Abstract

As monopolists of land supply and responsible for carbon reduction, local governments can utilize low-carbon land supply strategies to affect carbon emissions. However, the effectiveness of these strategies remains unclear. This paper introduces the terms land-based fiscal revenue (LF) and land-based investment (LI) for land supply strategies and analyzes the spatial impacts of land supply strategies on CO2 emissions using Chinese city-level data from 2003 to 2017. Results show that land supply strategies directly increase CO2 emissions locally and in adjacent regions. Land-based fiscal revenue has a more robust negative externality in neighboring cities than land-based investment, which signifies a more competitive dynamic and intensified spatial interactions among local governments in land-based fiscal revenue. The land-based investment has revealed considerable heterogeneity across different regions. Western regions and underdeveloped cities are more likely to cause low-quality competition in land-based investment. Further analysis of the mechanisms reveals that environmental regulation is effective in curbing CO2 emissions from land-based investment, and urbanization primarily affects the CO2 emissions associated with land-based fiscal revenue. Meanwhile, financial development exerts differential impacts on land supply strategies and their associated carbon emissions. These findings confirm the specific role of land supply strategies in determining carbon emissions in Chinese cities and reveal the interactive effects of multiple mixed factors involved. Our study provides empirical support for city managers to balance land use and environmental management.

Similar content being viewed by others

Introduction

In China, the income from land transfers is essential to support the country’s fast industrialization and urban sprawl (Tong et al. 2023). As an essential production factor and spatial carrier, land transfer fees serve as a major source of public goods (Kang and Homsy, 2020; Zhang et al. 2022). Local governments in China use different land supply strategies to attract investment and increase local fiscal revenues through their monopoly to supply land (Yuan et al. 2023). The two types of land provided by local authorities are land-based fiscal revenue and land-based investment. Land-based fiscal revenue refers to the revenue generated by local government through selling the commercial/residential land at a premium price, which increases the government’s income and supports the expenditure of local public goods (Ding and Lichtenberg, 2011; Huang and Chan, 2018; Wang and Hou, 2021; Wang et al. 2021). While land-based investment refers to the low sale of industrial land to encourage enterprises to invest, increase potential tax revenue sources, and drive local economic development (Du and Peiser, 2014; Wang and Hou, 2021; Wu, 2022). While this represents a simplified categorization of the two strategies, land-based investment is, in reality, far more complex. The governments also use land as a tool for financing platform companies to issue urban investment bonds and obtain bank loans, which are known as local government financial vehicles (LGFVs) (Wu, 2022, 2023; Feng et al. 2022). Under China’s unique land system, land has both commodity and financial attributes. There are two primary methods by which local governments can attract investment from land. One of the strategies involves selling industrial land at reduced prices to attract enterprises, establishing multiple industrial parks to encourage investment, and promoting industrialization while cultivating sources of tax revenue (Du and Peiser, 2014; Wang and Hou, 2021; Wang et al. 2021). The second strategy involves leveraging land to secure investments by establishing various LGFVs that utilize state-owned assets, such as land, as collateral. Additionally, projected income from land transfers can serve as both collateral and repayment funds for borrowing through these LGFVs (Chen et al. 2020b; Wu, 2022, 2023; Zhang and Tsai, 2024). Local governments contribute land assets to LGFVs to facilitate their debt financing. This includes using land use rights as collateral to secure loans from banks and issuing urban investment bonds backed by land transfer income. These measures aim to raise funds to support urban construction and development (Chen et al. 2020b; Wu, 2022, 2023; Chen and Wu, 2022; Zhang and Tsai, 2024).

The models of LF and LI complement each other. The sale of industrial land at low prices attracts manufacturing enterprises to start production. The development of industrial parks subsequently drives an increased demand for both commercial and residential land. Furthermore, improvements in the living environment and infrastructure further stimulate the appreciation of land and housing prices, thereby expanding the scope of land finance. The rise in land value can provide local governments with the necessary assurance to secure external loans, boost their confidence and capacity to repay these loans, and motivate them to allocate land to LGFVs. This, in turn, enables them to leverage funds for urban construction projects (Chen et al. 2020a, 2020b; Chen and Wu, 2022; Wu, 2022, 2023). Serve as a crucial source of funding for the construction of industrial parks and subsidies to reduce industrial land prices, these models can alleviate the financial constraints faced by local governments and further expand the scale of land-based financing. These incomes are invested in industries related to real estate and infrastructure. The improvements of living conditions and infrastructure have boosted the ability to attract investments in land, while also increasing land values (Cong et al. 2019; Wu, 2022, 2023; Zhang and Tsai, 2024).

Chinese local governments promote urbanization, economic growth, and industrialization through the above dual land supply strategies. But these strategies may be “high cost and low efficiency”. These strategies also result in distortions in the land utilization pattern and land resource mismatch, ultimately reducing production efficiency for businesses and exacerbating environmental pollution (Das et al. 2024; Zhang et al. 2024a). Urban land use structure affects climate change, such as increasing CO2 emissions (Das et al. 2024; Zhang et al. 2024a). The influences of different land use types on environmental hazards have been widely tested, such as forests, water, and wetlands (Rajbanshi and Das, 2021). There is no direct evidence that land supply strategies impact environmental quality. However, land transfer is often accompanied by land use changes, and it expands the urban land supply amount through acquiring arable land, wetland, and agricultural land (Zhang et al. 2023). These studies conclude that land transfer poses a great challenge to basic farmland protection and ecological conservation. Moreover, the reduction in green space will lead to local climate or temperature changes (Argüeso et al. 2014; Arantes et al. 2016; Searchinger et al. 2018), water contamination (Chamblee et al. 2009), or soil degradation (Oliveira et al. 2015), and these changes have directly or indirectly led to the deterioration of environmental quality.

Land is a crucial resource for production and serves as a spatial carrier. To alleviate the pressure of development competition, authorities utilize discounted industrial land prices to attract capital inflow. However, if the introduced enterprises are seriously polluting, they will transfer the potential environmental costs to the local area and increase the local environmental pollution emissions (Cole et al. 2011). The competition for investment is predominantly driven by the low land prices and is prone to occur in the industrial sector (Yuan et al. 2023). Industry is the critical pillar of a country, but low land prices will induce low-quality capital inflow and cause a severe and prominent impact on environmental quality (Kunce and Shogren, 2007; Wu et al. 2020). Several scholars have confirmed the existence of a race-to-the-bottom model in regulatory competition (William and Olney, 2013). This model also exists in land use (Kunce and Shogren, 2007; Wu et al. 2020). Local governments often prioritize economic benefits over environmental protection when supplying land, particularly in land-based investment. In addition, land financial via LGFVs is primarily utilized for urban construction, and the scale of build-up areas is regarded as a key element contributing to CO2 emissions (Zhang et al. 2024a, 2024b). The above analyses provide theoretical support for the possibility that land supply strategies can lead to serious environmental emission problems. This is shown by the fact that factors closely related to land supply also have potential hazards in relation to climate change.

