Abstract

Renewable (Green) hydrogen is expected to play a key role in the green energy transition, but the levelized cost of hydrogen remains high. The European Union’s Delegated Regulation 2023/1184 outlines criteria for classifying hydrogen as green. This analysis presents a technoeconomic methodology based on Green Power Purchase Agreements, using market projections, renewables profiles, and data from a 30 MW electrolyzer project in Greece, where temporal correlation requirements of the Delegated Act apply. Results indicate that in the case of Greece, regulatory incentives, active trading, and efficient resource use can reduce hydrogen cost. In our case study, a decrease of 1.2 Euros per kg can be achieved, for proton exchange membrane electrolysis and alkaline electrolysis technologies.

Similar content being viewed by others

Introduction

The diversification of energy sources required to contribute to decarbonization, and a net-zero economy as pledged by the Conference of Parties (COP), the International Energy Agency (IEA), and adopted by the European Union, is driving energy policy and technological improvements towards increased use of electrolysis1. Hydrogen is an energy carrier that is deemed necessary to complement the toolset of existing measures on storage of renewable energy and utilized for carbon reduction, due to its high energy density and its ability to be stored, transported, and reproduce electrical and thermal energy with direct applications in transportation, maritime, and electricity production. This necessity was first formulated in the Paris Agreement at the COP 212 and reaffirmed at COP 263 and COP 284. By 2050, green hydrogen demand is anticipated to increase substantially, by 15 times, representing a sizeable portion of the global energy mix, in an attempt to substitute traditional fossil fuel demand and therefore raising the need for additional renewable generation capacity, mainly solar and wind. This is attributed to the requirement for producing green hydrogen, whose production shall be driven by electrolysis through renewable electricity1.

Hydrogen, according to the European Commission’s approved Commission Delegated Regulation 2023/1184 on Union Methodology for RFNBOs (DA), qualifies as a renewable fuel of non-biological origin (RFNBO), when produced by renewable electricity within the European Union or hydrogen produced outside the European Union and then imported into the European Union5. The DA identifies two scenarios for hydrogen to be regarded as fully renewable: (i) the hydrogen production facility is directly connected to a renewable asset and is not connected to the grid or (ii) when besides any direct renewable connection, the hydrogen facility is also connected to the grid, but the electricity used is “demonstrably” renewable. The latter can be demonstrated, under three conditions: (a) when there is high renewables concentration in a bidding zone in the previous calendar year (over 90%), (b) hydrogen or fuel production with electricity that is consumed during an imbalance settlement, where the system operator can demonstrate that renewable energy sources (RES) were re-dispatched downwards and (c) there is a reliance on renewable power purchase agreements (PPAs) with specific constraints regarding additionality, temporal and geographical correlation. In case the emission intensity in a bidding zone is lower than 18 g CO2eq per MJ in the previous calendar year the additionality requirement does not apply. The key requirements which are expected to be satisfied for a PPA contract in place and energy from the grid to count as renewable, are summarized in Table 1 according to5.

The European Union has set targets for 2030 on green hydrogen production costs in the region of 3 Euros per kg6,7 in order to compete with natural gas. Previous studies have shown that the cost of electricity (CoE) in green hydrogen production represents about 60–70% of the total operating costs8,9,10,11. Initial studies conducted immediately after the 2020’s “energy crisis”, modeled the impact of capital and operational costs on levelized cost of hydrogen (LCOH) showing that a potential range between 1.6 and 3 Euros per kg could be achieved12,13. Updated studies that used more recent costs of the RES prices and include the disruption in supply chains, showed an increase of LCOH in the area of 4–8 Euros per kg14,15 and can estimate important drops in LCOH terms towards 205016. According to the IEA, while global hydrogen demand increased 3% from the original estimates and continues on a growing trend, a very small fraction of the projects under development over 1 MW capacity have reached a Financial Investment Decision17, whereas on many occasions State Aid schemes are involved, as is the case in Germany18. This results in a scarcity of green hydrogen for the European Union until 2030 and 2035 on a global level, where low-emission hydrogen remains less than 1% of the final energy demand17. This is due to a combination of economic, technological, policy, and market factors that make large-scale deployment challenging. Green Hydrogen electrolysis is currently much more expensive than producing hydrogen from fossil fuels, especially gray hydrogen or blue hydrogen19. Combined with a still sizeable cost of electrolyzers and peripheral equipment. Hydrogen distribution and storage infrastructure is still underdeveloped, and this in turn hinders the cultivation for stable hydrogen demand, spiraling back to the challenges for investment decisions. In most countries there is a lack of comprehensive set of policies and regulatory frameworks that incentivize green hydrogen production and applications. Effectively, Green Hydrogen projects need clear, long-term policy support like subsidies, tax incentives, or carbon pricing, which is often delayed or inconsistent across regions. A recent study has suggested that green hydrogen demand, green hydrogen supply, and hydrogen infrastructure in general has to be ramped up simultaneously20.

A recent study from Boston Consulting Group21 utilized data from actual project cost projections in 2023 to show that the variance of LCOH is higher and less optimistic than pre-anticipated. The authors of that study show that the main parameters affecting the LCOH are electricity costs and the electrolyzer’s efficiency, utilization, total cost, and cost of capital for its financing. The study shows that the resulting LCOH varies between 2.6 and 8.5 Euros per kg, arguing that regulatory support is a key driver to realizing the lower, competitive levels. Equivalent studies for the United States provide for a much smaller range of 2.02–2.88 USD per kg but assume the relevant production tax credits of up to 3 USD per kg22,23. The challenge of a higher LCOH estimated in recent studies is a global phenomenon10,13,16,24,25. A detailed analysis from the authors of26 contributed to the modeling of various regulatory aspects and potential settings by creating a variety of scenarios with hydrogen storage and direct connection to the hydrogen plant versus grid-connected setting. In that study, the authors focus on using input data from the literature on RES profiling and electrolyzer technology while utilizing electricity prices from the German market. Their results show that simultaneity (a term introduced to encompass temporal correlation and congruency between RES and hydrogen production) may not decrease the overall emissions for the whole energy system, however, they recognize that their modeling does not delve deeply on regulatory charges and spatial correlation. A similar study that focuses on the grid emissions impact of additionality requirements has taken place regarding the US hydrogen market is rather inconclusive23, while extensive research has taken place in China, by introducing hydrogen as a long-term energy storage technology27,28.

The existing literature treats green electricity procurement under a stationary PPA (usually in a Pay-as-Produced) format. In real application scenarios, the role of a Market participant, that is responsible to represent the RES producer in electricity markets (usually a RES Aggregator) should be accordingly considered. Taking into account the temporal correlation requirements of the delegated act (DA), the performance of different electricity market bidding strategies, as well as trilateral agreements between the RES producer, the Aggregator, and the hydrogen producer, becomes significant in terms of the total CoE supply to the Hydrogen producer. The Greek market has not been analyzed in detail in relevant research, with real RES production profiles and wholesale market prices forecasts, but rather with stationary electricity costs. As it is highlighted in recent relevant research29, location has a very substantial impact on the assessed LCOH, due to electricity wholesale market conditions, RES PPA levels, and RES levelized cost of energy (LCOE), as well as other financial parameters. Our work contributes to the existing literature as follows:

-

The provisions of the DA regarding temporal correlation (both monthly and hourly settlement) are explored under 3 distinct market operational scenarios and compared against an off-grid operational scenario. The market scenarios have been developed to reflect the most prominent business models and sensitivity assessments have been conducted.

-

An additional LCOH reducing component (DA provision on otherwise curtailed energy) is explored.

-

We contribute to state-of-the-art enhancement by analyzing green hydrogen production economics in detail for the Greek Market, by:

-

Using actual hourly RES data offered by a major RES Aggregator in Greece30.

-

Using detailed data used for the electrolyzer modeling, for both alkaline electrolysis (AEL) and proton exchange membrane electrolysis (PEMEL) technology, originates from state-of-the-art electrolyzer data as published by the Clean Hydrogen Joint Undertaking and complemented with a global tender process conducted in the framework of EPHYRA project31. The application of real Renewables production curves and current electrolyzer data provides the most up-to-date insight to the expected LCOH within the Greek Market frame.

