Abstract

Communities respond to flooding events based upon risk perceptions and available adaptive behaviors (e.g., emigrating, purchasing insurance, constructing levees). Across the United States, sea level rise, intensifying storm-surges, and extreme rainfall may alter human-flood dynamics. Here, we use calibrated Socio-Environmental models of contiguous US coastal census tracts and two shared socio-economic pathways (SSP245 and SSP585). We project that by 2100, total flood insurance claims will increase by +25% to +130% under low (SSP245) and high (SSP585) emissions scenarios, respectively. The increase in flood insurance claims will impact mainly socially vulnerable communities. Further, we project that active NFIP policies will increase from +30% under low emission scenario to +60% under high emission scenario. Our finding also suggests the growing debt of the National Flood Insurance Program under higher emissions. Raising the water elevation threshold for coastal flooding by +1 meter via levees may reduce future surge-related losses by 95% and 40% under low and high emission scenarios and stabilize housing markets. Our future projections of flood insurance claims, policy coverage, and the impact of water elevation serve as credible hypotheses for the evolution of human flood dynamics under climate change. They can inform national flood policy and future research.

Similar content being viewed by others

Introduction

Coastal human-flood systems are shaped by dynamic and complex relationships between environmental hazards, policy decisions, perceptions of individuals, and housing markets1. Flooding is the costliest and most widely experienced natural disaster in the US2,3 and globally4,5. The frequency and magnitude of coastal flood inundation events in the US has risen sharply in recent decades, a trend likely to accelerate6,7,8,9. Projections of sea level rise (SLR) alone suggest that a 1.8 m rise in mean sea water elevations could result in 2% of the current US housing market ($882 billion USD in 2017) being underwater by 210010. Homeownership is central to social welfare in America. In the context of a relatively weak social safety net, buying a home–importantly, one that increases in value year after year–is how Americans build wealth and ensure the economic security of their families. Many local communities also depend on value-assessed property taxes to generate public revenue, especially in contexts where there are no or low income taxes in place. As the 2007–8 financial crisis made dramatically clear, the US housing market is a critical component of the national and global economy. Climate impacts escalating coastal flooding risks pose a significant threat to the US national and global financial systems11,12,13, necessitating credible predictions of human-flood co-evolution under climate change.

Approximately 42% of the contiguous United States (CONUS) population lives in coastal areas, which account for less than 10% of the total land area14. The US National Flood Insurance Program (NFIP) has functioned since 1968 to transfer some risk from flood-exposed homeowners to the broader US tax base, with the long-term goal of reducing the nation’s systemic risk by attempting to disincentivize building and rebuilding in floodplains, and requiring specific construction standards for new flood exposed development15. However, in many cases, individuals are not legally mandated to participate in the NFIP, and most homeowners in coastal tracts are uninsured against flood damage (90% across coastal CONUS census tracts)16,17. Annual NFIP claims from coastal tracts fluctuate substantially due to the high temporal stochasticity of extreme weather events, coupled with their capacity to impact many homeowners simultaneously18. Over the past four decades, claims have outpaced premiums collected on policies, putting the NFIP in a financially tenuous position19,20 and prompting unsuccessful attempts at reform21,22,23. Present legislative proposals avoid fiscal reform that would make the program financially self-sustaining in favor of increasing the NFIP borrowing limit and eliminating interest payments on future NFIP debt, supported by measures to increase future NFIP participation24. FEMA launched a new rating methodology in 2022, called “Risk Rating 2.0”, which bases premiums on an individual property’s specific flood risk, rather than on a general risk category defined by location and property type.

A challenge to increasing NFIP participation is that flood risk across the US is disproportionately experienced by socially vulnerable groups25,26. Participation in NFIP and its associated program the Community Rating System, which sets community wide rates for flood insurance, is highly uneven across individuals and communities, often due to the intersectional nature of social vulnerability (SV) and environmental hazards27,28,29,30. Intensifying coastal flooding hazards could exacerbate these current inequalities in flood risk, putting socially vulnerable communities in even more tenuous positions arising from disproportionate shifts in their exposure (i.e., increased populations and properties in flood-prone neighborhoods with deficient infrastructure) and vulnerability (i.e., decreased capacity to emigrate or cover losses through insurance). Given current policy proposals to increase the NFIP debt, and observed socio-economic barriers to mitigating flood risks, we require robust predictions of future flood losses, NFIP participation levels, the volatility of the housing market, and emigration from coastal areas.

We studied human-flood dynamics across 1124 CONUS coastal tracts with an established socio-environmental (SE) modeling approach31,32,33,34,35 to quantify feedbacks between coastal hazards (high water elevations and intense rainfall), economic loss, mean home values (HVs), NFIP policy uptake, and population density. SE models were calibrated with Open FEMA claims and policies36, US census population density37, and US census median tract-level HVs38. First, we explored how hazard thresholds for flood losses, risk behavior, and housing market responses to historical flooding varied by region (i.e., Pacific, Gulf, and Atlantic coasts) and across measures of SV defined by CDC/ATSDR39. We then used two climate change scenarios based upon Shared Socioeconomic Pathways (SSP): SSP245 & SSP585, to predict how changing hazards (i.e., SLR, land subsidence, intensifying storm-surge, and extreme rainfall) will cascade into changes in human-flood relationships across CONUS tracts. Finally, we evaluated the potential to offset future risks via increased thresholds for coastal high water elevation flooding (i.e., construction of levees to eliminate tidal and storm surge inundation) to predict the limits of capital investments as a mitigation option.