The above researches contribute to our knowledge of the impact of land utilization patterns, structures, and allocation on CO2 emissions. However, systematic evidence of how land supply strategies affect CO2 emissions remains scarce. Several important aspects deserve intensive research. First, current studies are concerned about the environmental risk of contemporary land utilization patterns. They explore the role of land “stock” but neglect the discussion of the anticipated influence of land “flow”. The changes in land supply can be viewed as the process of the “flow” of land as a production factor among industries. “If local governments adopt low-carbon land supply strategies, can carbon emission levels be fundamentally restricted?”. However, existing researchers have not conducted an in-depth examination of this. Second, the literature mainly analyzes the CO2 emission efficiency from one type of land use or total land supply scale, such as the total amount of land transfer fees (Zhang and Xu, 2017; Wang et al. 2020a) or industrial land agreement transfer (Chari et al. 2021; Wang and Hou, 2021; Zhang et al. 2022; Hu et al. 2022). They neglect the impact of heterogeneity in urban development and land supply decision-making on CO2 emissions. The environmental risks associated with land supply strategies in different regions have not been distinguished. Indeed, this is beneficial for analyzing specific land use issues and proposing targeted recommendations. However, it results in a lack of comprehensive consideration of multiple effects and features. The ultimate consequence of poor decision-making may lead to the sacrifice of the environment. Third, local government land supply strategies have a demonstration effect under the influence of inter-city fiscal and capital attraction competition. Therefore, CO2 emissions are not only influenced by local land supply strategies. They may also be influenced by land supply strategies in nearby areas. Other factors closely related to land supply also have potential hazards to climate change. Few scholars have tested the mechanisms by which land-based fiscal revenue and land-based investment affect CO2 emissions.

As monopolists of land supply and responsible for carbon reduction, local governments can utilize low-carbon land supply strategies to affect regional carbon emissions. Long-term maintenance of a reasonable CO2 level can be achieved by optimizing the supply structure and modifying the quantity available. However, the effectiveness of strategies remains uncertain. Local governments adopt dual land supply strategies, and China’s land supply and low-carbon transformation are subject to multiple constraints from economic development and the environment. Based on these typical facts, this study investigates the effectiveness and mechanisms of land-based fiscal revenue and land-based investment in relation to carbon emissions. This paper aims to clarify the following issues. Have the two types of land supply strategies promoted CO2 emissions? Why and in what way do land-based fiscal revenue and land-based investment affect CO2 emissions? How do dual land supply strategies affect urban CO2 emissions in different development stages and with different resource endowments? To address these problems, we first use the system GMM and Spatial Dobbin methods to test the spatial effect of land-based fiscal revenue and land-based investment on CO2 emissions. Next, we test the heterogeneous impacts of land-based fiscal revenue and land-based investment on CO2 emissions from geographical locations, city size, and urban resource dependence. Lastly, using the stepwise analysis method to test the intermediary effects of land supply strategies on CO2 emissions resulted from fiscal decentralization, urbanization, financial development, and environmental regulation. Otherwise, considering the robustness of the results, the study characterizes the dual land supply strategies from the price, quantity, and financing channels. We use nighttime light data and the ODIAC fossil fuel emission dataset as indicators of CO2 emissions.

This study makes the following major contributions. First, this paper provides an empirical basis and theoretical explanations for the changes in CO2 emissions from dual land supply strategies. This highlights the CO2 emissions risks of land supply strategies using land-based fiscal revenue and land-based investment. This paper provides robust evidence about the specific role that land supply strategies play in determining carbon emissions across Chinese cities. Second, the complex connections in how the fiscal decentralization, urbanization, environmental regulation, and financial development influence the land supply strategies and CO2 emissions will be revealed.

Theoretical framework

The theoretical analyses of the relationship between land supply strategies and CO2 emissions focus on two main aspects. Firstly, this paper describes the effect of land supply strategies on the acceleration of carbon emissions and their potential ripple effect at the spatial level. These inquiries can be confirmed by direct tests. Secondly, other factors closely related to land supply strategies also have potential hazards to climate change. Fiscal decentralization, urbanization, financial development, and environmental management intertwining will produce complex effects. The paper discusses the complex impact of these factors on land supply strategies and carbon emissions.

Land supply strategies directly affect CO2 emissions

Understanding China’s rapid economic growth requires an understanding of its land supply policy. To promote the rapid development of cities, local governments utilize land as a tool for managing urban areas. Taking advantage of the main monopoly position of land supply, they adopted the dual land supply strategies of land-based fiscal revenue and land-based investment to increase local fiscal revenue and attract investment. Specifically, from the primary market transactions associated with land supply, one is to expand the fiscal revenue by supplying residential or commercial land at high prices, and the other is to attract investment by supplying industrial land at low prices (Ding and Lichtenberg, 2011; Wang and Hou, 2021; Huang and Chan, 2018). Correspondingly, variations exist in land supply prices, types, quantities, and land transfer methods under these two objectives. In addition to the price and the type differences that have already been introduced, there is a limited supply of residential or commercial land, but a sufficient supply of industrial land (Fig. 1). Industrial land primarily utilizes agreement allocation, which involves minimal competition and low prices. While residential or commercial land is conducted through land bidding auctions and listing methods. The highest bidder often gets the right to operate the land. In addition, land-based investment also includes injecting land into LGFVs to leverage funds for urban construction financing. Due to enhancements in land acquisition compensation and resettlement standards, along with adjustments to the land supply structure, net income from land finance has declined. Consequently, local governments are increasingly relying on local financing platforms to generate funds (Chen and Wu, 2022; Wu, 2022, 2023; Zhang and Tsai, 2024). Land acts as a natural source of credit, and local governments, with their monopoly on land supply, benefit from implicit government guarantees. Financial institutions often prefer financing platforms, and with state support, these platforms enable local governments to secure financing for urban construction. This will improve the living environments and public service facilities, thereby boosting land value and enhancing the debt repayment capacity and creditworthiness of financing platforms, and consequently leading to the establishment of an operational model where local governments borrow through these platforms for urban development. Land mortgage loans and urban investment bonds issued by LGFVs have emerged as a significant source of land-based investment (Fig. 2). The illegal use of reserve land for mortgage financing totaled 71.62 billion Yuan over the three-year period from 2016 to 2018 (Data from the Ministry of Natural Resources). The average annual amount of land mortgage loans during these three years has reached 23.87 trillion Yuan, with an astonishing growth rate.

However, this supply behavior promotes urban CO2 emissions. Land-based fiscal revenue can increase CO2 emission concentrations in two ways: Firstly, increasing the amount of urban built-up land. Local governments rely on incremental land supply to maintain revenue. The high-price sale of commercial/residential land has increased fiscal revenue, and it is also accompanied by construction and urban sprawl (Gyourko et al. 2022; Tong et al. 2023; Yuan et al. 2023). Land-based fiscal revenue has further intensified the rapid expansion of urban areas (Huang and Chan, 2018). One significant source of CO2 emissions is urban built-up land, and changes in its land supply structure are a major factor in altering ecosystem carbon cycle processes and regional microclimates (Zhang et al. 2024a, 2024b; Das et al. 2024; Zhang et al. 2024a). The increase in the amount of urban commercial/residential land has also resulted in issues such as energy shortages, environmental pollution, traffic congestion, water supply shortages, and other related problems. Secondly, the reduction in green space. Urban expansion has led to a decrease in agricultural land, grassland, farmland, and other ecological land, while the construction of areas with a heat island effect has increased. Forests, grasslands, and other green spaces that can absorb CO2 are diminishing, while construction lands that increase CO2 emissions are extending. Most Chinese cities need to improve land use efficiency (Deng, 2021). The reduction in green space leads to local climate or temperature changes (Argüeso et al. 2014; Arantes et al. 2016; Searchinger et al. 2018).

Land-based investment may increase CO2 emissions in two ways: Firstly, the increase in industrial land. Various industrial development zones and low-end manufacturing projects have emerged as a result. Manufacturing overcapacity and homogenization hinder the optimization and modernization of industries. Cheap land enables enterprises to reduce land costs and distorts industrial land prices. This is not conducive to decreasing energy utilization efficiency in the region and improving CO2 emission efficiency. Secondly, land-based investment emphasizes the scale of investment while neglecting quality. To gain a competitive edge in the development tournament, local governments prioritize the scale of investment over its quality when attracting investors. Consequently, attracting enterprises is often accompanied by high emissions and high energy consumption. This model poses ecological risks. Local governments adopt low-price and low-quality competition to attract investments. The competition for low industrial land prices would attract enterprises with high pollution emissions (Du and Li, 2021; Kılkış, 2022). As a result, this approach has attracted the agglomeration of capital-intensive heavy industrial enterprises, thereby increasing regional CO2 emissions. Additionally, it should be noted that land investment via LGFVs prioritizes upgrading the urban infrastructure (Wu, 2022; Feng et al. 2022). While contributing to infrastructure development, this investment has a significant impact on CO2 emissions and may result in increased emissions due to construction activities and the use of carbon-intensive materials.