-

Incorporating into the modeling framework specific regulatory incentives that can affect LCOH for the Greek Market.

-

The modeling inputs include: (i) real production data for 162 solar parks and 22 wind farms in Greece were used, clustered and normalized, utilizing 2-year hourly values to create the locational profiles for each technology type, (ii) tariffs and values applicable to the Greek transmission network for grid scale electrolysis systems as well as their potential discounts to evaluate regulatory charges impact and (iii) three electricity prices scenarios with hourly resolution for a 10-year period are utilized to reflect the cost of wholesale electricity price. In addition, to the market operations, an additional cost-reducing component (leverage on curtailed renewable energy) is also explored.

The scenarios under evaluation aim to represent pragmatically the current business and regulatory environments:

-

The first scenario reflects a business-as-usual operation in which the different entities (RES producer, Aggregator, and hydrogen producer) compete for their margins. The RES producers seek certainty for financing their assets and hedges the full RES production in a PaP PPA. The Aggregator charges standard fees for representation of the RES assets and the hydrogen producer are, in essence, the price taker. The RES producer requests a PPA based on LCOE plus a weighted average cost of capital (WACC) estimate that differs for each country32.

-

The second scenario is aimed at capturing electricity market opportunities; the RES producer may finance their assets by hedging 80% of their energy (but requires an increased WACC32) and allow the remainder 20% to bring market revenues. The Aggregator provides active trading to both actors and withholds 10% of the market capture, while the rest of the revenues are split between the RES producer and the hydrogen producer according to their share in the PPA agreement (80% for the hydrogen producer and 20% for the RES producer accordingly).

-

The third scenario reflects a hydrogen-driven end-to-end project under which the single owner assumes all roles to drive minimization of LCOH by charging at cost the electricity and the intermediary charges.

The scenarios described above are further classified according to temporality, between monthly and hourly temporal correlation. Furthermore, each scenario is applied to both electrolyzer technologies (PEMEL and AEL). We define as a base scenario the case in which there is no electricity market price arbitrage, to evaluate the levels of electrolysis plant utilization required to achieve the minimum LCOH. This scenario reflects a direct connection of RES with the electrolysis plant without any grid link, to emulate an island and provide a clear representation of the expected use of the electrolysis plant without jeopardizing electricity market prices. The base case scenario is introduced to define the optimal utilization levels of the electrolysis unit that correspond to the minimum achievable LCOH. In the base scenario, an LCOE cost of the optimal renewables mix is assumed as the electricity commodity cost for the electrolyzer unit, without any premiums. For the simulation purposes, and in order to penalize additional capacity of RES in the hydrogen PPA, the base scenario is modeled containing no market transactions, meaning parameter a in Eqs. 3 and 5 is set to zero (0), emulating a direct line connection. That means that as more RES are being deployed to cover the utilization requirements, the more energy is left unutilized for hydrogen production purposes due to the RES production profiles. The RES energy that exceeds electrolyzer capacity is (a) not used for hydrogen production and (b) valued with 0 Euros per MWh instead of providing an electricity market revenue as in the market scenarios. Since the excess energy is paid under the PPA but draws nothing from the electricity market, the value of that energy counts against the overall LCOH. This allows the identification of the minimum RES assets required to cover the minimum utilization. For each remaining scenario (scenarios 1–3), we maintain the optimal utilization level suggested by the base scenario, and we provide sensitivity analysis on the Hydrogen settlement period (i.e., monthly vs hourly), electricity market prices scenarios (Supplementary Fig. 1), and regulatory discounts to reflect subsidies. By maintaining the base case scenario optimal utilization level and corresponding RES mix across all scenarios, we are addressing the issue of PPA overdimensioning that would take place if market prices were high enough to drive the optimizer towards revenue from the electricity market instead of focusing on the Hydrogen production process. The scenarios are summarized in Table 2.

According to32 the standard WACC for Greece ranges between 5 and 7.6% for onshore wind farms and 5.5–6.5% for PV parks. For the scenario formulation we have considered the low end of this range for each technology to represent the required WACC for scenario 1. Scenario 2 introduces a degree of uncertainty for the RES producer and the required WACC is increased to the mean of the range. Scenario 3 is strongly in favor of the Hydrogen production side. No WACC is required, since the RES producer, the hydrogen producer, and the Aggregator are part of the same entity and are working towards minimizing LCOH. Regarding market revenue shares, under scenario 1, the Aggregator is not required to actively trade in the markets or optimize energy management considerations. In addition to that, the RES producer is assumed to be fully compensated via the PaP PPA and requires no further compensation. As such, all-market revenues (if any) from excess energy that cannot be consumed in the electrolysis process are directed to the Hydrogen producer, that undertakes all of the risk. In scenario 2, the RES producer does not hedge part of the production under the PPA contract. At the same time, an incentive for optimal trading is introduced from the Aggregator side. Each participant in the 3-party agreement (hydrogen producer, RES producer, and Aggregator) receives the proportion of the market revenues according to the original hedged quantities. The 5–10% market revenue share towards the Aggregator represents an average RES balancing/ profiling cost in Greece according to RESs operators and Guarantees of Origin reports for 2021–202233.

Results and discussion

Base case scenario

The Base case scenario RES optimization methodology Fig. 1 showed that the minimum LCOH was achieved for both technologies close to 70% utilization rate. The resulting PEMEL LCOH was found to be 7.80 Euros per kg with a RES mix of 59.29 MW of wind and 47.15 MW of solar energy for hourly settlement. The corresponding AEL LCOH was found to be 6.16 Euros per kg with a RES mix of 64.55 MW wind and 45.02 MW solar energy. Conversely, for monthly settlement circumstances the LCOH for PEMEL was found to be 6.11 Euros per kg with a RES mix of 40.11 MW Wind and 85.13 MW solar energy and for the AEL 4.89 Euros per kg with a RES mix of 45.23 MW wind and 90.18 MW of solar energy respectively; for this scenario the most beneficial utilization rate was found to be 90%. A utilization rate of 90% for monthly correlation and 70% for hourly correlation provides under the base scenario the minimum achievable LCOH and serves as the baseline for all other operational scenarios. One hundred percent availability within a year cannot be physically achieved, since a proportion of hours is mandatorily reserved for maintenance purposes. The standard vendor suggestion, under the global tender, is around 400–450 h to be reserved for maintenance purposes, which translates to about 5% of total available hours.

The red full line represents the LCOH for a PEMEL electrolyzer in hourly temporal correlation settlements. The red dashed line represents LCOH for a PEMEL in hourly temporal correlation settlements. The blue full line represents the LCOH for an AEL electrolyzer in monthly temporal correlation settlements. The blue dashed line represents LCOH for an AEL in monthly temporal correlation settlements.

To reach the minimum 70% utilization requirement through a PPA hourly temporal correlation requirement, a substantial capacity of RES assets needs to be committed. Specifically, for AEL, a total of 64.55 MW of wind farms and 45 MW of solar parks have to be contracted for the hourly settlement. In the monthly temporal correlation scenario, the corresponding values are 5.5 MW of wind and 121 MW of solar. Similarly, for the PEM DA scenario, 59.3 MW of wind and 47 MW of solar are required. Monthly settlement yields 120 MW of solar. These figures are the result of optimally combining the assets presented in Table 3, according to their hourly energy production and relevant PPA proposal. For the 30 MW electrolyzer under study, this means that ~110 MW are required to satisfy hourly settlement granularity, whereas ~120 MW (of a different mix) are required to satisfy monthly settlement periods. The resulting RES mixes identified under the base case scenario remain stable under all subsequent iterations, in order for the overall hydrogen production to remain unhindered.

