an urgent research priority (Ivanov and Dolgui 2020; Luo and Zhu 2020). SCR refers to an enterprise’s ability to quickly resume normal operations and sustain development amid external shocks and uncertainties (Ponomarov and Holcomb 2009). This concept emphasizes adaptability and resilience in the face of uncertainty and disruption to ensure supply chain stability and continuity. Research has indicated that enhancing SCR not only improves an enterprise’s risk response but also strengthens its overall competitive advantage (Ciccullo et al. 2018). With technological advancements and intensified market competition, the complexity and vulnerability of supply chains have increased, making SCR enhancement crucial for maintaining competitive advantages.

In this context, intellectual property protection (IPP) has emerged as a significant mechanism promoting innovation and technological development, potentially profoundly impacting enterprise SCR. IPP encourages R&D investment and technological progress, thereby enhancing innovation capabilities and market competitiveness (Zhou and Wang 2020). Additionally, a robust IPP environment facilitates technology diffusion, fosters cooperation and exchanges among enterprises, and provides resources and support for supply chains (Wang et al. 2021). While existing research has underscored the positive effects of IPP on innovation performance and technology diffusion, its specific impact on SCR remains underexplored.

Theoretical research on SCR has focused on several key dimensions. First, SCR relies on supply chain flexibility and adaptability, which involve redundant design, diversified supplier selection, and rapid response mechanisms (Golgeci and Ponomarov 2013). Second, collaboration and information sharing within the supply chain are critical for enhancing SCR by reducing supply chain vulnerability through improved information flow and cooperation (Lengnick-Hall et al. 2011). Additionally, risk management and emergency planning play crucial roles in improving SCR (Tang 2006). Most existing studies have emphasized the central importance of innovation and technological development in strengthening SCR (Srivastava et al. 2018; Troise et al. 2022; Yang and Zhao 2016).

However, much of the current SCR research is situated within the context of Western economies, with few empirical studies focusing on China’s specific policy environment. As the world’s second-largest economy has a vast manufacturing base and a highly intricate supply chain network, studying SCR in China has both significant theoretical and practical implications. Since 2012, China has implemented the intellectual property pilot and demonstration city (IPPDC) policy to boost urban innovation and development by enhancing intellectual property protection and management. The IPPDC initiative aims to increase the standards of IP management, foster an innovation-friendly environment, and provide legal protection for enterprises. Research has indicated that the establishment of IPPDCs positively influences urban innovation capacity and contributes to economic growth (Yu et al. 2023).

Although IPP is long established and widely accepted, particularly in developed countries, significant disparities remain between the levels of IPP in developed and developing nations. For example, the 2023 International Property Rights Index (IPRI) rated China’s IPP at 5.6 out of 10, whereas the United States and Germany scored 8.2 and 8.0, respectively, indicating a notable gap in IPP enforcement between China and these developed economies. Furthermore, research has shown that, in certain cases, strengthening intellectual property protection may hinder imitation-based innovation and economic growth in developing countries. This study addresses this gap by focusing on China, a developing country with relatively low levels of IPP. In the context of China’s IPPDC policy, the specific impact of IPP on SCR remains underexplored. This research seeks to provide empirical evidence of how IPP influences SCR, with particular emphasis on its practical relevance for enterprise innovation, technology diffusion, and fostering a cooperative culture. In a rapidly changing global environment where supply chains are increasingly vulnerable to disruptions, IPP provides a protective framework that not only stimulates innovation but also strengthens firms’ resilience to external shocks. Therefore, exploring the nuanced effects of IPP policies on SCR is essential for both scholars and policy-makers aiming to build more resilient and adaptive supply chain systems.

This study focuses on China to empirically analyse the impact of the establishment of the IPPDC on enterprise SCR and clarify the underlying mechanisms involved. Specifically, it integrates resource-based view theory, dynamic capability theory, and innovation diffusion theory to examine the effects of IPP on three dimensions of SCR: resistance, recovery, and creative ability. The study investigates the positive influence of the IPPDC policies on SCR through enhanced enterprise innovation, improved technology diffusion, and a strengthened cooperative culture. Additionally, it explores the nonlinear characteristics of the marginal effects of the IPPDC policies on SCR, considering enterprises’ levels of innovation, technology diffusion capabilities, and cooperative culture. Finally, it examines the heterogeneous impacts of IPPDC policies. These insights are particularly valuable for countries striving to balance innovation and supply chain management in an increasingly globalized and competitive environment.

This research contributes to the literature in several key ways. First, it enriches the theoretical research on the IPP–SCR relationship by offering new perspectives and empirical evidence. Second, uncovering the specific mechanisms through which the IPPDC policies enhances SCR emphasizes the importance of considering SCR when developing IP policies, thus providing practical guidance for policy-makers. Third, the heterogeneity analysis reveals the varying impacts of IPPDC policies across different enterprises, industries, and regions, providing detailed recommendations for policy implementation. Finally, this study expands SCR research application scenarios by incorporating China’s unique policy context and enterprise practices, offering a reference for other emerging economies. The findings offer an important theoretical basis for policy-makers, suggesting that they consider the potential impacts on SCR when formulating and implementing IP policies to build a more robust and flexible supply chain system, thereby enhancing enterprise competitiveness and responsiveness in the context of globalization.

The paper is organized as follows: Section 2 reviews the relevant literature. Section 3 proposes research hypotheses on the basis of relevant theories. Section 4 introduces the research methods and data sources. Section 5 presents the empirical results and discusses their implications. Section 6 conducts a heterogeneity analysis and further examines the policy effects on state-owned and private enterprises. Section 7 discusses the research findings in detail, offering insights into their theoretical and practical implications. Finally, Section 8 summarizes the research conclusions and provides policy recommendations.

Literature review

In recent years, supply chain management has advanced significantly in both theoretical research and industrial applications. The supply chain has become a critical system for organizations across various sectors. However, the contemporary era presents numerous challenges, such as heightened competition, the impacts of globalization, diverse technological innovations, and increasing customer expectations. These factors collectively contribute to greater uncertainty and risk within supply chains (Hsu et al. 2022). Furthermore, the frequency of disasters has exacerbated supply chain disruptions, positioning SCR as a key priority for both the public and private sectors. Consequently, SCR is recognized as a crucial capability that complements traditional risk management processes and holds significant potential to mitigate the severity of supply chain vulnerabilities (Bak et al. 2020). In the context of globalization, SCR has emerged as a focal point for both academia and industry, serving as an essential capability to address uncertainty and risk.

Research on SCR has continued to expand. Christopher and Lee (2004) suggested that supply chain collaboration and information sharing are critical for improving SCR. Enhancing the flow of information and cooperation between supply chain nodes can effectively reduce the vulnerability of the supply chain. Sheffi and Rice (2005) further emphasized that supply chain flexibility and adaptability are essential for improving SCR, which includes redundant supply chain design, diversified supplier selection, and rapid response mechanisms. Tang (2006) argued that risk management and emergency planning are necessary strategies for enhancing SCR. Ponomarov and Holcomb (2009) defined SCR as an enterprise’s ability to quickly resume normal operations and maintain sustainable development in the face of external shocks and uncertainties. Wieland and Wallenburg (2013) proposed that SCR comprises the structure, processes, and management of the supply chain and highlighted its integral role in an enterprise’s competitiveness. Melnyk et al. (2014) identified two key and complementary components of resilience: resistance and recovery. Resistance refers to minimizing the impact of disruptions, either by avoiding them entirely or by reducing the time between disruption occurrence and recovery initiation. Recovery is the ability to return to a stable, functional state after a disruption. Kamalahmadi and Parast (2016) defined SCR as the adaptive capacity of the supply chain, including the ability to maintain control over its structure and function, resist the spread of disruptions, and recover through effective response plans to restore the supply chain to a robust operational state.