Spatial spillover effects of land supply strategies on CO2 emissions. Land supply strategies directly increase local CO2 emissions while playing a role in connected regions. The competitive effect and economic interconnections among cities have encouraged the expansion of the land supply in surrounding areas. The demonstration-imitation effect and development competition lead to a convergence of land supply strategies among cities, which will encourage neighboring governments to imitate and even extend the reduction of ER to increase investment attractiveness. All of these lead to the acceptance of inefficient and high-polluting enterprises in neighboring areas (Zhang et al. 2022). Moreover, local governments will increase infrastructure construction and improve surrounding facilities to enhance urban competitiveness (Palmer and Berrisford, 2015). The improvement of infrastructure, such as transportation, electricity, healthcare, and education in the surrounding areas, will have a certain degree of spread and radiation, which will attract enterprises with high emissions. Therefore, the local land supply strategies have a spillover effect on CE in adjacent areas.

Mechanism of land supply strategies in relation to CO2 emissions

The mechanism of land supply strategies and CO2 emissions is complex. The reform of fiscal decentralization (FD) is the driving force behind the government’s adoption of land supply strategies. FD refers to empowering local governments with the appropriate tax administration authority and assigning them responsibility for economic development. It means that local governments assume the function of supplying public goods. Gandhi and Phatak (2016) noted that land finance had caused a rise in the revenue of public bodies. Land transfer fees as a public revenue source also significantly affect government expenditure structure (Palmer and Berrisford, 2015). As the government’s independent decision-making power increases, there is a risk of fostering a short-sighted tendency in authorities to blindly seek GDP growth while neglecting green development. For local governments, infrastructure construction is more conducive to remarkable or visible development achievements. Environmental management is a part of non-economic public goods that has no economic output or significant results or achievements in the short term (Tang et al. 2019). Local fiscal expenditures prefer “hard capital construction over soft public services” expenditure. Scholars confirmed that the income from land transfer fees was mainly used for infrastructure construction (Zhong et al. 2019; Chowdhry, 2022). In contrast, the spending on environmental protection products has been ignored. This shows that fiscal decentralization affects the total price and expenditure of land supply, driving higher CO₂ emissions. For urbanization (UR), the land transfer fees significantly contribute to fiscal revenue (Huang and Chan, 2018; Wang and Hou, 2021). It is an important tool in the start-up phase of urbanization. The huge revenues generated from land supply have provided financial support for urban construction (Tong et al. 2023). Urbanization is accompanied by energy consumption, transportation agglomeration, construction, and encroachment on ecological land, resulting in uncontrolled CO2 emissions (Du and Li, 2021; Hu et al. 2023). For environmental regulation (ER), it refers to employing administrative measures to reduce emissions (Becker et al. 2013). Low industrial land prices would bring immoderate investment, low production of enterprises, and an increase in pollution emissions. Low-cost land will attract heavy industries with high emissions (Du and Li, 2021; Zhang et al. 2024a). The “seeking development with land” model promotes the accumulation of primitive development capital for China (Liu et al. 2016; Wu, 2022, 2023). However, it is also accompanied by environmental degradation. In this context, land-based investment is accompanied by a lower level of ER, thereby promoting carbon emissions. Local governments will pursue fiscal expansion in land-based fiscal revenue to make up for the loss of economic benefits brought by ER. Therefore, the impact of ER on local governments’ land supply strategies in reducing carbon emissions may be significantly reduced. Financial development (FIN) is considered a critical mediator in CO2 emissions by optimizing resource allocation (Mahalik et al. 2016; Liu and Song, 2022). It accomplishes this through market-oriented mechanisms, which direct capital into green and low-carbon sectors. China’s public land ownership and the combination of the economic value of land have positioned land as a momentous element in advancing urban development. In practice, a variety of land-based financing instruments have emerged, including loans, equities, bonds, and funds, all of which leverage land use rights as collateral or underlying assets. This promotes a close connection between land supply and financial development. The advancement of financial systems facilitates local governments’ ability to collateralize land assets for credit acquisition (Wu, 2022; Feng et al. 2022; Chen et al. 2020b; Zhang and Tsai, 2024), thereby enhancing their fiscal capacity for infrastructure development. This financing mechanism may increase carbon emissions (Mahalik et al. 2016). Nevertheless, financial development significantly contributes to economic decarbonization. Specifically, it helps reduce CO2 emissions through fostering technological progress and improving energy efficiency (Liu and Song, 2022; Tamazian et al. 2009). Numerous land-related financing products are gradually embedded in urban governance and land development processes, becoming deeply intertwined with residents’ wealth, municipal finances, the real estate market, and industrial development—ultimately influencing urban carbon emissions.

This paper tests whether two modes of land supply strategies can result in spatial impacts on CO2 emissions. First, the spatial Durbin model measures the spatial effects. It is noteworthy that the government is responsible for deciding on land transfers and regulating CO2 emissions. Other elements that influence CO2 emissions, such as energy intensity, financial development level, population density, economic structure, and capital, are also considered in the model construction. Second, considering that China has regional differences, the heterogeneous effect of land-based fiscal revenue and land-based investment on CO2 emissions from geographical locations, city size, and urban resource dependence is examined. Third, the intermediary effect of land supply strategies on CO2 emissions from FD, UR, ER and FIN is tested. The research flowchart is shown in Fig. 3.

Model and method

Benchmark analysis method

To test the direct correlation between land supply strategies and CO2 emissions. The Sys-GMM method utilizes the lag variable as the tool variable to ensure the stability of estimated result and avoid the variable’s endogeneity (Arellano and Bover, 1995). The Sys-GMM method is employed to assess the panel data. The model is constructed as follows:

where the variable \({{{\rm {CE}}}}_{{it}}\) represents the CO2 emissions of i city at t year, and LFit and LIit mean the level of land-based fiscal revenue and land-based investment of i city at t year, respectively. The variable xit represents the other critical variables acting on CO2 emissions, and \({\varepsilon }_{{it}}\) represents the error term.

Spatial evaluation model

Due to the extensive and close economic ties among regions in China, the spatially related regions usually show a strong correlation in land policy, economic operation, and other aspects. As Li (2022) has confirmed, variables such as carbon emissions and land policies among regions in China have obvious spatial spillover effects. Land supply strategies directly influence native CE, and they also generate spatial spillover impacts on adjoining regions due to mutual imitation behavior among regional governments. The traditional econometric model based on mutual independence among individuals is not suitable for this study, and it is necessary to include this interaction mechanism in the scope of the investigation based on spatial econometric models. At the same time, economic output, energy, capital, labor and other factors that affect carbon emissions may also show the characteristics of spatial dependence. In view of this, the general spatial evaluation model is constructed:

where the variable \({{{\rm {CE}}}}_{{it}}\) denotes the CO2 emissions of i city at t year, and Wij denotes the spatial weights matrix. Based on Parent and Lesage (2008), there may be a deviation in the estimation of the geographical distance spatial weight matrix (Wd), this paper constructs an economic geographical weight matrix (\({W}_{{{\rm {ge}}}}\)) to analyze spatial effects. LFit and LIit mean the level of land-based fiscal revenue and land-based investment, respectively. The variable xit represents the other important factors influencing emissions, namely, economic structure, energy intensity, FD, ER, and control variables. εit represents the error term. In order to reduce heteroscedasticity and dimensional impact, the model logarithmically treats non-proportional variables.