Results

Regional and demographic variations in human-flood dynamics

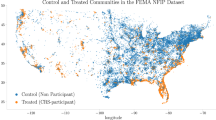

SE models of human-flood dynamics (Supplementary Note 1, Fig. S1a, b) that predict annual NFIP claims, active NFIP policies, population density, and HVs from annual peak water surface elevations and maximum daily precipitation were validated for 1124 coastal CONUS census tracts (72% of tracts with sufficient data) (Fig. 1a) with publicly available datasets (Supplementary Note 2, Table S1, Figs. S2, S3). This calibration exercise yielded census-tract level estimates of the critical thresholds at which NFIP claims are generated for peak water elevations (S) and rainfall (R), the over-threshold hazard to NFIP claims ratio (βR), as well as parameters describing temporal changes in HV (b1, b2, b3, d), awareness (ɑA, μA), preparedness (ɑP, μP), and population density (ɑD, U) in response to NFIP claim events.

a Study region (b) Distribution of calibrated parameter values and exogenous variables (U[Urbanization], R[Rain threshold], S[Surge threshold]) across CONUS coasts, categorized into quartiles (0–25th, 25–50th, 50–75th, 75–100th). b2, b3, d, & b1 are housing parameters representing immediate drop in housing value after flood, sustained decline in following years, duration until the impact of flooding subside, and rate at which housing value rises in no-impact years respectively. ɑa & μa are flood insurance participation parameters indicating rise in participation due to flood and gradual lapse rate in subsequent years. ɑd is the risk attitude parameter representing the impact of flood in settlement density. c Correlation plot between model parameters and measures of social vulnerability for the entire CONUS coastline. Significance level are measured at P < 0.05(*), P < 0.01(**), and P < 0.001(***) using Spearman’s Ranked correlation.

This calibration revealed strong regional variations in human-flood behaviors during the calibration period (1970–2021) (Fig. 1b). SE model calibration metrics and their relationships to validation datasets are discussed in Supplementary Note 3 (Figs. S4–S7). The Pacific coastal housing market showed larger and more sustained negative impacts of flooding events on both HVs (b2, b3, d; parameters describing median HV responses to flooding) and NFIP policy uptake (ɑa, μa; parameters describing NFIP policy uptake responses to flooding) than the Gulf or Atlantic regions, but also a higher threshold for coastal flooding hazards (S) (Fig. 1b). The Pacific coast exhibited a slower ambient population density growth rate (U; the growth rate in years when flooding has no impact) but a larger fluctuation in density (ɑD; parameter describing density responses to flooding) after floods. In contrast, tracts along the Atlantic and Gulf coasts exhibited less potential for fluctuations in HVs and NFIP participation, but likely more exposure to loss events (Fig. 1b).

Across the CONUS, there were consistent and significant correlations between SV metrics and SE model parameters describing human-flood dynamics (Fig. 1c; S8–S14). SV metrics are 16 US Census variables used by CDC/ATSDR39 to identify communities at risk according to their capacity to withstand and recover from stressors such as flooding hazards. Decreases in HV immediately after flood loss events (b2) were positively correlated with SV measures related with older populations, and more residents in group quarters, indicating that communities with more elderly residents and group quarters experience more pronounced decreases in median HVs immediately after flood. Communities with older populations also showed a slower rate of HV growth during flood-free periods (b1). Further, a positive correlation observed between SV measures and housing market recovery duration (d), suggested that median HVs in vulnerable communities required more time to rebound from floods. The positive correlation between changes in population density post-flood (ɑD) and SV measures indicated that vulnerable communities experience greater fluctuations in population density following flooding events. Additionally, more socially vulnerable demographic exhibited significantly smaller increases in NFIP policy uptake immediately following flood events (ɑA) and more rapid NFIP policy lapse rate in non-flood years (μA) with the exception of the group “age 65 and older.” State-level correlations with SV metrics are presented in Fig. S15.

Human-flood dynamics under future coastal flooding regimes

We predicted future tract-level flooding claims, active NFIP policies, housing densities, and median HVs using projections of future coastal peak water surface elevations (accounting for changes in the mean sea level, land subsidence, tidal fluctuations, and storm-surge) and future rainfall intensities (Table S3) with SE models calibrated to past conditions to understand how shifting environmental hazards might influence human-flood dynamics. Here and elsewhere, SSP245 & SSP585 scenarios refer to annual water surface elevations estimated by adding generated storm-surges and tides on top of mean SLR projections for SSP245 & SSP585, along with annual maxima daily precipitation estimates for SSP245 & SSP585. Time series of both historical and predicted loss (Fig. S18), NFIP policies (Fig. S19), housing density (Fig. S20), and median HVs (Fig. S21) for each state are presented in Supplementary Note 5.

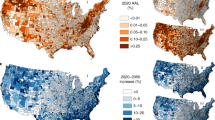

The SE models predicted increases in NFIP claims across all states with the exception of Texas. SE models for Texas predicted sharp declines in coastal population density due to SLR inundating coastal areas (and therefore a corresponding decline in NFIP claims) likely due to observed historical patterns in density following several flood events (Hurricane Ike 2008; Hurricane Harvey, 2017)40,41,42 (Figs. S18, S20). Our modeling suggested that the largest increases in NFIP claims are anticipated across the Atlantic coast (North Carolina, New Jersey, South Carolina, New York, Florida, Virginia, Maryland) (Fig. 2a, b) likely driven by Atlantic basin tropical storm landfalls43. We predicted that NFIP claims originating from coastal tracts across CONUS will increase between 25% (SSP245) and 130% (SSP585) above historical levels (1979–2021) (Figs. 2b, S22b). In parallel with rising claims, the SE models predict only modest increases in the number of properties covered by NFIP from 10% in the historical period to 13% (SSP245) and 16% (SSP585) by 2100 (Figs. 2c, S22c), though we note that regional variations in model parameters suggest that the ratio of policies to anticipated loss varies substantially by state (Figs. 2d, S22d).

a Map showing the predicted cumulative flood loss for 2021–2100 across the coastal CONUS census tracts under climate change emission scenario SSP585. b Average annual flood loss claims expressed as a percentage of housing value across the CONUS coast for the observed period, projected under SSP585 until mid-century (2021–2050), and until the end of the century (2051–2100). c same as (b) for annual average flood insurance policy purchases expressed as a percentage of housing units (d) ratio of (b) and (c). The error bar represents standard error.