Additionally, some studies have emphasized that resilient systems exhibit greater innovation potential, as they can generate innovative solutions to mitigate stress and shocks (Folke, 2006). Innovation also enhances system resilience by promoting new forms of self-organization and facilitating adaptation in response to crises and disturbances (Martin-Breen and Anderies 2011; Yin and Zhao 2024b). Ivanov et al. (2019) explored the impact of digital technology and Industry 4.0 on SCR, suggesting that technological applications significantly improve supply chain response capabilities and recovery speed. Similarly, the United Nations Conference on Trade and Development’s (2020) World Investment Report indicated that the rapid advancement of digital and advanced manufacturing technologies will continue to serve as a valuable resource for enhancing the adaptability of global supply systems. In summary, this article integrates existing research and defines enterprise SCR across three dimensions: the ability to maintain normal operations and supply chain stability during crises (resistance ability); the ability to quickly restore normal operational levels after crises (recovery ability); and the ability to enhance SCR through innovation and improvements in response to changes and uncertainty (creative ability).

IPP is a critical mechanism for legally protecting innovative outcomes and preventing unauthorized use and copying, thereby stimulating innovative activities (Papageorgiadis and Sharma 2016). IPP plays a significant role in fostering enterprise innovation. Li and Xiao (2023) noted that a robust IPP environment promotes technological innovation and R&D investment, enhancing enterprises’ market competitiveness. Moser (2005) reported that IPP effectively improves patent output and innovation performance. In the context of China, Cao et al. (2023) examined the impact of IPP on enterprise innovation and reported that the establishment of IPPDCs significantly improved urban innovation capabilities and facilitated technology diffusion. Yang et al. (2024) noted that China’s IPP policy has substantially promoted enterprise innovation and technological progress, although its effects vary across regions and industries. While the impact of IPP on enterprise innovation is well documented, its influence on enterprise SCR remains underexplored. Theoretically, IPP can affect SCR in several ways: first, by motivating enterprises to innovate and improve their technological capabilities, thereby enhancing supply chain adaptability and resilience (Neves et al. 2021); second, by promoting technology diffusion and cooperative innovation, which strengthens synergy and information sharing among supply chain nodes (Naghavi and Strozzi 2015); and third, by improving enterprises’ market position and competitiveness, which can enhance their influence and risk response capabilities within the supply chain (Zhao et al. 2013). This theoretical framework provides a critical foundation for understanding the potential impact of IPP on SCR.

The IPPDC initiative is China’s innovative practice in IPP and management, aimed at promoting urban innovation and economic development through strengthened IPP. Research has shown that the establishment of IPPDCs has significantly improved urban innovation capabilities and contributed to economic growth (Song et al. 2024). Research within this policy context offers a unique perspective on IPP’s impact on enterprise SCR. Specifically, the establishment of IPPDCs not only improves urban intellectual property management but also creates an innovation-friendly environment and provides legal protection for enterprises, which may positively influence enterprise SCR by increasing innovation levels, promoting technology diffusion, and fostering a cooperative enterprise culture. However, empirical research on the impact of IPP on enterprise SCR, particularly in the context of China’s IPPDC initiative, remains limited. Therefore, this paper empirically explores the impact of establishing IPPDCs on enterprise SCR, aiming to uncover its underlying mechanisms and provide policy-makers with new theoretical insights. These findings can assist policy-makers in considering IPP’s potential impact on enterprise SCR when formulating and implementing intellectual property policies.

Theoretical basis and research hypothesis

IPP and enterprise SCR

In the context of globalization and rapid technological advancements, the IPP issues faced by enterprises have become increasingly prominent. The establishment of the IPPDC initiative provides companies with a stable and predictable legal environment, significantly enhancing the overall level of IPP. This section explores the impact of IPP on three key dimensions of enterprise SCR: resistance, recovery, and creative abilities.

Resistance ability

Resistance ability refers to an enterprise’s capacity to maintain normal operations and supply chain stability in the face of market fluctuations, policy changes, or external shocks (Sheffi and Rice 2005). IPP enhances market competitiveness by reducing intellectual property infringement and illegal competition, thereby increasing supply chain resistance. According to resource-based view theory, enterprises can effectively utilize and integrate internal resources through IPP to strengthen their core competitiveness (Barney 1991; Kumar and Anbanandam 2019). This resource optimization extends across various supply chain links, enhancing the resilience and stability of the entire supply chain. Specifically, enterprises can obtain legal protection for their innovative achievements through patents and trademarks, enabling them to focus on core business development and improve supply chain risk resistance (Hasan and Kobeissi 2012). For example, Hori and Yamagami (2018) reported that enterprises in cities with higher IPP levels are more inclined to invest in high-tech development, thereby improving their market resistance. Additionally, IPP promotes technology diffusion and collaborative innovation, both of which are crucial in supply chain management. Romer’s (1990) endogenous growth theory emphasizes that knowledge diffusion and utilization are key drivers of economic growth. In the supply chain context, IPP ensures the legitimacy and security of innovation outcomes, encouraging technological cooperation and information sharing among enterprises, thereby enhancing overall resistance to disruptions (Ivanov et al. 2017).

Recovery ability

Recovery ability refers to an enterprise’s capacity to return swiftly to normal operating levels following a disruption or crisis (Christopher and Lee 2004). IPP plays a crucial role in this process. Dynamic capability theory emphasizes that enterprises can achieve sustained competitive advantages by adjusting and reconfiguring internal resources and capabilities in a rapidly changing environment (Altay et al. 2018; Teece et al. 1997). A robust IPP environment ensures that an enterprise’s technological and innovative achievements are protected from illegal copying and misappropriation, enabling the rapid recovery of core competitiveness after a crisis (Guo and Jiang 2022). Moreover, IPP reduces uncertainty and transaction costs in technology transfers and collaborations (Hu and Yin 2022), allowing enterprises to secure favourable positions in supply chain cooperation and implement effective emergency plans and risk management strategies. Consequently, when external shocks affect the supply chain, enterprises can quickly mobilize resources for recovery and reconstruction, thereby improving overall resilience (Nguyen et al. 2023). A well-established IPP environment often includes sound legal and policy support, assisting enterprises in obtaining the necessary legal protections and policy assistance postcrisis, thereby facilitating the rapid resumption of operations. For example, Qian et al. (2023) demonstrated that IPPDCs help enterprises swiftly resume normal production and supply chain operations after market disruptions by providing legal support and policy preferences.

Creative ability

Creative ability refers to an enterprise’s capacity to enhance SCR through innovation and improvement in response to changes and uncertainties (Teece 2007). IPP fosters continuous technological innovation and product development, thereby enhancing competitiveness and the supply chain’s creative capabilities. Innovation diffusion theory suggests that the spread of new technologies and innovations significantly enhances an enterprise’s adaptability and competitiveness (Rogers 2003). Gangopadhyay and Mondal (2012) noted that IPP policies improve innovation capabilities by motivating enterprises to engage in knowledge management and organizational learning, enabling them to adapt continuously to market demand changes. Additionally, IPP promotes technology diffusion and knowledge sharing, fostering a cooperative culture and encouraging information exchange among enterprises, which further enhances the creative capabilities of the supply chain. For example, Mohamed et al. (2023) reported that improving technology diffusion capabilities helps companies apply new technologies more swiftly and optimize production processes, thereby enhancing the supply chain’s flexibility and creative ability.