In order to recognize a proper spatial panel model, this study uses the Lagrange multiplier (LM) test and the likelihood ratio (LR) test (LeSage and Pace, 2009). The LM spatial error value is 117.667. The LM-lag is 263.947. P values are significant. R-LM spatial error and R-LM lag are 1710.566 (p = 0.000) and 2.318 (p = 0.128), respectively. The results acknowledge that LM-error, LM-lag, and R-LM error tests are significant, whereas R-LM lag is not significant. These results show that spatial econometric analysis is suitable. The Wald (SEM) test and Wald (SAR) are 56.89 and 56.81, respectively. The prob > chi2 values are significant, suggesting that the model is applicable. The LR (SEM) test is 118.28, and LR (SAR) test is −76.49, and the P value is insignificant (p > 0.1). The results of the W and LR tests show that SDR is applicable. The Hausman test (32.32) is significant at 1%. Due to individual regional differences and period factors, estimation bias may occur. This paper uses the dynamic spatial panel model with spatiotemporal fixed effects and SDM for spatial econometric analysis.

To comprehensively investigate the spatial effects of CE, this paper tests Moran’s I spatial correlation indices (Li et al. 2022). The formulas are as follows:

where I and Ii represent the global and local Moran’s I, n = 1, 2, 3, …, 284, respectively. wij represents the spatial weight matrix, xi and xj represent the CE of the research regions i and j, respectively, and \(\bar{x}\) denotes the average level of CE.

In reality, China has significant regional differences. The economic structure, resource endowments, land-use level, and other aspects among regions are significantly different. Therefore, local governments in different regions have different land transfer tendencies and impacts on CE. To investigate the influence of heterogeneity factors, this paper tested the heterogeneity factors in three respects: heterogeneity in geographical locations, city size, and urban resource dependence.

Evaluating transmission mechanism

Based on previous analysis, this paper analyzes the mechanism of land-based fiscal revenue and land-based investment in relation to CO2 emissions from FD, UR, ER, and FIN. Using the stepwise analysis method to test the CO2 emission risk of land supply strategies by influencing FD, UR, ER, and FIN. The model is developed as follows:

where Mit is the intermediary variable. The above intermediary effect model focuses on the regression coefficient of FD, UR, ER and FIN; \({\theta }_{0}\) is a constant term; \({\theta }_{1}\) represents the effect of land-based fiscal revenue on intermediary variables; \({\theta }_{2}\) represents the effect of land-based investment on intermediary variables; εit represents the error term.

After adding intermediary variables, the correlation among land-based fiscal revenue, land-based investment, and CE is estimated again, and the model is developed as follows:

where \({M}_{{it}}\) is the intermediary variable; \({\beta }_{0}\) is a constant term; \({\beta }_{1}\), \({\beta }_{2},\) and \({\beta }_{3}\) are the coefficient values to be estimated. If the \({\beta }_{1}\) value decreases, it indicates that the intermediary variable is an important transmission path for land supply strategies to affect CO2 emissions. εit represents the error term.

Variable

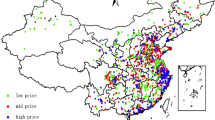

The dependent variable (CE) is urban CO2 emissions. This paper draws on Chen et al.’s (2020a; 2020b) research and uses DMSP-OLS and NPP-VIIRS nighttime lighting data to simulate and calculate the total CO2 emissions of Chinese cities. This simulation is based on the theory that the brighter the night light brightness, the higher the consumption of all types of energy. Chen et al. (2020a, 2020b) shown their detailed calculation process. The spatial distribution of CE is shown in Fig. 4. During the research period, CE showed an overall rising trend. This paper also employs OADIC emission data (ACE) as an alternative variable of CE. The ODIAC Fossil fuel emission dataset is calculated by Oda et al. (2018) based on fossil fuel combustion.

This paper introduces the terms land-based fiscal revenue (LF) mode and Land-based investment (LI) mode, which reflect the land supply strategies. Land-based fiscal revenue is expressed by proceeds from the sale of state-owned land through bidding, auction, and listing. Land-based investment is expressed by proceeds from the sale of state-owned land through an agreement. The spatial distribution of land-based fiscal revenue and land-based investment is shown in Fig. 4. The amount of land-based fiscal revenue is much higher than that of land-based investment. Moreover, this paper also uses the area of state-owned land transferred through bidding, auction, and listing as an alternative variable of land-based fiscal revenue. The area of state-owned land transferred through the agreement is used as an alternative variable of land-based investment for the robustness test. The land transfer data come from China Land and Resources Statistical Yearbook (2004–2018). In China, the agreement transaction was the main method of industrial land transfer before 2007. The negotiated sale price is below the land market price. More business investment will be attracted through a favorable price advantage. It is easier to realize the cooperation between enterprises and the government.

As to the effect of land supply strategies on CE, factors closely related to land supply strategies also pose potential hazards to climate change. To further explore the CO2 emissions mechanism of land-based fiscal revenue and land-based investment, the econometric equations are referred to (3)–(5). FD, UR, FIN, and ER are considered in the model. For FD, a large part of local government tax revenue is surrendered to the central government, leading to a decline in the local government’s income (Li, 2022). With the double dilemma of fiscal pressure and construction affairs, the land transfer fees became the dominant local fiscal revenue source after 1994. UR will lead to a great demand for energy consumption (Nathaniel and Adeleye, 2021; Zhang et al. 2024a). UR is expressed by the proportion of municipal districts in the city’s population (%). FIN profoundly affects the land supply behavior of local governments (Wu, 2022; Feng et al. 2022; Chen et al. 2020b; Zhang and Tsai, 2024). Credit expansion stimulates land development, driving real estate and infrastructure investment. These are all carbon-intensive industries. It also affects carbon emissions and ecological sustainability by altering land-use efficiency, energy consumption patterns, and spatial development. Following Li and Qin (2024). This paper measures financial development using the ratio of total loans to financial institutions to GDP. For ER, industrial wastewater, SO2 and smoke (dust) emissions are selected as indicators of the environmental indicator system. This paper has employed the comprehensive index of regional industrial pollution as a pollution variable (Shen et al. 2017). The formula for calculating the comprehensive pollution emissions index is as follows:

where the variable \({p}_{{ij}}\) stands for the pollution emissions of the j pollutant in i city. \({{pv}}_{{ij}}\) stands for the value of j pollutant in i city. Pollution emissions indices for 284 municipalities are calculated for three industrial emissions.

Based on previous articles, carbon emissions, economic development, energy factors, population density, capital investment, and infrastructure construction are central factors that affect CE, which are considered as control variables in this paper. For economic structure, this paper employs industrial structure (INDU) and income (PGDP) to represent the economic structure. PGDP reflects the income level, which significantly affects environmental pollution (Tamazian et al. 2009; Tang et al. 2019). China’s early crude development was built on the sacrifice of the environment. For the financial environment, besides the FIN mentioned above, this paper also employs the loan-to-deposit ratio (FINDL), Local government debt stress (LGD) and accessibility of credit (FIXL) as control variables to represent the financial environment. FINDL employs financial institutions’ loan-to-deposit ratio as a measurement indicator (Wang et al. 2020a, 2020b; Li and Qin, 2024). According to Tian et al. (2024), this study employs the ratio of local government funding gap to regional GDP as a measure of Local Government Debt (LGD) levels. FIXL is measured by the ratio of fixed asset investment loans for municipal utility construction to total loans. For energy intensity, Li (2022) confirmed that energy utilization provided a strong foundation for China’s rapid development, and this entailed environmental pollution. Energy consumption per capita (ENE) and structure of energy consumption (EC) are two key factors describing energy use levels. The ratio of coal consumption to energy consumption reflects EC. ENE means that a higher output level from the same energy input indicates a more efficient use of energy, thus implying a more pronounced “green bias” characteristic. This paper measures energy consumption per capita in terms of GDP per unit of energy consumption. The rise in production and living costs caused by excessive population density (DENS) may also produce a “congestion effect”, which will hinder improvement in productivity. The profit-seeking nature of capital investment leads to its negative externalities. The capital investment is estimated by the perpetual inventory method. CO2 emissions will continue to be produced by infrastructure construction. PROAD is gauged using the per-capita road area.