We classified CONUS coastal communities in three SV bins (High, Med, Low) (Fig. S16) and analyzed shifts in human-flood dynamics among these bins under climate change scenarios. Under scenario SSP585, SE models predicted that total cumulative flood losses would likely increase linearly for all SV groups from 2021 through 2100, with the most socially vulnerable tracts experiencing approximately 55% more cumulative loss than low SVI tracts (Fig. 3a). Despite high SVI tracts experiencing disproportionately more economic loss, we predicted that NFIP policy uptake will increase more slowly in these tracts than in low SVI tracts, suggesting a growing insurance coverage gap (Fig. 3b). Under SSP245, the relationship of SV with losses and policy uptake persists, but with lower total losses experienced by all groups (Fig. S23a, b).

a Cumulative average flood loss for three different social vulnerability groups (Low SVI, Med SVI, & High SVI) across coastal CONUS census tracts under shared socio-economic pathway SSP585. Linetype;dashed, dotted, & solid depicts median values across Low SVI, Med SVI, & High SVI respectively. Line color;gray & red represents historical and projected estimates respectively. Shading represents 5 to 95 percentile distribution for each social vulnerability group across all models. b Same as a for median active policies with shading depicting 25 to 75 percentile distribution. c same as (b) for housing density. d same as (b) for housing value. The difference between the projected estimates for each vulnerability group is tested with Mann–Whitney U test with significance level measured at P < 0.001(***), P > 0.05 (ns).

Our models (calibrated to past loss events where housing density was observed to remain stable) project that the CONUS coastline, despite increasing claims (Fig. 3a), will exhibit minimal changes in population density (Fig. 3c) except for sustained decline observed in Texas and South Carolina (Fig. S20) likely attributable to sea level rise and land subsidence. Under scenario SSP585, the SE models predicted that coastal housing markets will be substantially negatively impacted evenly across all SV groups beginning around 2065 (Fig. 3d). We note that the average CONUS decline is largely attributable to market declines in several Atlantic coast states (Fig. S21). The decrease in HVs is driven largely by slight increases to surge elevations on top of steadily increasing mean sea level, echoing predictions that SLR and land subsidence together will inundate a substantial portion of the present housing stock10,44. Under SSP245, we predicted a limited impact of flooding on HVs (Fig. S23d).

Effect of increasing storm-surge thresholds on projected flood risk

Under present conditions, 20% (SSP245) to 55% (SSP585) of total NFIP claims by 2100 will be attributable to high coastal water elevation events (Fig. 4a). Raising the coastal water elevation threshold for all CONUS tracts by +1 m (above the estimated current levels of protection for each census tract) reduced surge-associated losses to 1% (SSP245) to 33% (SSP585) of total NFIP claims (Fig. 4a) and negated the sustained impacts of flooding on HVs (Fig. 4d). Disconnection of communities from frequent losses attributable to high water elevations will likely result in limited NFIP policy growth (Fig. 4b). Residents may, accurately or not, understand themselves to be at lower risk of flooding.

a Projected cumulative average flood loss for CONUS coastal census tracts for 2021–2100 under shared socio-economic pathways; SSP245 & SSP585 for modeled surge threshold (water elevation threshold) and increment of 1, 2, & ∞ m respectively. Shading depicts 5th to 95th percentile distribution across all models. b same as (a) for median active policy with shading depicting 25th to 75th percentile distribution. c same as (b) for housing density (d) same as (b) for housing value. Rows represent the current surge thresholds, +1 m, + 2 m, and +∞ m (i.e., no surge losses).

Discussion

Human-flood dynamics under present and future coastal flooding regimes

Our analysis of historical data on the NFIP and the housing market revealed significant regional and demographic disparities in human-flood dynamics across the coastal CONUS. Our projections serve as credible hypotheses for the evolution of human-flood systems under climate change. We predict further economic burden on the NFIP and destabilization of the coastal housing market. We predict that these changes will disproportionately negatively affect the most socially vulnerable communities.

The observed historical resilience of the housing market and stability of NFIP participation within the Atlantic and Gulf Coast (Figs. 1, 2) suggested a “risk enduring”32 characteristic of these communities possibly due to more frequent flooding45,46 and lower water elevation thresholds for flooding than the Pacific Coast (Fig. 1b). Our finding agrees with prior studies that showed an increase in built environment exposure in regions with currently elevated coastal risks across the CONUS47,48. In addition, we observed larger impacts of flooding losses on both population (ɑD) and HVs (b2, b3, d) change in these high-exposure regions (Fig. 1b). We observed steady increases in coastal population density across CONUS despite historical flood loss events31 has led some to hypothesize that risk perception has been decoupled from actual and increasing coastal hazards49,50. The high projected losses in North Carolina (Fig. 2b) possibly reflect the policy uncertainty surrounding the use of SLR in development decisions51.

The SE projections suggested that the gap between NFIP claims paid and the uptake of NFIP policies held will continue to widen (Figs. 2d, S22d), likely exacerbating NFIP debt. There will continue to be a shortfall of policyholders paying premiums into the program to meet the outgoing liabilities. Stronger interventions will likely be required to close the insurance coverage gap52. Issues in NFIP affordability53,54,55 are clear in historical OpenFEMA records and are subsequently encoded in the SE model through calibration. Correlations between SV and SE parameters describing NFIP uptake (Fig. 1c) may reflect that these policies, where actuarially rated or modulated by the community rating system27, are likely to be relatively more expensive, given the exposure to flood risk, and are thereby difficult to buy and maintain on relatively constrained resources. The pattern of a small immediate rise in policy purchases post-flood by more socially vulnerable demographics followed by a larger decline in subsequent years, coupled with greater fluctuations in population density can be linked with the barriers to insurance purchases stemming from NFIP affordability53,54,55 concerns and the inequitable distribution of resources for disaster mitigation and recovery for these disadvantaged groups56,57,58.

Changes to NFIP such as Risk Rating 2.0 could exacerbate the affordability issue. Policies across the program, including those that previously benefited from subsidization or rate grandfathering, may move in an actuarial direction (subject to statutory limits on yearly rate increases) in the context of generally increasing flood risks. It is hard to know how Risk Rating 2.0 will impact the overall fiscal health of the NFIP. Where possible to do so, people may indeed drop policies that get too expensive. FEMA hopes Risk Rating 2.0 will have the opposite effect and will shrink the insurance coverage gap–not only by expanding risk assessment and pricing beyond flood zones, but also by creating more opportunity for private flood insurers to compete for NFIP business, increasing the options available to consumers. But if those private insurers pick off the “best” risks and leave the “worst” ones to the public program, this could further strain the NFIP.