In summary, IPP significantly strengthens the resilience of enterprise supply chains by enhancing their resistance, recovery, and creative abilities. These mechanisms enable companies to maintain stable operations amid external shocks and promote innovation and development in response to changes and uncertainties, ensuring long-term supply chain health and sustainability. On this basis, we propose Hypothesis 1:

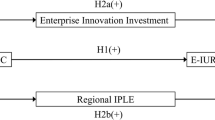

H1: Establishing IPPDCs is conducive to improving the SCR level of enterprises.

Mechanistic effects of enterprise innovation, technology diffusion capability and enterprise cooperation culture

The IPPDC policy enhances enterprise SCR through several mechanisms. First, policy support and legal guarantees encourage enterprises to engage in technological innovation and product differentiation, which enable them to adapt to rapid market changes (Ding and Xue 2023). Demonstration cities typically provide a more flexible and supportive policy environment, allowing enterprises to implement innovation strategies and promote new technologies. This support includes financial assistance and guidance from government departments in the formulation of technical standards and market access requirements, significantly reducing the risks associated with enterprise innovation and enhancing market competitiveness (Mao and Failler, 2022).

Second, strengthening technology diffusion capability is essential for improving enterprise SCR. Technology diffusion capability refers to an enterprise’s ability to acquire and apply external technologies, thereby enhancing production efficiency and market adaptability (Alvarenga et al. 2023). Research has indicated that improving technology diffusion capability reduces information asymmetry and technological inefficiencies within the supply chain, enabling enterprises to adapt quickly to changes in market demand, thereby improving overall supply chain resilience (Habib et al. 2019). For example, companies that swiftly acquire and apply new technologies can adjust production processes and product designs to meet customer needs, thus mitigating the impact of market fluctuations on supply chain stability.

Finally, strengthening the cooperative culture among enterprises and effectively sharing resources and information helps mitigate supply chain risks and challenges (Konara et al. 2022). An enhanced cooperative culture fosters the sharing of technology and experience, improving enterprises’ risk resistance in the face of increasing market uncertainty and thereby further strengthening overall supply chain resilience (Czarnitzki et al. 2015). For example, in demonstration cities, governments may promote cooperation and resource sharing among enterprises by establishing sharing platforms or industrial alliances, thereby enhancing the risk resistance and market responsiveness of the entire industrial chain.

In summary, the IPPDC policy supports and ensures enhanced enterprise SCR by improving innovation capabilities, strengthening technology diffusion, and promoting a cooperative culture. On this basis, we propose Hypothesis 2.

H2: The establishment of IPPDCs has a positive effect on enterprise SCR primarily by improving innovation capabilities, enhancing technology diffusion, and strengthening cooperative culture.

Threshold effects of enterprise innovation level, technology diffusion capability, and cooperative culture

As previously mentioned, enterprise innovation levels and technology diffusion capabilities play crucial roles in enhancing SCR. In a supportive IPP environment, enterprises can more easily acquire and apply the latest technological advancements, enabling them to adjust production and operational strategies swiftly to adapt to the changing market environment. This adjustment capability mitigates market risks and supply chain uncertainties caused by outdated technologies (Balakrishnan and Ramanathan 2021; Yin and Zhao 2024a).

First, according to resource-based view theory, enterprises gain sustainable competitive advantages through unique resources and capabilities (Liu and Lee 2018). The IPPDC policy supports enterprises in developing and utilizing these unique resources, particularly in terms of technological innovation and knowledge diffusion. Innovation capability includes not only the development of new products and technologies but also the improvement of existing ones. Enterprises with strong innovation capabilities can rapidly develop products that meet emerging demands, thus gaining a competitive edge. Moreover, technology diffusion capability facilitates the swift dissemination and application of innovations both within enterprises and across the supply chain, thereby improving responsiveness and adaptability (Cui et al. 2023).

Second, dynamic capability theory emphasizes that sustained competitive advantages are achieved through the continuous adjustment and reconfiguration of internal resources and capabilities in rapidly changing environments (Brusset and Teller 2017; Yin et al. 2024a). Dynamic capabilities involve not only internal adjustments but also collaboration and resource sharing with supply chain partners. Enterprises with stronger innovation and technology application capabilities can rapidly adjust strategies and implement countermeasures in response to market fluctuations and external shocks (Charatsari et al. 2022). For example, technology upgrades and process optimizations improve production efficiency and product quality, thereby enhancing supply chain stability and reliability. Additionally, enterprises can collaborate with supply chain partners to share technology and information resources, jointly responding to market changes and risks and ultimately improving overall supply chain resilience and adaptability (Yang et al. 2021).

Notably, enterprises that reach a certain level of innovation and technology diffusion capability may experience a nonlinear cumulative effect on SCR. For technology leaders, IPPDC policies can further reduce innovation and application costs, thereby facilitating market or product expansion. This expansion, in turn, enhances both market competitiveness and supply chain resilience (Deng et al. 2019). For instance, high-tech enterprises can accelerate the commercialization of new technologies, quickly launching new products and gaining competitive market advantages. Additionally, they can leverage the R&D platforms and innovation resources provided by IPPDCs to further improve their technological capabilities and innovation potential, thereby enhancing market adaptability and supply chain stability (Wan et al. 2023).

For enterprises with lower technology application and innovation capabilities, the government may need to provide additional support in the form of training, market access concessions, or technology transfer guidance to help these enterprises gradually increase their innovation capabilities and technology application levels (Yin et al. 2024b). These support measures can strengthen the status and role of enterprises within the supply chain, making them more resilient to risks from external shocks and market fluctuations (Brown et al. 2017). For example, technical training and consulting services can help enterprises acquire the latest technological knowledge and application skills, thereby improving their technology application capabilities and innovation levels. Additionally, preferential market access policies can reduce entry barriers, enabling enterprises to obtain market resources and technical support more efficiently, thus enhancing their market competitiveness and SCR (Kashcheeva 2013). Liu et al. (2018) demonstrated that policy support and technical training significantly improved small and medium enterprises’ technology application and innovation capabilities, thereby enhancing their role within the supply chain.

In addition to the threshold effects of enterprise innovation levels and technology diffusion capabilities on SCR, cooperative culture also plays a significant role. Cooperative culture, characterized by collaboration, trust, and shared values within and between enterprises, enhances information sharing, reduces transaction costs, and strengthens collective problem solving, which is crucial during supply chain disruptions (Lengnick-Hall et al. 2011; Christopher and Lee 2004). From the perspective of resource-based view theory, cooperative culture is a strategic resource that enables enterprises to integrate and leverage internal and external resources more effectively. Firms with a strong cooperative culture can build lasting competitive advantages by improving communication, collaboration, and resource sharing with supply chain partners, thereby enhancing resilience (Barney, 1991). Additionally, dynamic capability theory suggests that firms with strong collaborative practices can reconfigure their resources to adapt to environmental changes, further strengthening their SCR (Golgeci and Ponomarov 2013; Teece et al. 1997). Empirical research supports the critical role of cooperative culture in improving SCR. For example, Wieland and Wallenburg (2013) reported that cooperation between supply chain partners fosters better information sharing and joint problem solving, thereby reducing supply chain vulnerability. Cooperative culture not only promotes innovation but also ensures that enterprises can respond more flexibly to market changes and external shocks (Ponomarov and Holcomb 2009).

Like innovation and technology diffusion, cooperative culture may have a threshold effect on SCR. Once a firm establishes a certain level of cooperative culture, the benefits to SCR can increase exponentially. The marginal effect of cooperative culture becomes more pronounced, particularly in facilitating joint problem solving and enabling quick responses to supply chain disruptions (Sheffi and Rice 2005). For example, Czarnitzki et al. (2015) demonstrated that stronger cooperative ties enhance a firm’s ability to mobilize resources and respond effectively to external shocks.