Scenario 1 results

Since energy procured from the PPA is at the disposal of the electrolyzer, any excesses can be redirected to the electricity market to be sold (Eqs. 3 and 5). Revenues from the electricity market can reduce the electricity cost and are sensitive to the spot market prices. Furthermore, they impact LCOH downwards compared to the base scenario, as we can observe in Figs. 2 and 3. The excess energy previously seen as a liability, while assessing the optimal mixes in the base scenario, now decreases the overall electricity cost as it provides an additional revenue stream from the wholesale market. In the case of the hourly settlement scenarios with no regulatory discounts, in the PEMEL case we can observe a final LCOH of 6.96 Euros per kg for the Reference case electricity prices scenario (7.80 Euros per kg in the base scenario case), 6.69 Euros per kg for the High prices scenario and 7.27 Euros per kg for the low prices scenario. The respective values for the monthly settlement cases are 6.59 Euros per kg for all market prices cases. In monthly settlement scenarios, the energy procured from the PPA is always consumed towards green hydrogen production. This leaves no room for electricity market transactions and exploitation, since no excess energy remains to be sold back to the wholesale market to incur additional revenues and thus lower the overall CoE (Eqs. 14 and 15). While monthly settlement allows for time shifting in production of hydrogen, which provides some flexibility, the overall produced green energy is directed in full towards Hydrogen production within the month. In the hourly correlation settlement scenarios, the amount of excess energy is redirected to the market and thus is able to decrease the overall LCOH regardless of technology. The corresponding values for the AEL unit are 5.36 Euros per kg for the base reference case (6.16 Euros per kg for the base scenario case), 5.09 Euros per kg for the high prices case, and 5.65 Euros per kg for the low prices case. The corresponding monthly settlement cases are 5.15 Euros per kg.

Scenario 2 results

In scenario 2, the aggregator is expected to enlarge the market value of the excess energy through active trading activities. As in scenario 1, the same mix of RES assets as in the base case scenario are maintained and the same utilization levels are realized. In this way, the hydrogen production is unaffected by electricity market operations. Supplementary Table 1 includes scenario 2 subsets. The Aggregator leverages on intraday markets and continuous trading activities, thus increasing the value of the excess energy traded, without affecting volumes. This would serve as the main incentive for both the RES producer to undertake a portion of the risk, as well as the Aggregator to actively seek market opportunities. If an overall increase of the excess energy market value is not achieved by the Aggregator, then there is no sense for either the Hydrogen or the RES producer to acquire such services and the scenario will degenerate to scenario 1. For the purpose of this work, we assume three different sub-scenarios regarding market-related results to assess the impact on the LCOH from risk sharing and active trading activities. In this scenario, the RES producer receives a fixed price for 80% of the energy produced at a premium price compared to Scenario 1. Nevertheless, the active involvement of the Aggregator is capable of negating that effect.

For the PEMEL unit, in hourly settlement and in the reference electricity market scenario a 10% increase of the market value of the excess energy by the aggregator yields an LCOH of 6.49 Euros per kg, a 20% increase value a 6.41 Euros per kg and a 30% increase value a 6.34 Euros per kg. For the AEL unit, the corresponding prices are 4.91 Euros per kg for 10% performance, 4.83 Euros per kg for 20% performance, and 4.76 Euros per kg for 30% performance. The aggregator performance for level LCOH is estimated at 25% with a market yield of 88.56 Euros per MWh to reach an LCOH of 4.47 Euros per kg. The aggregator should underperform by about 52% for the LCOH to rise up to the original value of 6.96 Euros per kg for PEM and 5.36 Euros per kg for AEL technologies. In terms of actual market value, this would be translated to a 10-year average loss of 32.26 Euros per MWh from the electricity market, compared to the 67.21 Euros per MWh electricity market revenue without active trading, which is an extreme for a 10-year period. As such, the market exposure through the aggregator appears to provide benefits for all involved parties. Results for all cases including regulatory discount scenarios are presented in Table 4.

It should be noted, the lack of substantial available energy to transact in the energy market in the monthly settlement scenarios is also impactful. The overall LCOH does not change despite Aggregator performance as it revolves around 6.19 Euros per kg for the base reference PEMEL case and 4.75 Euros per kg for the AEL unit.

Scenario 3 results

In scenario 3, a concept where all individual participants (RES producer, hydrogen producer, and Aggregator) are the same entity and are working towards minimization of the LCOH. This would imply that the RES asset would not require margins in their operations and would provide the energy at an LCOE cost. At the same time, the Aggregator actively seeks to enhance the revenues from market transactions and retains only some necessary streams to cover operational expenses, with no interest in margin creation. All savings from this process are directed towards the reduction of the electricity cost and subsequently the LCOH reduction.

As in scenario 2, for the PEMEL unit, in hourly settlement and in the reference electricity market scenario a 10% increase of the market value of the excess energy by the aggregator yields an LCOH of 6.75 Euros per kg, a 20% increase value a 6.66 Euros per kg and a 30% increase value a 6.56 Euros per kg. For the AEL unit, the corresponding prices are 5.16 Euros per kg for 10% performance, 5.06 Euros per kg for 20% performance, and 4.97 Euros per kg for 30% performance. The aggregator performance for level LCOH (6.96 Euros per kg for PEMEL and 5.36 Euros per kg for AEL in scenario 1) is again irrelevant, as results are already formed lower than scenario 1. In both cases, the reduction of necessary performance is due to the fact that the drop in the PPA price absorbs most of the market transaction requirements. As we can observe in Table 4, the lower PPA cost of scenario 3 (LCOE without premiums) lowers the overall electricity cost to an extent that the Aggregator should underperform, which is out of the study framework. In the best-case scenario of high market prices with impactful aggregator performance, combined with regulatory discounts, the resulting LCOH can drop to 5.74 Euros per kg for PEMEL and 4.18 Euros per kg for AEL. Results for all cases are presented in Table 4.

The differences between technologies are based on both CAPEX and OPEX gaps. As it can be observed in Table 5 PEMEL units have an almost 37% higher CAPEX cost compared to AEL units (1.43 mil Euros per MW versus 0.896 mil Euros per MW). On top of that, system efficiency is higher in AEL units, starting at 54.08 kWh per kg H2 produced for PEMEL versus 53.88 kWh per kg H2 produced for AEL. The efficiency deficit is further augmented by the degradation factor of the units, where PEMEL units degrade almost 40% faster than AEL units. PEMEL units degrade at a rate of 0.19% per 1000 h of operations, while AEL units degrade at a rate of 0.115 %.

Regulatory charges discounts

Regulatory charges are calculated across all scenarios separately. Depending on the scenario, they amount to about 15% −20% of the overall electricity cost. Discounts can decrease regulatory charges by almost 75%, as can be seen in detail in Table 6. These reductions are directly reflected in the final LCOH, resulting in lower values of 0.45–0.6 Euros per kg depending on technology provider and settlement considerations, as can be seen in Table 6. The impact of regulatory charges discounts can be observed in all scenarios (1, 2, and 3). It is indicated, therefore, that in the current state of market maturity, and to promote Green Hydrogen, discounts or regulatory incentives would have to be examined as an option. Nevertheless, the horizontal application of such discounts for green Hydrogen production would not be optional from a socioeconomic point of view, as that energy is used for the production of a commodity, in this case, hydrogen. Further investigation is required to assess the impact of network discounts on part of the Hydrogen production, for example, only for the part that is used for system balancing or the application of otherwise curtailed energy.

Curtailments

Scenario 1 for no regulatory discounts and base reference electricity prices yields an LCOH of 6.96 Euros per kg for PEMEL technology and 5.36 Euros per kg for AEL technology. This indicates that for the two technologies to converge and for the gap in LCOH to be bridged, the PEMEL technology would have to be able to draw from the curtailment provisions of the DA the appropriate energy at a specific price. PEMEL can reach peak capability within seconds (less than 1 min) in a warm start-up mode. AEL, on the other hand, would require from a minute to a full hour34,35. This means that PEMEL technology can utilize 6–30 times more energy coming from curtailments in comparison to AEL facilities, according to the information provided in Table 5. Typical RES curtailment events by the Greek TSO have a duration ranging between 30 min and 2–3 h, depending on substation36. This affects Hydrogen production that would be produced on top of the original scheduling, but would also incur extra costs for water, maintenance, and electricity charged at a different price (curtailment price) than that of the PPA. Furthermore, it would speed up the degradation of the equipment due to overuse compared to the examined scenario.