We note that our SE modeling approach separates immediate damages to properties from indirect effects such as a sustained decline in HVs59 (Fig. S1). If a property is insured, direct damages may be covered by NFIP, however, the sustained decline in HV could remain unaddressed. Such a decline might limit homeowner capacity to relocate by discouraging prospective buyers, or forcing sellers to sell at a loss or with too small a return to purchase safer housing elsewhere60,61,62. Indirect losses are often obscure and are derived from the community’s perception of risk, memory of past flooding, access to flood insurance, and SV status among other factors31,63.

Effect of increasing storm-surge thresholds on projected flood risk

Given widely accepted projections of SLR and land subsidence9,64,65, increasing losses attributable to high water elevations6,7,8, and limited historical NFIP reforms21,22,23, it is likely that capital projects currently proposed in several US regions (e.g., levees) may be increasingly explored as viable options for flood risk mitigation, under the open assumption that they reduce systemic risk66,67,68,69. The predicted stabilizing effect of levees on HVs (Fig. 4d) is likely related to changes in the frequency and severity of loss. Repetitive inundation events (i.e., increasing frequency of tropical storm inundation due to SLR) may prevent HVs from rebounding between loss events31. In contrast, portions of the CONUS coastal housing market have demonstrated a capacity to rebuild in between loss events with decadal or longer intervals (Figs. S20, S21). Raising flood barriers above +1 m has only a marginal benefit for flooding loss mitigation and HVs. The majority of losses under scenarios where levees are increased above +1 m is attributable to intense rainfall causing overland runoff and overwhelming stormwater infrastructure70,71(Fig. 4a). We therefore highlight that levees will not serve as a tool to completely eliminate flooding losses, but could stabilize systems to avoid catastrophic economic collapses in the near term.

We caution that over longer time-horizons (i.e., beyond 2100), such modifications may increase systemic risks, as observed for other structural responses to flooding72. Structural coastal flood defenses may also have unintended consequences of coastal ecosystem degradation, reducing the natural infrastructures capacity to migrate and mitigate storm-surges73. Without large public investments in coastwide infrastructure development, sea walls are likely to be developed unevenly, exacerbating unevenness in coastal flood exposure74,75. The same is true for managed retreat and buyout programs, whereby programs that do not explicitly engage with social equity issues and take into account adequate spatial and temporal scales may exacerbate uneven flood impacts and exposure76. A reliance on market mechanisms, insurance, and cost-benefit analysis without robust and inclusive participatory pre-disaster planning has tremendous potential to exacerbate the environmental injustice of flooding across the US77,78. Further studies are needed on the effectiveness and equity of the complex mix of policy and infrastructure responses required to mitigate our predictions of increasing flood losses and exposure.

Limitations and extensions

The goal of the future projections presented in this research was to predict how the NFIP and coastal housing markets may evolve under climate change assuming no substantial policy or structural changes to NFIP or changes to any major externalities beyond the scope of the SE model. The SE models used to generate these predictions were trained exclusively on historical conditions and therefore may not accurately simulate behavioral changes related to exposure- and policy-change.

Through calibration to past events, the SE models inherited the assumption that the NFIP will be able to absorb flooding losses and finance rebuilding in flood prone zones (i.e., continuing behavior exhibited during past loss events) and amassing debt without limit. This assumption may be unreasonable given that policy uptake may not occur proportionally to loss (Figs. 2d, S22d), and public attitudes around the desirability of federal financing of flood prone properties may shift as losses accrue (Figs. 2d, S22d, 3b). Substantial changes in NFIP (e.g., increases or decreases in policy premiums, an expansion of mandatory purchase requirements, increasing private sector participation in underwriting primary flood risk) may result in changes to population density, HVs, and future flood losses that are beyond the capacity of these SE models to simulate. Changes in flood protection measures could also unintentionally change community flood perceptions and behaviors that might actually increase total loss79,80,81.

Additionally, substantially raising the height of levees could separate coastal communities from the ocean, leading to unexpected effects on the relationships between levees, insurance uptake, and the housing market; this might be particularly true for communities reliant on ocean-based tourism and recreational activities. Further, there is a possibility of infrastructure failure. Levee failure occurring after a sustained period in which risk perceptions are adjusted to a “lower-risk” condition could similarly result in greater long-term losses82,83. Coastal levees can also elevate water levels in upstream rivers and tributaries, hinder natural drainage, and potentially exacerbate inland flooding in some areas. Our SE model does not simulate these potential human-flood dynamics resulting from infrastructure changes.

Additional social and economic externalities that exist beyond those explicitly considered in the SE model may affect HVs, such as perceived coastal risks on the West Coast US following the 2011 tsunami and Fukushima nuclear disaster, and observed relationships between HVs and coastal water quality84. Similarly, future policy uptake may be affected by unforeseeable factors such as significant changes in NFIP, educational programs aimed at bridging true versus perceived risk, and other socioeconomic changes85, all of which are limitations to our analysis. We also acknowledge possible limitations due to limited availability of dataset on flood insurance and housing market, inherited uncertainty and biases of SV data, and a simplistic model formulation.

Finally, the treatment of hazards used in this work neglected the role of joint flooding where co-occurring intense rainfall and high coastal water elevations could exacerbate water conveyance systems beyond either individual hazard. To gain a more comprehensive understanding of human-flood dynamics under changing climate, future research may evaluate flooding hazards with hydrodynamic models to capture complex hazard interaction, account for joint probabilities of surge and rainfall, explore datasets and techniques to supplement our limitations associated with infrastructure change, and better incorporate other non-flood mechanisms that can impact NFIP and housing market.