Data source

The carbon emissions data is collected from the Carbon Emission Accounts & Datasets (CEADs). The OADIC emission data comes from the ODIAC fossil fuel CO2 emissions Dataset. Land transfer data comes from the China Land and Resources Yearbook (2004–2018). Other data are taken from the China City Statistical Yearbook (2004–2018) and the China City Construction Statistical Yearbook (2003–2017). Local yearbook, local government official website, and other channels are supplementary sources of data. The data on urban investment bond (UIB) and land mortgage (LM) is sourced from the Wind database and the Land Market of the Ministry of Land and Resources of China (due to the difficulty in obtaining long-term panel data for urban investment bonds land mortgage issued by local government financing platforms, this paper has conducted expanded analysis using UIB and LM data exclusively). The pricing variables have been deflated using the CPI index (2003 = 100), and the actual foreign investment has been adjusted to the current year’s Yuan price based on the foreign exchange rate. Descriptive statistics of the variables are shown in Table 1.

Empirical results

Spatiotemporal characteristics of CO2 emissions

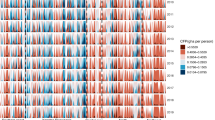

Moran’s values of CE were calculated for the period 2003–2017. P-values are positive and significant (Fig. 5), suggesting that CO2 emissions have an obvious spatial autocorrelation and spillover impact on geographical space. This coincides with the research of Li et al. (2022). The cities with relatively high/low CO2 emissions are confirmed to be clustered together. Specifically, Moran’s I value of CE shows an increasing trend before 2008, meaning that the spatial agglomeration of CE gradually increases during this period. The period between 2009 and 2017 shows a fluctuating trend. After a brief decline in 2009, it began to rise until 2012. China’s economy experienced rapid development in this period. A phase decline occurred from 2012 to 2014, and China began to carry out transformational development reforms. After 2014, Moran’s I value rose slightly and declined in 2016, indicating that CO2 emissions in this period were mainly influenced by regional efforts to reduce emissions. The reduction of CO2 emissions intensity varies widely among regions, resulting in a fluctuating trend in the impact of local CE on surrounding cities.

To understand the spatial clustering more intuitively, Fig. 6 plots the cluster maps using the software ArcGIS 10.8. High–High cluster members are mainly located in Gansu, Shanxi, Guangxi, Hunan, and Jiangxi provinces. Beijing, Tianjin, Tangshan, and other cities have always been in the High–High cluster. It shows that the CO2 emissions in local and adjacent regions are high. Nanning, Lanzhou, Fuzhou, and other cities have always been in the High–Low cluster. It suggests that the local CO2 emissions are high and the CE of adjacent regions is low. Chengde, Weihai, Panjin, Laiwu, and other cities are always in the Low–High cluster, indicating that their CE levels are low and the levels of neighboring cities are high. Jiayuguan, Jiuquan, Zhangye, Lincang, and other cities are always clustering in the Low–Low segment, suggesting that the local CE levels are low and the CE of neighboring cities is also low. Cities with high CE spillover effects are mostly gathered in the northeastern coastal areas, and cities in the western and central provinces show low agglomeration. This feature is stable during the study period, but some cities show heterogeneity. For example, Qinhuangdao changed from the Low-High cluster in 2003 to High–High in 2012. Ganzhou was Low–Low aggregation in 2003 but switched to High–Low in 2012 and 2017. The results indicate that the CO2 emissions levels of these cities have gradually exerted prominent influences on the CO2 emissions of neighboring cities.

From the estimated results, the first conclusion to draw is that CO2 emissions cluster through spatial spillover, meaning that the reduction of CO2 emissions in this region will radiate to surrounding areas through geographic or economic correlation. Second, urban CE exhibits local aggregation characteristics. CO2 emissions show significant regional heterogeneity, Beijing–Tianjin–Hebei and Yangtze-River-Delta in particular, which are more prominent than other areas. Additionally, the economic developments of these two clusters are also most outstanding in China. In addition to adjacent cities affecting the local CO2 emissions, the changes in CO2 emissions will also be affected by other factors. The specific mechanism affecting CO2 emissions needs further in-depth analysis.

Analysis of benchmark regression

The Sargan and AR (2) tests in Table 2 are not significant, indicating that the instrumental variables are appropriately selected and second-order serial autocorrelation is uncorrelated. The result shows that LF significantly increases CE. This is consistent with previous studies (Zhang and Xu, 2017; Wang et al. 2020a). The result also confirms that an increase in land-based investment will elevate CE. It also adds to the proof that the dual land supply strategies exacerbate CO2 emissions. The Main and Wx coefficients of SDM analysis are also shown in Table 2. Main is the local region’s influence on the variable, and Wx refers to the spatial overflow coefficient of the variable in other regions. The coefficients of land-based fiscal revenue and land-based investment under the two spatial weights are significant, providing further confirmation that land-based fiscal revenue and land-based investment promote CO2 emissions. LeSage and Pace (2009) found that the interpretation of SDM regression results focused on the coefficients of direct, indirect, and total (Table 3) rather than Main and Wx coefficients. Overall, the estimated coefficients of GMM and Main in Table 2 are similar. The results are relatively robust.

Other variables, such as FIN, FD, economic structure (PGDP and INDU), energy intensity (ENE and EC) and FIXL have significant positive impacts on CE. FIN has improved enterprises’ access to financing, and the resultant expansion of production scales has ultimately led to increased CE. The impact of financial factors on CE is complex. It can suppress CE through green finance and technological innovation, as well as increase CE through the expansion of carbon-intensive appliances and implementation (Tamazian et al. 2009; Mahalik et al. 2016; Liu and Song, 2022). Some scholars confirmed that FD has both promoting and inhibiting effects on carbon emissions, and promoting green finance is an important path to reduce CE (Tamazian et al. 2009; Mahalik et al. 2016). Under fiscal decentralization, local governments often exhibit a short-sighted tendency to prioritize GDP growth while neglecting green development (Zhong et al. 2019; Chowdhry, 2022). The economic structure is an important factor influencing CE. According to EKC, it may deteriorate environmental quality (Kuznets, 1995; Nathaniel and Adeleye, 2021). The study also confirms the effect of energy intensity on CE, which is consistent with previous studies (Wang et al. 2020a; Li, 2022). The inspection results of FIXL indicate that a higher credit based on fixed asset investments correlates with increased CE. The results also imply that UR has not significantly increased environmental risk. Although some scholars believed that UR increased CE in the long term (Sufyanullah et al. 2022). Of course, some scholars have different views on this. According to Nathaniel and Adeleye (2021), UR has asymmetric effects on the environment in African countries. Sufyanullah et al. (2022) found that CE is related to the level of UR. The reason for such differences is that the UR policy presents different roles and effects in different countries. Following the improvement of the quality of China’s urbanization, the sustainable improvement of UR will be conducive to controlling CE. LGD and CAP have significant negative impacts on CE. This is inconsistent with the researchers’ findings (Dong et al. 2024). Therefore, this paper conducts a regression analysis of individual indicators, and these variables positively affected CE, but the effects became negative after adding control variables. The reason may be that, driven by multiple factors, the financing costs and policy risks associated with the expansion of energy-intensive enterprises have significantly exceeded the costs of green transformation. Local governments tend to support the development of green industries to enhance their creditworthiness, while CAP in green industries is also gradually increasing.