In summary, when enterprises reach a certain level of innovation, technology diffusion capabilities, and cooperative culture, IPPDC policies can significantly accelerate SCR improvement. This nonlinear characteristic of increasing marginal effects indicates that enterprises with sufficient innovation and technology application capabilities can fully capitalize on the advantages of IPPDC policies to achieve rapid SCR growth. Specifically, companies with strong innovation capabilities can enhance market competitiveness and supply chain stability by continuously improving their technological expertise and product quality. Companies with robust technology diffusion capabilities can improve SCR by enhancing supply chain responsiveness and adaptability through the rapid dissemination and application of new technologies. Moreover, companies with greater cooperative capabilities can better leverage external resources and collaborate effectively with supply chain partners, leading to enhanced SCR. On this basis, we propose Hypothesis 3:

H3: When the enterprise innovation level, technology diffusion capability, and cooperative culture are combined as threshold variables, the establishment of IPPDCs exhibits a nonlinear characteristic of increasing marginal effects on improving enterprise SCR.

This study applies resource-based view theory and dynamic capability theory to explain how IPP can enhance SCR through innovation, technological diffusion, and cooperation. Furthermore, it explores the interaction between policy-makers and firms by emphasizing how firms can leverage IPP policies to reinforce supply chain resilience. The practical effects of IPP policies are not realized solely through their implementation but also through how firms adopt and integrate them into their operational strategies. Fostering cooperation among policy-makers, who create conducive policy environments, and firms, which implement these policies, can significantly strengthen SCR. This study thus highlights the reciprocal relationship between policy and practice, ensuring that IPP policies effectively support SCR.

Research design

Variable measurement and explanation

Explanatory variable: IPP (\({\boldsymbol{D}}{\boldsymbol{id}}\))

In 2011, the State Intellectual Property Office of China promulgated the “National Intellectual Property Pilot and Demonstration Cities (Urban Districts) Assessment Methods” outlining the procedures and criteria for assessing and managing demonstration cities. The IPPDC initiative is a key component of China’s national innovation-driven development strategy. It aims to promote economic and innovation-driven growth, strengthen IPP and institutional guarantees, accelerate talent and capital flow, and enhance cities’ regional competitiveness and international influence. Since 2012, China has established six batches of 77 demonstration cities. This paper selects 813 listed companies from 162 cities in China, covering the period from 2010–2022, including 77 experimental groups and 85 control groups. A dummy variable, \(D{id}={Treat}* {Post}\), is used to measure the impact. If a city is an IPPDC, \({Treat}\) is assigned a value of 1; otherwise, it is 0. \({Post}\) is assigned a value of 1 after the establishment of the demonstration city; otherwise, it is 0.

Explained variable: Enterprise SCR (\({{Chain}}\))

Enterprise SCR refers to the ability of an enterprise’s supply chain system to respond to challenges quickly and effectively and resume normal operations when faced with internal and external changes and shocks (Gu et al. 2021). This paper constructs indicators from three dimensions, i.e., supply chain resistance, recovery ability and creative ability, and uses the entropy method to measure them. (1) Supply chain resistance ability (\({Chain}1)\), including ① capital recovery ability: prepaid expenses/operating income (Cull et al. 2009); ② financial health: total liabilities/total assets (Yi et al. 2022); and ③ supplier concentration: Herfindahl‒Hirschman index \({HHI}=\mathop{\sum }\nolimits_{j=1}^{5}{(\frac{{{Sales}}_{{ijt}}}{{{Sales}}_{{it}}})}^{2}\); \({{Sales}}_{{ijt}}\) represents the sales of supplier \(i\) to buyer \(j\) in year \(t\), and \({{Sales}}_{{it}}\) represents the total sales of supplier \(i\) in year \(t\) (Dhaliwal et al. 2016). (2) Supply chain recovery ability (\({Chain}2\)), including ① chain stability: the bullwhip effect \({AR}=\frac{{Var}\left({Production}\right)}{{Var}\left({Demand}\right)}\), Production and Demand represent, respectively, the output and demand of the enterprise (Shan et al. 2014); ② inventory management efficiency: cost of goods sold/average inventory balance; ③ cash reserve level: net cash flow/total profit; ④ cost management level: management expenses/operating income; and ⑤ enterprise profitability: net profit/average total shareholders’ equity. (3) Supply chain creative ability \(({Chain}3)\), including ① technological innovation ability: R&D expenses/operating income; ② employee work efficiency: total profit/total labour cost; and ③ talent quality level: number of employees with a bachelor’s degree/number of employees.

Mechanism variables

-

(1)

Enterprise innovation (\({Innova}\))

Enterprise innovation refers to the process by which an enterprise introduces new ideas, methods, or technologies in products, services, processes, organizational structures, or business models to create value, enhance competitiveness, and achieve sustainable growth (Yang et al. 2019). This paper measures innovation ability via the total number of applications for invention patents, utility models, and design patents, with weights assigned as 3:2:1 (Chen et al. 2021).

-

(2)

Technology diffusion (\({Tech}\))

Technology diffusion refers to the process of spreading, adopting, acquiring, and applying new technologies through learning, cooperation, or competition. It is closely related to factors such as the characteristics of the technology itself, the internal structure of the enterprise, external partners, and the market competition environment. This paper measures technology diffusion by the number of citations of patents applied for by the enterprise in the subsequent year (Cao and Zhang 2020).

-

(3)

Enterprise cooperation (\({Colla}\))

This paper refers to the research of Loughran and McDonald (2013) and Pan et al. (2019) and uses enterprise cooperation culture, which refers to a value concept and code of conduct established within the organization emphasizing support, trust, and resource knowledge sharing among teams, as a proxy variable for enterprise cooperation. The specific method uses the “cooperation” vocabulary constructed by Fiordelisi and Ricci (2014) to determine “cooperation, unity, union, coordination, collaboration, coordination, cooperation, joint efforts, mutual assistance, sharing, communication, exchange, win-win, and working together” as the text analysis vocabulary to measure the word frequency of a listed company’s annual report.

Control variables

The city level includes the following: ① employment number \(({Pop})\): employees at the end of the year (10,000 people); ② degree of fiscal control (\({Fiscal}\)): local general public budget revenue/general public budget expenditure; ③ scientific and technological level \(({Scie}n)\): (science and technology + education expenditure)/GDP; ④ economic development level (\({Eco}\)): year-on-year change rate of regional GDP; and ⑤ financial level (\({Fin}\)): balance of deposits and loans of financial institutions at the end of the year/GDP. (2) Enterprise level includes ① enterprise scale (\({Size}\)): the natural logarithm of the total assets of enterprises; ② the net profit growth rate (\({Npg}\)); ③ the property rights ratio (\({Der}\)); ④ capital intensity (\({Cap}\)); ⑤ return on net assets (\({Roe}\)): the net profit/average balance of shareholders’ equity; ⑥ financial leverage (\({Fl}\)); ⑦ board size (\({Board}\)); ⑧ Tobin’s Q value (\({Tobinq}\)); and ⑨ the duality of COB and CEO (\({Dual}\)).