Methods

Datasets of coastal hazards and socio-economic conditions

Historical observed daily precipitation totals for the period of 1970–2021 were obtained at a spatial resolution of 0.5 × 0.5 degree from CPC Unified Gage Analysis86. Localized Constructed Analog downscaled precipitation estimates for the period of 2021–2100 were obtained for four CMIP6 Global Climate Models: CNRM-CM6-1, GFDL_ESM4, NorESM2-LM, & MIROC687. These estimates are available at a 6 km spatial resolution over North America and at 3 km over the California region. Historically observed annual peak water surface elevations (1970–2021) were obtained from NOAA46. Sea Level Rise (SLR) projections (2021–2100) which are inclusive of vertical land motion were obtained from the 2022 NOAA SLR Technical Report9. Both the precipitation and SLR projections were obtained for shared socio-economic pathways SSP245 and SSP585. We used Monte Carlo sampling of Gumbel extreme value distributions of future annual maxima surge and tide heights (relative to MSL) using parameters developed for tidal gauging stations across CONUS from the CoDEC dataset88. We sampled 1000 storm surge and tides annually, and added them on top of SLR projections to estimate future peak water surface elevations for each year and coastal census tract. FEMA flood insurance claims (1979–2021) and policies purchased (2009–2021) were collected from Open FEMA36. Housing density, median housing values (HVs), and aggregate HVs across the coastal census tracts of CONUS (2010–2021) were obtained from the US Census37,38,89. It was required that all socio-economic datasets be normalized to align with socio-environmental (SE) model state variables. This process is detailed in the Supplementary Note 2 (Fig. S3). We obtained tract-level social vulnerability (SV) metrics from CDC/ATSDR39.

All described datasets were collected for 2197 coastal census tracts across the CONUS coastline. Coastal census tracts are tracts that border the US coastline. The number of tracts was reduced to 1555 after tracts lacking any flood insurance claims, policies, housing density or median HV data (i.e., non-populated tracts and tracts with no documented historical flood events) were removed from analysis.

SE modeling of historical human-flood dynamics

We quantified human-flood relationships within the context of an SE modeling framework31 (Fig. S1a, b) fit to coastal CONUS census-tracts. Simulated annual NFIP claims (L) was fit against reported NFIP flood loss claims, simulated active policies (A) was fit against active NFIP flood insurance policies, simulated population density (D) against census tract population density, and simulated HVs against US census median HV data.

For calibration o SE parameters for each tract, all models were forced with historical observed peak annual water elevation46 & annual maxima 24-hour precipitation totals86. US tidal gauging stations were assigned to each census tract based on geographical proximity (Fig. S2). SE model parameters for each tract were optimized through 100,000 simulations using the DDS algorithm90, minimizing the Euclidean distance from the optimal solution of normalized root mean square efficiency (NRMSE) metrics for NFIP reported losses (NRMSELoss), the proportion of active NFIP policies (NRMSEPolicy), population density (NRMSEDensity), and median tract HVs (NRMSEHP). A full list of model parameters and feasible ranges is presented in Table S2. To screen poorly calibrated tracts from further analysis, we set an objective function threshold to accept or reject model calibrations, resulting in 1124 tracts (72%) with satisfactory scores. The threshold was determined by examining a histogram of census tract objective function values to identify where drop offs in model performance occurred (detailed in Supplementary Note 3). The distribution of calibration metrics, along with cutoff values, is presented in Fig. S4. Similar to prior studies of human-flood dynamics31,32,33, we observed correlations between calibration metrics and validation data (Fig. S5), suggesting that model performance is attributable in some tracts due to a combination of data limitations and model structure. Trade-offs between calibration metrics are shown in Fig. S6. Distributions of calibrated model parameters are presented in Fig. S7. All state-wise results are shown for those states with at least 10 census tracts that met the calibration threshold. State-aggregated time series of calibrated loss, NFIP policies, housing density, and median HVs is presented in Figs. S18–21.

We examined correlations between SE model parameters (describing tract-level behaviors) and 16 US census variables used by CDC/ATSDR39 across the CONUS coastal tracts with Spearman’s Ranked correlation test. To address the Margin of Error (MOE) associated with these census variables, we used the provided MOE91 and generated 10,000 Monte Carlo samples of each census variable across CONUS tracts under the reported assumption of normally distributed errors91. We evaluated the significance results at the ɑ = 0.001, 0.01 and 0.05 thresholds by using the median of the p-value from Monte Carlo sampling (Supplementary Note 4, Figs. S8–S14). This analysis was then repeated, aggregating tracts to the state-level.

Projecting the evolution of human-flood relationships under climate change

The calibrated SE models were forced with climate projections (2021–2100) of annual maxima water surface elevations9,88 and 24-h precipitation87 under Shared Socioeconomic Pathways (SSP) SSP245 and SSP585 to predict future NFIP claims, active policies, population densities, and median HVs for all coastal tracts. A detailed description of the projection datasets used for this study is presented in Table S3.

We binned coastal census tracts into three groups based on overall Social Vulnerability (SV) metrics as defined by CDC/ATSDR39 to test if projected flooding risks varied with SV. Tracts were assigned to the low social vulnerability group (Low SVI) if they fell within the 0–25th percentile of the SV distribution, medium social vulnerability group (Med SVI) if they fell within the 25th–75th percentile, and high social vulnerability group (High SVI) if they fell within the 75th–100th percentile of the SV distribution (Fig. S16). We projected flood claims, the proportion of households holding flood insurance policies, tract housing density, and median HVs until 2100 for each tract under higher emissions climate change scenario SSP585 (Fig. 3) and lower emissions climate change scenario SSP245 (Fig. S23). The differences between the median projected results among the SV groups are compared using non-parametric Mann–Whitney U-tests.