Analysis of spatial spillover effect

Table 3 reports the estimated results of the direct, indirect, and total spillover effects of indicators on CE. The two types of land supply strategies significantly affect local CE and neighboring CE. The direct effects of land-based fiscal revenue and land-based investment are both positive. Zhang and Xu (2017) also found that a 1% increase in LF will raise CE by 0.15% in central China, possibly because the low-cost land-based investment strategies have attracted backward production capacity and high-emission enterprises. A consensus has emerged that land use change largely affects atmospheric carbon content (Arantes et al. 2016; Penazzi et al. 2019; Wang et al. 2020a). However, they do not discuss land supply strategies. Land-based fiscal revenue has promoted the accumulation of capital in the short term, but it has also caused problems such as tight water supply, energy shortages, environmental pollution, and traffic congestion. This has resulted in the unrestricted sprawl of urban space and the encroachment on ecological land, such as arable land and forest land.

For the indirect effect, the results indicate that the demonstration effects exist in inter-regional CE. The coefficient value of land-based fiscal revenue and land-based investment is positive. The results show that local land-based fiscal revenue and land-based investment promote CE in the ambient cities. It is demonstrated that the two land supply strategies have the same demonstration effects on the adjacent areas. Land-based fiscal revenue will provide financial support for local urban development and promote UR. Neighboring districts, under the pressure of development championships, will also compete to adopt land-based fiscal revenue strategies. The consequence of these strategies is an increase in CO2 emissions in nearby areas. This model for attracting investment is likely to result in local industrial agglomeration. Industry is a critical pillar of a country as it has the most prominent impact on environmental quality. The “seeking development with land” model has been instrumental in accelerating economic growth, boosting fiscal revenues, and attracting investments (Wu, 2022, 2023; Feng et al. 2022). Consequently, a competition-driven development paradigm inevitably induces strategic convergence in land supply strategies across local governments. The spatial correlation of local governments’ land supply strategies reveals a significant relationship between economic output and CE across various cities. These land supply strategies both influence local CE levels and generate spillover effects that exacerbate CE in spatially correlated cities.

Regarding the outcome of other variables, the financial environment, economic structure, energy intensity, and other socio-economic variables have significant spatial spillover impacts on CE. Different financial environment indicators affect CE in varying ways. FIN, LGD and FIXL curb local CE, while FINDL promotes local CE. Moreover, FIN, FINDL and LGD have positive indirect impacts on CE in neighboring districts. Financial development helps to swell CE in neighboring regions. Ren et al. (2023) confirmed this. Liu and Song (2022) have put forward different viewpoints. This indicates that the impact of the financial environment on CE is complex and multidimensional. ENE and EC have positive direct spatial impacts on CO2 emissions. This is close to previous studies (Wang et al. 2020a; Nathaniel and Adeleye, 2021). However, their impacts on neighboring regions’ CE differ: ENE increases emissions in adjacent areas, whereas EC reduces CE. The results also demonstrate that the high demand for energy, resources, infrastructure, population and capital for local economic growth will attract the inflow of these elements from neighboring regions. This competitive absorption effect not only leads to local economic growth towards a crude model with high emissions (Li et al. 2022) but also promotes CO2 emissions in spatially connected areas. The results also suggest that the EKC has not yet entered the inflection point during the study period. Meanwhile, UR and ER can effectively reduce local CE. However, their effect on CE in neighboring areas is not significant. These results further illustrate the complexity of carbon neutralization, which requires the key theory and technology of a multi-scale model combined with the natural social–economic system.

Robustness test

The endogeneity bias may originate from reverse causality. In view of this, this article adopts Barro’s (2000) method for the reverse causality test. Dividing the data from 2003 to 2017 into 5 groups based on 3 consecutive years. The explained variables are the three-period averages of each dataset, and the core explanatory variables use the initial values of each dataset. The treatment methods of control variables are consistent (see Table 4). The estimated coefficients on the core variables are generally consistent with the previous estimates. It indicates that the core explanatory variables of this paper are not endogenous variables in the model.

The replacement of core variables is also employed for robustness tests. The land supply strategies and CO2 Emissions were removed, and CE was replaced with the emission data of calculated Fossil fuel (Table 5). Furthermore, LG and LS were adopted as alternative measurements of LI and LF, respectively (Table 6). The results support the previous analysis and contradict the findings of the earlier estimations. It means that compared to the land transferred area, the CE of nearby regions is more significantly impacted by the land transferred amount. The impact of the amount on local governments is relatively greater than that of the transfer area. Essentially, the scope of the land transfer fee is broader, but the land transfer area is limited by geographical location.

Heterogeneity test

Tests of heterogeneity in geographical locations were conducted. Tables 7–9 show the spatial effects of land supply strategies on CE in terms of geographical location, city size, and urban resource dependence in all three cases. 284 cities are divided into three groups according to their geographical locations: eastern, central, and western China. Similarly, SDM is chosen for further analysis (Table 7). For the eastern region, it exacerbates CE through LF significantly. In the central region, the indirect effect of LF on CE is positive and significant, and the total effect is the same. However, in the less economically developed western regions, the effect of LF on CE presents an opposite trend. Local governments in the western cities have been committed to the governance of environmental issues, and the land transfer incomes have been increasingly used in environmental protection expenditure. The impact of LI on CE varies greatly among regions. In the eastern and central cities, land-based investment negatively affects CE spatially, suggesting that land-based investment in these regions will not result in a decline in ecological quality. The results show that it is easier to attract high-quality investment in the eastern and central regions. On the contrary, it is harder to attract high-quality investment in the western region. The hard introduction of investment in the West is a cause of ecological degradation.

Tests of heterogeneity in city size. According to the “Ranking of the Attractiveness of Cities for Business in 2021”, 284 cities were divided into five categories: first-tier, second-tier, third-tier, fourth-tier, and fifth-tier. Table 8 shows the spatial effect results of land supply strategies on CE in the five regions. Notably, the direct coefficient values of LF are positive in all cities. The indirect coefficient values of LF are positive, except for those in the third and fourth-tier cities. It shows that the spatial spillover effect of LF varies significantly among city levels. The impacts of LI on CE vary in different regions. The direct effects of the LI are negative in higher-tier cities (first to third tier) but positive in lower-tier cities (fourth and fifth tier). This indicates that underdeveloped cities may relax environmental regulations to attract investment, resulting in an increase in local CE. The direct effects of the LI are negative in second-tier and fifth-tier cities, while they are positive in other cities. Implying that different cities and regions in China may have varying preferences for land-based investment. And the impact of land-based investment on CE in nearby regions also varies.

Tests of heterogeneity in urban resource dependence. Following the “National Sustainable Development Plan for Resource-based Cities (2013–2020)”, 284 cities were separated into two categories: resource-based cities and non-resource-based cities. The results are reported in Table 9. The direct effects of LF on CE are positive in both categories. The indirect effect of LF shows statistically significant variation between the two regions. The results show that LF directly promotes local CO2 emissions, and it also accelerates the CO2 emissions of surrounding cities in resource-based cities. However, LF shows an increasing trend in CO2 emissions from neighboring non-resource-based cities, while the impact is not significant. In general, resource-based cities are more considerate of land development, and the resources contained in these cities have made a huge contribution to the local economy (Qiu et al. 2021). For land-based investment, Table 9 shows that its direct effect is more significant than its indirect effect in terms of both dimensions. Implying that land-based investment in each region is stronger for local emissions than for neighboring regions.