Through the proposed methodology (IV methods, subchapter E) we are able to provide some estimates regarding the cost of curtailed energy (Pricecurt) that could level the LCOH between the two technologies, by taking into account the better PEMEL performance as well as all other relevant operational costs (such as water consumption and faster equipment degradation). In an hypothetical scenario, we assume that all the available (Ecurt) capacity (the available energy beyond the minimum target utilization factor of 70%) of an electrolyzer will be eligible to consume energy from RES that would otherwise be curtailed, then the remaining hours until 100% utilization would amount to 1868 hr per year. If a PEMEL can indeed utilize the edge case of 30 times more energy than AEL, that means that a PEMEL unit would reach 100% utilization using all available hours, whereas an AEL unit would reach only 71% utilization, by managing to draw only 62 h from curtailments. Curtailments are energy used at any time they occur within any given period and are thus irrelevant towards temporality constraints towards the original PPA. The eligibility of the electrolyzer to draw from otherwise curtailed energy affects the relevant utilization levels. A summary can be seen on Table 7.

In both PEMEL and AEL cases, as the utilization increases and the curtailment electricity cost is lower than the original PPA cost, the LCOH improves. The different final electricity cost is highly dependent on the curtailment price (Pricecurt). The lower the curtailment prices, the lower the LCOH can decrease. The rate of the decrease is faster for PEMEL electrolyzers since they can utilize under the above assumptions more electricity for curtailments, but with a certain limit, as can be seen in Table 7.

This happens due to the fact that as the available hours from curtailments between PEMEL and AEL grow diminish, so does the PEMEL leverage, and prices should also be low enough to create the opportunity. All solutions converge on an equal LCOH of 5.28 Euros per kg for both technologies in the 30 times more efficient PEMEL vs AEL edge case. If we assume that the electrolyzer can procure otherwise curtailed energy with zero extra costs (0 Euros per MWh), the relevant curtailment eligibility percentage should not drop below 82.48%. In a similar approach for six times better performance for the PEMEL equipment, for a no-cost energy procurement, the capacity availability should not drop below 96% with LCOH converging on 5.09 Euros per kg. According to the DA, the TSO is responsible for verifying the would-be curtailed energy. The TSO could compensate the hydrogen producer for consuming energy rather than charging for it if the prices are formed in the balancing or a balancing resembling- market. This would imply that the agreements and contracts between the RES producers and the TSO versus the potential compensation of the Hydrogen producer would make financial sense for the System Operator. Agreements and mechanisms such as these would affect the balancing market behavior and must be investigated further.

Conclusions

In the current work, we have investigated the temporal correlation implications of the European Union Additionality DA for the production of renewable fuels of non-biological origin. Focus is given on the requirement that would demand RFNBO production to take place simultaneously with the production of energy from renewables via a dedicated PPA. The hourly versus monthly correlation is tested against different market participation strategies, which include trilateral agreements between the hydrogen producer, the RES producer, and an Aggregator. Against those scenarios, the applicability of regulatory discounts is also explored, and their impact on LCOH is investigated.

Optimal RES mix selection methodology

An optimization methodology for selecting the optimal mix of renewables has been developed and presented. The methodology was deployed with data collected for the needs of the EPHYRA project, for a 30 MW electrolyzer facility in Greece. Our findings suggest that the utilization level is optimized around 70% for both investigated technologies (PEMEL and AEL) in a no-market transactions scenario. This scenario is unbiased from market prices, which would otherwise affect the LCOH upwards or downwards. We have maintained the utilization level identified to examine various PPA structures and trilateral agreements between the RES producer, the hydrogen producer, and a RES Aggregator, responsible for market operations. In this study, the Pay as Produced PPA was investigated. According to regulation prior to the DA (RED II), the certification of hydrogen as RFNBO, was relevant to the cancellation of adequate Guarantees of Origin, without strict temporal correlation requirements. Under the current framework, the temporal correlation between RES and Hydrogen production affects the LCOH, as it can be observed in the basic Scenario. The needs of RES assets towards Green Hydrogen production are highly dependent on the temporal correlation requirements. For the 30 MW electrolyzer case study an increase in wind power from 40 to 59 MW is required for PEMEL technology between monthly and hourly temporal correlation respectively. The solar capacity required decreases from 85 to 47 MW. Similarly, for the AEL technology an increase in wind power from 45 to 64 MW is identified, and a decrease in solar power from 90 to 45 MW can be identified between monthly and hourly temporal correlation respectively. The increase of the LCOH due to settlement in smaller resolution periods occurs due to the fact that an important proportion of the RES produced PPA energy exceeds the electrolyzer capacity and cannot be used towards Hydrogen production. It is therefore necessary to consider more flexibility in PPAs towards green hydrogen production, by promoting the engagement of parts of the production of specific assets in order to form the optimal mixes in any given case. This could entail the allocation of part of the production of new RES to be redirected from hydrogen-related PPAs instead of the market or other remuneration mechanisms.

Electricity market optimization and different electricity market strategies

The excess energy can be traded back into the wholesale market via an aggregator under different arrangements. Three different scenarios are investigated, focusing on the transactions and arrangements between the hydrogen producer, the RES producer, and the Aggregator. The analysis shows that if resources are diverted towards hydrogen production, then the LCOH can drop if electricity market trading is efficient enough. Another important factor is subsidies in the form of grid charge discounts. The application of discounts affects the final electricity cost and can result in up to 10% lower LCOH. We utilized our framework to show that for a fixed 10-year offtake baseload of 70% (from the 30 MW electrolysis unit) in a 72.73 Euros per MWh electricity market, an LCOH of 6.96 Euros per kg (5.36 Euros per kg) is expected for PEMEL (AEL), and this may be reduced to 6.11 Euros per kg (4.69 Euros per kg) if network charges are discounted. Future work to that end could focus on synthesizing realistic hydrogen offtake profiles and probabilistic analysis for medium to short-term taking into account national/regional regulatory advancements on the primary and secondary hydrogen markets.

The best-case scenario LCOH still does not meet the level of natural gas (NG) equivalent prices. In order for hydrogen to be able to replace fossil-based gases, regulatory measures and incentives have to be deployed, such as the allocation of part of the new RES towards hydrogen production in the attempt to form modular and dispersed PPAs, thus better able to cover the baseload electrolyzer requirements.

Curtailment signals response capacity

Furthermore, an initial investigation of the PEMEL potential to better respond to curtailment signals has been performed. The results indicate that equalizing the LCOH between the two technologies the cost of curtailment energy is feasible and depends on the curtailed energy cost and the efficiency of the units. This finding needs to be further investigated with regard to the balancing market mechanisms and potential revenues instead of low curtailment energy prices. The curtailments scenario presented is an edge case hypothesis that assumes that the electrolyzer unit can indeed complement the energy procured via a dedicated PPA with an inexhaustible reserve of otherwise curtailed energy. Curtailments have only recently had of impact in the Greek bidding zone, as RES capacity increases, and are expected to be of significance in the future. According to National Regulatory Authority (NRA) publicly available information37, in the period January 2024–March 2024 about 76 GWhs were curtailed. The respective number for the period January 2025– March 2025 amounts to 230 GWhs. As previously mentioned, the curtailments are subject to locale on a substation level and cannot be treated in a uniform manner even within the same electricity bidding zone. In addition to the above, no large-scale (TSO level) electrolysis plants are active in Greece at the moment, and no operational data are thus available. The EPHYRA project electrolysis plant aims to become the first major project able to quantify operational and curtailment leverage data on a Grid scale level. Nevertheless, the curtailed quantities trends indicate that the edge case scenario is not unrealistic for electrolysis systems and must be further investigated, according to NECP provisions.

Curtailments within the Greek market framework are at the moment skewed by the fact that no negative balancing prices are permitted and thus the TSO resorts to direct signals. The curtailment leverage scenario under this study is limited to ramping rates differences across electrolyzer technologies, based on actual vendor-acquired data. These extremes indicate the capabilities of the different technologies to respond to market-driven signals and leveraging curtailments can affect the utilization level of the electrolysis plants. Further analysis will be possible based on actual operational data from the EPHYRA project electrolyzer, as well as the allowance of negative balancing prices.