Model construction

Baseline regression model

In accordance with Paravisini et al. (2015), this paper analyses the impact of IPP on enterprise SCR via the difference-in-differences (DID) method. The core principle of DID is the comparison of changes between two groups—the treatment group (IPP model cities) and the control group (non-IPP model cities)—before and after a specific point in time. Observing the changes in enterprise SCR before and after policy implementation in both groups effectively controls for potential confounders, enabling an accurate estimation of the causal impact of IPP on enterprise SCR. The advantage of the DID method is its ability to eliminate unobserved confounders through double differences (i.e., time differences and group differences). Prior to implementing DID, the parallel trend hypothesis must be tested to ensure that trends in enterprise SCR are similar in the treatment and control groups before the policy’s implementation. Additionally, regression analysis is conducted via Stata, with a focus on the significance level, and the key variable is estimated to assess the impact of IPP on enterprise SCR. Therefore, the econometric model is set as follows:

where \({\rm{i}},{\rm{j}},{\rm{t}}\) represent enterprise, city and year, respectively; \({{\rm{Chain}}}_{{\rm{ijt}}}\) represents the SCR level of enterprise \({\rm{i}}\) in city \({\rm{j}}\) in year \({\rm{i}}\); \({{\rm{Policy}}}_{{\rm{ijt}}}\) represents the policy shock of whether city \({\rm{j}}\) is established as an IPPDC; \({{\rm{Ctrls}}1}_{{\rm{ijt}}}\) and \({{\rm{Ctrls}}2}_{{\rm{jt}}}\) represent control variables at the enterprise and city levels, respectively; \({{\rm{\mu }}}_{{\rm{i}}},\,{{\rm{\delta }}}_{{\rm{j}}},{{\rm{\lambda }}}_{{\rm{t}}},{{\rm{\varphi }}}_{{\rm{it}}},{\rm{and}}\,{{\rm{\eta }}}_{{\rm{jt}}}\) represent enterprise, city, year, enterprise-year and city-year fixed effects, respectively; and \({{\rm{\varepsilon }}}_{{\rm{ijt}}}\) represents a random disturbance term.

Mediation effect model

This paper employs the mediation effect model to explore how IPP affects enterprise SCR through mediation variables (Baron and Kenny, 1986). According to the results of the theoretical foundation analysis in the previous study, the intermediary variables chosen include enterprise innovation, technology diffusion, and enterprise cooperation; the meanings of the remaining variables remain consistent with those of the previous analysis. First, Eq. (2) is constructed to detect the direction and intensity of the influence of IPP on the intermediary variable. The focus is the estimated coefficient, which helps to understand the extent to which the independent variables promote the mediating activities. If the result is significant, it lays the foundation for the subsequent test; otherwise, the appropriateness of the chosen intermediary variable or the applicability of the data needs to be reconsidered. Second, Eq. (3) is used to assess the relationship between the intermediary variable and enterprise SCR, with a focus on the estimated coefficients to assess the extent to which the intermediary variable influences the relationship between IPP and enterprise SCR. This approach facilitates a better understanding of how the direct effect of the independent variable operates in conjunction with the mediating effect. Finally, the results are interpreted by discussing how IPP affects enterprise SCR through enterprise innovation, technology diffusion, and enterprise cooperation while exploring the theoretical and practical implications.

Threshold effect model

Threshold effect models can be used to explore whether the impact of IPP on enterprise SCR is moderated by threshold variables (Hansen 1999). In addition to mediating the impact of IPP on enterprise SCR, enterprise innovation, technology diffusion and enterprise cooperation culture may also contribute to the nonlinear spillover effects between the two. First, different threshold levels are set according to the quantile of the threshold variable, and the validity of the threshold is confirmed via bootstrapping. Second, after the threshold value is determined, segmented regression is used to analyse the influence of the independent variable on the dependent variable at different threshold intervals. Finally, the influence of the threshold variable on enterprise SCR is analysed via the DID method. Therefore, the threshold effect model is constructed as shown in Eq. (4), where \({\rm{T}}\) is the threshold variable for enterprise innovation, technological diffusion, and enterprise cooperation culture; \({\rm{I}}\) is the indicator function, which takes a value of 1 when the conditions are met and 0 otherwise; and \({{\rm{\lambda }}}_{{\rm{n}}}\) is the threshold confidence interval value that enterprise innovation and technological diffusion need to meet. The test results indicate whether the situation involves a single threshold or multiple thresholds.

Data sources and descriptive statistics

This study utilizes panel data from 10,491 observations across 813 enterprises in 162 cities in China, covering the period from 2010 to 2022. City-level data were sourced from the China City Statistical Yearbook, while enterprise-level data were obtained from the CSMAR, CNRDS, and WIND databases. Data on IPPDCs and the number of local intellectual property trial cases were manually collected from the official website of the State Intellectual Property Office and the Peking University Law Judicial Case Library. Before the sample was finalized, several steps were taken to ensure data quality and relevance: first, samples of ST, ST*, and delisted enterprises within the sample interval were removed; second, samples of financial industry enterprises were excluded to avoid industry-specific biases; and third, samples with significant missing data were eliminated to ensure robustness. Table 1 reports the descriptive statistical results. The mean and standard deviation of the enterprise SCR (\(Ch{ain}\)) are 0.0499 and 0.0277, respectively, and the mean and standard deviation of IPP (\({Did}\)) are 0.551 and 0.497, respectively. To reduce the dispersion of sample data, natural logarithm transformations were applied to the variables \({Te}{ch}\), \({Colla}\), \({FL}\), \({Board}\), \({Pop}\), \({Fiscal}\), \({Scien}\), and \(Fin\). These steps ensure the quality and relevance of the data, providing a reliable foundation for analysing the impact of IPPDCs on enterprise SCR.

Findings and discussion

Baseline results

Table 2 reports the baseline regression results for the impact of IPP on enterprise SCR. Columns (1) to (4) present different combinations of fixed effects, with Column (4) including both company-year and city-year fixed effects. The results show that the regression coefficient of the core explanatory variable, IPP (\({Did}\)), is significantly positive across all columns. This result indicates that the establishment of IPPDCs significantly enhances enterprise SCR. After accounting for control variables and fixed effects, enterprises in pilot cities experienced an average SCR increase of approximately 0.0105 times that of non-pilot cities, thus verifying Hypothesis H1.

Among the control variables, enterprise-level board size (\({Board}\)) and the Tobin’s Q value (\({Tobinq}\)) significantly inhibit the improvement of enterprise SCR. A large board size may reduce decision-making efficiency, create coordination difficulties, lead to excessive supervision, and cause resource dispersion. A high Tobin’s Q value makes companies overly optimistic about future development potential, leading them to invest in long-term projects while neglecting short-term development, thereby inhibiting SCR improvement. At the city level, the coefficients for employment (\({Pop}\)), technological level (\({Scien}\)), and financial level (\({Fin}\)) are significantly positive. Conversely, fiscal dominance (\({Fiscal}\)) has a negative effect. Increased urban employment provides enterprises with a broad talent pool and a sufficient labour force, which are key factors for ensuring smooth production operations and logistical processes. Enhancing scientific and technological levels offers cities abundant innovation resources and advanced technical infrastructure, thereby providing enterprises with diverse development opportunities through technological innovation and knowledge exchange. The improvement of urban financial levels offers enterprises ample financing channels and investment opportunities, thus helping them expand supply chain networks to cope with market fluctuation risks. However, increased fiscal dominance is typically accompanied by strict financial supervision and regulations, which can limit the flexibility of enterprises in terms of resource allocation and collaboration, thus weakening their competitiveness in the supply chain.

Identification hypothesis test

Parallel trend test

This section conducts a parallel trend test to determine whether the development trends of the experimental and control groups were parallel before the implementation of the IPPDC policy. The year 2012 is set as the “policy impact year” (Current), 2010 as Pre2, and 2013 as Post1, with 2022 as Post10, following Beck et al. (2010). The results in Table 3 show that before 2012, the regression coefficients were close to 0 and not significant. After 2012, the treatment group exhibited a significant upwards trend. This result indicates that both the experimental and control groups demonstrated the same development trend before the policy implementation, validating the parallel trend assumption. Moreover, Fig. 1 shows that the coefficient of the dummy variable for the prepolicy period is not significant and is not equal to 0. Post-policy implementation, the SCR level of enterprises in the experimental group shows a significant upwards trend compared with that of the control group. This result further indicates that the research sample satisfies the parallel trend test. Therefore, establishing an IPPDC positively impacts the improvement of enterprises’ SCR levels, with the policy effect gradually increasing over time.