Intermediation effect test

The intermediary effect of land supply strategies is reported in Tables 10 and 11. The effect of LF on the mediating variable FD is tested in column (1). The estimated result remains robust after adding control variables in column (3). It confirms that the FD will significantly increase LF. The mediating variable, FD, is added in columns (2) and (4). The Sobel test value and indirect effect are significant, indicating that LF can significantly increase CE through FD. According to the theory of FD, the tightening of funding restrictions motivates municipal governments to sell land at high prices to alleviate financial pressure (Liu and Lin, 2014; Wang et al. 2020a). However, local governments will increase investment in infrastructure rather than environmental governance (Liu et al. 2016). Columns (5)–(8) test the impact of LF on CE through UR, and the result confirms that LF can significantly increase CE through UR. Columns (6) and (8) test the correlation between UR and CE. Its coefficient values are 0.008 and 0.006. The coefficients of the Sobel–Goodman test and indirect effect are significantly positive, suggesting that UR positively moderates the effect of LF on CE. The results of columns (9)–(12) show that the Sobel–Goodman tests are insignificant, suggesting that ER cannot fully address the detrimental impact of LF on CE. Previous studies have confirmed that ER can directly inhibit CE; however, its effect is weakened by the intervention of other factors. Local governments will pursue fiscal expansion in LF to make up for the loss of economic benefits brought by ER. The endeavors for short-term profits by city managers greatly affect the strict implementation of ER. The long-term nature of structural transformation and the bottleneck of economic development pose challenges to environmental protection. The endeavors of short-term profits by city managers greatly undermine the strict implementation of ER. Columns (13)–(16) test the impact of LF on CE through FIN, and the result confirms that FIN significantly contributes to the increase in CE resulting from LF. It is likely that municipal authorities boost land values by supplying residential/commercial land at high prices. The rise in land value provides a guarantee for utilizing financial instruments to secure funding for urban development (Chen et al. 2020a, 2020b; Chen and Wu, 2022; Wu, 2022, 2023). Under the influence of local government development preferences, financial resources mainly flow into the real estate and infrastructure sectors, thereby constricting the funding available for green technology progress and green industries. Given this evidence, LF strengthens the support of FIN for traditional industries, ultimately inducing a sustained increase in CE. Perhaps due to the stable credit guarantee provided by LF for the financial system, it has led to a large-scale flow of bank credit to traditional high-carbon industries.

The intermediary effect of land-based investment is reported in Table 11. The Sobel–Goodman tests and indirect effects in columns (1) and (2) are significant, confirming that land-based investment can alleviate CE through FD. The coefficient value became insignificant after adding control variables in columns (3) and (4). Local governments need more revenue to meet public expenditure under the FD. The introduction of a large number of enterprises means more tax revenue. Enterprises can reduce costs by obtaining land at a lower cost. During this process, it may cause environmental pollution issues (Lan et al. 2023). The results in columns (5)–(8) show that UR brings about the improvement of infrastructure and the gathering of capital and talent. It means that the land cost will be higher. The coefficients of the Sobel–Goodman tests and indirect effect are significantly positive in columns (9)–(12), suggesting that ER positively moderates the effect of land-based investment on CE. Becker et al. (2013) found that ER might gain production costs and reduce the competitiveness of firms that are reluctant to control emissions. Local governments depend on introducing investment to boost their competitiveness in the development competition. They believe that it is preferable to benefit from the other regions where CO2 emissions control measures are implemented, rather than invest significant effort in environmental management. For FIN, the Sobel–Goodman test and the coefficients of indirect effects are not significant in columns (13) and (14). Indicating that pure financial development has failed to effectively establish a transmission mechanism for CE reduction; however, after introducing control variables in columns (15) and (16), the effect becomes significant, revealing that this transmission path has significant conditional dependence. This result indicates that financial development must create synergies with other variables to effectively encourage the low-carbon transformation of LI.

Expanded analysis

The financial system plays a fundamental role in the allocation of resources for economic development. However, structural flaws continue to exist in China’s financial market, especially the deep intervention of local governments in economic development through land finance, credit allocation, and other means. Land-based fiscal revenue and land-based investment have distorted the linkage between land supply and the financial market. Disrupting the allocation of financial resources through land supply strategies. The governments use land as a tool for financing platform companies to obtain bank loans, trust loans, issue urban investment bonds and financing through shadow banking (Chen et al. 2020b; Wu, 2022; Feng et al. 2022). The main sources and destinations of funds for LGFVs are shown in Fig. 7. Local governments have implemented unprecedented stimulus measures through various financing platforms to secure substantial construction funds. By leveraging land assets, they integrate these into financing platform companies to enhance their debt financing capacity. This strategy involves using land use rights as collateral for bank loans. And the anticipated land-transfer revenues enable the issuance of urban construction bonds with implicit fiscal guarantees. However, these practices have led to a continuous increase in debt levels and leverage. The central government restricted formal credit channels to mitigate local debt risks, compelling local governments to seek shadow banking for financing (Chen et al. 2020b; Wu, 2023; Zhang and Tsai, 2024). Local governments rely on shadow banking to access diverse funding sources, such as credit products, wealth management products, and Public–Private Partnership instruments. These funds are predominantly allocated to urban construction and infrastructure development, while a portion is directed toward loan repayments and industry subsidies. However, this financing model often conceals the underlying risks of ecological degradation, which may exacerbate environmental challenges over time.

Based on this, considering that different cities and regions in China may have different preferences for financing channels, the choice of financing channels is related to other urban characteristics that may affect CO2 emissions. Based on the availability of data, this article utilizes UIB and LM as indicators of land-based investment activities in the secondary land market. By prioritizing the upgrading of urban infrastructure, this financing approach significantly affects CO₂ emissions. Due to the varying preferences for financing channels among different regions, substantial data loss may occur. The lack of long-term panel data on UIB and LM poses significant limitations for empirical testing, especially in terms of spatial correlation analysis, which requires rigorous panel data requirements. The dynamic panel model can simultaneously account for the differences among individuals (cross-sectional dimension) and the changes in individuals over time (temporal dimension), and the system GMM model is used for evaluation. This paper uses UIB and LM as proxies for land finance investment to further analyze the impact of Land finance via LGFVs on CO2 emissions. Correspondingly, the issuance number of urban investment bonds (NUIB), the scale of urban investment bonds (UIB), and the ratio of UIB to GDP (RUIB) refer to urban investment bonds, while the amount (LML) and area (LMA) of land mortgage loans pertain to land mortgages. The regression results are shown in Table 12. It is observable that UIB and NUIB significantly affect CE. Implying that the practice of injecting land into LGFVs to raise funds for municipal projects exacerbates carbon emissions in cities. The LML and LMA coefficients are also significantly positive. These findings further corroborate that there are substantial environmental risks inherent in the local governments’ pursuit of development through land utilization.

Under the auspices of the urban development championship, local governments utilize land to primarily generate funds for urban development and construction projects. Following the launch of the four trillion economic stimulus plans, this initiative targets key infrastructure sectors, such as construction, electricity, gas, railways, and highways. Investments in real estate and infrastructure have become the primary drivers of economic development. This growth model highly relies on land mortgage financing. Local governments have implemented unprecedented stimulus measures through various financing platforms, resulting in substantial bank loans. The efficient land financing model has become a crucial support mechanism for China to achieve rapid economic growth and capital accumulation, providing land security and funding sources for local governments to promote industrialization and urbanization. However, while heavy industry sectors, such as steel and cement, which are linked to real estate and infrastructure, have experienced rapid development, the risk of ecological degradation is also on the rise. The funds obtained by local governments through financing platforms are primarily allocated for the construction of various projects, with a substantial portion invested in energy-intensive, carbon-heavy industries. Meanwhile, infrastructure projects undertaken by local government departments are facing looser environmental regulations, which may lead to significant negative impacts on urban CO2 emissions.