Hydrogen storage

The EPHYRA project does not include any provisions for hydrogen storage capacity. The pilot studies under the project satisfy a direct consumer in proximity to the Hydrogen production plant. The hydrogen offtake is as-produced and directly correlated with the renewables production profile. Thus, the LCOH approach under this study does not take into account hydrogen storage or transportation costs. Potential future work could include a future study under a hydrogen valley concept or the relevant costs for satisfying volatile hydrogen offtake scenarios will be further investigated.

Additional life-cycle costs future investigation

Additional costs must be explored and analyzed towards a full life-cycle cost analysis and breakdown, including recycling, electrolyzer decommissioning, and water resource cost must also be explored as the EPHYRA project evolves. The additional costs triggered by environmental factors will present a better depiction of the overall costs that due to their nature, may offset the positive environmental impact of green Hydrogen applications. The actual operation of the electrolyzer unit in the EPHYRA project will also allow for real operational testing of the degradation and efficiency mechanisms involving partial load charges, temperature, and pressure sensitivities that will take place during the intermittent power supply of the RES units under the relevant PPA.

Impact of oxygen as a byproduct

High-purity oxygen can be captured with the deployment of oxygen separators, as a by-product of the electrolysis process38. Oxygen as a commodity product is valued in the literature between 0.1 and 4.2 Euros per kg11,39, creating a potential additional revenue stream. The exploitation of oxygen as a byproduct of the electrolysis process yields interesting results. According to a number of studies, an improvement in LCOH results can be observed in the area of 0.3–1 Euros per H2 kg11,40,41, when oxygen is produced as a by-product from electrolysis. However, oxygen separators incur additional CAPEX costs as standalone units and impact the overall Balance of Plant, electricity consumption and maintenance costs (CoM). Future work for improving the LCOH further will require the study of the potential oxygen markets, policy, and bankability in addition to related total expenditure for its production. On this account, we have excluded potential oxygen revenue streams from the LCOH methodology. Nevertheless, the exploitation of oxygen produced in the electrolysis process must be further evaluated.

Long-term parameters trend

Our analysis extends on a 10-year period and incorporates a number of parameters listed in Supplementary Table 2. A number of these parameters are difficult to predict for a long forecasting horizon. These parameters are specifically Water€, Land€. TaxDeprt and Tax are treated statically.

The reason for the difficulties across these parameters varies. Water cost has no relevant trend or regulated market, while land cost fluctuates and is highly dependent on exact locations. Another set of parameters includes governmental decisions and legislation (such as Taxes or Depreciation) as well as regulatory charges. The regulatory charges framework in Greece is revised according to the “Methodology for Calculating the Required Revenue of the ESMIE Operator” and the “Management Code of ESMIE” in 4-year regulatory periods. Regulatory charges are not easy to predict, as they depend on a series of unpredictable variables such as operating expenditures, revenue deductions from non-regulated activities, and the employed capital incorporated in a single weighted average cost of capital for the entire duration of the regulatory period42. Our framework ensures that any changes in the regulatory environment can be integrated in LCOH estimations. The regulatory framework considered for this study embraces the set or rules and regulations that are active in 2025 in Greece as imposed by the European Commission. The regulatory domains related to this study include electricity markets, electricity networks, hydrogen, and water. Our proposed framework was built with flexibility in its core to enable such policy-related sensitivities. Potential future work could include a sensitivity analysis on all otherwise statistically treated parameters.

Methods

PPA structure and transaction settlement

There are two main types of potential PPAs considered for a hydrogen production facility that satisfy the DA requirements:

-

a.

Physical PPA: In this arrangement, the corresponding link between the RES producer and the electrolysis plant, is not settled via the wholesale electricity market prices. In this arrangement, two variants are identified:

-

i.

Direct link without a connection to the external grid from either the RES or the electrolysis plant.

-

ii.

A utilization of the main grid to transport electricity from the RES asset to the electrolysis plant. The settlement of this arrangement is based on nominations of energy in the electricity market to the electrolysis plant. Energy nominated is not traded in the wholesale market quantities.

-

i.

-

b.

Virtual PPA: In this arrangement, the energy from renewables is sold to the wholesale market at a specific price in Euros per MWh equal to the market clearing price. The electrolysis plant procures from the market the required energy at the same MCP. Transactions in a virtual PPA between the RES producer and the electrolysis plant are the contract for fifference (CfD)43. It should be noted that while CfDs are generally linked to governmental subsidies, they are a financial instrument that can be applied to a variety of buyer/seller counterparties44. A financially settled Pay-as-Produced (PaP) at a fixed contract price (in Euros per MWh) would apply to each generated and metered MWh per market time unit (MTU) -usually an hour- and would require that the plant pays to the RES producer:

where Eprod equals the energy that is produced by the RES in a specific hour, the PPAstrike price is the agreed fixed PPA price, and MCP is the market clearing price in that specific hour. To simplify the market operating model, we assume that the role of the distribution network operator is to manage the grid and provide meter readings, the role of the market operator is to produce associated Guarantees of Origin (GoOs) from RES, the role of the transmission system and network operator (TSO/TNO) is to operate the HV network and associated balancing markets. The role of the energy supplier is to provide settlement of the invoiced energy consumption of the electrolysis facility. PPA contract duration is assumed to be 10 years, Pay-as-produced and fixed price contract45.

For the purposes of this study, we consider that Pay as Consumed (PaC) PPAs do not ad hoc satisfy the additionality principle, since specific renewables must be included in the relevant contract, and thus we exclude them from further analysis. In all cases, the following actors are assumed with their defined roles:

-

RES producer: is the owner and operator of the RES plant;

-

Aggregator/trader: represents the RES asset in the electricity market and may utilize trading capabilities for market optimization;

-

Hydrogen producer: the offtaker of the renewable energy

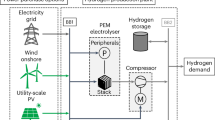

A conceptual model of the energy interactions between the hydrogen production facility, the RES aggregator, and the RES assets that are included in a relevant PPA contract is depicted in Supplementary Fig. 2.

The energy produced by each RES asset n in hour h is defined as follows:

where,

\({{degr}}_{re{s}_{ny}}\) is the degradation factor applicable for RES asset n in year y,

\({{Prof}}_{{nh}}\) is the hourly production profile of RES asset n and

\({{Cap}}_{n}\) is the capacity of asset n

The different RES profiles are presented in detail in Table 3.

The hourly settlement correlation is modeled as follows:

where,

\({{{PPA}}_{{Strike\; price}}}_{n}\) is the PPA contract strike price of RES asset n

\({{Eprod}}_{{nh}}\) is the production of RES asset n in hour h

\({{Econs}}_{h}\) is the energy consumed by the electrolysis unit in hour h

\({{MCP}}_{h}\) is the wholesale market clearing price in hour h

a is a binary variable that annotates the ability to perform market transactions.

The monthly settlement correlation is modeled as follows:

where

Energy produced from RES asset n is aggregated on a monthly level (month m) by summing the energy produced on each hour h belonging to month m.

Energy consumed from the electrolysis plant is the sum of energy consumed for each hour h belonging to month m

\({{WAP}}_{m}\) is the weighted average price of month m

a is a binary variable that annotates the ability to perform market transactions.

Supplementary Fig. 3 presents a graphical representation of hourly settlement of a 120 MW PV RES asset versus a 30 MW electrolyzer. The aggregated excess energy is 13,372.8 MWhs. Supplementary Fig. 4 presents a graphical representation of monthly settlement of the same configuration. The aggregated excess energy is 2208.12 MWhs.

Electrolyzer model

The most common technologies for electrolysis technologies are alkaline (AEL) and polymer electrolyte membrane (PEMEL)46. The electrolyzer plant contains the electrolyzer stack, which is the core component responsible for Hydrogen production using energy, and the balance of plant (BoP) that includes water purification modules, gas separators, hydraulic pumps, compressors, and oxygen capture modules, as well as other electrical components such as rectifiers34. The electrolyzer unit operates under different states (cut off/ stand-by/production). In the cut-off state, the electrolyzer facility does not produce hydrogen under a certain threshold. The cut-off threshold has been acknowledged in the Electrolyzer model. Stand-by energy has been modeled as an increase in energy required to produce a unit of hydrogen. Concerning compressors, hydraulic piston systems are the most frequently employed due to their ability to handle high pressures, especially when compared to mechanical piston compressors, and their maturity in contrast to membrane compression47. These systems rely on electricity to increase the hydrogen pressure and distribute it to end-users or storage devices, and more than one compressor can be deployed. The energy required for the compressor units is integrated in the overall system-level energy demand.