Placebo test

A placebo test is conducted to assess whether the treatment effect of IPP on enterprise SCR is genuine and to exclude the influence of other potential factors. This paper follows the methodology of Cai et al. (2016), which involves randomizing the experimental group. Seventy-seven cities are randomly selected from the sample to form a fictitious experimental group, while the remaining 85 cities constitute the fictitious control group. This process is repeated 500 times to examine whether the kernel density distribution map is centred around zero. Figures 2a, b present the regression coefficient beta test map and the t value test map from the placebo test, respectively. The results show that the estimated coefficients follow a normal distribution with a mean of 0. These results indicate that the effect of the policy shock on improving enterprise SCR levels does not arise from other influencing factors, thus verifying the robustness of the regression results.

Sample model replacement

Importantly, insignificant coefficients do not necessarily imply passing of the ex ante parallel trend test, nor do significant individual coefficients suggest unreliable trend test results. This study employs various methods to verify the robustness of the multiperiod DID approach.

First, PSM-DID regression (Heckman et al. 1997) is used. This method involves constructing a propensity score via PSM and matching the scores via logit regression to control for confounding variables and effectively reduce self-selection bias. The DID model then compares the differential impact of policies before and after the establishment of the IPPDC initiative.

Second, DID2S regression is employed. Given that China’s IPPDC initiative was implemented in six batches from 2012 to 2019, the average treatment effect of the experimental group varies with time and group. Traditional DID models cannot accurately identify and measure typical treatment effects. In accordance with the practices of Butts and Gardner (2021), the DID2S method isolates time and group effects, eliminates them, and then regresses the enterprise SCR treatment variables.

Finally, DIDM regression, a multiperiod individual doubling method, is applied. This approach uses dynamic treatment groups (De Chaisemartin and d’Haultfoeuille 2020) and relaxes the constant treatment effect assumption in traditional DID models, thereby enabling the evaluation of the implementation effect of IPPDC policies.

Columns (1) to (3) in Table 4 present the regression results of PSM-DID, DID2S, and DIDM, respectively. The coefficients are all significantly positive, indicating that IPP can effectively improve enterprise SCR levels.

Mechanism analysis

Mediation effect analysis

The previous sections discussed the mechanism of IPP influence on enterprise SCR from a theoretical perspective. This section constructs a mediation effect model from an empirical perspective to test the transmission paths of enterprise innovation level, technology diffusion capability, and enterprise cooperation culture. Columns (1)-(2), (3)-(4), and (5)-(6) in Table 5 represent the direction and intensity of the roles played by enterprise innovation, technology diffusion, and enterprise cooperation, respectively, in the process by which IPPDC establishment affects enterprise SCR.

Specifically, Columns (1), (3), and (5) in Table 5 verify that IPP can promote increased enterprise innovation levels, enhance technology diffusion capabilities, and strengthen enterprise cooperation culture, with all passing the 1% significance test. Columns (2), (4), and (6) add the three intermediary variables—enterprise innovation, technology diffusion, and enterprise cooperation culture—to the baseline regression equation. The results show that IPP continues to significantly enhance enterprise SCR, although the slight decrease in regression coefficients compared with the baseline results indicates a partial mediating effect.

This result not only confirms the robust impact of IPPDC establishment on improving SCR but also reveals that the enhancement of enterprise innovation levels, technology diffusion capabilities, and enterprise cooperation culture indirectly promotes the empowerment of IPP. Therefore, this result supports Hypothesis H2.

Threshold effect analysis

To explore the nonlinear effect of IPP on enterprise SCR and help enterprises understand their market attractiveness and differentiation advantages from the perspectives of innovation and technology diffusion, enterprise innovation (\({Innova}\)), technology diffusion (\({Tech}\)) and enterprise cooperation culture (\({Colla}\)) were selected as threshold variables. These variables were analysed via bootstrap sampling repeated 300 times. The results in Table 6 indicate that enterprise innovation significantly passes the single threshold test but fails the double and triple threshold tests. This result suggests that enterprise innovation has a single threshold effect on the impact of IPP on enterprise SCR, with a threshold value of 6.028. Similarly, technology diffusion also passed the single threshold test, with a threshold value of 18.000. Enterprise cooperation aligns with the double threshold test, with threshold values of 0.0005 and 0.0007. Table 7 shows that when an enterprise’s innovation capability does not exceed the threshold value, the estimated coefficient is 0.0115. When innovation capability exceeds the threshold value, the enterprise’s SCR regression coefficient increases to 0.0164. Similarly, when technology diffusion exceeds the threshold value, the estimated coefficient significantly increases from 0.0138 to 0.0159. For enterprise cooperation, when it is lower than the first threshold value of 0.0005, the promotion coefficient of enterprise SCR is 0.0150; when it is between 0.0005 and 0.0007, the estimated coefficient decreases to 0.0112; and when it is greater than the threshold value of 0.0007, the coefficient value increases again to 0.0208. These results indicate that in regression models with enterprise innovation or technology diffusion as threshold variables, the enabling effect of IPP on enterprise SCR continues to increase, demonstrating a positive and increasing nonlinear spillover effect. Consequently, in addition to improving enterprise competitiveness, innovation capability, and technology diffusion, the effect of IPP also strengthens overall supply chain system resilience, increasing its ability to cope with market challenges. Additionally, enterprise cooperation shows a decreasing and then increasing promotion effect on the impact of IPP on enterprise SCR resilience. This result supports Hypothesis H3.

Endogeneity test

Establishing an IPPDC can increase the IPP awareness and technological innovation capabilities of enterprises in a city, thereby increasing the competitiveness and resilience of these enterprises within the supply chain. Conversely, enterprises with higher resilience are more adaptable to external changes and shocks, making them attractive for inclusion in IPPDCs. To address the endogeneity problems caused by two-way causality and omitted variables, this paper employs two instrumental variables to control for potential influencing factors.

Following Nunn and Qian’s (2014) research methodology on instrumental variable interaction terms, we first select the “Confucian academy logarithmic value*duration of intellectual property protection policy (\({IV}1\))” (Kung and Ma 2014) for each prefecture-level city. The cultural tradition advocated by Confucian academies emphasizes knowledge protection and inheritance and is usually regarded as central to knowledge transfer and academic exchange. The vigorous development of urban Confucian academies signifies the local emphasis on the value of knowledge and the creation of an atmosphere that respects intellectual property rights, reflecting the regional IPP level to some extent. However, this indicator does not directly affect the current enterprise SCR level.

Second, we introduce the “British Concession dummy variable*duration of intellectual property protection policy (\({IV}2\))” (Wu and Tang 2018). If the United Kingdom established a concession in a particular province in China, the prefecture-level city in that province is assigned a value of 1; otherwise, it is 0. Historically, British concessions have enjoyed a degree of autonomy and a special legal system, often implementing a strict IPP system, thus reflecting the importance of IPP in the region. There is no direct correlation between this variable and enterprise SCR.

Columns (1) and (2) in Table 8 present the regression results of the first and second stages in 2SLS, respectively. In Panels A and B, Column (1) shows a significant positive correlation between \({IV}1\), \({IV}2\), and IPP. In Column (2), IPP still significantly promotes the improvement of enterprise SCR. The Kleibergen‒Paap rk LM statistic significantly rejects the underidentification hypothesis, and the Kleibergen‒Paap rk Wald F statistic also rejects the weak identification hypothesis, indicating that the promotion effect is robust.