In addition to the previously mentioned land mortgage loans and urban investment bonds, local governments also utilize a range of multi-channel financing options, including silver banks (Chen et al. 2020b; Wu, 2022, 2023; Zhang and Tsai, 2024). After the launch of the 4 trillion Yuan economic stimulus plan, the central government allocated a budget of 1 trillion Yuan, leaving a financing gap of 3 trillion Yuan for local governments to cover. The total land transfer revenue from 2009 to 2010 was 4.46 trillion Yuan, while the net land income, after deducting land development costs, amounted to 1.34 trillion Yuan. Local governments need to secure 1.66 trillion yuan from alternative funding sources. If bank loans are further deducted, there will be fewer funds available for local governments to allocate. With the issuance of Document 631 by the Ministry of Finance in 2009, local governments are permitted to borrow funds through financing platforms. Local governments have initiated large-scale urban development projects funded by local financing platforms. However, due to the substantial existing debt, these governments are under significant debt rollover pressures (Chen et al. 2020b; Wu, 2022, 2023; Zhang and Tsai, 2024). Debt risks of local governments in some regions have started to emerge (Cong et al. 2019). Thus, in 2014, the State Council issued Document No. 43 to strengthen supervision of local financing platforms, allowing local governments to issue bonds to repay bank loans, carry out debt replacement plans, and restrict bank borrowing by LGFVs. However, local governments still face enormous debt rollover pressures, which drive highly leveraged local financing platforms to turn to shadow banking. Wu (2022), Chen et al. (2020b), Zhang and Tsai (2024) and others have provided a detailed discussion on this issue. Due to the regulatory evasion of the shadow banking system and hidden local debts, there is limited panel data available on the shadow financing activities of local government financing platforms. Therefore, only a textual discussion will be provided here. Most of the local government financing comes from trust loans and wealth management products (Chen et al. 2020b; Zhang and Tsai, 2024). According to data from the China Trustees Association, the government-trust cooperation sector has more than tripled since 2010, reaching over 1 trillion Yuan in 2014 and surpassing 1.4 trillion Yuan in early 2016. However, according to the CTA Trust Asset Report (Fig. 8), this figure may be underestimated. There is a category for infrastructure in the report, and it can be observed that the infrastructure data has climbed annually from 1 trillion Yuan to over 3 trillion Yuan in 2017. From 2010 to 2017, the scale of trust assets allocated to real estate surged 4.7 times, and there was a significant increase in both categories of data. Although direct official data is unavailable, scholars estimate that urban investment bonds account for a significant portion of the growing bond holdings in shadow financial products. According to Chen et al. (2020b), the share of urban investment bonds purchased through wealth management products rose from 38.9% in 2014 to 61.5% in 2016. 27% of the underlying assets in wealth management products originate from the real estate and construction industries (Bell and Feng, 2022; Zhang and Tsai, 2024). Further evidence indicates that the funds raised by local governments through shadow banking are primarily allocated to urban infrastructure construction (Chen et al. 2020b; Bell and Feng, 2022; Zhang and Tsai, 2024), which is a highly energy-consuming sector. Existing analysis demonstrates that local governments employ diverse mechanisms to attract investment through land, utilizing urban state-owned land use rights as a core asset. Variations in the direction and intensity of national policy interventions have led local governments to adapt their financing strategies over time. Nevertheless, urban construction remains the central focus across all financing approaches. This pattern has significant implications, particularly in exacerbating urban carbon emissions.

These findings confirm that local government land supply strategies, which are deeply involved in resource allocation within the financial market, have resulted in multiple distortion effects. Firstly, local governments allocate land resources excessively to industries that can bring rapid GDP and tax returns, aiming at short-term economic output and financial revenue, such as real estate and heavy industry, which are carbon-intensive. This practice provides implicit support for traditional industries. Secondly, concerning the allocation of financial resources, local governments leverage land to obtain financing through bank loans, local government bonds, urban investment bonds, and trust loans. This strategy directs a substantial influx of funds from financial institutions into sectors such as industrial park development, urban infrastructure projects, and public utility services. Consequently, this approach diverts financial resources that should be allocated to supporting green technology innovation and the transition to low-carbon industries. Otherwise, this land supply strategies also distort price signals, with low prices for industrial land and high prices for commercial/residential land as implicit guarantees. The price difference structure formed by the low price of industrial land and the high price of commercial/residential land essentially distorts the resource allocation mechanism, rendering it challenging for the market to authentically reflect environmental costs, and weakening the financial system’s ability to guide emissions reductions through price mechanisms.

Discussion

Comparison with previous studies, this article reveals complex connections between land supply strategies and CO2 emissions in China, highlighting how urbanization, environmental regulation, financial development, and fiscal decentralization interact with land supply strategies to affect CO2 emissions. This study confirms that the accumulated ecological hazards of China’s dual land supply strategies are beginning to emerge. Several academics have confirmed the risk of contamination associated with land supply (Du and Li, 2021; Hu et al. 2022). However, their researches only consider industrial land or focuses on the total price or land supply mechanism. The effects of dual land supply strategies, considering multiple constraints and the complex formation background, on carbon emissions are still unclear. In this sense, this research provides insights into measuring dual land supply strategies based on different approaches to pricing and quantity in land supply. It is noteworthy that the spatial effect of land-based fiscal revenue on CO2 emissions is more robust than land-based investment. The acceleration in land-based fiscal revenue promotes the CO2 emissions of both local regions and their spatially correlated regions. Moreover, this paper also confirms that land-based fiscal revenue has a more robust promoting effect on CO2 emissions in nearby areas. Local governments face greater development pressure, and there are competition effects, demonstration effects, and economic correlation effects among cities. This competitive effect leads to high demand for energy, resources, infrastructure, population, and capital, which will encourage these elements to flow in from neighboring areas, leading to local economic growth towards a crude model with high CO2 emissions (Li et al. 2022). Meanwhile, the real purpose of local governments is to generate taxes, employment, and economic growth from land-based investment, which may lead local governments to adopt a more relaxed attitude on environmental supervision and regulation for high-energy-consumption enterprises (Hu et al. 2023). The expanded analysis further confirms that the practice of local governments using land to secure construction funds poses significant hidden ecological risks. The rapid urbanization and structural change fueled by land have resulted in miraculous growth in China. Nonetheless, with the accumulation of potential problems in the “seeking development with land” model, the effectiveness of promoting development by land has declined, and unsustainability has emerged. In the long term, China’s economic development model needs to be driven by technology and technological progress rather than relying on resources.

This study proves that the effectiveness of land supply strategies varies among cities based on their different geographical location, sizes, and levels of resource dependence. Especially for land-based investment, its heterogeneous effects are even more pronounced. Land-based investment in more developed cities, such as eastern areas, central areas and first, second, and third-tier cities, suppresses CO2 emissions. It has a suppressive effect on CE in neighboring areas. Cities with better economic development have both locational advantages and agglomeration effects, which are more attractive to high-quality companies. The well-developed cities provide better conditions for sustained industrial development. Local governments in these cities have discarded projects that degrade environmental quality when they attract investment. However, the western area and underdeveloped cities do not have these advantages. They can only introduce high-emission and low-efficiency companies by lowering entry barriers and adopting lower-land-price policies (Hu et al. 2023). Moreover, small cities have sufficient land supply indicators, and high-energy-consuming industries are more inclined to migrate to western and underdeveloped cities, thereby exacerbating the emissions in these cities.