Therefore, the core characteristics of the facility that are modeled in our framework are presented in Table 8.

Financial model

The LCOH metric value is formulated when the discounted sum of revenues equals the discounted sum of costs. The LCOH is calculated “as produced” at the metering point of the electrolysis plant with no additional storage or transportation cost included. The calculation of the LCOH takes into account any remaining value of the asset at the end of the PPA contract period and incorporating it into the overall TOTEX (Eq. 4).

where r stands for the discount rate, TOTEXy are the total (CAPEX and OPEX related) costs in year y, QH2y is the quantity of hydrogen produced in year y in kg, and TaxDepry is the tax depreciation value in year y8. For TaxDeprt calculations, a value of 10% of Electrolyzer CAPEX was used, spread across the 10-year effective electrolyzer lifetime (t). The 10% depreciation value does not apply to engineering, procurement, and construction (EPC) or any other CAPEX costs

The TOTEX component is the sum of both CAPEX and OPEX.CAPEX component is the sum of all costs including all related EPC costs. The development, BoP costs, and the actual cost of the electrolyzer unit are embedded in the CAPEX component, which represents the upfront expenses prior to the initiation of operations or relevant CAPEX during operations. It also includes the cost of land (CoL) if the facility is erected on an owned land. In case the land is rented, the relevant cost is allocated to the OPEX component. These expenses are dependent on the different suppliers or contractors deployed in each case and are presented in terms of Euros per MW installed in Supplementary Table 2. TOTEX, includes cost of water (CoW), CoE, CoL (in case the land upon which the facility is erected, is leased), personnel cost (CoP) and CoM including SLAs with the electrolyzer vendor, as well as any kind of reinvestment costs (CoR) in case of stack replacement minus any remaining value (\({{Value}}_{{rem}}\)) of the asset at the end of the period under evaluation, (\({Projec}{t}_{{life}}\)).

where \({{{{\rm{Water}}}}}_{\euro}\) is the unitary CoW in Euros per lt, \({{{{\rm{Land}}}}}_{\euro}\) is the unitary CoL expressed in Euros per 1000 m2/year, \({{{{\rm{Maint}}}}}_{\euro}\) is the cost of annual maintenance in Euros per MW installed. The CoW is assumed at 1 Euro per m3 (or 0.001 Euros per lt), based on the current industrial charges for water in most of Greek areas and the CoL at 250 Euros per 1000 m2/year, per market value for non-arable land in rural Greek areas.

The CoE is calculated as follows for hourly settlement:

Or for monthly settlement:

where

PSO are the Public Service Obligation regulatory charges imposed on the consumption of the facility and expressed in Euros per MWh, RES are the levy regulatory charges imposed on the consumption of the facility and expressed in Euros per MWh, system are the power network related regulatory charges expressed in Euros per MW per month, month is the number of months in period t, Unitary values for the regulatory charges can be found on Suplementary Table 3.

The amount of hydrogen produced can be calculated by the linear relationship shown in Eq. 15.

degr represents the stack degradation rate, that results in less gas production per energy consumed. The discount rate (r) is estimated via the WACC for the investment calculated as follows48:

where Tax stands for the corporate tax rate (also called tax shield in terms of WACC calculation), \({Deb}{t}_{{ratio}}\) represents the ratio of debt to capital within an organization, the Debtcost stands for the yield to maturity on existing debt and Equitycost the required rate of return for equity in an investment. In the case of Greece, a corporate tax of 22% was utilized. The WACC resulting in this particular case study mounts to 11.44%.

The utilization of the electrolysis plant can be described as the ratio of the full hydrogen producing hours to the available hours in a specific period (usually a full calendar year)25,49.

where operating hours in period y are the equivalent full production hours (h) when the electrolysis facility produces green hydrogen and total hours in period t are the total available hours in given period (8760 for a full calendar year, 744 for a full calendar month, etc).

LCOH minimization

The aim of the optimization problem is to identify the necessary mix of assets and their respective capacity based on the production profile of each asset and their corresponding capacity that results to the lowest possible LCOH, while satisfying a minimum utilization factor for the facility, that implies a minimum amount of Hydrogen production restriction per year. The asset pool is presented in Table 3. The objective function selected is the LCOH, which can better represent the production costs of Hydrogen. The LCOH function as defined in Eq. 8 does not take into account the potential market selling price for Hydrogen itself.

As such, the fitness function of the optimization is reduced to the LCOH formula (Eq. 8), as follows:

Subject to the following constraints:

-

\({{Cap}}_{n}\ge 0\)

-

\(0{\le {Eprod}}_{{nh}}\) \(\forall\) \(h\in {Projec}{t}_{{life}}\)

-

\({\sum }_{1}^{n}{{Eprod}}_{{nh}}\ge {{Econs}}_{h}\) \(\forall\) \(h\in {Projec}{t}_{{life}}\)

-

\({MinUT}{\le {Utilization\; Factor}}_{y}\le 100 \%\) \(\forall y\in {Projec}{t}_{{life}}\)

-

\({{{Thr}}_{{cut}}\le {Econs}}_{h}\le {P}_{{en}}\) \(\forall h\in {Projec}{t}_{{life}}\)

Where \({{Utilization\; Factor}}_{y}\) is the utilization factor (Eq. 3) in year y, \({MinUT}\) is the minimum allowed utilization factor across all operational years, that ensures a minimum Hydrogen amount production, and \({Projec}{t}_{{life}}\) is the estimated project lifetime.

We have modeled our framework using the expanded GRG optimization engine by frontline systems.

Curtailments impact assessment methodology

To assess curtailments impact, we have isolated additional energy that can be consumed from the grid (otherwise curtailed energy) as

Pen is defined as maximum energy that can be consumed on a specific hour at maximum capacity P, in Table 8. As \({{Econs}}_{h}\le {P}_{{en}}\) \(\forall h\in {Projec}{t}_{{life}}\) (minimization problem constraints), the \({E}_{{curt}}\) quantity is always greater than zero and represents the capacity of the electrolyzer unit to consume energy up to the maximum energy \({P}_{{en}}\), above the production capacity of the RES unit under the PPA contract, leveraging on grid-scale curtailments.

The electrolyzer can utilize this extra energy by a degree depending on other factors (such as plant availability). This degree is defined as capacity factor (c) and expressed in %. The utilized curtailed energy (\({{UE}}_{{curt}}\)) is

This additional energy creates a new consumed energy for hydrogen production defined as Econsh’, where,

The final consumption replaces original consumed energy (Econsh) in Eq. 16 and increases the produced hydrogen.

The CoE (Eq. 8) is amended as follows:

Where \({{Price}}_{{curt}}\) is the curtailment price (in Euros per MWh) that would be charged for the extra energy consumed.

Inputs

Electricity network charges

Regulated electricity charges are used to model the costs related to network charges. The values applicable to the Greek Transmission Network (Supplementary Table 3) are used, according to the 198/2023 Greek NRA50.

According to Greek Law 4951/2022, all electricity storage facilities, either standalone or combined with RES assets, are exempt from PSO and RES levy charges. Regarding system charges, storage stations are charged according to a specific methodology, approved by the NRA, to the extent that their demanded energy contributes to the system peak. If a similar methodology and discount approach is considered for hydrogen facilities, the discounted charges amount to 2200 Euros per MW per month installed with no energy-related charges. The potential discounted values for hydrogen facilities (if they are regarded as storage facilities would drive PSO and RES levy charges to 0 Euros per MWh and the system charges to 2200 Euros per MW per month.