Robustness test

To ensure the reliability and accuracy of the regression results, several robustness tests are conducted.

First, the sample range is adjusted. Since China’s municipalities have more comprehensive legal frameworks and regulatory mechanisms, they possess certain advantages in IPP and enterprise SCR. Thus, municipalities are excluded from the analysis to reduce the impact of confounding variables, avoid result bias, and enhance the credibility of causal inference.

Second, the core explanatory variables are replaced. Instead of the establishment of IPPDCs, the number of intellectual property approval cases closed in prefecture-level cities (Ipp) is employed (Shen and Huang 2019) to verify data quality and hypothesis compliance.

Third, other policy interferences are excluded. The State Council issued the “13th Five-Year Plan for National Intellectual Property Protection and Utilization” in 2017, which impacted IPP strengthening, management optimization, and utilization promotion. A dummy variable for the 2017 time node is added to avoid interference from these external factors.

Fourth, the estimation model is replaced. Because IPPDC establishment may have a lag effect on the SCR of enterprises, a system GMM estimation is employed to regress the IPP variable with a lag of one period. This approach accounts for the gradual accumulation of experience and improvement of capabilities in long-term cooperation and practice, which is essential for enhancing local enterprises’ innovation and competitiveness and promoting the overall coordinated development of the supply chain.

Columns (1) to (4) in Table 9 present the estimation results of adjusting the sample range, replacing explanatory variables, excluding other policy interferences, and replacing the estimation model. The coefficient values are all significantly positive at the 1% statistical level, verifying the robustness of the conclusion that IPP promotes the improvement of enterprise SCR.

Heterogeneity analysis and further analysis

Heterogeneity analysis

Quantile heterogeneity

The results of the threshold effect analysis indicate that IPP can effectively enhance enterprises’ SCR and has a nonlinear effect of marginal increase when it is moderated by innovation capability. To assess whether this empowerment effect primarily benefits enterprises with weaker resilience or helps those with stronger resilience advance further, quantile heterogeneity regression is employed. This approach explores the impact of IPP on SCR at different quantiles rather than limiting the analysis to average changes. Columns (1) to (5) in Table 10 present the regression results for enterprises at the 10th, 25th, 50th, 75th, and 90th quantiles, respectively. The coefficient values are all significantly positive and increase as the quantiles rise. Specifically, the coefficient at the 90th quantile is 118% greater than that at the 10th quantile, indicating that the empowerment effect of IPP is more pronounced for enterprises with stronger SCR.

There are two primary reasons for this finding. First, resilient companies typically possess the financial strength and resource support needed to invest in R&D and innovation. IPP effectively protects these companies’ core technologies and patent achievements, ensuring that their technological advantages are not infringed upon, thereby further enhancing their resilience and competitive edge. Second, companies with superior SCR often focus on risk management to address market challenges and uncertainties. For these companies, IPP is particularly effective in reducing legal and business risks, minimizing infringement losses, and mitigating legal disputes (Quan et al. 2016).

Heterogeneity of the SCR subindicators

This paper divides enterprise SCR into supply chain resistance ability (\({Chain}\)1), recovery ability (\({Chain}2\)) and creative ability (\({Chain}3\)) and explores the role of IPP in these three dimensions to help enterprises operate their supply chains more robustly and flexibly when facing uncertainties and risk challenges. Columns (1)-(3) in Table 11 are the regression results of IPP empowerment on \({Chain}1\), \({Chain}2\) and \({Chain}3\), respectively. The estimated coefficients are all significantly positive, with creative ability being numerically slightly greater than resistance and recovery. An analysis of the reasons why creative ability has a better promotion effect shows that, first, it stimulates innovation and investment. IPP ensures that the innovation results of enterprises are legally protected and rewarded, motivating them to conduct research and development and innovation in the supply chain field and establishing competitive advantages in the fields of patent technology, trademarks and brands, thereby enhancing the chain’s creative ability. Second, it attracts investment and cooperation. IPP enhances the level of trust between enterprises and chain partners; ensures that technology, design, and market information is not abused and infringed upon; reduces the risk of knowledge loss; and promotes cooperation and innovation between upstream and downstream suppliers. However, the effect of improving supply chain resilience is slightly lacking. This may be because resilience is constrained by external environmental factors such as natural disasters and political changes. In particular, when major disasters or global crises occur, a longer period of time is required to recover. The IPP focuses on existing technological achievements and innovation capabilities and has relatively little impact on the resilience ability to respond to changes and challenges in the external environment.

Heterogeneity of industry types

The impact of IPP on enterprise SCR varies across different industries due to their unique characteristics and needs. The primary industry group includes agriculture, forestry, animal husbandry, and fisheries, which provide raw materials. The secondary industry group comprises mining, manufacturing, and construction, with a focus on processing and production. The tertiary industry group encompasses the service sector, which is responsible for sales and services. Conducting targeted research and analysis helps clarify the mechanism through which IPP affects these three major industry sectors. The results in Table 12 indicate that IPP positively affects enterprise SCR in primary, secondary, and tertiary industries, with coefficient values increasing sequentially. Notably, the empowerment effect of IPP on primary industry is not significant. Primary industry products typically possess natural characteristics, have limited technical content and low levels of innovation, and are subject to regional and cyclical constraints. IPP, which focuses on protecting intellectual property rights associated with knowledge and creative ability, is effective only in specific areas of primary industry. Conversely, tertiary industry, particularly in science, technology, and services, benefits significantly from IPP. The high value density of products and services in this sector facilitates the enhancement of enterprise competitiveness and sustainable development capabilities through multiple channels: promoting innovation incentives, establishing market entry barriers, and safeguarding cooperative rights and interests (Seokkyun et al. 2015).

Regional heterogeneity

China’s vast territory encompasses regions with diverse economic levels, industrial structures, legal environments, and policy support. This study divides China into four regions—eastern, central, western, and northeastern—on the basis of their economic belts to examine the regional development impact of IPP on enterprise SCR enhancement. The results in Table 13 indicate that IPPDC establishment significantly promotes the improvement of enterprise SCR across all four regions. The coefficient values are ranked from highest to lowest by region (western, eastern, central, and northeastern, respectively).

Several factors may explain the superior performance of the empowerment effect in the western region. First, the demand potential in the western region is substantial. Despite being relatively underdeveloped, with challenges such as imperfect infrastructure and a relatively simple industrial structure, the region possesses significant market development potential and space for demand growth. The establishment of IPPDCs fosters innovation and investment in this region, promoting the coordinated development of the upstream and downstream sectors of the industrial chain and, consequently, enhancing the efficiency and resilience of the supply chain. Second, the western region benefits from industrial complementarity. Its industrial structure complements those of other regions, particularly in terms of energy development, agricultural product processing, and high-tech industries, to form a comprehensive industrial chain. IPP effectively promotes cross-regional industrial technology cooperation and resource sharing, enhancing industrial competitiveness by leveraging resource endowments and addressing technological gaps, thus increasing the diversity and innovation of the supply chain. Third, strong policy support exists in the western region. Governments in the western region have introduced various IPP support policies, such as strengthening intellectual property law enforcement, establishing intellectual property dispute resolution mechanisms, and enhancing intellectual property publicity and education. Additionally, these governments promote innovation through policy measures such as tax incentives, scientific and technological innovation awards, and R&D subsidies, thereby enhancing the competitive advantage of enterprises in the western region.