Estimating the benefit of capital investments in future flood risk reduction

We estimated the future risk-reduction benefits of increasing thresholds for storm-surge driven loss (i.e., levee heights) with all tract-level SE models meeting the calibration threshold. We repeated all simulations of future conditions, but increased storm-surge loss thresholds by +1 m, +2 m, and +∞ m above the threshold values derived through calibration (S) with historical hazard and NFIP claims. Here, +∞ m represents the scenario where levees are raised to their maximum possible height, preventing any losses from storm-surges. For each surge threshold scenario, we computed changes in NFIP flood loss claims, the proportion of households with active NFIP policies, tract-level housing density, and median HVs under climate projection scenarios SSP245 & SSP585. We also attributed total NFIP loss in each scenario to rainfall and surge damage. When surge thresholds are increased to infinity, the total loss is entirely attributed to rainfall. In all other scenarios, the rainfall-attributed loss remains constant. For these scenarios, we subtract this constant rainfall loss from the total loss to determine the surge loss. Both surge and rainfall losses are then expressed as percentages of the total damage. The simulation results were aggregated for the entire CONUS coastline (Fig. 4) and for each state individually (Figs. S24–27).

Code availability

All model code is publicly available at https://github.com/snpoudel/CoastalUS_SocioHydroModel.

References

Kron, W. Flood risk = hazard • values • vulnerability. Water Int. 30, 58–68 (2005).

Kunreuther, H., Wachter, S. M., Kousky, C. & LaCour-Little, M. Flood risk and the U.S. Housing Market. SSRN Scholarly Paper at https://doi.org/10.2139/ssrn.3426638 (2019).

Strömberg, D. Natural disasters, economic development, and humanitarian aid. J. Econ. Perspect. 21, 199–222 (2007).

Jonkman, S. N. Global perspectives on loss of human life caused by floods. Nat. Hazards 34, 151–175 (2005).

Tanoue, M., Hirabayashi, Y. & Ikeuchi, H. Global-scale river flood vulnerability in the last 50 years. Sci. Rep. 6, 36021 (2016).

Tebaldi, C., Strauss, B. H. & Zervas, C. E. Modelling sea level rise impacts on storm surges along US coasts. Environ. Res. Lett. 7, 014032 (2012).

Sweet, W. W. V., Dusek, G., Obeysekera, J. T. B. & Marra, J. J. Patterns and projections of high tide flooding along the US coastline using a common impact threshold. NOAA Tech. Rep. (2018).

Spanger-Siegfried, E., Fitzpatrick, M. & Dahl, K. Encroaching Tides: How Sea Level Rise and Tidal Flooding Threaten U.S. East and Gulf Coast Communities over the Next 30 Years. (2014).

Sweet, W. V. et al. Global and Regional Sea Level Rise Scenarios for the United States: Updated Mean Projections and Extreme Water Level Probabilities along US Coastlines (National Oceanic and Atmospheric Administration, 2022).

Rao, K. Climate change and housing: will a rising tide sink all homes? Zillow https://www.zillow.com/research/climate-change-underwater-homes-12890/ (2017).

Masters, J. Bubble trouble: climate change is creating a huge and growing U.S. real estate bubble» Yale Climate Connections. Yale Climate Connections http://yaleclimateconnections.org/2023/04/bubble-trouble-climate-change-is-creating-a-huge-and-growing-u-s-real-estate-bubble/ (2023).

Gourevitch, J. D. et al. Unpriced climate risk and the potential consequences of overvaluation in US housing markets. Nat. Clim. Change 13, 250–257 (2023).

Curcio, D., Gianfrancesco, I. & Vioto, D. Climate change and financial systemic risk: evidence from US banks and insurers. J. Financ. Stab. 66, 101132 (2023).

A NOAA Capability For Coastal Flooding and Inundation Information and Services at Climate Timescales to Reduce Risk and Improve Resilience. (2022).

Horn, D. P. & Brown, J. T. Introduction to the National Flood Insurance Program (Nfip). (Congressional Research Service Washington, 2017).

Shao, W. et al. Understanding the effects of past flood events and perceived and estimated flood risks on individuals’ voluntary flood insurance purchase behavior. Water Res. 108, 391–400 (2017).

Bowers, C., Serafin, K. A. & Baker, J. W. Uncovering drivers of atmospheric river flood damage using interpretable machine learning. Nat. Hazards Rev. 25, 04024022 (2024).

Historical NFIP Claims Information and Trends | FloodSmart. https://www.floodsmart.gov/historical-nfip-claims-information-and-trends (2023).

Knowles, S. G. & Kunreuther, H. C. Troubled waters: the national flood insurance program in historical perspective. J. Policy Hist. 26, 327–353 (2014).

Klein, C. A. The National Flood Insurance Program at fifty: how the fifth amendment takings doctrine skews federal flood policy. Georget. Environ. Law Rev. 31, 285–338 (2018).

Tier, M. Overcoming Contemporary Reform Failure of the National Flood Insurance Program to Accelerate Just Climate Transitions. https://jpia.princeton.edu/news/overcoming-contemporary-reform-failure-national-flood-insurance-program-accelerate-just-climate (2021).

Strother, L. The national flood insurance program: a case study in policy failure, reform, and retrenchment. Policy Stud. J. 46, 452–480 (2018).

Elliott, R. Who pays for the next wave? The American Welfare State and Responsibility for Flood Risk. Polit. Soc. 45, 415–440 (2017).

Legislative Proposals for the National Flood Insurance Program | FEMA.gov. https://www.fema.gov/flood-insurance/rules-legislation/congressional-reauthorization/legislative-proposals (2023).

Wing, O. E. J. et al. Inequitable patterns of US flood risk in the Anthropocene. Nat. Clim. Change 12, 156–162 (2022).

Tate, E., Rahman, M. A., Emrich, C. T. & Sampson, C. C. Flood exposure and social vulnerability in the United States. Nat. Hazards 106, 435–457 (2021).

Jacobs, F. H. Insuring Inequity: An Intersectional Analysis of the Community Rating System (Texas A&M University, 2018).

Hersher, R. Many people living in flood-prone areas can’t afford expensive flood insurance. NPR (2019).

Wilson, B., Tate, E. & Emrich, C. T. Flood recovery outcomes and disaster assistance barriers for vulnerable populations. Front. Water 3, 1–15 (2021).

de Ruig, L. T. et al. An agent-based model for evaluating reforms of the National Flood Insurance Program: A benchmarked model applied to Jamaica Bay, NYC. Risk Anal. 43, 405–422 (2023).