Renewables

Renewable energy production profiles and locations were taken from historical values of operational plants from a renewable’s aggregator in Greece with more than 850 MW RES portfolio mix of solar and wind projects under management. Data were curated and cleansed in order to create hourly normalized profiles for each location. Generic RES production profiles for the Greek bidding zone were used from the Greek NRA51 as a benchmark which utilized the cost of new entry (CONE) methodology. Subsequently, a PPA price was estimated based on each asset's performance vs the baseline generic equivalent, while taking into account the current level of wholesale electricity market prices. The technical characteristics and PPA prices of the RES Assets used are shown in Table 3. RES asset degradation was estimated by technology at 0.5% per year for wind farms52,53 and 0.3% per year for solar installations54,55.

Wholesale electricity market prices

Greek electricity market price scenarios are utilized in the reported analysis; the base reference scenario is based on the Greek NECP56, a low price scenario, and a high price scenario. MCP is modeled on an hourly basis throughout the period under consideration. Results of the simulation and aggregated day-ahead market, market prices for the decade 2030–2039 are presented in Supplementary Fig. 1. 2030 is the initial year where the temporal correlation condition will be applied on an hourly basis, since a transitional period with monthly temporal correlation is provisioned until 2030. Both monthly and hourly temporal correlation is further explored in the study scenarios, presented in Chapter III.

Electrolysis system inputs

A global tender exercise for a 30 MW electrolyzer facility took place during June–September 2023, as part of the EPHYRA project requirements. A total of nine different manufacturers responded (two PEMEL and seven AEL), providing a total of ten separate technical and commercial proposals. In order to enable technologies comparison, an “average PEMEL” and an “average AEL” electrolyzer have been generated, as averages of the data provided by each vendor. The information is summarized in Table 5 and is relatively aligned with the strategic research and innovation agenda by the clean hydrogen JU state-of-the-art data for 2020 and relevant 2024 targets35.

In addition to the global tender, detailed market research took place that consolidated input from various electrolyzer systems manufacturers based on publicly available data and proprietary quotes, in order to solidify the results of the global tender and ensure the consistency of the received offers. An additional reason behind the separate market research was to validate the outstanding outliers observed throughout the tender process in a number of metrics and KPIs.

Electrolyzer stack replacement takes place according to vendor specifications. A number of vendors provide a guarantee in years, while others in hours of operation. In this case study, a stack refurbishment is assumed for all electrolyzer models after 80,000 h of operation9. If the 80,000-h limit is not reached within the 10-year period, the remaining value of the equipment is calculated and its depreciated value counted against the CAPEX component of the LCOH. Under the current simulations, the trigger of 80,000 h of operation was not reached under any scenario; as such the CoR component of Eq. (4) is set to zero €. CoMs are considered as 2.5% of CAPEX based on8,9,57, for the simulation requirements. Regarding CoPs, a total of 8 employees are assumed with an average cost of 30,000 Euros per year/employee. The number of employees is suggested by the vendors proposals and is also supported by the MOH refinery operations. The cost assumption is based on the average wages for site engineers in Greece according to Randstad HR and the salaries tends 2024 report58. CoMs can be treated under two different approaches. The first approach provides for an annual fixed CoM proportional to the installed capacity and the CAPEX. The second approach provides for a non-static CoM, linked to the strain of the equipment and relevant utilization levels and Hydrogen production. The static approach is preferred in both vendor quotes as well as relevant literature8,9,57.

Data availability

A summary of values utilized in the technical and financial modeling is presented in Supplementary Table 2. Data includes water cost that can also be accessed on https://www.eydap.gr/en/CustomerSupport/normalrates/, land costs that can also be accessed on https://maps.gsis.gr/valuemaps/, Tax coefficients (Depreciation and income tax) available at https://minfin.gov.gr/en/tax-policy/tax-guide/income-taxation/ and WACC values used in the financial model. Generic Renewables production profiles for Solar and Wind assets are derived from historical data available at https://www.admie.gr/en/market/market-statistics/detail-data and https://www.raaey.gr/energeia/diavoulefseis/9467/. Curated production profiles and Greek Wholesale electricity market prices based on NECP are available and can be accessed at https://doi.org/10.6084/m9.figshare.28807028.v1 Data supporting renewables production profiles are not publicly available as they represent the historical production efficiency of motor oil renewable energy SA (a subsidiary of Motor Oil Hellas SA) own assets. Data supporting wholesale Greek electricity market prices forecast scenarios are not publicly available, as they are intellectual property of Motor Oil Hellas SA and Motor Oil Renewable Energy SA and are utilized for operational and market participation strategy purposes.

References

Dalius, T. The role of hydrogen in energy decarbonisation scenarios. (JRC, 2022) https://doi.org/10.2760/899528.

Adoption of the Paris Agreement in Framework Convention on Climate Change Paris.

COP26: Together for our planet | 1United Nations, accessed 10 November, 2023. [Online]. Available: https://www.un.org/en/climatechange/cop26.

COP28 UAE - United Nations Climate Change Conference, accessed 27 December, 2023. [Online]. Available: https://www.cop28.com/.

European Commission. Commission Delegated Regulation (EU) 2023/1184 - EUR-Lex − 32023R1184, accessed 10 November, 2023. [Online]. Available: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.L_.2023.157.01.0011.01.ENG&toc=OJ%3AL%3A2023%3A157%3ATOC.

COM/2020/301. A hydrogen strategy for a climate-neutral Europe. [Online]. Available: https://www.eu2018.at/calendar-events/political-events/BMNT- (2020).

EU Hydrogen Strategy. DG Energy, accessed 10 November, 2023. [Online]. Available: https://energy.ec.europa.eu/topics/energy-systems-integration/hydrogen_en.

Fan, J. L., Yu, P., Li, K., Xu, M. & Zhang, X. A levelized cost of hydrogen (LCOH) comparison of coal-to-hydrogen with CCS and water electrolysis powered by renewable energy in China. Energy 242, 123003 (2022).

Matute, G., Yusta, J. M. & Naval, N. Techno-economic model and feasibility assessment of green hydrogen projects based on electrolysis supplied by photovoltaic PPAs. Int. J. Hydrog. Energy 48, 5053–5068 (2023).

María Villarreal Vives, A., Wang, R., Roy, S. & Smallbone, A. Techno-economic analysis of large-scale green hydrogen production and storage. Appl. Energy 346, 121333 (2023).

Squadrito, G., Nicita, A. & Maggio, G. A size-dependent financial evaluation of green hydrogen-oxygen co-production. Renew. Energy 163, 2165–2177 (2021).

Lazard (Levelized Cost of Hydrogen Analysis, 2021).

Biggins, F., Kataria, M., Roberts, D. & Brown, D. S. Green hydrogen investments: investigating the option to wait. Energy 241, 122842 (2022).

Lazard (LCOE plus, 2023).

Minutillo, M., Perna, A., Forcina, A., Di Micco, S. & Jannelli, E. Analyzing the levelized cost of hydrogen in refueling stations with on-site hydrogen production via water electrolysis in the Italian scenario. Int. J. Hydrog. Energy 46, 13667–13677 (2021).

Wolf, N., Tanneberger, M. A. & Höck, M. Levelized cost of hydrogen production in Northern Africa and Europe in 2050: a monte carlo simulation for Germany, Norway, Spain, Algeria, Morocco, and Egypt. Int. J. Hydrog. Energy 69, 184–194 (2024).

I. International Energy Agency. Global Hydrogen Review 2023. [Online]. Available: www.iea.org (2023).

BMWK - European Commission gives the go-ahead for the funding of 24 German IPCEI hydrogen projects, accessed 10 January, 2025. [Online]. Available: https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2024/02/20240215-european-commission-approves-funding-for-key-hydrogen-projects.html.

Islam, A. et al. Accelerating the green hydrogen revolution: a comprehensive analysis of technological advancements and policy interventions. Int. J. Hydrog. Energy 67, 458–486 (2024).

Odenweller, A., Ueckerdt, F., Nemet, G. F., Jensterle, M. & Luderer, G. Probabilistic feasibility space of scaling up green hydrogen supply. Nat. Energy 7, 854–865 (2022).

Burchardt, J. et al. Turning the European Green Hydrogen Dream into Reality: A Call to Action Without additional regulatory support, European green hydrogen may remain the fuel of the future (2023).

Bracci, J. M., Sherwin, E. D., Boness, N. L. & Brandt, A. R. A cost comparison of various hourly-reliable and net-zero hydrogen production pathways in the United States. Nat. Commun. 14, 7391 (2023).