Further analysis: Policy effects on state-owned enterprises and private enterprises

There are significant differences in ownership structure between China’s state-owned enterprises (SOEs) and private enterprises. SOEs are government owned or controlled, with an emphasis on national interests and social responsibilities. In contrast, private enterprises are typically owned by individuals or collectives, with a focus on economic outcomes and profit maximization. These differences manifest in various areas, including resource allocation, financing channels, business models, management systems, development paths, and cooperation strategies. Examining the impact of IPP on SCR from the perspective of enterprise ownership provides a deeper understanding of the unique needs, challenges, and strategic choices of different enterprise types. This analysis can offer targeted guidance and support for both enterprise decision-makers and policy-makers.

Columns (1) to (3) and (4) to (6) in Table 14 present the regression results of enterprise innovation as a mediating variable affecting the IPP-enabled enterprise SCR transmission mechanism in SOEs and private enterprises, respectively. For SOEs, Column (2) shows that IPP significantly promotes the improvement of enterprise innovation capabilities. However, the regression result of enterprise innovation on enterprise SCR in Column (3) is positive but not statistically significant. After the Sobel test is conducted, the results become significant, indicating that innovation-driven productivity enhances enterprise competitiveness within the supply chain. For private enterprises, the regression coefficients for each step of the mediation effect test are significant at the 1% level, indicating the presence of a partial mediation effect.

A comparison of the estimated coefficients of SOEs and private enterprises reveals that the policy effect on private enterprises is slightly stronger than on SOEs. This difference is evident in both the enabling effect of IPPDCs on improving enterprise SCR and the role of enterprise innovation in this improvement. The primary advantages of private enterprises are as follows:

First is flexibility and innovation. SOEs are typically subject to multilevel administrative management and government guidance, resulting in a slow and complex decision-making process. In contrast, private enterprises are not constrained by bureaucratic systems or government-level procedures. They are flexible and innovative, able to respond swiftly to IPP challenges, protect their achievements, and enhance supply chain resilience.

Second is market competitiveness. Private enterprises face intense market competition, which pressures them to focus on technological innovation, product upgrades, service optimization, and IPP. This competitive pressure drives them to improve SCR to safeguard their interests and maintain their competitive position.

Third is specialization. Private enterprises often focus on the specialized development of specific fields. They excel in technology accumulation, brand building, and IPP, leading them to prioritize IPP strategies such as technology patents, trademark registration, and brand value protection. These strategies make private enterprises more competitive and resilient within the supply chain.

In summary, the innovation capabilities of private enterprises have a more pronounced promotion effect. By relying on their technology and brands to maintain competitiveness, private enterprises demonstrate superior innovation awareness and capabilities. This focus on IPP allows them to protect their technological and innovation achievements from infringement, thereby promoting the improvement of enterprise SCR.

Discussion

This study builds on the established relationship between innovation and SCR (Ponomarov and Holcomb 2009; Sheffi and Rice 2005) by providing empirical evidence positioning IPP as an enabling factor in promoting innovation-driven SCR. Although IPP has gained widespread recognition from policy-makers and stakeholders, its role in enhancing SCR through innovation and technology diffusion remains underexplored, particularly in the context of developing economies such as China. Our findings align with prior research that highlighted the critical role of innovation in enhancing SCR (Srivastava et al. 2018) while also offering new insights into the nonlinear characteristics of IPP effects. Specifically, the study demonstrates that the impact of IPP on SCR is not merely theoretical but is grounded in practical mechanisms, such as fostering enterprise innovation, promoting technology diffusion, and strengthening cooperative culture. These mechanisms provide firms with clear pathways to enhance their SCR within the established IPP framework.

While IPP policies are well established, their implementation and the ways in which enterprises respond to these policies are critical in determining their effectiveness on SCR. Enterprises can leverage IPP to secure intellectual property rights, which in turn encourages investment in innovation and technology, increasing their capacity to withstand supply chain disruptions. Although policy reform may not always be the primary tool for improving SCR, the strategic alignment between IPP and enterprise operational strategies presents significant opportunities for resilience building. Our findings reveal a nonlinear impact of IPP on SCR, with increasing marginal benefits as firms’ innovation capabilities and technology diffusion levels improve. Enterprises with high levels of innovation and robust technology diffusion are better positioned to capitalize on the protections and incentives provided by IPP, resulting in greater supply chain flexibility and adaptability in response to external market fluctuations (Yin et al. 2023).

Furthermore, the positive relationship between cooperative culture and SCR aligns with earlier studies (Lengnick-Hall et al. 2011), providing additional empirical support for the argument that strong collaborative ties within supply chains significantly enhance resilience. However, our research offers a more nuanced perspective on cooperative culture, demonstrating that the influence of IPP on SCR through cooperative culture initially experiences diminishing effects. This result is likely due to the high coordination costs and complexities associated with fostering collaboration across supply chains. In the early stages of developing a cooperative culture, these costs may hamper the effectiveness of SCR improvements. Nonetheless, as a cooperative culture matures and trust is established, firms begin to realize synergistic benefits, enabling them to collaborate more effectively with supply chain partners, share technological resources, and collectively respond to challenges. This culture ultimately enhances supply chain stability and adaptability. Therefore, while cooperative culture may initially present barriers to SCR improvements, once it surpasses a certain threshold, it becomes a crucial driver of resilience.

These findings underscore the importance of the interaction between policy-makers and enterprises in enhancing SCR. While IPP serves as a fundamental policy tool, its practical effectiveness depends on how enterprises adapt and align their strategies with the protections offered by IPP. Policy-makers can further amplify the positive effects of IPP on SCR by developing complementary measures, such as providing incentives for technological innovation and fostering public‒private partnerships to facilitate technology diffusion. For example, R&D subsidies or tax incentives for collaborative innovation projects can encourage firms to invest in new technologies that improve supply chain agility and resilience. These additional measures not only strengthen the overall impact of IPP but also offer practical solutions tailored to industry-specific challenges, particularly for sectors that are highly susceptible to supply chain disruptions.

Enterprises, in turn, can proactively enhance their internal innovation capabilities and cooperative culture by aligning their strategies with the IPP framework. By doing so, firms not only protect their innovation outcomes but also establish long-term collaborative relationships with global supply chain partners. This approach strengthens firms’ competitive positioning and enhances the resilience of their supply chain networks. In this context, IPP serves as more than just a legal protection tool; it becomes a strategic enabler for fostering differentiation and building robust, resilient supply chains.

In conclusion, while IPP is widely accepted as a foundational policy, its practical significance for SCR depends on how effectively policy-makers and enterprises apply and complement these policies. Policy-makers should prioritize the implementation of supportive measures that incentivize innovation and foster cooperation, thereby maximizing the operational impact of IPP on SCR. Enterprises, in turn, should leverage IPP as a strategic tool to enhance their innovation capabilities and strengthen their cooperative culture, thereby ultimately building more resilient and collaborative supply chains. This interaction between policy and practice not only advances theoretical understanding but also offers actionable insights for enhancing SCR in real-world settings.

Conclusions and implications

Main conclusions

This study empirically investigates the role of IPP in enhancing SCR through China’s IPPDC policy. The findings demonstrate that IPP significantly strengthens SCR by fostering enterprise innovation, promoting technology diffusion, and cultivating a cooperative culture. These mechanisms not only enhance the adaptive capacity of supply chains but also bolster their resilience against external disruptions, making supply chains more robust and flexible in the face of market uncertainties. Furthermore, the study identifies nonlinear effects, showing that enterprises with higher levels of innovation and technology diffusion benefit more from IPP, thereby accelerating SCR improvements. In contrast, the role of cooperative culture reveals a different dynamic: initial barriers to SCR improvements arise owing to high coordination costs, but effectiveness increases once cooperative practices mature.