Poudel, S., Caridad, C., Elliott, R. & Knighton, J. Housing market dynamics of the post-Sandy Hudson estuary, Long Island Sound, and New Jersey coastline are explained by NFIP participation. Environ. Res. Lett. 18, 094009 (2023).

Knighton, J., Hondula, K., Sharkus, C., Guzman, C. & Elliott, R. Flood risk behaviors of United States riverine metropolitan areas are driven by local hydrology and shaped by race. Proc. Natl. Acad. Sci. USA 118, e2016839118 (2021).

Barendrecht, M. H. et al. The value of empirical data for estimating the parameters of a sociohydrological flood risk model. Water Resour. Res. 55, 1312–1336 (2019).

Di Baldassarre, G. et al. Debates—perspectives on socio-hydrology: capturing feedbacks between physical and social processes. Water Resour. Res. 51, 4770–4781 (2015).

Di Baldassarre, G. et al. Socio-hydrology: conceptualising human-flood interactions. Hydrol. Earth Syst. Sci. 17, 3295–3303 (2013).

Federal Emergency Management Agency (FEMA), OpenFEMA Dataset: Disaster Declarations Summaries - v2. https://www.fema.gov/openfema-data-page/fima-nfip-redacted-claims-v2 (2024).

B25001: Housing Units - Census Bureau Table. https://data.census.gov/table/ACSDT5Y2022.B25001?q=Housing%20units&g=010XX00US$1400000 (2024).

B25077: Median Value (Dollars) - Census Bureau Table. https://data.census.gov/table/ACSDT5Y2022.B25077?q=Housing%20values&g=010XX00US$1400000 (2024).

Centers for Disease Control and Prevention/ Agency for Toxic Substances and Disease Registry/ Geospatial Research, Analysis, and Services Program.CDC/ATSDR Social Vulnerability Index 2020 Database US. https://www.atsdr.cdc.gov/placeandhealth/svi/data_documentation_download.html (2022).

Xu, C. et al. Damage curves derived from hurricane ike in the west of Galveston bay based on insurance claims and hydrodynamic simulations. Int. J. Disaster Risk Sci. 14, 932–946 (2023).

Sebastian, A. et al. Hindcast of pluvial, fluvial, and coastal flood damage in Houston, Texas during Hurricane Harvey (2017) using SFINCS. Nat. Hazards 109, 2343–2362 (2021).

Shu, E. G. et al. Integrating climate change induced flood risk into future population projections. Nat. Commun. 14, 7870 (2023).

Garner, A. J. Observed increases in North Atlantic tropical cyclone peak intensification rates. Sci. Rep. 13, 16299 (2023).

Buchanan, M. K. et al. Sea level rise and coastal flooding threaten affordable housing. Environ. Res. Lett. 15, 124020 (2020).

US EPA, O. Climate Change Indicators: Coastal Flooding. https://www.epa.gov/climate-indicators/climate-change-indicators-coastal-flooding (2016).

NOAA Tides and Currents. https://tidesandcurrents.noaa.gov/ (2023).

Braswell, A. E., Leyk, S., Connor, D. S. & Uhl, J. H. Creeping disaster along the U.S. coastline: understanding exposure to sea level rise and hurricanes through historical development. PLoS One 17, e0269741 (2022).

Xu, C. & Liu, W. The spatiotemporal assessments for tidal flat erosion associated with urban expansion in the conterminous coastal United States from 1985 to 2015. Sci. Total Environ. 899, 165660 (2023).

Bakkensen, L. A. & Barrage, L. Going underwater? Flood risk belief heterogeneity and coastal home price dynamics. Rev. Financ. Stud. 35, 3666–3709 (2022).

McGuire, C. J. U. S. Coastal flood insurance, risk perception, and sea-level rise: a perspective. Coast. Manag. 43, 459–464 (2015).

Durkin, E. North Carolina didn’t like science on sea levels … so passed a law against it. Guardian https://www.theguardian.com/us-news/2018/sep/12/north-carolina-didnt-like-science-on-sea-levels-so-passed-alaw-against-it (2018).

Jarzabkowski, P., Chalkias, K., Cacciatori, E. & Bednarek, R. Disaster Insurance Reimagined: Protection in a Time of Increasing Risk (Oxford University Press, Oxford, New York, 2023).

Council, N. R. et al. Affordability of National Flood Insurance Program Premiums: Report 1. (National Academies Press, 2015).

Kousky, C. & Kunreuther, H. Addressing affordability in the national flood insurance program. J. Extreme Events 01, 1450001 (2014).

Horn, D. P. Options for Making the National Flood Insurance Program More Affordable. Congressional Research Service (CRS) Reports and Issue Briefs (Congressional Research Service, 2023).

Stanley, M., Hotard, A., Pilgreen, D. & Meyer, M. Critical review of national flood policy outcomes. J. Homel. Secur. Emerg. Manag. 20, 239–269 (2023).

Finch, C., Emrich, C. T. & Cutter, S. L. Disaster disparities and differential recovery in New Orleans. Popul. Environ. 31, 179–202 (2010).

Emrich, C. T., Tate, E., Larson, S. E. & Zhou, Y. Measuring social equity in flood recovery funding. Environ. Hazards 19, 228–250 (2020).

Thomson, H., Zeff, H. B., Kleiman, R., Sebastian, A. & Characklis, G. W. Systemic financial risk arising from residential flood losses. Earths Future 11, e2022EF003206 (2023).

Ortega, F. & Taṣpınar, S. Rising sea levels and sinking property values: Hurricane Sandy and New York’s housing market. J. Urban Econ. 106, 81–100 (2018).

Bunten, S. M. & Kahn, M. E. Optimal real estate capital durability and localized climate change disaster risk. J. Hous. Econ. 36, 1–7 (2017).

Siders, A. R., Hino, M. & Mach, K. J. The case for strategic and managed climate retreat. Science 365, 761–763 (2019).

McNamara, D. E., Smith, M. D., Williams, Z., Gopalakrishnan, S. & Landry, C. E. Policy and market forces delay real estate price declines on the US coast. Nat. Commun. 15, 2209 (2024).