Giovanniello, M. A., Cybulsky, A. N., Schittekatte, T. & Mallapragada, D. S. The influence of additionality and time-matching requirements on the emissions from grid-connected hydrogen production. Nat. Energy, https://doi.org/10.1038/s41560-023-01435-0 (2024).

Song, S. et al. Production of hydrogen from offshore wind in China and cost-competitive supply to Japan. Nat. Commun. 12, https://doi.org/10.1038/s41467-021-27214-7 (2021).

Ríos, C., Molina, P., Martínez de León, C. & Brey, J. J. Simulation of the optimal plant size to produce renewable hydrogen based on the available electricity. Int. J. Hydrog. Energy, https://doi.org/10.1016/J.IJHYDENE.2023.08.306 (2023).

Ruhnau, O. & Schiele, J. Flexible green hydrogen: the effect of relaxing simultaneity requirements on project design, economics, and power sector emissions. Energy Policy 182, 113763 (2023).

Fan, J. L. et al. Co-firing plants with retrofitted carbon capture and storage for power-sector emissions mitigation. Nat. Clim. Change 13, 807–815 (2023).

Fan, J. L. et al. A net-zero emissions strategy for China’s power sector using carbon-capture utilization and storage. Nat. Commun. 14, 1–16 (2023).

Brandt, J. et al. Cost and competitiveness of green hydrogen and the effects of the European Union regulatory framework. Nat. Energy 9, 703–713 (2024).

MORE Energy | Let’s build our energy future. Expect more, accessed 03 January, 2024. [Online]. Available: https://www.more-energy.gr/

EPHYRA - European Commission, accessed 04 January, 2024. [Online]. Available: https://www.clean-hydrogen.europa.eu/projects-repository/ephyra_en.

Roth, A. et al. Renewable energy financing conditions in Europe: survey and impact analysis Insights on cost of capital, significance of explanatory variables, and cash-flow impacts on support cost in auction and non-auction environments Renewable energy financing conditions in Europe: survey and impact analysis. (2021).

Renewable Energy Sources Operator & Guarantees of Origin, accessed 25 September, 2024. [Online]. Available: https://www.dapeep.gr/.

Lange, H., Klose, A., Lippmann, W. & Urbas, L. Technical evaluation of the flexibility of water electrolysis systems to increase energy flexibility: a review. Int. J. Hydrog. Energy 48, 15771–15783 (2023).

Clean Hydrogen Joint Undertaking. Strategic Research and Innovation Agenda 2021 – 2027.

Περιορισμοί ΑΠΕ | IPTO. Accessed: Jan. 20, 2025. [Online]. Available: https://www.admie.gr/en/node/266775.

Estimated Energy Surplus - ΡΑΑΕΥ Ενέργεια. Accessed: Mar. 31, 2025. [Online]. Available: https://www.raaey.gr/energeia/en/market-monitoring/greek-wholesale-electricity-markets/electricity-prices-statistics/estimated-energy-surplus/.

Ramsden, T., Steward, D. & Zuboy, J. Analyzing the Levelized Cost of Centralized and Distributed Hydrogen Production Using the H2A Production Model, Version 2. [Online]. Available: http://www.osti.gov/bridge (2009).

Perey, P. Levelized costs of low-carbon hydrogen production technologies -An analysis of the competitive position of bio-hydrogen. [Online]. Available: http://www.rug.nl/feb/.

Hönig, F., Rupakula, G. D., Duque-Gonzalez, D., Ebert, M. & Blum, U. Enhancing the Levelized Cost of Hydrogen with the Usage of the Byproduct Oxygen in a Wastewater Treatment Plant, accessed 01 June, 2023, MDPI. https://doi.org/10.3390/en16124829.

Gül, M. & Akyüz, E. Techno-economic viability and future price projections of photovoltaic-powered green hydrogen production in strategic regions of Turkey. J. Clean Prod. 430, 139627 (2023).

Charging - ΡΑΑΕΥ Ενέργεια, accessed 31 March, 2025. [Online]. Available: https://www.raaey.gr/energeia/en/electricity/infrastructure/transmission/tariffs/.

Beiter, P., Guillet, J., Jansen, M., Wilson, E. & Kitzing, L. The enduring role of contracts for difference in risk management and market creation for renewables. Nat. Energy, https://doi.org/10.1038/s41560-023-01401-w (2023).

Florence School of Regulation. Contracts-for-Difference (CfDs), accessed 30 September, 2024. [Online]. Available: https://fsr.eui.eu/contracts-for-difference/.

Gabrielli, P., Aboutalebi, R. & Sansavini, G. Mitigating financial risk of corporate power purchase agreements via portfolio optimization. Energy Econ. 109, 105980 (2022).

Reksten, A. H., Thomassen, M. S., Møller-Holst, S. & Sundseth, K. Projecting the future cost of PEM and alkaline water electrolysers; a CAPEX model including electrolyser plant size and technology development. Int. J. Hydrog. Energy 47, 38106–38113 (2022).

White paper “Hydrogen Compression” & webinar - EFRC Recip, accessed 10 January, 2025. [Online]. Available: https://www.recip.org/white-paper-hydrogen-compression-webinar/.

Frank, M. Z. & Shen, T. Investment and the weighted average cost of capital. J. Financ. Econ. 119, 300–315 (2016).

Papadopoulos, V., Desmet, J., Knockaert, J. & Develder, C. Improving the utilization factor of a PEM electrolyzer powered by a 15 MW PV park by combining wind power and battery storage – feasibility study. Int. J. Hydrog. Energy 43, 16468–16478 (2018).

RAEWW Decision 198/2023 - (Rae Website, accessed 11 December, 2023). [Online]. Available: https://www.rae.gr/apofaseis_/63998/

Public Consultation - Cost of New Entry - (Rae Website, accessed 05 December, 2023). [Online]. Available: https://www.rae.gr/diavoulefseis/9467/.

Staffell, I. & Green, R. How does wind farm performance decline with age? Renew. Energy 66, 775–786 (2014).

Mathew, M. S., Kandukuri, S. T. & Omlin, C. W. Estimation of Wind Turbine Performance Degradation with Deep Neural Networks 2022.

Atia, D. M., Hassan, A. A., El-Madany, H. T., Eliwa, A. Y. & Zahran, M. B. Degradation and energy performance evaluation of mono-crystalline photovoltaic modules in Egypt. Sci. Rep. 13, 1–16 (2023).

Aboagye, B., Gyamfi, S., Ofosu, E. A. & Djordjevic, S. Degradation analysis of installed solar photovoltaic (PV) modules under outdoor conditions in Ghana. Energy Rep. 7, 6921–6931 (2021).

HELLENIC REPUBLIC Ministry of the Environment and Energy, “National Energy and Climate Plan.”

Moberg, T. Levelized cost of green hydrogen produced at onshore wind farm sites-A case study comparing local production in Sweden and importing from Chile. UPPSALA (2022).

HR trends. Accessed: Sep. 24, 2024. [Online]. Available: https://www.randstad.gr/en/hr-trends/.

Acknowledgements

This research is undertaken in the framework of EPHYRA project which is supported by the Clean Hydrogen Partnership and its members Hydrogen Europe and Hydrogen Europe Research under Grant Agreement No. 101112220.

Author information

Authors and Affiliations

Contributions

G.G. co-designed the study, led the writing of the paper and analyzed the main results. P.P. co-designed the study and contributed to editing the paper. G.M. contributed data and analysis. S.G. contributed data and analysis. All authors contributed to editing and discussion of the paper.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Communications Earth & Environment thanks Jingli Fan, Jonathan Brandt and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. Primary Handling Editors: Yuwan Duan and Martina Grecequet. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Georgopoulos, G., Papadopoulos, P., Mitkidis, G. et al. Active trading and regulatory incentives lower the levelized cost of green hydrogen in Greece. Commun Earth Environ 6, 370 (2025). https://doi.org/10.1038/s43247-025-02349-3

Received:

Accepted:

Published:

Version of record:

DOI: https://doi.org/10.1038/s43247-025-02349-3