Bagheri-Gavkosh, M. et al. Land subsidence: a global challenge. Sci. Total Environ. 778, 146193 (2021).

Ohenhen, L. O., Shirzaei, M., Ojha, C., Sherpa, S. F. & Nicholls, R. J. Disappearing cities on US coasts. Nature 627, 108–115 (2024).

US Army Corps of Engineers. NY & NJ Harbor & Tributaries Focus Area Feasibility Study (HATS). https://www.nan.usace.army.mil/Missions/Civil-Works/Projects-in-New-York/New-York-New-Jersey-Harbor-Tributaries-Focus-Area-Feasibility-Study/ (2024).

ENR. Galveston Corps Eyes Building Up Gulf Coast | Engineering News-Record. https://www.enr.com/articles/56163-galveston-corps-eyes-building-up-gulf-coast (2024).

Rasmussen, D. J., Kopp, R. E. & Oppenheimer, M. Coastal defense megaprojects in an era of sea-level rise: politically feasible strategies or army corps fantasies? J. Water Resour. Plan. Manag. 149, 04022077 (2023).

Rasmussen, D. J., Kopp, R. E., Shwom, R. & Oppenheimer, M. The political complexity of coastal flood risk reduction: lessons for climate adaptation public works in the U.S. Earths Future 9, e2020EF001575 (2021).

Davenport, F. V., Burke, M. & Diffenbaugh, N. S. Contribution of historical precipitation change to US flood damages. Proc. Natl. Acad. Sci. USA 118, e2017524118 (2021).

Neumann, J. E. et al. Climate change risks to US infrastructure: impacts on roads, bridges, coastal development, and urban drainage. Clim. Change 131, 97–109 (2015).

Lorie, M. et al. Modeling coastal flood risk and adaptation response under future climate conditions. Clim. Risk Manag. 29, 100233 (2020).

Gittman, R. K. et al. Engineering away our natural defenses: an analysis of shoreline hardening in the US. Front. Ecol. Environ. 13, 301–307 (2015).

Hummel, M. A., Griffin, R., Arkema, K. & Guerry, A. D. Economic evaluation of sea-level rise adaptation strongly influenced by hydrodynamic feedbacks. Proc. Natl. Acad. Sci. USA 118, e2025961118 (2021).

Beasley, W. J. & Dundas, S. J. Hold the line: modeling private coastal adaptation through shoreline armoring decisions. J. Environ. Econ. Manag. 105, 102397 (2021).

Siders, A. R. Social justice implications of US managed retreat buyout programs. Clim. Change 152, 239–257 (2019).

Elliott, J. R. & Wang, Z. Managed retreat: a nationwide study of the local, racially segmented resettlement of homeowners from rising flood risks. Environ. Res. Lett. 18, 064050 (2023).

de Ruig, L. T. et al. Climate-proofing the National Flood Insurance Program. Nat. Clim. Change 12, 975–976 (2022).

Ludy, J. & Kondolf, G. M. Flood risk perception in lands “protected” by 100-year levees. Nat. Hazards 61, 829–842 (2012).

Terpstra, T. & Gutteling, J. M. Households’ perceived responsibilities in flood risk management in the Netherlands. Int. J. Water Resour. Dev. 24, 555–565 (2008).

Cannon, C., Gotham, K. F., Lauve-Moon, K. & Powers, B. From the general to the specific: the influence of confidence and trust on flood risk perception. J. Risk Res. 24, 1161–1179 (2021).

Collenteur, R. A., de Moel, H., Jongman, B. & Di Baldassarre, G. The failed-levee effect: do societies learn from flood disasters? Nat. Hazards 76, 373–388 (2015).

Montz, B. E. & Tobin, G. A. Livin’ large with levees: lessons learned and lost. Nat. Hazards Rev. 9, 150–157 (2008).

Nicholls, S. & Crompton, J. A comprehensive review of the evidence of the impact of surface water quality on property values. Sustainability 10, 500 (2018).

Darlington, J. C. & Yiannakoulias, N. Experimental evidence for coverage preferences in flood insurance. Int. J. Disaster Risk Sci. 13, 178–189 (2022).

Chen, M. et al. Assessing objective techniques for gauge‐based analyses of global daily precipitation. J. Geophys. Res. Atmospheres 113, 2007JD009132 (2008).

Pierce, D. W., Cayan, D. R., Feldman, D. R. & Risser, M. D. Future increases in North American extreme precipitation in CMIP6 downscaled with LOCA. J. Hydrometeorol. 24, 951–975 (2023).

Muis, S. et al. A high-resolution global dataset of extreme sea levels, tides, and storm surges, including future projections. Front. Mar. Sci. 7, 1–15 (2020).

B25082: Aggregate Value (Dollars) - Census Bureau Table. https://data.census.gov/table?q=B25082&g=010XX00US$1400000 (2024).

Tolson, B. A. & Shoemaker, C. A. Dynamically dimensioned search algorithm for computationally efficient watershed model calibration. Water Resour. Res. 43, 1–16 (2007).

Fuller, S. Using American Community Survey estimates and margins of error. Webinar Present. Decennial Census of Population and Housing, April 18 (2018).

Acknowledgements

The funding for this study was provided by Connecticut Sea Grant, University of Connecticut through Award No. NA22OAR4170093, Project No. R/CH-2.

Author information

Authors and Affiliations

Contributions

S.P. conception, data aggregation, analysis, quality control, manuscript preparation. R.E. conception, manuscript preparation. R.A. conception, manuscript preparation. Z.G. conception, manuscript preparation. J.K. conception, quality control, manuscript preparation.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Communications Earth and Environment thanks Hamed Moftakhari and David Muñoz reviewers for their contribution to the peer review of this work. Primary Handling Editors: Rahim Barzegar and Martina Grecequet. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Poudel, S., Elliott, R., Anyah, R. et al. Differential flood insurance participation and housing market trajectories under future coastal flooding in the United States. Commun Earth Environ 5, 668 (2024). https://doi.org/10.1038/s43247-024-01848-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s43247-024-01848-z